Leading Multifamily Investment Firm

Leading Multifamily Investment Firm

El Paso County is the fastest-growing county out of the 64 counties in Colorado and is experiencing incredible growth. Since 2010 the population of Colorado Springs has grown by over 12%.

Colorado Springs has attracted national attention as one of the top apartment markets in the country. Multiple publications have ranked Colorado Springs as one of the best markets for rent growth in the nation, with a 36% increase over the last five years.

Wage growth has experienced a remarkable yearover-year increase at 11.63%, more than triple the national average of 3.37%. This translates to an average income increase per person of nearly $300 more per month.

The Colorado Springs economy has experienced massive growth in the last few years. Colorado’s economy is at the head of the pack nationally, with wage growth outpacing the national average at 3.3% and existing business renewals growing by 3.9% since last year to over 142,000, according to the report. Colorado’s economy continues to lead the nation in wage growth and employment. The study names Colorado Springs as solidly in the group of cities around the country that are outperforming the nation as a whole. Many factors have contributed to the exciting success in Colorado Springs. The city has taken steps to revitalize and attract businesses. The rapid development of industries such as cybersecurity and health care, two brand new sports stadiums, the US Olympic Museum, and new restaurants have energized the metro area, attracting young, educated new residents.

Forbes has recently ranked Colorado Springs as the #5 Most Educated City in the United States. Thirty-eight percent of the population holds a bachelor’s degree or higher. Colorado Springs is home to top tier higher educational institutions and has a large number of highly trained veterans transitioning into the workforce, making it a very attractive location for companies looking to relocate or expand their presence in Colorado.

Current effective rents at Stratus are significantly below the rest of the market. Nearby communities are leasing units on average for $150-$300 more per unit per month, creating ample room for rental revenue increases.

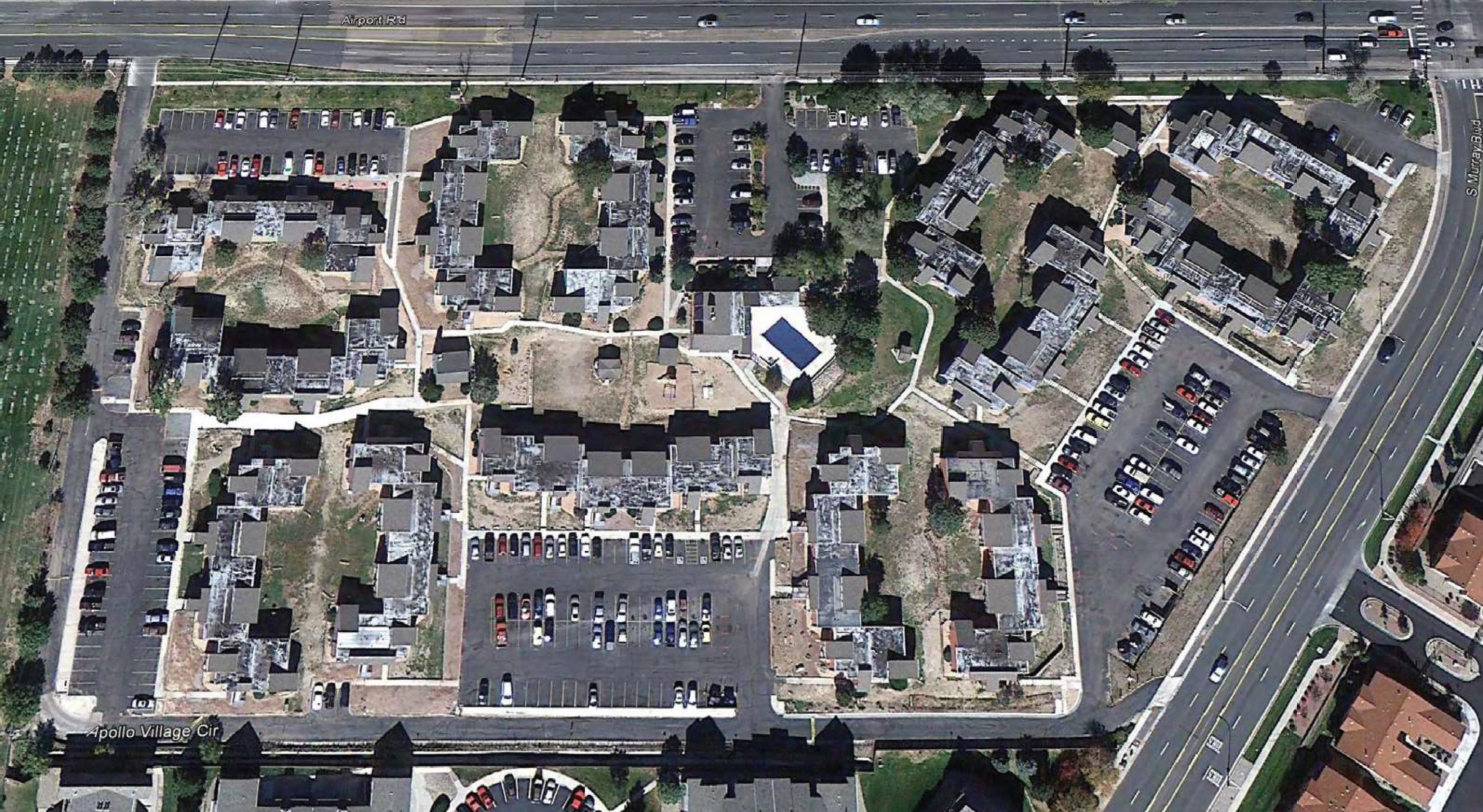

In the past ten years, over $2.5 million ($11,500 per unit) in capital improvements have been invested into the property. Highlights include new roofs, a completely renovated clubhouse, fitness center and pool area, exterior paint, new signage and landscaping upgrades. In addition, new energyefficient double pane windows, cabinets, siding, and boilers have been installed.

The property has an inherent competitive advantage with average floorplans over 900 square feet, and a favorable unit mix of 90% two and three bedroom floor plans. It is very rare to find a 1970s vintage property with a significant amount of 2 and 3 bedroom units in this area of Colorado Springs, making it extremely difficult for properties to compete with Stratus.

Stratus is located in the Airport submarket, which consistently produces strong rent growth. In the second quarter of 2019, year-over-year rent growth is 8.5%, making it the second highest performing submarket in the metro area.

Just a few miles east of the property lies the city’s aviation employment hub which is anchored by Peterson Air Force Base, and the Colorado Springs Municipal Airport. These facilities help attract a number of distribution and defense related businesses that are driving impressive job growth. The airport is the second busiest in the state, and has seen more than a 30% increase in traffic year-over-year. Lockheed Martin, the largest defense contractor in the city, recently expanded its offices, and now occupies over 48,000 square-feet of space near the Colorado Springs Airport. Amazon is opening a distribution center located near the Colorado Springs Airport, which is initially expected to employ 300 people.

Colorado Springs is ranked among the Top 5 metro areas in the nation for job growth, with a 5.5% year-over-year increase (18,000 jobs), far exceeding the national average of 1.87%.

According to city planning documents and recent press release, Amazon is planning to construct a new office, warehouse, and distribution complex next to an existing fulfillment center at the Colorado Springs Airport. Scheduled to break ground in Q1 of 2020, this development will be the largest commercial facility in Colorado or the surrounding 7 states and is located roughly 2 miles from Stratus.

Stratus is surrounded by some of the most significant retail corridors in the city. Just two miles north of the property on Academy Boulevard is the one-million square-foot Citadel Mall, which is home to over 100 retailers. Across the street from the mall is the Citadel Crossing Shopping Center, which includes popular retailers such as Lowe’s and PetSmart. Residents at Stratus are also within a short drive to the Powers Boulevard retail corridor which includes the First & Main Town Center and over 1.4 million square feet of additional retail. Notable tenants include Super Target, Best Buy, Lowes, Dick’s Sporting Goods and the 17-screen Cinemark 3D IMAX Theater.

Stratus is a quick 15-minute drive to downtown Colorado Springs, which has been ranked as one of America’s Most Beautiful Downtown Areas.* Downtown features a wide range of office, retail, restaurants, and cultural amenities for residents to enjoy. Recently, the state granted over 120 million dollars for the newly proposed City for Champions. The major development will include a Downtown Stadium, United States Olympic Museum, Sports Medicine and Performance Center as well as an Air Force

Academy Visitors Center. With over 4 million square feet of office space, downtown offers strong employment opportunities, and is home to a workforce of more than 29,000 employees. The workforce grows every year as more companies choose to start and grow their businesses in the downtown area.

DaVita, Kaiser Permanente and UC Health all have facilities located within three miles of Stratus. These reputable healthcare providers are crucial to the Colorado Springs economy. Healthcare is currently one of the fastest growing industries in the city.

Over the last ten years, Colorado Springs has benefited from only one market rate property being built in the last 20 years in southeast Colorado Springs, with a limited pipeline moving forward. This eliminates the threat of additional competition being added to the area, potentially luring current and prospective tenants away from Stratus.

Forbes has recently ranked Colorado Springs as the #5 Most Educated City in the United States. Thirty-eight percent of the population holds a bachelor’s degree or higher. Colorado Springs is home to top tier higher educational institutions and has a large number of highly trained veterans transitioning into the workforce, making it a very attractive location for companies looking to relocate or expand their presence in Colorado.

According to a recent study, millennials are moving to Colorado Springs at a higher rate than anywhere in the nation. Colorado Springs ranks sixth in the nation for the highest overall share of millennials at 26.4%. Job opportunities in growing industries such as technology and cyber-security, along with a relatively affordable cost of living and an overall good quality of life are driving millennials to the metro area.

Colorado Springs has recently been ranked as the #2 most desirable place to live among technology professionals. Colorado Springs ranked high on cost of living, weather/climate, commute times, job security, income/salary, and learning opportunities/job expertise. All of these factors support the wage growth, population growth, and strong apartment fundamentals Colorado Springs has been experiencing, and will continue to experience in the future.

1. We are partnering with Dunmire Property Management Company and immediately beginning the following:

Complete a thorough landscaping update that will focus on creating a sense of community for our residents through the addition of additional amenities.

Implementing higher standards for properly qualifying new residents to bring the delinquency numbers more in line with local market averages.

Implementing a thorough value-add program that focuses on renovating the unit interiors with new flooring, electrical and plumbing fixtures, appliances, and countertops.

Note - Dunmire Property Management Company managed this property in the late 2000s, and their familiarity with the property will enable us to begin the rehab program immediately with the goal of capitalizing on the primary leasing season in 2020.

Turn 90% of the units within 18 months of taking possession utilizing our own staff to keep contractor costs to a minimum.

In addition to the interior upgrades, update landscaping in the interior portions of the complex, replace or reinforce the retaining walls as necessary, and replace any sewer lines noted as defective in the due diligence process.

Dedicate substantial resources to drive potential traffic to Stratus and will utilize many of the same methods employed at our neighboring property, Lincoln Springs.

Note: By using a variety of outlets we were able to turn over nearly a third of the tenant base in 4 months at Lincoln Springs (our most recent acquisition), simultaneously improving both the overall income and the community atmosphere.

MONTHS OF INTEREST ONLY PAYMENTS

(MONTHS)

OR ADJUSTABLE

PERIOD (YEARS)

Located just 60 miles south of Denver, Colorado Springs is the second-largest city in Colorado and is located in El Paso County, the secondmost populous county in the state of Colorado. Known for its natural attractions and mild climate, Colorado Springs experiences 300 days of sunshine annually. The community’s beautiful setting and high quality-of-life have helped to build a growing community of academic, government, high-tech, non-profit, and defense-related businesses.

Located one-hour south of Denver and 30 minutes north of Pueblo, Colorado Springs is home to over 717,000 people and is an easy commute for more than 3 million.

The city-owned Garden of the Gods Park is one of the area’s most popular recreation spots, and the famed Broadmoor hotel hosts thousands of tourists and vacationers monthly from all over the world. Other significant attractions include the U.S. Olympic Training Center, Cheyenne Mountain Zoo and Pikes Peak.

The

The overall goal with Lincoln Springs is to improve the property operations through a variety of renovations and cost-cutting measures that will both generate profit during the ownership period and drive appreciation of the asset for capital gains upon sale.

• Replacing all roofs immediately using an existing insurance claim

• Professionally manage the property for economic occupancy

• Drive value for current and future tenants through landscaping upgrades and interior renovations

Increase asking rents by an average of 7%

not

with Ashcroft

with substantial value-add

any classic

of the

rental revenue with renovations of

community

for

with

100% value-add

as well as implement numerous

out capital event (supplemental, refinance) in years

Seeks multifamily acquisitions appropriate for institutional and high net worth funds. Life Bridge Capital prides itself in identifying comparatively low-risk investments that have excellent revenue growth potential. The mission is to preserve and grow investor capital though a conservative acquisition strategy and a hands-on asset management approach. It is of utmost importance to deliver a solid current return to investors while implementing a specific business plan designed to add value to the property.

A lifelong learner, Sam Rust is the founder of VGI Capital. Sam graduated Thomas Edison State University in 2009 with a BSBA in Business Management, currently lives in Colorado with his wife and 4 daughters, and has been active in commercial real estate since 2017. He currently manages a portfolio of properties in Colorado with value in excess of $30 million.”

Life Bridge Capital LLC is owned and operated by Whitney Sewell, a real estate investor who began his real estate investing career back in 2009. Life Bridge Capital has invested in over 1150 doors and currently has 250 units under management. The company works with investors, helping them improve their investment returns via the exceptional opportunities that multifamily syndication offers. Whitney has always had a passion for both real estate and helping others, and Life Bridge Capital LLC affords him the opportunity to do both, while also funding a very important cause that has become deeply personal.

This document is confidential and may not be reproduced or redistributed. The information presented herein has been prepared for informational purposes only and is not an offer to buy or sell, or a solicitation of an offer to buy or sell any security or fund interest or any financial instrument and is not to be considered investment advice. This presentation is for institutional use only and is not to be distributed to any party other than its intended recipient.

The following materials present information regarding a proposed creation of a special purpose vehicle (the “Issuer”) which would offer securities (the “Securities”) to finance its acquisition of a portfolio of financial assets to be selected and managed by the portfolio manager referred to herein (the “Manager”). These materials have been prepared to provide preliminary information about the Issuer and the transactions described herein to a limited number of potential underwriters of the Securities for the sole purpose of assisting them to determine whether they have an interest in underwriting the Securities.

The views and opinions expressed in this presentation are those of Life Bridge Capital LLC (“Life Bridge Capital”) and are subject to change based on market and other conditions. Although the information presented herein has been obtained from and is based upon sources Life Bridge Capital believes to be reliable, no representation or warranty, expressed or implied, is made as to the accuracy or completeness of that information. No assurance can be given that the investment objectives described herein will be achieved. Reliance upon information in this material is at the sole discretion of the reader.

This data is for illustrative purposes only. Past performance of indices of asset classes does not represent actual returns or volatility of actual accounts or investment managers, and should not be viewed as indicative of future results. The investments discussed may fluctuate in price or value. Investors may get back less than they invested.

The forward-looking information contained in these materials is subject to certain inherent limitations. Such information is information that is not purely historical in nature and may include, among other things, expected structural features, anticipated ratings,

proposed or target portfolio composition, proposed diversification or sector investment, specific investment strategies and forecasts of future market or economic conditions. The forward-looking information contained herein is based upon certain assumptions, which are unlikely to be consistent with, and may differ materially from actual events and conditions. In addition, not all relevant events or conditions may have been considered in developing such assumptions. Accordingly, actual results will vary and the variations may be material. Prospective investors should understand such assumptions and evaluate whether they are appropriate for their purposes. These materials may also contain historical market data; however, historical market trends are not reliable indicators of future market behavior.

Information in these materials about the Manager, its affiliates and their personnel and affiliates and the historical performance of portfolios it has managed has been supplied by the Manager to provide prospective investors with information as to its general portfolio management experience and may not be viewed as a promise or indicator of the Issuer’s future results. Such information and its limitations are discussed further in the sections of these materials in which such information is presented.

Past performance of indices or asset classes does not represent actual returns or volatility of actual accounts or investment managers and should not be viewed as indicative of future results. The comparisons herein of the performances of the market indicators, benchmarks or indices may not be meaningful since the constitution and risks associated with each market indicator, benchmark, or index may be significantly different. Accordingly, no representation or warranty is made to the sufficiency, relevance, importance, appropriateness, completeness, or comprehensiveness of the market data, information, or summaries contained herein for any specific purpose.

Past performance is not indicative of comparable future results. Given the inherent volatility of the securities markets, it should not be assumed that investors will experience returns comparable to those shown here. Market and economic conditions may change in the future producing materially different results than those shown here. All investments have inherent risks.

The following information is an investment summary provided to prospective investors and others. This information is not an offering to sell either a security or a solicitation to sell a security. At the request of a recipient, the Company will provide a private placement memorandum, subscription agreement, and the Limited Liability Company Operating Agreement. The Managing Member in no way guarantees the projections contained herein. Real estate values, income, expenses, and development costs are all affected by a multitude of forces outside the Managing Member’s control. This investment is illiquid and only those persons that are able and willing to risk their entire investment should participate. Please consult your attorney, CPA and/or professional financial adviser regarding the suitability of investment by you.