BUILDING A NEW CREDIT FUND AT INTEGRITAS CAPITAL

For decades, we have built a real estate practice unparalleled in the US. Now, as the global legal powerhouse HSF Kramer, we are so much more. As the only law firm ranked in Chambers Band 1 on three continents, we continue to transform skylines and reshape landscapes. Please visit our website to learn more. Kramer Levin is now HSF Kramer

EDITORIAL

Editor

Debra Hazel

Director of Communications and Marketing

Penelope Herrera

Director of Newsletter Division

PRESIDENT/CEO

Jeff Mann

ART

Art Director

Virginia Sanchez

Cover Photography

Isaiah Gill

Frank DeLucia

Technology Consultant

Eric Loh

Cheri Phillips Distribution Mitchell’s Delivery Service

Michael Gifford

Eric Ives

Kris Kiser

Bob Knakal

Andreas Koutsoudakis

Kelly Kreth

Teresa Minnick

Oded Noy

James Philbin

Laura Rapaport

Ben Reinberg

Stuart Saft

Carol A. Sigmond

Fabio Zaniboni

DIGITAL MEDIA

Designers

Virginia Sanchez

Editors

Debra Hazel

Penelope Herrera

Rose Leveen

Cheri Phillips

Web Developer

CS Designworks

West Coast Office: 578 Washington Blvd., Suite 827

Marina Del Rey, CA 90292 866-306-MANN (6266) mannpublications.com

East Coast Office: 450 7th Ave, Suite 2306 New York, NY 10123 212-840-MANN (6266)

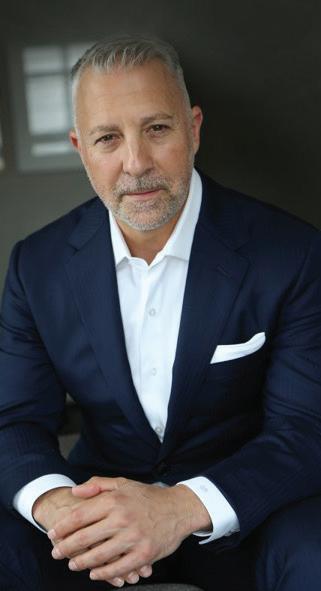

Ask someone about a typical real estate broker personality, and you’ll hear words like “extroverted,” “reactive” and “flexible.” Developers and bankers, on the other hand, evoke traits such as “stability,” “visionary” and "structure." It’s rare to find someone who combines them — but Stephen Palmese, our cover subject, embodies all.

A top broker for years at Massey Knakal, Cushman & Wakefield and JLL, Stephen has turned to his original plan with Integritas Capital, which both finances developments and creates new projects. It’s a fascinating portrait and a great way to cap the year.

Elsewhere, you’ll see the photos from the Mann Charitable and National Realty Club Foundations’ Annual Golf Outing. It was a great day of sport, dining and networking, with monies going to great causes. It’s my privilege to organize this great event.

And that’s it for 2025 — though as always, we’ll be publishing our weekly newswires throughout the next two months to keep you up-to-date on the latest news. Send us your news and ideas for 2026!

On behalf of the Mann family and the Mann Publications family, thank you for your support and loyalty this year. We wish you a holiday season of health, joy and peace.

We’ll see you next year!

“We all get the exact same 365 days. The only difference is what we do with them.” — Hillary DePiano

Join us for an insightful evening featuring expert discussions on the latest advancements in Artificial Intelligence! Enjoy cocktails and a buffet as you connect with industry leaders and learn about the future of AI and its impact on consumer goods and real estate.

Don’t miss this opportunity to learn about the future of AI and its impact on these industries.

Date: December 1, 2025

Time: 6:00–9:00 p.m.

Location: Versa, 218 W 35th St, 7th Floor, New York, NY 10001

Registration Fee:

$250 (includes speakers, cocktails and buffet)

Keynote Speaker:

Agenda:

6:00p.m. – Cocktails and Networking

7:00p.m. – Keynote Presentation: Rob McGillen, “Transforming Consumer Goods and Real Estate with AI”

8:00p.m. – Buffet, Audience Q&A and gifts

Sponsorships available upon request

For more information and to RSVP, please contact:

Penelope Herrera pherrera@mannpublications.com 212-840-6266 ext.313

Michael Sacco, CPA Managing Director National Consumer & Industrial Products Industry Leader, CBIZ

Host:

Abe Schlisselfeld, CPA, EA Senior Managing Director National Real Estate Industry Leader, CBIZ

Jeff Mann, CEO President/CEO of Mann Publications

At Peninsula Property Management (PPM), we do more than manage properties—we elevate them. With a leadership team that is deeply involved, hands-on, and responsive, PPM is redefining the standard for property management in New York City. Our mission is simple: deliver results with integrity, precision, and a hospitality-first approach.

Proactive Management

Stop issues before they start — from Local Law 97 to vendor oversight.

Financial Clarity

Clean, timely financials. No surprises –just strategic planning and transparency.

NYC Compliance Expertise

DOB, HPD, LL88, LL97, FISP we navigate every regulation so you don’t have to.

New Development Services

Schedule B, TCO phasing, hiring of staff, punch-list, insurance implementation.

Smart Cost Control

Energy savings, bulk contracts, vendor negotiations we cut waste, not corners.

Track requests, tasks, and reports live through our integrated digital platform.

Well, it’s been quite a year. Amid constant discussions of tariffs, interest rates and proptech, I’m still trying to figure out where the last 12 months have gone. But now, in this year-end double issue, we see some predictions for the future, advice on staging and discussions of various aspects of artificial intelligence.

That’s what makes real estate so dynamic — it’s always evolving and always responding to the needs of its users. It will be fascinating to learn the retail sales results for this holiday season, and to see if year-end will see a rash of transactions.

It’s also time to express appreciation. Thank you to our readers, who inspire us to keep finding the best stories; our contributors, who share their expertise to advance our industry, and everyone in the Mann Publications family.

Whatever holidays all of you celebrate over the next two months, I hope they are filled with joy, family, good friends, health and peace.

We’ll see you in January.

More than 100 golfers enjoyed a day of sport, dining and networking at the first-ever joint Annual Golf Tournament hosted by the Mann Charitable Foundation and National Realty Club Foundation at the Fresh Meadow Country Club in Lake Success, N.Y.

This year specifically, the event was held in honor of the late Michael Kerr, former president of M&R Management, and a long-time supporter of both foundations. The honorees this year were Martin Efron, managing director at White Oak Commercial Finance, and Jaimee L. Nardiello, partner at Zetlin & DeChiara LLP. Mitti Liebersohn, CEO of brokerage operations in the Tri-State region at Savills, was the recipient of the Michael Kerr Humanitarian Award.

“Michael was a dear friend from my childhood, and his loss is a terrible one for our family and our industry,” said Jeffrey Mann, CEO and president of Mann Publications, principal officer of the Mann Charitable Foundation and president of the National Realty Club.

The Mann Charitable Foundation, established in honor of Irving and Marion Mann, supports research to fight life-threatening diseases including, but not limited to, Alzheimer’s Disease, heart disease, Crohn’s & Colitis, breast cancer and autism.

The National Realty Club Foundation, founded in 1947 by leading real estate owners, operators, builders and attorneys, facilitates industry education and networking and supports causes dedicated to improving the lives of all in New York City, including the Bronx Historical Society, Community Mainstream, National Jewish Museum, Jewish National Fund and Nassau County Law Enforcement.

Hadassah Nassau hosted a Day of Play for Israel at the Lake Success Golf Club, honoring Shari and Neil Garfinkel and Pam and Rich Krauss for their steadfast dedication to Hadassah and unwavering support of Israel. All enjoyed a day filled with games, golf, shopping with favorite vendors, eating, socializing and winning prizes!

Hadassah is the only level one Trauma Center in Jerusalem and serves as the official hospital for the IDF. Its multidisciplinary team is dedicated to a holistic approach to medicine, delivering hope and healing to the many casualties of the conflict. The advanced techniques

being developed at Hadassah will not only benefit its patients but will be shared worldwide,.

The organization has recently opened the state-of-the-art Gandel Rehabilitation Center. Construction was expedited in response to the terrorist attacks of October 7 and the organizaiton is continuing to fundraise in order to fully operationalize the center.

Its goal is to expand its services to a wide range of individuals in need, including terror victims, injured soldiers, stroke victims and those suffering from trauma, disease or accidents.

Top

Erald

Darlene

Norbert

$650,000

The Children’s Happy Faces Foundation, Marsh and Ronald McDonald House New York had a special day at its yearly charity golf and tennis experience, held at Sleepy Hollow Country Club and Trump National Golf Club. Happy Faces Guests were joined by the 3rd Annual Marsh Nine & Wine Golfers. Golfers at Sleepy Hollow were greeted with a bluegrass band and omelets overlooking the Hudson River.

In total, 296 golfers and tennis players and 100 donors gathered for dinner for the Networking Experience at the Mansion of Sleep Hollow Country Club, enjoying live music by the Parker Reilly Band to benefit Ronald McDonald House New York.

“The continued support from the New York real estate industry that directly benefits Ronald McDonald House New York is truly remarkable,” said Event Chairman

David Lipson, CEO and founding member of Children’s Happy Faces Foundation and senior managing director of Century Management Services Inc.

“For 45 years, Ronald McDonald House New York has provided needed support for the children and their families, with an incredible staff and dedicated volunteers offering daily programs for the children and their families,” Lipson said. “It’s truly their home away from home — the house that love and hope built on the Upper East Side of Manhattan; centrally located near the finest hospitals in the world, ensuring that families can be with their children while undergoing care. It is wonderful to see such an outpouring of love and support from so many.”

The Title Sponsor was Century Management Services Inc. The Platinum Sponsor was Andrew & Abby May Family Foundation.

Gold Sponsors were Efficient Combustion & Cooling Corp., Marsh LLC, Morgan Stanley, National Cooperative Bank, Ronald & Connie Perry and Spring Scaffolding LLC. Silver Sponsors were Bargold Storage Systems, C.A.C. Industries, DirecTV, Gallet Dryer & Berkey LLP, M&R Management and Scott M. Panzer Foundation. Bronze Sponsor were Daniels Norelli Cecere & Tavel and Mann Publications.

“We are grateful to the Children’s Happy Faces Foundation, Marsh LLC and all who have partnered with us to bring this year’s golf outing to life,” said Ruth C. Browne, president and CEO of Ronald McDonald House New York “The funds raised for this event are critically important in supporting our families as they experience the most difficult fight of their lives.”

Milestone event honors Robert C. Garrett, CEO of Hackensack Meridian Health, and raises funds for critical healthcare initiatives

Town Title Agency hosted its 10th Annual Golf Outing at the prestigious Ridgewood Country Club in Paramus. N.J. Organized by the Town Title Foundation, this year’s event marked a decade of charitable impact and community support, bringing together business leaders, healthcare advocates, and supporters for an unforgettable day of sport and generosity.

The outing began with a special presentation as Town Title and former New York Giants quarterback Eli Manning honored Robert C. Garrett, FACHE, CEO of Hackensack Meridian Health, with a signed event jersey. The gesture celebrated Garrett’s visionary leadership and dedication to advancing healthcare across New Jersey. Manning also marked his own milestone this year, celebrating 10 years with the Tackle Kids Cancer initiative.

All proceeds from the outing will benefit four impactful Hackensack Meridian Health programs: Tackle Kids Cancer at the Joseph M. Sanzari Children’s Hospital, Inserra Diabetes Research Institute at the Joseph M. Sanzari Children’s Hospital, Caryl and Jim Kourgelis Foundation for Behavioral Health at Hackensack Meridian Carrier Clinic and John Theurer Cancer Center.

These initiatives provide critical resources and support for patients facing cancer, diabetes, mental health challenges and other complex diagnoses, ensuring that care, innovation and hope remain close to home for New Jersey families.

“This 10th anniversary event was a milestone for the Town Title Foundation and a testament to the power of community,” said Christopher Rotio, executive vice president of Town Title. “We are proud to honor Robert Garrett, welcome Eli Manning, and support programs that make such a lasting impact.”

large public universities with robust student communities. TSB Capital Advisors arranged financing for both transactions.

The team will develop two sites — one will be located on East College Avenue adjacent to the heart of the Penn State campus and the other on the corner of North Eagleville Road and Ledoyt Road, adjacent to the UConn campus core.

Liberty Mutual Investments (LMI), the investment firm for Liberty Mutual Group, and Landmark Properties (Landmark), a fully integrated real estate firm specializing in the development, construction, acquisition, investment management and operation of high-quality residential communities, announced joint ventures for the acquisition and development of two new student housing projects, The Mark State College and The Mark Mansfield.

The joint ventures will deliver 1,255 purpose-built, off-campus student housing beds at Pennsylvania State University (Penn State) and The University of Connecticut (UConn).

These developments represent the first venture between LMI and Landmark, leveraging Landmark’s track record of more than 20 years, while continuing LMI’s focus on investing in premier student housing opportunities. LMI’s student housing portfolio includes approximately 17,000 beds and is focused on adding purpose-built housing near

“These properties represent exceptional opportunities to deliver premier off-campus student housing at thriving universities — communities that will attract students and provide long-term value for residents,” said Christopher Finn, managing director and head of real estate at Liberty Mutual Investments. “We are excited to expand LMI’s student housing platform with Landmark, a leading developer of purpose-built, best-inclass student housing.”

The Mark State College, a 12-story student housing project serving Penn State students, will add 515 beds upon completion. Planned amenities include a skydeck, rooftop pool and hot tub with campus views, jumbotron, modern fitness center and sauna, clubhouse/amenity area, grilling area and fire pits, sports simulator, study lounge with café and computer lab, structured parking deck and bicycle/scooter parking. This is LMI’s third investment in student housing development within the Penn State market.

The Mark Mansfield, a nine-story student housing project serving UConn students, will add 740 beds. Planned amenities include a fitness center and clubhouse, sauna, nearly pool-sized hot tub, study lounge, computer lab, gaming lounge and bicycle parking.

“We’re excited about forging this relationship with LMI and look forward to working together on future initiatives,” said Walt Templin, president and chief investment officer of Landmark Properties. “Our shared commitment to providing housing options in university communities will help students excel in their academic careers while also reducing the pressure on the local housing market.”

to deliver flexible, fee-efficient access to high-quality real estate opportunities across the United States.

Designed to eliminate traditional fees and enhance alignment, RVAlliance provides access to high-quality, off-market real estate opportunities with a structure that prioritizes transparency, flexibility and capital efficiency. RVAlliance reflects Rose Valley’s core belief in combining a family-office mindset with institutional rigor, providing investors with a more aligned, transparent and attractive structure than traditional real estate funds.

“The right relationship is everything, and with RVAlliance, we’re building a unique platform that prioritizes investor capital while creating access to well-underwritten, cycle-tested real estate,” said Daniel Rosenthal, CEO of Rose Valley. “This is not just another fund — it’s an alliance between investor and operator and a better way to invest.”

RVAlliance stands out as a unique investment vehicle given its lack of vehicle-level fees and special upside through advantaged promotes that favor the investor, the firm continued.

Rose Valley offers RVAlliance investors access to off-market, value-add and opportunistic real estate deals. The firm’s approach is conservative, cycle-aware and focused on value appreciation and capital preservation.

Marty Burger of Infinite Global Real Estate Partners and Andrew Heiberger of Buttonwood Development, in partnership with 400 Capital Management LLC (400CM), have acquired 29 West 35th St., marking the first major offi ce-to-residential conversion under New York City’s new Midtown South Mixed-Use Plan.

The joint venture will introduce 107 boutique residences to the area, offering a distinct alternative its large-scale rental developments. Financing for the project was provided by Allegiant and 400CM, while additional equity partners include David Levinson of L&L and Terracotta Management. The project will serve as a blueprint for the district’s transformation by repurposing underutilized offi ce space into muchneeded housing as part of the city’s commitment to deliver over 10,000 new residences across Midtown South.

“New York City is home to some of the world’s most beautiful and iconic structures, many of which have outlived their original commercial purpose but possess incredible architectural character that deserves preservation. Rather than tearing these buildings down, we have an incredible opportunity to breathe new life into them as homes for New Yorkers,” said Burger. “This is a model example of adaptive re-use of an obsolete building in which we are creating much-needed housing — both affordable and market rate — in an ESG (Environmental, Social and Governance) compliant manner to create a residential enclave that will operate in a carbon neutral environment after its conversion. The city’s rezonings, led by the Mayor’s offi ce, City Council and City Planning, made this possible, and we are proud to be at the forefront of this transformation in Midtown South.”

The residences will consist entirely of studios ranging from 400 square

feet to 575 square feet, featuring soaring ceilings of 11 feet to 14 feet, designer kitchens, natural light and in-unit washer/dryers. Notably, 70% of the units will include fl exible spaces such as home offi ces, alcoves or bonus rooms.

The project utilizes the new 467-m real estate tax abatement program along with the Mandatory Inclusionary Housing program to create affordable housing units which will co-exist with market rate units, enabling the project to benefi t from a 35-year tax abatement program. Of the total units, approximately 75% will be market-rate, with 27 designated as affordable units at $1,701 per month through the inclusionary housing program.

An expansive rooftop amenity space will offer multiple seating areas, game tables and a large outdoor movie screen for films and sporting events, with views of the Empire State Building, NoMad, Hudson Yards and Bryant Park. Residents will also benefi t from a state-of-the-art security system, doorman and three elevators ensuring minimal wait times and maximum convenience. Additional amenities will include a dedicated pet wash station, bike and storage bins and a laundry facility with commercial-grade washers and dryers for oversized items.

“Midtown South is on the cusp of an incredible transformation, much like we saw in the Financial District, but with its own unique energy,” added Heiberger. “The neighborhood has it all — great energy, excellent transit access and top companies like Amazon and Salesforce anchored here — yet it lacks quality housing.”

The building is situated just three blocks south of Bryant Park and two blocks north of NoMad. Prime retail opportunities are also available at its base.

The developers were represented by Ben Schlegel of Ariel Property Advisors on the debt, lender Allegiant was represented by Richard Stanton, and the seller was represented by the Colliers team of Zach Redding and Matt Mastrocola. The project was designed by Ismael Leyva Architects. Archstone is the general contractor and project management services are being provided by L&L.

The Shop Workspace announced the official opening of its new Brooklyn location within 420 Carroll, a mixed-use development in the Gowanus neighborhood. The Shop is a design-forward coworking space tailored for freelancers, creative professionals and growing businesses rooted in the evolving Gowanus community. Offering 3,000 square feet of coworking space in the building’s second floor, The Shop at 420 Carroll will be the brand’s third location, with others in Salt Lake City and New Orleans. The Shop will soon open a new location in Greenpoint and plans to expand

with artists, nonprofits and local businesses. By blending high-touch hospitality with authentic community connections, we’ve created an ecosystem that makes people want to work here. Opening in Gowanus gives us the chance to welcome members into a space that reflects the neighborhood’s energy and creativity, while continuing to grow The Shop’s presence in New York. With a Greenpoint location confirmed, we are eager for continued growth across the city.”

The Shop offers pet-friendly offices, shared common areas, meeting spaces, cutting-edge technology, phone booths, a staffed reception area, mail and business services, an office kitchen, unlimited Beanmonger coffee, espresso, tea and more. Members of The Shop BK unlock access to over 100 coworking spaces across the globe through the League of Extraordinary Coworking Spaces (LeXC) and access to the Salt Lake City and New Orleans locations and any future locations of The Shop.

“At The Shop, service is far from an afterthought, it’s the core of our model,” said Anne Olsen, director of coworking at The Shop Workspace. “From Day One, we’ve designed this space around Gowanus. Our new location is rooted in our neighborhood through partnerships

Made possible by the Gowanus Mix zoning, The Shop is partnering with Arts Gowanus to offer subsidized space for local artists in addition to its commercial and reduced-cost Gowanus Mix community offerings. Seven Arts Gowanus studios have recently been awarded to local artists in a lottery system managed by Arts Gowanus, alongside five additional market rate Art Studios. A limited number of additional studios are available for leasing, starting from $1,881 up to $6,227.

totaling 79,775 square feet and eight commercial units spanning 4,385 square feet, which will remain after conversion. The site also features a 31,027-square-foot parking garage on the 1.61-acre parcel. The financing was arranged by loan originator Joe Siegfried, a member of the Eastern Union “President’s Team” under the leadership of company president and co-founder Abe Bergman.

Eastern Union, one of the largest commercial real estate mortgage brokerages in the United States, has secured $15.9 million in financing toward the condo conversion of River Rock Apartments, a five-floor, 82-unit, mixed-use property located at 116 West Mishawaka Ave. in Mishawaka, Ind.

Built in 2015 and 2016, the property includes 82 residential units

“This transaction supported the borrower’s business plan by securing the best possible full-leverage, interest-only financing,” Siegfried said in the announcement. “The loan structure gives the client sufficient time to sell off the condo units.”

River Rock Apartments features steel-frame construction with concrete, metal and fiberboard walls, along with interior entrances, a common area and elevator access.

The lender, Republic Bank, provided a three-year, interest-only loan with an 8% interest rate, a 75% loan-to-value ratio and no prepayment penalties. The borrower was not identified.

“One of Eastern Union’s core principles is to remain fully focused on our clients’ business needs,” Bergman said. “True to this commitment, Joe Siegfried has successfully arranged financing across a wide range of asset categories.”

Corcoran Group LLC continues to expand its domestic affiliates with the launch of Corcoran Plaza Properties, the brand’s first in New Mexico. Based in Santa Fe and led by Broker/Owner and CEO Rob Thorwald, the firm will serve clients across the city and surrounding areas up to the Colorado state line.

“Santa Fe is a premium example of refined living, where centuriesold heritage meets contemporary luxury,” said Pamela Liebman, president and CEO of The Corcoran Group. “Establishing Corcoran Plaza Properties in this market is a strategic milestone for our brand. The city’s allure, its architectural elegance, cultural diversity and breathtaking natural surroundings have long attracted discerning buyers seeking more than just a home. Rob Thorwald and his team embody the depth of local expertise and elevated service that defines Corcoran, making them the perfect stewards of our brand in this exceptional market.”

Founded in 1986 by Edward W. “Wally” Sargent, Santa Fe Properties has long been a top-performing and highly respected brokerage in

the region. Now operating as Corcoran Plaza Properties, the firm has grown to include more than 65 experienced agents, as well as support staff. In 2024, the company represented the sellers in the highestpriced home sale of the year, further cementing its reputation and skillset in the market’s luxury segment.

“Santa Fe is a wonderful place with a unique blend of cultures, arts, and the outdoors,” said Thorwald. “It’s a combination that has always drawn people here, and we’re looking forward to continuing to provide top-tier real estate services to our clients, now in affiliation with the excellence and prestige that the Corcoran brand embodies.”

Thorwald discovered the draw of Santa Fe in 1982 and moved to the area over a decade ago. Corcoran Plaza Properties will continue to serve clients interested in buying, selling and investing throughout Santa Fe’s key neighborhoods including Downtown/Eastside, Las Campanas, Monte Sereno, Eldorado and the Foothills, with a focus on high-end residential properties, farms, ranches and select commercial listings. The firm will continue to be based and operate out of its existing offi ces in downtown Santa Fe.

Santa Fe’s real estate market is characterized by high-value transactions, with the average sale price for homes within the most desirable areas easily surpassing the million-dollar mark. The city’s buyer demographic is predominantly domestic yet evolving, with an uptick in international interest. As a luxury resort destination, there is strong demand from second-home buyers and investors, particularly from markets such as Texas, California, Colorado, Washington, D.C. and the Tri-state area.

“Santa Fe’s unique blend of culture and natural beauty makes it one of the most compelling luxury markets in the country,” said Stephanie Anton, president of Corcoran Affiliates. “Rob’s leadership and the offi ce’s deep local roots align perfectly with the Corcoran brand’s values. We’re excited to help them elevate their business and support them in bringing our brand to life in New Mexico.”

Forbes Global Properties has added Junot, a family-owned firm based in Paris, to its international brokerage network. Junot will represent Forbes Global Properties across France and Belgium.

Widely regarded for its expertise in the sale of luxury properties and its

intimate knowledge of the Parisian market, Junot is backed by a team of more than 210 professionals and a network of 24 offi ces situated within the city’s most desirable neighborhoods.

“Junot’s reputation for excellence, discretion and local expertise makes them an ideal addition to our network,” said Michael Jalbert, CEO of Forbes Global Properties. “Their client-first commitment and long-standing market leadership refl ect the qualities we seek in every member, and we are proud to welcome them to Forbes Global Properties.”

Founded in 1984 and known for its expertise, in-depth market knowledge and client first approach, Maison Junot represents luxury real estate in Paris, Lille and Brussels through the integration of Victoire Properties.

“Forbes Global Properties allows us to offer our clients global visibility while staying true to our honored values and identity. We look forward to our continued growth across France, supported by an exceptional international network,” said Sébastien Kuperfi s, president of the Junot Group, in the announcement.

Forbes Global Properties provides branding and marketing services to premier real estate firms and is now represented by real estate agents across 29 countries in more than 600 locations. As members of this network, Junot will benefi t from Forbes’ engaged audience of more than 167 million to connect, inspire and inform affluent potential homebuyers and sellers about the finest properties for sale globally.

above-ask sale prices in most areas.

“Overall, the Q3 luxury market remains highly active, with fast absorption rates, limited supply and notable gains in high-end price bands. While median prices fluctuated slightly in some areas, strong demand and low inventory suggest continued momentum into Q4,” said Houlihan Lawrence President and CEO Liz Nunan.

Westchester County recorded 292 luxury sales (defined as more than $2 million) a 13% increase year over-year. Homes sold at an average of 104.4% of asking price, spending just 32 days on market.

The luxury real estate market across Westchester, Putnam, Dutchess and Fairfield Counties remained strong in the third quarter, with rising transaction volume, competitive pricing and robust demand, according to the “Houlihan Lawrence Q3 Luxury Market Report.”

Sellers continued to benefit from low inventory, fast-moving deals and

While the median sale price dipped slightly to $2.6 million, strength in the $5 million to $10 million segment and steady activity in the $3 million to $5 million range underscore sustained buyer appetite.

Putnam and Dutchess Counties posted a 61% jump in $1 million-plus sales in Q3. The median price declined 10% to $1.3 million, influenced by increased activity at the entry luxury level. However, homes sold quickly and competitively at 103% of asking. Greenwich, Conn. saw a 3% dip in sales but a median sale price increase of 11% to $4.8 million. The average price per square foot jumped 12% to $1,008. Homes sold faster and demand was strong.

Darien, New Canaan and Rowayton collectively experienced strong luxury activity in the quarter. Darien led with a 35% increase in sales, driven by a surge in $2 million to $3 million transactions. New Canaan followed with a 34% rise in sales while Rowayton remained steady. Across all three, homes sold quickly and often above asking.

Sentral, the Class A multifamily management company, announced the addition of three properties to its portfolio: a new development in Houston, and two takeovers — one in San Francisco and one in Alameda, Calif. Together, the three buildings add nearly 1,000 units to Sentral’s portfolio.

Located in Houston’s Museum District and slated to open in early 2026, the Houston project is a new development with 32 stories and 475 units, many of which will be designer-furnished. The building’s 60,000 square feet of amenity space will include a luxurious gym and yoga studio, state-of-the-art coworking spaces, pool, event lounge, restaurant and bar. The soon-to-be-named project is being developed by Raven Capital Management and RCM Living and will offer short-term stays and Sentral’s signature hospitality-inspired services and amenities.

“This incredible new project, which will include some of the best amenities in the market, was purpose-built for a group like Sentral — who has a solid track record of seamlessly operating buildings with both short- and long-term stays that attract residents and travelers looking for superb service and modern luxury,” said Noah Himmel, chief operating officer at RCM Living.

Star Harbor in Alameda offers luxury waterfront living inside a historic, 98-year-old former warehouse. Residents receive free transit passes, which include convenient ferry access to San Francisco and access to community amenities including a clubroom with kitchen, rooftop

and

Across the bay, in San Francisco’s Cathedral Hill neighborhood, the multifamily building at 830 Eddy St. offers sweeping city views and expansive floor plans with sleek design and modern appliances, Sentral said. Building amenities include a rooftop pool and lounge, coworking spaces and fitness center. With the addition of the two properties, Sentral now manages seven multifamily communities in the Bay Area.

830 Eddy is owned by the same institutional investor behind three other recently announced Sentral-managed communities — Reveal Playa Vista and 1600 Vine in Los Angeles, and 24Fifty at University Park in Denver.

A new study from Vector Solutions, a provider of safety, compliance and workforce readiness solutions for critical industries, has revealed the growing pressures construction supervisors face on today’s jobsites.

“The State of Frontline Safety Leadership in Construction” report, based on a survey of more than 600 full-time construction supervisors and managers across the United States, found that while supervisors feel accountable for both safety and culture, many say they lack the preparation and resources to deliver on those responsibilities.

Construction remains one of the most dangerous industries in the U.S., and has one of the highest suicide rates of any profession, according to the Centers for Disease Control and Prevention (CDC). Against that backdrop, the findings show how important it is for employers to better prepare supervisors to protect both safety and well-being on the jobsite. In fact, 93% say that structured supervisor training leads to fewer safety incidents. Yet, without stronger investment from leadership, supervisors are left in the dark to navigate hazards and sensitive crew issues.

The findings show that workers are increasingly turning to their supervisors for support that extends well beyond day-to-day operations: 71% of supervisors say a crew member has approached them with personal issues such as mental health or substance abuse.

Yet many don’t feel equipped to respond, as 64% worry that saying the wrong thing could make a worker’s personal situation even worse, and 38% admit that their company hasn’t provided them with clear protocols for handling these types of issues.

Even though supervisors aren’t always prepared when a crew member turns to them for help, they still recognize the responsibility they carry: 96% feel personally responsible for creating a safe, supportive culture on their jobsite and 95% believe their leadership directly reduces the

“Construction supervisors are carrying enormous weight for their crews, from managing safety and performance to supporting workers through personal challenges,” said Clare Epstein, general manager of commercial at Vector Solutions. “As the jobsite becomes more complex, supervisors need consistent training, clear guidance and accessible tools. We’re committed to providing the resources that help supervisors lead with confidence and keep crews safe.”

Supervisors are often left to make tough calls without backup, putting both safety and productivity at risk. Many say additional training would give them the confidence to respond more decisively when hazards arise. Two in three (67%) have had to make an important safety-related decision on site without clear guidance or support from their company and more than four in 10 (45%) have felt pressured to prioritize project deadlines over safety on the job.

Nearly half (49%) are concerned about burnout or mental health challenges among their team, but don’t know how to address it. Barriers to addressing these concerns include workplace stigma (33%), liability concerns (29%) and limited training (22%).

disassembled in roughly half the time of other conventional or luxury sidewalk shed systems, cutting both labor hours and street disruption at a moment when landlords and developers are facing new, stricter laws in the city governing how long sheds can be erected on street fronts.

New York City-based infrastructure design and distribution fi rm Shed announced the offi cial market debut of Halo, a modular scaffolding system aimed at rethinking how cities build — and experience — sidewalk sheds. Halo is set to be rolled out to contractors citywide, following successful pilots across high-traffi c corridors in Manhattan.

Engineered for speed, safety and simplicity, Halo combines a proprietary screwless, pin-based system with a refi ned structural aesthetic. Early installations show that Halo can be assembled and

“We designed Halo to complement urban environments and genuinely support contractors who need more control over how they plan and price their work,” said Marco Libani, co-founder of Shed Innovation. “Once we solved for ineffi ciencies in manufacturing and assembly, we were able to signifi cantly reduce downstream operational costs compared to other sidewalk shed systems on the market. And by offering Halo to contractors through a leasing model, we are enabling landlords to leverage their existing relationships, providing a level of trust and comfortability as they bid out and implement the new system.”

By removing the need for screws or fasteners, Halo’s modular structure allows for faster assembly with fewer tools and simplifi ed logistics. The system has been deployed at 210 Fifth Ave. and 1132 Broadway.

Halo’s design also promotes sidewalk visibility, a lighter street presence, and more reusable components — reducing waste and extending product life cycles.

“Halo refl ects a shift in how scaffolding can serve the needs of a modern city,” added Libani. “It’s modular — engineered to streamline contractor workfl ows while enabling property owners to elevate their street presence.”

hardware and labor expenses, and bring innovative access management to virtually any door — exterior, interior or exit.

“Our partnership with KoreLock allows us to bring powerful, connected access control to more businesses at a fraction of the cost,” said Kyle Henning, vice president of emerging capabilities at Levata, the parent company of the TrueSecure door lock brands. “The TrueSecure WP Series of Wi-Fi Direct locks is redefining how organizations deploy secure, remote access without the need for rewiring their buildings.”

KoreLock and Levata have introduced the TrueSecure WP Series, a lineup of six Wi-Fi Direct Smart Locks powered by KoreLock, delivering commercial-grade access control without the cost and complexity of traditional wired systems.

The TrueSecure WP Series provides secure, keyless access at up to 50% lower cost than conventional wired access control solutions, the companies said. These commercial Smart Locks install quickly, reduce

With TrueSecure’s streamlined installation and KoreLock’s turnkey wireless IoT technology platform, businesses can modernize their access control systems without major retrofits, new wiring or network infrastructure upgrades. The TrueSecure WP Series of Wi-Fi Direct Smart Locks includes six new models: Deadbolt, Grade 2 Lever, Grade 1 Lever, Exit Trim and Interconnected models, all of which are compatible with most commercial door lock applications.

Powered by KoreLock’s integrated IoT Smart Lock technology platform, TrueSecure WP Smart Locks feature BLE and Wi-Fi direct connectivity that operates securely over existing networks. Mobile credentials can be issued or revoked instantly from anywhere, providing unmatched flexibility for property managers, building administrators, and end-users.

“TrueSecure WP Smart Locks represent a powerful combination of innovation and practicality,” added Rob Goff, vice president of product and co-founder of KoreLock. “They make it easy for partners to increase profitability while providing customers with a secure, future-ready solution.”

Rental management software RentRedi announced the launch of its new AI-powered onboarding feature to make it easier and faster for landlords to set up their accounts and begin collecting rent by eliminating the manual data entry step of the onboarding process.

Landlords can upload their lease documents, and RentRedi’s advanced machine learning engine will scan the leases, extract key data (such as property addresses, tenant details, rent amounts and lease terms) and automatically populate their accounts.

“As with everything we do, this new AI onboarding capability helps landlords work smarter, not harder,” said RentRedi Co-founder and CEO Ryan Barone. “By removing the hassle of manual setup, we’re making it more seamless and effortless for landlords to get started, collect rent and grow their portfolios with confi dence.”

The AI onboarding feature is designed to remove friction and lower the barrier to entry for new customers. Key benefi ts include automating the extraction and inputting of lease data, cutting onboarding time from hours to minutes; easy set-up; precise data extraction, reducing errors from manual entry and accelerated rent collection with RentRedi’s full suite of tools.

“RentRedi was built for real estate investors who are building a path to fi nancial independence,” added Barone. “AI onboarding is one more way we’re making sure landlords can focus on their business, not their busywork.”

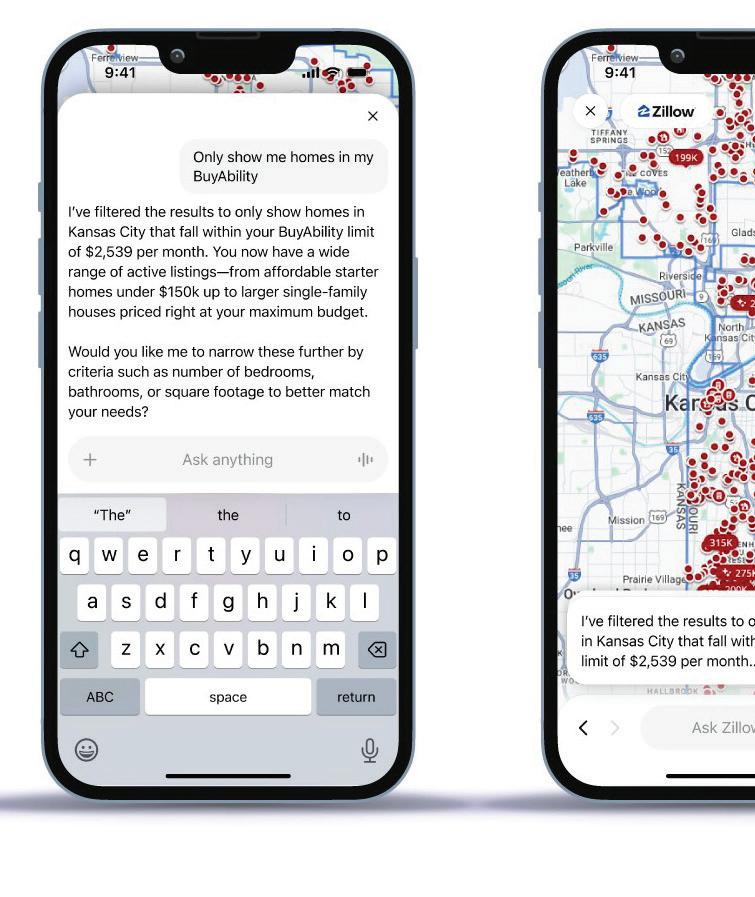

Zillow has become the only real estate app available in ChatGPT, giving people a first-of-its-kind way to begin their housing journey on the most widely used AI platform. The Zillow app in ChatGPT delivers listings, complete with photos, maps and pricing, and guides users back into Zillow to schedule a tour, connect with an agent or explore financing.

“As people increasingly turn to conversational AI to make their lives easier, Zillow is bringing that same simplicity to the home journey within ChatGPT,” said David Beitel, Zillow’s chief technology officer. “Our goal is to make it feel simple, intuitive and approachable. Partnering with OpenAI puts Zillow at the forefront of generative AI adoption; this builds on years of work as we continue to use AI to simplify and improve the path from searching for a home to actually unlocking the door.”

Zillow was an early partner that worked on building an app in ChatGPT, underscoring Zillow’s brand, scale and track record of turning technology breakthroughs into consumer-first innovations. This builds on decades of Zillow investment in AI, ensuring that consumers and the agents who guide them remain at the center of the journey.

The Zillow app in ChatGPT mirrors Zillow’s familiar design and is powered by Zillow’s housing insights, real-time listings and technology. Consumers see listing photos, property details, maps and pricing as well as broker and MLS attribution. Important next steps such as scheduling a tour, connecting with an agent or exploring financing will continue to flow through Zillow.

The experience supports most listing types, including rentals and homes for sale by agents or owners. Over time, Zillow plans to integrate newconstruction listings and immersive 3D tours.

Built, an AI-powered platform for real estate finance, has launched Built Payments with Lien Waivers, the first no-cost digital payments and lien waiver workflow for the construction industry. The solution is designed for everyone from general contractors and subcontractors to owners and developers. It allows businesses to send secure digital payments at no cost while automatically managing lien waivers in the same workflow whenever projects require them.

“This is a line in the sand. We’re designing low to no-cost solutions to help people pay and get paid faster and easier. With Built, making digital payments is free and lien waiver management comes built in. It is faster,

it is simpler, and once you experience it there is no going back,” said Chase Gilbert, co-founder and CEO of Built. “Built delivers a lightweight solution designed so that any builder, from the largest GC to the smallest subcontractor, can get up and running the same day.”

Construction finance has been weighed down by paper checks that take days to clear, lien waivers that arrive late or incomplete and reconciliations that consume hours at month-end. These delays stall projects, frustrate vendors and owners and leave back-office teams carrying the burden of extra work just to keep payments moving.

For the first time, any construction business can pay payables for free with digital payments and, if required, attach lien waivers in one simple workflow. Built processses payments and automatically generates lien waivers tied to each disbursement, ensuring compliance without extra steps. Payment recipients can optionally elect even faster access to their money for a small fee.

Finance teams gain real-time visibility into cash flow and project status without relying on duplicate systems, manual tracking or hidden fees. At the same time, subcontractors receive payment for free when they expect it, general contractors reduce overhead and avoid delays, and owners and developers gain confidence knowing that every downstream vendor is being paid to keep their project moving forward.

Any firm can send unlimited digital payments through Built at no cost, with lien waiver management automatically included for free. Payment recipients never pay to access the system or receive digital payments but can optionally choose to receive funds even faster for a small fee.

Real estate experience platform HqO announced the launch of the CRM for CRE, a purpose-built system for experiential landlords to manage tenant relationships, unify operations and close the experience gap across commercial real estate portfolios.

The unified platform will transform how landlords earn, retain and grow tenant business beyond the lease, the company said.

“Tenant expectations have outpaced traditional operating models, and transactional ownership is no longer enough,” said Chase Garbarino, CEO and co-founder of HqO, in the announcement. “Landlords who

deliver outcomes, not just space, are the ones who will thrive. The CRM for CRE gives them the infrastructure to do exactly that. It is the system of record and action that enables experiential landlords to finally operate in a customer-centric way.”

HqO’s CRM for CRE unifies leasing, operations, experience and intelligence in one cohesive platform. By consolidating tenant data, automating workflows and surfacing actionable insights, the system empowers property and asset teams to drive performance and loyalty at scale.

New enhancements to tenant lifecycle management, intelligence and operations in the Fall 2025 release bring disconnected processes and technologies into a connected ecosystem. Key capabilities include centralizing profiles, lifecycle-based navigation and omnichannel workflows; real-time analytics; multichannel communication, event management and engagement management tools; integrated access, visitor, resource booking and service request tools; a flexible monetization engine and an AI-ready foundation.

“This release represents the next chapter in how landlords operate,” said Shelly Just, senior vice president of client strategy and operations at HqO. “We’re giving property and asset teams a true CRM that unites data, workflows and intelligence across the entire tenant lifecycle. When paired with an experience program like HqOX, asset owners can build the deep loyalty and financial returns their investors demand. It’s about running real estate portfolios like modern customer organizations, intentionally, insightfully and at scale.”

With over 75 years of experience and deep understanding of industry challenges, IDB’s Commercial Real Estate team supports property owners, developers and builders across every type of financing requirement. We can help you keep pace with changes in the marketplace, while maintaining high credit quality levels and providing the personalized service, efficiency and flexibility to fit your specific needs.

For more information about financing solutions that meet your specific needs, visit idbny.com.

Derby Lane Partners has launched as an alternative investment management firm with up to $1.8 billion committed across the platform from the strategic anchor partners.

Derby Lane Partners said that it will provide flexible, creative capital solutions to the market across asset classes, with an initial focus on the compelling investment opportunity in commercial real estate credit in North America.

Strategic anchor partners include BTG Pactual, funds managed by affiliates of Fortress Investment Group, Koch Real Estate Investments, Liberty Mutual Investments, Silver Creek Capital Management and Stable.

Adam Piekarski, Derby Lane’s founder, chief executive and chief investment officer, brings to the firm over two decades of investment experience across public and private markets in commercial real estate credit, corporate credit and private equity.

He most recently served as the co-head of real estate credit at BDT & MSD Partners, where he co-founded and led the buildout of the investment team and the deployment of more than $5 billion of capital for commercial real estate credit investment strategies.

“Today’s market presents an attractive opportunity to invest in commercial real estate debt. We have assembled a seasoned team, paired with flexible capital and a differentiated approach to the market, that positions our firm to play offense while others continue to play defense,” Piekarski said in the announcement. “As we strive to drive value and sustainable performance across market cycles, we will always remain focused on our disciplined credit process and proactive asset management with our partners.”

In addition to Piekarski, the initial senior members of Derby Lane include Partner Kory Klebanoff, previously the co-head of East Coast originations at ACORE Capital, and Urian Yap, partner and CFO, previously the CFO of Madison Realty Capital. Klebanoff will be joined on the investment team by Matt Doneth, managing director, previously at Apollo Global Management, and Heecheol Pak, managing director, previously at Blackstone.

RFR announced that workplace experience company Industrious has committed to taking 33,231 square feet of space at 190 Bowery, a 38,000-square-foot landmarked office building located at the corner of Spring Street and Bowery in the NoLita neighborhood of Manhattan.

“The building itself is an evolving work of art situated in the heart of one of the city’s most vibrant neighborhoods,” said AJ Camhi, executive vice president and director of leasing of RFR. “It represents a one-of-a-kind opportunity for Industrious to provide a curated workplace experience in one of New York City’s most storied spaces.”

RFR was represented by an in-house team of AJ Camhi, Paul Milunec and Rob Weller along with Alexander Riguardi, Clark Finney, Robin Olinyk, Dana Goldman and Jake Bargas of JLL. Industrious was represented in house by Natalie Levine, director of real estate, and Kylie VanBuren, director of real estate transactions.

“We’re excited to plant our first flag for Industrious in this pocket of Manhattan,” Levine said. “While we have a strong presence across the city, this space is a trailblazer for our footprint in the walkable, energetic NoLita and Lower East Side area. The building’s architecture and fascinating history make it an inspiring setting. It’s a natural fit for the thoughtful, hospitality-driven workplaces we’re known for.”

Built in 1898 and designed by architect Robert Maynicke, 190 Bowery is a Beaux-Arts building which was commissioned by The Germania Bank and included a grand banking hall and offices above. Germania and its successor banks operated at the building until its sale to photographer Jay Maisel in 1966. Maisel maintained his residence, studio and gallery at the building for nearly 50 years – he also hosted his wedding and raised his daughter in the building. Maisel notably rented out the fourth floor as studio space to American pop artist Roy Lichtenstein.

The building became a mecca for street artists over the years and famously would get covered in chalk by Keith Haring. The building had an aura of mystery with this unique counterpoint of Gilded Age architecture contrasting with graffiti.

When RFR acquired the building in 2015, the firm kept the periodspecific architectural details in place which had been virtually untouched by Maisel. RFR updated the building systems throughout allowing the building to gain the functionality and comforts of a modern office building. RFR even relocated the building’s original copper cage elevator to the second floor where it serves as a private phone room.

The rooftop water tower, which is highly visible from the street, features a mural by artist Shepard Fairey called “Power and Equality” with a portrait of actress Rosario Dawson, who grew up in the neighborhood.

In today’s fast-moving and increasingly complex financial environment, successful business owners need more than just an advisor—they need a trusted partner who sees the full picture, anticipates change, and integrates every facet of their financial world. For over 30 years, Louis C. Ciliberti & Associates has delivered exactly that.

We are a full-service financial firm and multi-family office that helps the most financially successful individuals and privately held companies in the nation. At Louis C. Ciliberti & Associates, we don’t just provide advice—we orchestrate and execute a total wealth strategy that aligns with our clients’ business goals, family needs, and long term vision.

FirstService Residential, one of the largest residential property management companies in North America, has promoted Marc Kotler to president of New York City.

Kotler’s elevation will position him to continue to expand FirstService’s offerings and growth in the city.

Kotler brings more than three decades of property management expertise to his position, having joined FirstService Residential in 2004.

Over the years, he has held a variety of leadership roles within the organization, most recently serving as president of the New Development Group, New York, at FirstService. During his tenure, he played a key role

in building the division into the industry’s top consultant and manager for luxury high-rises, co-ops, condominiums and multifamily developers and institutional investors, making a lasting impact on New York City’s residential landscape, the company said.

As president of New York, Kotler will lead a team managing a diverse portfolio of properties that includes luxury high-rises, rental multifamily buildings, cooperatives, HOAs and condominiums from Manhattan, Brooklyn, Queens, Staten Island, The Bronx, Long Island and Westchester County.

“Marc’s comprehensive knowledge of property management and his proven leadership make him the ideal fit to lead our New York City operations,” said John Brea, president of the North Region at FirstService Residential. “His dedication to service excellence and his deep understanding of the market will help drive continued growth while elevating the client experience in New York.”

Kotler has been involved in the development and management of some of New York City’s most iconic properties, including The Plaza, 432 Park Ave., The Baccarat, 8 Spruce Street (NY by Gehry) and, more recently, 277 Fifth Ave., One Wall Street, 53 West 53rd St. and 520 Fifth Ave.

“I am dedicated to leveraging our unmatched local talent and expertise to deliver superior service that consistently exceeds the expectations of our clients and residents,” Kotler said.

Bungalow Projects, a real estate development firm focused on creating production hubs for episodic, film and digital content creation, and Bain Capital Real Estate announced the successful closing of $304 million in construction financing to aid the development of Echelon Studios, two high-end film and television production studios in Brooklyn, N.Y.

CounterpointeSRE provided a $156 million Commercial Property Assessed Clean Energy (C-PACE) financing to support the project’s sustainable development efforts, representing the largest C-PACE transaction in New York State and first-ever C-PACE financing for ground-up development in New York City. An affiliate of Farallon Capital Management provided $147 million in additional financing.

Combined, the two Brooklyn developments will result in approximately 600,000 square feet of production space across 10 state-of-theart soundstages, top-tier production office and support spaces and significant below-grade parking. With 40-foot clear-to-grid heights, the

purpose-built soundstages will offer column-free space with marketleading electric, HVAC, floor load and acoustic specifications designed to meet or exceed modern-day production requirements.

“We are excited to move forward on developing these state-of-the-art facilities that will cater to all types of episodic and film production and fill New York City’s undersupply of purpose-built stages that are critical to the growth of New York’s content production ecosystem,” said Travis Feehan, co-founder of Bungalow Projects.

Located at 242 Seigel St., Echelon Studios Bushwick will comprise six stages totaling 102,000 square feet of stage space, 86,000 square feet of production support space, 76,000 square feet of production office space and 91,000 square feet of below-grade parking for over 230 spaces.

Echelon Studios Red Hook is located at 176 Dikeman St. and will comprise four stages totaling 67,000 square feet of stage space, 75,000 square feet of production support space, 49,000 square feet of office space and 55,000 square feet of below-grade parking.

“We are grateful for the support we received from our lending partners and look forward to their continued support as we break ground on these cutting-edge and sustainable projects that will expand the realm of opportunities for New York City’s vibrant film and television production industry,” said Susi Yu, co-founder of Bungalow Projects.

Both projects are slated to be completed in mid-2027. Productions filming at Echelon Studios will benefit from the recently expanded New York State Film Tax Credit Program, which provides $800 million in annual incentives through 2036. Bungalow Projects and Bain Capital have a joint venture focused on investing in and developing sustainable and cutting-edge production hubs in New York City.

By Debra Hazel

Once a broker, always a broker? Not so for Stephen Palmese, who has taken the lessons learned at some of New York City’s top commercial real estate brokerages to inform his shift into financing at Integritas Capital, a vertically integrated investor and developer, as well as a direct lender.

Since 2004, Integritas Capital and its predecessor firm have been the direct developer of more than $1 billion in real estate transactions and lead investor in more than $2.5 billion in real estate projects across ground up development, direct investment and preferred equity investment, the acquiring of non-performing loans and the origination of whole loans and mezzanine financing. And it’s ramped up quickly, originating $800 million in loans in the past 18 months.

“Typically, building a business can take a decade,” said Palmese, Integritas founder and managing principal. “Buying and lending during a downturn, we knew we could build a company in a shorter time frame.”

Real estate development had always been his plan, even as a child wandering the city with his father looking at skyscrapers. The youngest of four children, Palmese grew up with real estate in his blood — some 90 years ago, his grandfather was a homebuilder who eventually transitioned his business to servicing multifamily and office buildings.

“In college, if you’d asked what I wanted to do, it was real estate development,” he said.

After graduating from Georgetown University in 2004 with a degree in international finance and business management, and having studied foreign exchange at Oxford University, Palmese found that opportunities in real estate development were scarce. Despite his strong academic background, he was also hesitant to join the family’s business.

An introduction from his now sister-in-law to Massey Knakal’s Jonathan Hageman brought him to commercial real estate brokerage, even as development continued to be his long-term plan.

“I met Jon and Bob Knakal with the idea of learning the business for a couple of years, and when I was ready to move into development, I’d do that,” Palmese said.

Circumstances, however, kept intervening.

“I started in August 2004. Then with the Great Financial Crisis of October 2008, when I was ready to move from brokerage into development, there were no jobs,” he said. “That was my inflection point. I should have taken a risk and started my own development company then.”

Meanwhile, Palmese, born in Brooklyn but raised in Staten Island, established Massey Knakal’s Brooklyn office — long before the borough became the “cool” place in the city. He quickly became an expert in the borough, facilitating transactions including the $345 million sale of 85-89 Jay St., the $340 million sale of 25-30 Columbia Heights and the $90 million sale of 9 Dekalb Ave.

His goal at that point was to build his visibility in brokerage prior to moving into development. Yet even as the market rebounded, Palmese remained with Massey Knakal, becoming a partner in 2012.

“Working at Massey Knakal was a such wonderful situation that you didn’t realize you were in a snow globe,” Palmese reminisced. “What kept me close to brokerage longer than I planned was the culture Bob and Paul created at Massey Knakal.”

But the idea of owning a portfolio of his own remained with him, and he founded Legacy Equity Holdings, a reboot of a long-inactive family business, to begin purchasing multifamily buildings, carefully avoiding conflicts of interest by acquiring through other brokers.

“The market was still dislocated, and I received a call from Marcus & Millichap asking if I’d buy an eight-family on Atlantic Avenue,” he said. “I knew I was the broker’s last call — because I’d told him to put me at the bottom of his list. And that’s exactly what he did — and we ended up buying it. That began the relationship and was where Legacy came from.”

He focused on acquiring small midcap buildings in Brooklyn and Queens, building a portfolio of 20 buildings over five years that Legacy would renovate and manage in then-unknown neighborhoods such as Crown Heights and Boerum Hill, Brooklyn until rent laws changed. Legacy stopped acquiring in 2018.

surprising at all that he is as successful in his new career as he was as a top producer in the brokerage business. I am so proud of his tremendous success.”

But working at publicly traded companies just wasn’t the same. The 2020 onset of the COVID-19 pandemic, which disrupted the local real estate market in so many ways, also pushed Palmese to rethink his own path, looking to pivot from multifamily into a new business line.

“During the summer of COVID, I realized that a Brooklyn brownstone that sold for $2 million in the Great Financial Crisis in 2010 or 2011 would now go for five times that,” he said. “I looked in the mirror and said ‘I’m not going to miss another opportunity to capitalize on that.’”

Other changes were taking place in his professional life at the same time. Massey Knakal was acquired by Cushman & Wakefield in 2015, and Palmese followed most of the team to the new firm, then again to JLL when Bob Knakal moved over there. (Knakal and JLL parted ways in 2024 and he has since founded BK Real Estate Advisors.)

“Stephen has always been a tireless worker who really understood the business from his first days. He was a great partner, always gave it his best effort, was extraordinarily likable and achieved great results for his clients and for our company,” said Knakal. “It is not

With partner Heights Advisors, an experienced developer and contractor and mentor from his earliest days in the business, he bought some strategic assets outside of New York in summer 2020 and 2021 and built momentum harvesting those projects as well as land with easements, lawsuits and environmental risks. After creating that portfolio, Legacy added lending, including direct loans. In 2023, he rolled all of that into Integritas, a direct investor, developer and lender. Legacy continues to own the multifamily buildings he acquired a decade ago.

“Where I am today is the culmination of the efforts that took place back then, inclusive of lending and direct investment and developing,” he said.

Today, Integritas — a key concept in the Spartan military meaning completeness, wholeness or soundness — provides loans of $25 million to $300 million, including bridge loans, construction loans or acquisition loans. Terms are slightly higher, but Integritas’ small size (just four staff, including Palmese) allows for quick decision making — he and Managing Director Michael Ottomanelli consult with partner Heights.

On the acquisition side, the firm focuses on properties that are in periods of dislocation, he said, such as the deeply distressed projects it acquired in 2020 and 2021, as well as projects it acquired

“These people know I foow through with what I say. YOU MAKE FRIENDS OVER TIME, AND I CERTAINLY KNOW HOW TO WORK WITH BROKERS.”

—Stephen Palmese

in Florida in 2018, where the upside at the time was greater than in New York.

“We’re not common equity — we’re not giving cash to another developer,” he explained. “We’re only buying to develop ourselves if it’s compelling. The strategies are complementary.”

That philosophy dates back to Palmese’s Massey Knakal days, when he was encouraged to not just be expert in the city, but to individual streets — and the projects on them.

“Fort Lauderdale was where the opportunities were,” he said. “Now, today, the opportunities are elsewhere.”

His background in commercial brokerage comes in handy.

“We take a bit of a different approach at Integritas,” Palmese observed. “When we issue a construction loan, we want to meet the subs and learn their pricing and sourcing. We comment on the plans, floor by floor.”

And all those years working with all of those owners mean a hefty network.

participate in their loans. And so, we put out a lot of money, partnering with companies who invited to participate as well as originating our own loans.”

Recent transactions include a $125 million construction loan to convert a Brooklyn office building at 175 Pearl St. into residential; an $18 million construction bridge loan to advance predevelopment in Queens, a $96 million loan to develop a condominium in Fort Lauderdale, a $53 million refinancing of a Red Hook, Brooklyn site that will house an industrial development, and a $155 million bridge loan to convert a 50-story, 466-unit Miami multifamily into the Miami Flow House condos.

“Going back to the Massey Knakal days, I can get to pretty much anyone in New York City with one, or maybe two, phone calls,” he said. “It’s also helped with authenticity. These people know I follow through with what I say. You make friends over time, and I certainly know how to work with brokers.”

Integritas has raised private capital on the lending side and is now in the position to grow its institutional business. Over the last 15 months, it’s loaned $800 million, with an average loan size of $80 million. Future opportunity is huge.

“In 2024, it ended up being a special point in time,” he said. “Many of the debt funds were tending to legacy books with loans from 2021 (and prior). Those loans were very low interest rate, and they had to adjust to the changes in value. They weren’t actively originating new loans. We came into the market with $100 million in cash. I was getting phone calls from debt funds asking if we were able to

Integritas also is proposing a 57-story tower with apartments and a hotel in Fort Lauderdale.

After spending time supporting multiple charities over the years, Palmese has chosen more recently to focus his energies on two organizations — Laugh it Out, an organization that brings improv comedy to inner city schools, and World Without Exploitation, a coalition that is dedicated to eliminating human trafficking.

“With Laugh It Out, you see these adolescents — the so-called bully, the jock, the nerd, all of these social categories — on stage, and that’s the equalizer,” he said. “Improv unifies everybody, and studies show that these kids are less likely to be susceptible to gang violence and have higher graduation rates.”

Integritas is also raising its first fund, with investors likely coming from high-net-worth families. The number of distressed projects is likely to increase as loans originated in a much lower interest rate environment come due. And that diverse experience will continue to benefit the company.

“I’ve bought multifamily and renovated multifamily,” said Palmese.“I have yet to build anything from the ground up, but my partner, Heights, has this experience. Now, as we’re doing large-scale loans, between lending and investing, this is how we’ll be able to scale.”

Zetlin & De Chiara LLP, one of the country’s leading law firms, has built a reputation on counseling clients through complex issues. Whether negotiating a contract, resolving a dispute, or providing guidance to navigate the construction process, Zetlin & De Chiara is recognized as a “go-to firm for construction.”

By Ben Reinberg, Founder and CEO, Alliance Consolidated Group of Companies

Commercial real estate (CRE) heads into 2026 with a new operating manual. Capital is selective, tenants prize flexibility and experience, and technology is now nonnegotiable. Meanwhile, geopolitics, especially tariffs, are shaping where companies expand and where investors follow. In this environment, the edge goes to owners and operators who demonstrate value in terms of cash flow, transparency and execution, not promises.

The next year won’t reward optimism; it will reward operational excellence. Below are seven 2026 predictions that capture where the market is going and how investors can prepare.

1. Cash Flow Is King

Inconsistent reporting will disqualify deals; transparency is now a baseline expectation. Deals that pencil on Day One beat pro formas that assume tomorrow’s growth. Limited partners will push for monthly reporting, including rent rolls, collections, variance to budget and aging accounts receivable (A/R). Operators who show consistent net operating income (NOI), disciplined expense control and scalable playbooks will command capital. Appreciation-only theses face a higher bar.

2. Hybrid-First CRE

Office and mixed-use assets that aren’t engineered for flexibility and tech integration will lag behind. Tenants want rooms that convert, robust connectivity and spaces that support both team time and individual focus time, often on the same day. In 2026, tenant-experience

strategists, not brokers, will drive value in office and mixed-use assets. The most valuable CRE professionals won’t just be dealmakers; they’ll be tenant-experience strategists who align design, amenities and services with how people actually work and can prove it in renewal rates.

3. AI Becomes Standard

Expect investors to ask: What models were used? What data trained them? How did AI shape pricing? Underwriting, tenant evaluation and real-time risk modeling will run on data engines that learn and iterate. Expect investors to request AI transparency in diligence: what models were used, which inputs drove the conclusions and how the outputs influenced pricing or structure. Teams that pair human judgment with machine speed will make sharper, faster decisions.

4. Inflation Normalizes, Clauses Harden

Even if inflation settles in the 3% to 4% range, lease language won’t soften. Annual escalations, stronger expense pass-throughs and tighter insurance/tax provisions will be standard. Owners who systematize renewals and standardize riders will keep income aligned with costs without slowing lease velocity. Tenants will accept clarity when it’s paired with better service and predictable operating expenses (OPEX).

5. Creative Debt Structures Rise

With rates elevated, floating-rate debt only works with caps or outsized cash flow. Middle-market deals will rely on seller

financing, joint venture (JV) equity and mezzanine tranches to bridge the gaps.

In 2026, debt creativity isn’t optional; it’s a survival skill. This stack adds complexity and opportunity for disciplined operators. Stress-test debt service coverage ratio (DSCR) under multiple interest-rate paths, hedge where appropriate and build optionality into maturities so you’re not forced to refinance on a bad day.

6. Tariffs Reshape Geography

Trade policy will matter more in site selection. Original equipment manufacturers (OEMs) will steer production to second-tier manufacturing markets where states offer aggressive incentives and logistics are favorable. Investors will follow with capital for modern industrial, workforce housing and supporting retail. Expect rising demand along supply-chain corridors that used to be “flyover” on national maps.

7. Manufacturing Anchors CRE Demand

Reshoring and clean-tech production will keep the industrial sector in the spotlight. Secondary manufacturing zones will see outsized absorption as plants come online and suppliers cluster nearby. Secondary metros will benefit first, especially where infrastructure and a workforce already exist. Data centers, logistics hubs and repositioned legacy retail will be absorbed into the supply chain. For diversified portfolios, this becomes the spine: dependable rent rolls tied to real production.

Proving value is the cost of capital in 2026: Prove it in the numbers and through experience. Underwrite acquisitions conservatively, assume realistic hold periods and plan multiple exits.

On operations, lean into tenant experience (fewer friction points, better communication and faster service) and demonstrate it in key performance indicators (KPIs) like renewal probabilities, blended rent growth and work order service-level agreements (SLAs). On capital, prepare for deeper diligence: clean data rooms, consistent monthly reporting and clear visibility into risks and mitigations (rate caps, expense management, rollover maps).

The practical next steps include:

• Recasting underwriting around in-place cash flow, not best-case mark-to-market.

• Standardizing leases: annual bumps, pass-through protections and escalation mechanics that keep pace with cost lines.

• Codifying your debt playbook with hedging guidelines, seller-finance templates and joint venture structures you can execute quickly.

• Operationalizing tenant experience: technology uptime, response times and amenity activation that shows up in renewals.

• Watching the manufacturing map: Freight lanes, incentive zones and supplier clusters will indicate the next industrial hot spots.

Opportunity Before

Cycles reward preparation. As AI reshapes diligence, tariffs redirect growth and leases become more stringent, the winners will be the teams that adapt quickly and execute with discipline. Build around cash flow. Design for hybrid work. Standardize your debt stack. Keep an eye on where production is headed. Do that, and 2026 won’t feel like a headwind; it will read like a roadmap.

By Laura Rapaport, Founder and CEO, North Bridge

2025 marked a turning point for the commercial property assessed clean energy (C-PACE) industry, defined by record-breaking deal volumes, expanding use cases and broad regulatory support.

What was once a niche financing mechanism has become a mainstream capital markets solution, with cumulative C-PACE financings surpassing $10 billion and transactions now reaching into the nine figures.

The year saw major growth in new construction and large-scale repositionings, the rollout of new programs in states like New Jersey and Idaho and the expansion of existing ones in New York City and Texas. Lender adoption hit new highs, spreads continued to compress, and institutional sponsors increasingly incorporated C-PACE into their capital stacks from the outset. Together, these milestones cemented 2025 as the year C-PACE truly scaled — and set the stage for an even more accelerated 2026.

According to PACENation, cumulative C-PACE financings surpassed $10 billion by mid-2025. What was once a niche tool has now become a mainstream financing mechanism, with transactions ranging from $5 million to more than $250 million.

Retrofits continue to represent an important share of C-PACE financing, particularly as local laws such as New York City’s Local Law 97 drive demand for energy upgrades. But the most notable shift in 2025 was the rise of new construction and major repositionings. New construction, which was unheard of in C-PACE until five years ago, is now close to 50% of annual dollar volume.

At the state level, several programs expanded eligibility and streamlined processes. New York City issued new guidelines allowing new construction, major renovations and ground-lease buildings to qualify, while modernizing savings to investment ratio (SIR) requirements and increasing maximum terms to 30 years.