Since its inception, this guide has been the industry standard for aiding investors in understanding the position of their assets in the overall market. Utilized by institutional and professional investors, developers, and private clients, this guide provides the data and resources necessary to make informed investment decisions effectively as you navigate the current industrial market in Orlando.

Whether you’re the owner of a single industrial property or a large portfolio, The Definitive Guide to Industrial Rents will provide you with immediate actionable information to:

› Protect your cash flow

› Increase your leverage as an owner

› Secure your wealth

Ultimately, you will thoroughly understand where your investment stands and how to plan for the future.

Matthews Real Estate Investment Services™, a commercial real estate investment services and technology firm, holds recognition as an industry leader in investment sales, leasing, and debt and structured finance. Matthews™ delivers superior results through the firm’s industry revered work ethic, unique culture, collaboration, and advanced technology.

Since 2015, Matthews™ has experienced unprecedented growth adding over 1,000 real estate professionals to serve clients. Headquartered in Nashville, TN, and strategically positioned in 25+ offices across the United States, Matthews™ continues to expand into new markets.

Matthews™ redefines what clients expect by accelerating the evolution of how the commercial real estate industry services clients through technology. By leveraging technology and industry-leading resources, Matthews™ is committed to growing and preserving client wealth and adding value to their investment strategy.

Our professional team of agents have many years of experience with representing the top institutions, developers, and private clients in commercial real estate. We hire the best and provide them with top of the line support, systems, and materials with the goal of exceeding expectations

25,477 TRANSACTIONS

$66.26B IN DEALS CLOSED

1,000,000 INVESTOR DATABASE

1,000+ AGENTS & EMPLOYEES

Our centralized client services foster specialization and collaboration across all divisions to provide an array of commercial real estate solutions for our clients.

INVESTMENT SALES

› Industrial

› Net Lease Retail

› Shopping Centers

Multifamily

Healthcare

Office

Self-Storage

Hospitality

Auction Services

When you hire Matthews™, you have the power of investment professionals strategically positioned across the country to sell your deal. We have access to the largest database of capital from private and institutional investors. With our collaborative culture, agents from across the country work together to source buyers through the Matthews™ network. CAPITAL MARKETS › Debt & Structured Finance › Equity LEASING › Landlord Representation › Tenant Representation

ASSOCIATE

DIRECT (407) 362-1758 | MOBILE (863) 604-1619

christian.peters@matthews.com

License No. SL3592674 (FL)

Christian Peters serves as a real estate professional at Matthews Real Estate Investment Services™ specializing in the acquisition, disposition, leasing, and sale-leaseback of industrial properties in Central Florida. By utilizing the technology offered by Matthews™, he gains in-depth insight into industry dynamics and trends. This enables him to effectively position his clients to achieve their long-term investment goals. Christian prides himself on setting the bar high for every client relationship and leveraging hard work to meet those expectations.

With direct experience in executing high-profile brokerage assignments in the largest markets in the Southeast, Christian’s clients receive an exceptional level of service by leveraging his experience, multi-market knowledge, and strong relationships within the industry.

Prior to joining Matthews™, Christian gained significant experience through internships at MidFlorida Credit Union and St. Joe Development Company.

ASSOCIATE

DIRECT (689) 348-5202 | MOBILE (817) 726-1493

easton.troutt@matthews.com

License No. SL3618560 (FL)

Easton Troutt is a distinguished agent specializing in exchanges, acquisitions, dispositions, financial advising, and leasing of industrial properties in Central Florida and its surrounding areas. Easton is renowned for his ability to build enduring personal relationships and his deep commitment to understanding and meeting the unique needs of his clients. Easton holds a deep knowledge of the Orlando and Central Florida markets, allowing him to deliver insightful and effective solutions, specifically for industrial assets. His proactive and dedicated approach ensures that every client receives the highest level of service and support.

Orlando’s industrial market is grappling with a significant supplydemand imbalance following its fastest-ever two-year inventory expansion. Vacancy rates have risen to a decade-high of 7.0%, in line with national averages but substantially higher for properties with over 500,000 SF, which hover near 20%. While demand for spaces under 50,000 SF remains strong with vacancy compressed below 4%, leasing activity has slowed for larger facilities, reflecting a shift in tenant preferences. Rent growth, once among the fastest in the U.S., has moderated to 6.2% YOY and is expected to decelerate further in 2025. Despite near-term headwinds, robust population growth and infrastructure projects are sustaining longterm investor interest, with a notable rise in deal velocity and sales volume. However, challenges persist in absorbing over 21 million SF of available space and aligning development trends with tenant demand for smaller, divisible spaces.

SOURCE: COSTAR GROUP

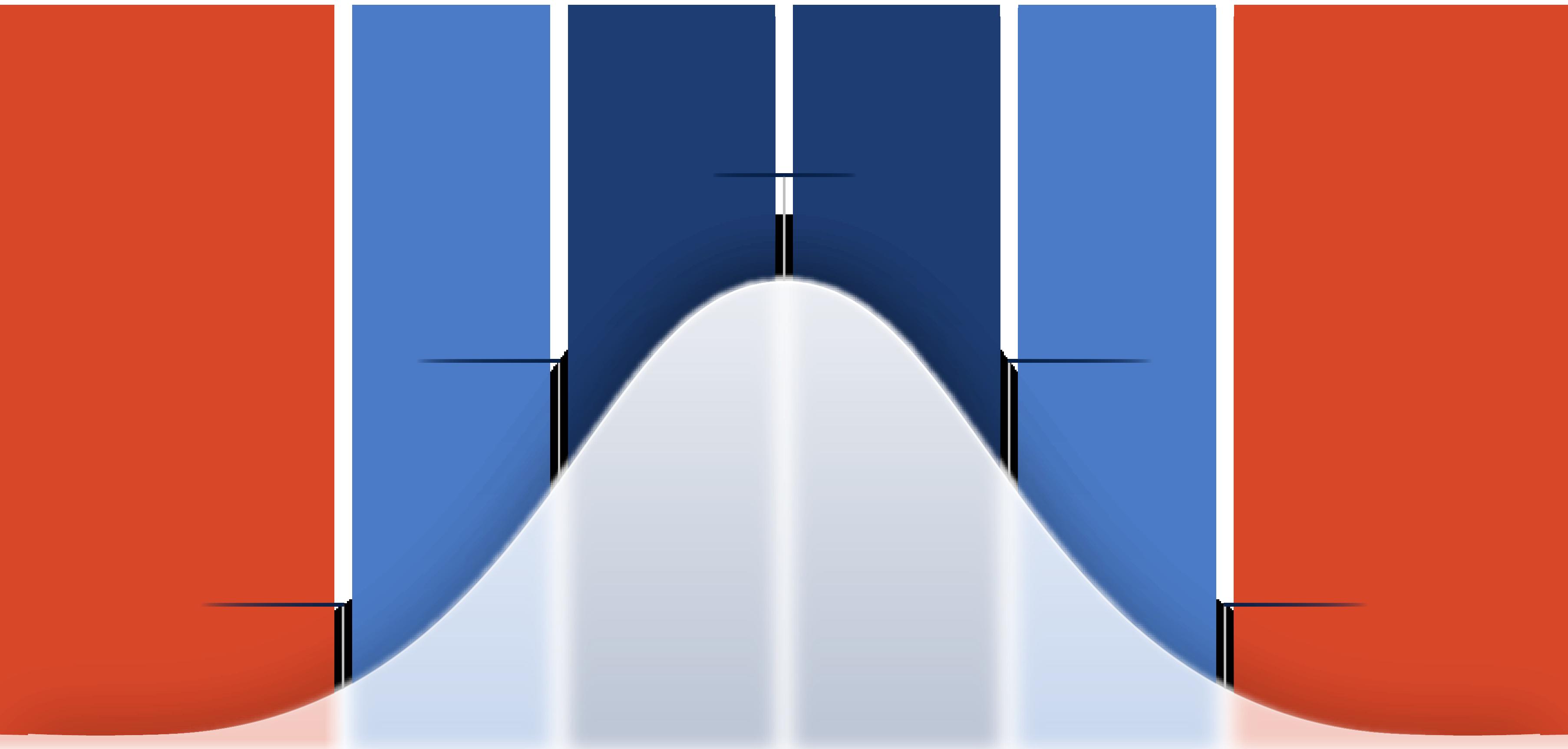

Less asking rent than 98% of all Orlando owned properties.

Less asking rent than 2% - 16% of all Orlando owned properties.

Less asking rent than 16% - 50% of all Orlando owned properties.

Higher asking rent than 50% - 84% of all Orlando owned properties.

Higher asking rent than 84% - 98% of all Orlando owned properties.

Higher asking rent than 98% of all Orlando owned properties.

Occupancy cost is simply defined as all costs related to a tenant occupying a space per the lease type. One of the largest expenses an industrial property will incur is the rent paid by the tenant to the landlord.

Low rent is advantageous for you as a landlord because it keeps the operator’s expenses low, allowing for greater profitability at a location, When your tenant is profitable, they continue to operate out of the space preserving your equity in your investment.

After reviewing the graph on the previous page, one is able to see the average rent per square foot in Orlando. By using this piece of data and the rent distribution bell curve, you are able to judge the overall health of your asset.