In a Nutshell

Our view on the markets

No landing?

Economic activity data have frequently been surprising on the upside lately while inflation has not receded as rapidly as hoped. A “no landing” scenario nevertheless is not a plausible one. There will either be a soft landing on the back of rapid disinflation, or the US Federal Reserve will make a monetary policy mistake by keeping interest rates too high for too long. A recession in 2024 is not yet off the cards.

Cash is king

After a rally, a correction often lurks around the corner, and in fact, the risk/reward tradeoff on equity markets has worsened in the wake of the recent share-price gains. Bonds are thus becoming even more interesting from a relative value standpoint in view of their high yields. But attractiveness varies even within the fixed-income sector. Thanks to high interest rates entirely without any risk, cash is king now more than ever.

A year of war and no end in sight

After a year of war in Ukraine, a swift resolution of the conflict seems a remote prospect. Neither Ukraine nor Russia is likely to emerge the clear victor. However, none of the other conceivable scenarios has a prob-

ability above 50% of materializing either. The armed conflict in the heart of Europe threatens to turn into a proxy war between the USA and China during the course of this year.

Central banks in the red

The era of ultralow and negative interest rates has been over since last year. This sea change means not just higher yields for investors, but also imposes massive losses on central banks. Although central banks can’t “go bankrupt” and are able to operate even with negative equity, the red ink on their balance sheets nonetheless has consequences. A long string of losses could endanger central banks’ independence.

Ask the experts

Has the recession been called off or merely postponed? Is the proverb “Don’t Fight the Fed” still valid? Can European and Chinese stocks continue to outperform? Are (US) government bonds still a valuable diversifying element in an investment portfolio? And why should a person continue to invest in stocks when a return of 4% to 5% p.a. can be earned with short-term investment-grade bonds (denominated in US dollars)? You’ll find our answers to these questions in our quarterly Q&A.

In recent years, quantitative easing (QE) was frequently cited as the main driver of the equity bull market. There accordingly was a lot of insecurity surrounding the inevitable end of QE. The last 15 months have put the theory that stocks are no longer capable of rising without the aid of liquidity injections to the test. The combined assets of the five most important central banks have shrunk by 6% since May 2022, but the global equity market had already plummeted by 18% over the five months prior to May 2022. The world equity index, in turn, has risen by 20% since October 2022 despite the continued shrinking of central banks’ balance sheets through quantitative tightening (QT), which is not visible on the edge of the chart solely due to securities purchasing by the Bank of Japan and currency effects. The psychological effect of the securities purchases likely had a bigger impact than their actual volume did. The reverse now applies: as long as the withdrawal of liquidity remains gradual and predictable, it shouldn’t pose a major risk to the market.

Macro Radar

Taking the pulse of economic activity

Economic activity data have frequently been surprising on the upside lately while inflation has not receded as rapidly as hoped. Although the risk of an imminent recession has diminished, postponed does not mean canceled, particularly since central banks threaten to overtighten the interest-rate screw.

Upside macro surprises

The US Economic Surprise Index rose in February to its highest level since summer of last year. Labor market data for January (unemployment rate at a 54-year low) and retail sales figures numbered among the surprises to the upside. Meanwhile, growth projections for 2023 have been revised upward again. The risk of an imminent recession appears to have been averted. The Conference Board’s index of leading economic indicators – a key recession signaler – is also showing an easing of recession tension: four of the index’s ten subcomponents have risen over the last six months. In the past, recessions consistently were over at this point. Nevertheless, a recession later on (i.e. next year) isn’t yet entirely off the cards, in our view.

No landing?

The recent increasingly propounded “no landing” scenario, under which inflation in the USA stays lastingly elevated because the Federal Reserve does not raise interest rates high enough, is improbable in our opinion. There will either be a soft landing on the back of rapid disinflation in the months ahead coupled with a quick cessation of rate hiking, or there will be a hard landing because inflation proves too sticky and US central bank-

ers can’t or won’t stop raising interest rates until they have sufficient evidence that inflation is approaching the 2% mark. The last few weeks of robust economic data and stubborn inflation tend to point to the latter scenario. A monetary policy mistake by the Fed remains one of the major macroeconomic risks this year.

First too accommodative, soon too restrictive

The European Central Bank also runs a risk of overtightening the interest-rate screw in the months ahead. ECB President Christine Lagarde has repeatedly sent a clear message in recent weeks that a practically already telegraphed 50-basis-point policy rate hike for the Eurozone in March will be followed by several additional ones. Speculation, in the meantime, now ranges to a policy-rate projection of up to 4%. There is still a short window of opportunity left to pivot to a less restrictive monetary policy course. The disclosure of new inflation forecasts at the ECB meeting in March (or in June at the latest) could present an occasion for such a pivot. We think that the ECB is overestimating the elevated inflation’s stickiness (it sees inflation still at an average of 3.4% in 2024).

Satellite View

Geopolitical heat map

After a year of war in Ukraine, a swift resolution of the conflict seems a remote prospect. Neither Ukraine nor Russia is likely to emerge the clear victor. However, none of the other conceivable scenarios has a probability above 50% of materializing either. The armed conflict in the heart of Europe threatens to turn into a proxy war between the USA and China during the course of this year.

A year of war and no end in sight

Late February marked the first anniversary of the war between Russia and Ukraine. It by now unquestionably qualifies as the most cataclysmic military conflict since the Second World War, and it is bound to leave a lasting imprint and permanent changes on Europe and the world. A bloody war of attrition has been playing out on the battlefield for months now. Observers expect Russia to widen its current offensive in the Donbass region in the weeks ahead. Ukraine looks set to continue concentrating on defense for now and on planning a spring counteroffensive. The two diametrically opposed extreme scenarios of a victory by Russia or a triumph by Ukraine are both very unlikely to come true as things currently stand. Russia’s military capabilities have been weakened too much to conquer all of Ukraine. Ukraine, on the other hand, would need much more Western weaponry (and at a much faster pace) than the West is prepared to supply. However, none of the other conceivable scenarios has a probability above 50% of materializing either. The likeliest development over the course of this year is continued attrition on both sides without any decisive breakthroughs.

Russia and China versus the West?

Perseverance and external support are bound to be the clinching factors for success or failure in the long run. Russia is at an advantage in terms of population size (140 million vs. 40 million) and potential for recruiting soldiers. Moreover, the armed conflict is playing out exclusively on Ukrainian soil and is steadily degrading Ukraine’s industrial base and the country’s civil and military infrastructure. On the other hand, Ukraine’s population has very high morale, whereas another mass mobilization in Russia could spark growing public discontent. Ukraine can upgrade the quality of its armaments with help from the West, whereas Russia is (officially) barred access to Western technology. Furthermore, ever stricter sanctions have thrust Russia’s economy into a downward spiral with no foreseeable bottom. After the Western world had already pledged more than USD 155 billion worth of military and civilian aid to Ukraine, US President Joe Biden underscored that commitment during a visit to Kyiv in late February. Ukraine can continue to count

on solid support from the West this year and next, but as the US presidential election in November 2024 draws closer, there is an increasing risk that Western countries may eventually lose patience and press for a resolution of the conflict. Recent news reports that China may be preparing to provide military support to Russia additionally heightens geopolitical risk both locally and globally. Protracted armed conflict in Ukraine could expand into a proxy war between the USA and China. That would further intensify and accelerate the decoupling of China from the West that is already underway anyhow.

The economic wreckage

After more than twelve months of war in the heart of Europe, the economic damage it has wreaked (on Europe) can be quantified by now, albeit only as preliminary rough estimates. The eurozone is facing drastically elevated general price levels particularly as a result of a huge spike in energy prices caused by radi-

cally reduced natural gas imports from Russia. The inflation rate in the Eurozone at the end of 2024 looks set to be at least eight percentage points higher than under the scenario with no war. The adverse impact of the war is likely to shave around three percentage points off GDP growth over the period through end2024. The biggest negative effects on economic activity are probably already behind us or will be digested in the quarters ahead. However, Russia still has levers and ways with which to hit back at Western sanctions. A cutback in Russian petroleum production, for instance, could put upward pressure on world oil prices and stoke inflation in the Eurozone.

After more than 12 months of war in the middle of Europe, its economic damage can now be quantified

Margins remained under pressure accordinglysince a high of 13% in summer 2021, they have now fallen for the sixth time in a row (to 11.3%)

Asset Allocation

Notes from the Investment Committee

After a rally, a correction often lurks around the corner, and in fact, the risk/reward tradeoff on equity markets has recently worsened. This further intensifies the competition posed by bonds as a result of their high yields. But attractiveness varies even within the fixed-income sector. Thanks to high interest rates entirely without any risk, cash is king now more than ever.

Asset Allocation Monitor

Cash

Fixed Income

Sovereign bonds

Corporate bonds

Microfinance

Inflation-linked bonds USA

High-yield bonds

Emerging-market bonds

Emerging markets

Alternative Assets

Insurance-linked bonds Gold

Convertible bonds

Duration

Currencies

US dollar

Swiss franc

Euro

British pound

Equities: Advantage Europe

• In the wake of a three-month-long rally, the air became much thinner on equity markets in February. While European markets drifted sideways, share prices on US stock exchanges dipped markedly. The S&P 500 index’s uptrend channel in place since October 2022 is a current topic of debate in the USA. A breach of the support zone would be a first sign of weakness and would put a potential retest of last year’s lows on the agenda. The recently observed outperformance by European markets could continue in the months ahead (see also “Ask the experts” on page 16).

• The recent flurry of macro data surprises to the upside was no longer supportive for the US markets in February. On the contrary, it portends that the US Federal Reserve’s interest-rate path is headed higher for longer, and the accordingly higher discounting factors are putting downward pressure on stock valuations. The earnings reporting season for the fourth quarter of 2022 also hardly generated any positive impetus. High inflation enabled corporations to boost their profits on aggregate, but when the energy sector is stripped out, earnings at US large-cap compa-

Real estate

Hedge funds

Structured products

Private equity

Scorecard

nies actually contracted by around 10%. Profit margins accordingly remained under pressure and have now fallen for six consecutive quarters (to 11.3%) since peaking at 13% in summer 2021. Earnings momentum may also remain negative in the near future. Many companies issued cautious guidance regarding US consumer spending.

• From a behavioral finance perspective as well, stocks at least no longer have a tailwind behind them at their current price levels. Not only has sentiment returned to normal (see “Chart in the Spotlight”), but so has investors’ positioning. Institutional investors in the USA have significantly reduced their cash allocations in recent weeks while trend-following strategies (CTAs)

have flipped their positions from short to long. Meanwhile, a short squeeze has forced hedge funds to pare back their bets on falling share prices for particularly speculative stocks. So, further (buying) demand is now missing from this side as well in the near term.

Fixed income: Cash is king

• Many analysts consider 2023 the year of the comeback for bonds, and investors see it the same way. They invested a record-breaking sum of more than USD 20 billion in investment-grade corporate bonds around the world in January and

February. At yields north of 5%, this asset class is indeed interesting, particularly in the USA. But it all depends on an investor’s time horizon. Now that credit spreads have tightened further recently and given the prospect that the Fed may continue to raise the federal funds rate and keep it high for longer than expected, immediate upside potential for bond prices appears constrained. Meanwhile, bonds are also facing competition from moneymarket investments. Cash is king now more than ever given the high rate of interest amid an environment of elevated economic uncertainty.

With yields above 5%, the asset class is indeed interesting, especially in the USA

Gold demand from central banks and sovereign wealth funds up twoand-a-half-fold

• (US) high-yield bonds are also currently trading at more attractive yield levels compared to the average for the last five or ten years. Here too, however, spreads over (safe) government bonds have tightened since the start of this year and are vulnerable to a correction in the event of deteriorating economic data. Any entry into the high-yield segment should therefore be done in a staggered manner. This strategy is likely to pay off for investors over an extended time horizon.

Alternative assets: Semi-liquid inertia

• Stocks posted a very good start to 2023 marked by high single-digit gains. Semi-liquid private-market funds could not keep up with that pace. Their unit price performance tends to be slow-acting by design. Their delayed reporting also contributes to a relative underperformance during times of strong equity markets. This circumstance can cause cognitive dissonance among some investors. They, however, should focus on the long-term nature of their investment strategy. Over the course of the year, the performance differentials are not only bound to diminish, but private-market assets are even likely to resume delivering a disproportionately high contribution to portfolio performance. We see good investment opportunities at the moment particularly in the private-equity secondary market and in the private credit space.

• According to data from the World Gold Council, demand for gold on the part of central banks and sovereign wealth funds surged two-and-a-halffold year-on-year in 2022, presumably on the back of increased interest mainly on the part of Russia and China but also other countries in diversifying away from the US dollar. Public-sector demand for gold looks set to stay robust in the future. Investment demand for bullion, however, may remain

Pessimists were in the majority among US retail investors for a record 44 weeks in a row. The resulting underinvestment in stocks was a driving force behind the equity rally since autumn of last year. Against their convictions, many investors had to jump on the moving train to keep themselves from falling too far behind their respective benchmarks or peer groups. Sentiment has since returned to normal in the meantime, but there are no traces of euphoria. In fact, the bear camp already started to grow larger again in late February. Moreover, more than 60% of US fund managers consider the recent share price advances merely a bear market rally, and more than a few analysts expect stock prices to fall to new lows during the course of this year. So, the chances are good that things won’t turn out that badly. Only in the event of a recession would we too consider a drop below last year’s lows practically inevitable this year.

weak because gold has lost attractiveness as a safe haven relative to government bonds (and cash).

Currencies: The SNB needs to up the ante

• EUR/USD: Europhoria reached an interim climax in early February uncoincidentally at the psychologically important 1.10 mark against the US dollar. Since then, US macroeconomic data have surprised on the upside, and the market has come to the opinion that the Fed has caught back up to the European Central Bank with regard to its further rate-hiking potential in the months ahead. From a longer-term perspective, though, the euro remains substantially undervalued. We expect the euro to embark on another upleg after the current consolidation phase.

• GBP/USD: Among the world’s major central banks, the Bank of England is the one facing the most precarious economic climate. After having raised its policy rate by 50 basis points in early February to 4%, the BoE is probably close to the top of the flagpole now. This means that it will soon fall behind the Fed and the ECB from a relative interestrate standpoint. The British pound’s underperformance in recent weeks already reflects this.

• EUR/CHF: The EUR/CHF exchange rate’s excursion above parity turned out to be a temporary blip for the time being. The markets these days appear to be betting on more than just a small (final) rate hike by the Swiss National Bank. SNB President Thomas Jordan will, in fact, likely try hard to avoid overly dovish rhetoric and attendant overly hesitant actions because an excessively large interest-rate differential between the euro and the Swiss franc and resulting currency weakness would be counterproductive in the fight against inflation.

Chart in the Spotlight

The bears have thrown in the towel (for now) | The window of (countercyclical) opportunity is closing Bulls and bears among US retail investorsKaiser Partner Privatbank joins SIX Digital Exchange

SIX Digital Exchange (SDX), Switzerland´s first fully regulated FMI for digital assets, welcomes Kaiser Partner Privatbank AG as the first Liechtenstein based member on its CSD platform.

As part of the strategic effort to grow the network of participating members, SDX welcomes Kaiser Partner Privatbank as new member on its Central Securities Depository (CSD), the first SDX member bank from Liechtenstein.

According to David Newns, Head of SIX Digital Exchange: “It is a great moment for SDX that Kaiser Partner Privatbank decided to join our CSD platform as an issuer and paying agent of digital securities. Kaiser Partner Privatbank´s services enrich SDX’s CSD offering and open up new opportunities for asset managers, family offices, and investors.”

“It is our mission to be the pioneer in offering institutional clients globally innovative, trusted, and efficient financial markets infrastructure and services for digital assets. Partnering with strategic members such as Kaiser Partner Privatbank represents a key step in building our platform”, said David Newns.

Christian Reich, CEO of Kaiser Partner Privatbank:

“Our existing services for intermediaries are a key element in meeting our clients’ complex financial needs, as they enable clients to finance investments or make trading of illiquid assets possible. SDX’s CSD offering will help us to meet these needs even better by improving efficiency throughout the investment process. Kaiser Partner has always strived to work with best-in-class partners to offer clients the best solutions possible. We are happy to extend our long-standing relationship with SIX Group by this new membership and to grow our intermediary business together with SDX.”

About SDX

SDX is licensed by Switzerland’s financial market regulator, FINMA, to operate an Exchange and a Central Securities Depository (CSD). SDX offers issuance, listing, trading, settlement, servicing, and custody of digital securities. SDX is committed to working with partners, members, and clients to promote and build out a new market structure for digital assets globally.

The Swiss National Bank (SNB) announced a provisional record annual loss of CHF 132 billion at the beginning of January

Theme in Focus

Central banks in the red

The era of ultralow and negative interest rates has been over since last year. This sea change means not just higher yields for investors, but also imposes massive losses on central banks. Although central banks can’t “go bankrupt” and are able to operate even with negative equity, the red ink on their balance sheets nonetheless has consequences. A long string of losses could endanger central banks’ independence.

A sea change for commercial banks and central banks

Banking stocks have ranked among the relative winners on the equity market in recent weeks and months. After a multiyear-long dry spell, net interest margin prospects for commercial banks have brightened considerably, and investors are finally seeing light at the end of the tunnel again, particularly for financial institutions in Europe that had long been plagued by ultralow interest rates. But the increase in policy interest rates and bond yields also has consequences for central banks – consequences that are neither trivial nor entirely unproblematic. Central banks, in fact, are piling up losses. The Reserve Bank of Australia (RBA) recorded a 2022 book loss of 37 billion Australian dollars, which more than wiped out the central bank’s equity. The Swiss National Bank (SNB) in early January reported a record preliminary loss of 132 billion francs for 2022. Last September, the central bank of the Netherlands notified the country’s government in a letter that it projects net interest losses amounting to a potential EUR 9 billion for the years 2023 through 2026. Even the US Federal Reserve has no longer been able to remit weekly billion-dollar transfers to the US Treasury since autumn 2022. Instead, a debt obligation to the US Treasury (a

liability that the Fed recognizes as a deferred asset) has been growing on the Fed’s balance sheet since then. The Fed eventually will have to pay this liability sometime in the future (when it resumes generating profits).

The mechanics of the losses

The causes of the transformation from profit-generating machines to loss-making sinkholes sometimes differ in the details from one central bank to another. By and large, though, the primary cause lies in the massive expansion of central-banks’ balance sheets over the last decade, which is now becoming a problem. For instance, central banks by now have had to resume paying interest on the commercial bank deposits on the liabilities side of their balance sheets. Those deposits likewise have massively accumulated in recent years. This interest expense in the meantime now substantially exceeds the interest income that central banks book on the assets side of their balance sheets through their bond holdings because those bonds were purchased in the past mostly at considerably lower or sometimes even negative yield levels. Since the interest expenses will increase further in the months ahead as policy rates climb higher while interest income only looks set to rise comparatively slowly, net interest losses for now will continue to mount for quite some time yet. The mechanics of the losses in the example of the Bank of England (BoE) feature an additional driver of losses. In contrast to the Fed (and soon also the ECB), the BoE in its quantitative tightening operations is not only running off securities holdings without replacing them, but is also selling bonds that it had previously purchased at much higher prices and thus is actively incurring realized losses. The situation facing the SNB and the RBA looks a bit different. They rank among the few central banks that use the mark-to-market method of valuing their securities holdings. This explains their enormous book losses caused by last year’s poor equity- and bond-market performances.

Does it matter?

Are losses by central banks really a problem, or are they a non-event? The fact is that central banks remain completely capable of conducting monetary policy even if

losses entirely wipe out their equity or turn it negative. Theoretically, a central bank can print as much money as it wants to at any time. It cannot become insolvent or go bankrupt. So, in theory, there is nothing that forces a central bank to repair an overleveraged balance sheet. One not-so-distant example of an overleveraged central bank is the Czech National Bank, which reported negative equity from 2002 through 2013 due to valuation writedowns on its sizable foreign currency reserves. Even the German Bundesbank, which was famously lauded by many for its commitment to a policy of stability, was technically overleveraged in the early 1970s because its losses exceeded its equity.

A feeble central bank, however, is not entirely without repercussions. Although it is not necessary to recapitalize overleveraged central banks, taxpayers are affected indirectly if central-bank losses lead to a reduction in or a cessation of profit distributions. This is exactly what has happened in the current example involving the Swiss National Bank. The gigantic losses at the SNB mean that Switzerland’s federal and cantonal governments have to completely forgo up to six billion francs

this year. An extended string of losses would arguably present an even bigger problem. If the general public perceives a chronically overleveraged central bank as posing a devaluation risk to the national currency, this could jeopardize the central bank’s reputation. If policymakers then feel compelled to recapitalize the central bank to curb the reputation damage, this not only could endanger the central bank’s independence, but would also hurt its credibility as a guardian of the stability of the value of money.

Conclusion: Losses at central banks will continue to mount in the months ahead, but this does not necessarily constrain their ability to operate. However, the prospect of massive losses could prompt the Fed and the ECB, for example, to shrink the amount of assets on their balance sheets faster than originally planned (which would have the effect of further tightening monetary policy). In a scenario of a long string of losses, recapitalizations could cause central banks to lose credibility and autonomy. This issue is unlikely to quickly vanish from the agenda.

Ask the experts

What moves our customers (and the financial markets)

Economic activity: No natural gas shortage in Europe and an overheating job market in the USA – has the recession been called off?

Kaiser Partner Privatbank: Electricity and natural gas prices have fallen, peak inflation is in the rearview mirror, and the “reopening” of China’s economy promises to give a boost to growth in the quarters ahead. This has banished the specter of a recession in Europe. After hitting bottom last autumn, business (and consumer) sentiment has since improved significantly (or at least has found a floor). More and more economists are scrapping their recession forecasts and raising their growth projections for 2023. GDP growth data for the Eurozone for the fourth quarter of 2022 already came in better than expected with a mini-uptick of 0.1%. Only Germany saw a surprising downward revision for the final quarter of last year and might actually experience a “technical” recession this winter.

So, of course, one cannot simply draw the curtain over the recession question. It continues to be a valid one for the US economy and remains a perplexing mystery for the analyst community because established macro indicators like the US yield curve and the Conference Board’s leading indicators index continue to signal a heightened risk of a recession. Announcements of mass layoffs, particularly at big tech firms and in the financial sector, appear to fit with this picture. But it is con-

tradicted by very robust US labor market data (which are prone to undergo substantial revisions, though): 514,000 new jobs were created in January while the US unemployment rate fell to a 54-year low (3.4%). The number of job openings recently resumed rising while initial unemployment claims decreased. This conflicting set of data is also reflected in the recession projections in the Wall Street Journal forecaster survey. In the latest survey, the expected probability of a recession within the next 12 months ranged widely from 10% to 100%, but the median projection stood at a relatively high 65%, which means that the consensus does not believe in a soft landing.

We, however, tend to side with the optimists. Our expectation expressed in our outlook for 2023 remains intact: a recession looms in the USA probably later than the majority is anticipating and is likely to turn out relatively mild. A recession most likely is unavoidable in the end because the many uncertainties and numerous variables (and a poor track record) make it too hard for the US Federal Reserve to keep on finely recalibrating its monetary policy, but it will take some more time before a recession arrives. There are currently 1.9 job openings for every unemployed person in the USA, and almost every industry is reporting more vacancies than usual. Anyone who was laid off recently and/or is currently looking for work will probably find a new job in the quarters ahead with relative ease. Moreover, US

households are still sitting on USD 1.4 trillion of excess savings from the pandemic. Based on the current personal saving rate, it would take 15 months to completely use up those savings. The US consumer-spending engine therefore won’t start to sputter so quickly. However, in mid-2024, the probability of a recession is bound to surge because the knock-on effects of the Fed’s ratehiking cycle should become increasingly palpable then. Moreover, a scenario in which the current phase of disinflation is followed by a second wave of inflation cannot be ruled out. The reopening of China’s economy could exert an inflationary impact, as could a future return to rising real wages (thanks to the current pullback in inflation). The Fed would then be forced to keep interest rates at a very restrictive level for a longer time. This scenario would automatically result in a sharper rise in unemployment and a recession.

Monetary policy: Fixed-income market participants are speculating that the US policy rate will pull back soon. Isn’t the proverb “Don’t Fight the Fed”?

Kaiser Partner Privatbank: The US Federal Reserve and the financial market were long in disagreement. Financial market participants specifically were anticipating that the Fed would revert to cutting interest rates by as early as the second half of this year either because inflation will recede very quickly in the months ahead or because the USA will soon slip into a recession. But the very robust January employment market data and the slower-than-hoped-for subsiding of inflation recently prompted them to change their thinking. So, have they decided not to fight the Fed after all? Fed officials’ dot plot sees the federal funds rate at 5.1% at the end of 2023 (median estimate). Current trading in federal funds futures contracts indicates that financial market participants now likewise see the policy rate at 5.1% in December, but they expect it first to climb much higher than that level this summer. The market prices basically imply that the interest-rate level temporarily will (needlessly) be raised too high and that the Fed will thus make a monetary policy mistake. There is also agreement that interest rates will soon start to fall again and that the current level is already well in restrictive territory. The Fed’s median projection sees the US policy rate at just 4.1% at the end of 2024 while the financial market’s expectation is situated not far from that forecast estimate.

So, the financial market is not necessarily positioned against the Fed and its monetary policy anymore. Investors should position themselves the same way because the best way right now to interpret the motto “Don’t Fight the Fed” is as follows: The Fed is still in the middle of a ratehiking cycle, and the stock-market rally in recent weeks has been thwarting its efforts to make the monetary environment more restrictive. In fact, various financial conditions indices have recently been showing a substantial easing. Investors should contemplate doing at least some profittaking because the already small probability of a soft landing by the US economy won’t come true unless the Fed immediately reverses course. But that’s not the Fed’s

plan. If interest-rate cuts do come sooner or later, they too wouldn’t necessarily be a reason for investor euphoria because if a recession actually turns out to be the cause of falling policy rates in the future, a dip to new share-price lows likely lies ahead on equity markets.

Headed backwards soon? | The financial markets expect the Fed to reverse course soon (Implicit) expected change in federal funds rate, in basis points

Sources: Bloomberg, Kaiser Partner Privatbank

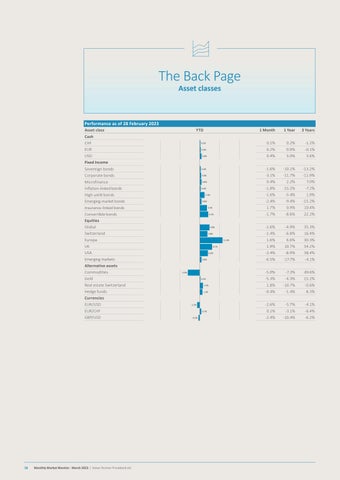

The Back Page

Asset classes

On our agenda

• March 4 to March 11: “Two sessions” in China

The “two sessions” – the National People’s Congress and the Chinese People’s Political Consultative Conference – mark the official start of President Xi Jinping’s third term in office. High-ranking officeholders in the government and the Chinese Communist Party will change, and Xi’s position of power is likely to be strengthened. Now that China has declared victory in the battle against COVID-19, all efforts will be focused on kick-starting the country’s economy. New economic stimulus programs are likely to be announced.

• March 10: Bank of Japan interest-rate decision

Haruhiko Kuroda, the engineer of “yield-curve controls”, is unlikely to spring any surprises at his last meeting as the governor of the Bank of Japan. He likely will leave it up to his successor, Kazuo Ueda, to wean Japan off ultra-monetary accom

modation. Ueda’s first policy meeting as the head of the BoJ is scheduled for April 27–28.

• March 10: US labor market data

In the wake of surprisingly robust January data showing more than 500,000 new jobs created and the lowest unemployment rate in 54 years (3.4%), the financial markets are excitedly awaiting the February numbers. Another round of upbeat data would make a recession in the near term (even) less probable, though so would a speedy end to rate hikes.

This document constitutes neither a financial analysis nor an advertisement. It is intended solely for informational purposes. None of the information contained herein constitutes a solicitation or recommendation by Kaiser Partner Privatbank AG to purchase or sell a financial instrument or to take any other actions regarding any financial instruments. Furthermore, the information contained herein does not constitute investment advice. Any references in this document to past performance are no guarantee of a positive future performance. Kaiser Partner Privatbank AG assumes no liability for the completeness, correctness or currentness of the information contained herein or for any losses or damages arising from any actions taken on the basis of the information in this document. All contents of this document are protected by intellectual property law, particularly by copyright law. The reprinting or reproduction of all or any parts of this document in any way or form for public or commercial purposes is expressly prohibited unless prior written consent has been explicitly granted by Kaiser Partner Privatbank AG.

Publisher: Kaiser Partner Privatbank AG

Herrengasse 23, Postfach 725

FL-9490 Vaduz, Liechtenstein

HR-Nr. FL-0001.018.213-7

T: +423 237 80 00, F: +423 237 80 01

E: bank@kaiserpartner.com

Editorial Team: Oliver Hackel, Senior Investment Strategist

Roman Pfranger, Head Private Banking & Investment Solutions

Design & Print: 21iLAB AG, Vaduz, Liechtenstein