Mercedes-Benz Mississauga is committed to delivering an exceptional experience at every touchpoint, whether you’re searching for the latest Mercedes-Benz models or expert vehicle maintenance. As part of the Zanchin Automotive Group, our dealership is more than a destination for premium vehicles—it’s a partner in shaping Mississauga’s vibrant community.

Discover the Mercedes-Benz Mississauga experience today in the heart of the city. Whether you’re in the market for a new vehicle or trusted service, we are here to exceed your expectations.

363-3322

As we embrace the change in season, it is essential to highlight Small Business Month in October Small businesses are navigating significant pressures, including rising input costs, tariff uncertainty, and the cost-ofliving squeeze. While these challenges persist, this is not the time to retreat. Now is the time to sharpen our approach and seize opportunities. The following tips highlight strategies many small businesses are using successfully.

Together, we can turn challenges into opportunities. Let us embrace these strategies with confidence and shape a stronger future for our businesses and our community.

The special six-month provincial tax deferral “holiday” is over. Recall that Ontario allowed businesses to defer payments on 10 provincially administered taxes (like EHT, Fuel/ Gasoline Tax, Beer/Wine/Spirits, and others) only from April 1 to October 1, 2025. Filings were still due on time, but now that it’s October, that tax bill is now due. Ensure your remittances are upto-date and submitted, and make sure your cash-flow is set up, so you are not surprised later this year.

On October 1, 2025, Ontario’s general minimum wage was increased forty cents or 2.33% to $17.60/hour. Now is the time to reprice quotes, revisit schedules, update employment contracts, complete performance reviews, and make sure your people resources are trained and ready for the busy holiday season. As a reminder, “server wages” are long gone; they earn regular minimum wage. Student minimum wage is at $16.60/hour now.

Most employers in Ontario are dealing with even more changes to employment laws in Ontario in 2025 and 2026. But if you are small (under 25 employees), then you are not legally required to make these adjustments. But it is good for small businesses to know what their competition is doing, and what they may have to do when they start growing.

Larger businesses must comply with all the following either now or soon:

• A publicly available job posting must have a salary or salary range of no more than $50,000 detailed on the job posting (unless the salary is over $200,000).

Canadian experience is not allowed to be in a publicly available job posting or associated job application form.

Disclosure of the use of AI to screen, assess or select applicants.

Disclosure of whether the job posting is for an existing vacancy.

• Mandatory contact within 45 of any person interviewed for a job.

• Retaining copies of every publicly advertised job posting and application form for 3 years and retaining a record of the info provided to interviewees for 3 years.

• Providing written confirmation of the employer’s legal name, operating name, contact information, description of the workplace, compensation information, pay periods, pay days, and initial anticipated hours of work.

JONATHAN N. BORRELLI 2025 MBOT Chair Partner, KMB Law

The WSIB has been giving small business tangible relief. Premiums in 2025 dropped on average to $1.25 per $100 of insurable payroll, which is the lowest in 50 years (WSIB, Nov. 21, 2024). If your small business has been safe, make sure your business has been receiving their WSIB surplus rebates (check your Statement of Account). If you did not see a credit, prioritize what was blocking you, be it outstanding filings, safety gaps, or classification issues. The WSIB also runs the Health & Safety Excellence Program (HSEp) which pays a minimum $1,000 per completed topic, plus extra where your business’ action plan is approved.

Mississauga’s small businesses are the reason our city hums. When you read “Stepping Up”, I hope you are not thinking “hang in there” but instead “Let’s Plan and Execute!” As MBOT Chair, I am with you along the way. This is your moment, small businesses: take the limelight!

MBOT has an exciting Fall and Winter lined up and I hope all our members (especially small businesses) take advantage of everything MBOT and Mississauga has to offer.

EXECUTIVE COMMITTEE:

• Jonathan N. Borrelli, KMB Law | Chair

• Sameer Sharma, Crown Group of Hotels | Immediate Past Chair

• Robyn Saccon, BD Canada | Vice Chair

• Crystal Reedie, RBC | Treasurer

• Amanda Pautler, University of Toronto Mississauga

• Joanne Islip, Sheridan College

• John McKenna, McKenna Logistics Centres

• Trevor McPherson, MBOT President & CEO (Ex-officio)

DIRECTORS:

• Adriano Mazzorato, Kaneff Properties Ltd.

• Anthony Petrucci, Palma Pasta Corporation

• Dave Buchanan, DXC Technology

• Gena Restivo, AstraZeneca Canada

• Malaika Mendonsa, Doane Grant Thornton LLP

• Paul Hainer, Insuranceland Inc.

• Ritu Kohli-Sethi, Greater Toronto Executive Centre

• Ross Thomas, TD Bank (Commercial Banking Division)

• Ryan O’Neil Knight, Detailing Knights

ADVERTISING INQUIRIES: Solange Barcena - sbarcena@mbot.com

EDITORIAL INQUIRIES: Katelin Mowder - kmowder@mbot.com

Established in 1961, Mississauga Board of Trade proudly serves as a the Chamber of Commerce for the seventh largest city in Canada – the fourth largest city in Ontario. Mississauga Board of Trade represents all businesses in Mississauga. MBOT’s large, diverse and active membership has made us one of the most vibrant business associations in Canada. As the “Voice of Business” we advocate on policy issues that impact local business at all levels of government, and are influential in helping to shape policy decisions. MBOT also offers a wide variety of valuable business services and professional development programs, networking events and marketing opportunities, to help business grow, prosper, and get connected.

PUBLISHER: Trevor McPherson President & CEO ceo@mbot.com

EDITOR: Katelin Mowder Marketing & Communications Coordinator kmowder@mbot.com

Ann Cozzi, Document Certification & Corporate Relations Manager - Executive Assistant acozzi@mbot.com

DESIGN & LAYOUT: Katika Integrated Communications Inc. www.katika.com

PRINTING: Katika Integrated Communications Inc. www.katika.com

DISTRIBUTION: Katika Integrated Communications Inc. www.katika.com

TREVOR McPHERSON President & CEO

Mississauga Board of Trade

This fall, Mississauga will host the Canadian Chamber of Commerce Annual General Meeting and Convention (October 8-9, 2025), bringing together business leaders and elected officials from across the country. It is a fitting backdrop for a discussion on the national policy choices that will shape Canada’s competitiveness and prosperity in the years ahead.

At the Mississauga Board of Trade (MBOT), we hear firsthand from our members about the pressures and opportunities shaping their businesses. Whether it is advanced manufacturers competing with U.S. rivals, life sciences firms bringing new treatments to

market, or logistics companies moving goods to international markets, decisions made in Ottawa land here at home. As the voice of business in one of Canada’s largest cities and Ontario’s second-largest economy, MBOT calls on the federal government to prioritize the issues that matter most to our region’s growth.

Double down on technology adoptionespecially AI.

Canadian firms are moving, but not fast enough. In Q2 2025, Statistics Canada cited, 12.2% of businesses reported using AI to produce goods or deliver services - up from 6.1% a year earlier (Statistics

Canada, Canadian Survey on Business Conditions, 2025). The payoff is clear: the Canadian Chamber of Commerce Business Data Lab estimates generative AI could lift productivity 1–6% over the next decade. Ottawa must scale incentives that de-risk pilots for SMEs, accelerate commercialization, and expand hands-on training with partners like Ontario’s Vector Institute.

Streamline approvals without lowering standards.

Investors need predictability. After the Supreme Court’s 2023 reference on the Impact Assessment Act, the federal government amended the law in 2024 to restore clarity. Under the new One Canadian Economy Act, passed in 2025, Ottawa now has explicit tools to fast-track nationally significant infrastructure through the Building Canada Act and a new federal major projects office - measures designed to provide clear, two-year timelines and a single window for proponents (Government of Canada, 2025; Financial Times, June 2025).

Local stakes are high.

Pearson Airport underpins $20 billion in annual GDP and anchors Canada’s second-largest employment zone (Greater Toronto Airports Authority, 2024). Its LIFT program begins with the “shovels in the ground” activity in 2025 Mississauga is also breaking ground on the 2.8-million-sq-ft The Peter Gilgan Mississauga Hospital and Shah Family Hospital for Women and Childrenone of the largest healthcare projects in Canada - backed by a $14 billion provincial investment (Infrastructure Ontario, 2024). While Ottawa does not directly approve such hospital builds, federal leadership in fast-tracking nationally significant infrastructure can ensure that projects like these unlock their full economic and service potential.

Keep Ontario trade-ready amid U.S. tariff turbulence.

The U.S. remains our indispensable market: 75.9% of Canada’s domestic exports went south in 2024 (Statistics Canada, Canadian International Merchandise Trade, 2024). Ontario’s fiscal and growth outlook has already been buffeted by tariff uncertainty this year (Ontario Chamber of Commerce, Ontario Economic Report 2025). Ottawa should maintain a united, rulesbased response and press for stability ahead of the USMCA’s 2026 review, while helping firms diversify into new markets and build stronger international partnerships. A strong “Team Canada” approach - with provinces and Ottawa presenting one voice - will be critical to our credibility abroad.

Align immigration with skills - and capacity.

Businesses still face shortages in key occupations. The federal 2025–27 plan introduces, for the first time, targets to reduce temporary residents to 5% of the population by the end of 2026 (Immigration, Refugees and Citizenship Canada, 2025), and caps on international students continue into 2025 (IRCC, 2025). That can ease pressure on housing and services, but Ottawa must pair it with faster pathways for in-demand talent and scaled-up skilling so employers, especially SMEs, are not left short.

Protect tax competitiveness while implementing global rules.

Canada’s general federal CIT rate is 15%; Ontario’s is 11.5% - a combined 26.5% for many firms (Government of Canada & Ontario Finance, 2025). The U.S. combined federal-state rate averages ~25.6% (Tax Foundation, 2024), and Canada has enacted a 15% global minimum tax (Pillar Two) for large multinationals (OECD, 2024). Ottawa should avoid

incremental burdens on investment and use targeted credits (e.g., for advanced manufacturing and clean tech adoption) to close the productivity gap with peers.

Break down interprovincial trade barriers.

Internal inefficiencies, including licensing mismatches, regulatory duplication, and non-recognition of standards, are estimated to cost Canada up to 4% of GDP per capita, or nearly C$200 billion in unrealized potential (Public Policy Forum, 2024). Ottawa’s efforts to enact frameworks like the One Canadian Economy Act, promising automatic recognition of standards and faster project approvals, are steps toward freeing up domestic capacity and creating a stronger internal market for exporters (Government of Canada, 2025).

The Mississauga lens.

From logistics and life sciences to ICT and advanced manufacturing, our region is primed to convert smarter national policies into growth. The Ontario Chamber of Commerce’s 2025 Ontario Economic Report warns that tariff threats and cost pressures still weigh heavily on business confidence - another reason to move quickly on AI adoption, approvals reform, and trade resilience.

We have seen that Mississauga’s businesses are resilient in the face of uncertainty. Now, Ottawa must match that resilience with growth-oriented, game-changing policies that will position both Canada and Mississauga for sustainable prosperity in the years to come. We look forward to advancing the dialogue and action when we convene with our Chamber Network colleagues this week to advance policy recommendations that align with these priorities and others.

For decades, Mercedes-Benz Mississauga, a proud member of the Zanchin Automotive Group, has been more than a destination for luxury vehicles, it has been a trusted partner in the growth and vibrancy of the community it calls home.

AMAN GUPTA

General

Manager

Mercedes-Benz Mississauga 6120 Mavis Road 905-363-3322

www.mbmississauga.ca

Located in the very heart of the city, Mercedes-Benz Mississauga houses one of the most extensive inventories in Canada, reflecting Mississauga’s own spirit of innovation and progress. Just like the city itself, the dealership is defined by diversity. The team represents a wide range of cultures, languages, and expertise, creating an environment where every customer feels welcomed, valued, and understood. This inclusive spirit allows Mercedes-Benz Mississauga to build relationships that extend far beyond the showroom floor.

At the core of the dealership’s philosophy is a dedication to personalized, reliable service. From the first handshake to years of ongoing care, customers know they can depend on a seamless experience built on trust, transparency, and a genuine passion for excellence.

But Mercedes-Benz Mississauga’s commitment doesn’t end with its customers—it extends into the very fabric of the community. Through supporting local initiatives, forging partnerships with organizations across the region like Trillium Health Partners, and giving back to causes that matter most, the dealership continues to invest in Mississauga’s bright future.

“At Mercedes-Benz Mississauga, we see ourselves not just as a dealership, but as part of the city’s story. Our mission is to serve, support, and celebrate the community that has supported us for so many years.” Aman Gupta, General Manager

As Mississauga grows as a hub for innovation, business, and cultural connection, Mercedes-Benz Mississauga remains steadfast in its commitment to being a cornerstone of that success. With world-class vehicles, exceptional customer care, and a proud dedication to the community, Mercedes-Benz Mississauga is driving forward—side by side with the city it proudly serves.

Mississauga enjoys a sizeable economic footprint that supports thousands of jobs. Keeping the local economy growing is vital for job creation and future prosperity. One way to keep the economy moving is to keep costs from rising.

Undoubtedly, there are many positives in the local economy, including:

• Mississauga is 5% of Ontario’s population and 7% of its economic output;

• Peel represents one-fifth of all of Ontario’s goods movement GDP; and, $1.8 billion worth of goods travel to, from and through Peel everyday.

By contrast, there are challenges facing our economy; for instance:

In 2024, the Bank of Canada declared that Canada has a productivity “emergency;” Ontario’s per capita GDP ranks 51st among 10 Canadian provinces and 50 U.S. states; and, Canada’s per capita GDP has declined steadily since the 1950s.

The chamber network across Canada – along with government officials, economists and policy-makers –need to contemplate how we resolve these short-term and long-standing economic problems. While we cannot expect to resolve all of the Canadian economy’s problems in a couple municipal budgets, we can start to craft a solution by limiting property tax increases for businesses. In addition, we can prioritize transportation infrastructure building in Mississauga and Peel to lessen gridlock. These initiatives, among others, are vital to minimize business cost increases and to continue Mississauga’s and Peel’s elevated economic performance in 2026 and beyond.

The tariff war has been difficult for the entire Canadian economy – including consumers, governments and businesses. No businesses have been more severely impacted than those that are heavily engaged in crossborder trade with the U.S. While there are no easy fixes for the foreseeable future, there are ways to apply for remission. Details on applying for remission can be found on the Government of Canada website here:

https://www.canada.ca/en/department-finance/ programs/international-trade-finance-policy/processrequesting-remission-tariffs-that-apply-on-certaingoods-us.html

The ongoing tariff and trade war will dominate debate as Mississauga hosts the Canadian Chamber of Commerce’s Annual General Meeting on October 8 and 9. Perhaps Mississauga is an ideal location to host because our city’s strong economic connections to North American (and global) supply chains.

How do we position Canada for business and economic success amidst trade turbulence and unreliable trading partners globally? This is one of the many questions facing chambers and their members from across the country.

Why is preservation of employment lands important locally? For Mississauga’s economy to continue to grow –especially near transportation infrastructure like highways and Toronto Pearson – businesses need an ample supply of land. Ease of access to that infrastructure ensures that businesses can distribute their products to markets – both domestically and internationally.

Amid the need to build more housing, there is substantial pressure to reclassify lands that are currently employment lands. While MBOT is very supportive of efforts to increase the supply of housing, we oppose efforts to do so at the expense of employment lands. Losing this land will place permanent constraints on Mississauga’s economic potential for decades to come.

Should you have any inquiries about MBOT’s advocacy on these issues and others, please contact Brett McDermott, MBOT Director of Government and Stakeholder Relations, at bmcdermott@mbot.com.

Mississauga is a city known for its growth and diversity, but behind the progress lies a growing challenge: career instability among mid-life adults. Increasingly, residents in their 40s, 50s, and 60s are finding themselves at a professional crossroads, often through no fault of their own.

For many newcomers to Canada, the journey begins with hope and ambition. Yet, once here, they face the harsh reality that their international credentials and experience may not be recognized. This forces many to retrain entirely—often while supporting families and adapting to a new culture.

Others are impacted by injury. After years in physically demanding jobs, a workplace accident can abruptly end a career. These individuals must pivot quickly, learning new skills to remain employable in a changing job market.

Then there are those affected by layoffs. As industries evolve and automation increases, long-time employees are being let go. For many, this is their first time reentering the job market in decades—and it’s a very different landscape than the one they left.

These challenges are deeply personal, but they are also systemic. Mississauga’s workforce is aging, and the need for accessible, practical retraining options has never been greater.

That’s where Progressive Training College steps in. For more than 25 years, PTC has been a trusted resource for those navigating career transitions. With programs tailored to adult learners, including newcomers, injured workers, and laid-off professionals, PTC helps individuals rebuild their confidence and skillsets.

As Mississauga continues to grow, so too must our support for those who built this community. Retraining isn’t just about learning something new—it’s about reclaiming purpose, stability, and dignity

PROGRESSIVE TRAINING COLLEGE OF BUSINESS & HEALTH

Trademarks are valuable business assets. A trademark is a source identifier for a business. It distinguishes your business, goods and services from the business, goods and services of others in the marketplace.

AHMED BULBULIA Partner Pallett Valo LLP

Under Canadian law, trademark infringement and passing off are two different claims a trademark owner may assert to enforce its trademarks. Both claims protect against confusion as to source in the minds of consumers.

Trademark infringement is only available for registered trademarks

A registered trademark is a trademark that has been examined and registered with the Canadian Intellectual Property Office (CIPO).

A registered trademark provides its owner with enforceable exclusive rights in that trademark throughout Canada in association with the goods/services specified in the registration.

In a trademark infringement lawsuit, the Court is concerned whether the defendant has used the registered trademark. The plaintiff must establish that the infringer is using a mark that is the same or confusingly similar to the registered trademark in relation to the goods/services specified in the trademark registration.

The plaintiff can rely on the registration as proof of ownership of the trademark, and the Court will presume that the registered trademark is valid, unless proven otherwise.

If the trademark owner has an unregistered trademark, then the owner is limited to enforcing the owner’s trademark by way of a claim for passing off.

An unregistered trademark, as the name suggests, is not registered with CIPO. Unregistered trademark rights are acquired by generating a reputation/goodwill in the mark through using it in the Canadian marketplace.

In a passing off claim, the Court is concerned with protecting the goodwill of a distinctive trademark.

In a passing off action, the enforcement of is limited to the geographic scope of the goodwill in the unregistered trademark. For instance, if the goodwill in the unregistered trademark only extends to the GTA, then the owner can enforce trademark rights within this area, but not beyond.

A plaintiff must prove the following three (3) elements in a passing off claim:

1. the existence of goodwill in the unregistered trademark;

2. a deception of the public due to a misrepresentation in such a way as to cause or be likely to cause confusion as to source; and

3. actual or potential damages suffered by the plaintiff.

Often, the plaintiff must prepare and file voluminous evidence to establish sufficient goodwill in the unregistered trademark. This is not required for a trademark infringement claim. Accordingly, passing off claims tend to be more involved and expensive than infringement claims.

Given the numerous advantages that comes with trademark registration, businesses should consider registering their key trademarks. Enhanced enforcement starts with registration.

We give you what you need, not what you don’t. With our flexibility and the right expertise across a wide variety of business law areas, we provide a customized legal solution for you and your business – all without compromising excellence in service or advice.

For legal representation that’s the right fit for you, try our Right-sized Thinking™.

WHAT OUR FACTORING PROGRAMS DO FOR OUR CLIENTS:

•

Improve Cash Flow and Reduce Credit Risk

Reduce employee workload by outsourcing credit checking, invoice processing and collection duties

Receive invoice payments by direct deposit when money is most needed

Have ready and available cash to pay suppliers and efficiently grow the business

Since 1989

• Cash for Invoices in 24 Hours

• No Application fees or hidden fees

• Customized low rates

• Free credit checks on your customers

• Non recourse Program (Credit Guarantee)

• Dedicated Account Executives

• Real Time Online Access

J D Factors specializes but is not limited to the following industries:

Transportation

and

Fast funding, bad debt protection, and the freedom to take on bigger opportunities— without fearing a customer default.

Cash flow is the lifeblood of every small business, yet for many Canadian entrepreneurs, it’s also their greatest vulnerability. In sectors like trucking, staffing, manufacturing, and wholesale distribution, payment terms of 30, 60, or even 90 days are the norm. For a small business with limited reserves, waiting that long can mean delaying payroll, missing supplier discounts, or putting growth plans on hold.

True non-recourse factoring offers a solution that is both immediate and protective. Unlike traditional “recourse” factoring—where unpaid invoices can be charged back to the business—true non-recourse factoring shifts the credit risk to the factoring company. If your customer can’t pay due to insolvency or other credit issues, the loss is absorbed by the factor, not you.

This model delivers multiple benefits:

• Immediate Working Capital – Invoices are funded within 24 hours, keeping operations running smoothly.

• Bad Debt Protection – Rigorous credit checks and monitoring safeguard against non-payment.

• Growth Confidence – Businesses can pursue larger contracts or new markets without fear of extended terms or customer default.

• Operational Relief – Many factors handle collections, freeing owners to focus on sales and service.

For many small enterprises, especially those young, asset-light, or rapidly growing, bank financing isn’t always an option. Banks assess a company’s own credit profile and collateral, while factoring is based on the strength of your customers’ credit. That distinction opens doors for businesses that would otherwise face financing roadblocks.

In today’s climate—marked by high interest rates, supply chain disruptions, and competitive pressures—true non-recourse factoring acts as both a financial accelerator and a risk management tool. It enables small businesses to turn invoices into cash without assuming the burden of bad debt, creating the stability they need to plan, invest, and compete.

Small businesses are the backbone of Canada’s economy. Protecting them from the consequences of slow or failed payments isn’t just good for the entrepreneurs themselves—it’s good for every community they serve. True non-recourse factoring isn’t merely an alternative to traditional financing; it’s a vital partner in building a more resilient, growth-ready small business sector.

CHRISTIAN HERNANDEZ - THE CASH FLOW KING Business Development Officer J D Factors Corporation chernandez@jdfactors.com Cell 289-242-3178

MELISSA BABEL B.A. (Hons) LL.B, Barrister and Solicitor Babel Immigration Law

Entry

From June to September 2025, Express Entry draws targeted healthcare professionals, francophone candidates, and in-Canada applicants (CEC), while maintaining steady PNP invitations. During this period, 17 rounds of invitations were held across various categories, reflecting IRCC’s continued reliance on both program-specific and category-based draws to meet economic and linguistic objectives.

1.

• Provincial Nominee Program (PNP): 7 draws

• Canadian Experience Class (CEC): 5 draws

• Healthcare and Social Services Occupations: 3 draws

• French-Language Proficiency: 2 draws

This distribution shows IRCC’s preference for targeted selection—with a heavy emphasis on PNP and CEC, while still prioritizing healthcare and French-language draws.

2. CRS Cut-off Trends

• PNP draws: Very high CRS cut-offs, ranging from 726 to 800, reflecting the 600-point boost from provincial nomination.

• CEC draws: Consistently high CRS cut-offs between 518 and 534. This CRS Point level shows the challenge faced by foreign workers in Canada seeking to apply for permanent residence.

• Healthcare draws: More accessible CRS cut-offs, 470–504, signaling demand for healthcare professionals.

• French-language draws: Mid-range cut-offs, 446–481, making French language skills a key consideration for intending immigrants

3. Invitations Issued

• Largest draw: 4,500 invitations (French-language proficiency, Sept 4).

• Healthcare draws: Significant allocations, e.g., 4,000 invitations on July 22.

• CEC draws: Varied between 1,000 and 3,000 invitations.

• PNP draws: Smaller cohorts (125–503 invitations), consistent with past patterns.

Overall, about 27,000 invitations were issued over these three months.

On July 16, 2025, IRCC announced the reopening of the Parents and Grandparents Program (PGP) intake for 2025. Starting July 28, IRCC began issuing 17,860 Invitations to Apply (ITAs) to potential sponsors who had submitted their interest forms in 2020. IRCC has a stated intention of accepting 10,000 complete applications out of the total invited. Those selected have until October 9, 2025 to submit their complete applications for permanent residency for their eligible family members.

International students applying for a PGWP must graduate from a program with a Classification of Instructional Programs (CIP) code that is currently listed as eligible. The IRCC updated this list on July 4, 2025, reinstating 178 fields that were previously removed on June 25, expanding the roster to a total of 920 eligible fields—including in high-demand sectors such as healthcare, trades, and early childhood education. Importantly, programs deleted during the June 25–July 4 window remain eligible for students whose study permits were submitted during that period, even if the fields are later removed in future revisions.

Babel Immigration Law is a boutique corporate immigration law

firm serving small and medium sized business in Canada and the U.S. We provide smart, strategic advice for our clients who want to live, work, study and do business on both sides of the border.

Students with study permits submitted before November 1, 2024 are exempt from the field-of-study requirement— meaning any CIP-coded program counts toward PGWP eligibility. This requirement also does not apply to graduates of degree programs (bachelor’s, master’s, doctoral) or flight schools, who remain eligible regardless of CIP codes.

On September 5, 2025, USCIS (U.S. Citizenship and Immigration Services) enacted a final rule granting certain employees the title of special agents with the power to carry firearms, execute arrests and search warrants, and conduct investigations into criminal immigration-related matters. This marks a major shift: USCIS, historically focused on processing benefits, now takes on active enforcement functions traditionally managed by Immigration

and Customs Enforcement (“ICE”) and U.S. Customs and Border Protection (“CBP”), which were created after September 11, 2001. Granting USCIS arrest authority is intended to combat immigration fraud, but the enforcement expansion blurs lines between service and policing functions.

Effective September 8, 2025, the U.S. Department of State restricted nonimmigrant visa applications by requiring applicants to apply only in their country of citizenship or residence, significantly limiting the practice of applying as a third-country national. While existing TCN appointments generally remain valid, applicants can expect longer wait times, tighter scrutiny, and non-refundable fees if they opt to reschedule—raising challenges for those previously able to apply in nearby countries. Individuals accustomed to applying from third countries must now

adjust for delays, revalidate eligibility, and manage increased logistical challenges.

Effective August 15, 2025, USCIS updated its policy for calculating beneficiaries’ ages under the Child Status Protection Act (CSPA). Under the new rule, more dependent children—especially those of H-1B and employment-based visa holders—may now “age out” before their parents’ green card petitions are finalized, rendering them ineligible for derivative status. The CSPA revisions mark a critical shift that may jeopardize dependent children’s eligibility, particularly among citizens of countries experiencing long waits for employmentbased green cards. Families may now need to explore alternative strategies—such as concurrent filings or independent petitions—to safeguard dependent status.

STATE OF THE CITY: A DIALOGUE WITH THE CITY’S LEADERS

JUNE 10, 2025

SPONSORS

Good Morning

Mississauga (GMM)

JUNE 11, 2025

SPONSORS

JUNE 17, 2025

SPONSORS

o our monthly Good Morning Session Thi t i , insight

JUNE 24, 2025

JUNE 18, 2025

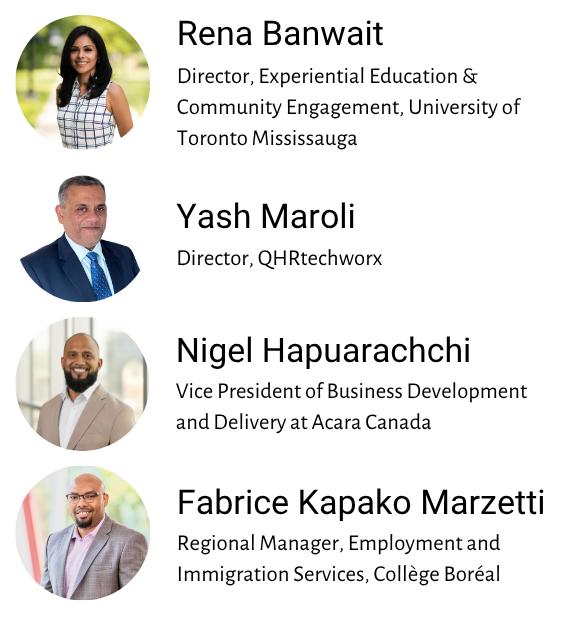

SPEAKER LINE UP

PRESENTING SPONSOR SILVER SPONSORS

PRESENTING SPONSOR, MINISTER PICCINI

JULY 7, 2025

DINNER SPONSOR SPONSORS

PRESENTING SPONSOR

Good Morning

Mississauga (GMM)

JULY 16, 2025

SPONSORS

Good Morning Mississauga (GMM)

AUGUST 13, 2025

SPONSORS

MBOT Summer PATIO PARTY & AFTER HOURS NETWORKING EVENT

AUGUST 20, 2025

you to our monthly Good Morning rking Session. This event promise ctions, insightful conversations, an

SPONSORS

MBOT is del d Morning Mi promises to ne

Registered Professional Accountants (RPAs) are trusted partners for small businesses, providing expertise in accounting, bookkeeping, taxation, and business advisory services. Each RPA in public practice holds a Practice Certificate, ensuring professionalism and competence— verifiable through the RPA Canada website. With an RPA on their side, small business owners gain reliable financial guidance, compliance support, and strategic insight, giving them the confidence to focus on growth while knowing their business is in capable hands.

The RPA Women Entrepreneur Awards, presented by the Society of Professional Accountants of Canada (RPA Canada), reflect our commitment to community involvement and social impact. As President & CEO of RPA Canada, I had the honour to launch this initiative in 2019 to empower women through economic independence by recognizing and supporting their entrepreneurial and professional achievements.

At its heart, the program embodies the philosophy of giving women a hand up rather than a hand out. By showcasing stories of resilience, creativity, and leadership, the awards inspire others to pursue entrepreneurship and demonstrate the transformative role women play in strengthening communities and the economy.

The mission of the awards is threefold: encourage, support, and recognize. Encouragement comes from celebrating women’s accomplishments and giving them visibility; support is delivered through RPA Canada’s professional network, where accountants provide financial guidance and mentorship; and recognition comes through national honours that highlight the collective impact of women entrepreneurs across Canada.

ZUBAIR CHOUDHRY President & CEO

RPA Canada

The 2025 RPA Women Entrepreneur Awards Gala Dinner will be held on Saturday, October 25, 2025, at 6:00 pm at the Hilton Meadowvale Hotel in Mississauga, Ontario, coinciding with Small Business Week Celebrations. This year’s Gala will feature distinguished Guests of Honour, including:

• Hon. Rechie Valdez, MP for Streetsville and Secretary of State (Small Businesses & Tourism)

• Hon. Nina Tangri, MPP for Streetsville and Associate Minister of Small Business

• Hon. Charmaine Williams, MPP and Minister of Women’s Social and Economic Opportunity

Their participation underscores the importance of women’s leadership in Canada’s economic and social development.

Professional accountants, particularly Registered Professional Accountants (RPAs), play a vital role in this mission. By offering accounting, bookkeeping, taxation, and advisory services, RPAs provide women entrepreneurs with the financial clarity and strategic insight needed to sustain and grow their businesses. Accountants are often the first professionals entrepreneurs turn to, making them key partners in driving innovation, job creation, and long-term success.

Through this initiative, RPA Canada demonstrates that true progress is inclusive. Empowering women to succeed in business strengthens families, communities, and Canada’s overall economy.

The RPA Women Entrepreneur Awards are more than an annual celebration—they are a movement for equity, opportunity, and resilience. With hands up, not hands out, RPA Canada is proud to stand with women in business and contribute to building a stronger, more inclusive future.

ARZOO JHA MFA-P™| RFC® Partner, Strategic Alliance Advisory Money Strategies Inc.

416 991 5959 | arzoo@amstrategies.ca

Permanent life insurance changes the game. It can:

• Generate tax-efficient growth inside the corporation

• Deliver a tax-free payout at death

• Improve corporate liquidity with early-access cash value

For wealthy business owners, this often outperforms traditional fixed-income investments on a tax-adjusted basis while maintaining liquidity and satisfying protection needs.

Permanent insurance isn’t for everyone. Clients need:

• A legitimate death-benefit need (such as covering terminal tax liabilities)

Good health and financial capacity to qualify

• A long-term estate or succession plan

It might surprise you that some of Canada’s wealthiest business owners are investing millions each year—not into real estate or stocks—but into permanent life insurance. What’s even more surprising? Many CPAs, while experts in tax efficiency, overlook this strategy.

Corporate-owned life insurance is no longer just about covering risk. Done right, it is a tax-efficient asset class, helping owners:

Minimize corporate tax during asset accumulation

• Minimize personal tax at death

• Preserve and improve liquidity for the business

In other words, it’s a tool that protects not only human capital but also financial capital—two sides of the same coin.

Beyond Protection: Life Insurance as an Asset

Traditionally, insurance was viewed as a necessary expense. For example, a business owner with a large loan might buy 10-year term coverage to protect against unexpected death. That addresses the human capital risk—but leaves untapped opportunities for wealth preservation.

When those criteria are met, life insurance becomes one of the most powerful—but underutilized—planning strategies.

1. Tax-sheltered accumulation – Shelter fixed-income returns inside a policy, free from annual tax.

2. Reliable returns – Whole life policies provide consistent, low-volatility growth and dividends.

3. Insured charitable bequests – Donate private company shares and use insurance to maximize benefits for both heirs and charity.

4. Efficient fund extraction – Use the Capital Dividend Account (CDA) to move money tax-free from a holding company to shareholders.

5. Generational wealth transfer – Cascade assets tax-free across generations.

6. Liquidity on demand – Borrow against cash values to access funds more efficiently.

7. Covering death taxes – Provide liquidity to cover estate or cross-border tax liabilities.

Strategy

8. Reducing corporate value

– Pair life insurance with annuities to reduce taxable corporate value at death.

Case Study: Turning a $3M Payout into $3M Tax-Free to the Family Profile

• Ontario business owner (age 55) with Holdco and $2.5M in passive assets

• Estate freeze already completed; large future tax bill expected on death

Objective: reduce taxes, improve liquidity, and extract funds efficiently

Holdco purchases a participating whole life policy on the owner:

• Face amount: $3,000,000

• Premiums: funded from Holdco’s after-tax cash flow

• Cash value: accumulates tax-sheltered within the policy What happens at death

• Tax-free death benefit to Holdco: $3,000,000

• CDA credit created: death benefit – ACB ≈ $3,000,000 (ACB ~ $0 in later years)

• Result: Holdco pays $3,000,000 out to heirs as a tax-free capital dividend

Why this is powerful (the math in one line) Without insurance/CDA room, extracting $3,000,000 as a taxable dividend could cost ~47% personal tax in Ontario (≈ $1,410,000).

With the policy, the CDA credit turns that same $3,000,000 into a $0 personal tax distribution.

Immediate tax avoided: ≈ $1.41M — while also delivering instant liquidity to cover estate taxes without a fire sale of assets.

• Policy cash value grows tax-sheltered inside Holdco (often outpacing fixed income on an after-tax basis).

• Collateral lending available for cash-efficient access if needed (bank loan secured by CSV).

Keeps the corporate balance sheet liquid and stable for succession.

Many owners (and even some CPAs) view insurance as an “expense,” not as a balance-sheet asset that creates CDA room and extracts capital tax-free.

Result: underutilized strategy, higher taxes, tighter estate liquidity.

Bottom line: A corporately owned permanent policy can convert a future $3M liquidity need into a $3M tax-free payout to family, while avoiding roughly $1.41M in personal dividend taxes and smoothing estate settlement.

The irony? CPAs pride themselves on tax efficiency, yet many fail to integrate insurance professionals into their clients’ advisory teams. By doing so, they risk missing opportunities to:

• Eliminate millions in unnecessary taxes

• Strengthen liquidity for families and businesses

• Enhance their role as trusted wealth advisors

Forward-thinking CPAs see life insurance not as an expense, but as an asset strategy that cements their leadership on the advisory team.

Client Situations Where We Can Help the Most

1. People with unrealized gains on investment real estate or in private business enterprise.

2. Clients with substantial incomes, paying lots of tax.

3. Single, widowed, or divorced clients without spousal rollover protection.

4. Owners with a recent or upcoming liquidity event (e.g., business sale, real estate sale).

5. Clients who have completed or plan an estate freeze.

6. Business owners seeking tax-efficient corporate cash extraction.

7. Business owners with non-registered investments wanting to use their CDA for efficient charitable donations.

Corporate-owned permanent life insurance is quietly reshaping the balance sheets of Canada’s wealthiest entrepreneurs. For CPAs, ignoring it means missing an opportunity to add immense value. For business owners, adopting it can mean protecting wealth, improving liquidity, and creating a legacy—for family and for community.

In short: It’s not just insurance. It’s strategy.

Feel free to reach out at www.amstrategies.ca or email arzoo@amstrategies.ca.

At a time when global trade headlines are dominated by tariffs, shifting policies, and uncertainty, it’s understandable that Canadian businesses might hesitate before expanding abroad. But one thing remains certain: a strong presence in the United States can help take your business to the next level. And we are here to help you make that transition.

The U.S. is not only Canada’s closest trading partner but also its most natural partner for growth. We share a long border, a common language, and deep cultural and economic ties.

For Canadian businesses, expansion into the U.S. offers something invaluable: stability and scale.

With more than 330 million consumers, a diverse economy, and unmatched infrastructure, the U.S. provides opportunities that can’t be replicated elsewhere. Whether it’s accessing new customers, expanding production capacity, or building partnerships with American suppliers, entering the U.S. market allows Canadian firms to grow beyond what domestic demand alone can offer.

Just minutes from the border, regions like Niagara County, for example, are especially well-positioned for Canadian expansion. We have over three hundred businesses in approximately 500 square land miles that are a part of a large advanced manufacturing sector and access to 40% of the North America’s population in a day’s drive time. It’s also worth pointing out that Western New York’s housing market continues to be ranked #1 by many national leaders in real estate, which can benefit those seeking to relocate workforce talent to the area.

Local governments and economic development organizations are eager to work with Canadian companies, offering incentives, site selection support, and connections to key networks that ease the process of setting up shop here.

Of course, uncertainty around trade and tariffs can feel daunting. But Canadian companies should view expansion not as a risk but as a strategy to build up. By establishing a U.S. presence, firms diversify their markets, reduce reliance on a single economy, and strengthen their ability to withstand global fluctuations.

We understand the challenges that come with international growth, and our mission is to guide businesses through the process, step by step. From navigating regulations to finding the right location and workforce, we are committed to ensuring Canadian companies succeed here.

In uncertain times, opportunity belongs to those willing to act. By expanding into the United States, Canadian businesses can find not just security but a pathway to greater growth, innovation, and long-term success.

JEREMY GEARTZ Director of Business Development

and Retention, NCIDA

jeremy.geartz@niagaracounty.gov 716-278-8755

Ontario’s economy is evolving quickly. Emerging industries, new technologies, and shifting skills demands are reshaping the future of work. Students need more than classroom knowledge — they need insights from people who’ve been there.

That’s where local businesses of all sizes come in. By stepping up as Career Coaches, employers offer students something they can’t find in textbooks: authentic stories, personal pathways, and lessons learned along the way. Whether you’re running a small family business, leading a growing startup, or managing a large organization, your perspective matters.

“Preparing young people for the future is a shared responsibility, and education can’t be expected to do it alone,” says Kelly Hoey, Executive Director at HIEC. “Through the Ontario Career Lab, we’ve seen what’s possible when education, industry, and community work hand in hand.”

Ontario’s future workforce is taking shape today — and it’s going to take all of us to prepare students for the opportunities ahead. The Ontario Career Lab, backed by the Government of Ontario and delivered by HIEC, is entering its second year with momentum, purpose, and a growing network of local businesses stepping up to inspire the next generation.

In its first year alone, the program delivered more than 145,000 hours of meaningful career conversations with Grade 9 and 10 students across Ontario. Thousands of volunteer Career Coaches — from nurses and tradespeople to tech professionals and entrepreneurs — shared their real-world experiences, helping students understand how today’s learning opens doors to tomorrow’s opportunities.

The program complements initiatives like Co-op, OYAP, SHSM, and Dual Credits by starting conversations earlier. Students gain the awareness and confidence they need before making key decisions about their next steps, while employers help shape a workforce that’s better informed and better prepared.

The Ontario Career Lab is actively recruiting Career Coaches from every sector. Whether you’re just starting out or decades into your career, your experience can help a student imagine what’s possible.

Learn more or sign up to participate at ontariocareerlab.ca — and be part of shaping Ontario’s future, one conversation at a time.

The Ontario Career Lab is a bold, provincewide initiative connecting Grade 9 and 10 students with mentors from all industries and occupations for honest, small-group conversations about the world of work

Backed by the Government of Ontario and delivered by HIEC, this program helps students build a clearer, more confident vision for life after high school—through real stories from real people, like you

We’re now recruiting Career Coaches from across the business community to share your career journey and help students explore what’s possible.

Whether you ' re just starting out, leading a team, or somewhere in between your experience matters.

Make a meaningful difference for students in your community

Showcase your industry and inspire future talent

Strengthen local partnerships between education and business

Contribute just a few hours of your time online or in person

Scan the QR code or visit OntarioCareerLab.ca to volunteer as a Career Coach.

100 Women Who Care Mississauga

647 Cyber Inc.

Brigient Technology Solutions Inc.

Canadian Blood Services

CollabHive

Cooksville BIA

Coral eSecure

Corpex Computer Inc.

COSTCO - Mississauga South

Dialogue (Square One District Rentals)

e-Del Logistics Inc.

Eric Grundy, RBC Wealth Management | RBC Dominion Securities Inc.

GLo Best Western Mississauga Corporate Centre

Humber Polytechnic

IT Pilots

Konnecture

Kormans LLP

Maawj TV

Mattel Canada

MAXtech Security

Mercedes-Benz Mississauga

Newrest Canada

Next Path Trading Inc.

Segmentide

Stand Up and Speak Inc.

Tagg CFO Solutions

UROSPOT

We Staff Canada

World Trade Developers Inc.

In the heart of Mississauga’s dynamic business district, Haleon Canada is quietly shaping the future of consumer health. As one of the country’s leading consumer healthcare companies, Haleon’s mission -- deliver better everyday health with humanity -- is more than a tagline. It’s a guiding principle that informs operations from the commercial headquarters on Standish Court in Mississauga to its globally recognized manufacturing facility in Montreal.

With household names like Sensodyne, Advil, Centrum, and Buckley’s, Haleon’s products can be found in the majority of Canadian households – and many are proudly made or prepared right here in Canada.

The company’s impact extends beyond the medicine cabinet. Haleon Canada contributes significantly to the national economy by supporting employment, driving innovation, and advancing community health. The Mississauga office leads commercial strategy, while the Montreal site -- designated a Centre for Liquids Excellence -- exports to more than 60 global markets.

Haleon’s presence in Mississauga also reflects a strong commitment to creating a positive impact on the community in which we live and work. In 2024, the company donated nearly $2.9 million in products and funds to support inclusive healthcare initiatives across Canada. A notable local example is the Health and Wellness Scholarship Fund, developed

PATRICK ROSETTIS Interim General Manager and Head of Finance

Haleon Canada

in partnership with the Children’s Aid Foundation Ontario. This initiative supports youth in care and in the community who aspire to pursue post-secondary education in health and wellness -- helping build a future healthcare workforce that reflects Canada’s diversity.

Through its integration of local manufacturing, extensive national distribution, and significant contributions to community initiatives, Haleon exemplifies corporate citizenship within Mississauga. As the city evolves as a centre for life sciences and advanced manufacturing, Haleon’s ongoing involvement highlights the importance of organizations that both maintain operations locally and support the broader community.

At a time when Canadians are reimaging self-care as an essential part of healthcare, Haleon is leading the way -- empowering individuals to manage their health while supporting the systems that make it possible. From Mississauga outward, Haleon Canada is helping build a healthier, more inclusive future.

Get amazing deals started at just $1.00 on trusted brands like Children’s Advil, Buckley’s, Centrum, Caltrate, Emergen-C, Sensodyne, Robitussin, TUMS and more!

All proceeds will benefit this year’s charitable partner

Second Harvest supporting our mission to deliver better everyday health with humanity. cash, debit and credit accepted

November 4 th (8am – 6pm)

55 Standish Court, lower level (Hurontario & 401)