The community has come together beautifully, a labour of love and exercise in innovation, craftsmanship, and design. Not surprisingly, the response has been extraordinary as residents of Braestone are happy to enjoy the remarkable trails, the skating pond, the horse paddocks and pumpkin patch, the nature preserve, streams and forests, and life, as promised, that is richer and more rewarding. We invite you to join in our vision and become part of Oro-Medonte’s finest community before it’s too late.

REGISTER TO RECEIVE UPDATES ON LOT AVAILABILITY & PRICING.

Distinctive & timeless bungalow, loft & two-storey homesteads on a selection of 1/2 acre to over 1 acre secluded lots.

Two distinctive communities with a shared horizon. Welcome to your

Georgian Communities invites you to follow our vision, as we create yet another remarkable community, in beautiful Oro-Medonte. Craighurst is a village brimming with small-town charm, neighbourly kindness, and historic character, set to welcome you and your family. Rich in history and surrounded by rolling green pastures and lush woodlands, simply the best of rural life, with daily necessities within walking distance, and urban conveniences found minutes away, in both Barrie, and Orillia.

OUR DESIGNER MODEL HOMES ARE NOW OPEN. PHASE ONE OVER 50% SOLD.

Modern farmhouse architecture on spacious fifty-foot lots immersed in one of the most beautiful landscapes in Ontario. craighurstcrossing.ca

We start with location. We let the land decide what our communities should look like. We create simple yet remarkable amenities to bring families together.

Ask yourself if you’re looking for a place to live –or a place to Live Remarkably.

Jesse Abrams is Co-Founder at Homewise, a mortgage advisory and brokerage firm based in Toronto. thinkhomewise.com

Mike Collins-Williams, RPP, MCIP, is CEO West End Home Builders’ Association. westendhba.ca.

Paul Baron is President of TRREB, and a career real estate executive with more than 30 years of experience. He is the Broker of Record for Century 21 Leading Edge Realty Inc., which he founded in 1993. trreb.ca

Debbie Cosic is CEO and founder of In2ition Realty. She has overseen the sale of more than $15 billion worth of real estate. With Debbie at its helm, In2ition has become one of the fastest-growing and most innovative new home and condo sales companies. in2ition.ca

Linda Mazur is an award-winning designer and Principal of Linda Mazur Design Group. With almost two decades of experience this in demand multi-disciplinary design firm is known for creating relaxed, stylish spaces and full-scale design builds throughout the GTA and Canada. lindamazurdesign.com @LindaMazurGroup

Ben Myers is the President of Bullpen Consulting, a boutique residential real estate advisory firm specializing in condominium and rental apartment market studies, forecasts and valuations for developers, lenders and land owners. Contact him at bullpenconsulting.ca and @benmyers29 on Twitter.

Lisa Rogers is Executive Vice-President of Design for Dunpar Homes. Lisa has shared her style and design expertise on popular television programs such as Canadian Living TV, House & Home TV and The Shopping Channel. Lisa is also a regular guest expert on CityTV’s Cityline. dunparhomes.com.

Jayson Schwarz LL.M. is a Toronto real estate lawyer and partner in the law firm Schwarz Law LLP. He can be reached by visiting schwarzlaw.ca or by email at info@schwarzlaw.ca or phone at 416.486.2040.

Dave Wilkes is president and CEO of the Building Industry and Land Development Association (BILD), the voice of the home building, land development and professional renovation industry in the GTA. For the latest industry news and new home data, follow BILD on Twitter at @bildgta or visit bildgta.ca

SENIOR VICE-PRESIDENT, SALES, NEXTHOME

Hope McLarnon 416.708.7987

hope.mclarnon@nexthome.ca

DIRECTOR OF SALES, ONTARIO, NEXTHOME

Natalie Chin 416.881.4288 natalie.chin@nexthome.ca

EDITORIAL DIRECTOR Amanda Pereira

EDITOR-IN-CHIEF – GREATER TORONTO AREA

Wayne Karl wayne.karl@nexthome.ca

CONTRIBUTORS

Jesse Abrams, Paul Baron, Mike Collins-Williams, Debbie Cosic, Sara Duck

Barbara Lawlor, Linda Mazur, Jason Mercer, Ben Myers, Lisa Rogers, Jayson Schwarz, Dave Wilkes

EXECUTIVE MEDIA CONSULTANTS

Jacky Hill, Michael Rosset

VICE-PRESIDENT, MARKETING – GTA

Leanne Speers

MANAGER, CLIENT RELATIONS

Sonia Presotto

MANAGER CUSTOMER SALES/SERVICE

Marilyn Watling

SALES & MARKETING CO-ORDINATOR

Gary Chilvers

BUSINESS DEVELOPMENT MANAGER

Josh Rosset

DISTRIBUTION distributionteam@nexthome.ca

ACCOUNTING INQUIRIES accountingteam@nexthome.ca

DIRECTOR OF PRINT MEDIA

Lauren Reid–Sachs

VICE-PRESIDENT, PRODUCTION – GTA

Lisa Kelly

PRODUCTION MANAGER – GTA

Yvonne Poon

GRAPHIC DESIGNER & ASSISTANT MANAGER

Alicesa Pullan

GRAPHIC DESIGNER & PRE-PRESS COORDINATOR

Hannah Yarkony

GRAPHIC DESIGNER

Mike Terentiev

Published by nexthome.ca

Advertising Call 1.866.532.2588 ext. 1 for rates and information. Fax: 1.888.861.5038

Circulation Highly targeted, free distribution network aimed at real estate buyers using street level boxes, racking and Toronto Star in-home delivery.

Canadian subscriptions 1 year = 13 issues – $70 (inc. HST). Canada Post – Canadian Publications Mail Sales Product Agreement 40065416.

Copyright 2024 All rights reserved. All copyright and other intellectual property rights in the contents hereof are the property of NextHome, and not that of the individual client. The customer has purchased the right of reproduction in NextHome and does not have the right to reproduce the ad or photo in any other place or publication without the previous written consent of NextHome.

Editorial Submissions from interested parties will be considered. Please submit to the editor at editorial@nexthome.ca.

Terms and Indemnification

Advertisers and contributors: NextHome is not responsible for typographical errors, mistakes, or misprints. By approving your content and/ or submitting content for circulation, advertisers and contributors agree to indemnify and hold harmless NextHome and its parent company from any claims, liabilities, losses, and expenses (including legal fees) arising out of or in connection with the content provided, including but not limited to any claims of copyright infringement, unauthorized reproduction, or inaccuracies in the content. Advertisers acknowledge that they have the necessary rights, permissions, and licenses to provide the content for circulation, and they bear full responsibility for the content’s accuracy, legality, and compliance with applicable laws upon approval. Contributors acknowledge NextHome reserves the right to omit and modify their submissions at the publisher’s discretion.

WAYNE KARL EDITOR-IN-CHIEF HOMES Magazine

EMAIL: wayne.karl@nexthome.ca

TWITTER: @WayneKarl

Let’s be honest – 2023 wasn’t the greatest year for homebuying or homebuilding in the GTA and elsewhere in Ontario.

But a new year brings hope, possibility and, perhaps most importantly, opportunity – and all of that and more awaits in 2024.

As our Special Report: Outlook 2024 beginning on page 24 examines, market influences appear poised to change for the better, providing relief and newfound belief for homebuyers and builders alike.

“I’m optimistic about the outlook for the housing market in 2024,” says Mike Parker, vice-president of sales and marketing at Georgian Communities. “Despite facing global economic challenges, our region has demonstrated remarkable resilience, and we expect a steady demand for new homes driven by Ontario’s continuously growing population and robust economic fundamentals.”

David Hill, president of Ballantry Homes, is similarly upbeat. “I think the market in 2024 will turn a corner and begin to improve. Interest rates have been high to fight off inflation, but the general consensus is that rates will begin to drop this year. Perhaps not in the first quarter, but by the summer. The housing demand is there, and lower rates will let homebuyers into the market again.”

As one of our expert columnists, Debbie Cosic, further summarizes in Home Realty on page 29, “2024 is sure to be a pivotal marker in what will become an even-stronger real estate market moving forward.”

If we faced a perfect storm of challenging conditions last year – higher interest rates, inflation and new home supply chief among them – the forecast now calls for brighter skies on most fronts on the horizon.

Is 2024 going to be your year for buying a new home in the GTA? A variety of expert sources in Outlook 2024 discuss the key determining factors to help you answer that question. You might be wise, for example, to use this time now, to do your due diligence, research and prepare as best you can to take advantage.

And when you’re ready, know that some great buying opportunities await. Not only the communities and projects such as those offered by Ballantry and Georgian, but perhaps for a limited time, incentives and price adjustments as conditions improve.

GTA new home sales were flat again in November 2023, maintaining gains since the summer months, but exceeding the lows of November 2022, the Building Industry and Land Development Association (BILD) reports.

There were 1,694 new home sales in November, up 13 per cent from November 2022 and 54 per cent below the 10-year average, according to Altus Group, BILD’s official source for new home market intelligence.

“This slow pace of sales is entirely due to current interest rates,” says Justin Sherwood, senior vicepresident of communications and stakeholder relations at BILD. “We are at a pivotal time in the market. The GTA population is expanding and we need housing, but slower sales today will lead to slower housing starts in the immediate future, which will hamper new supply coming to market. With total inventory actually decreasing month over month, the balanced market from a month’s inventory perspective is a factor of

low sales, not more product coming to market. We cannot be lulled into a false sense of security, because when rates moderate and sales pick up, we will be right back into a supply crunch.”

“The inventory of new homes available to purchase shrank in November,” adds Edward Jegg, research manager with Altus Group. “But with sales slowing, that inventory will last longer, now taking nine months to absorb.”

Condominium units, including in low-, medium- and highrise buildings, stacked townhouses and loft units, accounted for 1,310 units sold in November, up seven per cent from November 2022 and 51 per cent below the 10-year average.

There were 384 single-family home sales in November, up 41 per cent from November 2022 and 62 per cent below the 10-year average. Single-family homes include detached, linked and semi-detached houses and townhouses (excluding stacked townhouses).

Total new home remaining inventory decreased compared to the previous month, to 20,760 units. It included 17,283 condominium units and 3,477 single-family dwellings. This represents a combined inventory level of nine months, based on average sales for the last 12 months. The GTA is on the cusp of a balanced market from a month’s inventory perspective. The last time this level was attained was December 2015. A balanced market has nine to 12 months of inventory. Remaining inventory includes units in pre-construction projects, in projects currently under construction and in completed buildings.

Benchmark prices decreased in November for single-family homes and increased for condominium apartments compared to the previous month. The benchmark price for new condominium apartments was $1.04 million, down 7.3 per cent over the last 12 months. The benchmark price for new single-family homes was $1.59 million, down 8.5 per cent.

After years of unprecedented irregularity, the real estate market may return closer to normal in 2024. According to the Royal LePage Market Survey Forecast, the aggregate price of a home in Canada is set to increase 5.5 per cent year over year to $843,684 in the fourth quarter of 2024, with the median price of a single-family detached property and condominium projected to increase 6.0 per cent and 5.0 to $879,164 and $616,140, respectively.

“Looking ahead, we see 2024 as an important tipping point for the national economy, as the majority of Canadians acknowledge that the ultra-low interest rate era is dead and gone,” says Phil Soper, president and CEO, Royal LePage. “We believe that the ‘great adjustment’ to tolerable, mid-single-digit borrowing costs will have a firm grip on our collective consciousness after only modest rate cuts by the Bank of Canada.”

Home prices are expected to rise next year in all major markets across the country, with Calgary forecast to see the greatest gains. Throughout the second half of 2023, while prices have been declining in other cities, the Calgary real estate market has bucked the trend continuing on an upward price trajectory.

Royal LePage says its forecast is based on the prediction that BoC

has concluded its interest rate hike campaign and that the key lending rate will hold steady at five per cent through the first half of 2024. The central bank is expected to start making modest cuts in late summer or fall of next year. Meanwhile, several major financial institutions have already begun offering discounts on fixed-rate mortgages.

“For the last year, many Canadians have been fixated on the idea of interest rates needing to come down significantly before they can afford to enter or re-enter the housing market,”

Soper says. “Acceptance that a mortgage rate of four to five per cent is the new normal should untether pent-up demand as first-time buyers, flush with savings collected during the extended down market in housing, regain the confidence to go home shopping. And, with the return of first-timer demand, we expect families who have put off upgrading their homes to begin to list their properties in much greater numbers.”

In the federal government’s Fall Economic Statement, billions of dollars were committed and reaffirmed towards increased levels of new housing construction. This includes favourable loan agreements

and tax benefits for developers of purpose-built rental buildings and public housing projects, as well as financial assistance for municipalities to crack down on short-term rentals in an effort to push more supply onto the resale market in urban centres.

“It is encouraging to see policy makers tackling Canada’s housing affordability issues and supply shortfall, yet there remains a large accessibility gap for first-time buyers and middle-income earners,” says Soper.

In the GTA, the aggregate price of a home in the fourth quarter of 2024 is forecast to increase 6.0 per cent year over year to $1.19 million. The median price of a single-family detached property is expected to rise 7.0 per cent to $1.48 million, while condominiums are forecast to increase 5.0 per cent to $754,845.

“There is a lot of uncertainty surrounding Canada’s economy and the real estate market these days, and that is especially true in the major centres like Toronto,” says Karen Yolevski, chief operating officer, Royal LePage Real Estate Services Ltd. “What is certain is that Canadians need housing, they value homeownership and most are willing to prioritize buying a home over just about anything else.”

The Building Industry and Land Development Association (BILD) has slammed the province’s approval of City of Toronto Official Plan Amendment (OPA) 591 as yet another example of how the province has abandoned its position of leadership and its electoral mandate to build housing in the Greater Toronto Area in favour of political expediency.

“In order to distance itself from its own past actions, the provincial government has overcorrected on the housing file to secure its political future at the expense of all future homebuyers in the province,” says Dave Wilkes, president and CEO of BILD. “Since early fall, there has been a series of government decisions that are effectively undermining the ability of the industry to add housing supply for future growth. The province is committing us all to unaffordable housing for generations to come.”

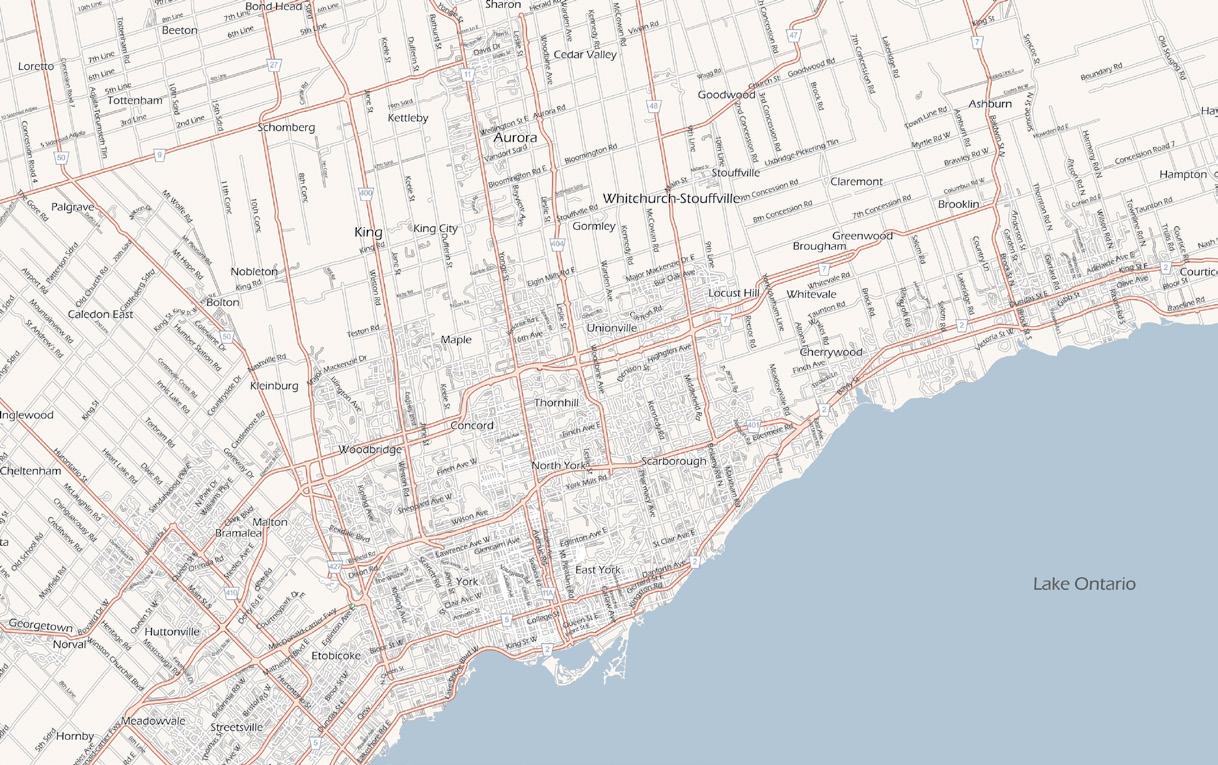

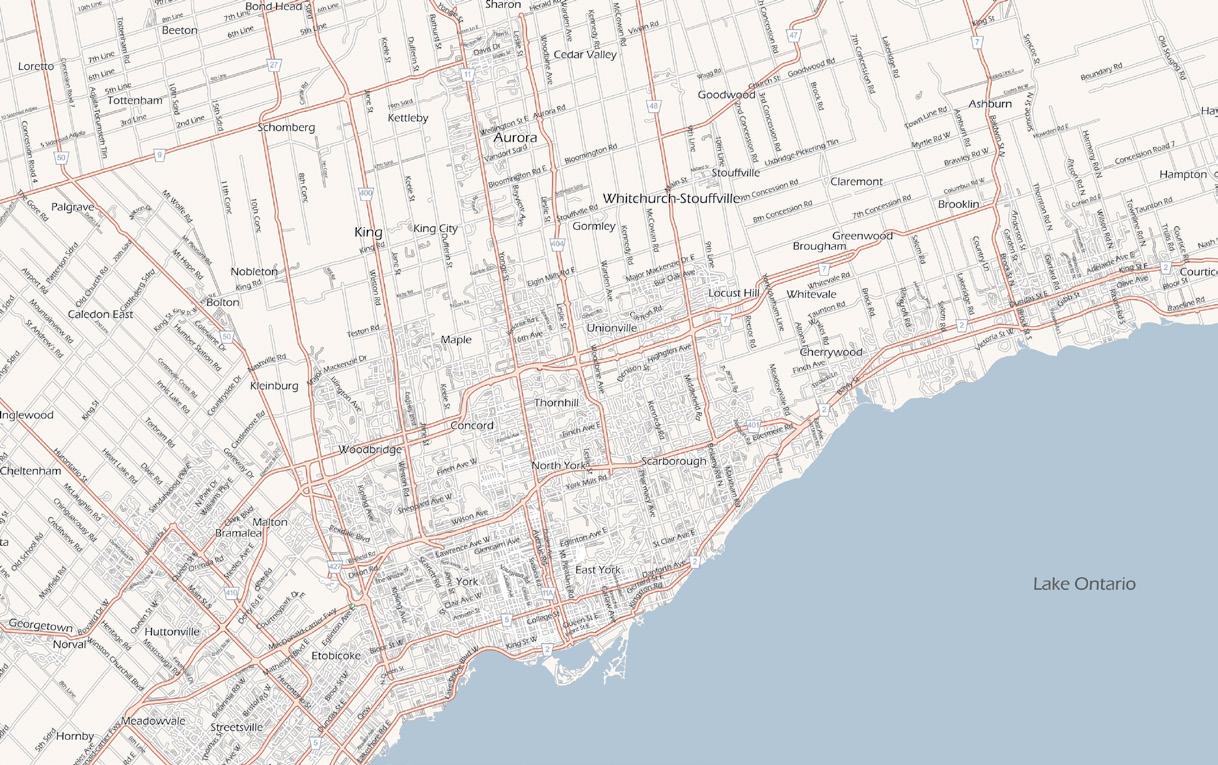

Toronto’s OPA 591 proposes new and updated policies related to employment and employment conversions, including mixed-use and land designated for homes. The city’s plans included 24 employment conversions that could accommodate 8,000 new housing units. There were 45 requests to the province through consultation to adjust the city’s OPA scope for potentially tens of thousands of new housing units (based on a BILD member assessment) with some employment space retention if those sites were made mixed use. As the province ignored those requests, these units will now not be built. In addition, based on BILD mapping, none of the city’s employment conversions are near transit, meaning the resulting housing will not be transit-supportive. Had the province moved forward with the expansion requests there would have been more housing and mixeduse opportunities built, much of it transit-supportive.

This is the latest in a growing list of decisions made by the province that are undermining the provision of housing and employment space supply in Ontario, BILD says. The decision in October to reverse expansions to urban boundaries in the Greater Golden Horseshoe (GGH) limits lands for future housing, meaning there will be a shortfall of 242,000 new housing units by 2051. The decision to indemnify the government against financial damages caused by this reversal has developers questioning whether it is prudent to invest capital into new projects in Ontario. The decision not to expand OPA 591 shelves another potential tens of thousands of housing units.

These decisions, coupled with the announcement to review its commitment to reduce taxes on new housing through proposed changes to development charges, has created unmanageable uncertainty for the housing industry.

“In the space of a few short weeks, in the middle of the most

significant housing crisis this region has faced, this government has made decisions that effectively cancelled nearly 300,000 housing units in the Greater Toronto and Hamilton Area and the GGH,” says Wilkes. “Even more critical, these decisions are undermining the very investors that are needed to finance new housing developments and call into question the viability of projects that that would have added much needed housing supply. Cities and developers around the world compete for this investment and the actions of this government are threatening this lifeblood of new housing.”

Housing cannot be a “political football,” BILD says, and the organization is calling on the province to urgently meet with all stakeholders and define an achievable and sustainable plan to build the housing that our region and province desperately needs to secure the future growth of our economy and communities.

High borrowing costs and uncertain economic conditions continued to weigh on Greater Toronto Area (GTA) home sales in November 2023, according to the Toronto Regional Real Estate Board (TRREB). Sales were down on a year-over-year basis, while listings were up from last year’s trough in supply. With more choice in the market, selling prices remained basically flat year-over-year.

“Inflation and elevated borrowing costs have taken their toll on affordability,” says TRREB President Paul Baron. “This has been no more apparent than in the interest ratesensitive housing market. However, it does appear relief is on the horizon. Bond yields, which underpin fixed rate mortgages have been trending lower and an increasing number of forecasters are anticipating Bank of Canada rate cuts in the first half of 2024. Lower rates will help alleviate affordability issues for existing homeowners and those looking to enter the market.”

GTA realtors reported 4,236 sales through TRREB’s MLS System in November 2023 – a six-per-cent decline compared to November 2022. Over the same period, the number of new listings was up by 16.5 per cent. On a seasonally adjusted monthly basis, sales edged up compared to October 2023, while new listings were down 5.5 per cent.

The MLS Home Price Index

Composite benchmark and the average selling price, at $1.08 million,

in November 2023 were basically flat in comparison to November 2022. On a seasonally adjusted monthly basis, the benchmark was down by 1.7 per cent. The average selling price was down 2.2 per cent month-over-month.

“Home prices have adjusted from their peak in response to higher borrowing costs,” says TRREB Chief Market Analyst Jason Mercer. “This has provided some relief for buyers, from an affordability perspective. As mortgage rates trend lower next year

and the population continues to grow at a record pace, expect demand to increase relative to supply. This will eventually lead to renewed growth in home prices.”

“Houses and condos are meant to be homes, first and foremost,” adds TRREB CEO John DiMichele. “We know the demand for homes, both rental and ownership, will grow for years to come. We have seen some productive policy decisions recently that should help with housing affordability, including allowing existing insured mortgage holders to switch lenders without the stress test. Additionally, in the interest of household and economic stability, we continue to call on the Office of the Superintendent of Financial Institutions (OSFI) to apply the same approach to uninsured mortgages. It also goes without saying that further policy work is required to bring more supply online.”

SOURCE: TRREB

Sink or swim? Top 5 issues drowning new-home buyers – and how to fix them What exactly is it pulling homebuyers underwater, and how do we fix it? Dunsire Developments has come up with a unique solution to keep buyers afloat.

Tips for buying a home in a higher rate environment

In today’s economic landscape, marked by higher interest rates and inflation, the decision to invest in real estate can be complicated and isn’t always simple. It’s about uncovering opportunities that can sometimes arise in markets where conditions are less favourable.

Municipal boundaries in GTA must expand to meet housing goals

Ontario aims to build 1.5 million new homes by 2031. Building enough homes to accommodate this growth in our region cannot be accomplished through intensification alone, and will require the expansion of municipal boundaries.

Canadians remain confident In homeownership – ReMax Canadians’ outlook on homeownership remains positive despite challenging market conditions in 2023, including a supply shortage and a tricky interest rate environment, according to the ReMax 2024 Housing Market Outlook Report.

A pulse on the GTA rental and homeownership market

High interest rates and economic uncertainty are keeping first-time buyers from moving off the sidelines and into the homeownership market. But overall demand for housing is still strong thanks to record population growth and a relatively resilient economy.

Find your dream home in Fieldgate’s signature GTA communities

Fieldgate Homes is now open for purchasing by virtual sales appointments across the GTA. Connect by phone, video chat or email for a secure and convenient homebuying experience for these featured communities.

Toronto’s new housing landscape is undergoing a seismic shift, with the new condo market experiencing a significant sales decline, with activity returning to 2003 levels.

New condo sales in the Greater Toronto Area at the end of Q3-2023 fell by 47 per cent annually, with

only 9,582 sales recorded. Bullpen is forecasting just 10,500 new condo sales in 2023, which is well below the long-run annual average of 23,250 from 2010 to 2022. Elevated interest rates and the lingering impact of last year’s property value surge have created headwinds for the market, leading to a slowdown in sales, fewer project launches, and an overall contraction in the real estate sector.

Despite the short-term challenges, the market remains undersupplied based on macro-economic factors, highlighting the enduring appeal

of condominium living in the GTA, especially among first-time buyers and young tenants leasing suites from investors. The demand extends beyond conventional preferences for walkability, transit proximity and contemporary amenities, attracting diverse age groups, including boomers looking to downsize in the coming decade.

While the market experiences a slowdown, certain projects have defied the trend by achieving robust sales. Developers who price their developments at levels observed in

“

” Pricing is expected to continue to decrease with unsold inventory increasing, with a clear glut of luxury penthouses and larger 1,500 sq. ft. or larger units sitting on the market unsold.

the summer and fall of 2021 have witnessed success. However, many developers face constraints due to having acquired land at peak prices, making it challenging to lower prices to previous levels. A market reset will take time to materialize, as projects under construction complete and construction costs decline. However, the underlying demand is strong for housing in Toronto, as demonstrated by the continued increase in rental rates. Developers making savvy land purchases in the current climate are poised to reap rewards when the market rebounds in a couple years.

New condo prices have increased for about 27 consecutive years in the GTA, but data suggest that pricing is down about nine per cent yearover-year based on per-square-foot asking prices. Notably, the correction varies by bedroom type, with onebedroom units experiencing a one-per-cent annual increase, while two-bedroom units witness a twoper-cent decrease.

Pricing is expected to continue to decrease with unsold inventory increasing, with a clear glut of luxury penthouses and larger 1,500 sq. ft. or larger units sitting on the market unsold.

Looking at all new housing types, October 2023 saw 1,872 new home sales, marking a seven-per-cent decline from the same month in 2022 and a staggering 50 per cent below the 10-year average. Condos, accounting for 1,304 units sold in October, which are down 20 per cent from the previous year and 49 per cent below the 10-year average. In contrast, single-family home sales experienced a surprising uptick of 47 per cent, totaling 568 units, yet still falling 51 per cent below the 10year average.

The new home remaining inventory has surged to 21,032 units, including 17,930 condos and 3,102 singlefamily dwellings – the highest level since 2016. Developers are cautiously testing the waters with new launches,

gauging buyer readiness. Justin Sherwood of BILD notes that current monetary policy, interest rates and affordability challenges contribute to buyers sitting on the sidelines, impacting future housing starts. Delays in preconstruction sales translate to delays in adding housing supply, and the market awaits signals of more moderate interest rates to spur increased supply.

Toronto’s developers are navigating challenging waters, grappling with a significant sales downturn and a gradual price correction. Despite these challenges, underlying demand for housing remains robust, driven by factors such as immigration, low unemployment and soaring rents. Bullpen advises developers to make strategic moves in the current market conditions, anticipating future rewards when the market comes roaring back in 2025 and 2026. As the market undergoes this transformation, careful consideration of pricing strategies and an awareness of evolving buyer preferences will be crucial for developers aiming to weather the storm and position themselves for long-term success.

From a buyer perspective, there are still select deals to be had, and anyone looking to purchase a preconstruction unit should compare the price of a new unit versus a comparable recently-completed unit. Contact an experienced broker that understands where that new housing premium should be, and make an informed decision. Good luck.

Ben Myers is the President of Bullpen Consulting, a boutique residential real estate advisory firm specializing in condominium and rental apartment market studies, forecasts and valuations for developers, lenders and land owners. Contact him at bullpenconsulting.ca and @benmyers29 on Twitter.

+MORE CONTENT ONLINE nexthome.ca

This spring, a new kind of community is taking shape in the heart of Niagara Falls. Legacy homebuilder Branthaven is bringing its renowned attainable luxury brand and an exciting line up of innovative new townhomes to market that are sure to bring joy to savvy homebuyers.

“With JOY, we have designed a forward-thinking community with

great home designs, plenty of layout options and truly something for everyone – from first-time buyers, move-up to multi-generational families and even an exciting real estate investment opportunity,” says Steve Stipsits, president of Branthaven. “JOY Towns Niagara has been carefully crafted and thoughtfully considered with

smart, stylish and flexible designs that are just right for today’s buyers wanting to experience attainable homeownership.”

JOY will offer a range of homes with excellent layout options – ideal for shared homeownership, rightsizing and an attractive alternative to condo living. Purchasers can explore Branthaven’s new line of FlexFit

floorplans – a collection of two-, three-, four- and five-bedroom plans, perfect for multi-generational, familyfriendly townhome living. “Our FlexFit plans have been very well received by those discerning buyers looking for ranging options for attainable homeownership. In addition to these versatile floorplans, we are introducing an incredible investment property type. Some of our most popular townhomes will now offer an optional legal secondary suite, builtin, as a turnkey “mortgage helper,” adds Stipsits.

JOY Towns Niagara is nestled in its own private enclave off Oakwood Drive. Defined by authentic architectural styles and coordinated streetscapes, JOY has been thoughtfully considered for its setting.

From the two welcoming street entrances, to the central community parkette, canal corridor amenity and greenspace, each surrounding block has been intentionally designed to create an intimate village ambience. Branthaven’s signature style and curated materials palettes boast traditional brick and stone accents, bold contemporary windows and modern maintenance-free cladding to ensure a joyful community you will love coming home to.

Buyers can discover the joy and harmony of coordinated two- and three-storey luxury towns on offer. The 20-ft., two-storey townhome collection has custom-inspired, new-traditional styling with high quality materials like stone skirting, rich silvery brick, welcoming porches and beautiful boxed windows. The collection has upgraded ends and corners all with private backyards.

There are three types of threestorey townhomes to consider at JOY, each designed with complementary colour palettes and crafted for architectural integrity.

Curated for maximum curb appeal, front and back, JOY’s rear-lane 20-ft. collection offers upgraded architecture, maintenance-free materiality, full-width terrace and plenty of functional floorplan options. Commuters will also appreciate the double car garages and driveway, as well as direct indoor access to their home. The rear-lane collection also offers an independent legal rental suite on the lower level.

JOY’s 21-ft., three-storey backto-back townhomes are the perfect fit for first-time buyers and growing

families. With well-designed and practical living space, one or two private balconies and premium maintenance-free materials, JOY’s back-to-back town living is joyfully easy.

The 16-ft. three-storey town collection at JOY Towns Niagara offers three levels of modern floorplans – with plenty of floorplan options to make the space your own. Handsome looks and hardy low-maintenance materials, private deck and backyard will add joy to your life.

“At JOY, Branthaven has introduced plenty of floorplan options for buyers to find ‘what’s right for you’,” adds Stipsits. “We have made room for everyone in the family with ‘generational flexibility’ in mind. We designed functional, flexible plans so buyers can experience the perfect combination of space planning and built-in features to live well without compromise.”

Growing families and multigenerational households will find JOY’s FlexFit floorplans perfectly suited to their lifestyle and extended family. Two-, three-, four- and five-bedroom layouts offer plenty of room for sleeping, studying, storage, work from home offices and hosting friends and family.

There are two-bedroom townhome layouts featuring dual primary bedrooms and Branthaven’s Fresh Thinking boutique chic ensuites – ideal for first-time buyers, shared homeownership or even as a potential “mortgage helper” roommate investment opportunity. These stylish townhome plans are so much more than a typical condo apartment suite.

“FlexFit Rent is an innovative new housing option we are excited to introduce at JOY,” suggests Dan Marois, director of sales at Branthaven. “With our FlexFit Rent floorplans, buyers can take advantage of a secondary suite that converts the townhome that converts the townhome ground floor and basement into an independent rental unit to generate additional income to offset household expenses.

Each suite has its own separate entrance, parking, living room, fullsize kitchen, bedroom, bathroom and laundry.” Marois adds, “having a well-designed income generating suite increases your property’s desirability and long-term market value too. FlexFit Rent is the smart solution to help today’s buyers realize their home ownership dream and ensure higher return on their investment.

JOY Towns Niagara’s location in the Niagara Falls South puts you in the centre of it all. Conveniently located off the QEW at Macleod Road, JOY is just steps from every modern amenity this booming new familycentric community offers. Take in the YMCA/MacBain Community Centre’s state-of-the-art pool, community gym and library. Discover the sublime beauty of the Niagara Parks systems, nature trails, stunning golf courses and conservation areas. Busy families can take advantage of the many conveniences such as shopping, services, schools and excellent commuter access to and from the nearby highways. The Niagara Region’s abundant entertainment choices from world-class wineries, nightlife, concerts, casinos abound.

Find your JOY. Register now at branthaven.com.

As one year ends and a new one begins, it is a time to reflect on the year’s accomplishments, and to set our goals and objectives for the year ahead. While it may not seem festive, it’s the perfect time of year to work on a financial and estate plan.

Estate planning simply means having a plan in place to enable succession planning in your business or how to deal with your assets in the event of your death. The legal documents associated with an estate plan can include a will, powers of attorney and trusts.

Everyone needs a will, no matter whether you have a complex estate or modest assets, you want to ensure they go to the right places and people without delay or undue expense. Powers of attorney grant

a trusted person the ability to act on your behalf should you become incapacitated. You can choose to cover medial decisions, financial ones or both. A trust is a contract that allows an individual you name (the trustee) to deal with the assets you bequeath for the benefit of designated people (the beneficiaries). A trust can be a particularly useful tool with elderly parents or dependent children to help them manage their affairs.

Many entrepreneurs start early, set up the company in their own name and then march forward growing the business and creating wealth.

For example, if you’re 60, successful and have two children involved in your business… you may be wondering, what happens if you die? First, there is a deemed disposition on death. This means that your estate will pay tax on the difference between the initial value of the shares in the company you hold and the value today. It could be a

significant amount of money. Where will it come from? Second, who gets the shares and control of the business? This is a recipe for disaster, unless there has been planning. All your work potentially at risk. In order to fix this, speak to an experienced corporate lawyer with tax knowledge or a tax specialist accountant. They can guide you on setting up the appropriate holding companies and performing permissible freezes and restructure to allow for orderly succession planning and tax minimization.

It really doesn’t matter what kind of business you have. You could be a doctor, lawyer, engineer or any professional with an operating company. You could be a sales organization, manufacturer or simply an investor; all can be helped, and moreover, maybe you need a company for tax and liability protection.

All in all, the good news is that you don’t need to do all of this alone. An estate lawyer can help you with more than just drafting a will. An experienced corporate tax and real estate lawyer can assist with planning and structure and may bring in the experts you require or just help get going.

Procrastination is the number one issue when it comes to estate, succession and corporate planning. Now is the time to add it to the top of your New Year’s resolutions.

Jayson Schwarz LLM is the Senior Partner and Founder of Schwarz Law Partners LLP, and Jacqueline Moneta is the head of the Commercial Law Section of the firm.

Last year might not exactly have been a walk in the proverbial park for the housing market, with interest rates, inflation, certain land use/ government policy concerns, uncertainty about the economy and other issues giving pause to newhome building and buying.

But 2024 is shaping up to be something altogether different, with relief – and belief – in sight on most issues.

“I’m optimistic about the outlook for the housing market in 2024,” Mike Parker, vice-president of sales and marketing at Georgian Communities, told HOMES Magazine. “Despite facing global economic challenges, our region

by WAYNE KARL

has demonstrated remarkable resilience, and we expect a steady demand for new homes driven by Ontario’s continuously growing population and robust economic fundamentals.”

“I think the market in 2024 will turn a corner and begin to improve,” adds David Hill, president of Ballantry Homes. “Interest rates have been high to fight off inflation, but the general consensus is that rates will begin to drop this year. Perhaps not in the first quarter, but by the summer. The housing demand is there, and lower rates will let homebuyers into the market again.”

Let’s take a look at why this might just be the year of the rebound.

Mike Parker

We can’t pretend that interest rates and inflation are no longer concerns, but there are clear signs things are improving. Statistics Canada reports that the Consumer Price Index (CPI) rose 3.4 per cent on a year-over-year basis in December 2023, up slightly from 3.1 per cent last November, but the acceleration was largely the result of higher year-over-year gasoline prices in December. Excluding gas, the headline the CPI would have slowed to 3.5 per cent in December 2023, from 3.6 per cent in November.

Translation: Somewhat persistent inflation – with inflation being the main reason the Bank of Canada (BoC) has maintained higher rates than a few years ago – BoC may be challenged to lower rates just yet.

In its most recent rate announcement at time of writing, Dec. 6, the BoC held its target for the overnight rate at five per cent. (Its next announcement was Jan. 24.)

Jan.

March

June

July

Oct.

Dec.

Most experts expect rates to begin declining in spring.

“This could be an interesting year when it comes to interest rates,” says Jesse Abrams, co-founder at Homewise, a mortgage advisory and brokerage firm. “Starting with fixed rates, we have already seen them drop 70 bps from their peak midway through 2023. This is due to economic factors, and can be tracked based on five-year Canadian bond yields, which have dropped

steadily since November. Moving into 2024, our team expects to see fixed rate mortgages continue to drop. However, we are not expecting a major drop. Potentially another 50 or so bps before the end of the year.

“On the variable side, this is where it’s even harder to guess,” he adds. “Rates went up as quickly as they did because consumer spending and inflation were out of control. And honestly, we are not out of the woods yet. CPI inflation is not true inflation, and while our leaders use that to determine our inflation, there are many lagging indicators that could still lead true inflation to increase again.”

Over the last six months, Abrams says, more buyers have been opting for shorter-term fixed-rate mortgages, believing that interest rates have peaked and should come down over the next two years. “So, we are seeing more and more twoand three-year fixed-rate mortgages. However, five-year fixed rates are still the most popular, as buyers consider them to be more ‘stable’ – especially first-time buyers.

There may be continued economic slowdown in 2024, setting the stage for a subsequent rebound in 2025 and 2026, with long-term Canadian GDP growth stabilizing about 1.8 per cent annually, according to TD Economics. This will be driven by solid population and labour force growth.

Business investment is expected to grow above trend over the forecast horizon. The need to build more homes will boost residential investment, and the opportunity to fast track the clean energy transition will cause a lift to investment in structures, machinery and equipment.

Consumer spending, TD says, will undergo a period of below trend growth through 2026, as Canadian households save more in the face of high mortgage debt.

Canada’s housing sector is impacted by conflicting forces, as population pressures require significant increases

“

” Since early fall there has been a series of government decisions that are effectively undermining the ability of the industry to add housing supply for future growth.

in building activity, but high costs and elevated lending rates, among other factors, simultaneously make homebuilding more challenging.

The good news is that all three levels of government are fully aware of these facts, and there have been policy changes to effect change –even if they are slow coming and not well coordinated.

Case in point, in a recent statement saying Ontario has “no coherent plan to increase housing supply,” the Building Industry and Land Development Association (BILD) slammed the province’s approval of City of Toronto Official Plan Amendment (OPA) 591. BILD calls it yet another example of how the province has abandoned its position of leadership and its electoral mandate to build housing in the GTA, in favour of political expediency.

“In order to distance itself from its own past actions, the provincial government has overcorrected on the housing file to secure its political future at the expense of all future homebuyers in the province,” says BILD President and CEO Dave Wilkes. “Since early fall there has been a series of government decisions that are effectively undermining the ability of the industry to add housing supply for future growth. The province is committing us all to unaffordable housing for generations to come.”

Toronto’s OPA 591 proposes new and updated policies related to employment, and employment conversions, including mixed use and land designated for homes. The city’s plans included 24 employment conversions that could accommodate 8,000 new housing units. There were 45 requests to the province through consultation to adjust the city’s OPA scope for potentially tens of thousands of new housing units (based on a BILD member assessment) with some employment space retention if those sites were made mixed use. As the province ignored those requests, these units will now not be built. In addition, based on BILD mapping, none of the city’s employment conversions are near transit, meaning the resulting housing will not be transit-supportive. Had the province moved forward with the expansion requests there would have been more housing and mixeduse opportunities built, much of it transit-supportive.

This is simply the latest in a growing list of decisions made by the province that are undermining the provision of housing and employment space supply in Ontario, BILD says. The decision in October 2023 to reverse expansions to urban boundaries in the Greater Golden Horseshoe (GGH) limits lands for future housing, meaning there will be a shortfall of 242,000 new housing units by 2051.

These decisions, BILD says, create unmanageable uncertainty for the housing industry – on top of existing challenges related to building costs and other issues.

“In the space of a few short weeks, in the middle of the most significant housing crisis this region has faced, this government has made decisions that effectively cancelled nearly 300,000 housing units in the Greater Toronto and Hamilton Area and the GGH,” Wilkes says. “Even more critical, these decisions are undermining the very investors that are needed to finance new housing developments and call into question the viability of projects that that would have added much needed housing supply. Cities and developers around the

world compete for this investment, and the actions of this government are threatening this lifeblood of new housing.”

BILD is calling on the province to urgently meet with all stakeholders and define an achievable and sustainable plan to build the housing that the region and province desperately needs to secure the future growth of our economy and communities.

If we could stage a roundtable of housing industry experts (which has already done, via the Housing Affordability Task Force), and the province would implement their recommendations (which it has not), what would we hear?

“Where do I start?” asks Hill of Ballanty Homes. “Development charges and fees are crushing firsttime homebuyers. Municipalities are using those fees to keep from raising property taxes and that puts an unfair burden on the new homeowner. We need a fair system that gives municipalities the revenue they legitimately need to deliver services to new neighbourhoods, but doesn’t push prices through the roof. Federal and provincial governments talk about affordability, but municipalities continue to raise the development charges and fees they charge.

“Then there’s the issue of red tape and approval times. Every month a project is delayed adds huge costs that end up in the price of a home. The province tries to set limits, and municipalities figure out ways around those limits and approval times become even longer.”

Without getting into the Greenbelt issue, specifically, land availability is a limiting factor. “We need communities across southern Ontario to make more land available in areas that are easily serviced and are naturally a part of existing neighbourhoods,” Hill adds. “That will protect our farmland and help smaller communities to become incrementally larger and more prosperous.

“We will need significantly improved infrastructure if we’re going to meet the needs of a million or more new residents. That means faster and better service on our GO Train system. And new lines that will open up areas that can become homes for commuters.”

Hill would drive home his advice to the province with some suggestions on housing programs. “In the past, governments both federal and provincial have instituted programs to help get young families into homeownership. Canada Mortgage and Housing Corp. was originally created to get the post-war Baby Boomers into homes, not just insuring banks against mortgage losses. The current Federal National Housing Strategy plans to create 160,000 new homes over the next decade. That’s an impossibly low number, and by helping homebuyers directly, they can do better.”

Richard Lyall, president of the Residential Construction Council of Ontario (RESCON), has similar advice for the province.

“We are in the middle of a perfect storm just now, as taxes, fees, levies and development charges on new housing are exorbitant,” he told HOMES Magazine . “We are taxing housing like alcohol, which doesn’t make sense. The cost of building materials remains high,

and we’ve been slow to modernize and improve the development approvals process.

“Scrap the sales tax for first-time buyers who are purchasing principal residences, and for those who are selling their existing homes and buying something new and smaller,” he says. The province should also allow RRSP funds to be used by first-time buyers who are purchasing principal residences and those who are downsizing. This would free up more housing for those looking to get into the market.

“We also need a modern, digitized development approvals process that would move construction of housing along more quickly,” he says. “The current process in Ontario has been marred by well-documented inefficiencies for decades and is slowing down the pace of new-home building.”

We must also look to offsite construction as a means of boosting housing supply. “The government should look at providing financial assistance and tax breaks to incentivize companies to build more modular housing manufacturing plants, and provide research and development funding so the industry can keep pace with new technology and building techniques.”

At the end of the day, all those fundamental challenges aside, Canadians remain confident in homeownership, and many are intent on buying in 2024.

Indeed, nearly one in five Canadians aged 18 and up say they probably will or may buy a home this year, and Canadians under 35 have the strongest intentions, according to a new Wahi survey of Angus Reid Forum members.

The ReMax 2024 Housing Market Outlook Report corroborates this sentiment, highlighting that Canadians’ outlook on homeownership remains positive, despite challenging market conditions in 2023.

The majority of Canadians (73 per cent) are confident that homeownership is the best investment, with an increase in buying activity forecast for this year.

“It’s been a challenging (2023) for Canadian homebuyers and sellers, who have been feeling the effects of a severe housing shortage and the high cost of living, but much like Canada’s housing market, Canadians have stayed resilient,” says Christopher Alexander, president, ReMax Canada. “Historically, real estate has given owners excellent returns and strong financial security – and that hasn’t changed. The slower market we’ve been experiencing across the country this fall could be an early indicator of an active 2024, as reflected in the modest price increase and sales outlook for next year, and the balancing of conditions in several regions across the country.”

And with all the talk of uncertainty last year, ReMax is forecasting healthy value appreciation in Ontario.

“The good news is that political leaders at all three levels of government have turned their attention to the housing crisis,” says Lyall. “However, they must continue to work with the residential construction industry on solutions.”

One benefit of expanding housing policy will be more diverse housing options that address the affordability challenge.

“This expansion in variety aims to accommodate a broader spectrum of preferences and budgets, offering more buyers the opportunity to find homes that align with their needs,” says Parker of Georgian Communities. And given new-home builders’ challenges in 2023, prospective buyers might also encounter more favourable purchasing conditions. “This could include lower or extended deposit requirements, flexible closing dates and other incentives designed to make homebuying more accessible,” says Parker. “While the real estate market is inherently subject to fluctuations, there is a prevailing sentiment of expected stability in both prices and interest rates.”

Says Hill, “When (rates) do come down, more buyers will be able to afford the type of home they’re looking for. Every level of government is now very aware of the need to create the right kind of housing policy to get people into homes.”

The provincial planning approvals system is in a state of disarray, following an announcement that the Ontario government would reverse changes made to a dozen municipal Official Plans. The provincial government has indicated that it wants to rebuild public trust in the provincial planning process. The West End Home Builders’ Association (WEHBA) supports a transparent land development process that provides certainty to municipalities, communities and the development industry. While the province takes the steps to achieve this, we urge all levels of government to not abandon efforts to address the housing crisis and take action to significantly increase housing supply.

Across southern Ontario, we are witnessing the impact the housing shortage has on people and communities. Young families are getting priced out and leaving larger cities for more affordable communities farther and farther away. There is a broad consensus that over the next ten years we will need to build at least 1.5 million more homes across Ontario to keep up with our growing population. That is a very big number. For perspective, we would need to double the current rate of construction to accommodate growth.

The original modifications made to a dozen municipal Official Plans by the provincial government were intended to uphold the

province’s own objective to increase housing supply, choice and achieve balanced growth. While some of the modifications may have been politically unpopular, they are absolutely necessary to accommodate population growth. The reality is that the changes needed to fix the housing crisis will be disruptive if they are to be transformative.

The Greater Golden Horseshoe is the fastest growing region in North America. Many municipal Official Plans were built on population forecasts generated prior to the federal government nearly doubling our annual population growth. Since those Official Plans were initially approved, many Ontario municipalities signed a Housing Pledge that reflects actual population growth and commits their support to significantly increasing housing construction. We need to provide residents with access to a variety of housing options that meet their needs.

Government, industry and the public must continue to support getting more “shovels in the ground” as urgently as possible. Municipal councils have a fresh opportunity to carefully review the provincial modifications and adopt key changes to provide enough homes for our growing population. Southern Ontario offers a vibrant and welcoming environment, and this is our opportunity to build a better future for everyone who lives here, and everyone who chooses to live here in future. It will require bold thinking and urgent action, but if we work together, we’ll make that future a reality, one home at a time.

Mike Collins-Williams, RPP, MCIP, is CEO West End Home Builders’ Association. westendhba.ca.

DEBBIE COSIC

A housing correction is taking place, and 2024 is sure to be a pivotal marker in what will become an even-stronger real estate market moving forward. The demand is only going to intensify with increased immigration, which also includes foreign students who may choose to live here once they’ve graduated. We ultimately benefit, but where is everyone going to live?

As of October 2023, the year-todate completion of new highrise homes was 18,808 units, according to a report by The Altus Greater Toronto Area High Rise Projects. This number is expected to drop due to the lack of sales volume in the last two years. Pre-construction sales, alone, have dropped by 70 per cent, which directly correlates with the amount of new housing scheduled to be built.

While there’s been a government push to increase rental housing, the rents are out of reach for so many, leaving individuals and families in a serious predicament when trying to come up with a living alternative. Those who are able to are offering to pay months in advance in order to stay competitive, rather than the conventional requirement of paying

the first and last months’ rent when signing a lease.

Savvy real estate investors tend to purchase real estate when the market is down. Playing the interest rate fluctuation game can be a bit of a gamble, but if you catch rates on the downswing, chances are you’ll be able to lock into a 10-year average on your mortgage at approximately four per cent.

We took a look at a detached home in Mississauga. The two scenarios will provide you with a better appreciation for how interest rates and price, are affected on this property.

Amortized over 30 years with a 20-per-cent down payment, this house was originally listed for $1.5 million before the interest rate increase. Paying full price, monthly mortgage payments for a five-year term at seven per cent would have been $7,903, at five per cent $6,404, and at four per cent $5,706.

After the interest rate increase, this home sold for $1.1 million. Again, with a 20-per-cent down payment, amortized over 30 years, monthly mortgage payments for a five-year fixed interest rate at seven per cent would be $5,796, at five per cent $4,696, and at four per cent $4,185.

As interest rates begin to decline, housing prices are expected to climb.

There are practical and impactful steps that the government should take to help people through the current interest rate predicament.

Number one is to increase the amortization period to 40 years, so that homeowners can better afford to carry the costs for their home. While some may say that this a short-term solution, the reality is that mortgage

payments have tripled in the last two years, and this step helps to protect people from losing their home.

Next, the government needs to escalate rezoning policies, so that those white-elephant homes in subdivisions can be repurposed to better service a larger population. Currently, Mississauga is tabling legislation to allow for a fourth dwelling on one property. Not only are these mega mansions unaffordable, but no wants to maintain them. Quality of life is far more important than the vastness of a floorplan. Any dwelling more than 4,000 sq. ft., that was built between 1980 and 2000, could be subdivided into duplexes or triplexes and the government should incentivize owners to convert their homes; whether it be adding a basement apartment or subdividing the home into a duplex, triplex or other design. And, one of my personal favourites, is to repurpose empty office spaces. Since the pandemic, our work/ life balance has changed. Vacant buildings are sitting on some of the hottest real estate in the city, and ought to be converted into condos or rental units.

We’re only limited by our imagination, and there are so many proactive opportunities. This year, 2024, is the time for a new outlook on life – and on housing.

Debbie Cosic is CEO and founder of In2ition Realty. She has overseen the sale of more than $15 billion worth of real estate. With Debbie at its helm, In2ition has become one of the fastest-growing and most innovative new home and condo sales companies. in2ition.ca

The Canadian proverb “there’s no place like home” is now more meaningful than ever before. Considering that phrase in the practical sense, it has long been known that owning real estate is one of the most lucrative ways to accumulate household wealth. In fact, a home or condominium is the single largest household investment for most people. Whether it is a financial or lifestyle investment – or both – a property is a tangible asset that is much more easily understood than stocks and bonds.

Just before the pandemic, a U.S. survey showed that homeowners had on average 40 per cent more household wealth than renters. Homeownership is the dream of most Canadians and immigrants to our country for financial investment potential, but for much more. Often overlooked is the psychological aspect of owning.

In 2022, a Canadian study resulted in 75 per cent of participants stating that their home has become even more important to them because of the COVID pandemic. That is easy to understand, as the pandemic forced most of us to rely on our homes more than before COVID hit. During those difficult years, our homes were where most of us lived, played and worked. Before and since then, the home has been a gathering place for family and friends – where lifelong memories are made and celebrated.

Owning a house or condominium brings with it a sense of permanency, of belonging to a community.

Many call it “putting down roots,” which may be a cliche, but it has an underlying truth to it. Recent surveys also show that most homeowners consider comfort and safety in their homes and communities extremely important. This fact shines a light on a family’s surroundings being considered “home” as well as their house or condo. That is why so many residential developers spend time and effort into ensuring their homes and condominiums are situated in areas where people will want to live. It is also why so many immigrants flock to Canada for the relatively safe lifestyle we enjoy.

Over the past handful of years at Baker, we have found that younger buyers are more educated than ever on the ins and outs of purchasing and owning real estate. Economic challenges such as rising prices and interest rates have kept some from signing on the dotted line, but in the end, people are still finding ways to live out their dream of homeownership. Whether it is

through co-owning, cashing in RRSPs, or accepting help from the bank of mom and pop, we see a new generation jumping onto the homebuying wagon. This is a smart move both financially and psychologically.

As challenging as the real estate market has become since the pandemic, people still need homes to fulfill their Canadian dream. I wish you a wonderful, healthy, happy new year. And remember that when it comes to wellbeing and happiness, there really is no place like home.

Barbara Lawlor is CEO of Baker Real Estate Inc. A member of the Baker team since 1993, she oversees the marketing and sales of new home and condominium developments in the GTA, Vancouver, Calgary and Montreal, and internationally in Shanghai. baker-re.com

+MORE CONTENT ONLINE nexthome.ca

JESSE ABRAMS

A new year is almost upon us, and many Canadians likely want to add homeownership to their goals for the new year. However, 2024 poses some unique challenges compared to previous years with record high levels of inflation and interest rates. Despite some of these hurdles, the good news is that homeownership is a goal that’s still achievable. There are simply some additional considerations that need to be top of mind to ensure you go into this prepared.

In today’s market where inflation and interest rates are high, our expenses on daily essentials such as groceries and fuel have gone up significantly. As a result, this has left many Canadians relying on their credit cards or tapping into savings to get by. If you want to purchase a home in 2024, your first step is a financial health check. This involves a thorough review of your savings, outstanding debts, and credit cards to determine your financial readiness. This will give you insight into whether you have enough money for a down payment and if your income can comfortably cover your monthly financial expenses.

To take things one step further, it’s worthwhile to get a credit check and understand where your credit score stands as this also plays a role in your mortgage application. Lenders increasingly focus on financial stability, so ensuring that your finances are in tip-top shape will make this process that much easier.

Once you confirm that your finances are in good standing, getting preapproved for a mortgage is a wise next step. Pre-approval provides insight into what banks, lenders or credit unions are willing to lend and how much you can borrow, helping you set a defined budget for your home search. This ensures you’re shopping in neighbourhoods you can afford, saving you plenty of time and heartache over those homes outside of your price range. Pre-approval also removes the stress of having to finance your home at the last minute and minimizes the risk of the deal falling through altogether – making things a lot less stressful.

When it comes to getting a mortgage, many people’s default choice is to go directly to their home bank. However, this isn’t always the best approach, as there are numerous other lenders, including monoline lenders and credit unions, that offer more competitive and flexible mortgage products with better rates and features. Our team at Homewise prides itself on exploring the marketplace for a variety of mortgage options, spanning Prime A, B and private lenders, and presenting those options to clients so they can make an informed decision. With interest rates at their peak, choosing the right mortgage type is a crucial decision. It’s important to weigh the pros and cons of fixed- versus variable-rate mortgages. A fixed-rate might seem more appealing because there is predictability in your payments, but variable rates could offer savings should interest rates go down. If

you’re unsure which way to go, this brings us to the next essential step: consulting the experts.

Given the current state of the market, you’ll want to consult a mortgage and real estate professional and get educated on current trends including interest rates, housing prices and inventory levels in your desired neighbourhood. Deferring to experts will help guide you toward decisionmaking that’s tailored to your unique financial circumstances, versus a one-size-fits all approach. Our team at Homewise and Homewise Real Estate works together with our clients to provide a holistic experience that walks them through the home buying process from start to finish.

by PAUL BARON AND JOHN DIMICHELE

In the face of Toronto’s growing housing affordability crisis, families are depending on evlected leaders focused on policy solutions that work. For City Council, that means shifting away from tinkering with housing taxes, which are not a sustainable revenue option, and instead must focus on boosting housing supply, improving

affordability and making it easier to afford a home in the city.

Since 2017, governments in Canada have been introducing measures on housing to curb demand. In Toronto, Council tripled the home vacancy tax and increased the Toronto Municipal

Land Transfer Tax (MLTT) for homes priced at $3 million or more. Fees such as the MLTT should not be relied upon as a major source of revenue for the City. Raising property taxes as a form of revenue can be justified, and the Toronto Regional Real Estate Board (TRREB) supports the city’s decision to develop a multi-year approach when

“

” Ambitious policy change is necessary to allow the conditions for cities to reach the housing supply targets required to restore housing affordability.

Toronto and surrounding municipalities should focus on supporting increasing density around transit stations and building more “missing middle” housing. The Expanding Housing Options in Neighbourhoods (EHON) initiative is one such opportunity to prove Council has the willingness to change existing policy tools, like showing greater ambition on “as of right” zoning on mid-sized apartment buildings on major neighbourhood streets, to encourage more housing to be built.

we are calling on the Office of the Superintendent of Financial Institutions (OSFI) to do the same with uninsured mortgage renewals which represent the majority of mortgages in Canada. This could allow homeowners access to better terms, preserving affordability. As it stands, the system disincentivizes competition and traps borrowers at high interest rates with their current lenders.

recommending rates. Toronto needs to bring property taxes more in line with surrounding GTA municipalities.

City staff is reviewing the feasibility of an increase to the land transfer tax (LTT) for buyers of residential resale property where the purchaser owns more than one property. Smallscale property owners have been responsible for bringing rental units onto the market in the last couple of decades. The additional LTT on these properties will deter those purchases or simply lead to higher rents, worsening the unaffordability crisis in the rental market.

Toronto must do more to make housing affordable for those looking to call our city home. Given the current year-to-date average price of $1.2 million for all housing types and $750,000 for condos in Toronto, the effectiveness of the MLTT rebate for first-time homebuyers, which exempted them up to a $400,000 home, has become insufficient. Most first-time buyers pay the upfront MLTT of $20,000 on the average priced home. TRREB is calling on the City to increase the current MLTT rebate threshold from $400,000 to $750,000 to match the average price of a condo in the city.

The City should permit more storeys to proposed developments and have the additional units earmarked as affordable units for low and middle-income households. This will help the City meet its pledge to build 65,000 affordable rental units.

Working with innovative building solutions, such as modular and pre-fabricated homes, creates the potential to drastically reduce construction costs and time, and allow cities like Toronto to scale up housing projects in the numbers we need.

Earlier this fall, TRREB Members, in partnership with the Canadian Real Estate Association, met with federal MPs to stress critical policy directions that all levels of government can work towards together. There is an opportunity for the federal government and the province of Ontario to make use of their respective infrastructure banks to invest directly in building the housing we need. They must also work through immigration and education to address the skilled labour shortage in construction.

TRREB applauds the federal government for recently removing the stress test requirements for insured mortgage renewals when borrowers switch lenders, and

Toronto is the largest social housing provider in Canada, yet it is facing additional pressures on its shelter system, partially due to the increased proportion of refugees and asylum seekers. About $1.1 billion of Toronto’s tax base is invested in areas of shared jurisdiction, such as housing, health and social services. The City and the province should continue the close collaboration that the “new deal” working group has allowed and ensure the longer-term sustainability of Toronto’s finances continue to be addressed through the planned Toronto-Ontario targeted review in the coming years.

The federal government must meet the requests from the “new deal” and match the provincial funding for Toronto that are conditional on Ottawa’s support. If Toronto can exceed its housing targets by 25 per cent, an additional $340 million has been promised to the City by the province.

Ambitious policy change is necessary to allow the conditions for cities to reach the housing supply targets required to restore housing affordability.

The Association of Registered Interior Designers of Ontario (ARIDO) is your connection to qualified, experienced, and innovative Registered Interior Designers.

ARIDO protects Ontarians to ensure every person using the title ‘Interior Designer’ is qualified. In accordance with the Ontario Titles Act, an individual cannot use the title ‘Interior Designer’ unless they are a Registered member with ARIDO.

Why should I hire a Registered Interior Designer?

Registered Interior Designers have completed the necessary technical education and passed the required exams to meet ARIDO’s rigorous standards for membership.

Once qualified, Registered Interior Designers must keep their knowledge updated through professional development on topics including the Ontario Building Code, accessibility, sustainability, building and mechanical systems, inclusivity, etc.

How do Registered Interior Designers become qualified?

They must graduate from an accredited 4-year Bachelor of Interior Design program and complete an extensive supervised work experience program under a qualified practitioner. Finally, they pass a rigorous 3-part practical exam which includes building code knowledge.

arido.ca Toll-free 800.334.1180

1 2 3 4 ARIDO’s

Meet with client, establish project goals, client’s wants, needs, and budget. Complete a site survey.

Prepare a variety of project documents, which may include construction drawings and/or product selections. Apply for building permits, as required.

Provide project oversight, including coordination of sub-contractors, consultants, suppliers, and vendors. Document progress to ensure compliance with design intent and project budget. Address issues as they arise.

Develop detailed design with images, sketches, and 3D views. Propose materials, lighting, furniture, and fixtures. Present concept ideas, preliminary drawings, and images to client. IT MATTERS. ASK YOUR INTERIOR DESIGNER IF THEY ARE A REGISTERED MEMBER OF ARIDO. LEARN MORE AT BLOGARIDO.CA

Download your copy now. Don’t know where to start with your project? Our Consumer Guide can help.

Not sure what you don’t know? Let a Registered Interior Designer help you ask and answer the important questions.

THESE BUILDERS ARE PROUD OF THEIR COMMITMENT TO EXCELLENT CUSTOMER SERVICE AND CREATING GREAT COMMUNITIES.

Fieldgate Homes has been shaping the southern Ontario landscape for more than 65 years, with award-winning master-planned communities and residences families have cherished for generations. Superior construction, innovative designs, unmatched attention to detail and attentive customer service are all hallmarks of the company’s excellence. Every home is designed to reflect the contemporary needs and wants of the homebuyer through consistent community engagement –and the assurance that when you own a Fieldgate home, you are family.

Fieldgate Homes is now open for purchasing by virtual sales appointments across the GTA. You can connect by phone, video chat or email for a secure and convenient homebuying experience. Sales teams are waiting to help you find your perfect Fieldgate home. Explore these featured communities and contact the company today.

Final release – 36- and 40-ft. singles

The final release at Emerald Crossing is now open, where you can discover a beautiful country landscape surrounded by every modern convenience imaginable in Shelburne’s most anticipated new

home community. Enjoy a collection of 36- and 40-ft. singles available now just minutes from big brand outlets, remarkable restaurants, breathtaking greenspaces, ski hills, golf courses and much more. Shelburne has been Canada’s second-fastest growing municipality, so there’s no better time to get in on its best new home opportunity. Register now at fieldgatehomes.com.

Final release – urban townhomes

The final release of stunning urban townhomes at the aTowns Park Collection in Ajax is now open. At Bayly Street and Salem Road, discover new family-sized residences backing onto open greenspace, a series of parkettes, sports court and more, all connected by winding walking trails weaved throughout. Better still, live surrounded by modern amenities and mere moments to Lake Ontario. Get the most out of Ajax’s bustling downtown area and enjoy great shopping, tasteful dining, convenient GO Transit, easy access to Hwy. 401 and so much more all nearby. Register now at fieldgatehomes.com.

Coming soon – freehold townhomes, semis, 30- and 36-ft. singles

Enter a serene natural landscape that merges with the convenience of big city amenities at Pickering’s awaited Seaton community. Live at the nexus of classic and contemporary with a remarkable collection of freehold townhomes, semis, 30- and 36-ft. singles in a skillfully designed community setting. This new community truly has something for everyone with Pickering Town Centre, beautiful Lake Ontario, shopping, greenspaces, restaurants, Toronto’s eastern border and much more just minutes away. Be first to own by registering now at fieldgatehomes.com.

Coming soon – freehold townhomes and 30-, 35-, 36- and 43-ft. singles

The newest sprawling masterplanned community carefully designed to reimagine Pickering’s landscape. This landmark community boasts a spectacular array of distinctive freehold townhomes and 30-, 35-, 36- and 43-ft. singles mere moments from downtown Pickering’s finest modern amenities and protected greenspaces. Quick and easy access to crucial transit options, Hwys. 407, 412 and 401 connect you to the whole of Durham and Toronto. Register now at fieldgatehomes.com.

Coming soon – freehold townhomes and singles

Experience a master-planned community that surrounds you with Brampton’s finest at The Crescents. A collection of 30-, 38- and 45-ft. singles and freehold townhomes – on mostly crescent streets – just steps from Conservation Drive Park and Heart Lake Conservation Park. Immerse yourself in the city’s unmatched urban amenities, schools and services. Forge new connections with the convenience of Ontario’s fastest transit network, or stroll through the incredible greenspace with woodlands, parks and trails. Find the perfect place for your growing family in the city, against a vibrant backdrop of culture and energy. Register now at fieldgatehomes.com.

Coming soon – executive 30-, 36and 43-ft. detached singles