Tuesday 18th November 7.30pm - 11pm OGV TAPROOM

BRIDGE PLACE I ABERDEEN I AB11 6HZ

Join WAES as we host a networking reception party with live entertainment that will provide you with opportunities to expand your business network, develop local contacts and blow off some steam after a busy day at the show.

As the global energy landscape undergoes a profound transformation, Africa is emerging as both a cornerstone of supply security and a frontier of new opportunity.

With shifting trade dynamics, growing demand for natural gas, and an urgent need to expand energy access across emerging economies, the world is turning to Africa’s vast resources, essential for balancing global markets and driving sustainable industrialisation,

Set against this backdrop, the Wider African Energy Summit (WAES) 2025, taking place in Aberdeen, Scotland, brings Africa’s energy future to one of the world’s most respected energy hubs. More than a conference, WAES is a platform for strategic dialogue, deal-making, and partnership, a global stage where African leadership and international investment converge to shape the next chapter of global energy,

Returning stronger and broader in 2025, WAES will convene government representatives, global investors, industry executives, and innovators for two days of focused engagement. The mission is clear, to accelerate access, investment, and development across Africa’s energy value chain, and to make energy poverty history by 2030,

Day One sets the tone for the summit with an inspiring Opening Address from Dr. Ollie, followed by NJ Ayuk of the AEC setting the scene for a powerful discussion on Africa’s evolving role in the global energy mix. A high-level Keynote Panel on Shaping Africa’s Energy Future outlines a continental vision for growth and transition, setting the agenda for the conversations to follow,

Subsequent sessions delve into the continent’s diverse energy mix, exploring how traditional resources can be leveraged alongside renewables to maximise value and sustainability. Industry showcases spotlight innovations in retrofitting and technology adaptation, while finance leaders from Standard Bank, Argentil Capital Partners, and the Africa Finance Corporation examine how capital, technology transfer, and localisation can unlock Africa’s full potential,

The afternoon sessions highlight the Just Energy Transition, exploring how Africa can balance growth, energy access, and sustainability. The day also features the African Farm-Out Forum, a showcase of high-value opportunities across the continent, and concludes with company case studies from Seplat Energy and Altera Infrastructure,

The day ends with a Happy Hour at the Marcliffe followed by a relaxed and exclusive Drinks Reception hosted by OGV Group at the OGV Taproom, offering delegates a unique opportunity to network and strengthen connections between Aberdeen’s energy community and Africa’s emerging markets,

Day Two opens with a keynote address on Pan-African Energy Integration and the vital role of stable policy frameworks in unlocking growth. The morning continues with a panel on De-risking African Energy Projects, focusing on finance, policy, and partnership models that can sustain long-term investment,

Company showcases follow, including Paradigm’s presentation on innovative approaches to field development. The Technical Deep Dive highlights how Aberdeen’s offshore expertise can be applied to Africa’s energy transition, demonstrating how the city’s engineering excellence continues to shape the future beyond oil and gas,

Later sessions focus on empowering African talent and supply chains, featuring practical models for local value creation, and a Project Showcase Networking Lunch, where investors and developers engage in targeted discussions,

The afternoon features panels on Africa’s role in global energy security, digitalisation in remote operations with ABB. The summit closes with NJ Ayuk’s Future Outlook and Call to Action, focusing on strengthening the Aberdeen–Africa Energy Corridor, followed by closing remarks and final networking led by Ollie Folan,

In a time defined by change and uncertainty, the Wider African Energy Summit offers clarity and connection. Africa is not on the sidelines of the global energy conversation, it is at its centre. Hosted in Aberdeen, Europe’s energy capital, WAES 2025 stands as more than a summit, it is a movement that embodies Africa’s ambition, resilience, and leadership in shaping a new global energy order,

For investors, operators, and innovators alike, the message is clear, the future of energy runs through Africa, and WAES 2025 in Aberdeen is where that future is defined,

Tuesday, November 18 2025

Time: Title

08:00 - 09:00 Registration & Welcome Coffee

09:00 - 09:10 Conference Opening

09:10 - 09:35 Opening Remarks & Welcome Address

09.35 - 10:25 Keynote Panel: Shaping Africa’s Energy Future A Continental Vision for Growth and Transition

10:25 - 10:45 Networking Coffee Break

10:45 - 11:30 Panel Session 1: Unlocking Investment Opportunities Across Africa – Pathways for Capital, Technology Transfer, and Localisation

11:30 - 12:00 Company Showcase Presentation: NOV

12.00 - 12:45 Panel Session 2: Driving a Just Energy Transition – Balancing Growth, Energy Access, and Sustainability

12:45 - 13:30 Networking Lunch

13:30 - 14:40 Presentation: Angola New Gas Consortium

14:40 - 14:55 Company Showcase Presentation: Seplat

14:55 - 15:15 Networking Coffee Break

15:15 - 16:00 Company Showcase Presentation: Altera Infrastructure

16:00 - 16:45 Panel Session 3: The Importance of Local Content in Powering Africa's Future

16:45 - 17:00 Close & Networking Opportunity

17:00 - 18:00 Happy Hour & “Aberdeen-Africa Connections” Reception

Wednesday, November 19 2025

Time: Title Speaker

08:30 - 09:00 Welcome Coffee

09:00 - 09:40 Presentation: Ghana Keta Basin

09:40 - 10:30 Panel Session 1: De-risking African Energy Projects: Finance, Policy, and Effective Partnership Models

10:30 - 10:45 Company Showcase Presentation : Paradigm

10:45 - 11:05 Networking Coffee Break

11:05 - 11:55 Technical Deep Dive: Leveraging Aberdeen’s Offshore Expertise for Africa’s Energy Future – Beyond Oil & Gas

11:55 - 12:45 Panel Session 2: Empowering African Talent & Supply Chains –Practical Models for Local Value Creation

12:45 - 13:45 Networking Lunch & “Project Showcase” Speed Dating

13:45 - 14:35 Panel Session 3: Africa’s role in global energy security and emerging energy markets

14:35 - 15:00 Company Showcase Presentation: ABB

15:00- 15:20 Networking Coffee Break

15:20 - 16:00 Company Showcase Presentation: Fugro

16:00 - 16:15 Future Outlook and Call to Action: Strengthening the Aberdeen-Africa Energy Corridor

16:15 - 16:30 Closing Remarks & Vote of Thanks / Final Networking

MULTIMODAL TRANSPORT AND LOGISTICS OPERATOR

Africa Global Logistics (AGL) is the leading multimodal logistics player in Africa, offering logistics, port, maritime, and rail solutions. With 23,000 employees across 50 countries, AGL leverages its developed expertise to provide tailored and innovative services to its African and international clients. AGL's ambition is to contribute sustainably to Africa's transformations. AGL is also present in Haiti, East Timor and Indonesia.

Operational - Scheme Design

• Detailed local surveys & feasibility studies

• Local environment knowledge

• Operational methods & planning

• Total freight cost analysis

• Dedicated assets (supply bases & fabrication yards)

Scalability - at all Project Stages

• Fine tuning of committed resources

• Innovative solutions for transportation

• Continuous investment in equipment, systems & training

End-To-End - One Stop Shop Approach

• Seamless door-to-door logistics including abnormal transport

• On-shore & off-shore supply bases & fabrication yards

• On-site logistics including heavy lift positioning / handling

Mastering - Overall Performance

• Asset based logistics (specialised handling equipment)

• Continuous cost optimisation

• Operational & ethical compliance

• Resilience in all circumstances

50 countries 250 subsidiaries

23 000 staff more than

Africa is asserting its place in the global energy arena –not as a spectator, but as a leader. With abundant oil, gas, renewables and minerals, the continent is powering its own future while offering solutions to global energy security, affordability and sustainability.

The African Energy Week: Invest in African Energies 2025 conference champions this vision by bringing African voices, resources and deals to the forefront.

North Africa remains a key energy corridor to Europe. Libya has launched its first licensing round in 17 years with 22 blocks on offer. Egypt, already a regional gas hub, has opened bidding for 12 blocks in the Mediterranean and Nile Delta while scaling solar capacity through the 10 GW Benban Solar Park and 1.65 GW Kom Ombo complex. Algeria awarded five licenses in its latest round, and Morocco is expanding renewables with the Noor Ouarzazate solar project. These projects cement North Africa’s role in both hydrocarbons and clean energy.

The MSGBC Basin has entered a new phase. Senegal marked first oil from Sangomar in 2024, with nearly four million barrels marketed in 2025 and output expected to surpass 30 million barrels by yearend. LNG exports from Greater Tortue Ahmeyim began in April 2025, while Yakaar-Teranga is on track for FID this year.

Elsewhere, Nigeria is advancing Train 7 of Nigeria LNG, expanding midstream capacity with processing plants and LPG terminals, and boosting refined product security through the Dangote Refinery. New licensing rounds are underway in Liberia, Ghana and Sierra Leone. Mauritania is progressing largescale green hydrogen with over 400 GW of potential identified. CWP Global’s $40 billion AMAN project and Chariot–TotalEnergies’ Project Nour position the region as a leader in hydrocarbons and the energy transition.

Southern Africa is drawing in global investment. Namibia’s Orange Basin discoveries have confirmed worldclass offshore resources. Angola is celebrating milestones in 2025, including first oil from the Agogo FPSO, Begonia field and CLOV Phase 3, a gas discovery at Block 1/14, and the inauguration of the CabindaRefinery in September. Mozambique’s LNG sector is regaining momentum as Cabo Delgado stabilizes, while CongoBrazzaville has become subSaharan Africa’s newest LNG

exporter, with 4.5 bcm expected this year. Equatorial Guinea is expanding gas processing capacity, bolstering regional trade. On renewables front, South Africa is advancing gigawatts of wind and solar under its REIPPPP, while Namibia and Botswana progress the 5 GW Southern Corridor Solar Development.

East Africa is advancing integrated projects. Uganda’s Tilenga and Kingfisher upstream developments are progressing, tied to the East African Crude Oil Pipeline (EACOP), scheduled for completion in 2026. Tanzania has relaunched exploration and is positioning itself as an LNG hub, while Kenya expands geothermal output at Olkaria, reinforcing its leadership in clean energy. Uganda is also advancing hydropower, Tanzania is accelerating LNG projects, and Kenya is building a diverse energy mix with geothermal, solar and wind. Together, these efforts will supply international markets while strengthening intra-African trade and energy security.

Africa is gearing up to attract a wave of investment in exploration blocks, with a surge in oil and gas licensing rounds being launched during the 2024/2025 period. According to the African Energy Chamber’s State of African Energy 2025 Outlook Report, these efforts are part of a broader strategy to unlock the continent’s untapped energy potential, attract international investment and stimulate long-term economic growth.

Libya launched its latest licensing round in March 2025, offering 22 onshore and offshore exploration blocks across the Sirte, Murzuq and Ghadames basins. The licensing round has already drawn interest from 37 prospective companies, with contracts with successful bidders expected to be signed by the end of the year. Algeria awarded five licenses in June 2025 as part of its latest oil and gas bid round. Launched in November 2024, the bid round featured six onshore blocks for competitive bidding and falls part of a broader multi-year licensing strategy aimed at attracting global investment in exploration opportunities. The blocks span five basins and represent a core component of the country’s strategy to invest up to $50 billion into hydrocarbon projects over the next four years. Egypt launched a new bid round in March 2025, comprising 12 investment opportunities. The bid round includes 10 offshore blocks in the Mediterranean Sea and two onshore blocks in the Nile Delta region and comes as the country intensifies exploration across undeveloped acreage.

Sierra Leone is preparing to launch a new licensing round in 2025 as part of its drive to fast-track exploration and become an oil-producing nation. The country currently has around 50 offshore blocks available for direct negotiation, spanning 63,000 km² and backed by a proven petroleum system. The upcoming licensing round will further entice spending. Nigeria is set to launch a new oil and gas licensing round in 2025, focusing on undeveloped fields. The upcoming round follows the successful conclusion of a 2024 tender, whereby 25 companies were awarded Petroleum Prospecting Licenses. Liberia also initiated a Direct Negotiation Licensing Round in 2024, with 29 offshore blocks available for investment in the Liberia and Harper basins. The licensing round seeks to drive new investment in the country’s frontier basins and is supported by an extensive library of multi-client subsurface data, including over 24,000 kilometers of 2D seismic data and more than 26,000 km² of 3D seismic data.

Tanzania is preparing to offer new oil and gas exploration opportunities with a licensing round launching in 2025. A total of 26 blocks will be made available, including three blocks in Lake Tanganyika and 23 in the Indian Ocean. The country’supstream regulator the Petroleum Upstream Regulatory Authority has already identified the blocks and compiled the necessary data for the process. Following government approval for the Model Production Sharing Agreement, the licensing round will be launched. The round represents

the first in more than ten years. Additionally, Kenya is expected to launch its inaugural oil and gas licensing round in 2025, offering ten blocks for exploration. The blocks were selected using geoscientific data to ensure a transparent allocation process. The licensing round is supported by comprehensive seismic surveys and geological reports, thereby supporting future exploration activities. Primary targets include the Lamu and Anza basins, both of which are known for their hydrocarbon potential. Uganda is also set to launch a licensing round during the 2025/2026 fiscal year, offering new areas for oil and gas exploration

Part of its six-year licensing strategy, Angola is expected to launch its next licensing round in 2025, offering ten blocks for exploration in the offshore Kwanza and Benguela basins. The bid round follows the successful conclusion of a 2023 tender, whereby nine companies qualified as operators and five qualified as non-operators. Namibia rolled out an opendoor licensing system in 2024 to address its backlog of applications and streamline procedures. The system comes as the country experiences a surge in exploration interest following major discoveries made since 2022.

The Central African Pipeline System (CAPS) is rapidly gaining momentum, offering the promise of a more connected and energy secure future in Africa.

As an integrated network of downstream and midstream oil and gas infrastructure, the project not only offers the opportunity to enhance energy access, reduce fuel imports and spur industrial growth in Central Africa, but unlocks a wealth of investment opportunities for global financiers and project developers.

CAPS is set to be a transformative project for Central Africa. The project involves a 6,500-km network of pipelines connecting the oil and gas resources of 11 Central African countries. The initiative will link together storage depots, LNG processing plants, power plants, pumping stations, truck loading stations, refineries and entry and discharge points. Once operational, the CAPS aims to address energy poverty by improving access to affordable

energy throughout the region, with the goal of making Central Africa an “energy povertyfree zone” by 2030.

CAPS has a threefold mission to address Africa’s deficits in food security, energy and manufacturing. Positioned as a cornerstone ofregional cooperation, CAPS aims to stimulate economic growth, expand energy access and accelerate industrialisation throughout Central Africa.

In July 2025, a significant milestone was achieved when the Central African Economic and Monetary Community, the African Petroleum Producers’ Organization (APPO) and the Central Africa Business & Energy Forum signed a Memorandum of Understanding (MoU) to kick-start a feasibility study for CAPS.

The MoU sets the foundation for participation from up to 11 Central African countries in evaluating the project’s viability, regional impact and national contributions. The 6,500km pipeline network will enhance Central Africa’s energy market resilience and affordability

by optimizing the exploitation, local beneficiation and distribution of Africa’s estimated 125.3 billion barrels of crude oil and 620 trillion cubic feet of gas resources.

With APPO finalizing the launch of the multi-billion African Energy Bank with the African Export-Import Bank this year, the organization’s participation in the MoU and interest in CAPS is timely. The MoU not only strengthens regional collaborationbut also strategically positions CAPS to be shortlisted for financing from the new bank.

Furthermore, with 18 oil-producing APPO member states focused on accelerating the exploitation of hydrocarbon resources, the organization’s involvement in CAPS represents a powerful step toward eradicating energy poverty and enhancing regional energy security. The CAPS project will encompass oil, gas and LPG pipelines, pumping stations, storage terminals, refineries and gas-fired power plants, all contributing to regional energy access and industrial transformation.

Africa is set to add 1.2 million barrels per day (bpd) of new refining capacity by 2030, marking one of the fastest downstream expansions globally, according to the newly released 2025 OPEC World Oil Outlook.

This medium-term growth –led by landmark projects in Nigeria, Angola and Uganda – signals a turning point for the continent’s energy sovereignty and investment attractiveness.

At the forefront of Africa’s refining expansion is Nigeria’s 650,000bpd Dangote Refinery, which began operations in 2024 and is already reshaping regional fuel trade dynamics. Further developments include the 200,000-bpd Akwa Ibom Refinery, also in Nigeria, and Angola’s state-driven push to bring online the 200,000-bpd Lobito Refinery and 100,000-bpd Soyo Refinery by 2030

According to OPEC, Africa will need over $40 billion in refining investments by 2030 to meet its middecade objectives. Beyond 2030, the figure climbs steeply – requiring an additional $60+ billion for refinery construction, modernization and secondary processing capacity upgrades. This opens a $100 billion investment window for project developers, institutional investors, sovereign wealth funds and energyfocused private equity. With nearly 86% of global refinery additions through

2050 concentrated in the AsiaPacific, Africa and the Middle East, Africa is increasingly seen as a highgrowth frontier.

Additionally, Africa’s rising domestic consumption of crude – forecast to reach 4.5 million bpd by 2050 from just 1.8 million bpd in 2024 – further underlines the case for investing in downstream infrastructure. This consumption shift, in turn, is expected to reduce Africa’s crude exports by over one million bpd by2050, emphasizing a structural

pivot toward internal value chains.

Africa’s medium-term refining expansion reflects both a technical development and strategic inflection point. If the continent seizes this momentum, it can move beyond being a raw crude exporter to becoming a competitive, resilient and integrated energy producer. With $100 billion in refining investment needs projected through 2050 and billions in trade deficits to reverse, the time to bet on the African downstream sector is now.

By NOV Process Systems

Africa’s energy story is one of progress, resilience, and potential. Across the continent, operators are working to unlock marginal fields, optimize brownfield assets, and strengthen national energy infrastructure. Achieving these goals requires more than technology, it requires partnership, flexibility, and local collaboration.

Our purpose is clear: empowering Africa’s energy future with full-cycle technology and expert field support

Delivering value across the asset lifecycle

We partner with energy operators to deliver technical excellence, innovative problem-solving, and collaborative field support across the entire asset lifecycle.

From concept design and processing systems to installation and long-term maintenance, we combine configurable technologies with a commitment to knowledge-sharing and local engagement. This ensures every solution is efficient, reliable, and tailored to the real-world challenges of operating in Africa’s dynamic energy environment.

Our approach is pragmatic, designed to help clients reduce total expenditure (TOTEX), accelerate return on investment, and maintain uptime across their production assets.

Strengthening technical partnerships

The foundation of our success is collaboration. We work closely with National Oil Companies (NOCs), International Oil Companies (IOCs), and local operators to co-create development strategies that balance performance, affordability, and national content goals.

By serving as a single accountable process partner, we simplify field development and ensures seamless execution from concept through to lifeof-field operations.

Our configurable process ecosystem integrates engineering, modular hardware, and digital intelligence, enabling faster project delivery and reduced complexity. Whether developing new marginal fields or optimizing existing facilities, our teams provide the expert support and technical partnership operators can depend on.

Enabling cost efficiency through configurable systems

Africa’s marginal fields face unique challenges: constrained budgets, technical limitations, and tight project timelines. We address these headon with repurposed equipment and configurable systems that deliver cost efficiency without compromise.

Our modular process designs eliminate unnecessary engineering and enable phased CAPEX investment, allowing operators to adapt their development pace to market conditions. This approach has consistently achieved 20–30% cost reductions and accelerated time-to-firstoil, transforming previously uneconomic fields into profitable, long-term assets.

We deliver innovative technologies for the separation and treatment of oil, gas, solids, seawater, and produced water. We also provide top-quality hydrate inhibition technologies for low-temperature offshore applications. Drawing on a deep understanding of fluids behavior and more than 40 years of experience, our engineers and project managers ensure excellence in both service delivery and project execution. Every solution we deliver is cost-efficient and customized to meet specific customer challenges and on-site conditions, ensuring our clients achieve performance, safety, and reliability in every project.

Local commitment. Global expertise.

We believe in creating sustainable value where we operate. Across Africa, we invest in local talent, joint ventures, and training programs that strengthen incountry capacity and align with national content policies.

Our Africa-based teams deliver on-theground engineering, commissioning, and maintenance, providing operators with direct access to NOV’s global expertise while building regional technical capability. This approach supports national development and infrastructure growth, ensuring that every project contributes to the broader prosperity of the communities we serve.

Innovation that works for the real world

From the first concept workshop to lifecycle optimization, we combine innovation with practicality. Our digital integration tools provide real-time monitoring and predictive maintenance to reduce downtime, extend equipment lifespan, and enable remote operations. Together with our modular hardware systems, these capabilities give operators a unified ecosystem that drives efficiency, safety, and long-term reliability.

We are redefining what it means to be a trusted partner in Africa’s energy transition. By aligning technology with local expertise, we help our clients achieve operational success while supporting the region’s broader development goals.

Whether it’s unlocking marginal fields, enhancing existing production, or delivering long-term lifecycle assurance, our mission remains the same, to empower Africa’s energy future, together.

NOV Process Systems Empowering Africa’s energy future with fullcycle technology and expert field support. Global Standards. Local Impact.

Africa is repositioning itself in the global oil market –not merely as a supplier to international markets, but as a rising energy consumer and industrial growth hub.

The OPEC World Oil Outlook 2025 underscores a continent in transition, leveraging its natural resources to meet domestic demand, expand refining capacity and strengthen regional energy security.

OPEC projects that Africa’s total crude and condensate exports will remain stable at around 5.2 million barrels per day (bpd) through 2035, thanks to modest increases in production. However, this steady supply will increasingly be used at home. By 2050, exports are expected to decline to 4.2 million bpd – not due to market loss, but as a result of rising domestic demand and strategic value addition on the continent.

One of the most significant insights from the report is the continent’s growing internal energy appetite. Domestic crude use is expected to rise from 1.8 million bpd in 2024 to 4.5 million bpd by 2050, nearly tripling over the outlook period. This growth is tied to Africa’s demographic boom, industrial expansion and a concerted push to enhance local refining and downstream infrastructure. As African governments invest in

capacity to process more of their own crude and produce their own fuels, the continentis taking steps toward energy independence and job creation across the value chain.

Meanwhile, global trade patterns are shifting in ways that present new opportunities for African producers. Exports to Europe are expected to increase to a peak of 3 million bpd in 2030, before gradually tapering to 2.3 million bpd by 2050, in line with Europe’s broader energy transition and shrinking reliance on imported oil. The Asia-Pacific region is emerging as a more prominent long-term partner, with African crude exports remaining stable at 1.9 million bpd through 2030, then rising modestly to 2.2 million bpd by 2040 before easing to 1.8 million bpd by 2050.

Trade with the U.S. and Canada, which stood at 400,000 bpd in 2024, is expected to fallto 100,000 bpd by 2045, as competition from Latin America intensifies. Yet rather than signaling decline, this trend underscores the importance of market diversification and deeper regional cooperation – a direction many African producers are already pursuing through integrated trade corridors, cross-border pipelines and African Continental Free Trade Area initiatives.

The shifting crude export landscape reflects a new era in which Africa’sown markets will increasingly drive energy demand and value creation. Rising domestic consumption, coupled with expanded refining and petrochemical capacity, positions the continent to capture more value from its resources while reducing dependence on imported fuels. This transition is not only about energy security—it is about industrialisation, job creation, and establishing Africa as both a producer and consumer powerhouse.

As exports plateau and eventually decline, the priority for African governments and companies will be to balance external market opportunities with the urgent need to serve domestic growth. Strategic investments in refining, transport infrastructure, and regional integration will be key to ensuring that energy development translates into broad-based economic benefits.

At the same time, changing global trade dynamics—with Europe diversifying supply and Asia emerging as a long-term anchor market— reinforce the importance of Africa’s adaptability. By aligning upstream growth with downstream expansion and regional demand, Africa is positioning itself as a self-reliant energy hub, capable of powering its demographic and industrial future while remaining a critical player in the global supply chain.

The Republic of the Congo and Chinese oil and gas company Wing Wah signed a $23 billion hydrocarbon agreement in 2025 for the integrated development of the Banga Kayo, Holmoni and Cayo permits.

The deal sets the stage for a transformative boost to the nation’s oil production, as the country strives to reach 500,000 barrels per day (bpd) within the coming three years.

Through the pact, the Republic of Congo is looking to ramp up cumulative production across the three permits to more than 1.3 billion barrels by 2050. The deal is a central pillar in the country’s broader economic and financial strategy, committing over $23 billion in investment and promising substantial fiscal and para-fiscal revenues.

The agreement advances energy sovereignty through the valorization

of associated gas for domestic use which is key to reducing routineflaring. A cornerstone of the project is the creation of a training center, aimed at boosting local content by equipping Congolese citizens at all skill levels to access new job opportunities generated by the development. Local employment is already substantial, with some 3,000– 3,300 Congolese workers involved, and social benefits such as excess power and treated water provided to nearby communities.

The project also includes an integrated gas monetization component, with multi-phase expansion of LNG, LPG, butane and propane production capacity–intended to satisfy both domestic demand and exports. The integrated nature of the development includes scalable gas treatment infrastructure, on-site power generation and water-management systems–all designed for efficiency and community benefit.

a significant presence in Congo via its development of the Banga Kayo field. This onshore permit currently comprises around 237–250 drilled wells and produces approximately 45,000 bpd, approaching a peak output of 50,000–80,000 bpd.

The Republic of Congo took a significant step towards maximizing its hydrocarbon resources with the signing of an amended Production Sharing Contract (PSC) between Minister of Hydrocarbons Bruno JeanRichard Itoua and China’s Wing Wah Oil Company for the Banga Kayo block last year. This move marked the beginning of development at the block and underscored the country’s commitment to tapping into its untapped resources. The amended PSC outlined a three-phase development plan, demonstrating the importance of public-private partnerships in developing oil and gas projects in Africa, providing a clear path to resource monetization.

Senegal is rapidly advancing its energy transition through large-scale infrastructure, regional gas integration and ambitious electrification goals.

With an electricity access rate of 84% and a target of universal access by this year, the country is investing in renewable energy, modern gas infrastructure and strategic partnerships under the Just Energy Transition Partnership. Key initiatives include expanding generation capacity by 70%, raising renewables to 40% of the energy mix and electrifying rural communities, schools, health clinics and supporting urban mobility.

Karpowership LNGto-Power Project

pan-African renewable energy developer Axian Energy, solar energy company Voltalia and digital consultancy firm Entech. The 60 MWp PV plant will be paired with a 70 MWh battery storage system, enabling three hours of grid support during peak demand. The project aims to enhance grid reliability, expand clean energy access and support Senegal’s sustainable energy transition. Construction on the project began in May 2025, with commissioning expected in 2026.

transportacross the Dakar metropolitan area. The project integrates bus rapid transit (BRT), regional express rail and restructured bus networks, while professionalizing informal transport sectors. The project includes climate-resilient infrastructure, lowemission buses and improved traffic management to reduce congestion and emissions. Supporting 3.8 million residents, the initiative lays the groundwork for future BRT expansion and enhanced connectivity with regional hubs, aligning with Senegal’s Vision 2050 and green growth strategy.

In July 2025, Senegal’s first LNGtopower project began generating electricity offshore Dakar through a partnership between the country’s state-owned Senelec and Turkey’s Karpowership. The project integrates the LNGT Africa floating storage and regasification unit (FSRU) with the 335 MW KPS 10 powership. The FSRU supports Senegal’s broader energy expansion following first production at the Greater Tortue Ahmeyim (GTA) conventional gas development, which was achieved in December last year.

Spanning 400km, Senegal’s $1.07 billion national gas pipeline project will connect offshore gas fields to power plants and industrial zones, replacing heavy fuels with natural gas. The project is advancing in phases, with procurement and contract negotiations nearly complete for the northern segment. Upon completion, the project is expected to reduce CO2 emissions by approximately 30 million tons by 2050 and lower energy costs, supporting Senegal’s transition to gaspowered generation.

Last June, international finance institution the World Bank approved $100 million in financing for the Dakar Sustainable Urban Mobility Project, aimed at modernizing

Senegal and Mauritania achieved first gas at the cross-border GTA conventional gas project last December, marking a milestone in West Africa’s energy landscape. Developed by energy major bp, deepwater exploration company Kosmos Energy, Senegal’s stateowned Petrosen and Mauritania’s stateowned SMH, Phase 1 of the project will produce 2.5 million tons per annum of LNG from a deepwater subsea system tied to a floating production storage and offloading and floating LNG vessel located 120 km offshore. Estimated to hold over 15 trillion cubic feet of natural gas reserves, the project is set to boost regional gas exports and support domestic supply in future phases, reinforcing Senegal’s emergence as a key global gas player.

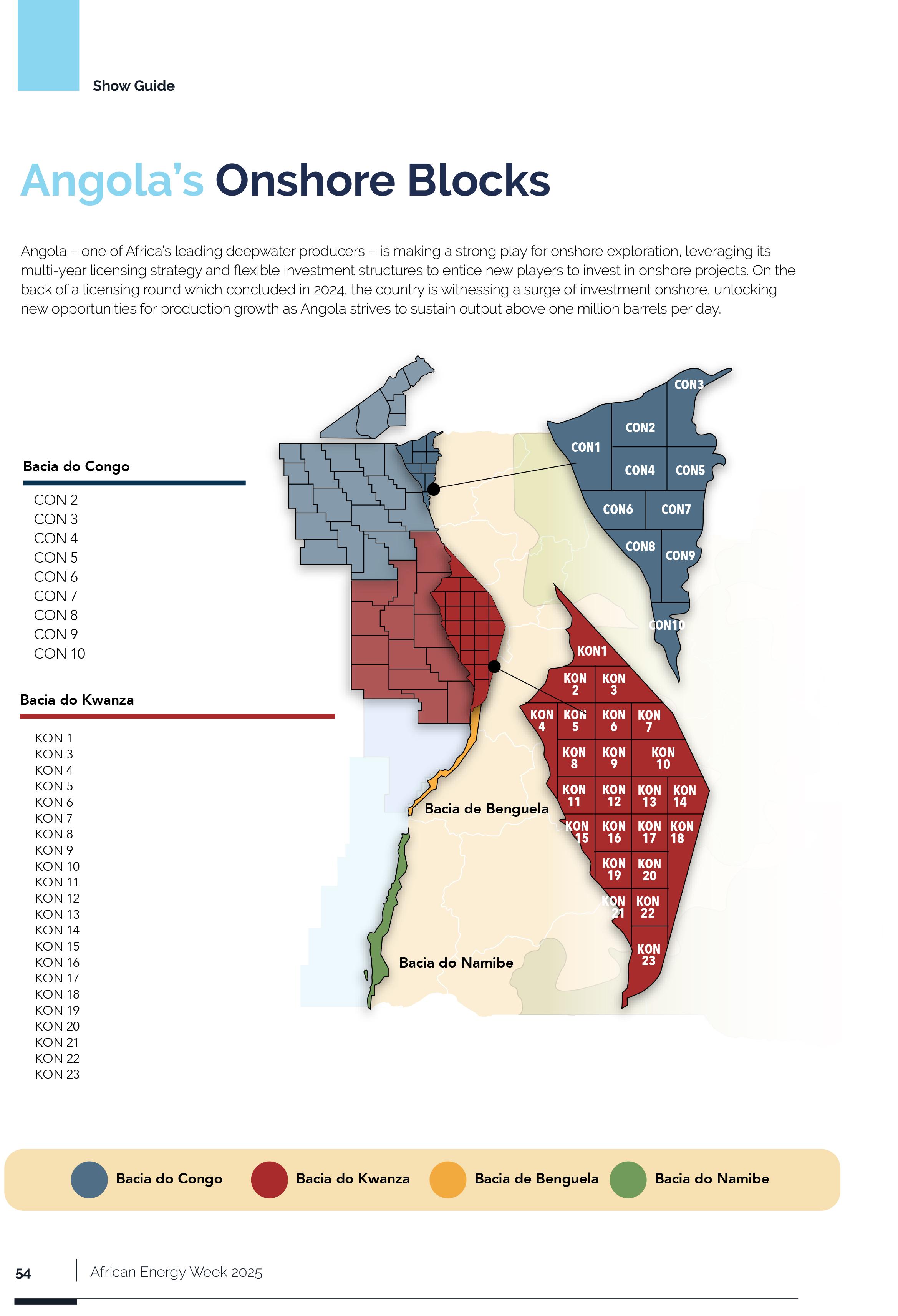

Angola – one of Africa’s leading deepwater producers – is making a strong play for onshore exploration, leveraging its multi-year licensing strategy and flexible investment structures to entice new players to invest in onshore projects. On the back of a licensing round which concluded in 2024, the country is witnessing a surge of investment onshore, unlocking new opportunities for production growth as Angola strives to sustain output above one million barrels per day.

With rising global energy demand and a renewed push for exploration and production, Angola has emerged as a prime investment destination.

The country has secured over $60 billion in commitments from global operators, ensuring robust growth over the next five years. Ongoing negotiations with new investors further signal confidence in Angola’s energy market.

Angola’s commitment to improving its business climate has led to significant regulatory reforms aimed at attracting investment. The National Oil, Gas & Biofuels Agency (ANPG)the country’s upstream regulator - has drastically reduced licensing response timelines from years to under 30 days, providing investors with a more efficient pathway to market entry. The government has also introduced investor-friendly policies, including enhanced fiscal terms and visa relaxations, further boosting confidence in the sector.

Over the past five years, Angola has launched four licensing rounds, offering 40 exploration blocks, and has initiated a gas production strategy, with its first non-associated gas project set to commence production in 2025. These measures have strengthened the country’s production outlook, maintaining an average production rate of over 1.1

million barrels per day. Additionally, Angola is preparingto launch its 2025 licensing round, which involves a limited tender for ten offshore blocks in the Kwanza and Benguela basins. The country also has four onshore blocks available, 11 blocks on permanent offer and five marginal fields open for participation, with the upcoming round expected to attract a diverse range of investors and reinforce Angola’s position as a leading destination for energy investment in Africa.

With transformative policies in place, Angola is witnessing an exploration revival. Over 30 wells have been drilled in recent years, particularly in frontier basins like the Namibe Basin. Additionally, Angola’s incremental production program is optimizing mature fields, while the introduction of new production assets in marginal fields strengthens its hydrocarbon portfolio. As Angola cements its role as a key energy supplier, the country has also prioritized reducing carbon emissions. A 60% reduction in gas flaring over the past 15 years reflects Angola’s commitment to sustainable energy development, ensuring that investments align with global environmental targets. As Angola solidifies its status as a leading energy investment hub, international investors have a strategic opportunity to capitalize on emerging opportunities as Angola advances its ambitious investment pipeline.

www.abb.com

www.fugro.com

In the modern world of unprecedented demand for electricity and rapid emergence of renewable energy as a viable alternative, ABB supports power operators in meeting their objective of scaling up while protecting and strengthening power distribution networks. Compliance to codes established for power grids goes well beyond just a tick in the box – it enables reliability, safety and efficiency in your operations.

ABB’s solutions and services are designed to drive control and stability of power systems across a wide range of power sources, whether conventional or renewable, by complying with standards established globally and for each region.

We are the world’s leading Geo-data specialist, collecting and analysing comprehensive information about the Earth and the structures built upon it. Through integrated data acquisition, analysis and advice, we unlock insights from Geo-data to help our clients design, build and operate their assets in a safe, sustainable and efficient manner.

NOV’s Process Systems delivers integrated, engineered processing solutions for oil, gas, and emerging energy applications—helping customers efficiently separate, treat, and optimize process streams.

With decades of process engineering expertise, the business acts as a full lifecycle partner, supporting projects from concept and design through fabrication, testing, operation, and maintenance. Its portfolio spans oil and gas separation, produced-water treatment, and compact processing technologies, along with brownfield solutions that modernize and enhance existing assets for improved performance and compliance. Backed by advanced digital monitoring tools, Process Systems enables reliable, efficient, and sustainable operations across the entire energy value chain.

At Canadian Natural we believe our employees are the key to unlocking asset potential. As one of the largest independent crude oil and natural gas producers in the world, our balanced mix of natural gas, light oil, heavy oil, in situ oil sands production and oil sands mining creates opportunity for people who want to be part of a challenging and competitive industry. Join our team as we continue to create value through innovation by “doing it right” with fun and integrity in North America, the North Sea, and Offshore Africa.

Global Maritime is a marine, offshore and engineering consultancy that specializes in marine warranty, dynamic positioning and engineering services. Known for innovation, practical experience, operational excellence, and safety.

Founded in 1979, Global Maritime’s services span the entire offshore project lifecycle from engineering and design, construction and third party verification through to marine warranty surveying, dynamic positioning, installation, risk management and decommissioning.

www.paradigm.eu

www.alterainfra.com

www.aglgroup.com

www.afbe.org.uk

Paradigm provide patented flow remediation technologies to the global oil and gas industry, enabling operators to quickly locate & remove challenging blockages in pipelines, flowlines and umbilicals. These include materials such as hydrates, wax, sand, and asphaltenes to restore or enhance production.

In addition, Paradigm deliver permanently installed In-Riser technology such as Velocity Strings to mitigate the impact of issues such as slugging and Riser Base Gas Lift to stabilise flow and maximise production recovery from mid to late life assets.

Paradigm focuses on delivering efficient solutions that address issues directly from topsides, which helps to eliminate the need for subsea intervention.

This approach significantly reduces the time, client resources, and costs associated with restoring production and flow, enhancing overall operational efficiency.

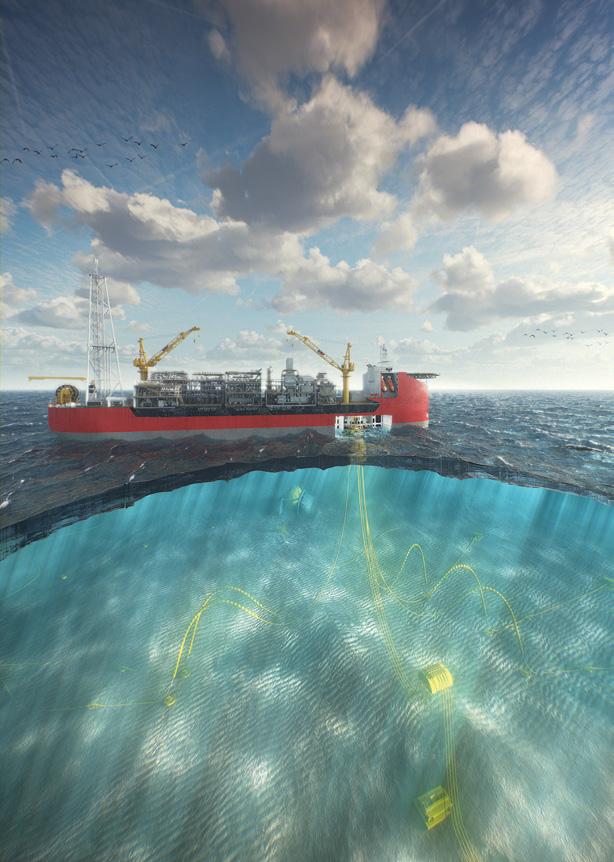

Altera Infrastructure is a leading global energy infrastructure services group focused on the ownership and operation of offshore energy assets.

Currently our fleet includes seven production assets (FPSOs) and two FSOs. Here, you will also find around 750 engaged and ambitious professionals that are committed to operational excellence.

Our strong culture, built upon our TEAM values, guides us to make sustainable choices and create lasting results. Through teamwork and innovation, we are shaping the infrastructure of offshore energy, leading the industry to a sustainable future.

Africa Global Logistics (AGL) is the leading multimodal logistics player in Africa, offering logistics, port, maritime, and rail solutions. With 23,000 employees across 50 countries, AGL leverages its developed expertise to provide tailored and innovative services to its African and international clients.

AGL's ambition is to contribute sustainably to Africa's transformations. AGL is also present in Haiti, East Timor and Indonesia

www.seplatenergy.com

AFBE-UK is a not-for-profit organisation that challenges and inspires individuals from Black and minority ethnic backgrounds to excel in their fields and contribute positively to their communities through engineering.

We encourage BME individuals to study engineering, support those pursuing engineering careers, promote engineering in schools, and champion workforce diversity. We also advise organisations on fostering inclusive environments where minority professionals can thrive and achieve their full potential. Our aim is to enhance the UK's engineering talent pool while driving economic growth.

Seplat Energy Plc is a leading Nigerian independent energy company, operating a strong portfolio of assets across the Niger Delta, including OMLs 4, 38, 41, 53, and other interests. In 2024, Seplat achieved a transformative milestone with the acquisition of ExxonMobil’s onshore and shallow-water assets, significantly expanding its production capacity and marking its entry into offshore operations.

Seplat Energy is also Nigeria’s leading domestic gas supplier, providing reliable energy to industries, homes, and power generation through facilities such as the Oben and ANOH gas plants.

Guided by its purpose, Driving Nigeria’s Energy Transition for the Future, Seplat Energy continues to create shared value through sustainable operations, community investment, and a commitment to environmental stewardship.

www.the-eic.com

www.globalunderwaterhub.com

www.energychamber.org

EIC is the world's largest, energy-agnostic trade association, supporting companies that supply goods and services to the world’s energy industries.

Established in 1943, the EIC is a not-for-profit organisation with a membership of over 800 companies worldwide.

EIC helps its members to export, diversify and grow, working with companies ranging in size from the world’s largest operators, contractors, operators and manufacturers, through to SME’s and more specialised product and service companies.

Global Underwater Hub (GUH) is the leading trade and industry development body for the UK's underwater sectors.

Owned and governed by the industry, the member-led organisation represents, promotes and supports the diverse range of businesses operating int the UK's £9.2 billion underwater industry. This includes companies working in oil and gas, offshore wind, decommissioning, CCUS and hydrogen, wave and tidal energy, defence, aquaculture, marine sciences, telecommunications and seabed mineral resources

With funding support from the UK and Scottish governments, GUH supports and accelerates industry growth to deliver new high value, sustainable green jobs, technology, and exports, bolstering the drive to net zero and building the blue economy.

We uphold a results-focused business environment for companies operating in Africa’s dynamic energy industry. The African Energy Chamber works with indigenous companies throughout the continent in optimizing their reach and networks.

Our partnerships with international dignitaries, executives, and companies allow for relevant servicing to other international entities looking to operate within the continent.

The African Energy Chamber brings willing governments and credible businesses together to continuing growth of the African energy sector under international standard business practices.

The Society of Petroleum Engineers (SPE) is a not-for-profit professional association with 132,000 members in 146 countries engaged in the exploration and production of oil and gas and related energy resources. SPE delivers solutions and empowers people to drive the energy industry forward. Members gain access to premier programs, content, and events designed to accelerate professional growth and career development, while fostering a strong network and sense of community.

www.spe.org

www.energia-africa.com

Energia Africa is a dynamic Ivorian platform dedicated to driving dialogue, innovation, and sustainable growth across Africa’s energy, mining, petroleum, and environmental sectors. Founded in 2020 by passionate young entrepreneurs, Energia Africa bridges industry leaders, investors, and policymakers through strategic communication, high-impact events, and expert consultancy.

With a vision to empower African solutions for African challenges, Energia Africa continues to shape the continent’s energy narrative — inspiring progress, partnership, and a sustainable future for all.

At ICR Group, we are committed to transforming the way assets and critical infrastructure are repaired, inspected, and maintained.

By leveraging advanced technology and industry expertise, we deliver innovative engineering solutions that enhance safety, reliability, and efficiency. Sustainability is at the core of our approach, with a strong focus on reducing emissions across every project.

We specialise in extending the life of critical infrastructure across a range of industries, including oil & gas, renewable energy, defence and nuclear. Our technology-led solutions help minimise downtime, reduce costs, and eliminate the need for costly steel replacements.

Arnlea is a software company specialising in Ex inspection solutions for the global energy industry. Its flagship product, Nexar, is a cloud-based application that streamlines Ex inspections and maintenance to improve safety, compliance, and efficiency across hazardous area operations.

Norco Group is a company that specializes in stored electrical energy systems. Norco have extensive knowledge and expertise in delivering innovative solutions for various applications that require battery-backed systems. Norco excel in procuring, installing, maintaining, testing, and repairing industrial and standby batteries, UPS systems, and chargers for critical power systems in both industrial and commercial settings, for any sector. What sets Norco apart is their commitment to research and development. Norco invest significantly in creating customized AC & DC system builds tailored to specific applications and client requirements. Overall, Norco offers comprehensive services and solutions to meet the diverse needs of their customers in the field of stored electrical energy systems.

Energy,

During its first ten years of activity, Replanet has consistently sought to create virtuous pathways together with its clients, with the aim of reducing energy costs related to both electricity and heating.

Its approach is therefore entirely tailor-made. Replanet’s MTP (Massive Transformative Purpose) is Enabling Regeneration.

In collaboration with Opera Don Bonifacio Azione Verde Odv ETS, Replanet is creating a local energy supply network that will power the school, hospital, and university in the community of Amaigbo, in Imo State (Nigeria), adopting a micro-grid approach.

OGV Group is a leading media, marketing, and events organization dedicated to the global energy, renewables, and technology sectors. Through its digital platforms, publications, and industry-leading events, OGV connects businesses, promotes innovation, and drives collaboration across the evolving energy landscape.

By combining expert insights, thought leadership, and strategic communication, OGV helps companies enhance visibility, share knowledge, and engage with key stakeholders worldwide, supporting growth and sustainability throughout the energy transition and beyond.

Gabon is shifting its focus towards deepwater exploration under efforts to bring new projects online and mitigate Central and West African production decline.

With 72% of the country’s deepwater acreage unexplored and only 28% developed to date, the country has set plans in motion to revise existing petroleum laws to offer fresh incentives that encourage deepwater exploration and investment. These plans are expected to transform Gabon’s oil and gas industry, supporting greater production and the development of a new hub for refined product distribution in Central Africa.

With over two billion barrels of proven oil reserves and significant gas potential, Gabon has set a goal of holding production above 220,000 barrels per day (bpd) for the short to midterm The shift to deepwater exploration stands to play an instrumental part in supporting this goal by unlocking new discoveries across the country’s offshore basins mid to long term.

Regulatory reform represents a cornerstone of the country’s exploration strategy, with potential improvements to petroleum legislation set to strengthen the competitiveness of investing inGabon’s deepwater blocks. In 2019, the country introduced its Hydrocarbons Code. The new government seeks to go even further, recognizing the presence of stiff competition from other offshore destinations globally. The code featured amendments to production sharing contracts

(PSC), state profitability and tax, therefore providing a quicker path to profitability for foreign operators. Looking ahead, further revisions of this code stand to support new investment, encouraging deepwater exploration and new forays by global operators.

Major players are already active in Gabon, with ongoing developments underscoring the potential available across Gabon’s offshore blocks. Exploration and production company BW Energy, for example, signed PSCs for exploration blocks Niosi Marin and Guduma Marin in 2024, covering an eight-year exploration period with a two-year extension option. BW Energy and its partner on the block VAALCO Energy have committed to drilling one well as well as carrying out a 3D seismic acquisition campaign. BW Energy also has stakes in the Dussafu license, which features 14 producing wells tied back to a FPSO through a 20km pipeline.

Partners on the license include the state-owned Gabon Oil Company (GOC) and Panoro Energy.

Independent oil and gas company Perenco spud the Hylia South West discovery in Gabon in early 2024, revealing substantial oil-bearing columns in the Ntchengue Ocean reservoir. Chinese oil firm CNOOC launched wildcat drilling on Blocks BC-9 and BCD-10 in early-2023 on the back of 1.4 billion barrels of recoverable resource potential, with future discoveries set to double Gabonese oil production while de-risking deepwater exploration. Despite these developments, much of Gabon’s deepwater potential remains underexplored, highlighting a strategic opportunity for both

active and potential players.

Increased hydrocarbon production in tandem with future deepwater discoveries are expected to support Gabon’s broader goals of creating a regional petroleum hub in Gabon. Strategically positioned on the West coast of Central Africa, Gabon is making strides towards enhancing oil and gas refining, storage and distribution capacity. Major infrastructure projects signal the country’s intention to become a petroleum hub. Perenco is advancing the development of the Cap Lopez LNG terminal in Gabon, targeting first production by 2026. Situated at the existing Cap Lopez oil terminal, the $2 billion project will introduce a FLNG vessel designed to monetize offshore gas reserves and reduce flaring. The FLNG vessel will feature a production capacity of 700,000 tons of LNG and 25,000 tons of LPG, supported by a storage capacity of 137,000 cubic meters. The project complements the Batanga LPG facility, which came online in December 2023 with a target production capacity of 15,000 tons of LPG annually.

Beyond LNG and LPG, Gabon is working towards enhancing refining capacity with plans to expand its sole operating refinery – SOGARA – from 1.2 million tons to 1.5 million tons of crude. This expansion would enable the country to achieve selfsufficiency in refined petroleum products by 2030. These initiatives have already begun to yield positive results, and as new investment flows into Gabon’s energy sector, the country is well positioned to become a leading regional supplier.

Nigeria is undertaking sweeping reforms across its oil and gas industry, driven by a landmark Executive Order signed by President Bola Ahmed Tinubu aimed at catalyzing investment and eliminating regulatory inefficiencies.

The order is expected to strengthen the competitiveness of the country’s investment climate, attracting new players to the market at a time when Nigeria strives to increase production to 2.5 million barrels per day.

The Executive Order, signed in April 2025, targets cost efficiency and fiscal competitiveness in upstream operations and introduces performance-based tax credits for oil and gas companies that deliver verifiable reductions in project costs. Under the framework, operators that meet annual cost-reduction benchmarks set by the Nigerian Upstream Petroleum Regulatory Commission are eligible to retain 50% of the incremental government revenue generated by their efficiency gains, with total credits capped at 20% of their annual tax liability.

This move directly addresses longstanding concerns over high operating costs in Nigeria’s upstream sector, which have historically deterred investment and delayed project execution.

By linking tax relief to measurable cost savings, the order is expected to unlock stalled developments,

attract new capital and create a more transparent, performancedriven investment climate. Reform is already reshaping Nigeria’s energy landscape – enabling more competitive bidding for contracts, accelerating international oil company divestments and positioning indigenous players to scale up their operations within a more commercially attractive and operationally efficient environment. In the past year, Nigeria has secured over$8 billion in deepwater oil and gas final investment decisions, signaling a renewed appetite among international investors. ExxonMobil, for example, has committed $1.5 billion to new deepwater field developments.

Shell is also strengthening its position in deepwater and integrated gas – recently increasing its stake in OML 118, which includes the prolific deepwater Bonga field – while Chevron is expanding operations at the Agbami field, one of Nigeria’s largest deepwater discoveries.

Meanwhile, Petrobras has declared its interest in returning to deepwater exploration in Nigeria, seeking frontier acreage as a result of improved regulatory clarity and investor-friendly reforms. The country has also unveiled major new initiatives to promote local content and industrial growth, with multibillion-dollar investments directed at building domestic capacity in fabrication, engineering and services. This includes the “Naira for Crude” initiative, which aims to

promote localrefining, enhance energy security and reduce reliance on foreign currency in the domestic oil market.

Nigeria is also doubling down on natural gas as the cornerstone of its long-term energy strategy. With over 200 trillion cubic feet of proven reserves, the country is accelerating infrastructure development to support both domestic utilization and regional exports. A flagship project, the NLNG Train 7 expansion, is nearing completion and set to boost production capacity by 35%, underscoring the critical role of LNG in Nigeria’s economic growth and energy transition plans. At the same time, upstream and midstream gas investments are being enabled through policy instruments that promote modular processing, flexible pricing frameworks and improved market access for domestic suppliers.

The private sector is poised to play a central role in this next phase. Companies like SLB and NOV are aligning their strategies with the government’s push for localization, efficiency and innovation, while firms such as Oando are expanding their portfolios to reflect new realities in the post-Petroleum Industry Act landscape. With enhanced policy stability and a deliberate focus on sector transformation, Nigeria is reasserting its status as one of Africa’s most strategic hydrocarbon hubs.

The 2024/2025 period has shown robust drilling activity across Africa, with the continent featuring 13 of the total 36 high-impact wells drilled globally in 2024.

According to the African Energy Chamber’s State of African Energy 2025 Outlook Report, approximately 38% of these wells were drilled in frontier basins, with southern Africa leading in terms of high-impact exploration. Ongoing drilling campaigns show the promise of making basin-opening discoveries across the continent’s emerging and established markets, thereby rewriting the continent’s exploration history.

Southern Africa continues to lead in terms of high-impact drilling. In Namibia, Galp successfully completed the first phase of the Mopane exploration campaign in H1, 2024, with two exploration wells and one drill stem test completed. The first well (January 2024) penetrated multiple reservoir intervals, with initial flow rates showing 14,000 bpd. The second well (March 2024) discovered significant light oil columns across exploration and appraisal targets, while a third well drilled in November 2024 encountered light oil and gas

condensate. Mopane-2A was spud in December 2024, while Mopane3X confirmed a new discovery in January 2025. Additionally, Chevron completed drilling activities at the Kapana-1X exploration well at Namibia’s Block 2913B in January 2025. The well unfortunately did not encounter commercial hydrocarbons.

Meanwhile, TotalEnergies aims to drill up to seven exploration wells in South Africa’s Deepwater Orange Basin (DWOB), following receiving the requisite environmental approvals. DWOB lies in proximity to major discoveries made on the Namibian side of the basin. In Angola, ongoing drilling activities in the offshore Namibe basin by ExxonMobil aim to unlock a new frontier basin in southern Africa. The company began drilling the Arcturus-1 wildcat in July 2024, with the rig departing the project site in late-October. Azule Energy signed RSCs for exploration Blocks 46, 47 and 18/15, with plans to conduct frontier drilling. In Zimbabwe, Invictus Energy is advancing an onshore exploration campaign in the Cabora Bassa basin. The company is working on a phased multi-steam approach to unlock resources and has identified multiple drillready prospects. These include the Baobab-1 target. Looking ahead,

the company is planning further appraisal drilling as it prepares for development drilling.

Apus Energy spud the Atum-1X well in Guinea-Bissau’s Block 2 in September 2024, targeting a prospect that could hold up to 314 million barrels of recoverable oil. Situated near Senegal’s Sangomar discovery, the drilling campaign represents the first offshore well drilled in the country in nearly two decades. In Central Africa, Kosmos Energy spud the Akeng Deep-1 well in Equatorial Guinea’s Block 5 in 2024, encountering oil zones in the Upper Albian. Although the well was not deemed commercial, drilling confirmed the elements of an active petroleum system in the interval, providing greater insights into the Lower Cretaceous.

In the Republic ofCongo, TotalEnergies completed its ultradeepwater Niamou Marine-1 exploration well in October 2024, which targeted a potential billionbarrel structure. Situated within the broader MarineXX block, the campaign targets 1.4 billion barrels of recoverable oil or 2.7 trillion cubic feet of exploitable gas. Perenco is also advancing drilling efforts in the country, with two to

three rigs operating for the next two years. The rigs will focus on drilling at Tchibouela-Est, Masseko, Emeraude and Marine XXVII. Perenco is also drilling in Gabon, spudding anappraisal well near the Hylia South West discovery – made in 2023. In São Tomé and Príncipe, Brazilian giant Petrobras acquired stakes in three exploration blocks – 10, 11 and 13 – in 2024. Alongside partners, the company plans to drill a well in Q3, 2025. Petrobras has also received approval from the government of Ivory Coast for a declaration of interest in nine blocks, with future drilling plans anticipated.

As a frontier region, East Africa is pursuing new exploration projects. Genel Energy is working towards drilling the Toosan-1 exploration well in Somalia’s SL10B. In 2024, the company optimized the well plan to reduce cost and maximize efficiency of the well delivery process. While drilling was put on hold in 2025, the company remains committed to exploring the country’s oil and gas potential. In Egypt, both Chevron and Eni did not encounter commercial discoveries, with Chevron relinquishing its 45% stake in the country’s Red Sea Block 1 in April 2025. The company has since pivoted towards the Mediterranean shelf in the country. For its part, Eni’s Orion X1 in Egypt’s North East Hapy was deemed unsuccessful. However, the company is progressing with a multi-well campaign at the Zohr field.

Ghana’s oil and gas sector is showing clear signs of resurgence, underscored by Eni’s recent declaration of commerciality for the EbanAkoma complex in the Cape Three Points Block 4.

Estimated to hold between 500 and 700 million barrels of oil equivalent, the find marks the country’s largest offshore discovery in years and lies adjacent to Eni’s existing Sankofa production hub, allowing for rapid and costefficient development.

In June 2025, Tullow Oil and Kosmos Energy – alongside partners PetroSA, Ghana National Petroleum Company (GNPC) and Explorco – signed a Memorandum of Understanding to secure the extension of petroleum licenses in the Jubilee and TEN fields through 2040. While the EbanAkoma discovery points to Ghana’s geological upside, the agreement with Tullow and Kosmos underscores the country’s institutional capacity to drive and sustain long-term energy growth.

At the center of both developments is a renewed focus on productionled investment. Eni is preparing adevelopment plan to bring its new find online, while Tullow and Kosmos have committed up to $2 billion to drill 20 new wells in Jubilee.

These aren’t speculative ventures – they’re anchored in existing infrastructure, supported by regulatory clarity and structured to deliver returns for both investors and the Ghanaian state. The resulting uplift in oil and gas production will expand the country’s revenue base through GNPC equity, royalties and taxes – laying the groundwork for greater investment in national development priorities such as healthcare, education and infrastructure. Crucially, Ghana’s ability to secure longterm upstream commitments also sends a strong signal to global markets that the country is stable, serious and investment-ready.

Energy security is also central to both projects. Eni already supplies a large portion of Ghana’s domestic gas needs, and Eban-Akoma will enhance that capacity. Under the extended production license

agreement, Tullow and Kosmos have committed to delivering 130 million standard cubic feetof gas per day from the Jubilee and TEN fields, supported by a restructured pricing and payment model that enhances access for power producers and industrial users. These volumes are vital for stabilizing the power sector, strengthening energy-intensive industries and supporting job creation. With sustained drilling and field optimization, Ghana’s proven and probable reserves will continue to grow, further strengthening its resource base and outlook.

Ghana’s institutional capacity also stands to benefit. Partnerships between Eni, Tullow and Kosmos and national bodies like GNPC and the Petroleum Commission include frameworks for knowledge transfer, technical support and regulatory alignment – all of which strengthen the country’s ability to manage its energy resources. Eni’s ongoing expansion, along with Tullow and Kosmos’drilling programs, is expected to directly and indirectly support thousands of jobs across engineering, logistics, fabrication and services, while creating new opportunities for Ghanaian companies to play a greater role in the oil and gas value chain.

Our purpose To deliver energy to the world, today and tomorrow.

Three significant developments in Africa’s energy infrastructure landscape made headlines in 2025: the East African Crude Oil Pipeline (EACOP) reached 60% completion, the Republic of Congo finalized a pipeline cooperation deal with Russia, and Nigeria and Equatorial Guinea advanced plans for a joint natural gas pipeline.

Together, these milestones highlight Africa’s growing momentum in cross-border infrastructure, crucial for unlocking hydrocarbons, spurring industrial growth and reducing energy poverty.

The 1,443-km EACOP is set to link Uganda’s oil fields in the Lake Albert region to the port of Tanga in Tanzania, facilitating the export of up to 246,000 barrels per day. With 60% of the project now completed – including land acquisition, environmental approvals and construction – EACOP is on track to become the longest heated crude oil pipeline in the world. More than just a logistical asset, EACOP represents a critical economic corridor. It is expected to generate thousands of jobs, stimulate local content and unlock ancillary infrastructure such as roads, storage facilities and power lines. By enabling Uganda to monetize its crude reserves, the pipeline also enhances fiscal revenues that can be reinvested into energy access, education and healthcare.

Just days after the EACOP update, Russia ratified a bilateral agreement with the Republic of Congo for the construction of the PointeNoireLoutete-Maloukou-Trechot oil pipeline. The agreement lays the groundwork for joint efforts in planning, financing, construction and operation of the pipeline, set to be completed in three years. The move strengthens energy ties between the two countries and opens the door for Russian investment in Congo’s midstream sector, potentially accelerating the development of critical infrastructure needed to monetize and export the country’s hydrocarbon resources. It also signals a shift in Africa’s external energy partnerships, with Congo turning to non-Western allies to build out its infrastructure and secure longterm offtake agreements. It reinforces the idea that diversified geopolitical engagement can help African nations close the infrastructure gap faster, provided partnerships are structured transparently and with shared development objectives.

An agreement between Nigeria and Equatorial Guinea, signed on June 18, aims to fast-track the development of a joint natural gas pipeline, designed to increase crossborder gas tradeand support export

capacity. This project is expected to deepen energy cooperation between the two countries, facilitate access to cleaner fuels and contribute to the diversification of energy sources in the region. It also exemplifies how collaborative infrastructure development can unlock new economic opportunities, stimulate investments and enhance regional energy security.

Existing operators are advancing regional gas integration. The West African Gas Pipeline Company— backed by Chevron and others— delivers Nigerian gas to Benin, Togo, and Ghana, supporting both power generation and industrial activity. In southern Africa, the Republic of Mozambique Pipeline Investments Company, which manages the Mozambique-South Africa Gas Pipeline, opened a new office in Maputo to reinforce connectivity and market integration.

While Africa accounts for 17% of the global population, it accounts for just 3.3% of global powergeneration. Energy poverty remains a major constraint on industrialisation, education, healthcare and entrepreneurship. Pipelines, by moving fuel to where it is needed most – across borders and into domestic markets – can help address this imbalance.

Investor confidence is growing in Ivory Coast’s energy sector, as new players enter the market and active companies’ ramp-up their investments.

As one of Africa’s final energy frontiers, the country stands to play a key part in boosting Africa’s oil and gas production, with recent deals pointing to a hydrocarbon-led economic transformation.

Brazilian state-owned energy giant Petrobras’ 2025 declaration of interest in nine offshore exploration blocks in Ivory Coast marks a significant milestone as the Brazilian national oil company (NOC) initiates its entry into West Africa’s promising hydrocarbon landscape. Approved by Ivory Coast’s Council of Ministers, the declaration of interest represents the first stage in a multiphase process aimed at acquiring exploration rights in the Ivorian sedimentary basin. This potential entry not only positions Petrobras to secure exclusivity in future contractual negotiations, but also aligns with its broader international strategy to diversify and replenish oil and gas reserves by tapping into high-potential frontier basins.

As a new entrant to the Ivorian energy market, Petrobras brings decades of world-class offshore experience, technological leadership and capital investment to a region increasingly recognised as a rising

hub forhydrocarbon development. With Ivory Coast’s offshore potential reaffirmed by recent discoveries and heightened investor interest from companies including bp, Vitol and Vaalco Energy, Petrobras stands to become a pivotal driver for accelerating exploration activity and unlocking additional value across the region.

The deal also reflects the Ivorian government’s proactive energy strategy, as demonstrated by its recently launched National Energy Compact vision. With a goal of attracting $6.56 billion in energy investment – including $2 billion in private capital for electricity access and renewables – Ivory Coast is charting a path toward inclusive and sustainable energy development. The Petrobras initiative complements this vision by strengthening energy security and promoting long-term economic growth through upstream development and job creation.

Petrobras’ decision to collaborate with PETROCI – Ivory Coast’s NOC – further illustrates its commitment to fostering local partnerships, knowledge sharing and capacity building. Exploration in frontier regions such as Ivory Coast is not only vital for increasing reserves but is also essential to achieving energy self-reliance and industrialisation across the continent.

South Africa is advancing developments in oil, gas and renewable energy, striving to address key economic challenges by monetizing untapped energy resources.

Through targeted regulation, the country is significantly improving the business climate for international companies, with policies such as the Gas Master Plan (GMP) and Upstream Petroleum Resources Development Act set to drive investment across the value chain, unlocking new opportunities for broader economic growth and energy security.

Rich in a variety of resources – most of which are largely untapped –South Africa has been revising its policies in recent months under efforts to secure foreign capital and drive projects forward. Key developments include the launch of the South African National Petroleum Company – a dedicated stateowned oil corporation – and the implementation of the Upstream Petroleum Resources Development Act. These regulatory efforts aim to unlock new opportunities for international participation across the South African oil and gas market and come as the country is advancing offshore exploration efforts.

Striving to unlock similar discoveries to those made in neighboring Namibia, South Africa is promoting an ambitious exploration drive

across the offshore oil and gas market. The country’s Orange Basin holds significant promise and ongoing exploration campaigns seek to open new frontiers offshore. Energy major Shell has recently received the greenlight to drill in the Northern Cape Ultra Deep block. The company plans to drill at least five deepwater exploration and appraisal wells in the Orange Basin, the results of which could lead to play-opening discoveries. Additionally, energy major TotalEnergies is targeting a two-well wildcat campaign in the South African side of the Orange Basin. Drilling is expected to commence in 2026.

Recent Merger & Acquisition activity in South Africa reflect a strong international drive to unlock the country’s potential oil and gas resources. Notably, Eco Atlantic –through its subsidiary Azinam South Africa – acquired a 75% working interest in Block 1 in June 2024. The company serves as the operator and will carry out a work program. Energy majors TotalEnergies and QatarEnergy acquired participating interests in Block 3B/4B in March 2024, while Africa Energy Corp become operator of Block 11B/12B –situated in the Outeniqua Basin. Ongoing exploration projects stand to reposition the country as an oil and gas producing market.

On the gas front, South Africa is making strides to enhance fuel security through domestic gas

monetization projects. Energy company Renergen – currently the country’s sole onshore gas producer – operates the Virginia Gas Project in the Free State province. Producing LNG and liquid helium, the project is expected to support economic growth across the province. With the country’s gas industry still in its infancy stage, the government is working to establish strong regulations to entice investment and development across the gas value chain. These include the GMP – currently under review – which provides a roadmap for critical infrastructure. The GMP is poised to spur the development of LNG terminals, pipelines and strategic production and storage infrastructure.

Africa’s position as a deepwater exploration and production (E&P) frontier is becoming increasingly central to global energy strategies, with 2025 shaping up to be a defining year for offshore development on the continent.

Bolstered by a string of highprofile discoveries and renewed interest from IOCs, Africa’s deepwater segment is evolving from a series of isolated successes to a full-fledged, transcontinental play with long-term commercial viability.

The resurgence of deepwater exploration in Africa has been driven in large part by landmark discoveries made in the Orange Basin. Namibia’s initial Venus, Graff, Jonker, and more recently, Mopane discoveries are estimated to hold upwards of 11 billion barrels of oil equivalent (boe),positioning the country as a major emerging player in global deepwater exploration. While these finds are still in the appraisal or development planning stages,

the pace at which operators like TotalEnergies are working to fasttrack production speaks volumes about their potential. Meanwhile, BW Energy and NAMCOR are revisiting the Kudu gas field – once considered stranded – using new seismic to reassess its scale and viability for a gas-to-power project.

To the northwest, Côte d’Ivoire has rapidly become a deepwater success story, led by Eni’s Baleine and Calao discoveries. Together, the two finds could hold up to 1.5 billion boe, cementing the country’s status as a formidable exploration player. Calao, discovered in March 2024, is the second-largest find in the country’shistory and has attracted a flurry of new entrants. VAALCO Energy acquired Svenska

Petroleum’s stake in the producing Baobab field and Shell has shown strong interest in blocks CI-602, 603 and 707. Eni itself has doubled down, signing contracts for four new exploration blocks – CI-504, 526, 706 and 708 – in November 2024.