BY JAMIE KATCHER, JLL

For decades, we have built a real estate practice unparalleled in the US. Now, as the global legal powerhouse HSF Kramer, we are so much more. As the only law firm ranked in Chambers Band 1 in the US, the UK and Australia, we continue to transform skylines and reshape landscapes. Please visit our website to learn more. Kramer Levin is now HSF Kramer

Holland & Knight’s New York Real Estate Practice Group and Real Estate Capital Markets Practice Group successfully closed deals worth more than $11.35 billion in 2024. From acquisitions, dispositions, development, condominium and cooperative formation and operation to hospitality, financing, leasing, land use and real estate capital markets, our attorneys do their utmost to deliver clients with exceptional results across all sectors.

Acquisitions and Dispositions: $1.93 billion

Financing: $4.1 billion

Leasing: $3.2 billion

Land Use: $290 million

Defaulted Loans, Workouts and Liquidations: $1.83 billion

www.hklaw.com

Stuart M. Saft, Partner | Real Estate Practice Group

Keith M. Brandofino, Partner | Real Estate Capital Markets Practice Group New York, NY | +1.212.513.3200

EDITORIAL

Editor

Debra Hazel

Director of Communications and Marketing

Penelope Herrera

Director of Newsletter Division

PRESIDENT/CEO

Jeff Mann

ART

Art Director

Virginia Sanchez

Cover Photography Adobe

Frank DeLucia

Technology Consultant Eric Loh

Cheri Phillips Distribution Mitchell’s Delivery Service

Amanda Goldsmith

Jamie Katcher

Kris Kiser

Bob Knakal

Joseph Mecagni

Ira Meister

Phillip Ross

Stuart Saft

Kenne Shepherd

Carol A. Sigmond

Simon Soloff

DIGITAL MEDIA

Designers

Virginia Sanchez

Editors

Debra Hazel

Penelope Herrera

Rose Leveen

Cheri Phillips

Web Developer

CS Designworks

West Coast Office: 578 Washington Blvd., Suite 827

Marina Del Rey, CA 90292 866-306-MANN (6266) mannpublications.com

East Coast Office: 450 7th Ave, Suite 2306 New York, NY 10123 212-840-MANN (6266)

For 50 years, R&E's attorneys have been instrumental in driving the firm's success, helping R&E achieve remarkable milestones and putting the firm at the forefront of the

One of the most fascinating aspects of publishing real estate and apparel business magazines is finding the crossovers between what at first glance would be two very different industries. Of course, retail has a strong impact on both, but another common tool has emerged with exciting effects — artificial intelligence (AI).

That’s why I’m extremely excited that the cover stories of both the Mann Report in your hands (or on your screens) and Fashion Mannuscript’s (FM) June/July issue offer comprehensive overviews of the ways AI are transforming these industries. Both are a must-read for anyone interested at in the future — and the present — of business. You can find FM at mannpublications.com — and think about a subscription.

Our events section also shows wonderful ways in how we get together to network, honor each other and do good for our community. Congratulations to the Real Estate Board of New York’s Deal of the Year honorees, to my dear friend Jeffrey Gural for being honored by NYC Outward Bound, our other gatherings and to all who organize these spectacular events. (Trust me, I know how hard they are.)

This is our annual Summer double issue, so I hope you enjoy a break, whether it’s in the Hamptons, the Jersey Shore, the mountains or overseas — our team certainly will!

See you in August!

“It is not the strongest species that survive, nor the most intelligent, but the ones most responsive to change.” — Charles Darwin

by Seth

CO-CHAIRS

DENNIS HERMAN

CHAIRMAN & CEO

BEEKMAN

GOLF COMMITTEE

FREDERICK W. BARNEY, JR

ROBERT EICHLER

MICHAEL HIGHT

JAMES A. INGRAM

GERARD F. JOYCE JR

SAMUEL WAXMAN, MD

ARI ZAGDANSKI

At Peninsula Property Management (PPM), we do more than manage properties—we elevate them. With a leadership team that is deeply involved, hands-on, and responsive, PPM is redefining the standard for property management in New York City. Our mission is simple: deliver results with integrity, precision, and a hospitality-first approach.

Proactive Management

Stop issues before they start — from Local Law 97 to vendor oversight.

Financial Clarity

Clean, timely financials. No surprises –just strategic planning and transparency.

NYC Compliance Expertise

DOB, HPD, LL88, LL97, FISP we navigate every regulation so you don’t have to.

New Development Services

Schedule B, TCO phasing, hiring of staff, punch-list, insurance implementation.

Smart Cost Control

Energy savings, bulk contracts, vendor negotiations we cut waste, not corners.

Track requests, tasks, and reports live through our integrated digital platform.

Welcome to our our Design issue and our Summer double issue.

Steve Jobs once said, "Design is not just what it looks like and feels like. Design is how it works.” And that’s never been more important than in real estate. A building can look magnificent, but it needs to serve its users.

That’s why I’m excited to share the insights on the importance of design from true industry experts, including my friend Kenne Shepherd on interior design, Cbiz’ Joe Mecagni on office design and its financial benefits and MGAC's Amanda Goldsmith on modular construction.

And, yes, there is still more to say about Local Law 97. Check out our contributor Carol Sigmond's column this month. And as you’ll see in my conversation with Fabio Zaniboni, the technology that will help owner/managers save on emissions may also reinvent the relationship between buildings and their users.

Thanks to all for your contributions. For now, I’m off to reacquaint myself with the ocean for a few days, and hope you’ll all be getting some R&R, as well.

Then meet us back here in August!

The Real Estate Gala is an exclusive, invitation-only black-tie event held annually at Peak in Hudson Yards in New York City. Founded and hosted by Don Tepman, president of TownCentre Capital (StripMallGuy), and co-hosted by Bob Knakal of BKREA, it brings together 250 top real estate professionals from across the U.S. to celebrate community, collaboration and the future of the industry. With media coverage, a red carpet and a focus on authentic connection, it’s become one of the most anticipated nights in real estate.

Sarah Saltzberg, Bohemia Realty Group, winner of the Eileen Spinola Award for Distinguished Service

New York City’s residential brokerage community gathered at Guastavino’s to celebrate the Real Estate Board of New York’s (REBNY) 36th Annual Residential Deal of the Year Charity & Awards Celebration. The event honored outstanding deals and professionals from 2024, while raising money to support the REBNY Member in Need Fund.

Agents from Brown Harris Stevens took home first and second place in the Sales Deal of the Year Awards, with Serhant and Compass winning third. Jessica Cloonan of Corcoran arranged the top Rental Deal of the Year. The awards were judged by members of the residential advisory board, residential ethics committee and co-chair of residential committees.

Hosted by WNBC’s Dave Price, the evening opened with a warm welcome and remarks from REBNY President James Whelan.

“This celebration is a testament to the resilience and heart of New York’s residential brokerage community,” Whelan said. “The stories behind each winning deal reflect not just savvy, but empathy, integrity and perseverance. The hallmarks of a strong, supportive industry.”

The annual celebration is organized by the Residential Member in Need Fund Committee, whose mission is to provide financial relief to residential agents and brokers facing unexpected hardship.

Since its inception, the Member in Need Fund has distributed over $1 million in grants to support residential members experiencing personal or financial crises.

In addition to the Deal of the Year awards, the gala honored several individuals for performance, leadership and service. Douglas Williford of Brown Harris Stevens received The Henry Forster Memorial Award. Sarah Saltzberg of Bohemia Realty Group was honored with the Eileen Spinola Award for Distinguished Service.

Brian Phillips of Douglas Elliman Real Estate received the Residential Agent of the Year Award. Josue Gonzalez of Coldwell Banker Warburg received the Residential Rookie of the Year Award.

A special recognition was given to Neil B. Garfinkel, managing partner of AGMB, who has represented REBNY and its members for 30 years.

Community Mainstreaming Associates (CMA) proudly hosted its 31st Annual Golf & Tennis Tournament, with a record-breaking turnout and overwhelming community support. The event was held at two of Long Island’s premier venues — The Muttontown Club and The Woodside Club — bringing together friends, supporters and partners in CMA’s mission of inclusion and empowerment for individuals with intellectual and developmental disabilities (I/DD).

This year’s tournament honored Dr. Andrew Greenberg and Orthopaedic Associates of Manhasset for their outstanding commitment to community health, service and leadership. Their dedication reflects the values at the heart of CMA’s work: compassion, excellence and impact.

The event drew an impressive 250 golfers, 20 tennis players and over 30 additional guests for a memorable evening dinner reception. Guests enjoyed a day of competition, connection and celebration, all in support of CMA’s vital programs and services.

“This event continues to grow year after year, and we are so grateful to everyone who helped make the 31st tournament our most successful yet,” said Eileen McDonald Egan, executive director of CMA. “Thanks to the support of our community, we can continue helping individuals with intellectual and developmental disabilities live full, independent lives.”

CMA celebrated its 50th anniversary in 2024. Proceeds from the event will directly support CMA’s residential, employment and day services — programs designed to foster independence, inclusion and dignity for people with I/DD.

NYC Outward Bound Schools hosted its 2025 Gala at Tribeca Rooftop, gathering more than 250 guests to celebrate the power of public education and the communities that make it thrive.

The event raised over $1.3 million to support organization’s work bringing crew, challenge and community to public schools across New York City.

The evening honored Jeffrey Gural of GFP Real Estate, a longtime champion of equity and education, as well as Board Chair Gifford Miller for his leadership and service. Rachel

Demaldaris, a teacher at one of NYC Outward Bound Schools’ network schools, received the 2025 R. Gaynor McCown Excellence in Teaching Award in recognition of her outstanding classroom practice and commitment to students.

The program was emceed by three student leaders — Joseph Chavez, Diana Ramirez and Katy Weng — who brought energy, humor and heart to the stage. Guests enjoyed a rooftop cocktail hour, dinner and a live auction, all in support of building stronger, more equitable school communities across the city.

JLL has completed a new lease for the Daily Bread Food Pantry at 125 Park St. in Danbury, Conn., the former home of the U.S. Military Museum that closed in 2017. The firm represented the Daily Bread Food Pantry in arranging a lease for 6,000 square feet on the ground floor of the property, which is owned by Orlando Properties LLC.

The location is vastly larger than its former home in a rear building of St. James Episcopal Church on Terrace Place. As part of the Park Street transaction, Daily Bread completed a renovation of the property that included new building systems, new windows and exterior siding and an upgraded driveway, drive-in door and parking lot.

The tenant has built out the space as a “Super Pantry,” dramatically improving the shopping experience for clients and positioning the organization to serve more people in need.

“This was an enormous project for an all-volunteer organization with limited funding. But with the help of an army of supporters we made it happen,” said Peter Kent, president of Daily Bread Food Pantry. “It’s not just an amazing new space, but a whole new way to think about what a modern food pantry should be.”

Ian Ceppos, executive vice president at JLL’s Stamford office, represented Daily Bread Food Pantry in the transaction.

“As a Danbury resident, it’s gratifying to see firsthand the positive impact the new Daily Bread location makes as they serve over nearly 1,000 families each week in our community, making it the largest food pantry in the Greater Danbury area,” Ceppos said. “The Super Pantry is positioned to better help many neighbors in need for years to come and will serve as a model for other communities to follow.”

Located near the intersection of Route 7 and Interstate 84, the new food pantry features expanded inventory, point-based “pricing” with monthly allowances, cheerful signage with nutrition guidance, translation kiosks, a social service library, children’s book nook, large warehouse space with walk-in refrigeration, pallet racks and equipment to receive and rescue thousands of pounds of food weekly.

Affordable and mixed-income real estate developer Tredway has acquired Ocean Park Apartments, a 602-unit, family-designated property located at 125 Beach 17th St. in the Far Rockaway section of Queens, N.Y.

Concurrent with the acquisition, Tredway entered into a new regulatory agreement with the New York City Department of Housing Preservation & Development to bring all units into rent stabilization and extend the affordability of 423 units at 60% area median income (AMI) and 179 units at 80% AMI, preventing substantial imminent rent increases.

Residents will also benefit from expanded food and nutrition services in partnership with City Harvest and swim and water safety lessons provided by the nonprofit Rising Tide Effect.

“We are pleased to take on the stewardship of Ocean Park and to execute a preservation that significantly strengthens the property’s affordability while providing critical capital repairs, energy-efficiency improvements and expanded social services,” said Will Blodgett, founder and CEO of Tredway. “Instituting rent stabilization at Ocean Park protects current and future residents from rapidly rising rental prices and will maintain the property as a beacon of opportunity for the entire Far Rockaway community.”

A substantial rehabilitation is planned for the beachfront complex, primarily aimed at correcting decades of deterioration caused by exposure to the elements and salt spray. The scope of work is slated to include critical structural repairs, the complete replacement of the parking deck, extensive waterproofing, window weatherization, roof replacement and Local Law 11 work across the site.

Tredway is investing in new resiliency infrastructure and will improve the property’s energy effi ciency by installing low flow fixtures, LED lights and Energy Star appliances, in addition to other electricity and water conservation measures, these changes will provide stability for current residents of Ocean Park and ensure a valuable source of affordable housing remains available for decades to come, the company said.

The acquisition is being financed with a loan from Merchants Bank coordinated by Michael Milazzo and Mathew Wambua. The transaction was brokered by Victor Sozio and Shimon Shkury of Ariel Property Advisors.

Alchemy-ABR Investment Partners announced that 288 East 88th St., a new, 24-story luxury residential rental building, has officially topped out at approximately 350 feet.

Located at the southwest corner of East 88th Street and Second Avenue, the Hill West Architects-designed tower will feature 45 residences, oversized picture windows and a soft gray facade that complements the neighborhood’s architectural charm.

Leeding Builders Group is serving as the general contractor for the project, which is expected to open to residents in 2026.

“We’re excited to reach this important milestone at 288 East 88th Street and bring a refined residential experience to the Upper East Side,” said Ken Horn, president and co-founder of Alchemy-ABR. “The building will offer thoughtfully designed homes and striking city views, all within one of Manhattan’s most established neighborhoods.”

Alchemy-ABR is developing the project in partnership with Carlyle Group. Additional partners include RC Structures, as well as legal advisors SSRGA, Kramer Levin, Simpson Thacher and Fried Frank. The financial team includes lenders Affinius Capital and Bank OZK, and Walker Dunlop.

Amenities at 288 East 88th St. will include a fitness center, a multipurpose sports court, a children’s playroom, a media/gaming room, a coworking space and a roof terrace.

Funds managed by affiliates of Strategic Value Partners LLC (SVP), One Investment Management (OneIM), RXR and Columbia Property Trust (CXP) announced the acquisition and recapitalization of Hudson House, an 829-unit luxury multifamily complex nearing completion in the Soho West neighborhood of Jersey City, N.J.

“Hudson House is a transformative project for the Jersey City residential market, and we are pleased to be partnering with OneIM, RXR and CXP,” said Mike Ungari, SVP’s head of real estate. “This investment highlights our shared ability to navigate complex capital structures and vision to drive long-term value creation through collaboration in institutional-quality real estate.”

Construction on the first phase of Hudson House is complete and leased. The remaining two phases of the development will be completed following this transaction and are expected to be delivered this summer with move-ins beginning shortly thereafter.

The complex transaction included a refinancing of the existing senior mortgage with a new loan from affiliates of Apollo Global Management, which will help fund construction completion, lease-up and additional

The buildings feature large unit layouts averaging 1,136 square feet as well as high-end amenities that include a resort-style pool deck, fitness center with three saunas, yoga studio, golf simulator, multiple resident lounges and approximately 48,000 square feet of groundfloor retail.

“We are excited to pair our team’s multifamily experience and vertically integrated platform with our partners to navigate, close and execute the development of Hudson House,” said Adam Frazier, Columbia’s president and CEO.

“This project is a high-quality asset in a uniquely desirable location with continued phases underway. This closing continues RXR’s robust presence in structured transactions, now comprising over $2 in capital placement over the past two years,” said Russ Young, executive vice president, investments at RXR.

JLL advised Manhattan Building Company on certain aspects of the transaction while Cushman & Wakefield advised certain participants on the acquisition and recapitalization.

The Hudson House development includes three distinct components.

Davis Polk & Wardwell LLP, Gibson Dunn & Crutcher LLP, Milbank LLP and Cleary Gottlieb Steen & Hamilton LLP acted as legal counsel on the transaction and refinancing.

Developer 280 E Palmetto Park Road LLC’s Glass House Boca Raton, the first modern glass building in the heart of downtown Boca Raton, Fla., closed on $9 million in early work development financing from Maxim Capital. The transaction was brokered by Arrow Real Estate Advisors.

Arrow Real Estate Advisors’ Morris Betesh, founder and managing partner; Morris Dabbah, senior vice president, and Louis Halperin, associate, helped to secure the loan.

The financing provides 280 E Palmetto Park Road LLC’s development team with the capital required to construct the underground parking garage, with the goal of having the project ready for vertical construction by the end of summer 2025. Glass House Boca Raton is expected to top off in Q1 2026, with full completion targeted for Q2 2027.

Spearheaded by Noam Ziv, CEO and partner of 280 E Palmetto Park Road LLC, the 28-residence luxury development has broken ground and remains on track for its projected timeline.

“We are very pleased to have entered a loan agreement with Maxim Capital with the help of Arrow Real Estate Advisors for the early work development financing for Glass House Boca Raton,” said Ziv. “This $9 million loan will bolster Glass House to continue toward its many milestones. This intimate luxury residential development is certain to be a luxury icon in the heart of Boca Raton.”

“The financing of Glass House showcases Arrow’s commitment to providing clients with best-in-class capital markets expertise,” said Betesh. “We worked closely with both the sponsor and lender to structure a tailored financing solution that ensures the development timeline stays on track and positions the project for long-term success.”

Featuring expansive two- to four-bedroom residences with private

terraces, the project boasts full-height impact windows, smart home integration and world-class amenities. Spanning 2,504 to 3,865 square feet, the residences at Glass House feature high ceilings, private terraces ranging from eight to 12 feet in depth, spa-inspired primary bathrooms with dual-sink vanities and spacious walk-in closets.

The smart home-ready residences are designed with European cabinetry, man-made stone countertops, backsplashes, islands and a state-of-the-art appliance package.

The development’s 10th-level rooftop deck offers ocean, Intracoastal and golf course views and includes a premier private pool, a Jacuzzi, private cabanas, an outdoor catering kitchen with a barbecue and a fire pit lounge.

Amenities on the first floor include a plunge pool, a state-of-the-art fitness center with outdoor turf lanes, a sauna and a steam room, and a residents-only Palmetto Lounge, offering demitasse and a tranquil space to meet privately.

Proper Hospitality, Rosso Development and Midtown Development announced the launch of Midtown Park Residences by Proper, a luxury residential tower set within a $2 billion mixed-use development, poised to reimagine nearly five acres in the heart of Midtown Miami at 3055 North Miami Ave. Anchored by lush open areas including two public parks and pedestrian paseos connecting Midtown to the Design District and Wynwood, the project will deliver over 120,000 square feet of prime retail with gourmet restaurants and cafes, designer shops, office buildings, a public eight-court racquet and padel club and more.

“There is a new Midtown being born in Midtown, one built around thoughtfully designed public and pedestrian green spaces that seamlessly connect the fabric of the area,” said Carlos Rosso, founder and CEO of Rosso Development. “This landmark project represents a defining ‘before and after’ for the neighborhood.”

The first 28-story tower to be launched, Midtown Park Residences by Proper, will offer a collection of 288 residences. Midtown Park Residences by Proper is the company’s second residential project, building on the success of Austin Proper Residences, which sold out at record prices.

“With Midtown Park Residences, we’re not just introducing a new living experience, we’re defining a new chapter of Proper. ‘By Proper’ captures the essence of our brand while celebrating the artistry of world-class designers who shape each destination,” said Brian De Lowe, co-founder and president of Proper Hospitality.

Midtown Park Residences is being brought to life by an ensemble of architects and designers including Arquitectonica, Meyer Davis Studio, and Naturalficial. Owners gain access to over 40,000 square feet of private amenity spaces, an expansive pool deck and exclusive owner events across the Proper Hospitality’s portfolio.

Residence layouts include studios, one-bedroom, one-bedroom plus den, two-bedroom, and three-bedroom configurations ranging in size from 510 to 1,730 square feet, and a private collection of penthouses averaging 3,150 square feet. A 40,000-square-foot tropical pool deck will offer a signature restaurant and bar overlooking panoramic skyline and water views. Wellness offerings include a state-of-the-art fitness center, dedicated Pilates studio, yoga and meditation garden, private pickleball court and a spa pool.

Charney Companies has received construction loan financing of $135 million for its development of 95 Rockwell Place in Fort Greene, Brooklyn, the center of Brooklyn’s Cultural District. With backing from BH3 Fund Advisors and Madison Realty Capital, the 45-story condominium will bring 182 new units to a neighborhood traditionally dominated by single-family homes.

“Closing this significant construction loan is a pivotal moment, allowing us to bring our vision to deliver high-quality condominium housing to Fort Greene and contribute a thoughtful addition to the Brooklyn skyline,” said Justin Pelsinger, COO of Charney Companies. “This endeavor is strengthened by our collaboration with Public Service, the design branch of the highly regarded Brooklyn institution Public Records. None of this would become reality without the crucial support and belief from our relationship partners, BH3 Fund Advisors and Madison Realty Capital, and we are deeply grateful.”

95 Rockwell will feature a mix of studio, one-, two- and three-bedroom units, along with approximately 500 square feet of commercial space. Building amenities will include outdoor garden space, a gym, a steam room, a spa, co-working spaces, a café and private party space for residents. Demolition began in May 2024 and completion is anticipated for Q4 of 2027.

“We are grateful for the opportunity to work with Charney Companies in financing 95 Rockwell,” said Adam Falk of BH3 Fund Advisors. “Located at the nexus of several core Brooklyn neighborhoods and within the borough’s cultural center, the area is primed for a thoughtful new condominium. Charney Companies have a proven track record and reputation of delivering thoughtful and contextual projects in Brooklyn and beyond. We expect 95 Rockwell will be another well-received and successful addition to the rapidly evolving neighborhood.”

Charney is collaborating with Public Service, a branch of Public Records, the music-driven, design-forward restaurant and community space in Gowanus for 95 Rockwell’s interior design. In addition to

musical sound curation throughout the building’s public areas, Public Service will design interior space utilizing sustainable materials and re-creating the sense of calm Public Records offers. More than 7,000 square feet is dedicated to amenities.

“We are pleased to provide flexible financing to Charney Companies, a repeat borrower and highly experienced developer of luxury residential projects,” said Josh Zegen, managing principal and co-founder of Madison Realty Capital. “95 Rockwell is a well-located, highly amenitized property within close proximity of Brooklyn’s premier dining and cultural destinations. This transaction reflects Madison Realty Capital’s commitment to supporting best-in-class developments and delivering creative financing solutions that advance transformative projects across New York City.”

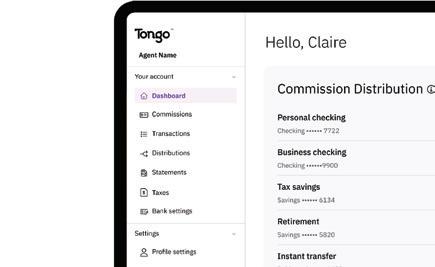

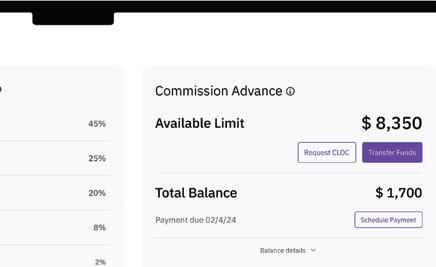

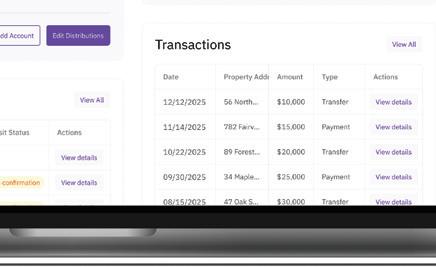

Tongo, a builder of financial products for the commission economy, announced that it will offer preferred rates on services for real estate agents affiliated with brokerages owned or franchised by a brand of Anywhere Real Estate Inc., a provider of residential real estate services.

The offer provides real estate agents with access to Tongo’s commission advance, allowing them to draw up to 75% of a pending commission up to 60 days early.

In an uncertain housing market, agents are navigating slower deals and delayed paydays. Tongo provides industry-leading rates as low as 3% for 30 days. This financial service allows agents to continue investing in their businesses and helps them stabilize their cash flow.

“We’re excited to offer this impactful solution to Anywhere-affiliated agents, offering them a new option to promote financial stability,” said Brandon Wright, CEO and founder of Tongo. “With approximately 1.5 million residential real estate agents in the U.S., there are still very few solutions addressing their financial needs. Tongo was created to fill that gap and offer agents a path to stabilize their cash flow and ultimately position themselves and their business for growth.”

Agents can add pending deals in Tongo to open their available balance. The available balance can be accessed as needed by instantly transferring funds to a linked bank account or by swiping the Tongo card. Agents can access the amount they need and only repay Tongo when they get paid. If a deal falls through, agents can repay when their next deal closes.

MONDAY, AUGUST 4, 2025

The Seawane Club | Hewlett Harbor, NY

Rockaway Hunting Club | Lawrence, NY

Hempstead Golf & Country Club | Hempstead, NY

Sunrise Day Camp–Long Island is the world’s first full-summer day camp for children with cancer and their siblings, provided completely free of charge.

Sunrise Day Camp–Long Island is a proud member of the Sunrise Association, whose mission is to bring back the joys of childhood to children with cancer and their siblings worldwide. Sunrise accomplishes this through the creation and oversight of welcoming, inclusive summer day camps, year-round programs and in-hospital recreational activities, all offered free of charge. Sunrise Day Camp–Long Island is a program of the Friedberg JCC, a beneficiary agency of UJA-Federation of New York.

EP Engineering announced that it has completed full engineering services for multiple Vuori locations around the country. The performance clothing store has expanded to most major cities across the United States and brought in EP Engineering’s team for new store openings in New York, Connecticut and five additional locations.

EP Engineering was involved throughout each step of the project process at every location, from preleasing to the end of construction. The EP team provided pre-lease site visits and assessments to determine if the spaces had any MEP issues or reasons Vuori should not lease the space. Once each location was selected, EP reused and modified existing MEP systems to accommodate the newly renovated spaces while keeping construction costs low. EP’s team responded quickly to rectify problems discovered as construction progressed and worked closely with the contractor to find readily available equipment and meaningful solutions to keep the project on schedule.

“This project underscored the full range of services that EP provides and how committed our team is to guiding our clients through every aspect of a project,” said Joe Vieitez, PE, partner at EP Engineering. “We are proud to be part of the growth and evolution of Vuori and work closely with them to make their vision come to fruition nationwide.”

Vuori’s new storefronts are now open.

Broad Street Realty, in partnership with Centennial and Madison Energy Infrastructure, announced the completion of a new 1 MW(dc) rooftop solar installation at Hollinswood Shopping Center in Baltimore County, Md. The project follows the 2.4 MW(dc) rooftop solar project that the companies recently completed at the 233,000-square-foot Cromwell Shopping Center.

The project is designed to reduce the cost of electricity for approximately 1,000 homes in the area, while increasing power production in the state. The project uses over 1,500 solar panels with a ballasted racking system across Hollinswood Shopping Center’s 100,000-square-foot roof.

“The rooftop solar project at Hollinswood Shopping Center is the most recent example of how owners of commercial real estate can grow their net operating income while contributing to efforts to lower electricity costs for households and businesses, while increasing energy generation in Maryland — a state that currently imports nearly 40% of the electricity that it consumes,” said David John Frenkil, founder and managing principal of Centennial.

Centennial developed the project, with construction performed by Halo, a solar engineering contractor. The project received financing from AccelDev and will be owned and operated by Madison Energy Infrastructure. Venable served as transactional counsel to Centennial.

“These recent solar projects align with our company’s commitment to reducing our carbon footprint and implementing ESG-focused initiatives across our properties,” said Michael Jacoby, chairman and CEO of Broad Street Realty. “We’re contributing to Maryland’s goals of supporting our local communities with reduced electricity costs for families, while increasing power generation in the state through clean energy.”

Architecture, engineering, environmental and planning firm ISG announced the acquisition of JDavis, a multidisciplinary design firm with offices in Raleigh, N.C. and Philadelphia. JDavis brings expertise in planning, landscape architecture, interior design, architecture and procurement management services, along with significant experience in multifamily housing. With their focus on placemaking and design quality, the work and people of JDavis will complement and enhance ISG’s residential and mixed-use portfolio, the announcement said.

The acquisition also expands ISG’s footprint to include Raleigh and Philadelphia as well as its architecture, interior design, planning and landscape architecture teams. JDavis clients will now benefit from ISG’s broad expertise, ranging from engineering and environmental professionals to value-added technologies.

“Joining ISG represents an exciting next step for the JDavis team,” noted Neil Gray, former JDavis CEO. “We see strong cultural and design compatibility and are looking forward to bringing our expertise to additional geographies and services as part of a larger team.”

With offices in six states, including the recent expansion into Arkansas and the opening of two new locations in South Dakota in 2024, ISG will now have offices in North Carolina and Pennsylvania.

“As JDavis joins ISG, we are strengthened by unifying two teams with growth-oriented, owner mindsets that will continue to drive strategic decisions and shared accountability,” said Lynn Bruns PE, ISG CEO. “In addition, expanding our footprint allows us to provide consistent quality and build deeper, more strategic relationships with our national clients — no matter where they operate.”

Viessmann, a manufacturer of high-efficiency heating and renewable energy systems, announced the launch of ducted and ductless air-toair heat pump solutions — Vitocal 100-S and Vitocal 200-S — designed to enhance energy efficiency and comfort for both residential and light commercial applications.

The Vitocal 100-S single-zone air-to-air ductless heat pump systems are designed for reliable comfort, even in extreme climates. Suitable for a wide range of installations, including both new builds and retrofits, the Vitocal 100-S offers ultra-quiet operation and high-efficiency inverter technology for increased energy savings. Minimal installation requirements make ductless heat pumps ideal for applications with limited space and where ductwork does not exist.

The Vitocal 100-S single-zone air-to-air ducted heat pump system

combines the advantages of traditional ducted heating and cooling with the efficiency and flexibility of ductless inverter technology, providing a compact, cost-effective and complete solution for whole-home comfort. This system offers quiet operation, a compact design and the enhanced efficiency of inverter technology while also supporting the reuse of existing refrigerant lines, ductwork, thermostats, fan coils and furnaces. Suitable for upgrading an existing ducted HVAC system, constructing a new home or expanding an existing one, the Vitocal 100-S ducted heat pump solution is a versatile and efficient choice.

The Vitocal 200-S multi-zone, air-to-air ductless heat pump system is designed for customizable comfort across multiple spaces, delivering reliable heating and cooling with advanced inverter-driven technology for optimized performance and energy saving efficiencies. Homeowners can mix and match each outdoor unit with up to five indoor units, bringing tailored comfort to individual rooms or the entire home. With increased capacity and energy efficiency, this model is can be used in residential and light commercial applications, or larger projects in more challenging climates. It also offers ease of use with an intuitive control system, ensuring long-term reliability and comfort for both residential and commercial properties.

“Our mission is to drive innovation that supports the ever-changing demands of the industry,” said Ben Jewell, head of product and engineer for North America at Viessmann. “These new products reflect our commitment to providing advanced, reliable, and energyefficient solutions for contractors and homeowners. By offering superior performance, simplified installation, and long-term reliability, we continue to set new standards in heating and cooling technology.”

FlowPath, a provider of computerized maintenance management system (CMMS) software, has launched a Work Order AI Automation package that it said will transform facility operations by automating work order management, monitoring and analysis, empowering teams to work faster, smarter and with greater confidence.

The FlowPath Work Order AI Automation Package is designed to serve as a 24/7 digital coordinator, ensuring that nothing slips through the cracks.

Leveraging customizable AI agents, the system autonomously parses inbound requests from emails, texts, calls, Slack messages and external forms, intelligently creating or routing work orders — even correcting errors or flagging duplicates before they become a problem.

“Facility teams shouldn’t have to spend their days chasing paperwork or wondering what’s falling through the cracks,” said Alex Cummings, CEO of Flowpath. “With our Work Order AI Automation Package, we’re giving every maintenance department the peace of mind that comes from knowing nothing gets missed and every detail is handled-so they can focus on what really matters.”

Key automations include inbound parse and triaging of new requests; continuous monitoring of all work orders for delays, missing information or unassigned tasks and AI-powered insights to forecast workload, identify cost spikes and optimize resource allocation.

Available as an add-on for $200 per month, the Work Order AI Automation Package is now accessible to all FlowPath customers via their AI Assistant settings.

AI Assistant was launched in February 2025 to automate routine processes and provide real-time, data-driven insights.

Homa, a home buying platform powered by artificial intelligence, has launched in Florida. Homa doesn’t rely on human real estate agents and old-fashioned processes. Instead, Homa enables buyers to navigate the home buying process completely unrepresented, removing the pressure, bias and financial conflicts often associated with agents.

Offering user-friendly tools and an advanced AI, Homa gives buyers the ability to purchase a home with the same level of expertise as a top-tier human agent. But unlike working with a costly agent, buyers can save money with Homa, ultimately lowering the cost of homeownership and making it more attainable.

CEO Arman Jahaverian, a former Zillow senior director, and CTO Federico Campeoto, a PhD-level computer scientist, bring deep industry expertise to the company’s mission of empowering home buyers. Developed with AI specialists and real estate professionals, Homa is trained on state-specific laws and the same coursework required for real estate licensing, making it as knowledgeable as top realtors, the company said. But unlike traditional agents, Homa is available 24/7, ensuring buyers get guidance whenever they need it.

“Our vision is to modernize the home buying process and make it more affordable by putting buyers in control,” said Jahaverian. “With AI and automation, we’re giving people the confidence to purchase a home independently while ensuring they have access to all the tools and resources they need.”

Buyers can use Homa to tour homes, analyze market data, draft offers and manage the escrow process. For those buyers still opting to work with an agent, Homa can supplement their agent’s services with

advanced tools, ensuring they have access to unbiased advice and advanced insights.

As the housing market tightens, Homa can enable buyers to make informed decisions while saving thousands in commissions, according to the company. The company has ambitious plans to expand nationally in the near future and aims to disrupt the traditional real estate model by offering a smarter, more cost-effective and more efficient way to buy a home.

In response to mounting uncertainty over the future of the Environmental Protection Agency’s Energy Star Portfolio Manager, Cambio, an AI-driven commercial real estate operations platform, has launched Cambio Vault, a free alternative to the EPA’s building benchmarking tool.

This move comes after recent reports raised serious concerns that the longstanding national repository for building energy data may soon be defunded or dismantled, putting at risk the data and reporting capabilities relied upon by thousands of commercial real estate owners and operators nationwide. Energy Star is currently used to benchmark half a million buildings and last year was credited with helping businesses avoid an estimated $14 billion in energy costs.

“Cambio is stepping up to fill the gap,” said Stephanie Grayson, cofounder and co-CEO of Cambio. “We’re proud to do our part during these uncertain times and offer a free, enterprise-grade alternative to Portfolio Manager. The launch of Cambio Vault honors our commitment to support the real estate industry with data empowerment. Cambio Vault ensures that the market can safeguard the data it needs to undertake critical benchmarking, reporting and retrofitting processes — without disruption or risk of data loss.”

Started in 1992, the Energy Star program enables property owners to measure the energy performance of their buildings, while helping them comply with state and local energy benchmarking ordinances that require the use of Portfolio Manager.

Cambio Vault integrates seamlessly with ESPM, enabling clients to push and pull building energy data for enhanced dashboard analytics, reporting and retrofit insights, the company said. Beyond energy performance data, Cambio’s AI algorithms ingest building characteristics like age, type, location and HVAC type via large language models (LLMs) to generate retrofit recommendations.

Key capabilities of Cambio Vault include secure data storage and historical record keeping, ongoing synchronization with ESPM to maintain the data backup, automated building-level energy and emissions tracking, visual dashboards and advanced analytics for performance insights and compliance-ready outputs for local benchmarking ordinances and ESG frameworks.

Onboard, the tech-enabled bulk internet management partner backed by Conservice’s utility expertise, announced a new strategic partnership with SKBM Smart Technologies, a provider of smart building solutions and a certified general contractor and installer. This partnership delivers a first-of-its-kind solution that combines infrastructure, installation and internet management into a single, turnkey offering for multifamily and build-to-rent owners and operators. By uniting Onboard’s expertise in amenity program architecture, deployment and resident onboarding with SKBM’s strength in designing, aggregating and installing smart building systems, the two companies now offer a path for owners and developers to implement technology amenities at scale without adding complexity for site teams, they said.

“Owners want to deliver a modern, connected living experience — but they don’t want the operational headache that often comes with it,” said Chris Breen, vice president of strategic solutions at Onboard. “Our partnership with SKBM removes the friction. With a bulk internet program from Onboard and smart locks, smart thermostats, access control and monitored cameras from SKBM, together, we manage the entire process — design, install, deploy, support.”

The partnership is structured to serve owners and developers in both the pre-construction and post-construction phases. SKBM provides design consulting, low-voltage infrastructure layout and white-glove installation of all smart building devices. Onboard then negotiates, activates and manages a customized bulk internet program, including provider selection, contract negotiation, resident onboarding, longterm support and ongoing amenity program management.

The result is a unified solution for two of the most in-demand technology amenities — smart building and internet — delivered through a single partnership.

“It’s more than tech — it’s turnkey operations,” said Cris Kimbrough, chief strategy officer at SKBM Smart Technologies. “Together, we’re creating communities that are smart, connected and move-in ready — while making life easier for ownership and staff.”

This partnership also includes ongoing maintenance and resident support. SKBM offers quarterly on-site systems reviews and an SLAbacked support model, while Onboard continues to provide resident enrollment optimization, internet service coordination and program performance tracking across the community.

Six former attorneys from Seiden & Schein P.C., a real estate boutique law firm, have joined the commercial real estate law firm Adler & Stachenfeld LLP: Named and Founding Partner Alvin Schein, Hillary A. Potashnick and Stacy E. Jacobson, as well as three associates and members of the Seiden & Schein professional team.

“This is an exciting time at Adler & Stachenfeld,” said Managing Partner Terri Adler. “Alvin, Hillary and Stacy are natural fits for A&S and are joining us at a time of significant growth. The additions to our NYC Real Estate Tax & Zoning Incentives Practice Group, and the creation of a Condominium & Cooperative Practice Group, will amplify our ability to serve our developer, owner and lender clients in guiding them through the ever-changing and highly complex landscape of New York City real estate and policies.”

“Adler & Stachenfeld’s sole focus on real estate and deep bench of expertise are the perfect fit for my background and the team of talented professionals that have joined me in this perfectly timed move,” Schein said. “This will enable us to continue to meet the growing demands of our high-profile developer clients.”

A recognized expert in cooperative, condominium and affordable housing law. Schein will co-chair the NYC Real Estate Tax & Zoning Incentives Practice Group with YuhTyng “Tyng” Patka, a partner at Adler & Stachenfeld who has chaired the practice since 2019. He has spearheaded the filing of more than 200 inclusionary housing plans with the NYC Department of Housing Preservation and Development and is one of the few attorneys in New York whose practice includes the representation of sellers and purchasers of inclusionary air rights.

Potashnick will chair the firm’s new Condominium & Cooperative Practice Group. The practice will represent developers of condominiums

and cooperatives — including market-rate, income-restricted and mixed-use projects — across New York City. Potashnick has more than 30 years of experience in acquisitions and sales of real estate; cooperative/condominium new construction and conversion projects; all aspects of registrations and representation of developers, lenders and co-op and condo boards; financing and workouts between purchasers and developers/lenders; advocacy before the New York State Attorney General’s office and general real estate practice.

Jacobson has joined as a partner and will focus her practice on a broad array of real estate transactions, financing, leasing and development matters, as well as practicing in inclusionary housing. With almost 25 years of experience, Jacobson counsels her clients on the acquisition, financing, leasing, development and disposition of real estate and real estate-related assets of all property types.

Associate David W. Lu will work with Potashnick in the Condominium & Cooperative Practice Group, and Associates Scott A. Schreiber and Efram Klipper will work with Patka and Schein in the Real Estate Tax & Zoning Incentives Practice Group.

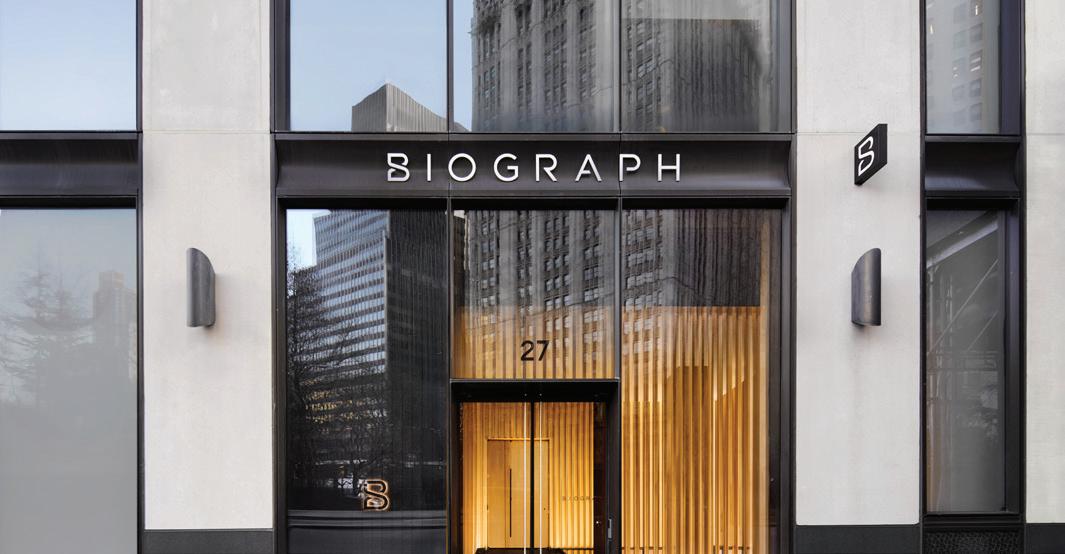

Biograph, an advanced preventive health and diagnostics clinic, announced the opening of its newest location, at 27 Park Row in the heart of New York City, shortly after the brand’s formal public launch. The clinic features an intuitive and biophilic design, reflecting its unique healthcare approach. This environment empowers members with early, actionable health insights and provides private, thoughtfully tailored care with empathy and comprehensive services.

Combining the latest in medical research and innovation, Biograph is pioneering a new model of proactive, personalized health — where advanced diagnostics are no longer cold or clinical, but integrated into a human-centered experience. The New York City clinic offers members the care and elegance of a five-star stay while leveraging state-of-theart equipment, diagnostics and evidence-based protocols.

“We designed our NYC clinic with our members’ needs in mind, envisioning a space that would inspire, energize, and empower every individual who walks through our doors to feel comfortable in their healthcare journey,” said John Hering, co-founder of Biograph. “The clinic is truly where luxury meets wellness, serving as a hidden oasis that offers total immersion in wellness just steps away from the buzz of urban life.”

Upon entering the Biograph clinic, members are welcomed into a thoughtfully curated setting with concierge-level care and luxe accommodations to ensure complete privacy and comfort. Private

suites serve as peaceful retreats between diagnostic tests, offering natural light, privacy and framed views of internal gardens and the city.

Diagnostic rooms are tailored for comfort and functionality, with dedicated spaces for consultation.

The 15,000-square-foot clinic features a reflection pool, a central courtyard inspired by Japanese garden design, intentional negative space to give each member room to breathe and experience comfort, private member suites that serve as peaceful retreats between diagnostic tests and cutting-edge diagnostic technology including next-generation MRI and CT scanners.

RFR’s Seagram building has seen a spate of lease renewals among high-profile, long-term tenants. Home Depot Co-founder Ken Langone’s Invemed Associates and Bill Berkley’s Berkely Insurance Group have committed to lease renewals that will bring their tenancies at Seagram to 33 years and 17 years, respectively. Mubadala’s MIC Capital will renew and expand to 36,428 square feet, doubling its space at Seagram and lining up space that does not become available until 2027.

“The prestige of a Seagram address is universally sought after and we’re seeing long-term commitments from tenants ranging from savvy innovators to longtime business visionaries,” said AJ Camhi of RFR At 99% occupancy, the competition for space here is still incredibly fierce.”

Ken Langone, founder and CEO of Invemed Associates, is a renowned philanthropist and author of the New York Times Best Seller “I Love Capitalism!”. Invemed Associates, which operates as a private equity and investment banking firm, renewed its 7,000-square-foot commitment at Seagram, signing an extension two years ahead of the original lease expiration, which was first executed in 1996. The deal extends the firm’s tenancy at the building to over 33 years.

Berkley Insurance Group, a subsidiary of W. R. Berkley Corporation, has been a tenant at Seagram since 2014. The firm renewed its 18,214-square-foot space, extending the company’s tenure to what

will be over 17 years at the building.

Mubadala’s MIC Capital Partners extended its existing lease through to 2044 and added another full floor comprising 18,214 square feet. The firm is part of Mubadala Investment Group, United Arab Emirates sovereign fund/investor for the government of Abu Dhabi. Mubadala is a $330 billion business that spans six continents with interests across multiple sectors and asset classes. MIC joined the roster at Seagram in 2018 and is now doubling in size and extending its term through 2044, bringing its commitment at the building to 26 years.

RFR was represented in-house by Camhi, executive vice president and director of leasing, and Senior Vice President Paul Milunec. Mubadala Investment Group was represented in the transaction by Justin Aronson of CBRE.

Multifamily property management company Sentral added three communities to its portfolio: Quincy in San Francisco, Reveal Playa Vista in Los Angeles and 24Fifty at University Park in Denver. Quincy expands Sentral’s Bay Area presence to seven communities; Reveal Playa Vista is its 10th community in the Los Angeles area and 24Fifty is Sentral’s second community in Denver.

Quincy, located at 555 Bryant St. in San Francisco, is a new development from Strada Investment Group that will open later this month. Each of the 501 studio, one-bedroom and two-bedroom homes is appointed with luxury finishes and smart appliances. Sentral will deliver its full-service model, including a lifestyle team, fitness director and event programming to provide Quincy residents with a refined hospitality-style experience.

Quincy’s amenities include an indoor/outdoor rooftop lounge and bar with views of Mission Bay and Oracle Park, speakeasy game room, demonstration kitchen, co-working lounge, fitness center, yoga/ training room and lobby atrium. Services include a 24-hour Experience Ambassador team, dry cleaning, home cleaning, valet parking with EV charging, fitness classes, private training, pet care and dog walking.

“We’ve seen the success Sentral has had with other Class A buildings in the Bay Area with their service-first approach to building a strong community, and we knew that partnering with Sentral would bring our vision for Quincy to life,” said Will Goodman, principal, Strada Investment Group.

Reveal Playa Vista, located at 5710 Crescent Park East in Los Angeles, offers 214 one-bedroom and two-bedroom apartments. Amenities provide residents with ample facilities for work and play, from open spaces to intimate alcoves with complimentary WiFi throughout. Lifestyle amenities include an oversized rooftop deck with a heated

pool and BBQ stations; a double-height clubhouse featuring a custom pool table, three large HDTVs and a spacious kitchen and a state-ofthe-art fitness room.

24Fifty at University Park is a luxury residential building located at 2450 South University Boulevard. The building offers amenities including a rooftop pool, jacuzzi and lounge with a firepit; outdoor terrace and grilling area; clubhouse with a kitchen and self-serve coffee bar; TV and game room with a billiard table; yoga studio; 24hour fitness center with Echelon virtual spin bikes; pet washing station and more. Under Sentral's management, 24Fifty plans to offer a number of fully furnished apartments that will be available for anylength-of-stay leases.

24Fifty and Reveal Playa Vista are owned by the same institutional investor.

“As we continue to grow in markets across the country, we are proud to be recognized by the world’s leading residential developers as the only property manager that can provide this level of hospitality lifestyle experience for residents,” said Roman Speron, president and chief operating officer of Sentral. “We are building engaged communities unlike any that exist in these markets.”

By Jamie Katcher, executive managing director, JLL

Commercial real estate shapes nearly every element of our daily lives. It’s where care is delivered, ideas are born and goods are exchanged. Hospitals, data centers, malls, warehouses and office towers are all dynamic ecosystems. They house people, energy, ambition — and, increasingly, data.

Artificial intelligence is now profoundly transforming how we engage with these spaces — not in futuristic flourishes from a scifi movie, but in real, practical shifts that make buildings smarter, deals faster and workplaces more human-centric.

AI in commercial real estate isn’t about replacing professionals — it’s about empowering them to work at a higher level, using tools that offer them clearer insights and a deeper understanding of how space functions.

JLL has long believed that AI can become the connective tissue between data and action. Our comprehensive approach to AI implementation, from our proprietary JLL GPT to our Falcon analytics platform, demonstrates our commitment to leveraging technology that enhances how real estate decisions are made and executed.

As a leader and innovator in AI integration across the commercial real estate industry, we’re driving transformation throughout our organization, business line by business line.

In the world of commercial real estate investment, timing and insight are everything. Investors navigate massive volumes of information — from building-level performance data to broader economic indicators — just to underwrite a single asset.

But CRE data is notoriously fragmented, with engineering specs, environmental reports, lease agreements, tenant profiles and regulatory filings all existing in different formats across different systems.

AI changes that equation. JLL’s proprietary AI platforms digest messy, unstructured data and turn it into structured insight. Machine learning algorithms identify transactional opportunities, flag anomalies and generate detailed forecasts faster than any analyst team ever could on their own.

For example, when evaluating a property portfolio in a volatile interest rate environment, our AI tools can instantly compare occupancy trends, rent rolls and energy usage patterns across hundreds of properties. That allows capital markets teams to model returns more accurately, price risk with greater confidence and unlock opportunities others might miss.

The result? Smarter, faster decisions. Reduced guesswork. And the ability to move at the pace of the market.

Traditionally, property operations have been reactive. A boiler goes down, a light goes out, a tenant complains, and someone is dispatched to fix the issue. But what if buildings could detect problems before they happen?

For corporate occupiers, finding the right space isn’t just a real estate decision — it’s a business decision. It’s about access to talent, optimizing workflows and building culture. And with hybrid work transforming how space is used, getting it right has never been more complex — or more important.

JLL’s leasing platform combines deep leasing expertise with advanced analytics to help clients ask better questions — and get sharper answers. Where should we expand next? How much space will we need? Which layout best supports our hybrid model? Our tools simulate usage patterns, evaluate local market dynamics and align space decisions with broader business goals.

From lease negotiations to workplace optimization, our leasing professionals equip clients to navigate uncertainty with confidence. And because they’re backed by JLL’s global platform, they can scale those solutions across cities, portfolios or continents.

The goal isn’t just to find space. It’s to find space that supports the people inside it.

Traditionally, property operations have been reactive. A boiler goes down, a light goes out, a tenant complains, and someone is dispatched to fix the issue. But what if buildings could detect problems before they happen?

Enter Hank, JLL’s intelligent building management AI. Hank functions like a 24/7 building engineer, continuously monitoring HVAC systems, adjusting airflow and switching boilers and chillers on and off based on real-time demand.

It responds to fluctuations in occupancy, outdoor weather and energy prices, ensuring optimal performance with minimal waste.

In high-performance buildings, Hank can reduce energy costs by double digits

while improving tenant comfort. But it does more than adjust thermostats. Hank identifies inefficiencies, flags performance issues and helps teams anticipate maintenance needs — turning the traditional repair-and-respond model into a proactive, predictive one.

Hank’s dashboard enables asset managers to view real-time savings, carbon reduction metrics and equipment performance. Building operations become more efficient, more sustainable and more accountable.

At the building systems level, AI is now enabling engineers to rethink how their facilities are designed and maintained. JLL’s AI models can now predict daily building performance based on dozens of dynamic factors, including occupancy, calendar events, historical data and external conditions.

For engineers, this creates a powerful shift from static schedules to adaptive systems. Maintenance routines, for example, can now be prioritized based on real-time risk rather than calendar dates. Ventilation systems can adapt based on the number of people in a space and the current air quality — supporting wellness goals and regulatory compliance at once.

AI also allows engineers to engage in scenario planning. What happens to energy usage if tenant density increases by 10%? What ROI could a lighting retrofit deliver in a particular asset class? These questions are now easier to answer, enabling better capex decisions and longterm planning.

Tenants don’t always remember when everything goes right — but they never forget when something goes wrong. AI helps building operators deliver more seamless, consistent service by learning tenant behaviors and anticipating needs.

From tracking work order history to

analyzing amenity usage and optimizing cleaning schedules, AI helps focus building services where they matter most. Over time, the system learns what tenants need, when they need it and how to deliver it most efficiently.

AI also enables more personalized experiences. In some properties, this means powering touchless entry systems, reservable workspace tools and digital concierge services that integrate with mobile apps. These tools reflect a workplace that understands and adapts to how people work today.

JLL GPT is the first generative AI purpose-built for commercial real estate. Developed by JLL Technologies, this powerful engine is tailored to CRE-specific data — leases, market reports, transaction histories — and tuned to understand the nuance of real estate.

It’s used by over 45,000 JLL professionals across the globe, helping them answer questions, generate reports, summarize legal documents and explore market trends in seconds. The result is greater speed and better outcomes, because team members can spend less time parsing spreadsheets and more time thinking strategically.

And within JLL’s technology ecosystem, JLL Falcon stands as our proprietary artificial intelligence platform designed specifically for commercial real estate applications. Falcon combines JLL’s industry expertise and data with advanced AI technology to provide insights and solutions for real estate decision-making, portfolio management and workplace optimization.

Built on a flexible, multi-modal architecture, it can analyze documents, process complex real estate data and deliver trustworthy, actionable intelligence that supports business decisions across our organization and for our clients.

This represents a new way of working at JLL — one where the best of human experience and AI combine to solve

problems faster, deeper and with greater creativity.

Sustainability is no longer a “nice to have.” It’s an imperative. And AI is helping bridge the gap between ambition and execution.

For landlords and occupiers alike, AI enables detailed energy modeling, real-time emissions tracking and more efficient allocation of sustainability budgets. It can suggest building retrofits that maximize ROI, automate utility reporting and help clients benchmark performance against regulatory frameworks like LEED, Well and Energy Star.

For clients with carbon-reduction goals, AI tools help simulate a variety of retrofit scenarios across a portfolio. We are able to rank upgrades by cost and impact — delivering a strategy that aligns both environmental and financial goals.

AI helps to move sustainability beyond a mission statement into a measurable, manageable element of the business strategy.

As the industry stands at the cusp of a new era, JLL is striving to become the first truly AI-driven commercial real estate company, using this game-changing technology to amplify our expertise.

AI is already accelerating deal underwriting. It’s improving energy modeling. It’s making real estate data more intuitive and accessible to employees at every level, from brokers to engineers to financial analysts.

Tomorrow, it will guide zoning decisions, tenant engagement strategies and staffing initiatives by identifying patterns we might otherwise miss.

From predicting the energy needs of a data center to helping an entrepreneur find the perfect space to spark their next big idea, AI will empower commercial real estate to be not just a backdrop to life — but a catalyst for progress in how we live, work and grow.

�aturday June 7, 2025

Honoring

Darrin Beer

CIT Commercial �ervices

Celebrate the Roaring ´20s Presented by CIT Commercial Services and Republic Business Credit

Matthew Begley Republic Business Credit

BENEFITING NATIONAL JEWISH HEALTH

Enjoy a dazzling gala celebrating two outstanding leaders in business and the community. Prepare to be captivated by live musical performances and show-stopping dancing when the ballroom doors open and we celebrate the roaring ‘20s.

9876 Wilshire Blvd., Beverly Hills, California 90210

6 p.m. Cocktails

7:30 p.m. Dinner, Dancing and More

Black-Tie Attire

Complimentary Valet Parking

Event Contact Information: Marisa Edwards EdwardsM@njhealth.org | 818.905.1372 njhealth.org/lablackwhiteball

Photo by Kendall Chase

In today’s fast-moving and increasingly complex financial environment, successful business owners need more than just an advisor. They need a trusted partner who sees the full picture, anticipates change, and integrates every facet of their financial world. For over 30 years, Louis C. Ciliberti & Associates, Ltd. has delivered exactly that.

Headquartered in the heart of the New York metropolitan area, we are a full-service financial firm and multi-family office with over 150 years of combined experience in helping business owners navigate the intersection of personal wealth, enterprise growth, and longterm legacy.

Our clients are among the most financially successful individuals and privately-held companies in the United States—visionary entrepreneurs who trust us to help them build, preserve, and transfer their wealth with precision, purpose, and confidence.

THE MULTI-FAMILY OFFICE BUILT FOR ENTREPRENEURS

As an entrepreneur, you don’t live in silos—and neither should your financial plan. At Louis C. Ciliberti & Associates, Ltd., we operate as your central financial hub—managing everything from investment strategy and estate planning to business succession

and executive benefits.

We don’t just provide advice. We orchestrate and execute a total wealth strategy that aligns with your business goals, family needs, and long-term vision.

Our areas of specialty include:

• Estate Planning

• Business Succession Planning

• Comprehensive Wealth Management

• Employee Benefits (Pension, Medical, Key Executive Retention)

• Insurance Strategy and Risk Management

• Banking Oversight, Lending Coordination, and Bill Pay Services

With our in-house team of credentialed professionals, we address the complex needs of modern business owners by bringing clarity and structure to even the most dynamic financial lives.

The strength of our firm lies in the depth of our people. Our team is composed of seasoned professionals with overlapping and complementary expertise, including:

• Certified Financial Planners (CFP®)

• Chartered Life Underwriters (CLU®)

• Accredited Portfolio Management Advisors (APMA®)

• Behavioral Financial Advisors (BFA™)

• Chartered Retirement Planning Counselors (CRPC®)

• Chartered Retirement Plans Specialists (CRPS®)

• Registered Employee Benefits Consultants (REBC®)

• Registered Health Underwriters (RHU®)

Our wealth management team includes full-time in-house portfolio managers supported by Chartered Financial Analyst (CFA) professionals to ensure that every investment strategy is custom-built, actively managed, and integrated into your broader estate and business plan.

When appropriate, we seamlessly coordinate with attorneys, accountants, and tax professionals—either from our network or yours—to deliver complete, taxefficient solutions that align with your goals

and values.

Protecting what you’ve built for future generations requires more than just documents—it requires coordination, insight, and intention. Our estate planning and succession strategies center around family dynamics, asset complexity, and tax mitigation.

We specialize in coordinating independent business valuations to help you take advantage of every available discount for leveraged wealth transfers, ensuring your family retains more of what you’ve built.

Additionally, our team actively collaborates with you to implement business succession plans that position your company—and personal finances—for lasting success. As you develop the next generation of leadership in your business, we do the same in ours: We build internal succession that ensures continuity of service and trust for years to come.

Attracting and retaining top talent is one of the biggest challenges for private companies. We help design and implement tailored employee benefit programs, including qualified retirement plans, executive retention strategies, and medical benefits that align with your business goals and cash flow realities.

Where needed, we engage vetted thirdparty professionals—such as pension third-party administrators, medical benefit consultants, and property and casualty insurance partners—to ensure you have best-in-class support across all benefit platforms.

For most clients, financial success leads to greater administrative complexity. That’s why we provide a suite of family office services, including:

• Banking Oversight

• Lending Coordination

• Bill Pay and Financial Administration

These concierge-level services help ensure that your wealth operates with the same discipline and efficiency as your business— freeing you to focus on growth, strategy, and legacy.

At Louis C. Ciliberti & Associates, Ltd., we’ve built our reputation on delivering beyond expectations— every time.

• Excellence in execution

• Service that anticipates needs

• Integrity that puts the client first

• Accountability that you can count on

Our commitment is simple: To serve our clients with the same dedication and care that they bring to their own enterprises.

That’s why we’ve trademarked our core belief:

Success Is a Well-Served Client™ It’s more than a phrase—it’s the way we do business.

Whether you’re preparing for a liquidity event, planning your exit strategy, or simply seeking a more unified and strategic approach to your wealth, Louis C. Ciliberti & Associates, Ltd. is here to help.

We bring over 150 years of combined expertise, a network of world-class professionals, and a relentless focus on your success—delivered with the personal attention of a boutique firm and the sophistication of a family office.

Louis C. Ciliberti & Associates, Ltd.

Trusted. Proven. Personal.

Because Success Is a Well-Served Client™

TOURNAMENT CHAIR

Roger A. Silverstein

Silverstein Properties, Inc.

Member, National Jewish

CHAIRS EMERITI

Robert E. Helpern

Tannenbaum Helpern

Syracuse & Hirschtritt LLP

Member, National Jewish Health Council of National Trustees

Samuel B. Lewis

SBL Property Consultants, LLC

Member, National Jewish Health Council of National Trustees

Stephen B. Siegel

CBRE, Inc.

Co-Chair, National Jewish Health Council of National Trustees

In today’s fast-moving and increasingly complex financial environment, successful business owners need more than just an advisor—they need a trusted partner who sees the full picture, anticipates change, and integrates every facet of their financial world. For over 30 years, Louis C. Ciliberti & Associates has delivered exactly that.

We are a full-service financial firm and multi-family office that helps the most financially successful individuals and privately held companies in the nation. At Louis C. Ciliberti & Associates, we don’t just provide advice—we orchestrate and execute a total wealth strategy that aligns with our clients’ business goals, family needs, and long term vision.

by Amanda Goldsmith, LEED AP BD+C, Director, MGAC

Modular construction has emerged in recent years as a transformative approach in the construction industry, offering significant advantages in efficiency, cost savings and sustainability. As a result, it is becoming increasingly important for developers, investors, project managers, architects and contractors to recognize its potential and how it can revolutionize project delivery across nearly every asset class and sector. While this method has been more widely adopted across industries such as residential, commercial, hospitality, healthcare and education due to its promise of greater efficiency and sustainability, it also comes with challenges that must be weighed.

Initially, modular construction was associated with low-quality or temporary structures; however, modern innovations and research have disproved this notion. In fact, today’s prefabricated buildings are made with the same high-quality materials and construction methods as traditional buildings. These buildings are often indistinguishable from their conventionally-built counterparts in

terms of aesthetics and functionality, and with advancements in design and a growing understanding of the technology, modular construction is now considered a durable and reliable building method that can meet the needs of a variety of industries.

Industries are now turning to modular methods for a variety of building types, ranging from single-family homes to largescale commercial developments. One of the key reasons for the shift is the significant cost savings associated with modular construction. Because much of the construction process takes place in a controlled factory environment, it is less susceptible to the variables that often lead to cost overruns in traditional construction, such as weather delays, labor shortages, and sitespecific complications.

A more streamlined process allows for greater efficiency, faster timelines and, ultimately, more predictable project costs — all of which are major selling points for developers and clients alike.

In more specific terms, modular construction can reduce project timelines by 20% to 50% compared to traditional methods, which translates to significant cost savings for developers and project owners. These savings are further bolstered by a decrease in onsite labor costs and the reduction of waste generated during the construction process.

Additionally, the controlled environments in which modular construction takes place lead to higher quality control and consistency. In traditional construction, the quality of work can vary depending on the contractor, site conditions and environmental factors. With modular construction, all aspects of production are conducted within a factory setting, allowing for precise quality control and faster production times.

Controlled factory environments lead to less waste than traditional building methods, as construction waste is minimized when materials are purchased and used in bulk. Moreover, any waste produced can

often be recycled or repurposed. This can result in waste reductions of up to 90% compared to conventional construction methods and, combined with the energy-efficient designs often incorporated into modular buildings, makes it an appealing option for environmentally conscious developers and clients.

These environmental benefits extend beyond waste reduction; by reducing the amount of on-site construction, modular construction also lowers the carbon footprint of a project. Traditional construction sites require a large number of workers to be present at various times, resulting in increased transportation emissions and on-site energy use.

Modular construction, on the other hand, reduces the number of workers needed on-site, as the majority of the work is completed in the factory. In addition, since modular buildings are often designed to be energy-efficient, they can help reduce long-term energy consumption and operating costs.

As sustainability remains at the forefront of the construction industry, modular construction provides a solution that both meets the needs of the clients and contributes to a greener, more sustainable future.

Modular construction does come with certain challenges, particularly as they pertain to regulatory hurdles and logistics. Building codes and regulations can vary significantly depending on location, and modular construction projects may require additional permits and approvals. While many jurisdictions have become more accepting of modular methods, project managers must still navigate the complexities of ensuring compliance with local building codes, zoning regulations and other legal requirements.

Further, while inspections are now often carried out during the factory process, on-site inspections may still be required, adding another layer of complexity. Ensuring all regulatory requirements are met while adhering to the modular building process is a key responsibility for project managers involved in these types of projects.