Global Gravity expands worldwide with TubeLock® Global Gravity expands global footprint, bringing

&

solution for tubular transportation to key markets

Global Gravity expands worldwide with TubeLock® Global Gravity expands global footprint, bringing

&

solution for tubular transportation to key markets

Cegal offers an extensive suite of plug-ins to complement the Petrel* E&P software platform, accelerate subsurface workflows, and allow you to connect data to the PythonTM ecosystem.

Unlock the full potential of your Petrel projects and revolutionize your approach to geomodeling workflows

Experience an extensive suite of close to 100 tools within the Blueback Toolbox, tailored to complement and expand the native capabilities of the Petrel platform. This comprehensive collection spans across geophysics,

geology, geomodeling, and reservoir engineering domains, empowering you to streamline project management and enhance productivity.

Discover a diverse range of tools designed for input data preparation, quality control, data analysis, fault analysis, reporting, 3D property modeling, and log data upscaling. From seismic data analysis to enhanced data manipulation and editing functionalities, our toolbox equips you with the necessary resources to optimize your workflow.

Are you ready to enhance your Petrel experience? cegal.com *Petrel is a mark of

Scan the QR code to learn more.

Welcome to the sixth and the final issue of 2025 of our OGV Energy Australia magazine on the theme of Marine and Lifting.

We have made it to issue six and are close to marking one year of OGV Group Australia, what a year it has been! Establishing in a new region, exploring new events all over Australia and APAC, not to mention making many new connections, friends and catching up with clients from across the globe looking at opportunities in Australia.

This first year would not have been possible without the support from our amazing clients old and new as well as the continuous guidance and encouragement from my superb colleagues in Aberdeen. Thank you endlessly.

Rounding off this year, we are thrilled to have Global Gravity as our front cover superstar and feature article. From humble beginnings in Denmark to global expansion across 8 regions, Global Gravity explains how their critical tubular handling solutions are changing the game in the oil and gas market. With their sights set on development in Australia and APAC, Dave Craig - General Manager APAC - details the opportunities in utilising their TubeLock technology to efficiently optimise operations in costs, time and most importantly, safety. To find out more, please turn our feature article on page 4.

We are also delighted to provide contributions in this issue from SLB, Rio Tinto, Three60 Energy and many more.

There are also comprehensive reviews from regions across the globe as well as the Mining industry here in Australia.

That’s all from me and OGV Group Australia for 2025 but we will be back and bigger for 2026 - keep your eyes peeled for

new happening in the New Year!

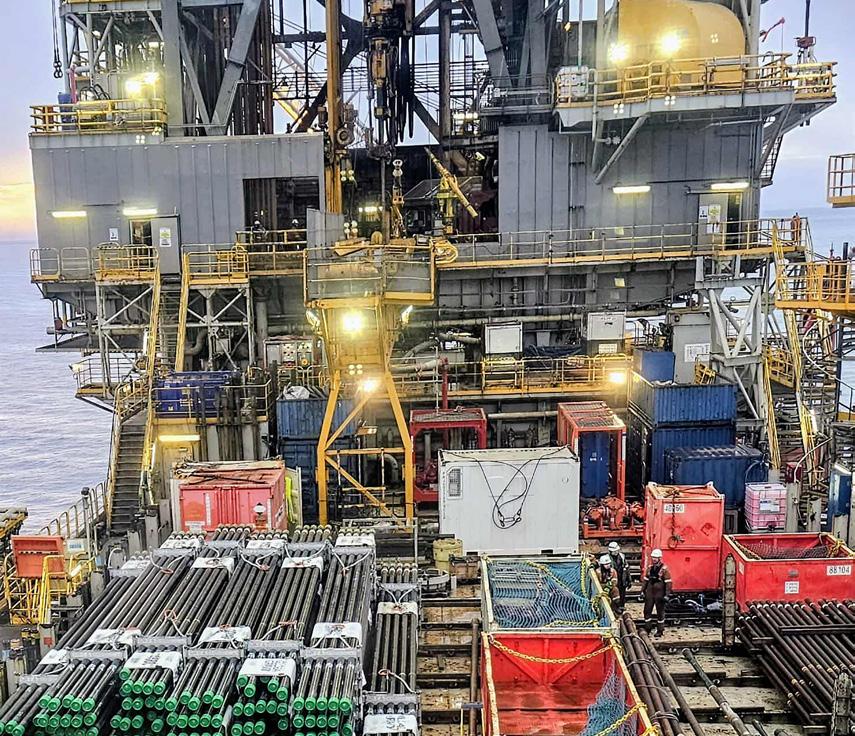

Offshore oil and gas operations depend on precision, safety, and efficiency. One of the clearest examples of this is tubular handling and transport, a task that has long been known as hazardous, time-consuming and expensive.

In the offshore oil and gas industry, where even small mistakes can have major consequences, innovation in safety and efficiency isn’t just welcome - it’s essential.

Since its founding in 2011 in the Danish port city of Esbjerg, Global Gravity has built its reputation on precisely that: practical innovation tailored to the unique challenges of the offshore oil and gas sector.

Global Gravity entered the oil and gas market with a clear purpose: to make tubular handling safer, efficient, and more optimised for the client’s operation. Anyone who has spent time on a rig floor or quayside knows the risks associated with traditional methods of pipe transportation.

The foundation of Global Gravity’s success is TubeLock®, the company’s patented Tubular Transport Running System (TTRS), widely recognised as a transformative step forward in how tubulars are handled, stored, and transported offshore.

Now, Global Gravity is taking its message and method further overseas. In addition to its headquarters in Denmark, as of this year, the company has established offices in Norway, the UK, Qatar, and Australia, signalling a decisive commitment to serving operators and drilling contractors worldwide.

TubeLock® is a patented, all-in-one pipe handling system that enables all preparation - drifting, tallying, and fitting of centralisersto be completed onshore, making offshore handling safer and smarter. TubeLock® is engineered for ultimate efficiency and protection, both onshore and offshore.

Its patented smart, stackable design makes it easy to transport by road, vessel, or directly to the rig, while allowing operators to run pre-numbered pipe one by one straight from the frame.

This innovative approach minimises manual handling, enhances safety, and streamlines the entire pipe-handling process.

TubeLock® effortlessly accommodates a wide range of pipe types, including OCTG, sand screens, assemblies, and more, in sizes from 2-3/8” to 20”.

Best of all, every TubeLock® system can be tailored to meet specific client needs, delivering a custom-fit solution that improves both safety and operational performance across any project.

TubeLock® is more than just a piece of equipment; it represents a fundamental shift in the way tubulars are managed offshore.

The advantages of using TubeLock®:

• Safety: Minimising risk to personnel and equipment during loading, transport, and running. With no slings to remove and far less pipe movement, the risk of dropped objects and personnel injury is reduced by at least 50%.

• Efficiency: Streamlining operations to reduce vessel time and non-productive delays. Operators report time savings of up to 50% on tubular handling processes, freeing cranes and deck crews for more critical drilling operations.

• Space: TubeLock® requires roughly half the deck space compared to traditional methods, a major advantage on crowded offshore platforms.

• Environmental impact: An independent study confirmed TubeLock® reduces CO₂ emissions per well from 52 tonnes to 16 tonnes, thanks to shorter vessel times and lower crane usage.

The design also considers practicalities. Manufactured from lightweight aluminium, no single TubeLock® component weighs more than 15 kilos, easing manual handling while avoiding galvanic corrosion with chrome alloy tubulars. For high-value assets such as chrome and super-chrome tubulars, TubeLock® provides superior protection against damage compared with slinging or transport baskets.

Importantly, TubeLock® has been certified under DNV ST-0378, ISO 9001, NORSOK R02 and meets LOLER recommendations, making it a globally recognised, best-practice solution. The company is also a member of the Lifting Equipment Engineers Association (LEEA) and the IADC Southern Arabian Peninsula Chapter.

TubeLock® has already established itself as an industry benchmark. Drilling contractors and operators adopting the system consistently report safer operations, faster turnarounds, and reduced environmental impact.

In a world where the cost of downtime can reach into the millions per day, cutting half the time spent on pipe handling has a measurable financial impact. And beyond the numbers, TubeLock® is transforming the daily reality of offshore crews by removing unnecessary risks.

Global Gravity’s CEO, Tom Rasmussen commented “TubeLock® is more than a piece of equipment, it represents a change in how the industry approaches tubular handling. By replacing unpredictable, manual processes with a structured and controlled system, we’re helping operators achieve safer, more efficient, and more consistent operations offshore.”

“Since joining Global

the

and

in

for

of

focus on introducing Tubelock® and showcasing the full range of benefits we can bring to clients in the APAC region”

Global Gravity has expanded with purpose from its roots in Denmark, carefully planning its global footprint to position TubeLock® in the markets that matter most.

Offices in Norway and in the UK brought Global Gravity closer to North Sea operators, among the earliest adopters of TubeLock®. In Qatar, where the company has been active since 2019, the official opening of an office in 2025 is built on years of established customer relationships, creating a permanent base in the Middle East - a region where operators face the same critical demands for safety and efficiency.

Now, with its latest expansion into Australia, Global Gravity is turning its focus to the growing Asia-Pacific (APAC) region.

The decision to establish an office in Australia is both strategic and timely. APAC remains one of the most dynamic oil and gas regions in the world. Offshore projects across the region have operators demanding solutions that improve safety, reduce costs, and limit environmental impact.

Global Gravity sees the APAC region as a strong growth opportunity for TubeLock®, driven by increasing offshore activity, tightening safety and emissions regulations, and the growing need for more efficient tubular handling solutions. The company’s ambition is clear: to establish TubeLock® as the standard system for transportation and handling all types of pipes used by drilling rigs within the region.

By establishing a presence there, the company is demonstrating its long-term commitment to supporting operators across the region.

The new office is led by industry veteran Dave Craig, who has relocated from Aberdeen to oversee APAC operations. Dave brings extensive experience in lifting and drilling operations and is eager for the challenge ahead.

The decision to establish the APAC headquarters in Perth was both practical and strategic.

Global Gravity has had active operations in Western Australia since 2022, also completing projects in New Zealand during that time so makes it the ideal base to support those working on the North-West Shelf and beyond. At the same time, Perth offers strong logistical connectivity across the wider APAC region, enabling Global Gravity to serve customers efficiently wherever they operate.

This dual advantage ensures that Global Gravity is not only close to its core Australian customer base but also well-positioned to play a meaningful role across APAC’s oil and gas sector.

integrated bypass maintains production during isolation

Dual Leak-Tight Seals

Double Block & Bleed Isolation

Isolated Pipeline

Monitored Zero-Energy Zone

The BISEP® has an ex tensive track record and provides pioneering double block and bleed isolation while

dual seals provide tested, proven and fully monitored leak-tight isolation, ever y time, any pressure.

Tide Breaker opens call for startups to join new digital initiative alongside global operators

Aberdeen tech company Elementz has officially opened the call for applications for its new digital accelerator initiative with AI startup companies now formally invited to apply.

Spearheaded by Elementz, a subsea asset integrity management software company, Tide Breaker is a digital initiative designed to fast-track the development of artificial intelligence (AI) in subsea operations.

Launched last week (October 30th) at Aberdeen’s ONE Tech Hub, Tide Breaker: Powering the Subsea Start Up Wave, attracted over 75 attendees from across the energy, technology, and innovation sectors, including oil and gas, renewables, software, and industry bodies.

New Partnership Strengthens Well Intervention Capabilities Across Australia

Unity Well Integrity (Unity), an international well integrity and decommissioning specialist, has announced a strategic partnership with Clear Cut Interventions (CCI) Australia, a respected provider of well intervention services to the Australian oil and gas industry.

The collaboration marks a significant step forward in delivering advanced intervention and well integrity solutions to operators across Australia. By addressing the offshore realities of limited POB, restricted deck space and crane capacity, the partnership ensures operators can execute critical well integrity work with greater efficiency, safety and certainty.

Thyra Paints the Oil Industry Pink - The fight against breast cancer deserves attention all year round.

For years, Izomax has proudly supported the Pink Ribbon campaign through annual donations each October. This year, they wanted to take their commitment one step further and make the important fight against breast cancer visible every single day of the year.

That’s why we’re introducing Thyra. She’s one of the AOGVs in our fleet that repair and maintain pipelines all over the world. From now on, Thyra will stand out, not in yellow, but in pink. And every time she’s sent out on a new assignment, Izomax will donate NOK 10,000 to the Pink Ribbon campaign.

ABL to support platform installations and rig moves for Chevron in Gulf of Thailand

ABL has received an award of work order from Chevron Thailand Exploration and Production, Ltd., Chevron Offshore (Thailand) Ltd. and Chevron Pattani Limited to provide marine warranty survey (MWS) and thirdparty support services in connection with wellhead platform installations and jack-up rig moving in the Gulf of Thailand.

ABL’s scope of work includes MWS services for wellhead platform installations including other associated services. The MWS scope comprises desktop document reviews, suitability surveys, loadout approvals, towage approvals and lifted installation approvals.

ABL’s operations in Thailand will head up the deliverables, supported by ABL’s offices in Malaysia and Singapore.

Direct Travel Acquires ATPICreates Modern Global Travel Management Powerhouse

Direct Travel, Inc., a leader in corporate travel management, has announced the acquisition of its long-time strategic partner, ATPI, creating one of the world’s largest travel management companies.

Together, the two companies will drive over $6 billion in annual total travel volume and offer leading technologies and unparalleled service across global corporate, leisure, events, and specialized travel sectors.

The acquisition of ATPI, one of the most experienced and long-established international travel and event management companies, serves as a natural progression of the companies’ multi-year collaboration to serve the business travel needs of global corporate clients.

SLB has signed a definitive agreement to acquire RESMAN Energy Technology, a global leader in wireless reservoir surveillance solutions, in a move aimed at strengthening its production and recovery portfolio

RESMAN’s proprietary tracer technologies, already in use across oil, gas, CO₂ storage, and geothermal projects, allow operators to track fluid movement in reservoirs with precision down to parts per trillion. These insights enable faster interventions, extended well life, and optimized recovery while minimizing operational disruptions.

GAC is a global provider of shipping, logistics and marine services. Emphasising world-class performance, a long-term approach, innovation, ethics and a strong human touch, we deliver a flexible and value-adding portfolio to help customers achieve their strategic goals.

Established since 1956, GAC employs over 7,500 people at more than 300 offices in over 50 countries worldwide.

www.gac.com

Film-Ocean provides innovative subsea solutions to the global offshore energy industry. We specialise in providing a turnkey managed service for the subsea inspection of floating assets and have ABS, BV, DNV and Lloyd’s approval for the inspection of the long term fixed moored system including our chain measuring equipment.

www.film-ocean.com

Dron & Dickson are specialists in integrated supply, installation and maintenance of harsh & hazardous area electrical equipment. Our UK network of wholesale branches can supply quality brand-name electrical equipment from all the leading manufacturers supported by the highest level of customer service.

www.drondickson.com

The Orphie business of i2S is a specialist in the design of complex underwater imaging systems.

Our aim is to make underwater operations more efficient, more cost-effective and safer, thanks to our patented technology.

www.i2s-orphie.com

Provider of specialist products, services and engineered solutions for renewable and conventional energy markets.

www.glacierenergy.com

Destec On-Site Services provide specialist engineering solutions across the UK and internationally, supporting a broad spectrum of industries including chemical and petrochemical, offshore, power generation (renewable and nuclear), marine, steel, mining, rail, fabrication, and vessel manufacturing.

www.destec.co.uk

At WellSense, we’re on a mission to extend the life of oil and gas fields, maximize well performance, and ensure effective well abandonment through innovative, practical solutions.

www.well-sense.co.uk

Penspen’s global teams design, maintain, and optimise energy infrastructure to improve access to secure and sustainable energy for communities worldwide.

www.penspen.com

Deepsea Technologies, Inc. specializes in the development, engineering and manufacturing of standard and customized equipment for the following applications: subsea production systems, SURF, subsea intervention, offshore & onshore drilling, and others. DTI was established in 2001 and headquartered in Houston, TX operating under an ISO 9001:2015 certified Quality Management System.

www.deepsea-tech.com/

By Tsvetana Paraskova

Australia’s biggest oil and gas companies projected optimism at their earnings and outlook releases, while Australia’s government continues to work to boost the rollout of renewable energy.

Following the withdrawn bid from an Abu Dhabi-led consortium to buy Santos, the Australian energy giant reported solid quarterly results for the third quarter of 2025, as the firm transitions from a period of high capital intensity to one that it expects to deliver stronger returns for shareholders.

Third-quarter sales volumes were lower than the second quarter, mainly due to maintenance activities in Western Australia, lower crude oil volumes due to timing of liftings, and lower third-party gas purchases. January-September sales volumes were slightly higher than the prior year.

Santos narrowed its production guidance for this year to between 89 million and 91 million barrels of oil equivalent (boe), down from the previous guidance of 90-95 million boe.

The downgrade primarily reflects a slower-thananticipated start-up of the floating production, storage, and offloading vessel (FPSO) at the new Barossa LNG project and the impact of floods on the company’s production in the Cooper Basin. Going forward, Santos expects the Barossa LNG project in Australia and the Pikka oil project in Alaska to boost its oil and gas production by 30 percent by 2027, compared to 2024 levels.

Xsix months of operations, September 2024 –March 2025.

Moomba CCS demonstrates the real potential for large-scale emissions reduction to be delivered by carbon capture and storage projects in Australia, according to CEO Gallagher.

Momentum is also building around our Narrabri Gas Project, with strong market interest reflected in recent MOUs and ongoing engagement with key stakeholders.

“With around $1.4 billion of free cash flow from operations generated year-to-date, Santos is well positioned to deliver strong shareholder returns with imminent production growth as we bring Barossa LNG online and move closer to the start-up of Pikka,” said Santos managing director and CEO Kevin Gallagher.

“Momentum is also building around our Narrabri Gas Project, with strong market interest reflected in recent MOUs and ongoing engagement with key stakeholders. Narrabri is the key to solving east coast gas supply concerns and would be a competitive supply source for local industry for decades to come,” Gallagher added.

Santos has also announced that its Moomba Carbon Capture and Storage (CCS) project achieved a major milestone for emissions reduction technology in Australia after receiving the single largest issuance of Australian Carbon Credit Units (ACCUs) from the Clean Energy Regulator (CER). The CER confirmed the issuance of 614,133 ACCUs to Santos under the approved CCS method, covering the Moomba CCS project’s initial

“Policymakers should seize the opportunity to deploy CCS to reduce emissions faster, at scale and cost competitively – particularly when Australia has a unique and natural advantage in carbon capture and storage that is complemented by a well-established, worldclass regulatory regime administered by the Clean Energy Regulator,” the executive added.

The other major Australia-based oil and gas producer, Woodside, reported solid production for the third quarter and raised its full-year guidance on the back of strong performance across assets.

Guidance was revised up in the range 192 –197 million barrels of oil equivalent (boe) for 2025, up from 188 million boe – 195 million boe previously anticipated. Unit production cost is now seen at between $7.60 and $8.10 per barrel this year, down from the previous guidance of $8.0 - $8.50 a barrel.

The company’s Scarborough Energy Project is now 91 percent complete and on track for first LNG in the second half of 2026, chief executive officer Meg O’Neill said.

At the 2025 Capital Markets Day in November, Woodside outlined its strategy to thrive through the energy transition and deliver long-term shareholder value by meeting rising global demand for affordable, reliable, lower-carbon energy.

“Over the next decade, with disciplined capital management, we will execute our strategy by maximising performance from our base business, delivering cash-generative projects to sustain and grow the business and creating the next wave of future opportunities for long-term returns for our shareholders,” O’Neill said.

Woodside expects its net operating cash to rise to around US$9 billion by the early 2030s, representing a more than 6 percent compound annual growth rate in sales and cash flow from 2024 and providing a pathway to a 50-percent increase in dividend per share from 2032.

“Our strategy is supported by ongoing robust global demand for our products. Woodside’s major growth projects will capitalise on this demand, with the Beaumont New Ammonia project expecting first ammonia this year, the Scarborough Energy Project on track to begin LNG shipments in the second half of next year, the offshore Mexico Trion field targeting first oil in 2028, and Louisiana LNG targeting startup in 2029,” O’Neill noted.

“With global LNG demand forecast to grow 60% by 2035, Woodside’s increasing scale across the Atlantic and Pacific basins, combined with our marketing and trading business, optimises our capability to meet customer needs.”

APA Group, for its part, has launched construction of the Sturt Plateau Pipeline (SPP), which is the crucial first-stage link to enable Beetaloo gas to reach power generation assets that keep the lights on across the Northern Territory.

SPP will play an important role in transporting Beetaloo gas to APA’s existing Amadeus Gas Pipeline, to power generation assets in Darwin.

Over the coming months the 37-kilometre pipeline will be welded together to ensure Beetaloo gas can flow in 2026.

“The SPP will help ensure Beetaloo gas is available to power the Territory, a critical first step in the basin’s development. Households and businesses in Darwin will be the first beneficiaries of this new infrastructure,” APA CEO and managing director Adam Watson said.

The Clean Energy Council has welcomed the federal government’s proposed reforms to the Environment Protection and Biodiversity Conservation Act 1999 (EPBC Act), describing them as a timely and balanced step towards protecting Australia’s environment while delivering the clean, reliable electricity the nation needs.

The long-anticipated reforms are pragmatic and thorough, providing the industry with greater clarity for the task ahead, of delivering a timely and successful renewables rollout, Clean Energy Council CEO, Jackie Trad, said.

The broader reform package also pledges to have clearer, more consistent guidance for the clean energy sector and a more streamlined approval process. Projects will be assessed and decided more efficiently, without compromising rigorous environmental standards, according to the proposed changes.

“The reforms provide us the certainty and confidence to continue delivering the

renewable energy projects that power Australian homes and businesses, while safeguarding the environment for generations to come,” Trad commented.

Despite growing power demand, wholesale electricity prices across all National Electricity Market (NEM) regions fell during the September 2025 quarter, thanks to higher renewable energy output and less market volatility, the Australian Energy Market Operator’s (AEMO’s) Quarterly Energy Dynamics report has shown.

Wholesale electricity prices for the NEM averaged AUS$87 per megawatt hour (MWh) in the September quarter, down by 27 percent year-on-year and down 38 percent compared to the second quarter of 2025, the report found.

“The impact of increasing renewable energy and storage connecting to the NEM became more evident in September when milder temperatures and less cloudy days led to a new 77.2% renewable contribution record on 22 September – up from 75.6% in Q4 2024,” said Violette Mouchaileh, AEMO Executive General Manager Policy and Corporate Affairs.

By Tsvetana Paraskova

Despite a slowdown in greenfield exploration, Australia is advancing many projects for mining critical minerals and rare earth elements as it looks to boost Western supply of the materials critical for the energy transition and the defence and auto manufacturing industries.

Expenditure for greenfield mineral exploration fell in the April-June quarter compared to the same period of 2024, the Australian Association of Mining and Exploration Companies (AMEC) said, commenting on the quarterly data by the Australian Bureau of Statistics (ABS).

The statistics data showed some solid numbers, along with a reason for concern, AMEC said in September.

The figures revealed expenditure for national greenfield exploration fell by 17 percent to AUS$253.2 million, compared to AUS$305.6 million in the June 2024 quarter. National brownfields exploration remained relatively flat year on year at AUS$753.1 million.

Led by an uptick in brownfield mineral exploration, Western Australia and Tasmania were the only jurisdictions to buck the trend, with 10.2 percent and 19.8 percent growth in total exploration spend, respectively, AMEC said.

Gold exploration boomed in the June quarter, as global gold demand and prices soar in a tense geopolitical global context.

“Gold has been on an incredible run of late and these stats back it up. It’s also a sizeable indicator that things are starting to improve,” said AMEC Chief Executive Officer, Warren Pearce.

“The introduction of clear timeframes, coupled with transparent consultation processes, will help unlock investment and reinforce WA’s reputation as a world-class destination for exploration and mining industries.”

Gold has been on an incredible run of late and these stats back it up. It’s also a sizeable indicator that things are starting to improve

“In fact, gold was responsible for 40 per cent of all exploration activity recorded across the quarter.”

However, “This continuing reduction in greenfields activity has critical implications for future new project discovery and development and filling the pipeline needed to ensure the future economic prosperity of the nation,” Pearce added.

Overall, the numbers are solid, AMEC noted. The total national exploration spend for FY2025 was AUS$3.83 billion, with brownfields accounting for AUS$2.82 billion and greenfields AUS$1.01 billion. Total metres drilled were only slightly down by 1 percent compared to last year.

AMEC also welcomed the introduction of a new State Development Bill 2025 in Western Australia as it sees the new legislation as “a significant step forward in ensuring investment certainty and timely decision making for strategically important projects across Western Australia.”

“WA’s approvals system is already strong, this ensures we can keep those high standards, but provides industry greater certainty about how and when decisions will be made,” AMEC’s Pearce said.

In addition, AMEC welcomed the joint AUS$600 million investment by the Federal and Queensland Governments to keep Glencore’s Mount Isa copper smelter and Townsville copper refinery operational.

“This investment ensures Australia retains critical processing capability at a time when global demand for our minerals is at a premium,” Pearce said in a statement.

The Queensland Government has announced a AUS$10 million investment in Vecco Group’s mine and commercial-scale electrolyte facility to establish Australia’s first vanadium battery supply chain

Using vanadium sourced from Julia Creek, the Townsville facility will anchor a pit-toport product manufacturing chain, supplying vanadium flow batteries for global energy storage markets, according to the plans.

Operations are expected to begin in early 2028.

“This investment forms part of our strategy to link international investors with Queensland innovation, by backing projects that leverage our strengths and create more jobs for our regions,” said Dale Last, Queensland’s Minister for Natural Resources and Mines and Minister for Manufacturing.

Mining giant BHP is investing more than AUS$840 million in a series of growth-enabling projects at Olympic Dam, to strengthen the foundations of underground mining productivity and continue building its copper province in the far north of South Australia.

The projects, including an underground access tunnel, a new backfill system, and expansion of ore pass capacity, and those underway elsewhere across Copper SA will improve efficiency and support future growth options of South Australia’s copper province, reinforcing the state’s role as a globally significant supplier, BHP said.

“BHP is the largest producer of copper in the world, and we expect to grow our copper base from 1.7 million tonnes to around 2.5 million tonnes per annum,” said BHP chief operating officer Edgar Basto.

“Achieving that scale requires significant copper growth, and we are fortunate to have a world-class copper province right here in South Australia to do just that.”

Charger Metals has seen its Programme of Works approved for drilling at its Lake Johnston Lithium and Gold Project in Western Australia. This work is being managed by Charger and funded by Rio Tinto Exploration Pty Limited, pursuant to Rio Tinto’s farm-in agreement with Charger in relation to the project. The Company has planned a programme of up to 29-holes for about 4,600 m across six priority lithium targets that have never been drill tested. The remainder of the programme, up to 23 holes, will focus on six priority target areas across the Mt Gordon prospect defined by lithium, gold, and niobium in-soils anomalies and/or structural positions interpreted from geophysics.

Gold has been on an incredible run of late and these stats back it up. It’s also a sizeable indicator that things are starting to improve

has the potential to become a significant producer of spodumene concentrate and contributor to the State’s critical minerals sector, according to Global Lithium Resources.

True North Copper Limited said that recent drilling at Wallace North, part of the company’s Cloncurry Copper Project (CCP), has confirmed significant coppergold mineralisation well beyond the current resource boundary, pointing to a substantially larger system

Moreover, the final results from Mt Oxide Phase 1 reverse circulation (RC) drilling program have confirmed the depth persistent, large-scale Aquila copper-cobalt-silver discovery, True North Copper said.

Global Lithium Resources was granted a Mining Lease for its flagship Manna Lithium Project by Western Australia’s Minister for Mines, Petroleum and Exploration for a term of 21 years. The granting of the Mining Lease significantly de-risks the Manna Lithium Project and accelerates its progress towards a Final Investment Decision (FID), following the optimisation of the project’s Definitive Feasibility Study that remains on track for the end of the 2025 calendar year.

The Manna Lithium Project remains the third largest lithium resource in the prolific Eastern Goldfields region, containing a Mineral

Hastings Technology Metals Ltd has completed an agreement with Wyloo Gascoyne Pty Ltd for the development of the Yangibana Rare Earths and Niobium Project. Via an Unincorporated Joint Venture (UJV), the two companies formalised their partnership to progress the Yangibana Project. Wyloo now holds 60 percent of the project and is the UJV Manager and Operator.

“This partnership with Wyloo provides a clear, credible and significantly de-risked pathway to production. It validates the world-class nature of the Yangibana deposit and allows us to unlock the immense value of the project for our shareholders while retaining a meaningful 40% stake,” Hastings CEO Vince Catania said.

Victory Metals Limited has said that recent infill aircore (AC) drilling at its North Stanmore Heavy Rare Earth Element (REE) project in Western Australia has returned some of the highest grades of Dysprosium results ever reported from clay-hosted systems globally. The Dysprosium oxide (Dy2O3) result of 218ppm is about 54 times higher than the Upper Continental Crust (UCC) average of 4.02ppm, Victory Metals said.

“The scale and grade of Dysprosium and Terbium we continue to uncover at North Stanmore is nothing short of extraordinary,” said Brendan Clark, Victory’s CEO and Executive Director.

The company says it is committed to advancing this world-class project to unlock its significant potential.

ABx Group Limited reported “outstanding rare earths extractions” in larger-scale tests conducted for the programme to produce a mixed rare earth carbonate (MREC) at its Deep Leads ionic adsorption clay rare earth project, located 45 km west of Launceston in northern Tasmania. High extraction results were seen for dysprosium (Dy), terbium (Tb), neodymium (Nd), and praseodymium (Pr).

ABx Group says that producing a high-purity MREC from a bulk sample represents a critical milestone for the company in the development of the Deep Leads project.

VHM Limited has received formal approval under the Environment Protection and Biodiversity Conservation Act 1999 for its flagship Goschen Rare Earths and Mineral Sands Project in northwest Victoria.

With the approval secured, VHM will now focus on finalising the Work Plan, finalising strategic off-take agreements and financing, advancing towards a Final Investment Decision, and commencing front-end engineering and design (FEED) studies.

Magnetite Mines Limited has said that nearsurface, clay-hosted Rare Earth Element (REE) mineralisation has been identified at its 100-percent-owned Ironback Hill Project in South Australia’s North-East, adjacent to the company’s large magnetite iron ore deposit.

“We are excited by this early-stage indication of rare earths mineralisation at Ironback Hill and are planning low-cost follow up exploration work to determine if a wider program of work is warranted,” Magnetite Mines managing director Tim Dobson said.

By Tsvetana Paraskova

Asia’s dependence on oil imports is rising, but many countries in the Asia Pacific region are looking to diversify their electricity supply away from fossil fuels and boost renewable energy generation

As Asia becomes more and more dependent on oil imports, a fundamental shift in crude flows is under way, Wood Mackenzie analysts said at the annual Asia Pacific Petroleum Conference (APPEC) in September.

For example, in Indonesia, the biggest economy in Southeast Asia, crude oil imports are increasing amid declining domestic production and rising oil demand.

Overall, rising crude demand in Asia’s mostly emerging economies will lead to higher crude oil imports, WoodMac’s oil research and oil trading analysts reckon.

“Our analysis suggests that these imports will have to come from new long-haul sources

to meet the quality requirements for Asian refiners,” they noted.

At the same time, refined product flows are changing rapidly due to structural shortages in key Pacific markets, another key point in WoodMac’s analysis revealed.

Furthermore, refinery maintenance in the fourth quarter is boosting margins for Asian refiners, but these margins could become squeezed again next year, the analysts noted.

In the third quarter of 2025, Asia’s refiners raised utilization rates to seize the strengthening of refining margins, which could be further boosted by heavy refinery maintenance in the fourth quarter.

“However, looking further ahead, lingering supply fears ease; creating the potential for refinery margins to become squeezed once again in 2026,” WoodMac’s analysts said.

The major US policy shift toward offshore wind, with tax break rollbacks and stop-work orders, could further strengthen China’s dominance in the offshore wind market by the end of the decade, Rystad Energy said in a report in October.

XThe US-China supply chain may be decoupled, but China’s position as a global renewables leader may have only been strengthened because of it.

The energy consultancy expects petrochemicals to play an increasingly important role in future Asian refinery operations, with healthy demand driving investment in specialised units for petrochemical feedstock production.

Integrated sites for petroleum refining and petrochemicals production have outperformed non-integrated sites, with top performers capturing value both from cheap Russian crudes and more robust petrochemical margins.

Operational flexibility has been a key differentiator, with high-performing facilities focusing on petrochemical yields when refined products cracks were weaker, according to Wood Mackenzie’s Refinery Evaluation Model.

Despite the attack on renewables on offshore wind in the US, Rystad Energy research showed that new global offshore wind capacity would reach 16 gigawatts (GW) by the end of 2025, due to projects already underway, with two thirds of them being developed in China.

By 2030, China’s offshore wind projects will claim 45 percent of the world’s cumulative capacity, making it difficult for the US market to compete in the long term, regardless of policy reversals, according to the energy intelligence firm.

“It is now clear that the energy policy shift in the US not only halts or slows progress on offshore wind projects that were previously greenlit but pushes European wind developers away from US investment,” said Alexander Fløtre, senior vice president and head of offshore wind research, Rystad Energy.

“The US-China supply chain may be decoupled, but China’s position as a global renewables leader may have only been strengthened because of it.”

Meanwhile, onshore wind capacity in Southeast Asia could jump from 6.5 GW in 2024 to as much as 26 GW by 2030, driven by a combination of short-term policy initiatives such as auctions, project awards, and attractive feed-in tariffs (FITs), alongside the rising acceptance of mainland Chinese wind turbines, a separate analysis by Rystad Energy showed in October.

Southeast Asia’s onshore wind capacity growth has been mild this decade due to a combination of regulatory hurdles, weak grid infrastructure, high costs associated with developing local supply chains, and persistent reliance on cheaper fossil fuels like coal, which are perceived as more stable.

However, acceleration is under way as nations in the region expand renewables and progress their energy transition goals, according to Rystad Energy.

Vietnam remains the largest market despite policy-driven fluctuations, with the Philippines and Thailand following closely behind.

“Government policies are further boosting momentum, with several new regulations introduced this year to support development,” said Raksit Pattanapitoon, Lead Renewables & Power Analyst, APAC, at Rystad Energy.

With more mature technology, falling equipment costs and improved performance even at lower wind speeds, onshore wind is increasingly a competitive option for meeting renewable energy targets

uneconomic, according to Wood Mackenzie’s new CCUS and Global Power Generation analysis.

The carbon capture costs for European power generators exceed US$300 per tonne, which makes most projects uneconomic, WoodMac says.

“With more mature technology, falling equipment costs and improved performance even at lower wind speeds, onshore wind is increasingly a competitive option for meeting renewable energy targets.”

Asia, where coal is still king, faces challenges in meeting its net-zero targets, but some Asian countries are looking to reduce emissions by turning to ammonia for power generation, particularly through co-firing—blending lowcarbon ammonia with coal or natural gas.

Rystad Energy expects China, Indonesia, Japan, and South Korea to emerge as key hubs for this transition to ammonia use in co-firing. However, a sizeable supply gap remains, with about 8.8 million tonnes per annum (Mtpa) of ammonia needed to meet 2030 targets, according to Rystad Energy’s analysis.

Asian countries appear willing to tackle the challenge of expensive ammonia and advance their co-firing plans, despite the high costs associated with low-carbon hydrogen production, ammonia conversion and transportation, Rystad Energy says.

Costs would be much higher than coal-fired power generation, indicating that costs must be tackled through innovation, economies of scale, or the implementation of a meaningful carbon price to make ammonia co-firing competitive, the intelligence firm reckons.

In carbon capture technology, the economics are in favour of China over Europe, a recent analysis by Wood Mackenzie found.

The global power sector faces a stark divide in carbon capture economics, with Chinese developers claiming dramatic cost advantages while European utilities have to contend with prohibitive expenses that make most projects

At the same time, China claims to build equivalent facilities with CCUS costs of roughly $30-40/tCO2, creating a significant viability gap for the technology across the two regions.

“China’s claimed 70% cost advantage in power plant carbon capture could prove as disruptive to this sector as their dominance in solar manufacturing,” said Peter Findlay, Director and Global Lead, CCUS Economics at Wood Mackenzie.

Smart grids would be critical to meeting the renewable energy surge and the fast-growing energy-intensive sectors, such as data centres, industrial parks, and manufacturing

hubs, in the ASEAN region, think tank Ember said in a report in October.

Smart grids could save ASEAN nations billions of US dollars and unlock clean energy growth, according to the climate think tank.

Ember believes that stronger and more reliable power systems could unlock up to $2.3 billion in annual economic value for ASEAN by 2040.

Smart grid investment of $4 billion to 10.7 billion is needed to modernise ASEAN’s power systems, support economic growth, and enable cleaner, more reliable energy, the report found.

“Smart grids are no longer optional – they are the backbone of ASEAN’s clean energy future. Investing in smart grid infrastructure is both an energy transition enabler and a driver of economic and industrial competitiveness,” said Alnie Demoral, an energy analyst at Ember.

“Modern grids unlock the full value of renewable assets, strengthen industrial growth, and position ASEAN at the forefront of the global green economy.”

By Tsvetana Paraskova

for our energy future,” the open letter to Chris McDonald, the Minister for Industry at the Department for Business and Trade, says.

The future of the UK tax regime for North Sea operators, the importance of job preservation and creation, and insights into wells and workforce featured as main themes in the UK North Sea oil and gas industry in the past weeks.

“Job losses are occurring at an unacceptable scale, and there is an urgent need for supportive policy to unlock investment, drive economic growth, and safeguard the UK’s energy transition.”

An Offshore Energies UK (OEUK) survey has shown that more than half, 55 percent to be precise, of the UK’s offshore energy firms have reduced their staff headcount in the past year.

The outlook remains challenging, with nearly half, or 45 percent, of surveyed companies expecting to cut jobs further over the next 12 months if the current policy environment continues, according to the latest Offshore Energies UK (OEUK) Pulse Survey.

The survey also reveals a growing trend of companies shifting focus overseas, with one respondent stating: “We’re now actively looking to reduce exposure to the UK energy industry and move operations overseas, reducing UK economic activity and tax take (personal and PAYE).”

“If we allow the decline of North Sea oil and gas to continue unchecked while failing to accelerate renewables, we risk creating a widening gap in jobs, investment and expertise – one that will be felt in communities and industries across the UK,” OEUK Communications Director Natalie Coupar said.

“This isn’t about choosing between energy sources. It’s about securing our energy future by strengthening both oil and gas and renewables.”

The UK Government should avoid accelerating the decline of North Sea oil and gas production through policies, the UK Parliament’s Scottish Affairs Committee said in a report at the end of October.

The committee’s report on the future of Scotland’s oil and gas industry is the conclusion of the first part of its inquiry into GB Energy and the net zero transition.

“The North Sea oil and gas industry has been a vital part of the UK’s and Scotland’s economies but is now at a critical junction as production declines and the UK’s clean energy transition ramps up,” the committee said.

More than 100 UK energy supply chain companies called on the government to reform the Energy Profits Levy (EPL), warning that without a permanent replacement for the tax the nation risks losing thousands more jobs, billions in investment, and critical supply chain capability essential for the UK’s energy security and transition.

OEUK’s Supply Chain Champion, Steve Nicol – Executive President, Operations at Wood, has led a call from more than 110 companies to Government urging them to work with industry and implement a competitive, permanent tax regime from 2026, as outlined in the Treasury’s 2025 oil and gas price mechanism consultation.

“We are witnessing an accelerated decline in activity that is undermining the value of the sector and the supply chain capability we need

Survey participants repeatedly highlighted the EPL as a critical barrier to investment, with one company calling it “the biggest problem we face as an organisation.”

“It’s not just offshore energy firms, our industrial heartlands and their skilled people that need this tax to change – it’s the whole economy,” said Katy Heidenreich, OEUK’s director of supply chain and people.

OEUK also supported the joint letter to the Treasury sent by the British Chambers of Commerce, Aberdeen & Grampian Chamber of Commerce, and the Scottish Chambers of Commerce. The letter emphasises a predictable fiscal regime would send a powerful signal that the UK is once again open for energy investment – unlocking growth, supporting thousands of high-value jobs, and securing billions in future tax revenues, the chambers said.

“The report concludes that reforms to the temporary tax, initially introduced in 2022, should be implemented as soon as possible to create certainty for the industry.”

Patricia Ferguson, Chair of the Scottish Affairs Committee, said, “It’s vital that the government moves quickly to plug this employment gap, replace jobs being lost and ensure a smooth energy transition for workers and communities. Until this is tackled, the government should avoid making decisions that would further accelerate oil and gas production’s decline.”

OEUK’s 2025 Workforce Insight report revealed that the UK could add thousands of jobs, retain economic value, and lead the world in energy with the right policies, collaborative action, and a focus on an integrated energy workforce.

In 2024, about 154,000 people were employed across the UK’s offshore energy sector, including roles in oil and gas, offshore wind, carbon capture and storage (CCS), and emerging technologies.

“With the right policies and investment, the UK can achieve a net addition of jobs, growing the offshore energy workforce from 154,000 today to over 212,000 by 2030, with continued growth in oil and gas playing a central role,” OEUK’s Heidenreich said.

An annual report from the North Sea Transition Authority, Wells Insights, found that well interventions across the UKCS declined from 443 in 2023 to 425 in 2024, continuing a gradual downward trend.

Yet, the interventions that were carried out demonstrated strong results, delivering 37.5 million barrels of oil equivalent (boe) in 2024, equivalent to 34 days of average UK production, the NSTA said in the report. Efficiency also improved, as intervention costs fell from £11 per barrel in 2023 to £9.60 in 2024, while the average Brent crude price was £63.10 per boe, highlighting healthy profit margins for such activity, the regulator noted.

The funding will be split between two workstreams. One will create an enhanced Geospatial Data Viewer which is intended to help users by bringing together datasets from multiple government agencies in one place.

The second workstream will create an AI chatbot to assist users in navigating NSTA’s Open Data and National Data Repository portals, with potential future expansion to other platforms.

With the right policies and investment, the UK can achieve a net addition of jobs, growing the offshore energy workforce from 154,000 today to over 212,000 by 2030

In company news, Vallourec has renewed its longstanding contract with a major North Sea operator to supply OCTG (Oil Country Tubular Goods) products, accessories, and integrated services for offshore operations in the UK North Sea. The multi-year, multimillion-pound agreement reinforces Vallourec’s role as a strategic partner in one of the world’s most technically demanding and cost-sensitive offshore environments, the company said.

P2544 licences, as one of the licence partners, NEO NEXT, has decided to take up its rights of pre-emption.

“While this outcome is of course disappointing, it was always known to be a possibility,” Serica’s CEO Chris Cox stated.

“Serica continues to actively pursue further M&A opportunities, as well as progress our attractive organic growth options, with a goal of diversifying the Company’s portfolio of assets, increasing production, and creating value for shareholders.”

INEOS celebrated in early November 50 years of the Forties Pipeline System, a feat of British engineering that has safely delivered over 9.6 billion barrels of oil and gas. At the same time, INEOS, which earlier this year halted investments in the UK energy sector due to the tax policies, warned that Britain is squandering its energy independence.

Since acquiring the Forties system in 2017, INEOS has invested more than £500 million to modernise and extend its life well into the 2040s, securing one of the UK’s most critical pieces of national infrastructure.

But the NSTA also urged operators to collaborate with the supply chain and unlock cost-efficient production, and keep wells in good shape to sustain production and support suppliers.

There are opportunities to further enhance production by targeting existing fields, as 30 percent of the UKCS’s well stock was shut-in last year.

“While decommissioning will be the next step for many of those wells, a significant number could be reactivated. Without investment, they will be lost permanently, along with domestic reserves and resources,” the NSTA said.

Since early 2024, the NSTA has proactively engaged with eight leading operators to promote interventions and help them identify about 200 shut-in wells which could be reactivated.

“While it is encouraging that some wells have been brought back into production, it is important for all operators to take urgent action by bringing the supply chain into the fold early, putting useful data on the table and making firm commitments to invest in the health of their wells,” said Keith Hogg, NSTA Wells Manager.

The Regulators’ Pioneer Fund has awarded the NSTA a total of £107,000 for a project intended to make North Sea data easier to access

Serica Energy plc has reached an agreement with Finder Energy to buy a 40 percent interest in the P2530 Licence for an initial consideration of about £500,000, or some $650,000. The Licence is currently held by Finder Energy with a 60-percent operated interest and Dana Petroleum with a 40-percent stake. The Licence contains the Wagtail oil discovery and the low-risk Marsh and Bancroft exploration prospects.

Serica, however, suffered a setback in its attempt to buy BP’s stake in the P111 and

However, INEOS warned that “Britain’s ruinous energy policies, including a 78% tax rate, overregulation and political hostility to oil and gas are deterring investment in the North Sea and undermining the nation’s hard-won energy independence.”

Andrew Gardner, CEO INEOS FPS said,

“We should never underestimate the value of home-grown energy. North Sea oil and gas have created enormous prosperity for Britain, and they will remain essential long beyond 2050. Even as we transition to cleaner forms of energy, we will still need reliable domestic supply to power industry, transport, and homes.”

By Tsvetana Paraskova

US oil production is hitting recordhigh levels while the Trump Administration moves to ease energy and power regulations and authorise new LNG export projects.

US Secretary of Energy Chris Wright has directed the Federal Energy Regulatory Commission (FERC) to initiate rulemaking procedures with a proposed rule to rapidly accelerate the interconnection of large loads, including data centres. This would position the United States to lead in AI innovation and in the revitalization of domestic manufacturing.

The proposed rule allows customers to file joint, co-located load and generation interconnection requests. It is also expected to significantly reduce study times and grid upgrade costs, while reducing the time needed for additional generation and power to come online.

Secretary Wright also directed FERC to initiate rulemaking procedures with a proposed rule to remove unnecessary burdens for preliminary hydroelectric power permits. Secretary Wright’s proposed rule clarifies that third parties do not have veto rights over the issuance of preliminary hydroelectric power permits.

“President Trump and Secretary Wright have been clear: The United States is experiencing an unprecedented surge in electricity demand and the United States’ ability to remain at the forefront of technological innovation depends on an affordable, reliable, and secure supply of energy,” the US Department of Energy said.

At the end of October, Secretary Wright signed the final export authorisation for Venture Global’s CP2 LNG Project in Cameron Parish, Louisiana. The authorisation allows exports of up to 3.96 billion cubic feet per day of U.S. natural gas as liquefied natural gas (LNG) to non-Free Trade Agreement (FTA) countries.

Xclosed in July the $15.1 billion project financing for the first phase of its third project, CP2 LNG, together with the associated CP Express Pipeline. Top exporter Cheniere has made a positive FID for the Corpus Christi Midscale Trains 8 and 9 and Debottlenecking Project. NextDecade has decided to invest $6.7 billion in the expansion of its Rio Grande LNG facility in Texas, in the second Rio Grande expansion announced this year, while Sempra approved a $14 billion Port Arthur LNG Phase 2 expansion.

As a major LNG exporter, the US, alongside Qatar, called on the European Union to significantly amend or rescind proposed corporate climate regulations that include penalties on companies for non-compliance.

President Trump and Secretary Wright have been clear: The United States is experiencing an unprecedented surge in electricity demand...

“Finalizing the non-FTA authorization for CP2 LNG will enable secure and reliable American energy access for our allies and trading partners, while also providing well-paid jobs and economic opportunities at home,” said Kyle Haustveit, Assistant Secretary of the Office of Fossil Energy.

As several LNG export plants ramp up and others are expected to begin commercial operations in the near future, the US is strengthening its global lead as the world’s biggest exporter of liquefied natural gas.

So far this year, Australia’s Woodside has announced the FID for the Louisiana LNG project, with plans to start production in 2029. Venture Global took FID and successfully

US Calls on Europe to Revise Due Diligence Directive

Secretary Wright and Qatari Minister of State for Energy Affairs, Saad Sherida Al-Kaabi, in October sent a letter to the heads of state of EU member states regarding the European Union's proposed Corporate Sustainability Due Diligence Directive (CSDDD).

In the letter, the US and Qatari top energy officials expressed “deep concern over the continued lack of action to address the universally acknowledged, serious, and legitimate concerns raised by the global business community regarding the Corporate Sustainability Due Diligence Directive (CSDDD). Particularly its unintended consequences for LNG export competitiveness and the availability of reliable, affordable energy for EU consumers.”

“We have consistently and transparently communicated how the CSDDD, as it is worded today, poses a significant risk to the affordability and reliability of critical energy supplies for households and businesses across Europe and an existential threat to the future

growth, competitiveness, and resilience of the EU's industrial economy,” the officials wrote.

“It is our genuine belief, as allies and friends of the EU, that the CSDDD will cause considerable harm to the EU and its citizens, as it will lead to higher energy and other commodity prices, and have a chilling effect on investment and trade.”

The EU member states are being urged to either repeal the CSDDD or remove the most economically damaging provisions such as the Directive's extraterritorial application, penalties, and civil liability of companies.

Meanwhile, the Americas LNG Summit & Exhibition in Lake Charles, Louisiana, discussed the economic impact of the US LNG export industry.

LNG projects continue to drive economic growth, workforce opportunities, and responsible development across the US Gulf Coast, panellists including Tim Tarpley, president of the Energy Workforce & Technology Council (EWTC), heard.

US LNG plays a critical role in meeting global energy demand while supporting American jobs, investment, and innovation at home, according to industry leaders.

Speakers highlighted the importance of a strong supply chain and a predictable regulatory environment to keep projects on track and maintain the US position as a trusted energy partner abroad.

EWTC’s Tarpley highlighted the stabilising effect of US LNG exports on domestic manufacturing and gas production, which in turn strengthens the energy workforce and broader economy. Tarpley also emphasised the need for permitting reform to accelerate LNG infrastructure and ensure growth across all US basins. The benefits of LNG extend far beyond individual projects, fuelling opportunity throughout the energy value chain, the executive said.

EWTC has also unveiled the Surface Operations Industry Guidelines, developed through the Well Stimulation Committee. These guidelines fill a long-standing gap in the sector by creating a single reference for handling surface operations. Built by people who do the work every day and combining technical knowledge with field experience, the guidelines represent an important step toward consistent, proactive safety practices across the industry, EWTC said.

The industry must take the lead on safety rather than waiting for outside regulation, said Ron Gusek, EWTC Vice Chair and president and CEO of Liberty Energy. Proactive standards like this put the industry in a stronger position and build public trust, Gusek added.

According to John Hutchison, District Manager at ProFrac Services, the guidelines create consistency between service companies and operators by more clearly defining hazard zones and improving communication before operations begin. Early collaboration with operators is key to building safety-focused relationships and ensuring everyone on-site is aligned, Hutchison noted.

Energy Workforce president Tarpley discussed in October the future of global energy with the Greater Houston Partnership and energy leaders from across the industry and government.

US policy must keep pace with market realities, Tarpley said, noting that “We need energy. We need a lot more energy, and that realization is starting to happen in the U.S. and all over the world—on both sides of the political aisle.”

By Tsvetana Paraskova

“Regulation without realism and legislation without logic, will only weaken economies, stunt societies and drive capital away,” the executive added.

Abu Dhabi hosted in November one of the biggest energy conferences in the world, ADIPEC, at which major UAE companies signed strategic deals and top officials noted the importance of continued investment in global oil and gas exploration and production.

Sultan Ahmed Al Jaber, UAE Minister of Industry and Advanced Technology and Managing Director and Group CEO of Abu Dhabi’s national oil company ADNOC, called on energy industry leaders, policy makers, and investors to follow the UAE’s lead and drive pragmatic policies and bold partnerships, to boost job creation, economic growth, and global competitiveness.

Energy and investment policies globally should be “pragmatic, not performative, based on insight, not ideology, built on first principles, not fleeting popularity,” Al Jaber said in his keynote address at the world’s largest energy event, ADIPEC.

“At ADNOC, we are using every technology available, including AI and robotics to collapse time and expand value. Through our homegrown company AIQ, we have embedded over 200 AI use cases, from the wellhead to the trading floor. These tools are cutting unplanned shutdowns by half and enhancing performance across our business,” ADNOC’s top executive said.

Al Jaber also called on the energy industry, policy makers and investors to “tune out the noise, track the signal” as geopolitics shape trade and news flows and sentiment moves markets.

“The signal is telling us that near-term uncertainty is real, while long-term demand remains strong. It is telling us to balance cost discipline with capital investment. Stay laser-focused on efficiency, while investing in people, technology and AI.”

Global annual capital investment needs in grids, data centres and all sources of energy have jumped to $4 trillion because “you can’t run tomorrow’s economy on yesterday’s grid,” Al Jaber noted.

Global electricity demand will keep surging through 2040, as power for data centers surges four-fold, 1.5 billion people will move into cities, and more than 2 billion air conditioners will come online. Aviation will also take off, with the global airline fleet doubling from 25,000 to 50,000 planes by 2040.

“As a result, renewables will more than double by 2040; LNG will grow by 50 percent; jet fuel will increase more than 30 percent and oil will stay above 100 million barrels per day beyond 2040, increasingly used not just for mobility, but more and more for materials,” Al Jaber said.

“What we are really talking about here is energy reinforcement not replacement.”

On the sidelines of ADIPEC, the UAE and ADNOC signed several major deals to power the AI advancement and invest in reliable energy.

ADNOC, Masdar, XRG, and Microsoft in early November announced a strategic agreement to accelerate artificial intelligence (AI) deployment across ADNOC’s value chain, and to deliver energy solutions for Microsoft’s global AI and data centre growth. The collaboration was announced at the ENACT Majlis in Abu Dhabi, ahead of ADIPEC.

Under the agreement, ADNOC and Microsoft will jointly develop and deploy AI agents to drive autonomous operations and unlock greater efficiency, building on ADNOC’s successful deployment of AI solutions across its value chain. Microsoft will also provide advanced AI tools and upskilling programmes, while both companies will explore a joint innovation ecosystem to create transformative solutions for the energy sector.

“As AI continues to reshape how value is created and enhanced across industries, ADNOC, Masdar and XRG are not only embedding AI into every layer of our operations - we are also advancing the energy systems that will power AI itself,” said Al Jaber, who is also executive chairman of XRG and chairman of Masdar.

“Through our partnership with Microsoft, we are unlocking new opportunities to fuel the future of AI, drive greater performance, and future-proof our business.”

ADNOC has also signed three agreements with Gecko Robotics to explore deploying robotics and AI across ADNOC’s operations and boosting future skills training for UAE nationals. The agreements cover a multiyear technology deployment for ADNOC Gas, joint training programmes with the ADNOC Technical Academy (ATA), and the rollout of robotics and AI-powered analytics across ADNOC’s assets to enhance efficiency, reduce downtime and support data-driven maintenance.

“There is a race to lead the AI and energy moment. And the energy companies that win won’t just utilize technology, they will become technology companies,” Gecko Robotics CEO Jake Loosararian said.

“There is only one way to win this race and that’s to acquire physical data using robotics and unlocking human and machine performance from the AI that data fuels.”

ADNOC has also teamed up with top oilfield services provider SLB to use an AI-powered Production System Optimization (AiPSO) platform with initial deployment across eight fields.

Powered by SLB’s Lumi data and AI platform and leveraging Cognite Data Fusion, AiPSO uses millions of real-time data points, AI, and ADNOC proprietary machine learning to proactively monitor and optimize the entire production system, comprising thousands of hydrocarbon wells and hundreds of processing facilities.

The deployment supports ADNOC’s ambition to become the world’s most AI-enabled energy company, the Abu Dhabi firm said.

petrochemical feedstocks. Under the terms of the long-term agreements, which are up to 10 years, TA’ZIZ will supply Sanmar with over 350,000 tonnes per annum of ethylene dichloride (EDC) and vinyl chloride monomer (VCM). The products will be produced at the TA’ZIZ Chemicals Industrial Zone in Al Ruwais Industrial City in Abu Dhabi and represent the first time either chemical has been exported from the UAE.

Saudi Aramco, the world’s largest oil firm by production and market value, reported solid third-quarter results, with adjusted net income rising slightly compared to a year ago, as higher production offset the impact of lower oil prices.

Aramco’s ability to adapt to new market realities has once again been demonstrated by our strong third quarter performance.

In energy supply, ADNOC has signed a 15-year Sales and Purchase Agreement (SPA) with Shell for the delivery of up to 1 million tons per annum (mtpa) of LNG, ADNOC’s first long-term LNG sales agreement with Shell and the eighth long-term offtake agreement secured for the Ruwais LNG project.

At ADIPEC, TA’ZIZ announced the award of a $1.99 billion Engineering, Procurement and Construction (EPC) contract to China National Chemical Engineering & Construction Corporation Seven, Ltd. (CC7), to build the UAE’s first, and among the top three largest integrated single-site polyvinyl chloride (PVC) production complexes in the world.

TA’ZIZ also announced two product sale agreement term sheets with The Sanmar Group of India, a leading producer of PVC and specialty chemicals, for the supply of key

Saudi Aramco’s adjusted net income inched up to $28.0 billion, up from $27.7 billion for the third quarter of 2024. Cash flow from operating activities and free cash flow also grew by about $1 billion each, to $36.1 billion and $23.6 billion, respectively.

“Aramco’s ability to adapt to new market realities has once again been demonstrated by our strong third quarter performance. We increased production with minimal incremental cost, and reliably supplied the oil, gas and associated products our customers depend on, driving strong financial performance and quarterly earnings growth,” president and CEO Amin Nasser said.

Saudi Arabia’s sovereign wealth fund, the Public Investment Fund (PIF), and Aramco have signed a non-binding term sheet outlining the key terms for Aramco to acquire a significant minority stake in HUMAIN, a

PIF company, advancing a full range of AI capabilities globally.

PIF and Aramco would contribute AI assets, capabilities, and talent into HUMAIN, with PIF and Aramco as its shareholders. PIF would continue to own the majority of HUMAIN. The intention is to enable the rapid scaling up of HUMAIN’s operations to capture value and accelerate its growth in the AI sector.

“Aramco is well positioned to capture opportunities from rising energy demand linked to AI growth, using advanced technologies to improve efficiency, reduce emissions, and sustain our competitive edge as one of the world’s leading integrated energy and chemicals companies,” Nasser said.

In Qatar, state firm QatarEnergy has awarded Samsung C&T Corporation the engineering, procurement, and construction (EPC) contract for a landmark carbon capture and sequestration (CCS) project to serve QatarEnergy’s existing LNG production facilities in Ras Laffan Industrial City.

QatarEnergy has also agreed on a 17-year Sales and Purchase Agreement (SPA) with Indian firm Gujarat State Petroleum Corporation (GSPC) for the supply of up to 1 million tons per annum (MTPA) of LNG to India. Pursuant to the terms of the SPA, the contracted LNG volumes will be delivered exship to terminals in India, starting in 2026.

QatarEnergy has also completed a farm-in transaction with Eni, acquiring a 40-percent participating interest in the North Rafah exploration block offshore Egypt.

The agreement, recently approved by the government of Egypt, grants QatarEnergy a 40-percent stake in the offshore concession, with Eni, as the operator, retaining the remaining 60-percent interest.

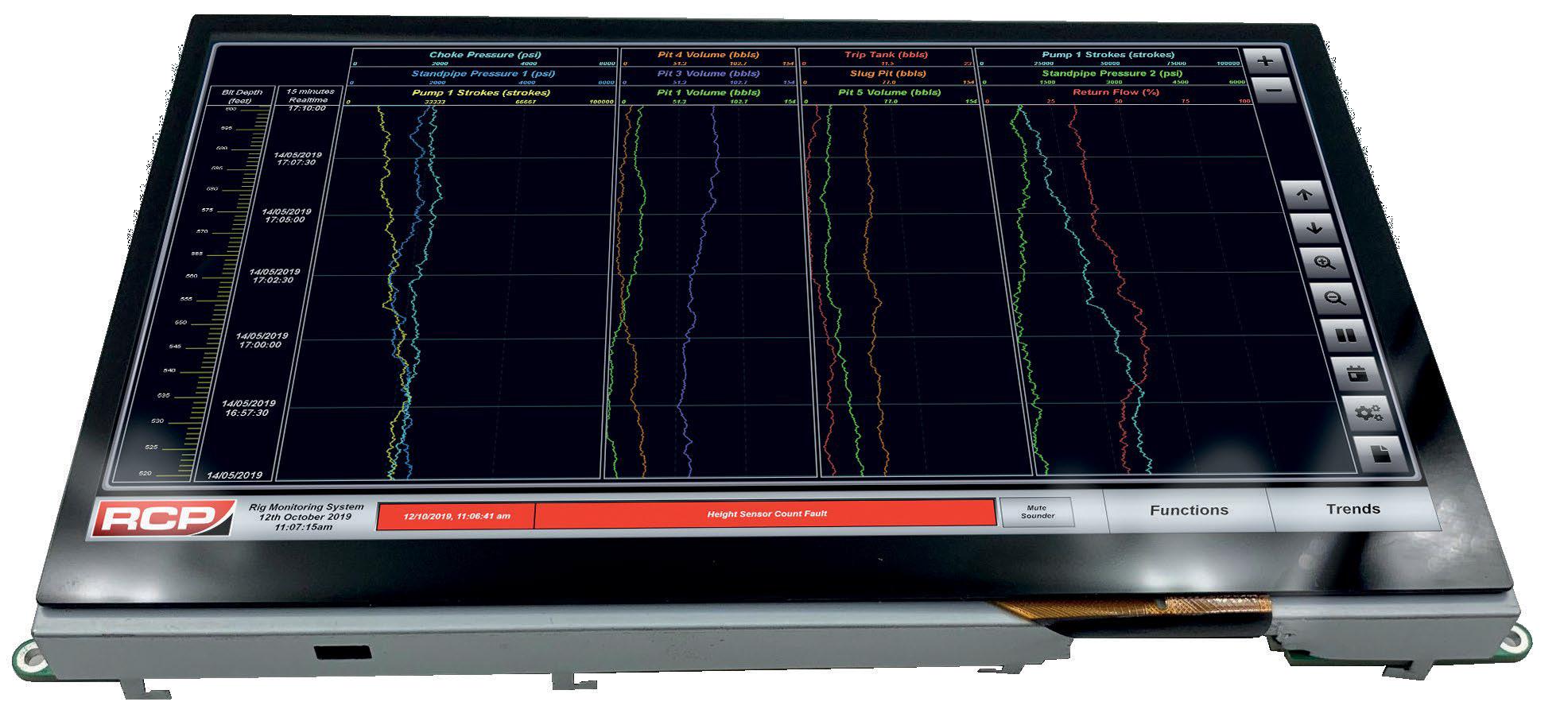

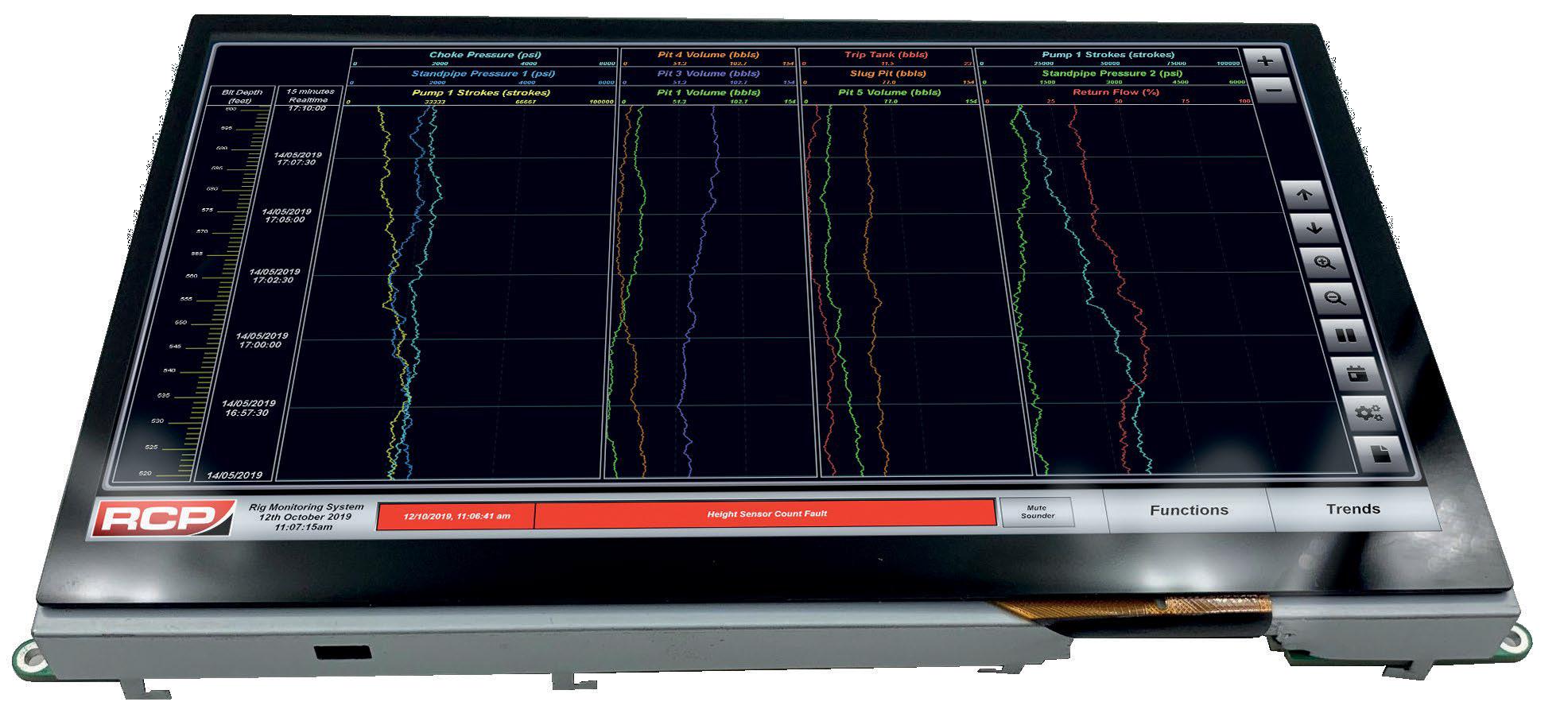

The RCP EDR is designed to give operators a clear, unambiguous overview of critical drilling and mud data processes The system has been developed by RCP to greatly improve how information is presented using the latest industrial technologies and user-friendly interfaces.

The RCP EDR offers a quick and cost-effective solution for clients considering a new installation or a partial upgrade to their existing drilling instrumentation systems Our highly experienced engineers and software developers allows us to tailor each new system to meet your exact needs meaning that you do not pay for functionality you will never use

The RCP EDR utilizes a variety of sensing technologies to monitor the drilling processes, (typically: Level, Pressure, Height, Temperature and Flow). Sensor output signals are received by the distributed I/O racks and are then processed by the EDR.

Processed information is then transmitted through network communication modules to each of the user interfaces including remotely networked PC’s and local HMI’s System and operator interface communications may utilize either: Fibre-Optic, Profinet, Profibus or Industrial Ethernet connection

1 YEAR AGO

November 2024: Around $74 per barrel, Brent reflected a moderately tight market. OPEC+ maintained production cuts, while resilient U.S. demand and geopolitical uncertainty in the Middle East supported prices. Inflationary pressures and slower European growth tempered optimism. Traders viewed oil as stable but vulnerable to macroeconomic headwinds and shifting supply expectations.

5 YEARS AGO

November 2020: At roughly $43 per barrel, Brent recovered from historic lows earlier that year when COVID-19 crushed demand. Lockdowns and global recession triggered an oil glut, briefly sending futures negative in spring. By late 2020, gradual reopening, vaccine optimism, and coordinated OPEC+ cuts stabilized prices, though uncertainty over recovery remained high.

10 YEARS AGO

November 2015: Brent near $42 per barrel

This reflected a severe downturn. Oversupply from U.S. shale and OPEC’s refusal to cut output drove prices to multi-year lows. Demand growth lagged amid weak global conditions, pressuring energy firms and exporters. The market signaled a long adjustment toward balance after years of abundance and competition.

At the heart of OGV Media Group is the OGV Community, a corporate membership service that connects energy sector organisations with our growing network of professionals, leveraging member engagement and platform traffic to maximize brand exposure.

Subscription to the OGV Community offers its members the following growing list of benefits:

SPONSORED BY

www.eicdatastream.the-eic.com

Energy projects and business intelligence in the energy sector

The EIC delivers high-value market intelligence through its online energy project database, and via a global network of staff to provide qualified regional insight. Along with practical assistance and facilitation services, the EIC’s access to information keeps members one step ahead of the competition in a demanding global marketplace.

The EIC is the leading Trade Association providing dedicated services to help members understand, identify and pursue business opportunities globally.

It is renowned for excellence in the provision of services that unlock opportunities for its members, helping the supply chain to win business across the globe.

The EIC provides one of the most comprehensive sources of energy projects and business intelligence in the energy sector today.

bp has confirmed the presence of a substantial hydrocarbon column of approximately 1,000 metres, including around 100 metres of oil and 900 metres of liquids-rich gas condensate. Planning for appraisal activities is underway, with well operations expected to begin in 2027, subject to regulatory approval. The operator has also indicated that one possible development option for the discovery is an early production system.

PV Drilling has been awarded the drilling contract for the project. The drilling operations are scheduled to take place between March 2027 and August 2027 with 40 development wells expected to be drilled. In addition, Velesto was previously awarded a drilling contract with drilling activities expected to commence in the H1 2026.

SLB OneSubsea has secured the EPC contract for the SPS scope of the project. The scope of work includes the supply of horizontal subsea trees, umbilicals, control systems and associated services.

The Saipem and BOS Shelf joint venture has been awarded three offshore contracts worth around $700 million for the SDC project. The contracts cover the transportation and installation of the SDC platform, along with the engineering, procurement, construction, and installation of subsea structures and approximately 26 km of new offshore pipelines linking the SDC platform to existing Shah Deniz infrastructure.

According to BW Energy, the project’s FID is expected before year-end, but the analyst assumes that sanctioning could be reached by Q1 2026. The project will feature the drilling of three new wells and will utilise the BW Energy Jasmine rig to be converted to a wellhead platform. The discovery’s recoverable resources have been updated to 18MMbbls.

Halliburton has been awarded an integrated drilling services contract in the project. The company’s project management team will lead execution, and deploy remote operations and automated technologies for the work.

The contracting activities for the FEED work and Long Lead Items (LLIs) are still ongoing and remain ahead of schedule. Completion of the PoD is expected in Q4 2025 with FID targeted for June 2026 and first gas anticipated by Q4 2028.

Tenaris will supply casing and tubing for the project, as well as line pipe and casing for bends, flowlines, and risers forming part of the subsea infrastructure. The contract covers 12,000 tonnes of casing and tubing, including 1,600 tonnes made of Super 13 Chrome steel. For the line pipe scope, Tenaris will deliver approximately 16,000 tonnes of pipe for flowlines and risers.

Bomesc Offshore Engineering has secured contracts worth up to US$240m to design and build topsides modules for an undisclosed FPSO in Guyana. The work will include chemical skids, electrical rooms, and water treatment systems. Delivery is scheduled between 2026 and 2027, with the topsides module package expected to be completed by June 2027, and the chemical skid, electrical, and water treatment modules by January 2027. Additionally, agreements were signed with ABB and VWS Westgarth, which will be responsible for the electrical systems and sulphate removal water treatment, respectively

Gas