For decades, we have built a real estate practice unparalleled in the US. Now, as the global legal powerhouse HSF Kramer, we are so much more. As the only law firm ranked in Chambers Band 1 on three continents, we continue to transform skylines and reshape landscapes. Please visit our website to learn more. Kramer Levin is now HSF Kramer

EDITORIAL

Editor

Debra Hazel

Director of Communications and Marketing

Penelope Herrera

Director of Newsletter Division

Kristen Pooran

PRESIDENT/CEO

Jeff Mann

ART

Art Director

Virginia Sanchez

Cover Photography

Binyan Studios

Morris Betesh

Frank DeLucia

Patrick Ghilani

Eric Hadar

Merilee Kern

Kris Kiser

Bob Knakal

Sabrina Lippman

Jamie Macartney

Ira Meister

John Meko

Austin Rabine

Stuart Saft

Abe Schlisselfeld

Carol A. Sigmond

Simon Soloff

Liz Snyder

James Whelan

Technology Consultant Eric Loh

Distribution Mitchell’s Delivery Service

DIGITAL MEDIA

Designers

Virginia Sanchez

Editors

Debra Hazel

Penelope Herrera

Rose Leveen

Web Developer

CS Designworks

West Coast Office: 578 Washington Blvd., Suite 827

Marina Del Rey, CA 90292 866-306-MANN (6266) mannpublications.com

East Coast Office: 450 7th Ave, Suite 2306

New York, NY 10123 212-840-MANN (6266)

February — the shortest month, the dead of winter and one we all hope to escape by going somewhere sunny and warm, even for a couple of days.

But as always, there is joy and warmth to be found.

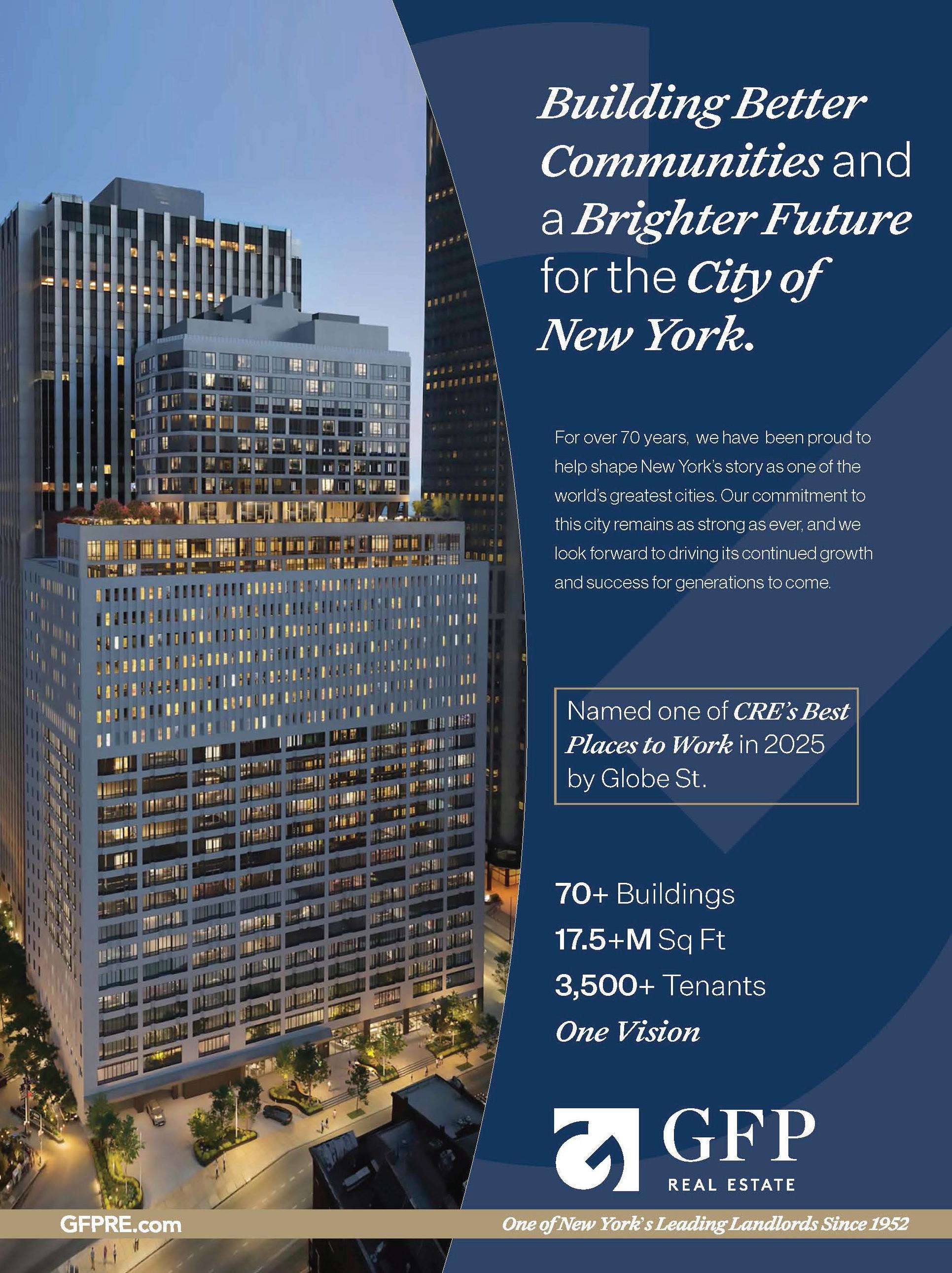

My dad knew Sol Goldman, once one of the largest landlords in the city, through other family friends, so it’s personally satisfying to feature Bldg Management, a descendent company now run by Sol’s nephew Lloyd, on our cover. But even more important is what Bldg is achieving with The Orchard — remaking the Queens skyline with an 823-foot-tall tower that is a testament to long-term thinking and patience. (The family has held the land for 60 years!)

It’s also a perfect lead-in to our annual focus on the multifamily sector, so critical and personal in this city dominated by renters.

In our Photo Events, you see how many of us spent the days leading up to the holiday season — celebrating genuine achievement and doing good for others. Congratulations to Urbahn Architects on its 80th anniversary, and thanks to Fried Frank for its always fun (and massive) holiday party and to National Jewish Health, whose fundraiser will help so many in the months and years ahead.

The joy they spread is enough to warm even a cold February.

“Real estate cannot be lost or stolen, nor can it be carried away. Purchased with common sense, paid for in full, and managed with reasonable care, it is about the safest investment in the world” — Franklin D. Roosevelt

At Peninsula Property Management (PPM), we do more than manage properties—we elevate them. With a leadership team that is deeply involved, hands-on, and responsive, PPM is redefining the standard for property management in New York City. Our mission is simple: deliver results with integrity, precision, and a hospitality-first approach.

Proactive Management

Stop issues before they start — from Local Law 97 to vendor oversight.

Financial Clarity

Clean, timely financials. No surprises –just strategic planning and transparency.

NYC Compliance Expertise

DOB, HPD, LL88, LL97, FISP we navigate every regulation so you don’t have to.

New Development Services

Schedule B, TCO phasing, hiring of staff, punch-list, insurance implementation.

Smart Cost Control

Energy savings, bulk contracts, vendor negotiations we cut waste, not corners.

Track requests, tasks, and reports live through our integrated digital platform.

Welcome to our annual focus on the Multifamily sector, the one nearly all of us have experienced at some point. Many of us may never have set foot inside a distribution center, but odds are we’ve rented an apartment or lived in student housing at some point. And the sector is particularly dear to New Yorkers — according to nyc.gov, 67% of us rent, rather than own our homes.

So it’s not surprising that when we called upon our contributors to give us their takes on the trends surrounding multifamily, we received a slew of articles and columns. Morris Betesh of Arrow Real Estate Advisors gives us a succinct summary of investment attitudes for the year, while EnTech’s Simon Soloff gives us a checklist on how to maintain your boiler when the season turns to spring. CBIZ Real Estate Industry Leader Abe Schlisselfeld offers his thoughts on creative financing for this category, and BKREA’s Bob Knakal tells us why he thinks COPA is a very bad idea for investors and residents alike.

And, of course, our cover features The Orchard, what will be tallest multifamily building in Queens.

Thank you to all of our contributors for sharing their wisdom and to all of you who will read it.

Fried Frank’s 2025 Real Estate Holiday Party welcomed more than 1,000 guests. Hosted by Fried Frank’s Real Estate Department, including department Chairman Jon Mechanic and Co-chairs Laurinda Martins and Michael Werner, the event is one of the year’s most sought-after tickets.

Held at Cipriani 42nd Street, the annual event brought together many of New York’s top real estate leaders in celebration of the holiday season.

Urbahn’s Natale V. Barranco, AIA, LEED AP; Martin D. Stein, AIA; Donald E. Henry Jr., AIA, LEED AP, CPHC; Enrico Kurniawan, AIA, NOMA; Bridgette Van Sloun, AIA, CPHC, Well AP; Lawrence Gutterman, AIA, DBIA, LEED AP; Daniel Kohn, AIA, LEED AP; Rafael Stein, AIA; Ijeoma D. Iheanacho, AIA, LEED AP, NOMA; Christopher Young, AIA and Nandini Sengupta, Assoc. AIA, LEED AP, NOMA.

Urbahn Architects, a New York City-based design and planning firm, marked its 80th anniversary with a reception at the Surrogate’s Courthouse, a landmarked Beaux-Arts structure in downtown Manhattan. The Urbahn-designed renovation of a section of the courthouse recently won a Lucy G. Moses Preservation Award from the New York Landmarks Conservancy.

Urbahn promoted eight professionals from within the firm to associate principals: Bridgette Van Sloun, AIA, CPHC, WELL AP; Christopher Young, AIA; Daniel Kohn, AIA, LEED AP; Enrico Kurniawan, AIA, NOMA; Ijeoma D. Iheanacho, AIA, LEED AP, NOMA; Lawrence Gutterman, AIA, DBIA, LEED AP; Nandini Sengupta, Assoc. AIA, LEED AP, NOMA and Ryan Bieber, AIA, LEED AP.

This diverse group brings perspectives from varied cultural and career backgrounds,

having worked across healthcare, sciences, public safety, governmental facilities, transportation, hospitality and multifamily housing markets. Their expertise guides what has become an increasingly global practice at Urbahn Architects.

“Our work is never formulaic,” explained Donald E. Henry Jr., managing principal at Urbahn. “Each project deserves a truly indepth analysis of desired functions, zoning and technical restrictions, budgets and architectural context.”

In a profession that often celebrates grand spatial gestures, this commitment to pragmatism may seem understated, Urbahn has observed. Yet over eight decades, Urbahn has demonstrated how this approach can transform public spaces, educational and healthcare facilities or transportation infrastructure in ways that enable meaningful impact on daily life.

“Each project deserves a truly in-depth analysis of desired functions, zoning and technical restrictions, budgets and architectural context.”

— Donald E. Henry Jr.

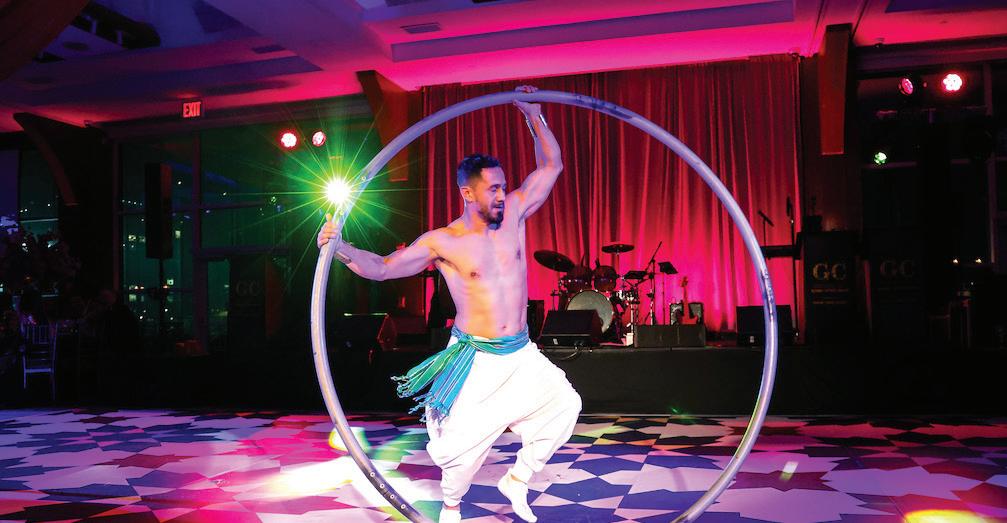

The 57th annual National Jewish Health “A Winter’s Evening” Dinner Dance honored Glen J. Weiss, executive vice president of office leasing and cohead of real estate at Vornado Realty Trust. More than 600 real estate and construction industry professionals attended the Moroccan-inspired event at Chelsea Piers.

The gala raised more than $2.2 million to establish The Staci & Glen Weiss Fund to Safeguard Critical Pediatric Research at National Jewish Health. The medical center offers unparalleled care to people with the most difficult cases of lung, heart, immune and related diseases.

Weiss was honored with the 2025 National Jewish Health Humanitarian Award, recognizing his significant contributions to National Jewish Health and other civic and charitable causes, and for his professional accomplishments.

Pier 60 was enveloped by a kaleidoscope of draperies and rugs, as well as aromatic and colorful spices evoking a Moroccan bazaar. Guests were drawn into the ambience by a drum troupe, belly dancers, fortune tellers and henna

Larry Silverstein, treasurer of the National Jewish Health Board of Directors, was honorary chair and helped lead the event’s program. Dinner chairs were Neil Goldmacher, Robert J. Ivanhoe, Gary Jacob, James D. Kuhn, Josh Kuriloff, Jonathan L. Mechanic, Bruce Mosler, Peter G. Riguardi, Stephen B. Siegel, co-chair of the National Jewish Health Council of National Trustees, and Roger A. Silverstein.

President’s Circle sponsors were CBRE’s New York and San Francisco offices; Feil Family Foundation, Wendy M. and Stephen B. Siegel, The Silverstein Family and Silverstein Properties.

The Honoree’s Circle sponsors included Michele and Marty Cohen, Cushman & Wakefield, Glenwood Management Corp., Maxine B. Murnick, Newmark, Northwood/Kukral Foundation and Vornado Realty Trust.

The Founder’s Circle sponsors included Brookfield Properties Inc.; Chicago Title; Citadel; Commonwealth Land Title Insurance Company; The Emmes Group of Companies; Extell Development Company; Fried, Frank, Harris, Schriver & Jacobson LLP;

The Walker & Dunlop Capital Markets Institutional Advisory Practice arranged the loan on behalf of InterVest capital partners, a global alternative investment manager. Dustin Stolly, Aaron Appel, Adam Schwartz, Keith Kurland, Jonathan Schwartz, Sean Reimer and Sean Bastian, arranged the financing from Apollo Global Management, J.P. Morgan Chase & Co. and TYKO Capital. Walker & Dunlop also advised on the extension of an existing $88.4 million C-PACE loan from Petros that remained in the capitalization, bringing the package to $867 million.

111 Wall Street is a 24-story, fully vacant offi ce tower being converted into a 30-story luxury residential rental community. The project includes a fi ve-story overbuild, a fully redesigned lobby and will feature approximately 1,568 rental units across more than 899,000 rentable square feet.

Walker & Dunlop announced that it has arranged a $778.6 million construction loan to facilitate the offi ce-to-residential conversion of 111 Wall Street, located along the East River waterfront in Lower Manhattan’s Financial District. The closing of this financing marks the largest single-building offi ce-to-residential conversion loan in New York City history and the country.

The redevelopment will also include 7,000 rentable square feet of ground fl oor retail. Approximately 25% of the units will be designated as affordable housing for residents earning an average of 80% of area median income (AMI), qualifying the project for New York City’s Affordable Housing Conversion Program.

“Manhattan’s apartment demand remains exceptionally strong, and projects like 111 Wall Street address both the growing need for housing and the repositioning of outdated, underutilized offi ce assets," said Stolly, senior managing director at Walker & Dunlop.

The development team includes MetroLoft Development as developer, Collaborative Construction Management as construction manager, Gensler as architect of record and Corcoran New Development as marketing and leasing agent.

The nearly 300,000-square-foot complex will be the first purpose-built studio in New Jersey specifically constructed for television and film production. In addition to the studio production space, the project will include offices, support space and parking for 145 cars, 22 trucks or trailers and 11 RVs. The full 12-acre facility will be owned and managed by Great Point Studios.

“As an organization dedicated to advancing the arts in Newark and the surrounding area, the construction of Lionsgate Studio completely aligns with NJPAC’s mission of transforming lives through artistic expression and production,” said Tim Lizura, executive vice president of real estate and capital projects at NJPAC.

“With roots in New Jersey dating back to 1966, it only made sense for Gilbane to help construct the first film and TV production studio of its kind in the Garden State,” said John E. Anderson III, business leader of Gilbane’s New Jersey office. Gilbane will serve as lead builder on the project. The company has recently built multiple high-profile buildings in the Newark area, including 50 Rector Park, the first market-rate rental residential tower in Newark in more than 50 years, and the Prudential Center, home to the New Jersey Devils NHL team.

Gilbane will leverage its extensive network of diverse-owned contractors to help the project meet its inclusion goals of dedicating 25% of total construction contracting to Minority Business Enterprises and 7% to Women’s Business Enterprises. Additionally, 40% of total worker hours will be dedicated to Newark residents.

Walker & Dunlop Inc. and Pretium announced a $250 million strategic joint venture designed to fill a crucial fi nancing gap for affordable multifamily housing. “Walker & Dunlop Affordable Bridge Capital, a joint venture with Pretium” will originate fl exible, short-term, first-mortgage bridge loans for properties that are being acquired, refi nanced or prepared for long-term government-affordable programs such as LowIncome Housing Tax Credit (LIHTC), Section 8 or tax-exempt bonds.

“It is a powerful new tool that offers flexible, interest-only bridge financing with loan sizes ranging from $10 million to $75 million and terms between six and 36 months,” said Sheri Thompson, executive vice president and head of affordable housing at Walker & Dunlop. “It is an impact-driven platform that will help clients accomplish their mission.”

The venture will provide bridge fi nancing that provides projects with reliable, permanent takeout through Agency and HUD programs.

“We designed this joint venture to help address the shortage of quality, affordable housing in communities across America,” said Jonathan Pruzan, co-president of Pretium.

“We are excited to combine our platform capabilities alongside Walker & Dunlop to deliver powerful fi nancing solutions for affordable multifamily developers,” said Karen Kulvin, managing director and portfolio manager for real estate debt at Pretium.

City flagship under a lease that runs through 2040. The upper floors, comprising approximately 24,300 square feet of office space, are leased to a roster of creative and technology tenants, including Comcast Ventures, Aptos Labs and Sister Group. The historic property underwent a comprehensive redevelopment in 2018, resulting in modernized interiors, upgraded systems and a penthouse level with a private terrace.

Newmark’s Adam Spies, Adam Doneger, Josh King, Marcella Fasulo and Meaghan Philbin brokered the all-cash transaction. Olmstead Properties will serve as the property manager and exclusive leasing agent at the building.

The acquisition follows Vertex’s purchase of 373 and 381 Park Avenue South from Atco Properties & Management for $104 million in 2025.

“This is exactly the type of stable, high-quality asset we want to own for the long term. We built Vertex to pursue both short-term opportunities and long-term holds that produce strong, tax-efficient cash flow,” said Patrick Pavone, co-founder of Vertex. “61-63 Crosby Street fits that approach — a well-located historic building in a neighborhood with real momentum.”

Vertex was co-founded by Adam Arnow and Patrick Pavone and is backed by the Rosenblatt and Arnow families — two long-established names in New York real estate. The platform was created to target strategic office acquisitions across the city and deploy capital where location fundamentals and long-term value align.

York

“Our goal is to assemble a portfolio of Manhattan assets with staying power. 61-63 Crosby has that — historic character, a stable rent roll, and a location that continues to improve,” said Adam Arnow, co-founder of Vertex.

Their deep local knowledge and commitment to clients make Corcoran Wiley an ideal addition to the Corcoran network.”

Founded in late 2016, Wiley Real Estate quickly established itself as a trusted name in Central Virginia’s real estate market. The firm’s success spans high-end residential properties, agricultural and pastoral farms, as well as various land development opportunities.

Corcoran Group LLC announced the continued expansion of its network with the launch of Corcoran Wiley, based in Charlottesville, Va. Formerly Wiley Real Estate, the firm is led by Broker/Owners Justin and Peter Wiley and will serve clients throughout Central Virginia and the greater Charlottesville area.

“Central Virginia offers a rare blend of natural beauty, cultural depth and enduring real estate value,” said Pamela Liebman, president and CEO of Corcoran Group LLC. “Justin, Peter and their affiliated agents bring unparalleled expertise in farms, estates and upper-end residential properties, along with a reputation for integrity and exceptional service.

“Our reputation has always been rooted in integrity, deep community ties and guiding clients through even the most complex transactions with care,” said Peter Wiley. “Affiliating with the Corcoran brand amplifies that foundation, marrying our local knowledge and trusted relationships with world-class marketing, technology and brand power.”

Peter Wiley returned to his hometown of Charlottesville and began brokering real estate in 2005, following an extensive career as a Congressional staffer and working as a lobbyist for venture capital and biotechnology industries in both Boston and Washington, D.C. Following his collegiate studies, Justin Wiley honed his skillset through the management and advisory of various large farms and historic estates throughout Central Virginia, ultimately bringing his expertise to his family’s real estate business in 1992.

Corcoran Wiley will continue to operate out of its existing Charlottesville and Orange County offices.

After outperforming traditional real estate in both sales and value in 2025, the luxury market is expected to continue its upward trajectory in 2026, said Sotheby’s International Realty’s “2026 Outlook” report, which offers insights into the trends and developments shaping the sector. Key drivers include the $6 trillion inherited in 2025, a transfer of generational wealth that is becoming a major demand driver for luxury real estate, and a 44% surge in foreign buyer activity in the U.S.

The result is that the threshold for defi ning a luxury home is rising, with national expectations starting at around $1.3 million, higher than in many other countries.

“The continued aim of the Luxury Outlook is to help clients and the wider market navigate a rapidly shifting landscape through data-based and expert insights informed by our global network of real estate advisors. The latest edition continues to offer the strategic intelligence and global perspectives that empower clients to make confi dent, wellinformed decisions,” said Bradley Nelson, chief marketing offi cer, Sotheby’s International Realty. “As we look ahead to 2026, inventory levels have largely returned to pre-pandemic norms. This renewed balance in the market signals healthier conditions and provides buyers

with a wider range of opportunities.”

The 2026 Luxury Outlook report draws on insights from Sotheby’s International Realty agents worldwide who specialize in transactions in the $10 million-plus price category. Their expertise is complemented by data from industry leaders including JPMorgan Private Bank, PricewaterhouseCoopers, Cerulli Associates, Henley & Partners, UBS and the National Association of Realtors (NAR).

The report found that luxury real estate continues to outperform the general housing market, driven by sustained wealth creation and less sensitivity to macroeconomic factors. Inventory levels of new construction homes have returned to pre-pandemic norms, creating a healthier and more balanced market. The U.S. supply of homes priced at $1 million is at its highest since 2020. There is signifi cant cross-border demand as foreign buyer activity surged 44% in the U.S. with Florida, California, Texas and New York as leading destinations. Crypto is increasingly influencing luxury purchases, especially in markets like Dubai, New York and California. Regulatory changes may allow crypto assets to count toward mortgage qualifi cation.

To respond to the changing market conditions, Sotheby’s advised that both home buyers and sellers should consider “first mover advantage” as acting decisively benefi ts them — early movers often secure better deals or faster sales.

“The overall real estate market was more impacted by elevated interest rates and affordability issues, but the luxury real estate market is positioned for continued outperformance. Building on 2025’s robust foundation, the luxury market is seeing increased inventory, growing international homebuyer activity and a larger percentage of all-cash sales, particularly at the higher end,” said Philip White, president and CEO, Sotheby’s International Realty. “We expect global sales to strengthen, as luxury property buyers — the strongest segment of the market — are less constrained by geography.”

McKenna Group,” said Dawn McKenna, DMG founder. “30A is among the most desirable coastal destinations in the country, and our clients have been increasingly asking for our expertise here. This expansion allows us to deliver the same exceptional service and market knowledge our clients expect — whether they’re buying a vacation home, investing in property or relocating to the Emerald Coast.”

Coldwell Banker Realty in Florida announced that the nationally recognized Dawn McKenna Group (DMG) has expanded to Destin and the 30A corridor in Florida. DMG/30A will be located at 2930 West County Hwy 30A, Unit #105 in Santa Rosa Beach, Fla.

DMG has seen strong demand for luxury real estate in Florida’s most sought-after vacation and second-home destinations, particularly along the scenic 30A corridor. Building on its success in Naples, the group’s expansion onto 30A refl ects its commitment to serving clients wherever they live, vacation and invest.

“Opening our DMG | 30A offi ce is an exciting milestone for the Dawn

DMG’s 30A agents bring more than 20 years of experience, over $200 million in sales volume, and a history of record-breaking transactions to the offi ce.

As part of the expansion, DMG has added Bonnie Hall, an awardwinning, highly credentialed professional. A resident of the area since 1997, Hall serves buyers and sellers on the Emerald Coast, from Fort Walton Beach to Rosemary Beach to Panama City Beach. Her clients include first-time buyers, luxury buyers and seasoned investors.

Hall joins the team with Maria McKenna, a dynamic real estate professional serving the communities along Florida’s 30A, including beloved destinations like Rosemary Beach, Alys Beach, Seaside and Watercolor. She began her career with DMG in Chicago in 2023.

“We are thrilled to see the Dawn McKenna Group bring its nationally recognized expertise to 30A,” said Duff Rubin, regional president, Southeast of Coldwell Banker Realty. “Their proven success in luxury real estate and commitment to client service make them a perfect addition to our Destin offi ce and this vibrant coastal community.”

agents and clients have enjoyed the exceptional convenience and oversight that this in-house platform brings to the entire real estate transaction process,” said Michael S. Liebowitz, president and CEO of Douglas Elliman Inc. “I am thrilled that clients in our New York markets will now have access to the competitive rates, diverse loan products and seamless integration that only comes from working with a single, trusted source for both their real estate and financing needs.”

Douglas Elliman Real Estate announced that Elliman Capital, its inhouse mortgage platform that launched in July 2025 in Florida, has now expanded to New York, which includes all of New York City, Long Island, the Hamptons, North Fork, Westchester and Hudson Valley.

Powered by an alliance with Associated Mortgage Bankers, Elliman Capital provides a seamless, full-service lending solution with a wide array of financing options — including conventional and jumbo loans, construction financing, commercial lending, bridge loans, FHA, VA and more, the company said. It also supports borrowers with non-traditional financial backgrounds such as self-employed individuals, investors and foreign nationals.

“In the short time since we launched Elliman Capital in Florida, our

Elliman Capital advances the company’s comprehensive service offering, providing clients access to an extensive range of loan products including conventional loans, jumbo loans, construction loans, investment property financing, bridge loans, commercial lending, second home mortgages, FHA loans, VA loans and USDA loans.

The platform is specifically designed to be flexible by extending financing to qualified self-employed individuals, investors, foreign nationals and other borrowers with unique financial circumstances who have historically faced challenges in securing appropriate financing.

The new mortgage platform incorporates advanced technology and streamlined processes that allow Douglas Elliman agents to easily refer clients, track loan progress and receive real-time updates throughout the financing process.

Key benefits of Elliman Capital include access to traditional and specialty loan products from multiple national and regional lenders, competitive rates due to strong lender relationships, an integrated technology platform that simplifies the mortgage application and approval process and tools and expert guidance from Douglas Elliman agents.

full suite of services including commercial landscaping maintenance, irrigation design and installation, drainage solutions and fertilization and weed control to a wide range of commercial and residential clients across New Jersey.

“By joining forces with Riverview, we can leverage greater resources to serve our clients even more effectively, while continuing to uphold the quality and personalized service our clients have grown to trust,” Raibick said. “We have the utmost faith in the Riverview team to continue the legacy we have built.”

Riverview Landscapes has acquired the landscaping and snow management business of Irrigation and Landscape Management Inc. (ILM), a landscaping and irrigation provider based in Parsippany, N.J. It is Riverview’s 19th acquisition since 2022.

Founded over 25 years ago by Steven Raibick, ILM has provided a

Raibick will remain involved in a consulting role, while longtime manager Alex Alonso will join Riverview’s Bergen County branch as an operations manager. Raibick will continue to independently support select longtime ILM irrigation-only customers.

“Adding ILM to the Riverview team allows us to deliver even more value to our clients in the Northern New Jersey region,” said Michael Waterman, CEO of Riverview Landscapes. “Their commercial landscaping expertise and specialized irrigation capabilities complement our existing offerings and position us to support properties with even greater effi ciency and quality.”

ILM will join Riverview’s Northern New Jersey region, which includes the previously acquired On-Site Landscape Management, Florence Landscaping and North Jersey Landcare. Riverview also operates in the Southern New Jersey, New York and New England regions.

The BRAVE title is an acronym for a practical, human-centered framework that equips leaders and coworkers to Be aware, Reach out, Actively listen, Validate and inform and Encourage next steps, turning awareness into meaningful action when mental health and safety matter most. Construction workers face some of the highest rates of suicide, substance use disorders and mental health concerns of any profession in the United States. High-stress job sites, physical risks and the stigma surrounding emotional vulnerability have created a hidden crisis.

Wellness Workdays, a national provider of workplace wellness solutions, announced the launch of “BRAVE: Building a Toolbox for Mental Health & Safety,” a first-of-its-kind training program built specifically for the construction industry. Designed to tackle the sector’s urgent mental health challenges, Brave equips frontline leaders, safety managers and crews with the skills to identify, address and prevent mental health crises before they escalate.

“Mental health is safety,” said Debra Wein, CEO and founder of Wellness Workdays. “BRAVE is not just another training program. It is a core layer of jobsite safety. By giving workers tools to recognize warning signs, listen without judgment and connect peers to help, we’re building stronger, safer teams.”

Delivered in-person by certified behavioral health professionals with experience in safety environments, BRAVE uses real-world construction scenarios, role play and guided discussion to help participants recognize signs of distress, substance misuse and mental illness among coworkers; apply the five-step BRAVE Action Plan for supportive, timely intervention; understand privacy, cultural humility and de-escalation techniques; connect peers to professional help and workplace resources and practice self-care and manage emotional stress after difficult interactions.

The program can be delivered as two, two-hour sessions or a single half-day workshop, with pre- and post-training evaluations to measure impact. Participants receive a certificate of completion and follow-up support materials.

Otis is expanding the program globally, strengthening community engagement by empowering Otis colleagues to serve as volunteers, and motivating students to explore STEM fi elds early.

The program recently expanded to the Middle East. In Saudi Arabia, Otis volunteers partnered with the Jeddah Orphans Association to deliver meaningful STEM experiences to young learners. And in Sharjah, United Arab Emirates, volunteers led 50 students through the program at Sharjah Indian School.

that it is making its successful

Engineers program for young STEM (science, technology, engineering and math) students available everywhere the global company does business.

Little Engineers is a hands-on, elevator-focused STEM education initiative designed to teach young students about the technology, safety and history of the elevator and escalator industry. Launched in Hong Kong, the program has hosted more than 800 students across Greater China and the Asia-Pacifi c regions program. Now,

Through interactive lessons, hands-on projects and virtual adventures, primary school students can explore the science behind elevators and escalators, learn about vertical mobility technologies, and build mini elevators and pulley systems.

The global expansion of Little Engineers supports Otis’ commitment to inspire youth around the world to become part of a dynamic industry, while reinforcing its dedication to safety, innovation, and community engagement.

“This global expansion refl ects Otis’ commitment to engaging meaningfully in the communities we serve. Through initiatives like Little Engineers, we’re helping young people discover the excitement of STEM, gain a basic understanding of elevator systems and core technology and learn and practice safe-riding tips,” said Matt Turner, vice president of social impact at Otis, in the announcement. “Programs like Little Engineers also allow us to introduce students to the human side of engineering — its creativity and real-world impact. It’s a way to spark interest early and share the passion that drives so many of our engineers today.”

sand to form new glass. Known for its durability, recycled glass extends the lifespan of installations and reduces the need for new materials to cover surfaces, supporting a more circular approach.

“With the launch of the Sagrada Collection, Tile Club is proud to introduce a sustainable tile option that delivers the look and performance of stunning Spanish-style tile, backed by a recyclable manufacturing process that designers can spec confidently,” said Fatima Mazanova, CEO of Tile Club. “Its versatility opens up greater creative freedom, whether specifying an eco-friendly commercial wall, backyard or a kitchen backsplash.”

By carefully selecting and color-sorting materials during the recycling process, glass is crushed and mixed with

Designed for both residential and commercial applications, the mosaic tiles deliver on visual impact and performance. A slip-resistant matte finish allows for use indoors and outdoors, including submerged environments such as shower floors and swimming pools, making it a versatile solution for high-traffic and wet-area applications.

Especially well-suited for swimming pool applications, the tiles meet ANSI A137.1 wet DCOF ≥ 0.60 and achieve proven slip resistance (R11). The glass construction resists frost, thermal shock and pool chemicals, enabling seamless indoor-to-outdoor transitions. UV color stability ensures long-lasting vibrancy in sun-exposed environments. The collection also includes corner tiles designed for pool ledges, enabling design continuity.

The mosaics are available in copper, white and multicolor and in various formats: 12.2 inch by 12.2 inch penny round, hexagon and square.

As part of the acquisition, Rowan Aldean, CEO of Opsansa, will join the VeriFast executive team as vice president of automation. In this new role, Aldean will spearhead the development of agentic automation within the VeriFast platform — moving beyond simple task automation toward autonomous AI agents capable of managing complex leasing workfl ows from end to end.

VeriFast is integrating Opsansa’s specialized technology to eliminate the “dead air” in the leasing cycle. By combining VeriFast’s expertise in resident screening with Opsansa’s agentic workfl ow automation, property managers can now move from initial inquiry to approved lease with greater speed and precision.

VeriFast, the AI-powered Verifi cation-as-a-Service platform, announced what it called “a defi nitive move to redefi ne the rental landscape” through the acquisition of Opsansa, a San Franciscobased provider of automated property management support.

This strategic acquisition accelerates VeriFast’s mission to provide a frictionless, end-to-end AI leasing ecosystem for the multifamily and residential sectors.

“This is a massive game-changer for the industry because tasks that used to take hours or days are now happening instantly,” said VeriFast CEO Tim Ray. “By bringing Rowan on board to lead our agentic automation strategy, we are ensuring that VeriFast isn’t just a tool, but a fully autonomous engine for property operators. Speed at which we approve qualifi ed residents is the ultimate currency in multifamily leasing, and we are now positioned to help operators and asset owners fill their buildings with qualifi ed residents at scale.”

The integration of Opsansa’s technology and Aldean’s expertise creates a singular, AI-driven platform that automates the most laborintensive aspects of the multifamily leasing offi ce. Agentic AI will be leveraged to manage support operations and applicant communication without manual intervention. Approvals can happen in minutes with faster handling of applicants’ identity, income and employment.

How buyers and sellers choose a real estate agent has shifted meaningfully over the past several years, said Zillow’s “2025 Consumer Housing Trends Report for Agents.”

More than one in three (36%) sellers fi nd their agents through online channels, more than double the 15% share in 2018, the report said. Among buyers, 33% said online research played a key role in chosing an agent. Repeat buyers account for 55% of all home purchasers, bringing greater experience, higher expectations and a more deliberate approach to hiring an agent.

After several years on the sidelines waiting for mortgage rates to

fall, many homeowners are reentering the market with a stronger understanding of rates, timing and trade-offs. These experienced buyers are returning with different priorities and higher expectations.

“These ‘comeback buyers’ have lived through multiple market cycles, they’ve adjusted to today’s rates and they’re intentional about who they hire, rewarding agents who show up with a clear strategy, strong process management and a truly modern, digital-first experience," said Amanda Pendleton, Zillow’s home trends expert.

While 79% of repeat buyers say they would consider working with the same agent again, only 13% ultimately hired their agent based on their past experience with them. Nearly half of repeat buyers interviewed two or more agents, often narrowing their short list through online research before making contact.

“This isn’t about loyalty disappearing,” Pendleton said. “It’s about buyers being more intentional. Agents who stay visible, communicate clearly and demonstrate expertise early are well-positioned to earn that business — even with experienced clients.”

Once contact is made, decisions tend to happen quickly; 47% of buyers hired the first agent they spoke with, and 59% of sellers did the same. This means that the hiring decision often happens before the first call, driven by how clearly an agent’s expertise, approach and track record come through online.

Compared with first-time buyers, repeat buyers place greater emphasis on effi ciency and strategic guidance, with 63% of repeat buyers ranked organizing and submitting paperwork as the most valuable agent service, compared to 51% of first-time buyers.

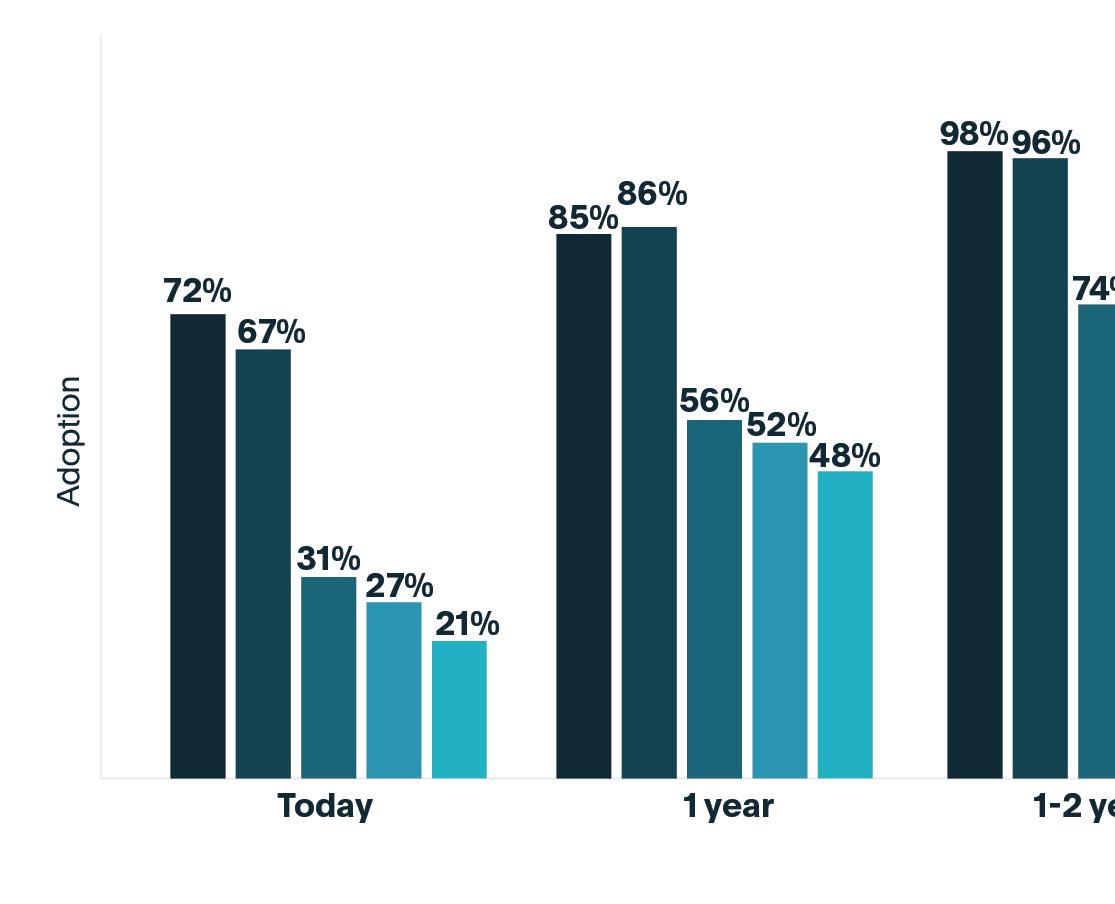

Artificial intelligence awareness is rising rapidly among commercial real estate professionals according to “The State of Property Management Technology, 2026,” a new global research report from Building Engines, a JLL company. The report is based on a survey of more than 350 commercial real estate (CRE) professionals conducted in partnership with BOMA International. More than 45% of respondents say they have a good understanding of how AI can support property management — more than double last year’s figure.

But many property management teams are struggling to translate innovation, particularly AI, into everyday operational impact. Only 28% of teams have implemented AI in their building operations, despite nearly half planning to invest more in property management software in the coming year.

Tenant satisfaction may be improving on paper, but the day-to-day

experience tells a different story. While 41% of property managers believe tenant satisfaction has improved over the past year, tenant comfort issues continue to account for nearly two-thirds of all service requests. More than half of property teams spend five or more hours each week managing tenant communications, most of it via email, creating inefficiencies that strain already-lean teams.

The report also highlights a growing disconnect between how satisfied property managers believe tenants are and the experiences of the broader employee population within buildings, underscoring the need for more proactive, technology-enabled tenant engagement tools.

Industry-specific insights reveal that retail and industrial property managers feel particularly underserved by existing software, with fewer than half confident that today’s tools meet their needs: creating opportunities for purpose-built technology focused on preventive maintenance, capital project management and tenant experience.

The report concludes that success in 2026 will depend on property teams’ ability to turn AI’s promise into practical tools that improve daily operations, deliver tenant experiences that match rising expectations and use sustainability data to reduce costs and improve performance.

“Property teams are interested in AI and technology, but many are still unsure how to apply it in ways that actually make their jobs easier. The opportunity in 2026 is to move AI from a concept to a practical tool that solves real, day-to-day challenges,” said Aliza Carpio, director of product management, JLL. “Across nearly a decade of our annual research, one theme remains consistent: property management continues to grow more complex, but teams that pair proven operational fundamentals with smart, focused technology investments are best positioned to succeed.”

operators optimize rents and leasing strategies.

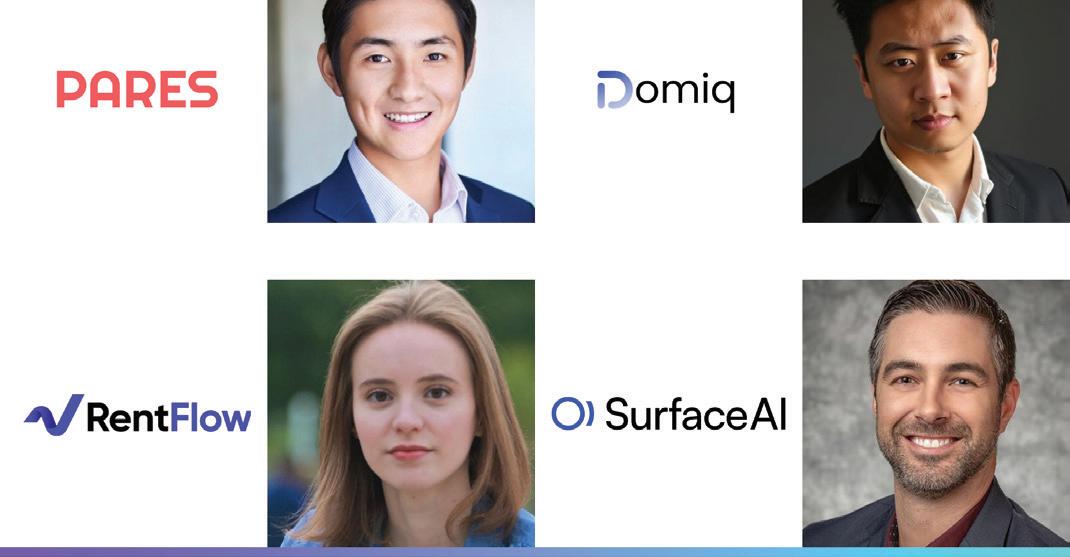

• SurfaceAI – An AI agent platform for property operations, focused on lease audits, due diligence and delinquency workflows.

• Pares – An AI-powered solution focused on operational insights and performance optimization for real estate teams.

• Domiq – An end-to-end agentic AI system that assists, scores and analyzes multifamily leasing teams, 24/7.

The Center for Real Estate Technology & Innovation (CRETI) has selected four startups for the first cohort of Foundations, a program aimed at helping early-stage proptech companies scale.

The six-week, non-dilutive program, known as CRETI Foundations, is designed to address a recurring challenge in real estate technology: promising products that struggle to gain traction with owners and operators navigating tighter margins and longer procurement cycles. The program centers on commercialization, operator feedback and realworld execution.

The inaugural cohort comprises:

• RentFlow – A pricing and leasing intelligence platform helping

According to CRETI, the group was selected based on product readiness and demonstrated owner and manager demand. The program is structured to mirror how adoption actually occurs, with startups engaging directly with property executives through working sessions, feedback forums and curated introductions.

Throughout the program, participating companies will work closely with multifamily leaders to refine their commercial strategies, pursue pilot opportunities and position themselves for partnerships and early revenue. The initiative culminates in private briefings with operators and investors, reflecting CRETI’s emphasis on execution over exposure.

“Foundations was built to close the gap between strong products and actual adoption,” said Ashkan Zandieh, managing director of CRETI. “In the real estate industry, technology only works if it aligns with operational realities and delivers clear economic value.”

CRETI plans to roll out additional Foundations cohorts focused on other real estate segments.

With over 75 years of experience and deep understanding of industry challenges, IDB’s Commercial Real Estate team supports property owners, developers and builders across every type of financing requirement. We can help you keep pace with changes in the marketplace, while maintaining high credit quality levels and providing the personalized service, efficiency and flexibility to fit your specific needs.

For more information about financing solutions that meet your specific needs, visit idbny.com.

is experiencing major disruption, our new alliance represents a deliberate and defining choice,” said Paddy Dring, head of global prime sales and Knight Frank’s Private Office. “We believe the future belongs to firms that uphold excellent standards of client privacy and combine the strength of a global platform with the agility, intimacy, and deep local expertise of a boutique brokerage. This alliance sets us apart; it’s about quality over scale and partners that truly understand their markets.”

Global property consultancy Knight Frank announced a new strategic alliance with Carolwood Estates, a boutique real estate brokerage based in Beverly Hills. The new alliance marks a pivotal moment for Knight Frank as it engages with the U.S. market with renewed energy, focus and commitment, the company said.

The new platform offers unique opportunities for Los Angeles clients involved in global real estate transactions, as well as for international clients looking to acquire property in Los Angeles.

“This is a hugely exciting step for Knight Frank with a partner that naturally aligns with our values. In a time when the real estate landscape

Los Angeles’ ultra-high-net-worth clients can also access Knight Frank’s Private Office, a specialist team delivering bespoke, end-to-end service. Knight Frank also is exploring similar partnership opportunities in New York, Miami, Palm Beach, Fla. and Aspen, Colo., Dring continued.

Headquartered in London, Knight Frank has more than 20,000 people operating from 600 offices across 50 territories. The group advises clients ranging from individual owners and buyers to major developers, investors and corporate tenants.

Carolwood’s roster of 200 associates closed $5 billion in sales in 2025. The firm represented both sides of the two highest sales in Los Angeles of 2025, both closing at $110 million each respectively.

“We are beyond excited to partner with Knight Frank and bring Knight Frank’s global audience to Los Angeles and the West Coast,” said Drew Fenton, CEO of Carolwood Estates. “Our level of clientele and the significance of the properties we represent are the perfect fit for such a legendary brand.”

professionals discover and qualify new project and relationship opportunities, reducing weeks of business development research into just minutes.

As part of a major Texas growth strategy, Mercator.ai, an AI-powered business development platform for commercial construction, announced its expansion into the Houston market. This strategic move follows the company’s launch in Austin earlier this year.

Mercator.ai is an AI-powered relationship-based business development software for general contractors, subcontractors, suppliers and construction service providers. Its goal is to transform how construction

“Houston’s sprawling growth and increasing competitive landscape make it ripe for innovation and the perfect next step in our Texas expansion,” said Chloe Smith, CEO and co-founder of Mercator.ai. “Our platform transforms how construction professionals discover and qualify new projects, reducing weeks of business development research into minutes and enabling teams to start building mutually profitable relationships at the earliest possible project stage.”

The platform’s expansion into Houston includes access to relationship mapping and contact information for key project stakeholders, complete coverage of private and public commercial and industrial construction projects across the City of Houston and real-time monitoring of early project signals including land and real estate transactions, permitting and development proposals.

“Houston’s construction community is known for innovation and relationship-building,” Smith continued. “We’re excited to offer Houston contractors a seven-day free trial of our platform, allowing teams to experience firsthand how early project detection can optimize their most limited resource — time.”

$800+ Million Originated. Built for Bor rowers.

Integritas Capital was built to serve independent sponsors. As developers and operators, we understand the needs of builders and owners.

Founded by Stephen Palmese, the firm leverages two decades of brokerage relationships, development, and real estate lending.

In the last 18 months, Integritas has originated $811 million in loans, financing adaptive-reuse, construction, and transitional projects.

Disciplined underwriting underpins our selection process across our robust pipeline.

We deliver professionalism: speed, structure, and certainty to close. We back independent sponsors with institutional execution.

Loan sizes typically range from $25 million to $300 million.

“Adam, Christy and Wally are nationally renowned real estate attorneys whom we have sat across from and worked alongside for years,” said Jonathan L. Mechanic, partner and chairman of Fried Frank’s Real Estate Department.

Fried Frank announced that a prominent team of lawyers have joined the firm’s global Real Estate department. Partners Adam Endick and Christy Mazzola, along with senior counsel Wallace (Wally) Schwartz, will be based in the firm’s New York office.

“This group’s broad and deep skillset in our core practice areas will only further enhance our ability to service our clients. They will fit seamlessly into our team, and we could not be more excited to welcome them,” said Laurinda Martins, partner and co-chair of Fried Frank’s Real Estate Department.

Endick, Mazzola and Schwartz have decades of experience advising clients on the full spectrum of commercial real estate transactions, including acquisitions and dispositions, development, leasing, joint ventures and financings, across all asset classes.

This group’s arrival adds to the global growth of the firm’s Real Estate Department, which welcomed David Evans and Roger Schofield as partners in the department’s Corporate Real Estate Practice in London.

square feet of ground-floor retail space. Designed by SO–IL, with Magnusson Architecture & Planning serving as architect of record, Anagram Gowanus will offer Brooklynites studio to three-bedroom residences and feature amenities curated around community and wellbeing including fitness and coworking spaces, a children’s playroom and rooftop terraces.

Global Holdings, the international real estate development and investment firm founded and led by Eyal Ofer, in partnership with MacArthur Holdings and Tankhouse, celebrated the topping out of the luxury, mixed-use residential tower Anagram Gowanus at 450 Union Street in the Gowanus neighborhood of Brooklyn. Anagram Gowanus is anticipated to be completed in Q2 2027.

“We’re proud to reach this significant construction milestone at Anagram Gowanus, which demonstrates the momentum behind the Anagram brand’s growth as we continue to deliver unique, curated living experiences for the city’s most discerning renters,” said Josh Feder, senior vice president, head of investments, Global Holdings. “This development extends our ambition to scale the unparalleled Anagram lifestyle in high-growth neighborhoods. As the project continues to take shape, we look forward to introducing to the market a best-in-class asset that will unveil a whole new lifestyle and experience to the neighborhood.”

Anagram Gowanus is a 20-story, 158-unit mixed-use tower with 22,000

“As with all our work across Brooklyn, Anagram Gowanus has been shaped through a deep commitment to design, collaboration, and care,” said Sebastian Mendez, co-founder, Tankhouse. “Located in the creative heartbeat of Brooklyn, Anagram Gowanus’ topping out is a meaningful moment as we move closer to delivering a residential offering that thoughtfully fosters connectivity to its neighborhood and reflects our belief that strong design leads to vibrant, thriving communities.”

Private outdoor space lines the majority of units, with 25% having an outdoor terrace and nearly every unit featuring a Juliet balcony. All residences will offer dual-corner exposure, providing views across Manhattan, Brooklyn and New York Harbor. Anagram Gowanus will also include a 5,700-square-foot waterfront esplanade that expands public access along the Gowanus Canal and supports the city’s waterfront activation goals.

“[The] topping out of Anagram Gowanus is a testament to the strength of our partnership and our long-term vision that carried this project through,” said Howard Katz, principal, MacArthur Holdings. “With decades of experience in building and operating across New York City, we see enduring potential in Gowanus and are proud to contribute to Brooklyn’s continued evolution.”

KSK Construction Group served as the general contractor, with Raptor Concrete engaged as the project’s foundation and superstructure subcontractor.

By Debra Hazel

The launch of leasing at The Orchard does more than signify the addition of much-needed housing in New York City — it is almost literally monumental.

Soaring 823 feet above Long Island City, Queens, making it the tallest rental tower in the borough, The Orchard offers 824 residences, comprising 576 market-rate rental apartments and 248 affordable homes.

Its goal, said Bldg Management Co., the full-service, verticallyintegrated real estate investment, management and development firm behind the project, is to introduce a new standard for luxury living in one of the city’s most vibrant and pace-setting neighborhoods, “where bold design, immersive amenities, rare outdoor experiences and sweeping views converge at one premier address.”

“We’re incredibly proud to introduce The Orchard, a project that reflects our long-standing commitment to shaping the future of Long Island City,” said Lloyd Goldman, president of Bldg Management. “Having owned this site for nearly 60 years, we set out to create a development that honors the neighborhood’s history and elevates its modern identity. From the residences to New York’s largest private backyard space, we’ve crafted an unparalleled living experience and look forward to welcoming our first residents as this remarkable new chapter comes to life.”

Located at the intersection of Orchard Street and Jackson Avenue and commanding a full city block, the 70-story tower offers a refined contemporary lifestyle framed by 360-degree skyline panoramas. Bridging Long Island City’s industrial heritage with its creative energy and modern appeal, The Orchard was conceived as both a landmark destination and an authentic expression of the neighborhood’s history and character.

Incorporated in 1870, Long Island City became an industrial hub due to its location on the East River waterfront, most famously as the home to the Silvercup Bread Company factory, as well as other manufacturing plants. The decline of manufacturing beginning in the 1970s saw these large spaces abandoned except for the toxic waste left behind.

But a waterfront property — especially a location that is within minutes of the 7, E, M, F, G, N, R and W subway lines, Long Island Railroad, Citi Bike stations and the New York City Ferry — couldn’t be neglected for long. Lloyd Goldman’s father and uncle, Irving and Sol Goldman, invested in the area, acquiring a site that was originally part of Greenpoint Terminal in the 1960s and the family bided its time.

Others, meanwhile, began building. The Silvercup Bread Factory was converted to the Silvercup Studios film and television production facility in 1983. Rezonings changed

abandoned factories into residential neighborhoods with schools, parks and more. In 2025, the New York City Council approved the “One LIC” plan that is expected to transform 54 blocks in the neighborhood. The $2 billion plan would add some 15,000 new residential units (about 4,300 of them affordable), commercial space and more.

By the early 2020s, the time was right for Bldg Management to build on its long-held property.

“We have held this site for nearly 60 years, and it ’s served the neighborhood in different ways, from the American Steel Wool building to Woody Allen’s cutting space,” said Lloyd Goldman. “Long Island City has become one of New York ’s most compelling residential neighborhoods, and this felt like the right moment to introduce something that reflects where Long Island City is today.”

In mid-2023, Bldg Management secured a $425 million construction loan, led by M&T Bank, along with U.S. Bank and Bank of China, Israel Discount Bank, City National Bank and Bank Hapoalim. Construction began in June 2023.

Designed by Perkins Eastman, The Orchard’s façade pairs brick, glass and metal elements with elegant vertical articulation to acknowledge the area’s past. Rising on a site once home to the

American Steel Wool Building and later a film distribution hub where movie canisters were shipped out and film editors worked, The Orchard reimagines this lively history as a new architectural icon for Long Island City. When illuminated, its crown will serve as a beacon on New York’s skyline. The Orchard was constructed by Triton Construction, with Thornton Tomasetti serving as structural engineer.

“Perkins Eastman is one of the most respected design firms. They truly understand how to design buildings that respond to their surroundings and history,” Goldman said. “They were able to capture Long Island City’s industrial roots while giving the building a modern, forward-looking feel, creating something that’s both timeless and distinctly of this neighborhood.”

The timing also aligned with how renter expectations have evolved, Goldman continued. Even as new buildings arose, prices increased, too. According to Apartments.com, the average rent in Long Island City in January 2026 was $3,676 per month, 126% higher than the national average rent, up 3.3% year-over-year.

“Today ’s renters are looking for a residence that enhances how they live, and The Orchard was designed to deliver on that while supporting Long Island City’s evolution as a vibrant residential and cultural neighborhood,” Goldman said, noting

“Long Island City has become one of New York's most compelling residential neighborhoods, and this felt like the right moment to introduce something that reflects where Long Island City is today.”

—Lloyd Goldman

that the area includes green spaces, shops and cultural institutions such as the MoMA PS1, The Noguchi Museum and the Museum of the Moving Image. “The amenities are exceptional: spaces for wellness, including indoor and outdoor pools, fitness facilities, work areas, social spaces and outdoor retreats that integrate seamlessly into daily life. We felt the market was ready for this level of offering, and we’re seeing residents embrace it.”

The Orchard’s interiors by McCartan also offer expressions of industrial modernism. Designed to evoke a tranquil retreat, the arrival sequence begins with an elevated entryway and covered porte-cochère that lead into a dramatic double-height lobby. Two tailored orchard murals with ornate embellishments add texture and depth, while tall columns, natural materials and art-inspired details create a spectacular first impression.

The Orchard’s studio to three-bedroom residences cater to multiple household styles, with select homes featuring private balconies or terraces. Residents can choose from four collections: The Residences, The Terrace Collection, The Premier and Penthouse Collection and The Sky Collection.

Each residence offers open layouts with high ceilings and oversized windows that flood interiors with natural light while framing sweeping city and backyard views. The kitchens are appointed with modern solid-surface countertops and matching backsplashes, stainless steel appliances, including a Samsung gas range stove, and two-tone custom cabinetry. Bathrooms feature refined, stylish tiled walls, floors and showers, illuminated vanity mirrors and integrated floating sinks. Premium flooring brings warmth into the space, and every home includes in-unit laundry, programmable climate control and pre-wired WiFi. Solar shades are provided throughout, with blackout shades in bedrooms for comfort and privacy.

Each residential floor is accented with one of four signature corridor colors – red, blue, yellow and green – allowing residents the chance to select the atmosphere and aesthetic that they prefer.

Amenities span multiple floors and total more than 100,000 square feet of indoor and outdoor space. The heart is a 60,000-squarefoot landscaped Backyard on the third floor, with plantings designed and selected by Hank White of HMWhite, a New York–based landscape architecture studio. Features include an apple orchard with shaded paths, a resort-style pool with cabanas, three pickleball courts, a large running track, an outdoor media screen for movies and events, a great lawn for picnics and relaxation, a yoga deck, a life-size chess set, an outdoor games area, barbecue grills, large fire pit, a children’s playground and a fenced dog park.

The third-floor Fieldhouse provides a fitness center with Technogym equipment, a boxing studio and a versatile openconcept studio with dedicated Pilates and stretch-and-flow spaces. A full size indoor basketball court with a screen and film projector offers space for games and training, while the aquatic center includes an indoor lap pool, hot tub, steam room and sauna for relaxation. The building also boasts The Treehouse, a playfully designed children’s playroom.

On the fourth floor, The Commons offers self-serve coffee bars and a variety of spaces for entertainment, leisure and dining. Highlights include a multi-sport simulator, full-size arcade game

room with ping pong and billiards tables and screening and multimedia theaters with kitchenettes. The business center is equipped with co-working areas, secluded nooks and conference rooms in addition to a podcast studio and lounge. An event room, outdoor terrace and overlook provide elegant settings for gatherings and connection.

The Orchard’s 70th floor Sky Lounge will be a full-floor retreat offering all residents penthouse views of the city. Complete with a bar, full-service kitchen and seating area centered around a bespoke fireplace, it provides an elegant setting for dining or unwinding with friends and loved ones.

On-site services are powered by LIVunLtd and a 24-hour attended lobby. Residents benefit from LIVunLtd’s dedicated hospitality team with personalized support such as move-in assistance and home setup to pet care, fitness programming, custom events and more. The covered porte-cochère connects directly to a two-story garage with 207 parking spaces available for rent.

Additional building amenities include bicycle storage, a mailroom, a package room with refrigerated storage, resident storage units and a dog wash. The tower also features 14,550 square feet of retail space along Jackson Avenue, which, upon opening in late 2026, will bring new offerings to residents and the broader community.

“Long Island City is one of New York’s most dynamic residential markets, with strong demand for full-service living,” said Jodi Stasse, executive vice president of new developments at The Corcoran Group, The Orchard’s exclusive marketing and leasing agent. “The Orchard takes that lifestyle to the next level with striking architecture, thoughtfully designed interiors and expansive outdoor spaces. From rooftop dining and co-working lounges to pet-friendly areas and courts for basketball and pickleball, every detail is curated to inspire. It’s a community with something for everyone — where convenience meets sophistication.”

Zetlin & De Chiara LLP, one of the country’s leading law firms, has built a reputation on counseling clients through complex issues. Whether negotiating a contract, resolving a dispute, or providing guidance to navigate the construction process, Zetlin & De Chiara is recognized as a “go-to firm for construction.”

For 130 years, the Real Estate Board of New York (REBNY) has served as a constant in a city defi ned by reinvention. From booms and busts to rebuilds and reimaginings, REBNY has helped shape the policies, planning decisions and industry standards that underpin New York City’s growth and resilience. Representing the owners, developers, brokers, managers and professionals who define the city’s skyline, the organization has long operated on a simple premise: when New York City succeeds, so does its real estate industry.

Today, New York’s real estate industry operates in an environment that is more complex, regulated and scrutinized than at any point in its history. REBNY can point to multiple examples over the last decade of deliberate organizational renewal to ensure that the institution remains agile, credible and indispensable to its members.

From Dinner Conversations to Industry Leadership

REBNY’s origins offer a useful reminder of how evolution has always been part of its DNA. When a small group of brokers gathered for dinner in the late 19th century, the goal was straightforward: share information in an era when market intelligence traveled slowly and unevenly. That commitment to transparency and collaboration — exchanging what space was available, what was needed and eventually what prices were being paid — laid the groundwork for an institution that would grow alongside the city itself.

Over time, that informal exchange matured into something more powerful. In the late 1970s, REBNY made a pivotal decision to bring owners fully into the organization, sharing power and perspective. That shift fundamentally changed the board’s posture — from a largely reactive body to a proactive advocate capable of shaping policy, zoning and land-use outcomes in partnership with city leadership.

The modern phase of reinvention began, as it often does, with people. While REBNY has always benefi ted from deep institutional knowledge, the scope and sophistication of its work expanded dramatically — spanning policy advocacy, global data standards, residential technology platforms and complex member services.

In response, REBNY refreshed its leadership and staff, recruiting professionals with expertise across government relations, IT, policy, brokerage, operations, events and social impact. Crucially, this infusion of outside perspective strengthened — rather than displaced — institutional memory.

By James Whelan, President, Real Estate Board of New York

Culturally, the organization shifted toward clear goals, accountability frameworks and performance metrics, replacing informal, tenurebased decision-making. Staff development, cross-functional collaboration, succession planning and inclusion became strategic imperatives. The result is a more agile, empowered workforce aligned around outcomes — not process.

Behind the scenes, REBNY rebuilt the technological backbone of the organization in recent years to improve insight, scalability and resilience. Outdated legacy systems have been replaced by Salesforce, cloud infrastructure and robust cybersecurity and data governance.

Leadership gained real-time visibility into member engagement, advocacy impact, program ROI and event performance. Automation replaced manual processes, freeing staff to focus on higher-value work — from policy leadership to member advocacy. These investments may be invisible to most members, but they are now the silent engine that allows REBNY to move quickly and decisively when it matters.

Operationally, REBNY has moved from compartmentalized execution to an integrated enterprise model.

Core workfl ows — budgeting, communications, policy development, event planning — were redesigned end-to-end to reduce delays and duplication. Silos were dismantled in favor of cross-functional teams aligned around member outcomes rather than departmental lines.

Financial discipline was strengthened through long-term planning, scenario modeling and reserves management, ensuring institutional stability even amid market volatility and political headwinds. As membership, programming and advocacy demands grew, REBNY built scalability into its operations — delivering more without increasing overhead at the same rate.

Perhaps the most visible evolution has been REBNY’s renewed focus on daily member value. Listening was formalized through surveys, advisory councils and direct engagement. Programming and communications were segmented to refl ect the diversity of the membership — from residential agents and commercial brokers to owners, developers, managers and emerging proptech fi rms.

Professional development courses keep practitioners competitive. Highly curated events and committees help members build reputational capital in a relationship-driven market. The Legal Line provides seven-day-a-week expert guidance in a regulatory environment that grows more complex each year. Market reports are widely cited by the media.

In addition, the organization’s seven core events have been reimagined as strategic platforms — including the Annual’s return to the Waldorf Astoria, a symbolic bridge between REBNY’s origins and New York’s post-pandemic resurgence.

As many members put it plainly: you cannot maximize your market presence in New York City without active involvement in REBNY.

That member-centric focus has shaped REBNY’s advocacy posture — especially during one of the most challenging political climates the industry has faced in decades.

In 2024, the FARE (Fairness in Apartment Rental Expenses) Act, which shifts the payment of real estate broker fees from tenants to landlords, galvanized the real estate community. REBNY convened working groups, organized testimony, mobilized members and rallied more than 1,000 agents on the steps of City Hall. When the law passed, REBNY moved swiftly, fi ling a federal lawsuit challenging the Act on constitutional grounds.

The same proactive leadership defi ned REBNY’s role in advancing City of Yes, the most signifi cant zoning update since 1961. Through expert testimony and sustained engagement, REBNY helped unlock new housing supply, offi ce-to-residential conversions and long-term opportunity across all fi ve boroughs. City of Yes comes as New York City is in desperate need of 500,000 new homes to keep up with population and economic growth.

REBNY’s approach to advocacy refl ects a long-standing institutional instinct: when the city is at risk, REBNY does not wait on the sidelines.

Nowhere is REBNY’s evolution more evident than in the Residential Listing Service.

Today, REBNY’s RLS connects brokerages to tens of thousands

of exclusive New York City listings and powers the internal listing platforms of more than 500 member firms. Recent upgrades to a new backend and full adoption of RESO Web API standards have dramatically improved data quality and interoperability. The fi rst-ofits-kind centralized building database for New York City, the RLS provides a single, authoritative source of building information directly from owners and managers. In a vertical city, accurate building data is not a luxury; it is essential.

Beyond New York, REBNY staff are helping lead global efforts to standardize building data, positively impacting hundreds of MLSs and technology providers worldwide. This work reflects a broader shift: REBNY is not simply responding to technological change — it is helping set industry standards.

After nearly a decade of intentional transformation, REBNY is stronger, more adaptive and more relevant than at any point in its recent history. It has a high-performing team, modern systems, disciplined operations, deeper member relationships and a strategy designed for long-term infl uence.

Most importantly, the organization has reaffi rmed its core purpose: to serve its members with clarity, consistency, and conviction — and to fi ght the big fi ghts when it matters most.

At 130 years old, REBNY is not looking backward. It is built to lead New York’s real estate community to new heights.

By Simon Soloff, President and Co-founder, EnTech

For apartment buildings in colder climates, winter puts boilers through their most demanding workload of the year. After months of continuous operation, fl uctuating temperatures and heavy demand from dozens (or hundreds) of residents, boiler systems often emerge from winter with hidden wear and tear. While everything may appear to be functioning normally on the surface, minor issues that are left unaddressed can quietly escalate into costly breakdowns by the next heating season.

As president and co-founder of EnTech, a company focused on smart energy solutions for multifamily dwellings, I’ve seen how spring boiler maintenance provides a valuable reset. Addressing issues during the warmer shoulder season boosts efficiency and safety, reduces emergency calls and extends equipment life. Unlike fall’s rush of cold-weather startups, spring allows time for thorough inspections, planned repairs and smart upgrades without urgency. Here’s how to position your building’s boiler system for a more reliable heating season ahead.

The first step in post-winter boiler care is reviewing how the system performed during peak heating months. Maintenance logs, service records, fuel usage data and tenant complaints provide valuable insight into where the system struggled. Look for recurring issues such as uneven heat distribution, pressure fluctuations, shortcycling or unexplained increases in fuel consumption. Were certain zones consistently colder? Did maintenance staff respond to repeated calls about hot water shortages? These patterns often point to underlying issues that deserve attention now, not later.

Using winter performance data to guide spring service priorities ensures that maintenance eff orts are targeted and eff ective instead of reactive.

An annual post-winter inspection by a licensed boiler technician is essential for multi-unit buildings. Even well-maintained systems benefit from a professional assessment after months of heavy use.

A spring inspection gives technicians the opportunity to closely evaluate critical components, such as checking heat exchangers for cracks, corrosion or scale buildup; burners and combustion chambers to ensure clean, effi cient ignition and safety controls and shutoff valves to confi rm they are operating properly.

Technicians should also assess expansion tanks and pressure relief valves to ensure the system can safely handle pressure changes under varying loads. Beyond mechanical performance, a comprehensive spring inspection includes verifying code compliance, testing all safety devices and updating system documentation.

Proper records both demonstrate adherence to local regulations and also provide important protection for owners and property managers in the event of an incident or insurance claim.

Cleaning is one of the most impactful (and often overlooked) parts of spring boiler maintenance. Over the winter, boilers accumulate soot, scale and sediment that reduce efficiency and increase wear. Key cleaning tasks include removing combustion byproducts from heat transfer surfaces, cleaning burners and combustion air openings and inspecting flues and venting systems for blockages, corrosion or deterioration.

Even small obstructions can affect draft and combustion efficiency, leading to higher emissions and fuel costs. A clean boiler operates more efficiently, runs quieter and experiences less stress on internal components, ultimately delivering measurable savings over time.

Check for Leaks, Corrosion and

Winter conditions create ideal environments for moisture buildup and condensation, which can accelerate corrosion throughout a boiler system. Spring inspections should include a detailed check of pipes, valves, seals, fi ttings and connections. Small leaks, rust spots or worn gaskets may seem minor now but can worsen during off-season

inactivity or when the system ramps up again in fall. Addressing these issues early prevents water damage, pressure loss and unexpected failures later.

This is also the time to inspect insulation around pipes and mechanical rooms, as doing so will help minimize energy losses year-round.

Safety systems are only effective if they work exactly as intended, and spring is the ideal time to test them thoroughly. Visual inspections alone are not enough. Technicians should verify the operation of low-water cutoff devices, pressure and temperature controls, emergency shutoffs, alarms and interlocks. These components protect both the building and its residents from dangerous conditions, including overheating, overpressure or dry fi ring.

Routine testing ensures safety systems respond correctly during an emergency, not just during routine operation.

Water quality plays a major role in boiler longevity and efficiency. Improper pH levels, hardness or high dissolved solids can lead to scale buildup, corrosion and reduced heat transfer. Spring is an ideal time to test boiler water chemistry and take corrective action. This may include flushing the system, skimming to remove oils and debris or adjusting chemical treatment programs.

Maintaining proper water chemistry during the off -season helps protect internal surfaces and prevents damage that could otherwise go unnoticed until performance declines.

As outdoor temperatures rise, boiler systems often operate inefficiently if controls are not adjusted. Spring maintenance should include recalibrating temperature set points, outdoor reset controls and staging sequences to match milder conditions. Reducing unnecessary run times minimizes short cycling, lowers energy consumption, and reduces wear on components. For buildings with domestic hot water systems tied to the boiler, programming appropriate setbacks can deliver additional savings without compromising resident comfort.

Fine-tuning controls ensures the system operates effi ciently year-round.

Spring and summer offer the best window for non-emergency repairs and system improvements. With lower demand and greater scheduling flexibility, building owners can address worn components, aging controls or deferred maintenance without disrupting residents. This is also an ideal time to evaluate effi ciency upgrades such as improved controls, variable-speed pumps, or enhanced monitoring systems.

Planning upgrades now allows owners to budget strategically and complete work well before the next heating season begins.

Clear communication with tenants is a key part of successful spring boiler maintenance. Residents should be notified in advance about any brief service interruptions, inspections or testing that may aff ect heating or hot water availability.

Spring is also a good time to set expectations about shoulder-season temperature fluctuations and encourage residents to report any ongoing issues promptly. Early feedback helps maintenance teams catch problems before they escalate.

All inspections, repairs, test results and recommendations should be thoroughly documented. Updated service records create a clear maintenance history, support warranty claims and demonstrate due diligence. Based on spring findings, property managers can also begin building a fall startup checklist, ensuring nothing is overlooked when colder weather returns. Strong documentation not only improves operational readiness but also protects owners and managers from liability.