Japan MarketDynamics

Author Research Manager HarukaMatsumaru

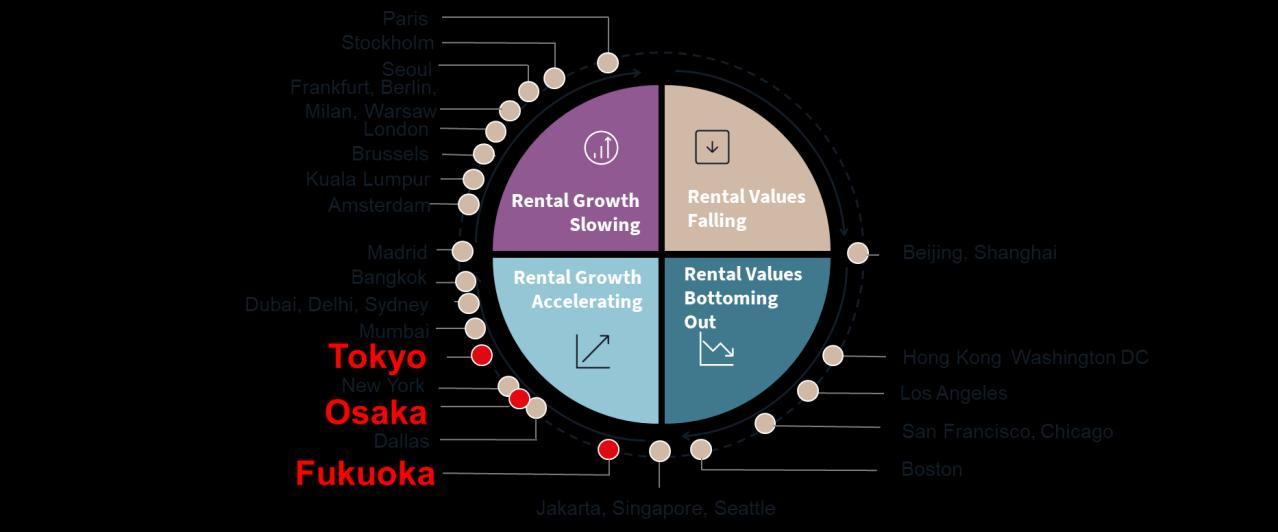

The Osaka-Umeda area, western Japan's largest transportation hub,has undergonesignificant redevelopment inrecentyears.The largest-ever new office supply in the area's history was witnessed in 2024, with five Grade A buildings* delivering a total net lettable area (NLA) of 210,000 sqm Despite initial concerns about rising vacancyanddecliningrents,robustdemandsuccessfullyabsorbed thismassivesupply,maintaining marketstability

The most notable redevelopment in Umeda is "Grand Green Osaka". This mixed-use project, situated on a vast site north of JR Osaka Station,encompassesoffices,retail,hotels,residential units, and MICE facilities. The office area of the South Building opened

first in March 2025, with Grand Green Park Tower and Grand Green Gate Tower delivering approximately 110,000 sqm of new office space

Particularly noteworthy is the integration with "Umekita Park," 4.5hectare park facing Osaka Station Since the COVID-19 pandemic, the importance of enhanced common areas and comfortable surroundings has increased as factors promoting office returns

The park's presence serves as a crucial element motivating employees to return to the office Additionally, prime office locations contribute to corporate brand image enhancement and talent acquisition strategies. Indeed, major corporations, including Kubota, Fujitsu, Honda Motor and Shionogi, have become tenants inGrandGreen ParkTower.

The large-scale redevelopment in Umeda resulted in approximately 210,000sqm of Grade A office supply in 2024alone, representing a 13-fold increase compared to existing 2023 stock Osaka's Grade A office monthly rent reached JPY 24,623 per tsubo in 2Q 2025, showing 8.5% year-on-year increase, surpassing Tokyo's 5.9% growth rate.Previously, Osaka’s peak rent level had once been JPY 23,574 per tsubo, recorded before the 2008 Lehman Shock Although rents fell to 70% of peak levels by 2010, theyroseconsecutivelyfor22quartersfrom3Q2014,recoveringto pre-Lehman levels by end-2019. Contrary to expectations, the prolonged COVID-19 pandemic kept rents below these levels from 2022 onward However, the unprecedented massive new supply in 2024, combined with robust office demand, drove rents to 23,799 yen in 1Q 2025, finally surpassing the pre-Lehman peak and the upwardtrend inrents continuing.

Looking ahead, with notably limited new supply until 2030, tight supply-demand conditions are expected to persist, suggesting continued rentgrowth.

Osaka office market is expected to experience sustainable growth inthelong termduetothefollowing factors:

1.Increasing Employment: Osaka Prefecture added 200,000 workers compared to three years ago (Q2 2025) Kansai's economic revitalization and expanding business demand will continue supporting office demand. (Please put chart figure 2 here)

2Naniwa-suji Line Opening (scheduled for 2031): Travel time from Kansai International Airport to Umeda will be shortened by approximately 8 minutes to about 45 minutes. Improved accessibility to Umeda/Nakanoshima area will further enhance

locational value

Conclusion

Osaka, exemplified by Umeda, is evolving from its traditional positioning as "Japan's secondary business centre" and transforming from a simple business district into complex urban space where work, learning, and leisure functions converge. While high rent levels for premium station-connected and stationproximate locations are expected to be maintained, significant rent declines across Osaka remain limited Ongoing redevelopment establishes unique positioning, with Umeda expected to enhance its presence as a new symbol of the Kansai economy. *JP

Author Research

AssistantManager

TomoyoNakamaru

As of Q3 2025, the pre-commitment levels for new Tokyo Grade A office supply reached more than 40% of total leasing volumes

More than half of the 390,000 sqm of new stock achieved over 90% pre-leasing

Strong demand for office relocation among large tenants drive this trend in central Tokyo Companies are benefiting from solid corporate earnings. At the same time, Companies need a new workspace solution that balances business expansion and

increasing headcount with the demand for workstyle reform. For example, auto parts maker Astemo will relocate its corporate headquarters to TOFROM YAESU TOWER in Autumn 2026. Security device manufacturer Toa Corporation has announced plans to relocate to Takanawa Gateway City, The Linkpillar 2, anticipating increased headcount and business expansion. Both companies willleaseseveralfloorsintheirrespective newbuildings.

Osaka-based manufacturer Monotaro will also relocate its Tokyo branchtotherecentlycompletedAkasakaTrustTowernext spring. It expects the open design and layout of its new corporate headquarters to foster better communication among employees and enable more creative, efficient work. This move aims to increasecorporate valueandsupportsustainablegrowth.

Pre-leases have also secured space in the highly anticipated Mitsubishi Estate-developed Torch Tower, which will be the highest office building in Japan upon completion in three years. Additionally, Leasing activity is strong for projects under development inDogenzaka,Akasaka/Roppongi andShinagawa

Leases now close faster than several years ago, as tenants struggle to find space due to limited availability in existing buildings. This is due to high fit-out and restoration costs, which are deterring many companies from relocating While some sub-markets like Shibuya saw new supply easily fill up several years ago, some of the larger buildings did not lease as quickly, although almost all were ultimatelyfullyoccupied.

Comparatively, nearly 60% of the 600,000 sqm supply for 2026 is alreadypre-leased indicating thatmomentum isstrong.

Next-generationofficebuildingsincreasinglyfeatureamenitiesand value-added facilities such as lounge spaces, conference rooms and other commercial services, like aspa and workers’ café These facilities are enhancing the productivity and overall experience of workers.

According to Oxford Economics, GDP growth in Tokyo is expected to rise 15% in 2025, up from 07% recorded last year This growth will be led particularly by the finance and IT sectors, with the latter

expected to be active due to recent shifts in office re-entry mandates.

While domestic companies are dominating recent leasing activity, foreigncompaniesarealsoexpectedtorelocatetoprimelocations as the Tokyo office market offers an increasing amount of highly competitive properties.

Source: JLL Research, 2025.10

Globalrealestateinvestmentcontinuestogrow, supportedbydeclininginterestratesandan improvinglendingenvironment.Arecovery in investorsentimenthasalsobeen drivenby reduced uncertainty,aspolicyriskssuchasU.S. tariffmeasureshaveeased.InU.S.andEMEA markets,transactionsofhigh-qualityofficeassets havebeenincreasing.

Inadditiontomacroeconomicshiftssuchas inflationandinterestrateincreases, realestate markettrends includingrisingrents have promptedadjustmentsinoccupiers’ realestate strategiesandinvestors’investmentapproaches, boostingtransactionactivity.Financialinstitutions havemaintainedanactivelendingstance,further supportingthestrongmomentuminthe investmentmarket.

Numerouslarge-scaletransactionshavebeen recorded, includingofficebuildings,logistics facilities,andmultifamilyportfolios.Total investmentvolumeinJapanreachedarecord high ofJPY4.71trillionduringthefirsttothirdquarters. Tokyoretaineditspositionasthetop-ranked globalcityforrealestateinvestment.

Theglobalrecovery inrealestateinvestmentis expected tocontinue,withoverseas investors projectedtoexpandtheirallocationstoJapan.As morecorporationssellnon-corerealestate holdingsandhigher-qualityinvestment opportunitiesincrease, totalrealestate investmentvolumeinJapanisanticipatedto exceed JPY6trillionin2025,backedbyresilient demand.

• Japan’srealestateinvestment volume reachedJPY 4.71trillioninthefirsttothirdquartersof2025,up 22%y-o-y (USD31.6billion,up23%).

• Inthethirdquarteralone, totalinvestment volume wasJPY1.52trillion,a22%increasefromthesame period lastyear(USD10.3billion,up23%y-o-y).

• Inaddition tolarge-scaletransactionsrecorded inthe firsthalfoftheyear,majordealswere observed in 3Q25,including Shiodome CityCenter andMatsushita IMPBuilding,aswellasthelargelogisticsfacilityESR AmagasakiDC.Thecumulativeinvestment volume for thefirsttothirdquarterswasthehighestsince records beganin2007.

Source:JLL

22%up

• Officesectoraccounted forJPY2.28trillion,or49%of totalinvestment volume inthefirsttothirdquarters of2025,expanding from36%forthefullyear2024.

• Retailandmultifamilysectorsalsoincreased their sharescompared to2024,reaching9%and18%, respectively. Incontrast,logisticsfacilitiesandhotels sawtheirsharesdecline to12%and10%, respectively.

• Multifamilysector'shighersharewasdriven byseveral largeportfolio transactionsinthethirdquarterof 2025.

Source:JLL

• Tokyo CBDaccounted for50%oftotalinvestment volume inthefirsttothirdquartersof2025,marking thefirsttimesincethesameperiod in2011thatthe shareexceeded 50%.Inaddition tolarge-scale transactionsinthefirsthalf,severalmajordealsinthe thirdquarter,suchaslargeoffice buildingsand multifamilyportfolios, contributed tothisincrease.

• GreaterOsakaaccounted for11%,down from19%in thesameperiod lastyear,despite notabledeals involving largeofficebuildingsandlogisticsfacilities. Thisdecline ispartlyattributedtoastronger preference forTokyo, Japan’s largestcity,asinvestors increasingly prioritisefuturerental growthpotential amidinflation,alongwithitsadvantagesincorporate andpopulation concentration.

Source:JLL

TokyoCBD(5-ku)

Tokyo(Excluding5-ku) GreaterTokyo(ExcludingTokyo)

Note:TokyoCBC(5-kus)referstoChiyoda-ku,Chuo-ku,Minato-ku,Shinjuku-kuandShibuya-ku;GreaterTokyoreferstoTokyo,Chiba,SaitamaandKanagawa;GreaterNagoyareferstoAichi, GifuandMie;GreaterOsakareferstoOsaka,Hyogo,KyotoandNara; GreaterFukuokareferstoFukuoka,Saga,Nagasaki,Kumamoto,Oita,Miyazaki,KagoshimaandOkinawa.

• Strong netabsorptionduetounwavering demand forofficefromheadcount increaseandbusinessexpansion

• Notabledrop invacancyratesto0.9%

• Rents rise2.4%toJPY37,042per tsubo,markingaseventhconsecutive quarterincrease

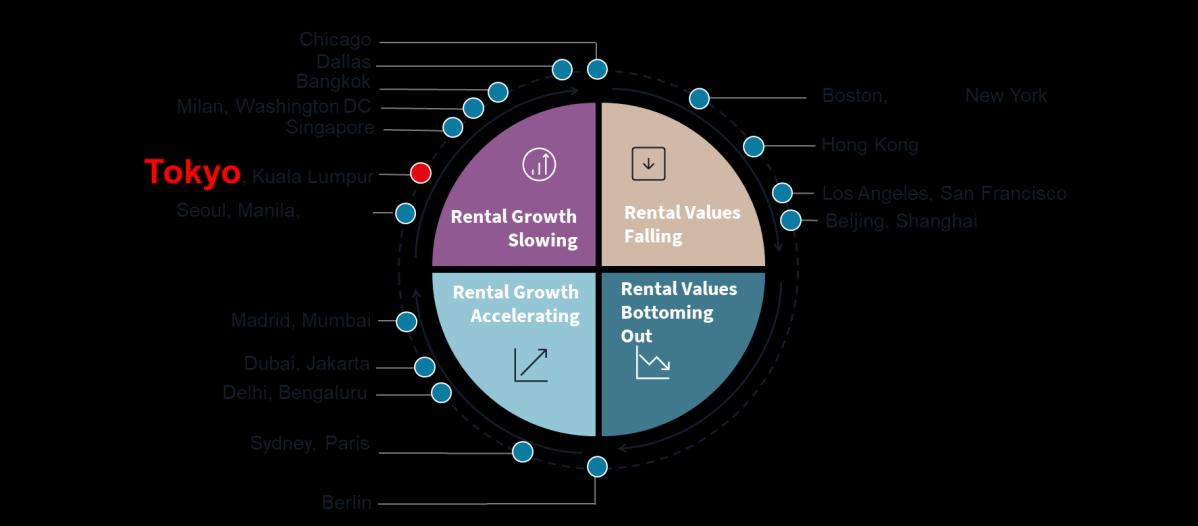

According totheTankanSurveyinSeptember, thediffusionindex of largemanufacturersrose1point to14.Theindex oflargenonmanufacturerswasunchanged at34.Strong demand forofficeisseen incentralTokyo duetobusinessexpansion andincreasein headcount. NetabsorptionforTokyo GradeAofficewas204,600sqm inQ32025.Byindustry, thefigurewasdriven byinformation services, manufacturing, andmedical services.

Onenew GradeAofficebuildingwascompleted inQ32025.Tokyo's vacancy rateintheGradeAofficemarketinQ32025averaged 0.9%, falling160bpsq-o-q and230bpsy-o-y. fell.Almostnovacancies left inOtemachi/Marunouchisubmarketanda140bpscompression was seeninAkasaka/Roppongi submarkets.

Rents inTokyo's GradeAofficemarketaveraged JPY37,042per tsubo,permonth, up2.4%q-o-q and7.5%y-o-ybyend Q32025. Rents inbothAkasaka/Roppongi andOtemachi/Marunouchi submarketsroseaslandlord-favourable marketconditions continue

duetotightsupplyanddemand.

CapitalvaluesinQ3wereup4.2%q-o-q and12.9%y-o-yasrents werehigherandcapratesremained unchanged fromtheprevious quarter.NotableGradeAofficetransactionsannounced thisquarter included apartialstakeofGranTokyo SouthTower (stratatitle) byJR EastRealEstateAssetManagement Co.Ltd.

According toOxfordEconomics' forecastasofSeptember 2025,the year-end 2025GDPgrowthhasbeenrevised upwardto1.0%andthe CPIto3.2%.Risksinclude impactoftariffs,heightened inflationfrom Sanaenomics andadownturn inoverseas economies. Leasing volume isexpected toslowdown inthenextyearasnew supplyis slightlylower, however, officedemand remains veryrobust.Capital valuesareprojected tocontinue torisenext yeardriven byfurther rentincreases.

Note:Financialandphysical indicatorsareforthe5KusGradeAofficemarket.Datais onanNLAbasis.

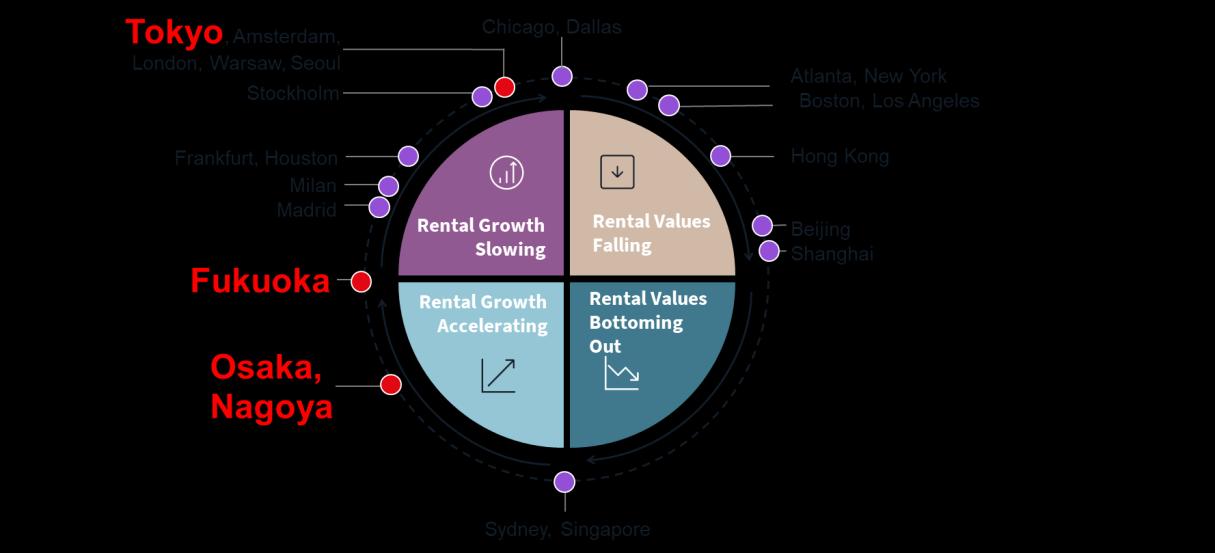

• Rent reachesrecord highofJPY25,420per tsubopermonth aftersevenconsecutive quartersofgrowth.

• Continued demand forhumanresourcestrategypurposes,withaseriesofrelocations toUmeda andalongMidosuji

• Vacancyratesdrop to2.5%asbothnewandexistingbuildingsseerapiddecline ofvacantspace

TheSeptember TankanSurvey forGreaterOsakashowedthat businesssentiment fellto13pointsfrom14forlargemanufacturers andto30pointsfrom 33forlargenon-manufacturers. Netabsorption totalled+22,000sqminQ32025.Themaindemand driver remained asrelocationsfortalentacquisition, withcompanies upgrading workplace environment andcorporate image.

TheQ32025vacancy ratefellto2.5%,adecrease of80bpsq-o-q and 130bpsy-o-y. Withthelimited availabilityoflargefloorsintheOsaka market,tenants soughttosecurefloorsquickly,resultinginadecline invacancy ratesinawiderangeofareas.Demand isparticularlyhigh inUmeda andalongMidosujibetween YodoyabashiandHonmachi. Therewere nonewcompletions inthequarter. YodoyabashiStation One, whichcompleted previous quarterwithNLA39,000sqmhas seensteadyabsorptionprogress andisnow approximately 80% occupied.

Theaveragemonthly grossrentpertsubowasJPY25,420,anincrease of3.2%q-o-q and10.8%y-o-y. Theprevious rentalpeak was approximately JPY24,600inQ22020.TheOsakamarkethasreached anew levelinthequarter.Capitalvaluesincreased by3.5%q-o-q and 15.5%y-o-yinQ32025,driven bycurrentrenttrends. Caprates remained stablefromtheprevious quarter.

Themanifestationofsecondary vacancieswillbedelayed dueto soaringconstruction costsanddelaysinrestorationworkcausedby labourshortages.Whilelargetenantactivitybymajorcorporations appearstohavecompleted one cycle, mid-tiercompanies are becoming more active,suggesting strongdemand willcontinue. As forrents, thetrend ofrisingrentsisexpected tocontinue overthe long term,buttherateofincreaseisexpected tomoderate inthe future,asthenumber ofavailableproperties thatwillcauserentsto rise,astypified bynewconstruction inUmeda, willbecome limited.

Note:Financialandphysical indicatorsareforthe5KusGradeAofficemarket.Datais onanNLAbasis.

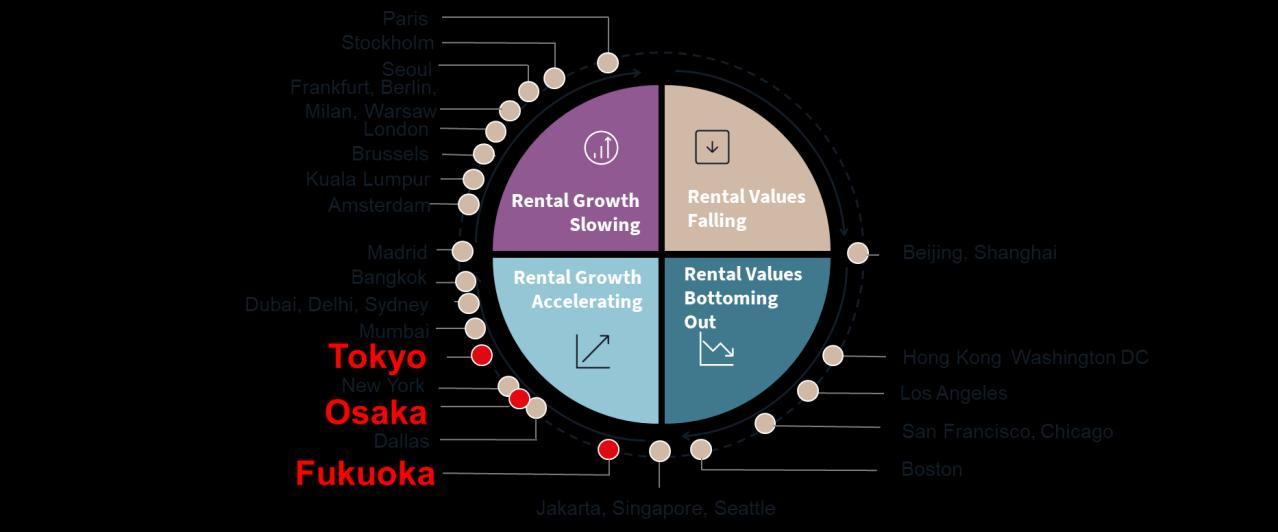

• Fukuokaofficerentsrise1.2%toJPY21,835pertsuboasgrowthmomentum slows

• Expansion relocationsduetobusinessgrowtharenotable

• Vacancyratedropssignificantlyto6.6%,down 2.1percentage pointsfromtheprevious period, asnewly constructed buildings absorbedvacantspace

According totheSeptember Kyushu-OkinawaTankansurvey,the businessconditions DIforlargemanufacturingcompanies was31 points(from25pointspreviously), whilenon-manufacturing was27 points(from30pointspreviously).

Withnonewsupplyinthethirdquarterandminimalsecondary vacancy generation, expansion relocations duetobusinessgrowth werenotable, resultinginnetdemand of11,000sqm.

Thevacancyrateattheend ofthethirdquarterwas6.6%,down 2.1 percentage pointsfromtheprevious quarterandup1.4percentage pointsy-o-y. Since 2021,continuous new supplyfromtheTenjin Big Bangdevelopment andsignificanttenantleasingattheTenjin Sumitomo LifeFJBusinessCentercontributed tothevacancyrate decline. Currently, clearpolarisationhasemerged, withtheTenjin areahavingover 300,000squaremeters ofvacantspace,whilethe HakataStation areahasvirtuallynovacancies.

Rent attheend ofthethirdquarterwasJPY21,835pertsuboper month, up1.2%fromtheprevious quarterandup8.0%y-o-y. The acceleration ofrentincreasesdriven bynewly suppliedbuildingshas runitscourse,withthepaceclearlydecelerating from2025onward.

According toOxfordEconomics' Octoberforecast, FukuokaCity'sreal GDPgrowth rateisexpected tobe1.2%in2025and0.5%in2026.In therentalmarket,newsupplyfor2025hasbeen exhausted. Secondary vacancy generation isalsoexpected toremainlimited, so thevacancy rateattheend of2025willlikelydecline slightly.Rents havecontinued toriseasnewly suppliedbuildingspushedupthe overallmarketlevel. However, threenewbuildings(totalleasable areaof75,000sqm)arescheduledfor2026,makingareturntorising vacancy ratesunavoidable. Underthesecircumstances, rentswill unlikelyrisesignificantlydriven bynew supplybuildings asinthe past.Rental trendswilllikelydiverge between newconstruction and existingbuildings.Intheinvestment market,yieldswilllikelyremain flatasinvestorscontinue toshowstronginvestment appetite.

Note: FinancialandphysicalindicatorsareforFukuoka’sGradeAofficemarket. DataisonaNLAbasis.

(thousands)

• Demand forprimeretailspaceremains robust,driven bydomestic andinternational consumption.

• HulicGinzaBuildingandSeiwaGinzaBuildingcompletes along GinzaChuo-dori.

• Rent growthcontinues, driven byground-floor rentincreases.

Domesticconsumptionisrecoveringonbettersentimentandincome, whilerecord tourismboostsinbound spending, fuellingretailsales growth. Thedrop inTokyo luxurysalesisonly againstanunusualhigh causedbyapre-price-hike rushdemand. Notablenewopenings inQ3 2025included TiffanyandHarryWinston onGinzaChuo-dori, Cartier alongside Harumi-dori, andtheHarryPotterShop, whichopened alongOmotesando.

NewsupplyinQ3included theHulicGinzaBuilding(GFA13,000sqm) onGinzaChuo-dori withHarryWinston andVanCleef&Arpelsas ground floortenants. TheSeiwa GinzaBuilding(GFAof5,000sqm) alsocompleted alongChuo-doriwithLoewescheduled astheground floortenant toopen inQ42025.Construction beganon theJingumae 3-chome Project(tentativename) inQ32025.Thisfive-storey, aboveground buildingwithaGFAof1,300sqmisscheduled forcompletion in2026alongHarajuku-dori.

Rent inQ32025reachedJPY102,164pertsubo,permonth, increasing 2.4%q-o-q and4.8%y-o-y. Againstthebackdrop oftightsupplyand demand, bothground-floor andupper-floor rentsincreased, marking the14thconsecutive quarterofpositiverentgrowth. Capitalvalues increased 1.1%q-o-q and4.0%y-o-y, reflecting rentincreases.

Notabletransactionsthisquarterincluded theacquisitionofJMF BuildingJingumae 01byadomestic operating company. Theprice wasJPY5.5billionwithanNOIyieldof2.4%.

Intherentalmarket,againstthebackdrop oflimited supply,groundfloorrentincreasesareexpected toaccelerate again,andupper-floor rentsarealsoexpected tocontinue rising,soaveragerentsare predicted tomaintainanupwardtrend. Intheinvestment market,as capratesareexpected toremainflat,pricesareanticipated torise gradually,reflecting rentincreases.

Note:FinancialindicatorsarefortheprimeretailmarketsofGinzaandOmotesando, whileretailsalesgrowthfiguresareforTokyoPrefecture.DataisonanNLAbasis.

• Demand expansion continues, driven bye-commerce salesgrowth

• Vacancyratedeclines significantlyto9.1%

• Rentalgrowth continues overall,thoughwithvaryingintensity bylocation

Solid demand continued withnetabsorptionreaching696,000sqm in3Q2025.Rental reductions incertainareasstimulatednew demand, whichexceeded new supply.Risingtransportation costsare strengthening demand forproperties inlocationsclosetocentral Tokyo, whileproperties infringe areaswithlonger transport distancesareexperiencing weakerdemand, withsometakingnearly twoyearstoreachfulloccupancy.

Newsupplyin3Q2025totalled472,000sqmacrossfourbuildings, withtwoproperties delivered intheBayareaandtheremaining two inInlandareas.GreaterTokyo's vacancy ratereached9.1%,falling 116basispointsq-o-q and79basispointsy-o-y. Bayareavacancy ratesfell16basispoints to8.3%,whileInlandareavacancy ratesfell 155basispointsto9.4%.

GrossrentinGreaterTokyo reached JPY4,724pertsubopermonth, up0.4%q-o-q and0.8%y-o-y. Risingconstruction costscontinue to driveuprentsfornew properties, subsequentlypushinguprentsfor surrounding properties.

GreaterTokyo logisticsfacilityprices(perunitarea)increased 0.5%qo-qand0.6%y-o-y, reflecting rental growth.Anotabletransaction wasMitsuiFudosan'slogisticsREITsaleoftwoproperties toWarburg Pincus.

Continued soliddemand expansion frome-commerce andrising construction costsareexpected tosustainrental growth. However, whileprimelocations willseenotablerentincreases,properties in fringeareaswithhighvacancy ratesandincreased transportation costsareexpected toexperience rentaldeclines.

Althoughinterestratesareexpected torisefurther,yieldsareforecast toremain stableduetomanyinvestors alreadypreparing forrate increasesandcontinued solidinvestment demand fromcore investorssuchasinsurancecompanies. Consequently, realestate pricesareexpected tocontinue risinginareasandproperties experiencing rental growth.

Note:TokyologisticsreferstotheGreaterTokyoprimelogisticsmarket.Dataisonan NLAbasis.

• Vacancyratedeclines driven byhighoccupancy ofnewproperties andvacancy absorptioninexistingproperties

• Rentalgrowth ledbynew supplyproperties

• Solid investment demand from domestic investors

Solid demand andsubstantialnew supplyresultedinnetabsorption of236,000sqmin3Q2025.Demand came fromvarioussectors, includinge-commerce companies, 3PLproviders, andretailers.

Newsupplyin3Q2025totalled345,000sqmacrossthreebuildings, increasingtotalstockto8,069,000sqm,up4.5%q-o-q. Vacancy absorptionprogressed inexistingproperties whilenewsupply properties achievedgenerally highoccupancy upon completion, resultinginOsaka'soverallvacancy ratefalling37basispoints q-o-q to4.6%.Thisrepresents a153basispointsincreasey-o-y.

GrossrentinGreaterOsakareached JPY4,245pertsubopermonth, up0.9%q-o-q and2.4%y-o-y. Theoverallaverageincreased dueto higherrents commanded bynewsupplyproperties.

Reflecting stableinvestment yieldsandrental growth, theupward trend inOsakalogisticsfacilityprices(perunitarea)continues. Notabletransactionsincluded 50%stakesinESRAmagasakiDCand ESRFujiideraDC.Bothproperties attracteddomestic investors,

demonstrating solidinvestment demand fromdomestic playersfor logisticsfacilities.

Intheleasingmarket,multipleprojects arescheduled tobesupplied from4Q2025onward, butnumerous pre-commitments havebeen secured, andhighoccupancy upon completion isexpected. Vacancy ratesareexpected todecline toward year-end 2025,withlowvacancy ratesanticipated tocontinue through2026and2027.

Soaring construction costscontinue driving rental increasesfornew properties. Existingproperties arealsoexpected toexperience rental growthledbynewdevelopments. Whiletenant affordabilityremains aconcern,overallrentalgrowthacrossOsakaisexpectedtocontinue, given expanding e-commerce demand andvirtuallynovacancy in existingproperties.

Note:OsakalogisticsreferstotheGreaterOsakaprimelogisticsmarket.Dataisonan NLAbasis.

• Newsupplyoutpaces absorption, driving vacancyrateshigher

• Averagerentssoftenmarginallyfollowing rental adjustmentsatselectproperties

• Newsupplyexpectedin2026–2027couldincreasevacancyrisks

In3Q2025,theGreaterFukuokalogisticsmarketsawnew supply exceed netabsorption. Newcompletions totalledapproximately 80,000sqmagainstnetabsorption ofjust4,000sqmduring the quarter.

Thecompletion ofLogistationFukuokaOgoribroughttotalstockto 1,688,000sqm, an11.0%increasey-o-y. Consequently, thevacancy rateinGreaterFukuokaroseto7.5%,up440bpsq-o-q and200bpsyo-y. However, thisincreasewasprimarilydriven bynew supply properties, whileoccupancy atexistingfacilitiesremained robust.

GrossrentinGreaterFukuokawasJPY3,547pertsubopermonth, down 0.1%q-o-q butup1.8%y-o-y. Rentaladjustmentsatselect properties toalignwithlocalmarketratesresultedinmarginal declines, thoughoverallmarketrentlevels remained stable.Some areaswithnew supplyalsorecorded rentincreases.

Investment yieldscontinued toremain flat.Despitesomerental adjustmentactivity,capitalvaluesforlogisticsfacilitiesmaintained

elevated levels.Investor interestremainsstrong, butinvestment opportunities areextremely limited.

Vacancyratesareexpected toimprove graduallyasleasingactivity progresses. Multipleinquiriesaboutnewdevelopments before completion, particularlyforhigh-specification properties withcold storagecapabilitiesandrampaccess,areexpected tounderpin marketdemand.

However, properties withsuboptimal roadaccessorlocation constraints mayexperience leasingchallenges, leadingtorent polarisationbasedonlocation andspecifications. From2026to2027, selectivedemand expansion centred ondistributionandcoldstorage facilitiesisexpected tocontinue, withtheoverallmarkettransitioning fromastablegrowthphasetoarecovery phase.

Capitalvaluesareforecasttocontinuerisinginlinewithrentalgrowth.

Note:FukuokalogisticsreferstotheGreaterFukuokaprimelogisticsmarket.Datais onanNLAbasis.

• Growthcontinues, driven byrobustinbound tourismdemand.

• Threeluxuryhotelssettoopen inTokyo inthelatterhalfof2025.

• Continued record highperformance.

Inthefirsthalfof2025,thenumberofforeign visitorstoJapan reached 21,518,100,markinga21.0%Y-o-Y increase.According tothe JapanNationalTourismOrganization, inQ12025,thetotalnumber of overnight staysinTokyo increased by5.4%Y-o-Y. Thenumber of foreign overnight guestscontinues toreachrecord highsevery month, whilethenumber ofJapanese guestsistrending downward.

Therewere noopenings ofnew international branded hotelsinQ2 2025.International brandsarestilleagertoopen newhotelsinTokyo. Thesecond halfof2025willseeawaveofluxuryandupscalehotel openings. Fairmont, JWMarriott,1HotelandCaptionbyHyattareall settodebut.

InQ2,Tokyo's hotelsectordemonstrated continued growthacrossall segments intermsoftradingperformance. Theongoing increasein inbound visitorshasdriven asustainedriseinADR,whileoccupancy

hasalsoshownsteadyrecovery. Theluxuryandupperupscale segments continued toshowstrongimprovements compared tothe sameperiod in2024.AsofYTDJune, bothADRandoccupancy increased Y-o-Y. Consequently, RevPAR sawasubstantialgrowthfrom thesametimelastyear.However, occupancy stilllaggedbehind Q2 2019.

Althoughstrongperformance trends continued throughQ22025, escalatinggeopolitical risksandgrowing globalinstabilitycreated uncertainty. Itwillbecrucialtocloselymonitor theimpact ofthese factorsontheperformance ofthesecond halfof2025.Inthefirsthalf of2025,exchange ratefluctuationshadno impactonactualhotel performance. Ontheotherhand, department storerevenues fellY-oYforfiveconsecutive months fromFebruary2025,indicating a change inthecomposition ofconsumer spending byforeign visitors toJapan.

Note:TokyoHotelsrefertoTokyo'soverallhotelmarket. Source:JLL,industrysources,STR

• Green buildingcertification acquisitionincreases,with19LEED-certifiedprojects including 2datacenters.

• Wellness certificationacquisitiondecreases, withWELLrecording zerocertificationsforthefirsttimein14quarters.

• TheJapaneseversion ofSustainabilityMarketDynamics includesaspecialreport on realestateenergy performance.

LEED: Nineteen projects acquired certification in 3Q25, bringing the total number of LEED-certified projects since 2009 to 352, representing a5.7%q-o-q increase.

CASBEE-BD: Twenty-three projects acquired certification in 3Q25, almost half in logistics facilities, rising the total number of CASBEE-BD-certifiedprojects by1.0%q-o-q to529.

CASBEE-RE: Certification was acquired by 137 projects in 3Q25, predominantly in the multi-family sector, increasing the total numberofCASBEE-RE-certified projects by51%q-o-q to2,699

WELL:Noprojects acquiredcertification in3Q25,withnineexpired projects, decreasing the total number of WELL-certified projects by150%q-o-q to51

Fitwel: No projects acquired certification in 3Q25, leaving the total number of Fitwel-certified projects unchanged at five for the sixth consecutive quarter

CASBEE-WO: Nine projects acquired certification in 3Q25, increasing the total number of CASBEE-WO-certified projects by 5.0%q-o-q to190,indicating acontinued recovery ingrowth rate.

Green building certification acquisition is increasing ahead of mandatory sustainability information disclosure requirements. Meanwhile, overseas investors primarily use CRREM* Pathway, which evaluates climate change risks, for real estate investment decisions Comparing DECC** data―Japan's only operational energy consumption database registered through third-party verification―with CRREM Pathway, and investigating climate change risks according to the CASBEE-RE energy performance evaluation level, the research revealed that many buildings have already reached their CRREM Pathway dis-alignment year as of 2025, and that some properties with the highest “S” rank of CASBEE-RE certification still have high climate change risks. Urgent review of building operations for energy performance improvement, fuel conversion for air-conditioning/plumbing systems,andrenewableenergyadoptionforelectrical systems are expected.

*CRREM CarbonRisk RealEstateMonitor

**DECC Data-baseforEnergyConsumptionofCommercialBuildings

Note:LEED,WELLandFitwelrefertoallratings.CASBEE-BD,CASBEE-REand CASBEEWOrefertoB+andabove.

Source:JLL,USGBC,IBECs,IWBI,Fitwel

Historicalvalidgreencertificationbycertifiedyear

Tokyo Headquarters

KioiTower, Tokyo Garden Terrace Kioicho

1-3Kioi-cho Chiyoda-ku, Tokyo 102-0094

+81343611800

Fukuoka

FukuokaDaimyoGardenCity

2-6-50Daimyo, Chuo-ku,Fukuoka-shi

Fukuoka810-0041

+81922336801

JLLJapanResearch

Tokyo.Research@jll.com

JapanResearchReports

Kansai

Nippon Life

Yodoyabashi Building

3-5-29KitahamaChuo-ku, Osaka541-0041

+81676628400

Nagoya

JPTowerNagoya

1-1-1Meieki, Nakamura-ku,Nagoya-shi

Aichi450-6321

+81528563357

JLL’s research teamdelivers intelligence, analysisand insight through marketleading reports and services that illuminatetoday’scommercialrealestatedynamicsandidentifytomorrow’schallengesandopportunities Our more than 550 global research professionals track and analyze economic and property trends and forecast future conditions in over 60 countries, producing unrivalled local and global perspectives Our research and expertise, fueled by real-time information and innovative thinking around the world, creates a competitive advantageforourclientsanddrivessuccessfulstrategiesandoptimalrealestatedecisions

For over 200 years, JLL (NYSE: JLL), a leading global commercial real estate and investment management company,hashelpedclientsbuy,build,occupy,manageandinvestinavarietyofcommercial,industrial,hotel, residential and retail properties A Fortune 500® company with annual revenue of $234 billion and operations in over 80 countriesaroundthe world, our more than 113,000 employees bring the power of a global platform combined with local expertise Driven by our purpose to shape the future of real estate for a better world, we help our clients, people and communities SEE A BRIGHTER WAY SM JLL is the brand name, and a registered trademark,ofJonesLangLaSalleIncorporated Forfurtherinformation,visitjllcom

This reporthasbeenpreparedsolelyforinformationpurposesanddoesnotnecessarilypurporttobeacompleteanalysisof thetopicsdiscussed, whichareinherentlyunpredictable.Ithasbeenbasedonsourceswebelieve tobereliable,butwe havenotindependentlyverified thosesourcesandwedonotguaranteethattheinformationinthereportisaccurateor complete.Anyviewsexpressed inthereportreflectourjudgmentatthis dateandaresubject tochangewithoutnotice. Statementsthatareforward-lookinginvolveknownandunknownrisks anduncertaintiesthatmaycausefuturerealitiesto bemateriallydifferentfromthoseimpliedbysuchforward-lookingstatements.Advice wegivetoclientsinparticular situationsmaydifferfromtheviews expressedinthisreport.Noinvestmentorotherbusinessdecisionsshouldbemade basedsolelyontheviewsexpressedinthisreport.