Since its inception, this guide has been the industry standard for aiding investors in understanding the position of their assets in the overall market. Utilized by institutional and professional investors, developers, and private clients, this guide provides the data and resources necessary to make informed investment decisions effectively as you navigate the Take 5 Oil Change property market.

Whether you’re the owner of a single Take 5 Oil Change Property or a large portfolio, The Definitive Guide to Take 5 Oil Change Rents will provide you with immediate actionable information to:

› Protect your cash flow

› Increase your leverage as an owner

› Secure your wealth

Ultimately, you will thoroughly understand where your Take 5 Oil Change investment stands and how to plan for the future.

Matthews Real Estate Investment Services™, a commercial real estate investment services and technology firm, holds recognition as an industry leader in investment sales, leasing, and debt and structured finance. Matthews™ delivers superior results through the firm’s industry revered work ethic, unique culture, collaboration, and advanced technology.

Since 2015, Matthews™ has experienced unprecedented growth adding over 1,000 real estate professionals to serve clients. Headquartered in Nashville, TN, and strategically positioned in 25+ offices across the United States, Matthews™ continues to expand into new markets.

Matthews™ redefines what clients expect by accelerating the evolution of how the commercial real estate industry services clients through technology. By leveraging technology and industry-leading resources, Matthews™ is committed to growing and preserving client wealth and adding value to their investment strategy.

When you hire Matthews™, you have the power of investment professionals strategically positioned across the country to sell your deal. We have access to the largest database of capital from private and institutional investors. With our collaborative culture, agents from across the country work together to source buyers through the Matthews™ network.

Our professional team of agents have many years of experience with representing the top institutions, developers, and private clients in commercial real estate. We hire the best and provide them with top of the line support, systems, and materials with the goal of exceeding expectations

25,477 TRANSACTIONS

$66.26B IN DEALS CLOSED

1,000,000 INVESTOR DATABASE

1,000+ AGENTS & EMPLOYEES

Our centralized client services foster specialization and collaboration across all divisions to provide an array of commercial real estate solutions for our clients.

INVESTMENT SALES

› Net Lease Retail

› Shopping Centers

› Multifamily › Industrial

Healthcare

Office

Self-Storage

Hospitality

Auction Services

CAPITAL MARKETS

› Debt & Structured Finance

› Equity LEASING

› Landlord Representation

› Tenant Representation

Connor KNauer

ASSOCIATE VICE PRESIDENT

DIRECT (404) 400-2794 | MOBILE (813) 335-5893

connor.knauer@matthews.com

License No. 413436 (GA)

Connor Knauer, Associate Vice President at Matthews Real Estate Investment Services™, specializes in the disposition and acquisition of net lease properties nationwide. His unrelenting work ethic, comprehensive knowledge of the industry, and unwavering commitment proves to be of exceptional value to his clients. In providing an unparalleled experience, Connor thrives in improving his client’s investment position and achieving their goals.

ASSOCIATE

DIRECT (954) 357-0614 | MOBILE (954) 288-3678

dylan.schroeder@matthews.com

License No. SL3579995 (FL)

Dylan Schroeder is an Associate at Matthews Real Estate Investment Services™, specializing in the disposition and acquisition of single-tenant net lease properties, with a focus on auto part stores in the Southeast. He offers clients unparalleled support by utilizing his extensive market knowledge, vast experience, and profound understanding of financial objectives. He takes pride in being a reliable resource for clients and peers alike, delivering consistent communication and unwavering professionalism.

ASSOCIATE

DIRECT (737) 309-2835 | MOBILE (512) 796-9025

dillon.mata@matthews.com

License No. 823074 (TX)

Dillon Mata is a real estate professional at Matthews Real Estate Investment Services™ specializing in the acquisition and disposition of single-tenant net lease retail assets, specifically, auto parts and auto repair centers. Dillon possesses strong communication skills, allowing him to effectively collaborate with clients and colleagues alike. His ability to navigate complex financial landscapes and identify strategic opportunities sets him apart in his field.

ASSOCIATE

DIRECT (214) 466-7487 | MOBILE (214) 564-3272

trey.nemeth@matthews.com

License No. 827281 (TX)

Trey Nemeth is a dedicated real estate professional at Matthews™, with a specialized focus on single-tenant net lease properties within the oil change service sector, including prominent brands such as Jiffy Lube, Take 5, Christian Brothers Automotive, and Meineke. With a deep understanding of the unique dynamics and investment potential in this niche market, Trey provides expert guidance to clients seeking to acquire or divest STNL oil change shop properties. His extensive knowledge of the STNL sector allows Trey to offer valuable insights into market trends, property valuations, and strategic investment opportunities.

Take 5 Oil Change is a chain of automotive service centers that specialize in providing quick and convenient oil change services. Founded in 1984, Take 5 has grown to become a well-known brand with locations across the United States. Their service model emphasizes efficiency, with most oil changes completed in just minutes, making it a popular choice for busy individuals seeking fast and reliable maintenance for their vehicles. In addition to oil changes, Take 5 offers other routine services such as fluid checks, filter replacements, and other preventative maintenance tasks to help keep vehicles running smoothly. With a focus on speed, convenience, and quality service, Take 5 Oil Change has become a trusted name in the automotive industry.

TAKE 5 OIL CHANGE BY THE NUMBERS

Last 12 Months |

Source: Placer.ai

30.2K AVERAGE VISITS PER LOCATION

30.5M TOTAL VISITS

1,089 NUMBER OF VENUES

TAKE 5 OIL CHANGE VISITS TREND | NATIONWIDE

Source: Placer.ai

Occupancy cost is simply defined as all costs related to a tenant occupying a space, including rent, taxes, insurance, maintenance, etc.

One of the largest expenses a retailer will incur is the rent paid by the tenant to the landlord. Low rent is advantageous for you as a landlord because it keeps the operator’s expenses low, allowing for greater profitability at a location. When your tenant is profitable, they continue to operate out of the space, preserving your equity in your investment.

On the other hand, high rent attaches additional risk as there is a higher probability of store failure and termination of the lease. Remember, although this guide is a great indicator for Take 5 Oil Change rents, the year that the rent commenced, as well as the location, plays a significant role in impacting market rent.

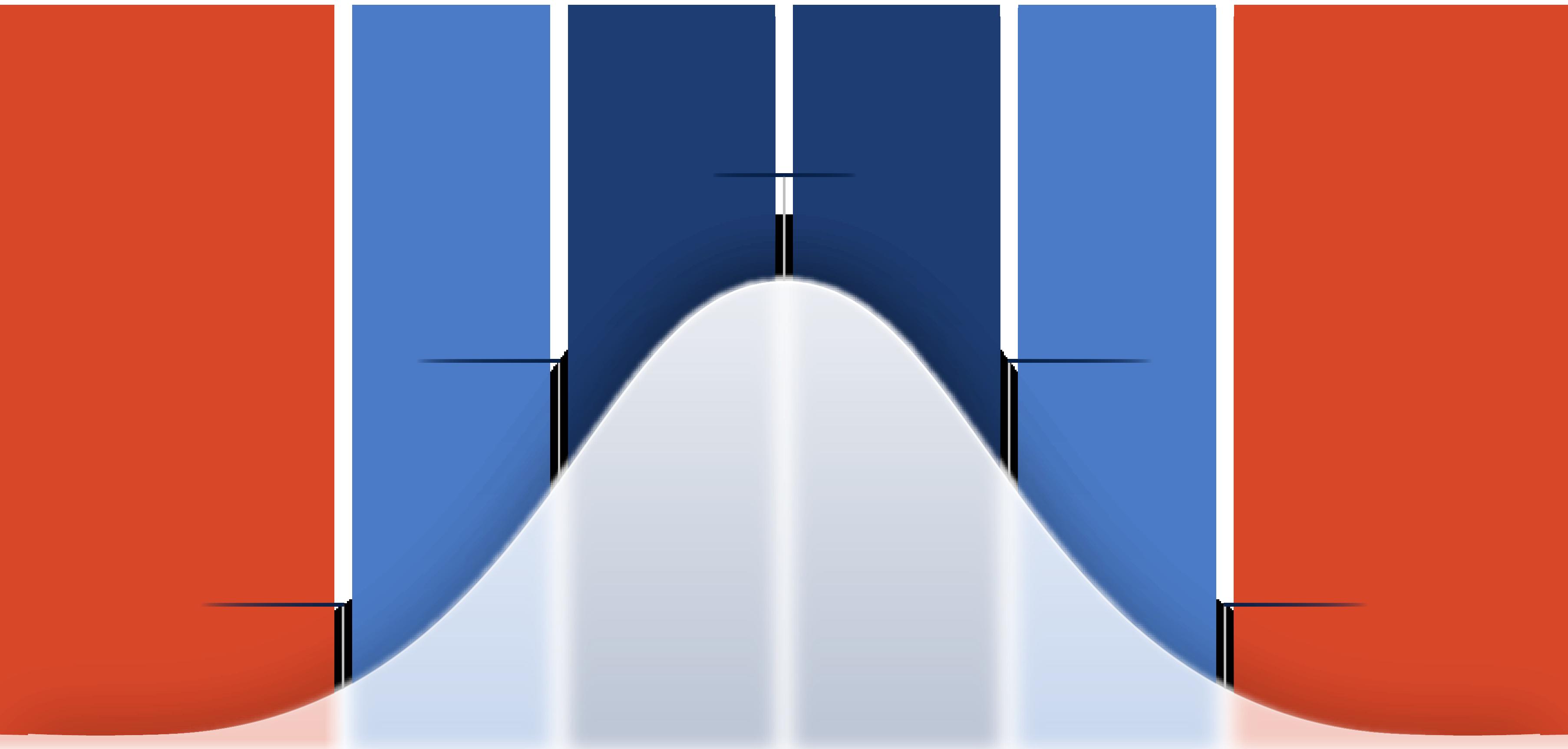

After reviewing the graph on the previous page, one is able to see that the average rent for Take 5 Oil Change is $89,681.39. By using this piece of data and the rent distribution bell curve, you are able to judge the overall health of your store.