Money, as we understand it, embodies more than just the physical currency that changes hands; it mirrors our core beliefs, values, and the aspirations we harbor within us. In this issue, we set forth on an enlightening expedition not just to unravel the complexities of financial markets but to uncover the profound significance of fostering a wealth mindset. This perspective goes beyond mere figures on a financial statement, embracing notions of abundance, gratitude, and purpose.

As the publisher of this magazine and an avid reader myself, I have encountered numerous books that have profoundly impacted my understanding and relationship with money. In hopes of sharing this wealth of knowledge, I am including my personal book list in this issue. Each book selected has offered me valuable insights into the psychology of wealth, cultivating a mindset geared towards abundance, and the practical steps to achieving financial independence. My goal in sharing these book lists is to offer you, our readers, resources that not only inform but also inspire and help in navigating your own journey towards financial enlightenment and personal growth.

Whether you are an experienced investor seeking to expand your understanding of the financial markets, an aspiring entrepreneur on the quest to unleash your potential, or someone exploring the path of personal development and self-discovery, our magazine—and the articles within—holds treasures that can spark your imagination and lift your perspective on creating and sustaining wealth and abundance.

We hold the belief that true wealth starts in the mind, with a mindset brimming with possibilities, resilience, and generosity. We aim to inspire you not just to attain financial success but to foster a life enriched with purpose, fulfillment, and giving back, thereby transforming the very essence of what it means to be wealthy.

JAHNA EICHEL, PUBLISHER @FORTCOLLINSCITYLIFESTYLEApril 2024

PUBLISHERS

Jahna Eichel | jahna.eichel@citylifestyle.com

Jason Eichel | jason.eichel@citylifestyle.com

EDITORIAL COORDINATOR

Macey VanDenMeerendonk | macey.v@citylifestyle.com

PUBLISHER ASSISTANT

Morgan Henderson | morgan.henderson@citylifestyle.com

MARKET SUPPORT ASSISTANT

Matthew Hart | matthew@thecreativeagencyco.com

ACCOUNT MANAGER

Michael Naumburg | michael@thecreativeagencyco.com

PHOTO EDITOR

Henry Magarotto | henry@thecreativeagencyco.com

STAFF PHOTOGRAPHER

Tony Deyo | tony@thecreativeagencyco.com

STAFF WRITER

Allie Bellows | allie@thecreativeagencyco.com

SOCIAL MEDIA COORDINATOR

The Creative Agency | hello@thecreativeagencyco.com

CONTRIBUTING WRITERS

Joshua Lewis, Erin Brandt-Moreli, Macey

VanDenMeerendonk, Linas Sudzius, J.D. , Jahna Eichel, The Creative Agency

CONTRIBUTING PHOTOGRAPHERS

Christa Tippmann Photography

CHIEF

CHIEF

Steven Schowengerdt

Matthew Perry

EXECUTIVE DIRECTOR OF HR Janeane Thompson DIRECTOR

Robinson

Josh Klein

Whitney Lockhart

1 - 3: Hope Lives! painted the town pink with their annual fundraising gala. The inspiring event showcased a celebration of life and resilience with ambassadors walking the runway in the fashion show, while sharing their impactful stories. Community members, sponsors, and current and past Hope Lives! clients came together on February 17 to support the efforts of Hope Lives! The Lydia Dody Breast Cancer Support Center.

We have such amazing, innovative business leaders in our community who are proud to serve you, our residents, with class and quality. We’ve compiled some of our top company picks for the services that might be on your mind this month in an effort to make your lives a little easier.

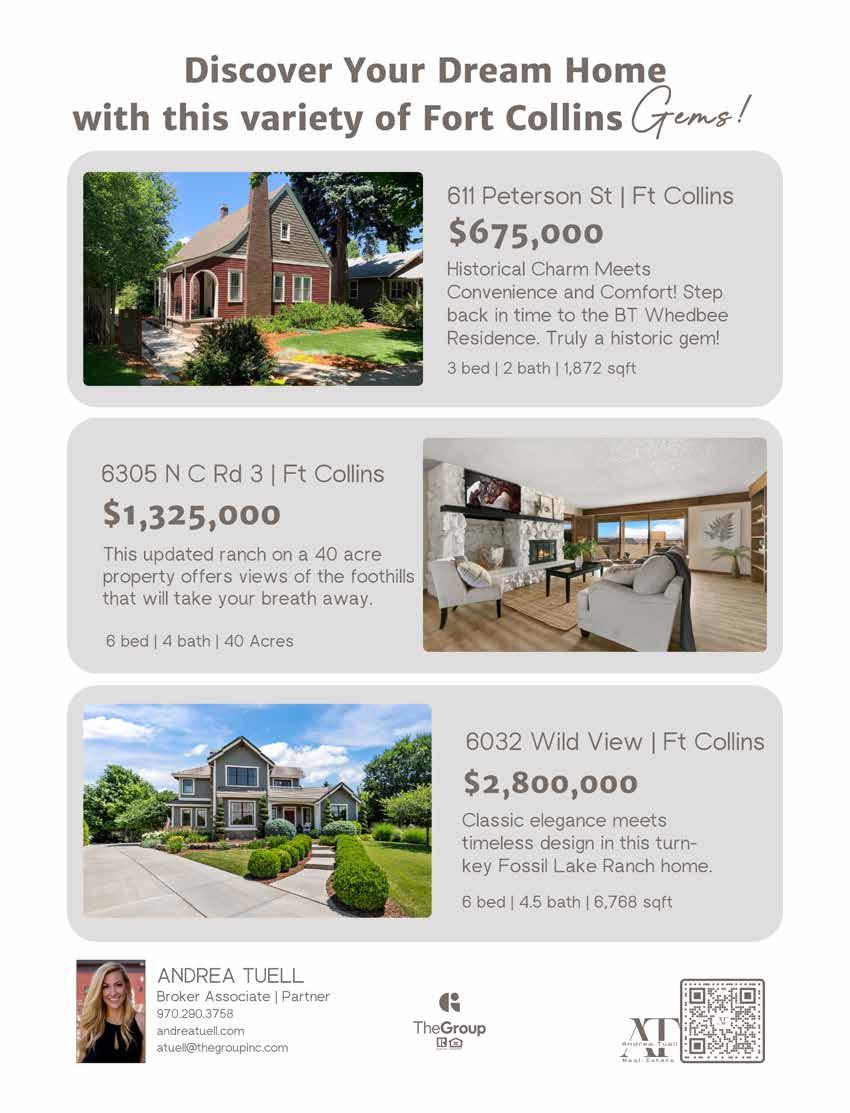

How to prepare for success in an ever-changing market

We’re all aware that one thing the vast majority of millionaires have in common is an investment strategy that incorporates some form of carefully managed real estate speculation.

In fact, a staggering 90% of those generating a seven- or eight-figure income are right now leveraging diverse real estate holdings that continue to bolster their personal financial portfolios. Although such investment strategies may at the outset appear complex, there do exist simple means toward realizing the full potential of what they offer.

While preparing to invest in residential properties, commercial real estate, or alternative revenue streams along the lines of Real Estate Investment Trusts (REITs), it’s essential to first recognize and understand what supportive management and financial resources are available to you.

By taking a step back and factoring your overall pre-existing financial commitments into your long-term economic goals, you will be able to better assess what initial capital you can manage for acquiring a new property. From here, you can more safely calculate your individual requirements for fiscal considerations along the lines of: down payments, closing costs, and expected renovation or improvement expenses.

An ample comprehension of mortgage loans is vital when delving into new real estate ventures. Commiserate with this crucial understanding is an awareness of: mortgage products, interest rates, and repayment structures. Investors should as such carefully review their myriad mortgage options, comparing terms and rates in order to secure the most favorable arrangement that will align with their financial capabilities and investment objectives.

The cornerstone of any successful real estate investment is a prudent financial plan. This plan should encompass an analysis of the investor’s expenses and liabilities, including their individual income. By so doing, investors will be able to tactfully develop custom strategies that can optimize their resources and mitigate potential risks.

Establishing contingency reserves for unforeseen expenses and periods of vacancy is imperative to cushion against financial shocks and uphold the stability of one’s investment portfolio.

While investigating areas in which you might want to invest, staying abreast of regional market trends, economic indicators, and regulatory developments is pivotal. For this reason, you’ll ideally want to employ a real estate professional who can expertly conduct thorough research into emerging opportunities for growth and appreciation in specific geographical areas and property segments.

Such expert investigation of macroeconomic factors — inflation, expected equity, and employment trends — can provide valuable insights into the broader impact on real estate markets where you may be exploring investments.

A seasoned professional can also spotlight how low interest rates may stimulate demand for real estate and facilitate favorable financing conditions, while higher interest rates may provide an opportunity to unearth affordable hidden gems. They can additionally point out how rising inflation may influence property valuations and rental yields.

Tapping the experience and knowledge of a professional will furthermore shed light on unique local factors, such as demographic shifts, urban development initiatives, and infrastructure projects that may significantly affect valuations on area properties.

The intersection of finances and real estate represents a dynamic domain that demands astute financial acumen, strategic planning, and a comprehensive interpretation of nebulous market dynamics. Successful real estate investment hinges on proper management of financial resources, the development of a solid fiscal plan, and the integration of economic insights into one’s investment choices.

As investors blaze their way through the evolving landscape of real estate speculation, it is of maximum import that they continually reassess their financial position and investment goals, while realistically adapting their strategies in response to ever-changing market conditions.

Ultimately, the fusion of finances and real estate presents boundless opportunities for individuals to build and preserve wealth, generate passive income, plan for retirement, and contribute to a well-rounded investment portfolio.

As we embark on a brave new year in 2024 there are a multitude of considerations in both the economy and investment landscape. Coming off the heels of a late year rally in equities, we will see some familiar names continue their upward ascent while others fall behind. 2023 was the year of Artificial Intelligence and those companies who were affiliated with the new technology garnered much of the market’s attention. All the while, the Federal Reserve and interest rates found themselves in direct competition with A.I. for the media’s attention. We believe this narrative will continue for some time as we unknowingly wait for the next latest and greatest technology that will somehow radically improve our lives, or at least lead us to believe that. In the meantime, there are some things to consider.

2024 will be a year dominated by the headlines as we navigate white-knuckled from one potential catastrophe to the next. While this may sound dramatic, it is the most basic form of what financial markets do, climb a wall of worry, and then they do what we least expect. When we

look out at our globally connected marketplace, it is easy to rattle off a laundry list of all the things that could go awry, and that list unfortunately is not getting any smaller. While it is easy to get caught up in all the negative things that MAY happen, we would like to first focus on some of the potential positives that lie ahead. After all, I am a budding optimist.

Much of the impending financial news will pertain to interest rates, the housing market, consumer spending, and of course unemployment. While all of these seem as though they are unrelated, they are very much the driving forces of our economy and the cost of capital. Looking ahead we see several pockets of attractive valuations and one of those places is in the bond market. With the dramatic increase in interest rates over the last 2 years, the yield here is as attractive as it has been in the last decade. While higher rates for longer is an ideal scenario for those low-risk investors looking to generate consistent cash flow, there may also be greater upside potential here as well. If the Federal Reserve decides to cut rates, bonds will appreciate and gain in value. This however can be something of a double-edged sword as rates go down, so the yield goes on any newly issued bonds. Depending on your situation, this may be a good opportunity to be an owner of bonds prior to the potential rate cuts that are likely to happen in 2024. It is also important to note that if the Fed is reducing rates, it means that inflation is coming down but also that the economy is beginning to soften. This is where consumer spending comes into play and will dictate not only inflation but how long rates stay elevated. Not to mention that if spending declines too far, rising unemployment will not be far behind. So, when the term “soft landing” is thrown around the news this is what they are referring to and a “Goldilocks” scenario is necessary to avoid a large-scale recession. After all, nobody wants to eat cold porridge.

Another segment of opportunity will be in the equity space. Much of last year’s returns were secular in the

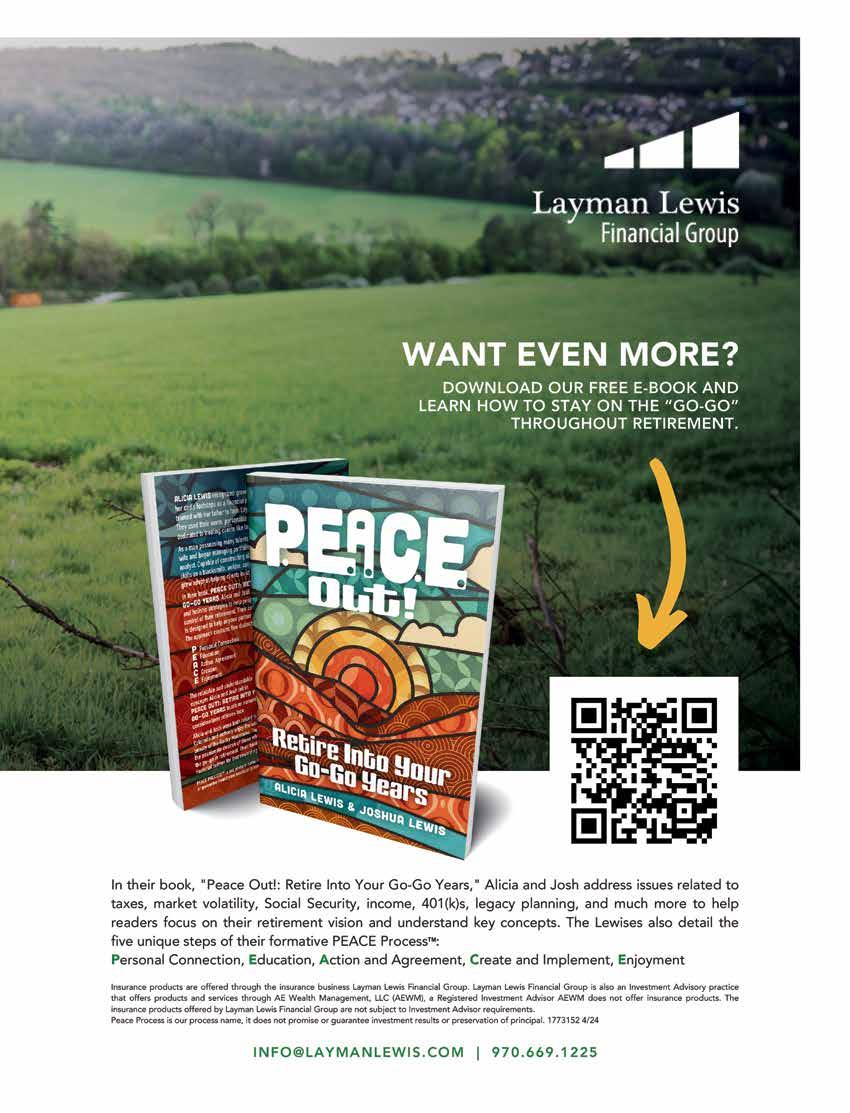

Joshua Lewis, Financial Advisor at Layman Lewis Financial Group

Joshua Lewis, Financial Advisor at Layman Lewis Financial Group

mega-cap growth stocks, particularly the “Magnificent 7.” This valuation expansion did not trickle down to everyone else. All those second derivative A.I. companies were left out of the rally right along with several other sectors like financials, utilities, and healthcare. Purely from a valuation standpoint, we believe these industries are worth a look. This would also be inclusive of small cap companies as well but with elevated risks as the smaller the company the greater the sensitivity to the underlying economic fundamentals. So, we see opportunities in size, style, and exposure, with some of that being outside of the U.S. Ultimately targeted exposure will be important but as always, diversification will be paramount.

Now I would be remiss if we did not also mention the fact that 2024 will be a hotly contested presidential election that will most likely drive some volatility along the way. What is of importance is that historically there have been 24 presidential

elections since the start of the S&P 500. During that time, 20 of those years the index had a positive return, with an average return of 11%. 1 So, as we know history does not repeat itself, the long-term averages are on our side. As the candidate field narrows, we will see more about potential policy, tax code, and legislation that will ultimately have a larger lasting impact on the world’s largest economy.

In summation, I am always reminded of the Chinese proverb, “May you live in interesting times” and to be candid for everyone who does not have a financial plan for their retirement, it is going to be especially interesting. For those that do have a plan, opportunity awaits in everyone else’s uncertainty.

1 This does not include the 2020 election results however Morningstar indicates that the S&P returned 16.26%. 2020 would be the 24th election and the 20th positive return for the index.

https://advisor.morganstanley.com/the-ernie-garcia-group/documents/ field/e/er/ernie-garcia-group/S%26P%20500%20in%20Presidential%20 Election%20years.pdf

This piece is for informational purposes only and is not a solicitation to buy or sell any of the products mentioned. The information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual's situation. Investment advisory products and services made available through AE Wealth Management, LLC (AEWM), a Registered Investment Advisor. Investing involves risk, including the potential loss of principal. 2219579- 2/24.

Burchard has pinpointed six habits that help people become more productive, better leaders, and increases joy and confidence. Using science-backed information and engaging exercises readers can achieve success at a faster rate.

Grant explores what the world’s most influential leaders have to say about power and its role in society. Through fascinating interviews and compelling data, readers are inspired and instructed on power and how it shapes our world.

Vaynerchuk teaches readers how to get the utmost potential out of every social media platform and instructs on how to amplify your personal brand for each. As a follow up to Crush It!, Crushing It! offers Vaynerchuk’s perspective on what has changed and what principles remain relevant.

Sincero breaks down ways to change your mindset to make financial success a reality. Intertwining humor with concepts to push through fear, Sincero will guide you through identifying your mindset and deliver real results.

Sethi’s 6-week, fool-proof program is designed to give readers the tools to find financial freedom. This program helps financial situations of all kinds and instructs in a simple and easy to understand format.

Dr. Murphy will change your mindset about money by teaching you how to make friends with money, develop wealth consciousness, reinstate your belief in your abilities, and how to always live in abundance.

In this updated edition of Hill's classic book, Arthur R. Pell, Ph. D. takes the same concepts, with a new generation refresh, and applies them to the modern millionaires and billionaires today, looking at how they’ve achieved their wealth.

Former international hostage negotiator for the FBI, Chris Voss, gives a practical guide with nine principles to help readers with high-stakes negotiations. This book offers strategies on how to become more persuasive in your personal and professional life, giving you a competitive edge in discussions.

Michalowicz uses a different approach to business with a profit-first system. By simplifying accounting in four simple principles and with dozens of case studies and practical advice, readers will learn to achieve long-term growth in their businesses.

Sullivan defines the four most important freedoms – time, money, relationship, and purpose, and provides tools on how to make the most of them. Using a quality over quantity approach, this book helps readers get more meaning and freedom in their lives.

Using easy to implement success habits, this book will help you navigate the habits that no longer serve your future. Using helpful recipes outlined in the book will get you to the level of wealth and abundance you desire.

Cease helps readers to let go of their beliefs and attachments to money, so that they can bring their gifts into the world authentically. In this book, Cease helps readers to prioritize their sanity, creativity, freedom, and the ability to step into your true power.

Inspired by the philosophy of stoicism, Holiday offers readers a framework to flip obstacles into opportunities. With this mindset approach, readers will learn the art of turning their trials into triumphs.

Washington guides readers step-bystep to create a life of peace, purpose, and prosperity. This book will help you stop chasing money and instead prioritize relationships, change habits, and set up your life to support your goals.

Lok addresses almost every kind of financial concern in this book and offers a no-nonsense guide to get readers to the financial freedom they’ve always dreamed of.

Entrepreneurship in Fort Collins can often feel like a whirlwind of change. Even though our economy is robust, business owners in Fort Collins continue to encounter challenges in talent acquisition and face stiff competition, given the city's desirability as a business location. We sat down with one of our area’s most seasoned professionals, business consultant Drew Yancey who shared his insights with us below.

“WE’RE GIVING PEOPLE IN OUR COMMUNITY THE OPPORTUNITY TO NOT JUST MAKE A LIVING BUT TO GROW IN THEIR CAREERS, TO DEVELOP AS HUMAN BEINGS, AND TO ENJOY THE WORK THAT THEY GET TO BE INVOLVED IN.”

- DREW YANCEY

WHAT INSPIRED YOU TO PURSUE A CAREER IN BUSINESS FINANCIAL CONSULTING, AND HOW HAS YOUR JOURNEY SHAPED YOUR APPROACH TO ADVISING CLIENTS?

My journey is a big part of what I do today. I had the great blessing of being born into a large family business. I was the fourth generation of one of the largest food distributors in North America. It started as a small produce stand in rural Northern Colorado. We were really able to live the full American dream of building that business over many generations, and eventually selling the business. After that, I spent many years in corporate strategy consulting. So, kind of the other end of the spectrum working with these large corporations, a lot of times publicly traded companies, and what I observed is that many of the same challenges that we faced in our own business, larger companies face as well. They're just magnified to a grander scale. It really gave me a passion

Drew Yancey

Drew Yancey

Drew is deeply passionate about helping companies achieve what they did not think was possible. He leverages his extensive track record in high-performance team building and strategic execution to solve challenging problems at the nexus of growth, strategy, and innovation. Drawing on vast advising and executive experience that stretches across multiple industries, Drew delivers unique results at scale.

Drew holds a Master of Divinity from Denver Seminary, an MBA from Texas A&M University, and a Ph.D. from the University of Birmingham, UK. He’s not just all business, though. Drew's an explorer at heart—40 countries and counting! A seventh-generation Coloradoan, he cherishes time with his wonderful family in the great outdoors.

for combining some of the sophisticated tool sets and analysis that comes with advising large companies but distilling that down and bringing it to smaller businesses to really help them grow.

WHAT SHOULD EVERY BUSINESS OWNER KNOW ABOUT FINANCES BEFORE STARTING THEIR BUSINESS AND HOW WOULD YOU ADVISE BALANCING FISCAL RESPONSIBILITY WITH GROWTH?

I wish every business owner understood the importance of cash flow management before starting their business. It's not just about profit; having the cash available to cover your expenses and invest in growth opportunities is crucial for sustainable growth. Balancing fiscal responsibility with growth involves careful planning and budgeting. Prioritize investments that offer the highest return on investment and consider using a mix of equity and debt financing to fuel growth without overextending financially.

IN YOUR EXPERIENCE, WHAT ARE THE MOST COMMON FINANCIAL CHALLENGES THAT BUSINESSES IN FORT COLLINS FACE, AND HOW DO YOU HELP THEM NAVIGATE THESE OBSTACLES?

For my family’s business, by probably the mid-90s, it made sense for us, logistically, to move out of Northern Colorado, because our client base expanded. But, we never did. We always wanted to stay rooted in Northern Colorado. Part of that was because of the strong economy that we have. In general, I still believe that Northern Colorado is a great place to build a business. But at the same time, it's never been harder to scale a business, especially in a place like Northern Colorado where all of those things that we know are great about our economy, a strong labor force and a relatively stable housing market, also make it really hard to find and attract talent. It's also a very competitive landscape. So, what this means for the financial strategic management of a business is that, first and foremost, you have to have a plan. A lot of businesses, as they grow into that middle market space, have to make a pretty big shift. The owners and the leaders of the business have to spend more time working on the finances of the business, as opposed to just working reactively.

CONSIDERING

The word resilience is absolutely critical here. As businesses grow and mature, it's really critical that their business models get further fortified financially. What we mean by that, is that they're less susceptible to the ups and downs that come with being either a startup or a business. It's just trying to get exposure. So, as I mentioned earlier, this really starts with having a financial planner. We wouldn't go on a hike in the Rocky Mountains without a map. Likewise, we wouldn't want to grow a business without a plan on how to grow financially. I always say a great place to start is work with

“AS BUSINESSES GROW AND MATURE, IT’S REALLY CRITICAL THAT THEIR BUSINESS MODELS GET FURTHER FORTIFIED FINANCIALLY.”

a three-year time window. Don't just think about the next year. What does ‘amazing’ look like for the finances of your business in three years? What that'll force you to think through is a lot of those long-term success factors. Things like developing your leadership, am I investing in the right, new markets and products, am I expanding our innovation footprint? All of these questions become a lot easier to see over a three-year time window. Then what you can do from there is reverse engineer and build a financial plan that has annual milestones. If you know you're hitting these annual milestones, you’re going to grow.

WHAT STRATEGIES DO YOU RECOMMEND FOR SOMEONE WANTING TO BE AN INDUSTRY LEADER?

To become an industry leader, focus on innovation and building a strong brand. Continuously improve your offerings based on customer feedback and stay ahead of industry trends to set the pace for your competitors.

HOW DO YOU ASSESS THE FINANCIAL HEALTH OF A BUSINESS, AND WHAT INDICATORS DO YOU LOOK FOR WHEN DETERMINING ITS POTENTIAL FOR GROWTH AND SUCCESS?

This is an area where I see a lot of business owners and leaders have some misconceptions. The obvious place to start is the financials of the business. There's absolutely a role to be played for knowing your financials, your profit and loss statement, your balance sheet, and cash flow statement. You don't necessarily have to know those the way that your CFO or director of finance would, but you need to know the big picture. If you think about it, those financial statements are ultimately looking in the rearview mirror. They're a statement about where the business is coming from. As a business owner and leader, you also need to be really focused on those leading indicators, not just a lagging indicator. That's where looking at your business from the outside is really valuable. One of the things that I've done as a focus area in my practice as an advisor is I work with a lot of businesses that are going through some sort of an exit. What we always say is we want to stress test your business the way that a buyer would, we're looking for those leading indicators. Is there a diverse revenue stream? Do we have strong management and leadership in place? Are we making wise decisions with the use of our cash? Other variables that are going to be more of a leading indicator of future growth?

For a profitable exit, an established business should focus on increasing its valuation through revenue growth, diversifying its customer base, and streamlining operations. Additionally, maintaining clean financial records and a strong management team will make the business more attractive to potential buyers or investors.

WHAT ROLE DO YOU BELIEVE SMALL BUSINESSES PLAY IN DRIVING ECONOMIC GROWTH AND INNOVATION IN COMMUNITIES LIKE FORT COLLINS, AND HOW DO YOU SUPPORT THEIR FINANCIAL GOALS?

They are essential. Small businesses is a term that I often say has become pretty broad. There are a lot of large small businesses, meaning that as a business moves past that startup phase and really enters into the middle market space, anywhere from five million in revenue all the way on up, they play an increasingly critical role, not just from the standpoint of the products and services they sell. Something that was always top of mind for us as a multi-generational family-owned

“AT TELEIOS, WE HELP COMPANIES DESIGN AND EXECUTE GROWTH STRATEGY.”

business was ultimately the people that came to work every day. This was core to who we were as a business, and by providing strong, foundational growth in our business we were giving people in our community the opportunity to not just make a living but to grow in their careers, to develop as human beings, and to enjoy the work that they got to be involved in.

At Teleios, we help companies design and execute growth strategy. I have taken my years of experience both as an entrepreneur that has successfully scaled a variety of businesses and as an advisor to Fortune 500s to focus on helping middle market businesses grow.

“"Tax-free money is the best type of income. There are three main types of investments that produce tax-free income."

- Linas Sudzius

As you plan for retirement, you face choices as to how you invest your money. When you are trying to decide how to invest your money, start with figuring out why you're investing.

If you're investing primarily to create a comfortable retirement, you'll want to choose investments that will one day help optimize your retirement income. Part of optimizing means planning to deal with taxes.

If you believe tax rates will only increase, one potential strategy is to invest in currently taxed assets to avoid future tax liability. Or you may want to look into potentially tax-free income options such as life insurance, a Roth IRA, or municipal bonds. Keep in mind, though, that certain tax advantages often come at a cost.

All else being equal, tax-free money is the best type of income. There are three main types of investments that produce tax-free income:

1. Municipal bonds

2. Roth IRAs

3. Life insurance held until death

While paying no tax on income is obviously better than the alternative, it comes at a cost, which may reduce or negate its benefits.

Municipal bonds are debt obligations issued by a federal, state, or local government. When you invest in a municipal bond, you are essentially loaning the governmental entity money in exchange for a set amount of interest to be paid over a predetermined period. At the end of the term, the full amount that you invested is returned to you. Interest earned from an investment is usually subject to ordinary income tax rates, but under the current rules, interest paid on municipal bonds is generally tax-exempt if the bonds are used to fund governmental projects constructed for the public good. The federal taxation of municipal bonds is complex.

To add to the complexity, each state has its own laws governing municipal bonds. However, most states do not tax individuals on the interest arising from municipal bonds issued by that state.

What are the problems with municipal bonds?

First, municipal bonds generally pay a lower interest rate than other investment options. Second, tax-free income from municipal bonds can also affect your Social Security benefits. This is because such interest is added back to the equation for determining your modified adjusted gross income (MAGI) for Social Security. This could push your income levels high enough to expose your benefits to taxation.

Bond obligations are subject to the financial strength of the bond issuer and its ability to pay. Before investing, consult your financial professional to understand the risks involved with purchasing bonds.

Investing in a Roth IRA can be another powerful tool to avoid income taxes on its growth. To fully understand the costs and benefits of investing in a Roth IRA, you need to know how they differ from traditional IRAs.

Here's the main difference: When you earn income and contribute to a traditional IRA, you don't currently pay taxes on that income. However, when you withdraw money from the traditional IRA, you will incur income taxes on the full amount that you withdraw.

Conversely, when you earn income and contribute to a Roth IRA, you are still required to pay taxes on that income. On the other hand, when you take money out of the Roth IRA, you generally do not incur any income taxes on that amount, assuming the account has been open for at least five years, and you are over age 59.

Simply put, traditional IRAs grow tax-deferred while Roth IRAs grow tax-free.

Finally, life insurance proceeds also provide an option to receive money tax-free. Life insurance comes in two main forms:

1. Term life insurance

2. Permanent life insurance

When most people hear about life insurance, the first thing they usually think of is term life insurance, where you enter into a contract that provides

a certain death benefit that will go to your heirs upon your death. In exchange for this possible death benefit, you must pay predetermined monthly premiums for a predetermined term - usually 10 or 20 years. If you don't die within the term, you won't receive anything from the policy.

On the other hand, as long as sufficient premiums are paid, permanent life insurance will pay a death benefit.

Because a death benefit will ultimately be paid, premiums under such policies are generally higher than term insurance contracts. However, as you make payments, the death benefit of the policy may increase.

If the life insurance policy is a non-modified endowment contract (non-MEC), you are generally allowed to withdraw funds from the cash accumulation value taxfree up to the amount you have contributed into it.

“If you’re investing primarily to create a comfortable retirement, you’ll want to choose investments that will one day help optimize your retirement income.”

If the policy is a modified endowment contract (MEC), withdrawals and policy loans are fully taxable as income to the extent that there is a gain in the policy over the amount of net premiums paid. Taxable distributions are also subject to a 10% federal tax penalty if the owner is below age 59 1/2.

One downside to planning for retirement with a life insurance contract is that the tax advantages are generally not available until your death. However, if the policy is a non-MEC, you may be able to borrow from the cash value throughout your life without incurring income taxes as long as the insurance contract is still in force.

Insurance products are offered through the insurance business Layman Lewis Financial Group. Layman Lewis Financial Group is also an Investment Advisory practice that offers products and services through AE Wealth Management, LLC (AEWM), a Registered Investment Advisor. AEWM does not offer insurance products. The insurance products offered by Layman Lewis Financial Group are not subject to Investment Advisor requirements. Investing involves risk, including the potential loss of principal. Neither the firm nor its agents or representatives may give tax or legal advice. Individuals should consult with a qualified professional for guidance before making any purchasing decisions. Layman Lewis Financial Group is not affiliated with the U.S. government or any governmental agency. 2266676 - 02/24

ARTICLE

A positive company culture is more than just an element of employee satisfaction; it’s a strategic asset that can significantly impact a company’s financial growth. When a company fosters an environment where employees feel valued, supported, and motivated, it lays the groundwork for enhanced productivity and innovation. This environment leads to employees who are not only committed to their work but are also willing to go above and beyond in their roles. Such dedication directly contributes to improved operational efficiencies, reduced turnover costs, and a stronger competitive position in the market. By investing in a culture that encourages employee engagement, companies can see a tangible increase in their bottom line, as a motivated workforce is key to driving sales, customer satisfaction, and sustainable growth.

The Creative Agency’s team sheds light on how a nurturing company culture translates into impact. Their collective feedback emphasizes that when employees feel a part of a supportive and dynamic environment, their innovative contributions increase, leading to the development of new products, services, and processes that can open up additional revenue streams. Moreover, a culture that attracts and retains top talent reduces the expenses associated with high turnover rates, such as recruitment, training, and lost productivity.

TONY DEYO Director of Web Development

TONY DEYO Director of Web Development

Our company’s inclusive culture, collaborative environment, and encouragement for innovation significantly contribute to my professional satisfaction by fostering a sense of belonging, teamwork, and the freedom to explore new ideas.

Being able to produce something that I know is going to be utilized on a daily basis gives me personal satisfaction. Whatever problem it might be that I’m solving, I know that, because of how much we work together and talk to each other, every single thing that I have a hand in creating people are going to find value in it.

We are very energetic and helpful here. Anytime I have a question, there’s always somebody there to answer it. There’s a lot of movement going on here, a lot of high fives flying around, and a lot of fun.

We’re all creative individuals and it’s a pretty free flowing atmosphere. A lot of times if you bring up an idea, good or bad, we can collaborate to make that bad idea good or elevate that good idea even further.

Working with such a creative group allows for a lot of really fun and constructive collaboration. When it comes to projects, we're just trying to make the bigger picture the way we all want it to look. We get to see a lot of our own visions and artistic creativity coming out and it's just a really fun environment to be able to grow professionally in.

MATTHEW HART Lead Graphic Designer MACEY VANDENMEERENDONK Editorial Coordinator MORGAN HENDERSON Executive Assistant MICHAEL NAUMBURG Sales Associate

As the leader of Hooman Resources, my main job is to supervise the office and make sure no one is ever sad. For me, The Creative Agency is the place I can go to work on important skills like socializing, back scratching, developing treat ball strategies, and being the life of the party!

HENRY MAGAROTTO Photo Editor

HENRY MAGAROTTO Photo Editor

Having access to resources has significantly accelerated my growth as an editor. Whenever I express the need for specific tools or software that could enhance my performance, the company promptly acknowledges and supports my requests. This not only fosters my personal and professional development but also propels the collective growth of our organization. It's an environment where growth thrives on all fronts.

CHAS LEDERER Production Assistant

CHAS LEDERER Production Assistant

I love that the CEO of our company is in the room with us every day. That she allows us to push ourselves and expects a lot of us, but not in a way that is unsupported. Helping people find creative ways to make themselves stand out. And being a small part of that every day, we can't really ask for anything better than that.

ALLIE BELLOWS Copywriter

ALLIE BELLOWS Copywriter

Every person in the office is so creative, and in a different way. I think we all inspire each other through our different strengths and our different creativities. It’s really inspiring being around other creatives that are so good at what they do.

GABE KAWAMURA Director of Cinematography

GABE KAWAMURA Director of Cinematography

Together, we are a very creative team and it's satisfying to me to work among these people who are all so passionate about the art we create. We lift each other up every day and support each other in our creative efforts and I'm better because of it.

By prioritizing a positive workplace culture, The Creative Agency not only enhances its employees' job satisfaction but also secures a more prosperous financial future, demonstrating the direct correlation between a thriving company culture and a company's financial performance.