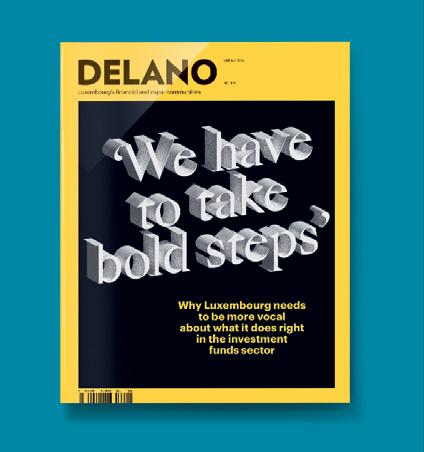

Why Luxembourg needs to be more vocal about what it does right in the investment funds sector

Why Luxembourg needs to be more vocal about what it does right in the investment funds sector

Oh, the poor Ucits. The liquid, retail-friendly investment structure has been the backbone of Luxembourg’s funds sector since the late 1980s. But in recent years it has been, in terms of net sales growth rates and PR buzz, eclipsed by private market funds. The main buzziness around Ucits that does exist these days has been around plain vanilla exchangetraded funds (ETFs), which are cheaper to run, increasingly domiciled in Ireland and not Luxembourg, and I imagine less profitable to manage.

Wednesday 15 May

For this edition, I had the opportunity to sit down with the Association of the Luxembourg Fund Industry’s new director general, Serge Weyland, in his first proper grilling by the press (see page 32). I went into the interview expecting to hear about how private market funds were shaping the local market, but Weyland surprised me. While not discounting the growth potential of private market funds, Weyland said, “I still believe that Ucits have a bright future” and specifically actively managed Ucits.

His argument was two-fold. Passive ETFs are typically very US-centric, with portfolios often tracking 80%-100% US equities. Such overexposure can present “an idiosyncratic risk by having the herd mentality” at play, Weyland stated. On the other hand, active funds provide a more diverse set of investment options.

Improved digital distribution will eventually draw in a “broader set of investors”. That’s where passive funds still have the advantage. “Today, the reality is, if you log on to Revolut or Swissquote, it’s easy to invest into a passive ETF, because it’s an ETF. It’s right there, you push the button and you can buy it. If tomorrow all your active funds are available through these platforms, that will attract new flows of money that currently is not invested in funds.” That is why he expects that “Ucits have a big reason to grow.”

Words AARON GRUNWALD For event information and registration, visit delano.lu/club Luxembourg’s private banks manage some €600bn in assets, but face significant challenges as digitalisation and personalisation take centre stage. This roundtable features, among others, Ananda Kautz of the Luxembourg Bankers’ Association (ABBL), pictured, Pascal Martino of Deloitte and Isabelle Waty of Indosuez Wealth Management.

FINANCE

8 PHILIP BROWN

“T+1 brings uncertainty to securities lending market”

60 FRANÇOIS CHAUVET

European Fund Trophy winners

66 CRYPTO-ASSETS

Getting ready for Mica

76 ESG RATINGS

Coming EU rules

BUSINESS

12 LOREN DANESI

“If you’re missing diapers, it’s for right now!”

86 MICHEL NICKELS

How much landlords can raise rents in Luxembourg

POLITICS

14 ANNE-MARIE NICOLAS & VÉRONIQUE HOFFELD

Bankruptcy law provides new options

22 ROBERTO MENDOLIA Trade union Aleba’s plans to go national

Clifford Chance is the market-leading law firm advising global fund sponsors seeking to facilitate access for European non-professional investors to alternative assets.

The Clifford Chance team provides exceptional legal and commercial input. They clearly stand out in the market.

As the US moves towards reducing the securities transaction settlement cycle from two business days after the trade (T+2) to one (T+1), Philip Brown spoke about the challenges ahead for Clearstream and its clients.

What are the main challenges of moving to T+1 settlement in the US by May 2024, and how is Clearstream preparing?

We have to separate the move to T+1 into two separate issues. One is the technical ability to cope with T+1, and the second is the ability of the businesses--and I don’t just mean our business, but we have to think about Clearstream as a vehicle through which our clients do business--to cope with T+1. So, let me address the first question. Technically, there’s no change needed for us. We run a real-time settlement platform today, and a majority of our settlements are already settled in T+0, meaning the same day. So, in that regard, a move to T+1 for us is not significant from a technical perspective.

Could you estimate Clearstream’s T+0 settlements?

percentage of the investments of Asian clients are in US dollar instruments, as the US is by far the world’s largest capital market. So anybody that’s investing cross-border is likely to have a US investment in their portfolio. And there are two main impacts on these clients due to the T+1 shift. The first is the timezone di erence, which means in a T+1 environment, they have less time to resolve settlement issues discovered during their day. This is particularly challenging for clients running batch processes, which can only be executed once a day. The second issue involves the foreign exchange market, which settles in T+2. This misalignment means clients needing to secure US dollars for investments must plan in advance or face potentially unfavourable currency exchange rates.

Are there any other challenges you foresee?

For the cluster of Luxembourg business, it’s north of 40%. And the reason for that is a lot of our settlement volume is related to the movement of collateral, and collateral moves on a same-day settlement basis.

So, there is no material impact on Clearstream?

Technically, from our business perspective, there’s no impact at all. See, we support the Chinese market, which is already at T+0. We supported the European markets when there was a mixture of T+3 and T+2, and the Indian market settles at T+1. So, we already support an array of more than 60 markets worldwide, each with di erent settlement protocols. From our perspective, it doesn’t really a ect our ability to run our business day-to-day if one market or a number of markets change their settlement cycle. The impact is more on customers.

How so?

The biggest impact will be on clients that are not based in Europe or the United States. A large

Yes, there is a third impact, true for all clients. The shift to T+1 brings uncertainty to the securities lending market. The way securities lending works is that if I lend out my securities and then decide to sell them, I have to recall them. With T+1 in the US, the recall period becomes shorter, requiring securities to be returned more quickly. So, I think there’s an unknown impact on securities lending.

Philip Brown, CEO of Clearstream Banking, a securities services provider, says the shift to T+1 settlement in the US will not directly a ect Clearstream’s operations, but it will impact its clients, especially in Asia.

Interview KANGKAN HALDER Photo GUY WOLFF

Interview KANGKAN HALDER Photo GUY WOLFF

“We took advantage of SNCI’s proInnovate programme, which is dedicated to companies that innovate in their sector by bringing to market new, highquality, reliable, and increasingly eco-responsible products.”

For us, entrepreneurship is made of a wide range of different projects, all of which stimulate and diversify Luxembourg’s economy. We support all entrepreneurs through our financial programmes. Do you have a business project that you would like to make a reality? Then don’t hesitate to contact us.

More information on snci.lu/en I / snci supporting entrepreneurship

Claude Maack GRADEL proInnovate

+5.000 attendees

+1.200 guests at the closing seated dinner

+200 start-up exhibitors

+200 speakers

11.000 m2 surface area

+70 exhibitors

3 Villages and 4 stages

Eryka Lehr Strategy & Operations Google

Gilles Roth Minister of Finance

Lex Delles Minister of Economy

Xavier Bettel Deputy Prime Minister

Eryka Lehr Strategy & Operations Google

Gilles Roth Minister of Finance

Lex Delles Minister of Economy

Xavier Bettel Deputy Prime Minister

How does the app work?

Food (and goods) delivery service Wolt has come to Luxembourg. Loren Danesi, general manager for the country, explains the app and how Wolt plans to compete.

We have three main stakeholders: merchants (restaurants and stores); courier partners; and customers--we thus have three interconnected apps.

For the customer, it’s an intuitive and very easy-to-use app which shows all the restaurants and shops that are open from where you are located right now, and what is available--you order what you want, see how much it costs and how long it takes to be delivered, and then you pay. And you have a live tracker.

How do you make money?

We have two sources of revenue. The first one is the customer, who pays delivery fees. And the second is the stores and restaurants, which pay a commission for being on the platform and using our delivery service.

On the merchant app, you receive orders, which you can accept or reject. When you accept it, you’re asked to confirm that you can prepare it in the previously determined average time. If you’re overloaded, you can say: sorry, I need five more minutes--then click and it updates the customer app, so everyone sees the progress in real time.

On the app for courier partners, you will get a delivery o er based on your location and see how much you can get for it--it’s super transparent--and you can accept or reject it. You know the distance, the restaurant, where to go… and you can connect whenever you want.

It’s not only restaurants, right?

Right. The idea is to deliver anything you need within 30 minutes. Imagine your fridge is empty-you didn’t buy any groceries--you can check our app and find a convenience store that can deliver your groceries (milk, eggs, anything). Or your iPhone cable is lost and Amazon delivers in 12 hours but you need it now.

Or diapers: in general, if you’re missing diapers, it’s for right now!

Luxembourg is the 30th country of operation for Wolt and Doordash [editor’s note: the latter acquired the former in 2022]. What challenges do you anticipate in this marketplace?

The first challenge was to have an excellent portfolio of restaurants for the initial launch. And it’s done; we’re happy.

And during this whole process, if you have any problem, our support team is always in the background. They will help you--merchant, courier partner, customer--at any stage and will answer your query within one minute.

LOREN DANESI

LOREN DANESI

If I’m understanding correctly, the courier partners are all freelancers? How does it work for them?

They apply, then sign a service agreement with us. And what makes it super flexible is that they connect when they want, for how long they want. Usually the average in Europe is approximately ten hours per week that they connect, i.e. are working.

Danesi, 31, joined Wolt to oversee its launch in Luxembourg and run its operation here. “We’ve already had great experiences in similarly sized markets like Iceland and Malta,” she says. “We believe we can recreate that success.”

[Editor’s note: at the time of writing, some 200 restaurants are on the platform.] The second challenge is to have the right number of courier partners… we have to secure customer experience first. And the last one is Wolt’s name here in Luxembourg--not everyone knows it. We have to build an awareness of the name.

Interview JEFF PALMS Photo GUY WOLFF

Interview JEFF PALMS Photo GUY WOLFF

For Anne-Marie Nicolas and

Véronique Hoffeld from Loyens & Loeff, Luxembourg’s new bankruptcy and business preservation law brings a “rescue culture.” But there are “blind spots” in the law and more judicial certainty is needed.Words LYDIA LINNA

Luxembourg, as of 1 November 2023, has a new law that focuses on business preservation and the modernisation of bankruptcy law. It gives other options to companies in distress, explained Anne-Marie Nicolas, a partner at Loyens & Loeff who heads the law firm’s banking & finance practice.

This new law, which implements EU directive 2019/1023 on preventive restructuring frameworks, emphasises the fact that companies now have options to restructure their debt. While options did exist before, these were not very efficient and thus were not often used.

There is also a “preventive process,” said Nicolas, and “there is a whole toolbox that was added to our legislation that allows companies to sort of ring the alarm bell to say, ‘I’m in trouble. Can someone look into my situation?’” The company can also discuss potential restructuring options with creditors.

With this new law, “there is a real rescue culture that could be implemented in Luxembourg. That was not the case before--it was pretty brutal,” said Nicolas.

“We had a very old-fashioned system,” added Véronique Hoffeld, partner and head of the firm’s litigation & risk management practice group. “In a case of bankruptcy, the receiver would try to sell as much as possible--and as quickly as possible--and then to close the bankruptcy. So you would lose a lot of value from your assets. That was a downside--no second chance, and also loss of value.”

The new law brings restructuring options, the “rescue culture” and the “cramdown” mechanism, which is when creditors can be forced to accept a restructuring.

“That makes a huge difference in practice, because you rarely have 100% of your

“We also don’t have the judicial certainty that other countries have now”

ANNE-MARIE NICOLAS

creditors on board once you want to restructure. So you need that mechanism to bind those who don’t agree,” said Nicolas. “We’ve seen it in other countries. That works really well, and we have that now. That, for me, is the biggest advantage.”

“One interesting new procedure is also that--as a creditor, or even a third-party that has an interest--if you see that there are irregularities in the management of the company,” you can ask for a provisional administrator to be appointed, noted Hoffeld. This existed before, “but you needed to actually prove that there was a blockage of the company. And that’s sometimes difficult to prove. Here, you have an additional procedure that’s in place.”

“It’s obviously not yet tested, because it’s a new law. I’m not aware of any case law, which is normal because the law dates back to November 2023. But we have one procedure ongoing,” said Hoffeld. “So that’s another new tool.”

But for Nicolas, Luxembourg’s new law, voted on by parliament in July 2023, was done “in a bit of a rush.” There was a risk of sanction from the EU if the restructuring directive was not implemented and the national elections were coming up. “The drafting was not perfect. There are some blind spots--quite a few, actually.”

It is, for instance, based on Belgian law, “which is not the most competitive law in terms of restructuring, but also has a different market--Belgium is more centred on industrial and operational companies.” Luxembourg does have operational companies, but it also has a lot of special purpose vehicles and funds, she noted. So some elements are not “completely aligned” with other legislation, which may create “interpretation issues” in the future.

And “because we are late in the process of implementation, we also don’t have the judicial certainty that other countries have now. For example, if you look at the restructuring proceedings in the Netherlands, in England, in France, in the US, even in Germany--they are tested, so people know what to expect,” said Nicolas. “In Luxembourg, we don’t have that advantage because it’s new, it’s late and it has blind spots. Time will tell.”

“Because there are so many blind spots and room for interpretation, I think that the judges will have a lot of leeway to interpret that law. So it all will depend very much on case law,” said Hoffeld.

A case brought to court in November 2023-after the law came into force--concerns an

entrepreneur in the real estate industry who made a request for reorganisation but seems to not have acted in good faith, said Hoffeld. The entrepreneur did, however, get the reorganisation. “The court decided that you do not have to prove your good faith-you just have to prove that there is risk for the continuation of the business.”

“That’s a bit astonishing,” said Hoffeld, adding that she thought it could “open the door to bad-faith entrepreneurs.”

The law’s scope remains quite open. “The entry requirements are unclear,” said Nicolas. “You don’t have to actually come up with a tonne of documents and justify yourself, which is also quite different from what you have to do in other countries.” Luxembourg’s new restructuring law also allows for the filing of a “stay,” which Nicolas explained as an “interruption--if you want--of enforcement rights for your creditors.” Once again, the company doesn’t have to provide a lot of justification. “And because of that effect that the filing has, it’s a massive incentive for companies who are either fighting with the creditors or don’t know what to do with themselves, to just file to get the stay, and to interrupt any kind of enforcement actions.”

It’s not necessarily a bad thing, added Nicolas. “Creditors, in a sense, might have had too much leverage on this point, and also because our bankruptcy procedure was

Luxembourg firms entering liquidation are more likely to be older outfits

Less than 5 years

More than 5 years

brutal,” she said. “But now it’s a bit the other way around. So we don’t know exactly if it’s going to balance out the sort of brutal bankruptcy procedure or if it’s going to just be abused all the time.”

Time will tell

“It will very much depend on the courts and how they implement those requirements,” said Nicolas. “The law is not precise enough that you can say--with certainty--this kind of company can file, this kind of company cannot file, is this stay abusive or not? That’s really for the practice to figure out.”

The blanks will have to be filled in. If the law is applied in a “pragmatic way, then it can be a huge advantage,” said Nicolas. But “we can’t say in advance to our clients how it’s going to go. The law isn’t precise enough. So we completely rely on the courts, and we don’t exactly know which way they’re going to go. It could go both ways.”

“It really depends a lot on the judges, on their way of applying the law,” concluded Hoffeld.

“I think it’s important to know as much as you can”

After studying music management, Astrid der Weduwe thought that maybe finance could rock when she arrived in Luxembourg in 2014. After several sales positions, she moved to Kieger, a healthcare asset manager, to manage investors relations… and more.

Astrid der Weduwe handles investor relations for healthcare investments at Kieger

Astrid der Weduwe handles investor relations for healthcare investments at Kieger

How do you help the investors?

I provide them economic data on the healthcare industry and ask my portfolio managers to write quarterly updates on where we stand, the driving factors of the industry and the upcoming catalysts. It is also important to keep investors aware of the market developments given the unusually low valuations of 2023 as we see rebound in 2024.

Is it important for you to know in detail the company you are investing in?

I think it’s important to know as much as you can. It’s about our company, our values and about the products. We need to be able to give a full presentation about the products and the companies that we invest in. It is our job to promote our product into the market and to shield portfolio managers so that they focus on managing the portfolios.

What are the current and the upcoming challenges for this role?

There are so many asset managers out there. As a small asset manager, you really need to go out there and be an advocate for the brand. The markets are super volatile on the back of economic and political challenges. In the recent past, investors suffered from the fear of missing out (FOMO) whereas now I feel there a fear of messing up (FOMU). Let’s hope that we get out of that cycle because people are very reluctant [to invest].

What is the point of having someone in investors relations in Luxembourg instead of a larger neighbour?

I believe you need both. Because a lot of companies have a presence in Luxembourg, you still need to meet the final decision-makers locally. It’s very important from the IR point of view where the decisions are being taken and who are the right persons to talk to.

What developments in the market have affected your business the most in your seven years in the role?

Regulatory constrains have tightened up. They added more and more costs, a challenging development for a small boutique. We want to grow but we need to

manage our budget carefully. When targeting a market, we need to be clear about our strategy and account for registration costs, additional reporting, etc. AI will help the IR person because a lot will be taken over on the admin side like mailing lists, the CRM system that we must maintain. Positively, we’ll be able to move more into the people side, which is what we’re here for.

What type of attitude is needed for the job?

One must be organised, openminded, persevere and be very consistent in your job. A personality trait that is also very important is the capability to build relationships and maintain them afterwards.

“You see a sector from all sides”

What type of trainings have been helping you in your role?

I did the CFA investment foundations programme to get [a better understanding] on how the figures are constructed, what the business is about and how it works. They take the information from the body of knowledge of the three-year CFA programme, and they make a summary out of that. I learned that CAIA offers a similar programme that may be relevant for people in investor relations. Even if you study business or economics, you don’t really get that market feeling.

What could attract youngsters into that position?

It is a diverse job. You need to be in touch with marketing, finance and portfolio managers. You see a sector from all sides. When it comes to finding our IR people, I believe that the cross-border regulation might make it difficult because people in IR need to travel a lot and you must live in Luxembourg. So, it’s quite difficult to find the right people for the right market and speaking the right languages living in Luxembourg. Besides, let’s be honest, the starting packages are often not very interesting given the very high cost of living.

Healthcare background

Founded in Zurich, Kieger was a family that sold its pharmaceutical business at the end of the 1990s and then started advising families with pharmaceutical firms on their investments.

Rock & finance

Astrid der Weduwe always worked in the financial sector, after studying and completing a bachelor’s degree in music management. She interned for Bon Jovi and Tyler Hilton and then told herself: “maybe I need a realistic plan for my life.”

Going digital

Astrid der Weduwe thinks that the healthcare sector should be more digitalised. Yet she admitted her grandma would never consult a doctor via a computer.

18,5-23,7

Informations environnementales : bmw.lu

100% ELECTRIC

Bilia Luxembourg

7, Rue Christophe Plantin L2339 Luxembourg www.bilia.bmw.lu

Muzzolini

6, Rue Romain Fandel Zi Um Monkeler L4149 EschsurAlzette www.muzzolini.bmw.lu

Schmitz

21, Rue de la Gare L7535 Mersch www.schmitz.bmw.lu

Schweig

6, Haaptstrooß L9806 Hosingen www.schweig.bmw.lu

KWH/100 KM • 0 G/KM CO2 (WLTP)The trade union Aleba has embarked on an ambitious expansion beyond its base in the financial sector. Aleba’s president Roberto Mendolia told Delano about the union’s action plan and what success looks like.

Photo MATIC ZORMAN Interview DINA JABER Roberto Mendolia has been president of the Aleba labour union since June 2019

Roberto Mendolia has been president of the Aleba labour union since June 2019

The Aleba trade union is expanding out of its historic base in the financial sector, with ambitious plans to grow its membership and be recognised as a national union, according to its president, Roberto Mendolia.

Mendolia explained that there are several factors that drove Aleba in this direction.

Firstly, Aleba’s integral structure can be replicated across different economic sectors, given that “the law is the same for everybody, and we are quite successful in the financial sector since more than 100 years.” In other words, Aleba realised that its existing structure equips them to effectively support significant labour disputes outside of the financial services industry. And Aleba concluded that limiting the union’s scope solely to the financial sector was unnecessary, especially considering the inquiries received from members transitioning out of financial roles asking Aleba, “‘why can’t I vote for you anymore? Why are you not [representing] other sectors?’ For example, somebody works in a bank, moves to a big 4, that’s two different sectors,” he said.

Mendolia noted that Aleba’s expansion plan was driven secondly by increased competition from national unions, resulting in “staff delegations from other unions [being elected] in our sector. Previously, it was exclusively Aleba” in the financial sector. But today there are “Aleba staff delegates elected, for example, in hospitals, shops, telecommunication and IT companies.”

“ We have to survive, to develop ourselves, otherwise, we won’t stay [around much] longer. We will slowly disappear like [what] we saw in the history of the unions.”

In the 2019 social elections, a significant portion of staff delegations, 58%, remained unaligned with either of the two major national unions, noted Mendolia. “And we call that a neutral staff delegation.” He opined that it’s a “weak” status for employers, “in the sense that” unaligned staff delegations “have themselves to pay lawyers if they have to start a conflict in which it’s necessary to use a lawyer. And this is the difference with the union, which can support, train, develop, explain and promote the social dialogue with the delegates, if the delegation is under the banner of a union.”

“Our main message: Dear neutral staff delegations, please align and create a delegation” linked with Aleba.

As for the team expansion, Mendolia said that “currently we are 11,000 members. We want to [reach] in the next mandate 15,000, because we have to be progressive.” Aleba has noticed a chain reaction, meaning that when the first member at a firm joins the trade union, others follow naturally. He hopes to reach 20,000 members, “which would be a reasonable target for 2029, because our target is to be a national union in 2029.”

The Aleba team will need to expand as well, he said. Currently “we have six board members,” who balance union activity with their full-time jobs in the private sector. “We are extending this to fifty board members for the next mandate.”

“ Our target is to be a national union in 2029”

“We have more or less ten lawyers working for us on a weekly basis, and we might arrive to fifteen lawyers,” since they need a ratio of roughly one lawyer per 1,000 members.

Despite the search for size, the union’s team still has its pulse on the workforce, he said. “Before being president for Aleba, I was first a staff delegate myself elected by co-workers [and] I’m still working for a company.”

“I had the chance to meet Mr. Georges Mischo, the new [CSV] labour minister [in February]. And we agreed to start a discussion about our topic, that could bring us to the European court, after the [social] elections.” The ministry “knows exactly what I’m” calling for, Mendolia stated. Meaning “the modification of the laws about representative status,” which Aleba lost in 2021.

Sector representative status is mostly “symbolic” but the way Mendolia remembered it, after the loss he “immediately” told colleagues: “‘letz’ be national, because if we’re national, then we can really represent our guys.”

ALEBA

IN FIGURES

11,000

Current members of Aleba

15,000

Membership target

6

Current Aleba board members

50

Number of board members planned for its expansion

10

Lawyers currently working with Aleba

15

28 RADAR Luxembourg fund ecosystem snapshot –

32 SERGE WEYLAND

Interview with new Alfi chief

40 GILLES ROTH Finance minister on competitiveness –

44 MICHÈLE EISENHUTH & OLIVIA MOESSNER Regulatory radar

52 SÉBASTIEN DANLOY Governance and reporting –

56 BARBARA SCHLYTER Tokenised asset potential

The Association of the Luxembourg Fund Industry’s Global Asset Management Conference takes place in Kirchberg, 19-20 March 2024.

The agenda is built around four themes: regulation, distribution, governance and innovation.

This special section features guest contributions on all four themes from 11 speakers at the conference, who outline what they will be talking about and what they hope the audience will get out of their panel or presentation.

But the section kicks off with an in-depth interview of Serge Weyland, Alfi’s recently appointed director general, who wants the grand duchy’s policymakers and its fund sector players to take “bold steps” in order to remain competitive.

Assets under management ticked up at the end of last year and beginning of this year. 2024 is expected to be a relatively good year for private equity and private credit funds.

Net

to the end of 2019. The long-term

towards fund consolidation continued last year, with the total number of funds down by 2%.

Net assets, €bn, as of 31 December 2022*

Promoters/initiators

JP Morgan Amundi

DWS Blackrock

Mancos/AIFM

JP Morgan Amundi

Administrators

DWS UBS State Street

JP Morgan

Total number of jurisdictions Luxembourg-domiciled funds distributed in, by group, as of June 2023**

Franklin Templeton Schroders

Blackrock

HSBC UBS

Fidelity International

JPMorgan Invesco

Amundi

Allianz

Aberdeen Standard

BNP Paribas

Credit Suisse

AllianceBernstein

Janus Henderson

T Rowe Price

Gam Investments

Pictet

Goldman Sachs

Custodians/depositaries

BNY Mellon Caceis State Street

JP Morgan

BNP Paribas Caceis

Transfer agents

ISDS/State Street

JP Morgan

RBC Investor Services

Auditors

Caceis PWC EY

KPMG

Deloitte

Legal advisers

Arendt & Medernach

Elvinger Hoss Prussen Linklaters

Allen & Overy

Wellington Management Co

Morgan Stanley

Capital Group

NN Group

Société Générale

M&G Investment

Jupiter

Deutsche Bank Orix

BPCE

Ninety One Axa

MFS Investment

Union Bancaire Privée

Prudential

Columbia Threadneedle Fundsmith

Bluebay Asset Management

Jones Lang Lasalle

Eurizon Capital

Multiconcept Fund Management

Oaktree Nordea

Mirae Asset

Capital Four Man

SEB

LGT

Investors continued to take cash out of retail-friendly Ucits funds the past couple of years, while net inflows into private market funds fared better*

€600bn €500bn

Article 8 funds experienced net outflows of €27bn in 2023, while article 9 funds recorded net inflows of €4.3bn and article 6 funds saw €93bn of net inflows***

Global survey of 500 fund selectors**

Private equity

Active funds

Index funds

Private credit

Separately managed account

Thematic strategies

Hedge funds

Annuities

Direct indexing

Funds of funds

Semi-transparent ETFs

As of December 2023***

In his first sit-down press interview since taking the reins of the Association of the Luxembourg Fund Industry, Serge Weyland says the grand duchy should learn to take a tougher line, talks about competition with France and Ireland, and calls for more teleworking.

Serge Weyland wants Luxembourg’s funds sector to have a bigger voice in Europe

Serge Weyland wants Luxembourg’s funds sector to have a bigger voice in Europe

He is the newly appointed director general of the Association of the Luxembourg Fund Industry, a 35-year-old trade group that said it represents “more than 1,500 Luxembourg-domiciled investment funds” and more than 350 asset management companies and service providers. In recent years, Serge Weyland has been known for being softspokenly outspoken on tokenisation technologies and the democratisation of private asset funds. Now he’s got to speak for the entire investment fund ecosystem. He certainly wants to give it a voice and he certainly has something to say.

Europhile

First things first: why did he take up the Alfi post? When introducing himself to stakeholders, “usually I talk a little bit about my background,” Weyland said during an interview with Delano. “My father was a diplomat” in Luxembourg’s foreign service. He had postings in New York, London and was in Brussels for roughly 14 years, where he served as Luxembourg’s representative to the EU. This is the post that outgoing Luxembourg for Finance CEO Nicolas Mackel will take up in the autumn. Weyland said that “Nicolas and my father worked together when my father was ambassador in Washington. That’s where I first met Nick. I grew up in a very international, very Europhile environment. My father contributed a lot to the building of Europe, because when Luxembourg had the [EU] presidency before the signature of the Maastricht Treaty, he was in Brussels, so obviously was very involved in those discussions.”

After his studies, Weyland started as a management consultant, then worked in asset servicing and for an asset manager. But his father’s career clearly inspired him. “After almost 30 years in the industry, when you have an opportunity to really do something for your country... it was a fairly obvious choice to make.”

The funds industry represents a significant part of the grand duchy’s economy, and tax base, and Weyland wants to secure the sector’s future growth and in turn the country’s prosperity. That will require what he called “bold steps”.

“The current government is very, very aware of the importance of the financial services industry, I think. But probably now, more than in the past, it is important to take bold steps. Luxembourg doesn’t necessarily have a reputation for taking bold steps. But in these times of change, we’re in fierce competition. A lot of existing or emerging financial centres are willing to get a piece of the cake we have. So we have to continue innovating, we have to be able to sometimes take bold steps. It’s about competitiveness. It is important to start with a government that understands the financial services industry and understands the economic weight of that industry. And the importance for it to continue to develop and understand the risks of seeing other financial centres compete.”

Learning to say ‘no’

“It never happened, for whatever political reasons”

What are some of the bold steps he has in mind? Weyland alluded to the grand duchy’s approach in recent years of applying the maximum level of EU financial regulations, a stance adopted to shake off the country’s historic image as a tax haven. “We--and when I say we, it’s the industry, the regulator, the lawmakers in Luxembourg--we should be confident enough in our understanding of the financial ecosystem to have our voice heard at the European level and say to the European Commission and [European Securities and Markets Authority] ‘no, this is not the right way of doing things, you should do it differently.’” On other occasions, Luxembourg’s financial regulator, the CSSF, could “take a different stance from Esma recommendations... provided, of course, risks are managed and I can still justify why I’m doing things a little differently.”

For example, when EU authorities are late publishing technical standards, a somewhat regular occurrence, the CSSF should be given leeway to implement provisional guidelines, “to say, this is how we are going to manage this. Luxembourg has been able to show that we have been fairly consistent--we haven’t had any major scandals--from the investor pro-

Association of the Luxembourg Fund Industry

Serge Weyland started as director general on 1 December 2023. Up until then, he had been co-chair of Alfi’s digital/fintech forum.

Previous

CEO of Edmond de Rothschild Asset Management Luxembourg for 6 years. Prior to that, management roles at Banque Internationale à Luxembourg, Caceis, Sal Oppenheim Jr & Cie and Accenture.

Weyland earned a master’s degree in finance from the Solvay Brussels School of Economics and Management.

tection perspective. And the expertise is there.” While EU regulations often leave room for manoeuvre, the grand duchy typically toes the line. On the other hand, referring to socially responsible investing, “you have countries like France having taken bold steps with respect to impact regimes. Why not do the same? Or even better?”

Luxembourg’s best practices

Better still, national leaders should promote “the things Luxembourg has been doing well for a long time.” For instance, the CSSF’s “circular 02/77 on investment breaches and Nav errors,” referring to net asset valuations, which he called “basic investor protection, really basic.” But many other member states and the EU itself have never implemented comparable standards. “I don’t understand why Luxembourg has had this regime for over 20 years and some of the other very large domiciles across Europe have not had a similar regime, meaning that their regulators were completely blind on investment breaches or Nav errors in retail funds. That means that

a pan-European regulator does not do its job properly. I mean, they should have looked at that and said, ‘this is best practice. You other guys, you should do the same.’ That was my understanding of the [point of] peer reviews from Esma, but apparently it never happened, for whatever political reasons.”

Retail-friendly Ucits investment funds are “one of the big export products of Europe to the rest of the world.” If the pan-EU regulator were one day to tighten the rules too far, things could snap. “It would really be sad if Esma would kill the best export success. They have the power to do so if we’re not careful.”

Weyland is not entirely critical of policymakers and does not think the burden hangs entirely on them. “Sometimes I think the difficulty is that regulators need to be a little remote from the reality of the business. That’s where we need to work harder to make sure that we always convey the business context for them, [so they can] understand the impact of regulation and laws.” That is something he aims to achieve at Alfi,

Net assets by domicile, as of 30 September 2023, €m

to help officials and stakeholders across the financial sector “connect the dots”.

At the same time, sometimes regulators get blamed when the industry itself should be more accountable. “Time to market for this industry is absolutely crucial. So how do we make sure we have clear rules and we can launch funds very quickly? I’ll share this little story from one of my previous jobs, where we would have a time to market for a fund launch of typically six months plus.” At the firm and across the sector, “people tended to say, well, you know, it’s the CSSF” that has been slow in responding to authorisation applications. “Then we worked on the process internally, between product teams, between the internal legal advisors, the external legal advisors, in the file preparation, and we were able to reduce that by half. So we ended up, on average, with a three-month turnaround for a product launch. Very often it is not the regulator, it’s actually the way people are organised. We need to make sure that Luxembourg--that’s law firms, service providers, the CSSF--that we deliver,

Net assets by domicile, as of 30 September 2023, €m

and that we all take responsibility. It cannot be that when a specific person is on vacation, then nothing happens. We’ve all heard the stories.”

“The CSSF has grown a lot over the past few years. They are now, I think, stabilising their size. They’ve been able to organise themselves and have addressed to a large extent these smaller issues” around responsiveness, where the Luxembourg agency often gets unfavourably compared to Ireland’s regulator. “Probably where I can see” room for improvement “is indeed for them to speak up more at the European level and to make their voice heard. And their voice is, partially, also making sure that they understand the industry better across all asset classes, which is a challenge because Luxembourg has such a broad reach. In terms of asset class, you don’t have that in Ireland, [a market] very far from the diversity we have in Luxembourg--very, very far. If you look at the size of the [exchangetraded fund] business alone in Ireland, that’s a really big chunk of their assets. And, you know, it’s plain vanilla stuff. So the complexity we have to deal with here is much higher, which I think we’re lucky to have,” Weyland stated. “But it needs to be said, because you have to compare apples with apples. Very, very often people tend to compare apples with pears, because then they’ll say, ‘well, we got approval in Ireland for this, that and the other, and it was half the time than in Luxembourg. But if you look at it in detail, you notice that it’s very different products. Competition is important, but the devil is in the details.”

Conveying granularity

The challenge for Alfi “is being able to actually dig deep when needed, to go and get the information that our policymakers need to understand what hurts the industry or what needs to be done differently for us and better accommodate the needs of the industry. If I had to summarise one element” that will be key for Alfi moving forward, it would be “understanding the business and being able to convey the granularity in those details, which sometimes are a killer to the industry. And sometimes can drive away business if they’re not addressed properly.”

At the same time, mutual respect and putting yourself in others’ shoes are impor-

Conversation Serge WeylandThe number of people working in Luxembourg’s funds and fund services sector* rose by 13% over the past 5 years.

tant, in Weyland’s view. “I’m very keen on engaging with” regulatory staff. “I’ve known the CSSF for a number of years and I’m very conscious of their context. And I think that’s important when working hand in hand with regulators and policymakers: understanding each other’s context. Because we all make mistakes, we all only have a limited perspective on the industry and it’s by working together with them we can have a broader perspective.”

A few days after his interview with Delano, Weyland planned to meet with Esma representatives and he said: “I fully appreciate where they are coming from, but I think sometimes we need to be able to articulate things the way they are, because otherwise we don’t make any progress. I’m very new in the job, so maybe I will have to revise some of my statements in a few weeks’ time, but I like to be a little provocative.” While he is a strong believer in “respecting other people’s work... I have very little tolerance for when things are done for the wrong reasons. Because that is where we need to be very vocal about it.

“ We are fighting for talent ”Specialised PFS Investment firms

Something I think we try to do, and I always try to do, is [when] things are done for the wrong reasons then it should be said” out loud.

Earlier in the conversation, Weyland discussed competition with rival European financial centres. “First of all, I think competition is sound, it keeps us on our toes. If I look at Ireland, very often we’re in the same boat [and have a] common position vis-à-vis European regulations or protectionist measures, etc. We need allies in that discussion.”

Asked about particular protectionist measures, he replied: “Unfortunately, we see examples of this protectionism come through in the way regulatory frameworks are actually shaped in Europe. A recent example for me is Eltif.” The European Long-Term Investment Fund “regime is a fabulous vehicle to ensure that people other than only institutional investors have access to private markets. Of course, we need to be mindful that it comes with risks, liquidity constraints, etc. But I think there is great value in creating a pan-European regime that will hopefully be able to leverage off the good things that have been happening in the various countries. But it is not a reason to kill this regime because one thinks that there’s local products that should continue. Because the reality is that local products very often only invest in the local markets, they are very small, they are costly for the investor. I think a pan-European product can be much more efficient. That’s an example of where we have seen some protectionism going on.”

Does he mean protectionism from Paris? “Yeah. The French regulator has been very vocal about trying to constrain the Eltif a lot or impose liquidity requirements, which funnily enough, they don’t impose on the local product. Which is quite interesting.”

And what about bold steps closer to home? Weyland said recruitment and retention efforts need to be stepped up to keep Luxembourg’s funds sector an attractive place to work, and that tax and teleworking policies would be a good place to start. Spe-

cifically, “tax breaks” which “could be temporary tax breaks for a few years, or if you had an inpat regime, for all these young talents, why not? I wouldn’t be shocked [for the government] to say, ‘you only get taxed 50% for your first five years, so you can at least afford to live in a flat in Luxembourg.’ Why not? We are fighting for talent and talent is extremely important in this industry, as a service industry.”

In terms of attracting more experienced staff, “it’s a combination of ease of relocating, having decent schooling for kids. There, a lot of initiatives have been taken. The university also is an important topic to continue attracting research and knowhow to Luxembourg. And, as I said, the tax component is important to remain competitive. We should not be at a disadvantage vis-à-vis other countries. I think that would be a mistake. I think people that are

fairly compensated need to pay their taxes, that seems clear, but we should not be in a situation, or we should not end up in a situation, where we are less competitive than our neighbours. That would be fatal.”

Along with taxes, Weyland said that EU rules on working from home--which despite recent changes is capped for cross-border commuters at 34 working days annually--potentially put Luxembourg at a disadvantage in terms of talent retention and recruitment. “We know that teleworking has been a game-changer, has had the effect of, indeed, becoming more interesting for people commuting to work in their own country by saying, ‘maybe I can instead of working for a Luxembourg law firm, I work for a Paris-based law firm whilst, I don’t know, living in Nancy and I [only] have to be in Paris one or two days a week. I can do that.’ So, yes, continuing to work on the arrangements with neighbouring countries on the double tax treaty side” should be a priority for the government.

Does Weyland have a specific number in mind? “You should, ideally, have between 50 and 100 days of teleworking per year. In those agreements, I think 50 is probably on the lower end. But we’re making progress. And I think one of the best reasons to go down that route is the environment. I stood in traffic this morning, and I thought, ‘well, I definitely need more teleworking’.”

Agenda for Alfi

Alfi plans to publish an ambition paper “by mid-year” spelling out its updated objectives and providing “a detailed action plan with milestones,” Weyland said. “We have four big areas in mind.” The first is being “asset management centric, so to continue really listening to the voice of asset managers and identifying the need for product innovation” and making Luxembourg attractive for those asset classes.

The second is “digitalisation of both the value chain, the distribution, so becoming more efficient, but also reaching out to more investors going forward as an industry. The third quadrant is the sustainability side... making sure that the asset management industry contributes to building a more sustainable world. Of course, it’s a journey, it’s a lot about engagement, about

Percentage of total net assets, as of 31 January 2024

transition, rather than trying to be all green from day one. That doesn’t work. And that also includes, for me, the whole transition, the need for assets or money flowing into the real economy. And then, the fourth quadrant is the investor engagement side, where that’s a lot about explaining what we do, being easier to understand.”

Part of that includes a big push for improved financial education for both youngsters and adults. “If you look at the past 15 years, what we would have achieved with very good financial education and good policymaking for channelling savings into financial products, I mean, people would be much better off today, much better off. You would have much less social conflicts. We should learn from that mistake.”

For two decades, ATOZ has crafted a unique melody, blending the precision of tax advisory services with the ongoing commitment to environmental sustainability, social responsibility, and the governance of excellence. The lush surroundings mirror our dedication to the cultural richness that defines our journey. Our team, a diverse ensemble of talents, each playing a crucial role in creating a masterpiece of client success.

Join us in cherishing this milestone, looking at the past, the present and... beyond!

The fund industry has proven resilient faced with a challenging global environment over the past few years that was marked by geopolitical tensions, high inflation and steep interest rate rises, as well as slower economic growth. At the same time, the industry has had to adapt to increased digitalisation of its processes and distribution channels as well as to stricter disclosure requirements around sustainability risks.

These are certainly challenges, but also new opportunities for an industry that is central to supporting sustainable economic growth and helping us address the challenges of a rapidly aging population, especially in Europe.

GILLES ROTH Luxembourg minister of finance

“We want to be first movers and avoid any form of gold plating”

As set out in its coalition agreement, the new government has made the development of the Luxembourg financial centre a key priority. Our financial centre has developed rapidly over the past decades and has managed to position itself in new areas such as alternative investment funds, corporate banking, financial technologies or sustainable investments. However, this is no reason to rest on our laurels.

We need to ensure that Luxembourg remains an attractive and competitive jurisdiction and a leader in cross-border financial services. Importantly, our overarching objective must be to create a conducive environment that allows our financial centre, across its different industry segments, to climb further up the value chain.

In the short to mid-term, I have thus given myself several priorities. In the context of the new and evolving international tax environment, I want to bring corporate taxation in line with the OECD average. As of 2025, I intend to lower the corporate tax rate by 1%, thus creating additional predictability for companies in Luxembourg. I also intend to reduce the subscription tax for actively managed ETFs in view of the growing popularity of this emerging fund product. I will continue to modernise our financial sector legislation to allow our financial centre to seize new opportunities, including in emerging areas such as alternative asset classes and digital assets.

The growth of our financial centre also means that access to the right skills and talent has become more crucial than ever. As finance minister, I am committed to further improving both the regime of profit-sharing bonuses as well as the expat tax regime to

support companies in attracting and retaining the highly skilled talent they need.

When implementing EU legislation, we want to be first movers and avoid any form of gold plating to create the best possible environment for our financial sector to grow and innovate.

Luxembourg will continue to defend cross-border financial services within an EU single market that remains open to the rest of the world. Here, the Capital Markets Union (CMU) is a case in point. We all agree that Europe needs deeper and more liquid capital markets. The fund industry can and must play a central role in this context. A successful CMU can, however, not be decreed from the top down. A CMU that works for all citizens in the EU must be built from the bottom up.

Rather than wasting time and energy discussing centralised supervision, we need to focus on achieving full mutual recognition, develop local expertise and make sure that financial services are easily accessible wherever a client may be in the EU.

We also need to step up our collective eff orts to increase fi nancial literacy, as underlined in the government’s coalition agreement. Financial literacy can help turn savers into investors and channel private funding into our economies.

The dialogue with the financial sector is central to the government’s efforts to strengthen the Luxembourg financial centre and its flagship fund industry.

AS YOUR DEDICATED ASSET SERVICING PARTNER WE STRIVE

TO

PROVIDE THE BEST SERVICE EXPERIENCE FOR YOU.

Your goals become our goals. We demonstrate responsibility towards all stakeholders, from clients to partners.

MAREN STADLER-TJAN Partner Cli ord Chance

“Regulators... play a significant role in the stimulation of private investment in the EU economy”

The regulators, both at the European and the national level, are crucial to the smooth functioning and ongoing development of the EU asset management industry. It is them that are in charge of the delivery, evolution, supervision and enforcement of investment fund regimes that are e cient, consistent and proportionate.

As such, the regulators of the European asset management industry play a signi cant role in the stimulation of private investment in the EU economy, particularly towards the green and digital transitions, which is currently a key priority in the European Union.

Next to stimulating economic growth via private investments, it is clearly of equal priority to protect the rights of investors, for example, in the form of increased transparency, granularity and standardisation of investor disclosures, as well as risk and liquidity management.

The EU has a broad range of regulatory regimes that seek to both support European economic development and the development of the European asset management industry, whilst building and maintaining robust investor protections (including the Eltif, Mifid, Priips Regulation, the Ucits Directive, AIFMD, Solvency II and SFDR). The regulatory environment which asset managers operate in is accordingly complex. Next to European-level regulation, member states have in place their own domestic investment fund regimes, which must be considered.

Di erent types of investors have di erent needs, vulnerabilities and expectations in their interactions with the asset management industry. Particularly when it comes to alternative investment funds, products range widely in both their asset strategy and fund terms and can be highly bespoke. As regulatory regimes strive to keep pace with the swift impact of technological developments, the evolving green transition and macro-economic factors, the expectation is that the regulatory environment is only going to become more complex over time. The regulators in the EU therefore have a central vantage point, overseeing the intersection of a host of intricate, multi-level rules and requirements and their implementation and enforcement in practice.

Against this multi-faceted background, I am looking forward to an interesting discussion with the CSSF and the opportunity to gain insight into the Luxembourg regulator's view of the direction of travel for the evolution of the regulatory landscape impacting European asset management. We will also discuss the challenges facing the asset management industry and the regulator’s perspective of fostering regimes that are both e cient and robust in an increasingly complex environment.

Maren Stadler-Tjan will interview Marco Zwick, a director at the Luxembourg Financial Sector Supervisory Commission (CSSF), during the “Let’s hear it from the regulator!” panel at the Alfi Global Assets Management Conference, Tuesday 19 March at 10:55am.

Consultancy, tailored to you

Parva is a Pan-European consulting firm specialised in financial services focusing on strategy, governance, business & operational change and transformation

www.parvaconsulting.com

Our approach is hands-on We work with clients to identify, design and implement customised solutions

Our people combine multi-year industry knowledge of the financial services sector with the experience of delivering real change

2024 continues to show see a flurry of regulatory activity in Europe.

Words MICHÈLE EISENHUTH AND OLIVIA MOESSNEREuropean institutions continue reshaping the digital landscape with the adoption of the Artificial Intelligence Act and the implementation of regulations such as Dora and Mica. The technological transition is on its way in Europe. Tokenisation of nancial instruments is emerging as a major trend in the asset management industry and is likely to reshape the products, their distribution, their operations and their managers.

On the sustainable finance side, the SFDR and Taxonomy Regulation remain at the forefront with ongoing clari cations and with the adoption of new delegated regulations relating to the criteria for meeting the environmental objectives under the Taxonomy Regulation, alongside the review of the SFDR regulatory technical standards and forthcoming Esma guidelines on funds’ names using ESG or sustainability-related terms. Those developments underscore Europe’s leadership in sustainable nance, where ESG considerations have become a fundamental element of the nancial sector to protect the environmental capital for the next generations and boost the green nance leading to creation of more and more article 9 funds.

Initiatives such as Eltifs and the RIS, coupled with rigorous reviews of costs and charges, liquidity rules and asset valuation rules signal a commitment that performance, transparency and fair prices are basic elements for a winning game.

Restoring that con dence also hinges on providing investors with access to

robust returns while managing risks e ectively. This would redirect funds currently remaining in savings accounts into the real economy.

On the costs and charges side, while fair pricing remains paramount for investor protection, regulatory interventions must strike a delicate balance to foster competition in the asset management industry and support nancial innovation, steering clear of indirect price regulation.

Ensuring liquidity for investment funds remains a cornerstone of nancial markets protection. Ucits VI and AIFMD II, which are being nalised, will amongst others bring more flexibilities for European funds in using liquidity management tools.

On the other side, efforts to revive investor interest should not be hindered by the review of Ucits eligible assets rules, another initiative led at EU level and closely monitored by the asset management industry. Restricting the scope of Ucits eligible assets risks undermining the competitiveness of Ucits products vis-àvis other nancial instruments, curtailing the exibility of active managers and limiting the nancial o er and return which retail investors can expect.

Conversely, expanding the spectrum of permissible exposures for Ucits, while adequately mitigating risks, could invigorate the sector, enhancing its appeal and diversifying investment opportunities, in line with how Eltif 2.0 has allowed retail investors to gain access to alternative asset classes. We trust that European institutions will keep supporting the Ucits brand that has been alive and safe for the past 35 years in Europe and beyond!

Meanwhile, in Luxembourg, the available “funds toolbox” has been modernised by introducing improvements and adjustments such as new structuring options and exibilities for Part II funds as well as a wider access to Raifs by well-informed investors other than professional investors.

Michèle Eisenhuth and Olivia Moessner speak on the “2024 regulatory update” panel at the Alfi Global Asset Management Conference, Tuesday 19 March at 11:30am.

Photos Elvinger Hoss Prussen, Matic Zorman/Maison Moderne

MICHÈLE EISENHUTH OLIVIA MOESSNER

Michèle Eisenhuth and Olivia Moessner speak on the “2024 regulatory update” panel at the Alfi Global Asset Management Conference, Tuesday 19 March at 11:30am.

Photos Elvinger Hoss Prussen, Matic Zorman/Maison Moderne

MICHÈLE EISENHUTH OLIVIA MOESSNER

The newly revised AIFM Directive tightens debt fund oversight, mandates liquidity tools, and eases cross-border depositary appointments.

Amélie Frontain, Authorised Director, VPsf (Value Partners)

Amélie Frontain, Authorised Director, VPsf (Value Partners)

The European Parliament’s adoption of the revised AIFM Directive on 7 February 2024 marks a pivotal moment for the European investment funds industry, building on the Directive’s foundation laid in 2011 and its Luxembourg law transposition in 2013.

This amendment, spurred by the European Commission’s 2021 proposal, aims to enhance the European capital market, strengthen investor protection, and align requirements with the UCITS Directive.

Key reforms include more stringent regulations for loan-originating AIFs to mitigate financial and systemic risks; and tighten the delegation model, ensuring better supervision, conflict of interest management, and accurate notifications to authorities.

The Directive allows appointing depositaries from another Member State under specific conditions, recognising the lack of presence of depositaries in certain Member States. It also mandates AIFMs to implement at least two liquidity management tools and dedicated procedures. Reporting obligations for AIFMs shall be expanded, covering the entire range of managed markets and instruments.

Expected to take effect in Luxembourg by 2026, these changes shall foster a more resilient and transparent European financial ecosystem.

As AIFMs and UCITS management companies are gearing up to align with these regulatory changes, Value Partners remains ready to guide clients through this transition and reconfigure operations to comply with new regulatory demands, facilitating a seamless shift to the evolving regulatory framework.

The industry-wide adoption of the Ume due diligence platform marks a groundbreaking paradigm shift within the nancial industry, strategically responding to the intensifying landscape of regulatory scrutiny and an increased emphasis on investor protection, sanctions enforcement and financial crime compliance. The Ume platform not only streamlines the due diligence process but fundamen-

tally reshapes industry dynamics by fostering collaboration among investment managers and distributors through a shared online platform.

This transformative approach extends beyond mere operational efficiency, as Ume sets an elevated standard for the entire industry. It cultivates a culture of continuous education and encourages strict adherence to regulatory standards, creating a framework that extends seamlessly from investment fund managers to distributors. The platform’s active engagement with major fund management groups, including 14 of the top 20 global investment managers, and a rapidly growing number of distributors underscores its pivotal role as a driving force for positive change in the nancial ecosystem.

LAURENT DENAYER CEO Ume

LAURENT DENAYER CEO Ume

“A single venue for exchanging due diligence information”

The widespread adoption of Ume is evident in the daily responses from hundreds of distributors to due diligence questionnaires. This swift and extensive uptake underscores the industry’s recognition of the platform’s innovative approach and its potential to revolutionise traditional due diligence practices, making them more e cient and comprehensive.

A pivotal practical outcome of leveraging Ume is the substantial reduction in time and e ort required for due diligence processes. The platform not only streamlines the collection of necessary documentation but also expedites the subsequent analysis and reporting of the amassed data. This newfound e ciency empowers investment managers to expedite the introduction of their products to market, substantially reducing the upfront

due diligence e ort traditionally associated with fund distribution.

Highlighting its distinct competitive edge, Ume boasts the largest fund distributor database and the most comprehensive collection of completed due diligence questionnaires. The continuous, and rapid, growth of the Ume ecosystem, with an increasing number of fund managers and distributors joining daily, further forti es Ume’s appeal to all participants as a single venue for exchanging due diligence information.

In conclusion, Ume has not only e ectively addressed the formidable challenges faced by investment managers in conducting due diligence on fund distributors but has also reshaped industry practices. By providing an innovative and e cient platform, Ume not only simpli es processes and saves valuable time and e ort but also empowers managers with unparalleled insights. With its distinctive o ering and evident market leadership, Ume is poised to continue steering the evolution of fund distributor due diligence, solidifying its position as an industry pioneer driving positive and transformative change.

luxembourg

book now on luxair.lu

Manchester up to 3 flights per week

starting from march 29th 2024

Despite its name, the retail investment strategy (RIS) is an omnibus directive amending several pieces of existing legislations with the ambition to improve the conditions for greater participation of retail investors in capital markets. The final requirements are expected to become applicable by the beginning of 2026 at the earliest.

Price regulation: threat or opportunity?

As part of their pricing process, product manufacturers and distributors will be

NORMAN FINSTER Wealth & asset management partner EY

“We could see a significant reshuffle in the offering of services and the distribution landscape”

required to identify and quantify all costs and charges and assess whether such costs and charges could undermine the value which is expected to be brought by the product. Pricing of Priips, Ucits or AIFs would need to consider cost benchmarks, which are relevant for the type of fund and investment strategy. These benchmarks will be developed by the European Securities and Markets Authority and European Insurance and Occupational Pensions Authority. In case of deviation from the benchmarks, manufacturers should be able to establish that costs and charges are justi ed and proportionate in order to obtain authorisation.

Such benchmarks and increased transparency on costs are likely to lead to a rationalisation of fund ranges at the manufacturer level in order to remain competitive versus direct lines. This price regulation could reinforce the trend to passive investment strategies while adding pressure on actively managed investments. It could also become a threat to the democratisation of private markets: when asset managers are prescribed to charge assumingly lower fees this could impact their interest in sourcing retail investor money.

In its current form, the directive foresees that in case of non-independent advice, investment firms, insurance undertakings and intermediaries will have to perform a client’s best interest test , replacing the Mifid “quality enhancement” and the IDD “consumer detriment” tests.

This new test will require intermediaries to perform more quantitative assessments of the eligibility of inducements and be attentive to the relevance and the added value of services provided to end clients. This di culty could lead to a switch to more value-added services to higher customer segments, on which it will be easier to deploy fee-based models.

Impact on distributor service models

The share of execution-only services remains high in the banking sector. However, more recently private banks have had to face erce price competition from electronic trading platforms in the execution-only arena, and now they see a growing demand for advisory services from investors who are seeking expertise but in a collaborative and interactive way. In this context, the future rules on inducements should be integrated by the distributors when they review their strategies, design their investment plans and adjust their service models.

As a consequence we could see a signi cant reshu e in the o ering of services and the distribution landscape which would impact product ranges too. The pressure on cost will also exacerbate the need to rethink service models, considering the expected increased share of digital distribution versus physical channels, leading to a form of hybrid models.

Turbulent market conditions are causing investment returns in the private equity industry to decline. Fund managers developed solutions to counter the exit and fundraising shortfalls, adapted their fund terms and used emerging trends as new opportunities to attract capital.

The private equity landscape is witnessing a surge in secondary transactions. These transactions, led either by fund sponsors ("GP-led") or investors directly ("LP-led"), offer liquidity solutions amid a challenging exit environment. GP-led transactions involve transferring assets to continuation funds to extend holding periods until market conditions for exit transactions improve. LP-led transactions enable investors to rebalance portfolios and maintain diversification. Additionally, NAV facilities emerge as a strategic liquidity management tool for late-stage funds. The additional capital provided by borrowers and secured against the fund portfolio is typically used to fund follow-on transactions or distributions.

Market dynamics influence fund terms negotiation, giving LPs more leverage, especially in the small to mid-market segment. Fund terms, such as fundraising and invest -

ment periods, have become longer and more easily extendable. GP clawback terms are scrutinised, with interim clawback calculations gaining traction to address market fluctuations. Side letters negotiations focus on management fees discount and co-investment opportunities. Smaller GPs use co-investments on a “no fee/no carry” as a sweetener to lure investors away from the largest fund managers where only the largest LPs have access to co-investments.

Consolidation trends are evident, with capital favoring established GPs and making it a challenging fundraising for emerging and mid-market players who (for some) are embarking on joint ventures or GP stakes transactions to attract more capital and tap into new markets in an effort to future proof their business. Private credit remains a prominent trend, thriving in a high interest rate environment despite some concern that borrowers’ default is likely to pick up.

The industry witnesses a shift in 2023, likely to accelerate in 2024, towards high-net-worth individuals and semiretail investors, prompting the development of access/ feeder funds and dedicated platforms to accommodate regulatory and operational complexities. Part II UCIs are in great demand while the industry awaits the final shape of the ELTIF 2.0 regulatory technical standards (RTS). Permanent capital solutions like evergreen funds gain momentum alongside closed-ended private equity funds.

SCAN TO READ THE EXTENDED ARTICLE

Loyens & Loeff Luxembourg

jerome.mullmaier@loyensloeff.com

mathilde.scheirlinck@loyensloeff.com

Mathilde Scheirlinck and Jérôme Mullmaïer, Investment Management experts

GUILLAUME SCAFFE

Partner Deloitte

“We identified jurisdictions offering promising cross-border opportunities”

Luxembourg, Europe’s largest fund domicile and second worldwide, ranks rst in cross-border distribution of investment funds, marketing over 50% of assets under management (AUM) around the world. An innovative cross-border distribution strategy is crucial for asset managers to boost their sales and attract new investors worldwide.

With more than 45,000 cross-border noti cation packages released in 2023, Deloitte Luxembourg leads in this industry. Based on this large experience, we identi ed jurisdictions o ering promising cross-border opportunities.

The APAC region ranks second in crossborder AUM (after Europe). In Singapore and Hong Kong, foreign products (especially Ucits) are very popular. Foreign funds marketed to retail investors outnumber domestic vehicles (ratios of 1:4 in Singapore and 1:3 in Hong Kong). Around 70% of these funds are Luxembourg-domiciled.

International asset managers also market their European flagships in South Korea, Taiwan, Macao and Japan. We see a growing appetite from retail investors in Brunei Darussalam.

Additionally, some local fund structures in Thailand and Indonesia are set up to invest in Luxembourg funds.

Private pension funds, especially in Chile, Peru, Colombia and Mexico, dominate the Latam segment. In Chile, 72% of foreign funds authorised for marketing to pension funds are Luxembourg-domiciled mutual funds. Public marketing, subject

to local regulator registration, is only possible in a few jurisdictions and sales are limited.

Passive ETFs listed on local stock markets in Mexico and Colombia are good alternatives for local retail investors. The region’s most important nancial market, Brazil, can be accessed via local feeder funds/fund of funds. High net worth clients in the region are often served via hubs in Uruguay, Panama and Miami.

The United Arab Emirates has become the frontrunner for foreign funds, offering attractive market entry options. However, this huge success has instigated a recent policy shift to the reinstate barriers to foreign funds with the objective of promoting local funds. Nevertheless, the UAE’s appeal persists; we see a rising interest in setting up local funds.

In Bahrain, foreign fund distribution massively surpasses local funds with a ratio of about 15:1. Based on our experience, Oman is also a promising market.

With over 150 foreign fund registrations, South Africa leads Africa in cross-border distribution. The Canadian market, though of high interest, is limited to institutional investors under exemption regimes, as retail distribution is complex given the province-speci c approach.

Guillaume Sca e moderates the “Latest distribution trends and opportunities in emerging markets” panel at the Alfi Global Asset Management conference, Tuesday 19 March at 5:20pm.„In and around the Philharmonie“

In today’s complex regulatory landscape, firms across the investment ecosystem are evolving to ensure that funds are well governed and offering value to investors.Words SÉBASTIEN DANLOY

In recent years, every industry conference seems to be dominated by the theme of regulation. Across our industry we are always adapting to new or revised regulations that influence how investment funds should be governed, and form part of a robust and resilient investment ecosystem.

In an increasingly complex environment, industry associations provide an essential connecting thread between investment managers, the firms that support them, and the regulator. Alfi’s working groups have provided feedback on key regulatory developments which will affect how funds operate, such as T+1 and AIFMD, as well as sustainability developments such as the EU sustainable finance package and Esma’s guidelines on fund labelling, to name but a few. These working groups--which BNP Paribas’ securities services business is a part of--provide an essential forum for dialogue and to align stakeholders’ interests, fundamentally helping to develop regulations that are fair, enforceable and protect investors.

Fund boards provide a driving force

Throughout my time in Luxembourg in the 2010s, another key change I witnessed was the growing responsibilities placed on fund boards. Under both the revised Ucits directive and the AIFMD directive, funds are now strongly advised to appoint at least one non-executive or independent director to the board of the relevant Ucits fund or AIF when distributed to retail investors. Following new substance and reporting requirements set forth in these directives, boards are also expected to ensure sufficient resources--technical and human--are dedicated to the oversight of delegated portfolio and risk management functions including delegated portfolio and risk management, and administration when applicable.

Liquidity and valuation have also come into the fund board’s purview. The CSSF’s recommendations on Esma’s supervisory action include recommendations for the validation and monitoring of valuation policies and the design of valuation policies in

“Reports are not just a tick-box, but an enabler of efficiency and decision-making”

SÉBASTIEN DANLOY

Global head of sales & relationship management for institutional investors, securities servicesBNP Paribas

stressed market conditions. Liquidity management tools have been examined by the FSB and Iosco, who provide standards on oversight requirements to ensure that these tools are used effectively. These developments will be vital in enabling the greater democratisation of private assets, as well as other less liquid asset classes. Boards will have a critical role in ensuring that their funds implement these requirements, and are equipped to take advantage of the new opportunities that arise