Welcome to the final edition of ‘OGV Energy Magazine’ for 2026 where this month we are exploring the theme of ‘Marine, Lifting and Logistics’ as well as looking back on some of the highlights of this year.

A big thank you to our front cover partner Proteus this month and you can read all about how they are driving AI powered project delivery and global expansion on pages 4 and 5.

We are also delighted to welcome contributions from Drager, Three60 Energy, Tess Oil and Gas, Cottrill & Co, PD&MS and Elementz

The rest of this month’s magazine as always provides you with a review of the Energy sector in the North Sea, Europe, Norway, Middle East, US and Australia, along with industry analysis and project updates.

Thanks as always to our corporate partners the Energy Industries Council, Leyton, InfinityPartnerships, Elemental Energies and Archer - the Well company, Three60 Energy, Brimmond, Dräger, Rotech Subsea, Stats-Group, Cegal, GDi, PTS Services, Tess, Intervention Rentals, Vulcan Completion Products, Viper Innovations, J&S Subsea, Wellpro and Scotsbridge.

Warm regards Dan Hyland, Director

by Colin Manson, CEO, Proteus.

The one good thing about having a certain number of years under your belt is that you know how things used to be (my rose-tinted specs say simple) and you can see how different the world is now (pretty complex). And you learn to tell the difference between a genuine shift and just another trend. Today’s engineering project landscape doesn’t just demand geographical reach. You need to actually work across time zones, manage teams scattered everywhere, win new clients quickly and keep delivery standards consistent. As engineering, energy and infrastructure companies grow through acquisition and push into new territories, the pressure to do more with less keeps intensifying. We designed Proteus to help organisations meet those challenges and scale intelligently. You can see that mission playing out in our recent expansion across Asia Pacific, backed by new leadership, new clients and a growing network of partners.

Denis Marshment Vice President for Asia Pacific

Denis is leading business development and client engagement across the region, working with organisations that need a platform capable of handling large frameworks, multi-disciplinary teams and increasingly distributed workforces. His years at Aurecon gave him real insight into how Proteus simplifies project setup, resource management and financial performance tracking. Now he’s helping other organisations go through similar transformations and speed up adoption across markets, seeing massive infrastructure and energy investment.

We’ve invested heavily in capabilities that support global teams, and Asia Pacific has become a real focus because teams there are after project delivery tools that improve control, accuracy and transparency. Part of that investment was bringing Denis

Marshment on board as Vice President for Asia Pacific. Denis spent his career managing projects on the client side, most recently as a senior leader at Aurecon, where he was actually a long-standing Proteus client. He gets what complex engineering organisations expect because he’s lived it. His move to us reflects something bigger happening in the market: technology isn’t a peripheral tool for project-based businesses anymore. It’s central to how they grow and compete.

We’ve already gained solid traction in the region. Our work with Aurecon showed how a large, multidisciplinary consultancy could standardise the way it developed bids, allocated resources and monitored delivery. That experience shaped our product direction and gave us practical benchmarks for new clients. It proved that a single platform, used properly, can streamline project delivery at scale.

We’re seeing the same pattern with other clients. Xodus relies on Proteus for clarity around resourcing and pipeline management as they expand globally. Genesis uses it to

support teams to align on project forecasts and performance metrics in ways that were genuinely difficult before across international offices. More recently, Penspen, Aquaterra and Venterra have come on board to improve efficiency and control. These global clients span energy, engineering and consultancy, but they all need the same thing: a single view of work, talent and performance that lets them operate across borders without losing visibility

If you read nothing else about AI this year, remember this (and yes, we know it’s almost impossible to avoid the noise): AI only works if the foundations are solid. Good data, consistent structure, clear processes are what makes AI useful. Without them, it can’t improve project delivery, no matter how impressive the marketing sounds.

There’s plenty of AI hype in the market, so we’ve deliberately kept our approach straightforward. We focus on problems that genuinely slow teams down and use AI

where it actually makes a difference. Proteus reduces repetitive tasks, improves forecast accuracy and strengthens the link between commercial planning and delivery. When AI can take manual weight off teams, we build it into the workflow. Simple as that.

Our goal isn’t to automate judgment. Instead, we want to give project managers clearer insights, help them estimate costs confidently, anticipate resourcing needs earlier, and spot risks before they become problems.

This practical approach comes from longterm relationships and lessons learned on real projects. Clients like Aurecon, Xodus and Genesis have helped us refine workflows that reflect how teams actually operate, not how software companies think they should. The result? Faster bid turnarounds, standardised project setup, better earned value visibility. For companies in growth mode, this matters. When you’re entering new regions or expanding service lines, inconsistent processes make it nearly impossible to measure performance properly. Proteus gives you a foundation that grows with the business.

The demand for better integration between commercial planning and operational delivery is particularly strong in Asia Pacific. Many organisations there are navigating significant transition with energy projects accelerating, infrastructure investment rising, talent more mobile than ever. Companies need to balance local decision-making with global oversight while operating with greater financial accuracy to protect margins. Proteus addresses these pressures by giving leaders confidence that their teams are aligned and working from one source of truth, regardless of location.

A key part of our APAC strategy has been developing a strong partner ecosystem. We recently formed a close partnership with Red to Green, led by Bronson Fernandez. They specialise in digital transformation and workflow optimisation for engineering and energy companies, playing a crucial role in supporting clients who want rapid adoption with regional expertise. By combining platform knowledge with local insight, the partnership helps organisations embed best practice as they scale. This is especially valuable in countries where project delivery culture and regulatory expectations vary significantly. Faster adoption means clients see results quickly.

Our ability to support global growth is already showing up in how clients use us to move into new markets. We’ve noticed a bit of a niche with companies following the buy-and-build model. They grow fast through acquisition, and usually there’s no joined-up digital strategy. You end up with hundreds of small teams all working differently on separate systems. What we do is work with those teams to put a solution in place that gives a single view of resources and project performance across the business. For clients in energy and similar sectors, this has been a gamechanger. It shows that if you get the digital foundations right, scaling globally doesn’t mean losing visibility or control. Teams can grow and move fast without everything turning into chaos.

Looking ahead, we’re focused on continuing to support global organisations that need clarity, simplicity and confidence in their project delivery. APAC will remain a priority as organisations there keep investing in digital transformation. With Denis leading regional growth and partners like Red to Green backing us up, we’re building the capability, presence and expertise to meet that demand.

Our direction is guided by one belief: global expansion shouldn’t require complexity. With the right technology and partnerships in place, organisations can scale with confidence and deliver better outcomes for their clients. Proteus is committed to helping them do exactly that by providing a tool that supports growth in a practical, reliable, futureready way.

As the tagline says, Proteus makes work simplified.

Royal Seal of Excellence: Viper Innovations Officially Presented with the King’s Award

Viper Innovations has marked another proud milestone with the official presentation of the King’s Award for Enterprise in International Trade. First announced in May 2025, the award recognises the company’s achievements in delivering innovative electrical integrity solutions to critical industries around the world.

Exporting has been central to Viper’s growth, driving its plans for global expansion and diversification. Over the past decade, the company has built a strong international presence, with exports now making up around 40 percent of its business and international revenue continuing to rise year on year. This progress is set to continue, supported by recurring revenues, proven technologies and the launch of new products.

Dales Marine Services Expands into New Facility in Montrose Port

UK dry dock specialist signs lease agreement to enter Montrose Port

Dales Marine Services, a specialist in dry dock and ship repair, fabrication and conversion, has expanded its footprint in Scotland by signing a lease agreement for a new operations space in Montrose Port.

Located on the north side of the port, the new 2,500sq ft facility will allow Dales Marine to deliver a range of services for ships docked at the strategic North Sea location.

Montrose Port is one of the world’s largest chain and anchor ports and is a hub for Scottish offshore wind projects, acting as the operations and maintenance base for the Seagreen and Inch Cape wind farms.

IKM Testing UK strengthens Valve Department following facility investment and team growth

Following recent investment in its valve facility, complete service provider to the energy industry IKM Testing UK is continuing to expand its Valve Department, strengthening both its technical capabilities and the next generation of valve specialists. At the centre of this growth is Gary Shaw, a respected industry figure with extensive experience in valve operations and testing. Having joined IKM in September 2024, Gary brings specialist expertise in In-Situ Pressure Safety Valve (PSV) testing, a method that allows set pressure verification of PSV valves while remaining live. The approach enables safe and efficient valve verification without removing the valve from service, reducing downtime and ensuring operational integrity.

Well Academy and ModuSpec celebrate training centre’s first anniversary

Global well control training specialist Well Academy has marked the first anniversary of its dedicated training centre in Westhill, Aberdeenshire, which it shares with sister company ModuSpec – experts in rig intake and inspection.

Since opening its doors in November 2024, the centre has hosted nearly 50 specialised training programmes, ranging from IWCF accredited well intervention pressure control courses to ModuSpec rig equipment training and technical masterclasses.

Delegate feedback has been overwhelmingly positive, with particular praise for classroom facilities, spacious breakout areas and the exceptional calibre of training delivered by industry experts.

Celebrating 10 Years at EPIT Group’s Dedicated Training Centre

Ten years ago, EPIT Group made a strategic leap forward with the opening of its purpose-built training facility in Blackburn Business Park, near Aberdeen. At a time when the oil and gas industry was facing significant challenges, the decision to invest in a custom-designed centre reflected not just ambition, but a deep-rooted belief in the value of high-quality training and industry resilience. That belief proved well placed.

Over the past decade, the facility has become a trusted hub for technical training, skills assessment, and consultancy, serving thousands of engineers, technicians, and contractors from across the UK and international markets including the Middle East, Africa, and Europe.

Subsea Supplies forms strategic partnership with DRIFT Offshore to strengthen subsea support for US market

Subsea Supplies has announced a strategic partnership with DRIFT Offshore to enhance subsea operations for its growing US customer base. This collaboration will provide customers across the region with faster access to Burton subsea connectors and cable assemblies, combined with DRIFT Offshore’s technical expertise from its base in Florida.

The partnership represents a joint $250,000 investment in machinery, tooling, stock and test equipment to support expanded operations. By providing local stock availability and faster response times, it will reduce downtime and enhance supply-chain reliability across the energy sector

IKM

IKM have over the years managed to combine strong growth with positive earnings. IKM have also succeeded in providing a safe work place for their employees and have become a reliable contractor for its customers.

The Orphie business of i2S is a specialist in the design of complex underwater imaging systems.

Our aim is to make underwater operations more efficient, more cost-effective and safer, thanks to our patented technology.

We save our customers time and money testing subsea assets. C-Kore can prove new installations, fault find existing ones or monitor assets in transit, all in a fraction of the time and without the manual processes of conventional testing. From factory floor to ocean floor and anywhere in-between C-Kore keeps you ahead of schedule, on budget and provides certainty in the state of your equipment.

www.film-ocean.com

Dron & Dickson are specialists in integrated supply, installation and maintenance of harsh & hazardous area electrical equipment. Our UK network of wholesale branches can supply quality brand-name electrical equipment from all the leading manufacturers supported by the highest level of customer service.

www.ikm.com www.drondickson.com

Destec On-Site Services provide specialist engineering solutions across the UK and internationally, supporting a broad spectrum of industries including chemical and petrochemical, offshore, power generation (renewable and nuclear), marine, steel, mining, rail, fabrication, and vessel manufacturing.

www.destec.co.uk

At WellSense, we’re on a mission to extend the life of oil and gas fields, maximize well performance, and ensure effective well abandonment through innovative, practical solutions.

Penspen’s global teams design, maintain, and optimise energy infrastructure to improve access to secure and sustainable energy for communities worldwide.

www.penspen.com

Deepsea Technologies, Inc. specializes in the development, engineering and manufacturing of standard and customized equipment for the following applications: subsea production systems, SURF, subsea intervention, offshore & onshore drilling, and others. DTI was established in 2001 and headquartered in Houston, TX operating under an ISO 9001:2015 certified Quality Management System.

www.c-kore.com www.deepsea-tech.com/

By Tsvetana Paraskova

McDonald, the Minister for Industry at the Department for Business and Trade, says.

The future of the UK tax regime for North Sea operators, the importance of job preservation and creation, and insights into wells and workforce featured as main themes in the UK North Sea oil and gas industry in the past weeks.

More than 100 UK energy supply chain companies called on the government to reform the Energy Profits Levy (EPL), warning that without a permanent replacement for the tax the nation risks losing thousands more jobs, billions in investment, and critical supply chain capability essential for the UK’s energy security and transition.

OEUK’s Supply Chain Champion, Steve Nicol – Executive President, Operations at Wood, has led a call from more than 110 companies to Government urging them to work with industry and implement a competitive, permanent tax regime from 2026, as outlined in the Treasury’s 2025 oil and gas price mechanism consultation.

“We are witnessing an accelerated decline in activity that is undermining the value of the sector and the supply chain capability we need for our energy future,” the open letter to Chris

“Job losses are occurring at an unacceptable scale, and there is an urgent need for supportive policy to unlock investment, drive economic growth, and safeguard the UK’s energy transition.”

An Offshore Energies UK (OEUK) survey has shown that more than half, 55 percent to be precise, of the UK’s offshore energy firms have reduced their staff headcount in the past year.

The outlook remains challenging, with nearly half, or 45 percent, of surveyed companies expecting to cut jobs further over the next 12 months if the current policy environment continues, according to the latest Offshore Energies UK (OEUK) Pulse Survey.

The survey also reveals a growing trend of companies shifting focus overseas, with one respondent stating: “We’re now actively looking to reduce exposure to the UK energy industry and move operations overseas, reducing UK economic activity and tax take (personal and PAYE).”

Survey participants repeatedly highlighted the EPL as a critical barrier to investment, with one company calling it “the biggest problem we face as an organisation.”

“It’s not just offshore energy firms, our industrial heartlands and their skilled people that need this tax to change – it’s the whole economy,” said Katy Heidenreich, OEUK’s director of supply chain and people.

OEUK also supported the joint letter to the Treasury sent by the British Chambers of Commerce, Aberdeen & Grampian Chamber of Commerce, and the Scottish Chambers of Commerce. The letter emphasises a predictable fiscal regime would send a powerful signal that the UK is once again open for energy investment – unlocking growth, supporting thousands of high-value jobs, and securing billions in future tax revenues, the chambers said.

“If we allow the decline of North Sea oil and gas to continue unchecked while failing to accelerate renewables, we risk creating a widening gap in jobs, investment and expertise – one that will be felt in communities and industries across the UK,” OEUK Communications Director Natalie Coupar said.

“This isn’t about choosing between energy sources. It’s about securing our energy future by strengthening both oil and gas and renewables.”

The UK Government should avoid accelerating the decline of North Sea oil and gas production through policies, the UK Parliament’s Scottish Affairs Committee said in a report at the end of October.

The committee’s report on the future of Scotland’s oil and gas industry is the conclusion of the first part of its inquiry into GB Energy and the net zero transition.

“The North Sea oil and gas industry has been a vital part of the UK’s and Scotland’s economies but is now at a critical junction as production declines and the UK’s clean energy transition ramps up,” the committee said.

“The report concludes that reforms to the temporary tax, initially introduced in 2022, should be implemented as soon as possible to create certainty for the industry.”

Patricia Ferguson, Chair of the Scottish Affairs Committee, said, “It’s vital that the government moves quickly to plug this employment gap, replace jobs being lost and ensure a smooth energy transition for workers and communities. Until this is tackled, the government should avoid making decisions that would further accelerate oil and gas production’s decline.”

OEUK’s 2025 Workforce Insight report revealed that the UK could add thousands of jobs, retain economic value, and lead the world in energy with the right policies, collaborative action, and a focus on an integrated energy workforce.

In 2024, about 154,000 people were employed across the UK’s offshore energy sector, including roles in oil and gas, offshore wind, carbon capture and storage (CCS), and emerging technologies.

“With the right policies and investment, the UK can achieve a net addition of jobs, growing the offshore energy workforce from 154,000 today to over 212,000 by 2030, with continued growth in oil and gas playing a central role,” OEUK’s Heidenreich said.

An annual report from the North Sea Transition Authority, Wells Insights, found that well interventions across the UKCS declined from 443 in 2023 to 425 in 2024, continuing a gradual downward trend.

Yet, the interventions that were carried out demonstrated strong results, delivering 37.5 million barrels of oil equivalent (boe) in 2024, equivalent to 34 days of average UK production, the NSTA said in the report. Efficiency also improved, as intervention costs fell from £11 per barrel in 2023 to £9.60 in 2024, while the average Brent crude price was £63.10 per boe, highlighting healthy profit margins for such activity, the regulator noted.

With the right policies and investment, the UK can achieve a net addition of jobs, growing the offshore energy workforce from 154,000 today to over 212,000 by 2030

operator to supply OCTG (Oil Country Tubular Goods) products, accessories, and integrated services for offshore operations in the UK North Sea. The multi-year, multi-million-pound agreement reinforces Vallourec’s role as a strategic partner in one of the world’s most technically demanding and cost-sensitive offshore environments,the company said.

Serica Energy plc has reached an agreement with Finder Energy to buy a 40 percent interest in the P2530 Licence for an initial consideration of about £500,000, or some $650,000. The Licence is currently held by Finder Energy with a 60-percent operated interest and Dana Petroleum with a 40-percent stake. The Licence contains the Wagtail oil discovery and the low-risk Marsh and Bancroft exploration prospects.

But the NSTA also urged operators to collaborate with the supply chain and unlock cost-efficient production, and keep wells in good shape to sustain production and support suppliers.

There are opportunities to further enhance production by targeting existing fields, as 30 percent of the UKCS’s well stock was shut-in last year.

“While decommissioning will be the next step for many of those wells, a significant number could be reactivated. Without investment, they will be lost permanently, along with domestic reserves and resources,” the NSTA said.

Since early 2024, the NSTA has proactively engaged with eight leading operators to promote interventions and help them identify about 200 shut-in wells which could be reactivated.

“While it is encouraging that some wells have been brought back into production, it is important for all operators to take urgent action by bringing the supply chain into the fold early, putting useful data on the table and making firm commitments to invest in the health of their wells,” said Keith Hogg, NSTA Wells Manager.

The Regulators’ Pioneer Fund has awarded the NSTA a total of £107,000 for a project intended to make North Sea data easier to access. The funding will be split between two workstreams. One will create an enhanced Geospatial Data Viewer which is intended to help users by bringing together datasets from multiple government agencies in one place.

The second workstream will create an AI chatbot to assist users in navigating NSTA’s Open Data and National Data Repository portals, with potential future expansion to other platforms.

In company news, Vallourec has renewed its long-standing contract with a major North Sea

Serica, however, suffered a setback in its attempt to buy BP’s stake in the P111 and P2544 licences, as one of the licence partners, NEO NEXT, has decided to take up its rights of pre-emption.

“While this outcome is of course disappointing, it was always known to be a possibility,” Serica’s CEO Chris Cox stated.

“Serica continues to actively pursue further M&A opportunities, as well as progress our attractive organic growth options, with a goal of diversifying the Company’s portfolio of assets, increasing production, and creating value for shareholders.”

INEOS celebrated in early November 50 years of the Forties Pipeline System, a feat of British engineering that has safely delivered over 9.6 billion barrels of oil and gas. At the same time, INEOS, which earlier this year halted investments in the UK energy sector due to the tax policies, warned that Britain is squandering its energy independence.

Since acquiring the Forties system in 2017, INEOS has invested more than £500 million to modernise and extend its life well into the 2040s, securing one of the UK’s most critical pieces of national infrastructure.

However, INEOS warned that “Britain’s ruinous energy policies, including a 78% tax rate, overregulation and political hostility to oil and gas are deterring investment in the North Sea and undermining the nation’s hard-won energy independence.”

Andrew Gardner, CEO INEOS FPS said, “We should never underestimate the value of homegrown energy. North Sea oil and gas have created enormous prosperity for Britain, and they will remain essential long beyond 2050. Even as we transition to cleaner forms of energy, we will still need reliable domestic supply to power industry, transport, and homes.”

By Tsvetana Paraskova

The swap is in line with DNO’s strategy of high-grading its North Sea portfolio following the acquisition of Sval Energi AS in June 2025.

Drilling contracts and asset reshuffles offshore Norway and Greece, the new UK budget for the offshore wind auction, and renewable project updates featured in Europe’s energy industry in the past weeks.

The asset swap also strengthens Aker BP’s position in the Alvheim area and accelerates the development of the Kjøttkake discovery, Aker BP said. The agreements include Aker BP assuming operatorship of the Kjøttkake discovery in the development phase, enabling the company to leverage its fast-track development capabilities for efficient project execution.

Northern Ocean Ltd announced an extension of the contract for Deepsea Bollsta with Equinor for drilling on the huge Johan Sverdrup oilfield. In continuation of the initial 2 years firm term, the contract has now been extended by 5 months in order to complete an eight-well programme for the Johan Sverdrup Unit. The contract still includes five one-year options available for Equinor following the extension.

Offshore Greece, ExxonMobil, Energean, and Helleniq Energy have reached a farmin agreement under which Exxon will buy 60 percent in the Block 2 concession in the northwestern Ionian Sea, next to the Italian Exclusive Economic Zone (EEZ).

Energean will remain the operator of the concession during the exploration stage, but if the partners make a hydrocarbon discovery, ExxonMobil will assume operatorship during the development stage.

Block 2 is the most mature concession in Greece in terms of readiness for exploratory drilling, Energean said.

Norwegian oil and gas operator DNO ASA has streamlined its Norwegian Continental Shelf portfolio through a multi-asset swap with Aker BP ASA.

The transaction strengthens DNO’s portfolio by increasing its stake in the Verdande field in one of the company’s core areas, Norne in the Norwegian Sea, from 10.5 percent to 14 percent. Verdande is currently in advanced development and scheduled to start production later this year. In exchange, DNO will transfer its stake in the non-core Vilje field and interests in the Kveikje discovery and three exploration permits to Aker BP.

Vår Energi has awarded to Ocean Installer the project management, engineering, flexible pipelines and risers product supply contract for the Balder Next development. This contract is the first step in the Balder Next development, securing engineering for execution and long lead flexible products deliveries. If the Project FID (Final Investment Decision) is approved the remaining project scopes Ocean Installer is expected to be awarded will re-classify the full project to a major contract award for the company.

In the Danish North Sea, natural gas production at the revamped Tyra Field is ramping up, partner BlueNord said in a trading update.

The UK government has announced an £1.08 billion overall auction budget for offshore wind technologies for the Contracts for Difference (CfD) Allocation Round 7 (AR7), which industry says is insufficient for maximising the opportunities from available capacity.

“A record amount of capacity is eligible for AR7 and this fierce competition will ensure new capacity is secured at the best possible value to consumers, despite increasing global cost pressures,” Claire Mack, chief executive of Scottish Renewables, commented

A record amount of capacity is eligible for AR7 and this fierce competition will ensure new capacity is secured at the best possible value to consumers, despite increasing global cost pressures

The Tyra hub continued its ramp-up, averaging 18.9 mboepd, reaching the upper end of revised guidance of 17.0 – 19.0 mboepd. September marked the highest monthly output since restart at 22.0 mboepd, BlueNord said.

The budget “would significantly restrict that value from reaching consumers and communities. We urge careful consideration to ensure the final budget best delivers on our long-term national interests,” Mack added.

RenewableUK’s Executive Director of Policy and Engagement Ana Musat said,

“We have a record amount of offshore wind capacity eligible for this auction - more than 20 gigawatts - and the current budget would only procure about a quarter of that.”

“Given the amount of competition in this year’s auction, we expect to see competitively-priced bids, so the Government should adjust the budget to maximise procurement, which could attract up to £53 billion in private investment in the UK economy,” Musat added.

Giles Dickson, CEO of WindEurope, noted that “This budget risks severely restricting the growth of offshore wind in the UK…It would undermine the UK’s leadership on offshore wind. And impact negatively on the whole of the UK and European wind supply chain.”

The UK government’s Clean Energy Jobs Plan creates new opportunities for careers in renewables throughout the UK, RenewableUK said, commenting on the cabinet’s plan.

“This long-awaited plan delivers on employers’ calls for a coherent Government workforce strategy for clean energy and we look forward to working with Ministers to realise its ambitions,” said Jane Cooper, RenewableUK’s Deputy Chief Executive.

“We’re reaching out to other industries like oil and gas to attract workers into the clean energy sector, as they have valuable experience to offer,” Cooper added.

Separately, the offshore wind industry is offering funding worth up to £25 million to each UK-based company wanting to enter the offshore wind supply chain or to expand their existing facilities. The first ever round of the multi-million pound Industrial Growth Fund is being paid for by wind farm developers who are members of the Offshore Wind Industry Council (OWIC).

The grants will boost the volume of wind farm components being made in Britain, creating thousands of high-quality jobs throughout the country, RenewableUK said.

The UK’s carbon storage industry has reached an important milestone with the drilling of an appraisal well on the Hewett field in the Southern North Sea, for the Bacton CCS project, the North Sea Transition Authority (NSTA) said in October. This is the first carbon storage appraisal well to be drilled on acreage licensed by the NSTA as part of the world’s first large-scale carbon storage licensing round in 2023.

“The carbon storage industry has entered an exciting period of delivery, with two multibillionpound projects getting the go-ahead in the past year, unlocking thousands of supply chain jobs,” said Andy Brooks, NSTA Director of New Ventures.

“Long-held ambitions for this industry, which is essential to the UK’s energy transition, are rapidly becoming reality.”

In company news, Ørsted has signed a deal with Apollo-managed funds to sell a 50-percent equity ownership share in the Hornsea 3 Offshore Wind Farm in the UK.

With a capacity of 2.9 gigawatts (GW), Hornsea 3 will produce enough electricity to power more than 3 million UK homes. The construction of the project is progressing according to schedule for onshore and offshore activities and component fabrication, Ørsted said in early November.

TotalEnergies has signed an agreement with European data centre firm Data4 to supply renewable electricity to Data4’s sites in Spain.

The contract will begin in January 2026 for 10 years and will represent a total volume of 610 GWh. TotalEnergies will supply Data4’s facilities with renewable electricity generated by Spanish wind and solar farms with a capacity equivalent to 30 MW, which are about to start production.

“Our ‘Clean Firm Power’ solutions are specifically designed to meet our clients’ requirements in terms of cost, consumption profile, and environmental commitment,” said Sophie Chevalier, Senior Vice President Flexible Power & Integration at TotalEnergies.

“These solutions are based on our integrated power portfolio, combining both renewable and flexible assets, and contribute to achieving our target of 12% profitability in the power sector.”

Germany’s RWE has completed the installation of the foundations for the 1.1GW Thor offshore wind farm in the Danish North Sea, which will be Denmark’s largest offshore wind farm. In September, the

final of 72 monopiles for the wind turbines was installed. RWE has now finalised the installation of the associated secondary steel structures - including boat landings, main access platforms, and internal cassettes.

The turbine installation works are scheduled to be carried out from the Port of Esbjerg in Denmark, starting in the spring of 2026. Thor will be the first offshore wind farm in the world to use 36 steel turbine towers that have been manufactured with a lower carbon footprint, RWE said. In addition, some of the turbines will be equipped with recyclable rotor blades.

When fully operational in 2027, Thor will be capable of producing enough green electricity to supply the equivalent of more than one million Danish households.

France-based green and renewable hydrogen producer Lhyfe has inaugurated its first commercial production site in Germany, in Schwäbisch Gmünd in the state of BadenWürttemberg. Lhyfe will distribute green hydrogen to a range of players from its first production site outside France.

On a one-hectare plot of land in Schwäbisch Gmünd, Lhyfe has installed a plant capable of producing up to 4 tonnes of renewable hydrogen per day, with an installed capacity of 10 MW. The hydrogen, produced via the electrolysis of water using renewable energy, will be used to decarbonise heavy-duty mobility and industry.

In heavy-duty transport, for instance, 4 tonnes of renewable hydrogen is enough to power 100 trucks for around 400 km per day, without emitting any CO2, the French company said.

By Tsvetana Paraskova

US oil production is hitting recordhigh levels while the Trump Administration moves to ease energy and power regulations and authorise new LNG export projects.

US Secretary of Energy Chris Wright has directed the Federal Energy Regulatory Commission (FERC) to initiate rulemaking procedures with a proposed rule to rapidly accelerate the interconnection of large loads, including data centres. This would position the United States to lead in AI innovation and in the revitalization of domestic manufacturing.

The proposed rule allows customers to file joint, co-located load and generation interconnection requests. It is also expected to significantly reduce study times and grid upgrade costs, while reducing the time needed for additional generation and power to come online.

Secretary Wright also directed FERC to initiate rulemaking procedures with a proposed rule to remove unnecessary burdens for preliminary hydroelectric power permits. Secretary Wright’s proposed rule clarifies that third parties do not have veto rights over the issuance of preliminary hydroelectric power permits.

“President Trump and Secretary Wright have been clear: The United States is experiencing an unprecedented surge in electricity demand and the United States’ ability to remain at the forefront of technological innovation depends on an affordable, reliable, and secure supply of energy,” the US Department of Energy said.

At the end of October, Secretary Wright signed the final export authorisation for Venture Global’s CP2 LNG Project in Cameron Parish, Louisiana. The authorisation allows exports of up to 3.96 billion cubic feet per day of U.S. natural gas as liquefied natural gas (LNG) to non-Free Trade Agreement (FTA) countries.

Xclosed in July the $15.1 billion project financing for the first phase of its third project, CP2 LNG, together with the associated CP Express Pipeline. Top exporter Cheniere has made a positive FID for the Corpus Christi Midscale Trains 8 and 9 and Debottlenecking Project. NextDecade has decided to invest $6.7 billion in the expansion of its Rio Grande LNG facility in Texas, in the second Rio Grande expansion announced this year, while Sempra approved a $14 billion Port Arthur LNG Phase 2 expansion.

As a major LNG exporter, the US, alongside Qatar, called on the European Union to significantly amend or rescind proposed corporate climate regulations that include penalties on companies for non-compliance.

President Trump and Secretary Wright have been clear: The United States is experiencing an unprecedented surge in electricity demand...

“Finalizing the non-FTA authorization for CP2 LNG will enable secure and reliable American energy access for our allies and trading partners, while also providing well-paid jobs and economic opportunities at home,” said Kyle Haustveit, Assistant Secretary of the Office of Fossil Energy.

As several LNG export plants ramp up and others are expected to begin commercial operations in the near future, the US is strengthening its global lead as the world’s biggest exporter of liquefied natural gas.

So far this year, Australia’s Woodside has announced the FID for the Louisiana LNG project, with plans to start production in 2029. Venture Global took FID and successfully

US Calls on Europe to Revise Due Diligence Directive

Secretary Wright and Qatari Minister of State for Energy Affairs, Saad Sherida Al-Kaabi, in October sent a letter to the heads of state of EU member states regarding the European Union's proposed Corporate Sustainability Due Diligence Directive (CSDDD).

In the letter, the US and Qatari top energy officials expressed “deep concern over the continued lack of action to address the universally acknowledged, serious, and legitimate concerns raised by the global business community regarding the Corporate Sustainability Due Diligence Directive (CSDDD). Particularly its unintended consequences for LNG export competitiveness and the availability of reliable, affordable energy for EU consumers.”

“We have consistently and transparently communicated how the CSDDD, as it is worded today, poses a significant risk to the affordability and reliability of critical energy supplies for households and businesses across Europe and an existential threat to the future

growth, competitiveness, and resilience of the EU's industrial economy,” the officials wrote.

“It is our genuine belief, as allies and friends of the EU, that the CSDDD will cause considerable harm to the EU and its citizens, as it will lead to higher energy and other commodity prices, and have a chilling effect on investment and trade.”

The EU member states are being urged to either repeal the CSDDD or remove the most economically damaging provisions such as the Directive's extraterritorial application, penalties, and civil liability of companies.

Meanwhile, the Americas LNG Summit & Exhibition in Lake Charles, Louisiana, discussed the economic impact of the US LNG export industry.

LNG projects continue to drive economic growth, workforce opportunities, and responsible development across the US Gulf Coast, panellists including Tim Tarpley, president of the Energy Workforce & Technology Council (EWTC), heard.

US LNG plays a critical role in meeting global energy demand while supporting American jobs, investment, and innovation at home, according to industry leaders.

Speakers highlighted the importance of a strong supply chain and a predictable regulatory environment to keep projects on track and maintain the US position as a trusted energy partner abroad.

EWTC’s Tarpley highlighted the stabilising effect of US LNG exports on domestic manufacturing and gas production, which in turn strengthens the energy workforce and broader economy. Tarpley also emphasised the need for permitting reform to accelerate LNG infrastructure and ensure growth across all US basins. The benefits of LNG extend far beyond individual projects, fuelling opportunity throughout the energy value chain, the executive said.

EWTC has also unveiled the Surface Operations Industry Guidelines, developed through the Well Stimulation Committee. These guidelines fill a long-standing gap in the sector by creating a single reference for handling surface operations. Built by people who do the work every day and combining technical knowledge with field experience, the guidelines represent an important step toward consistent, proactive safety practices across the industry, EWTC said.

The industry must take the lead on safety rather than waiting for outside regulation, said Ron Gusek, EWTC Vice Chair and president and CEO of Liberty Energy. Proactive standards like this put the industry in a stronger position and build public trust, Gusek added.

According to John Hutchison, District Manager at ProFrac Services, the guidelines create consistency between service companies and operators by more clearly defining hazard zones and improving communication before operations begin. Early collaboration with operators is key to building safety-focused relationships and ensuring everyone on-site is aligned, Hutchison noted.

Energy Workforce president Tarpley discussed in October the future of global energy with the Greater Houston Partnership and energy leaders from across the industry and government.

US policy must keep pace with market realities, Tarpley said, noting that “We need energy. We need a lot more energy, and that realization is starting to happen in the U.S. and all over the world—on both sides of the political aisle.”

By Tsvetana Paraskova

“Regulation without realism and legislation without logic, will only weaken economies, stunt societies and drive capital away,” the executive added.

Abu Dhabi hosted in November one of the biggest energy conferences in the world, ADIPEC, at which major UAE companies signed strategic deals and top officials noted the importance of continued investment in global oil and gas exploration and production.

Sultan Ahmed Al Jaber, UAE Minister of Industry and Advanced Technology and Managing Director and Group CEO of Abu Dhabi’s national oil company ADNOC, called on energy industry leaders, policy makers, and investors to follow the UAE’s lead and drive pragmatic policies and bold partnerships, to boost job creation, economic growth, and global competitiveness.

Energy and investment policies globally should be “pragmatic, not performative, based on insight, not ideology, built on first principles, not fleeting popularity,” Al Jaber said in his keynote address at the world’s largest energy event, ADIPEC.

“At ADNOC, we are using every technology available, including AI and robotics to collapse time and expand value. Through our homegrown company AIQ, we have embedded over 200 AI use cases, from the wellhead to the trading floor. These tools are cutting unplanned shutdowns by half and enhancing performance across our business,” ADNOC’s top executive said.

Al Jaber also called on the energy industry, policy makers and investors to “tune out the noise, track the signal” as geopolitics shape trade and news flows and sentiment moves markets.

“The signal is telling us that near-term uncertainty is real, while long-term demand remains strong. It is telling us to balance cost discipline with capital investment. Stay laser-focused on efficiency, while investing in people, technology and AI.”

Global annual capital investment needs in grids, data centres and all sources of energy have jumped to $4 trillion because “you can’t run tomorrow’s economy on yesterday’s grid,” Al Jaber noted.

Global electricity demand will keep surging through 2040, as power for data centers surges four-fold, 1.5 billion people will move into cities, and more than 2 billion air conditioners will come online. Aviation will also take off, with the global airline fleet doubling from 25,000 to 50,000 planes by 2040.

“As a result, renewables will more than double by 2040; LNG will grow by 50 percent; jet fuel will increase more than 30 percent and oil will stay above 100 million barrels per day beyond 2040, increasingly used not just for mobility, but more and more for materials,” Al Jaber said.

“What we are really talking about here is energy reinforcement not replacement.”

On the sidelines of ADIPEC, the UAE and ADNOC signed several major deals to power the AI advancement and invest in reliable energy.

ADNOC, Masdar, XRG, and Microsoft in early November announced a strategic agreement to accelerate artificial intelligence (AI) deployment across ADNOC’s value chain, and to deliver energy solutions for Microsoft’s global AI and data centre growth. The collaboration was announced at the ENACT Majlis in Abu Dhabi, ahead of ADIPEC.

Under the agreement, ADNOC and Microsoft will jointly develop and deploy AI agents to drive autonomous operations and unlock greater efficiency, building on ADNOC’s successful deployment of AI solutions across its value chain. Microsoft will also provide advanced AI tools and upskilling programmes, while both companies will explore a joint innovation ecosystem to create transformative solutions for the energy sector.

“As AI continues to reshape how value is created and enhanced across industries, ADNOC, Masdar and XRG are not only embedding AI into every layer of our operations - we are also advancing the energy systems that will power AI itself,” said Al Jaber, who is also executive chairman of XRG and chairman of Masdar.

“Through our partnership with Microsoft, we are unlocking new opportunities to fuel the future of AI, drive greater performance, and future-proof our business.”

ADNOC has also signed three agreements with Gecko Robotics to explore deploying robotics and AI across ADNOC’s operations and boosting future skills training for UAE nationals. The agreements cover a multiyear technology deployment for ADNOC Gas, joint training programmes with the ADNOC Technical Academy (ATA), and the rollout of robotics and AI-powered analytics across ADNOC’s assets to enhance efficiency, reduce downtime and support data-driven maintenance.

“There is a race to lead the AI and energy moment. And the energy companies that win won’t just utilize technology, they will become technology companies,” Gecko Robotics CEO Jake Loosararian said.

“There is only one way to win this race and that’s to acquire physical data using robotics and unlocking human and machine performance from the AI that data fuels.”

ADNOC has also teamed up with top oilfield services provider SLB to use an AI-powered Production System Optimization (AiPSO) platform with initial deployment across eight fields.

Powered by SLB’s Lumi data and AI platform and leveraging Cognite Data Fusion, AiPSO uses millions of real-time data points, AI, and ADNOC proprietary machine learning to proactively monitor and optimize the entire production system, comprising thousands of hydrocarbon wells and hundreds of processing facilities.

The deployment supports ADNOC’s ambition to become the world’s most AI-enabled energy company, the Abu Dhabi firm said.

petrochemical feedstocks. Under the terms of the long-term agreements, which are up to 10 years, TA’ZIZ will supply Sanmar with over 350,000 tonnes per annum of ethylene dichloride (EDC) and vinyl chloride monomer (VCM). The products will be produced at the TA’ZIZ Chemicals Industrial Zone in Al Ruwais Industrial City in Abu Dhabi and represent the first time either chemical has been exported from the UAE.

Saudi Aramco, the world’s largest oil firm by production and market value, reported solid third-quarter results, with adjusted net income rising slightly compared to a year ago, as higher production offset the impact of lower oil prices.

Aramco’s ability to adapt to new market realities has once again been demonstrated by our strong third quarter performance.

In energy supply, ADNOC has signed a 15-year Sales and Purchase Agreement (SPA) with Shell for the delivery of up to 1 million tons per annum (mtpa) of LNG, ADNOC’s first long-term LNG sales agreement with Shell and the eighth long-term offtake agreement secured for the Ruwais LNG project.

At ADIPEC, TA’ZIZ announced the award of a $1.99 billion Engineering, Procurement and Construction (EPC) contract to China National Chemical Engineering & Construction Corporation Seven, Ltd. (CC7), to build the UAE’s first, and among the top three largest integrated single-site polyvinyl chloride (PVC) production complexes in the world.

TA’ZIZ also announced two product sale agreement term sheets with The Sanmar Group of India, a leading producer of PVC and specialty chemicals, for the supply of key

Saudi Aramco’s adjusted net income inched up to $28.0 billion, up from $27.7 billion for the third quarter of 2024. Cash flow from operating activities and free cash flow also grew by about $1 billion each, to $36.1 billion and $23.6 billion, respectively.

“Aramco’s ability to adapt to new market realities has once again been demonstrated by our strong third quarter performance. We increased production with minimal incremental cost, and reliably supplied the oil, gas and associated products our customers depend on, driving strong financial performance and quarterly earnings growth,” president and CEO Amin Nasser said.

Saudi Arabia’s sovereign wealth fund, the Public Investment Fund (PIF), and Aramco have signed a non-binding term sheet outlining the key terms for Aramco to acquire a significant minority stake in HUMAIN, a

PIF company, advancing a full range of AI capabilities globally.

PIF and Aramco would contribute AI assets, capabilities, and talent into HUMAIN, with PIF and Aramco as its shareholders. PIF would continue to own the majority of HUMAIN. The intention is to enable the rapid scaling up of HUMAIN’s operations to capture value and accelerate its growth in the AI sector.

“Aramco is well positioned to capture opportunities from rising energy demand linked to AI growth, using advanced technologies to improve efficiency, reduce emissions, and sustain our competitive edge as one of the world’s leading integrated energy and chemicals companies,” Nasser said.

In Qatar, state firm QatarEnergy has awarded Samsung C&T Corporation the engineering, procurement, and construction (EPC) contract for a landmark carbon capture and sequestration (CCS) project to serve QatarEnergy’s existing LNG production facilities in Ras Laffan Industrial City.

QatarEnergy has also agreed on a 17-year Sales and Purchase Agreement (SPA) with Indian firm Gujarat State Petroleum Corporation (GSPC) for the supply of up to 1 million tons per annum (MTPA) of LNG to India. Pursuant to the terms of the SPA, the contracted LNG volumes will be delivered exship to terminals in India, starting in 2026.

QatarEnergy has also completed a farm-in transaction with Eni, acquiring a 40-percent participating interest in the North Rafah exploration block offshore Egypt.

The agreement, recently approved by the government of Egypt, grants QatarEnergy a 40-percent stake in the offshore concession, with Eni, as the operator, retaining the remaining 60-percent interest.

By Tsvetana Paraskova

Norway expects high oil and gas production and budget revenues from the petroleum industry in its 2026 budget, while power from shore, or electrification of oil and gas fields, has helped the country reduce its emissions from the upstream sector.

“The revenues from the petroleum industry are very large and important for financing our welfare state. The revenues in 2025 provides a basis for public spending of close to 20 billion NOK every year going forward. The way we manage the revenues ensures that they benefit both current and future generations,” Minister of Energy Terje Aasland said.

Total petroleum production in Norway is expected at 238 million standard cubic meters (Sm3) of oil equivalents in 2025. The estimate is about 1.3 percent lower than in 2024, when the petroleum production on the Norwegian continental shelf reached the highest level since 2008.

But investments are expected to decline as the large projects are completed, which could hurt the domestic supply chain, the ministry warned.

“The supply industry needs new projects going forward to sustain value creation, competence and employment in Norway. To do so, it is crucial with new developments which the supply industry can compete for,” Aasland said.

We will develop, not dismantle, the activity on the Norwegian continental shelf

“Over the next few years, production is expected to remain at a stable, high level before it is expected to decline throughout the 2030s as fields are depleting,” the Ministry of Energy said. “Without continued exploration and investment in discoveries and existing fields, oil and gas production on the Norwegian continental shelf will decline significantly.”

Norwegian petroleum production plays an important role in ensuring energy security in Europe, minister Aasland noted.

Norway’s government expects in the National Budget 2026 the state’s net cash flow from petroleum activities would be 664 billion Norwegian crowns, or $65.8 billion, in 2025. The estimate for 2026 is about 521 billion crowns, or $51.6 billion, in net cash flow from petroleum activities for Norway.

The world and Europe will need oil and gas for decades to come, and it is therefore crucial that Norway continue to develop the shelf to remain a stable and long-term supplier of energy.

“Therefore, the government wants to ensure stable and predictable regulatory framework, and a high level of exploration activity,” said Aasland.

Ongoing construction and development projects have contributed to a high level of activity and large investments on the continental shelf in recent years. The investments in the petroleum industry are estimated to account for 23 percent of the total investments in Norway in 2025.

“The government facilitates continued exploration, increased extraction and development of discoveries though stable and predictable regulatory framework,” the minister noted.

“We will develop, not dismantle, the activity on the Norwegian continental shelf.”

The Norwegian Offshore Directorate in November announced new guidelines for documents related to the storage of CO2 on the Norwegian continental shelf.

The goal of drawing up the guidelines is to ensure that the Norwegian authorities receive status reports with the correct content and in the correct format.

As of October 2025, Norway’s authorities had awarded 14 licences pursuant to the Regulations relating to storage and transport of CO2 on the shelf.

Under the regulations, licensees shall submit a status report to the Norwegian Offshore Directorate within three months after an exploration or exploitation licence is surrendered, lapses, or expires.

The status report shall provide a summary of any collected data, studies and associated results, as well as an overview of potential storage sites in the exploration or exploitation

licence. It shall also provide an overview of all geotechnical material and where such material is stored.

Norway’s offshore oil and gas industry has seen greenhouse gas emissions drop by 27 percent, or by 4.1 million tonnes, since 2015, thanks to power from shore as a replacement for gas turbines at oil and gas fields, the Norwegian Offshore Directorate said in a new report

Greenhouse gas emissions from the petroleum sector account for about a quarter of Norway’s total emissions. Power from shore has been the most important measure for reducing these emissions. The increase in the number of power from shore projects that have been approved since 2020 is a result of factors such as increased carbon dioxide (CO2) costs.

Work is also under way on other measures to reduce emissions from Norway’s petroleum sector. Among these, the industry considers energy efficiency measures and reduced flaring to be the most important, according to the directorate.

Between 2020 and 2025, the number of fields offshore Norway that have or have decided to use power from shore increased from 16 to 39 when associated fields are included. Additional emission reductions are expected once all the projects under development become operational, the offshore regulator said.

Transitioning to power from shore has been approved on Sleipner, Njord, Draugen, Oseberg field centre, Oseberg Sør, Troll B and C, as well as the Hammerfest LNG onshore facility. A decision has also been made to develop the fields in the Yggdrasil area using power from shore.

Replacing gas turbines with power from shore has contributed to a significant reduction in greenhouse gas emissions, the directorate’s report found.

From 2019 to 2024, emissions from the NCS were reduced by 2.9 million tonnes of CO2equivalent. Since 2015, the reduction amounts to 4.1 million tonnes of CO2-equivalent, or 27 percent. Additional emission reductions are expected when all projects currently under development come on stream.

While some more challenging projects for power supply from the shore have been discarded as uneconomical, studies are currently under way on the Balder and Grane fields in the North Sea. The timing of a potential investment decision is planned for 2026.

In alternative energy solutions, Norway’s hydrogen producer Gen2 Energy and Germany’s energy company MB Energy have signed a Memorandum of Understanding (MoU) to collaborate on production, offtake, and distribution of Renewable Fuels of nonbiological origin (RFNBO)-compliant liquid hydrogen from Gen2 Energy’s project portfolio in Norway to MB Energy’s end customers in Germany. The companies will assess various logistics and transport options, taking into account price, as well as technical and safety implications.

“Our collaboration with MB Energy provides access to the German market. Producing RFNBO compliant liquid Hydrogen at industrial scale requires access to a significant hydrogen market, including Germany”, said Lena Halvari, CEO of Gen2 Energy.

“We are pleased to see that the production and supply chain under our development can serve customers like MB Energy that see green liquid hydrogen as a valuable enabler of the energy transition.”

By Tsvetana Paraskova

Australia’s biggest oil and gas companies projected optimism at their earnings and outlook releases, while Australia’s government continues to work to boost the rollout of renewable energy.

Following the withdrawn bid from an Abu Dhabi-led consortium to buy Santos, the Australian energy giant reported solid quarterly results for the third quarter of 2025, as the firm transitions from a period of high capital intensity to one that it expects to deliver stronger returns for shareholders.

Third-quarter sales volumes were lower than the second quarter, mainly due to maintenance activities in Western Australia, lower crude oil volumes due to timing of liftings, and lower third-party gas purchases. January-September sales volumes were slightly higher than the prior year.

Santos narrowed its production guidance for this year to between 89 million and 91 million barrels of oil equivalent (boe), down from the previous guidance of 90-95 million boe.

The downgrade primarily reflects a slower-thananticipated start-up of the floating production, storage, and offloading vessel (FPSO) at the new Barossa LNG project and the impact of floods on the company’s production in the Cooper Basin. Going forward, Santos expects the Barossa LNG project in Australia and the Pikka oil project in Alaska to boost its oil and gas production by 30 percent by 2027, compared to 2024 levels.

Xsix months of operations, September 2024 –March 2025.

Moomba CCS demonstrates the real potential for large-scale emissions reduction to be delivered by carbon capture and storage projects in Australia, according to CEO Gallagher.

Momentum is also building around our Narrabri Gas Project, with strong market interest reflected in recent MOUs and ongoing engagement with key stakeholders.

“With around $1.4 billion of free cash flow from operations generated year-to-date, Santos is well positioned to deliver strong shareholder returns with imminent production growth as we bring Barossa LNG online and move closer to the start-up of Pikka,” said Santos managing director and CEO Kevin Gallagher.

“Momentum is also building around our Narrabri Gas Project, with strong market interest reflected in recent MOUs and ongoing engagement with key stakeholders. Narrabri is the key to solving east coast gas supply concerns and would be a competitive supply source for local industry for decades to come,” Gallagher added.

Santos has also announced that its Moomba Carbon Capture and Storage (CCS) project achieved a major milestone for emissions reduction technology in Australia after receiving the single largest issuance of Australian Carbon Credit Units (ACCUs) from the Clean Energy Regulator (CER). The CER confirmed the issuance of 614,133 ACCUs to Santos under the approved CCS method, covering the Moomba CCS project’s initial

“Policymakers should seize the opportunity to deploy CCS to reduce emissions faster, at scale and cost competitively – particularly when Australia has a unique and natural advantage in carbon capture and storage that is complemented by a well-established, worldclass regulatory regime administered by the Clean Energy Regulator,” the executive added.

The other major Australia-based oil and gas producer, Woodside, reported solid production for the third quarter and raised its full-year guidance on the back of strong performance across assets.

Guidance was revised up in the range 192 –197 million barrels of oil equivalent (boe) for 2025, up from 188 million boe – 195 million boe previously anticipated. Unit production cost is now seen at between $7.60 and $8.10 per barrel this year, down from the previous guidance of $8.0 - $8.50 a barrel.

The company’s Scarborough Energy Project is now 91 percent complete and on track for first LNG in the second half of 2026, chief executive officer Meg O’Neill said.

At the 2025 Capital Markets Day in November, Woodside outlined its strategy to thrive through the energy transition and deliver long-term shareholder value by meeting rising global demand for affordable, reliable, lower-carbon energy.

“Over the next decade, with disciplined capital management, we will execute our strategy by maximising performance from our base business, delivering cash-generative projects to sustain and grow the business and creating the next wave of future opportunities for long-term returns for our shareholders,” O’Neill said.

Woodside expects its net operating cash to rise to around US$9 billion by the early 2030s, representing a more than 6 percent compound annual growth rate in sales and cash flow from 2024 and providing a pathway to a 50-percent increase in dividend per share from 2032.

“Our strategy is supported by ongoing robust global demand for our products. Woodside’s major growth projects will capitalise on this demand, with the Beaumont New Ammonia project expecting first ammonia this year, the Scarborough Energy Project on track to begin LNG shipments in the second half of next year, the offshore Mexico Trion field targeting first oil in 2028, and Louisiana LNG targeting startup in 2029,” O’Neill noted.

“With global LNG demand forecast to grow 60% by 2035, Woodside’s increasing scale across the Atlantic and Pacific basins, combined with our marketing and trading business, optimises our capability to meet customer needs.”

APA Group, for its part, has launched construction of the Sturt Plateau Pipeline (SPP), which is the crucial first-stage link to enable Beetaloo gas to reach power generation assets that keep the lights on across the Northern Territory.

SPP will play an important role in transporting Beetaloo gas to APA’s existing Amadeus Gas Pipeline, to power generation assets in Darwin.

Over the coming months the 37-kilometre pipeline will be welded together to ensure Beetaloo gas can flow in 2026.

“The SPP will help ensure Beetaloo gas is available to power the Territory, a critical first step in the basin’s development. Households and businesses in Darwin will be the first beneficiaries of this new infrastructure,” APA CEO and managing director Adam Watson said.

The Clean Energy Council has welcomed the federal government’s proposed reforms to the Environment Protection and Biodiversity Conservation Act 1999 (EPBC Act), describing them as a timely and balanced step towards protecting Australia’s environment while delivering the clean, reliable electricity the nation needs.

The long-anticipated reforms are pragmatic and thorough, providing the industry with greater clarity for the task ahead, of delivering a timely and successful renewables rollout, Clean Energy Council CEO, Jackie Trad, said.

The broader reform package also pledges to have clearer, more consistent guidance for the clean energy sector and a more streamlined approval process. Projects will be assessed and decided more efficiently, without compromising rigorous environmental standards, according to the proposed changes.

“The reforms provide us the certainty and confidence to continue delivering the

renewable energy projects that power Australian homes and businesses, while safeguarding the environment for generations to come,” Trad commented.

Despite growing power demand, wholesale electricity prices across all National Electricity Market (NEM) regions fell during the September 2025 quarter, thanks to higher renewable energy output and less market volatility, the Australian Energy Market Operator’s (AEMO’s) Quarterly Energy Dynamics report has shown.

Wholesale electricity prices for the NEM averaged AUS$87 per megawatt hour (MWh) in the September quarter, down by 27 percent year-on-year and down 38 percent compared to the second quarter of 2025, the report found.

“The impact of increasing renewable energy and storage connecting to the NEM became more evident in September when milder temperatures and less cloudy days led to a new 77.2% renewable contribution record on 22 September – up from 75.6% in Q4 2024,” said Violette Mouchaileh, AEMO Executive General Manager Policy and Corporate Affairs.

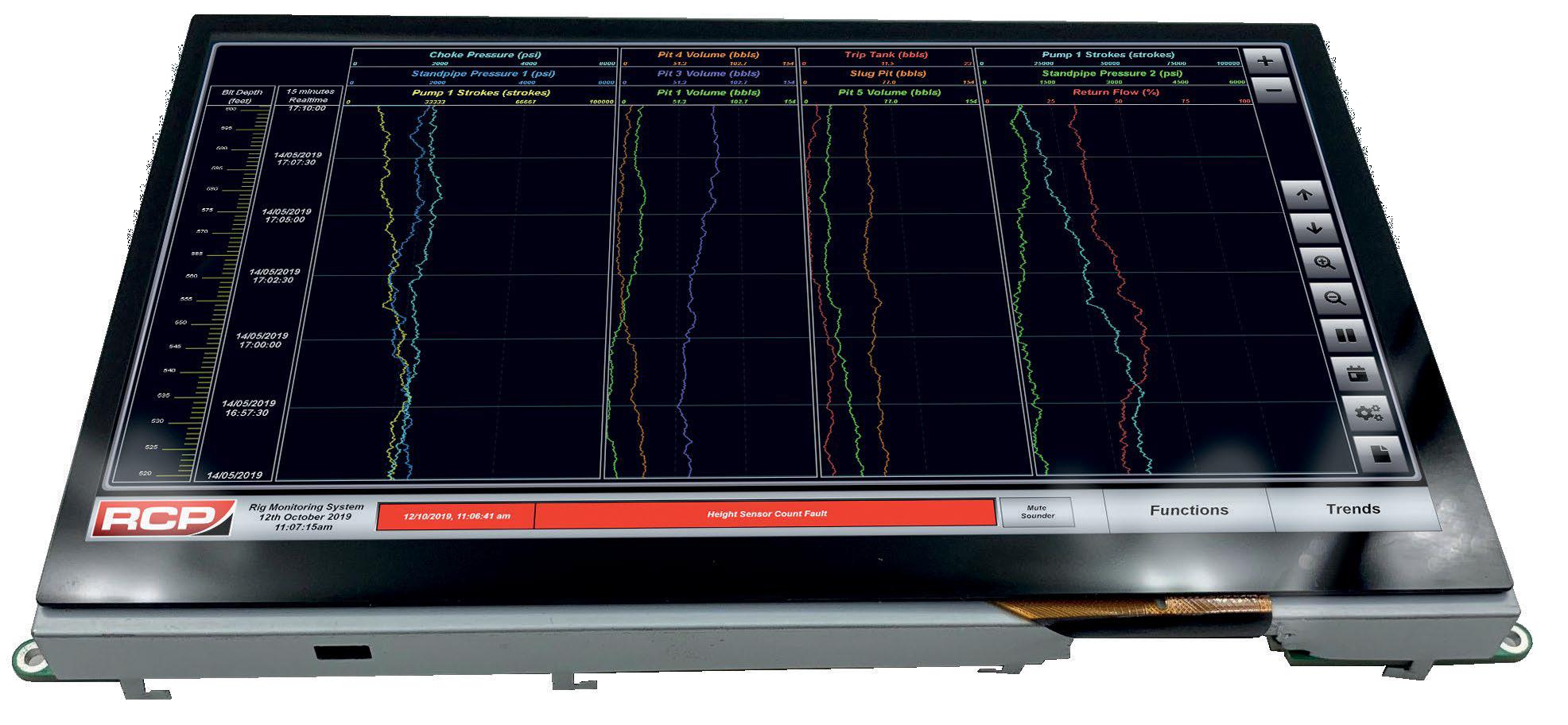

The RCP EDR is designed to give operators a clear, unambiguous overview of critical drilling and mud data processes. The system has been developed by RCP to greatly improve how information is presented using the latest industrial technologies and user-friendly interfaces.

The RCP EDR offers a quick and cost-effective solution for clients considering a new installation or a partial upgrade to their existing drilling instrumentation systems. Our highly experienced engineers and software developers allows us to tailor each new system to meet your exact needs meaning that you do not pay for functionality you will never use.

The RCP EDR utilizes a variety of sensing technologies to monitor the drilling processes, (typically: Level, Pressure, Height, Temperature and Flow). Sensor output signals are received by the distributed I/O racks and are then processed by the EDR.

Processed information is then transmitted through network communication modules to each of the user interfaces including remotely networked PC’s and local HMI’s. System and operator interface communications may utilize either: Fibre-Optic, Profinet, Profibus or Industrial Ethernet connection.

1

1 year ago (2024):

Brent traded around US$80–81/ bbl. Prices were supported by strong post-pandemic demand, OPEC+ production management, and ongoing geopolitical risks that tightened global supply and kept the market relatively firm throughout the year.

5 YEARS AGO

5 years ago (2020):

Brent hovered near US$42/bbl. The extremely low price was primarily driven by the COVID-19 pandemic, which caused a historic fall in global fuel demand and briefly led to severe storage shortages and supply-chain disruptions worldwide.

10 YEARS AGO

10 years ago (2015):

Brent crude averaged around US$52–53/bbl. Prices were still recovering from the dramatic 2014 collapse, which was driven by surging U.S. shale production and OPEC’s decision not to cut output, flooding the market with excess supply.

November 2025

Brent crude trades near US $62.4 per barrel. This level reflects a recent modest rebound after a dip earlier in the week, though overall the market remains under pressure from concerns about surplus supply and slower demand growth.

At the heart of OGV Media Group is the OGV Community, a corporate membership service that connects energy sector organisations with our growing network of professionals, leveraging member engagement and platform traffic to maximize brand exposure.

Subscription to the OGV Community offers its members the following growing list of benefits:

SPONSORED BY

www.eicdatastream.the-eic.com

Energy projects and business intelligence in the energy sector

The EIC delivers high-value market intelligence through its online energy project database, and via a global network of staff to provide qualified regional insight. Along with practical assistance and facilitation services, the EIC’s access to information keeps members one step ahead of the competition in a demanding global marketplace.

The EIC is the leading Trade Association providing dedicated services to help members understand, identify and pursue business opportunities globally.

It is renowned for excellence in the provision of services that unlock opportunities for its members, helping the supply chain to win business across the globe.

The EIC provides one of the most comprehensive sources of energy projects and business intelligence in the energy sector today.

bp has confirmed the presence of a substantial hydrocarbon column of approximately 1,000 metres, including around 100 metres of oil and 900 metres of liquids-rich gas condensate. Planning for appraisal activities is underway, with well operations expected to begin in 2027, subject to regulatory approval. The operator has also indicated that one possible development option for the discovery is an early production system.

PV Drilling has been awarded the drilling contract for the project. The drilling operations are scheduled to take place between March 2027 and August 2027 with 40 development wells expected to be drilled.

In addition, Velesto was previously awarded a drilling contract with drilling activities expected to commence in the H1 2026.

SLB OneSubsea has secured the EPC contract for the SPS scope of the project. The scope of work includes the supply of horizontal subsea trees, umbilicals, control systems and associated services.

The Saipem and BOS Shelf joint venture has been awarded three offshore contracts worth around $700 million for the SDC project. The contracts cover the transportation and installation of the SDC platform, along with the engineering, procurement, construction, and installation of subsea structures and approximately 26 km of new offshore pipelines linking the SDC platform to existing Shah Deniz infrastructure.

According to BW Energy, the project’s FID is expected before year-end, but the analyst assumes that sanctioning could be reached by Q1 2026. The project will feature the drilling of three new wells and will utilise the BW Energy Jasmine rig to be converted to a wellhead platform. The discovery’s recoverable resources have been updated to 18MMbbls.

Halliburton has been awarded an integrated drilling services contract in the project. The company’s project management team will lead execution, and deploy remote operations and automated technologies for the work.

The contracting activities for the FEED work and Long Lead Items (LLIs) are still ongoing and remain ahead of schedule. Completion of the PoD is expected in Q4 2025 with FID targeted for June 2026 and first gas anticipated by Q4 2028.

Tenaris will supply casing and tubing for the project, as well as line pipe and casing for bends, flowlines, and risers forming part of the subsea infrastructure. The contract covers 12,000 tonnes of casing and tubing, including 1,600 tonnes made of Super 13 Chrome steel. For the line pipe scope, Tenaris will deliver approximately 16,000 tonnes of pipe for flowlines and risers.

Bomesc Offshore Engineering has secured contracts worth up to US$240m to design and build topsides modules for an undisclosed FPSO in Guyana. The work will include chemical skids, electrical rooms, and water treatment systems. Delivery is scheduled between 2026 and 2027, with the topsides module package expected to be completed by June 2027, and the chemical skid, electrical, and water treatment modules by January 2027. Additionally, agreements were signed with ABB and VWS Westgarth, which will be responsible for the electrical systems and sulphate removal water treatment, respectively

Gas

ADNOC Gas has initiated the bidding process for at least three EPC packages for Bab Gas Cap (BGC). The packages cover early works, onshore pipelines, and process buildings. The project, estimated to aims to enhance gas recovery and condensate production from the Bab field. The project is expected to reach FID in 2026, with completion targeted by 2030.

COOEC has been awarded the EPC contract for the project. The EPC scope covers the engineering, procurement, installation, and commissioning (EPIC) of over 60 offshore oil and gas structures, 40 subsea pipelines and cables, as well as modifications to existing platforms and the decommissioning of outdated facilities. KBR has been awarded a contract for detailed engineering service for the project.

Kuwait Oil Company (KOC), a subsidiary of Kuwait Petroleum Corporation, has announced a major offshore discovery at the Jazah field. The field delivered the highest vertical well production in Kuwait’s history from the Maqwa formation, producing over 29 million cubic feet of gas and more than 5,000 barrels of condensate per day. Jazah spans 40 square kilometres and holds an estimated 1 trillion cubic feet of natural gas and 120 million barrels of condensate.

The marine and lifting industries are set to benefit from rising investment in offshore oil and gas as producers look to boost resources to meet growing global energy demand.

By Tsvetana Paraskova

The energy logistics market, for its part, has thrived in recent months as oil and LNG exports continue to rise and the number of long-haul voyages increases as energy buyers have to navigate through geopolitical upheavals and sanctions regimes on major oil exporters. The shipping sector is also looking to move to cleaner marine fuels to reduce emissions.

The offshore sector is seen as key to bridging the gap between energy needs and reducing emissions in the energy transition, analysts at Rystad Energy said earlier this year.

Offshore oil and gas development was once poised to be the global leader of supply growth between 2004 and 2012, but the rise and boom of the US shale revolution overshadowed the prospects of offshore oil and gas, said Maierdan Halifu, regional research director for North America.

“Offshore is witnessing a rebirth as competitiveness improves, positioning the sector well for steady future expansion, albeit at a more modest pace than initially anticipated. This resurgence sees Brazil and other basins in the Americas and Africa show strong growth, while East Africa presents significant LNG potential,” Halifu said.

Last year, offshore oil production hit 28.4 million barrels per day (bpd), which was nearly a third of the world’s total output. Offshore gas production was also substantial, hitting about 115 billion cubic feet per day (Bcfd), and accounting for about 30 percent of global gas supply, according to Rystad Energy data. For 2024, the global average of mobile offshore drilling units (MODU) on contract was 550 units (408 units for jackup, 82 for drillship, and 60 for semisub), resulting in a marketed utilisation rate of 88 percent. These three rig types combined drilled about 2,600 offshore wells.

Last year saw one of the lowest volumes of new discoveries in two decades, but a staggering 80 percent of those were made offshore, primarily in deepwater, the intelligence firm said.

Rystad Energy expects deepwater supply to outpace US shale growth in the next few years, Halifu said. The key regions to watch for future offshore crude oil supply are the Gulf of America (Gulf of Mexico), the GuyanaSuriname Basin, Brazil’s pre-salt region with the Santos and Campos Basins, and West Africa, particularly Namibia and Angola.

“These areas have seen significant discoveries and investment and are expected to contribute substantially to global supply,” Halifu noted.