Q: My father passed away two years ago and my mother is getting to the point where she needs to move to a managed care facility. We have all agreed that it would be better to sell her house than try to hang on to it and worry about tenants and upkeep. We contacted a Realtor who agreed to list the house. She put a sign on the front and listed it in the Multiple Listing Service. We just got a call from her indicating that we need to clean up the title. Apparently my father is still on title to the property and we won’t be able to sell it without his signature. What do we do right now?

A: Over the past several weeks I’ve been getting an incredibly high volume of ques tions about relatives going to live in extended care facilities and trying to figure out what to do with their homes.

But to answer your question; it depends upon how title is held. Generally, there are two ways a husband and wife hold title to property in California. Community property has, historically, been the way title is held.

If the title company is telling you your father and mother held title as community property you will need to execute a spousal property petition. This can involve a court appearance and hearing before a judge.

The problem is the time it takes.

Depending upon what county can take from a couple of weeks

If you’re dealing with community property you should find an estate attorney to help you with the process. The cost should be nominal, as far as legal services

It is almost as likely that your mom and dad held the property

holding title was very popular for about 20 years because of certain tax and probate issues.

Dealing with the house would be a little simpler.

You need to execute a document called an Affidavit of Death of Joint Tenant and record it at your county’s recorders office. You’ll need a copy of the death certificate.

The other possible complications involve various types of estate planning documents.

Sometimes people have created for themselves any number of complicated trusts

Editor’s note: Solano Real Estate Transactions were not available this week. See Jones, Page 4

This quarter-point rate cut will make it cheaper for banks to borrow, which can lead to lower rates for consumers.

Thirty-year fixed mortgage rates usually spike up a little bit before and after this overnight lending rate is cut because cuts are usually priced into the mortgage market. So when the cut comes, the yield on the 10-year treasury will occasionally go up like it has this past 10 days. Fixed mortgage rates follow the longer end of the yield curve.

The good news for the stock, real estate and bond market is that the yield curve has normalized after being terribly inverted from July 22 to December 24. Today, the 1-year T-bill is 3.5%, the 2-year is 3.61%, the 10-year is 4.1% and the 30-year is 4.81%.

HELOC rates will go down next month because the prime rate will fall from 7% today to 6.75%. Prime is what HELOC rates are based on, and historically this prime rate is 3% over the Fed’s overnight lending rate, which fell to 3.75% this week.

Credit card rates should drop to an average of under 23%, which is still high enough to keep millions of Americans living paycheck to paycheck and unable to buy a house. I cannot emphasize enough that parents and grandparents should teach their kids to do whatever it takes to avoid borrowing at 23%.

On a positive note, mortgage rates are nearly 1% lower

See Porter, Page 4

Before all the Christmas celebrations officially commence, now is the perfect moment to set aside some time for some serious decluttering.

Getting the house clean, organized and festive can feel like an overwhelming task, but the snowflake rule offers a simple way to make it more manageable.

We got in touch with professional organizer, Lesley Spellman, who hosts “The Declutter Hub” podcast with Ingrid Jansen, who explained exactly what this tidying trend entails and how it can bring a sense of much-needed calm amid all the Christmas chaos.

Just as no two snowflakes are the same, this decluttering trend encourages you to eliminate any duplicates in your home to create a more streamlined space.

“The idea is that you go through your stuff in a really simple way and make choices based on duplicates that you have in your home,” explains Spellman. “You look at where you’ve got duplicates, and then determine which one is the most useful or the most sentimental to you.

“This rule takes decluttering right back down to a simple ‘choose this one or that’ kind of idea and encourages you to not have anything additional to what you need in your home.”

It helps simplify the often daunting prospect of decluttering.

“A very simple method like this is perfect for people who have just found themselves in a position where they’ve got a little

bit too much stuff and want to do a clear out ready for Christmas,” says Spellman. “The whole premise of the snowflake method is that it’s quick and speedy and you can get through lots of different rooms before Christmas.”

Why is the lead up to Christmas the perfect time to use this method?

• Helps creates space

influx of stuff that tends to accumulate during all the festivities.

“It obviously depends on your individual circumstances, but if you’ve got children then there is usually an exponentially crazy influx of stuff coming into the house around Christmas,” says Spellman. “There’s only so much space in your house, so clearing the decks a little bit allows space for these things to come in.”

The snowflake method may also lead to a pile of items that are in a good enough condition to take to the charity shop.

It’s a great way to prepare your house before the inevitable

• Provides an opportunity to take extra things to a charity shop

“It’s an absolutely brilliant time of year to take things like partywear, brand-new items and Christmas decorations to a charity shop,” says Spellman. “It’s a good thing to do this side of Christmas because a lot of these things will be less useful to charity shops afterward.”

Getting the house clean, organized and festive can feel like an overwhelming task, but the snowflake rule offers a simple way to make it more manageable. See Declutter, Page 4

Whether you’re shivering through winter, sweating through summer or enjoying mild weather yearround, your home’s energy efficiency makes a big difference in both comfort and cost.

While major upgrades like solar panels and geothermal systems can make a huge impact, small everyday actions often bring surprising results and prevent your hard-won warm air from slipping away.

tenance task of all: changing the air filter. A $10 filter can make or break your system’s efficiency. Running your HVAC without changing filters is like driving your car without changing the oil; sooner or later, it will catch up with you. When it clogs with dust, your system must push harder to circulate air, driving up both wear and energy costs. Replacing it every one to three months is an easy way to save money.

ADOBE STOCK

Don’t forget the simplest maintenance task of all: changing the air filter. A $10 filter can make or break your system’s efficiency.

From Page 2

that specify how property is to be treated.

If your parents have a trust, and the house is listed as a trust asset, you should, at a minimum, have an attorney review the trust documents so you can be sure the transfer takes place in accordance with the documents.

If you don’t take any steps to transfer title to your mom, or you mom’s trust as the case may be, you are likely to get all the way to the close of escrow and then find out that you can’t get title insurance and therefore can’t sell the property.

By that time, you’ll be breaching the contract you have with the buyer and your mother will find herself in an expensive, and ultimately avoidable, lawsuit.

This is the single most important thing you can do to keep energy costs in check. Your heating and air-conditioning system works hard year-round, and it’s full of moving parts that need attention. A professional should inspect it twice a year (typically in spring and fall) to catch small issues before they turn into expensive repairs.

And don’t forget the simplest main-

From Page 3

• Helps you feel calmer

“There’s just this feeling of calm that comes with having less,” highlights Spellman. “Having control of your home and that feeling that you get from decluttering and organising your home just makes you feel a little bit calmer.”

• Provides the opportunity to teach your kids a lesson

“If you’ve got children, I think it’s really important to teach them that you can’t just ask for loads more stuff from Santa or mum and dad without letting go of some of the stuff that you’ve already got,” says Spellman. “I think teaching those lessons early

Once your home reaches a comfortable temperature, you want to keep it that way. Air leaks can undo all your HVAC’s hard work. Take a few minutes every season to inspect doors, windows and the foundation for gaps. Seal them with caulk or weatherstripping. It’s not glamorous work, but it’s among the most cost-effective energy fixes you can do.

You don’t have to live at a constant 70 degrees to stay comfortable. Adjusting your thermostat by just a few degrees at night or while you’re out can make a noticeable difference. A programmable thermostat lets you schedule temperature changes

See Hicks, Page 8

If it were me, I would instruct your Realtor to take the home off of the market until you can get the title straight.

Then sit down with your Realtor and go over the title company’s preliminary title report. Your agent will be able to help you figure out how title to the property is held. With that information you should have an idea of how to proceed.

Tim Jones is a real estate attorney in Fairfield. If you have any real estate questions you would like to have answered in this column, you can send an email to AllThingsRealEstate@ TJones-Law.com.

on is a really good thing.

• Can help you uncover things

“By following the snowflake method you will probably uncover a lot of stuff that you completely forgot about which might stop you from buying new things, so will therefore help you save money,” says Spellman. “Through this process you might also uncover things like Christmas cards, gift bags and wrapping paper that you can use up rather than buying new.”

• Gives you a kickstart on new year organizing

“So many people wait until January, which is obviously a big time for decluttering, but it’s brilliant to start now and get ahead of the game,” says Spellman. “Investing a little bit of time in declut-

tering now will help you feel so much calmer and more accomplished.”

Here are some helpful tips on how to get started…

“It’s really important to understand what the big picture goal is,” says Spellman. “Ask yourself, why do you want to do it? Is it for the children or have you got guests coming over?

“Think about what’s important to you and what’s going to help turn the dial on a little bit more.”

“Decluttering the communal rooms is probably going

to be the priority,” says Spellman. “The kitchen is a great place to start as it’s the hub of the home and it’s important to have that as a space that you are proud of and feel comfortable in.”

“If you start a massive declutter which takes you from 8 am on Saturday morning to 7 pm at night, then you are going to be completely worn out and won’t want to do any more the following day,” says Spellman. “But if you instead break it down over a few different weekends and start with the kitchen and break it down cupboard by cupboard that will help you manage your own energy levels.”

From Page 3

than they were a year ago, and the number of homes for sale in Solano and Yolo counties has doubled in these past 12 months.

Now is the time to get serious about moving up, down or out. Call a local Realtor and mortgage professional to take a look at your options. If you already own a home and have too much credit card and personal loan debt, you should refinance or get a HELOC to consolidate into a much lower payment.

Jim Porter, NMLS No. 276412, is the branch manager and senior loan adviser of Solano Mortgage, NMLS No. 1515497, a division of American Pacific Mortgage Corporation, NMLS No. 1850, licensed in California by the Department of Financial Protection and Innovation under the CRMLA / Equal Housing Opportunity. Jim can be reached at 707-449-4777.

LINDA BELL BANKRATE.COM

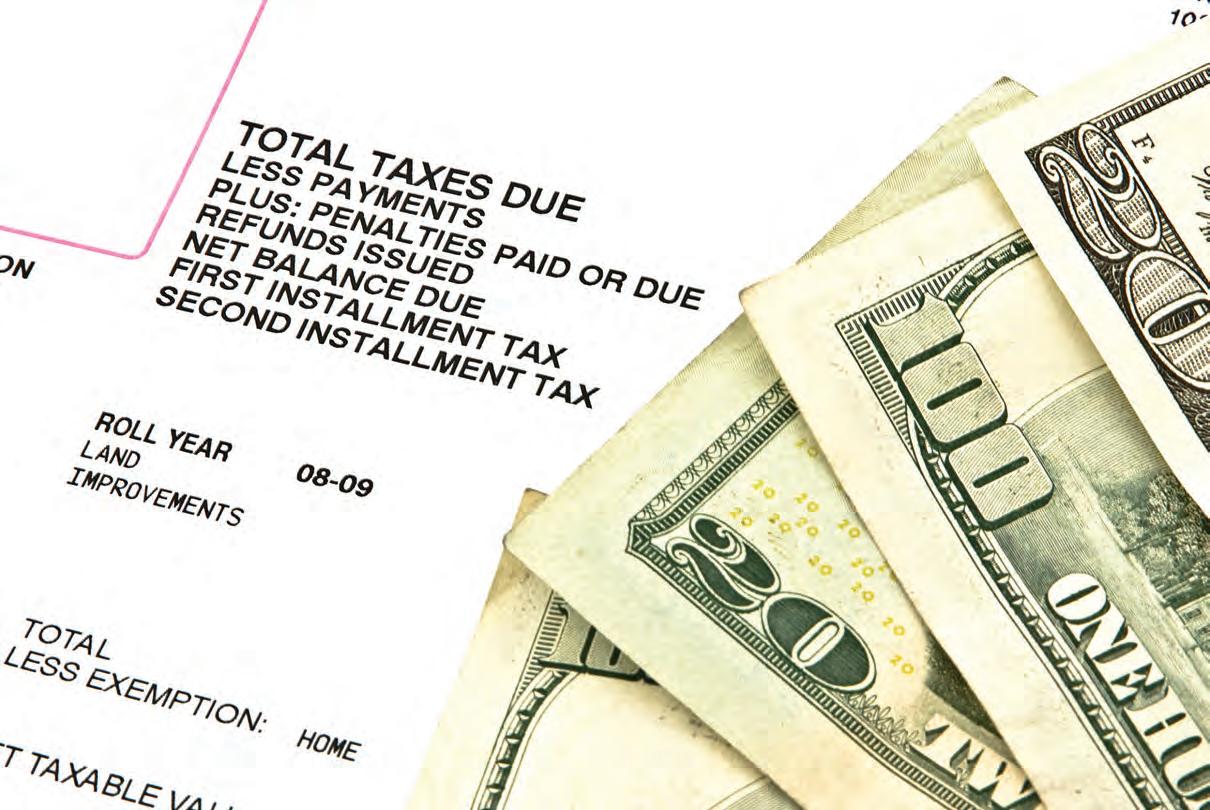

be higher than it needs to be

y property taxes have ballooned 134% over my 20 years of homeownership. It seems like every year I grumble about another increase, pay the bill and move on. Reacent data, however, has me rethinking my approach –it turns out I might be leaving serious money on the table.

More than 40% of properties in the U.S. could save $100 or more – and sometimes much more – with a property tax appeal, according to a Realtor.com analysis. For millions of homeowners, the savings could add up to about $539 annually, and that’s just for a median property. You could save more (or less) depending on where you live.

“Somewhere between 3% and 5% of homeowners actually file an appeal, and of those, between 30% and 50% win some kind of reduction,” says Pete Sepp, president of the National Taxpayers Union, a nonprofit, non-partisan taxpayer advocacy organization based in Washington, D.C. In other words, there’s a real chance to save money.

Take Tomball, Texas-based homeowner Russell Lindley, who has appealed property taxes for 10 of the 11 homes he’s owned with his wife. He says he’s succeeded more than half of the time.

“Why would you allow them to assess a value on your house and not protest to try to save money?” he asks. “The largest property tax reduction I received was approximately

More than 40% of properties in the U.S. could save $100 or more with a property tax appeal, according to a Realtor.com analysis.

may be able to call them and say

estimates or contractor quotes to show your home’s true condition.

reporters like me can miss opportunities to save money, and now I’m on a mission to help you avoid my mistake. Let’s break down what happens before, during and after the appeals process so you have the best shot at lowering your tax bill.

Before we dive into property tax appeals, let’s step back and pull back the curtain on what went into determining the amount on that dreaded tax bill to begin with.

While every state, county or

Pace, co-founder of Ownwell, a company that helps homeowners appeal their property taxes.

“It works much of the time, but it inevitably produces misdiagnoses. That means the model often misses unique property traits, interior condition or hyper-local market nuances.”

Armed with that data, the assessor sets your home’s assessed value, multiplies it by the local tax rate (set by your city, county, or school district), and voilà, that’s your property tax bill.

“It’s not necessarily evil intent or anything like that,” Sepp says. “It’s just that there

to build a successful case? Sepp advises homeowners to begin with evidence-based homework, focusing on two key aspects: the accuracy and comparability of the property’s assessment.

“Accuracy has to do with simple errors the assessor makes,” Sepp says. “There are only two bathrooms in your house, not three. It’s a one-car garage, not a two-car garage. Sometimes you can bring those up with the assessor without

outdated 1980s kitchen, probably won’t move the needle because they are subjective. But clear, tangible issues, like multiple leaks in your roof? Absolutely.

The next case builder is researching the comparability of the assessment, which involves looking at recent sales of similar homes in your neighborhood.

“Look up the values, not only the sale values, but the values the assessor has for similarly situated properties

From Page 6

I am hearing from gardeners in the South that they can’t wait to try it with Supertunia Mini Vista Indigo. That could break my Nikon camera! (Just kidding.)

I wish I had tried that, but I did go blue true. I used Supertunia Vista Yellow and Superbells Grape Punch calibrachoa. This calibrachoa has the largest flowers and I see blue and purple when I look at it.

I used a lot of Supertunia Mini Vista Yellow petunias in combination pots with Snow Princess sweet alyssum. These combos are wonderful and like a soft triadic or threepart harmony.

James Winter and his Eden Estate Management Team put

some in a copper window box in Columbus, Georgia. The partners in the box were Superbena Violet Ice verbena, Laguna Azure lobelia, ColorBlaze Mini Me Chartreuse coleus and Graceful Grasses Queen Tut papyrus grass.

One container really stood out in its surroundings, and I admit it was quite by accident. The pot had a backdrop of Double Play Candy Corn spirea, which showed golden fall leaf color. Then to add a touch of gaudy there was a turquoise blue container in the distance.

All my containers are still blooming as I write this. We will be flirting with a freeze in a few days but I’m going with the forecast that says no.

The Supertunia Mini Vista petunias are game changers in containers. Choose a good lightweight potting mix and containers that drain well. Give

them plenty of sun and food. If you are growing through the winter where you live, use a water-soluble mix every two to three weeks. These nutrients are more readily available to the plant. That is what I use in the warm season too although I keep controlled release granules on hand if needed.

There are 11 color variations in the Supertunia Mini Vista series, and this spring Mini Vista Pink Cloud will disappear off the shelves, so don’t dawdle when shopping.

Norman Winter is a horticulturist, garden speaker and author of “Captivating Combinations: Color and Style in the Garden.”

Follow him on Facebook @ NormanWinterTheGardenGuy. He receives complimentary plants to review from the companies he covers.

ABOVE:

and

LEFT: James Winter and the Eden Estate Management Team designed this copper window box planting using Supertunia Mini Vista Pink Cloud petunias, Superbena Violet Ice verbena, Laguna Azure lobelia, ColorBlaze Mini Me Chartreuse coleus and Graceful Grasses Queen Tut papyrus.

From Page 5

in your neighborhood,” says Sepp. “What are five, better yet, 10 properties in your neighborhood that were assessed? ‘What were their levels on a per square foot basis, and do they compare with your property’s assessment on a per square foot basis?’

But here’s where things can get a little tricky. Some areas use a fractional assessment system, meaning your property isn’t taxed on its full market value. Instead, they tax a percentage of your property’s market value, like 90%, for example. Because of the methods used, it can be harder to compare your property’s assessed value to recent home sales. Another important consideration: In most jurisdictions, the sale price of your home isn’t considered the same as the assessed value, and those numbers can be wildly different.

Chang Fu learned this lesson firsthand. When Fu and his wife lived in Seattle, he successfully appealed his property taxes in 2019 by using his home’s sale price as evidence, saving $1,000 a year. When he moved to Austin, Texas, he tried the same approach when appealing his property taxes in 2025 and was denied. Now in arbitration, Fu is confident he can present a stronger case by comparing his property’s assessment to that of similar homes as well as its current market value.

“I literally have six neighbors in my cul-de-sac and my six neighbors all have lower [home] values,” says Fu. “I’m hoping to get a fair arbitration and, ideally, a positive outcome so I can pay similar property taxes as my neighbors.”

The success or failure of your appeal could have a lot to do with where you live. For example, in Indiana, if the

assessment has increased by more than 5%, it’s up to the assessor to prove their findings are correct. As Pace notes, homeowners in assessor-burden-of-proof states like Indiana tend to have much higher appeal success rates. While that might sound like an advantage, it doesn’t mean homeowners don’t have to do any research.

“Even if the assessor has the burden of proof that, that doesn’t mean you have the ability to say, ‘Well, I think [my house] should be valued at $1,’” says Sepp. “You have to have some kind of basis to say, ‘He [the assessor] says he’s proven his case. Here’s why I disagree.’”

The not-so-good news? Pace says that in approximately 80% of geographies, the responsibility for proving the case flips to property owners or the tax agent, which is the company helping the homeowner with the appeal. This can make it harder for homeowners to win, and as Pace explains, “This is a higher burden than convicting someone of a crime. It’s not [just] beyond a reasonable doubt. You have to completely show that they are wrong.”

While it’s not impossible to win in these cases, research and preparation are critical.

The idea of appealing your property taxes can sound daunting, but Sepp says it’s not as scary as it seems.

“It’s not as if you’re going to be put before a tribunal and interrogated about all of the features of your house,” he says. “Most assessment appeals processes are set up to be no more difficult than traffic court. If you feel you got a parking ticket that you didn’t deserve, you gather evidence to show why you feel that way, and you present it to a panel that’s hearing a couple of dozen of these things a day. You’re not on trial. You’re simply being asked to present evidence of why you have the opinion you do.”

The process of appealing has also become easier with services that provide comparable property assessments and online access to records. “Even in the assessor’s office itself, there are AI tools that can probably help you with preparing an appeal,” says Sepp. “And in some jurisdictions, which occurred a lot during Covid appeals, hearings are often held online, or you can file an appeal by mail.”

After the appeal, you’ll receive a written notice of the decision and the reason behind it. If you disagree, you can often appeal to a higher board. The total time frame varies depending on where you live and the complexity of the case.

Nothing says you can’t DIY your property tax appeal. Many homeowners, like Fu, go that route. “If you’re comfortable doing it yourself, go do it,” he says. Keep in mind that you will likely have to pay a small appeal fee, which can vary depending on where you live or the value of the property.

But if you’d rather not go it alone, there are companies, like Ownwell, that offer professional assistance, charging a fee only if they successfully reduce your tax bill. “You hire a doctor to solve your problems, why not hire an expert?” says Lindley, who used property tax negotiation services for most of his property tax appeals. “You don’t pay money unless they save you money. It always seemed like a no-brainer to me.”

If your situation is complicated or you have a high-value property, Amy Loftsgordon, legal editor at legal resource Nolo, says it might make sense to hire an attorney or a reputable tax reassessment company. However, she cautions homeowners against using reassessment companies that try to solicit business from you.

“They send out notices that look something like a tax bill and say you might be entitled

to reduce taxes,” says Loftsgordon. “This is without making it very clear that they’re a profit company and that [a property tax appeal] is something that you can indeed do on your own. Typically, a reputable company isn’t going to send you tricky advertising or contact you.”

Once you get that property tax assessment notice in the mail, don’t wait to act on it. While the proposed assessments may take effect in the upcoming fiscal year or the latter half of the current one, it doesn’t mean you have plenty of time to respond.

“Typically, when you get the thing in the mail, you have between 30 and 60 days to either give notice or file your appeal,” says Sepp. “If you have a 30-day deadline to file an appeal, it may be a very simple matter of filling out a form that says, ‘I disagree with my assessment because it’s overvalued compared to other properties.’ You may not have to submit all of your evidence at that point. You just have to put in the appeal, then your hearing date will be scheduled. It then triggers another two weeks or so for you to file all of your stuff online or through the mail.”

Appealing your property taxes might sound tedious, but it’s a commonly overlooked way to save money as a homeowner. “Making the assumption that the government has done its homework would be a mistake,” Sepp says.

I will be tackling my own appeal next year, so stay tuned for that. The key takeaway? Don’t assume your bill is set in stone. Taking the time to double-check your property assessment and file an appeal when the numbers don’t add up can translate into hundreds, even thousands, of dollars in savings every year. Your wallet will thank you.

From Page 4

automatically. Smart thermostats take this further by learning your habits and adjusting on the fly. The result: comfort when you need it, savings when you don’t.

If your bills seem out of control and you’re not sure why, an energy audit can pinpoint the problem. A certified energy auditor will inspect your home’s insulation, HVAC system and airflow, using diagnostic tools like infrared cameras or blower door tests to find hidden inefficiencies. Expect to pay between $200 and $650 for a full audit, which typically takes most of a day. The result is a detailed report explaining what’s working, what isn’t and how to fix it. It’s a professional-grade roadmap to lower costs and greater comfort.

Windows account for a surprising amount of energy loss. Heavy drapes or insulated curtains act as an extra barrier, reducing winter heat loss by up to 10% and summer heat gain by about 33%, according to the U.S. Department of Energy. It’s a simple, stylish way to boost comfort and efficiency without a major investment.

Small changes often add up to big savings. With a little attention and the right habits, you can keep your home comfortable year-round while cutting down those utility bills.

Tweet your home care questions with #AskingAngi and we’ll try to answer them in a future column.