BEYOND THE WORKPLACE

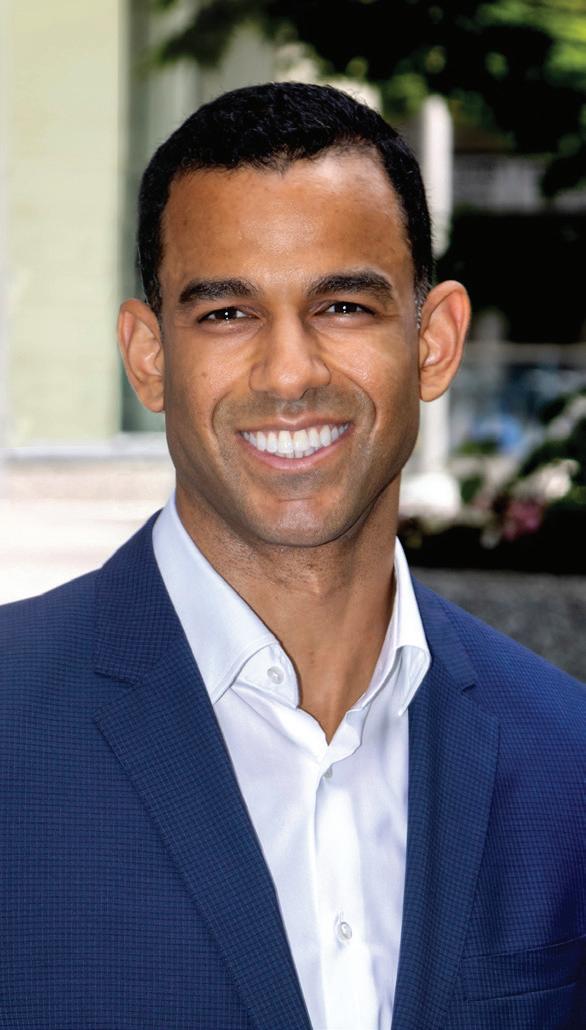

JONATHAN KAUFMAN IGER, CEO AND PRESIDENT

For decades, we have built a real estate practice unparalleled in the US. Now, as the global legal powerhouse HSF Kramer, we are so much more. As the only law firm ranked in Chambers Band 1 on three continents, we continue to transform skylines and reshape landscapes. Please visit our website to learn more. Kramer Levin is now HSF Kramer

EDITORIAL

Editor

Debra Hazel

Director of Communications and Marketing

Penelope Herrera

Director of

Newsletter Division

Cheri Phillips

PRESIDENT/CEO

Jeff Mann

ART

Art Director

Virginia Sanchez

Cover Photography

Kat Slootsky

Joel Berenson

Pieter Berger

Lisbeth M. Bulmash

Frank DeLucia

Ben Eidlisz

Carla Hinson

Jonathan Kaufman Iger

Kris Kiser

Bob Knakal

Stuart Saft

Carol A. Sigmond

Simon Soloff

Technology Consultant Eric Loh

Distribution Mitchell’s Delivery Service

DIGITAL MEDIA

Designers

Virginia Sanchez

Editors

Debra Hazel

Penelope Herrera

Rose Leveen

Cheri Phillips

Web Developer

CS Designworks

West Coast Office: 578 Washington Blvd., Suite 827

Marina Del Rey, CA 90292 866-306-MANN (6266) mannpublications.com

East Coast Office: 450 7th Ave, Suite 2306

New York, NY 10123 212-840-MANN (6266)

Maybe it’s because I’m a lifelong New Yorker, but it always surprises me when others are surprised that our local real estate industry is populated with many multigenerational companies. Here, we have several such firms, including one led by our cover feature author, Jonathan Kaufman Iger, CEO and president of Sage.

Sage is the brand and operating name of The William Kaufman Organization, and Jonathan (William’s great-grandson) is the fourth generation to lead the firm. But his article, while mentioning Sage’s centennial, focuses on the future — and it’s a fabulous read. Great-granddad would be proud.

I’m looking forward to The Mann Charitable Foundation and the National Realty Club Foundation annual golf tournament, being held at the Fresh Meadow Country Club on October 6. Monies raised will support causes including Alzheimer’s Disease, Crohn’s and Colitis, Lymphoma and Macular Degeneration, as well as organizations such as the Bronx Historical Society, Community Mainstream, National Jewish Museum, Jewish National Fund, Catholic Faith Network and Nassau County Law Enforcement Exploring, among others.

Just as exciting is our upcoming, first-ever educational event, “Artificial Intelligence Unplugged,” sponsored by Cbiz and being held on December 1 from 6 p.m. to 9 p.m. at Versa, 218 West 35th St. Rob McGillen, chief innovation officer at Cbiz Financial Services, will discuss the latest advancements in AI and its impact on real estate and consumer goods. For information on both events, contact Penny Herrera at pherrera@ mannpublications.com.

See you next month!

“Maintaining a family business isn’t just about sustaining a company, but nurturing relationships and building a legacy.” — Richard Carlson

Hosted by Mann Publications, Sponsored by CBIZ

Join us for an insightful evening featuring expert discussions on the latest advancements in Artificial Intelligence! Enjoy cocktails and a buffet as you connect with industry leaders and learn about the future of AI and its impact on consumer goods and real estate.

Don’t miss this opportunity to learn about the future of AI and its impact on these industries.

Date: December 1, 2025

Time: 6:00–9:00 p.m.

Location: Versa, 218 W 35th St, 7th Floor, New York, NY 10001

Registration Fee:

$250 (includes speakers, cocktails and buffet)

Keynote Speaker:

Agenda:

6:00p.m. – Cocktails and Networking

7:00p.m. – Keynote Presentation: Rob McGillen, “Transforming Consumer Goods and Real Estate with AI”

8:00p.m. – Buffet, Audience Q&A and gifts

Sponsorships available upon request

For more information and to RSVP, please contact: Penelope Herrera pherrera@mannpublications.com 212-840-6266 ext.313

Host:

Michael Sacco, CPA Managing Director National Consumer & Industrial Products Industry Leader, CBIZ

Abe Schlisselfeld, CPA, EA

Senior Managing Director National Real Estate Industry Leader, CBIZ

Jeff Mann, CEO President/CEO of Mann Publications

Rob McGillen, vice president of business innovation at CBIZ Financial Services, is enabling thousands of our professionals to better serve mid-market clients with artificial intelligence, data analytics, intelligent automation, and digital solutions which provide enhanced insights to client needs. Multi-industry, digital transformation leader, startup CEO, board member, and globally experienced CIO/CDO. 25+ years’ working with innovative companies, building value in while optimizing people, process, and technology. Industry focus includes Consumer & Industrial Products, Real Estate, Professional Services, Financial Services, Private Equity, Manufacturing, Health and Life Sciences, Technology/ SaaS, Insurance, and Energy.

CBIZ is recognized as a global leader and innovator in leveraging AI solutions to drive value and efficiency for our clients. CBIZ stands at the forefront of the industry, pioneering advanced AI technologies and strategies for smarter business outcomes.

6-7pm

Caprese Salad, Tomato, Mozzarella, Basil, Balsamic Glaze (VEG)

Antipasti Platters, Marinated Vegetables, Assorted Charcuterie

8-9pm

Tricolor Salad, Lemon Vinaigrette (V)

Orecchiette Pasta, Italian Sausage, Broccoli Rabe, Marinara

Ricotta Cavatelli, Wild Mushrooms, Parmesan Cream, Grana Padano (VEG)

Chicken Parmesan Cutlets, Marinara, Basil, Mozzarella

From Ricardo Beverly Hills

Deluxe Organizing Bag

At Peninsula Property Management (PPM), we do more than manage properties—we elevate them. With a leadership team that is deeply involved, hands-on, and responsive, PPM is redefining the standard for property management in New York City. Our mission is simple: deliver results with integrity, precision, and a hospitality-first approach.

Proactive Management

Stop issues before they start — from Local Law 97 to vendor oversight.

Financial Clarity

Clean, timely financials. No surprises –just strategic planning and transparency.

NYC Compliance Expertise

DOB, HPD, LL88, LL97, FISP we navigate every regulation so you don’t have to.

New Development Services

Schedule B, TCO phasing, hiring of staff, punch-list, insurance implementation.

Smart Cost Control

Energy savings, bulk contracts, vendor negotiations we cut waste, not corners.

Track requests, tasks, and reports live through our integrated digital platform.

After attending both the CREi Summit, which focuses on real estate social media influencers and marketers, and proptech conference Blueprint Las Vegas in the same month, it’s fair to say I’m dealing with a bit of artificial intelligence overload. (You’ll see coverage of the latter next month.)

Perhaps that’s one reason why it was a pleasure to focus on more concrete concerns this month, with our focus on Mixed-Use and practical concerns. In addition to our cover story celebrating Sage’s focus on incorporating hospitality practices in its office buildings, we also have features on how one Florida developer turned to tech to market its mixed-use project and how a group of builders and architect MVE + Partners are blending adaptive re-use with new construction in Downtown Salt Lake City. Also look for advice on mediation and how to run an Airbn.

Meanwhile, our columnists are looking forward to winter, with views on how BIDs can prepare for holiday, my own roundup of retail sales predictions (mostly leaning toward so-so) and preparations for tax season next year.

Next month is our year-end double issue — please send your thoughts about 2025 and what you hope to see in 2026!

The Fresh Meadow Country Club in Lake Success, N.Y. was once again the scenic location for the Samuel Waxman Cancer Research Foundation’s (SWCRF) Annual Golf Tournament. More than 80 participants enjoyed a spectacular day on the green to raise more than $200,000 for groundbreaking cancer research programs aimed at eradicating cancer and developing innovative and more effective treatments with fewer harmful side effects.

Thanks to a partnership with The Mark Foundation for Cancer Research, all funds raised at the tournament will be matched, dollar for dollar.

Over the last 20 years, scientific advancements have led to a decrease in cancer mortality by nearly 30%. Yet despite this significant progress in treatment and prevention, cancer incidence is increasing worldwide. In fact, according to the World Health Organization, cancer incidence is expected to rise to 35 million cases globally by

2050, up from 20 million in 2022. This is primarily driven by an aging population, since aging is the top risk factor for cancer.

“Our mission has always been to eradicate cancer through groundbreaking research, but we also recognize that to truly change the trajectory of this disease, we must confront its greatest risk factor: aging,” Waxman said. “By advancing research that addresses the biology of aging, we are opening new doors to prevention and treatment strategies that can improve lives and bring us closer to a world without cancer.”

Gary Jacob, executive vice president of Glenwood Management Corp., and Dennis Herman, chairman and CEO of Beekman International Center Ltd., co-chaired the SWCRF Golf Tournament. The golf committee members included Frederick W. Barney Jr., Robert Eichler, Michael Hight, Gerard F. Joyce Jr., Samuel Waxman MD and Ari Zagdanski.

Sunrise Day Camp-Long Island hosted its 19th Annual Mildred & Samuel Levine Memorial Golf Classic, raising over $1.3 million to support children with cancer and their siblings. The organization honored Rena and Andrew Goodman and Allison and Joel Simon for their dedication, and to present the Joe Weksler Memorial Community Service Award to Ryan Scannell for his outstanding service.

The organization thanked event chairman Larry Levine, co-chairman Michael Faltischek, its dedicated committee chairs and the entire event committee for making this event such a success.

The New York Apartment Association held its Annual Golf and Tennis Outing at Old Westbury Country Club in Old Westbury, N.Y. This year’s event drew more than 160 golfers, 40 tennis players, and an additional 60 guests for the cocktail and dinner reception.

The team of Harry Kucharczyk, Daniel Ilibassi, Feris Kukaj and Skully Kukaj took first place in the modified scramble. Chuck Merrit executed the most accurate drive while Kevin McHale triumphed in the men’s long drive contest.

On the tennis courts, the association offered congratulations to first-place winners Brandon Liebeskind and Caroline Simon.

The New York Apartment Association also expressed its sincere appreciation to the event sponsors for helping to make this year’s golf and tennis outing such a resounding success — particularly the event’s prime sponsor, Capital One Bank.

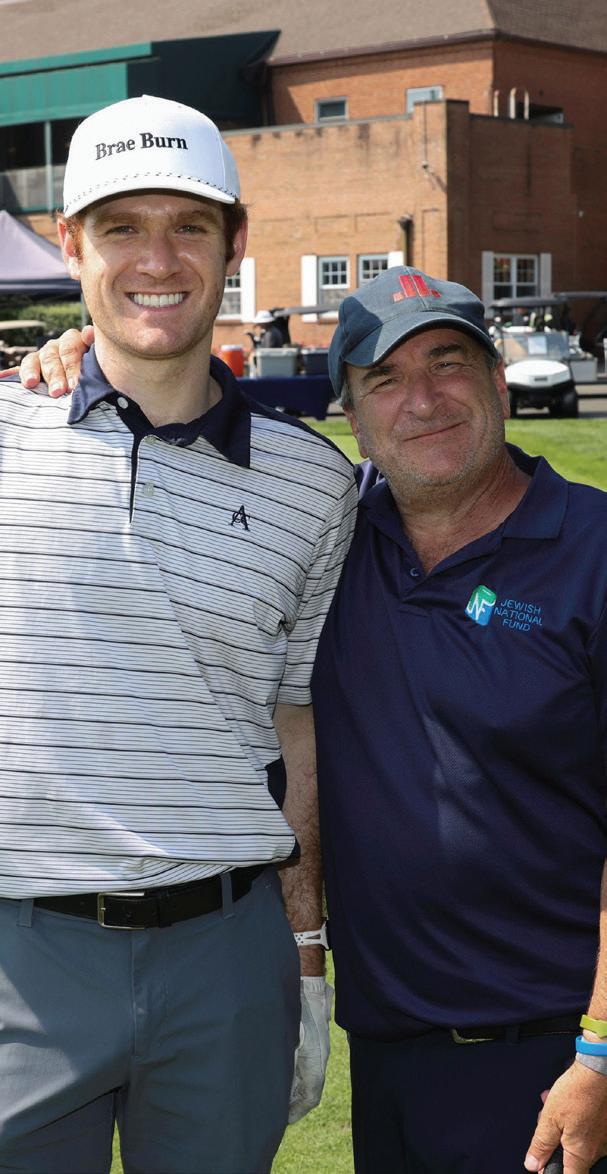

Over 160 Long Island philanthropists and corporate executives in the real estate and finance industries recently attended Jewish National Fund-USA’s 17th Annual Long Island Golf Classic at Pine Hollow Country Club in East Norwich, N.Y.

The exclusive event was chaired by Mark Engel, Langsam Property Services Corp., and honored Bruce Azus, partner, Affiliated Adjustment Group, and Johnathan C. Lerner, founder of Lerner, Arnold & Winston, for their dedication and support of the land and people of Israel.

After a day on the greens, attendees heard from local lay leaders who showcased how Jewish National Fund-USA is leading efforts to rebuild and rehabilitate Israel’s North and South.

By investing in new housing sites, employment initiatives, medical centers, mental health services, schools, playgrounds, resilience centers and more, the organization is creating multiple “circles of impact” that support its vision of attracting 800,000 new residents to Israel’s frontier regions.

“Over the years, this tournament has had a profound impact on the land and people of Israel,” said Jewish National Fund-USA Long Island President Rosemary Klipper. “Jewish National FundUSA is more than an emergency organization; thanks to you, we’ve invested millions of dollars in quality of life, security and sustainability, while giving generations a voice in building a prosperous future. We were there yesterday, we are there today, and we will be there tomorrow.”

Closest to the Pin – Joseph Mawad

Closest to the Line #1 – Ben Rosengart

1st Ind Gross – David Azus

2nd Ind Gross – Ethan Bloomberg

1st Team Gross – Jesse Fein, Steve Gutenplan, Marc Fein and Ethan Bloomberg

2nd Team Gross – Frank Lombardi, David Azus, Steve Patson and Dan Wollman

1st Team Net – Mike LoFrumento, Jeff Catterson, Don Russoand Gordon Samit

2nd Team Net – Joe Ginsto, Matthew Taub, Philip Oliver and Matthew Cossidente

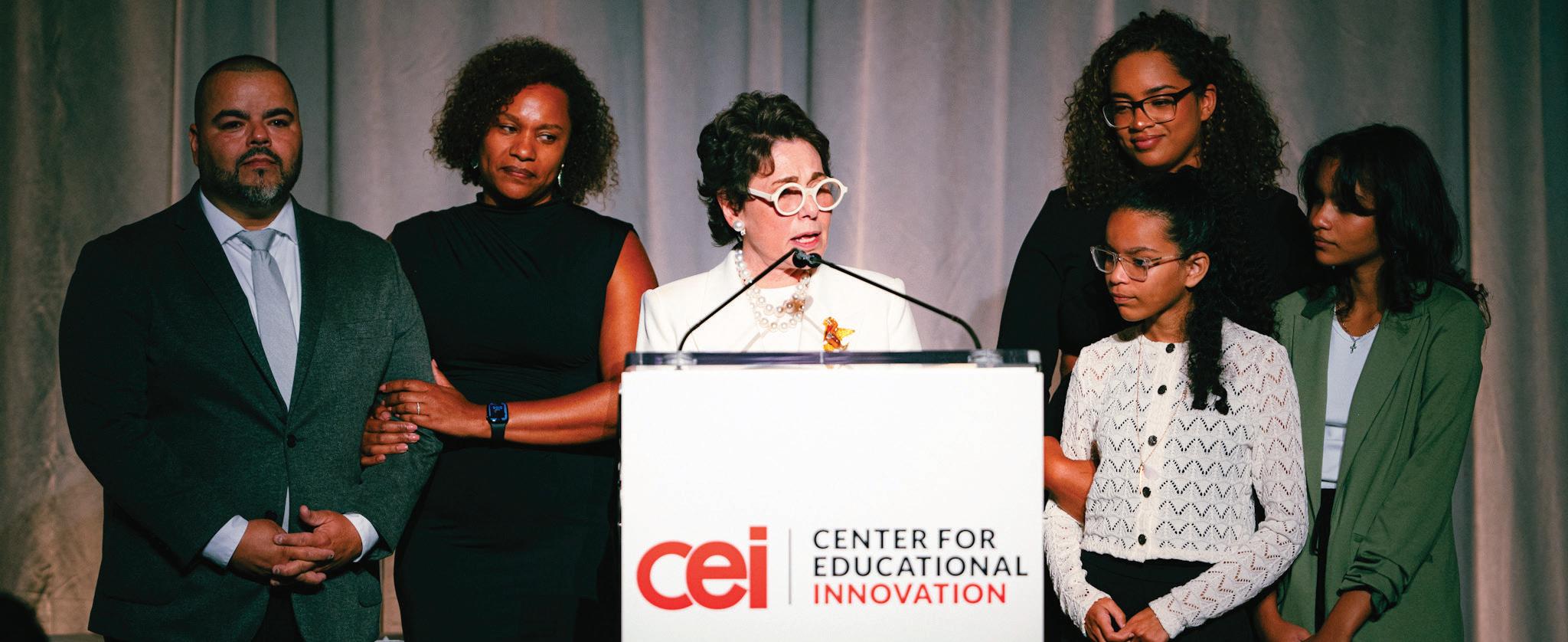

Simone Development Companies, a full-service real estate investment company that specializes in the acquisition and development of healthcare, mixed-use, office, industrial, retail and residential properties, was recently honored by the Center for Educational Innovation (CEI) at its annual gala at the Plaza Hotel in Manhattan.

Joe Simone, president of Simone Development Companies, accepted the award on behalf of the organization for the company’s ongoing efforts to expand access to education and create opportunities for students in the Bronx. The company boasts a portfolio of over seven million square feet throughout the Bronx, Manhattan, Queens, Long

Island, Westchester County, Orange and Fairfield Counties and New Jersey.

“I’m deeply honored to accept this recognition from CEI on behalf of Simone Development Companies. We are proud to continue our support of initiatives that strengthen STEAM education and healthcare-focused programs in the Bronx and beyond, preparing the next generation for future success,” Simone said. “Thank you to CEI for this meaningful recognition and for your continued commitment to ensuring every child has access to a quality education.”

In addition to Simone Development, Montefiore Einstein Hospital was also recognized with awards presented to former Assemblyman Marcos A. Crespo,

now senior vice president of community affairs at Montefiore Einstein, and former Bronx Borough President Ruben Diaz, Jr., now senior vice president of strategic initiatives for the hospital.

Rounding out the honorees was Graham Dugoni, founder and CEO of Yondr, a creator of phone-free spaces. Yondr has partnered with thousands of schools across New York State and with venues worldwide.

CEI is a nonprofit education organization located in New York City. Its mission is to make the school the center and driving force of public education reform and innovation, working directly with teachers, school leaders and the community.

Simone Development Companies, Montefiore Einstein Hospital and Yondr

More than 150 brokers from across the city joined Global Holdings for cocktails and light bites at 25 Kent, a 500,000-square-foot, eight-story office building in East Williamsburg and Brooklyn’s first ground-up commercial development in more than 40 years. Global Holdings, which has maintained a stake in 25 Kent since 2018, officially announced its transition to primary manager of the building. The firm is bringing new resources, capital and momentum to 25 Kent, starting with the launch of a targeted pre-built program and the hiring of Newmark as exclusive leasing agent. Guests were also able to experience the 25 Kent rooftop terrace boasting 12,000 square feet of river and skyline views.

Meridian negotiates and closes more than $1 billion in underlying cooperative loans and lines of credit annually

represented the seller of 7-11 East 115th St., Albert Rabizadeh of Global Asset Management Inc. The buyer, Bardhok Kodra of Kodra Construction, was represented by Hillstone Properties NY

“Ariel has remained very active in the Northern Manhattan development sector this year, and our market share is a testament to our team’s deep understanding of the landscape and our ability to execute for our clients,” said Sozio. “Given the city and state’s pro-housing policies and tax abatements, we are anticipating increased activity for the remainder of the year.

Ariel Property Advisors announced the sale of a 55,000-buildablesquare-foot (BSF) development site at 7-11 East 115th St. in East Harlem, N.Y. for $8.9 million. The final price of $163 per BSF reflects an easement for 19 parking spaces required for an adjacent property.

An Ariel team comprised of President and Founder Shimon Shkury, Founding Partner Victor Sozio, Director Alexander Taic, Founding Partner Michael A. Tortorici and Sales Associate Erik Moloney

Development in Northern Manhattan is being spurred by government initiatives such as the City of Yes and the 485-x tax incentive program, according to Ariel’s “Northern Manhattan 2025 Mid-Year Commercial Real Estate Trends” report.

The site features 135 feet of frontage along 115th Street and fl exible zoning allowing for 68,000 BSF under the City of Yes’ Universal Affordability Preference (UAP) and 88,000 BSF with a community facility bonus.

“The sale of 7-11 East 115th Street marks the fifth development site for a total of 184,000 BSF that Ariel has sold in Northern Manhattan so far this year,” Taic added. “We also have nine additional development sites totaling close to 200,000 BSF in contract and on the market.”

Meryem’s acclaimed restaurant, La Maison du Gourmet, has cemented her reputation, with appearances on Top Chef France and MasterChef France. Lechantoux is joined by Chef Aïcha Sbaih, a French-born Moroccan chef who grew up immersed in the traditions of Moroccan cuisine. Their collaboration brings an expertly crafted menu that blends classic and contemporary Moroccan flavors, offering guests a culinary journey through Morocco’s rich heritage.

restaurants

At the helm of Ayah’s kitchen is Executive Chef Geoffrey Lechantoux, known for French cuisine. To master Moroccan flavors, Chef Geoffrey trained under Chef Meryem Cherkaoui, a graduate of the Institute Paul Bocuse and a global ambassador for Moroccan gastronomy. Chef

“We’re excited to bring Morocco to New York. Every dish and every detail have been crafted with authenticity to create an immersive dining experience that transports our guests to Morocco’s vibrant culinary world,” Lechantoux said.

Menu highlights include chhiwates, a colorful assortment of traditional Moroccan small plates; ayah pastilla, a crispy pastry filled with spiced chicken, almonds and cinnamon; a section of tajines and couscous; slow-cooked stews and whole fish and rack of lamb, cut tableside. The bar program is by top mixologist Adrien Lefort.

Designed in collaboration with DMDesigns, Ayah custom-made tables, handcrafted windows, flowing velvet curtains and archways were meticulously created by Moroccan artisans and imported directly to New York City. The restaurant offers three distinct dining rooms, a central bar and long banquet tables for larger groups, allowing the atmosphere to transition effortlessly from intimate dinners to lively celebrations. Hand-painted walls, perforated panels and striking local murals further enhance the authenticity.

Bridge Housing, a nonprofit affordable housing owner and developer on the West Coast, has launched its first private equity fund to accelerate its mission-driven work to address the affordability crisis for lowand moderate-income families in some of the nation’s costliest housing markets.

Bridge Housing Impact Fund I is on course to raise $350 million of equity, enabling about $1 billion in investment potential to acquire, preserve and create affordable and workforce housing in major metropolitan areas in California, Oregon and Washington.

“We are innovating every day to extend our reach and capacity to build, acquire, and redevelop affordable housing communities on the West Coast,” said Ken Lombard, Bridge Housing president and CEO. “Our Impact Fund will enable us to move quickly on acquisitions not only to protect long-term affordability but also to add new affordable and workforce housing by converting market-rate units into homes for lowand middle-income earners, driving greater and faster impact along with steady returns for investors.”

KeyBank and BMO will each invest $25 million to anchor one of the largest equity funds to be sponsored and managed by a nonprofit affordable housing provider. PGIM Real Estate is also a launch investor, and Bridge said that it expects to announce additional stakeholders in the coming months.

Bridge was the first nonprofit housing firm to earn a credit rating and issue both taxable and tax-exempt bonds, it noted. It has also forged creative partnerships with major financial institutions, like Morgan Stanley and California’s state employee pension fund CalPERS, as well

as leading affordable housing finance organizations such as National Equity Fund (NEF).

Bridge Housing currently has more than 14,500 units and over $4 billion in total assets, and acquisitions are an increasingly important strategy for expansion, accounting for half of the nonprofit’s planned addition of 5,100 affordable units between 2024 and 2027.

The Impact Fund will pursue three main investment strategies to create a diversified portfolio and optimal returns for investors: acquire and preserve housing whose income restrictions are due to expire; acquire market-rate properties and layer in income restrictions to create affordable housing (serving those earning up to 80% of Area Median Income) and workforce housing (serving those earning 80% to 120% AMI) and acquire naturally occurring affordable and workforce housing. Incorporating new income-restricted units will allow Bridge Housing to benefit from tax abatements and below-market financing. In select cases, the Impact Fund may consider new construction projects.

Over the past year, Bridge Housing has completed four acquisitions to preserve more than 600 units whose affordability covenants were poised to expire and create 257 additional affordable homes by converting market-rate units. The Impact Fund leverages Bridge’s capital to accelerate acquisitions, as well as its leadership team’s decades of real estate and finance experience to deliver strong returns for its institutional investors.

While institutional capital has long played a critical role in affordable housing, it typically has been used to provide debt financing or purchase tax credits in public-private partnerships, a lengthy, complex process that requires assembling multiple funders and competing for limited public resources.

Bridge Housing anticipates acquiring about 20 properties, with an estimated total of 3,500 units, during the three-year investment period. It supplements Bridge’s ground-up construction and redevelopment activity from Seattle to San Diego. The affordable housing nonprofit has more than 10,000 units in its development and acquisition pipelines.

Koeppel Rosen LLC, leasing and management agent for the Rosen family portfolio, announced new office leases at 902 Broadway and 236 West 27th St.

MD2 International LLC secured 4,500 square feet at 902 Broadway. MD2, a concierge medicine practice offering patients around-the-clock access to dedicated physicians in upscale environments, will occupy a partial space on the 16th floor of the building. The space will be used as a medical office clinic. Charles Gerace with Jones Lang LaSalle represented the tenant and ownership was represented in-house by Max Koeppel.

West 27th St. The New York City–based interior design firm, founded in 2020 by designer Sebastian Zuchowicki, will occupy a partial space on the 10th floor of the building. Noah Jay and Eric Best with Compass represented the tenant and ownership was again represented in-house by Max Koeppel.

“It’s gratifying to see the continued leasing momentum throughout our portfolio,” said Max Koeppel, director of leasing at Koeppel Rosen LLC, in the announcement. “We’re pleased to announce these latest deals which reaffirms the desirability of our properties and the long-term strength of the office market.”

Built in 1911, 902 Broadway has undergone a comprehensive capital improvement program to modernize the historic property, including a new lobby, security, destination dispatch elevators and other building systems. With 12-foot ceiling heights and large windows, each 18,200-square-foot floor is filled with light and affords efficient layouts.

a new wave of buyers in Queens,” said Bentley Zhao, chairman and CEO of New Empire Corp. “Sunnyside East is experiencing the same transformative energy we saw in Long Island City, and Centric stands at the center of that evolution, bringing Manhattan-level luxury to a vibrant and authentic neighborhood.”

Centric, the tallest condominium in Sunnyside East, has officially topped off — a major construction milestone reached just months after securing a record-breaking $1.512 million penthouse sale, the highest in Sunnyside and Woodside, Queens history.

“We should all be celebrating the private developers who work doggedly every single day and put their own capital at risk to build projects and employ people, alongside their dedicated partners and suppliers who help bring these developments to life,” said Thomas J. Grech, president and CEO of the Queens Chamber of Commerce. “This is a gorgeous luxury development in a vibrant, growing area with local retail and transportation. It’s a great place to buy and why Queens is the place to live, work and play.”

Developed by New Empire Corp., a New York-based development and construction management firm, Centric is located at 58-01 Queens Blvd. at the prime intersection of Sunnyside and Woodside, immediately adjacent to Long Island City. The project delivers 131 luxury residences along with a full suite of lifestyle-driven amenities, establishing itself as a new benchmark for design and quality in the borough’s evolving luxury landscape.

“With Centric now topped off and a historic $1.5 million-plus penthouse contract signed, it’s clear this building has captured the attention of

Centric’s sleek architectural design and upscale interiors are the product of Tang Studio Architect and Whitehall Interiors. Many homes feature panoramic Manhattan views, floor-to-ceiling triple-pane windows, openconcept layouts and high-end finishes, including wide plank hardwood floors, radiant heated bathroom floors and smart home technology preinstalled in select units.

All units are compatible with smart home technology which can be installed by Centric for interested buyers.

The sale of Penthouse 12A — a three-bedroom, two-bathroom residence with 1,259 interior square feet and over 1,280 square feet of private outdoor space — set a new pricing record for the area and validated Centric’s positioning as a true luxury product in the market.

“The response from buyers has been extraordinary,” said Michael Bethoney, senior vice president and managing director of new development at Nest Seekers International. Sales are led by the Bethoney Shen Team at Nest Seekers International and co-exclusive agent One Realty Global. “The record-breaking sale at Centric proves what we’ve long believed — that Sunnyside East is one of the most exciting emerging luxury markets in New York City. Centric combines stunning design, unmatched amenities and exceptional access, making it a standout for investors and end-users alike.”

Centric’s full amenity suite spans several floors and includes a private fitness center, co-working spaces, resident lounges, a podcast/music studio, and expansive outdoor offerings such as a rooftop terrace with skyline views, pickleball court and mini golf area. Residences are priced from $599,000.

“With New Jersey’s housing demand continuing to grow, Lennar remains focused on delivering thoughtfully designed homes in locations that offer both lifestyle and convenience,” said Dana Romano, Lennar New Jersey division manager. “These new communities reflect the values homebuyers care about most — accessibility, quality, sustainability and connection to thriving local neighborhoods.”

Bringing modern two-story townhomes to the community, Preston Pointe is located across from U.S. Route 130 in one of Mercer County’s most desirable towns. It also is located just minutes from Robbinsville Town Center.

Reserve at Turgyan Farm in Bordentown will offer luxury single-family homes, close to urban hubs and the Jersey Shore.

Featuring three-story townhomes, West End in Hammonton will be located within walking distance from restaurants, shops and entertainment, and less than one mile from New Jersey Transit and Amtrak stations.

Carnegie Crossing in South Brunswick will offer modern townhomes in one of the state’s top-ranked school districts. Residents will enjoy ample amenities including a community garden, tot lot and sports courts.

International developer Grupo T&C announced that Edge House Miami, a 56-story luxury home-sharing tower designed by Kobi Karp, has officially received approval from the City of Miami’s Urban Development Review Board. The decision paves the way for the transformative project at 1825 Northeast Fourth Ave. in Miami’s Edgewater neighborhood, setting the stage for the next phase of development.

“This marks a major milestone as we move closer to bringing a first-of-itskind living experience to one of Miami’s most desirable neighborhoods,” said William Ticona, founder and CEO of Grupo T&C. “Edge House Miami represents the future of urban living with a fusion of luxury, flexibility and thoughtful design that responds to how today’s residents want to live, work and invest.”

Envisioned as a forward-thinking community hub, Edge House Miami will feature 608 turnkey units ranging from studios to three-bedroom homes, with fully furnished interiors by Adriana Hoyos Design Studio. Residences span from 410 square feet to 1,242 square feet and will showcase high-end finishes, floor-to-ceiling windows, nine-foot ceilings, private outdoor terraces and smart building technology.

“Edgewater has quickly become one of Miami’s most dynamic neighborhoods, and Edge House Miami will add to that momentum in a meaningful way,” said Carlos Lago, shareholder of the Greenberg Traurig Miami Land Use and Land Development Practice. “We are proud to have worked alongside Grupo T&C and Kobi Karp Architecture & Interior Design to make this beautiful project a reality.”

Edge House Miami’s amenities will occupy two levels plus a skyline deck, and will include active and tranquil pools, a wellness center with treatment rooms, a private yoga studio, state-of-the-art fitness facilities and expansive indoor and outdoor lounges. The tower will also feature co-working areas, private meeting rooms, a podcast studio and a lobby lounge with bar, gourmet coffee and snack service, complemented by 24/7 valet and concierge services. Outdoor spaces will showcase lush landscaping by Witkin Hults & Partners, including a garden, children’s playground and resident-only putting green. The project is also the first Biosecure short-term rental tower in the area, featuring Clear advanced in-unit air, water and surface purification to elevate wellness-first living.

Douglas Elliman Development Marketing is the exclusive sales and marketing broker for the project.

Christie’s International Real Estate Group, the exclusive affiliate of Christie’s International Real Estate serving New York, New Jersey, and Connecticut, has established its Luxury Advisory Team with the addition of Associate Broker Filippa EdbergManuel.

The team is composed of a group of specialists offering clients whiteglove real estate services alongside a full suite of concierge offerings in art, design and luxury goods.

This holistic approach creates a highly tailored, world-class experience for buyers and sellers at the highest level of the market, the firm said.

“We could not be more excited to welcome Filippa to Christie’s. Having

the opportunity to work together again is such a joy — I’ve always admired her incredible work ethic, professionalism, and drive,” said Melissa True, team leader, Christie’s Flatiron office. “Filippa embodies exactly the kind of talent we are proud to grow Christie’s NYC with — bringing unmatched experience, global connectivity and an exceptional reputation.”

With over $1 billion of properties sold, Edberg-Manuel brings not only her in-depth knowledge of the intricacies of the New York City real estate and new development market, but also a global perspective which perfectly aligns with Christie’s international network spanning more than 50 countries and territories, the firm said.

Her 18 years of experience in New York City’s luxury real estate sphere includes serving as a senior global real estate advisor at Sotheby’s International Realty. She is the former associate director of sales for 520 Park Ave., part of Zeckendorf Development Group.

During her career, she has sold some of the most expensive residences in New York, including a $74 million duplex, at the time the eighth-most expensive apartment sale ever recorded in New York City. In 2018, her team completed the top two sales of the year.

Fluent in English, French, Swedish and Spanish, Edberg-Manuel studied International Marketing at IMF in Sweden and Design at Fashion Forum in Paris. She holds designations of Certified Negotiations Expert (CNE) and Certified Buyers Representative (CBR).

The Stonewall Group, a private investment firm focused on acquiring, investing in and operating premier architecture and engineering (A&E) companies across the United States, announced its partnership with AMDG Architects, an architecture and design firm headquartered in Grand Rapids, Mich.

Founded in 2018, The Stonewall Group partners with A&E firm owners and founders to support their transition out of business ownership and into the next chapter of their personal, professional and financial lives. The firm now operates in more than eight major U.S. cities and supports over 200 employees. AMDG represents The Stonewall Group’s sixth partnership to date.

Established in 1992, AMDG Architects provides architecture and interior design services to clients across education, workplace, civic, worship and residential markets.

“Our partnership with The Stonewall Group allows us to remain committed to our mission while gaining the resources and support needed to expand our reach and capabilities,” said Peter Baldwin, AMDG principal. “We are excited to build on our foundation while creating new opportunities for our clients and team members.”

The Stonewall Group’s portfolio of architecture, engineering and design firms delivers services to a diverse range of end markets, including

K-12 and higher education, hospitality, luxury resorts and hotels, athletic facilities, healthcare, restaurants, industrial, manufacturing and energy.

“AMDG embodies the characteristics we look for in a partner — exceptional design talent, a strong leadership team, and a deep commitment to serving clients with excellence,” Ben Moody, cofounder and CEO of The Stonewall Group, added. “We look forward to supporting AMDG’s continued growth while honoring the culture and values that have made them successful for more than 30 years.”

In a significant expansion of its New York City practice, government affairs strategic consulting firm Brown & Weinraub (B&W) has brought in the core of former government relations firm Capalino’s awardwinning land use practice. The new hires have extensive land use experience with multiple New York City administrations.

Joining the firm are Mark Thompson, Brian Cook, Matt Green, Kieth Tubbs, Richard Barth and Christopher Boylan. The new additions will join Roberto Perez and Rebecca Lamorte, whose skills anchor B&W’s New York City practice.

“I have been a big fan of Jim Capalino and his team for close to 40 years. Pat Brown and I regularly looked to what Jim did as we built our firm. I am grateful that this first-in-class land use team has chosen to join our firm,” said Brown & Weinraub Founding Partner David Weinraub in the announcement.

Thompson was a founding member of Capalino 22 years ago. Prior to that, he worked for the City of New York at the Department of General Services and the Public Development Corporation, and currently serves in leadership roles in several organizations including the Samuel J. Tilden Democratic Club and the Stonewall Democratic Club. As the former chair of Manhattan Community Board Six, Thompson has deep expertise on the issues at the heart of new development. His work ranges from securing tens of millions of dollars in funding for not-forprofits, to helping businesses navigate the complicated world of public approvals, to winning government contracts via Request for Proposal processes. He graduated from Harvard University’s John F. Kennedy School of Government and the University of Southern California.

Cook’s resume includes serving director of land use, planning and development for the Manhattan Borough President; director of the Economic Development Bureau of the New York City Comptroller; a

commissioner of the New York City Banking Commission and a board member of the New York City Industrial Development Agency and its related non-profit BuildNYC.

Green previously was deputy chief of staff and district director for New York City Council Speaker Corey Johnson. While at the council, he oversaw major land-use and budget processes, and collaborated with city and state agencies, nonprofits and community groups to advance affordable housing, public safety, sanitation, transportation and homelessness initiatives.

Tubbs served as a senior advisor to the Bronx Borough President Ruben Diaz Jr. focusing on external affairs, intergovernmental relations and assisting with policy and implementation. He also served as the director of outreach and intergovernmental affairs for the New York City Civilian Complaint Review Board. He also worked as the chief of staff for Assemblywoman Latrice Walker, who represented Brownsville.

The U.S. Green Building Council (USGBC), the global developer of the LEED (Leadership in Energy and Environmental Design) green building program, has released a guide on how green rating systems can accelerate sustainable finance by increasing confi dence in performance outcomes while lowering transaction costs.

“Green Building & Sustainable Finance: Accessing Capital to Accelerate Market Transformation” covers key concepts and strategies for investing in green buildings and how tools such as LEED and Perform, USGBC’s portfolio-level verifi cation program, can align expectations and validate achievements for owners, investors, lenders, tenants and regulators. The guide explores a two-sided value proposition, whereby finance is a catalyst for green building and green building is a solution for sustainable finance instruments.

“Sustainable finance isn’t just about capital — it’s about change,”

said Sarah Zaleski, chief products offi cer, USGBC. “When capital is directed toward green building, it becomes both a catalyst for innovation and a system of accountability, demonstrating that what’s good for people and the planet is also good for investors.”

USGBC is committed to engaging with the finance sector to help bridge the gap between corporate climate goals and the financial feasibility of achieving them. Greater access to capital is critical to financing largescale projects at the portfolio level and accelerating decarbonization efforts in the built environment, which is responsible for nearly 40% of all carbon emissions.

Green building rating systems such as LEED are used in a wide range of finance instruments, including mortgages, bonds, linked loans and equity engagement. The guide showcases the breadth of these applications to make them accessible to a broader audience of professionals.

The guide provides finance practitioners with an overview of how green rating systems can be used as a set of tools to create value, reduce risk and obtain credible data to analyze green projects. It includes investment strategies that maximize ROI while supporting the adoption of green building standards and how green building programs such as LEED and Perform address priority impact areas.

Additionally, the guide aims to help green building practitioners understand the different financing options for their projects and how to make them bankable.

office and making their workday more seamless.

“By bringing Work&Mother into 1290 Avenue of the Americas, we are ensuring that mothers returning to work have access to spaces designed with dignity, privacy, and care at the forefront,” said Jules Lairson, cofounder and COO of Work&.

In a continuing effort to create human centered-workplaces, Vornado Realty Trust is opening a Work&Mother Suite at 1290 Avenue of the Americas. This newly outsourced, fully serviced mother’s room will debut this month, joining Vornado’s WorkLife program at the tower.

The Work&Mother Suite brings a fully outsourced approach to lactation space management. 1290 Avenue of the Americas’ occupants and guests will benefit from private, secure rooms equipped with hospitalgrade pumps and refrigeration; smart booking and access technology ensuring privacy and compliance with the Pump Act and stocked supplies and educational resources for new parents. By providing fully equipped spaces on-site, the suite gives valuable time back to mothers who pump — eliminating the need to carry pump bags to and from the

The impact of this type of support is clear: 90% of mothers using Work&'s lactation resources are still breastfeeding at six months, compared to just 10% nationally, the company said.

“Our WorkLife program at 1290 is a testament to our commitment to create workplaces that elevate both performance and personal wellbeing,” said Glen J. Weiss, executive vice president-office leasing and co-head of real estate at Vornado Realty Trust. “The addition of a Work&Mother Suite is an integral extension of our ‘Work Naturally’ program — providing a thoughtful, accommodating and high-quality solution for working parents that reinforces our position as a leader in the tenant-focused work environment.”

The 43-story, 2.1 million-square-foot Class A office tower has recently undergone a $50 million workplace modernization. The LEED Gold–certified property will debut an expansive amenity collection this fall, including a landscaped terrace, tenant-only wellness and fitness center and an upcoming restaurant from Maple Hospitality Group.

totaling seven hours of instruction, which can be completed at the learner’s own pace through Colibri’s online platform.

Real estate professionals completing the certifi cation will gain access to 25 practical AI tools they can implement immediately, along with real-world examples and ethical AI strategies to ensure compliant practice. The curriculum covers foundational AI knowledge through advanced applications, including AI tools for client service, property analysis, risk management and communication.

To help the 75% of top U.S. brokerages and nearly 80% of their agents already using artifi cial intelligence (AI) tools, Colibri Real Estate has launched the Real Estate AI Specialist (REAIS) certifi cation, the first comprehensive AI training program designed specifi cally for real estate professionals.

The REAIS certifi cation provides licensees with the knowledge and practical skills needed to integrate AI into their daily workfl ows while maintaining compliance with industry regulations and consumer protection laws. The program consists of four expert-led courses

“This certifi cation isn’t about chasing trends — it’s about giving real estate professionals the tools they need to work smarter, close more deals, and take back control of their day,” Diana Weir, head of experience and strategic product growth, said. “We’re seeing agents struggle to keep up with rapid technological changes, and REAIS provides the structured learning path they need to stay competitive.”

The certifi cation enables agents to enhance client experiences through AI-powered communication and analytics tools while boosting effi ciency and accuracy through predictive analytics and multi-factor property valuation models. Participants also learn to communicate complex data effectively and build lasting trust by balancing innovation with human-centered service delivery.

Licensees who complete the REAIS certifi cation receive professional credentials to showcase their AI expertise, lifetime access to all course materials and the knowledge to evaluate and implement AI technologies safely and effectively in their practice.

Visitt, an artifcial intelligence (AI)-native building operations platform, has unveiled the first in what will be a growing lineup of fully autonomous AI agents designed to transform commercial real estate property management. This AI agent is the first of its kind in the commercial real estate proptech space, the company said. Designed to fully automate Certificate of Insurance (COI) management and compliance, this release marks the next evolution of Visitt’s AI offering and the first in a new suite of autonomous AI agents built to eliminate manual work across every aspect of property operations.

The debut of Visitt’s COI AI Agent builds upon its existing AI-powered platform. Previously, Visitt leveraged machine learning and automation to deliver capabilities like predictive maintenance scheduling, smart issue detection, automated work order routing and data-driven asset

management, helping property teams prevent costly breakdowns, extend equipment lifespans, and operate more efficiently. This latest release represents the next step in that evolution: adding fully autonomous AI agents that go beyond traditional automation to self-direct tasks and decisions across property operations.

“This launch underscores Visitt’s long-standing commitment to pioneering AI solutions that streamline operations, enhance tenant experiences, optimize resource allocation and set the standard for what’s next in the industry,” said Jonathan Kroll, co-founder of Visitt. “It is a direct response to what property teams have been asking for: real, endto-end automation that reduces administrative load without sacrificing accuracy or compliance, so teams can focus on what really matters — running their buildings efficiently and serving tenants better.”

This launch marks the beginning of a broader vision to bring intelligent, self-directed capabilities to building operations, streamlining processes, enhancing tenant experiences and unlocking new efficiencies. This initial AI agent signals the start of a new era where advanced automation plays a central role in managing and optimizing properties at scale.

Key innovations of Visitt’s COI AI Agent include autonomous insurance requirements extraction, communications on autopilot, self-validating intelligence, continuous auditing of compliance and coverage and easy onboarding.

Designed to address the tech stack overload faced by CRE owners and operators, Visitt consolidates critical property management functions into a single, intuitive platform, streamlining workflows and automating repetitive tasks so teams can focus on higher-value work.

Real estate marketplace and technology platform Crexi announced Crexi Vault, a solution that converts real estate documents such as offering memorandums (OMs) and marketing materials into structured, enriched, searchable data.

Professionals often spend hours manually extracting data from OMs and other deal documents; for example, a broker receiving five OMs as comparables, at an average of 25 pages per OM, can spend hours parsing through the PDFs just to build a comp set. Vault allows users to set up a private, proprietary location to upload documents, where it can extract data and depending on the subscription, link it with Crexi’s data.

“You can evolve and compare data,” Ryan Sawchuck, vice president of product at Crexi, told Mann Report at the Blueprint proptech conference in Las Vegas. “We always work closely with our customers to understand their pain points. They might have a junior agent or analyst spending 20 hours a week taking notes on offering memorandums. This saves a ton of time.”

Crexi’s advanced extraction capabilities alongside user contributions ensure information remains current and comprehensive rather than a static snapshot. Vault is purpose-built to streamline critical workflows, including underwriting, listing preparation and comp tracking,

“Crexi Vault represents the next generation of AI tools built specifically for the CRE community, and it encapsulates Crexi’s vision of creating a personal, dynamic archive of market intelligence that empowers CRE professionals with greater efficiency,” said Michael DeGiorgio, founder and CEO of Crexi. “The industry has been drowning in information but starving for insight. We’re bridging the gap from simply managing information to truly harnessing it, enabling smarter decisions, enriching data-driven strategies and fostering long term growth.”

Key elements include bulk or single PDF upload of one to 100 files; automatic data extraction of 16 property data points, with more to come; the ability to create, search, group and manage structured records; the ability to export, edit and reuse extracted records across different processes and seamless integration with Crexi Pro and Crexi Intelligence, enriching records with comps and property insights.

Vault will be available to all by mid-Q4.

designed for office-centric businesses, to image-first workflows designed for the field-centric industries like construction.

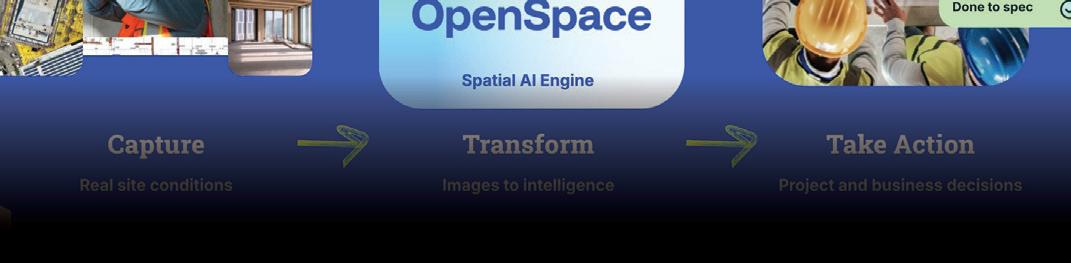

OpenSpace has provided reality capture products such as OpenSpace Capture, OpenSpace BIM+ and OpenSpace Air, enabling builders to document jobsites with 360-degree cameras, drones and laser scanners. With OpenSpace Field and OpenSpace Progress Tracking, the company has evolved into a full Visual Intelligence Platform.

Introducing a new system of work for construction, OpenSpace launched its Visual Intelligence Platform at its Waypoint customer summit, turning reality data into intelligence that both powers field workflows like punch lists and logging issues and business insights like percent complete and productivity tracking.

While ERP systems track financials and project management tools coordinate processes, neither provides true visibility into what’s really happening on site. OpenSpace’s Visual Intelligence Platform closes this gap by capturing field data in real time and turning it into intelligence that drives both daily action and executive insight. The Visual Intelligence Platform powers a transformation from document-centric workflows

The launch introduced OpenSpace Field, a field-first system of work powered by breakthrough spatial AI. With just a smartphone, teams can capture, track and manage site data, with every image automatically pinned to the right location in floorplans and aligned to BIM models. These capabilities integrate with tools like Procore and Autodesk Construction Cloud. OpenSpace Field beta customers have reported time savings of 85% when addressing common field tasks like punch lists and logging issues.

In addition to OpenSpace Field, OpenSpace Progress Tracking turns reality data into high-level insights to validate work-in-place for billing, identify schedule risks early by comparing actual progress to planned milestones and deliver trusted progress summaries to all stakeholders. It also integrates with schedules in P6, Asta, Microsoft Project and Excel.

“For years, reality capture has been treated as a nice-to-have—useful for documentation or dispute resolution,” said Jeevan Kalanithi, co-founder and CEO of OpenSpace. “We are moving beyond reality capture, and redefining reality data as a strategic asset that simplifies workflows and fuels results, from the field to the C-suite."

With over 75 years of experience and deep understanding of industry challenges, IDB’s Commercial Real Estate team supports property owners, developers and builders across every type of financing requirement. We can help you keep pace with changes in the marketplace, while maintaining high credit quality levels and providing the personalized service, efficiency and flexibility to fit your specific needs.

For more information about financing solutions that meet your specific needs, visit idbny.com.

DeMarco boasts more than 20 years of experience serving public and private entities. As Somerset County counsel and former municipal administrator for Bayonne and West New York, N.J., he has been directly involved in the redevelopment and governance issues that shape New Jersey communities. At the same time, he has represented private developers, investors and businesses in land use, real estate transactions and regulatory compliance. This dual background allows him to anticipate challenges, navigate local politics and deliver practical solutions for projects of any scale, the firm said.

Scarinci Hollenbeck LLC has added former Somerset County (N.J.) Counsel Joseph DeMarco as partner. DeMarco is a veteran attorney and municipal administrator with significant experience leading complex, large-scale development projects.

Scarinci Hollenbeck also welcomed two associate attorneys, Jessica R. Dietz and Daniel Tokarz. The additions bolster the firm’s capabilities across several key practice areas, including litigation, public and education law.

“Joe DeMarco is a deal maker. Make no doubt about it. Land use regulations, municipal ordinances and politics are often central to the success of New Jersey real estate transactions, areas in which Joe brings extensive experience,” said Managing Partner Donald Scarinci. “His hands-on redevelopment experience, industry insight and commitment to public service are a tremendous asset to the firm.”

Tokarz has joined the firm’s litigation department, where he will advise clients on civil litigation matters ranging from contract disputes to real estate litigation. Meanwhile, Dietz is the latest member of the firm’s public law and education law departments, handling a broad spectrum of matters on behalf of New Jersey public entities, including school boards, municipalities and administrators. Their experience and fresh perspectives further enhance the firm’s ability to deliver comprehensive counsel across a wide range of practice areas.

completed by the end of 2026.

The expansion, led by architect Leo Hansen, Miller Construction, EDSA and Brizaga, marks the official start of construction for the improvements.

The Historic Stranahan House Museum — the oldest house in Fort Lauderdale and the epicenter of Broward County’s long history — celebrated the groundbreaking of the museum’s campus-wide transformation into the “Center of Community,” a return to its original role in 1901 as Fort Lauderdale’s first gathering place.

In 2018, the Stranahan House embarked on a transformational capital improvement campaign to further protect the historic site and create new opportunities for locals and visitors alike. The capital campaign aims to enhance Stranahan House’s facilities and offerings, ensuring its continued significance as a vital cultural institution. Accomplishments to date include the new seawall, the New River Patio and updated historic porches donated by Old Florida Lumber. The project is expected to be

“These enhancements will allow residents and visitors of all ages to learn about Fort Lauderdale’s fascinating history, furthering the community’s social, cultural and historical viability,” said Stranahan House Executive Director Jennifer Belt. “This would not be possible without the vision and generosity of our dedicated donors, partners and community stakeholders who are committed to creating a space that will serve the Fort Lauderdale community and inspire generations to come.”

The renovation of the administration building will include The Egret Classroom, a state-of-the-art education center funded by a private family foundation, and the Kitchenworks Hospitality Center. New ADAcompliant facilities, including restrooms, as well as an on-site archival and storage facility, will enhance the museum’s ability to serve the community and preserve its collections for future generations. The Mosser Family Education Planning Center, funded by John and Pamela Wilkes, will ensure the creation of new, dynamic programming.

The east side of the property will be home to a new welcome center featuring a ticketing window and gift shop, funded by the City of Fort Lauderdale, and an event pavilion, funded by Broward, Palm Beaches and St. Lucie Realtors.

The Rogers Family Foundation donated the Virginia and Dwight Rogers Courtyard, which will be an additional location for community gatherings and celebrations.

In a move that continues its expansion into the real estate sector, global alternative asset manager Rithm Capital Corp, has entered into a definitive agreement to acquire Paramount Group Inc., a vertically integrated real estate investment trust that owns, operates, manages and redevelops Class A office properties in New York City and San Francisco, for approximately $1.6 billion. Paramount’s portfolio includes 13 owned and four managed office assets, totaling more than 13.1 million square feet, 85.4% of which was currently leased as of June 30, 2025. The transaction is expected to close in late Q4 2025.

The agreement has been approved by the boards of directors of both companies. Rithm expects to fund the transaction with a combination of cash and liquidity from Rithm’s balance sheet and potential opportunities from co-investors. The addition of the Paramount portfolio will create new opportunities for investors to access Rithm’s real estate platform and bolster Rithm’s asset management business.

“The Paramount portfolio is situated in cities where we have a strong conviction in the recovery of office market fundamentals, including improving rent rolls, a more favorable interest rate environment and increasing demand,” said Michael Nierenberg, CEO of Rithm. “We believe Rithm’s asset management business is well-positioned to create value in the commercial real estate market, with a growing footprint of high-quality office assets and the expert urban development and complimentary office management capabilities of our GreenBarn team and broader platform.”

“We are incredibly proud of the high-quality portfolio we’ve built and believe strongly in its intrinsic value,” said Martin Bussmann, lead independent director of Paramount. “Together, the board and management team have found an ideal partner in Rithm, which offers the financial scale needed to improve our fundamental operating performance. After an extensive process and evaluation of a range of strategic alternatives, we are pleased to have reached this agreement which will deliver immediate, full and fair value to our shareholders.”

its interests in a portfolio of completed properties and assets under development, for $347 million.

The transaction will immediately scale to Kennedy Wilson’s investment management platform and its rental housing capabilities, while monetizing a significant portion of Toll Brothers’ investments in rental properties. The transaction is expected to close this month.

“This purchase helps create an unparalleled national platform within the rental housing space that totals over 80,000 units we own, finance or manage,” said William McMorrow, chairman and CEO of Kennedy Wilson.

in 18 apartment and student housing properties with assets under management (AUM) of $2.2 billion. Kennedy Wilson will also acquire a pipeline of 29 sites in various stages of development which, if completed, would total approximately $3.6 billion of invested capital, with Kennedy Wilson to assume construction management responsibilities.

Kennedy Wilson will also manage 20 apartment and student housing properties that will remain with Toll Brothers following closing, representing another $3.0 billion of AUM for Kennedy Wilson. Toll Brothers intendes to dispose of these remaining assets over time and exit multifamily development.

“This transaction will unlock significant capital for our stockholders, while allowing us to focus on our core homebuilding business and continue our transformation to a more asset-light homebuilder. We are pleased that our Toll Brothers Apartment Living employees have found a new home at Kennedy Wilson,” said Douglas C. Yearley, Jr., chairman and CEO of Toll Brothers.

Kennedy Wilson will also acquire the expertise of the Toll Brothers Apartment Living management team. In addition, the transaction is expected to create a new long-term relationship between the two companies for future investment opportunities a. Kennedy Wilson will refer prospective for-sale housing opportunities to Toll Brothers, and Toll Brothers will reciprocate with rental housing opportunities, creating a mutually beneficial pipeline of shared deal flow.

J.P. Morgan Securities LLC acted as Kennedy Wilson’s exclusive financial advisor. Latham & Watkins served as Kennedy Wilson’s legal counsel. Goldman Sachs & Co. LLC and Vestra Advisors acted as Toll Brothers’ financial advisors, and Fried, Frank, Harris, Shriver & Jacobson LLP served as Toll Brothers’ legal counsel.

By Jonathan Kaufman Iger, CEO and President, Sage

This year, Sage turns 100, a milestone that makes me both proud and reflective. Over a century, our values — quality, integrity and creating spaces that matter — have remained constant. What’s evolved is how we bring those values to life, especially as the office itself is being redefined.

For me, the biggest shift has been recognizing the importance of hospitality in the workplace. The office today isn’t just about desks or square footage — it’s about creating experiences that make people want to come in, connect and thrive. That’s why we’ve introduced “flagging,” our hospitality-inspired approach to office. Each Sage property is designed as a destination, with consistent service, thoughtful amenities and a sense of community. We even call our tenants “Members” because joining a Sage building is about belonging, not just leasing space.

As we celebrate 100 years, I see hospitality not as a trend, but as a guiding philosophy — one that has always been at the heart of Sage and will continue to shape our vision for the next century. Grounded in the principles of hospitality, we’re helping redefine what the office can mean — today and for the next century.

In hotels, a “flag” signals both consistency and character. And while this isn’t a Marriott or Four Seasons, every building under the Sage flag carries the same DNA: hospitality-forward design, activated amenities and programming that curates an experiencefocused environment where tenants aren’t just tenants — they’re Members. Yet each property retains its own personality, tailored to its neighborhood, Member base and scale.

And much like guests at a high-end hotel, Members enjoy curated experiences such as white-glove garment care with on-site alterations, immersive events (from meditation sessions to wine tastings) and even a signature Sage scent. Every interaction is guided by hospitality-trained staff who specialize in those “surprise and delight” moments that make the everyday memorable.

Hospitality provides the framework to meet this demand. The concierge who greets you by name, the lounge designed for both quiet work and lively connection, the seamless technology that ties services together — all of it adds up to a workplace that feels intentional. Just as hotels create loyalty through service and atmosphere so, too, can office buildings become destinations people actively want to return to.

The goal is to elevate and innovate the traditional landlord-tenant relationship from transactional to relational, anchored not only by a lease, but by a brand promise.

Amenities with a Pulse

“Amenities” has become a buzzword in office culture. Yet a rooftop or fitness center, without thoughtful activation, quickly becomes underused. Sage focuses instead on amenities with a

pulse — spaces animated by programming that evolves with Members’ needs.

Wellness studios host yoga and meditation classes. Coffee bars transform into tasting rooms for local roasters. Lounges double as venues for networking events, cultural programming and speaker series. Even everyday services — bike tune-ups, laundry drop-offs, tech support — add to the sense of being cared for.

Exclusivity is also a key factor in the hospitality world as it creates a sense of privilege and personal attention. When access is limited or experiences are curated, guests feel recognized and valued, heightening their connection to the space. This careful curation fosters loyalty, encourages engagement and transforms ordinary visits into memorable, sought-after experiences. This is central to the Sage approach.

This intentional scarcity not only elevates the quality of interactions but also fosters a community where Members feel recognized, valued and immersed in a setting designed to enrich both professional and personal life. Sage offers its signature “Oasis” amenity space providing inviting, hospitalitystyle shared areas to Members. Serving as an extension of the workplace, Oasis provides thoughtfully designed locations for dining, meeting, conferencing and socializing that are available to Members. Oasis includes a range of meeting environments, from Salon Meeting Rooms with soft seating to traditional Boardrooms and smaller Breakout Studios, and even the Winter Garden — a special event room for private dining with banquette seating — accommodating both company and employee needs.

Tenants of Sage properties automatically become Sage Members, with access to Oasis amenities as well as Sage Services and Sage Social, all managed through the Sage Connected app. Currently, Oasis is available at 437 Madison Ave. where Members have access to offerings such as a 5,630-squarefoot wraparound Terrace Garden, Café Bar, Lounge, Winter Garden, Library, a flexible event space called The Forum, Breakout Studios, a Meditation Studio and Catering Kitchen.

Most recently, our former 77 Water St. location was home to the Sage Candy Store that opened more than 40 years ago. Today, that same candy store has been revived at 747 Third Ave., carrying forward its charm with a mix of nostalgic sweets, everyday treats and some thoughtful little essentials for our onthe-go Members.

The point is not simply to offer amenities, but to create experiences that resonate.

If amenities are the stage, programming is the performance. A holiday market featuring neighborhood artisans. A fireside chat with a thought leader. A week devoted to wellness, complete with nutrition workshops and guided meditation. These activations help build a community that makes the office more than just a place of work.

In many ways, programming has become the new anchor for tenants — an attraction that shapes the life of the building no matter who occupies the floors within.

Rethinking the Landlord’s Role

Underlying all of this is a redefinition of what it means to be a landlord. For much of the last century, landlords were providers of square footage. Today, they are curators of experience.

This shift in mindset makes the landlord-tenant relationship more collaborative. By aligning operations with tenants’ priorities — supporting culture, wellness and productivity — Sage strengthens both tenant engagement and adaptability. In a competitive market, a building known for its hospitality is more than a commodity; it’s a partner in business success.

As Sage enters its second century, the flagging model is both a celebration of heritage and a blueprint for the future. Technology will play a critical role, offering data-driven insights into Member preferences and

enabling more personalized service. Despite a tech-forward approach, the essence will remain human — empathy, hospitality and community cannot be automated.

It’s this blend of tradition and innovation that defines Sage’s next chapter. One hundred years of experience, reimagined for the next generation of companies and employees. For Sage, it is both an achievement and a responsibility: proof of resilience, but also a challenge to keep evolving.

Flagging is the company’s answer to that challenge. By weaving hospitality, service and programming into every property, Sage is redefining what the office can be: not just a workplace, but a destination.

As the company looks to its next 100 years, the vision remains clear: properties that don’t simply house people, but welcome them, inspire them and connect them.

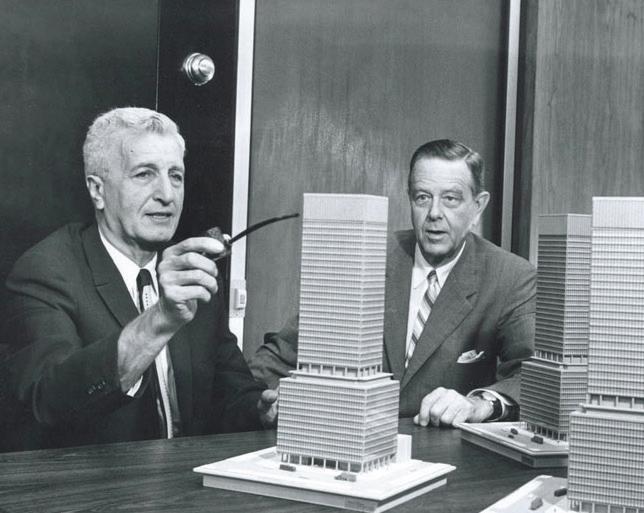

All in the Family Sage, formally the William Kaufman Organization and Sage Realty Corporation, was founded by Jonathan Kaufman Iger’s great-grandfather William Kaufman, a Russian immigrant, in 1924.

The William Kaufman Organization initially focused on developing single-lot family homes and investing in main street retail, eventually developing ground-up office buildings across New York City. Shortly after World War II, William Kaufman’s two sons, Robert Kaufman, (Iger’s maternal grandfather), and Melvyn Kaufman joined and eventually co-ran the firm alongside him. Iger’s father, Mark Iger, spent a portion of his career at

Sage, serving as general counsel and then as director of leasing and real estate acquisitions.

Sage Realty Corporation was established as the property management arm of The William Kaufman Organization in the late 1960s, eventually expanding into leasing, asset management and construction management for the firm. In 2010, Robert Kaufman asked his grandson Jonathan, who had been working in real estate for a decade, to join the company as a vice president.

Jonathan Kaufman Iger became Sage CEO in 2014 and president in 2016 following Robert’s death.

In today’s fast-moving and increasingly complex financial environment, successful business owners need more than just an advisor—they need a trusted partner who sees the full picture, anticipates change, and integrates every facet of their financial world. For over 30 years, Louis C. Ciliberti & Associates has delivered exactly that.

We are a full-service financial firm and multi-family office that helps the most financially successful individuals and privately held companies in the nation. At Louis C. Ciliberti & Associates, we don’t just provide advice—we orchestrate and execute a total wealth strategy that aligns with our clients’ business goals, family needs, and long term vision.

Salt Lake City is experiencing rapid growth, with a current population increase of 1.4% annually, according to the World Population Review. Attracted by the city’s relative affordability, youthful demographic, strong economy, abundant outdoor recreation and urban presence, more people are moving to the elevated city.

A growing destination flourishes with a vibrant mix of living areas, commercial spaces and entertainment venues that support the needs of its population. In a city with a rich history, thoughtfully designed new buildings that complement existing architecture can attract tenants and consumers, as it celebrates the city's progressive spirit while honoring its heritage.

By Pieter Berger, AIA, Principal at MVE + Partners

design with historic elements to create a vibrant, creative hub within a city block.

MVE + Partners entered the Salt Lake City market to help meet the region’s demand for mixed-use spaces. In turn, the architecture firm connected with Lowe Property Group to work on one of city’s most ambitious adaptive reuse projects — The Post District.

The Post District is dynamic, mixed-use development by Lowe Property Group, Blaser Ventures and Bridge Investment Group, spanning 13.14 acres in Downtown Salt Lake City, making it one of the largest developments of its kind within a mid-sized U.S. city.

Designed to blend adaptive reuse with new construction, the $144 million project draws its name from the area’s historic newspaper buildings. Located along the Intersate 15 corridor within a designated Opportunity Zone, the Post District offers a bustling setting for a harmonious mix of residences and commercial tenants.

MVE had the unique opportunity to serve as the master planner of the Post District Residences, an expansive development featuring five ground-up buildings comprising 580 residential units and 27,000 square feet of vertically integrated, mixeduse retail. The buildings are sited to allow for the adaptive reuse of existing structures, some of which have been left untouched for over a century.

Each of the five buildings possesses a distinctive character but collectively delivers a “sophisticated grit” that blends modern

Part of developing within an Opportunity Zone is being able to design units that suit a variety of renter profiles. MVE viewed this as a chance to create a “complete neighborhood” through five different apartment offerings, ranging from $1,300 to $5,000 per month, that all embrace the character of the Post District. These include Post House North and South, The Register and 801 Flats (comprised of two buildings).

MVE served as the architect of both Post House buildings. These structures emulate the shape of the Wasatch Mountains on the city’s horizon while incorporating earth-hued colors and bricks from historic structures. Windows are arranged in asymmetrical patterns, distinguishing this building from its neighbors.

Collectively comprised of 474 units, both properties provide an elegant residential lifestyle with varying floorplans. However, a key differentiator between the two is their podium level decks. The Northern building has a space that emulates a park-like atmosphere whereas the Southern residence offers a resort-style pool experience.

Additionally, The Register brings 33 loftstyle luxury apartments of different sizes within a building that was repurposed from a warehouse. 801 Flats also draws inspiration from shipping containers that pay homage to the historic freight rail spurs that run throughout the Granary District. This was adapted into 73 diverse units, comprised of one- and two-bedroom dwellings.

Following the completion of the residential portion in 2023, 70% of units were leased

within a couple of months.

Development projects spanning 13 acres are rare in Salt Lake City, largely due to the higher costs associated with neighborhoods in an urban setting. However, designing within an Opportunity Zone and incorporating adaptive reuse can provide ample cost savings.

In general, adaptive reuse projects can reduce costs by up to 15%. However, when developing a project in an area that has lacked economic activity for over a century, it can be eligible for tax credits as well, which provides robust design flexibility.

For the Post District, these cost savings provided leeway to create space for robust housing options and world-class retail and hospitality tenants on the ground floor of each building. Notable occupants include the award-winning Urban Hill Cafe, Sunday’s Best restaurant, Level Crossing Brewery alongside the establishment of the EVO Hotel SLC location (comprised of a completely adaptive reuse building) and Traeger Grills’ new headquarters. Many of these tenants are unique to the Post District or specifically requested that their Salt Lake flagship be in the area due to the creative and authentic local culture.

While blending adaptive reuse with new construction presented certain challenges, the process ultimately enhanced MVE’s design expertise, particularly in finding innovative ways to integrate materials from the existing built environment.

One notable challenge was determining which existing structures could be used effectively to comply with building and seismic code. The Magna Earthquake of

2020 forged decisions to ensure buildings were resilient to unprecedented natural events. MVE leveraged its design expertise in earthquakeprone areas like California to design durable mixed-use buildings that could outlive other structures not originally designed with these principles in mind.

Another unique design feature was incorporating existing billboards into the Post District. As the project is positioned along Interstate 15, there were ultimately six billboards present on-site. Even though billboards can be considered an eyesore, there was an opportunity to integrate them into various parts of the project. Post House and The Register were strategically built around billboards, in a way that added to the industrial

grit of the structures. The billboards also created an interesting juxtaposition of highlighting prominent upcoming announcements like the 2034 Winter Olympics in front of a project that represents Salt Lake’s history.

As Salt Lake City continues to grow, there are many ways to incorporate adaptive reuse to create the next best structures of tomorrow. MVE broke ground on Silo Park in December 2024, located one block west of the Post District. Slated to be a “sister project,” this $300 million, mixed-use entity will incorporate the use of silo towers and two historic warehouses — also serving as a tribute to Salt Lake City’s industrial roots and Utah’s enduring significance in the production of wheat, corn and barley.

The first phase of the project will feature two six-story residential buildings with a total of 286 apartments and nearly 20,000 square feet of commercial space. Additionally, two historic warehouses will be converted for retail use, alongside the addition of off-site parking and ample green space.

The Post District is proof that adaptive reuse is a robust solution to meet increasing housing and retail needs, while offering ample cost savings. It also demonstrates how innovative projects can come to cities with the addition of new construction to enhance its presence, without erasing history.

Developers should know that the next best thing can start with what is already in front of them.