Lincoln Springs Apartments Confidential Investment Summary

By Life Bridge Capital A Leading Multifamily Investment Firm

This document is confidential and may not be reproduced or redistributed. The information presented herein has been prepared for informational purposes only and is not an offer to buy or sell, or a solicitation of an offer to buy or sell any security or fund interest or any financial instrument and is not to be considered investment advice. This presentation is for institutional use only and is not to be distributed to any party other than its intended recipient

The following materials present information regarding a proposed creation of a special purpose vehicle (the "Issuer") which would offer securities (the “Securities”) to finance its acquisition of a portfolio of financial assets to be selected and managed by the portfolio manager referred to herein (the "Manager"). These materials have been prepared to provide preliminary information about the Issuer and the transactions described herein to a limited number of potential underwriters of the Securities for the sole purpose of assisting them to determine whether they have an interest in underwriting the Securities

The views and opinions expressed in this presentation are those of Life Bridge Capital LLC (“Life Bridge Capital”) and are subject to change based on market and other conditions. Although the information presented herein has been obtained from and is based upon sources Life Bridge Capital believe to be reliable, no representation or warranty, expressed or implied, is made as to the accuracy or completeness of that information No assurance can be given that the investment objectives described herein will be achieved Reliance upon information in this material is at the sole discretion of the reader

This data is for illustrative purposes only. Past performance of indices of asset classes does not represent actual returns or volatility of actual accounts or investment managers, and should not be viewed as indicative of future results. The investments discussed may fluctuate in price or value. Investors may get back less than they invested.

Forward looking information contained in these materials is subject to certain inherent limitations. Such information is information that is not purely historical in nature and may include, among other things, expected structural features, anticipated ratings, proposed or target portfolio composition, proposed diversification or sector investment, specific investment strategies and forecasts of future market or economic conditions. The forward looking information contained herein is based upon certain assumptions, which are unlikely to be consistent with, and may differ materially from, actual events and conditions In addition, not all relevant events or conditions may have been considered in developing such assumptions Accordingly, actual results will vary and the variations may be material Prospective investors should understand such assumptions and evaluate whether they are appropriate for their purposes These materials may also contain historical market data; however, historical market trends are not reliable indicators of future market behavior.

Information in these materials about the Manager, its affiliates and their personnel and affiliates and the historical performance of portfolios it has managed has been supplied by the Manager to provide prospective investors with information as to its general portfolio management experience and may not be viewed as a promise or indicator of the Issuer's future results Such information and its limitations are discussed further in the sections of these materials in which such information is presented

Past performance of indices or asset classes does not represent actual returns or volatility of actual accounts or investment managers and should not be viewed as indicative of future results. The comparisons herein of the performances of the market indicators, benchmarks or indices may not be meaningful since the constitution and risks associated with each market indicator, benchmark, or index may be significantly different Accordingly, no representation or warranty is made to the sufficiency, relevance, important, appropriateness, completeness, or comprehensiveness of the market data, information, or summaries contained herein for any specific purpose.

Past performance is not indicative of comparable future results. Given the inherent volatility of the securities markets, it should not be assumed that investors will experience returns comparable to those shown here Market and economic conditions may change in the future producing materially different results than those shown here All investments have inherent risks

Life Bridge Capital LLC. All Rights Reserved. No part of this document may be reproduced, stored, or transmitted by any means with the express written consent of Life Bridge Capital.

The following information is an investment summary provided to prospective investors and others. This information is not an offering to sell either a security or a solicitation to sell a security. At the request of a recipient, the Company will provide a private placement memorandum, subscription agreement and the Limited Liability Company Operating Agreement. The Managing Member in no way guarantees the projections contained herein. Real estate values, income, expenses and development costs are all affected by a multitude of forces outside the Managing Member’s control. This investment is illiquid and only those persons that are able and willing to risk their entire investment should participate. Please consult your attorney, CPA and/or professional financial advisor regarding the suitability of an investment by you.

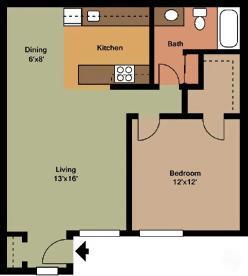

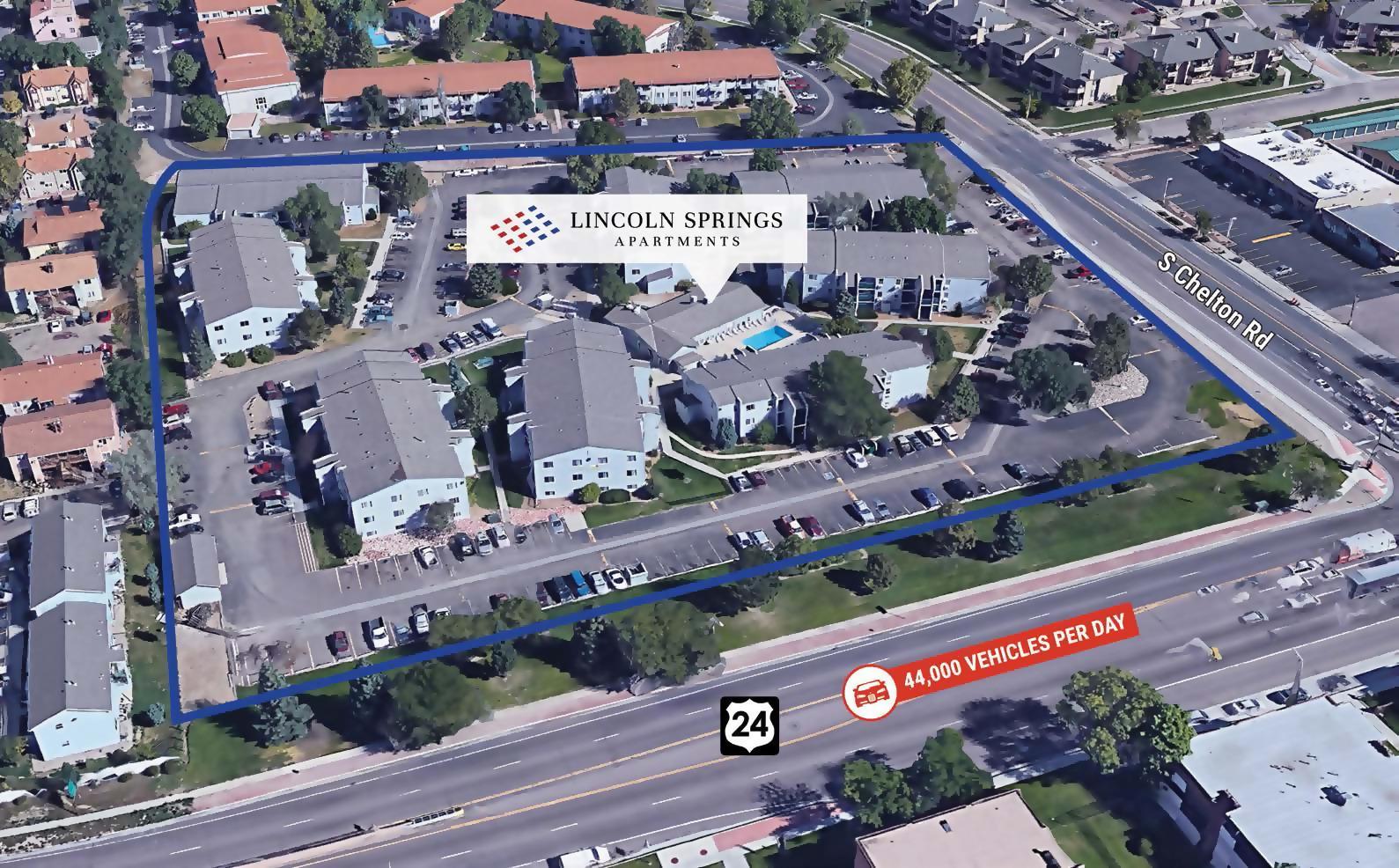

Life Bridge Capital has identified Lincoln Springs Apartments (”Lincoln Springs”) for acquisition The asset is an institutional quality, 180 unit property that was built in 1974. Lincoln Springs is located in Colorado Springs, CO.

Colorado Springs has attracted national attention as one of the top apartment markets in the country Multiple publications have ranked Colorado Springs as one of the best markets for rent growth in the nation, with a 36% increase over the last five years.

Due to extremely favorable fundamentals, El Paso County is experiencing incredible growth, and is the fastest growing county out of the 64 counties in Colorado. Between 2016 2018, the population increased by an impressive 24,000 people.

Wage growth has experienced a remarkable year over year increase at 10%, more than triple the national average of 3.37%. This translates to an average income increase per person of nearly $300 more per month. Assuming a third of income is spent on housing, Colorado Springs rents are poised to grow $100 across the board in 2019.

Cap (Adjusted)

Reversion Cap 5.99%

Expense Ratio (T12) 40% Occupancy (as of 3/22/1019) 99.44%

DSCR 1.31x

Purchase Price $19,500,000 Hold Time 5 Equity Required $7,000,000 Investor Equity Multiple 2.09x

Preferred Return 8.0%

Average Annual Return** 21.70%

Rate of Return (IRR) 18.59%

Includes proceeds from sale

Lincoln Springs Apartments

Investment Summary

The Colorado Springs economy has experienced massive growth in the last few years. A recent study by the University of Colorado Leeds School of Business shows Colorado Springs leading the state in employment growth; both in 2018 and heading into 2019. The study names Colorado Springs as solidly in the group of cities around the country that are outperforming the nation as a whole. Many factors have contributed to the exciting success in Colorado Springs. The city has taken steps to revitalize and attract businesses. Rapid development of industries such as cybersecurity and health care, two brand new sports stadiums, the US Olympic Museum, and new restaurants have energized the metro area, attracting young, educated new residents.

Forbes has recently ranked Colorado Springs as the #5 Most Educated City in the United States. Thirty eight percent of the population holds a bachelor’s degree or higher. Colorado Springs is home to top tier higher educational institutions and has a large number of highly trained veterans transitioning into the workforce, making it a very attractive location for companies looking to relocate or expand their presence in Colorado.

The overall goal with Lincoln Springs is to improve the property operations through a variety of renovations and cost-cutting measures that will both generate profit during the ownership period and drive appreciation of the asset for capital gains upon sale.

Some of the steps include:

✓ Replacing all roofs immediately using an existing insurance claim

✓ Professionally manage the property for economic occupancy

✓ Drive value for current and future tenants through landscaping upgrades and interior renovations

✓ Increase asking rents by an average of 7%

1. In addition to replacing the roofs we plan to replace all windows on the property. This will drive down utility costs for both the property and our residents. We also plan to update all signage throughout the property, and reconfigure the clubhouse to include a full workout facility.

2. Lincoln Springs is currently at 99.44% occupancy, which speaks to the strength of the local market, as well as the occupancy goals of the current management. Our property management partner has a long track record of effective management in Colorado Springs, and will be a vital component in achieving market rents.

3. We will immediately remediate the exterior landscaping to provide a warmer and more welcoming atmosphere for our tenants. The unit interiors will be remodeled by our on-site maintenance crew as they come available with new paint, backsplashes, and furnishings. This will both enhance the property profile, and drive maintenance costs down.

4. 2 Bedroom units are a valuable commodity in Colorado Springs, and units with 2 bathrooms are very rare. With our combination of interior and exterior renovations the property will be able to command higher rents. This rent premium is well-established in the local sub-market by comparable properties managed by our property management partner.

5. The entire parking lot will be completely redone and restriped improving the overall appearance immediately.

Cap (Adjusted)

Reversion Cap

Expense Ratio (T12) 40%

Occupancy (as of 3/22/1019) 99.44%

DSCR 1.31x

Purchase Price $19,500,000 Hold Time 5

Equity Required $7,000,000

Investor Equity Multiple 2.09x

Investor Preferred Return 8.0%

Investor Average Annual Return** 21.70%

Internal Rate of Return (IRR) 18.59%

Includes proceeds from sale

($32,090)

($33,080)

$1,942,023 $2,000,284 $2,062,012

$445,578 $458,945 $472,714

$2,387,601 $2,459,229 $2,534,725

Real Estate Taxes $31,000 1.49% $78,000 3.36% $79,950 3.35% $81,949 3.33% $83,997

Insurance $55,000 2.64% $56,375 2.43% $57,784 2.42% $59,229 2.41% $60,710

Contract Services $12,600 0.60% $12,915 0.56% $13,238 0.55% $13,569 0.55% $13,908

Trash Removal $28,500 1.37% $29,213 1.26% $29,943 1.25% $30,691 1.25% $31,459 Electric $106,492 5.11% $94,253 4.07% $96,609 4.05% $99,025 4.03% $101,500 Gas $45,290 2.17% $41,422 1.79% $42,058 1.76% $43,109 1.75% $44,187

Waterand Sewer $150,000 7.20% $138,256 5.96% $141,712 5.94% $145,255 5.91% $153,360

Legal $2,500 0.12% $2,563 0.11% $2,627 0.11% $2,692 0.11% $2,760

ManagementFee $62,524 3.00% $69,542 3.00% $71,268 3.00% $73,777 3.00% $76,042

Repairs and Maintenance $45,000 2.16% $46,125 1.99% $47,278 1.98% $48,460 1.97% $49,672 General/Admin $37,000 1.78% $37,925 1.64% $38,873 1.63% $39,845 1.62% $40,841

Payroll $195,000 9.36% $160,000 6.90% $164,000 6.87% $168,100 6.84% $172,303

Other $22,400 1.07% $22,960 0.99% $23,534 0.99% $24,122 0.98% $24,725 Deposit to

Reserve $45,000 2.16% $45,000 1.94% $45,000 1.88% $45,000 1.83% $45,000

$838,306

$834,548

$853,875

$874,824 35.57% $900,463

Big City

Economy in The Nation

Mid-Sized

Cities

Desirable Place To Live

COLORADO SPRINGS, COLORADO - Located just 60 miles south of Denver, Colorado Springs is the second largest city in Colorado and is located in El Paso County, the second most populous county in the state of Colorado. Known for its natural attractions and mild climate, Colorado Springs experiences 300 days of sunshine annually. The community’s beautiful setting and high quality of life have helped to build a growing community of academic, government, high tech, non profit, and defense related businesses.

A Thriving Metropolitan Area - Located one hour south of Denver and 30 minutes north of Pueblo, Colorado Springs is home to over 717,000 people and is an easy commute for more than 3 million.

Tourism - The city-owned Garden of the Gods Park is one of the area’s most popular recreation spots, and the famed Broadmoor hotel hosts thousands of tourists and vacationers monthly from all over the world. Other significant attractions include the U.S. Olympic Training Center, Cheyenne Mountain Zoo and Pikes Peak.

EMPLOYMENT Colorado Springs’ economy boasts a cybersecurity industry that is one of the top five for jobs in the nation, an unrivaled aerospace and defense cluster that makes the area a hub for national military technology and strategy, 57 national and international sports organizations, and groundbreaking innovation in life sciences and medical devices. While the military outposts boast the majority of the metro area’s employment, companies such as Memorial Hospital-UCHealth and Penrose-St. Francis Heath Services also have a large presence. The military concentration has led to many large aerospace employers in the area, including Northrop Grumman Corporation. Total military employment in Colorado Springs is 54,500.

Life Bridge Capital LLC seeks multifamily acquisitions appropriate for institutional and high net worth funds. Life Bridge Capital prides itself in identifying comparatively low risk investments that have excellent revenue growth potential. The mission is to preserve and grow investor capital though a conservative acquisition strategy and a hands on asset management approach. It is of utmost importance to deliver a solid current return to investors while implementing a specific business plan designed to add value to the property.

A lifelong learner, Sam Rust is the founder of VGI Capital. Currently Sam is the sole owner or managing partner of over $10 million worth of real estate, mostly in the Front Range of Colorado. Started investing in real estate in 2017, quickly moved to syndication and am a managing partner for 65 units.

Whitney Sewell is the founder of Life Bridge Capital, LLC and a strategic partner of VGI Capital. Life Bridge Capital works with accredited investors, helping them improve their investment returns via the exceptional opportunities that multifamily syndication offers. Whitney has been involved with in over 800+ units valued at over $100M+. He is host of the daily podcast The Real Estate Syndication Show. Life Bridge Capital LLC has committed 50% of it’s profits to helping families that are committed to adopting children while providing the same great return to investors.

▴

Capitalization Rate (Cap Rate) A rate of return on a real estate investment property based on the expected income that the property will generate. Capitalization rate is used to estimate the investor's potential return on his or her investment. This is done by dividing the income the property will generate (after fixed costs and variable costs) by the total value of the property.

▴When acquiring income property, the higher the capitalization rate (“Cap Rate”), the better

▴When selling income property, the lower the Cap Rate the better.

▴A higher cap rate implies a lower price, a lower cap rate implies a higher price

▴Cash Flow Cash generated from the operations of a company, generally defined as revenues less all operating expenses.

▴

Cash-on-Cash A rate of return often used in real estate transactions. The calculation determines the cash income on the cash invested.

▴Calculated: Annual Dollar Income Return / Total Equity Invested = Cash on Cash

▴Debt Service Coverage Ratio (DSCR) It is the multiples of cash flow available to meet annual interest and principal payments on debt. This ratio should ideally be over 1. That would mean the property is generating enough income to pay its debt obligations.

▴Return on Equity (ROE) – The amount of net income returned as a percentage of shareholders equity

▴

Investor Average Annual Return, excluding disposition The average return per year during the investment hold.

▴Investor Average Annual Return, including disposition The average return per year including profits from disposition This calculation does not include the return of invested capital.

▴Internal Rate of Return (IRR) The rate of return that would make the present value of future cash flows plus the final market value of an investment opportunity equal the current market price of the investment or opportunity. The higher a project's internal rate of return, the more desirable it is to undertake the project.

▴Return on Equity (ROE) The amount of net income returned as a percentage of shareholders equity.

▴ROE is expressed as a percentage and calculated as: Return on Equity = Net Income/Shareholder's Equity