Local Businesses are Superstars of Investing in the Future

LOCAL SERVICES

INVESTING IS ABOUT MUCH MORE THAN MONEY

LOCAL SERVICES

INVESTING IS ABOUT MUCH MORE THAN MONEY

How many times have you been considering a purchase of a vehicle, some furniture, or electronics and the clerk uses the term “investment” to encourage a purchase “today”?

In the financial advisory profession, the term investment is intended to mean acquiring an asset. Assets are defined in accounting as something having present value with a reasonable expectation that the value will be greater in the future than the cost to obtain and handle upkeep on the asset.

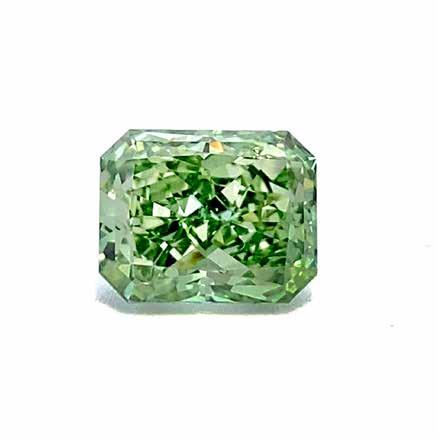

Assets might be things like collectibles, stocks and other financial instruments known as securities. They might be real estate or even precious metals. The objective is to buy low and sell later at a profit.

In this issue we’ll explore a few ways investing in quality improvements can give a home greater future value.

We’ll also explore some financial concepts that may be less familiar to many but which have great potential when used strategically.

We hope you enjoy what we share.

GJ LIFESTYLE STAFF @GRANDJUNCTIONLIFESTYLE

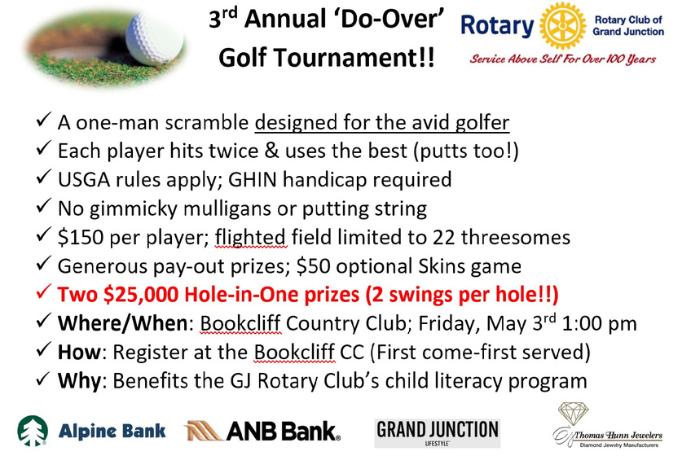

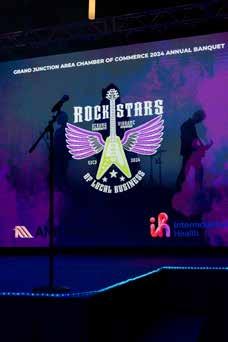

1: Welcome Sign at 2024 Grand Junction Chamber Annual Banquet 2: Alpine Bank Staff Lip Sync Bruno Mars’ “24K Magic” 3: Volunteer and Staff Badges. The “roadies”! 4: GJ Chamber Members arrive ready to ROCK this year’s banquet! 5: Chamber Members are Rock Stars of Local Business. 6: Setting “records” for a good time. 7: Young Entrepreneur Award Aliva Nicodemus, founder - Hometown Macrame Presented by Candace Carnahan Pres./CEO Photography by Ryan Sanchez

1: Welcome Sign at 2024 Grand Junction Chamber Annual Banquet 2: Alpine Bank Staff Lip Sync Bruno Mars’ “24K Magic” 3: Volunteer and Staff Badges. The “roadies”! 4: GJ Chamber Members arrive ready to ROCK this year’s banquet! 5: Chamber Members are Rock Stars of Local Business. 6: Setting “records” for a good time. 7: Young Entrepreneur Award Aliva Nicodemus, founder - Hometown Macrame Presented by Candace Carnahan Pres./CEO Photography by Ryan Sanchez

1: Friend of Agriculture Award, Phil Patton. Presented by Jessica Burford, Pres./CEO Palisade Chamber of Commerce 2: Carol and Richard of Z’s Orchard with family and staff. Lifetime Achievement award recipients. 3: Hillbilly Catering presented a top notch appetizer and dinner lineup. 2024 Palisade Chamber Banquet 4: Grins from the Talbott Family 5: Business of the Year and Citizen of the year. Kristin Seymour, Harlow

1: Friend of Agriculture Award, Phil Patton. Presented by Jessica Burford, Pres./CEO Palisade Chamber of Commerce 2: Carol and Richard of Z’s Orchard with family and staff. Lifetime Achievement award recipients. 3: Hillbilly Catering presented a top notch appetizer and dinner lineup. 2024 Palisade Chamber Banquet 4: Grins from the Talbott Family 5: Business of the Year and Citizen of the year. Kristin Seymour, Harlow

ARTICLE BY GJ LIFESTYLE STAFF

ARTICLE BY GJ LIFESTYLE STAFF

Beginning with cash, what places can it be put to be relied upon later? Checking and Savings Accounts are liquid or readily accessible for immediate spending needs. Some even pay a small interest amount but rarely do these keep pace with inflation. They are best used for living expenses and short-term deferred spending.

A “money market” account usually pays a higher interest rate than standard checking/ savings but these often require a minimum balance of over $10,000 to be maintained. A CD (certificate of deposit) has a maturity period and usually outpaces inflation by a little bit as long as money is not withdrawn early. The longer period accounts often pay better returns but still often lag behind inflation in preserving spending power.

Other “fixed rate” accounts include things like immediate and fixed rate annuities, traditional life insurance, indexed life and annuity products

and even hard assets like gold, jewels and other precious metals can provide some preservation of capital and spending power.

Some authors and self-proclaimed gurus even decry certain assets and asset classes as foolish and tell their followers to “never buy” those types of assets. Frankly, if the assets they speak so strongly against were as unreliable as they claim, those asset classes would not be legal.

Finance is such a specialized field that there are numerous professions requiring current licensing and ongoing continuing education. Much like healthcare professionals are required to stay abreast of new developments, financial professionals - CPAs, Attorneys, Financial Advisors, Investment Advisors, Insurance Professionals, Financial Consultants and Financial Analysts are all required to keep current licenses. So what about the alphabet soup of retirement accounts? CONTINUED >

IRA - Individual (personal) Retirement Arrangement - allows contributions before tax on current income.

ROTH IRA - Contributions go in after income is taxed and growth comes out tax-free after retirement age.

401k and SEP now allow “Roth” contributions allowing individuals to create diversity in tax treatment upon assets built up for later use.

SEP IRA - Simplified Employee Pension has among the highest annual contribution limits for individuals of high income allowing for a plan that maintains lifestyle in retirement years.

To explore these options, speak with a licensed financial professional.

I’m a Colorado girl through and through. Born and raised in Colorado, I settled on the Western slope 35 years ago. I’ve also lived in northern, southern and frontrange Colorado. One thing I have noticed living in different areas of the state: From super small communities to large ones, the more you invest in community, the stronger it becomes.

When we think of investment, we usually mean - money; stocks, bonds, mutual funds, real estate, etc. Returns take time and planning. Investing in our community is similar. We can volunteer, and serve in other ways, in hopes of building a stronger community now and for future generations.

We live in a very self-focused world. It seems that few these days, take the time to look up and see the people around them and when they do, they either disregard and go on their way or become overly offended and things tend to escalate. News, social media, and the influences of the world make it super easy for this to happen.

So, how do we change things? We can start by looking up. When we do, let’s look to see what we can do to help make our community better, what we can do to help make our community stronger; Investing in our future.

There are so many things in this community that we could invest our time and talents in. Here are a few suggestions:

Housing Resources of Western Colorado is currently facilitating the construction of 8 homes for low-income families here in Grand Junction. The program accepts volunteers who commit to the required 15 of the 30 hours of service work. Volunteer support is greatly needed and will have a huge impact on the families.

CONTINUED >

Clifton Christian Church Food Bank is always looking for volunteers to help check in and distribute food, as well as donations of food. This is an ongoing opportunity that occurs on the 4th Saturday of the month.

Donating blood at a local blood bank is another way to serve others and it is literally life-saving.

Diaper Depot Diaper Bank needs donations of diapers, wipes, and rash creams. They also need volunteers to help repack the diapers into smaller packages. This is so helpful for children, as it is a hidden consequence of poverty. Without a supply of diapers, toddlers cannot participate in early childhood education.

Being a volunteer and/or donating isn’t the only way we can invest. Here are a few more suggestions that are completely free.

Smile. It really is contagious. When we smile at people it lets them know we see them, that they are noticed. Often times just a smile can change the outlook or attitude of the person it is directed at. It has huge benefits. Not just for the person, but for yourself.

Say something nice. How great is it to be complimented? We can help lift others by our words. Tell someone how helpful they are, you like the shoes, their hair looks nice. It doesn’t have to be complicated but do be genuine.

Hold the door open for someone. We tend to be in such a hurry that the courtesy of holding open a door is overlooked.

Say please and thank you. You’d be amazed at what a difference this makes. It doesn’t seem like much, but it really is, besides, it’s just polite.

Text someone. Let them know that you are thinking about them. Tell them how important they are to you. All of us have bad days. Hearing from people and knowing they are thought about can help in those hard times we all have now and then.

All these things are just tiny ways to invest in our community. When we do things like this, we set an example for others to follow; especially for the younger generations - which is exactly the point of investing in building something of value for the future.

"You don't age out of FAMily."

-Kimberly Raff, Founder and Executive Director of FAM

Experience life-changing relief at FHW Pain Specialist Clinic led by Dr. Kyle Christopherson. Our comprehensive approach addresses various conditions, from common back and neck pain to migraines, joint issues, and neuropathy.

Meet Al, a patient of 30 years, who struggled

with persistent pain despite multiple surgeries and interventions.

“I missed family reunions, holidays, and my grandson’s birth because I couldn’t ride in a car for more than 30 minutes.”

Al attests to getting his life back with a small device

called a spinal cord stimulator. Today, Al said, his pain is 100% relieved, and he couldn’t be more thankful.

“Recently we strolled the local fall festival shopping and listening to music. In the past I would have never entertained the idea of

even riding in the car to town,” Al said with a smile.

Don’t wait, contact FHW Pain Specialists clinic today atfhwcare.org/pain or call 970.858.2239.

ARTICLE BY IAGO B.

ARTICLE BY IAGO B.

“Have you looked at that shower surround?!”

”I hate those countertops!”

“Our vanity has nothing to be vain about!”

Sound like your typical conversation about parts of your house that don’t quite feel like home? Robert and his team understand.

Is your kitchen less than beautiful? Does your bathroom feel like you got sucked into the “Barbie” movie?

Robert Klein started refinishing kitchen and bath surfaces in Colorado’s high country over 20 years ago. The demand for an economical way to redo high-use living spaces grew so rapidly, he was constantly traveling. His work ranged from Steamboat Springs to Durango and as a one-man crew. Bigger, commercial jobs came along which required additional crews and technicians, trained in a precise system of renovation. Robert chose

Here’s what homeowners often say - before/after!

Before - “Our vanity has nothing to be vain about!”

After - ”Miracle Method, GJ recently worked a white-granite looking “miracle” on the writer’s kitchen counters. Beautiful!”

Before Ugly Kitchen

After

the Miracle Method system to partner with, due to the quality of their product and the training available to assure consistent outcomes from one job to the next.

Western Colorado Miracle Method recently worked a white-granite appearance “miracle” on the writer’s kitchen counters. Beautiful!

Today, hundreds of homes and lodging properties across western Colorado have a fresh and enduring look in kitchen surfaces and bath surrounds without the mess, high cost or long build-out time of traditional structural resurfacing that accompanies bath-wall resurfacing or countertop swap-outs.

Retirement marks the culmination of years of dedication, perseverance and sound financial choices. A key element of effective retirement planning is diversifying your income sources. While staples like 401(k)s or IRAs are foundational, it’s equally important to branch out. Tax considerations significantly influence retirement strategies. Each financial action, from asset sales to account withdrawals, can carry tax consequences. Knowing these details can greatly influence one’s overall retirement income. Tactics such as Roth IRA conversions can help distribute tax liabilities over time, allowing for tax-free withdrawals later on. Using strategies like tax-loss harvesting can balance out capital gains, ensuring proactive steps to reduce tax impact.

Annuities have long been recognized as a popular retirement income source. An annuity is essentially a financial contract that can offer a steady and predictable income, with options that might even extend to lifetime payouts. Retirees should also be aware of certain drawbacks. These might include fees and expenses, issues around liquidity, and potential concerns related to inflation.

Delving into the world of Alternative Investments, retirees can consider assets such as hedge funds, private equity and real assets, among others. These investments may promise higher returns and provide diversification away from traditional stocks and bonds. However, the complexities of these investments mean they often come with challenges like illiquidity, higher fees and the need for a thorough understanding of the investment itself.

The backbone of many retirement plans, Social Security Income, provides a safety net for millions. Established with the intent of financial assistance, the amount one receives depends on various factors. There are also strategies retirees can employ to maximize these benefits, such as deciding on the optimal time to claim or considering the implications of working while receiving benefits.

Delaware Statutory Trusts (DSTs), while not familiar to everyone, can be a potential retirement income source. Historically rooted, DSTs offer a form of passive real estate investment, which can lead to regular distributions. They also open doors to 1031 exchange possibilities, offering tax deferral benefits. But, just like any other investment, DSTs have their limitations, notably the lack of liquidity and the heavy reliance on trust management.

You only get one retirement. In the ever-evolving world of finance, staying updated and flexible is essential to ensure the continued relevance and efficiency of one’s retirement strategy.

Disclosures

Securities offered only by duly registered individuals of Madison Avenue Securities, LLC (MAS), member FINRA/SIPC. Advisory services offered only by duly registered individuals of Csenge Advisory Group, LLC. MAS, Csenge Advisory Group, LLC and Impact Wealth, LLC are not affiliated entities.

Investing involves risk, including the potential loss of principal. This is intended for informational purposes only. It is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. Our firm is not permitted to offer and no statement made during this presentation shall constitute tax or legal advice. Our firm is not affiliated with or endorsed by the U.S. Government or any governmental agency.

Every retirement journey is distinct, and each vision merits expert guidance. Impact Wealth is based in Boulder Colorado. You can contact them at Impact@ImpactWealth.com.

APRIL 2024

APRIL 1ST

Anywhere and Everywhere | 12:00 AM

If you’re one who loves to laugh or loves to make others laugh, this is your day. Make it fun and bring joy to others with good humor and good cheer! You might be a FOOL not to have a bit of fun on April Fools’ Day; and of course, keep it kind.

APRIL 4TH

210 E. Aspen Street, Fruita | 7:00 PM

Open Mic Night is each Thursday at Cavalcade in Fruita. This event gives local performers a creative outlet.

APRIL 4TH - 6TH

Mesa County Fairgrounds | 9:00 AM

This three day event goes until 6pm on 4/6.

Boats, RVs and tons of accessories will be on display from local and traveling vendors at Mesa County’s centrally located outdoor venue.

APRIL 5TH

530 Colorado Ave., Grand Junction | 3:00 PM

This event goes until 7pm and includes flavor samplings of locally sourced cuisine and beverages. It is also a key fund raiser for United Way of Mesa County.

APRIL 6TH

Grand Junction Convention Center | 10:00 AM

With free admission, the 2024 Grand Junction Holistic Trade Show will be from 10 am to 7 pm, featuring 44 vendors and ten individual presenters covering a variety of natural wellness topics.

APRIL 6TH

Avalon Theater, Grand Junction | 7:30 PM

This musical event is at 7:30 pm the first night and 3pm on day two. Both performances are held at the Avalon Theater at 7th and Main streets.

APRIL 6TH & 7TH

Wine Country Inn, Palisade

5:00 PM

Dinner event 5-8:30pm on April 6th. Adventure event April 7th, Noon to 4pm.

Wine Country Inn, Hosting.; This is a key fundraising event for Marillac clinics each year.

APRIL 6TH

Mesa Mall - Gracie Jiu-Jitsu | 12:30 PM

This free self-defense workshop is for women and girls ages 12 and up and requires pre-registration to attend. Contact Gracie Jiu-Jitsu for tickets to participate in this educational workshop.

APRIL 9TH

Lincoln Park Barn | 2:00 PM

Seasonal hiring event for summer jobs with the City of Grand Junction goes from 2-6pm. Great for college and high school students looking for summer work.

CONTINUED >

APRIL 12TH

Quilt Show - Mesas to Monuments

Grand Junction Convention Center

10:00 AM

This two day quilt show will be held form 10am to 5pm both days, featuring vendors, suppliers and displays of the amazing art form of quilting.

APRIL 14TH

Help Elevate KidsFun Run!

Las Colonias Park | 8:30 AM

This 5k fun run supports several local non-profit organizations and schools. Register online before midnight on 4/12 and get your “move-it, move-it” on. Starts at 8:45 am.

APRIL 27TH

Viva

Wine Country Inn | 6:00 PM

This event is a fund raiser for Mesa County Junior Service League, supporting local non profit groups as an all women’s service organization. Tickets available at jslgj.com

You’re invited to be a difference maker!

Join us to make an impact in our community and be inspired by stories of those who overcame challenges after foster care.

May 11, 2024

Colorado Mesa University Ballroom Center

To purchase tickets, scan the QR code or go to our website: fosteralumnimentors.org

AT WESTERN SLOPE MEMORY CARE, THE IDEA THAT THE PERSON COMES FIRST INFLUENCES EVERYTHING WE DO AND CREATE.

• A Boutique All Memory Care community

• All Private Studio Apartments with individual bathrooms

• The Innovative Vigil Monitoring System

• Specialized Dementia Care: Our entire staff is trained in and dedicated to the care of those suffering from Alzheimer’s and other-related dementias.

• Moments Program: A complete-person approach to care and engagement

Thank you to our amazing community sponsors!

2594 PATTERSON ROAD

GRAND JUNCTION, CO 81505

P 970.462.9696

WESTERNSLOPEMEMORY.COM

For more information or to schedule a tour, please contact us today.