LUNCH & LEARN

At Matthews™, our mission is to redefine client expectations by accelerating the evolution of how the commercial real estate industry services investors through technology and streamlined support. By leveraging proprietary technology and industry-leading resources, Matthews™ is committed to growing and preserving client wealth and adding value to investment portfolios nationwide.

HIGHLIGHTS & RECOGNITIONS

$66.26B IN DEALS CLOSED

1,000,000 25,477 TRANSACTIONS AGENTS & EMPLOYEES

INVESTOR DATABASE 1,000+

MATTHEWS™ OFFICE LOCATION

MATTHEWS™ TOP MARKET

SHARED NATIONAL DATABASE STRUCTURE & SPECIALIZATION

WE GET YOUR LISTING TO THE MASSES AND THE MOST LIKELY BUYERS.

OWNER PURCHASES A BUILDING CLICKS ON AN EMAIL DOWNLOADS AN OFFERING MEMORANDUM REGISTERS AS AN INTERESTED BUY ON A LISTING SEARCHES ON OUR WEBSITE REGISTERED AS AN INTERESTED BUYER ON A LISTING

DIRECT TARGETING OF HIGH PROBABILITY BUYERS

A real-time profile based on investor activity in the marketplace and engagement with Matthews™ Marketing Identifies first time buyers in new markets and products

EXPOSING YOUR PROPERTY TO THE MOST INVESTORS LEADS TO THE BEST RESULTS.

SHOPPING CENTER 2,070 CONTACTS HOSPITALITY 2,500 CONTACTS

INDUSTRIAL 2,175 CONTACTS RETAIL 1,975 CONTACTS

HEALTHCARE 3,870 CONTACTS

All of our agents research and add thousands of contacts into our shared database, exposing your listing to the biggest buyer pool in the industry.

INDUSTRIAL 2,070 CONTACTS RETAIL 2,500 CONTACTS NET LEASE 2,150 CONTACTS

SELF-STORAGE 800 CONTACTS

SHOPPING CENTER 2,175 CONTACTS

DATABASE +1,000,000 INVESTORS

MULTIFAMILY 3,870 CONTACTS MULTIFAMILY 1,820 CONTACTS

HEALTHCARE 1,975 CONTACTS

MAXIMUM EXPOSURE

Matthews™ shares a database across agents in all product types and industries, ensuring your listing will be proactively marketed to the maximum amount of investors.

Exposing your listing to the largest amount of investors will generate the greatest number of qualified offers, which in turn helps you achieve the highest price for your listing.

Outside brokerage firms and their agents have a personal database and not a shared company database. They are restricted to their own individual research , offer no cross industry marketing capabilities, and offer limited exposure. Your property deserves better.

COMPETING BROKER DATABASE ±355 INVESTORS

COMPETING BROKER DATABASE ±250 INVESTORS

COMPETING BROKER DATABASE ±750 INVESTORS

CEO & CHAIRMAN

Kyle Matthews is the Founder, Chairman, and Chief Executive Officer of Matthews Real Estate Investment Services™.

Since Kyle founded the company in 2015, Matthews™ has become the fastest-growing commercial real estate firm in the country, is the largest privately held brokerage platform in the U.S.

Kyle is the host of the Matthews Mentality Podcast, launched in 2023, where he shares insights on business, leadership, and the evolving commercial real estate landscape.

Kyle has an extensive background in the industry, with an aggregate value of $9 billion in transaction volume.

Prior to starting Matthews™, Kyle served as Vice President of Investments and thereafter as Executive Vice President at two publicly traded commercial real estate brokerage firms.

robert anderson VICE PRESIDENT OF AUCTION SERVICES

(949) 544-1722

robert.anderson@matthews.com

Robert brings 20 years of experience in the commercial real estate space.

Robert has been actively involved with over $5 billion in total asset value, including the record-setting sale of Beltway Business Park for $205 million in November of 2021.

Prior to joining Matthews™, Robert was a Vice President of Transaction Services at Crexi, where he grew revenue from $3 million in 2020 to $20 million and tripled the auction asset count.

Robert also worked for Ten-X as a member of the team selling over $30 billion of commercial and residential properties and notes (performing and non-performing).

From 2014-2018, Robert generated an averaged $1.5 million in revenue per year.

Ben snyder

EXECUTIVE VICE PRESIDENT

(216) 503-3607

ben.snyder@matthews.com

Ben Snyder brings over a decade of experience in the shopping center space.

Ben leads shopping center agents in the disposition and acquisition of multi-tenant shopping centers in the Midwest.

During his career, Ben has led the execution of over $2 billion transactions around the country, as one of the most active principals in the nation.

Prior to his current role at Matthews™, Ben established himself as an essential asset at DDR Corp. where he served as the Vice President of Transactions.

What I do and our approach

What’s transpired in NYC the last 15 years

Rent laws and effect on NYC CRE

Broad multifamily metrics

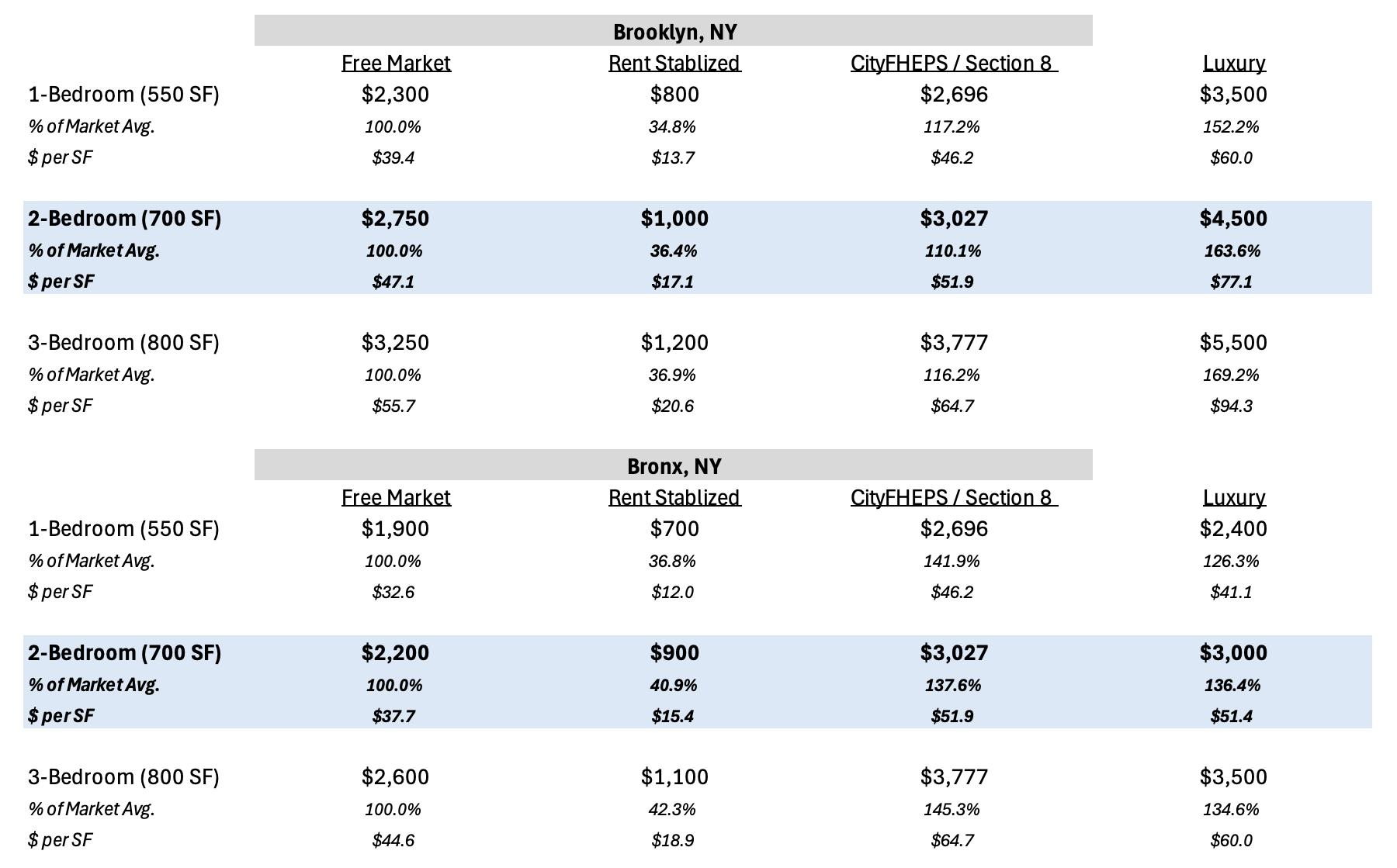

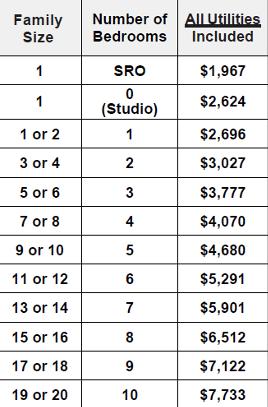

Market rents vs. subsidies

Getting to the right NOI Landmines

NYC nuances and recent changes

Case studies

How to leverage Matthews™ Q&A

DJ Johnston EXECUTIVE VICE PRESIDENT

(718) 701-5367

dj.johnston@matthews.com

DJ Johnston is a professional real estate agent at Matthews Real Estate Investment Services™ where he leads investment sales in Brooklyn, NY.

To date, he has helped clients value over 2,000 properties and has personally executed the sale of 350 transactions, with an aggregate value of $1.5 billion.

Previously, he was a Partner and Senior Managing Director at B6 Real Estate Advisors, where he was the top producer for 5 consecutive years.

Prior to B6 Real Estate he was a Director at Massey Knakal Realty, starting his career in 2009. Massey Knakal Realty was acquired by Cushman in Wakefield in 2015 where he worked for three years.

15+ yrs

BROOKLYN EXPERIENCE

400+ BUILDINGS SOLD

$2B SALES VOLUME

$1.5M BUILDABLE SF SOLD 2,963 VALUATIONS COMPLETED

$300M FINANCED

Major Capital Improvements:

Building-wide improvements translated to permanent rent increases of 1/9 of the cost, up to 6% / year, uncapped over time.

Building-wide improvements that are considered essential translate to temporary rent increases of 1/12 of the cost, up to 2% / year, with a 30-year expiration, after which rents reverts back.

Individual Apartment Improvements (IAI):

Landlords could permanently increase legal rent of an apartment by up to 1/40 of the cost of improvements, with no cap on increases.

Vacancy Decontrol:

Once a regulated rent exceeded $2,775 and the apartment became vacant, the unit was no longer subject to rent stabilization.

Landlords can temporarily increase legal rent of an apartment by up to 1/168 of the cost of improvements, with a 30-year expiration, after which rent reverts back. IAIs are limited to three improvements per 15-year period.

Preferential Rent:

Landlords could charge a tenant rent that is lower than registered legal rent, with the right to increase back to legal rate upon lease renewal.

Apartments can longer be deregulated by reaching a rent threshold, regardless of incremental increases via IAIs, MCIs, or annual escalations.

Unit Reconfiguration / First Rent:

A landlord could alter the footprint of units resulting in apartments never registered with DHCR. This meant the landlord could establish a first market rent (whatever rent they could achieve).

Landlords must base all future rent increases on the preferential rent as long as the tenant remains in the apartment. Proper notice of preferential rents are required in leases, or legal rent can be reduced to preferential rent.

Unit reconfiguration results in new market rents that, in aggregate, cannot exceed the total legal rent of affected units.

2650-2654 MARION AVENUE, FORDHAM, BRONX

Pre-War Rent Stabilized Cap Rate: 7.50-8.50%

GRM: 6-8X

Price Per SF: $100-300

Price Per Unit: $100-300K

Expense Ratio: 45-55% of EGI Tax Ratio: 20-27% of EGI

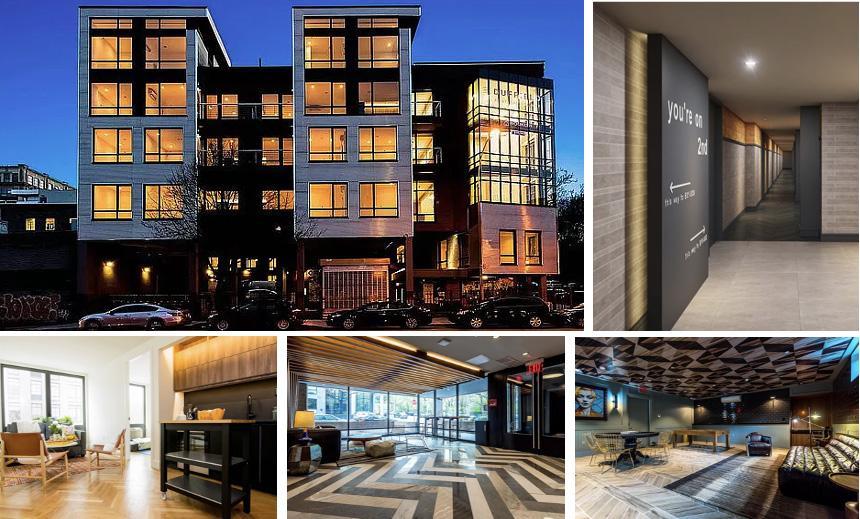

303 WYTHE AVENUE, WILLIAMSBURG, BROOKLYN

Free-Market New Construction

Cap Rate: 5.75-7.00%

Price Per SF: $500-1,000

Price Per Unit: $500-900K

Expense Ratio: 15-40% of EGI Tax Ratio: 0-27% of EGI

1118 WILLOUGHBY AVENUE, BUSHWICK, BROOKLYN

Free-Market Walk-Up

Cap Rate: 6.25-7.50%

Price Per SF: $400-750

Price Per Unit: $250-500K Expense Ratio: 15-25% of EGI Tax Ratio: 5-10% of EGI

422

Rent Stabilized Walk-Up

Cap Rate: 7.00-8.00%

Price Per SF: $150-$300

Price Per Unit: $150-250K

Expense Ratio: 30-40% of EGI Tax Ratio: 10-15% of EGI

2468 TIEBOUT AVENUE, FORDHAM, BRONX

Program

Cap Rate: 8.00-10.00%

Price Per SF: $250-500

Price Per Unit: $250-450K

Expense Ratio: 20-30% of EGI Tax Ratio: 0-27% of EGI

RENTAL INTEL CHEAT CODE:

The DHCR and HPD demand accurate and complete record keeping, including:

- IAI substantiation (pre-2019)

- MCI substantiation (pre-2019)

- Vacancy decontrol substantiation (pre-2019)

- Proper DHCR filings

- RS leases must be perfect, including preferential rent riders, when applicable

Though NYC recommends record retention of 6-years for most neighborhoods, the lookback periods for DHCR and HPD are essentially indefinite, as suspicion of fraud or overcharge can prompt a deeper investigation into historical records beyond the standard timeframes.

Most properties in NYC have open violations. However, the type and quantity of violations makes a substantial difference whether a buyer can close.

Class C violations typically cost $5K/ ea. to resolve.

Many open violations can accrue financial penalties, such as unaddressed Environmental Control Board (ECB) Class 1 violations. The seller is typically responsible for monetary penalties, regardless if they are cleared before closing.

Open permits can also cause significant complications, as they leave the buyer vulnerable to incomplete work or code infractions, unresolved inspections and may cloud title.

ALTERNATIVE ENFORCEMENT PROGRAM (AEP) TENANT ARREARS

HPD identifies up to 250 of the most distressed buildings per year

What earns you AEP Status:

- Number of violations

- Class C violations

- Open HPD Orders to Correct

Owner is allotted 4 months to address repairs and improvements, or face penalties.

Frequent HPD inspections, potential for emergency repairs addressed by HPD with owner reimbursement, could result in significant fines, liens, etc.

NYC is notoriously tenant-friendly, with eviction rulings for non-payment or holdover cases averaging 12-18 months.

With that in mind, buyers are extremely sensitive to tenant arrears, particularly when the eviction process is not underway.

Significant arrears can have a profound impact on value and on depth of the buyer pool.

CityFHEPS is a rental assistance program to help individuals and families find and keep housing. It is administered by the Department of Social Services (DSS), which includes both the Department of Homeless Services (DHS) and the Human Resources Administration (HRA).

(determined on individual basis by Department of Social Services)

Tenant must have a gross income at or below 200% of federal poverty level, or meet one of the following criteria:

Veteran at risk of homelessness

Household gets Pathway Home benefits and meets income criteria

CityFHEPS qualifying program referred household, at risk of homelessness

Household is facing eviction in court, or was evicted in past year, and has previously lived in DHS shelter, has an active Adult Protected Services case, lives in a RC apartment

BENEFITS FOR LANDLORDS:

First month’s rent + 3 month’s CityFHEPS rent paid up front

Monthly rental assistance payments from DSS/HRA for up to 5 years + possible extensions for good cause

Up front payment equivalent to one month’s rent to hold the unit or room vacant while paperwork is processed

Broker fee up to 15% of the annual rent

Inconsistent collections, limited recourse for late payment

Tenant’s eligibility can change, potentially causing program rent supplement to cease at any time while unit is occupied

Unit and building must be clear of certain violations, and undergo a physical walkthrough to determine eligibility

city of yes

Higher density housing (~20% FAR increase) for sites with affordable housing component

Relaxed setback / light and air requirements

Parking requirements reduced or waived

Higher max building heights

Focus on transit-oriented neighborhoods

Eased regulations for ADUs

Streamlined permitting and approvals process, particularly for green initiatives

Emphasis on adaptive reuse, office to residential conversion

$215,000,000 budget increase for CityFHEPS program

The proposed MSMX impacts 42 blocks in Midtown Manhattan, roughly bounded by W 23rd St to W 40th St and Fifth Ave to 8th Ave. The plan is intended to revitalize what is currently a commercial and industrial zone into a vibrant 24/7 mixeduse neighborhood, by adding nearly 10,000 new residential units.

Zoning Reform – Update existing industrial districts to permit a mix of residential, commercial, and light manufacturing uses

Affordable Housing – Implement MIH zones to increase number of permanently affordable units

Public Amenities – Encourage owners/developers to include amenities to the public, such as transit access, public space, atriums, etc

Residential potential as-of-right will spur renewed ground up development and adaptive reuse from commercial / office to rental apartments

Value of existing commercial/office buildings will be surpassed by value of the land beneath them, prompting developers to pursue demolition / groundup development.

Bank-Owned | Rent Stabilized | AEP Program | Tenant Evictions

Top Offer: $1,000,000 | $117 / SF

15-BUILDING BUSHWICK / RIDGEWOOD PORTFOLIO

96 Units | 86,000 SF | 85% Free Market

Asking $38,400,000 | 6% Cap In-Place | $447 / SF | $400K / Unit

303

1 DUFFIELD STREET, DOWNTOWN BROOKLYN

100 Units | 96,000 SF | Assumable Debt At 4.6% | 27% Expense Ratio High Offer $25,000,000 | 7.6% Cap | $260 / SF

422 BLEECKER STREET, BUSHWICK, BROOKLYN

we can help you build your resource team

Expediters Tax Tertiaries

Property Managers

DHCR Specialists

Appraisers Broker Network

Environmental Specialists