Since its inception, this guide has been the industry standard for aiding investors in understanding the position of their assets in the overall market. Utilized by institutional and professional investors, developers, and private clients, this guide provides the data and resources necessary to make informed investment decisions effectively as you navigate the current office market in Palm Beach County.

Whether you’re the owner of a single office or a large portfolio, The Definitive Guide to Office rents will provide you with immediate actionable information to:

› Protect your cash flow

› Increase your leverage as an owner

› Secure your wealth

Ultimately, you will thoroughly understand where your investment stands and how to plan for the future.

Matthews Real Estate Investment Services™, a commercial real estate investment services and technology firm, holds recognition as an industry leader in investment sales, leasing, and debt and structured finance. Matthews™ delivers superior results through the firm’s industry revered work ethic, unique culture, collaboration, and advanced technology.

Since 2015, Matthews™ has experienced unprecedented growth adding over 1,000 real estate professionals to serve clients. Headquartered in Nashville, TN, and strategically positioned in 25+ offices across the United States, Matthews™ continues to expand into new markets.

Matthews™ redefines what clients expect by accelerating the evolution of how the commercial real estate industry services clients through technology. By leveraging technology and industry-leading resources, Matthews™ is committed to growing and preserving client wealth and adding value to their investment strategy.

When you hire Matthews™, you have the power of investment professionals strategically positioned across the country to sell your deal. We have access to the largest database of capital from private and institutional investors. With our collaborative culture, agents from across the country work together to source buyers through the Matthews™ network.

Our professional team of agents have many years of experience with representing the top institutions, developers, and private clients in commercial real estate. We hire the best and provide them with top of the line support, systems, and materials with the goal of exceeding expectations

25,477 TRANSACTIONS

$66.26B IN DEALS CLOSED

1,000,000 INVESTOR DATABASE

1,000+ AGENTS & EMPLOYEES

Our centralized client services foster specialization and collaboration across all divisions to provide an array of commercial real estate solutions for our clients.

INVESTMENT SALES

› Office › Net Lease Retail › Shopping Centers

ASSOCIATE

DIRECT (561) 489-5829 | MOBILE (561) 818-7587

connor.anthony@matthews.com

License No. SL3608675 (FL)

Connor Anthony is a real estate professional at Matthews™ specializing in office investment sales in South Florida, leveraging his extensive market knowledge to provide top-notch service to his clients. Connor has demonstrated a strong work ethic and a deep understanding of the office market.

VICE PRESIDENT

DIRECT (954) 237-4510 | MOBILE (954) 232-9768

rob.goldberg@matthews.com

License No. 2018005194 (OH)

Robert Goldberg is a premier national client advisor within the Matthews™ shopping center division. Robert specializes in advisory consulting on the disposition and acquisition of shopping center assets in the Mid-West. Utilizing his in-depth knowledge of the real estate market, he leverages his relationships with large institutional clients, developers, REITs, and high net-worth individuals across the nation.

SENIOR ASSOCIATE

DIRECT (305) 359-5207 | MOBILE (305) 905-3215

alexander.machado@matthews.com

License No. SL3507121 (FL)

Alexander Machado is a Senior Associate at Matthews™, specializing in the acquisition and disposition of single tenant net lease retail properties. As a professional in advisory services and retail investment sales, Alexander has built relationships with publicly traded REITs, preferred developers, multi-state franchisees, and high networth individuals to create comprehensive investment strategies for his clients. Alexander is committed to finding the best opportunities and solutions available in any market and continually exceeds client expectations.

Palm Beach County’s office and healthcare real estate markets remain active, driven by population growth (over 6% in the past decade) and increasing demand for medical services. While traditional office vacancy rates have risen to around 14-16%,

Class A office space continues to perform well, with rents averaging $35-$45 per SF in prime submarkets. Medical office space is in high demand, with occupancy levels exceeding 90% in many areas and rental rates reaching $40-$55 per SF, driven by an aging population and healthcare expansion. Investors are increasingly targeting value-add properties that can be converted to medical use or redeveloped into higherdensity projects.

Despite interest rate pressures, cap rates for well-located office and medial assets remain competitive, typically ranging from 6-8%, with stabilized medical assets often trading at the lower end. Retail-integrated healthcare facilities are growing in popularity as providers seek high-visibility locations with easy patient access. Looking ahead, investment opportunities will focus on repositioning underutilized office assets, securing long-term medical tenants, and capitalizing on highdemand suburban corridors near major hospitals and affluent residential areas.

KEY INDICATORS

Source: CoStar Group

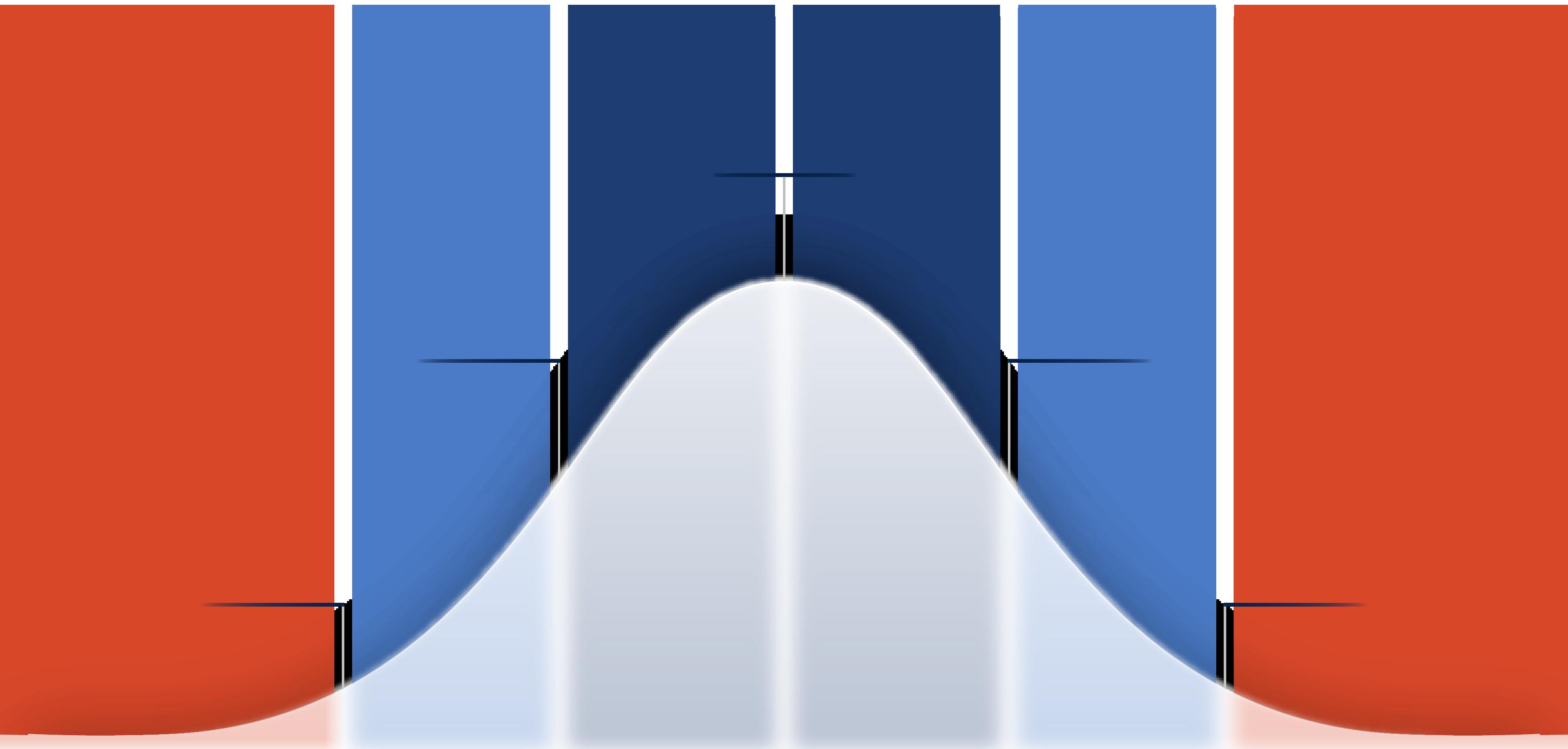

Less effective rent than 98% of all Palm Beach County owned properties. Less effective rent than 2% - 16% of all Palm Beach County owned properties. Less effective rent than 16% - 50% of all Palm Beach County owned properties. Higher effective rent than 50% - 84% of all Palm Beach County owned properties. Higher effective rent than 84% - 98% of all Palm Beach County owned properties. Higher effective rent than 98% of all Palm Beach County owned properties.

Last 12 Months Source: Costar Group

Delivered SF Absorption SF Vacancy Rate Market Asking Rent Growth

This submarket has a substantial office presence with approximately 5.3 million square feet of commercial space, mainly centered along Glades Road and Powerline Road. The submarket has easy access to various academic campuses, including Florida Atlantic academic, hospitals, and the Boca Raton Airport.

Sales volume has rebounded in 2024, totaling $173 million over the last 12 months and exceeding the five-year average annual volume of $144 million. Annual rent growth has slowed to 3.7%, falling below the 10-year average of 5.9%. Limited supply additions in the next few years will assist in tempering an increase in space availability, but this will not boost rent growth, which is likely to remain below 2% for the foreseeable future.

Last 12 Months Source: Costar Group

Delivered SF Absorption SF Vacancy Rate Market Asking Rent Growth

The Boynton Beach office submarket has around 120,000 square feet of space listed as available, representing a 4.2% availability rate. As of the first quarter of 2025, no office space was under construction in Boynton Beach. In comparison, the submarket has averaged 58,000 square feet of under construction inventory over the last decade. The submarket has 3.0 million square feet of inventory, compared to 61.2 million square feet throughout the entire metropolitan area. The average rent is approximately $28.06 per square feet, compared to the Palm Beach average of $47.00 per square feet. Rents have risen by 4.1% year over year, compared to a 4.2% increase across the entire metropolitan region.

Last 12 Months Source: Costar Group

Delivered SF Absorption SF Vacancy Rate Market Asking Rent Growth 128K 31,462 9.4% 2.5%

The Delray Beach office submarket had a vacancy rate of 9.8% in the year end 2024. The submarket’s vacancy rate has changed by 2.4% over the last year, reflecting 130,000 SF of net delivered space and 26,000 square feet of net absorption. Approximately 450,000 square feet of space are advertised as available, representing a 11.4% availability rate. Delray Beach has 5,700 square feet of office space under construction as of the year end 2024.

Last 12 Months Source: Costar Group

Jupiter’s average rent is approximately $29.67 per square foot, compared to the Palm Beach average of $47.00. Jupiter rents have risen by 4.3% year over year, compared to a 4.2% increase across the metro area. The annual rent growth rate of 4.3% compared to the submarket’s fiveyear and ten-year averages of 5.8%. The Jupiter office submarket has a 4.4% vacancy rate. Over the last year, the submarket’s vacancy rate has increased by 0.9% due to no net new space and a negative net absorption of (34,000) square feet.

Last 12 Months Source: Costar Group

Delivered SF Absorption SF Vacancy Rate Market Asking Rent Growth

This submarket is dominated by services, finance, insurance, and real estate tenants that benefit from easy access to coastal communities and can tap into a substantial talent pool in Palm Beach, Martin, and St. Lucie counties’ western suburbs. The submarket is easily accessible for commuters, with I-95 running through the center and allowing access to Downtown Palm Beach and larger South Florida. The average asking rent growth rate has remained solid at 4.5%, surpassing the Palm Beach market average but falling short of the 10-year average of 5.6%. Despite high leasing activity, net absorption has been negative over the past year. However, minimal development activity has kept the availability rate from rising, keeping at 9.3%, lower than the Palm Beach market average of 11.6%.

Last 12 Months Source: Costar Group Delivered SF Absorption SF Vacancy Rate Market Asking Rent Growth

Available office space in the West Palm Beach submarket remains restricted, with an availability rate of 8.5% as of the year end 2024. Since 2023, net absorption has slowed due to a scarcity of available space and new construction. Since 2022, transaction activity has moderated, with $30.7 million traded in the last twelve months. Despite this near-term slowdown, the West Palm Beach market remains appealing on a relative basis, with vacancy rates well below the national average of around 14% and positive rent gains indicating that the market may be somewhat wellinsulated from future economic uncertainty when compared to its highgrowth peers. However, a near-term decline in institutional buyer activity is expected to last until 2025, as lower rent gains and still-high interest rates affect value creation and investment decisions.

Last 12 Months Source: Costar Group

Delivered SF Absorption SF Vacancy Rate Market Asking Rent Growth

Lake Worth holds 1.2 million square feet of inventory, in comparison to 61.5 million square feet in the metropolitan area. The average rent stands at $39.00 per square foot, lower than the Palm Beach market average of $47.00. The Lake Worth office submarket has around 36,000 SF of space listed as available, representing a 3.1% availability rate. Construction activity has been limited in this submarket over the last decade. As a result of no delivered space, the submarket’s vacancy rate has seen a 1.1% change in its vacancy rate.

Occupancy cost is simply defined as all costs related to a tenant occupying a space per the lease type. One of the largest expenses an office property will incur is the rent paid by the tenant to the landlord. Low rent is advantageous for you as a landlord because it keeps the operator’s expenses low, allowing for greater profitability at a location. When your tenant is profitable, they continue to operate out of the space preserving your equity in your investment.

After reviewing the graphs on the previous pages, one is able to see the average rent per property type and lease structure. By using this piece of data and the rent distribution bell curve, you are able to judge the overall health of your asset.