With our deep insight and experience, where others see challenges, we see opportunities.

• Registration/Breakfast: 9:30 am

• Shotgun Golf Start: 11:30 am

• Tennis & Pickleball Start: 1:30 pm

• Cocktails/Dinner: 4:30 pm

Meridian’s national dominance in multifamily financing gives us a unique vantage point from which to approach markets on our clients’ behalf. By leveraging our 30+ year relationships and depth of experience, we are able to see what others can’t and produce exceptional outcomes — especially in turbulent markets. Remain informed and be agile with Meridian.

EDITORIAL

Editor

Debra Hazel

Associate Editor

Alex Baumbusch

Director of Communications and Marketing

Penelope Herrera

Director of

Newsletter Division

Cheri Phillips

PRESIDENT/CEO

Jeff Mann

ART

Art Director

Serena Bhullar

Graphic Designer

Laura Chousa

Graphic Designer

Madi McCreesh

Cover Photography

Ezekiel Jeremiah

Jeremy Bergstein

Marshal Cohen

Frank DeLucia

Terri Jensen

Kris Kiser

Nate Larmore

Nolan McKeever

Ira Meister

Carl J. Montante Jr.

Charleston Morford

Technology Consultant

Joshua Fried

Distribution

Mitchell’s Delivery Service

DIGITAL MEDIA

Designers

Serena Bhullar

Laura Chousa

Madi McCreesh

Editors

Alexandra Baumbusch

Debra Hazel

Penelope Herrera

Cheri Phillips

Web Developer

CS Designworks

West Coast Office: 578 Washington Blvd., Suite 827

Marina Del Rey, CA 90292

866-306-MANN (6266)

East Coast Office: 450 7th Ave, Suite 2306

New York, NY 10123

212-840-MANN (6266)

mannpublications.com

May 9, 2024

Jennifer L. Widay

CHAIRS EMERITI

Kathy A. Chazen, CLU, ChFU

Roger A. Silverstein

Properties, Inc. Trustee, National Jewish Health

It’s really interesting when a cover feature brings back the past, even as the story is all about the future. That’s the case this month. Bob Knakal and his then-partner, Paul Massey Jr., were the first cover subjects for Mann Report. It’s been a lot of years, a lot of covers and a lot of events, conversations and more with Bob, who’s a good friend, since then.

Bob’s newest venture, BK Real Estate Advisors (BKREA), wants to redefine how a brokerage can be run, using the latest technology to find new patterns in data, new ways to eliminate repetitive tasks and build new relationships. I’m thrilled for Bob and it will be fascinating to watch this grow.

Meanwhile, we’re continuing to grow our social media presence and bring you the latest news via our many newswires. Sign up for our free weekly reports on our website, mannpublications.com.

And we’re out and about. Look for our editor Debra Hazel at the ICSC Las Vegas conference this month after attending Marcum LLP’s Retail Symposium in April. We want to hear what you want to know as we plan for the rest of the year and beyond.

Enjoy the rest of the spring!

“For everything you have missed you have gained something else.” - Ralph Waldo Emerson

PKF

With

It’s ICSC month, so once again, welcome to our annual Retail issue.

I won’t admit to how many of the ICSC annual conferences I’ve attended, but I’ve seen a lot of changes in the industry, from the “Malling of America” to de-malling to mixed-use and more. Now, we’re seeing completely new iterations of development, as you’ll see in our features and columns. A former train station is becoming a luxury hotel, right at the entrance to a Downtown Salt Lake City office/retail complex. Uniland’s Carl J. Montante Jr. tells us what his company is doing to transform Eastern Hills Town Center into a neighborhood with retail, entertainment, wellness, residences and offices.

We haven’t ignored other sectors. Technology also is at the fore, with our cover subject Bob Knakal discussing how he’s using artificial intelligence to serve clients at his new company, and MGAC’s Nate Larmore discussing how AI can reinvent project management.

Just as projects are being reinvented, so, too are retail and the industry as a whole. It’s an exciting time. If you’re at ICSC, too, find me and tell me what you’re seeing.

JEWISH NATIONAL FUND-USA

Newmark

Tree of Life® Award Honoree

CrossCountry Mortgage, LLC

Gregory A. Davis Leadership Award Recipient

MONDAY, JUNE 3, 2024 · 6:30 PM

Midtown East, Manhattan

RSVP to jnf.org/NYtreeoflife

CHAIR

Glen Weiss, Vornado Realty Trust

HONORARY CHAIRS

David R. Greenbaum, Vornado Realty Trust

Jeffrey E. Levine, Douglaston Development

More information

Sarah Azizi, Tristate Director, Manhattan sazizi@jnf.org • 212.879.9305 x505

JEWISH NATIONAL FUND - USA builds a strong, vibrant future for the land and people of Israel through bold initiatives and Zionist education.

St. Jude Children’s Research Hospital kicked off spring in South Florida for the 14th Annual St. Jude Palm Beach Cocktail Party “Reach for the Stars”. Presented by and in memory of Robert Thomas Butler and hosted at The Colony Hotel, the spring soirée included a reception with delectable cuisine, cocktails and special St. Jude moments.

The chairs for the event were Stephen and Erin Hawthornthwaite and the honorary chair was Ashley Miller. The event benefited the lifesaving mission of St. Jude, “Finding cures. Saving Children.”

“Collectively, our community is committed to advancing many missions, but with your demonstrated support and presence, we celebrate the active role you play in advancing St. Jude’s mission,” said Erin Hawthornthwaite. “We fund the research that will save the lives of hundreds of thousands of children stricken with cancer and other life-threatening diseases throughout the nation and around the globe. We would like to recognize our event co-founder and former American Lebanese Syrian Associated Charities (ALSAC)/St. Jude Board Member, Thomas Quick, whose foundation, passion and commitment to St. Jude over the years has shaped our fundraising efforts, specifically here in Palm Beach, but truly around the globe.”

During the event, guests heard from local St. Jude patient Slater and his entire family about the 10-year-old’s life-changing experience at St. Jude. The evening concluded with a call to the heart “Give to Live” where guests were able to make charitable contributions to St. Jude.

The distinguished host committee included Maura Ziska Christu and Eric Christu, Alison and Will Pappas, Stephanie and William Eady, Emilia and Brian Pfeifler, Mary Frances Garrett, Mary and MacGregor Read, Jessica and Dana Koch, Alexia and Baird Ryan, Gloria and Michael Masterson, Kiki and Drew Shilling, Deborah and Bruce Miller, Elena Marie Siems, Rhonda and Gene Milner, Vanessa Rooks-Stefanski and Marc Stefanski, Nievera Williams Design and Leslie and Spence Whitman.

The event’s sponsors included presenting sponsor in memory of Robert Thomas Butler. Gold Benefactors included Nancy DiGiulio, Erin and Stephen Hawthornthwaite and Mary Frances Garrett. Silver Benefactors included Trillion Inc. and The Fortin Foundation of Florida. Bronze Benefactors included Maura Ziska Christu and Eric Christu, Alison and Will Pappas, Stephanie and William Eady, Courtney Parmenter and Juan Rionda, Mary Frances Garrett, Emilia and Brian Pfeifler, Hive Collective, Mary and MacGregor Read, Jessica and Dana Koch, Alexia and Baird Ryan, Gloria and Michael Masterson, Kiki and Drew Shilling, Deborah and Bruce Miller, Elena Marie Siems, Rhonda and Gene Milner, Vanessa Rooks-Stefanski and Marc Stefanski, Nievera Williams Design and Leslie and Spence Whitman.

Sawyer, Shari Anne, Shane and Slater Bushman

Tom Abraham and Tom Quick

Alexia Ryan and Ashley Miller

Oliver Green and William Eady

Nancy Digiulio and Jane Hsieh

Jill Schecter and Trish and Lizzy Davies

Spence and Leslie Whitman

Elena Siems and Phyllis and Hilaria Simon

Elizabeth DeWoody and Mary Frances Garrett

Sawyer, Shari Anne, Shane and Slater Bushman

Tom Abraham and Tom Quick

Alexia Ryan and Ashley Miller

Oliver Green and William Eady

Nancy Digiulio and Jane Hsieh

Jill Schecter and Trish and Lizzy Davies

Spence and Leslie Whitman

Elena Siems and Phyllis and Hilaria Simon

Elizabeth DeWoody and Mary Frances Garrett

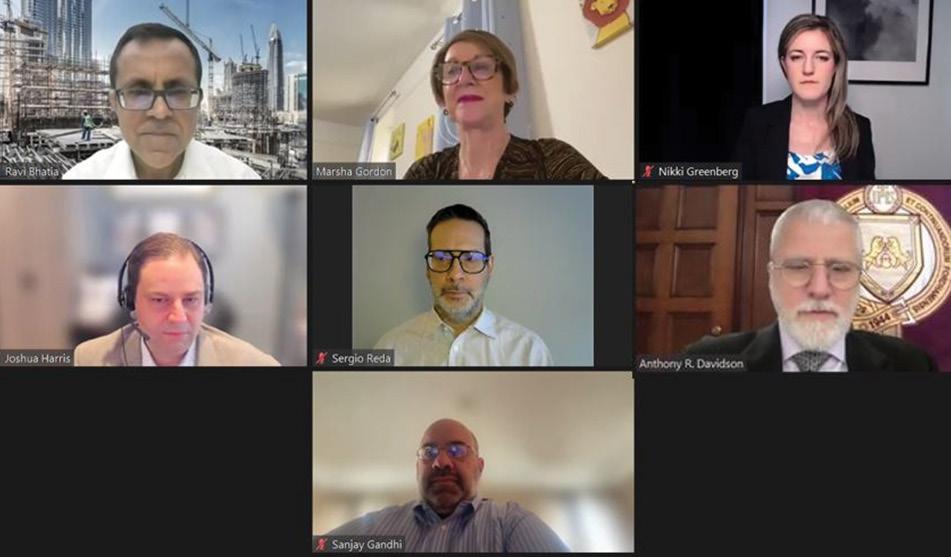

Artificial intelligence (AI) is affecting virtually every industry, offering opportunities to transform business as usual. Understanding the technology and how best to leverage its potential in real estate was the topic of a recent in-depth forum hosted by Fordham University’s School of Professional and Continuing Studies and The Business Council of Westchester.

Presented virtually, “Revolutionizing Real Estate: The Smart Solutions of AI” featured Nikki Greenberg, founder and chief innovation officer, Real Estate of the Future; Ravi Bhatia, business development manager, Skanska USA Civil and adjunct professor, Fordham Real Estate Institute (REI); Sanjay Gandhi, senior managing director, property management, Besen Partners and Serge Reda, co-founder, AlphaRithm AI and adjunct professor at Fordham REI and chair of its Technology Committee. The discussion was moderated by Joshua Harris, executive director of Fordham REI and managing partner of Magnolia Hill Partners.

“Artificial intelligence is impacting every industry,” said Business Council of Westchester President and CEO Marsha Gordon. “We’re delighted to partner with Fordham’s School of Professional and Continuing Studies and its Real Estate Institute to explore strategies and innovative solutions to maximize AI’s potential.”

Greenberg set the stage by presenting an overview of AI’s rapid evolution — including generative AI and the rise of ChatGPT — and how business professionals can leverage technological advancements.

“We’re at a turning point in terms of where technology is and the impact it is going to have. Is AI revolutionary? I believe it is. But, while the technology is getting better, human beings should not be flatlining – we all have to evolve along with this,” she cautioned. “AI is math, not magic. There’s an algorithm behind the scenes, a set of instructions. It relies on information it’s given to make an analysis. If you give it wrong information, it’s going to give you a wrong outcome. We need to be thinking about the quality of data we give to AI to enable it to give us a quality outcome.”

Harris asked the panel what AI’s single, most consequential impact will be on real estate.

“I see great opportunities to improve efficiencies and reduce risk,” said

Bhatia. “We’ve all gone through the supply-chain shocks of a postCOVID-19 world. As information becomes more readily available, there’s going to be more transparency in pricing, in terms and conditions and in streamlining contracts. That’s huge. If we can reduce transaction costs, improve safety and improve efficiencies in the supply chain, it is going to be game-changing.”

“The advantages we see are in automating the mundane, repetitive tasks we do in our industry,” Gandhi agreed. “A lot of the research tools can be automated and, if we can reduce transaction costs, that’s great. These are exciting times. But real estate has been traditionally a handshake industry and that is going to be one of the challenges.”

Reda pointed to real estate investing and development as an area where AI could have a significant impact, in terms of identifying opportunities and reducing risks.

“Investing in real estate is an enormous investment so it requires a lot of information and analysis. AI could be extremely impactful in the incorporation of data that humans are just not capable of analyzing on their own,” he said. “Those who can leverage that kind of capability will have an advantage in the market.”

The panel also addressed one of the most common concerns related to AI: potential job loss.

“Jobs are going to evolve,” said Greenberg. “We’re going to learn to use new tools. Some will lean in, others won’t. What we’re going to see with AI is a combination. AI is great at crunching numbers, [and performing] analysis very quickly. Humans are great at relationships, trust and ambiguity. Combine them, and you’re super-charged.”

“We’re proud to collaborate with The Business Council of Westchester and share these important conversations with our colleagues in the business community,” said Anthony R. Davidson, dean, Fordham University School of Professional and Continuing Studies. “Artificial intelligence is reshaping the commercial real estate landscape and we want to support business professionals and prepare future industry leaders to leverage AI’s potential.”

ATCO Properties & Management announced that full-service menswear company Eton Inc., has signed a 10-year and nine-month, 5,000-squarefoot office and showroom lease at 381 Park Avenue South in Manhattan’s Midtown South.

Founded in the Swedish village of Gånghester in 1928 by Annie Pettersson, Eton specializes in creating men’s luxury shirts, accessories and lifestyle garments. Known for pioneering the wrinkle-free cotton shirt, its collections range from sharp dress shirts for formal occasions, to casual shirts, T-shirts and overshirts in luxuriously refined materials. Eton will relocate from 24 West 57th St. in the summer of 2024 and occupy part of the 12th floor at 381 Park Avenue South.

“We are pleased to have welcomed so many new and returning tenants to 381 Park Avenue South over the past six months,” said Kate Hemmerdinger Goodman, co-president at ATCO Properties & Management. “With its classic architectural charm, location in the highly desirable Flatiron District and the exceptional tenant service that we pride ourselves on, the building is an attractive choice for companies like Eton.”

Anthony Manginelli of CBRE represented the tenant and Robert Tunis, Kyle Berlinsky and Joseph Mangiacotti of Colliers represented building ownership. The asking rent was $62 per square foot.

Boasting 228,000 square feet of office space, 381 Park Avenue South was built in the early 1900s. Other prominent office tenants in the building include FGS Design LLC, Two Sticks Inc., EVOS, ListenFirst Media and the Stephen B. Jacobs Group. Bakery and restaurant Sarabeth’s Kitchen is located at the base of 381 Park Avenue South.

Real estate developers and investors Thor Equities Group and Vesper Holdings have launched a joint venture student housing platform to be called Thor Vesper. The joint venture will be led by Managing Director of Student Accommodations Christian Davis, who will be based in Thor’s London office.

“As thematic investors, we are constantly observing trends and seeking out new opportunities. Student housing is a resilient sector with strong fundamentals alike our other focuses, data centers and logistics, and we are thrilled to partner with Vesper Holdings on this latest venture,” said Thor Equities Group CEO and Chairman Joe Sitt.

With nearly 20 years of expertise in the real estate industry, Davis will oversee Thor’s student housing platform as the demand for space strengthens. Over the course of his career, Davis has executed more than 50 major transactions in the student housing industry totaling over 20,000 beds.

Davis joins Thor from CA Ventures, a real estate investment management company specializing in niche asset classes, where he led a team responsible for the sourcing, structuring and execution of the UK and Ireland PBSA. Prior to CA Ventures, Davis held senior positions at Watkin Jones, The Student Housing Company and Cushman Wakefield.

NEAL BERMAN Brainstorm Promotions

DEREK BESTREICH Bestreich Realty Group

PETER BLOND Brandt, Steinberg, Lewis & Blond

MITCHELL BLOOMBERG International Lights

MICHAEL BONARDI D&D Elevator

FRANK DELUCIA HUB International

DAVID DIAMOND Diamond Property Group

CHAIRMEN: MARK ENGEL & MATT ENGEL • Langsam

TANG FAN JPMorgan Chase

PERRY FINKELMAN American Development Grp

ROBERT FRANK Academy Energy Group

JASON & WAYDE GILSTON Gilston Electric

JOSH GOLDMAN

Storage Systems

IRA GORDON Land Appliance

ALAN GREENE ESQ.

Abstract Corp.

STEVE HERTZ

Cherson & Rosenthal

GARY MEILUS

ROBERT MILLER

PELTON

Lynch

MICHAEL RAMIN

JACOB REKANT Landmark Abstract Agency

ALLEN ROSS

Morris

SHIMON SHKURY

Property Advisors

RONI SHOYFER

Bank

ROBERT SINGER Singer & Falk

JAMES SLATTERY

TICHNER

Paint

WALDMAN

So long, CNN, hello, The Center. CP Group, a vertically integrated commercial real estate and management firm, is repositioning the 1.2 million-square-foot CNN Center as “The Center,” offering office space, retail, dining, content creation and entertainment at the core of downtown Atlanta’s entertainment district.

“CP Group’s rebranding of the former CNN Center into The Center aims to create a unifying destination for commerce, culture and connection while also honoring the building’s legacy as a historic Atlanta landmark in media, sports and entertainment,” said Chris Eachus, partner at CP Group. “Our vision includes curating an unparalleled selection of dynamic users, dining and retail experiences, entertainment offerings and elevated lifestyle amenities — all of which will be carefully crafted to draw the community into the heart of the city.”

CP Group’s evolution of The Center will focus on activating the ground floor experience, appealing to retailers and innovative tenants seeking a historic and highly accessible site in a buzzing downtown environment. Since CNN Center was occupied by its namesake tenant for nearly four decades, this marks the first time in 40 years that office users can claim space within the property.

Coleman Weatherholtz of Healey Weatherholtz Properties is the retail leasing agent, while Jeff Keppen and Nicole Goldsmith of CBRE are The Center’s exclusive office leasing agents.

The Center was built in 1976 as the Omni Complex and was converted into the CNN Center by media mogul Ted Turner in 1986. In 2021, CP Group purchased the project from AT&T — CNN’s former parent

company — via a sale leaseback that ran through 2024.

Located at the heart of Atlanta’s Central Business District, The Center is directly connected to State Farm Arena, home of the National Basketball Association’s Atlanta Hawks, and adjacent to the fourth largest convention center in the United States, the Georgia World Congress Center, as well as Centennial Olympic Park, Georgia’s legacy of the 1996 Summer Olympic Games and a year-round destination for locals and visitors. Those facilities and the nearby Mercedes-Benz Stadium attract over 12 million visitors annually.

The project currently includes the Omni Atlanta Hotel within its site and boasts an array of prominent cultural sites and institutions within walking distance, including the World of Coca-Cola, the Children’s Museum of Atlanta, Georgia Aquarium, the College Football Hall of Fame Museum and the Center for Civil & Human Rights.

Hudson Valley iCampus, New York’s hub for innovation, ingenuity and industry, signed three new leases and two expansion agreements in the first quarter of 2024, totaling 35,124 square feet and having a value of over $4 million.

“Many of the deals were for laboratory uses,” said Jamie Schwartz, president of Hudson Valley iCampus. “Although the headlines report life sciences and biotech investments slowing due to high interest rates and other factors, we continue to experience brisk leasing activity from both large and small companies.”

RK Pharma Inc., an American multinational pharmaceutical and biotechnology corporation that focuses on the development, manufacturing and sale of high-quality and affordable generic pharmaceutical products worldwide, leased an additional 22,584 square feet of stability chamber space in Building 100. RK Pharma also leases 82,975 square feet of laboratory, manufacturing and office space in Buildings 215 and 215A.

Allied Health Management Service Organization LLC, a healthcare company that is advancing proton therapy, leased 5,677 square feet of laboratory space in Building 205. Michael Baraldi of Cushman & Wakefield represented the tenant. Robert Lella of Colliers International represented Hudson Valley iCampus.

Cosmetic, fragrance and skincare company Avon Products Inc. leased 4,719 square feet of laboratory and office space in Building 205. Robert

Armistead Mechanical Inc., one of the largest employers of plumbers and pipefitters in New Jersey and the New York Hudson Valley region, leased 1,468 square feet for shop space in Building 205.

Olaplex Inc., one of the largest independent hair care brands in the world with over 100 worldwide patents, expanded its footprint by 676 square feet in Building 205 to 11,612 square feet of laboratory and office space.

Hudson Valley iCampus offers “plug and play” laboratory, manufacturing and support space available for immediate occupancy. For example, Building 205, a 125,000-square-foot, tenant-ready laboratory building, was 40% leased two years ago, and now it is 100% leased.

COMPLETING BILLIONS OF DOLLARS IN TRANSACTIONS ANNUALLY FOR MANY OF THE MOST INFLUENTIAL PARTICIPANTS IN THE REAL ESTATE INDUSTRY

Corcoran Group LLC has welcomed its first franchise in Oregon with the launch of Corcoran Prime. Owned and led by Becky Jackson, the new brokerage will serve clients throughout the greater Portland metropolitan area and will hold a dedicated office space in Portland’s Pearl District.

“Portland’s market holds immense opportunity, and to be entering the market with Corcoran Prime is an ideal accompaniment, not only to our strong existing West Coast presence, but also our greater international affiliate network,” said Pamela Liebman, president and CEO of The Corcoran Group. “The experienced team behind Corcoran Prime provides a foundation that is poised for both growth and success when paired with Corcoran’s innovative tools, iconic branding and world-class support systems.”

Jackson and fellow broker Matt Lesher founded The Agency Inc. Realtors, now Corcoran Prime, in 2014 with an intimate team, and has grown to include roughly two dozen licensed agents, as well as several support staff holding across marketing, management and transaction coordination roles.

“We lead with the philosophy that our role as professionals in the real estate industry is to bring a superior level of service to our clients, across all real estate transactions, ensuring they receive the best possible outcomes,” said Jackson. “The Corcoran culture is thoroughly aligned with this philosophy, and the brand meshes with our position as a sophisticated, yet approachable company. By embracing Corcoran’s modern technology and tools and continuing to deliver unparalleled service to our dedicated clients in the vibrant Portland market, we are perfectly poised for growth in the future.”

Situated along the Willamette River in northwest Oregon, Portland’s diverse economy spans the healthcare, technology, manufacturing and sportswear industries, with numerous Fortune 500 companies

The city is also home to institutions such as Portland State University and Oregon Health & Science University and is celebrated for its vibrant arts scene, contemporary culinary community and commitment to sustainability.

“Portland is brimming with a vibrant culture and a diverse real estate market,” said Stephanie Anton, president of Corcoran Affiliates. “Corcoran’s decision to expand into this key market is underscored by the strength of the leadership and agents behind Corcoran Prime, whose stellar reputation, client dedication and commitment to continued growth melds so well with our brand. Together, I am excited to make a meaningful impact on the Portland market.”

Z Life, the future-focused real estate company known for its glass curtain wall systems and walkable city designs, is set to initiate plans for a national expansion. The announcement comes on the tail of a March 15th launch and the subsequent success and traction of Midtown, its latest project in Las Vegas’ rising Arts District.

The company’s expansion will include strategic commercial developments in key cities across the country including Salt Lake City, Utah; Reno, Nevada; Austin, Texas; Nashville, Tennessee and San Francisco, California. The locations were carefully selected as host sites to showcase Z Life’s vision of residential spaces that foster sustainability, luxury, and community.

“Z Life is crafting ecosystems for living that meet the needs and aspirations of the younger generation,” said Weina Zhang, CEO of Z Life. “Our success in Las Vegas, highlighted by the overwhelming response to our Midtown launch event, is a testament to the demand for our unique approach to development. We’re excited to bring our vision to more cities across the nation.”

Midtown, developed adjacent to the English Hotel, exemplifies Z Life’s commitment to innovative design and sustainable luxury, the company said. With the largest single unitized curtain wall contract in the United States, Z Life’s architectural designs, including the newly opened Fontainebleau hotel, have set new standards in the real estate and glass industry. The Midtown project features micro-retail spaces, cutting-edge workspaces, biohacking facilities and an exclusive on-site shared Tesla program for residents.

“We’re incredibly proud of Midtown; it stands as our proof of concept, showcasing our commitment to redefine urban living,” said Anna Olin, COO of Z Life. “This expansion is bringing our vision to a national stage, assisting first-time buyers and creating spaces where people can truly live where they work.”

The Midtown community is dedicated to innovation and affordable luxury, offering its residents amenities such as a pool, gym and comprehensive urban living solutions at significantly lower costs compared to industry standards.

Thanks to the commercialization of a portion of the development, Z Life is able to keep HOA fees at just 25 cents per square foot, providing an accessible pathway to homeownership for the younger generation, while promoting a sustainable, car-free lifestyle.

Z Life is set to break ground on two additional towers in the Midtown area in the fall of 2024.

Greenbrook Partners, a privately held, vertically integrated real estate operating and investment company headquartered in New York City, has completed the conversion of a former convent at 784-786 President St. in Park Slope, Brooklyn into 12 modern, family-sized apartments.

The deteriorating, vacant building, acquired from the Sisters of St. Joseph, has undergone a comprehensive $3 million gut renovation completed over the past 20 months without any government subsidies. This redevelopment included converting 30 dormitory rooms into four two-bedroom duplexes and eight three-bedroom units with outdoor green spaces.

“We are thrilled to bring 784-786 President St. back to life, marking the completion of a project that adds valuable housing stock to Brooklyn and demonstrates our commitment to sustainability and the vibrancy and economic health of the community,” said Gregory Fournier, managing principal of Greenbrook Partners.

Greenbrook Partners also focused on reducing the property’s carbon footprint and adding to the neighborhood’s portfolio with modern, sustainable homes, by switching from gas to electric heating systems, the installation of LED lighting, the implementation of low-flow water fixtures and more. In addition, the building was transitioned from a nontaxable religious property to a taxable entity generating $83,000 of new annual property tax revenue for New York City.

Edina Realty, the largest residential real estate firm in Minnesota and western Wisconsin, recently announced its expansion into the southwest Florida market. A new Edina Realty office in Naples, Florida concentrates on serving communities along the state’s Gulf Coast between Sarasota and Marco Island. Florida listings are now available on edinarealty.com for consumers to search for primary or secondary homes anywhere in the state of Florida.

Edina Realty began expanding its footprint in 2023 to include southwest Florida, giving agents an additional opportunity to serve clients — especially snowbirds — looking to relocate or split time between the Midwest and Florida.

“A number of our agents who winter in Florida or spend significant time there asked for this expansion,” said Chief Executive Officer Greg Mason. “They want access to Edina Realty’s technology, products, network and services when they’re working with clients in the Sunshine State as well in Minnesota and western Wisconsin.”

Roughly 20 Edina Realty agents are now conducting business in Florida, and the company expects that number to increase.

Empire State Realty Trust Inc. has become one of the first commercial office and multifamily portfolios in the U.S. to achieve the Well Equity Rating through the International Well Building Institute (IWBI)’s Well at Scale pathway. Additionally, ESRT received the 2023 IWBI HealthSafety Leadership Award for prioritizing occupant health and well-being through industry-leading indoor environmental quality measures and achieving the Well Health-Safety Rating across 100% of its portfolio in each year of participation since 2020.

“Our continued leadership and long-term commitments to the wellness and health equity of our tenants and employees are celebrated through our consistent achievements within the IWBI’s Well at Scale program,” said ESRT Chairman and CEO Tony Malkin. “Our achievement of the inaugural Well Equity Rating is a reflection of our accountability and strides in diversity, equity and inclusion (DEI) within our corporate culture.”

Throughout 2023, ESRT focused on employee health and well-being and promoted an inclusive culture through competitive benefits, employee engagement and volunteerism and industry-leading practices in sustainability and indoor environmental quality. ESRT was the first commercial real estate portfolio in the Americas to achieve the Well Health-Safety Rating in 2020 and among the first to commit to Well at Scale and inaugural Well Equity Rating in 2022.

“Leading organizations that prioritize the health and well-being of their employees and tenants are not only helping cultivate a safer, healthier and more productive workforce, but also experience higher occupancy and retention,” said Rachel Hodgdon, president and CEO of IWBI.

“We are excited to celebrate Empire State Realty Trust for its steadfast commitment to people-first places. Not only has it achieved the Well Health-Safety Rating for the third year in a row, but it has also achieved the Well Equity Rating across its entire portfolio. We commend ESRT for this outstanding leadership milestone.”

The Well Health-Safety Rating is an evidence-based, third-party verification for all new and existing buildings that focuses on operational excellence and long-term resilience through air and water quality, cleaning procedures, emergency preparedness, health resources and stakeholder engagement. The Well Equity Rating is a roadmap designed to help organizations act on their diversity, equity, inclusion and accessibility goals and improve company culture and employee health.

JLL Foundation, a non-profit founded and backed by JLL, has expanded its investments in early-stage companies focused on climate change mitigation, according to its new annual report. Of the 15 startups supported by JLL Foundation in 2023, 100% are helping to reduce greenhouse gas emissions, 73% are making a sustainable impact on real estate and land, 60% are reducing water consumption, 53% are reducing waste and 33% are making a social impact.

“The JLL Foundation takes a non-traditional approach, providing zerointerest loans, which allow companies to survive and thrive during the challenging early stages in their journey towards commercialization,” said Trish Maxson, chair of the JLL Foundation.

JLL Foundation’s mission closely aligns with JLL’s purpose to shape the future of real estate for a better world and its own sustainability program focused on climate action, healthy spaces and inclusive places. JLL Foundation offers catalytic funding particularly to entrepreneurs who traditionally have less access to venture capital — for example, 53% of the 2023 portfolio companies are fully or partially female-founded. Since its inception in 2022 and in partnership with Good Machine, a venture studio specializing in the climate impact space, JLL Foundation has invested in 30 impact-driven startups across five continents.

“Providing interest-free loans from the JLL Foundation to startups is one way to accelerate the transition to a more sustainable world,” said

Christian Ulbrich, global CEO and president of JLL.

Christian Ulbrich, global CEO and president of JLL.

The impact of the foundation’s investment varies based on the needs of each company. In 2023, the foundation’s loans helped Kadeya, a closedloop beverage system manufacturer, fund its first fully autonomous unit; Minus Materials, a carbon-negative, bio-renewable limestone producer, focus on markets that consume higher quality calcium carbonate; Zafree, a tree-free paper pulp fabricator, purchase a machine that will help increase its capacity and GoPowerEV on its mission to ensure that every electric vehicle owner has affordable and convenient access to charging.

Invitation Homes Inc., a Dallas-based single-family home leasing and management company, announced that it is under contract to acquire approximately 500 additional newly built homes for a total investment of approximately $140 million. The homes will be located in Charlotte, North Carolina, Jacksonville, Florida and Nashville, Tennessee and are being acquired through new relationships with three top-tier homebuilders. Deliveries are expected to begin later this year.

“As lack of supply continues to be a primary culprit in the high cost of housing, we are proud to further broaden our strong homebuilder partnerships to create additional housing,” said Scott Eisen, the company’s chief investment officer. “At the same time, we believe our strategy of partnering with the largest and best homebuilders to grow our footprint across the country offers the best risk-adjusted returns to our stockholders.”

Invitation Homes, an S&P 500 company, provides access to high-quality, updated homes with features such as close proximity to jobs and access to good schools. The company received deliveries of 648 newly built homes in 2023 and currently anticipates deliveries of approximately 1,000 new homes from its new product pipeline in 2024.

In response to growing demand from clients in the U.S. Southwest, global architecture and design firm Perkins&Will has opened a studio in San Antonio, Texas. The new studio is located in the heart of San Antonio’s Historic Pearl neighborhood, just north of downtown at 303 Pearl Parkway. The addition joins studios in Dallas, Austin and Houston, and strengthens the regional network that includes studios in Denver and Monterrey, Mexico.

The new studio will be led by lifelong San Antonian Adrianna Swindle, who heads cultural and civic as well as corporate and commercial practices, and Omar Cantu, health practice leader. The studio will also deliver local services in urban design, workplace and higher education.

“We couldn’t be more excited to officially put down roots in San Antonio,” said Tom Reisenbichler, Southwest region director. “With many projects here over the years, this studio has been a long time coming, and we have significant new work already in progress. Perkins&Will and San Antonio are a great fit. We see a strong appetite here for placemaking, or the kind of design-driven, sustainable, human-centric spaces that our firm is known for.”

The firm’s local portfolio includes the University of Texas at San Antonio Student Center, Methodist Texan and Methodist Westover Hills hospitals, a renovation and expansion of the historic Thomas Jefferson High School and the award-winning University Hospital Sky Tower, one of the largest hospitals in the country to earn LEED Gold.

Swindle, a Distinguished Alumna of the University of Texas at San Antonio and co-founder of the AIA San Antonio Chapter Latinos in Architecture (LiA) Committee, is a long-time advocate for the development and visibility of local designers, also having served as the San Antonio AIA board president in 2021.

Qira, a financial services platform that provides renters and property managers a way to improve cash flow and avoid debt, now offers full security deposit management services. As a part of its overall goal to give renters more financial options and decrease the upfront cost of moving, these items include security deposit alternative programs, security deposit payments and refund processing with full escrow management and, now, security deposit payment plan services.

“Qira is proud to provide comprehensive security deposit services that offload administrative tasks, ensure properties are compliant with state laws and significantly reduce properties financial risk,” said Revital Gadish, CEO of Qira. “We believe these programs greatly benefit our audience of property managers who often prefer to outsource the entire security deposit management to Qira and to our renters who now have more alternatives to pay their deposit.”

When using Qira security deposit solutions, properties can offer their renters a zero-deposit program for a fee or pay the full security deposit either as a lump sum or in installments over the lease term. To minimize risk to the property or portfolio, regardless of the renter’s choice, Qira covers the full security deposit for the renter from Day One and handles all operational aspects of the transaction with a fully automated and integrated security deposit refund when the renter moves out, reducing the burden on onsite teams.

The security deposit payment plan services include: flexible installment payment plans of three, six and 12 months; renter eligibility to receive a full security deposit refund at the end of the lease; funds held in escrow per state regulations and a fully automated security deposit system for renters and property managers handled exclusively by Qira.

The security deposit management system allows Qira to manage the escrow accounts and ensure operators are compliant with state regulations (including interest-bearing account capabilities). This benefits properties or portfolios that do not offer a security deposit alternative or payment programs to their renters.

Qira’s security deposit alternative service allows renters to opt into paying a nominal fee, as low as $5 a month, rather than paying a bulky upfront security deposit. The property can offer this as an amenity to renters, while Qira covers the full security deposit amount.

This is a low-risk solution for property managers to obtain their deposit amount and offer renters a $0 upfront move-in cost.

“Our security deposit management technology is unique, and we have the only integrated payment plan solution on the market,” said Roy Doron, chief technology officer at Qira. “This plan enhances our already-existing integration with leading property management software like Rent Manager, Resman, Yardi, Realpage and more to maximize efficiency for both renters and property managers.”

Play ball! Major League Baseball Major League Baseball leads major sports leagues in total real estate developments, with 16 ballparks (53% of venues) having a related development, according to RCLCO Real Estate Consulting’s just launched Venue-Anchored Development Tracker of every major league stadium in the United States and Canada.

The tracker will allow users to track existing, under construction and planned venue-anchored development of a sector which is increasingly a driver for mixed-use development throughout the country. RCLCO counts 43 venue-anchored real estate development projects (MLB, NFL, NBA, NHL, MLS) on the ground, seven under construction and 34 planned/publicly under consideration.

“We are seeing a burst in development interest around sports venues and stadiums, as teams and owners seek to diversify and control future revenue streams, as well as enhance the fan experience and deliver local community benefits,” said Erin Talkington, managing director of RCLCO. “There is no one formula for a successful development. While the most well-known projects are held up as places to replicate, the unique local-market responsive elements of places like Titletown are what will differentiate future venue-anchored developments.”

RCLCO defines a venue-anchored development as one where the venue serves as the focal point around which real estate is organized. The Venue-Anchored Development Tracker includes detailed information regarding every stadium’s ownership, announced future plans and the surrounding associated real estate development.

Notably, teams/ownership groups have only been involved in 43% of existing projects but are involved in 68% of planned projects.

RCLCO expects that the development pipeline will to continue to grow, as one impetus for planning a new real estate project is venue reinvestment or replacement. More than 40 venue leases across the five leagues expire in the 2030s, suggesting the focus on real estate opportunities will continue.

“It is tremendous to see the high-quality analysis and information RCLCO is publishing with the first-of-its-kind Sports Venue-Anchored Development Tracker as a way to further cement our place as industry leaders at the intersection of sports and real estate,” said RCLCO Managing Director Joshua Boren. “As rising franchise values and new ownership continue to increase and teams look for additional ways to expand their brand and increase revenues, real estate will continue becoming an even more critical component of these transactions and the industry’s future. RCLCO has been fortunate to be at the forefront of this movement, as the industry continues to evolve and become more sophisticated.”

While the initial tracker is focused on professional league venues, RCLCO will expand the tracker to include numerous other leagues and venues throughout the year and on an ongoing basis.

JUNE 5 TH , 2024 | 5:00 PM - 8:00 PM

ARNO RISTARANTE

141 38TH ST - NEW YORK

The Top Hat Award is a prestigious honor presented annually to an individual for lifetime achievement and dedication in the Credit Industry. We are proud to recognize Richard Simon and Glenn Schwartz, who have reached new levels of achievement within our community. This year, we will celebrate their accomplishments with an award ceremony at New York Hilton & Towers.

Richard Simon

Richard Simon

at www.475toppers.com

InvestorFlow, a cloud-based platform for alternative investment firms, announced the acquisition of Coyote Software, a U.K.-based softwareas-a-service company powering many of the largest commercial real estate firms in the U.K. and Europe. InvestorFlow will now expand collaboration across all fundraising, transaction and asset management stakeholders and provide more granular reporting to investors within the CRE ecosystem on a single platform, the company said.

The Coyote solution enables investment teams to review more opportunities, close more deals and increase investment returns, the company said. Additionally, asset and property managers use the platform to consolidate real estate data, manage portfolio performance and risk and provide actionable insights to deliver better financial outcomes. The company has over 80,000 assets on its platform, with a combined 500 million square feet and a roster of major firms including Nuveen, Legal & General Investment Management (LGIM) and Royal London Asset Management.

“Coyote was designed and built by real estate professionals,” said Todd Glasson, CEO and founder of InvestorFlow. “The addition of Coyote will expand InvestorFlow’s capabilities to drive collaboration among investment, asset and property managers at scale, while yielding faster and deeper insights into performance and risk for LPs. This transaction immediately expands our footprint in EMEA and will accelerate our continued growth across all alternative asset classes globally.”

The deal builds on InvestorFlow’s strategic combination with Cloud Theory to form a complete suite for private market firms to turn relationships into capital, knowledge into investment opportunities and collaboration into lasting partnerships. In an industry marked by highly distributed teams and fierce competition, InvestorFlow provides a single

source of truth to clients, empowering fundraisers, deal teams and client services to operate at scale with reliable data, asset transparency and team coordination, all while keeping LPs informed on investment performance and new fund opportunities.

“Coyote is delighted to be joining InvestorFlow in its mission to power the alternatives industry,” said Coyote Software CEO and Co-Founder Oli Farago. “We embarked on this journey over a decade ago to transform the way real estate investment firms source opportunities, manage deals and maximize asset performance. Alongside the broader InvestorFlow team, we can extend our capabilities into fundraising and investor relations. This will provide deeper and more granular reporting for clients that demand real-time transparency and insights as we expand this capability to new and emerging private asset types.”

“We are excited about Coyote and the product and geographic expansion the acquisition provides to InvestorFlow,” said Christine Blehle, managing partner at Ambina Partners, which provided the capital.

Radix, a provider of multifamily market research, performance, and data analytics, has launched the Radix Resident Portal, a public data platform aimed at enhancing consumer visibility into property data.

“Our aim with the resident portal is to empower consumers with enhanced market visibility, illuminate prevailing concessions, and champion economic empowerment,” said Radix CEO Blerim Zeqiri. “Renters deserve access to real-time information.”

Radix champions data accessibility, dismantling the barriers that hinder market efficiency. Boasting over nine million units, Radix’s independent data ecosystem furnishes the industry with unbiased insights and market trends, encompassing occupancy, traffic, ATR and net effective rents. With the introduction of the Radix Resident Portal, renters gain access to this data, facilitating streamlined price discovery, spotlighting concessions and discounts and facilitating the discovery of rental options tailored to their specific needs.

“Our aim with the resident portal is to empower consumers with enhanced market visibility, illuminate prevailing concessions and champion economic empowerment,” Zeqiri said. “If a national retailer offers a discount and no one knows about it, did it help the consumer? Renters deserve access to real-time information. We stand as the sole data provider in the industry actively tracking concessions and offering comprehensive search functionalities, thereby invigorating market dynamics.”

The Radix Resident Portal will soon grant apartment seekers the agency to craft their search narrative, encompassing location preferences, unit specifications, square footage, amenities and other essential features. Leveraging AI technology, the portal aligns renter preferences and

lifestyle choices with properties that match their criteria, devoid of advertising biases.

Additionally, the portal will offer comparative value assessments based on product quality, location and pricing parameters. Radix clients can incorporate these assessments on their websites, further educating renters and extending ongoing concessions and discounts, thus mitigating common consumer grievances. Clients will also gain the ability to highlight detailed concessions by unit type, enhancing pricing efficiency and facilitating consumer access to optimal deals.

“The resident portal prioritizes consumer needs, striving to connect them with the best deals available,” Zeqiri continued. “Our clients stand to benefit from receiving qualified leads at no cost, while our continuously expanding data ecosystem ensures a continually improving resource for all stakeholders. Our mission is to facilitate consumer discovery and match clients with prospective residents based solely on data integrity, eschewing the influence of advertising and sponsorships. This paradigm shift will revolutionize the relationship between renters and property managers.”

“An extremely talented real estate group with an impressively deep bench: the team is ideal for handling the most complex matters.”

— Chambers USA

Counsel to Related Companies and Oxford Properties Group in connection with the development of and all leasing activities at the 26-acre Hudson Yards on the West Side, the largest private development in Manhattan since Rockefeller Center.

Counsel to Google in connection with its US$2.4 billion acquisition of Chelsea Market in New York City.

Counsel to BlackRock in its 850,000square-foot lease for its planned headquarters relocation to 50 Hudson Yards.

Counsel to Brookfield Property Partners on all aspects of the development of Manhattan West in the Hudson Yards District, including its recent lease to the National Hockey League.

Counsel to Vornado Realty Trust and Related Companies on the redevelopment of Penn Station, including the redevelopment of the James A. Farley building and construction of Moynihan Train Hall.

Counsel to J.P. Morgan, as lead lender, in its US$900 million construction loan syndication to Extell Development for the development of Central Park Tower.

Counsel to SL Green Realty Corp., including all zoning approvals, in connection with the development and leasing of One Vanderbilt Avenue, an iconic 1,401-foot tall, 1.7 million square foot office tower being constructed on the full block to the west of Grand Central Terminal.

Counsel to Maefield Development in its approximately US$1.5 billion acquisition of the EDITION hotel, retail, and signage project known as 20 Times Square.

Counsel to JP Morgan Chase in connection with various aspects of its planned 2.5-million-square-foot headquarters redevelopment at its 270 Park Avenue location.

National commercial real estate finance company Greystone announced that Alex Chang has joined the firm as a senior managing director. In his new role, Chang will focus on a number of initiatives, including the firm’s bridge lending capabilities through Greystone Monticello as well as expanding the firm’s bank and alternative capital relationships. Primarily based in New York, Chang reports to Debby Jenkins, co-president of Greystone’s lending business platforms.

“Alex’s deep expertise across CRE debt, securitization and capital markets areas is incredibly valuable, and I am thrilled to have his level of proficiency here at Greystone as we continue to refine and build out our bridge and alternative capital platforms,” Jenkins said.

Bringing over 20 years of commercial real estate experience spanning agency, CMBS, mezzanine, bridge and loan securitization executions, Chang was most recently focused on bridge-to-agency opportunities at PGIM Real Estate. Prior to that role, he spent over 13 years at Freddie Mac Multifamily, where he oversaw the credit quality of more than $500 billion in securitizations, structured and approved complex transactions, and was responsible for the credit policies governing all multifamily products.

Earlier in his career, Chang also spent time at Mezz Cap and Bear Stearns. He earned a bachelor’s degree from University of Virginia and a master’s degree in finance from American University.

The most expensive street for office space in the United States is not in New York City, Chicago or Miami — it’s Sand Hill Road in Menlo Park, California, with average full-service gross asking rents reaching $167.74 per square foot, said JLL’s “Most Expensive Streets 2024” report. The street is home to many venture capital and private equity firms, especially those focused on the tech sector.

New York’s 34th Street in Hudson Yards isn’t far behind, asking $162.43 per square foot, followed by Royal Palm Way in West Palm Beach, Florida, running at $134.31 per square foot. Rounding out the top five are University Avenue in Palo Alto, California, at $109.04 per square foot and Greenwich Avenue in Greenwich, Connecticut, at $105.00 per square foot.

The study, which analyzed more than 50 U.S. markets, explored how U.S. prime office corridors have shown resilience amid a confluence of market headwinds, urban migration and supply constraints. At the same time, off-core, peripheral urban neighborhoods with robust dining and entertainment amenities have increasingly attracted high-end tenants looking for a vibrant atmosphere.

Prime office corridors have been relatively immune to recent challenges in the commercial real estate market; JLL research showed that vacancy remains highly concentrated in inferior assets with 10% of buildings comprising 60% of national vacancy. It also saw positive absorption in 2023, while U.S. office market overall registered more than 50 million square foot of negative net absorption.

“U.S. office assets in prime corridors have shown resiliency over the past four years as companies recognize the value in high-quality offices, not just as a means to motivate return-to-office strategies, but also as a recruitment and retention tool,” said Jeff Eckert, president, Americas agency leasing at JLL. “The best buildings in the best locations will continue to shine.”

Interest in mixed-used environments, in particular, has flourished as

cities continue their post-pandemic transformation and consumer habits evolve. Activity levels in those areas with a more diverse distribution of property types among commercial, residential and entertainment uses have recovered more quickly than commercially dominated cores.

“It’s not surprising to see emerging submarkets become more dominant, said Jacob Rowden, research manager, U.S. office at JLL. “These neighborhoods outside the CBD tend to be in the middle of the action and offer tenants everything they’re looking for — from dining and shopping to entertainment amenities and fitness centers.”

Across the markets analyzed in the study, rents on the most expensive streets exceed the market average by 75%.

and

plus a deep

That’s where Janover comes in. We get to know both you AND your

our knowledge of the system to tailor a detailed tax plan

At Janover, our greatest value is the ability to help you look at the whole picture - numbers, family, business. You’ve worked hard to have it all... wouldn’t you like to keep it?

Sotheby’s International Realty announced the opening of Poland Sotheby’s International Realty, signifying the brand’s 194th office in Europe. The company is headquartered in the Europejski building in Warsaw’s prime City Centre and will service the districts of Śródmieście, Mokotów, Wilanów and beyond.

“The luxury residential real estate market in Poland has witnessed significant growth and robust demand in recent years,” said Philip White, president and CEO of Sotheby’s International Realty. “As the capital and largest city of Poland, Warsaw serves as the economic, cultural and political hub of the country. Its strategic location within Europe attracts a diverse range of buyers and expatriates, along with a growing number of high-net-worth individuals seeking premium properties in prime locations. We greatly look forward to supporting Paulius and the Poland Sotheby’s International Realty team.”

Poland Sotheby’s International Realty is headed by Paulius Gebrauskas, who brings more than a decade of real estate experience to the company and a proven track record of working with Polish clients. An international businessman, Gebrauskas is also an owner of Baltic Sotheby’s International Realty in Lithuania.

“Warsaw’s luxury residential real estate market offers a compelling blend of sophistication, culture and investment potential, attracting both domestic and international buyers seeking premium living experiences in

Continuing its expansion into the student housing sector, Time Equities Inc. (TEI) has acquired The Armory at Sam Houston (The Armory), a student housing complex located at 2257 Sam Houston Ave. in Huntsville, Texas, for $25.75 million. This acquisition marks TEI’s fourth venture into student housing, and its first property in the sector in Texas.

Built in 2018, the 145-unit, 502-bed development stands as the nearest privately owned student housing property to Sam Houston State University’s campus.

“The purchase of The Armory presented TEI with an exceptional opportunity to further our student housing portfolio in a new market,” said Bobby Cohan, senior acquisition and asset manager at TEI. “We continuously identify value and growth potential in student housing nationwide, and we are actively seeking new acquisitions to augment our portfolio within this asset class.”

TEI strategically targets assets serving public, Tier 2 institutions, catering to schools with a student population ranging between 10,000 and 20,000. TEI also owns assets at East Tennessee State University in Johnson City and Tennessee Tech University located in Cookeville, as well as a property in Richmond, Virginia that serves Virginia Commonwealth University (VCU).

“Time Equities was the ideal candidate to acquire The Armory, given their track record of success with student housing projects in Tennessee,” remarked Ryan Lang, head of student and co-head of alternative real estate assets at Newmark, who served as Stonemont and TEI’s broker for the transaction.

TEI was represented in-house by Bobby Cohan and Brad Gordon. The seller, Stonemont, was represented by Newmark.

After 40-plus years of a real estate career that has seen some 2,300 transactions totaling over $21 billion in New York City, and stints with some of the largest brokerages in the world, Bob Knakal has realized one major thing.

He’s an entrepreneur at heart. And he wants to pioneer a new path using the latest technology that shows others can be, too.

“The world is changing,” Knakal said. “The real estate world has always been way behind in terms of new technologies. It’s an analog business in a digital world.”

That’s why Knakal, just weeks after an unceremonious departure from JLL in February, formed BK Real Estate Advisors (BKREA). The new firm, which provides capital markets transaction and consulting services to property owners, utilizes technology such as AI to better serve the team and clients, Knakal said. The result could even marginalize the need for large brokerages.

“This can change the business in two very profound ways. One is in the prospecting and executing of business,” Knakal said. “The other is the interpretation of data. Even a single-person shop can do what a big company used to do in the past.”

Massey Knakal Realty Services, growing the firm over the next twoplus decades.

“Although Paul and I were at CB for four years, we really wanted to leave after two — we didn’t think we could easily get a bank loan,” Knakal recalled. “We had that entrepreneurial spirit.”

In 2014, the pair sold Massey Knakal to Cushman & Wakefield for $100 million, and Knakal rejoined the world of big brokerages. He served as chairman of New York investment sales until 2018, then joined JLL in a similar role until this year.

The pandemic had given him an opportunity to push the business in a different way. With the city shut down, Knakal and his team walked the empty streets and created detailed maps of every building in Manhattan south of 96th Street. Stored in one secret location, the “Knakal Map Room” has become real estate lore, and something of a pilgrimage site for select real estate professionals.

“The real estate business is the information business and the relationship business.”

-Bob Knakal

From his early childhood, running his own business has been in his blood. A child who had to be dragged out of bed to go to school was the first one up to shovel neighborhood driveways on snow days, he recalled.

Later on, Knakal’s career began with a bit of serendipity. The Maywood, New Jersey native had planned to be an investment banker after attending the Wharton School at the University of Pennsylvania. On spring break during his freshman year, he sent a resume to Coldwell Banker (later CB Richard Ellis, then CBRE), thinking he was applying to a bank, for a summer job. Instead, he landed in and fell in love with real estate. After three college summers at CB, he decided to work for the company full time after college in Manhattan. On his first day, he met Paul Massey Jr., who guided him to the office’s coffee machine and became his partner, building a business based on deep market expertise. In 1988, the two formed

And then came social media. Knakal said that he has always believed that business comes through networking, attending events almost daily throughout his career. Pressured by his peers, Knakal quickly saw that social media could provide another entrée to deals.

Starting in January 2023, Knakal and his social media team began posting about business, his own history and bits of advice, and rapidly grew a national following.

“I wanted to go beyond posting the price and the size of the building. I wanted to be different from what everyone else was doing,” he said. “I enjoyed motivating the troops at Massey Knakal, so that became Motivational Monday. We have Testimonial Tuesday. I have boxes of photos and material from the old days, so that became Throwback Thursday. It’s very different from ‘I just listed this’ or ‘I just sold that.’”

Today, he has more than 40,000 followers on LinkedIn, 32,000 followers on X (formerly Twitter) and 8,000 followers on Instagram, achieving more than 23.5 million impressions and views in 2023. In

March, he was named the No. 1 commercial real estate influencer on LinkedIn by CREiSummit, a group of real estate professionals focused on expanding the use of digital marketing in the industry.

That higher visibility came at a price. Within days of a February 11 “New York Times” profile on Knakal and the Knakal Map Room that mentioned JLL just once, the company parted ways with the veteran broker. Speculation was rife online about Knakal’s next move — joining another big firm, partnering with another superstar broker or going out on his own.

They didn’t have long to wait. On X, Knakal announced BKREA, a firm that will utilize the data he has compiled and applying AI and other technologies to find trends and patterns to serve his clients.

“The time at Cushman & Wakefield was expected because anyone who would buy us would expect us to be on service contracts,” he said. “The time at JLL was not at all what was expected. It’s great to be an entrepreneur again.”

With 40 years of relationships and deals under his belt, joining another large firm wouldn’t have given him much more in terms of client access, he said. Instead, he sought the opportunity to once again build a firm his own way, while exploring what artificial intelligence can offer.

With a Midtown office (and a secure location for the Knakal Map Room), Knakal’s first hire was Sam Samowitz, a data scientist who is creating proprietary algorithms that can reveal market trends, as well as perform the support tasks that had been one of the benefits of working with a larger firm.

“Most data sets in the real estate business are not very good,” Knakal said. “These data sets from third-party aggregators are collected by people who are not participants in the transactions, so they can’t give, or obtain, inside details.”

Absolute numbers, he continued, don’t mean all that much — what matters is the relationship between the numbers and where they’re going. Even definitions can vary. Is the Empire State Building, which has some retail at the base, considered a mixed-use project? How will a shift in public policy affect a market? BKREA’s mission is to put data into context in order to maximize the potential value to investors.

“For example, in 2019, there was $23.6 billion in investment sales activity in Manhattan for deals over $10 billion,” he observed. “But in 2015 there was $54.7 billion. When it comes to information, it’s the

interpretation of the information that matters.”

Prior to forming BKREA, Knakal had been working with two data scientists for about a year, applying AI models to see what factors or combinations of factors will be predictive of changes in the market. The first result will be the Knakal Land Index, focused on Manhattan south of 96th Street, with other indices to come. Other models will focus on the multifamily market, where Knakal has 40 years of data, and office rents. But even with all this information, the goal is the same.

“The more clients are informed, the better decisions they can make,” he said. “The best time is to have that information is now, particularly if the AI algorithms can do what they think they can.”

BKREA has also formed the Knakal Affiliate Program, or KAP, a group that will facilitate referrals and collaborations between brokers and firms.

“The real estate business is the information business and the relationship business,” Knakal said. “We’re not a tech company. We’re a real estate brokerage business that uses the technologies that are available. You can have the greatest model in the world, but if people don’t like you or want to work with you, you can’t succeed.”

Just weeks into BKREA’s life, it has a nine-person team and several deals already under way, Knakal said. And life is freeing as an entrepreneur.

“There’s a new vivaciousness to every aspect of every deal you’re doing,” he said.

That noted, he doesn’t plan to expand BKREA into another megacompany.

“A firm of 15 to 20 people can do what 100 people could do in the past,” he said.

And just as important is his legacy of encouraging others to start their own businesses or run their own departments.

“What I’m most proud of is that today, there are 30 companies or divisions of companies being run by former Massey Knakal brokers,” he said. “We ran that business with a true servant leadership philosophy. We told them how proud we were of them. We believed in building up folks, training intensely and getting them to realize they could do even better. That produced some of the best investment sales brokers in the city. History doesn’t necessarily repeat itself, but it always rhymes.”

“History doesn’t necessarily repeat itself, but it always rhymes.”

Levy Goldenberg stands out for its unwavering dedication to clients. Located in downtown Manhattan, Levy Goldenberg LLP specializes in commercial and real estate litigation. With a foundation of extraordinary legal representation, Levy Goldenberg LLP is becoming a trusted partner in the Big Apple's complex legal world.

We aim to provide a transparent, practical approach to commercial and real estate disputes in New York. Our vision is to not only offer exceptional legal services but also to drive progress and innovation in the legal community and New York City.

Courtesy of The Athens Group

Courtesy of The Athens Group

It might seem that the development of the Asher Adams Hotel in downtown Salt Lake City is a tale of preparing for the Olympics. But the redevelopment of the former Union Pacific Train Station into a luxury hotel is also a story of preserving the past, the ongoing energizing of an urban area to create a new future and, yes, the Olympic Games.

What had been a vital transportation hub in the early part of the 20th century eventually became obsolete and turned into an events venue. Now, The Athens Group is recreating the space into the Asher Adams, a 225-key hotel that will keep the integrity of the original building, including preserving the train station’s iconic French empire architecture, while creating a destination that will serve travelers and a thriving downtown residential and business area when it opens in the fourth quarter of this year.

“Salt Lake City is ready for a new upscale hotel,” said Eric Peterson, vice president of development and project executive at The Athens Group. “We are fortunate to be in the heart of downtown and to restore the historic train station as part of this development. This makes for a powerful combination to offer something the city has never seen before.”

It’s the latest chapter in a century-long saga. The Union Pacific Railroad opened the train station in 1908, and saw it flourish through the early part of the century. In the 1970s, however, when Amtrak took over passenger rail services, all trains were moved several blocks south. Some redevelopments were undertaken over the years, but the building largely was used for special events. Meanwhile, what had been the outskirts of the city became the core of downtown.

“I’ve visited that mall and Union Pacific building many times over the last 20 years, and that amazing train station has wanted to be a hotel for a long time,” Peterson said.

The station is often considered the front door to the Gateway retail complex that had been developed in time for the 2002 Olympics, surrounding the Salt Lake Olympic Plaza. Arizona-based development company Vestar acquired the property in 2016, and revitalized the Gateway retail, office and entertainment property, even as the downtown had grown into a 24/7 destination. The complex is the home for major celebrations including New Year’s Eve, and is within walking distance of the Delta Center, home of the Utah Jazz, and other arts facilities. But Vestar saw that the train station was being underutilized.

“The main hall was a beautiful icon that wasn’t fulfilling its purpose used for wedding receptions,” said Bryan Hill, general manager at Vestar. “We wanted to create a living room for the city.”

Vestar brought in The Athens Group, long known as a luxury hotel developer, to turn the existing station

into 13 historic guest suites, as well as adding a new building to house 212 modern rooms, multiple food and beverage outlets. The team then waited as the pandemic paused development.

Meanwhile, the group made extensive plans to preserve the character of the existing building, even as it adds modern amenities. Its stained-glass windows were preserved, as was much of the original lighting, even as the acoustics were upgraded to align with hotel standards. All was done under the rigorous review of the Historic Landmark Commission.

“My favorite part of the development is the careful restoration of the old building; to see things like the old brick, the windows, the decorative plaster come back to life,” Peterson said.

The redevelopment couldn’t have come at a better time. The 2002 Winter Olympic Games brought new attention to Salt Lake City — annual skier days rose 43% in the years following the games. It also revitalized interest in the city as a great place to live.

“The Olympics helped put Salt Lake City on the map,” Peterson said. “In the last 15 years, we’ve experienced a real building boom, and now the city has become a prime destination for leisure travel, operating a business and raising a family.”

Specifically, the downtown is booming with entertainment, apartment construction and hospitality and new developments. There is a burgeoning healthcare and life sciences industry moving in. In 2002, Vestar leased space at the Gateway to the BioHive Hub, which is now home to multiple science companies.

The Gateway has seen only minor inconveniences during the construction, Peterson observed.

And now the city is looking to repeat as a global sports home, named by the International Olympic Committee in April 2024 as the preferred host for the 2034 Summer Olympics. The result is an anticipated immense uptick in visitors, many of whom will want a luxury experience in the heart of the action.

The Adams Asher will boast two bars inspired by the train station: General Baggage, located in what once was part of the baggage storage area, and Little Nugget, named for a luxury lounge car. An upscale restaurant also is planned, with the goal of serving locals as well as visitors.

“Our restaurant is going to be a destination of its own, whether or not you’re staying at the hotel,” Peterson said. “And the restoration of the space in the train station will give everyone access to this tremendous history that they will be able to experience in a new way — everything in the restaurant from the menus, the recipes and the service is being curated to complement the design and restoration of the train station.”

Malls, once emblematic of consumer culture, are now undergoing a profound metamorphosis to align with the evolving demands of the 21st century. Transitioning into vibrant lifestyle destinations termed “Town Centers,” these spaces seamlessly blend entertainment, dining, retail, housing and collaborative work environments.

A prime example of this transformation is unfolding in Buffalo, New York, where the Eastern Hills Mall is currently undergoing a redevelopment initiative that will reshape its identity into an urbanesque, pedestrian-friendly setting that harmoniously integrates retail, entertainment, health and wellness amenities, alongside office spaces and residential options. According to the American Planning Association, mixed-use development allows for greater housing variety and density, encourages more compact development which supports tax revenue growth for the surrounding community, strengthens neighborhood character and sense of place and promotes pedestrian- and bicycle-friendly environments.

Built in 1969 and opened in 1971, the Eastern Hills Mall was home to several anchor stores including JCPenney, Sears and Macy’s. The mall underwent an extensive overhaul in 1987 that added a food court and, throughout the years, minor cosmetic renovations.

Following well-documented changes in consumer buying preferences, the growth of online shopping and the subsequent closure of several brick-and-mortar anchor stores, in January 2024 mall owners and developers Uniland Development Company and Mountain Development Corp. (MDC) closed the interior concourses of the mall to begin the transformation into a new town center.

Although in-store shopping is still preferred when looking at the data, 20.1% of retail purchases are expected to take place online in 2024, up from an estimated 18.8% in 2023, according to eMarketer’s forecast 2024 report. And this number is expected to grow each year — by 2027, online retail purchases are expected to hit nearly 23%, according to Statista figures.

Upon full buildout, Eastern Hills Town Center is projected to be home to 1,500 residential units, one million square feet of office and medical space, multiple restaurants, retail stores, hotels and parks for outdoor event space. The total landscape is made up of 100 acres, located on the sought-after border between Clarence and Amherst, two of the strongest towns for population growth and income in western New York.

The future town center will provide a mixed-use, village-like atmosphere, with 24/7 activity supporting a live/work/play lifestyle.

To save the American mall model from its own demise, we must adapt to 21st century trends. The consumer pool has broadened because of mixed-use developments. We’re now catering to corporations, retailers, tourists and residents. As we crafted the vision for what the town center would be, we remained persistent in our commitment to prioritizing the needs and desires of consumers.

Town centers are experiencing increased popularity throughout the United States due to rising demand for the charm of suburban living coupled with the convenience of walkability and accessibility to nearby vendors. According to a National Association of Realtors report, 79% of respondents rate walkability as “very” or “somewhat” important, and 78% say they’d pay more for a home in a walkable community. This figure increases to 90% when looking at Gen Z and millennial respondents.

As for amenities, according to McKinsey, “Around 50% of U.S. consumers now report wellness as a top priority in their day-to-day lives, a significant rise from 42% in 2020.”

Mixed-use developments like this are especially appealing to businesses regarding talent recruitment. Employees are drawn to the convenience of having lifestyle amenities within easy walking distance, eliminating the need for driving. Walking or biking also leads to financial benefits, such as lower auto expenses for insurance, maintenance and gas.

The town center model supports many Americans’ recent prioritization of work/life balance. In recent years, studies have shown that the workforce prioritizes work-life balance, sometimes even over salary — 72% of workers believe work-life balance is a critical factor when choosing a job, according to a Zippia report.

Adaptation is essential for navigating the complexities of an ever-evolving world, and within the realm of commercial real estate, this holds particularly true. Amidst dynamic shifts in work patterns, housing trends and consumer preferences, the imperative to adapt has never been more pressing. We perceive these shifts not as a challenge, but as an opportunity for advancement. By embracing change, we unlock the potential to bolster the economic vitality of entire communities, ushering in a new era of prosperity and progress.