Welcome to the September issue of ‘OGV Energy Magazine’ where this month we are exploring the theme of ‘Digitalisation’ and we are very excited as it is our largest issue of the year for the energy sector’s biggest UK energy event at Offshore Europe in Aberdeen!

A big thank you to our front cover partner GDI - An Oceaneering company and you can read all about how they are helping their clients to ‘Find the signal in the noise’ on pages 4-5.

In this bumper 60 page issue, we are also delighted to welcome contributions from Cegal, J&S Subsea, Three60 Energy, Tess, Elementz, Envizion, Petrasco Energy Logistics, PD & MS, Rosen, Mysep, Exceed Energy, GQS, Kranji, STATS Group, Intervention Rentals, OPITO, Brodies and ATPI

The rest of this month’s magazine as always provides you with a review of the Energy sector in the North Sea, Europe, Norway, Middle East, US and Australia, along with industry analysis and project updates.

Thanks as always to our corporate partners the Energy Industries Council, Leyton, Infinity-Partnerships, Elemental Energies and Archerthe Well company, Three60 Energy, Brimmond, Drager, Rotech Subsea, Stats-Group, Cegal, GDi, PTS Services, ESWL, Tess, Intervention Rentals, Vulcan Completion Products, Viper Innovations, J&S Subsea, Wellpro and Scotsbridge. Warm regards, Dan Hyland

In asset integrity management, the problem is rarely a lack of information. Across the global energy sector, vast amounts of data are being collected every day - inspection readings, anomaly records, corrosion rates, condition monitoring results, and operational history. In theory, this should make decision-making faster and more precise. In practice, it often has the opposite effect.

The challenge for many operators is finding the signal in the noise - identifying which of the thousands of data points actually require action, which can safely be deferred, and which indicate developing risk that must be addressed before it impacts safety, production, or compliance.

This challenge is being amplified by the changing operational landscape:

• Ageing infrastructure demanding more frequent and targeted interventions

• Budgetary pressure limiting headcount and offshore access

• Increasing regulatory demands for traceability and documented justification

• Operational complexity across multi-asset portfolios and extended supply chains

At the same time, the expectation on integrity teams is not simply to maintain the status quo but to actively extend asset life, minimise unplanned outages, and deliver this with greater efficiency than ever before.

This is where many traditional integrity approaches show their limitations. Scaling resource to meet rising demand can only go so far before cost, complexity, and diminishing returns set in. What is needed is not more effort, but more focus - transformative tools and processes that allow existing teams to work at maximum efficiency, cutting through the noise to act where it matters most.

GDi, an Oceaneering Company is committed to providing exactly that. As a technologydriven company grounded in engineering expertise, our focus is on building systems that streamline integrity workflows from planning to closeout, enabling operators to do more with less - not by adding people, but by removing the friction that slows them down.

GDi’s Vision platform is built to restore flow across the integrity cycle. By integrating planning, execution, anomaly management, and reporting into a single environment, Vision enables operators to cut through the noise and focus effort exactly where it matters.

Our approach is defined by six capabilities that work together to deliver faster, better decisions with less wasted resource.

GDi’s SRA module applies proven statistical methods to your asset data - including historical inspection records, design parameters, and corrosion rates - to calculate time to failure for individual components.

Using mathematical techniques, SRA converts a qualitative likelihood estimate into a quantified probability of failure (PoF). This shifts planning from recurrence-based intervals to genuinely risk-driven inspection strategies.

Integrated within Vision, SRA creates inspection programmes that are statistically defensible, operationally efficient, and aligned with recognised methodologies such as API 581.

Why it matters:

• True risk-based planning using quantifiable models

• Reduced inspection scope without loss of coverage

• Justifiable deferrals with full audit traceability

• Greater confidence in asset life predictions and budgeting

2. Automated Workpack Generation: Targeted, Data-Led, and Offshore-Ready

Powered by the Oceaneering’s Inform PredictTM algorithm, GDi’s workpack engine analyses historical inspection data to determine the optimal distribution of inspection at a test-point level.

Inform PredictTM pinpoints the highest-priority locations based on degradation history, design context, and operational conditions. Each test point is plotted on the 3D asset model and linked to its plot plan location, so offshore teams can navigate directly to the inspection site and complete tasks in the most efficient sequence.

The result is an execution-ready workpack that combines engineering precision with offshore practicality.

Why it matters:

• Focuses inspection on highest-risk, highest-value locations

• Removes unnecessary low-priority inspection

• Provides visual and plot plan references for easy access

• Improves offshore efficiency and reduces downtime

• Delivers the most efficient inspection programme possible

3. Remote Visual Inspection (RVI): Insight Without Offshore Burden

RVI is fully integrated into the Vision workflow - not treated as a workaround, but as a recognised, auditable inspection method.

RVI scans are planned, executed, reviewed, and closed out entirely within Vision by our team of competent senior inspectors. Findings are traceable, supported by photographic evidence, and linked to follow-up work where required. This allows operators to progress inspection scope without waiting for shutdowns or mobilising full offshore teams.

Why it matters:

• Progresses inspection without bed space or shutdown dependency

• Maintains technical assurance and compliance

• Reduces MAH exposure and offshore logistics cost

• Shortens inspection-to-decision timelines

Where RVI can’t finish the job, offshore inspection success depends on more than defining scope - it requires execution logic that works in the field.

Using the asset’s 3D model, Vision enables planners to group work by zone, access type, and permit boundary, bundling tasks to minimise unnecessary movement and duplicated access. Campaigns can be modelled and adjusted before mobilisation to eliminate clashes and optimise sequencing.

Why it matters:

• Reduced offshore time and cost

• Fewer access and permit conflicts

• Improved integration between inspection, maintenance, and scaffolding

• More predictable campaign delivery

Registration within Vision ensures every component, from major equipment down to test point, is uniquely identified, fully traceable, and linked to its complete condition and inspection history. This guarantees that no item is “off the radar” and that all records are tied to the correct location, function, and operational context.

Records are structured, searchable, and visually attached to their related equipment within the 3D model. This eliminates the inefficiency of chasing files across different systems or static documents and provides decision-makers, auditors, and operational teams with instant access to current, validated information.

Why it matters:

• Reduces wasted time locating and validating data

• Improves internal governance and oversight

• Ensures complete and accurate component registration

• Speeds up audit and compliance reporting

Anomalies can overwhelm even the most capable integrity teams. Without effective triage, urgent issues risk being buried among routine or low-impact findings.

GDi’s anomaly management process is designed to separate the signal from the noise.

Anomalies are classified at the point of capture using consequence-led logic, defect type, and degradation rate. This enables automated prioritisation - routing high-consequence findings for immediate review and grouping low-risk items for bundling or deferral.

Reviewers work with full context - historical data, design details, images, and comparable cases - ensuring decisions are both consistent and auditable.

Why it matters:

• Ensures the highest-risk issues are addressed first

• Reduces backlog by streamlining lowpriority reviews

• Improves consistency across reviewers and assets

• Maintains a complete, traceable record from detection to closeout

Vision consolidates all integrity datainspection history, anomalies, workpacks, reviews, registration records, and supporting evidence - into a single, unified environment.

• Supports continuous improvement across inspection cycles

The energy industry is continually under pressure to deliver more output with fewer resources, while maintaining safety, compliance, and profitability. In this environment, the organisations that will succeed are those that can extract maximum value from the data they already hold - and transform it into timely, confident, and defensible decisions.

GDi’s role is to make this transformation achievable.

We don’t simply digitise existing processes; we design and deliver systems that connect them - removing wasted effort, automating where it adds value, and keeping the focus firmly on risk and outcome. By doing this, we help operators reduce inspection backlog without compromising integrity, shorten campaign durations to improve offshore efficiency, and consistently prioritise the highest-risk issues for action. Additionally, we ensure the maintenance of clear, auditable records that are readily available for regulatory scrutiny.

The key is clarity. Clarity about where to act, clarity in how decisions are made, and clarity in demonstrating that those decisions are the right ones.

Effective integrity management relies on clarity rather than data volume. It enables teams to focus on the work that protects safety, preserves asset value, and meets operational targets.

The goal is to deliver clear insights that enable operators to move beyond managing noise and consistently focus on the critical signal. This is where effective digital transformation brings efficiency, safety, and performance into alignment.

integrated bypass maintains production during isolation

Dual Leak-Tight Seals

Double Block & Bleed Isolation

Isolated Pipeline

Monitored Zero-Energy Zone

The BISEP® has an ex tensive track record and provides pioneering double block and bleed isolation while

dual seals provide tested, proven and fully monitored leak-tight isolation, ever y time, any pressure.

Editorial

+44

Advertising

+44 (0) 1224 084

Design

Jennifer McAdam Cali Gallow

Editorial Tsvetana Paraskova

QHSE ABERDEEN Launches Specialist

ISO 27001 Training Service to Bolster UK Information Security

In response to the growing demand for robust information security frameworks, QHSE ABERDEEN today announced the launch of a new, dedicated ISO/IEC 27001 consultancy and training service. This new offering is designed to help UK organisations implement and maintain world-class information security management systems (ISMS) to protect against evolving cyber threats and meet critical compliance standards. With data breaches and compliance failures becoming more prevalent, ISO/IEC 27001:2022 has emerged as the international gold standard for managing information security risks. The new service positions QHSE ABERDEEN at the forefront of assisting UK businesses in achieving and retaining this essential certification.

JMSL Strengthens Leadership and Expands Team to Drive Strategic Growth

JMSL has entered a new phase of strategic growth, building on the recent key appointments to its Advisory Board. These appointments bring additional industry expertise and insight to guide the company’s long-term direction and ensure it remains at the forefront of the energy sector.

Alongside this strengthened leadership, JMSL has established a new entity in the Middle East to expand its presence in key international markets. While pursuing opportunities abroad, the company remains firmly committed to its traditional roots in the UK energy sector, which it has successfully supported since its formation in 2003. JMSL continues to deliver high-quality manpower, project services, and fabrication expertise to its valued clients.

Integrity HSE has bolstered its renewable energy offering with the appointment of Tim Worth as a QHSE Advisor. Tim arrives from Sulmara, bringing with him a depth of experience in subsea operations, with particular emphasis on offshore wind projects.

His arrival aligns with a period of growing recognition for Integrity HSE, which has been shortlisted in the ‘Best Practice’ category at the Scottish Green Energy Supply Chain Awards 2025, a testament to their continued work in the lowcarbon sector.

Tim’s early professional background includes a distinguished spell in the Royal Navy, reflecting Integrity HSE’s active support of the Armed Forces Covenant. After leaving military service, he transitioned to offshore oil and gas, progressing to the role of Senior Wireline Supervisor at Expro. He subsequently held key QHSE-related positions at Helix Energy Solutions Group and SERIMAX, and more recently provided HSE support to Shell, focussing on drilling and well interventio.

ATPI, the travel partner of choice to the global oil and gas and energy market, has retained its position as an industry leader through updated contracts with two of the largest offshore drilling contractors within the Americas.

Securing both contracts in quick succession, each deal is worth an 8-figure sum per annum and follows established relationships that have been in place for over 10 years. The updated terms for each contract will continue for the next five years.

Following the recent announcement of an 11% sales increase between 2023 and 2024, the confirmation of these two contracts has placed ATPI in a favorable position heading into the end of the US fiscal year.

Well Academy recently supported a group of oil and gas professionals on the latest leg of their well control training journey – culminating in the successful completion of the IWCF Well Control in Design and Lifecycle Management course.

The delegates from Sasol began their training pathway in 2017 completing IWCF Drilling Well Control Level 2 and IWCF Well Intervention Pressure Control 2 courses. Well Academy delivered the courses, which provide a solid grounding in essential well control principles, in Johannesburg, South Africa and Temane, Mozambique respectively.

As their development progressed, the individuals advanced to IWCF Drilling Well Control Levels 3 & 4 and IWCF Well Intervention Pressure Control Levels 3 & 4. These courses were delivered both virtually and at Well Academy’s Apeldoorn training centre in the Netherlands

Perth’s new Pulse Technology Hub has officially opened, offering a fresh approach to technology, collaboration, and industry growth. Founded by Obi Gjerde, Aston Ladzinski, Ian Grant, and Thrym Kristofferson in late 2024, the Hub was born from frustration with a lack of innovation in local companies.

Located in the city’s heart, Pulse combines a showcase gallery with a workshop to support new entrants and international firms entering the Australian market. At its grand opening, attended by senior industry leaders, the Hub was praised as a much-needed space for safe innovation, project support, and technology-driven transformation.

COMET improves performance by combining expertise, data-driven software, and technology solutions to reveal and resolve past, present and future business risks. By enabling you to see the unseen, we take you on a journey from complexity to clarity, from confusion to resolution. This is applied risk intelligence.

www.cometanalysis.com

www.deltafabs.co.uk Our highly skilled technical team supported by industry-leading plant and equipment allows us to deliver premium quality projects on time and safely. It is our dedication to quality and prompt service that gives you satisfaction in knowing that you are receiving the best possible solution at a very competitive price.

www.cangroup.net

With over 76 years’ experience, and two divisions covering a wide range of engineering capabilities, the AJT Group is one of Scotland’s premier multidisciplined engineering organisations.

www.ajt-engineering.co.uk

www.xcd.com

RenQuip are UK Distributors for leading brands such as Festec Tools, Norbar, Atlas Copco, TesnionPro, Climax H&S Tool, JEI Drilling Solutions, Cengar, Chicago Pneumatic & Universal Air Tools and offer customer owned equipment maintenance, repair & calibration through to complete equipment tracking and asset management services and product familiarization training.

www.renquip.com/

deliver the world’s most

connected ecosystem of software to ensure industrial assets are managed proactively at every stage of their lifecycles. Our disruptive technologies make a demonstrable, positive impact on business, on people and on the planet.

www.mods.solutions

Engage PR work with UK companies to produce a market-orientated strategy to improve brand awareness, celebrate achievements, strengthen market position and enhance company reputation. Our services include public relations, marketing, digital communications and publications (print and online).

www.engagepr.co.uk

For over 120 years, MRS Training & Rescue (formerly known as Mines Rescue Service), has developed specialist skills, experience and knowledge gained from working in difficult and potentially dangerous environments, to effect the rescue and escape of mine workers from underground.

www.mrsl.co.uk

By Tsvetana Paraskova

The importance of the UK’s oil and gas resources, the state of decommissioning of the energy infrastructure offshore Britain, and new projects and contracts have featured in the UK North Sea oil and gas sector in recent weeks.

Offshore Energies UK (OEUK) responded to NESO’s Future Energy Scenarios report, which set out four possible pathways for the UK’s energy transition.

Energy efficiency, demand flexibility, infrastructure and energy supply, and switching to low-carbon technologies will be the critical enablers for success in the energy transition, the report said, noting that “Success along the route to 2050 depends on the choices made today.”

OEUK Market Intelligence Manager Ben Ward commented,

“This report makes one thing clear: the UK’s journey to net zero is becoming increasingly challenging, there is a need for an acceleration of the deployment of low-carbon energy sources in partnership with meaningful engagement with the public to shape the way we consume energy in the future.”

The North Sea’s natural gas and emerging carbon capture industry remain essential to powering the country and cutting emissions, according to OEUK.

“Hitting our climate goals is getting harder each year. The UK already has the expertise, experience and world-class supply chains present in existing industries to deliver on the energy transition,” Ward said.

“To achieve our climate goals we need to continue to support our homegrown energy sectors.”

Oil and gas will remain part of the UK’s energy mix “for a long time,” the UK’s Prime Minister Keir Starmer said during a meeting with US President Donald Trump in Scotland at the end of July.

This reinforces the messaging from Offshore Energies UK, the trade body representing a sector that is vital to the UK economy, OEUK said.

“We believe in a mix, and obviously oil and gas will be with us for a very long time, and that’ll be part of the mix, but also wind, solar, increasingly nuclear…” Sir Keir Starmer said.

“As we go forward, the most important thing for the United Kingdom is that we have control of our energy and we have energy independence and security,” the Prime Minister added.

David Whitehouse, Chief Executive of Offshore Energies UK, commented on the PM’s statements,

“It is good to hear this clear recognition from the Prime Minister that the UK will need a diverse energy mix and that oil and gas remain essential to the UK’s energy future. We’ve long said that this is not a choice between renewables or oil and gas – we need both.”

Whitehouse added, “If we are going to use oil and gas, let’s produce it here – responsibly, with lower emissions, and with all the benefits to jobs, taxes and growth that come from homegrown supply.”

The North Sea Transition Authority (NSTA) published its UKCS Decommissioning Cost

and Performance Update 2025 report, which found that the North Sea oil and gas industry is forecast to spend £27 billion on decommissioning between 2023 and 2032.

Decommissioning is a key activity for the UK’s upstream oil and gas sector, with operators spending a record £2.4 billion in this area in 2024. This is clear evidence that operators are dedicating significant resources to cleaning up their legacy.

The sector is in a pivotal 10-year period, with operators estimating they will commit £27 billion to decommissioning between 2023 and 2032 – more than half the total forecast (2025 onwards) cost of fully decommissioning the remaining UKCS scope, which now stands at £44 billion in 2024 constant prices.

This is a £3 billion increase in the estimate through 2032 from last year’s report, showing that all decommissioning activities have become more expensive. The increase is due to multiple factors, including decommissioning work being brought forward, inflation, higher day rates for rigs, and activities exceeding planners’ initial cost estimates.

While several companies are performing admirably and are in the top quartile for efficiency, many are struggling to keep costs under control, NSTA’s report found.

The activity with the greatest potential for cost savings is well plugging and abandonment (P&A), which is set to account for about half of total decommissioning expenditure. It is also the area causing the greatest concern, as too many companies are delaying well P&A work, NSTA said.

A backlog of more than 500 wells which missed their original decommissioning deadline has built up, while more than 1,000 wells will be due for P&A between 2026 and 2030.

“The supply chain should be able to count on well P&A as a reliable revenue stream which keeps them anchored in the basin until more service companies can transfer their skills to energy transition projects, such as carbon storage, which are now starting to materialise and create opportunities,” NSTA said.

Together with the decommissioning cost update, NSTA warned that operators must immediately start tackling their backlog of wells that are already due for decommissioning to stop rigs leaving the North Sea and prevent billions of pounds of additional costs for themselves and taxpayers.

“Operators face higher costs if they continue to keep the supply chain waiting for work, causing further reductions in rig availability as the rig -owners seek opportunities overseas,” the industry regulator said.

“They also risk fines as last year the NSTA opened its first investigations into missed deadlines – and more could follow.”

Pauline Innes, NSTA Director of Supply Chain and Decommissioning, said,

“The stark reality is that operators are running out of time to get to grips with the backlog as more contractors consider taking their rigs abroad, which damages the supply chain’s ability to meet demand and remain cost competitive. We need operators to rise to the challenge and use the supply chain before they lose it.”

group has been renamed NEO NEXT and becomes one of the largest producers on the UK Continental Shelf. The joint venture is owned by Repsol E&P Group with 45 percent and NEO UK with 55 percent, with a projected 2025 production of approximately 130,000 barrels of oil equivalent per day (boe/d).

“Our strategy can be summarised as “Resilience, Yield and Growth”: the combined company has much more scale and diversity and opportunities for cost consolidation and portfolio high-grading giving resilience despite the tough conditions in the UK,” said John Knight, Executive Chair of NEO NEXT.

The stark reality is that operators are running out of time to get to grips with the backlog as more contractors consider taking their rigs abroad, which damages the supply chain’s ability to meet demand and remain cost competitive

Separately, NSTA fined Chrysaor £150,000 for vent breaches at the Armada hub in the Central North Sea in 2022.

Chrysaor, which was acquired by Harbour Energy in 2021, blamed the breach on high winds preventing it from relighting the flare on the Armada platform which is 132 nautical miles East of Aberdeen.

In total, Chrysaor vented 370.046 tonnes at Armada from 1 January 2022 to 31 December 2022, exceeding its consent by 145.566 tonnes, or almost 65 percent.

“Reducing the emission of harmful greenhouse gases is vital, and the NSTA will continue to support industry in its efforts to reach net zero by 2050,” said Jane de Lozey, NSTA Director of Regulation.

“In the few cases where companies fail to comply with requirements, the NSTA will not hesitate in applying tough sanctions.”

NSTA will enhance transparency of company specific information in new policy following a consultation launched in 2024. The policy will see companies named when an investigation is opened into a suspected breach, such as exceeding production or flaring and venting consents or failure to decommission.

Previously companies were only named once a sanction was given. A decision has been made to publish names earlier as it was decided it was in both public and sector interest, NSTA said.

In company news, Repsol UK has completed the strategic merger with NEO Energy. The combined

“This company will also be very well positioned to choose both organic and inorganic growth. We will certainly look to be making more value accretive acquisitions.”

Serica Energy said in early August it continues to make progress on advancing future production opportunities. Subsea tie-in work on Serica’s 100-percent operated Belinda field is progressing well, and this new field will come onstream at the start of 2026.

Well-Safe Solutions has been awarded a multi-year contract by EnQuest. The firm scope, expected to generate revenue in excess of $45 million, will be executed using the Well-Safe Defender and consists of a minimum of 100 days of activity in 2026 and a minimum of 130 days in 2027.

The contract also includes options for further activity between 2028 and 2034, creating a multiyear strategic partnership and securing vital supply chain resources in the North Sea well into the next decade, Well-Safe Solutions said.

Shelf Drilling’s North Sea subsidiary has secured a new contract for its premium jack-up rig, Shelf Drilling Fortress, for operations in the UK Continental Shelf. The contract is for one firm well with an estimated duration of three months, and a total value of approximately $12 million. Operations are expected to commence in late August or early September 2025. The rig most recently concluded a contract in the UK in May 2025.

By Tsvetana Paraskova

The

official opening of Norway’s new Arctic oilfield, oil and gas discoveries and development plans, and the UK’s offshore wind allocation round featured in Europe’s energy sector in the past few weeks

The Johan Castberg field, Norway’s northernmost oilfield, was officially opened in early August by Norway’s Minister of Energy, Terje Aasland.

The field, which started up earlier this year, already produces 220,000 barrels of oil per day. Production is expected to continue for at least 30 years, field operator Equinor said.

The new field “creates great value and ripple effects and is important for Norway’s role as a reliable, long-term energy supplier,” the company added.

“This is a milestone for the petroleum industry in the Barents Sea. With Castberg on stream, the Barents Sea now has both our second largest producing oil field, our second largest gas field and the largest discovery being considered for development,” Aasland said in his speech to the FPSO crew right after the opening.

Kjetil Hove, Equinor’s executive vice president for Exploration & Production Norway, said, “We are well underway and have already made new discoveries in the area.”

Less than three months after coming on stream the Johan Castberg field was producing at peak capacity of 220,000 barrels of oil per day. Every three or four days, cargoes depart from Johan Castberg.

Vår Energi and its partners have made a gas and condensate discovery in the Vidsyn prospect in the Norwegian Sea. Preliminary estimates indicate that the size of the discovery is 25-40 million barrels of oil equivalent.

The licensees will now assess the discovery together with prospects in the area for a potential development tied back to existing infrastructure, the Norwegian Offshore Directorate said.

The Vidsyn discovery is Vår Energi’s third commercial exploration success so far this year.

The recent Goliat Ridge discoveries are being matured as a fast-track subsea development with flexibility to include potential future discoveries, and two appraisal wells are planned in the Goliat Ridge later this year, Goliat North and Zagato North, Vår Energi said.

The company is progressing around 30 early-phase projects accounting for net 2C contingent resources of around 600 mmboe and expects to sanction over 10 projects during 2025. Four projects have been sanctioned year to date, including Balder Phase VI, a fast-track development operated by Vår Energi that will contribute with high value production through the Jotun FPSO already in late 2026. Fram Sør, a subsea tieback development to Troll C, took a final investment decision in the second quarter, developing 116 mmboe gross resources, Vår Energi said.

TechnipFMC has been awarded a significant integrated Engineering, Procurement, Construction, and Installation contract by Equinor for its Heidrun extension project in the Norwegian North Sea.

For TechnipFMC, a “significant” contract is between $75 million and $250 million.

Energy data and intelligence provider TGS, in collaboration with Axxis Multi-client AS and Viridien, have announced the successful completion of the final imaging of OMEGA Merge, to deliver a single, seamless, and unified high-quality dataset across the Heimdal Terrace, Utsira, and Sleipner Ocean Bottom Node (OBN) multi-client surveys.

Spanning a total area of 3,700 square kilometres from the deployment of over 250,000 nodes and 9.5 million shots, OMEGA Merge is the largest continuous OBN dataset on the Norwegian Continental Shelf, TGS said. Energean and its partner INA – INDUSTRIJA NAFTE d.d. have taken Final Investment Decision (FID) for the development of the Irena gas field offshore Croatia. Energean has a 70 percent working interest in the project. The development plan is for a single platform tie-back to the existing infrastructure at the Izabela field. First gas from the Irena field is expected in the first half of 2027.

“The decision to invest in the development of the Irena gas field is another important step in advancing our strategy of strengthening domestic oil and gas production and ensuring Croatia’s long-term energy security,” Josip Bubnić, Operating Director of Exploration and Production at INA, said.

Offshore Energies UK (OEUK) has proposed key reforms to accelerate offshore wind generation following the government’s publication of its Review of Electricity Market Arrangements (REMA).

The decision to take a national approach to pricing will encourage more wind energy investment to help the government hit its Clean Power 2030 targets and boost growth in the critical offshore energy supply chain, OEUK says.

OEUK’s analysis shows that to meet the goal of 95 percent clean power by 2030, the UK must deliver half of this target from offshore wind. This means at least 43 gigawatts (GW) of offshore wind capacity must be installed by 2030, but current projections fall short at just 35 GW. The next three Contacts for Difference

(CfD) rounds must therefore secure an additional 20 GW—equivalent to powering around 15 million homes, according to OEUK.

OEUK welcomed the government’s reforms to the CfD scheme or Allocation Round 7 for offshore wind.

“This new and pragmatic approach to planning, timelines and budgets is important for making Allocation Round 7 (AR7) a success,” said OEUK’s wind and renewables manager, Thibaut Cheret.

“It will enable fixed-bottom offshore wind projects without finalised planning permission to enter this year’s AR7 Contracts for Difference auction. OEUK is pleased the UK government has also followed our recommendations to expand Contracts for Difference (CfD) from 15 to 20 years to unlock investment and reduce cost to consumers.”

To get to the Clean Power 2030 goals, OEUK believes it’s critical the AR7 raises 8.4 GW of offshore wind capacity, which depends on working in partnership with industry.

The UK Government has shortlisted six projects to start negotiations to join the HyNet carbon capture cluster in the North West. These are Connah’s Quay Low Carbon Power, Essar Energy Transition Industrial Carbon Capture (EET ICC), Hydrogen Production Plant 2 (HPP2), Ince Bioenergy with Carbon Capture and Storage (InBECCS), Parc Adfer Energy from Waste Industrial Carbon Capture Project, and Silver Birch.

OEUK head of energy policy Enrique Cornejo, commented, “If we are to hit the UK’s net zero targets and keep our industries thriving, CCUS projects like this must move from plans to delivery much faster.”

Energy technology and oilfield services group SLB has been awarded a technologies and services contract for carbon storage site development in the North Sea by the Northern Endurance Partnership (NEP), an incorporated joint venture between bp, Equinor, and TotalEnergies.

NEP is developing onshore and offshore infrastructure needed to transport CO2 from carbon capture projects across Teesside and the Humber — collectively known as the East

Coast Cluster — to secure storage under the North Sea.

The project scope for SLB includes drilling, measurement, cementing, fluids, completions, wireline, and pumping services.

Another major energy services provider, Halliburton, has also been awarded a contract by the Northern Endurance Partnership (NEP)—to provide completions and downhole monitoring services for the carbon capture and storage (CCS) system.

Halliburton will manufacture and deliver the majority of the equipment required for this project from its UK completion manufacturing facility in Arbroath.

Statkraft, Europe’s largest generator of renewable energy, is to take forward plans for its Shetland Hydrogen Project 2, after agreeing a lease on a site owned by Shetland Islands Council.

in areas including Scotland, Devon, Greater Manchester, and Wales.

The Cydnerth project, which will support the expansion of the Morlais tidal energy scheme, has moved into its construction phase as work has begun on-site at Parc Cybi, Holyhead to strengthen the grid infrastructure for Morlais, a flagship tidal energy project run by local social enterprise, Menter Môn Morlais Ltd.

Backed by the North Wales Growth Deal and funding from both the Welsh and UK Governments, the £16-million Cydnerth project will future-proof Morlais by increasing its grid capacity from 18 MW to an eventual 240 MW.

This is an important and welcome step toward realising the full potential of Ynys Môn’s tidal resources and establishing the area as a hub for sustainable energy

Shetland Islands Council has settled a lease with Statkraft, which plans to build a green hydrogen hub and ammonia production adjacent to the disused Scatsta Airport.

The proposed scheme is an electrolytic hydrogen to green ammonia production facility of up to 400 MW, on land adjacent to the disused Scatsta Airport which is near the existing Sullom Voe Oil Terminal and Shetland Gas Plant.

Pulse Clean Energy has secured a £220 million green finance deal from a consortium of six international banks, marking one of the largest financings in the UK for battery storage infrastructure. This green financing will facilitate the construction of six ready-tobuild battery energy storage system (BESS) sites, including the conversion of existing diesel sites to BESS assets. It will also support the ongoing funding of nine sites already in operation or in late stage construction. These sites are strategically located across the UK

“This is an important and welcome step toward realising the full potential of Ynys Môn’s tidal resources and establishing the area as a hub for sustainable energy,” Andy Billcliff, Chief Executive of Menter Môn Morlais Ltd, commented.

The European Commission has approved an 11-billion-euro French scheme to support offshore wind energy in line with the objectives of the Clean Industrial Deal.

The measure will support the construction and operation of three floating offshore wind farms: one in the sea off the coast of Southern Brittany and two others in the Mediterranean Sea. Each windfarm is expected to have a capacity of around 500 MW, and to generate electricity equivalent to the annual consumption of 450,000 French households.

This measure will contribute to France’s transition towards a net-zero economy and reaching the renewable energy target set at EU level for 2030, the Commission said. The scheme was approved under the Clean Industrial Deal State Aid Framework (CISAF) adopted by the Commission on 25 June 2025.

By Tsvetana Paraskova

The US industry faces contrasting outlooks for oil and natural gas production as oil drilling activity has slowed while the number of active rigs drilling for gas has increased over the past year.

“The primary drivers of drilling activity in North America are commodity prices, corporate cash flows and capital allocation strategies, not government policies. And those factors have not, in general, incentivised management teams to pursue growth this year,” Ed Crooks, Vice Chair Americas at Wood Mackenzie, said in an analysis in August.

“Drill, baby, drill” may work well at political rallies and on social media. It is less of a winning message in boardrooms and in investor meetings.”

Despite US President Donald Trump’s ‘drill, baby, drill’ slogan, the number of active oil and gas drilling rigs has dropped since his inauguration, and since the summer of 2024.

The US Administration strongly supports oil and gas output, infrastructure expansion, and exports.

But companies base their investment and activity on commodity prices, cash flows, and capital expenditure strategies. These have not favoured a boost to US oil rig counts or a surge in production.

Despite reaching record output levels, US crude oil production has seen growth slow in recent months, amid lower oil prices and uncertainties about demand and markets in the second half of the year and early next year.

“Drill,

WoodMac reckons oil prices will be lower next year compared to 2025, while global oil demand is set to level off in the early 2030s. The energy consultancy sees US oil production levelling off before the peak in global oil demand.

In gas, the outlook is completely different. The AI-driven surge in power consumption will support higher gas-fired power generation, while LNG exports will continue to rise. These two key growth drivers will warrant higher gas production in the United States.

baby, drill” may work well at political rallies and on social media. It is less of a winning message in boardrooms and in investor meetings.

While the number of oil rigs sunk, the number of gas drilling rigs rose, suggesting that the current conditions in the US energy industry favour increased gas production but slower growth in US crude oil production.

The number of rigs drilling for oil in the US has dropped over the past year by about 14 percent, but the number of rigs drilling for gas has risen by 20 percent, according to estimates by WoodMac.

The contrast is most evident in key oil and gas producing basins, according to Ryan Duman, a director on Wood Mackenzie’s US Upstream research team.

The number of active rigs in the oil-focused Permian Basin has fallen by 44 this year, while the number in the Haynesville gas-producing shale play has risen by 10.

The trends reflect two contrasting outlooks—a more bearish one for oil and a bullish outlook for US gas production.

Wood Mackenzie expects that North America’s domestic gas demand plus exports will jump by about 33 percent over the next 10 years, from about 1.26 trillion cubic metres (tcm) in 2025 to about 1.67 tcm in 2035.

LNG exports are set to more than double, while data centres for AI and new factories are driving a surge in US electricity demand, with gas-fired plants playing a key role in meeting that increased demand, WoodMac says.

As a result of the bullish outlook on gas, US producers are signing supply agreements to deliver gas to power plants close to the producing centres.

Recent deals “mark a strategic turning point for Appalachian producers,” said Robert Clarke, Wood Mackenzie’s vice president of Upstream research.

These agreements signal the rise of a new asset class for Lower 48 shale gas: driven by data centre demand, adjacent to infrastructure, and supported by long-term contracts, Clarke noted.

Despite rising activity and new demand growth, most gas-focused companies have not moved yet to significantly hike investment.

“Some of the leading listed gas-focused E&Ps are restraining their spending and prioritising financial strength, because they still face pressure from investors to maintain capital discipline, cut borrowings and return cash to shareholders,” according to WoodMac.

The shale basins, especially the high exposure to the Permian Basin, offer strategic advantages to the US supermajors ExxonMobil and Chevron, compared to their European rivals, say WoodMac’s Clarke and Luke Parker, Vice President, Corporate Analysis.

The shale resource is an advantage in a portfolio of a major international firm as it offers scale, the capacity to produce volumes in the longer term, and the flexibility to ramp investment up or down in response to price, WoodMack’s analysts reckon.

The consultancy expects Exxon and Chevron’s domestic shale production to continue growing despite an imminent peak in total US liquids production. Both majors have amassed huge Permian positions, and each has over 10 years’ running room in Tier 1 inventory at sub-US$45 WTI price breakeven cost at current rates of drilling. As the play matures, these leading players are intensifying efforts to reduce capital intensity, including through the use of AI.

Chevron’s Permian production is expected to jump by nearly 25 percent to above 1.2 million boe/d by 2030, when it will contribute around one-third of the company’s total output, according to Wood Mackenzie.

The aim thereafter will be on maintaining production around that level and maximising free cash flow generation.

The Permian basin is even more important to ExxonMobil as it contributes almost a third of 2025 volumes. Exxon’s output in the Permian is forecast to surge by 55 percent to 2.3 million boe/d by the end of this decade. This would be equal to BP’s total production, WoodMac says, expecting Exxon to hold that level through to 2040.

Other majors will not find easily available shale acreage to buy, if they wanted.

“Buying into US tight oil at scale at this mature stage of development seems unlikely,” WoodMac’s analysts noted.

High-quality opportunities aren’t obvious after sector consolidation, while buying into tight oil and its unique ecosystem in the past has often proved a costly mistake for outsiders.

US Gulf Coast gas development is set to shape the future of the US gas market, according to Daniel Myers, Senior Research Analyst, North America Gas, at Wood Mackenzie.

The US Gulf Coast natural gas market faces unprecedented expansion, with demand projected to grow over 28 bcfd by 2050, Myers said in a report in July. The growth on the US Gulf Coast extends far beyond LNG exports, as power generation, industrial applications, and blue hydrogen development are set to account for more than 30 percent of expected demand increases.

The Permian and Haynesville basins emerge as critical supply sources supporting the US Gulf Coast regional expansion, each adding around 10 bcfd to Gulf Coast supplies over the long term, according to WoodMac.

By Tsvetana Paraskova

The OPEC+ group plans to complete the 2.2 million barrels per day production cuts in September, earnings at Saudi Aramco were hit by the lower oil prices in the second quarter, but the world’s top crude oil exporter is bullish on global oil demand in the second half of the year.

The OPEC+ allies reaffirmed their “commitment to market stability on current healthy oil market fundamentals and steady global economic outlook,” OPEC said.

“The phase-out of the additional voluntary production adjustments may be paused or reversed subject to evolving market conditions. This flexibility will allow the group to continue to support oil market stability.”

Granted, the actual increase is likely to be lower than the headline figures suggest – as in previous months – due to the producers that are foregoing large output hikes to compensate for previous overproduction, such as Iraq, OPEC’s second-largest producer, for example.

The eight OPEC+ countries will continue to hold monthly meetings to review market conditions, conformity, and compensation.

With the output increase in September, OPEC+ will have unwound the biggest layer of cuts in recent years.

One final layer, of 1.66 million bpd, remains to be rolled back. Currently, OPEC+ plans to do so by the end of 2026.

However, if markets tighten due to sanctions, penalties, or additional crackdowns on Russian and Iranian oil exports, OPEC+ could step up and unroll these cuts sooner than expected, analysts say.

“We believe the group is finished with its supply hikes, as we move out of the stronger summer demand period and inventories start to rise,” ING commodities analysts said after OPEC+ announced the decision in early August.

“However, much also depends on what happens to Russian oil flows.”

The Middle East is set to surpass Asia to become the world’s second-largest gas producer in 2025, ranking only behind North America, Rystad Energy said in new research and analysis.

Natural gas production in the Middle East has jumped by about 15 percent since 2020, and the future growth underscores the determination of regional producers to monetize gas reserves and develop export potential to meet global demand, the independent research and energy intelligence firm said.

The Middle East currently produces about 70 billion cubic feet per day (Bcfd) of gas. This is expected to jump by 30 percent by 2030 and 34 percent by 2035 thanks to significant developments in Saudi Arabia, Iran, Qatar, Oman, and the UAE. By 2030, the region will add another 20 Bcfd, equivalent to half

These are some of the most recent themes in the Middle East oil and gas sector, which also include rising investment in Oman’s oil and gas sector and the UAE’s ADNOC Drilling reporting record revenues and profit.

OPEC+ Proceeds with Output Hikes

The OPEC+ alliance decided in early August to increase their collective production in September by 547,000 barrels per day (bpd).

The eight countries implementing the 2.2-million-bpd cut – Saudi Arabia, Russia, Iraq, UAE, Kuwait, Kazakhstan, Algeria, and Oman – will have completed the rollback of all these output reductions in September.

of Europe’s entire gas demand as of today, Rystad Energy reckons.

This outlook hinges on Brent oil prices holding at $70 per barrel and oil-indexed gas prices hovering at the range of $7-9 per million British thermal units (MMBtu). If prices fall below $6 per MMBtu, new projects could be delayed, and expected volume growth by 2030 could slow, depending on the severity and duration of the price decline.

“About half of the 20 Bcfd new supply will meet rising domestic demand, particularly from industrial users, while the rest will be available for export,” said Mrinal Bhardwaj, Senior Analyst, Upstream Research, Rystad Energy.

“As more long-term gas contracts are signed and export volumes rise, the Middle East is on track to become a key energy hub for countries seeking stable and dependable sources of natural gas.”

Foreign Direct Investment (FDI) in Oman surged to approximately $79.5 billion by the end of the first quarter of 2025, with inflows reaching $13.6 billion, up from $10.7 billion during the same period in 2024, preliminary figures released by the National Centre for Statistics and Information (NCSI) showed.

Upstream oil and gas remained the largest recipient of FDI, attracting $64.1 billion, or 81 percent of total investment, with quarterly inflows of $12.5 billion, according to the data.

The United Kingdom remained the largest FDI contributor, accounting for 51 percent of total FDI at $40.5 billion, followed by the United States with $20.3 billion, and Kuwait with $3.2 billion.

Despite higher oil production in line with the OPEC+ deal, Saudi Aramco booked a 19-percent drop in second-quarter earnings as

lower oil prices weighed on liquids realizations. Aramco reported a net income attributable to shareholders of $22.85 billion for the second quarter, down by 19 percent from the same period last year. The income also fell compared to the first quarter as Aramco’s average realized crude price was $66.70 per barrel in April to June, down from $76.30 in the first quarter and from $85.70 a barrel for the second quarter of last year.

The world’s biggest oil firm, however, remains bullish on the oil market in the second half of the year and in the long term.

ADNOC Drilling Company PJSC, said it delivered record-breaking performance across revenue, EBITDA, and net profit while maintaining strong momentum in shareholder returns and delivering regional expansion.

For the first half of 2025, ADNOC Drilling booked a record net profit of $692 million, up by 21 percent from the same period last year. Revenues jumped by 30 percent to $2.37 billion, EBITDA rose by 19 percent to $1.08 billion, and free cash flow soared by 67 percent to $727 million.

Market fundamentals remain strong and we anticipate oil demand in the second half of 2025 to be more than two million barrels per day higher than the first half

“Market fundamentals remain strong and we anticipate oil demand in the second half of 2025 to be more than two million barrels per day higher than the first half,” Aramco president and CEO Amin Nasser said.

“Our long-term strategy is consistent with our belief that hydrocarbons will continue to play a vital role in global energy and chemicals markets, and we are ready to play our part in meeting customer demand over the short and the long term.”

In the United Arab Emirates, Abu Dhabi’s ADNOC has announced its intention to transfer its 24.9 percent shareholding in OMV AG to XRG, its wholly-owned international investment company focused on gas, chemicals, and green energy.

ADNOC Drilling is expanding regionally in Oman and Kuwait, while Turnwell, ADNOC Drilling’s unconventional drilling specialist, reached new operational milestones in the second quarter of 2025 as it expanded its presence across the UAE’s onshore unconventional basins.

ADNOC Drilling also continues to embed AI, automation, and advanced analytics across its operations to enhance efficiency, safety, and reliability.

“ADNOC Drilling has consistently demonstrated its ability to grow in any phase of the energy cycle,” said Abdulla Ateya Al Messabi, ADNOC Drilling CEO.

“With high and visible cash flows, growing earnings and strong visibility of future returns, we remain confident in our ability to continue delivering long-term value to our shareholders.”

By Tsvetana Paraskova

Oil and gas operators offshore Norway have raised production in recent months and announced discoveries in recent weeks, while the Norwegian government moved to strengthen the supply chain in the domestic offshore wind industry.

“The results are affected by lower liquids prices, which were partially offset by higher gas prices and higher production,” Equinor said.

Equinor delivered a total equity production of 2.096 million barrels of oil equivalent per day (boepd) in the second quarter, up by 2 percent from the same quarter last year and above the 2.064 million boepd in the analyst consensus estimate.

“We are on track to deliver production growth in 2025 in line with our guidance,” Equinor’s chief executive officer Anders Opedal said in a statement.

“Strong operational performance and Johan Castberg reaching plateau are key contributors this quarter. In today’s volatile markets we stay committed to being a long-term energy provider to Europe.”

Norway’s energy major Equinor, partly owned by the government, reported earnings for the second quarter in line with analyst estimates as it boosted oil and gas production and reiterated its commitment to be Europe’s longterm energy provider.

Equinor booked an adjusted operating income, its closest metric of core earnings, of $6.53 billion for the second quarter, a decline of 13 percent compared to the same period of 2024. The result was in line with a companyprovided consensus estimate of 21 analysts.

The contract secures a substantial share of BASF’s natural gas needs in Europe. BASF uses natural gas both as an energy source and as a raw material in the production of basic chemicals.

Deliveries will start on 1 October 2025, Equinor said.

“Natural gas not only provides energy security to Europe but also critical feedstock to European industries,” Equinor’s Opedal said.

“I am very happy that our gas also supports BASF’s efforts to reduce their carbon footprint. Gas from Norway comes with the lowest emissions from production and transportation.”

Natural gas not only provides energy security to Europe but also critical feedstock to European industries

After less than three months in production, the Johan Castberg field in the Barents Sea reached a plateau on 17 June. The same month, an oil discovery estimated at approximately 9-15 million barrels was made in the area and can contribute with additional reserves for the field.

Moreover, Equinor and UK’s Centrica have signed a long-term gas sales agreement of 55 terawatt hours (TWh) of natural gas per year for a period of 10 years, demonstrating the importance of long-term gas supplies from the Norwegian Continental Shelf to support the UK’s energy security.

Equinor also confirmed its strategic partnership with BASF by signing in July a ten-year natural gas supply agreement, which will see an annual delivery of up to 23 TWh of natural gas over the period.

Another operator on the NCS, Aker BP, said in July that its field development portfolio was progressing according to plan, “with several projects even moving ahead of schedule.”

“Our robust balance sheet and solid cash flow generation enable us to navigate market volatility with confidence – while continuing to deliver attractive and resilient dividends to our shareholders,” CEO Karl Johnny Hersvik said.

Aker BP has also strengthened its North Sea portfolio with an agreement with Japex to swap a 10-percent interest in the Aker BP-operated Alve Nord development and a 3.5-percent interest in the Verdande development. In exchange, Aker BP will receive Japex’s Northern North Sea portfolio and a cash consideration of $14 million.

The effective date of the transaction is 1 January 2025, with completion subject to approval by Norwegian authorities.

Japex’s Northern North Sea portfolio comprises a 15 percent interest in the

Kjøttkake discovery (PL1182S), a 10 percent interest in the Kveikje discovery (PL293B/ PL293CS), and a 20 percent interest in PL1212S.

By increasing its stake in Kjøttkake to 45 percent and entering Kveikje with 10 percent, Aker BP strengthens its position in a high-potential cluster of discoveries, the company said.

Norwegian oil and gas operator DNO ASA has confirmed a gas and condensate discovery on the Vidsyn prospect, close to its producing Fenja oil and gas field, both within the Norwegian Sea licence PL586. DNO has a 25 percent stake in the licence, up from 7.5 percent prior to the recent acquisition of Sval Energi Group AS completed in June.

Preliminary estimates at Vidsyn put gross recoverable resources in the range of 25 to 40 million barrels of oil equivalent (MMboe) with a mean of 31 MMboe, above the predrill estimate range. The partnership, including Vår Energi ASA (75 percent and operator), considers the discovery commercial and sees a potential to unlock a larger volume in the licence.

Vidsyn is located just eight kilometres west of the Fenja field, which is tied back to the Equinor-operated Njord field facilities 35 kilometres to the northeast. Njord oil is exported by shuttle tankers while gas is piped to the market via the Åsgard Transport System.

The Norwegian government unveiled in August a new strategy for the local offshore wind service and supplier industry. The government sees great opportunities for the domestic industry to support the local offshore wind sector and win contracts abroad.

In 2023, more than 800 companies, many of which with experience in the petroleum industry, had a combined turnover of NOK 44.6 billion, or $4.4 billion, up by nearly 30 percent from a year earlier, according to the government’s latest figures.

New projects both on the Norwegian continental shelf and internationally make authorities confident that the offshore wind supply chain has the chance to grow further.

Norway will not provide state support for offshore wind projects in the foreseeable future, but will contribute to the crucial startup phase of the supplier companies, Energy Minister Terje Aasland said.

Norway’s supply-chain companies are competing internationally because they have built

on world-class offshore expertise in the petroleum industry, Minister of Trade and Industry, Cecilie Myrseth, said.

The Norwegian supplier industry plays a key role in the low-emission economy, Myrseth added.

The Norwegian government has an ambition to allocate acreage for the development of 30 GW of offshore wind by 2040. This is almost as much as the entire Norwegian hydropower production today.

Sørlige Nordsjø II and Utsira Nord are the first steps toward achieving the offshore wind goal. Sørlige Nordsjø II will be Norway’s largest power plant in terms of installed capacity and will provide electricity equivalent to the consumption of about 450,000 households.

In May this year, the government announced a competition for project areas for offshore wind in Utsira Nord. Each project area may have an installed capacity of up to 500 MW of floating offshore wind.

To support the supply chain companies, Norway’s government pledged to facilitate regular calls for proposals and support competitions in a start-up phase.

“Vidsyn is another exciting addition to our string of Norway discoveries,” said DNO’s executive chairman Bijan Mossavar-Rahmani.

“Together with Vår Energi, we will work hard to put it into production faster than is the norm in Norway.”

In another exciting discovery, Equinor and its partners have made a gas discovery in the Skred prospect close to the Johan Castberg oilfield in the Barents Sea. The well was drilled about 23 kilometres north of discovery well 7220/8-1 on the Johan Castberg field and 210 kilometres northwest of Hammerfest.

Preliminary calculations indicate the size of the discovery is 1.9 – 3.1 million barrels of oil equivalent. The licensees will now assess the discovery with a view toward a possible tie-in to the Johan Castberg field.

https://varenergi.no/

By Tsvetana Paraskova

Australia’s major energy firms have strengthened their domestic operations and boosted oil and gas production while the federal government raised the clean energy targets.

Woodside Energy has agreed to assume operatorship of the Bass Strait assets, unlocking potential development of additional gas resources, following an agreement with ExxonMobil Australia.

From completion, Woodside will assume operatorship of the offshore Bass Strait production assets, the Longford Gas Plant, the Long Island Point gas liquids processing facility, and associated pipeline infrastructure. Woodside and ExxonMobil’s equity interests in the assets and current decommissioning plans and provisions remain unchanged.

As operator, Woodside will take on the responsibility for asset planning and execution activities, pursuing a value maximisation strategy that targets further production and reliability improvements, the Australia-based company said.

“As a proudly Australian company, Woodside supports essential domestic energy needs in both Western Australia through the North West Shelf, Pluto and Macedon operations, and on the east coast through its equity participation in Bass Strait,” said Woodside EVP and COO Australia Liz Westcott.

“Taking operatorship of Bass Strait demonstrates Woodside’s continued commitment to meeting Australia’s domestic energy demand while maximising the value of existing infrastructure,” she said.

Woodside also reported quarterly production of 50.1 MMboe (550 Mboe/d) for the second quarter, up by 2 percent compared to the first quarter of this year.

“We delivered strong production of 50 million barrels of oil equivalent for the quarter from our diverse portfolio of high-quality assets. At the same time, ongoing focus on cost control has enabled us to lower our unit production cost guidance for 2025,” Woodside CEO Meg O’Neill said.

“Our announcement in April of a final investment decision to develop the Louisiana LNG Project positions Woodside as a global LNG powerhouse, complementing our established Australian LNG business and enabling us to meet growing global demand from a broader range of customers.”

Woodside also remains focused on delivering the Scarborough Energy Project for gas-toLNG on schedule and budget.

In May, Woodside had the floating production unit hull and topsides for the project connected. Scarborough is now 86 percent complete and on track for first LNG cargo in the second half of 2026, O’Neill said.

Another Australian energy major, Santos, said it had increased second-quarter production

to 22.2 mmboe, up 1 percent compared with the prior quarter.

Western Australia domestic gas production increased by 15 percent compared to the first quarter, driven by successful John Brookes well intervention campaign, steady production from Halyard-2, and strong reliability at Varanus Island, averaging 98 percent for the first half, Santos said in its Q2 results release.

As part of activities for the Moomba Carbon Capture and Storage (CCS) project, Santos executed a non-binding Memorandum of Understanding with the South Australian Government to explore CO2 import and pipeline infrastructure opportunities in support of CCS and low-carbon fuels ambitions in the Cooper Basin.

The Barossa LNG project is around 97 percent complete. The BW Opal FPSO (floating production, storage and offloading) vessel arrived at the Barossa gas field and was successfully hooked up to the subsea infrastructure. Final commissioning activities are progressing to plan. All scopes of work, including the Darwin LNG life extension activities, remain on track for first gas in the third quarter, Santos said.

“We continue to see very strong demand and premia for high heating-value LNG from projects such as Barossa and PNG LNG, as well as for reliable regional supply,” Santos managing director and CEO Kevin Gallagher said.

“Santos’ diversified LNG contract mix provides the flexibility to adapt to evolving market dynamics and capture value-accretive opportunities.”

While Australian firms look to boost gas production and supply domestically and globally, the federal government in July raised the capacity target in its Capacity Investment Scheme (CIS) from 32 gigawatts (GW) to 40 GW.

The CIS will help deliver the Australian Government’s target of having 82 percent renewable electricity by 2030.

The scheme has so far seen 6 oversubscribed, successful tenders launched, and it is on track to deliver 18 GW of generation and dispatchable storage projects.

The 8-GW capacity increase is set to incentivise investment in projects to deliver an additional 5 GW of storage and 3 GW of renewable power generation by 2030. A 3 GW boost to CIS generation was helped by the competitive nature of the tenders and falling costs of solar, the government said.

The uplift is expected to support investment of around US$13.6 billion (AUS$21 billion) in storage capacity. Investments of nearly US$34 billion (AUS$52 billion) are expected in solar and wind technologies.

More renewable generation and dispatchable projects will create jobs within local communities, support Australian supply chains and manufacturers, and help replace aging coal plants and support rising demand, the government says.

Australia should address the gaps and overlaps in emissions reduction incentives, speed up approvals for clean energy infrastructure, and create a resilience-rating system for all housing to meet its clean energy targets, the interim report of the Productivity Commission inquiry recommends. The Productivity Commission (PC) is the Australian Government’s independent research and advisory body on a range of economic, social, and environmental issues.

The report calls for reforms to the Environment Protection and Biodiversity Conservation Act, which is slowing down vital approvals without effectively protecting the environment. These reforms would introduce national environmental standards, improve regional planning, and set clear rules about engaging with local communities and Aboriginal and Torres Strait Islander people.

The interim report also calls for a greater focus on approvals for priority projects and recommends the Government appoint an independent Clean Energy CoordinatorGeneral to work across government and break through roadblocks. A specialist ‘strike team’ should also be established to ensure priority projects are efficiently assessed.

“Getting to yes or no quicker on priority projects would meaningfully speed up the clean energy transition,” said Commissioner Martin Stokie.

The second quarter of 2025 saw record generation output from wind, grid-scale solar, and rooftop solar energy, the Australian Energy Market Operator (AEMO) said in its quarterly report.

Across the National Electricity Market (NEM), a warmer and sunnier start to the June quarter, combined with more new renewable generation capacity, saw record Q2 generation output in wind, up by 31 percent, grid-scale solar (+17 percent), and rooftop solar (+15 percent).

New all-time 30-minute output records were also set, with wind generation reaching 9,472 megawatts (MW) on 25 June, up 13 percent on the previous high. Grid-scale battery discharge surged 119 percent to average 162 MW, driven by 3,116 MW/6,415 MWh of new battery capacity since the end of Q2 2024, the market operator said.

Continued investment in new wind and solar has lifted renewables’ share of generation from 32 percent to 38 percent year-on-year for the quarter, said AEMO Executive General Manager Policy and Corporate Affairs Violette Mouchaileh.

In periods in June, isolated cold conditions and low wind conditions triggered spikes in heating demand and reduced wind generation. This led to a greater reliance on gas-fired generation and batteries to meet evening peak demand, AEMO noted.

“Ongoing investment in gas-fired power remains critical to generate energy during these periods of low wind or solar, or when storage reserves are depleted, and to support growing demand as our power systems transition,” Mouchaileh said.

Renewables remain the lowest-cost newbuild electricity generation technology, while nuclear small modular reactors (SMRs) are the most costly, according to the final 202425 GenCost Report by CSIRO, Australia’s national science agency, in collaboration with the AEMO.

Yet, rising construction costs in Australia and supply chain constraints for some technologies remain a challenge for reducing costs, the report found.

“The latest GenCost report released by the CSIRO today reaffirms the longstanding reality that renewables are the lowest-cost, and most practical option to transition Australia’s energy system,” said Anna Freeman, Clean Energy Council General Manager – Advocacy & Investment.

“The truth remains that renewables remain the lowest cost form of energy, even when taking into account the cost of firming these generation assets, including the costs of storage, transmission, and system security.”

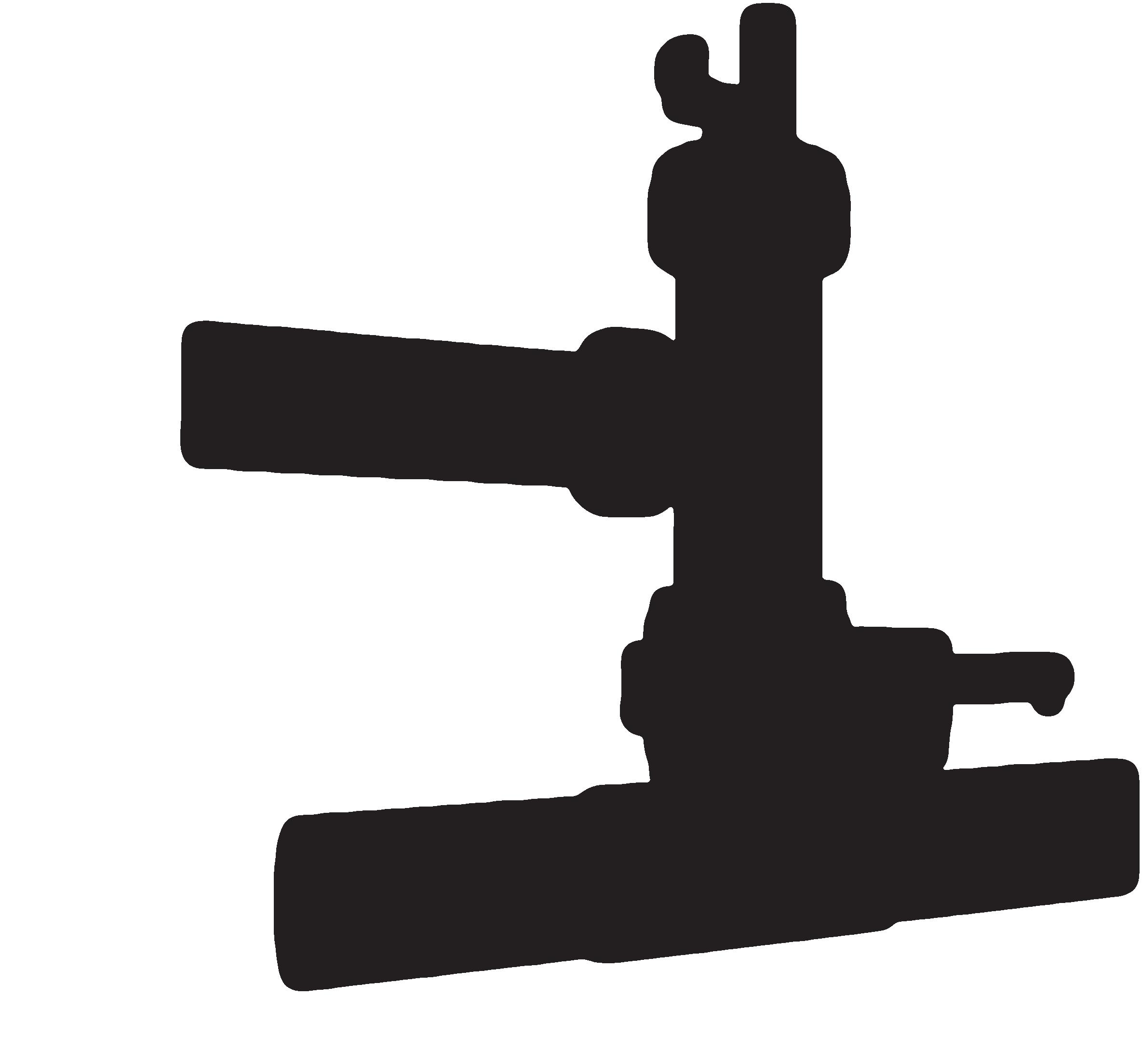

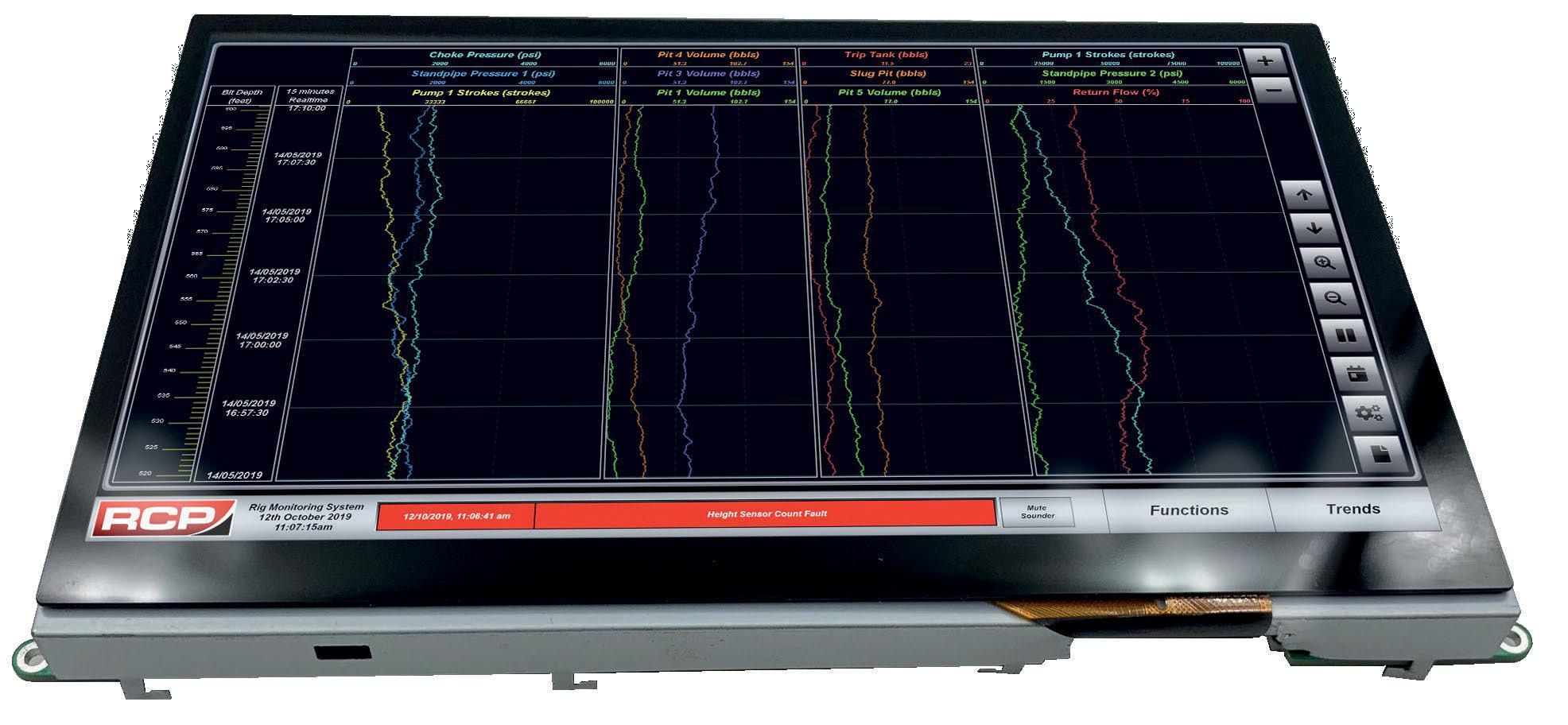

The RCP EDR is designed to give operators a clear, unambiguous overview of critical drilling and mud data processes The system has been developed by RCP to greatly improve how information is presented using the latest industrial technologies and user-friendly interfaces.

The RCP EDR offers a quick and cost-effective solution for clients considering a new installation or a partial upgrade to their existing drilling instrumentation systems Our highly experienced engineers and software developers allows us to tailor each new system to meet your exact needs meaning that you do not pay for functionality you will never use

The RCP EDR utilizes a variety of sensing technologies to monitor the drilling processes, (typically: Level, Pressure, Height, Temperature and Flow). Sensor output signals are received by the distributed I/O racks and are then processed by the EDR.

Processed information is then transmitted through network communication modules to each of the user interfaces including remotely networked PC’s and local HMI’s System and operator interface communications may utilize either: Fibre-Optic, Profinet, Profibus or Industrial Ethernet connection

1 YEAR AGO

1 Year Ago - $75.12

Brent crude rose following Israeli air strikes on Lebanon, stoking fears of supply disruptions from the Middle East. Prices were further supported by optimism over global demand after China unveiled major economic stimulus measures aimed at boosting growth. The combination of heightened geopolitical tensions and positive demand expectations pushed oil markets higher.

5 YEARS AGO

5 Years Ago - $40.89

Rystad Energy forecast a cautious offshore rebound, with FPSO-based projects spearheading recovery. Floaters were expected to account for 41% of offshore sanctioning value between 2021–2023, surpassing fixed platforms and subsea tiebacks, as operators leaned into deep-water, cost-effective deployments.

10 YEARS AGO

10 Years Ago - $47.33

In 2015, with Brent crude prices under $50 and markets gripped by volatility, Shell abandoned its costly Arctic drilling campaign. After spending over $7 billion in Alaska’s Chukchi Sea, the company found disappointing reserves. High operating costs, regulatory uncertainty, and weak long-term oil price prospects made the project commercially unviable, highlighting how low prices can derail even major exploration efforts.

At the heart of OGV Media Group is the OGV Community, a corporate membership service that connects energy sector organisations with our growing network of professionals, leveraging member engagement and platform traffic to maximize brand exposure.

Subscription to the OGV Community offers its members the following growing list of benefits:

SPONSORED BY

www.eicdatastream.the-eic.com

Energy projects and business intelligence in the energy sector

The EIC delivers high-value market intelligence through its online energy project database, and via a global network of staff to provide qualified regional insight. Along with practical assistance and facilitation services, the EIC’s access to information keeps members one step ahead of the competition in a demanding global marketplace.

The EIC is the leading Trade Association providing dedicated services to help members understand, identify and pursue business opportunities globally.

It is renowned for excellence in the provision of services that unlock opportunities for its members, helping the supply chain to win business across the globe.

The EIC provides one of the most comprehensive sources of energy projects and business intelligence in the energy sector today.

The operating joint venture comprising of and KUFPEC announced a financial investment decision for the field development.

The Mina West gas field, located in water depths of approximately 250 metres, will be developed as a subsea tie-back to the existing infrastructure of West Delta Deep Marine (WDDM).

A final investment decision has been announced with first oil expected to be reach in Q2 2028. The discovery which is estimated to hold around 74 million barrels of oil equivalent (P50 resources) will see the drilling and completion of two production wells. The wells will be tied back to the Shenandoah FPU using a 3.2km flowline and a dedicated riser.

SOCAR-KBR LLC has secured a contract to provide detailed engineering design solutions and procurement services for the SDC gas field project. The company was also awarded a contract to support the BP operated Sangachal Terminal Electrification (STEL) Project.

Following the award of a Production Sharing Agreement for Block C in Brunei, EnQuest will now look to form a JV with Brunei Energy Exploration Sdn Bhd. Once established the JV will focus on the development plan for Merpati with the aim of reaching a final investment decision in 2027, and starting gas production in 2029.

Azule Energy has announced a gas discovery through the Gajajeira-01 exploration well, drilled by the Valaris 144 jack-up rig.

Preliminary estimated resources are about 1Tcf of gas and 100MMboe of condensate. Drilling operations will continue on the well targeting the Lower Oligocene LO300 interval.

Iraq has signed a new agreement with SLB to increase the production at the Akkas gas field in Al-Anbar province.

Schlumberger will be drilling new wells to achieve an initial production rate of 100 MMcf/d, and targeting a longer term production rate of 400MMcf/d.

SABRATHA GAS

PROJECT – A AND E

INTEGRATED FIELD DEVELOPMENT

A project management services contract has been awarded to Hill International. The scope of work includes detailed design to approve engineering on new infrastructure and upgrades, fabrication, installation and hook-up, and testing and commissioning of the onshore facilities.

TechnipFMC has been awarded an iEPCI contract worth between USD$75m and USD$250m for the project. The company previously had been awarded and conducted an iFEED study. The field development will involve the installation of two new production templates with eight slots, and the drilling of five new wells; two production wells and three injection wells, plus a new umbilical to Heidrun.

Oceaneering has been awarded a three-year contract to provide services in support of offshore operations in the block.

Under the agreement, the company will provide ROVs, ROV tooling, intervention workover control systems (IWOCS), satellite communication systems, subsea inspection, hydrate remediation, and engineering services.

CEPetroleum has announced an oil and gas discovery via the Wolin East 1 well drilled utilising the Noble Resolve jack-up rig. The project’s estimated to contain 200MMboe. The operator will now advance conceptual infrastructure development studies on the discovery which is located in water depths of 9.5 metres.

The operator has taken a final investment decision on the 30.5 Bcf gas field. The field is to be developed as a single platform tie-back to the existing infrastructure at Izabela field. First gas is expected in the first half of 2027.

A consortium of Yinson and PTSC has been awarded the contract to provide an FSO for the project. The contract includes a firm period of 14 years with a potential extension of up to 9 years. The FSO is expected to be a newbuild, double-hull, turretmoored unit to be installed in a water depth of 80m. The FSO will have a storage capacity of 350,000 barrels of condensate.

Digitalisation plays an increasingly important role in helping the energy industry explore and achieve greater efficiency in operations, streamline seismic data interpretation and other data management, and develop new business models via wellsite automation or Internet of Things (IoT) integration.

By Tsvetana Paraskova

In recent years, digital transformation in the industry has helped operators and the supply chain with issue detection and asset monitoring, creating the predictive maintenance approach to ensure safe and reliable operations of well drilling, pipeline safety, turbine or refinery operations.

Just like in everyday life, digitalisation and digital devices have seen exponential use in the energy industry and will continue to be the driving force of technology and performance innovation in the sector.

The digital transformation market in the global oil and gas industry is set to rise by 14.5 percent each year between 2025 and 2029, or by $56.4 billion in total, a report by technology research and advisory company Technavio showed earlier this year.

The surge in the use of the digital twin technology, the rise in AI-driven models for optimisation, asset utilisation, production efficiency, and risk management are driving the exponential growth in digital solutions for the oil and gas industry globally.