EAST BAY

A NEWSLETTER BY

MICHAEL PERRY

Hot Spots

This month’s spotlight features two highly anticipated openings by pandemic era pop-ups that were shut down at their peak.

JUNE’S PIZZA

2408 Mandela Pkwy, Oakland

Craig Murli, former chef at 3 Michelin star restaurant, Atelier Crenn in SF, has recently reopened his insanely popular Oakland pizza venture, June’s Pizza. The menu is easy to navigate as it only contains two pizza choices per day, margherita and a rotating special and both are only available as whole pies. Also available are wines made especially for June’s by Richmond winemaker, Les Lunes. Wed-Sun 4-9PM.

Could San Pablo Ave Be The Next

Solano Avenue?

BAD WALTER’S

5800 College Ave, Oakland

Sydney Arkin’s first go around with an ice cream shop was out of her house during the pandemic. It was hugely successful. This time she’s taking her talents to College Avenue in the same storefront that housed Smitten Ice Cream shop. With mind blowing flavor combinations (marshmallow custard with candied Rice Krispies and bourbon fudge) and a 90’s vibe that is cool to the core, Bad Walter’s is unlike any place I’ve ever been.

Just over two years ago the City Council of Albany

officially adopted a plan that could have a significant impact on development along San Pablo Avenue. The San Pablo Avenue Specific Plan, along with the 2016 General Plan, aims for a “transformation of this corridor from auto oriented commercial uses to more attractive, pedestrianoriented, mixed use development.” The borders of this corridor consist of Adams St. to the west, Kains Ave to the east and city limits on the north & south ends.

According to the plan, “State and regional government had an expectation that the City would accommodate 335 units during the 2014-2022 5th cycle Housing Element. This unit count more than tripled to 1,114 units during the 2023-2031 cycle. In order to comply with State Housing Element law, the City expects to accommodate a majority of this new housing on San Pablo Avenue.”

(Continued)

Home Wise

Egg & Pancetta Muffins

This recipe is one that I stumbled upon a long time ago and it’s been in my repertoire ever since.

Is Your Home Insured For Its Current Value?

The rapid increase in home values over the last 5 years has been widely documented. Many home owners who bought before 2018 have seen their home values skyrocket, especially during the COVID-19 pandemic.That’s the good news. The not- so-good news? Many homeowners haven't updated their home insurance to match these increased home values. Imagine this: your home, which was once worth $800k, might now be well above $1 million. But if you're still insured at that $ 800k mark and something unforeseen happens, you could be out of pocket for a sizable chunk of change.

In California, maintaining an open line of communication with your home insurance provider is especially paramount. The state has recently experienced unprecedented challenges related to climate change, including widespread wild fi res and persistent droughts. These environmental hazards have placed immense strain on the insurance industry, leading many providers to reevaluate their coverage areas and even cease issuing policies in certain high-risk zones. By staying connected with your insurer, homeowners can stay informed about any potential changes to their policy, ensure they are adequately covered, and make proactive adjustments if needed. Given the evolving landscape, those who are out of touch with their providers may find themselves underinsured or even without coverage when they need it most.

It's a common oversight, and trust me, I get it. With the pace of life, it's easy to set our insurance on auto-renew and forget about it. But considering the drastic rise in property values, that old policy might not cover the full cost of rebuilding or repairs anymore. Do yourself a favor give your insurance policy a quick glance and see if you're keeping pace with the market. It might not be the most exciting 30 minutes you spend all week but you will be better off for it.

It’s insanely easy to make. It tastes delicious and get this, even my kids like it. Winner, winner! Plus, you can make them in bulk and toss them in your lunch, eat them while sitting in traffic or just scarf them down while watching your favorite football team get pummeled on Sundays.

Enjoy!

Ingredients

• Eggs (I prefer free range for darker, flavorful yolks)

• Mozzarella cheese

• Sliced pancetta

• Salt & pepper

• Optional: I like using herbaceous sauces such as pesto, zhoug or romesco

Steps

1. Preheat over to 400°

2. Spray a muffin tin with non-stick cooking spray or olive oil. Line each muffin tin with a slice of pancetta, ensuring that pancetta is pressed gently against the tin.

3. Sprinkle a dash of cheese into each tin and if you’re using a sauce add just a teaspoon or so. Then crack an egg into each tin. Add a light sprinkle of salt, pepper and/or red pepper flakes.

4. Bake for 15 minutes or until yolks are set. Remove from oven and use an offset spatula to remove each “muffin”.

You can make as many as you want. But trust me, they will go fast!

FED CUTS RATES FOR FIRST TIME IN 4 YEARS

At the beginning of 2024 the outlook for interest rates was seemingly very optimistic. At one point there was speculation that interest rates could be in the mid 5% range by the end of the year. This was very encouraging seeing how rates had hit 8% just two months earlier.

Fed meetings came and went in early ’24 without any rate cuts. Inflation wasn’t showing signs of consistently heading downward and interest rates were back to nearly 8% again in April.

On Sept. 18th the Fed met and announced a 50 basis points rate cut which was bigger than expected and the second biggest since 2008. The good news continued as the Fed left the door open for another 50 bps cut by the end of the year. So we may just get to see interest rates in the 5% range after all.

What does this mean for the housing market?

The quick answer is more affordability. A 1% reduction in interest rates increases a buyer’s borrowing power by 10%. Good news for buyers except that home prices in our area have remained at near record levels. Even with better rates today than a year ago, high home prices remain a big hurdle for many.

Another impact of lower rates is that we’ll likely see the condo market start to pickup as rates drop. Currently, condos are simply not moving. That’s making it very tough for condo owners who can’t sell to level up to a single family home. It’s also been tough for investors to pull money out of their condo rental investments.

While mortgage rates are not directly tied to interest rates they do generally move in the same direction. That hasn’t quite been the case at the time of writing this, however. Mortgage rates have climbed roughly 10 basis points since the Fed made their announcement. But over time mortgage rates are anticipated to follow the downward direction of the interest rates.

The next meeting of the Fed is November 6-7 and there is continued optimism that we’ll see at least one more cut before the end of the year.

(Continued)

Driving down San Pablo Ave in El Cerrito and Berkeley you can see completed mixed - use buildings as well as active construction on mixed-use buildings.

Seeing longtime establishments such as the Albany Bowl and Albany Twin Theater close certainly tugs at the nostalgic heart strings for many, but it also raises an important question for residents: what next? The former Albany Bowl, closed down during the COVID-19 pandemic, is currently being proposed as the new site of a 207 unit mixed-use space.

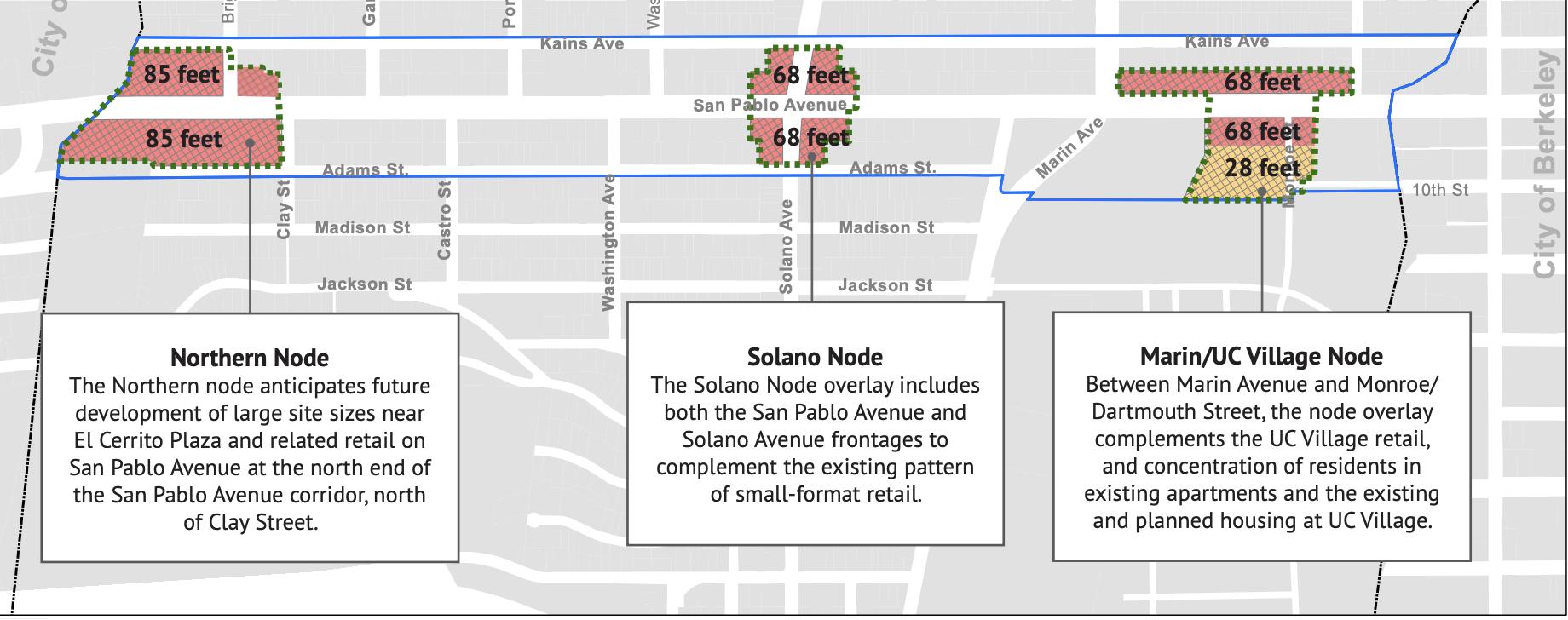

The San Pablo Avenue Specific Plan identifies 3 nodes along SanPablo Avenue. These nodes are “a focus point in a neighborhood for activity and gathering that establishes a sense of place.” The proposed development in the former Albany Bowl site would be located in the Northern Node. The other two areas are the intersection of Solano & San Pablo Ave and then from Marin Avenue south to Monroe.

For more information about the plan and other proposals visit the City of Albany website. There you can find the plan in its entirety as well as upcoming events, discussions and meetings.

Upcoming Events

Oct 5th | Trumer Brewery, Berkeley

OCTOBER 31st 3-5pm

TREATS & MUSIC AT THE OFFICE

(1559 Solano Ave)

Costume contest @ 5pm at Solano-Peralta Park

Break out your lederhosen and dirndl and celebrate Oktoberfest in style. Enjoy tons of traditional German food, beer and music while soaking up the sun at Trumer Brewery in West Berkeley. Accordion energy, chicken dances, boisterous toasts and stein hoisting contests. This family friendly event is free, too! 1404 Fourth St, Berkeley.

Oct 7th-14th

Most businesses along Solano will host trick-or-treats for the kiddos. Dress up, bring the family!!

Michael Perry

510.641.6543

m.perry@ggsir.com 1559 Solano Ave. Berkeley, CA 94707

Lic #02193642

SF Fleet Week The week is full of events including ship tours, concerts, ceremonies and everyone’s favorite . . . the air show. Pro tip: grab a seat on a boat to have the BEST view of the air show without the epic crowds. Red & White Fleet is a great option for a 2 hour ride AND your ticket includes two free drink tickets!

Oct 17th-20th | Fort Mason

The San Francisco Fall Show Experience the West Coast’s leading art, antiques and design show. With Mid Century Danish furniture, Italian hand blown glassware, vintage maps and everything in between. The event features exhibitions, lectures and endless inspiration. Tickets $20 at www.eventbrite.com

Oct. 26th | Berkeley

The School of the Madeleine Fall Festival is its annual autumn-themed event aimed at celebrating the season and building community. Yes, and it’s also a shameless plug to help support our school. There will be dozens of kid games & prizes, a petting zoo, face painting, beer garden, food trucks, music and more. Come on down! 1225 Milvia St, Berkeley.

Oct. 27th| Oakland Coliseum

Reggie Jackson Softball Classic features Jose Canseco, Barry Bonds, Dennis Eckersly, Dave Stewart, David Justice and many more. If you missed last month’s opportunity to say goodbye to the Coliseum, this may truly be your last chance. Tickets available online.