DATA CENTERS ARE MORE NEEDED THAN EVER BUT BUILDING THEM ISN’T EASY

For decades, we have built a real estate practice unparalleled in the US. Now, as the global legal powerhouse HSF Kramer, we are so much more. As the only law firm ranked in Chambers Band 1 in the US, the UK and Australia, we continue to transform skylines and reshape landscapes. Please visit our website to learn more. Kramer Levin is now HSF Kramer

EDITORIAL

Editor

Debra Hazel

Director of Communications and Marketing

Penelope Herrera

Director of

Newsletter Division

Cheri Phillips

PRESIDENT/CEO

Jeff Mann

ART

Art Director

Virginia Sanchez

Cover Photography Business Wire

Faron Brazis

Frank DeLucia

Stephen Gilman

Merilee Kern

Kris Kiser

Bob Knakal

Scott Krinsky

Nate Larmore

Itay Oren

Austin Rabine

Stuart Saft

Carol A. Sigmond

David Fuller Watts

Technology Consultant Eric Loh

Distribution Mitchell’s Delivery Service

DIGITAL MEDIA

Designers

Virginia Sanchez

Editors

Debra Hazel

Penelope Herrera

Rose Leveen

Cheri Phillips

Web Developer

CS Designworks

West Coast Office: 578 Washington Blvd., Suite 827

Marina Del Rey, CA 90292 866-306-MANN (6266) mannpublications.com

East Coast Office: 450 7th Ave, Suite 2306

New York, NY 10123 212-840-MANN (6266)

The past two decades have seen an extraordinary change in our industry and our world with the rise of technologies including the Internet of Things (IoT), artificial intelligence and more. It’s also necessitated the rapid expansion of a new real estate sector — data centers, to house all of the storage, circuitry and more to run this brave new world.

But these buildings are more than just fancy warehouses. They require careful site locations, specific systems for cooling and a lot of money to build them, as you’ll see in this month’s cover feature. If done well, however, they are critical infrastructure and a great investment.

On a more earthly level, there’s still time to register for our annual golf tournament that benefits two very important foundations — The Mann Charitable Foundation and the National Realty Club Foundation — being held at the Fresh Meadow Country Club on October 6. The event will honor Martin Efron, managing director at White Oak Commercial Finance, and Jaimee L. Nardiello, partner at Zetlin & DeChiara LLP. Proceeds will support causes including Alzheimer’s Disease, Crohn’s and Colitis, Lymphoma and Macular Degeneration, as well as organizations such as the Bronx Historical Society, Community Mainstream, National Jewish Museum, Jewish National Fund, Catholic Faith Network and Nassau County Law Enforcement Exploring.

For more information about tickets and sponsorships, please contact Penelope Herrera at pherrera@themanncharitablefoundation.com or penny@ nationalrealtyclub.org.

See you next month!

“One machine can do the work of 50 ordinary men. No machine can do the work of one extraordinary man.” — Elbert Hubbard

by Adrian

8:30 AM Arrival and Registration

9:00 AM Breakfast/Brunch

11:00 AM Call to Carts

11:15 AM (Sharp) Shotgun Start

5:00 - 6:00 PM Hors d’Oeuvres and Cocktails

6:00 - 7:00 PM Dinner and Presentation of Golf Winners and Honorees

Join Jeff Mann, The Mann Charitable Foundation and the National Realty Club Foundation as we are having a joint golf outing this year. On October 6, 2025, be prepared for another stellar annual golf outing. This outing will support causes such as Alzheimer’s disease, Crohn’s and Colitis, Lymphoma, Macular Degeneration along with raising money for the areas of NYC that need support including Bronx Historical Society, Community Mainstream, National Jewish Museum, Jewish National Fund, Catholic Faith Network, Nassau County Law Enforcement Exploring, among other areas.

With over 75 years of experience and deep understanding of industry challenges, IDB’s Commercial Real Estate team supports property owners, developers and builders across every type of financing requirement. We can help you keep pace with changes in the marketplace, while maintaining high credit quality levels and providing the personalized service, efficiency and flexibility to fit your specific needs. For more information about financing solutions that meet your specific needs, visit idbny.com.

At Peninsula Property Management (PPM), we do more than manage properties—we elevate them. With a leadership team that is deeply involved, hands-on, and responsive, PPM is redefining the standard for property management in New York City. Our mission is simple: deliver results with integrity, precision, and a hospitality-first approach.

Proactive Management

Stop issues before they start — from Local Law 97 to vendor oversight.

Financial Clarity

Clean, timely financials. No surprises –just strategic planning and transparency.

NYC Compliance Expertise

DOB, HPD, LL88, LL97, FISP we navigate every regulation so you don’t have to.

New Development Services

Schedule B, TCO phasing, hiring of staff, punch-list, insurance implementation.

Smart Cost Control

Energy savings, bulk contracts, vendor negotiations we cut waste, not corners.

Track requests, tasks, and reports live through our integrated digital platform.

Welcome to our Artificial Intelligence issue.

AI is changing how all of us interact with the world, helping us process information in moments rather than weeks, guiding development, property management, leases and more. The breadth of AI is behind the growth of the data center sector, as you’ll see in our cover feature. But our contributors also show us how it’s becoming ever more vital in many different ways.

This month, experts Itay Oren and Nate Larmore tell us how AI is elevating property operations and aid in healthcare design and construction and respectively. Kinexio’s David Fuller Watts discusses the role tech is playing in creating and running mixed-use centers, while our friend Merilee Kern’s interview with GreatBuildz can help us avoid costly mistakes in home renovation. And look at our focuses on residential conversions and a great new community in Orlando, too.

Tech also appears among our columnists, including the possibility that cryptocurrency can be counted as assets for mortgages, robotics and more in construction and even the dangers of relying too much on AI in legal research. All of them are fascinating reads from some of the great minds in our business. Enjoy.

Broadacre Financial and the Taub Institute hosted the Ninth Annual “Laugh to Remember” at Gotham Comedy Club in New York City. The event raised over $300,000 in support of the Taub Institute for Research on Alzheimer’s Disease and the Aging Brain at Columbia University Irving Medical Center. The funds will advance research into Alzheimer’s, Parkinson’s, ALS and Frontotemporal Dementia.

This night of comedy, hosted by Chris Haynes of Broadacre Financial, brought together 230 guests and top-tier talent, including comedians Mark Normand, Jimmy Failla, Mike Yard and Ophira Eisenberg.

The event’s success was made possible by the generous support of corporate sponsors Vranos Family Foundation, AEI, Bank of America, Broadacre Financial, Bryan Cave Leighton Paisner, Cadwalader, Doughnuttery, First Nationwide Title, Gotham Comedy Club, Health/ROI, LCK Wealth Management, M&T Bank, McGuireWoods, Park Bridge Financial, Polsinelli, Seyfarth, Stewart Title and The Henry & Marilyn Taub Foundation.

$300,000

This spring, American Friends of Rabin Medical Center (AFRMC) brought together supporters, friends, and community leaders for two successful charity golf outings, held at Suneagles Golf Club in New Jersey and Westchester.

Both outings were marked by beautiful weather, competition, and a strong sense of purpose. Participants rallied around AFRMC’s mission to support Israel’s Rabin Medical Center, with proceeds from the outings directed toward expanding critical emergency and rehabilitation services for patients in need.

The season kicked off with the Annual AFRMC New Jersey Golf Outing, where guests enjoyed a warm and memorable day on the lush fairways of. The outing featured a spirited round of golf followed by a lively dinner celebration, awards for tournament and contest winners, and a selection of exceptional prizes from a raffle and silent auction.

Just a few weeks later, AFRMC hosted its highly anticipated Annual New York Golf Outing at the prestigious Old Oaks Country Club in Purchase, New York. This year’s event was held in honor of longtime AFRMC supporter Yoav Oelsner of Upland Property Advisors, whose steadfast support has advanced AFRMC’s mission over the years.

Samantha Sweeney, Subcontractors Trade Association

Accounting, tax and advisory firm Anchin proudly announced the winners of its 2025 Construction and Design Awards during the firm’s 15th annual celebration, hosted at The Meeting Galleries in Midtown Manhattan.

The milestone event, presented in collaboration with the New York Building Congress (NYBC), the American Council of Engineering Companies of New York (ACEC New York) and the Subcontractors Trade Association (STA), recognized leaders in the architecture, engineering and construction (AEC) sectors for their exceptional achievements, innovation and impact on the industry.

The evening featured a keynote address from Stephen Sigmund, chief of public outreach for the Gateway Development Commission, who shared insights on the progress and importance of modernizing the 115-year-old Gateway rail tunnels linking New York and New Jersey, one of the most significant infrastructure undertakings in the nation. Sigmund emphasized the role of the A/E/C community in delivering transformative projects that shape the future of the region.

Elizabeth Weiss, A.J. McNulty & Co.

During his opening remarks, Phillip Ross, co-leader of Anchin’s Architecture & Engineering and Construction Industry Groups, highlighted the event’s significance in this landmark year, reflecting on the industry’s strength in navigating an evolving economic landscape, shifting policies and generational infrastructure investments.

“What began as a gathering to highlight standout firms has grown into one of the most anticipated evenings of the year for the AEC community: a testament to the progress and resilience of this industry,” Ross said.

Fred Ackerman, co-leader of Anchin’s Architecture & Engineering and Construction Industry Groups, closed out the celebration with remarks that noted the importance of collaboration.

This year’s honorees in the form of Anchin Legacy Awards, were ACEC of New York, EJ-Electric Installation Co., Gensler, Langan, New York Building Congress (NYBC), Perkins Eastman, Shawmut Design & Construction, Subcontractors Trade Association (STA), Thornton Tomasetti and Turner Construction Company.

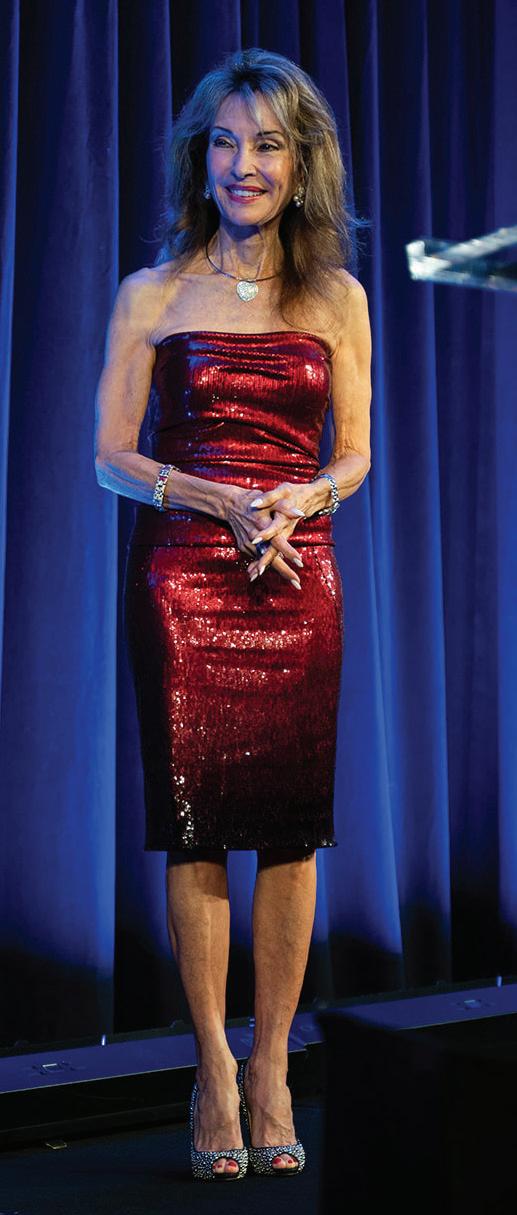

The 2025 Heart of New York City Gala united 500 guests at Pier 60, Chelsea Piers for an evening of inspiration and impact. Organized as part of the American Heart Association (AHA) New York City Heart Challenge chaired by JLL Tris-tate President Peter Riguardi, the annual event was themed “The Future of Heart,” and highlighted AHA science that will be responsible for shaping the future of cardiovascular health and healthcare as we know it.

NBC’s Today show nutrition expert and bestselling author Joy Bauer emceed the evening, which was chaired by CBRE’s Michael Monahan, and featured powerful stories from survivors. Among them were JLL Vice Chairman Alex Chudnoff, a two-time open-heart surgery survivor, and Bonni Brodnick, a stroke survivor, who were recognized as “caretakers of the torch” for their dedication to the AHA’s mission across generations.

Guests enjoyed an evening of fine dining, an exciting auction and futuristic entertainment. Actress Susan Lucci, national ambassador for the Go Red for Women initiative, also took to the stage to spotlight how the AHA empowers people of all ages to live longer, healthier lives.

The gala is the cornerstone of the Heart of New York City campaign, celebrating milestones in research funding, education, and community outreach. Funds raised will support research, advocacy, and programs to fight heart disease and stroke—the leading causes of death in New York and nationwide—while driving change to improve health outcomes for everyone, everywhere.

Meridian negotiates and closes more than $1 billion in underlying cooperative loans and lines of credit annually

Verizon will relocate its New York headquarters to Penn 2, Vornado Realty Trust’s reimagined office tower in the heart of The Penn District campus.

As part of a 19-year lease, Verizon will occupy nearly 200,000 square feet in office space across the eighth through 10th floors of Penn 2, which will also include exclusive access to more than 25,000 square feet of outdoor space. Verizon will also establish a flagship retail location on Seventh Avenue.

“We are thrilled to welcome Verizon to the growing roster of world-renowned business, communications, technology, finance and entertainment firms that have chosen The Penn District for their corporate homes,” said Glen Weiss, executive vice president-office leasing and co-head of real estate for Vornado Realty Trust. “Our reinvention of The Penn District has produced a vibrant gateway to New York’s new West Side and represents a new era of workplace thinking, where dynamic environments, unparalleled connectivity and employeefocused design come together to inspire collaboration and innovation.”

Vornado’s Penn 2 transformation incorporates a new, modern and

highly efficient curtain wall; a triple-height lobby; 16 distinctive doubleheight outdoor tenant loggias and The Bustle. The new Penn 2 also encompasses 30,000 square feet of curated retail, including The Dynamo Room, a 7,100-square-foot, full-service restaurant and bar from Sunday Hospitality. The building features 72,000 square feet of outdoor green spaces; The Perch, a rooftop glass pavilion and event space that opens onto a lushly landscaped 17,000-square foot private green space available to all tenants and a 280-seat Town Hall suspended above the 33rd Street promenade.

Penn 2 also serves as the corporate headquarters for Madison Square Garden, Universal Music Group and Major League Soccer. Together with its neighboring Penn 1, the towers create a two-building connected campus in the heart of The Penn District. The twin projects encompass 4.4 million square feet of premium offi ce space, new and improved entrances to Penn Station and the surrounding subway system, as well as acres of new public plazas, landscaping and granite-paved sidewalks.

All Penn District tenants have access to 180,000 square feet of Vornado’s WorkLife amenity package, highlighted by The Landing, a full-service restaurant, bar and private dining rooms; a 53,000-squarefoot sports, wellness and fitness center and 100,000 square feet of flexible workspace and conference facilities.

A Cushman & Wakefield team led by Executive Vice Chairman Josh N. Kuriloff, Peyton Horn, Heather Thomas and Kyle Ernest represented Verizon. Vornado was represented in-house by Weiss, Josh Glick, Jared Silverman and Anthony Cugini.

RFR announced several largescale renewals at its 17 State St. as the firm plans for a new amenity center and updates to its public plaza. In total, RFR has recently inked 80,680 square feet of new and renewed leases at 17 State St.

Alphadyne Asset Management, an alternative investment management firm, signed an early renewal of its 43,872-square-foot, threefloor lease. The firm has been at 17 State since 2005. Alphadyne was represented by Silvio Petriello of CBRE; RFR was represented in-house by AJ Camhi, Paul Milunec and Ryan Silverman.

“This building is a prominent landmark in the downtown New York skyline,” said Camhi, director of leasing for RFR. “With its proximity to Battery Park and sweeping views of New York Harbor, 17 State St. is one of the most sought-after addresses in Manhattan. Our plans to introduce a new lounge and conference center in the building has further elevated the allure of the building for new and existing tenants while fortifying its reputation as one of New York’s premier office buildings.”

The new amenity space — designed by Studios Architecture and dubbed Liberty Lounge & Conference Center — will include hospitality and flexible space. The amenity space will feature four distinct functions: social/collaborative seating that can transform into a Town Hall-Screening Room, a well-appointed café, a library lounge and a 32-person boardroom. The interior design will celebrate the character

of the flourishing neighborhood with warm-toned modern fixtures and accents and natural green foliage. For healthy commuting, an “End of Trip” facility offers a changing room, shower and space to freshen up.

On the public plaza, RFR is enhancing the landscaping and providing updated seating.

Several tenants have re-committed to long-term leases while four tenants signed on for 12,000 square feet of new leases. Camhi, Milunec and Silverman represented RFR Realty, which has also hired a JLL team of Mitchell Konsker, John Wheeler, Andrew Coe and Margaux Kelleher to assist in leasing:

• Law firm Bressler, Amery & Ross, a tenant since 1995, will renew and relocate its 8,243-square-foot commitment. Robert Goodman of Cresa represented the tenant.

• Atlantic Specialty Coffee, a commodity services group specializing in coffee, cocoa and cotton, renewed its 6,167-square-foot space and has been a tenant since 1994. CBRE’s Michael Rizzo and Richard Levine represented the tenant.

• Asset management firm Friendly Capital, a tenant since 2003, renewed its 3,899-square-foot commitment.

• Samson Funding, which provides capital to small and mid-size businesses, renewed its 6,181-square-foot commitment. It has been a tenant since 2021.

• AI-powered life insurance tech firm Optifino joined the tenant roster with a 5,138-square-foot lease. Derrick Ades and Lewis Gottlieb of CBRE represented the tenant and Konsker, Wheeler, Coe and Kelleher of JLL along with the RFR leasing team represented the landlord.

• Law firm Pierkarski Law signed a new 3,917-square-foot lease. Jimmy Ishay of Gotham Realty represented the tenant.

• Medical technology firm Aspargo Laboratories signed a new, 3,263-square foot lease coming out of a sub-tenancy at 17 State.

investment to enhance and elevate the property. Our goal is to create a best-in-class experience for tenants, offering the kind of amenities typically reserved for major corporate campuses. This effort has positioned the building to meet the evolving expectations of today's tenants,” said Michael Hakakian of Creed Equities.

JLL has leased 39,522 square feet of office space in several transactions at 1330 Avenue of the Americas, a boutique, 525,000-square-foot Midtown tower owned by a joint venture of Creed Equities, Hakimian Capital, CH Capital Group and Nassimi Realty.

The 40-story tower, featuring rare floorplates of 10,000 square feet to 16,000 square feet along Sixth Avenue, is undergoing strategic renovations by ownership to meet the demands of tenants seeking premium amenities, custom pre-built space and a premier location.

Ownership’s capital improvements will feature a suite of amenities called Club 1330, which will consist of shared conference facilities, a tenant lounge, a large café, state-of-the-art golf simulator and dedicated wellness room set to be complete this month.

“We’re thrilled by the recent leasing momentum, which validates our

A JLL team led by Executive Managing Director Christine Colley, Managing Director Simon Landmann, Vice Presidents Lance Yasinsky and Thomas Swartz and Vice Chairman Mitch Konsker serves as exclusive leasing agent for the property.

Prime Finance expanded to 10,400 square feet, taking the entire 25th floor with a new lease extension; York Capital Management renewed its 10,000-square-foot direct lease for five years, with JLL's Evan Margolin representing the tenant.

Pamplona Capital Management relocated from 667 Madison Ave., leasing 5,243 square feet on the 24th floor, represented by Corrine Neupaur of Tishman Real Estate; MFG Partners extended and expanded to 4,525 square feet on the 26th floor, represented by David Yablon of Katz & Associates.

Sellaronda Global renewed its 3,445-square-foot lease for three years, represented by Jonathan Anapol of Prime Manhattan. Apollon Wealth Management renewed its 3,072-square-foot lease for five years, represented by Barry Zeller and Troy Elias of Cushman & Wakefield; General Equities renewed its 2,837-square-foot lease for five years.

Triangle Equities has been awarded a $1 million grant from Empire State Development in recognition of Terminal Logistics Center, a Class-A, 413,936-square-foot, five-story vertical warehouse facility located at 130-02 South Conduit Ave. in Jamaica, Queens, along with the project’s job creation and community impact efforts.

The facility is divided into two units. A warehouse used for air cargo currently being leased by DO & CO, an international airline caterer headquartered in Austria, features two stories of truck courts connected by a ramp. The second unit is comprised of part of the cellar as well as the third through fifth floors, and is currently occupied by Safeguard, a selfstorage facility providing storage to individuals and small businesses.

“Triangle Equities is incredibly proud to have developed Terminal Logistics Center in Queens. As a third-generation firm founded and built in the borough, we have always sought to deliver projects with meaningful impacts to the Queens community, as well as the tri-state region at large,” said Evan Petracca, chief operating officer at Triangle Equities. “This grant from Empire State Development affirms our commitment to excellence in community-building and development. We are excited to continue our work to further add value and contribute to our great city.”

“Terminal Logistics Center is a model of smart, community-driven development — transforming an underutilized site into a hub of economic opportunity and innovation,” said Empire State Development President, CEO and Commissioner Hope Knight.

Prior to its redevelopment, the site was home to one of JFK International Airport’s satellite parking lots, employing approximately five full-time employees. To date, Terminal Logistics has created 900 jobs for Queens County and directed more than $10.8 million to minority and womenowned business enterprise (M/WBE) contractors. The project’s air cargo infrastructure is essential to JFK International Airport’s global competitive advantage, answering the call to a rapidly increasing need for fast and reliable logistics, further alleviating supply chain pressures, and generating approximately $29 million of output growth annually,

Terminal Logistics Center is located in a dense urban area, a rarity for facilities of this size and nature. Due to its location, Triangle Equities approached the development of the facility with innovative tactics, prioritizing the needs of the local community. To capitalize on the building’s relatively small footprint, Triangle Equities worked with architecture firms Nelson and GF55 Architects to design Terminal Logistics Center as one of the first multistory industrial buildings in the United States at the time of its planning, building upward rather than outward. The project team developed a ramp connecting the first and second floors of the building, large enough for 53-foot trucks to navigate its 28 loading docks. Additionally, Triangle Equities liaised with Queens Community Board 10 and local representatives from nearby PS 124 Osmond A. Church to alleviate

New construction is becoming a more affordable, and increasingly attractive, option for today’s homebuyers as the price premium over existing homes hit a record low of 7.8% in Q2 2025, according to the latest Realtor.com “New Construction Quarterly Report”. Newly built homes are not only more plentiful than they’ve been in recent years but also offer better value on a per-square-foot basis than existing homes, especially in the South where supply is rebounding fastest.

“In a market still grappling with a shortage of nearly four million homes, affordable new construction plays a critical role in restoring balance. Even with recent slowdowns in starts and permits, builders continue to deliver new homes to the market at a healthy pace,” said Realtor. com Chief Economist Danielle Hale. “In many areas, these homes are not only available, they also offer better value compared to existing home inventories. We’re even seeing new home price declines in some of the most active pandemic-era hot spots, signaling a shift toward greater affordability in markets that were previously out of reach for many.”

In Q2 2025, the price premium for new construction compared to existing homes dropped to a record low of 7.8%, as builders held pricing steady and existing home prices continued to rise. The median list price for a newly built home was $450,797 in Q2, essentially flat from a year ago, while the median existing home prices rose 2.4% to $418,300.

Nationally, new builds averaged $218.66 per square foot, compared to $226.56 for existing homes.

The affordability edge is strongest in the South and West, where new homes make up a greater share of for-sale listings. The West, which offers relatively lower new construction prices compared to the other regions, was the only region where the new-home premium rose year over year – a reflection of strengthening new home prices and an influx of lower-priced existing homes.

Locally, new build list prices declined in 30 of the 100 largest metros, with the steepest declines in the South, where inventory is high and demand has cooled. The top five markets seeing the biggest drops in new construction list prices are Little Rock, Ark. (-15.6%); Austin, Texas (-8.5%); Wichita, Kan. (-7.9%); Jacksonville, Fla. (-7.8%) and Cape Coral, Fla. (-7.4%). These price drops are from a combination of factors: builder efforts to offer more affordable options, rising competition from existing homes and weaker buyer demand.

The South continues to lead the nation in housing supply, accounting for more than 50% of both new and existing home listings, outpacing its 39.4% share of U.S. households. It’s also the only region where its share of new builds exceeds its share of existing homes for sale, thanks to high levels of builder activity. In contrast, the Northeast remains the most inventory-constrained region, with a significant shortage of both existing and new construction homes for its 17.1% share of U.S. households. In the Midwest and Northeast, tighter inventories and high demand have pushed new build prices well above existing homes, more than 50% higher in many cases, making new construction largely a premium product in those regions.

While builder activity has softened amid tariff concerns and the threats of lower demand and higher material costs, completions have continued to hit the market at a steady rate since the pandemic, as builders stepped in to meet elevated housing demand.

closer to revealing the project’s full architectural form and introducing a distinguished new landmark on the Upper East Side.”

The condominium is a timeless reinterpretation of classic prewar architecture, featuring an Indiana limestone façade with sculpted reliefs, signature rope-trimmed window surrounds, and custom decorative railings that lend an added sense of craftsmanship and distinction.

Investment

1122 Madison Ave., a new condominium development that will introduce 26 residences to the Upper East Side.

and

“The start of superstructure at 1122 Madison Ave. is an important milestone for Legion Investment Group,” said Victor Sigoura, founder and CEO of Legion Investment Group. “With each slab pour, we come

The 26 homes are designed with large floor plans for modern city living, and select residences include terraces, balconies and, in many cases, uninterrupted and protected views of Central Park.

“William Sofield and his team have crafted a condominium that both honors the architectural legacy of the Upper East Side and introduces something truly distinctive. With vertical construction now underway, we look forward to seeing Studio Sofield’s vision come to life at this iconic landmark location,” said Genghis Hadi, managing principal and cofounder at Nahla Capital.

Sales are expected to launch this fall, exclusively led by Corcoran Sunshine Marketing Group and The Cathy Franklin Team at The Corcoran Group. Residences will begin at $10 million, and the building is slated for completion in mid-2027.

Manhattan-based real estate private equity firm and debt fund manager Northwind Group announced the origination of a $11 million senior firstmortgage loan for the acquisition of 10 West 17th St., a fully entitled, vacant land parcel planned for the development of an 18-story, 23unit luxury residential condominium project in Manhattan’s Flatiron submarket.

The loan was originated by Northwind Debt Fund III, the firm’s latest flagship closed-end fund, focused on real estate credit investments across major U.S. gateway markets. Following a record year in 2024 with over $1.1 billion in originations, Northwind continues to originate and close new loans across its target markets.

Prosper Property Group, a vertically integrated real estate firm with a track record in New York City residential projects, will lead the development of the property, located on 17th Street between Fifth and Sixth Avenues. Once complete, the project will feature 23 boutique luxury residences ranging from two to four bedrooms.

“We are pleased to provide financing at a favorable basis in one of Manhattan’s most sought-after neighborhoods,” said Ran Eliasaf, founder and managing partner of Northwind Group. “We look forward to working with Prosper Property Group on this development and building a long-term relationship, as part of our broader commitment to supporting New York City’s residential market and helping to deliver much-needed new housing”

The financing was arranged by Andrew Iadeluca, a principal of New Development Capital.

In a market where affordability and space are increasingly rare, The Openaire at 26-15 4th St. in Astoria, Queens introduces a value-driven alternative on the Astoria-Long Island City border. The 13-story, 143unit condominium offers spacious layouts, extensive amenities and unobstructed views of the Manhattan skyline and East River, at price points starting under $500,000.

Prices for the studio to two-bedroom homes are priced from $499,000 to $915,000. The project represents a timely opportunity for first-time buyers, investors and families alike, especially given the low monthly carrying costs and strong rental demand in the area.

“We see The Openaire as a return to what city living should be — livable, light-filled homes with room to grow,” said Eric Benaim, CEO of Modern Spaces, which is leading the sales for the building. “You’re not sacrificing location, amenities or design to access value. This is one of the smartest buys on the waterfront right now.”

The Openaire offers studios starting at $499,000, one-bedrooms from $582,000, and two bedrooms from $803,000. Most residences feature private outdoor space, many with sweeping views of the Manhattan skyline and East River. Residents will enjoy a full suite of amenities, including a rooftop terrace with barbecue grills and landscaped lounge areas, a fully equipped fitness center, a residents’ lounge and coworking space. The building also features a 24-hour doorman, on-site parking and a private shuttle service that connects to nearby subway and ferry stops. The Openaire offeres convenient access to Midtown via the N/W trains, the Astoria ferry and the RFK Bridge.

Sales launched in early August 2025.

EV charging software provider Epic Charging has migrated 148 smart charging stations to its own charge point management system (CPMS) at a 401-unit condominium building in downtown Chicago. With over a quarter of the units opting for an EV charger in their dedicated parking spaces, this project is believed to be one of the the largest residential installations of EV chargers in the United States to date.

The migration followed the abrupt exit of Enel X Way from the U.S. market, leaving many multifamily buildings in search of a reliable, scalable charging solution.

“After exploring all the options, we concluded that Epic Charging was the only company offering the fully integrated smart solution we wanted,” said Sunil Mehra, board president of the 600 N Lake Shore Drive Condominium Association. “[Epic’s] turnkey software and support services made configuring and operating 148 individual EV chargers in a multi-story parking garage seamless and hassle-free. And with the capacity to install many more, this project cements 600LSD as a

cutting-edge high-rise residence in downtown Chicago.”

To ensure a smooth transition, Epic’s CTO Michael Fridshtand traveled onsite to work closely with the building’s IT team, bringing handson expertise in reconfiguring the network to the Open Charge Point Protocol (OCPP) platform. The integration required custom engineering — particularly for RFID authentication on discontinued Enel X hardware. In addition, Epic partnered with local utility ComEd to enroll the property in its Voluntary Load Reduction Program, which helps support grid reliability during peak hours while continuing to satisfy resident charging needs. ComEd’s VLR pays participating sites at least $0.25 per curtailed kWh during peak-demand events.

Residents at 600LSD now use Epic’s mobile app and RFID cards with both the existing Enel X Way and new Autel chargers to activate, schedule, monitor and pay for their charging sessions. With real-time visibility and analytics, residents can optimize electricity usage and schedule charging during off-peak hours, while the building benefits from load-limiting features that reduce infrastructure strain and support future charger expansion.

“Multifamily units account for about 31% of housing in the U.S., and with most charging happening at home, it’s critical for multifamily property owners to begin deploying EV charging infrastructure,” said Michael Bakunin, Epic co-founder and CEO. “Successfully migrating 148 chargers at a sizable condo building in downtown Chicago further cements our leadership in the multifamily market, which is the fastestgrowing segment in the U.S. for Level 2 charging, by demonstrating our ability to deliver scalable, grid-friendly solutions for large residential communities.”

region president. “Stephen is a respected leader who understands the unique challenges and expectations of healthcare clients. His expertise, combined with Suffolk’s national resources and technology-driven approach, will allow us to deliver unmatched value to our partners.”

National builder Suffolk is expanding its California footprint with the opening of a new office in Newport Beach. This strategic expansion strengthens Suffolk’s presence in Southern California and enhances its ability to serve sophisticated healthcare clients along the vital corridor from San Diego to Los Angeles, the firm said.

The Newport Beach office will be led by construction industry veteran and Suffolk General Manager Stephen Green, who brings decades of experience managing large-scale, complex healthcare projects and high-performance teams.

“Suffolk is proud to deepen our investment in Southern California through this strategic expansion,” said Jeff Hoopes, Suffolk West Coast

By leveraging AI, predictive analytics and sophisticated digital tools, Suffolk, a full-service general contractor, helps clients make smarter decisions, minimize risk and drive efficiencies at every stage of the building lifecycle, from early planning and preconstruction to closeout and turnover, the company said. This integrated, collaborative approach is especially valuable in healthcare, where certainty, safety and schedule are critical to success.

“We’ve built the right team of local experts who understand this region and bring the specialized healthcare experience our clients need,” Green said. “This team’s deep roots and proven track record position us to make an immediate impact in the market and deliver exceptional value to our partners.”

Suffolk’s healthcare and life sciences clients include the corporate headquarters of Regeneron in Tarrytown and White Plains Hospital in Westchester County, both in New York; Tampa General Hospital in Florida; Gilead Life Sciences in Foster City, California and Boston Children’s Hospital.

The New York Chapter of Professional Women in Construction (PWC NY) announced the 2025 recipients of its annual Scholarship Program, which recognizes six students pursuing a degree in the AEC industry. The recipients are Carmen Herranz, City College of New York (CCNY); Pop Joslaine Manos, CCNY; Richie Ng, Columbia University; Lada Sokolova, New York University; Natalia Tanko, CCNY and Jerrica Wallack, CCNY.

PWC NY is a nonprofit organization that supports and connects careerminded women and works to promote diversity within the architecture, engineering, construction and related fields. PWC NY actively engages members through committees and activities structured to provide leadership opportunities, networking and professional development. The PWC NY Scholarship Program was created in honor of Founder Lenore Janis to encourage the next generation of women in AEC.

“There are so many opportunities in AEC for young women today,” said Regina Rivera, executive cirector of PWC NY, in the announcement. “We can provide guidance and resources to help them on their way to a successful career.”

The PWC NY scholarships for 2025 are funded through a partnership with Designers Lighting Forum of New York (DLFNY) in honor of Caroline Rinker, past president.

“Caroline Rinker was a passionate advocate in the New York Lighting Community and her commitment to advance women in the profession embodies the mission of PWC NY,” Rivera added. “We are honored to celebrate her legacy through this scholarship partnership with DLFNY.”

In addition to the monetary award, each scholarship recipient receives a one-year complimentary membership to the PWC NY Chapter, which includes access to all committee and member-only events, and will be an invited guest to PWC’s Salute to Women of Achievement celebration in September.

Savills has acquired Hoffman, a move management consultancy, along with Compustall Services Inc., a technology relocation services provider. The acquisition of both companies marks a continued expansion of the firm’s integrated service platform, providing clients with a single, seamless solution for planning and executing complex workplace transitions across sectors and geographies.

“In the spirit of continuity, stability and growth for our team and our clients, I’ve decided it’s the right time to join a global company led by people I know and trust,” said Rick Hoffman, founder of Hoffman, now president of Savills North America Relocation Management. “We’ve worked with Savills for decades. They understand our business and share our values. With their global platform and resources, we’re positioned to grow together in powerful ways.”

Founded in 1987 in New York City, Hoffman began as a specialist in office relocations and has since evolved into a national consultancy serving a broad range of industries and space types, including headquarters, hospitals, labs, trading floors, media studios and academic campuses. The firm manages both single-site and portfoliowide relocations, overseeing projects totaling approximately 10 million square feet annually. Compustall specializes in the management of seamless IT transitions during workplace relocations.

Rick Hoffman and his leadership team will continue to oversee the business as part of Savills Relocation Management.

“Hoffman has long collaborated with Savills on cross-client relationships in legal, healthcare, education and other sectors where workplace transitions are mission-critical. We are pleased that Rick and his leadership team will be staying on to lead this service,” said David Lipson, CEO of Savills North America. “This acquisition allows us to

offer essential relocation services that impact the employee experience across the life of a lease. When done well, these services enhance productivity and engagement, and we are proud to welcome one of the industry’s best providers to the platform.”

Savills Relocation Management will work with clients through every stage of occupancy, from move-in to ongoing transitions and end-oflease decommissioning. Savills clients will gain access to an expanded suite of services, including planning, logistics, relocation, activation, technology support, storage and decommissioning, delivered through a consistent, scalable process nationwide.

“Hoffman is a long-time trusted partner to several of our clients, and we are proud to have them aboard. Together, we are building upon an established working relationship and a shared commitment to service,” said Michael Glatt, president, Savills North America Project Management. “The team will work closely with Savills Change Management and other consulting practices to deliver integrated, endto-end support for complex transitions.”

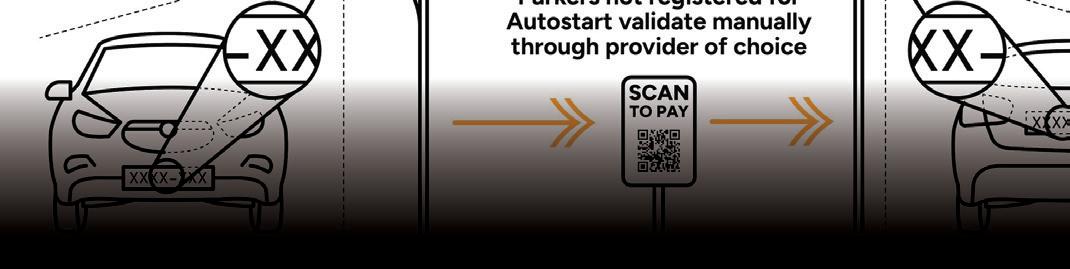

Unlike other payment networks serving the parking industry, this open network allows parking owners and operators to choose their preferred payment provider for collecting parking fees.

“Autostart is a game changer when it comes to parking,” said John Conway, co-founder and chief business development officer for PRRS. “Ticketless parking enables a more efficient, cost-effective and driverfriendly experience, but it has always been challenging to manage payments fairly and accurately. Autostart solves that problem and makes free-flow parking work for any parking facility.”

PRRS, a provider of parking compliance solutions, announced the introduction of Autostart, an AI-powered parking management technology designed to transform the way drivers access and pay for their parking. Powered by Paralign’s ARCFlex software and leveraging advanced AI vision, Autostart offers an open network; precise payment activation for gateless, free-flow parking facilities, capturing and verifying license plate data the instant a vehicle enters and exits a facility and automatic charging of drivers for the exact amount of time that the parking session lasted via a preferred payment platform.

Autostart provides instant vehicle recognition with 99.88% accuracy, using AI vision technology; automatic payments if the driver is preregistered with the facility’s preferred payment provider; flexible options for all parkers; real-time notifications and precision billing.

ARCFlex is already integrated with more than 45 parking payment providers and PRRS is migrating payment providers to Autostart.

“Until the introduction of Autostart, drivers parking in ticketless parking lots and garages had to pre-pay for a set amount of parking,” said Conway. “The problem is that people don’t always know how long they will park. Meetings run long or people just lose track of time. When that happens parking owners have had to treat overstays as an enforcement issue, sending notices for noncompliance fees. Drivers hate receiving notices for $50 or more. Autostart minimizes this unpleasant pain point.”

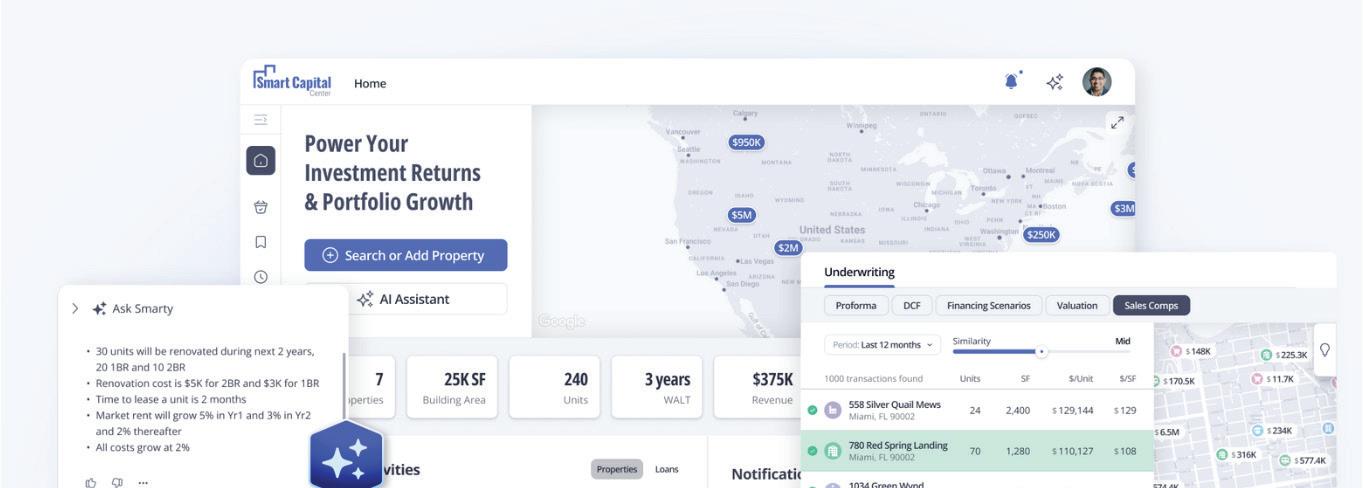

CRE loan underwriting and due diligence, eliminate operational bottlenecks in CRE asset management, reduce risk exposure through real-time portfolio intelligence and expand deal volume without the cost of additional hires.

Whether a professional is pricing loans, modeling cash flows or tracking lease expirations, these assistants can bring CRE workflow automation to every part of the investment lifecycle.

AI-powered CRE finance platform Smart Capital Center announced the launch of its AI Analysts and Assistants — always-on, intelligent team members built to automate complex workflows, extract critical insights and elevate performance across the full commercial real estate lifecycle.

Smart Capital’s AI Analysts operate like 100 times-capacity teammates, available around the clock to support investment, lending and asset management teams. They handle high-volume tasks across underwriting, portfolio management and loan servicing — streamlining decision-making, reducing manual work and maximizing ROI. From rent roll interpretation and investment analysis to clause-level legal review and real-time risk alerts, the platform delivers a fully deployable, end-toend CRE solution designed for scale.

By automating these workflows, the platform enables firms to accelerate

The CRE platform’s AI analysts are capable of acting as underwriters, asset managers, analysts, legal reviewers, project managers and capital markets professionals across the full deal-to-asset lifecycle.

Capabilities include answering document-based questions instantly, summarizing key legal clauses, understanding financials and KPIs, generating property overviews instantly and natural-language search across all documents.

Key functions include semantic clause-level comparison, data validation and exception management, tenant-level lease analysis, comparative market analysis (CMA) integration, insurance compliance verification and real-time alerts.

The platform adapts to each organization’s workflows and communication style, ensuring consistent output, compliance with internal standards and smooth integration.

“We built these AI analysts to help CRE businesses stay focused on what matters: strategy, relationships and growth,” said Laura Krashakova, CEO of Smart Capital Center. “Our platform handles the complexity — so your team can handle the opportunity.”

solutions that deliver value across their entire portfolio,” said Daniel Russo, president of property management technology at JLL. “Prism AI supercharges our professionals to make smarter decisions. This isn’t just about efficiency; it’s about fundamentally elevating the standard of property management while delivering exceptional value to our clients and tenants.”

JLL has introduced artificial intelligence (AI) capabilities that are now available as an add-on to its Prism building operations platform. As part of JLL’s property management technology ecosystem powered by JLL Falcon, Prism AI provides comprehensive, predictive operational intelligence across all aspects of building operations — with the results driving faster decisions on resource allocation, tenant satisfaction, risk mitigation, vendor management, capital investments and more, the company said.

“In today’s market, where expectations around building performance are multifaceted, investors are hyperfocused on implementing technology

Prism AI transforms disparate property documents stored in Prism into an integrated, searchable knowledge base that automates administrative tasks and streamlines workflows. Property teams can get smart recommendations to improve tenant satisfaction based on Prism AI’s analysis of service request patterns. Teams can analyze years of property task and workflow data. Engineers can leverage Prism AI to analyze service manuals against warranty documentation to detect coverage opportunities and prevent costly out-of-pocket repairs.

Prism’s interface allows users to simple, conversational questions like, “What issues from last quarter’s property inspection are still outstanding?” and get instant answers plus relevant recommendations. Prism AI maintains complete data separation so property data, tenant information and financial details remain private to each organization.

“Prism AI represents a transformative leap forward in property management technology, seamlessly combining advanced data analytics with practical, actionable intelligence,” said Yao Morin, chief technology officer at JLL. “As client expectations continue to evolve, JLL remains focused on developing solutions that not only meet today’s challenges but anticipate tomorrow’s opportunities, setting new standards for excellence across commercial real estate.”

“AI’s real promise lies in how it reshapes the human experience of work,” said Dana Jones, RealPage CEO and president. “It’s about removing daily barriers, reducing burnout, and giving teams the bandwidth to show up with energy and purpose to focus on what matters most — delivering exceptional experiences for their residents.”

RealPage, a global provider of AI-enabled software platforms to the real estate industry, unveiled the Lumina AI Workforce, the multifamily industry’s first agentic AI platform, at RealWorld 2025, an event focused on multifamily innovation, held in Las Vegas.

The Lumina AI Workforce marks a decisive shift away from fragmented tools and task-based automation toward an orchestrated network of intelligent agents that act, learn and collaborate across multifamily domains. These AI agents operate in sync with human teams, handling repetitive tasks, coordinating workflows and surfacing actionable insights. This allows property staff to stay focused on strategic, highimpact work.

The first five Lumina AI Agents, each specialized in a core multifamily domain, yet built to collaborate and drive results together, are AI Leasing Agent, which connects with prospects, answers questions and helps guide them from first contact to signed lease; AI Resident Agent, which keeps residents informed, engaged and supported; AI Operations Agent, which handles the day-to-day details of running a property, like move-ins, renewals, audits and reporting; AI Facilities Agent, which responds to maintenance needs, schedules inspections and keeps repairs on track with staff and vendors and AI Finance Agent, which handles routine finance tasks like coding invoices, catching errors, reconciling accounts and sending reports.

The agents are built directly into familiar platforms such as OneSite, Knock and Loft.

The Lumina AI Workforce is powered by the Lumina AI Data Platform, RealPage’s multi-year investment in secure, scalable and deeply integrated AI infrastructure. This foundation ensures AI is not a bolt-on, but a core capability embedded across the RealPage ecosystem.

Founded in 1998 and headquartered in Richardson, Texas, RealPage joined the Thoma Bravo portfolio of market-leading enterprise software firms in 2021.

earthquake striking California within the next 30 years, according to the United States Geological Survey.

“You can’t control when the next quake hits, but you can control how ready you are for it,” Tourjé said.

The recent tsunami warnings issued along California’s coast following a magnitude 8.8 earthquake off Russia’s Kamchatka Peninsula may have seemed excessive — especially when only small waves reached the shore.

But when it comes to California’s seismic readiness, “There is no such thing as an overabundance of caution,” Kyle Tourjé, executive vice President of Alpha Structural said, noting that many California cities remain unprepared for the 99% chance of a magnitude 6.7 or larger

Recent policy changes could set the state back decades in terms of disaster readiness. In May, the Federal Emergency Management Agency (FEMA) canceled $30 million to $33 million in retrofit grants intended for California’s highrisk softstory apartment buildings. These buildings, common in Los Angeles and tracked for compliance by the Los Angeles Department of Building Safety (LABDS), have historically caused deadly collapses in events like the 1994 Northridge quake.

San Francisco enacted an ordinance on May 9, 2025, requiring preliminary structural assessments of nearly 4,000 nonductile concrete or tiltup buildings to be completed within 18 months. This means owners must hire engineers to evaluate seismic risks, which can cost thousands per building. In contrast, Los Angeles passed an ordinance targeting both soft-story and non-ductile concrete buildings, but retrofitting non-ductile concrete structures presents far greater funding challenges because of their size, complexity and high costs. This blend of urgency and caution has experts calling for faster progress — pushing Californians from assessment to implementation and building the partnerships needed to safeguard the city’s buildings.

a billion dollars in lifetime sales, is led by Ashley Reidy Quinn and Nick Montalbano. Quinn co-founded the team with Montalbano, and in addition to overseeing and generating the team's sales and rental transactions, she leads its operations, marketing and client experience strategy. She earned the distinguished Real Estate Board of New York’s “Rental Deal of the Year” award during her first year in the business. Montalbano leads the team's business development and sales strategy. The team’s transactional range spans Manhattan, Brooklyn and the Hamptons, and includes work within prominent properties such as 212 Fifth Ave. and 33 East 74th St.

Coldwell Banker Warburg (CBW) announced that two teams are joining the firm from Elegran Real Estate: the Asset Advisory Team and the Waterview Advisory Group. In recent months, 25 real estate brokers and agents have joined CBW from Elegran and other brokerages and firms.

“We’re thrilled to welcome not one, but two exceptional teams to Coldwell Banker Warburg. The fact that they’ve chosen CBW as their next home is a testament to the culture we’ve built, the standards we uphold, and the future we're creating together,” said Kevelyn Guzman, regional vice president of Coldwell Banker Warburg. “The Waterview Advisory Team is a powerhouse — they’re analytical, growth-focused, and bring a modern investment approach to every deal. The Asset Advisory Team leads with integrity, collaboration and a strong track record of client success.”

The Asset Advisory Team, which has amassed more than a quarter of

The Waterview Advisory Group boasts a quarter of a billion dollars in transactions across New York and globally. It provides a wide range of agent and advisory services, ranging from residential sales listings, buyer representation, rental listings, property investment analysis and to commercial real estate sales and rentals. The group is led by its founder, agent Jules Garcia, a former regional vice president and 20-year financial services industry veteran. He focuses on upscale townhouses, new developments and multifamily properties in Brooklyn and Queens. Also on the Asset Advisory Team are Agents John David Henning, an expert in digital marketing, social media strategy and consumer behavior and Allie Dornier, The granddaughter of a real estate broker, with experience in property management.

The Waterview Advisory Group also includes Agents William Yau, who previously negotiated multimillion-dollar media investments with Fortune 500 companies in the financial, travel, retail, and e-commerce industries, and Nikita Idira, whose 10 years of experience spans Manhattan, Brooklyn and Long Island.

The two teams join three other agents who recently moved to CBW from Elegran Real Estate: Gina Conzo, Jarrod Duncan and John Cella.

Flexspace AI is following the success of its industry-first Flexspace AI Dynamic Pricing with a new 2.0 version that allows coworking space and flexible real estate operators the ability to automatically optimize pricing of their spaces and adjust in real-time, just like hotels.

Flexspace AI’s SmartPricing Agent taps into the power of AI to automatically optimize pricing based on various demand data sets and market trends, deliver the best rate at the right time to increase real-time booking conversion and learn about the price elasticity for each of their offices and meeting rooms.

“With our SmartPricing Agent, we’re turning flexible real estate into intelligent commerce: said Eyal Lasker, co-founder and CEO of Flexspace AI. “Just like Shopify transformed online retail, our AIpowered ecommerce revenue platform gives coworking and flexible real estate operators the tools to sell and price dynamically, from hourly meeting rooms to monthly offices, in real time.”

Coworking space operators like Werqwise, The Malin, The Shop Workspace and Venture X have experienced five times revenue on average in the first 12 months with the e-commerce revenue platform.

“Flexspace AI has driven consistent, measurable growth for The Malin across customer engagement and website revenue performance, with over 70% growth quarter-over-quarter in 2025, and strong momentum heading into Q3,” said Jordan Gallagher, director of operations, The Malin.”This has been largely fueled by actionable trend and behavior data that helped us refine our positioning, pricing and local marketing for greater efficiency.”

Operators like Gallagher can increase their revenue without having to make time-consuming manual adjustments.

Representatives of CBRE, led by Jeffrey Dunne, Stuart MacKenzie, Eric Apfel and Travis Langer of CBRE Institutional Properties, in partnership with Roland Merchant and Tom Pryor of CBRE’s Investment Banking team, announced the $177 million sale of The James, a Class A multifamily community in Park Ridge, N.J. CBRE advised the owner, Veris Residential, on the sale.

Built in 2021, The James consists of 240 apartments along with nearly 18,000 square feet of ground- floor retail space. The property features luxury Class A finishes along with an expansive amenity package, including a fitness center with Precor equipment; a yoga and spin studio; coworking spaces; multiple clubrooms, including a game room with billiards and shuffleboard; a plunge pool; an outdoor lounge with TVs, firepits and BBQ grills and more.

The property is situated in downtown Park Ridge, an affluent suburb in Bergen County, and adjacent to Park Ridge Station, which serves NJ Transit’s commuter railroad, offering frequent service to Hoboken and easy connections to Midtown Manhattan in under an hour.

“Following the $85 million disposition of Signature Place in Morris Plains for Veris Residential last month, we’re pleased to advise the company in the disposition of another trophy multifamily asset in suburban New Jersey,” said Dunne. “The James is well positioned in downtown Park Ridge, benefiting from the area’s affluent clientele and proximity to the Park Ridge train station.”

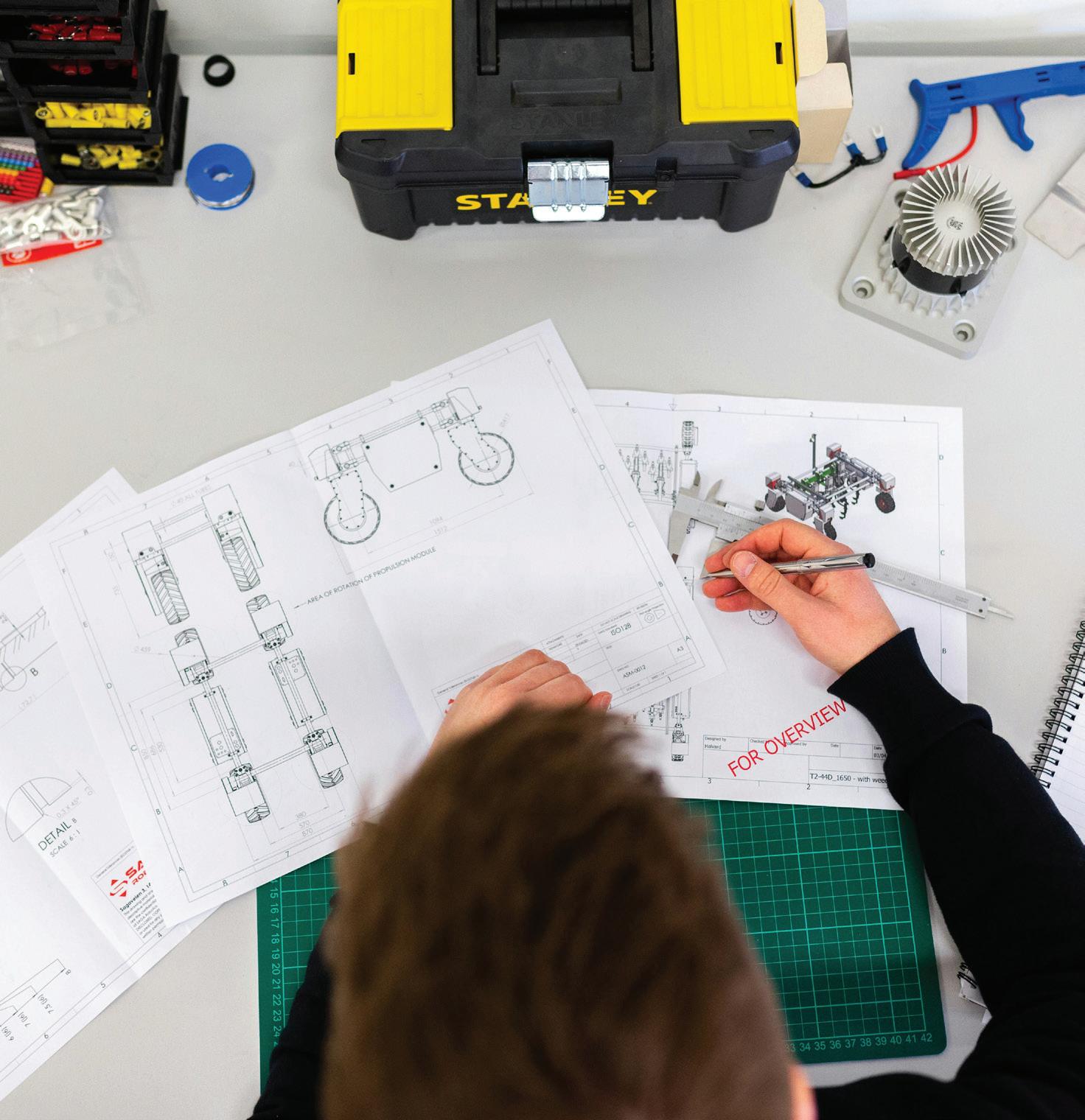

Data Centers are more needed than ever but building them isn’t easy

By Debra Hazel

The exponential growth of digital information and processes in the cloud is creating some down-to-earth real estate problems.

Whether it’s being used in proptech, artificial intelligence, social media or other businesses, the amount of data continues to soar — and that growth is necessatating massive new data center developments to house needed technology.

“If the global data center industry in 2024 could be summed up in two words, they would be ‘accelerated growth.’ The industry experienced rapid expansion throughout the year, a trend expected to continue into 2025 and 2026,” said CBRE’s “Global Data Center Market Comparison” report in May 2025. “Artificial

intelligence (AI) and machine learning (ML), which gained prominence in 2022, are key drivers of this demand now and into the future.”

Builders are responding.

“By the end of 2024, the data center development pipeline reached nearly 50 million, effectively doubling the volume from five years ago. Capital deployment in data center construction reached an all-time high of $31.5 billion annually in 2024, with no signs of plateauing this year,” reported Newmark in its “2025 United States Data Center Market Outlook.”

But this potential boom faces a number of challenges to be overcome, including site criteria, NIMBYism, power needs and logistics.

The main question is where to build them. Unlike warehouses and distribution centers — which data centers physically resemble — these buildings have very specific needs. Data center development requires access to reliable power and water for cooling, strong network connectivity, local incentives given the extremely high cost of construction and a low risk of natural disasters — CBRE noted that a facility should have no more than 29 hours of downtime per year.

Currently, Virginia remains the largest data center market in the world, CBRE said.

“Virginia’s operational data center capacity is larger than the combined capacity of the next three largest data center markets in the Americas. It also represents more than 25% of total operational capacity throughout North, Central and South America,” the company reported.

But it may not be as dominant for long, as creeping NIMBYism and competition from other areas in the United States increase.

“Local opposition to rapid data center growth is reshaping the regulatory environment in the Richmond market,” reported Avison Young in its “Q2 2025 Data Center Market Overview.”

As of June 2025, Henrico County has placed new requirements and restrictions on data center developments, even including areas previously amenable to such projects. Some companies have withdrawn plans for properties in the county amid opposition.

Other regions are looking decidedly more appealing. Newmark reports that data center development is taking place in at least 23 states around the United States, including Pennsylvania, the Carolinas and Texas.

In late August, social media giant Meta’s $1 billion Kansas City Data Center opened after three years of construction,

“In 2022, we selected Kansas City because it offered excellent infrastructure, a robust electrical grid, a strong pool of talent for construction and operations jobs and incredible community partners,” said Brad Davis, data center community and economic development director at social media giant Meta.

Funds managed by Blue Owl Capital and affiliates of Chirisa Technology Parks and Machine Investment Group recently closed on a joint venture partnership to include $4 billion of funding for previously announced CoreWeave developments in Lancaster, Pa. CoreWeave has invested in the campus and will lease the site.

London-based Yondr Group, a leading global developer, owner and operator of hyperscale data centers, has secured

a 163-acre site in Lancaster, Texas, just south of Dallas to develop a campus with the capacity to accommodate 550 megawatt (MW) critical IT load. The company also has projects in Northern Virginia and Toronto.

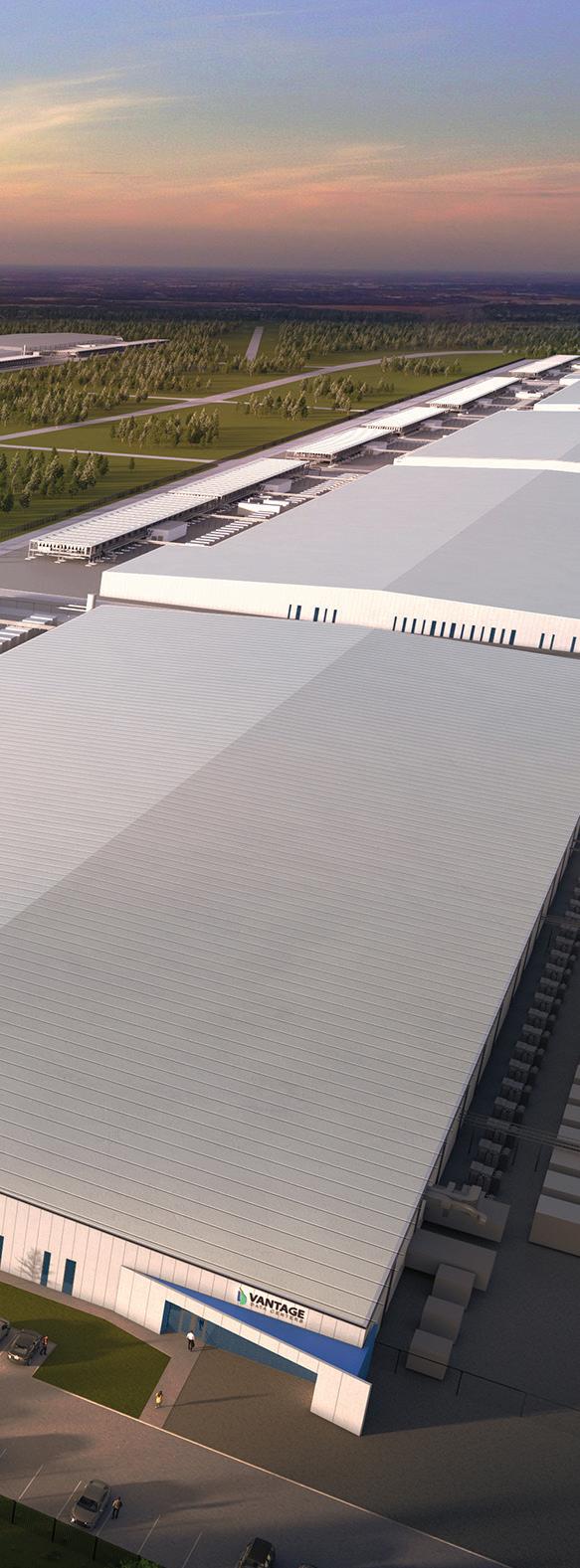

Elsewhere, Vantage Data Centers recently announced a $25 billion investment to develop a 1.4 gigawatt (GW) data center campus in Shackelford County, Texas. Situated on 1,200 acres, the campus will be home to 10 data centers totaling 3.7 million square feet.

“Texas has become a critical and strategic market for AI providers. In particular, the launch of our Frontier campus with 1.4GW of GPU compute capacity marks a watershed moment for Vantage as we deliver on our promise to meet the unprecedented requirements of our customers,” said Dana Adams, president of North America at Vantage Data Centers. “This investment in Texas will be a significant economic growth driver for the area as we rapidly deploy the digital infrastructure needed to support AI applications.”

In Mississippi’s Rankin County, Avaio Digital Partners is investing $6 billion into a 175-acre campus in the City of Brandon (near Jackson) that it said will host the computer server, networking and data storage technologies that underpin cloud computing and AI applications.

GW once all data centers are operational. However, utilities are set to supply only 20.6 GW of that needed capacity. Newmark reported.

And demand for power globally continues to increase. A report from International Energy Agency notes that the world’s electricity consumption is projected to grow 4% annually through 2027 due to a number of factors.

“The data center development pipeline — already at record heights — would be substantially higher if not for the singular issue of power constraints,” said Newmark in its “2025 United States Data Center Market Outlook.”

Even in areas where power is available, it could take years to build the infrastructure needed, given supply chain shortages.

“The data center development pipeline — already at record heights — would be substantially higher if not for the singular issue of power constraints,”

Construction of the first phase of the project, totaling over 600,000 square feet of data center buildings and 116MW of power, will be complete and energized in the first half of 2027.

Newmark in its “2025 United States Data Center Market Outlook.”

In late August, Zenith Volts Corp. announced that the Chaves County Commission had granted county approval for a 300acre data center project located 20 miles south of Roswell, N.M. Designed to support 1.25GW or more of power capacity with expandable land resources, the project is expected to be fully operational by November 2027.

The approved 8,500-acre site will integrate advanced power solutions, including on-site solar, natural gas generators for dependable backup, modular solar-thermal hybrid systems for 24/7 thermal storage, a 250-acre battery energy storage system, and geothermal cooling for optimal efficiency.

Even if all other elements align, power is critical. Newmark reports that Analysis from S&P Global Market Intelligence indicates that the power demand from both existing and planned datacenters in the U.S. is expected to total about 30.7

“These challenges will continue to intensify as the data center sector expands rapidly into new geographies,” JLL said in “2025 Global Data Center Outlook.”

As a result, some developers are taking matters into their own hands. In August, digital infrastructure company Equinix announced that it is working with energy companies including Oklo, Radiant, ULCEnergy and Stellaria that are developing innovative approaches to generating reliable and sustainable electricity to support the needs of Equinix data centers worldwide.

“Access to round-the-clock electricity is critical to support the infrastructure that powers everything from AI-driven drug discovery to cloud-based video streaming,” said Raouf Abdel, executive vice president of global operations at Equinix, in the announcement. “As energy demand increases, we believe we have an opportunity and responsibility to support the development of reliable, sustainable, scalable energy infrastructure that can support our collective future. By working with our energy partners, we believe we can support the energy needs of our customers and communities around the world by helping to strengthen the grid and investing in new energy sources.”

Equinix also designs highly efficient data centers aimed at optimizing energy use. In 2023, Equinix announced plans to expand support for highly efficient advanced liquid cooling technologies — like direct-to-chip — to more than 100 data centers across 45 metros around the world.

Nuclear power and natural gas are emerging as preferred solutions, as well.

The environment is also a factor for NIMBYism, with some builders focusing on green developments. Like all of its data centers, Meta's Kansas City Data Center is LEED Gold-certified, and its electricity use is matched with 100% clean and renewable energy.

Albany, N.Y.-based Soluna Holdings Inc., a developer of green data centers for intensive computing applications recently reached a key milestone with 1 GW of clean computing projects in either operation, construction or development, with the launch of two new Texas-based sites: Project Fei, a solar-powered facility in northern Texas, and Project Gladys, a wind-powered facility in the southeast region of the state.

Project Fei is a 100 MW data center co-located with a 240 MW utility-scale solar farm, Soluna’s second solar-based project to date. Developed in partnership with a global leader in energy infrastructure investment, Project Fei will convert underutilized solar energy into clean, high-performance computing power. The project is currently advancing through land acquisition, power contract negotiation, and Electric Reliability Council of Texas (ERCOT) interconnection planning.

Project Gladys, a 150 MW facility, will be co-located with a 226 MW wind farm and developed in partnership with a prominent U.S.based independent power producer (IPP) managing over $40 billion in assets and more than 80 energy facilities nationwide.

“Reaching one gigawatt of clean computing projects in our total development pipeline is a transformative moment for Soluna. Getting these projects from development to operational will put us on par with some of the biggest companies in the world when it comes to clean-powered computing capacity, including Amazon, Meta, and Google,” said John Belizaire, CEO of Soluna.

The result, Belizaire said, is that the company could possibly effectively displace nearly 48 million metric tons of CO2, equivalent to removing 11 million cars from the road over the life of these assets, and we believe this is just the beginning of what clean computing can do.”

As with all new construction, logistics is a challenge for data center developers.

“Materials like lumber, PVC, plumbing components, gypsum and concrete have remained relatively immune to supply chain woes and can be sourced rather quickly, while copper wire, steel and light fixtures typically face two- to three month wait times,” CBRE reported. “The most critical components, like switchgear, chillers, generators and transformers, have lead times exceeding six months, with some taking more than a year to procure. Stockpiling of components, which became more common in 2024, is further exacerbating this issue, as construction speed became a significant competitive advantage for developers.”

But demand remains strong, with vacancy rates at record lows.

“While analyses vary on adoption scenarios, some forecasts, including an October 2024 analysis by McKinsey, suggest that up to 70% of total data center demand will be AI-driven by 2030, up from under 50% currently,” Newmark said. “This trend will require significant further expansion of digital infrastructure for training, inference and other use cases in the coming years.”

In today’s fast-moving and increasingly complex financial environment, successful business owners need more than just an advisor—they need a trusted partner who sees the full picture, anticipates change, and integrates every facet of their financial world. For over 30 years, Louis C. Ciliberti & Associates has delivered exactly that.

We are a full-service financial firm and multi-family office that helps the most financially successful individuals and privately held companies in the nation. At Louis C. Ciliberti & Associates, we don’t just provide advice—we orchestrate and execute a total wealth strategy that aligns with our clients’ business goals, family needs, and long term vision.

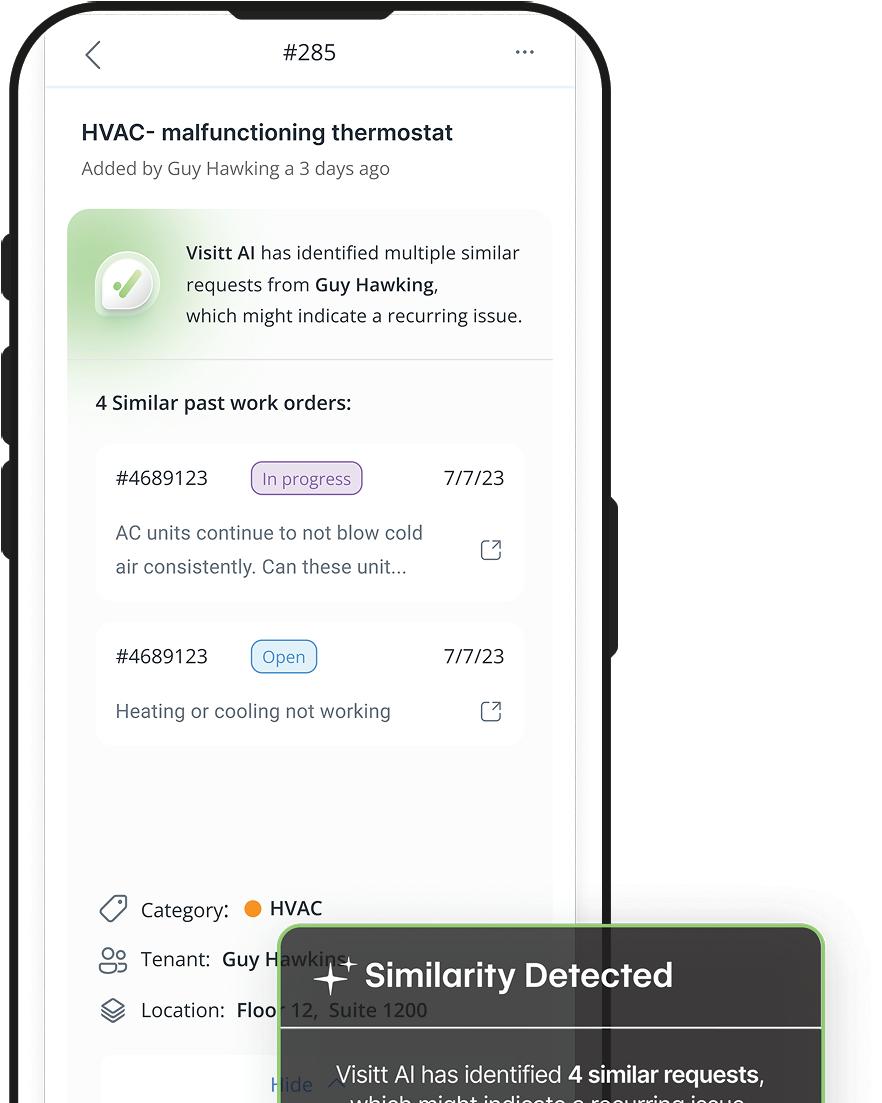

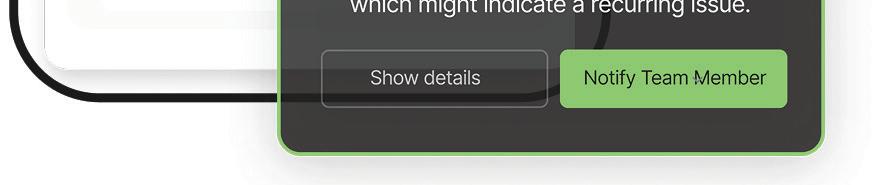

By: Itay Oren

Over the past year, few topics have dominated industry conversations as thoroughly as artificial intelligence (AI). From panel discussions at real estate conferences to casual conversations with property managers, AI is not just a buzzword anymore, it’s a looming presence. For many, it sparks excitement. For others, apprehension. And for most, a mixture of both.

The proptech sector finds itself at a crossroads. AI is no longer an abstract concept confined to tech blogs; it’s entering day-to-day operations across commercial real estate. But as the technology gains momentum, so do the debates around what it actually means for the people working in the field.

At the heart of these discussions lies a fundamental concern: Is AI coming for our jobs?

This question isn’t unfounded. History offers plenty of examples of technological disruption leading to workforce reductions. Automated processes have replaced factory workers; self-checkout kiosks have trimmed retail staff and AI-driven algorithms handle customer service chats that once required human agents. Given these precedents, it’s understandable why property managers, operations teams and facility staff might feel uneasy.

However, there’s a growing school of thought within the industry suggesting a different narrative, one that frames AI not as a threat, but as an opportunity to rethink how teams work.

It’s easy to get swept up in the AI gold rush, but thoughtful implementation is critical. Visitt has been working on AI-driven solutions since 2022, well before the recent surge in mainstream AI interest. Visitt has taken the time to test, iterate and refine the tools in

collaboration with property teams, ensuring the technology addresses real-world pain points. This intentional approach contrasts with the reactive rollouts seen in other industries, where AI tools are sometimes deployed hastily in the name of innovation, often leading to more confusion than clarity.

The companies leading the way in AI adoption within property operations are those that view technology as a means to an end, not an end in itself. They are less concerned with flashy features and more focused on building solutions that integrate seamlessly into existing workflows, making life easier for property teams rather than complicating it.

As AI continues to evolve, the conversation around its role in property management will no doubt intensify. But the most forward-thinking players in the industry are already charting a path that rejects the binary of “AI versus jobs.” Instead, they envision a future where AI acts as an enabler, augmenting human capabilities and freeing teams to concentrate on the high-value tasks that thrive on human insight and connection.

The shift won’t happen overnight. It will require ongoing collaboration between technology providers, property teams and industry stakeholders. It will also demand a cultural shift, moving from viewing AI as a threat to embracing it as a partner in achieving operational excellence.

At this juncture, one thing is certain: AI is not a passing trend. Its impact on property operations is already evident, and its potential is just beginning to be realized. For those willing to engage thoughtfully with the technology, the coming years could mark a period of unprecedented innovation in how properties are managed, maintained and experienced.

In the complex ecosystem of property management, a significant portion of daily work is repetitive and administrative. Tasks such as processing service requests, scheduling maintenance tasks, following up on work orders and logging inspections, while essential, consume a disproportionate amount of time and mental bandwidth.

AI’s potential lies in automating this tedious, repetitive work that slows teams down, so that human workers can focus on highervalue activities. These include problem-solving, relationship building with tenants and proactively managing assets to optimize performance. Rather than replacing teams entirely, AI can enhance their effectiveness by taking care of the mundane tasks, enabling them to focus on meaningful engagement.

This shift will inevitably change how teams are structured and how buildings are managed, but the bigger opportunity lies in enabling organizations to operate smarter and faster, while empowering their people to concentrate on the work that requires creativity, judgment and personal connection. This philosophy has been gaining traction, especially among organizations that have been experimenting with AI-driven workflows for several years. Companies like Visitt advocate for “purpose-built AI”, technology specifically designed to address the unique challenges of property operations, rather than generic AI solutions retrofitted to the real estate sector.

While AI’s influence in real estate is undeniable, there is also a significant gap between the idea of AI and the practical realities on the ground. Many property managers are still trying to make sense of how AI fits into their day-to-day responsibilities. The technology is evolving fast, and amidst the excitement, there’s a lot of noise: terms like “machine learning,” “predictive analytics” and “automation” are often used interchangeably, adding to managers' confusion.

But those with hands-on experience implementing AI in property operations point to clear, tangible benefits. AI-powered predictive maintenance saves time and cost by quickly identifying similarities and root causes, allowing teams to fix issues at the source instead of repeatedly addressing symptoms. Automated tenant communication tools can streamline updates, reminders and service notifications, ensuring faster response times and a better tenant experience. Recurring issues can be identified across multiple properties and automatically flagged for escalation, helping teams stay ahead of potential problems before they disrupt operations.

With fewer emergencies and more efficient workflows, teams can cut costs, improve building performance and focus on high-value activities like tenant engagement.

Another critical area where AI is making a difference is data consolidation. Property operations generate a vast amount of data daily, from work orders and service tickets to inspections and compliance reports. Sifting through this data manually is inefficient and prone to errors. AI can aggregate and analyze this information in real time, providing actionable insights that help teams stay ahead of potential issues.

Predictive maintenance powered by AI is not just helpful, but transformative. AI tools now analyze building management system data, work orders, and recurring maintenance patterns to detect early signs of equipment stress, such as HVAC units teetering on failure during a heat wave, long before human teams could reasonably intervene.

Rather than reacting to breakdowns, operations leaders can proactively address issues, reduce downtime and better allocate staff time. This shift from reactive to predictive is a game-changer for property teams navigating the complexities of modern building management.

We see AI as a strategic tool that cuts through the noise of overwhelming alerts, surfaces critical insights and supports decisionmaking.