INNOVATION & TECHNOLOGY

GLOBAL

ENERGY

VULCAN COMPLETIONS P.22 MYSEP P.24 ROTECH SUBSEA P.26 CEGAL P.28 VIPER INNOVATIONS P.30 ARNLEA P.31 INTERVENTION RENTALS P.32 ASSET 55 P.33 FIELDNODE P.34 HGF P.35 BRODIES P.36 LEYTON P.37 READ ONLINE AT In this issue... INNOVATION & TECNOLOGY MAY 2024 - ISSUE 80

ENERGY NEWS

MAP

PROJECTS

FocusAI Discover the AI Revolution That's Transforming The Energy Industry READ ON PAGE 4

INNOVATION & TECHNOLOGY LEGAL RENEWABLES CONTRACT AWARDS DECOMMISSIONING STATS & ANALYTICS EVENTS

At Wood, our people are what sets us apart, a global community of inquisitive minds. Each one committed to making a difference, to lifting each other up, to showing courage in the face of problems.

As part of Team Wood, you’ll be challenged and inspired to power progress for our people, our business and our planet. Join us as we embark on a quest to unlock solutions to the world’s most critical challenges. careers.woodplc.com

Our people make it possible.

A WORD FROM OUR EDITOR

Welcome to the May and 'OTC' edition of ‘OGV Energy Magazine’ where we will be exploring the theme of ‘Innovation and Technology’

A big thank you to our front cover partner GDi, where you can read all about the launch of their latest AI product on pages 4 and 5.

In this packed publication, we also have contributions on this theme from Vulcan Completion, Mysep, Rotech Subsea, Cegal, Viper Innovations, Arnlea, Intervention Rentals, Asset 55, Fieldnode, HGF and ESWL, along with our monthly contributions from Brodies and Leyton.

The rest of this month’s magazine as always provides you with a review of the Energy sector in the North Sea, Europe, Middle East and the USA, along with industry analysis and project updates from Westwood Global Energy Group and The EIC.

Warm regards Dan Hyland - Director

3 CONTENTS FOLLOW US @OGVENERGY OGVENERGY @OGVENERGY OGV-ENERGY OGV COMMUNITY NEWS GLOBAL ENERGY NEWS ENERGY PROJECTS MAP MONTHLY THEME LEGAL INNOVATION RENEWABLES CONTRACT AWARDS DECOMMISSIONING STATS & ANALYTICS EVENTS P.09 P.10 P.18 P.20 P.36 P.37 P.39 P.40 P.42 P.44 P.46 4 8 20 26 31 37 40 34 10 VIEW THE OGV MAGAZINE ONLINE AT www.ogv.energy/magazine

22

Discover the AI Revolution That's Transforming The Energy Industry FocusAI

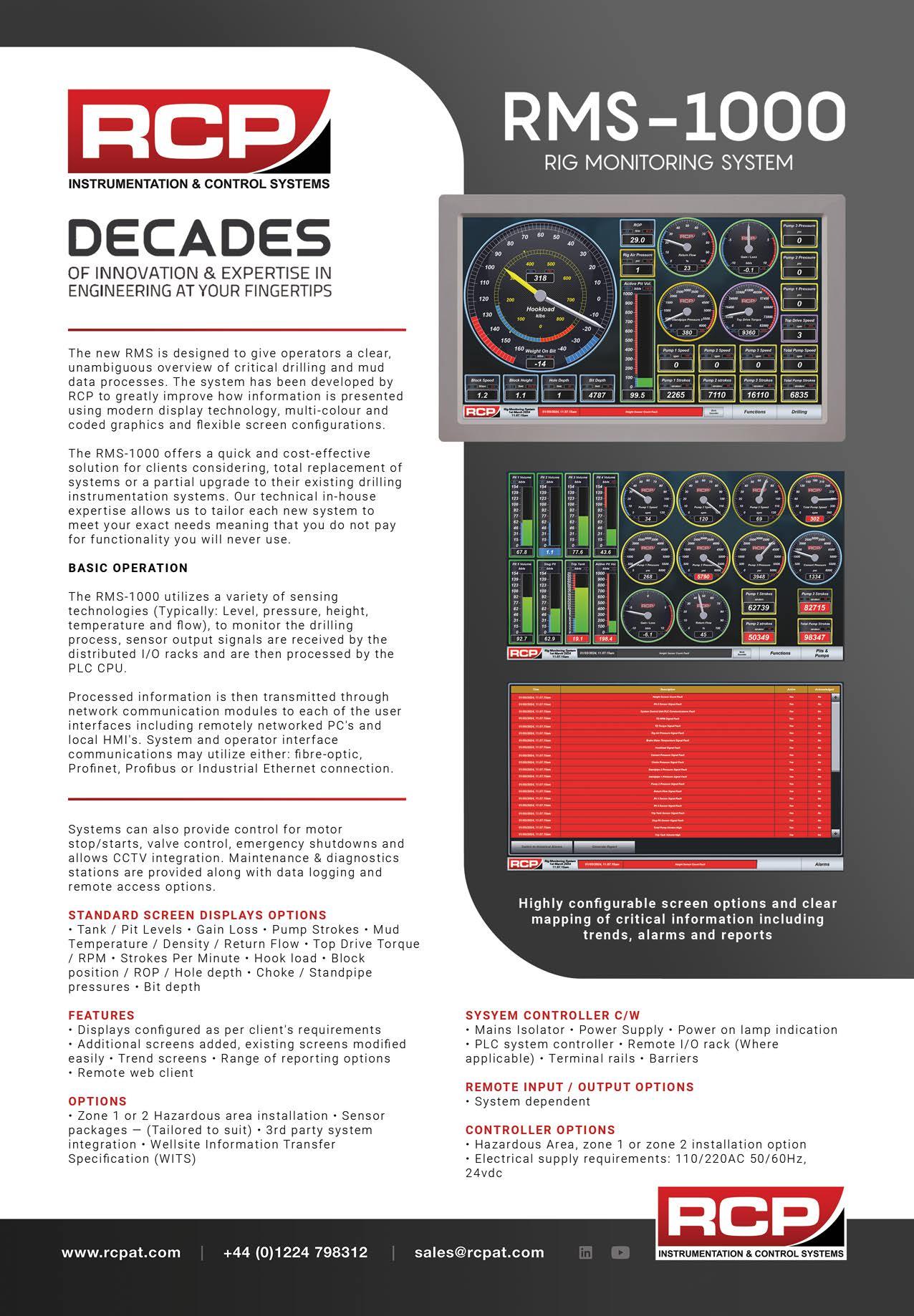

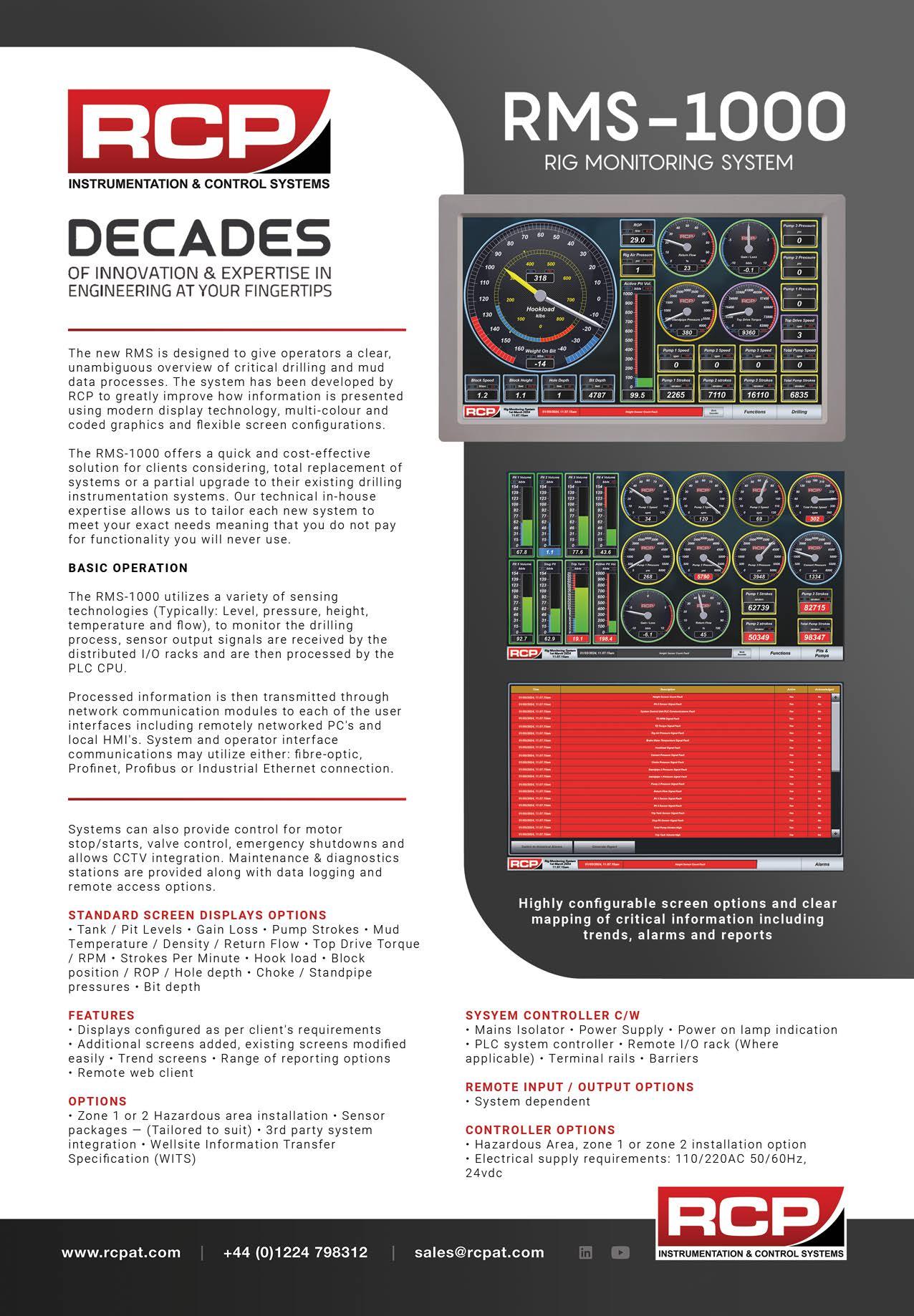

GDi’s latest application, FocusAI leverages the latest LLM technology along with tailored workflows to transform how text data is generated within the oil and gas industry.

Asset owners have been enabled to operate their assets beyond design life through the deployment of innovative data analytics –including more recently machine learning technology – to optimise operations. The focus of these analytic systems to date has predominantly been numerical data.

A significant gap remains, where text-based information such as work instructions has not been subject to the same analysis and therefore remains of highly variable quality.

FocusAI allows tailored workflows to be defined to ensure rapid, part-automated, and high-quality output is consistently generated in response to the user input. GDi have engaged with select industry leaders to identify and validate several use cases, some examples of which are noted below.

Use case examples

• Work Order Generation & Close Out

The application provides users with a selection of templates and use cases, making it straightforward to execute tasks efficiently and effectively. This feature not only enhances user experience but also streamlines the process flow within organisations.

A standout feature of FocusAI is the recording and display of interactions between users and the large language model (LLM) in a conversational style. This functionality offers an unprecedented level of auditability and discrete insight into the decision-making processes at the core of operations. The interaction mimics a real-life dialogue between a technician and a technical authority, collaboratively navigating through tasks to arrive at the best possible solutions.

The Chat function allows users to interact with the LLM in a manner that is tailored specifically to their industry and business needs. This customisation ensures that the advice and solutions offered are relevant and directly applicable, maximising the utility and impact of its output.

Is FocusAI safe?

Unlike many AI applications, FocusAI was designed to be private-first and is achieved in part by hosting the LLM ourselves. Strict segregation of customer data guarantees all your information remains confidential. We use modern end-to-end encryption methods ensuring your data is secure in transit and at rest.

Case Studies

Work Order

The advent of Large Language Models (LLM) has created a significant opportunity to transform technical writing within industrial settings. A LLM is a type of AI that uses deep learning techniques and prodigious data sets to understand, generate, and refine text content.

Introducing FocusAI

GDi’s latest application, FocusAI leverages the latest LLM technology along with tailored workflows to transform how text data, like a Work Instruction, is generated within the oil and gas industry. Not only will users of FocusAI gain significant insight through access to extended knowledge bases but they will also be guided in an efficient and structured process to complete their objectives. FocusAI ensures that the huge potential of this technology is applied in a focussed, relevant, and secure manner that could revolutionise daily tasks common within the industry.

• Anomaly/Inspection Report Generation, Assessment & Close Out

• Preventative Maintenance Generation

• Root Cause Analysis Review

• Contractual Review

• Performance Standard Generation

• RBI Assessment

Key Features

FocusAI revolutionises task execution with its intuitive user interface, designed to minimise the need for training. This user-friendly approach allows employees to quickly adapt to the system, facilitating a smoother transition and integration into daily operations.

GDi have collaborated with a UKCS O&G operator to prove how FocusAI can be deployed within the context of Work Order generationtransforming a task that occurs thousands of times every day throughout the industry.

Through this collaboration, GDi developed a thorough understanding of the work order process, key requirements, and the details within. Defining the work order process and aligning with procedures meant that the output generated from FocusAI was precise and high quality, verifying that all users responsible for creating work orders did so in compliance with specified corporate procedures & standards.

Result:

• Removal of poor-quality work order content and their associated risks

• Reduced reporting time by up to 30%.

• Increased productive time.

• Removed issues with procedural compliance.

www.ogv.energy I May 2024

4 COVER FEATURE

Preventative Maintenance Generation

In another collaborative approach, GDi set out to prove how, with minimal input information, FocusAI can generate a preventative maintenance regime for equipment on an offshore asset. Using two input fields

- Manufacturer & Model - FocusAI asked relevant questions to the user about operating conditions and equipment age before generating a concise and accurate regime. This output can be exported and then imported into a third-party maintenance management system. The potential for this single use case could save asset owners millions of pounds in maintenance builds and audits.

Result:

• Rapid generation of high-quality preventative maintenance regimes.

• All regimes generated in a precise and consistent supporting adoption.

• Aligned to procedural requirements.

• £Ms saved by removing requirement for outsourced consultancy.

Anomaly Assessment

Working with a long-standing client, GDi tailored FocusAI to drive improvements into the assessment of anomalies found during routine inspection programmes.

The client presented the variance and poor-quality output of current anomaly assessments and engaged GDi to carry out discovery sessions where FocusAI was configured to guide any user on how to accurately review, assess the risk, and recommend follow up actions in a compact, consistent, and high-quality manner.

Poor anomaly assessments introduce risk and cost into operations by, for example, missing data leading to an event, or low standard information resulting in significant inefficiencies in remediation. In this example, FocusAI eliminated poor quality, ensured compliance with procedures, and provided consistent output.

Result:

• Implemented robust control where procedural guidance was lacking.

• Improved risk assessments by removing ambiguity within the assessment.

• Removal of poor-quality anomaly assessments.

• Reduced assessment time by up to 30%.

• Removed any issues with procedural compliance.

Ultimate benefits

FocusAI significantly enhances organisational operations by aligning the vast capabilities of large language models with daily tasks. It not only supports but also amplifies the technical acumen of the workforce, ensuring that data quality is enriched and maintained right from the source.

Through focused upskilling and broadening the technical knowledge of employees, organisations are poised to thrive. Streamlining workflows and partially automating routine tasks have already shown a marked improvement in productivity in pilot studies. These adjustments reduce the administrative overhead commonly found in industrial environments, thus freeing up more time for productive activities and significantly lowering operating costs.

In sectors where maintaining critical infrastructure is both crucial and costly, innovative technologies like FocusAI are essential. They maximise operational periods and provide a cost-effective means of managing assets. By ensuring adherence to procedures and processes, and actively notifying users of any deviations, FocusAI promotes consistent compliance across all levels of operation.

One of the notable impacts of implementing technical compliance in complex tasks is the reduction in challenges associated with employee turnover. By leveraging its extensive knowledge base, FocusAI facilitates ongoing learning and continuous improvement within the workforce.

By integrating into workflows in procedurally intensive industries, FocusAI is positioned to revolutionise operations. While no application has yet fully achieved this ambitious objective, FocusAI is on track to transform how compliance is managed within complex organisations, setting a new standard for technological integration.

About GDi

Since its inception in 2016, GDi has positioned itself as a key technology provider of specialised solutions to asset intensive industries such as oil and gas, utilities, and power generation. GDi’s technology stack features innovative software applications that enable cost-effective and efficient service delivery. By utilising these proprietary cuttingedge applications, GDi supports its customers in modernising and digitally transforming their business processes and operations.

5 COVER FEATURE ENGINEERING. INNOVATION. AUTOMATION.

Editorial

+44 (0)

Advertising

+44

Design

Editorial

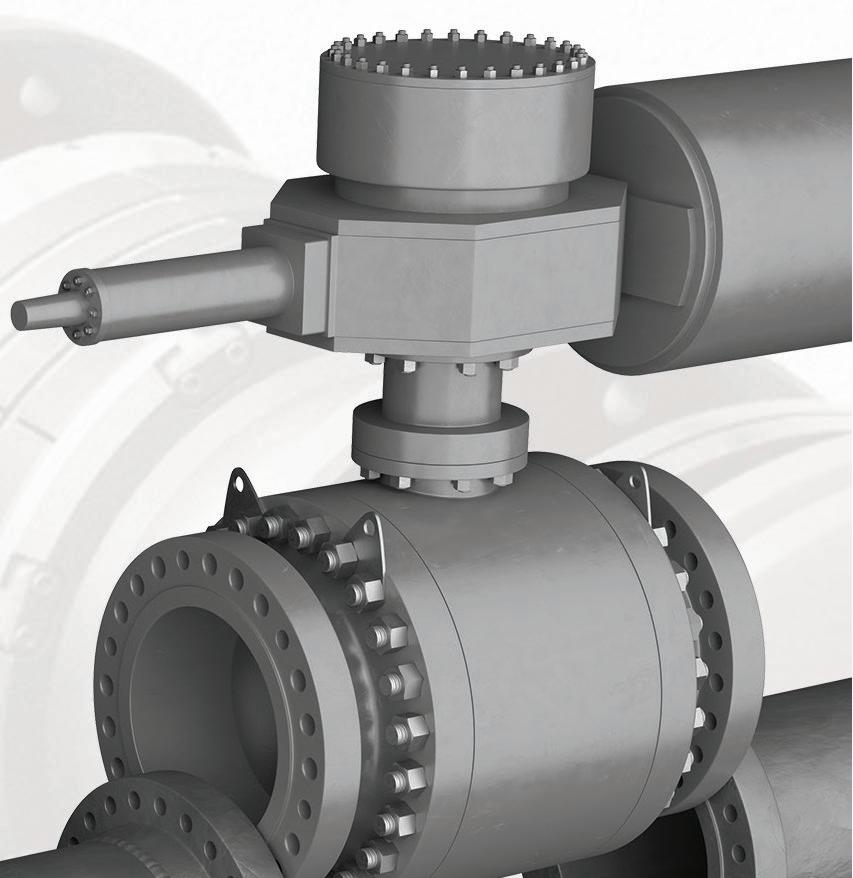

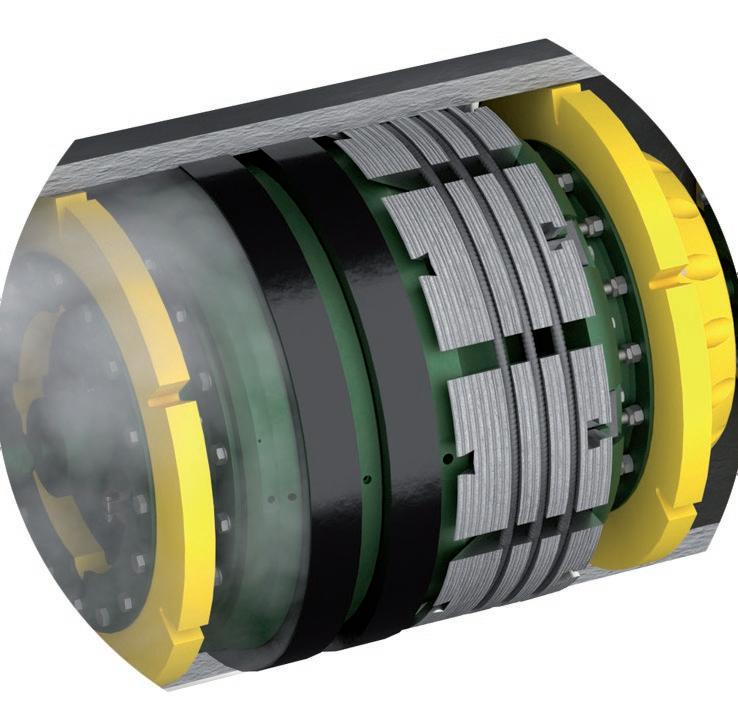

7 HEADER www.quanta-epc.co.uk YOUR ASSET IN SAFE HANDS Safe, efficient and low-cost delivery of Asset Management projects, ensuring best value every time. Operations Maintenance Repair orders Technical support

The views and opinions published within editorials and advertisements in this OGV Energy Publication are not those of our editor or company. Whilst we have made every effort to ensure the legitimacy of the content, OGV Energy cannot accept any responsibility for errors and mistakes. OUR PARTNERS FEATURING TRAVEL MANAGEMENT PARTNER LOGISTICS PARTNER Leading provider of logistics services to this industry, offering its customers airfreight, road freight, sea freight, project forwarding, customs compliance, training and consultancy, packing, crating, lashing & securing services warehousing, distribution, freight management, rig relocation and mobilisation services and offshore logistics. The ATPI Group delivers world-leading corporate travel and events solutions to organisations operating in a variety of specialist sectors around the world.

Disclaimer:

newsdesk@ogvenergy.co.uk

084 114

1224

office

@ogvenergy.co.uk

114

(0) 1224 084

Jen McAdam Cali Gallow Ben Mckay

Tsvetana Paraskova VIEW our media pack at www.ogv.energy/advertise-with-us or scan the QR code ADVERTISE WITH OGV

OGV Community News

Provider of Marine & Offshore Living Quarters & Technical Buildings, Modutec, Acquires Marine Electrical Specialists SeaKing Group

UK-headquartered Modutec has today announced a majority investment in Birkenhead based electrical engineering group SeaKing.

SeaKing provides electrical engineering and installation services to its customers in the marine, defence, renewables, and offshore sectors. Recognised internationally for their expertise in hazardous area electrical works, SeaKing undertakes major overhaul of assets through to minor maintenance activities.

SeaKing, which employs 105 staff, enhances Modutecs offering and closely follows the integration of HVAC specialists CO-AT Marine as part of the expanding portfolio.

The positive trajectory continued in 2023 as Semco Maritime accelerated growth, lifted profitability and boosted its order book, with strong contributions from both business areas delivering very satisfactory operational and financial performances exceeding the expectations for the year.

Semco Maritime grew revenue by 47% to DKK 5 billion and lifted earnings by 51% to DKK 305 million for a profit margin of 6%.

“We are pursuing our Sustainable Growth strategy by applying our extensive expertise and in-depth experience from the offshore sector to capitalise on opportunities in the energy markets and shift the balance of our operations further in favour of the Renewables business."

Pier Solutions, a leading engineering and modular solutions provider, has announced strategic appointments to strengthen its Leadership Team with a new Chief Executive Officer (CEO) and Finance Director (FD) as it targets growth in the energy sector.

Jordan Ferguson joins the company as CEO after serving the role on an interim basis from late 2023. His experience in commercial roles spans positions at Valor Energy Group, Hutcheon Mearns and H2scan, as well as running his own Consultancy to support businesses with investment and strategic growth.

Doug Gibb joins Jordan as Finance Director with over 10 years experience in senior finance positions. Doug has previously worked alongside Jordan, as part of their consultancy offering and has also supported several SMEs through periods of significant growth in the energy industry, both domestically and internationally..

Leading providers of cutting-edge integrity solutions, ROSEN Group (ROSEN), celebrates a successful first quarter of 2024, highlighted by strategic expansion and the addition of two senior members to its esteemed team.

Since relocating its Aberdeen office in late 2023 to accommodate an expanding engineering team and future growth plans, ROSEN reaffirms its commitment to delivering expert-led operational support, integrity, and late-life asset management solutions.

The latest additions to the ROSEN team, Mei Ling Cheah, joining as Senior Corrosion Engineer, and Gordon Blair, appointed as Area Business Development Manager, strengthen the company's technical capabilities and business development competence.

As the global energy landscape undergoes a transformative shift, developing regions such as West Africa offer substantial opportunity to international markets. With the forthcoming ‘West Africa Energy Summit’, organised by OGV Group, set to take place this September in Ghana, the spotlight is once again on the region's immense potential and the fantastic opportunities that it presents for businesses, particularly those hailing from Scotland.

The Scottish Africa Business Association (SABA) is delighted to be partnering with OGV Group at this event and will be highlighting how Scotland, renowned for its expertise in oil, gas and renewable energy, is primed to play a pivotal role in West Africa's energy development, as well as showcasing the potential for partnerships in education, local content and skills training.

Interwell announces two key appointments

Interwell, a leading provider of innovative solutions for the Energy sector, proudly announces the appointment of two well-respected individuals to key sales management positions.

Richard Whittington has been appointed as the UK Sales Manager, while Kevin Buchan assumes the role of Africa Sales Manager.

This strategic restructuring is poised to bolster support and development within their respective regions. By allocating dedicated managers for the UK and Africa, Interwell aims to streamline operations, cultivate closer client relationships, and drive tailored growth opportunities.

Both Richard & Kevin will lead proficient sales teams in their regions, ensuring Interwell remains agile and proactive in meeting client needs.

9 COMMUNITY NEWS

Strategy

execution secured profitable growth for Semco Maritime in 2023

SABA takes academic delegation to West African Energy Summit

ROSEN Group Excels in Q1 2024 with Strategic Expansion and Key Leadership Additions news www.pier-solutions.com www.interocean.co.uk www.vantage-tags.com www.interwell.com OGV Latest Community Sign Ups

Pier Solutions Announces New Leadership Team

FIND ALL THE FULL COMMUNITY NEWS ARTICLES ON THE OGV ENERGY WEBSITE

North Sea Energy Review UK

By Tsvetana Paraskova

UK energy production figures, opportunities to grow energy output and the economy, exclusive merger talks, and field developments featured in the UK North Sea oil and gas industry over the past month.

The 2024 Business and Supply Chain Outlook by Offshore Energies UK (OEUK) found that oil and gas projects could create £145 billion for the UK’s supply chain, together with new offshore wind farms around the UK generating £260 billion worth of work, new hydrogen projects creating £25 billion, and fresh carbon capture and storage (CCS) technology bringing in £34 billion.

However, without stable energy policy and a globally competitive tax regime, the UK will miss out on the lion’s share of the benefits from its domestic offshore energy market that could grow to £450 billion by 2040, OEUK said in the report.

Across the UK, the existing oil and gas supply chain already has up to 80 percent of the capabilities needed to develop these new energy technologies.

“But current policy and political rhetoric present serious challenges to these firms’ ambitions to scale up and seize these opportunities,” OEUK said.

“With the right conditions, the UK offshore energy sector could benefit from a global export market worth more than £1 trillion within the next 15 years – generating thousands of new jobs and billions in new revenue for the UK economy.”

Strategy Group (DSG), has laid out draft unifying principles which are intended to promote collaboration and data sharing among North Sea users, the North Sea Transition Authority (NSTA) said in early April.

Stakeholders in the UK offshore sector will be asked to commit to a set of principles to help the sector achieve the energy transition through digitalisation by embracing targeted, collaborative data-sharing to strengthen predictive models such as digital twins, optimise operations, and achieve net-zero objectives, NSTA added.

“Sharing data is critical to an integrated energy system that will help to ensure UK energy security and support the energy transition,” said Nic Granger, Offshore Energy Digital Strategy Group Chair and Director of Corporate at North Sea Transition Authority.

NSTA also published a new emissions reduction plan, which emphasises that operators should take action and budget to reduce flaring and venting, with the latter focused on methane. The plan also sets out a clear requirement that operators monitor and reduce fugitive emissions.

UK energy production fell by 9 percent in 2023 to the lowest level since records began in 1948, and is down 36 percent compared to 2010, and 66 percent compared to 1999 when UK production peaked, the latest UK government data showed.

Oil production in the UK reached a record low while natural gas production hit the secondlowest level on record last year. Nuclear output, following both plant closure and maintenance outages, also hit a record low and is down 62 percent on 1998 when output peaked. On the other hand, production from wind, solar, and hydro increased by 2 percent but these renewable technologies contribute less to primary energy than fossil fuels.

Power generation from fossil fuels declined by 22 percent to 103.8 TWh in 2023, the lowest value since the 1950s, the government data showed.

Attracting the private investment needed to maintain the UK’s existing energy industry and its highly skilled workforce would be key to success, according to the leading offshore energy body.

“The UK has a £450bn domestic energy opportunity that could transform the economy and support jobs – but warning lights are flashing,” OEUK CEO David Whitehouse said, commenting on the report.

“But investors, firms and workers need stability, predictability and fair returns to build a low carbon future here and keep jobs in the UK,” Whitehouse added.

“We are in a global race for investment, and UK energy companies need supportive long-term policies, a stable tax regime, and responsible rhetoric from all sides.”

The Data Principles Group, one of the task forces set up by the Offshore Energy Digital

The requirements outlined in the plan build on existing commitments made by industry, including in the North Sea Transition Deal, with operators having agreed to deliver 50 percent reduction by 2030, and invest £2 billion-£3 billion in platform electrification. In addition, industry has itself committed to 90 percent reduction by 2040, and to reach net zero by 2050.

“The Plan places electrification and low carbon power at the heart of emissions reduction and makes it clear that where the NSTA considers electrification reasonable, but it has not been done, there should be no expectation that the NSTA will approve Field Development Plans and similar decisions that give access to future hydrocarbon resources on that asset,” NSTA said.

The authority expects to increase scrutiny of assets with high emissions intensity and their cessation of production (CoP) dates. The NSTA recognises that to secure production while reducing emissions overall, it is crucial to look at trade-offs between installations. Closing some low-producing, high-polluting

www.ogv.energy I May 2024

UK NORTH SEA REVIEW SPONSORED BY

installations earlier could allow higher producing and cleaner new assets to come online while still reducing overall UKCS level emissions, the authority noted.

Mark Wilson, OEUK’s HSE and operations director commented on the plan,

“The UK offshore energy sector is committed to meeting the decarbonisation targets and has made great progress already by reducing emissions 24% since 2018 with a 45% reduction in methane from flaring and venting in the same time period.”

“As part of the OGA plan ongoing engagement will occur between industry and the NSTA to ensure that the full range of decarbonisation opportunities are evaluated to meet the North Sea Transition Deal targets.”

The UK Government has committed to support the building of new gas power stations to maintain a safe and reliable energy source for days when the weather forecast doesn’t power up renewables.

“While the renewable share will increase in the years ahead, they aren’t failsafe, and future supply can only be calculated based on estimation. That is why flexible power generation is needed, to keep electricity secure and reliable, acting as back-up generators to keep the lights on,” the government said in March.

In response to the new plan, OEUK’s Whitehouse said,

“Today gas remains the single largest source for UK electricity generation and will remain a critical part of our energy mix in the decades to come.”

“On our journey to net zero, we should be making the most of our own UK gas reserves rather than imports,” Whitehouse added.

offshore the UK, the North Sea operator said.

Following the announcement of a potential merger with Eni’s UK business, Fitch Ratings placed Ithaca Energy’s Long-Term Issuer Default Rating (IDR) of 'B' and senior unsecured rating of 'B+' on Rating Watch Positive, to reflect the credit rating agency’s expectations “that the merger will be credit positive given that it will boost Ithaca's business profile and the new assets are debt-free.”

EnQuest reported a loss after tax of $30.8 million for 2023, reflecting the impact of the UK Energy Profits Levy. In 2022 EnQuest had booked a loss of $41.2 million. This year, the group expects its net production to average between 41,000 boepd and 45,000 boepd, with output at around 44,500 boepd in January and February 2024.

“On our journey to net zero, we should be making the most of our own UK gas reserves rather than imports,”

Orcadian Energy announced in early April the completion of the previously announced farm-out of an 81.25-percent interest in licence P2244, which contains the Pilot field, to Ping Petroleum UK plc. Ping is focused on shallow water offshore production and development opportunities and has a significant acreage holding to the East of Pilot. The completion of the deal means that Orcadian Energy retains an 18.75-percent interest in the Pilot field development, fully carried to the first offload of oil produced from the field. Orcadian has no requirement to fund the preproduction development project work programme.

“Backing our homegrown energy sector grows our economy, boosts jobs across our world class supply chain and delivers reliable supplies of cleaner energy for the UK.”

David Whitehouse OEUK Chief Executive

In company news, independent UK North Sea oil and gas operator Ithaca Energy has entered into an exclusivity agreement with Italian energy major Eni SpA in relation to a potential transformational combination with substantially all of Eni’s UK upstream assets, including the recently acquired Neptune Energy assets, but excluding certain assets such as Eni’s CCUS and Irish Sea assets. If the parties reach an agreement, a combination of the businesses will add significant scale and diversification to Ithaca Energy’s business, with pro forma production rising above 100,000 boe/d and creating the second-largest independent operator in the UKCS by production.

A potential deal would also boost Ithaca Energy’s status as the largest independent operator by resource, holding stakes in 6 of the 10 largest fields

Deltic Energy Plc has received the required regulatory and partner consents in respect of the farm-out of a 25-percent interest in Licence P2437, containing the Selene Prospect, to Dana Petroleum (E&P) Limited. The farm-out, which was announced on 7 February 2024, has therefore completed.

This transaction, in combination with the existing Shell UK Ltd carry, results in Deltic retaining a 25-percent non-operated interest in Licence P2437 and having no exposure to 2024 drilling and testing costs up to a cost cap of $49 million gross, which is in excess of current success case well cost estimates provided by the Operator. Following the announcement of the rig contract for the Valaris 123 on 5 February 2024, the Selene well remains on track, with operations expected to commence in July 2024, Deltic Energy said.

Shearwater GeoServices Holding AS has been awarded two 4D monitoring projects by Equinor for the Mariner field in the UK North Sea and the Heidrun field in the Norwegian Sea, Norway.

11

UK ENERGY REVIEW

Europe Energy Review

By Tsvetana Paraskova

Oil & Gas

New oil and gas projects and discoveries offshore Norway, the UK’s progress toward net zero, and a number of clean energy projects across Britain and Europe were the highlights in the European energy sector in the past month.

OKEA ASA and its partners announced the final investment decision (FID) for the Brasse development of the field in the northern North Sea, 13 kilometres south of the Brage field. Brasse is estimated to contain 24 million barrels of oil equivalent gross in recoverable reserves and will be developed as a tie-back to the Brage field, OKEA said.

The development plan for Brasse consists of a two-well subsea tie-back to the Brage platform, which will serve as the host facility for production, processing, and export. Use of standard solutions, well-proven technology, and close cooperation with strategic partners will ensure an efficient and cost-effective development, according to the company.

OKEA has also won the consent of the Norwegian Ocean Industry Authority, Havtil, to extend the lifetime of the Draugen field and facility in the southern part of the Norwegian Sea, which began production in 1993. The consent for Draugen facilities was previously valid until 9 March 2024, but this has now been extended to 31 December 2040.

Harbour Energy and its partners have confirmed a gas discovery in well 15/9-25 in the North Sea, the Norwegian Offshore Directorate said. 15/925 is the first well in production licence 1138, which was awarded in Awards in Pre-defined Areas (APA) in 2021.

The Norwegian Ocean Industry Authority (Havtil) has given Equinor consent to use Kristin Sør phase 1, a field in the Norwegian Sea, a few kilometres southwest of the

Åsgard field. The consent applies to the use of seabed installations, pipelines, control cables and associated modifications on the Kristin facility. The field is developed with four subsea templates and 12 production wells tied-back to a semi-submersible facility for processing. Production started in 2005.

DNO ASA announced completion of an appraisal well and sidetrack that further delineated the 2023 Heisenberg oil and gas discovery in the Norwegian part of the North Sea. Heisenberg, a new shallow play in the northern part of the Norwegian North Sea, is now estimated to hold recoverable volumes in the range of 24 to 56 million barrels of oil equivalent, while oil-bearing sands were encountered in a deeper secondary target, Hummer.

Equinor, on behalf of the partners, is exercising two options to extend contracts with Archer, KCA Deutag Drilling Norway, and Odfjell Operations for a total of four years.

The Norwegian major is also reducing emissions at the Sleipner field centre, the Gudrun platform, and other associated fields as they are now partly operating on power from shore. This will reduce annual emissions from the Norwegian continental shelf (NCS) by 160,000 tonnes of CO2. All installations on the Utsira High are now receiving power from shore, saving emissions amounting to about 1.2 million tonnes of CO₂ per year, Equinor says.

TotalEnergies announced at the end of March the restart of production from the Tyra hub in the Danish North Sea, after the completion of a major redevelopment project of the hub.

www.ogv.energy I May 2024

Photo: TRANSOCEAN

Low-Carbon Energy

The UK’s North Sea Transition Authority (NSTA) has published two sets of guidance which will help the developing carbon storage industry prepare for first injection. The new guidance will help industry manage storage sites and boost job creation, the authority said.

Wind power generated a record share, 28.7 percent, of UK electricity in 2023, while the share of generation from fossil fuels fell to a record low, a share of 36.3 percent, the latest government data showed. However, power generation from gas remained the principal form of UK generation at 34.3 percent. Low carbon generation with renewables and nuclear combined increased to a record high share of 61.5 percent.

Scotland’s 2030 climate goals are no longer credible, due to continued delays to the updated climate change plan and further slippage in promised climate policies, the Climate Change Committee said at the end of March. The Scottish Government is unlikely to meet its statutory 2030 goal to reduce emissions by 75 percent and there is no comprehensive strategy for Scotland to decarbonise towards Net Zero, the Committee said.

“Scotland has laudable ambitions to decarbonise, but it isn’t enough to set a target; the Government must act. There are risks in all reviewed areas, including those with significant policy powers devolved to the Scottish Government,” said Professor Piers Forster, interim Chair of the Climate Change Committee.

The Electricity System Operator (ESO) has published a report, ‘Beyond 2030’, which proposes a £58 billion investment in the electricity grid to meet the growing and decarbonising demand for electricity in Great Britain by 2035.

The plan would connect additional 21 gigawatts (GW) of offshore wind development off the coast of Scotland to the grid in an efficient and coordinated way, and this investment will allow Britain to exploit the economic potential as a leader in offshore wind by moving the power to where it is needed, ESO said.

In response to the proposed investment, RenewableUK’s Director of Future Electricity Systems Barnaby Wharton said,

“This investment in new networks is absolutely vital, to slash bills, make our economy more competitive and boost Britain’s energy security.”

Two UK ports, Port Talbot in Wales and the Port of Cromarty Firth in Scotland, are advancing for further consideration by the Department for Energy Security and Net Zero for funding to support floating wind projects.

Another port, Port of Aberdeen, is a step closer to becoming a strategic hub for floating offshore wind, with its proposed South Harbour upgrade project progressing to Stage 2 ‘priority’ status in the Scottish Offshore Wind Energy Council’s (SOWEC) Strategic Investment Model (SIM).

In company news, the Thistle Wind Partners (TWP) consortium involving DEME, Qair, and Aspiravi, has awarded Ramboll the contract for pre-FEED of the foundations for its 1-GW Bowdun offshore wind project.

TWP started developing its projects in January 2022 after winning seabed lease options from Crown Estate Scotland for the 1-GW Ayre Offshore Wind Farm off the coast of Orkney and the 1-GW Bowdun Offshore Wind Farm off the Aberdeenshire coast.

The Secretary of State for Energy Security and Net Zero has granted development consent to the Hynet Carbon Dioxide Pipeline application. The consent will allow the construction, operation, and maintenance of infrastructure to transport captured CO2 as part of the HyNet CCS cluster, where Italy’s Eni is the transportation and storage operator.

Hitachi Energy has won an order from SP Energy Networks to design and deliver a first-of-its-kind power quality solution to balance the grid and boost the flow of renewable energy across the UK. The solution will enable the addition of more renewables into the grid of SP Energy Networks, the electricity network operator for Central & Southern Scotland and Merseyside, Cheshire, North & Mid-Wales, and North Shropshire.

TagEnergy and Harmony Energy have powered their 49MW/98MWh Jamesfield battery energy storage system (BESS) near Abernethy, Scotland, after completing the standalone project.

Liverpool City Region’s Mayor Steve Rotheram has unveiled advanced proposals to build the world’s largest tidal scheme on the banks of the River Mersey. The scheme would need government backing to complete the development stage.

Worley has been awarded services contracts by Shell supporting the delivery of Europe’s largest renewable hydrogen project located in the Port of Rotterdam in the Netherlands.

bp pulse, bp’s electric vehicle charging brand, has acquired the freehold of one of the largest truck stops in Europe, Ashford International Truckstop in Kent, as part of its drive to support heavy goods vehicles (HGV) fleets as they

electrify. bp pulse plans to transform the site with mega-watt EV chargers for HGVs.

Net Zero Teesside Power (NZT Power) and the Northern Endurance Partnership (NEP) have selected contractors for engineering, procurement, and construction contracts with a combined value of around £4 billion. The selection of nine leading specialist contractors across eight contract packages is a major milestone for the Teesside-based projects, which would contribute to the UK’s journey towards net zero emissions by 2050, the joint venture partners bp and Equinor said in March.

Top offshore wind developer Ørsted and Dillinger, the largest heavy steel plate producer in Europe, have strengthened their partnership by agreeing that Ørsted will be offered the first production of lower-emission steel for offshore wind foundations from Dillinger, subject to availability and commercial terms and conditions. Taking the current technology outlook into account, the reduction of the process-related carbon emissions from production is expected to be around 55-60 percent compared to conventional heavy plate steel production, Ørsted said.

The generation arm of UK’s Octopus Energy is investing in German renewables developer Lintas Green Energy by Octopus’ Sky fund taking a 50-percent stake of the Oldenburg-based green energy developer to accelerate their growth across the country. The investment will help build new wind and solar farms, targeting 1 GW by 2030 – enough clean energy to power 370,000 German homes.

TotalEnergies said in early April it would develop a second battery storage project in Belgium, at its depot in Feluy, following a first such project at the Antwerp refinery. Start-up of the Feluy battery storage project is expected at the end of 2025.

“We are pleased to announce this new storage project in Feluy, just a year after we began our Antwerp project, which should be operational by the end of the year,” said Olivier Jouny, Senior Vice President, Integrated Power at TotalEnergies.

“These projects are fully in line with our integrated development strategy for electricity, not just in Belgium, but globally.”

13 EUROPEAN ENERGY REVIEW EUROPE NEWS SPONSORED BY

Artists impression of a tidal barrage across the River Mersey.

Energy Review USA

By Tsvetana Paraskova

The company outlook about the future of the US oil and gas sector has improved despite little change in industry activity in the first quarter of the year, while breakeven prices have increased from a year ago, the latest Dallas Fed Energy Survey showed.

of ready-to-be-turned-in-line wells once prices rebound.

The industry has also made progress in reducing emissions while industry organisations are calling on Congress to overturn some proposed new rules the Biden Administration plans for the transportation and energy production sectors.

US Breakeven Prices Rise

The latest Dallas Fed Energy Survey showed at the end of March little change in oil and gas activity in the Eleventh District, which includes Texas, northern Louisiana, and southern New Mexico.

The business activity index, the survey’s broadest measure of conditions energy firms in the Eleventh District face, was 2.0 in the first quarter, suggesting little to no growth during the quarter, and was essentially unchanged from the previous quarter, according to oil and gas executives responding to the Dallas Fed Energy Survey.

Oil and gas production decreased, especially sharply for natural gas, while costs increased at a slightly faster pace for both oilfield services and E&P firms, the survey found.

The company outlook index rebounded in the first quarter, jumping by 24 points to 12.0. Yet, it is still below the series average. The overall outlook uncertainty index dropped by 22 points to 24.1, suggesting that while uncertainty

On average, respondents expect a West Texas Intermediate (WTI) oil price of $80 per barrel at year-end 2024, with responses ranging from $70 to $120 per barrel. When asked about longer-term expectations, respondents on average expect a WTI oil price of $83 per barrel two years from now and $90 per barrel five years from now, the survey showed.

Survey participants expect a Henry Hub natural gas price of $2.59 per million British thermal units (MMBtu) at year-end, $3.18/ MMBtu two years from now, and $3.94/ MMBtu five years from now. WTI spot prices averaged $82.52 a barrel and Henry Hub spot prices averaged $1.44/MMBtu during the survey collection period 13–21 March.

Executives stated in the latest survey that the average breakeven price for existing wells across the US is now about $39 per barrel, up from $37 a barrel last year. Across regions, the average price necessary to cover operating expenses ranges from $31 to $45 per barrel. Almost all respondents can cover operating expenses for existing wells at current prices, the survey found. The Delaware basin of the Permian has the lowest average breakeven at $31 per barrel, while the average breakeven for non-shale US oil production is $45 a barrel.

For the entire sample, companies need $64 per barrel on average to profitably drill a new well, higher than the $62-per-barrel price when this question was asked last year.

www.ogv.energy I May 2024 Your Global Procurement Partner - Procurement Services - Spend Analysis - Cost + - Vendor Consolidation - Specification Sourcing - E-procurement ESWL Ltd, 4 Prospect Place, Westhill, Aberdeenshire, AB32 6SY ESWL Americas Inc, 1010 Goodnight Trail, Houston, TX 77060 sales@eswl-ltd.com | houston@eswl-ltd.com www.eswl-ltd.com SPONSORED BY

Photo: Monty Jackson Flickr

Across regions, average breakeven prices to profitably drill range from $59 to $70 per barrel. Breakeven prices in the Permian Basin average $65 per barrel, up by $4 compared to last year. Almost all firms in the survey can profitably drill a new well at current prices.

Respondents also noted that the Environmental Protection Agency’s (EPA) guidance regarding the methane charge from the Inflation Reduction Act would have a net negative impact on their firm. The mostselected response among E&P firms was “slightly negative,” chosen by 46 percent of respondents. Another 34 percent selected “significantly negative,” while 19 percent selected “neutral,” and 1 percent expect a positive impact.

Commenting on the survey, an executive at one exploration and production (E&P) firm said that “Natural gas prices remain challenged, primarily due to the overhang of storage and lack of winter demand. Crude oil markets have continued to be constructive. We have decreased capital investments in our natural gas portfolio and increased capital investments in our oil portfolio.”

“Operator performance varied, however, and we believe the next five years will prove critical for companies to address easier-toabate emissions ahead of quickly changing regulations,” said Ivana Petrich, senior associate with EIR.

“Despite a 23% drop in reported methane emissions, we calculate that many plays would still, on average, be exposed to the Inflation Reduction Act’s waste emissions charge that came into effect on Jan. 1, based on 2022 emissions.”

Industry Opposes Latest Biden Administration Rules

“This tax on American energy is a serious misstep that could jeopardize our nation’s energy advantage and weaken our energy security,”

Natural Gas Producers Cut Output and Prepare for a Price Rebound

US natural gas producers have announced production reductions this spring in response to historically low prices, due to a milder winter, which led to lower gas demand for heating and power and to above-average levels of working gas in storage.

The low prices are setting up American producers for a more difficult 2024 than they had probably expected. Gas producers are using their operational flexibility in well drilling and completion, Enverus said at the end of March. Companies are deferring production and well completions and are stocking up on wells ready to be turned in line when natural gas prices recover.

“While companies are certainly protective of cash flow, they all want to be ready to service the next wave of LNG projects coming online in 2025,” Enverus notes.

US Oil and Gas Sector Cuts Emissions

The oil and gas sector’s reported upstream and gathering emissions fell between 2020 and 2022, Enverus Intelligence Research (EIR) said in a report in March. Total emissions declined by 5 percent despite a 9-percent increase in production. This led to a 12-percent drop in emission intensity across the Lower 48.

The American Petroleum Institute (API) has joined with 19 associations representing all segments of the US oil and natural gas industry operating across the country in calling on the US Environmental Protection Agency to revise what API described as a “misguided methane fee” on American energy.

In comments submitted to the EPA on the “waste emissions charge” proposed rulemaking, the associations argued that the proposed rule creates an incoherent regulatory regime, fails to meet the statutory requirements outlined by the Inflation Reduction Act, and discourages emissions reduction efforts by the industry.

“This tax on American energy is a serious misstep that could jeopardize our nation’s energy advantage and weaken our energy security,” said API Senior Vice President of Policy, Economics and Regulatory Affairs Dustin Meyer.

“U.S. oil and natural gas is innovating throughout its operations to reduce methane emissions while meeting growing energy demand. Yet this proposal creates an incoherent, confusing regulatory regime that will only stifle technology advancements and hamper energy development,” Meyer added.

EPA issued at the end of March a final rule that sets new, more protective standards to further reduce harmful air pollutant emissions from light-duty and medium-duty vehicles starting with model year 2027.

API and the American Fuel & Petrochemical Manufacturers (AFPM) said the final rule would eliminate most new petrol cars in less than a decade.

“At a time when millions of Americans are struggling with high costs and inflation, the Biden administration has finalized a regulation that will unequivocally eliminate most new gas cars and traditional hybrids from the U.S. market in less than a decade,” API President and CEO Mike Sommers and AFPM President and CEO Chet Thompson said in a joint statement.

“This regulation will make new gas-powered vehicles unavailable or prohibitively expensive for most Americans. For them, this wildly unpopular policy is going to feel and function like a ban.”

API and AFPM noted that currently, only EVs and five plug-in hybrid models meet the 82 grams/mile threshold in EPA’s rule. No petrol, diesel, or traditional hybrids come close, they noted, and said that if Congress doesn’t overturn the rule they are prepared to challenge it in court.

According to an Ipsos poll, 75 percent of US registered voters oppose government policies that would ban new gasoline, diesel and traditional hybrid vehicles, including 80 percent of Independent voters and 56 percent of Democrats, API said.

15 USA ENERGY REVIEW

USA NEWS Sponsored by:

Photo: Getty Images

MIDDLE EAST Energy Review

By Tsvetana Paraskova

OPEC’s continued production cuts, Saudi Aramco’s view on the energy transition, and a number of gas and LNG projects and contract awards marked the past month in the Middle East’s oil and gas industry.

OPEC Remains on Course with Oil Output Cuts

The Joint Ministerial Monitoring Committee (JMMC), the OPEC+ group’s panel that monitors market developments and compliance with the cuts, met in early April and did not make any recommendation to the OPEC+ alliance about changing its production policy.

The committee expects the countries that have so far exceeded their quotas, most notably Iraq and Kazakhstan, to submit their detailed compensation plans to the OPEC Secretariat.

“The Committee welcomed the Republic of Iraq and the Republic of Kazakhstan pledge to achieve full conformity as well as compensate for overproduction. The Committee also welcomed the announcement by the Russian Federation that its voluntary adjustments in the second quarter of 2024 will be based on production instead of exports,” OPEC said in a statement after the panel’s regular meeting.

The next meeting of the JMMC is planned to be held on 1 June, when OPEC+ participants are expected to decide how to proceed with the current cuts into the second half of the year.

OPEC Says $14 Trillion Investment Needed to Meet Oil Demand by 2045

The oil industry needs cumulative oil-related investments of around $14 trillion from now until 2045, Dr. Ayed S. Al-Qahtani, Director of OPEC’s Research Division, said at the 10th Joint IEA-IEF-OPEC Workshop on the Interactions between Physical and Financial Energy Markets at the end of March.

“This massive spending will be required to meet global oil demand, which is expected to reach 116 mb/d by 2045,” Al-Qahtani added.

“This must be an industry priority if we are to maintain security of supply and avoid unwanted volatility in the years ahead.”

According to Al-Qahtani, “we must continue to do everything we can to avoid volatility, and this includes speculative positioning, which can adversely impact the global oil market.”

Saudi Arabia Warns Against Ideas to Phase Out Oil and Gas

At the CERAWeek in Houston, one of the top annual oil industry events, Saudi Aramco’s president and CEO, Amin Nasser, warned that “We should abandon the fantasy of phasing out oil and gas, and instead invest in them adequately, reflecting realistic demand assumptions.”

The current energy transition strategy ignores the message from consumers globally, who

“want energy that helps protect the planet and their pocket books, with minimal disruption to supplies and their daily lives,” the chief executive of the world’s largest oil firm told the CERAWeek audience.

The world should ramp up efforts to reduce carbon emissions, aggressively improve efficiency, and introduce lower carbon solutions, he added.

“We should phase in new energy sources and technologies when they are genuinely ready, economically competitive, and with the right infrastructure, adjusting all of the above as needed, as we go,” Nasser said, noting that the energy transition enthusiasm faces hard truths such as still low wind, solar, and EV shares compared to conventional energy sources and the huge subsidies given out to clean energy sources.

Aramco Key Investor in China

Saudi Aramco, the world’s single largest crude oil exporter, is investing in China, the top crude importer, and will continue to do so in refining, petrochemicals ventures, and venture capital to explore new strategic investment in critical materials and renewables, Aramco’s Nasser said at the China Development Forum 2024 in late March.

“While energy remains a strategic pillar of our rock-solid relationship, our vision of the future extends far beyond investing and cooperating in energy alone. Here we have noted with keen interest what Premier Li recently called the “strategic emerging industries and futureoriented industries,” he added.

“We want to be a partner of first resort in China’s economic development journey, as new opportunities clearly come into focus,” Nasser said, noting that Aramco was among the leading direct investors in China last year.

Contracts To Boost Middle East’s Oil and Gas Supply

Meanwhile, Aramco awarded in early April $7.7 billion worth of engineering, procurement and construction (EPC) contracts for a

www.ogv.energy I May 2024

Ras Laffan Industrial City © QuatarEnergy

major expansion of its Fadhili Gas Plant in the Eastern Province of Saudi Arabia. The project is expected to increase the plant’s processing capacity from 2.5 to up to 4 billion standard cubic feet per day (bscfd). The additional processing capacity is expected to contribute to the company’s strategy to raise gas production by more than 60 percent by 2030, compared to 2021 levels. The Fadhili Gas Plant expansion, which is expected to be completed by November 2027, is also expected to add an additional 2,300 metric tons per day to sulphur production.

“The award of these contracts reflects Aramco’s goal to increase supplies of natural gas, help efforts to reduce greenhouse gas emissions, and free up more crude oil for value-added refining and export,” said Wail Al Jaafari, Aramco Executive Vice President of Technical Services.

In the United Arab Emirates (UAE), ADNOC has issued a Limited Notice to Proceed (LNTP) for early engineering, procurement and construction (EPC) activities for its low-carbon liquefied natural gas (LNG) project in Al Ruwais Industrial City, Abu Dhabi. The early EPC award went to a joint venture led by Technip Energies with JGC Corporation and National Petroleum Construction Company PJSC.

The Final Investment Decision (FID) for the project is expected this year. Once completed, Ruwais LNG will consist of two 4.8 million metric tonnes per annum (mmtpa) LNG liquefaction trains with a total capacity of 9.6 mmtpa, and is set to more than double ADNOC’s LNG production capacity, from 6 mmtpa to around 15 mmtpa.

Ruwais LNG is set to be the first LNG export facility in the Middle East and North Africa region to run on clean power, making it one of the lowest-carbon intensity LNG plants in the world, ADNOC says.

ADNOC has also signed a 15-year Heads of Agreement with a subsidiary of Germany’s SEFE Securing Energy for Europe GmbH, for the delivery of 1 million metric tonnes per annum of LNG. Deliveries are expected to start in 2028, upon commencement of the facility’s commercial operations. The fuel will

primarily be sourced from ADNOC’s Ruwais LNG project.

The deal with the German firm is the second long-term LNG supply agreement from the Ruwais LNG project, following the 15-year agreement with China’s ENN Natural Gas signed in December 2023.

ADNOC announced at the end of March the start of crude oil production from its Belbazem offshore block, which is operated by Al Yasat Petroleum, a joint venture between ADNOC and China National Petroleum Corporation (CNPC).

Production capacity at the Belbazem offshore block is set to progressively ramp up to 45,000 barrels per day (bpd) of light crude and 27 million standard cubic feet per day (mmscfd) of associated gas, contributing to ADNOC’s target of reaching 5 million bpd by 2027 and enabling UAE gas self-sufficiency, ADNOC said.

Qatar’s state firm QatarEnergy has signed time-charter party (TCP) agreements with Qatar Gas Transport Company Limited (Nakilat) for the operation of 25 conventional-size LNG vessels as part of the second ship-owner tender under QatarEnergy’s LNG fleet expansion programme.

Seventeen of the 25 LNG vessels are being constructed at the Hyundai Heavy Industries (HHI) shipyards in South Korea, and the remaining eight are being constructed at Hanwha Ocean (formerly Daewoo Shipbuilding & Marine Engineering), also in South Korea.

QatarEnergy has also signed long-term agreements with four international shipowners for the operation of 19 new, ultra-modern conventional size LNG vessels, bringing the total number of ships for which it has signed TCPs to 104 vessels, said QatarEnergy’s chief executive officer Saad Sherida Al-Kaabi

“These signings form a significant milestone in QatarEnergy’s LNG fleet expansion program, as it marks the conclusion of the conventional sizes vessels portion of program, bringing the total number of ships for which we have signed TCPs to 104 vessels, a massive undertaking that is the largest shipbuilding and leasing program ever in the history of the industry,” said Al-Kaabi, who is also the Minister of State for Energy Affairs of Qatar.

“These ships will support our expanded LNG production capacity from the North Field in Qatar and Golden Pass in the U.S., while also meeting our longterm fleet replacement requirements.”

“These ships will support our expanded LNG production capacity from the North Field in Qatar and Golden Pass in the U.S., while also meeting our long-term fleet replacement requirements.”

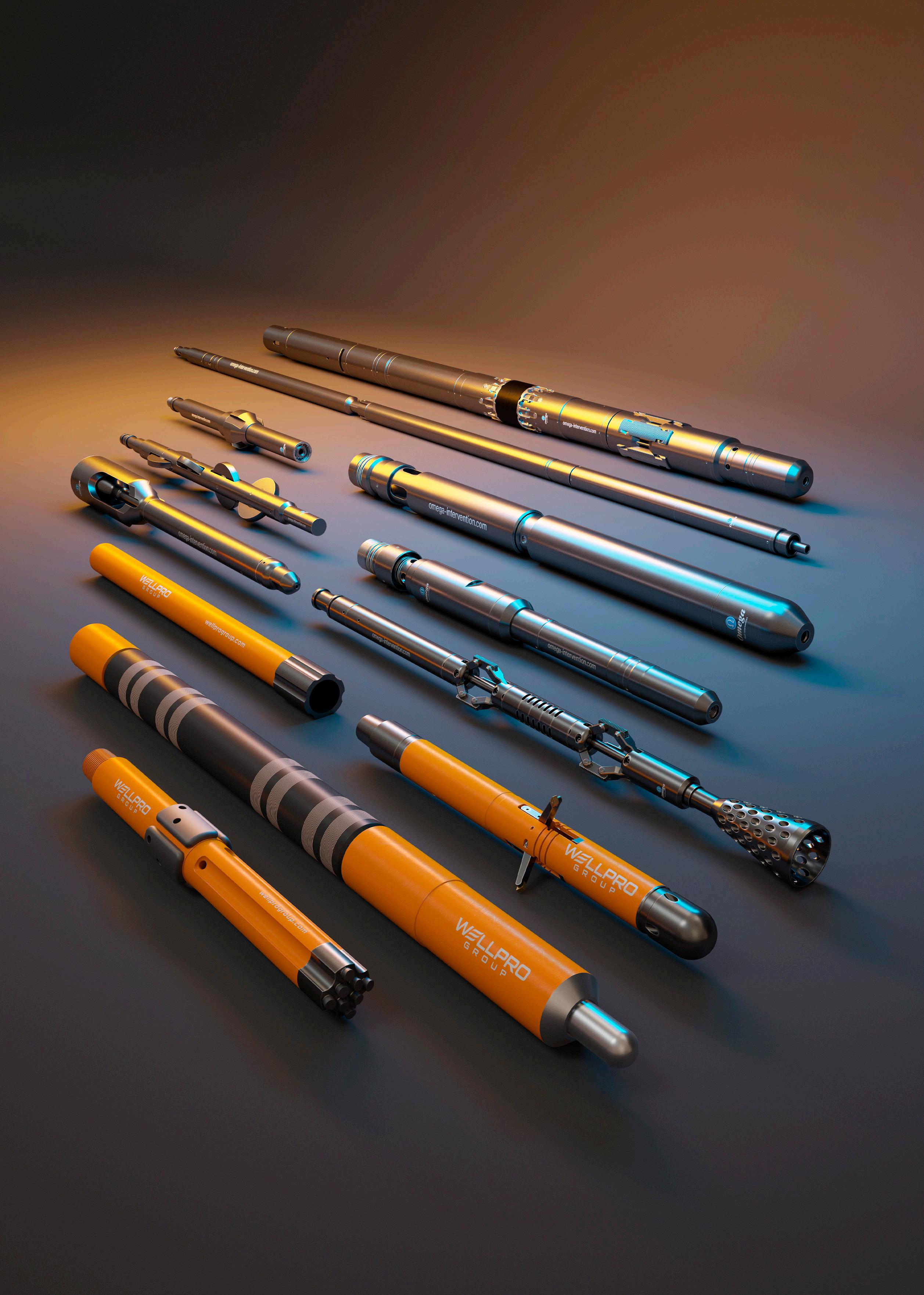

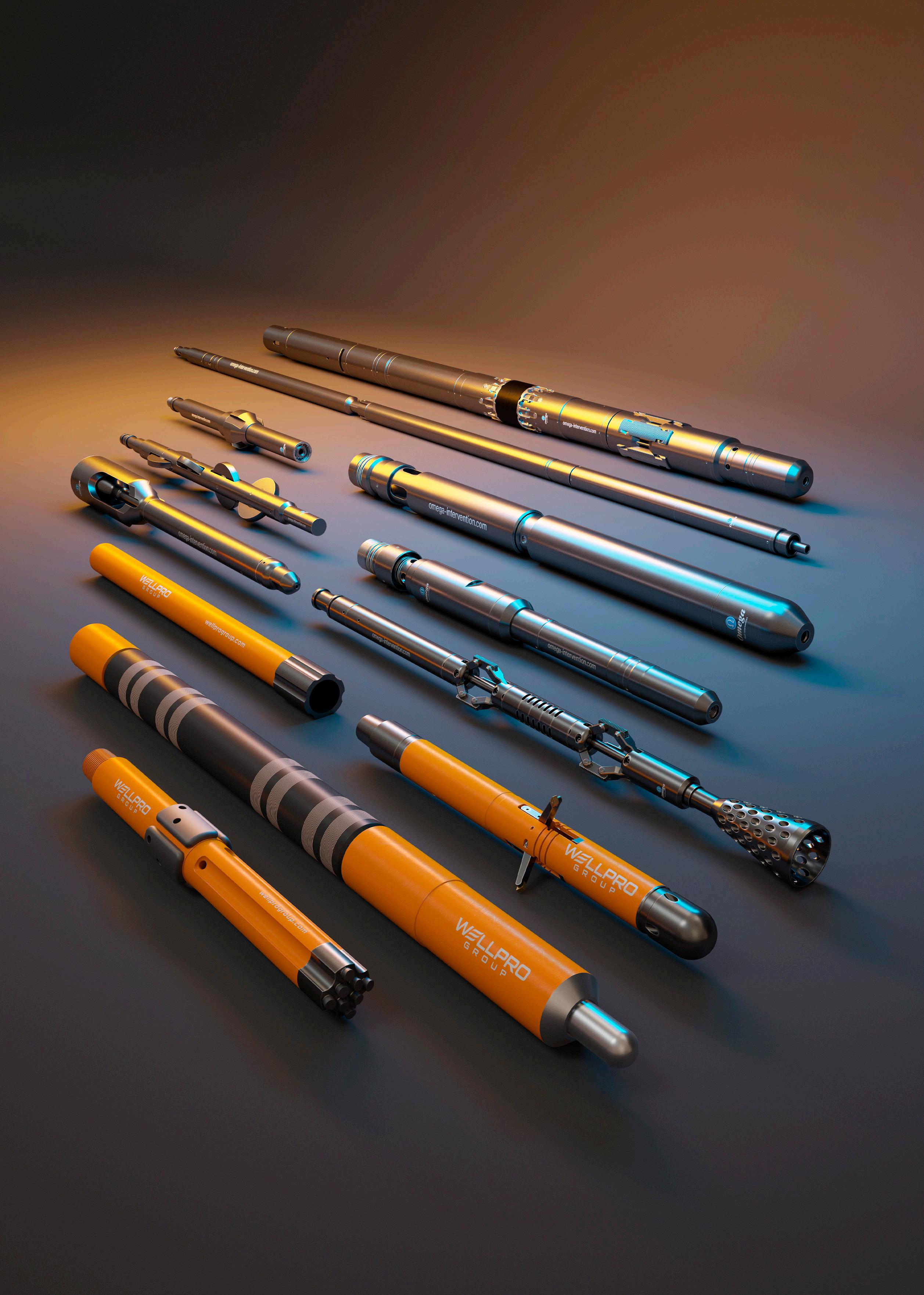

Wellpro Group & Omega Well Intervention provide a complete Thru Tubing, Inflatable Packer & Well Intervention portfolio including operational design, project management, service, rental & sales.

17 MIDDLE EAST ENERGY REVIEW 17 Middle East Review SPONSORED BY

Image by Suphanat Khumsap via iStock

SPONSORED BY

www.eicdatastream.the-eic.com

Energy projects and business intelligence in the energy sector

The EIC delivers high-value market intelligence through its online energy project database, and via a global network of staff to provide qualified regional insight. Along with practical assistance and facilitation services, the EIC’s access to information keeps members one step ahead of the competition in a demanding global marketplace.

The EIC is the leading Trade Association providing dedicated services to help members understand, identify and pursue business opportunities globally.

It is renowned for excellence in the provision of services that unlock opportunities for its members, helping the supply chain to win business across the globe.

The EIC provides one of the most comprehensive sources of energy projects and business intelligence in the energy sector today.

18 ENERGY PROJECTS MAP

2 8 10 11 12 5 7 1 9 World Projects Map 4 6 3 www.ogv.energy I May 2024

NORWAY

$550 million

BESTLA OIL AND GAS FIELD

A final investment decision has been reached by the operating group for the project. OKEA has awarded a contract to Aker Solutions for the project's topside scope, as well as to Subsea7 and OneSubsea for subsea requirements. Contracts for drilling rig services will be awarded in 2Q 2024

BUL HANINE OIL FIELD –REDEVELOPMENT –PHASE 2

Tender documents for EPCI Package 1 have been issued for the project. EPCI Package 1 involves a new central processing platform, living quarters, utility platform, gas injection platform, riser platform and modifications of existing structures.

KIKEH OFFSHORE

AND GAS FIELD

McDermott International has won an offshore transportation, installation and commissioning contract for the Kikeh subsea gas lift project off Malaysia, worth up to $50 million. McDermott will replace the existing gas lift riser and install new equipment to deliver gas to a subsea production system linked to the Kikeh FPSO vessel. 6

BLOCK 15/06: AGOGO FULL FIELD DEVELOPMENT

Blue Water’s Floating Productions Systems (FPS) project team will oversee the transportation of 15 Agogo topside modules for the Agogo FPSO, with the heaviest weighing 3,211 metric tonnes. The initial transportation, which is slated to commence in May 2024, will encompass both domestic and international routes from Vietnam and Indonesia to China.

7

NAMIBIA

BLOCK 2913B VENUS OIL DISCOVERY

BLOCK P – VENUS OIL FIELD

The Government of Equatorial Guinea has approved the Joint Operating Agreement (JOA) for the Venus plan of development (POD). All partners have signed the final documents of the JOA, allowing the project to advance. FEED work will now commence. Once the FEED is completed the operator anticipates taking a final investment decision.

BLOCK 29 – POLOK AND CHINWOL DISCOVERIES

BW Offshore has been awarded the contract to undertake FEED studies on the project. The project is expected to utilise a medium sized FPSO with a production capacity of up to 60,000 b/d of oil. First oil is expected in 2026.

$800 million Prima Energi 4

It has been announced that TotalEnergies are to launch the development of the Venus oil discovery during 2024. Reservoir characteristics are considered to be impressive, and the announcement follows two completed drill stem tests. 8

GATO DO MATO OIL FIELD

MODEC has been awarded the FEED contract for the FPSO on the oil field. MODEC will be responsible for the design of the hull and all related topsides facilities for the FPSO, which is projected to be moored by a SOFEC Spread Mooring system.

INDONESIA

ANDE ANDE LUMUT OIL FIELD

The operator has received approval for the revised Plan of Development. The expected production from the heavy oil field is 20,000 b/d. The project is to be developed in two stages the first of which will see the installation of a wellhead platform and the drilling seven horizontal production wells.

BLOCK B PROJECT

The final investment decision for the project was announced on the 28 March. The offshore development which will have a production capacity of 490 MMcf/d of gas is expected online by the end of 2024. A consortia comprising of McDermott and Petrovietnam Technical Services Corporation will provide the EPCI and HUC services for a central processing platform, living quarters platform, flare tower and bridges for the project.

DRAGON GAS FIELD

The developers have started preparations for pre-FEED studies associated with the Dragon development. The government of Trinidad & Tobago expects Shell to issue an FID for the Dragon field in 2025. Dragon's initial output is estimated at 5MMcm/d - which will be exported and processed in Trinidad.

KASKIDA OIL FIELD

It was announced during March that BP could reach a final investment decision around June 2024. FEED work is currently underway. Plans for Kaskida to be developed will see the deployment of a semi-submersible floating production unit with oil and gas processing capacities of 80,000 b/d and 25 MMcf/d.

19 ENERGY PROJECTS MAP WORLD PROJECTS SPONSORED BY

1

OKEA

billion QatarEnergy 2

QATAR $2

$5 billion TotalEnergies 3

MALAYSIA $1 billion PTTEP 5

OIL

ANGOLA $10 billion Azule Energy BRAZIL $3 billion Shell VIETNAM $6.8 billion PetroVietnam 12

9

10

11

EQUATORIAL GUINEA $500 million Vaalco MEXICO $2.5 billion Repsol VENEZUELA $3 billion Shell USA $10 billion BP

Innovation and Technology in the Energy Industry

By Tsvetana Paraskova

By Tsvetana Paraskova

Energy companies are increasingly relying on technology and innovation to boost their bottom line and reduce emissions.

The oil and gas industry bets on digitalisation and innovation in exploration, drilling, and production, using the latest tech advances to ensure safe and continuous operations. The energy sector is also looking to incorporate the latest innovations to bring down emissions from operations as many firms, including the biggest European oil majors, have pledged to become net-zero energy businesses by 2050.

Innovation helps energy firms close the gap in net-zero technologies and boost domestic resource development.

North Sea – ‘A Vibrant Hotbed of Technology Innovation’

A recent report from the UK’s North Sea Transition Authority (NSTA) found that digital applications and solutions aimed at reaching net zero are driving technology growth in the North Sea, which, the authority says, “remains a vibrant hotbed of technology innovation.”

The triple targets of supporting current oil and natural gas production, reducing emissions, and accelerating the transition to net zero are driving technological innovation in the North Sea, NSTA said in its 2023 Technology Insights report earlier this year.

The authority gathered information from 55 UK North Sea operators about the technologies they have already installed and their efforts to identify solutions which could enhance operations in future.

“There was strong evidence of a continuing focus on technologies for the effective and cost-efficient development of remaining hydrocarbon resources, complemented by efforts to reduce emissions,” NSTA found in the survey.

The report shows that 1,200 new technologies, including aerial drone and self-driving subsea vehicles, have been reported in the latest survey, up from the 1,080 developments recorded the previous year, and 880 in 2021.

Innovations in digital applications and Net Zero technologies have jumped in recent months. Net Zero technologies have risen from 61 in 2021 to 140 in 2023, and the number of Data and Digital technologies has grown from 190 to 381 in the same time period, the survey found.

Facilities management technologies, including deployment of aerial drones and autonomous underwater vehicles to monitor equipment remain the single largest place for

innovation, while there has been significant growth in the innovation in installations and topsides, and reservoir and well management, NSTA noted.

Other areas are seeing innovative thinking, too, with exciting new ideas implemented in seismic surveying and exploration, well drilling and construction, subsea systems, well P&A, and facilities decommissioning.

“The North Sea is full of opportunities related to hydrocarbons and net zero, but at the same time can be a difficult place to work. Operators must focus on finding solutions to many challenging problems,” said Ernie Lamza, NSTA Technology Manager.

“World-leading technologies, skills and experience boost production and support the energy transition, placing UKCS workers and companies in a great position to secure work and deliver products and services in the UK and in other producing regions around the world.”

20 www.ogv.energy I May 2024 INNOVATION & TECHNOLOGY

Notable examples of innovation in drilling and well construction include low-cost platform modular drilling rig systems, lightweight compact trees, thru-tubing isolation barrier valve, and digital well planning using AI, according to NSTA’s report.

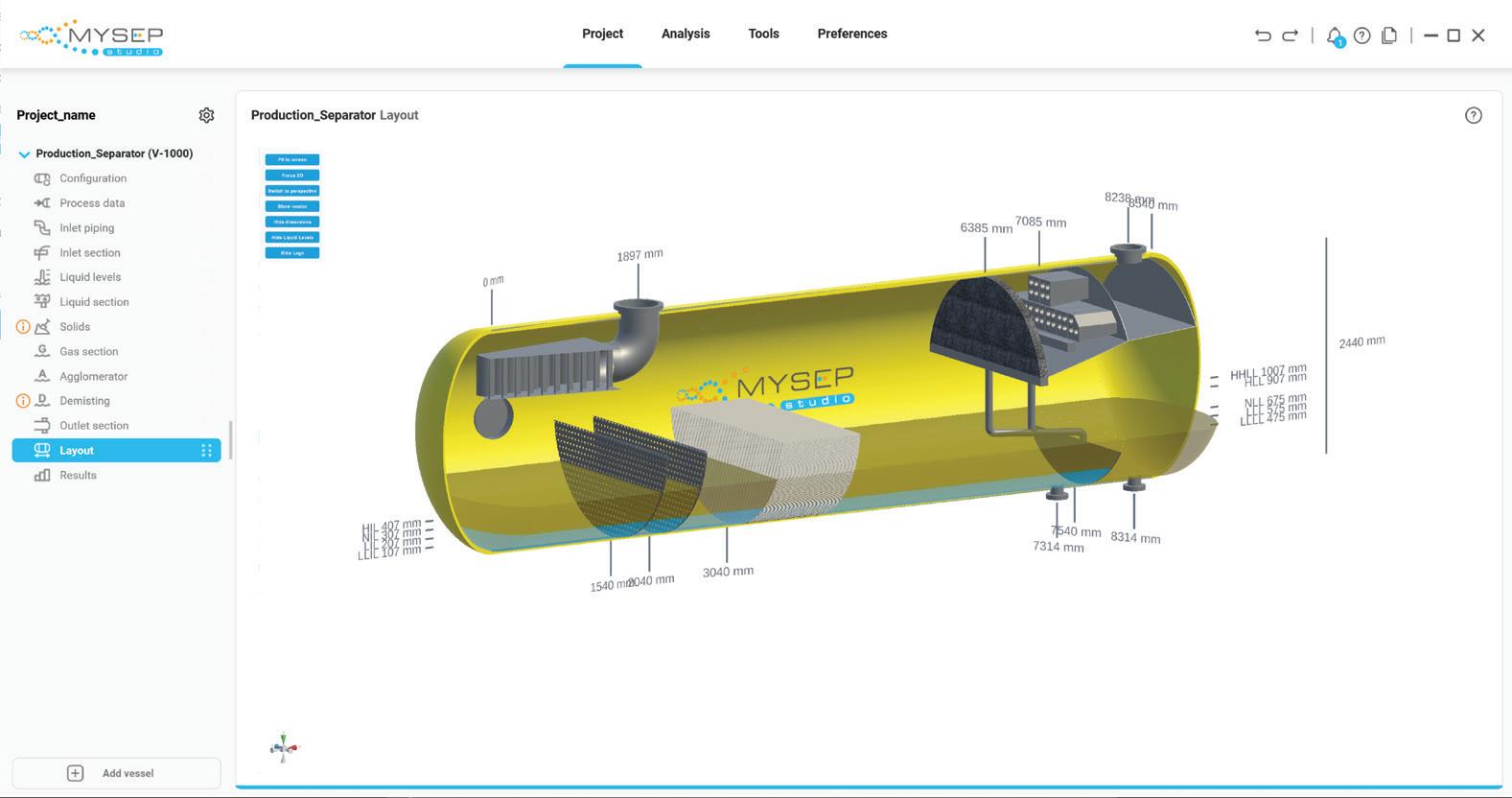

In facilities design and inspections, operators are innovating with cost efficient pipelines and longer tie-backs, subsea gas compression and multiphase boosting, compact and effective fluid separation, and non-intrusive inspection technologies, controls and automation.

Well intervention is seeing innovative technology in wireless downhole surveillance technologies, disposable fibre-lines, retrofit DHSVs and ESPs, and water shut-off solutions.

Last but certainly not least, in the area of emission reduction, operators are deploying innovative technology for enhanced emissions monitoring, including fugitives and flare efficiency, vapour recovery systems, and electrification of platforms.

and rising materials costs, evolving policies and regulations, and the emergence of new technologies,” Deloitte partners and research leaders Amy Chronis, Kate Hardin, and Anshu Mittal wrote.

In the field of technology, artificial intelligence (AI) has the potential to be a transformative force for the industry, with applications across the value chain, ranging from initial resource exploration to refining, according to Deloitte.

Generative AI is now all the craze in many industries, not only oil and gas. This innovation, the next frontier of technology, could help the energy industry cut costs, boost efficiency of processes, create new revenue streams, and accelerate company-wide innovation, the consultancy noted.

In terms of technology uptake, NSTA’s survey found that more than half of the technologies are sourced directly from vendors and/or suppliers, but in over 30 percent of the cases, operators actively partner with selected suppliers to develop solutions in partnership, and/or form joint industry projects.

In addition, there has been a visible contribution of the Net Zero Technology Centre (NZTC) in supporting and facilitating technology innovation, in 10 percent of overall technologies surveyed, NSTA noted.

Global Uptake of Innovation

Innovation and technology go beyond the North Sea to the entire energy industry globally, which is striving to improve operating performance and deploy technologies that would help it cut emissions.

Technology adoption is one of the key trends to follow in the oil and gas industry in 2024, consultancy Deloitte said in its 2024 oil and gas industry outlook earlier this year.

“The energy landscape continues to be shaped largely by four disruptors: geopolitical factors, macroeconomic variables such as high interest rates

For example, predictive maintenance has a significant value for an oil and gas organisation as it could lead to immediate cost reductions. AI and other related technologies could also optimise drilling operations, make value chain management more efficient, and introduce virtual assistance to boost process efficiency, Deloitte reckons.

Generative AI could also create more value by expanding revenues thanks to optimisation of exploration and reservoirs and of refinery processes. Finally, this technology could accelerate further innovation in material design and oilfield services, Deloitte analysts say.

“Harnessing value across these dimensions using generative AI can enhance operational sustainability for O&G companies through carbon emissions monitoring, energy efficiency optimization, and waste reduction while also predicting emission intensities across their supply chain,” they wrote.

According to EY, “the adoption curve for AI is faster than for any other technology so far, so companies must act quickly.”

The oil and gas companies that look to maximise operations, proactively manage emissions, and embrace new energies will be positioned to thrive in the coming decades, say Patrick Jelinek, EY Americas Oil and Gas Leader, US West Energy & Resources Market Segment Leader, and David Kirsch, Managing Director, Energy, Ernst & Young LLP.

AI in the oil and gas industry is expected to be valued at $3.5 billion in 2024, with the market set to reach $13 billion by 2034, Future Market Insights said in a report in February.

Between 2019 and 2023, the AI market in the oil and gas sector jumped by 17 percent each year, and is expected to grow at a 14.1-percent rate every year over the next ten years, according to Future Market Insights.

The need to optimise production and cut costs, safety and environmental impact reduction, and the exponential growth in data from sensors and other data-gathering technologies will be key growth drivers of AI adoption in the oil and gas industry, FMI said.

“The sophistication of AI technology and its potential to deliver increased assets itself is driving its adoption in the oil and gas industry,” says Nikhil Kaitwade, Associate Vice President at Future Market Insights, Inc.

“As AI becomes more affordable and reliable for several industries, they can address increasingly complex problems and deliver more accurate predictions and recommendations even in the oil and gas sector.”

UK and international growth for completions market experts

An international leader at the forefront of next generation creative solutions for the oil and gas completions market has announced significant expansion at home and abroad.

Vulcan Completion Products’ (VCP) has doubled the size of its team in each of the last three years, from seven in 2022 to 24 and rising in 2024. From the company’s global headquarters at Westhill, Aberdeenshire the team boasts more than 200 years of combined experience into delivering the best design, manufacture, and application of bespoke, innovative, and ground-breaking solutions to a growing customer base all over the world.

Having built up a global network of carefully selected agents along with Vulcan Completion Products’ own regional offices, the company sells directly to IOCs, major players and headline service companies. From centralisation, reamer and guide shoes to float equipment, cement plugs, collars and cable protectors Vulcan Completion Products has an unmatched record of success, with the prime directive firmly focused on being a quality service provider which consistently exceeds client expectations.

Growing global footprint creates Malaysia hub

As the global footprint continues to expand, the already impressive list of regional offices in the UK, US, Dubai, Baku, Saudi Arabia and Jakarta has recently grown to add Malaysia where a new regional office to service the APAC area opened in March. The move is seen as a natural next step and allows the team to channel vast career-spanning experience of this market into creating a hub which will further extend its reach into Australia and Asia. Under the leadership of APAC Regional Manager Alex MacGregor, the five-strong team managed from Kuala Lumpur is already making significant gains by fostering pre-existing relationships and deepening the company’s roots in the area.

R&D investment redoubles commitment to UK roots

Meanwhile back in the UK, significant domestic investment has led to the creation of a new research and development hub at Vulcan Completion Products’ global headquarters at Westhill, Aberdeenshire, effectively doubling the company’s footprint at its existing premises and redoubling its commitment to the North East of Scotland. The move will provide a springboard in further accelerating Vulcan Completion Products’ already enviable track record for innovation, empowering the growing team to continue leading from the front and bring new and exciting products to the market to foster future sustainability and prosperity in all the company’s chosen markets. In this part of the business alone, three new members of staff have been brought on board to bolster efforts to ensure the pace of development

INNOVATION & TECHNOLOGY

22

57 granted patents worldwide

Ongoing global investment in intellectual property has accrued some 57 granted patents covering key markets including the USA, UK, Europe, China, India, the Middle East and Eurasia. These mark Vulcan Completion Products’ innovative products out as truly unique and ensure they stand out from the crowd in offering trailblazing solutions which sit in a class of their own.

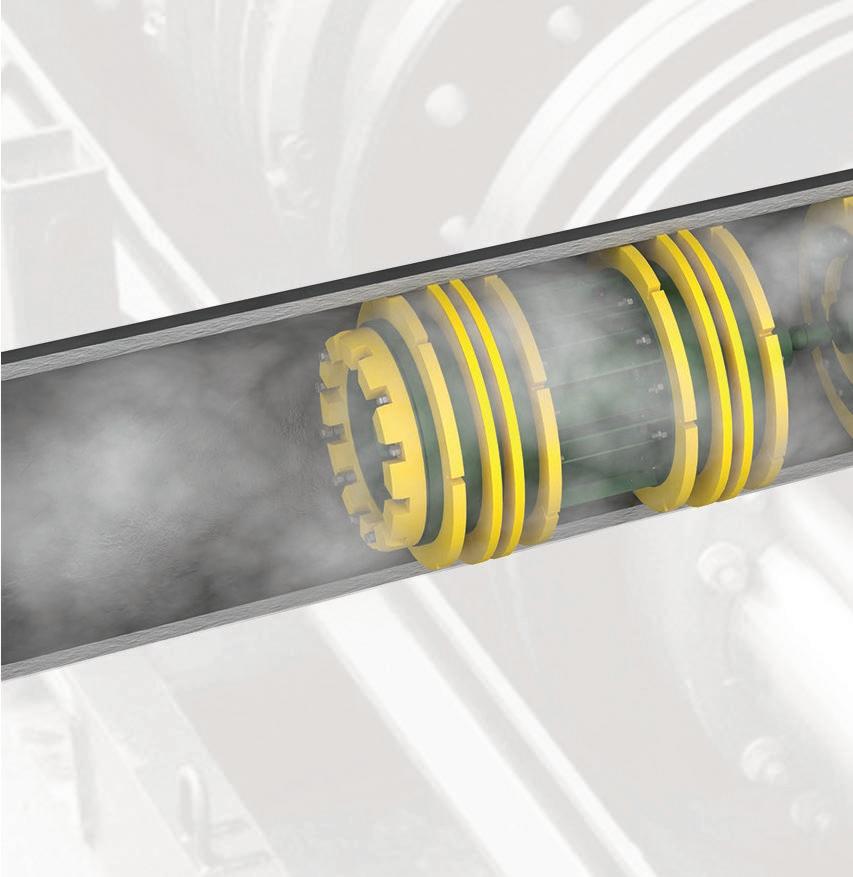

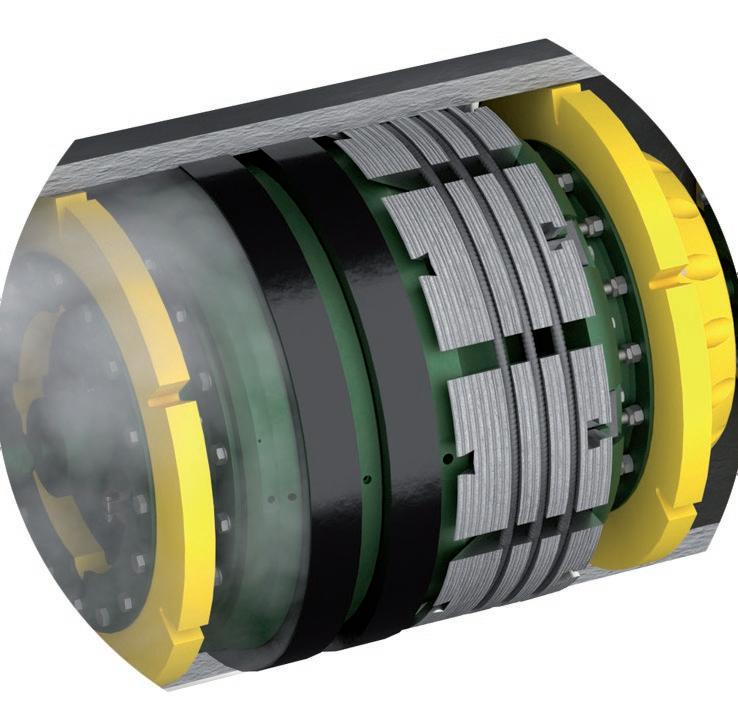

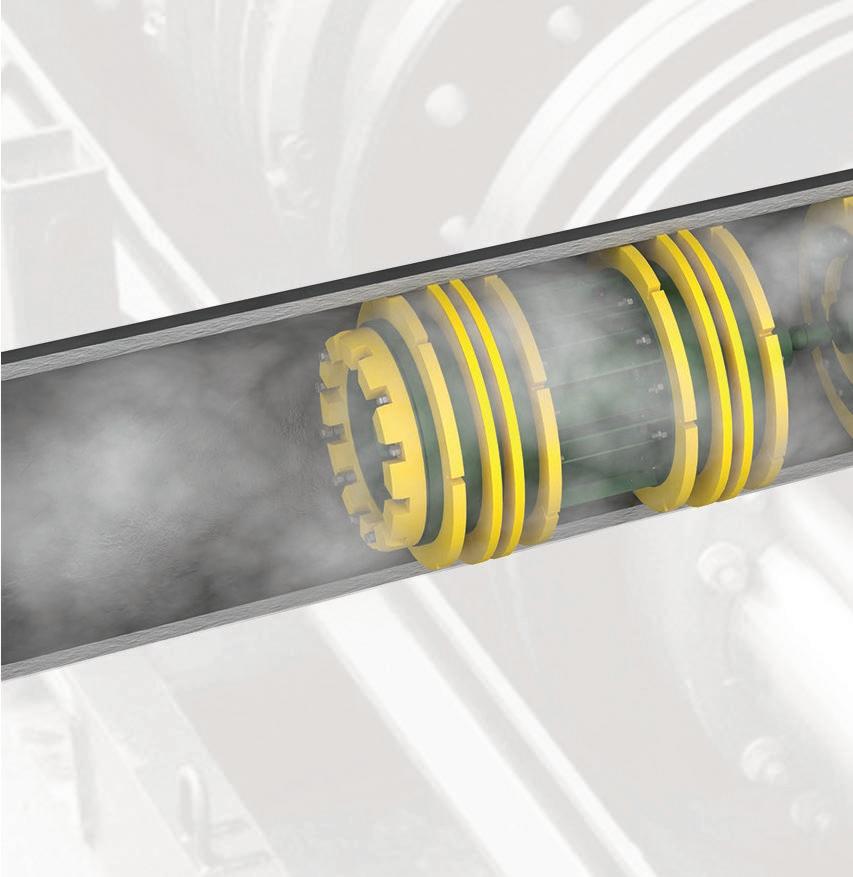

Stars of the company’s comprehensive suite of products, and the subject of 30 patents alone, are the industry hailed, boundary pushing Phazer™ Flex and Phazer™: Flex TT (Tight Tolerance). These under-reamed centralizers reduce drag/ running forces and minimise ECDs, whilst providing positive stand-off and the best possible conditions for zonal isolation.

Phazer™ Flex has been engineered to fulfil the required extreme specifications for under-reamed applications whilst Phazer™: Flex TT tackles annular clearances of less than 0.25” (6mm) in ultra-extreme cases. All testing is performed to surpass API 10D (7th Edition) and meet all the rigorous demands of clients under-reamed wellbores.

North Sea sector success for Phazer™ Flex

In one recent success for Vulcan Completion Products, a major operator in the North Sea sector had been experiencing difficulties sourcing a competent under reamed centralizer to allow them to case and effectively cement their 7 ¾” liner which was required to pass a 9 5/8” casing to surface (ID 8.535”) and centralize in a 10 ¼” under-reamed open hole section. Previously the operator had seen a total loss of hookload/string weight in the 9 5/8” casing using a competitor’s under-reamed centralizer. The customer opted to trial Vulcan Completion Products’ Phazer™ Flex in a “fishhook” shaped profile with 9 5/8” casing set at 6,300 ft and an open hole section of around 4,500 ft building from 45° to just short of horizontal for the lower 3,000ft. Simulation software predicted RIH hookloads/drag and downhole effective stand-off. A spacing plan of three per two joints for the lower 600 ft followed by one per joint for the next 1,450ft was agreed with stand-off in the 75-85% region over the critical isolation zone. The predicted RIH drag analysis showed positive hookload and confidence the liner RIH was achievable which it accomplished, with excellent cementation throughout.

By supplying consistent, as specified products backed up by sound data, Vulcan Completion Products was once again able to achieve successful outcomes which exceeded client expectations.

Commenting on recent company growth, Ian Kirk of Vulcan Completion Products said: “By creating centres of knowledge simultaneously in the UK and in key overseas locations we can not only grow our presence globally but also strengthen our relationships with current and prospective clients by being physically closer to them.

“Our entire business is built on the importance of customer relationships and the team Vulcan now have on board are probably the most knowledgeable in the field today. By listening to their needs, and those of the wider industry, we can place them at the heart of our ethos to innovate and evolve our products in step with the requirements of those we serve.

“Adding more people in more locations ensures that allimportant reach and investing in our global headquarters in the North East of Scotland consolidates the nucleus from which we will realise our future growth aspirations.”

23 INNOVATION & TECHNOLOGY

To find out more about Vulcan Completion Products, visit www.vulcan-cp.com email Sales@Vulcan-CP.com or call +44 (0) 1224 446710.

Susan Goonting (Admin Manager) and Khalid Saufee (Business Development Manager) at VCP’s office in Malaysia

Pictured right: Ian Kirk

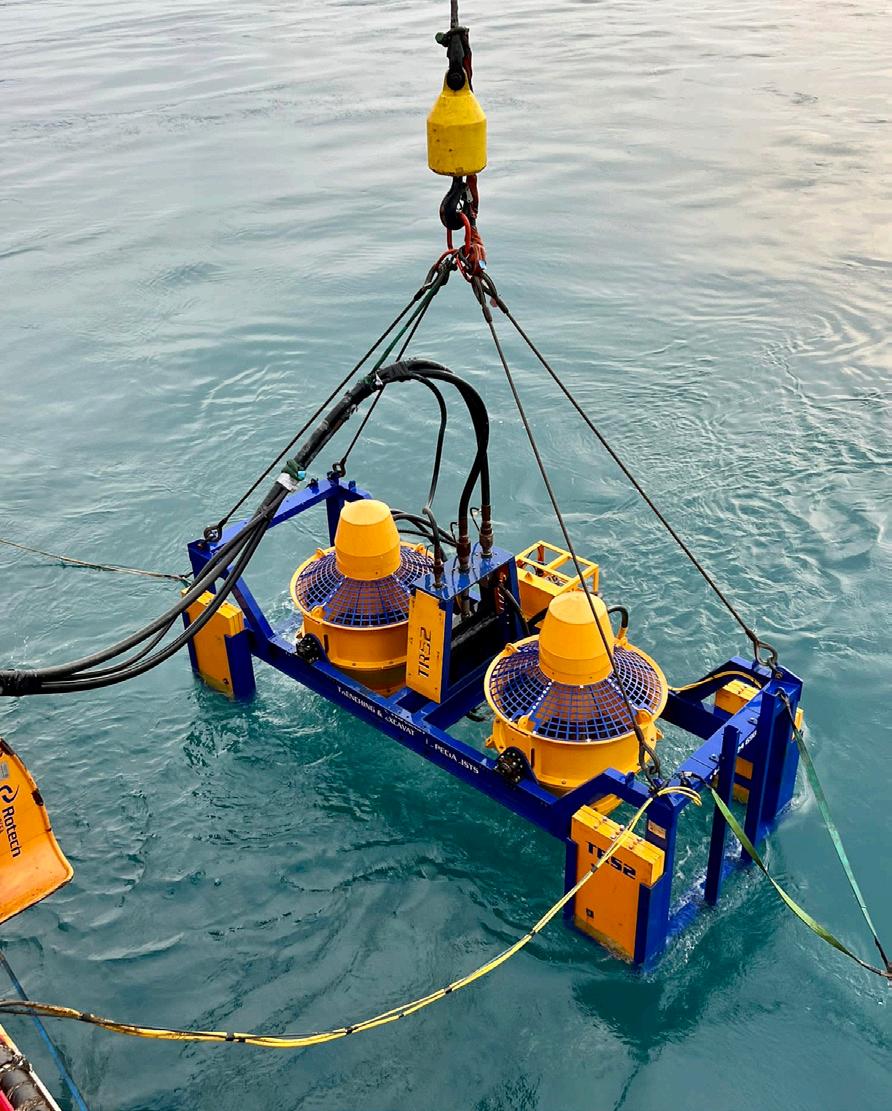

ROTECH SUBSEA SIGNS OFF BUSY YEAR IN OIL & GAS MARKET WITH NEW CFE JET TRENCHING TECH IN HIGH DEMAND

Rotech

Subsea, the leading provider of subsea jet trenching and controlled flow excavation (CFE) services to the energy industry, may have captured the headlines recently for being the global leader in offshore renewables pre-commissioning, commissioning and IRM but that is only half the story.

The Aberdeen-based technology-driven contractor known for its cutting-edge proprietary range of CFE, Jetting and Hybrid Jetting tools built its reputation in oil and gas - and continues to service the sector.