Since its inception, this guide has been the industry standard for aiding investors in understanding the position of their assets in the overall market. Utilized by institutional and professional investors, developers, and private clients, this guide provides the data and resources necessary to make informed investment decisions effectively as you navigate the current multifamily market in Santa Ana.

Whether you’re the owner of a single multifamily property or a large portfolio, The Definitive Guide to Multifamily Rents will provide you with immediate actionable information to:

› Protect your cash flow

› Increase your leverage as an owner

› Secure your wealth

Ultimately, you will thoroughly understand where your investment stands and how to plan for the future.

Matthews Real Estate Investment Services™, a commercial real estate investment services and technology firm, holds recognition as an industry leader in investment sales, leasing, and debt and structured finance. Matthews™ delivers superior results through the firm’s industry revered work ethic, unique culture, collaboration, and advanced technology.

Since 2015, Matthews™ has experienced unprecedented growth adding over 1,000 real estate professionals to serve clients. Headquartered in Nashville, TN, and strategically positioned in 25+ offices across the United States, Matthews™ continues to expand into new markets.

Matthews™ redefines what clients expect by accelerating the evolution of how the commercial real estate industry services clients through technology. By leveraging technology and industry-leading resources, Matthews™ is committed to growing and preserving client wealth and adding value to their investment strategy.

Our professional team of agents have many years of experience with representing the top institutions, developers, and private clients in commercial real estate. We hire the best and provide them with top of the line support, systems, and materials with the goal of exceeding expectations

25,477 TRANSACTIONS

$66.26B IN DEALS CLOSED

1,000,000 INVESTOR DATABASE

1,000+ AGENTS & EMPLOYEES

Our centralized client services foster specialization and collaboration across all divisions to provide an array of commercial real estate solutions for our clients.

INVESTMENT SALES

› Multifamily

› Net Lease Retail

› Shopping Centers

Industrial

Healthcare

Office

Self-Storage

Hospitality

Auction Services

When you hire Matthews™, you have the power of investment professionals strategically positioned across the country to sell your deal. We have access to the largest database of capital from private and institutional investors. With our collaborative culture, agents from across the country work together to source buyers through the Matthews™ network. CAPITAL MARKETS

› Debt & Structured Finance › Equity LEASING

› Landlord Representation › Tenant Representation

DIRECT (949) 503-9824 | MOBILE (949) 423-9310

jacob.howhannesian@matthews.com

License No. 02216335 (CA)

Jacob Howhannesian serves as an Associate for Matthews Real Estate Investment Services™, specializing in the acquisition and disposition of multifamily assets in Orange County, CA. His dedication and effective communication steer his clients toward achieving their investment objectives. Through the utilization of Matthews™ proprietary database and the firm’s powerful marketing platform, coupled with his unwavering work ethic, Jacob consistently surpasses his clients’ expectations.

Mark Bridge

EXECUTIVE VICE PRESIDENT & SENIOR DIRECTOR

DIRECT (949) 681-8388

mark.bridge@matthews.com

License No. 01316702 (CA)

Mark Bridge is a real estate professional specializing in the acquisition and disposition of multifamily assets throughout Southern California. Mark graduated from California State University, Fullerton in 2000 with a Bachelor’s degree in Finance and an emphasis in Real Estate. He began his 24+ year career immediately after college and quickly earned the Sales Recognition Award in 2004 and 2005 and rose to senior associate in 2005. Mark was promoted to vice president of investments in 2013, first vice president of investments in 2015, managing director in 2018, and executive vice president and senior director in 2025. He has been a licensed real estate broker since 2008

Santa Ana, has seen significant development and changes in its apartment market in recent years. Over 1,100 new units were delivered in 2023, with notable projects including Park on First (603 units), Bloom South Coast Metro (262 units), and VRV (300 units). Another major development, Rafferty (218 units), opened in early 2024, while the Cloud House (321 units) is set to complete in 2025, featuring a rooftop sky deck and luxury amenities. Downtown Santa Ana continues to gentrify, attracting younger residents with its growing mix of restaurants, shops, and cultural offerings. The city’s affordability and centrality, along with Opportunity Zone incentives, have made it a target for developers. However, Santa Ana’s rent control measure, passed in 2021, limits rent increases on older properties to 3% annually or 80% of inflation, which has drawn mixed reactions from investors. Despite this, rent growth remains moderate, averaging 1.4% year-over-year. Santa Ana’s government seat status, proximity to major employment hubs, and the upcoming OC Streetcar line in 2025 further enhance its appeal. Recent deals in the city include AEW Capital Management’s sale of partial interest in multi-family properties to Essex Property Trust and smaller value-add transactions like the Birch Manor and South Standard Avenue complexes.

Source: CoStar Group

Source: CoStar Group

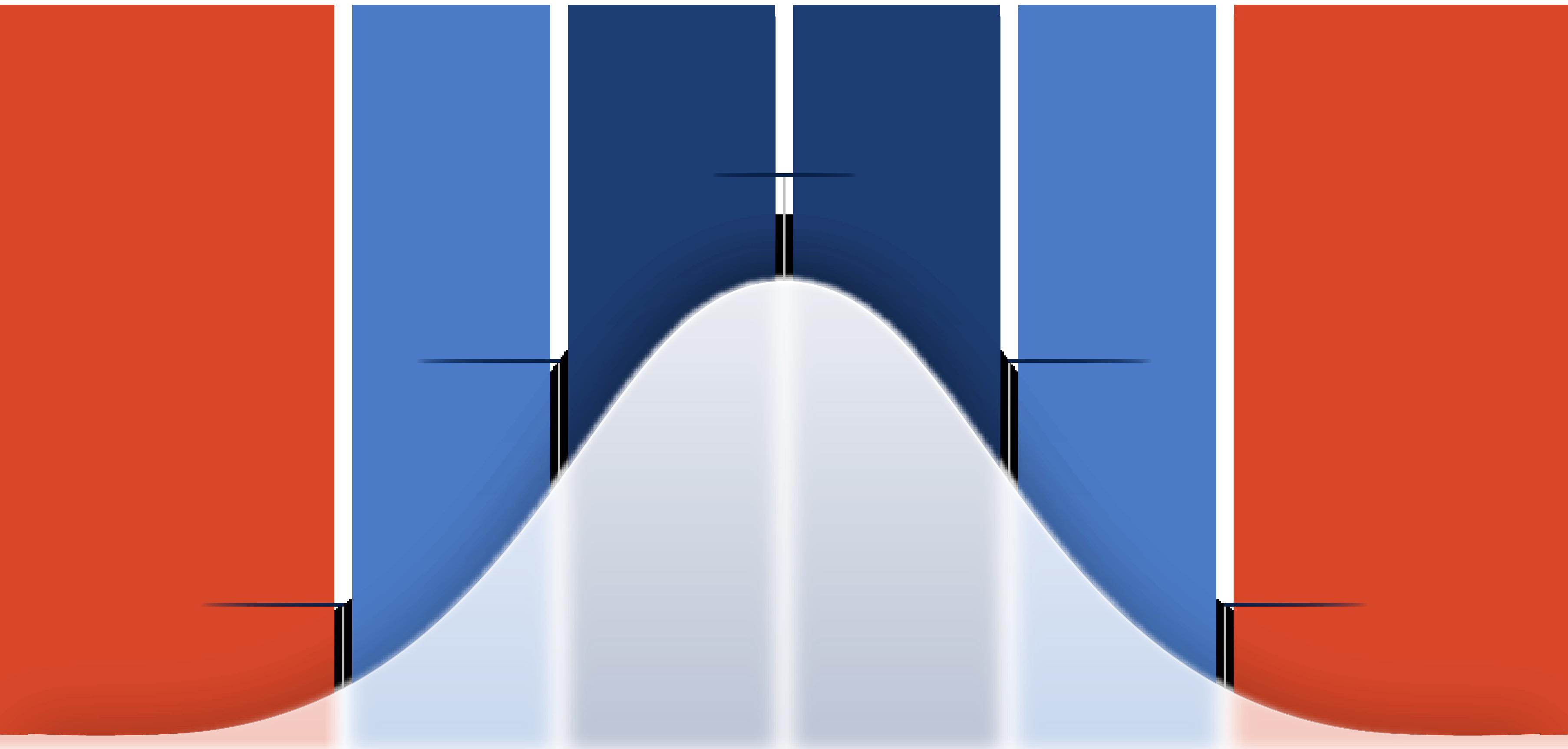

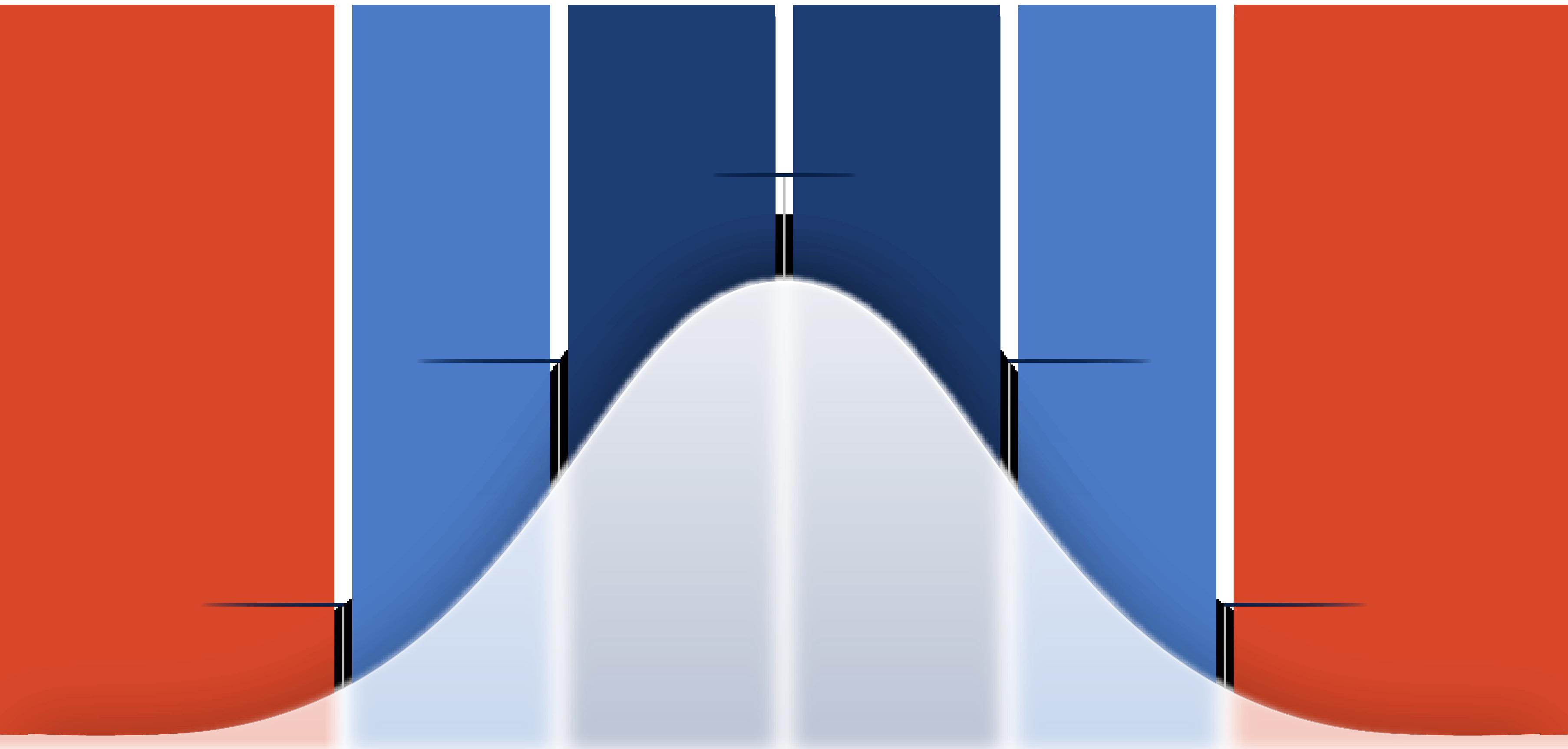

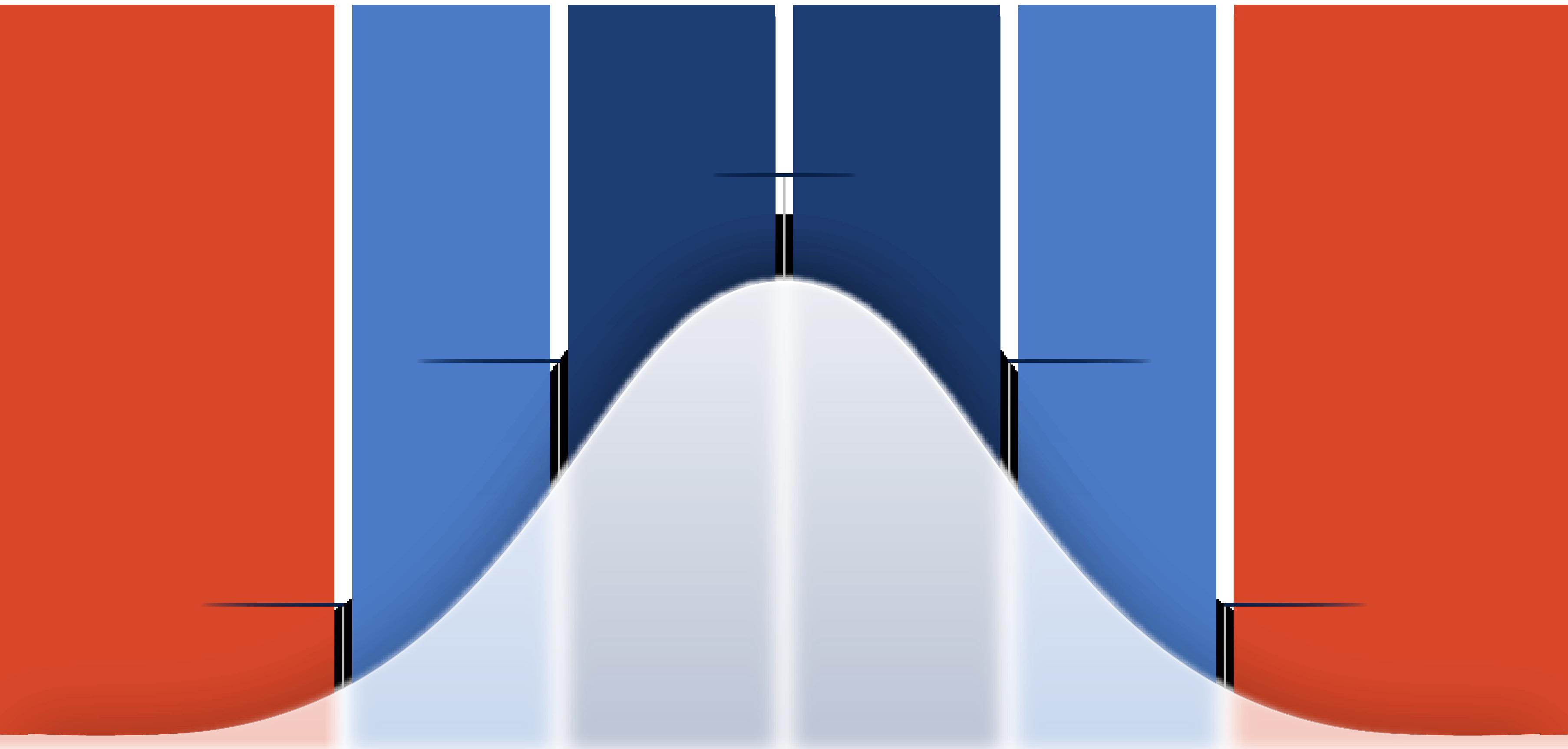

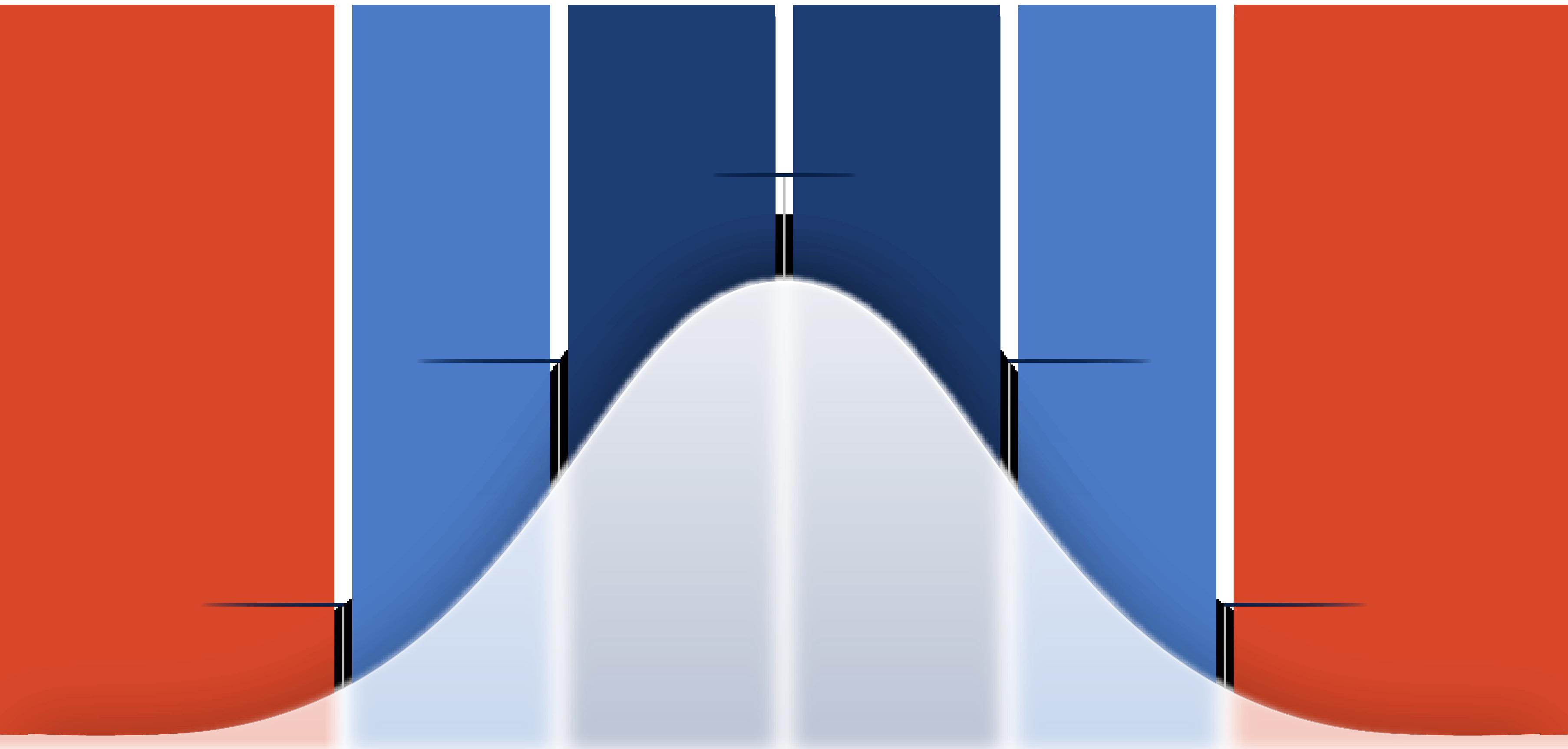

Less asking rent than 98% of all Santa Ana owned properties. Less asking rent than 2% - 16% of all Santa Ana owned properties.

Less asking rent than 16% - 50% of all Santa Ana owned properties. Higher asking rent than 50% - 84% of all Santa Ana owned properties. Higher asking rent than 84% - 98% of all Santa Ana owned properties. Higher asking rent than 98% of all Santa Ana owned properties.

The goal of a landlord/owner is to increase the income earned from rents and fees during which the property is held by either increasing the rents or selling the property at the highest price possible. The key to maximizing your income is to charge a competitive but realistic monthly rent.

As demonstrated by the normalized distribution graphs on the previous pages, you can determine the health of your multifamily property. So long as your rent falls within the same Zone (standard deviation), you are considered to have an average investment. By comparing your property to similar multifamily properties in Santa Ana you are more accurately able to determine a competitive and realistic rent for your tenants. Having a high rent is not a bad thing so long as your vacancy is low. Conversely, having low rent and low vacancies is not a bad thing, however it is recommended to increase your rent to market rent if demand is present. Should your rent fall in the high or low zone with high vacancy, it might be a good idea to analyze how the market is performing as your investment is considered risky.

A strong market with strong demand will support rent increases. A good indicator of a strong market is when population increases are occurring, or when development is taking place. In markets that have seen a lot of new multifamily construction, it’s important to analyze the improvements that other properties have undertaken.