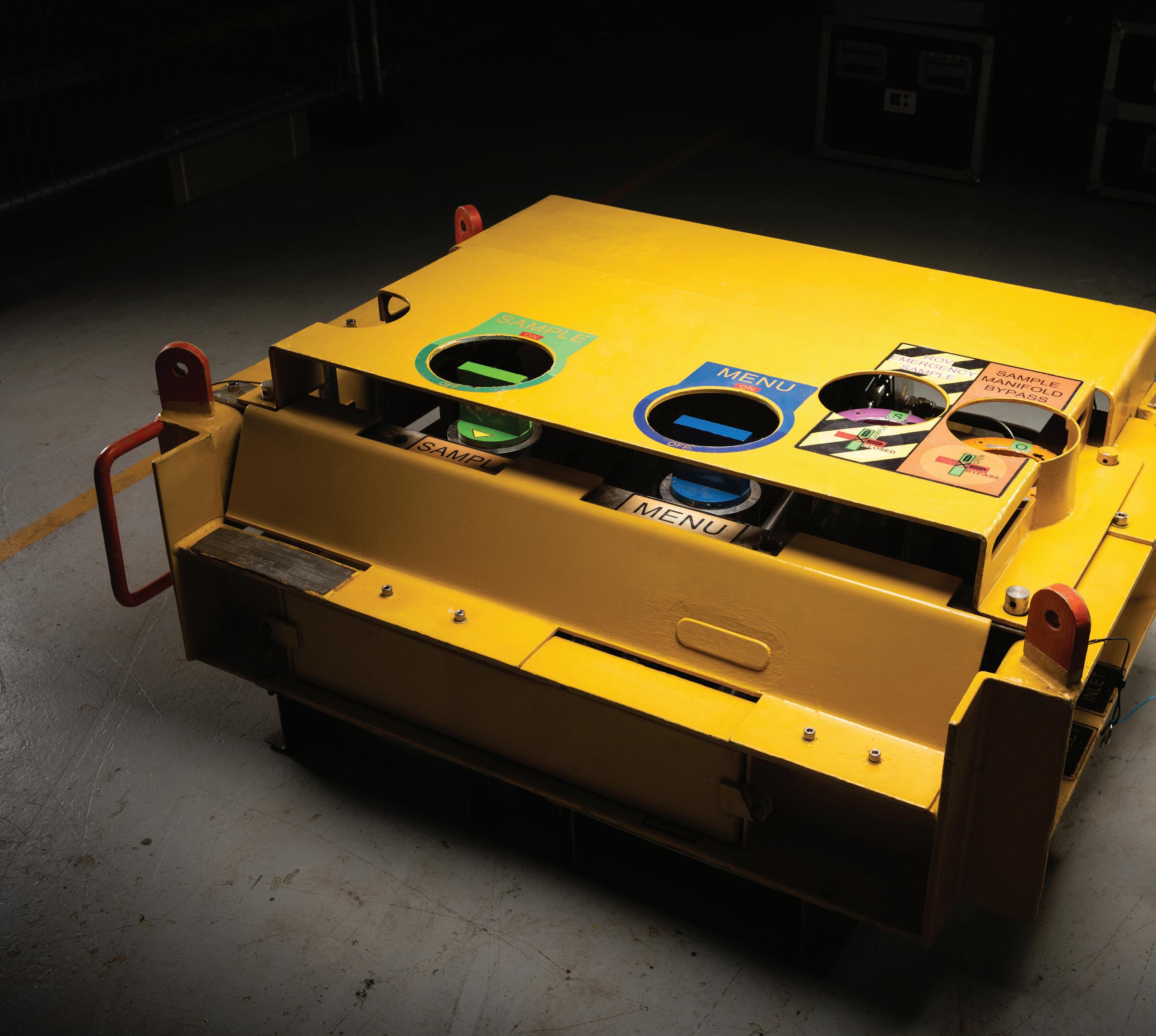

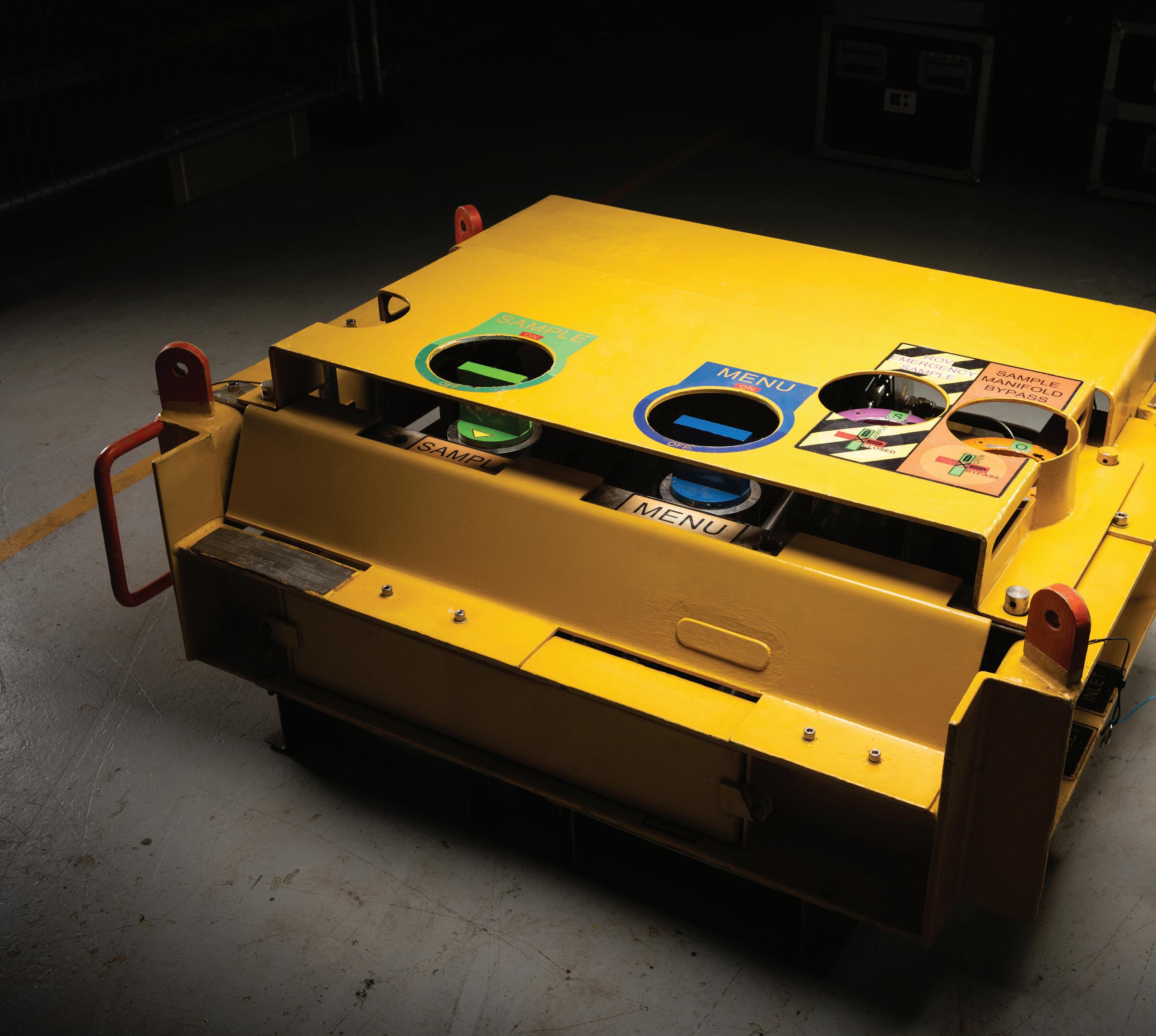

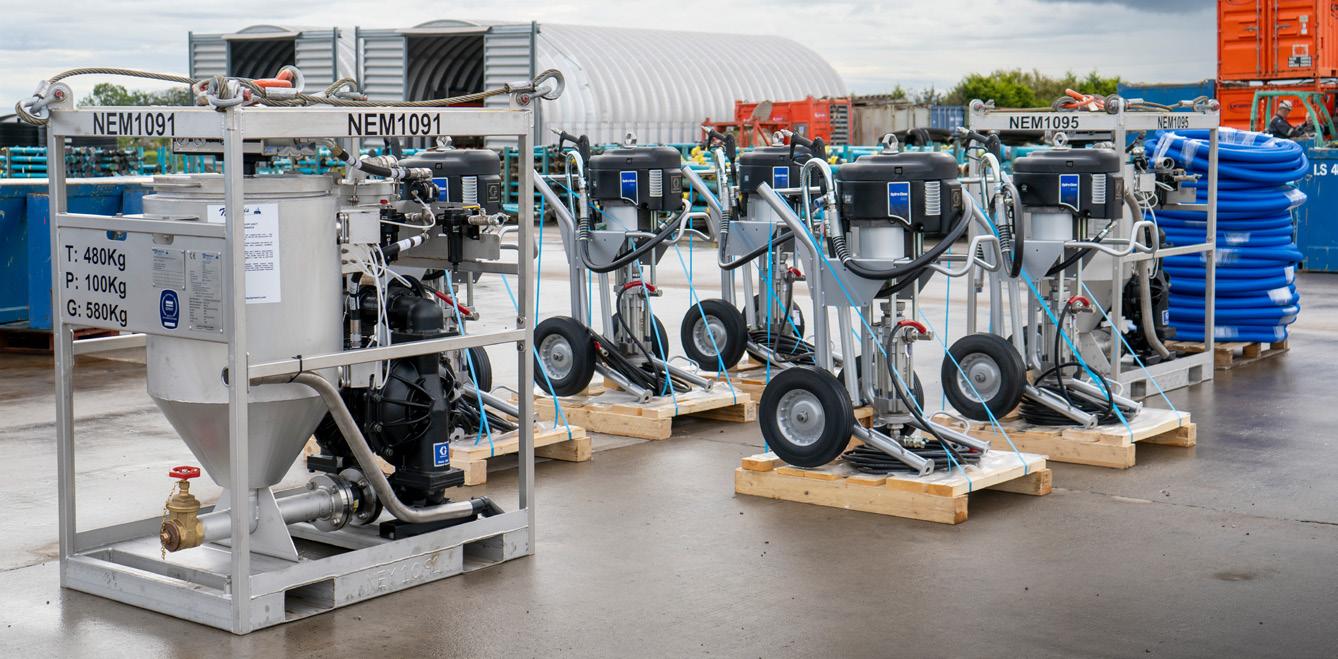

Our cutting-edge data logging and testing equipment elevates assurance across the full pipeline lifecycle.

Results? Freed support vessel capacity. Streamlined workflows. Full operational confidence. Significant cost savings.

Smarter Data. Safer Operations. Lower Costs. Whether you’re monitoring pipelines, systems, or subsea assets, we make sure that no detail goes unrecorded. That’s reassuring.

Welcome to the February issue of ‘OGV Energy Magazine’, where this month we are exploring a ‘Subsea’ theme whilst also attending the Subsea Expo event in Aberdeen.

A big thank you to our front cover star Ocean Installer and this month and you can read all about how their organisation is partnering with Oceaneering to deliver a major life-extension project in Angola on pages 4 and 5.

We are also delighted to welcome contributions in this edition from Elementz, Viper Innovation, Tess, Intervention Rentals and IK Trax

The rest of this month’s magazine as always provides you with a review of the Energy sector in the North Sea, Europe, Norway, Middle East, US and Australia, along with industry analysis and project updates.

Thanks as always to our corporate partners the Energy Industries Council, Leyton, Infinity-Partnerships, Elemental Energies and Archer - the Well company, Three60 Energy, Dräger, Rotech Subsea, Stats-Group, Cegal, GDi, Safelift, Tess, Intervention Rentals, Vulcan Completion Products, Brodies, Flotation Energy, Viper Innovations, J&S Subsea, Wellpro and Scotsbridge and of course our corporate travel partner ATPI.

Warm regards, Dan

The close collaboration between Ocean Installer and Oceaneering ensured a safe execution and early production restoration in Angola.

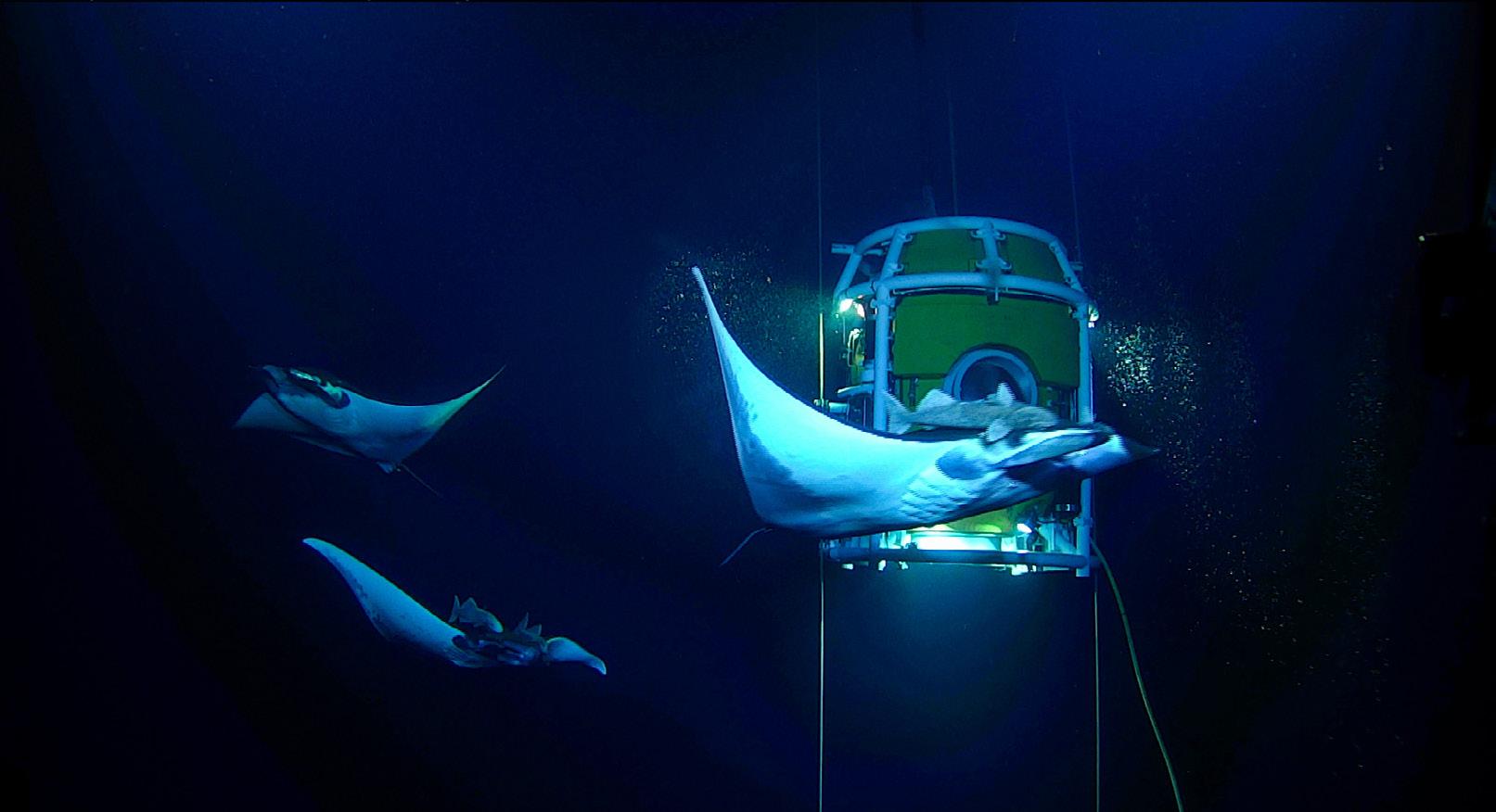

In April 2025, Ocean Installer and Oceaneering successfully completed a significant collaborative project for a major life extension project offshore Angola. The initiative aimed to replace nine risers and one umbilical that analysis had identified as potential failure points on a floating production, storage, and offloading (FPSO) vessel. The joint agreement enabled the successful execution of the work scope including removal, installation, connection and pre commissioning activities supported by surface and saturation diving and ROV for a major operator as part of life extension projects in the region.

The project had to be completed within a tightly constrained client shutdown window. The deepwater scope, at 1,500-meter water depth, also needed strategically planned diver intervention down to 150 meters to disconnect and reconnect the risers safely and efficiently. Additionally, the interdependencies between the topside scope and construction work on the vessel (including saturation diving and surface

diving) had to be methodically planned in order to optimize the execution. Collaboration between Ocean Installer and Oceaneering teams was essential to ensure the successful coordination of all activities to minimize the offshore campaign duration and reduce the client’s overall cost.

The consortium implemented an integrated delivery model, combining offshore construction and subsea execution activities including diving. A configuration that enabled an efficient vessel management throughout the project, reduced the overall vessel requirements, and helped shorten the overall offshore execution window.

The consortium’s engineering teams planned and controlled the removal and installation sequence - riser recovery, gooseneck spool change-outs, and subsequent riser and gas-lift umbilical installations - to minimize offshore campaign duration and interface risk. The consortium coupled this with in-country support, including personnel deployment, logistics coordination, and local procurement, to maintain schedule assurance and ensure safe, compliant execution throughout.

The project faced several operational challenges, including a significant schedule impact caused by manta ray sightings, which required divers to maintain a mandatory 30-minute standby after each sighting. Deepwater conditions and the complexity of mobilizing a modular saturation system onto a consortium partner vessel added further logistical demands. Additionally, the large volume of personnel movements required precise coordination to maintain safety and minimize delays throughout the campaign.

Despite these challenges, the campaign demonstrated strong operational performance and collaboration, executing a complex scope with a substantial team of offshore personnel, and global teams from Ocean Installer and Oceaneering. Highquality task and diving plans underpinned safe and effective operations execution, while exceptional diver efficiency and a steep learning curve drove continuous improvement, enhancing productivity throughout the project.

Notable achievements include:

The project was delivered safely, efficiently, and ahead of schedule, reinforcing Ocean Installer and Oceaneering’s commitment to operational excellence. The scope included the removal of nine risers from the FPSO, installation of replacement risers and a gas lift umbilical, and the removal and reinstallation of 9 gooseneck spools.

1,000+ hours of saturation diving performed over 153 bell runs at depths ranging from 40 m to 150m 1,581 personnel movements managed throughout the campaign

Offshore schedule completed ahead of plan through efficient operations

Through meticulous planning, robust engineering, and seamless execution, the team restored FPSO production earlier than expected, while maintaining zero Lost Time Incidents. This achievement not only minimized downtime for the client but also extended the FPSO’s operational life well beyond its original design, ensuring continued asset integrity and production reliability.

Collaboration played a critical role in this success. The close cooperation between Ocean Installer and Oceaneering not only reduced the number of vessels required, it also streamlined operations.

The result? A safer and more efficient campaign that delivered measurable value to the client and demonstrated the power of integrated solutions in overcoming complex subsea challenges. Zero Lost Time Incidents (LTI) or Days Away from Work (DAFW)

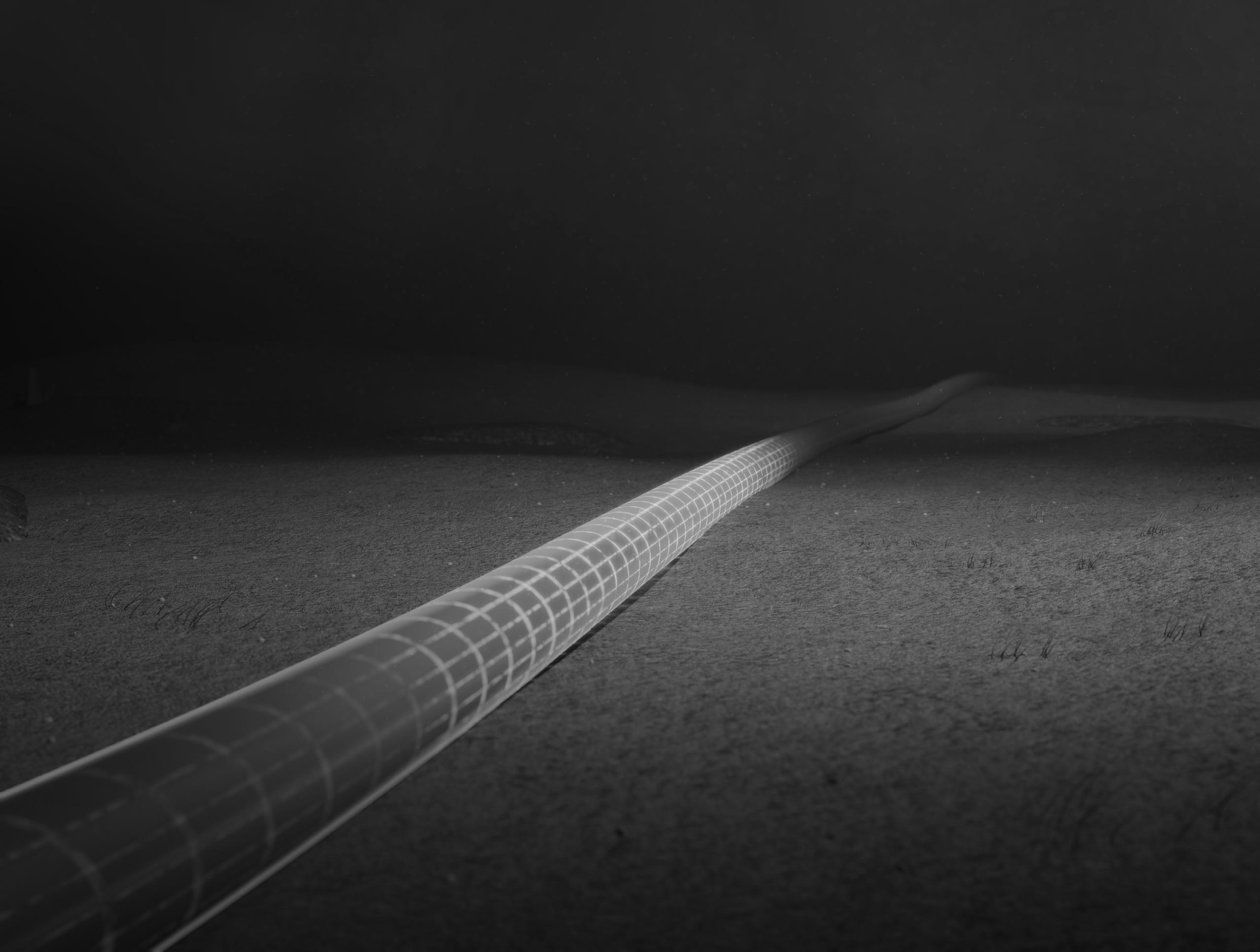

Proserv’s ECG™ contributes to reliability at Hywind Scotland

Full cable and termination monitoring deployed at world’s first floating offshore wind farm, supporting energy security for UK homes and the sector’s growth

Proserv’s proprietary Electro Cable Guard (ECG™) system is now fully operational on Hywind Scotland development, the world’s first commercial floating offshore wind farm, owned by operator Equinor and its partner Masdar.

Located off the coast of Peterhead, Aberdeenshire, the project generates clean energy for around 35,000 UK homes. This critical infrastructure assurance milestone represents a significant step forward for the reliability of power generated by floating wind.

4Subsea Awarded DeepStar Project to Develop Guideline for Polyester Mooring Line Monitoring

4Subsea has been awarded a project under the DeepStar® consortium to develop a guideline for monitoring of polyester mooring lines used in deepwater floating systems. The project will support the establishment of best practice for integrity monitoring, contributing to safe operations, reduced risk and improved design verification.

The guideline will address what to monitor, how to monitor it, and how to interpret monitoring data for polyester mooring lines. The work is based on operator needs and operational experience and includes data quality and analytics, best-practice monitoring strategies tailored to polyester rope behaviour, and model-supported evaluation using monitoring data and OrcaFlex analyses.

This year Motive Offshore Group enters a new chapter of operational excellence in the European Energy sector with the transformation of its Peterhead base.

Following completion of extensive works in Q4,2025 the centralised, operator-designed hub drastically enhances the company’s ability to deliver integrated offshore support and rapidresponse solutions for global clients.

The site is now fully operational as a highcapacity support base, purpose-built to meet the complex demands of global O&G and Renewables operations.

Unique Group, global leaders in subsea technologies and engineering, has signed a Memorandum of Understanding (MoU) with Decom Engineering (Decom), strengthening its capability to deliver integrated subsea decommissioning services across key global oil and gas regions, including the Middle East, the UK, Europe, and APAC.

Delivering Integrated End-to-End Subsea Decommissioning Services

Under the agreement, the two companies will combine their respective expertise to provide a comprehensive, end-to-end decommissioning offering that addresses the growing demand for safe, efficient, and cost-effective removal of ageing subsea infrastructure.

Surviving ten years in business is a significant achievement in any sector, but in Australia’s hazardous area and energy markets, it is particularly telling.

With more than 60% of SMEs failing within their first three years, specialist EEHA businesses face heightened pressure from technical complexity, regulatory scrutiny, and the consequences of getting it wrong. Against this backdrop, Haztech Solutions marks ten years of operation, a milestone that reflects sustained performance, sound governance, and an ability to consistently deliver in high-risk, high-consequence environments.

Founded by two experienced HR professionals with a shared passion for people, Reset HR helps organisations rethink, refresh, and reset their approach to HR — putting people, culture, and trust at the centre of everything they do.

Gillian Tierney and Emma Barker are delighted to reunite after previously founding and running a successful HR consultancy in Aberdeen. They believe the time is right to bring their combined expertise, practical insight, and people-first approach back to the market.

Based in the West End of Aberdeen, Reset HR partners with a wide range of organisations across the energy, professional services, and third sectors, delivering tailored HR solutions that make a real difference.

Gillian said: “We believe in helping businesses and human capital thrive — through smart, peoplecentred HR solutions that build trust, a strong culture and sustainable success"

Aize was founded with a vision to fundamentally change how capital projects and operations are performed. Developed by and for domain experts, the company is building on 30 years of software experience and 180 years of industrial heritage as part of the Norwegian Aker group, contributing directly to the global energy transition today. Aize is based in Norway, the UK and the U.S.

www.aize.io

Bold St Media is a creative brand agency delivering PR, marketing, design and video solutions for ambitious organisations.

Established in 2016, we combine strategic thinking, sector understanding and high-quality creative content to help Energy and Marine businesses communicate clearly, create connections, build trust and drive growth.

www.boldstmedia.com

Since Arnlea’s inception in 1994, the company has transformed into a SaaS company over the years that specializes in tracking, inspection, and maintenance solutions for the Energy industry. A global leader in our field, our software has been deployed on 200 assets across 6 different continents and counting.

www.arnlea.com

TRACS International Limited (TRACS) was founded in 1992 to provide training and consultancy services to the upstream energy industry.

Based in Aberdeen, TRACS has a worldwide client base and experience in every major producing basin. Over 30 years of quality, innovation and independence.

www.tracs.com

FCS is a Project Management and Recruitment Company, providing Project Management and Technical personnel to the Oil & Gas Industry. FCS believes that whether your Company’s requirement is for a complete Project Management Team with logistical support, or for individual Project personnel, FCS can meet and exceed your expectations.

www.fcs-group.net

We're technology experts based in the UK, dedicated to the digital transformation of companies and helping them to create their own modern workplace.

At Evolve we encourage a sustainable and transparent work approach, and believe in gaining deep insight into our customers' business so that we can make informed decisions together.

www.evolveims.com

Premium Torque units, Pressure Test Bay, Machine Shop & Refurbishment.

Uniconn has been providing equipment and services to the North Sea Oil industry for over 20 years. Founded in 1998 we have built up solid relationships with all the major service and oil companies in the industry and are renowned as the “go to” company providing not only an excellent service but proudly boasting the experience to match.

www.uniconn.co.uk

CoreRFID builds RFID-integrated solutions and CheckedOK software that replace the manual processes slowing your teams down. Real-time asset tracking. Automated inspections. Reports that actually tell you something useful. We help organisations manage their equipment without the paperwork, reduce risk without guesswork and stay compliant without the headaches.

www.corerfid.com

At Reset HR, we believe that strong businesses are built on strong people practices. Founded by two experienced HR professionals with a shared passion for HR, we help organisations rethink, refresh, and reset how they manage and support their teams.

www.resethr.co.uk

Continued calls on the UK government to go further to support the UK’s industrial capabilities and new activity contracts featured in the UK North Sea oil and gas sector at the beginning of 2026.

Offshore Energies UK (OEUK), the leading industry body, says the government must go further and faster to protect the UK’s industrial capability.

The cabinet issued the Government Response to the Scottish Affairs Committee’s report from October, which had warned that without tax reforms, the Government is accelerating the decline of North Sea oil and gas production, as job losses amid the decline in Scotland’s oil and gas industry currently exceed jobs created by clean energy.

Referring to the Energy Profits Levy that was kept as-is in the Autumn Budget unveiled in November, the government said that it “is committed to managing the North Sea in a way that ensures a fair, orderly and prosperous transition, while recognising domestic oil and gas will continue to have a role in the energy mix for decades to come.”

“On tax, we are taking a responsible and proportionate approach which recognises the ongoing role of the oil and gas industry and workforce in our current energy mix while ensuring the sector contributes more towards our energy transition,” the response reads.

Essentially, the UK government said that while recognising that oil and gas will continue to have a role in the energy mix during the transition, it “also need to drive public and private investment towards cleaner energy.”

In response to the UK Government’s reply to the Scottish Affairs Committee on North Sea jobs and energy, Katy Heidenreich, Supply Chain & People Director at OEUK, said that “The Scottish Affairs Committee was right to highlight the gap between declining North Sea activity and the pace of clean energy job creation.”

“The UK Government acknowledges that challenge but their response must now go further and faster if we are to protect the UK’s industrial capability and the communities that rely on it,” Heidenreich added.

According to OEUK, the UK needs domestic oil and gas supply, alongside renewables, to maintain energy security, affordability, and the world class supply chain required to expand energy projects across wind, hydrogen, and carbon storage.

“That is why the Government must bring forward the Oil and Gas Price Mechanism (OGPM) in 2026. Investors cannot wait until 2030. Without this we risk more supply chain companies being forced to go overseas, further job losses, and continued industrial contagion,” OEUK’s Heidenreich said.

The industry body also responded to the Allocation Round 7 (AR7) for renewable energy, which announced 8.4 GW of additional offshore wind power capacity.

OEUK and industry say there is a pathway to Net Zero which prioritises homegrown energy versus imports, delivering renewable energy and the domestic oil and gas that is needed in parallel for decades to come.

“While today’s news is a positive step, the UK will still need continued investment in producing homegrown gas and maintaining our gas generation infrastructure, which remains essential for providing the dispatchable power needed to keep the lights on when the wind doesn’t blow and the sun doesn’t shine,” said OEUK’s Energy Policy Director, Enrique Cornejo.

“Long-term success for UK energy policy will rely on a balanced approach that builds on our existing industrial strengths.”

Most Scots want a continued role for the oil and gas sector with fairer taxes for UK energy companies, according to a new poll conducted by the Diffley Partnership on behalf of OEUK, with 2,154 Scottish adults questioned in December.

Scots believe offshore energy is the most important sector for the nation’s economy and they favour the country expanding renewables while maintaining the existing North Sea industry, prioritising lower prices for households and growth in industrial jobs, the poll found.

Asked about different energy sources, 58 percent of respondents said that oil and gas

By Tsvetana Paraskova

provides good, stable jobs for people in Scotland, and more than two-thirds, or 69 percent, said Scotland can “expand renewable energy while maintaining a role for oil and gas during the transition”.

From a long list of sectors, offshore energy was selected by 53 percent of voters as being important for Scotland’s economy in the next decade –followed by tourism and hospitality in second place.

More than half of voters – 54 percent – said they support taxes on companies making large profits from oil and gas set at a level that is “fair and keeps the UK internationally competitive”.

Only 4 percent said the current balance of taxation should remain the same.

A staggering 85 percent said energy companies should “lead the transition to renewables while maintaining oil and gas,” the poll found.

The new poll sends a clear signal to parties ahead of this year’s Holyrood election to support measures to unlock UK offshore energy investment or risk a backlash at the polls, OEUK says.

The leading offshore energy industry body has been calling on politicians to prioritise homegrown energy over imported supplies—that means recognising oil and gas will be needed alongside renewables.

“Voters want affordable, secure energy – and that is delivered by unlocking investment in UK energy – oil, gas, renewables, hydrogen, and carbon capture,” David Whitehouse, OEUK Chief Executive, commented.

The North Sea Transition Authority (NSTA) has fined two North Sea oil and gas operators with a total of £350,000 as the regulator continues to take a firm line on breaches of emissions limits and on well decommissioning.

CNR International was fined £250,000 for excessive venting that exceeded venting limits twice in the same year on the same fields.

NEO has been fined £100,000 for attempting to fully abandon a well without the required consent

to undertake the work. NEO attempted in 2024 to decommission the Leverett well to ‘AB3’ status – the final abandonment phase. However, NEO failed to apply for consent from the NSTA before undertaking this work due to its misunderstanding of the relevant requirements, which raises questions about the company’s processes, the regulator said.

The penalties underline the importance of complying with regulations to show that the industry is well run and takes its responsibilities seriously – and that all licensees are on a level playing field, the NSTA said.

“Investors and the public rightly expect that this industry is held to high standards and there is no excuse for operators not complying with their regulatory responsibilities,” said Jane de Lozey, NSTA Director of Regulation.

In company news, US refining giant Phillips 66 Limited has agreed to acquire Lindsey Oil Refinery assets and associated infrastructure.

The announcement follows a bidding process handled by FTI Consulting, who began serving as special managers of the Lindsey Oil Refinery assets after the Official Receiver was appointed liquidator in June 2025.

The deal is subject to satisfaction of closing conditions, including customary regulatory clearances.

Phillips 66 plans to integrate the key assets to be acquired into its Humber Refinery operations.

Following a thorough assessment undertaken during the bid process, the company has decided to not restart standalone refinery operations at the Lindsey Oil Refinery. Due to the limitations of its scale, facilities, and capabilities, evaluations have shown that the refinery is not viable in current form, Phillips 66 said.

According to the buyer, once completed, the acquisition and strategic investment will increase the company’s ability to supply the UK market from the Humber Refinery, boost UK energy security, and support hundreds of well-paid, high-quality jobs through site operations and future investment.

AF Offshore Decom, part of Norway-based AF Gruppen, has signed a contract with Ithaca Energy for the engineering, receipt, dismantling, and recycling of a floating production platform from the UK sector of the North Sea.

“We are very pleased to have been awarded this contract by Ithaca Energy. The award is a recognition of our track record and continued commitment to delivering sustainable decommissioning solutions, also for large floating assets,” said Lars Myhre Hjelmeset, EVP Offshore at AF Gruppen.

Ithaca Energy has also exercised all three remaining weeks of options for the Safe Caledonia to continue providing accommodation support at the Captain field in the UK sector of the North Sea through to 22 February 2026, the service provider Prosafe SE said. The total value of this contract extension is approximately $2.73 million, Prosafe noted.

Norway’s new oil and gas production licences and the UK’s record-breaking offshore wind auction were the highlights of the European energy sector at the beginning of the year.

Norway awarded in January a total of 57 new production licences to 19 companies in the APA 2025 licensing round in mature areas of the Norwegian Continental Shelf, as Western Europe’s top oil and gas looks to stave off an expected production decline in the 2030s.

Of the 57 production licences offered in the latest round, 31 are located in the North Sea, 21 in the Norwegian Sea, and five in the Barents Sea. All major companies operating on the shelf, including Equinor, Aker BP, Vår Energi, Harbour Energy, and TotalEnergies, were awarded licences as operators or part of consortia.

“Norway is Europe’s most important energy supplier, but in a few years production will begin to decline. Therefore, we need new projects that can slow the decline and deliver as much production as possible,” Energy Minister Terje Aasland said.

“We are offering 57 new production licenses to 19 companies. This is a significant contribution to ensuring continued activity in the oil and gas industry. That activity is important for jobs, value creation, and Europe’s energy security,” the minister added.

Vår Energi has completed the appraisal well with two production tests on the Zagato structure in the Goliat Ridge discovery in the Barents Sea, confirming reservoir quality and adding recoverable volumes.

The latest well tested two intervals with each showing maximum flow rates of more than 4,000 barrels of oil per day, confirming reservoir quality.

“The recent discoveries reinforce Vår Energi’s position as a leading exploration company on the Norwegian Continental Shelf (NCS) and continue to strengthen our ability to sustain high value production of 350-400 thousand barrels of oil equivalents per day beyond 2030,” Vår Energi COO Torger Rød said.

The US Treasury Department granted Russian oil firm Lukoil, sanctioned by the US, more time to divest its international assets, extending the general license for Lukoil to negotiate sales of Lukoil International GmbH entities. The extended licence expires on 28 February 2026. The previous licence was set to expire on 14 January 2026.

The UK’s latest offshore wind auction, known as Contracts for Difference AR7, has secured

a record capacity of 8.4 GW of offshore wind. This capacity could generate enough clean electricity to power the equivalent of 12 million homes, the UK government said, adding that “the ground-breaking result puts Britain firmly on track to achieve its clean power mission by 2030.”

The UK plans to have its power grid run on 95 percent clean power, which includes nuclear energy, by 2030.

The results delivered the biggest single procurement of offshore wind energy in British and European history, and are “a major vote of confidence in the UK’s new era of energy sovereignty and abundance,” the government said.

The record renewables auction will unlock £3.4 billion of private investment, which will flow into British manufacturing, factories, and ports, according to the government.

The results will bring huge benefits to the industrial base of Scotland in particular, with an up to £1.1 billion supply chain investment boom and up to 2,400 clean energy jobs. Investment will flow to Scottish ports like Nigg and Aberdeen, and manufacturers of offshore wind equipment in Scotland. Delivering on the government’s energy mission will create up to 40,000 extra jobs in Scotland by 2030, the cabinet said.

The record amount of new offshore wind capacity will strengthen Britain’s energy security and reduce electricity bills, the RenewableUK association commented

“Investment in renewables is also crucial to keep pace with the UK’s need for more energy,” RenewableUK’s Executive Director of Policy and Engagement Ana Musat said.

“Electricity demand is set to increase significantly in the years ahead as existing nuclear and gas capacity retires, so the 8.4 GW awarded contracts today will be crucial for economic growth.”

Added Musat, “Homegrown power is the best defence against geopolitical volatility, and this auction is a significant step forward towards energy independence.”

The offshore industry has welcomed the recordbreaking auction results which will trigger further investment in factories and jobs.

“The results send a clear signal to investors that the UK continues to be a world leader in offshore wind, and today's announcement will directly trigger investment in factories and jobs across the UK needed to build and operate these projects,” said Adam Morrison, Industry Co-Chair of the Offshore Wind Industry Council and Ocean Winds UK Country Manager.

The WindEurope association noted that strong competition in the auction led to competitive average prices of £91.20/MWh in England and Wales and £89.49/MWh in Scotland.

“These results reinforce offshore wind’s role as the most competitive large-scale clean electricity generation technology,” the association said, adding that other European Governments should follow the UK example.

In the auction, SSE successfully secured a 20-year contract for 1.4 GW of offshore wind power from Phase B of its Berwick Bank Wind Farm project.

SSE will now progress Berwick Bank B towards a final investment decision in line with its hurdle rates and investment criteria, expected in 2027.

Located in the outer Firth of Forth around 38 km east of the Scottish Borders coastline, SSE’s Berwick Bank Wind Farm is targeting the delivery of 4.1 GW of offshore wind capacity in total across three roughly equal phases.

“If built to its full projected capacity of more than 4GW, Berwick Bank Wind Farm can rank among the largest offshore wind projects globally,” said Martin Pibworth, Chief Executive of SSE plc.

Germany’s RWE secured Contracts for Difference for 6.9 gigawatts (GW) of offshore wind capacity in the UK offshore wind auction. RWE’s Norfolk Vanguard East and Norfolk Vanguard West projects, as well as its two Dogger Bank South projects, all of which are located in the British North Sea, and its Awel y Môr project located in the Irish Sea secured 20-year CfDs at a strike price of £91.20 per megawatt hour (MWh), in 2024 prices, inflation-indexed.

Outside the UK auction, companies have also signed deals for renewable energy.

Orrön Energy, for example, has secured grid connections for six large-scale projects with an estimated combined capacity of 2.9 GW.

The grid connections have been secured as part of the grid reform, enabling the connection of six large-scale projects, of which three are solar energy projects with a combined estimated capacity of 1.8 GW, and three are data centre projects with a combined estimated capacity of 1.1 GW.

Binding grid offers and additional details around grid connection dates are expected to be received during the third quarter of 2026. With both land and grid secured, the projects are at the ready-to-permit stage, and the company will seek to evaluate divestment options once the final grid connection agreements have been issued, Orrön Energy said.

Investment manager Downing LLP and Tokyo Century Corporation have agreed to jointly acquire and construct around a 500 MW portfolio of utility-scale ground mounted solar projects in the UK. The joint venture will acquire ready-to-build projects that have CfD arrangements in place. Projects will be sourced from Downing’s own development pipeline and from third party developers, targeting grid connection dates in 2027 and 2028.

egg Power, Liberty Global’s clean energy infrastructure investment business, has secured up to £400 million in debt financing from NatWest Group to accelerate its development of large-scale renewable energy projects across Europe.

egg Power says it is strategically positioned to meet the accelerating clean energy needs of telecoms operators, digital infrastructure providers, and other energy-intensive industries. This demand is being driven by the surge in AI adoption and exponential growth in data usage, heightening the need for reliable, sustainable power at scale.

“The agreement marks a significant step towards egg Power’s goal of delivering 1,500 MW of clean energy capacity by 2028 under long-term Power Purchase Agreements (PPAs),” said Ilesh Patel, who leads the egg Power business at Liberty Global.

US oil and gas activity is still being weighed down by uncertainty and continued pessimism about the prospects of the shale industry amid lower oil prices.

The biggest US oil firms are not rushing to do business with Venezuela despite US President Donald Trump’s insistence that US companies would help restore and revive the oil industry of the country holding 17 percent of all global proven oil reserves.

Activity in the oil and gas sector in the key shale regions in Texas, New Mexico, and Louisiana edged lower in the fourth quarter 2025, according to oil and gas executives responding to the quarterly Dallas Fed Energy Survey

The business activity index, the survey’s broadest measure of the conditions energy firms face in the Eleventh District, remained negative, though relatively unchanged at -6.2 in the fourth quarter.

The Eleventh District includes Texas, southern New Mexico, and northern Louisiana and the four prime shale basins—the Permian Basin, the Barnett Shale, Eagle Ford Shale, and Haynesville Shale.

The company outlook index improved slightly during the fourth quarter of 2025, but remained firmly in negative territory. The index edged up from -17.6 in the third quarter to -15.2 in the fourth quarter, suggesting continuing pessimism among firms, the survey found.

Meanwhile, the outlook uncertainty index remained elevated and was relatively unchanged at 43.4.

Oil and gas production was little changed in the fourth quarter, according to executives at exploration and production firms. The oil production index remained negative, though it advanced from -8.6 in the third quarter to -3.4. The natural gas production index increased slightly from -3.2 to 0.

Cost increases slowed when compared with the prior quarter. The input cost index for oilfield services firms declined from 34.8 to 24.4. Among exploration and production firms, the finding and development costs index remained positive but fell from 22.0 to 5.7. Also, the lease operating expenses index decreased from 36.9 to 28.4, according to the quarterly survey.

Oilfield services firms, for their part, reported modest deterioration in nearly all indicators, including equipment utilization and operating margins. Meanwhile, the prices received for services index declined from -26.1 to -30.0.

Asked about capital spending in 2026 versus 2025, executives had widely varied responses. A total of 19 percent of executives said they expect capital spending to decrease slightly, while an additional 20 percent anticipate a significant decrease. Another 24 percent expect spending in 2026 to remain close to 2025 levels, 26 percent of executives said they expect capital spending to increase slightly, while an additional 11 percent anticipate a significant increase.

“Remain close to 2025 levels” was the mostselected response from executives at large E&P firms (35 percent), whereas the mostselected response from executives at small E&P firms was “increase slightly”, at 29 percent. At oil and gas support services firms, more executives (48 percent) expect their firm’s capital spending in 2026 to decrease relative to the number of executives (29 percent) anticipating an increase.

The survey’s special questions also revealed that executives from small and large E&P firms have differing views on the potential impact of artificial intelligence (AI) on breakeven prices. Most executives at large E&P firms expect AI to provide some reduction to their firms’ break-even prices for new wells over the next five years. A total of 38 percent of executives at large E&P firms anticipate reductions of $0.01–$1 per barrel, 25 percent expect $1.01–$2 per barrel, and an additional 13 percent expect $4.01–$5 per barrel. However, the majority of executives at small E&P firms expect AI will not lower their firm’s break-even price.

By Tsvetana Paraskova

In comments to the special question about AI and its impact on costs, an E&P executive said “AI has helped reduce our effective well costs, not through a single measurable dollar impact, but through broad productivity gains across our office.”

“These incremental improvements make our operations more efficient and ultimately lower our aggregate cost of drilling a well.”

The general comments on current issues showed a variety of takes on the prospects and challenges for US oil and gas producers.

One E&P executive said that “Decreasing oil prices are making many of our firm’s wells noneconomic,” while another flagged “elevated uncertainty stemming from government policies and geopolitics” and “near-term global oil market dynamics” as issues affecting their business.

A third executive, however, is optimistic, saying “We are bullish on 2026. The One Big Beautiful Bill Act tax breaks, lower interest rates and rising natural gas demand from LNG exports and data centers are set to strengthen our company’s outlook.”

Another executive reckons that “Until the midterm elections next November are over, the price of crude oil will stay artificially depressed.”

Executives at oil and gas support services firms appear more concerned about the geopolitical and tariff repercussions on their business. One executive said “We continue to monitor with concern how geopolitical events and tariffs are impacting our supply chain and operating environments.”

Another one warned that “Steel tariffs are causing significant increases in well costs.”

US President Donald Trump wants American oil companies to invest in the restoration and upgrade of the dilapidated oil infrastructure of Venezuela after US forces extracted Nicolas Maduro and flew him to New York to stand trial on drugtrafficking charges.

The US President convened a meeting at the White House a week after Maduro’s arrest to discuss opportunities in Venezuela with executives from the biggest US oil firms. The Trump Administration is seeking $100 billion of investment commitments to restore Venezuela’s oil industry and boost crude production to the peak of the 1990s, when output exceeded 3 million barrels per day, compared to about 1 million bpd now.

However, the US Administration received lukewarm reception of the Venezuela pitch, with major companies telling President Trump that they would need legal and security guarantees and a complete overhaul of the Venezuelan oil sector, oil contracts, and oil laws to consider investing in the world’s biggest oil resource holder.

ExxonMobil chairman and CEO Darren Woods, for example, told President Trump that “We've had our assets seized there twice. And so, you can imagine to re-enter a third time would require some pretty significant changes from what we've historically seen here and what is currently the state.”

Woods did not mince words and said

“If we look at the legal and commercial constructs—frameworks—in place today in Venezuela, today it’s uninvestable.”

“And so significant changes have to be made to those commercial frameworks, the legal system, there has to be durable investment protections, and there has to be a change to the hydrocarbon laws in the country,” Exxon’s top executive said.

The key OPEC+ producers, led by the top Middle Eastern exporters, agreed to keep their oil production levels flat throughout the first quarter of 2026. OPEC presented its first outlook of the global oil market in 2027, while the top national oil companies in the Middle East signed a series of strategic deals.

At a brief online meeting in early January, the key OPEC+ producers that have been withholding supply to the market in recent years agreed to keep their production levels flat through the first quarter of 2026, reiterating a decision they first took at the end of last year.

Saudi Arabia, Russia, Iraq, UAE, Kuwait, Kazakhstan, Algeria, and Oman reaffirmed their commitment to market stability, on the back of a steady global economic outlook and current healthy oil market fundamentals as reflected in low inventories, OPEC said.

The eight participating countries reaffirmed their decision from November 2025 to pause production increments in February and March 2026 due to seasonality.

The countries reiterated that the 1.65 million barrels per day may be returned in part or in full subject to evolving market conditions and in a gradual manner.

“The countries will continue to closely monitor and assess market conditions, and in their continuous efforts to support market stability, they reaffirmed the importance of adopting a cautious approach and retaining full flexibility to continue pausing or reverse the additional voluntary production adjustments, including the previously implemented voluntary adjustments of the 2.2 million barrels per day announced in November 2023,” OPEC said.

Following the January meeting, Saudi Arabia reduced the price of its crude loading for Asia in February, in the third consecutive monthly reduction as supply remains abundant and Middle Eastern benchmarks weakened.

Saudi Arabia, the world’s largest crude oil exporter, lowered the official selling price (OSPs) of its flagship Arab Light grade for Asia by $0.30 per barrel above the average of the Oman and Dubai benchmarks, the lowest premium in more than five years.

The Saudi decision to slash the prices of all its crude for all regions signalled concerns that the global market is in oversupply and oil would be readily available despite lingering uncertainties about barrels from Russia and Venezuela.

OPEC offered a first glimpse of its outlook of 2027 global economy and oil demand in its closely-watched Monthly Oil Market Report (MOMR) for January.

The first look to 2027 was rather optimistic. OPEC expects global oil demand growth to grow by 1.3 million bpd from this year, which is set to see 1.4 million bpd growth. In 2027, oil demand in the OECD is expected to grow by 100,000 bpd year-over-year, with OECD Americas again expected to lead oil demand growth in the region. In the non-OECD, oil demand is forecast to grow by about 1.2 million bpd, led by Other Asia, followed by India and China.

In terms of oil products, transportation fuels are set to drive oil demand growth in 2027, with air travel further expanding, as both international and domestic traffic continue to increase. Petrol demand is also expected to be supported by steadily rising road mobility in India, Other Asia, the Middle East, and the US. On-road diesel demand is set to see support from trucking, as well as industrial, construction, and agricultural activities, mainly in the non-OECD region. Finally, light distillates will be buoyed by petrochemical capacity additions, mostly in China and the Middle East.

The 2027 oil demand growth is expected to be a function of the world economy’s robust growth of 3.2 percent, supported by a steady expansion in the major economies. This is slightly higher than the 2026 economic growth forecast of 3.1 percent, OPEC said in its report.

In 2027, liquids supply from countries outside the OPEC+ agreement is forecast to expand by about 600,000 bpd over 2026, underpinned by planned developments and projected upstream capital commitments. Upstream oil investment in non-OPEC+ countries in 2027 is expected at around $284 billion, slightly higher than the spending anticipated for 2026.

Non-OPEC+ liquids supply growth in 2027 is primarily set to come from Latin America at about 400,000 bpd. US liquids production is forecast to expand by a minor 30,000 bpd year-over-year, mainly from non-conventional NGLs, as US crude oil output is set to drop, OPEC reckons.

In addition to offshore producers in Latin America such as Brazil, the other main liquids growth drivers are expected to be Canada, Qatar, and Argentina.

Abu Dhabi National Oil Company (ADNOC), in partnership with Eni nd PTT Exploration and Production Public Company Limited (PTTEP), has announced the successful signing of a landmark structured financing transaction of up to $11 billion, to monetize Hail and Ghasha’s midstream future gas production.

Hail and Ghasha is part of the larger Ghasha Concession, located offshore Abu Dhabi, which is expected to produce 1.8 billion standard cubic feet per day (bscfd) of gas. It is also the world’s first offshore gas project of its kind that aims to operate with net zero emissions, capturing 1.5 million tonnes per year (mtpa) of carbon dioxide (CO2), equivalent to removing over 300,000 cars off the road every year.

ADNOC has also signed a $2 billion green financing agreement backed by Korea Trade Insurance Corporation (K-SURE) to fund lower carbon projects across its operations. The deal reinforces ADNOC’s ambition to integrate sustainable finance into its growth plans.

The agreement marks ADNOC’s first green financing facility backed by a Korean export credit agency (ECA), following a $3 billion transaction with the Japan Bank for International Cooperation (JBIC) in 2024. Together, these deals bring ADNOC’s total green funding to $5 billion in just 18 months, strengthening its track record in green finance.

In early January, ADNOC announced the Final Investment Decision (FID) for the SARB Deep Gas Development, a strategic project within the Ghasha Concession offshore of Abu Dhabi.

The development will deliver 200 million standard cubic feet per day (scfd) of gas before the end of the decade, enough energy to power more than 300,000 UAE homes daily. This technically advanced project will embed advanced technologies and AI and will be operated remotely from Arzanah Island, using existing infrastructure to maximise efficiency and enhance safety.

Qatar’s state firm QatarEnergy has signed a Memorandum of Understanding (MoU) with Egypt’s Ministry of Petroleum and Mineral Resources to strengthen cooperation in the energy sector, with special focus on the supply of LNG from QatarEnergy to Egypt.

QatarEnergy and the Egyptian Natural Gas Holding Company (EGAS) have reached agreement for the supply of up to 24 LNG

cargoes for the summer of 2026. The two companies have also agreed to initiate discussions on additional and long-term supplies of LNG from QatarEnergy to Egypt.

QatarEnergy has also signed a long-term sales and purchase agreement for up to 15 years with Uniper Global Commodities SE (Uniper) for the supply of 70 million cubic feet per annum of helium from its facilities in Ras Laffan.

The agreement marks QatarEnergy’s first direct relationship with Uniper, who has a strong history in providing bulk wholesale helium to customers around the world.

TotalEnergies and Bapco Energies are launching BxT Trading, an equally owned trading joint venture backed by flows from Bapco Energies’ Refinery.

With BxT Trading, TotalEnergies is strengthening its trading position in the Middle East, where the French supermajor already has trading activities, in addition to its international hubs in Houston, Geneva, and Singapore.

“Through this partnership with TotalEnergies, we are enhancing our global trading capabilities, strengthening our downstream value chain, and reinforcing Bahrain’s position as a competitive and trusted player in the international energy markets,” said Shaikh Nasser bin Hamad Al Khalifa, chairman of Bapco Energies.

Norway had its best exploration year in 2025 in several years, yet it will need further exploration efforts and investments to maintain the high level of oil and gas production into the 2030s, the industry regulator said in its annual report.

At the same time, companies operating on the Norwegian Continental Shelf (NCS) continue to explore for resources and consider tie-backs to new nearby discoveries as they aim to maximise the use of existing infrastructure and keep output stable as older fields mature.

The Norwegian Offshore Directorate’s “The Shelf in 2025” annual report showed in January that last year’s exploration result offshore Norway was one the best in several years. Last year marked the second-best exploration year in ten years, surpassed only by 2021, according to the regulator’s summary of activity on the shelf.

Many discoveries were made, some of which were significant. Several discoveries were the result of applying advanced new technology. A new record was reached for the Norwegian sector with 2 wellbores being drilled in excess of 10km among other things, the directorate said.

“It’s truly inspiring that successful exploration can still be achieved on such a mature shelf,” commented Torgeir Stordal, Director General of the Norwegian Offshore Directorate.

Despite the best exploration results in years, the industry and the regulator are not complacent and call for further exploration and investments, which will be needed to offset the anticipated decline in production.

In 2025, both production and investments were very high, the report found. Oil production was at the highest since 2009. Production from the NCS is nearly equally distributed between oil and gas. Total oil and gas exports fell slightly from the record-breaking year of 2024.

The Troll field in the North Sea accounts for about one-third of overall gas production, and this trend will continue over the next few years.

At year-end 2025, there were 97 fields in operation on the Norwegian shelf. The Halten Øst and Verdande fields in the Norwegian Sea, as well as Johan Castberg in the Barents Sea, came on stream, while no fields were shut down over the past year. The Norwegian Offshore Directorate expects a number of new fields to come on stream in the coming years.

Oil and gas production remains at such high levels because the fields are producing for longer than originally planned. New and improved technology has allowed the Norwegian regulator to continuously improve the understanding of the subsurface. This

has enabled the industry to further develop the fields. New development projects, more production wells, and exploration in the surrounding area have helped extend the lifetimes of most fields.

“We expect gas production to remain at this level over the next three to four years. Norwegian gas accounts for about 30 per cent of EU gas consumption, and Norway is Europe’s largest supplier after cutting off Russian gas,” Stordal said.

The Norwegian Offshore Directorate expects investments of 256 billion Norwegian crowns, or $25.5 billion, this year, which would be a reduction of 6.5 percent from last year. Leading up to 2030, the regulator expects the investment level to decline gradually due to the completion of development projects without equivalent new projects to replace them.

Toward the end of the 2020s, the Directorate expects a reduction in overall oil and gas production. Norway would need a number of new field development decisions to slow this anticipated decline.

“It will also be important to maintain high exploration activity. Failing to invest will lead to a substantial dismantling of the petroleum industry,” the directorate said.

In addition, there is significant interest in secure storage of carbon dioxide on the NCS.

Last year saw the establishment of the world’s first full-scale value chain for carbon capture and storage. The Norwegian Offshore

By Tsvetana Paraskova

Directorate also mapped mineral resources and the environmental conditions in the relevant areas.

Operators offshore Norway have made discoveries in recent weeks, bolstering the chances of additional supply.

In December, Harbour Energy and its partners proved gas condensate in the ‘Camilla Nord’ prospect in the Norwegian section of the North Sea.

Wildcat wells 35/8-8 S and A were drilled in production licences 248 LS and 248 B, which are part of the Vega Unit in the North Sea, 100 kilometres southwest of Florø. Preliminary estimates indicate the size of the discovery is between 2.2 and 4.7 million barrels of oil equivalent.

The licensees will now consider tying the discovery back to existing infrastructure on the Vega field.

Also in December, Equinor and its partners discovered oil, condensate, and gas in the ‘Tyrihans Øst’ prospect, about 250 kilometres southwest of Brønnøysund in the Norwegian Sea.

Preliminary estimates put the size of the discovery at between 1 and 8 million barrels of recoverable oil equivalent.

The licensees will assess the discovery for a potential production well from the same location, with production over Tyrihans to the existing Kristin installation.

In January, Equinor awarded framework agreements to seven supplier companies with a total value of around 100 billion Norwegian crowns, or about $10 billion.

These agreements lay the foundation for safe and competitive operations at Equinor’s offshore installations and onshore plants in the years to come, the Norwegian energy major said.

The awards are 12 new framework agreements for maintenance and modifications on Equinor’s offshore installations and onshore plants. The agreements commence in the first half of 2026, have a duration of five years, and include extension options of three and two years.

“The agreements will ensure long-term activity and value creation across Norway, with job creation estimated at around 4,000 man-years at the suppliers,” said Jannicke Nilsson, chief procurement officer at Equinor.

“The goal is close, long-term, and predictable cooperation that strengthens the culture for safety and security and our shared competitiveness. Together, we will work safer and smarter, and scale up the use of new technology,” Nilsson added.

As regards new technology, Equinor has estimated that Artificial intelligence (AI) contributed to value creation and savings for Equinor and its partners amounting to $130 million in 2025. AI is now utilized on offshore platforms and land facilities to solve industrial tasks on a large scale in a safe, efficient, and profitable manner, the company said in early January.

Another operator on the Norwegian shelf, Aker BP, has found that new well technology provides better insight into wells at Alvheim following a pilot test at the field.

HIPlog, a wireless solution for measuring how oil and gas flow in different parts of a well, makes it possible to measure production down in the well without stopping production, and has been tested offshore for the first time, Aker BP said.

“The fact that we can obtain detailed production information without disrupting operations is ‘the very core of what HIPlog is developed for’,” said Tore Ottesen, CEO at Wellstarter, which delivers the service.

Aker BP has also conducted a successful pilot test with partner Effee of digital, robotic structural welding in confined areas. The new technology makes it possible to monitor the welding process in real time, which reduces the risk of errors and provides better control over quality.

“The result marks an important step in the digitalisation of welding processes offshore,” Aslak Næss, project manager at Aker BP, commented on the test at the Alvheim field.

“In addition to the work on Alvheim, Aker BP and Effee intend to further develop a method for swivel repairs on Skarv,” Næss added.

“Now the goal is to realise even greater benefits through fully digital welding offshore, also in the modification alliance. Robotic, digital welding fits very well with our operational strategy.”

Australia’s government plans to introduce a domestic gas reservation scheme to ensure affordable supply in one of the world’s biggest LNG exporters. Meanwhile, companies operating in Australia have announced new gas discoveries and LNG export deals.

In the clean energy market, energy storage projects set new records in the third quarter of 2025, while investment activity continued to slow for large-scale electricity generation.

ConocoPhillips has identified probable gas presence in all target reservoirs being drilled at the Charlemont-1 gas exploration/ appraisal well within VIC/P79 exploration permit, offshore Otway Basin in Victoria, the company’s junior partner, 3D Energi Limited, said in early January.

3D Energi holds a 20-percent equity interest in the exploration permit, whose operator is ConocoPhillips Australia with 51 percent. Korea National Oil Company owns the remaining 29 percent.

“We are incredibly excited by early indications consistent with gas presence in multiple Waarre reservoirs. Wireline logging will be critical in assessing the quality and extent of these indications, and the Company remains optimistic as it continues to plan to progress to the evaluation phase,” said 3D Energi’s executive chairman Noel Newell.

“If successfully appraised, this cluster could be among the largest gas pools in the Otway Basin”.

Santos has executed a conditional sale and purchase agreement to sell its 42.86-percent operated interest in the Mahalo Joint Venture, in Queensland’s Bowen Basin, to Comet Ridge Limited.

Santos has also recently completed the divestment to Eni Australia of its 42.71-percent interest in the Petrel fields and 100 percent in the Tern fields in the Bonaparte Basin offshore Northern Australia. This has delivered cash and contingent consideration and reduced Santos’ future decommissioning exposure.

“Santos’ near-term priorities are to deliver Barossa and Pikka, and to progress the next phase of growth opportunities that leverage our existing operating footprint,” Santos managing director and CEO Kevin Gallagher said.

Another major Australian oil and gas firm, Woodside, has signed a deal with Turkey’s BOTAS to supply 0.5 million tonnes per annum of LNG, for a period of up to nine years starting in 2030. Under the agreement, LNG will be supplied primarily from the underconstruction Louisiana LNG project in the

United States as well as from Woodside’s broader portfolio.

Woodside announced in December that its CEO and Managing Director, Meg O’Neill, resigned as she has accepted the role of CEO at bp. The Board of Woodside has appointed Liz Westcott as Acting CEO, effective 18 December 2025. Westcott has led Woodside’s Australian Operations as Executive Vice President and Chief Operating Officer Australia since joining Woodside in June 2023.

“The Board’s ongoing focus on CEO succession planning means Woodside is fortunate to have a number of highly qualified internal candidates as we also assess external talent options to ensure the best possible CEO appointment,” Woodside Chair Richard Goyder said.

“We are well positioned to conclude this process efficiently with the intention of announcing a permanent appointment in the first quarter of 2026.”

At the end of December, the Australian government said it would introduce a domestic gas reservation scheme in a bid to secure more affordable gas for Australians, better protect businesses from international price spikes, and ensure industry is on a stronger footing in negotiating gas contracts.

Under the proposal, the government will require LNG exporters to reserve between 15 and 25 percent of their gas production for the domestic market.

By

“Secure and affordable gas is key for our Future Made in Australia agenda, particularly for nationally significant, trade exposed industrial users who can’t currently electrify,” said the government.

Detailed design of the gas reservation scheme will be developed in consultation with industry, international partners, and communities, with a preference for a system where exporters need to meet domestic supply obligations before exports are approved, the government said.

The reservation scheme, planned for launch in 2027, will see a preferred export approval model, in which exporters will need to meet domestic supply obligations first.

The scheme would allow producers to have flexibility to meet domestic and export obligations through a variety of standard commercial/market-based arrangements, including contracting with exporters or domestic producers so long as supply obligations are met.

“Gas has an important role to play in our energy system as we transition towards 82 per cent renewables,” Minister for Climate Change and Energy Chris Bowen said.

“Unlike coal, gas power generators can be turned on and off in a couple of minutes – providing the ultimate backstop in our energy grid.”

Minister for Resources Madeleine King commented,

“This important reform to the national market will secure the gas Australians need while ensuring Australia continues to play its critical role in regional energy security."

The Australian Energy Market Operator (AEMO) forecasts that Western Australia’s domestic gas market will remain broadly balanced in the near-term.

New supply will progressively come online from late 2026, while consumption is expected to grow from 2026 and reach its highest point in 2030, said Kirsten Rose, AEMO Executive General Manager WA.

A potential supply gap in 2028 is lower than previously expected and could be mitigated with higher domestic output from existing facilities, or new gas supply projects coming online earlier than currently anticipated, according to AEMO.

“A combination of solutions, including the continued investment in new gas developments, alongside increased supply flexibility, could address potential longerterm shortfall risks,” Rose said.

The Association of Mining and Exploration Companies (AMEC) released in early January its ‘Design Paper for Australia’s Critical Minerals Strategic Reserve’, recommending a model for the government to launch a Critical Minerals Strategic Reserve (CMSR), as pledged in the campaign ahead of the 2025 election.

The design paper, an industry informed perspective on how to implement the CMSR, offers the association’s recommended model, the Rare Earths Production Scheme (REPS). This model would use a Contract for Difference (CfD) with a price collar to support rare earths projects in Australia, while minimising risks to taxpayers and aligning with the Government’s policy objectives.

Under the REPS, the Government covers any gap when the spot price falls below an agreed floor. Similarly, the Government receives a negotiated proportion of revenue when the spot price rises above an agreed ceiling.

Australia has the potential to develop its own rare earths capacity. It currently ranks fourth globally in rare earths reserves and fourth in rare earths production, AMEC noted. However, China’s dominance in rare earths has created volatile market conditions, placing supply at risk and creating headwinds for investment, the association warned.

That’s why industry is proposing CfDs, which are already emerging as a key mechanism to support government interventions in strategically important markets, while maintaining economic and fiscal objectives.

The REPS mirrors the Australian Government’s Capacity Investment Scheme, which uses CfDs with a price collar to underwrite investment in renewable energy and storage.

“These minerals are not only the very heart of the energy transition but are also central to Australia’s and our partners’ national security and continue to be in global demand,” AMEC chief executive officer, Warren Pearce, said

“The Government's election commitment for Australia's critical minerals strategic reserve fits neatly with the intent of the Future Made in Australia.”

The third quarter of the 2025 saw energy storage projects in Australia continue to charge ahead with new records set, while momentum for renewable energy investment activity continued to slow for large-scale electricity generation, the Clean Energy Council said in its latest quarterly investment report

Five storage projects worth 1,199 MW / 4,062 MWh reached financial close during JulySeptember, marking the third highest quarterly result seen for new storage projects. In addition, three storage projects were commissioned in the quarter, for a total of 541 MW / 1,766 MWh, representing new records.

Australia currently has 74 committed storage projects, either standalone or hybrid, in the financial commitment or under construction pipeline, equivalent to 13.3 GW in capacity or 35.0 GWh in energy output, the report found.

Meanwhile, 2025 has seen momentum slow for new generation projects, with just 1.1 GW reaching financial commitment. The third quarter saw that trend continue with just one electricity generation project, the Wathagar Solar Farm – Stage 2, representing 27 MW in new capacity, securing financial commitment.

The rolling quarterly average of generation capacity reaching financial close plummeted by 34 percent to 680 MW, highlighting the impacts of lengthy and inconsistent planning, permitting and environmental assessment processes, delays in transmission roll-out, and a lack of long-term offtake and revenue certainty, the Clean Energy Council said.

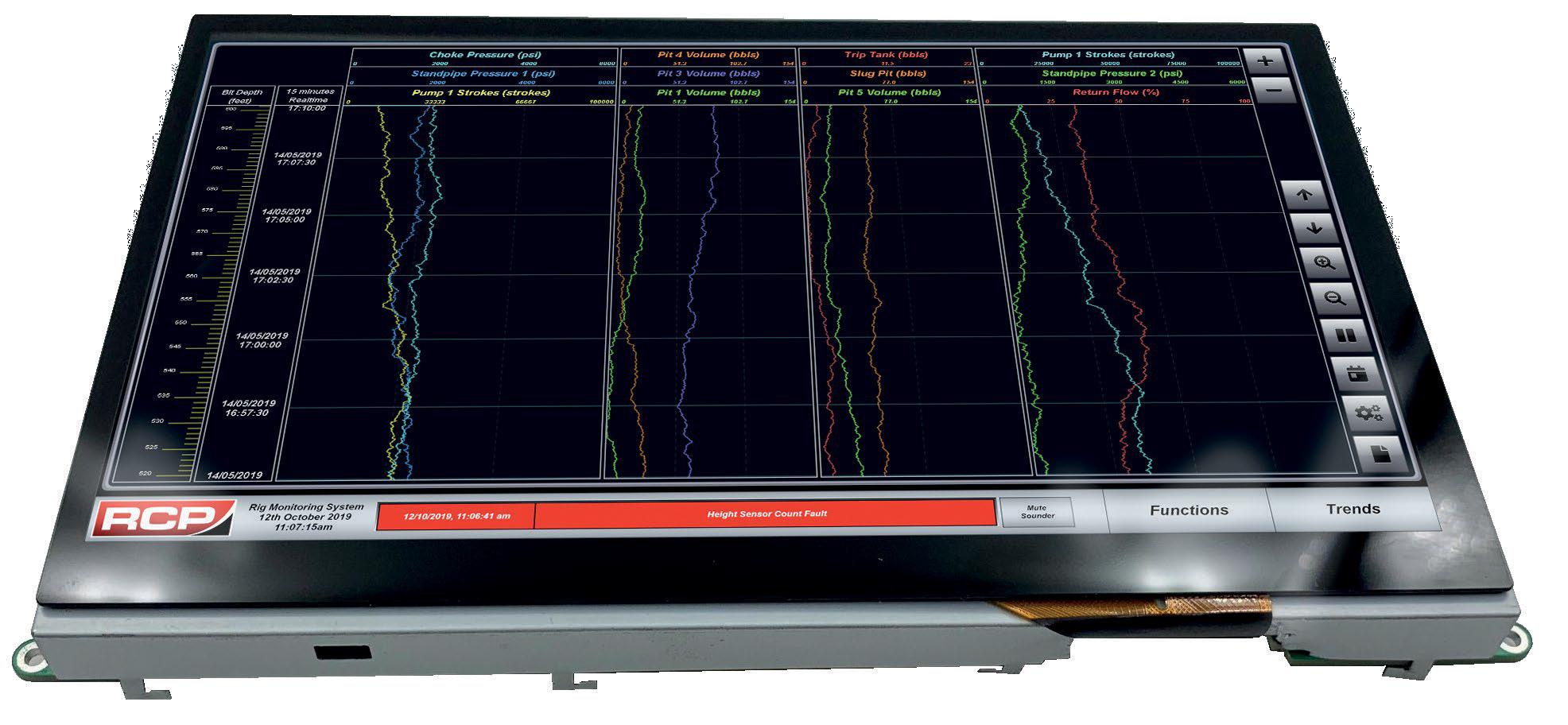

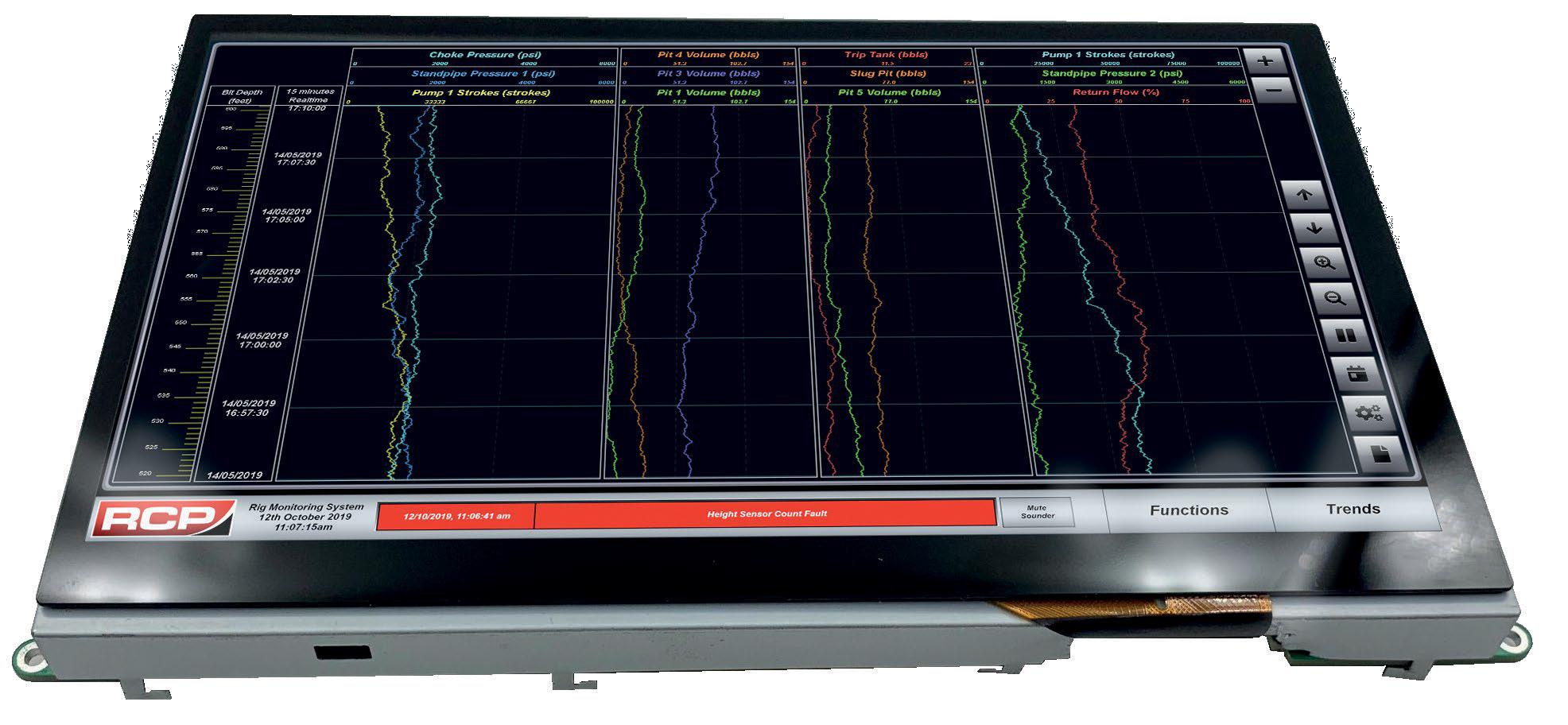

The RCP EDR is designed to give operators a clear, unambiguous overview of critical drilling and mud data processes The system has been developed by RCP to greatly improve how information is presented using the latest industrial technologies and user-friendly interfaces.

The RCP EDR offers a quick and cost-effective solution for clients considering a new installation or a partial upgrade to their existing drilling instrumentation systems Our highly experienced engineers and software developers allows us to tailor each new system to meet your exact needs meaning that you do not pay for functionality you will never use

The RCP EDR utilizes a variety of sensing technologies to monitor the drilling processes, (typically: Level, Pressure, Height, Temperature and Flow). Sensor output signals are received by the distributed I/O racks and are then processed by the EDR.

Processed information is then transmitted through network communication modules to each of the user interfaces including remotely networked PC’s and local HMI’s System and operator interface communications may utilize either: Fibre-Optic, Profinet, Profibus or Industrial Ethernet connection

Today’s Brent Price: ~$65 per barrel

Brent crude trades in the mid-$60s amid balanced supply/ demand conditions and ongoing geopolitical influence on markets.

1 YEAR AGO

1 Year Ago (~2025): ~$80–$82/bbl

A year ago, Brent was significantly higher, supported by OPEC+ discipline, geopolitical uncertainty, and tighter markets, before easing supply concerns later in the year weighed on prices.

5 YEARS AGO

5 Years Ago (~2021): ~$70–$78/bbl

Five years back, oil was rebounding from the pandemic slump, with demand recovery boosting Brent prices as travel resumed and economies reopened.

10 YEARS AGO

10 Years Ago (~2016): ~$43–$57/bbl

A decade ago, Brent was much lower after a major price crash in 2014–15, reflecting oversupply and weaker demand that kept crude prices subdued.

At the heart of OGV Media Group is the OGV Community, a corporate membership service that connects energy sector organisations with our growing network of professionals, leveraging member engagement and platform traffic to maximize brand exposure. Subscription to the

SPONSORED BY

www.eicdatastream.the-eic.com

Energy projects and business intelligence in the energy sector

The EIC delivers high-value market intelligence through its online energy project database, and via a global network of staff to provide qualified regional insight. Along with practical assistance and facilitation services, the EIC’s access to information keeps members one step ahead of the competition in a demanding global marketplace.

The EIC is the leading Trade Association providing dedicated services to help members understand, identify and pursue business opportunities globally.

It is renowned for excellence in the provision of services that unlock opportunities for its members, helping the supply chain to win business across the globe.

The EIC provides one of the most comprehensive sources of energy projects and business intelligence in the energy sector today.

$100 million China National Offshore Oil Corporation (CNOOC)

CNOOC has made oil discovery at Qinhuangdao 29-6, located in the central waters of Bohai Sea that is located offshore China. The well was drilled to a total depth of 1,688 m and encountered an oil pay zone of 66.7 m. Production testing recorded oil flow rates of 2,560 b/d.

CIMIC subsidiary Leighton Asia has been awarded civil and mechanical works by JGC to support the onshore scope of the project. The scope includes general civil works for site development and mechanical tie-in works for the project.

$9

SAFANIYA, ZULUF, BERRI, MARJAN, HASBAH, RIBYAN, QATIF AND ABU SAFAH FIELDS - BROWNFIELD DEVELOPMENT - LONG TERM AGREEMENT (LTA) PROGRAMME

Saipem has been awarded two offshore Contract Release Purchase Orders (CRPOs) by Aramco worth a combined $600 million under their LongTerm Agreement, covering EPCI of 34 km of 20- and 30-inch pipelines and topside works at the Berri and Abu Safah fields (CRPO 162, 32 months), as well as subsea interventions at Marjan field and EPC of 300 m of onshore pipeline and tie-ins (CRPO 165, 12 months.

Saipem has been awarded a USD$425m EPCI contract in the project. Under the agreement, the company will be responsible for the EPCI of 3 additional pipelines, totalling 153km, with associated subsea structures, to connect the new natural gas reserve recently discovered at the Goktepe field (see related projects) to the Phase 3 facilities.

Gas discovery has been made through the Konta-1 exploration well which was drilled to a total depth of 4,575 m in 570 m of water. Production testing showed gas flow rates of up to 31 MMcf/d and 700 boe/d of condensate. Preliminary estimates indicate a discovered volume of approximately 600 Bcf of gas in place.

Finder Energy has secured the FPSO Petrojarl I from Amplus Energy for both of Kuda Tasi and Jahal oil fields project. Final investment decision (FID) for this project is now targeted to be achieved by H2 2026 and first oil by Q4 2027. Under the new arrangement, ownership of the vessel will transfer to Finder, while Amplus will continue to lead the FEED work, life-extension and upgrade programs, and ultimately provide operations and maintenance services once the vessel is deployed.

KAIKIAS OFFSHORE OIL FIELD WATERFLOOD

Shell has issued a positive FID for a waterflood project at its Kaikias offshore field, located in the US GoM. Water will be injected to displace up to 60MMboe of additional oil out of the reservoir. First injection is expected in 2028.

TechnipFMC has been awarded Tiber-Guadalupe's SURF/subsea production systems contract. The agreement covers an array of equipment including subsea trees and manifolds that can handle pressure of 20,000 pounds per square inch (20k). The contract has been valued at US$600-800m.

Subsea 7 has been awarded the subsea installation contract for the project. The scope of work includes project management, engineering, procurement, fabrication, transportation, installation and pre-commissioning of subsea equipment and associated infrastructure. Offshore operations are expected to commence in 2028.

Equinor has announced the decision to invest over USD$394m at Johan Castberg's "next phase". The project will be developed via two wells in a new subsea template tied back to existing subsea facilities via pipelines and umbilicals.

NOV has secured a contract from ExxonMobil Guyana to supply four actively heated risers and production flowlines totalling approximately 14.4km for the project, alongside pull-in latching mechanisms, bend stiffeners, buoyancy modules and topside equipment.

ADNOC has announced that a final investment decision has been made on the project. The project comprises a new offshore platform with four gas production wells which connect to Das Island. The project will produce 200MMcf/d of gas once it enters production.

By Tsvetana Paraskova

The global subsea industry and supply chain are poised for a solid year in 2026 on the back of increased offshore energy developments and the return of frontier exploration by the majors and national oil companies.

Exploration and production (E&P) companies have recently focused on boosting oil and gas supply as peak demand is still years away and governments are prioritising energy security and affordability. Offshore oil and gas, especially deepwater developments, have become more important for the majors and the key oilproducing countries, while frontier exploration and development offshore Guyana in South America and Namibia and Angola off Africa’s west coast is back on the table for the firms with sufficient financial resources to invest in exploring for new supply.

The subsea industry and its vast supply chain of support vessels, subsea wellheads, manifolds, pipelines, power cables, monitoring sensors, processing and storage systems, and floating production storage and offloading (FPSO) units is set to benefit from the rise of offshore development.

In addition, the subsea industry is undergoing critical transformation with the increased digitalisation in the energy industry and the supply chain diversification into offshore renewable energy and power systems to hedge against oil price downturns. Companies have embraced digital technology for monitoring and repairs to reduce risks to people and create efficiencies. Robotics, remotely operated vehicles (ROVs), and autonomous underwater vehicles (AUVs) have already become the industry standard in many subsea operations and applications globally.

The world’s biggest Western oil firms – BP, Chevron, ExxonMobil, Shell, TotalEnergies, and Eni – are refocusing on frontier regions in pursuit of new discoveries essential for sustaining long-term growth, Rystad Energy said at the end of last year.

Big Oil have both the technical skills and financial muscle needed to explore technically challenging and high-cost frontier areas, according to the energy intelligence firm.

“These majors have communicated the importance, to varying degrees, of frontier exploration in their quest to replenish reserves bases and maintain profitability,” said Taiyab Zain Shariff, Vice President –Upstream Exploration at Rystad Energy.

“Overall, the six majors are pushing the boundaries of exploration, targeting frontier areas in search of new discoveries to sustain their businesses. While the risks are high, the potential rewards are significant, and the industry is likely to see increased activity in these regions in the coming years.”

This year, exploration will feature sustained capital discipline, with global spending expected to hold steady at just over $60 billion, in line with 2025, Rystad’s analysts said in their outlook for 2026.

The majors’ strategy is targeted entry into new frontiers without accelerating shortterm drilling programs, Aatisha Mahajan, Head of Exploration - Oil & Gas at Rystad, reckons.

“More than 60 offshore frontier wells are anticipated next year, primarily across Asia, Africa and South America. Oil-focused activity remains robust in Namibia, Brazil and the US Gulf of America, while gas-prone basins such as the East Mediterranean, Norway and Southeast Asia continue to underpin low-risk additions, particularly through ILX [infrastructure-led exploration] opportunities,” Mahajan said.

As regards the supply chain, a softer start to the year is set to turn into a gradually improving second half of 2026 as capacity tightness and pricing momentum will begin to surface in deepwater, subsea, and select international markets, according to Binny Bagga, Senior Vice President, Supply Chain Research at Rystad.

“Subsea pricing is expected to remain resilient, supported by strong backlogs and integrated project offerings, with a clearer upside building into late 2026 and 2027,” Bagga said.

“Across offshore subsea vessels, deepwater rigs, and floating production, storage and offloading (FPSO) vessel fabrication, capacity constraints begin to build through 2026 and intensify in 2027 as a new wave of deepwater and LNG-linked final investment decisions (FID) come to fruition.”

South America is set to drive non-OPEC+ supply growth through 2030, with oil production from offshore Brazil, Guyana, and Suriname, as well as Argentina’s Vaca Muerta shale well-positioned to supply costcompetitive barrels until 2030, Rystad Energy analysts said at the end of 2025.

“South America is well-positioned to offer competitive barrels to a global market due to its success with deepwater projects. Looking ahead, continued investment and a stronger focus on deepwater expansion as the supply gap might widen after the mid-2030s,” commented Radhika Bansal, vice president, Upstream research, at Rystad Energy.

South America was set to lead supply growth in 2025, adding more than 560,000 barrels per day (bpd) of crude and condensate, followed by North America with around 480,000 bpd. By 2026, South

America’s additions are expected to exceed 750,000 bpd, keeping the region among the few regions with additions over 500,000 bpd driving non-OPEC+ growth.

Offshore oilfields which have come online since 2020, and those set to start up by 2030, will account for over 65 percent of South America’s conventional production, Rystad Energy reckons. South America will also maintain a strong final investment decision (FID) momentum through 2030, leading to a cumulative conventional greenfield capital expenditure (capex) for oilfields of $197 billion between 2020 and 2030, largely concentrated in offshore deepwater projects, the intelligence firm said.

Blocks offshore Trinidad and Tobago and Peru could also join the South American supply increase if new discoveries are made in recently awarded exploration licences there.

US deepwater production has reached alltime highs following an outstanding 2025 in terms of startup activity, says Thomas

Liles, Senior Vice President of Upstream Research at Rystad Energy.

While floaters have dominated the headlines, four new subsea tiebacks also commenced operations in US Gulf in 2025 with material growth prospects going into 2026.

The next five years will see significant new commissioning activity with the likes of floating production unit FPU-based projects such as Sparta, Kaskida, and Tiber – all of which target more challenging Lower Tertiary reservoirs, according to Liles.

In the near term, the key themes in the 2026 upstream industry will be operators looking to add material growth opportunities for the 2030s and a sharper focus on efficiency, Wood Mackenzie said in early January.

Brownfield rejuvenation and recovery factors will gain prominence, as well as new upstream business models and crossborder partnerships, WoodMac noted.

Subsea cables carry 99% of international data, and critical underwater infrastructure faces evolving threats. Subsea infrastructure has never been more critical, nor more vulnerable.

For 2026, successfully adapting to this world will be the name of the game and Elementz is already leading the charge on moving away from traditional, sector-specific approaches that can no longer keep pace with the scale and complexity of what lies beneath the waves.

that Elementz moves from a vertical oil and gas focus to a multi-sector approach supporting energy, renewables, subsea power, telecommunications, defence and other critical marine infrastructure. And we are really excited by the possibilities.

Much of the existing infrastructure underpins global energy security, data transmission and economic stability but it is still managed by fragmented systems, siloed data and bespoke solutions that no longer reflect operational reality. Imagine, then, a shared, secure digital environment where data, workflows and intelligence can be trusted, integrated and shared across the subsea value chain.

But there’s no need to imagine the emergence of this blue digital ecosystem: it already exists and Elementz sits at its core.