Investment Summary

This document is confidential and may not be reproduced or redistributed. The information presented herein has been prepared for informational purposes only and is not an offer to buy or sell, or a solicitation of an offer to buy or sell any security or fund interest or any financial instrument and is not to be considered investment advice. This presentation is for institutional use only and is not to be distributed to any party other than its intended recipient. The following materials present information regarding a proposed creation of a special purpose vehicle (the "Issuer") which would offer securities (the “Securities”) to finance its acquisition of a portfolio of financial assets to be selected and managed by the portfolio manager referred to herein (the "Manager").

These materials have been prepared to provide preliminary information about the Issuer and the transactions described herein to a limited number of potential underwriters of the Securities for the sole purpose of assisting them to determine whether they have an interest in underwriting the Securities. The views and opinions expressed in this presentation are those of Life Bridge Capital LLC (“Life Bridge Capital Capital”) and are subject to change based on market and other conditions. Although the information presented herein has been obtained from and is based upon sources Life Bridge Capital believes to be reliable, no representation or warranty, expressed or implied, is made as to the accuracy or completeness of that information. No assurance can be given that the investment objectives described herein will be achieved. Reliance upon information in this material is at the sole discretion of the reader. This data is for illustrative purposes only. Past performance of indices of asset classes does not represent actual returns or volatility of actual accounts or investment managers, and should not be viewed as indicative of future results. The investments discussed may fluctuate in price or value. Investors may get back less than they invested.

The forward-looking information contained in these materials is subject to certain inherent limitations. Such information is information that is not purely historical in nature and may include, among other things, expected structural features, anticipated ratings, proposed or target portfolio composition, proposed diversification or sector investment, specific investment strategies, and forecasts of future market or economic conditions. The forward looking information contained herein is based upon certain assumptions, which are unlikely to be consistent with, and may differ materially from actual events and conditions. In addition, not all relevant events or conditions may have been considered in developing such assumptions. Accordingly, actual results will vary and the variations may be material. Prospective investors should understand such assumptions and evaluate whether they are appropriate for their purposes. These materials may also contain historical market data; however, historical market trends are not reliable indicators of future market behavior.

Information in these materials about the Manager, its affiliates and their personnel and affiliates and the historical performance of portfolios it has managed has been supplied by the Manager to provide prospective investors with information as to its general portfolio management experience and may not be viewed as a promise or indicator of the Issuer's future results. Such information and its limitations are discussed further in the sections of these materials in which such information is presented.

Past performance of indices or asset classes does not represent actual returns or volatility of actual accounts or investment managers and should not be viewed as indicative of future results. The comparisons herein of the performances of the market indicators, benchmarks, or indices may not be meaningful since the constitution and risks associated with each market indicator, benchmark, or index may be significantly different. Accordingly, no representation or warranty is made to the sufficiency, relevance, importance, appropriateness, completeness, or comprehensiveness of the market data, information, or summaries contained herein for any specific purpose.

Past performance is not indicative of comparable future results. Given the inherent volatility of the securities markets, it should not be assumed that investors will experience returns comparable to those shown here. Market and economic conditions may change in the future producing materially different results than those shown here. All investments have inherent risks.

Executive Summary Property Profile Financial Analysis Market Overview Portfolio & Case Studies Index 7 16 23 30 35 42Table of Contents

Executive Summary

Summary

Investment

Investment Offering Investment Highlights

Thoughtful Design

Each unit only shares one common wall that is double framed for extra dampening and the interior is designed to naturally project sound back into the unit. Additionally, both the shared wall and ceiling of the first floor units contain sound channeling and insulation for further privacy.

Suburban Living

The four-plex style design brings an attractive aesthetic while lowering the density of the complex. Each unit comes with an assigned covered parking space.

Bridge Capital has identified Ridgecrest Commons for acquisition.

This asset is a 172-unit surface parked fourplex/townhome community completed in 2019. Located in the heart of Idaho’s Treasure Valley, Ridgecrest benefits from significant nearby development ranging from a variety of manufacturers, health care facilities, entertainment venues, and the country’s fastest growing community college.

The property differentiates itself from other nearby product with the 172 carports on site, the fourplex/townhome style development that is attractive to a wide variety of tenants seeking a suburban lifestyle, and a fantastic unit mix that can accommodate professionals who seek to take advantage of the work-from-home trends.

Life

OFFERING SUMARYOFFERING SUMARY CAP (T12) 4.71% REVERSION CAP 5.50% EXPENSE RATIO (T12) 38% OCCUPANCY (AS OF 3/4/20) 100% DSCR 1.28 PURCHASE PRICE $28,500,000 HOLD TIME 7 YEARS EQUITY REQUIRED (TOTAL) $10,200.000 CLASS A IRR & AVG ANNUAL RETURN 10% CLASS B. INVESTORY EQUITY MULTIPLE 2.29 CLASS B INVESTOR AVERAGE ANNUAL RETURN* 8.48% CLASS B INVESTOR AVERAGE ANNUAL RETURN** 18.40% CLASS B INTERNAL RATE OF RETURN (IRR) 15.03% *Excluding proceeds from sale **Including proceeds from sale Investment Summary

Class A investors in the capital stack, per the diagram. Class B has a preferred return of 8% which will accrue over the life of the deal. Cashflow from operations remaining after paying out Class A will be distributed to Class B investors monthly. The minimum investment in Class B is $50k. This tier is for investors who want to maximize their returns over the life of the investment. Class B investors will participate in the upside upon disposition or capital events.

INVESTOR DISTRIBUTION OF CASH FLOW 10% Preferred to Investor MEMBERSHIP OWNERSHIP 10% Preferred to Investor Two-Tiered Equity Structure CLASS B PARTNERSHIP STRUCTURE INVESTOR DISTRIBUTION OF CASH FLOW 8.0% Preferred to Investor 70/30 Split Thereafter MEMBERSHIP OWNERSHIP 70% GENERAL PARTNER DEBT LIMITED PARTNER (B) LIMITED PARTNER (A) 30% Owner 70% Owner$10,200,00 $20,520,000

Sample Returns INVESTOR RETURNS BASED ON $100,00 INVESTMENT – CLASS A INVESTMENT YEAR 1 YEAR 2 YEAR 3 YEAR 4 YEAR 5 YEAR 6 YEAR 7 INVESTOR ANNUAL PERCENT RETURN 10% 10% 10% 10% 10% 10% 10% INVESTOR RETURN ON INVESTMENT ($100,000) $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 $10,000 RETURN FROM DISPOSITION – LIMITED PARTNER - - - - - - $100,000 TOTAL RETURN – LIMITED PARTNER ($100,000) $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $170,000 INVESTOR RETURNS BASED ON $100,00 INVESTMENT – CLASS B INVESTMENT YEAR 1 YEAR 2 YEAR 3 YEAR 4 YEAR 5 YEAR 6 YEAR 7 INVESTOR ANNUAL PERCENT RETURN 6.1% 13.2% 9.1% 9.2% 10.7% 8.0% 8.2% INVESTOR RETURN ON INVESTMENT ($100,000) $6,102 $13,160 $9,110 $9,196 $10,705 $8,000 $8,246 RETURN FROM DISPOSITION – LIMITED PARTNER - - - - - - $164,297 TOTAL RETURN – LIMITED PARTNER ($100,000) $6,102 $19,262 $28,372 $37,568 $48,273 $56,273 $228,816 RETURN SUMMARY IRR EQUITY MULTIPLE AVG COC* ANNUALIZED** LIMITED PARTNER (CLASS A) 10.0% 1.70x 10.0% 10.0% LIMITED PARTNER (CLASS B) 15.0% 2.29x 9.2% 18.4% *Excluding proceeds from sale **Including proceeds from sale

Investment Offering

Serene Fourplex community provides residents proximity to both employers and retail in the immediate vicinity, as well as a fantastic central Treasure Valley location with great access to Downtown Boise, the Greenbelt, and a wide variety of recreational opportunities in nearby mountain ranges and lakes.

Energy Efficient Appliance Package

Black kitchen appliances and washer/dryer in every unit

Investment Highlights Four Plex Buildings 43 Units 172 Parking Stalls 357 Completion Date 2017-2019 Acres 10.87

Property Profile Property Specifications Amenities Business Plan Floor Plans

Property Specifications PROPERTY DETAILS YEAR BUILT 2017/2019 ROOF ASPHALT BUILDING STYLE FOURPLEX ROOF AGE 2017/2019 NUMBER OF BUILDINGS 40 RESIDENTIAL, 1 CLUBHOUSE/LEASING STAIRWAYS OPEN AIR CONCRETE NUMBER OF STORIES 2 CONSTRUCTION TYPE WOOD FRAME ACRES 10.87 FOUNDATION CONCRETE SITE DENSITY (UNITS/ACRE) 15.8 APPLIANCES ALL ELECTRIC UNIT MIX (AS OF JUNE 2020) BED/BATH AVG SF # UNITS RENT/UNIT RENT/SF PROJECTED RENT PRO. RENT /SF 1BR/1BA 722 24 $830 $1.15 $950 $1.32 2BR/2BA 972 80 $1,045 $1.08 $1,115 $1.15 2BR/2BA 1,014 30 $1,125 $1.11 $1,195 $1.18 2BR/2.5BA 1,037 8 $1,175 $1,13 $1,225 $1.18 3BR/2BA 1,171 30 $1,230 $1.05 $1,400 $1.20 TOTAL 982 172 $1,067 $1.09 $1,161 $1.18 PARKING SURFACE PARKING 357 COVERED PARKING 172 SPACES PER UNIT 2.07

• 24-hour Fitness Center with Cardio, Resistance, and Free Weights • Low-Density Life Style • On-Site Clubhouse with Multimedia Center and Refreshment Bar • Leash-Free Dog Park • Easy Access to I84 • Expansive Playground • Covered Parking for Every Unit • Online Rent Payments and Maintenance Requests Amenities & Features • All units are 100% Energy Start Certified • All units include a full electric appliance package • Full-size washer and dryer • Balconies • Open Layout • Granite Countertops • Fitness Center with 24 Hour Access • Clubhouse • Picnic Area • Playground • Wheelchair Accessible • Walk-In Closets • Hardwood Floors • Boise Airport 18.2 miles away

Fitness Center Cardio, Resistance, and Free Weight Stations Expansive Clubhouse Multimedia Center, Game Consoles, and Snack Lounge

Under-Market Rents: Currently Ridgecrest Commons is managed by the developer who has placed a heavy emphasis on maintaining occupancy and minimizing turnover. In partnership with TableRock Residential, Life Bridge Capital plans to implement cutting edge management strategies to bring rents up to market, maximize the economic potential through dynamic pricing and the implementation of a robust RUBS system, while simultaneously driving tenant satisfaction through community engagement.

UNIT MIX (AS OF JUNE 2020)

BED/BATH

1BR/1BA

2BR/2BA

1,014

SF # UNITS RENT/UNIT RENT/SF

RENT PRO. RENT /SF

$1.32

$1.08 $1,115 $1.15

$1,125 $1.11 $1,195 $1.18

$1,225 $1.18

Path of Progress: Ridgecrest Commons is located in a burgeoning economic zone with significant opportunities for development and growth in the retail, office, and industrial sectors. Additionally, several large transportation initiatives nearby will bring even more access to the north and west ends of the Treasure Valley, further improving the already stellar location of the property and driving demand from possible tenants.

Manage for Cashflow and Long-Term Growth : The Boise Nampa MSA is one of the fastest growing in the country with expectations to add 300,000 more residents by 2040. The quality of life available in the Treasure Valley combined with a business-friendly environment favorable to start-ups and relocations alike will continue to drive both population and income growth. These factors provide the foundation for both the excellent cashflow and tremendous equity growth here at Ridgecrest Commons.

Business Plan

AVG

PROJECTED

722 24 $830 $1.15 $950

972 80 $1,045

2BR/2BA

30

2BR/2.5BA 1,037 8 $1,175 $1,13

3BR/2BA 1,171 30 $1,230 $1.05 $1,400 $1.20 TOTAL 982 172 $1,067 $1.09 $1,161 $1.18

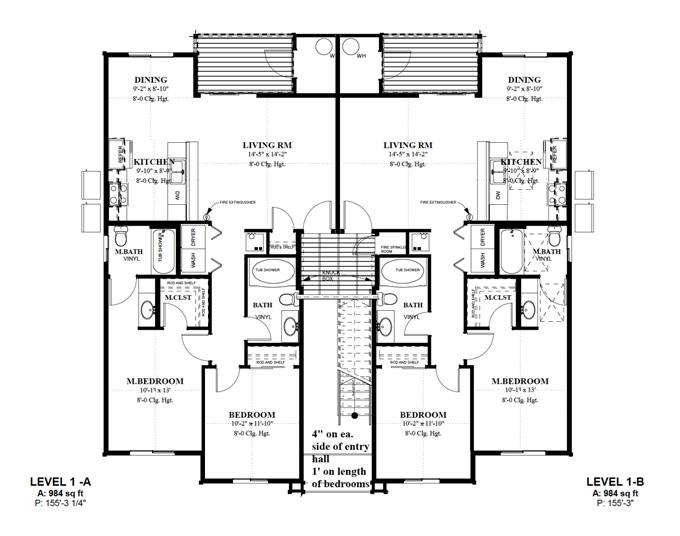

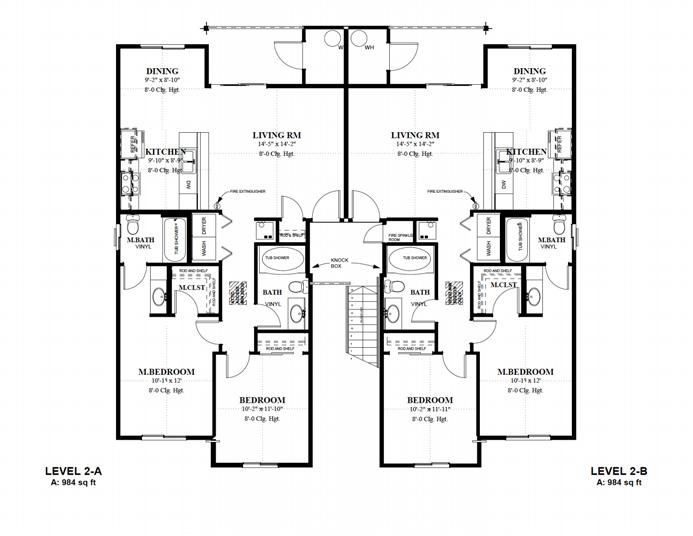

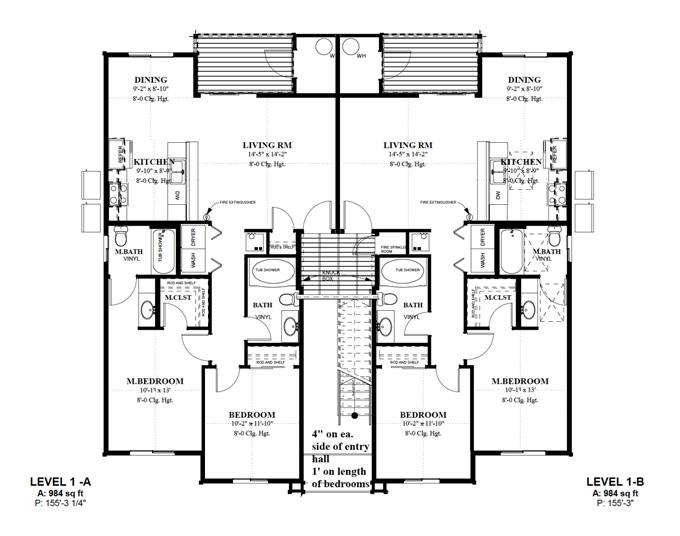

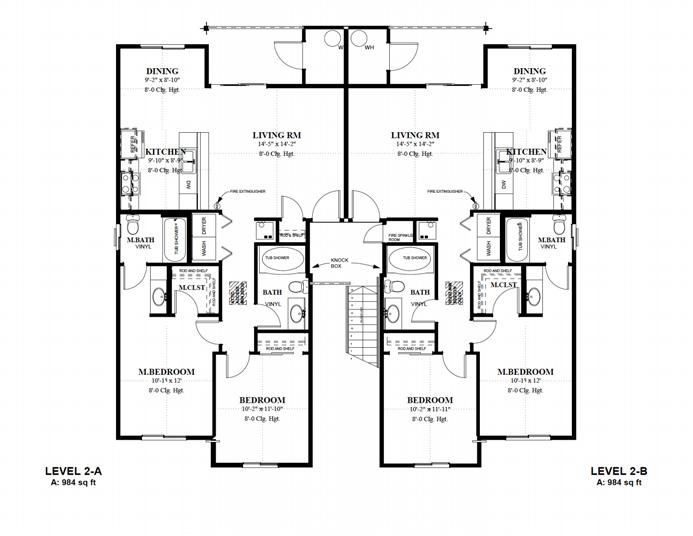

Floor Plans 1BR/1BA (722 sq feet) 14% 2BR/2BA (972 sq feet) 47% 2BR/2BA (1,104 sq feet) 17% 2BR/2.5BA (1,037 sq feet) 5% 3BR/2BA (1,171 sq feet) 17%

Financial Analysis Debt Financing Pro Forma Projections Rent Comps Sale Comps Sensitivity Analysis

Debt Financing DEBT FINANCING PRINCIPAL BALANCE $20,520,000.00 LOAN TO VALUE 72% INTEREST RATE 3.20% MONTHS OF INTEREST ONLY PAYMENTS 60 TERM (YEARS) 10 FIXED OR ADJUSTABLE FIXED AMORTIZING PERIOD (YEARS) 30 PREPAYMENT PENALTY DEFEASANCE

Pro Forma Projections YEAR 1 YEAR 2 YEAR 3 YEAR 4 YEAR 5 YEAR 6 YEAR 7 INCOME GROSS POTENTIAL RENT $2,393,400 $2,477,169 $2,570,063 $2,698,566 $2,820,001 $2,946,902 $3,079,512 OTHER INCOME $140,507 $145,425 $150,878 $158,422 $165,551 $173,001 $180,786 LOSS TO LEASE/BAD DEBT ($131,637) ($49,543) ($38,551) ($40,478) ($42,300) ($44,204) ($46,193) VACANCY LOSS ($119,670) ($123,858) ($128,503) ($134,928) ($141,000) ($147,345) ($153,976) EFFECTIVE GROSS INCOME $2,282,600 $2,449,193 $2,553,887 $2,681,582 $2,802,252 $2,928,354 $3,060,129 OPERATING EXPENSES PAYROLL $198,768 $201,750 $204,776 $207,847 $210,965 $214,130 $217,342 CONTRACT SERVICES $18,132 $18,404 $18,680 $18,961 $19,245 $ 19,533 $19,826 REPAIRS & MAINTENANCE $14,855 $15,077 $15,304 $15,534 $15,767 $17,619 $17,883 TURNOVER $25,025 $25,400 $25,781 $26,168 $26,561 $26,959 $27,363 UTILITIES $100,570 $102,079 $103,610 $105,164 $106,741 $108,342 $109,968 ADMINISTRATIVE $12,920 $13,114 $13,311 $13,510 $13,713 $13,919 $14,127 INSURANCE $22,360 $22,695 $23,036 $23,381 $23,732 $24,088 $24,449 MANAGEMENT FEE $74,185 $79,599 $83,001 $87,151 $91,073 $95,171 $99,454 REAL ESTATE TAXES $335,000 $343,000 $348,145 $353,367 $358,668 $364,048 $369,508 REPLACEMENT RESERVES $43,000 $43,000 $43,000 $43,000 $43,000 $43,000 $43,000 MARKETING $15,618 $15,852 $16,090 $16,331 $16,576 $16,825 $17,077 TOTAL OPERATING EXPENSES $860,433 $879,970 $894,734 $910,414 $926,041 $943,634 $959,997 % OF EGI 38% 36% 35% 34% 33% 32% 31% NET OPERATING INCOME $1,422,167 $1,569,223 $1,659,153 $1,771,168 $1,876,211 $1,984,720 $2,100,132

Rent Comps BUILDING NAME UNITS YR BLT/REN AVG SF AVG RENT/SF AVG RENT/UNIT 1 BEDROOM 2 BEDROOM 3 BEDROOM THE FARMSTEAD 260 2020 1,001 1.29 1,288 1,123 1,316 1,470 THE FRANKLIN 256 2016 1,120 1.30 1,273 1,088 1,301 1,417 HIGH POINT 190 2016 1,000 1,18 1,080 972 1,270 1,455 ORCHARD LOFTS 75 2019 820 1.32 1,080 950 1,145 RIDGECREST COMMONS 172 2017/2019 982 1.09 1,067 830 1,074 1,230

Sales Comps SALE DATE PROPERTY NAME SUBMARKET # OF UNITS YEAR BUILT SALE PRICE PRICE PER SF Oct 18 Verraso Village Meridian 96 2018 $21,500,000 $182.96 Dec - 18 Cimmarron West Boise 80 2018 $12,800,000 $172.41 Aug 20 Ridgecrest Commons East Nampa 172 2017/2019 $28,500,000 $168.70 *Idaho is a non disclosure state

Sensitivity Analysis OCCUPANCY GROSS INCOME TOTAL EXPENSES* 95% $2,414,237 $1,520,711 85% $2,174,897 $1,512,932 75% $1,935,557 $1,505,154 65% $1,696,217 $1,497,375 60% $1,576,547 $1,493,486 56% $1,504,745 $1,491,152 CAP RATE IRR 4.75% 18.51% 5.13% 16.66% 5.50% 15.03% 5.88% 13.32% 6.25% 11.66% *Total expenses include debt services.

Market Overview

Nampa, Idaho Boise, Idaho

Growing Logistics and Manufacturing Hub

This property is located just off I-84’s Garrity exit, a booming logistics, manufacturing, and retail hub that services the Central Treasure Valley. Home to the nearly completed Project Bronco, this new Amazon development will bring nearly 1,500 jobs to the immediate area upon completion in late summer 2020. Additionally, the surrounding 1-mile radius boasts the Idaho Center, a premier entertainment venue, and one of the largest, most modern medical centers in the Treasure Valley

Idaho

Nampa,

• Located 15 miles west of Boise, Nampa is a principal city of the Boise-Nampa Metro area and is centrally and ideally located to reach all western U.S markets.

• Nampa is known for its successful food processing, manufacturing, and blossoming logistics sectors and continues to attract a wide variety of retail and office space. Employment opportunities abound, and the low cost of living, 89.8% of the national average, and low cost of business, 30% lower than California and Washington, continue to attract companies such as Mission Aviation Fellowship, Amazon, Autovol, and Matern North America.

• Ridgecrest Commons, ideally located right on the eastern edge of Nampa, is uniquely positioned to benefit from all the previously mentioned economic growth. With a low-density design style and first-class unit finishes, Ridgecrest will continue to attract a wide variety of high-quality tenants who value the lower cost of living and accessibility of the Property to all the Treasure Valley has to offer.

Nampa, Idaho

102,030 2019 Population 24% 2010 -2019 Population Change 50,000+ New Residents through 2040

Burgeoning Boise Market Contributes to Nampa Growth

Boise’s economic growth continues to directly affect the population boom across the Treasure Valley. The recent lane additions on I-84 to the Garrity Interchange is a vital transportation link that facilitates easy access to major employment centers across the valley, with residents at Ridgecrest Commons only a 20 minute drive from either Downtown Boise or the Boise Airport.

Boise, Idaho

6.5% Income Growth in Boise (2018) 100,000 Jobs added over past decade, net growth of 30%

Portfolio

Stratus

Homes

Springs

Apartment

Lincoln

Apartments The Vue at Chapel Hill The Estates of Las Colinas Northern Cross

PROPERTY DETAILS CLASS C CONSTRUCTED 1975 LOCATION Colorado Springs, CO UNITS 216 PURCHASE PRICE 29.6M Stratus Apartment Homes

Lincoln Springs Apartments PROPERTY DETAILS CLASS C CONSTRUCTED 1974 LOCATION Colorado Springs, CO UNITS 180 PURCHASE PRICE 19.5M

The Vue at Chapel Hills PROPERTY DETAILS CLASS C CONSTRUCTED 1967 LOCATION Colorado Springs, CO UNITS 64 PURCHASE PRICE 7.55M

Marabella at Las Colinas PROPERTY DETAILS CLASS B CONSTRUCTED 1989 LOCATION Las Colinas UNITS 415 PURCHASE PRICE 61.75M

Northern Cross Apartments PROPERTY DETAILS CLASS B+/ACONSTRUCTED 2001 LOCATION Fort Worth UNITS 398 PURCHASE PRICE 48.6M

Index

Management

Team

Property

Our

TABLEROCK RESIDENTIAL

Property Management

TableRock Residential is a full-service property management company. Built on a foundation of more than 35 years of industry experience, the organization has deep roots in Boise and the Treasure Valley area.

Principals Tami Greene and Rich Fernandez previously worked for some of the most well-known and respected companies in real estate, including Legacy Partners, AvalonBay, HSC Real Estate, Riverstone, and Greystar. The two honed their skills in large, competitive markets such as Denver, Seattle, and Nashville, gaining experience at every level, from onsite leasing representative and assistant manager, to management, regional leadership, and executive roles.

LOCAL MARKET EXPERIENCE MATTERS

In real estate, maybe more than any other industry, local market experience matters. Since 2004, the combined background of our executive team includes direct oversight of over 5,000 units in the Treasure Valley. In addition, when considering all services provided, including due diligence, analysis, consulting, and management, we have worked on more than 11,750 units throughout Idaho.

Leveraging our deep understanding of the area and an extensive local network of brokers, on-site employees, and vendors, TableRock provides the highest level of service to clients, residents, and associates. Boise is a unique market, and our knowledge of, and connection to, the city and the region is unmatched.

Our Team

Life Bridge Capital is a multifamily investment firm with over $60,000,000 of assets under management. Life Bridge is focused on acquiring properties in Rocky Mountain metropolitan statistical areas (MSA’s) which demonstrate consistent rent growth, low vacancy and a growing Real GDP. The firm repositions properties through operational efficiencies, moderate-to-extensive renovations and complete rebranding.

SAM RUST:

A lifelong learner, Sam Rust is a managing partner at Life Bridge Capital and full-time investor in commercial real estate. Sam graduated from Thomas Edison State University with a BSBA in Business Management and currently lives in Colorado with his wife and 4 daughters. He has been active in commercial real estate since 2017 and has led the acquisition of a portfolio of properties in Colorado with value in excess of $60 million, and currently directs Life Bridge Capital's acquisition efforts throughout the Rocky Mountain region.

WHITNEY SEWELL:

Founder of Life Bridge Capital LLC, Whitney began his real estate investing career in 2009. Whitney’s passion is working with investors, helping them secure financial security via the exceptional opportunities that multifamily syndication offers. Whitney hosts The Real Estate Syndication Show, a daily podcast where he has now interviewed over 550 experts providing cutting edge tools and strategies of the syndication business. Whitney and his wife Chelsea are on a mission to help other families through the process of adoption. They have personally endured the financial burdens that the process puts on families and have committed 50% of their profits to this goal. Whitney and Chelsea have three children by adoption.

JIM COX:

Jim Cox is the president and founder of JC Constructors, Inc. and has been active in the construction industry since the 1980s as a professional structural engineer. Over the last 10 years, JC Constructors has completed projects for both public and private clients that total over $400MM. Jim has over a decade of experience investing in real estate and is a lead partner on a variety of multifamily and self storage projects totaling over 500 doors. His portfolio is concentrated primarily in the Boise and Colorado Springs MSA's.

A Leading Multifamily Investment Firm sam@lifebridgecapital.com 720-230-6804 whitney@lifebridgecapital.com 540-585-4338 SAM RUST: WHITNEY SEWELL: