Monthly Market Monitor

May 2024

After a five-month rally, equity markets experienced their first noteworthy correction in April.

May 2024

After a five-month rally, equity markets experienced their first noteworthy correction in April.

Steady but slow – that’s how the International Monetary Fund (IMF) describes the growth pace for the world economy in its latest outlook. Its global growth projections for 2024 and 2025, at +3.2% for both years, are accordingly less than spectacular. At a lower flight level, however, the IMF also detects significant granular divergences. Ranking among them is inflation, which is proving to be intractable particularly in the USA. The ECB for the first time therefore looks set to loosen the interest-rate screw before the Fed does in the current cycle.

After a five-month rally, equity markets experienced their first noteworthy correction in April. The interim breather was particularly brought about by the renewed substantial increase in market interest rates in recent weeks. Market participants for a long time had viewed rising interest rates favorably as a sign of robust economic growth, but that has been outweighed lately by fears that rates probably are rising more as a result of stubborn US inflation. However, investors shouldn’t overrate the recent slump in share prices. So far, it has just been the kind of drawdown that one would normally expect to see during the course of any year on the stock market and is thus business as usual.

Financial markets come with risks, including geopolitical risks, which seem at least to have further increased in recent years, frequently dominating news headlines.

In the Satellite View section of this publication, we track and observe the most important macroeconomic and geopolitical risks of our times, gauge their probability of occurrence, and infer their implications for financial markets.

For three years, the price arrow on the Chinese equity market only knew one direction: down. Every recovery quickly fizzled out, and whoever bought countercyclically walked right into a trap. The recent trend reversal, however, may have a little more staying power because it comes on the heels of a classic capitulation by investors and public authorities. The odds of a cyclical rally are good, but whether China is worth more than just one trade remains an open question, the answer to which is largely in the hands of the country’s government.

The word “volatility” frequently triggers negative associations in the minds of (retail) investors because it usually is uttered when volatility is high (and prices on financial markets are falling). Moreover, elevated market fluctuations are often a cause of investment mistakes. Whoever knows how volatility is calculated and understands its psychological effects can outwit it and achieve better investment results without fraying his or her nerves.

Tracking seasonal patterns is a popular pursuit among statistically savvy stock-market traders. They scrutinize them usually in the hope of gaining better bearings and knowing more about the future on the markets than other investors. However, one shouldn’t place too much trust in statistics regarding (US) election years. After all, only around two dozen US presidential elections have been held over the last 100 years, producing too few data points from which to draw statistically grounded conclusions about one or the other party’s political influence on market behavior. Apolitical assertions about the typical progression on the US equity market in an election year are perhaps more helpful. The Chart of the Month shows that volatility increases from the start of the summer until the election in November. However, this information doesn’t provide much added value because over the last 30 years at least, it matches what actually happened also in every other (non-election) year.

Inflation also continues to feature on the IMF’s list of concerns.

Resilient and divergent

Steady but slow – that’s how the International Monetary Fund (IMF) describes the growth pace for the world economy in its latest outlook. Its global growth projections for 2024 and 2025, at +3.2% for both years, are accordingly less than spectacular. At a lower flight level, however, the IMF also detects significant granular divergences. It sees the USA remaining the growth engine among industrialized nations this year, with an economic expansion rate of +2.1%. It sees a substantial pickup in growth for the Eurozone (+1.4%) on the heels of stagnation last year. However, the economic growth outlook for Germany (+0.7%) is once again very subdued. Despite the IMF’s guarded optimism, its April report also sees a number of challenges ahead, including high public debt, geopolitical risks, the green transition, and mediocre medium-term potential growth.

Stubborn inflation

Inflation also continues to feature on the IMF’s list of concerns. Although inflation has been retreating everywhere in recent quarters, the latest inflation prints have repeatedly surprised on the upside, particularly in the USA. Even though this is partially attributable to sticky rent price inflation and some exceptional items (car insurance premiums, to cite an example), it has prompted rethinking and a rhetorical course correction at the US Federal Reserve. Several Fed officials have recently spoken out in favor of slowing the pace of upcoming interest-rate cutting. Even the “no rate cuts” variant no longer seems completely far-fetched by now. Rate-cut

fantasy has also largely fizzled out on the financial market. Only around one-and-a-half quarter-point rate cuts by year-end were still priced in at last look.

ECB ahead of the Fed this time

Whereas an initial rate cut in the USA doesn’t seem realistic right now until autumn at the earliest, the European Central Bank remains on an imminent easing course. ECB President Christine Lagarde has repeatedly communicated relatively unequivocally that an initial rate cut is on the agenda in June. This means that for the first time in its history, the ECB would loosen the interest-rate screw before the Fed does. However, after the initial cut, ECB officials will probably glance sideways across the Atlantic with one eye because an overly large interest-rate differential could weaken the euro and cause inflation pressure.

China keeping up appearances

The IMF projects economic growth of +4.6% for China this year, which is significantly below the +5% target set by Beijing. Actual realized growth at least in the first quarter of 2024 came in well above that level at +5.3%. Economic activity was kick-started particularly by investments in infrastructure and industry. Those areas are likely to be heavily supported by the state also in the quarters ahead even if longer-term problems such as production overcapacity and low productivity are already foreseeable today. Economic stimulus of that kind may enable China to maintain an external appearance of solid growth. Beneath the surface, though, low consumer confidence and China’s weak real estate market remain problematic and exert a braking effect on growth.

Financial markets come with risks, including geopolitical risks, which seem at least to have further increased in recent years, frequently dominating news headlines.

• Global Technology War

• Persian Gulf in Flames

• Devastating Cyberattacks

• Grave Terrorist Attacks

• Tensions in East Asia

• Russia-NATO Conflict

• North Korea Conflict

Financial markets come with risks, including geopolitical risks, which seem at least to have further increased in recent years, frequently dominating news headlines. Many a pessimist thus is likely to be of the opinion that markets have become completely uninvestable by now. But whoever stuffs his or her money under a mattress or stashes it in a safe for that reason can only lose out in the long run. That person’s wealth will inevitably lose purchasing power in any event.

However, one also cannot just ignore global hot spots. As an asset manager, we have a special duty to analytically examine the most important macroeconomic and geopolitical risks of our times, to gauge their pro-

Overlooked by Markets

• The Great Trump Panic

• Anti-Green-Wave Sentiment

European Malaise

bability of occurrence, and to infer their implications for financial markets. Fortunately, this routine exercise results not just in a concise heat map of trouble spots seen (and overlooked) by market participants, but also ultimately in the realization – more frequently than one might suspect – that a risk is improbable, is already priced in or, if it does materialize, is relevant only to rather exotic assets and niche markets.

True to the motto “political stock markets are shortlived,” investors should take headlines for what they are and shouldn’t allow the incessant chatter on the spectrum of channels to divert them from their longterm investment strategy.

Global Technology War

Conventional Wisdom

Market Attention | High

Probability | High

Description

The USA and China in recent years have deliberately been seeking to decouple from each other, particularly in the area of highly sophisticated and militarily relevant technologies. The USA is employing a variety of tools (export controls, vetting of foreign investments) in an attempt to safeguard its lead in cutting-edge technologies (artificial intelligence, semiconductors, quantum computers). The scope of those measures is continually widening (e.g., biotechnology). Similar measures are also being contemplated in Europe. China is working on its own capabilities and is likely to achieve some technological breakthroughs on the strength of its human capital, its massive investments in research and development, and its centralized coordination. This is

The Great Trump Panic

Overlooked Risk

Market Attention | Low

Probability | High

Description

Although Joe Biden’s physical condition is a subject of frequent discussion, Donald Trump’s personality is the more important matter, at least for financial markets. As an outsider with a huge fan base, Trump is not reliant on the Republican political ma-chine. Only Trump is threatening to withdraw from NATO, to slap high tariffs on im-ports from Europe, Japan, and Mexico, and to militarize the USA’s southern border. Only Trump exercises presidential powers so erratically and aggressively. If Trump gains a significant lead in the polls during the election campaign, mounting political uncertainty threatens to spark a correction on the equity market. A post-election re-lief rally would be more the rule than the exception particularly if Trump cuts taxes as

• ↘ Chinese renminbi

• ↘ US investment-grade bonds

• ↘ Asia ex-Japan technology

• ↗ Infrastructure

bound to further stoke fears in the West and is likely to cause sustained tensions and to result in the development of parallel competing technologies.

There is growing apprehension in the USA and Europe that China will inundate the world market with less sophisticated semiconductor chips for high-volume applications and, in doing so, will squeeze Western manufacturers out of the market. Those concerns also apply to other technological areas (including renewable energy and electric vehicles) in which China has gained a lead on the back of massive subsidies. Protectionist countermeasures by the West are becoming ever more likely.

Impacted Assets

• ↘ US Treasury bonds

• ↗ VIX index

• ↗ Bitcoin

• ↗ Gold

he has said he will. However, panic could break out on the bond market if Trump addi-tionally stimulates economic activity and further increases the federal budget deficit.

Biden’s popularity is plummeting despite a booming economy, whereas Trump’s approval ratings are edging upward despite the massive litigation he is facing. Both are neck-and-neck in the polls, though Biden is behind in the swing states. Trump is firmly in charge in the Republican Party; only incarceration could change that. It appears possible that he will be sentenced to prison before November 5, but there is little chance that he will actually be incarcerated during the appeal process.

Trump is firmly in charge in the Republican Party; only incarceration could change that.

The upcoming US elections raise uncertainty about the future of NATO – a Trump 2.0 administration would possibly mean less US backing for the alliance.

Tensions in East Asia

Headline Risk

Description

The USA and China have braced themselves for a longterm competitive relationship that could become more rancorous in the decade ahead in Southeast Asia. Although the meeting between Presidents Biden and Xi in November of last year reflected serious efforts on both sides to improve stability and communication in the relations between the two countries, this thus far appears to be merely tactical maneuvering and not a structural change in the relationship dynamics. Taiwan remains the most important potential trouble spot, as evidenced anew by the presidential election outcome there in January 2024. A conflict over Taiwan would have serious worldwide repercussions even if a military

Russia-NATO Conflict

Headline Risk

Description

After more than two years of fighting and in the wake of a fruitless counteroffensive by Ukraine, the war in eastern Europe may be at a turning point. A ceasefire or a diplomatic solution is unlikely at present, but pressure looks destined to mount on both sides in 2024. On one hand, Western support for Ukraine threatens to ebb, and on the other hand, Russia’s economy is soon likely to face even bigger problems than before. A political, economic, and military stalemate between the West and Russia is the most probable long-term outcome. If Russia considers itself successful in Ukraine, Moscow might contemplate attacking the Baltic countries or Poland. This appears to be a low-odds scenario as things

Impacted Assets

• ↘ Taiwanese equities

• ↘ Chinese high-yield bonds

• ↗ Defence sector stocks

• ↗ Gold

escalation is unlikely in the near future. The inauguration of the new president of Taiwan in May is the next key event to watch.

Presidents Biden and Xi spoke on the phone in April and discussed several critical issues that overshadow relations between the USA and China (the Taiwan question, China’s support for Russia’s arms industry, unfair trade practices). Their agreement on the low-hanging fruit (including on reopening military communication channels) cannot obscure the fact that deep mistrust continues to prevail, as reflected also by the bipartisan attempt to ban TikTok in the USA.

Impacted Assets

• ↘ Russian equities

• ↘ Russian rouble

• ↗ Crude oil

• ↗ Gold

stand today because NATO continues to possess massive deterrence capability.

The upcoming US elections raise uncertainty about the future of NATO – a Trump 2.0 administration would possibly mean less US backing for the alliance. To counter this risk, NATO Secretary-General Jens Stoltenberg plans to set up a 100-billion-euro five-year fund to aid Ukraine, with the costs to be spread more equitably across all NATO members. In addition, aid to Ukraine is no longer to be spearheaded by the USA in the future, but instead is to be coordinated by the alliance.

Persian Gulf in Flames

Description

The attack on Israel by Hamas was the deadliest assault on the country since the Yom Kippur War in 1973 and has resulted in a humanitarian crisis. Israel’s harsh military response and corresponding backlashes from proIran factions in Lebanon, Syria, Iraq, and Yemen have recently further escalated hostilities. Militant Houthi rebels, for instance, have repeatedly attacked ships in the Red Sea, which has caused major trade disruptions and threatens to impact the world economy. The USA has implemented extensive military countermeasures in response to the attacks by the militias and to safeguard freedom of navigation in the Red Sea. Efforts by the West are currently focused on liberating Israeli hosta-

North Korea Conflict Headline Risk

Description

North Korea in recent years has continued unabated to pursue its nuclear program and to isolate itself from the West. In the meantime, it has also forsaken a peaceful reunification with South Korea as a core policy objective. In the runup to the US pres-idential election, Kim Jong Un might initiate further provocations to exert pressure on the USA. Meanwhile, North Korea’s rapprochement with China and Russia continues apace – North Korea has since become one of the most important arms suppliers to those two countries. In late 2023, North Korea successfully launched its first military satellite, further exacerbating tensions with the West. South Korea and Japan are strengthening their defenses and are deepening their relations with each

• ↗ Crude oil

• ↗ VIX index

• ↗ Swiss franc

• ↘ US high-yield bonds

ges, engineering a ceasefire, and ramping up humanitarian aid. A sustained pacification of the conflict seems illusory for now.

Tensions in the Middle East have further escalated in recent weeks. An Israeli airstrike on the Iranian consulate in Damascus on April 1 killed several high-ranking Iranian military officers. Iran retaliated with a massive barrage of cruise missiles, ballistic bombs, and drones, but inflicted little damage. Israel then refrained from further escalating hostilities and responded with only a symbolic strike on an Iranian nuclear facility.

• ↗ Japanese yen

• ↘ South Korean won

• ↘ South Korean equities

• ↗ Industrial metals

other and the USA. The risk of renewed provocations and military actions by North Korea is growing, but a potential North Korea conflict remains just a “headline risk” for now.

North Korea conducted a series of short-range ballistic missile tests in April that included the launch of a new intermediate-range missile (the Hwasong-16B), which North Korea claims can carry a nuclear warhead. Russia used its UN veto to dissolve the Panel of Experts (PoE) that monitors compliance with sanctions against North Korea. The sanctions (in place since 2006) remain in force, but the PoE’s mandate ends on April 30.

Tensions in the Middle East have further escalated in recent weeks.

Governments and organizations are working continuously on strengthening their cyberdefences and cyber resilience.

Devastating

Description

Along with the intensification of geopolitical strife, there has been a continual increase in the scope, scale, and sophistication of cyberattacks. State-sponsored hackers, particularly from Russia and China, have many times over already infiltrated vital Western infrastructures such as power grids and transportation and healthcare systems and have broken into government officials’ digital accounts, exposing critical vulnerabilities. Large-scale ransomware attacks on enterprises highlight vast vulnerability in the business world as well. Malicious cyberactivity picks up particularly in conflict zones and ahead of elections, which can cause disruptions and breakdowns and puts pressure on

• ↗ US dollar

• ↗ Swiss franc

• ↘ Utility sector stocks

• ↗ Cybersecurity stocks

national security agencies to adopt a more proactive posture.

Governments and organizations are working continuously on strengthening their cyberdefences and cyber resilience. However, the continual evolution of cyberthreats, the difficulty of identifying cyberattackers, and rapid advancements in artificial intelligence make effectively preventing major cyberattacks a constant challenge. The market for cyberinsurance and cyber reinsurance is growing quickly, opening new opportunities for investors via insurance-linked securities.

• ↘ Airline stocks Grave

• ↗ German government bonds

• ↗ Swiss franc

• ↗ Japanese yen

Description

Financial markets’ alertness to worldwide terrorism risks has increased in recent years. The conflict in the Middle East especially raises the terrorism threat not just in that specific region, but also in the USA and Europe. Western law enforcement and intelligence agencies view violent extremists and “lone wolves” as the biggest concern. Al-Qaida and ISIS are further extending their global reach, giving rise to new terrorism hot spots, for example in the Sahel, where military coups threaten to undermine Western efforts to combat terrorism. In the USA, the Biden administration has declared domestic terrorism a serious risk.

There’s an elevated danger of a major terrorist attack in Western countries in the runup to presidential elections in 2024.

On March 22, 2024, Moscow was struck by a terrorist attack that killed over 100 people. ISIS-K, the Afghanistan branch of the Islamic State militant group, claimed responsibility for the act. The attack dealt a blow to Vladimir Putin’s carefully crafted “strong man” image. Experts suspect that the Kremlin might use the attack to justify a crackdown on dissidents and to tighten its authoritarian grip on Russia.

European Malaise

Description

The risk of a fragmentation of Europe has increased in the 2020s – the war in Ukraine, an energy crisis, inflation pressure, and an economy on the brink of a recession have put a temporary tailwind behind populist parties in some countries (e.g. Germany, the Netherlands). Nevertheless, Europe is united on core issues and objectives such as increasing its strategic autonomy and decoupling from China, supporting Ukraine, and reforming migration policies. Differences of opinion mainly concern details such as implementation and funding. European Parliament elections will be held in June 2024. EU-skeptical, right-wing populist, and (extremist) right-wing parties look poised to gain more votes. A number of issues could strain political cohesion

Anti-Green-Wave Sentiment

Overlooked Risk

Discounted Risk Market Attention |

Description

The war in Ukraine has pushed energy security higher up in governments’ rankings of risks. The energy shock has prompted ambitious decarbonization plans in Europe in a race against the USA to seize the leadership mantle in the field of clean energy. This “green race” could act as a catalyst for accelerating the development of low-carbon technologies. However, the progressive transition agenda clashes with many other national priorities and is irking ever wider swaths of the pubic that are angry about the high transition costs. Green parties in Europe are losing ground, reflecting voter dissatisfaction. The markets tend to be overlooking the risk of a

• ↘ Hotels & leisure stocks

• ↘ Italian government bonds

• ↗ Swiss franc

in Europe in the medium term. One of them is irregular migration to the EU, which last year reached its highest level since 2016.

The latest macroeconomic data indicate that a European malaise is more subjectively perceived than actually existent. While the core (mainly Germany) remains weak, countries on the periphery are growing much more strongly – the convergence could reinforce unity and sentiment toward the euro. Credit spreads on Italian government bonds have tightened lately, reflecting the market’s relaxed stance on the risk of Europe fragmenting.

• ↘ Industrial metals

• ↘ Renewable energy stocks

• ↗ Utilities sector stocks

• ↗ Uranium

negative swing in sentiment toward the energy transition and of delays resulting from that.

The US Securities and Exchange Commission (SEC) in April announced that it has suspended the implementation of its recently enacted disclosure rules on climate-related risks and greenhouse gas emissions. Companies had already mounted legal challenges against the new regulation prior to its final adoption and publication in March. The SEC declared that it nevertheless would continue to “vigorously defend” the new climate-related disclosure requirements.

Differences of opinion mainly concern details such as implementation and funding.

After a nearly uninterrupted five-month-long rally, equity markets experienced their first noteworthy correction in April.

Fixed Income

Sovereign bonds

Corporate bonds

Microfinance

Inflation-linked bonds

High-yield bonds

Emerging-market bonds

Insurance-linked bonds

Convertible bonds

Duration 04/2024

Currencies

US dollar

Swiss franc

Euro

British pound

Equities: Business as usual

• After a nearly uninterrupted five-month-long rally, equity markets experienced their first noteworthy correction in April. The interim breather was particularly brought about by the renewed substantial increase in market interest rates in recent weeks.

Market participants for a long time had viewed rising interest rates favorably as a sign of robust economic growth, but that has been outweighed lately by fears that rates probably are rising more as a result of stubborn US inflation. In the wake of three consecutive unpleasant inflation surprises (in the sense of higher-than-expected inflation), the “higher for even longer” scenario has rapidly gained relevance. However, investors shouldn’t overrate the recent slump in share prices. So far, it has just been business as usual – bear in mind, after all, that double-digit percent drawdowns during the course of a year on the stock market are the general rule (average intrayear drawdown: –14.2%).

• The progression of the correction to date accordingly also matches the typical pattern: near-term momentum indicators quickly turned oversold, suggesting that a consolidation phase will likely occur soon. How far it will extend and whether new record-high stock prices will soon be possible is bound to depend in part on the future performance of corporate earnings. Prior to the ongoing first-quarter reporting season, analysts significantly lowered their

Global

Switzerland

Europe

UK

USA

Japan

Emerging markets

Alternative Assets

Gold

Hedge funds

Structured products

Private equity

Private credit

Infrastructure

Real estate

Scorecard

Macro

Monetary/fiscal policy

Corporate earnings

Valuation

Trend

Investor sentiment

04/2024

04/2024

earnings forecasts for the period, as they usually are prone to do. With projected earnings growth of +3% in the USA and –11% in Europe, the bar this time is set very low, so surprises to the upside can safely be expected. It remains to be seen, though, how much impetus this will provide for lastingly higher stock prices because forecasts for the remainder of this year are still very ambitious at the moment: in the example of the S&P 500 index, profits through the fourth quarter are projected to increase by around 20% year-on-year. There is potential here for disappointments.

• Investors should make some fine adjustments in view of the recent shifts in monetary policy expectations (less rate-cutting in the USA, ECB lowering rates before the Fed does) and in light of global economic activity momentum (growth differential narrowing in favor of Europe). The increase in market interest rates means that the period of relative strength in growth stocks may be over at least temporarily. Cy-

clical stocks, in contrast, might be at an advantage and could benefit from the accelerating economic growth dynamics outside the USA. It is also advisable to review regional weightings. Any overweight in the USA should be trimmed to neutral given the reasoning above. Regardless of how actively an investor would like to tactically maneuver, we continue to recommend focusing on the “quality” factor.

Fixed income: Caught wrong-footed again

• Many bond investors will get caught on the wrong foot again this year. The consensus scenario for 2024 actually foresaw bond yields edging downward and bond prices accordingly drifting upward. Investor demand for interest-bearing securities with long terms to maturity was accordingly high. In reality, though, the at least temporary halt to the disinflation process in the USA is now throwing a wrench in the works for many investors. After all, the yield on 10-year US Treasury notes has climbed by around 80 basis points year-to-date while the yield on 10-year German bunds is up by around 50 basis points for the year thus far. The long-term yield level is practically unchanged year-to-date only for Swiss Confederation bonds thanks to inflation surprises on the downside in Switzerland.

• Corporate bonds in the investment-grade segment have held up comparatively better in recent months on the back of a further tightening of credit spreads. However, the potential for even tighter spreads going forward is now constrained at the current level. Nevertheless, we continue to consider the risk/ reward tradeoff in this segment attractive in view of the relatively high total returns. Investment-grade bonds, particularly in the sovereign sector, remain a rather inexpensive hedge against a scenario of a substantial slowdown in economic activity. We view high-yield and inflation-linked bonds, in contrast, as being on the expensive side. We are staying selective in those segments, which we both continue to underweight.

• Whoever was hoping that the “halving” of Bitcoin would lend impetus to cryptocurrency prices ended up getting disappointed. As so often happens on financial markets, the event that had been anticipated for months in advance got priced in beforehand. Although there was no noteworthy selling on the news, the price of Bitcoin has only been drifting horizontally on the whole since the start of March. The price of digital gold has thus decoupled downward from the price of traditional gold – the price of a troy ounce of bullion has risen by almost 20% at its peak over the last two months.

• Other commodity markets have also registered strong price movements year-to-date. That particu-

larly goes for the commodities cocoa (+150%) and coffee (+30%), whose prices have soared as a result of adverse weather conditions and a corresponding decrease in supply. However, investors who want to “play” trends of that kind should bet neither on single commodity derivatives nor on broad commodity indices. Whoever would like to participate in medium- and long-term trends on commodity markets can do that best by investing in trend-following strategies (CTAs) – good CTA funds are up more than 20% year-to-date. This thought, by the way, also goes for crude oil, though it is suitable as a hedge against geopolitical risks (in the Middle East) only in the worst case.

Currencies: US dollar with interest-rate advantage

• EUR/USD: The US Federal Reserve has fallen behind the European Central Bank in the upcoming rate-hiking cycle. This gives the US dollar an interest-rate advantage, which has come to bear in recent weeks, knocking the EUR/USD exchange rate to a new year-to-date low. However, despite the volatility of interest-rate expectations, the currency pair has held astoundingly steady when viewed from a greater distance. The euro’s trading range in place for a year now between 1.05 and 1.13 against the greenback is rather narrow. It would take a breakout of this range to provide the next trend signal. A resolution of the pattern to the upside would be surprising, but also only logical given the valuation of the currencies. This scenario could become realistic if US inflation resumes receding soon and economic growth in Europe continues to accelerate.

• GBP/USD: The Bank of England also looks set to lower interest rates this summer ahead of the Fed. After the recent downward lurch in the GBP/USD exchange rate, the next stop line is at last autumn’s low at the 1.21 level. Good arguments for a sustained downtrend for the pound are lacking, so a neutral tactical positioning in the GBP/USD cross is appropriate.

• EUR/CHF: The Swiss National Bank is playing a special cameo role this year among the world’s major central banks. It is the only one that has already cut interest rates because nowhere else but in Switzerland have inflation figures pleasingly come in so much lower than expected. This macro picture in the back of one’s mind puts the Swiss franc’s weakness in recent months into perspective: its slump marks a correction in a long-term appreciation trend that remains intact as a result of Switzerland’s low inflation. The interest-rate disadvantage and less of a tailwind from the SNB could keep the franc under pressure in the near term, but the currency could quickly come back into demand in the event of geopolitical escalations (as the market reaction after Israel’s limited retaliatory strike against Iran on April 19 demonstrated).

Many bond investors will get caught on the wrong foot again this year.

Gold has been glittering especially brightly this year: its price has risen by around 15% (in US dollar terms) year-to-date through the end of April. But the broad investor community appears not to be participating in this rally, as evidenced at least by data on gold holdings held by ETFs, which have registered continuous net capital outflows in recent months. Many investors seem to prefer safe yields on the money market to the uncertain return on the precious metal. Gold’s steep climb despite this headwind owes to other factors. One of them in particular is that central-bank interest in gold has increased substantially since the start of 2022 (and since the imposition of sanctions against Russia).

Geostrategic competition between China and the West will likely keep this source of demand from drying up anytime soon. The gold price’s lasting ascent above the technical resistance at the USD 2,075-per-ounce mark has recently also prompted momentum-based trend followers to jump on the bandwagon. Gold’s future prospects look promising for the medium term. In the event of a correction, the previous resistance line is likely to turn into a support level.

For three years, the price arrow on the Chinese equity market only knew one direction: down. Every recovery quickly fizzled out, and whoever bought countercyclically walked right into a trap. The recent trend reversal, however, may have a little more staying power because it comes on the heels of a classic capitulation by investors and public authorities. The odds of a cyclical rally are good, but whether China is worth more than just one trade remains an open question, the answer to which is largely in the hands of the country’s government.

A long list of concerns…

“The trend is your friend, until the end, when it bends.” This stock-market adage warns investors not to try to catch proverbial falling knives. At the same time, though, it is also a reminder that every (downward) trend ends at some point at least when it comes to an entire equity market (and not an individual stock). A trend reversal is usually almost inevitable when “weak hands” have sold their positions and all of the negative news and data are fully discounted in market prices. Since there has been plenty of grounds for pessimism in recent years, the Chinese equity market may have traced out a bottom inflection point of that kind on the charts over the past several weeks.

The following well-known problems top investors’ list of concerns: the crisis-wracked real estate market, disappointingly weak post-pandemic economic growth, geopolitical tensions with the West, the government of China’s confidence-rattling crackdown on technology companies, and the country’s longer-term demographic challenges. The government’s timid efforts until recently to get economic growth and sentiment back on track likewise turned out to be hardly confidence-inspiring. Instead of serving up stimulus with a giant ladle as it has done so often in the past, Beijing put emphasis on the quality rather than on the quantity of economic growth. The undesired side effect of this cautious soft approach was a slip into deflation and attendant high real interest rates, which exert a braking effect on growth. In view of this toxic cocktail, some institutional investors already consider the Chinese equity market to be uninvestable. More than a few of them by now are even viewing China as a standalone asset class separate from the rest of the emerging economies. This fact as well is merely a reflection of investors’ increasing exasperation with Chinese stocks and is a strong contraindicative signal for countercyclical investors.

Deflation averted? | One swallow does not make a summer

Inflation rate in China

Sources: Bloomberg, Kaiser Partner Privatbank

…and sheer exasperation

But the evolution of prices on the Chinese equity market has probably exerted the biggest single impact on investor psychology in recent years. After all, Chinese stock prices have been falling in almost a straight line since February 2021, and every intermittent rebound has consistently fizzled out quickly. The MSCI China index shed around 60% of its value during the three-year downtrend up until its recent low point at the start of February. The only time the last 30 years saw even bigger drawdowns was during two systemic crises (during the Asian crisis in 1997/98 and the global financial crisis in 2007/08). However, the absolute share-price declines in the current crisis have erased USD 6 trillion worth of market capitalization (equal to roughly 35% of China’s annual economic output) and are thus even worse than the plunges during the previous crises.

To catch the falling knife, Chinese authorities have been using all of the instruments in the intervention toolbox since autumn of last year, hesitantly at first, but then with increasing activism. For example, to enhance the attractiveness of investing in stocks, China’s securities regulator amended rules governing dividend payments

But the evolution of prices on the Chinese equity market has probably exerted the biggest single impact on investor psychology in recent years.

and share buybacks. In addition, investment companies were instructed to stop acting as net sellers on the equity market. Then, after the turn of the year, Chinese authorities took aim at quantitative trading strategies and their “abnormal” trading behavior. To stop the net outflow of capital, they also restricted access to investment vehicles that invest in foreign markets. A ban on short-selling additionally followed shortly afterwards.

A burst without a bubble | Historical patterns match only in terms of price Chinese equity market today vs. Japan bubble

Sources: Bloomberg, Kaiser Partner Privatbank

What more can go wrong? | (Almost) everything is already priced in China CAPE ratio today vs. Japan bubble

Sources: Research Affiliates, Kaiser Partner Privatbank

A “big bang” approach, though, is very unrealistic.

By January at the latest, the psychological strain had likely become so distressful even among politicians that the notorious “national team” of investors was deployed. This group of state-backed sovereign wealth funds, investment firms, and insurance companies provided massive support to the market by buying ETFs to the tune of almost USD 60 billion in the space of a few weeks. The only other time the “national team” had intervened to a comparable extent – and with success –was during the stock-market crash in 2015/16. Another parallel with the crash at that time – and another sign

of capitulation by Chinese authorities – was the ousting of the head of the securities regulator in early February. However, a special form of capitulation on the part of Chinese retail investors had been observable beforehand: to evade censorship, they vented their anger on the US embassy’s account on Weibo (a platform similar to X (formerly Twitter)), posting over 100,000 critical comments full of frustration and sarcasm in view of the unremitting bear market. Amid a climate of abysmal pessimism and sheer exasperation, the interventions by the “national team” arguably delivered the clinching impetus for a turnaround. The major China indices have risen intermittently by around 15% since the start of February from a low which in all likelihood will stand for quite some time.

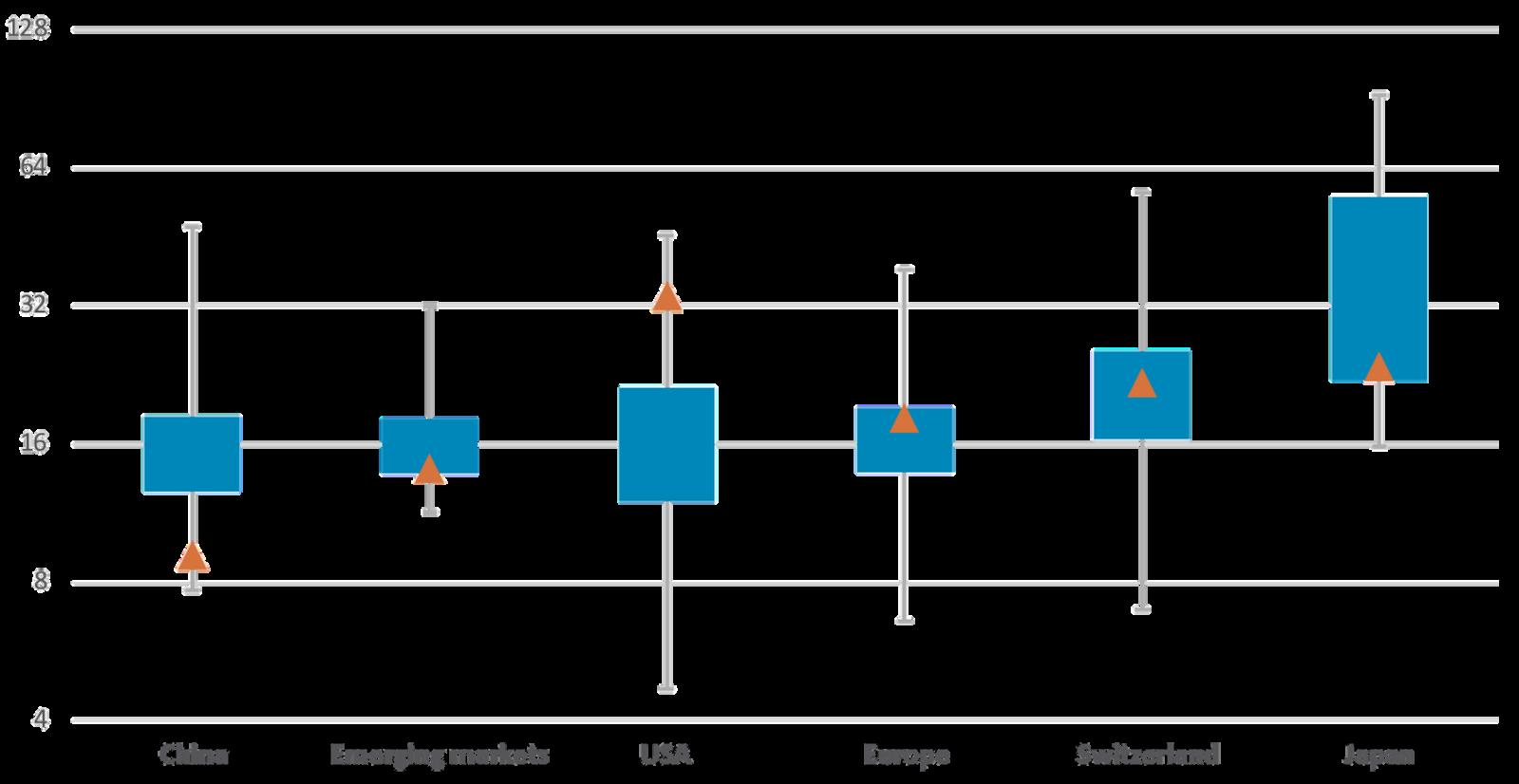

In the meantime, a technical selloff and depressed sentiment merely provide the necessary fertile ground. However, fundamental arguments are also needed to justify a trade. In the case of China, fundamental arguments are in place at the moment, and they relate to a stabilization in leading economic indicators and an easing of monetary policy by the People’s Bank of China, but especially to the Chinese stock market’s valuation. At the start of the descent at the beginning of 2021, China’s price-to-earnings multiple of 17x wasn’t necessarily at a bubble level. At its trough point, though, its P/E of 8x was at an absolute depression level and marked its lowest valuation in 20 years. China is currently trading at a massive discount even to emerging markets (MSCI Emerging Markets), which are already inexpensively valued in their own right. This means that the stock market is pricing in a full-blown economic disaster. If one doesn’t materialize (which we presume will be the case), the rally that commenced in February on the Chinese equity market could continue into the medium term.

We see three scenarios as alternatives to the worst case:

• „Whatever it takes“: Beijing gives up its hardline stance and resorts to the old playbook of unleashing massive economic stimulus. Given the ambitious, hard-to-reach targets for 2024 (economic growth of +5%, 12 million new jobs), the government will likely have fairly little tolerance for growth surprises on the downside. A “big bang” approach, though, is very unrealistic. Big-bang stimulus would certainly spark a small share-price explosion, but it’s questionable how sustainable it would be in the face of further mounting economic imbalances and risks in that event.

• „Muddling through“: Policymakers stay the course pursued in recent months and add further elements here and there to the colorful bouquet of select support measures. In this scenario, the growth path admittedly remains bumpy, but with time the stock market would acknowledge that reality is better than what’s priced in and would ditch its sense of doom and gloom. Developments in recent weeks suggest that the government of China is following exactly such a “muddling through” path. With a higher budget deficit than a year ago, Beijing plans, for example, to expedite key projects in strategically important sectors and to lend a financial hand to particularly feeble local governments. On the real estate market, instead of “red lines” there are now “white lists” bearing the names of property developers that are to be nursed back to health with generous loans. Xi Jinping’s declaration that “houses are for living in, not for speculation” did not turn up in Prime Minister Li Qiang’s recent government work report and appears to have been scrapped for the time being. Consumers, too, are to do their part to stabilize economic activity – cash-for-clunkers rebates are aimed at motivating consumers to make big-ticket purchases in order to boost growth with money tapped from household savings that have increased further in recent years.

• Strukturreformen: In the third scenario, which brings with it not only a cyclical rally, but also a significantly higher long-term valuation rerating on the equity market, Beijing no longer confines itself to just handing out Band-Aids. Instead, the government presses the reboot button and structurally improves the country’s economic prospects. There is no clear sign yet that the government intends to move in this direction. The focus under the “Invest in China” slogan thus far has been on measures aimed at winning back lost trust (also outside China). Foreign capital, for instance, has recently been allowed to acquire wholly-owned interests in financial institutions in China. Chinese authorities also say they intend to better address foreign companies’ concerns about issues such as market access to the services sector, cross-border data flows, and fair and equal participation in public procurement tenders. The fact that China at least still captivates many captains of industry was evident in March at the China Development Forum, where there was a crowd of dozens of top-level managers from the West in attendance. Despite widespread misgivings, the lure of doing lucrative business in China is still powerful.

Cheap, cheaper,… | …China

Comparison of CAPE ratios*

Sources: Research Affiliates, Kaiser Partner Privatbank

*Maximum/minimum = gray line; 2nd/3rd quartile = blue bar; current = orange triangle

Regardless of which of the paths described above that Chinese policymakers tread in the months ahead, the motto “don’t fight the national team” applies from a tactical standpoint.

…and for caution in the longer term

However, in contrast to many a captain of industry, numerous investors are much more skeptical about China’s long-term ability to institute reforms. They therefore are more likely than not to interpret the Chinese government’s latest charm offensive, which in recent months has also included a further removal of restrictions on travel to the country and a more conciliatory tone toward the USA, as just another opportunistic short-term initiative of the sort that has so often been observable in the past. To regain the trust of foreign investors and domestic businesses, political consistency and market-oriented structural reforms are needed. Moreover, the government must create an environment in which property rights are protected. A new “private enterprise law” is aimed exactly at addressing this issue and establishing the same competition conditions for all companies. Formal legislation could possibly revive Chinese entrepreneurial spirit. However, the damage to confidence that has been inflicted in recent years is severe, and it is even graphically well visible in the Policy Uncertainty Index. From an investment strategy perspective, this huge political uncertainty – also with regard to the handling of long-term problems such as demographics –is what argues more in favor of just a China trade rather than a dedicated investment in China.

Regardless of which of the paths described above that Chinese policymakers tread in the months ahead, the motto “don’t fight the national team” applies from a tactical standpoint. There is considerable upside potential on the Chinese equity market even in a scenario of mediocre economic growth and unambitious reform efforts. Foreign investors have continually withdrawn capital from China and have cut their exposure to the country in half over the last three years and now are distinctly underpositioned there. Despite the recent stabilization of stock prices, China remains one of the most popular short bets, according to a survey of fund managers conducted by Bank of America. In the past, whenever the Chinese equity market was valued as cheaply as it is today (at a price-to-earnings multiple of less than 10x), it rose by over 20% on average over the next twelve months. The downside potential, on the other hand, appears limited to a retest of the February lows (and the subsequent establishment of a double bottom). Against this backdrop, structured products with capital protection and a barrier beneath the recent lows are suitable vehicles for a China trade.

Kaiser Partner Privatbank

Kaiser Partner Privatbank with another record result

The full Annual Report of Kaiser Partner Privatbank can be found at: kaiserpartner.bank/2023

The word “volatility” frequently triggers negative associations in the minds of (retail) investors because it usually is uttered when volatility is high (and prices on financial markets are falling). Moreover, elevated market fluctuations are often a cause of investment mistakes. Whoever knows how volatility is calculated and understands its psychological effects can outwit it and achieve better investment results without fraying his or her nerves.

Stock prices to go

Have you already checked stock-market prices today?

Don’t worry, you’re in good company. Be it while waiting at a traffic light or in a traffic jam or while queuing at a coffee machine or paying a visit to the restroom, people here and there quickly pull out their smartphones, on which the current prices of their favorite stocks are only a tap away. The constant availability of

Stress-free from A to B | Less (observation) is more S&P 500 index (daily, monthly, and yearly observation)

Sources: Bloomberg, Kaiser Partner Privatbank

financial data gives many a person a daily dopamine rush. The rampant gamification of stock-market trading in recent years through apps like Robinhood and its ilk additionally stimulates the urge to press the refresh button. And even those who succeed in doing a long-lasting digital detox probably nonetheless still follow the market chatter at least on traditional channels like newspapers, television, or radio. However, looking away (or plugging one’s ears) would be the better option for many investors because investors’ perceptions of volatility contribute to causing their investments to perform much worse on average than even a simple investment in an index, just like a host of other investment mistakes do.

Although the objective (mathematical) annualized volatility of a market price is the same regardless of whether it is based on daily, monthly, or yearly observations, the human psyche and the way one subjectively perceives volatility behave differently. The less an investor actively pays attention to phases with high daily fluctuations and/or substantial price corrections, the less volatile and thus the less risky a market seems to him or her. Just how big the difference between frequent and sparse glances at the market can be is illustrated by the extreme example from “pandemic year” 2020: Whoever buried his or her head in the sand throughout that year, ignoring the day-to-day performance of financial markets, chalked up a pleasing gain of 16.3% at the end of the year in the example of the S&P 500 index. Such an out-of-touch investor would have simply slept through the intermittent drawdown of more than 30% that surely caused more than a few market participants headaches (and prompted some to sell in a panic). Of course, putting this advice to just look away into action is easier said than done because it’s highly likely that even those who are notoriously out of touch will receive the gloomy news anyway from his or her asset manager sooner or later. That’s because asset managers are required by law to inform a client when his or her portfolio loses more than 10% of its value within a single quarter.

What should investors do to dodge such annoying letters and to block out short-term market volatility? Would it be best to move to a desert island, bury your smartphone, and send stock-trading orders only as messages in a bottle? Although that is hardly doable in actual practice, the idea is built on a sound analytical foundation – whoever looks at his or her portfolio less frequently and has fewer opportunities to trade achieves better investment results.

“It is usually agreed that casinos should, in the public interest, be inaccessible and expensive. And perhaps the same is true of Stock Exchanges.”

JohnMaynard Keynes (1936)

With regard to observation frequency, Peter Mallouk, in his 2023 book titled “Money, Simplified”, notes that investors who look at their portfolios once a month have an average allocation of 59% bonds and 41% stocks. In contrast, investors who survey their portfolios only once a year are positioned with a much more growth-oriented bias with an allocation of 30% bonds and 70% stocks and are thus likely to earn better returns in the long run. Ed deHaan (Stanford University) and Andrew Glover (University of Wahington), in their 2023 study titled “Trading Hours and Retail Investment Performance,” show that investors who have less of an opportunity to trade also perform better. The starting point of their investigation is the fact that the United States stretches over four time zones and that active trading on the New York Stock Exchange takes place during different phases of daily life in those four zones. For example, the NYSE’s opening bell (at 9:30 AM) and closing bell (at 4:00 PM) ring on the East Coast during most people’s productive waking hours while the average investor on the West Coast is usually still in bed when the stock exchange opens (6:30 AM) and is at lunch when the closing bell rings (1:00 PM). The authors found that investors in western time zones, for whom standard trading hours are less convenient, pay higher capital gains taxes than investors in eastern time zones do (because they earn higher capital gains). Specifically, the annual investment performance increases by 3.9 percentage points in each time zone moving westward. To reduce the impact of any influencing factors (economic, education, demographic, health status) on this statistic as much as possible, the performance differential between counties immediately adjacent to an interior time zone border was also measured. Here, too, the discrepancy was significant, with capital gains being 2.9 percentage points higher on average just west of a time zone border. DeHaan and Glover see two different causes of the substantial outperformance by “westerly” investors: they trade less frequently, and they are invested less in single stocks and are more invested in equity funds. In a nutshell, their study shows in detail that the more retail investors are exposed to the daily volatility of the stock market and the more they are able to participate in it, the worse their investment portfolios perform. Retail brokerages like Robinhood, which recently launched the Robinhood 24-Hour Market (thus enabling 120 hours of non-stop trading a week), clearly haven’t done their investors any favors by extending stock-market trading beyond the New York Stock Exchange’s floor trading hours. The more that the focus of investor’s attention gets steered to the ever shorter term, the more that investors lose sight of the fact that stocks always generate positive returns over a sufficiently long time horizon.

Sources: Bloomberg Intelligence, Kaiser Partner Privatbank

Since the “desert island” solution described above is probably workable only for very few, if any, of us, this raises the question of to what extent an investor can lower the actual – or at least the perceived – volatility of his or her portfolio in a different way in order to invest with less stress, fewer mistakes, and thus ultimately with more success in the final accounting. One way to reduce volatility while boosting performance at the same time is to blend in private-market assets (private equity, private credit, private real estate, infrastructure). Private-market assets often face criticism that they undergo valuation appraisals with a substantial time lag and that their valuations are artificially inflated. The latter accusation can be refuted with facts, but the criticized reporting lag really does exist. It varies between one and twelve months in the case of private equity funds (which report most frequently with a three- to four-month lag, according to the CEM benchmarking study). However, from an investor psychology perspective, the non-uniform and time-delayed valuation reporting is more a positive feature than a bug because it automatically results in an aggregation of different valuation points and smooths the performance of an investor’s diversified private-market portfolio.

An additional smoothing effect with private-market assets comes from the fact that experts estimate their valuations on the basis of models that tend to be inertia-prone. All in all, both factors cause the volatility of private-market assets to be much lower than the volatility on public equity markets, in terms of both felt perceptions and what an investor actually sees in his or her portfolio. Just how strongly the two factors affect the smoothing of performance and volatility can

Turning an apple into an orange | Smoothed stock-market performance is similar to that of private equity S&P 500 index, indexed (market price and adjusted variants)

be ascertained by means of a little reverse experiment in which we apply both smoothing mechanisms to the S&P 500 index. First we calculate Wall Street analysts’ estimated fair value for the US blue-chip index using a bottom-up approach. Then we build in the reporting lag specific to the private equity asset class. This turns the original S&P 500 index with an annualized volatility of 15% into an adjusted version with a volatility of just 5%, resulting in a massive two-thirds reduction in volatility.

Sources: Bloomberg, Kaiser Partner Privatbank

Conclusion: Volatility has a nasty reputation, and not without good reason. The higher the volatility perceived by an investor, the more often that investor makes mistakes and the more frequently that he or she is positioned overly defensively. Deliberately looking away would be a simple but very successful method of dealing with this problem. But since precious few people have what it takes to follow this strategy, an alternative recommendation is to blend private-market assets into a classic portfolio. Although private-market assets are just as volatile as stocks in theory, what’s relevant is the habitual pattern of smoothed performance and attenuated volatility perceived in an investor’s mind and actually visible in portfolio reports, which helps an investor to stay disciplined and to ride out tricky market phases.

This document constitutes neither a financial analysis nor an advertisement. It is intended solely for informational purposes. None of the information contained herein constitutes a solicitation or recommendation by Kaiser Partner Privatbank AG to purchase or sell a financial instrument or to take any other actions regarding any financial instruments. Furthermore, the information contained herein does not constitute investment advice. Any references in this document to past performance are no guarantee of a positive future performance. Kaiser Partner Privatbank AG assumes no liability for the completeness, correctness or currentness of the information contained herein or for any losses or damages arising from any actions taken on the basis of the information in this document. All contents of this document are protected by intellectual property law, particularly by copyright law. The reprinting or reproduction of all or any parts of this document in any way or form for public or commercial purposes is expressly prohibited unless prior written consent has been explicitly granted by Kaiser Partner Privatbank AG.

Publisher: Kaiser Partner Privatbank AG Herrengasse 23, Postfach 725 FL-9490 Vaduz, Liechtenstein HR-Nr. FL-0001.018.213-7

T: +423 237 80 00, F: +423 237 80 01 E: bank@kaiserpartner.com

Editorial Team: Oliver Hackel, Senior Investment Strategist Roman Pfranger, Head Private Banking & Investment Solutions

Design & Print: 21iLAB AG, Vaduz, Liechtenstein