Japan MarketDynamics

JapanMarketDynamics -2025年第3四半期

近年大阪梅田では過去最大規模の再開発が行われている。

2024年には21万㎡の新規オフィス供給があったものの、旺 盛な需要により市場は安定を維持。グラングリーン大阪など 大型プロジェクトが相次ぎ竣工し、賃料は最高水準を超えて 上昇を続けている。

西日本最大の交通拠点である大阪・梅田エリアは、近年、大 規模な再開発が進められている。

2024年には、グレードAビ ル5棟[1]が21万平方メートルの総賃貸面積(NLA)を提供す るなど、過去最大の新規オフィス供給があった。当初は空室 率の上昇や賃料の下落が懸念されたが、旺盛な需要がこの膨 大な供給をうまく吸収し、市場の安定性を維持する結果と なった。

主要な再開発プロジェクト

梅田エリアの再開発において特に注目されるのが「グラング

リーン大阪(うめきた2期地区開発)」である。

JR

大阪駅北 側の広大な敷地を開発対象とし、オフィス、商業、ホテル、 住宅、MICEなどの複合開発が現在進行中で行われている (2025年9月現在)。南館のオフィスエリアは2025年3月に 先行開業し、グラングリーンパークタワーとグラングリーン ゲートタワーの2棟合わせて約11万平方メートルの新たなオ フィススペースを提供した。

特筆すべきは、大阪駅前という一等地における約4.5ヘク タールの大規模公園「うめきた公園」と一体となった開発で ある点だ。特にコロナ禍以降、オフィス回帰を促進する要素 として、充実した共用部や快適な周辺環境の重要性が高まっ ており、公園の存在は従業員にとって出社する動機を高める 重要な要素となりうる。また、最新のオフィス立地が企業の ブランドイメージ向上に寄与し、人材確保戦略に繋がると考 えられる。実際に、グラングリーンパークタワーのオフィス へは、クボタ、富士通、本田技研工業、塩野義製薬など、大 手企業が入居テナントとなっている。

JapanMarketDynamics -2025年第3四半期

オフィス市場の動向

梅田エリアの大規模再開発により、2024年の1年間でAグ レードオフィス供給量は約21万平方メートルとなり、2023 年までの既存ストックと比較して約1.3倍に増加した。この 大量供給にもかかわらず、大阪の2025年第2四半期のグレー ドAオフィス月額賃料は24,623円/坪となり、前年同期比+ 8.5 % と東京の 5.9 % を上回る高い成長率を記録した 。 大阪のオフィス賃料の変遷を振り返ると、2008年の世界金 融危機以前にはピーク時月額賃料23,574円/坪に達し、その 後2010年には最高水準の7割まで下落した。しかし、2014年 第3四半期から22期連続で賃料は上昇を続け、2019年末に リーマン・ショック前の最高水準へ回復した。しかし期待と は裏腹に、新型コロナウイルスの長期化により2022年以降 は再び同水準を下回る状況が続いていた。そのような中、 2024年のかつてないほどの大量新規供給と旺盛なオフィス 需要が相まって、2025年第1四半期には賃料が23,799円へ到

出所:大阪府「労働力調査地方集計結果(四半期平均)」をもとにJLL作成

達し、リーマン・ショック前の最高水準を再度超え、現在も 賃料上昇が継続している。今後については、2030年まで新 規供給が際立って限定的であることから、需給バランスの ひっ迫した状況が続き、賃料上昇は継続すると予想される。 長期的な将来展望

梅田エリアをはじめ大阪のオフィス市況は中長期的には以下 の要因により持続的な成長が期待される

1.雇用の増加:増加傾向にある大阪府での就業者数は2025年 第2四半期時点、3年前と比較し20万人増加している。関西 経済の活性化とビジネス需要の拡大がオフィス需要を下支え するであろう。

2. 地下鉄なにわ筋線開業(2031年予定):関西国際空港か ら梅田までの所要時間が約8分短縮され、約45分となる。梅 田・中之島エリアへのアクセス性が向上し、立地価値の更な る向上が見込まれる。

結論

梅田に代表される大阪は、従来の「日本の第二の中枢都市」 という位置づけから脱却し、単なるオフィス街から働く、学 ぶ、憩う機能が融合する複合的な都市空間へと進化しつつあ る。駅直結・駅至近のプレミアムエリアでは高水準の賃料水 準が維持されるとともに、大阪全体の賃料の大幅な下落は限 定的と見込まれる。現在進行中の再開発により、梅田は独自 のポジショニングを確立し、関西経済の新たなシンボルとし ての存在感を高めていくことが期待されている。

[1] JPタワー大阪、イノゲート大阪、グラングリーン大阪パークタワー、グ ラングリーン大阪ゲートタワー、プライムゲート梅田

著者 リサーチ事業部 アシスタントマネージャー 中丸

好調な業績に裏打ちされた国内大手企業が東京のオフィス賃 貸市場を牽引している。既存ビルの空室は枯渇しつつあり、 2026年の新規供給床の内定率も上昇。旺盛なオフィス需要 は2028年竣工予定プロジェクトまで滲み出している。本稿 では、2026年の新規供給物件の成約状況を分析した。

90%以上が予約契約

JLL日本 リサーチ事業部の調査によると、2025年第3四半期 時点で、東京Aグレードオフィスの新規供給における予約契 約面積は新規賃貸面積の40%以上を占め、年初から第3四半 期までに竣工した新規オフィスストック39万㎡のうち半数 以上が90%以上の予約契約面積となっている。

JapanMarketDynamics -2025年第3四半期

東京都心5区におけるこのオフィス床に対する旺盛な需要増 は、働き方改革の必要性、堅調な企業業績に伴う事業拡大・ 人員増などを背景に、大手テナントを中心にしたオフィス移 転需要に支えられている。

例えば 、 自動車部品メーカーの Astemo は 2026 年秋に 「TOFROM YAESU TOWER」に本社を移転し、警備機器 メーカーの東亜建設工業が人員増加と事業拡大を見込んで 「高輪ゲートウェイシティ ザ・リンクピラー2」への移転計 画を発表している。いずれも複数フロアが賃借される予定で ある。

別の事例では、大阪に本社を置く間接資材の通販大手である モノタロウが来春、2025年10月に第2期竣工を迎えた「赤坂 トラストタワー」に東京支社を移転する。新本社のオープン なデザインとレイアウトが従業員間のコミュニケーションを 活性化し、より創造的で効率的な業務を可能にすることで、 企業価値の向上と持続的成長につながることを期待している という。

3年後の2028年の竣工時には日本最高層のオフィスビルとな る三菱地所の大注目プロジェクト「Torch Tower」でもすで に予約が進んでいる他、渋谷、赤坂・六本木、品川で開発中 のプロジェクトでも内定が次々に決まっている。

高額な内装工事費と原状回復費用がオフィス移転を抑制しな がらも、既存ビルで枯渇しつつある賃借可能床の“争奪戦”が 繰り広げられているため、竣工前の新規供給床に対する契約 成立のペースは以前よりも速くなっている。渋谷などの一部 のサブマーケットでは数年前から新規供給床は容易に埋まっ ていたが、一部のビルでは時間がかかった(ただし最終的に は横浜から移転した単一テナントによって完全に賃借され た)。

市場全体を俯瞰すると、2026年供給予定の約46万㎡のうち

既に約60%が内定となっており、勢いが強いことを示してい る。東京駅周辺には空室がほとんど存在しないため、主に丸 ノ内・大手町の新規供給床は強い需要を見込まれる。

新規供給オフィスの多くはラウンジや会議室、スパ、ワー カー向けのカフェなどのテナント向けのアメニティや付加価 値施設を備えており、テナント企業の生産性向上や優良な体 験に資するものとして、ますます注目されている。

オックスフォード・エコノミクスによると、東京のGDP成 長率は2025年に1.5%上昇すると予想されており、昨年記録 した0.7%から上昇する見込みである。特に金融とIT部門が 牽引役となり、後者は最近のオフィス回帰の義務化によりオ フィス拡張移転が活発になると予想されている。

活況を呈す最近の東京オフィス賃貸市場は国内企業が主導し ているが、競争力の高い物件が増加していることから、外資 系企業も一等地への移転が期待されている。

出所:JLL日本 リサーチ事業部 2025,10

1

環境改善と不確実性低下で投資拡大 世界の不動産投資額は、金利低下と融資 環境の改善で拡大が続いている。米国の 関税政策などの各国の政策リスクが低下 し不確実性が低下したことで投資家の投 資意欲が回復も一因。欧米でもグレード の高いオフィスビルの取引が増加してい る。

3

様々な変化が取引市場を活性化

2

日本の投資額は過去最高額

大型のオフィスや物流施設、賃貸住宅 ポートフォリオなどの売買が多数見られ、

第1-第3四半期の投資額は過去最高の4兆 7,100億円を記録した。東京は世界都市別 ランキングで引き続き第1位となった。

4

物価や金利の上昇などマクロ経済環境の 変化に加え、賃料上昇といった不動産市 場の動向も、企業の不動産戦略や投資家 の投資戦略の変化を促し、不動産取引の 増加要因となっている。金融機関の積極 的な融資姿勢が続いており、不動産投資 市場の活況を下支えしている。 見通し

世界的な不動産投資の回復が続いており、 日本に対する海外投資家の投資も拡大が 予想される。企業による保有不動産売却 が増加しており、良質な投資機会の増加 と堅調な需要により、2025年の不動産投 資額は6兆円超えると予想される。

主要指標 (2025年第1-第3四半期) +21%

世界の投資額の前年同期比 +22%

日本の投資額の前年同期比 39%

東京の世界都市別投資額ランキング

国内投資額における海外投資家の投資額割合 1位

49%

国内投資額におけるオフィスの投資額割合

JapanMarketDynamics -2025年第3四半期

日本の投資額推移

日本の投資額

• 2025年第1-第3四半期の日本の不動産投資額は前

年同期比22%増の4兆7,100億円(米ドル建てで

前年同期比23%増の316億ドル)となった。

• 2025年第3四半期の日本の不動産投資額は前年

同期比22%増の1兆5,169億円(米ドル建てで前

年同期比23%増の103億ドル)となった。

• 上半期までの大型取引に加えて、第3四半期には 汐留シティセンターや松下IMPビルなどの大型 オフィスやESR尼崎DCなどの大型物流施設の取 引が見られた。第1-第3四半期の投資額は2007年 の集計開始以来で最大の金額となった。

JapanMarketDynamics -2025年第3四半期

セクター別投資額割合

• セクター別投資額割合では、オフィスは2025年 第1-第3四半期の投資額が2兆2,829億円となり、 49%を占めた。2024年通年の36%から拡大して いる。

• リテール、賃貸住宅は2024年通年の割合から拡 大し、9%、18%となった。一方、物流施設、ホ テルは減少し、それぞれ12%、10%となった。

• 賃貸住宅の割合拡大は2025年第3四半期に複数 のポートフォリオが取引されたことが要因であ る。

JapanMarketDynamics -2025年第3四半期

地域別投資額割合

• 地域別投資額割合では、 東京都心5区が2025年 第1-第3四半期で50%となり、2011年第1-第3四 半期以来の50%超えとなった。上半期に続いて、 第3四半期にも大型オフィスビルや賃貸住宅ポー トフォリオなどの取引が見られたことが影響し た。

• 大阪圏は大型オフィスビルや大型物流施設の取 引がみられたものの11%にとどまり、前年同期 の19%から縮小した。背景にはインフレ下で不 動産の今後の賃料上昇が重視される中で、企業 集積や人口集積の点から、最大都市である東京 に対する選好性が高まっていることが要因と考 えられる。

出所:JLL

注釈:東京都心5区は千代田区、中央区、港区、新宿区、渋谷区を、東京圏は東京都、千葉県、埼玉県、神奈川県を、名古屋圏は愛知県、岐阜県、三重県を、大阪圏は大阪府、兵庫県、京都府、奈良県を、福岡圏は福岡県、佐賀県、長 崎県、熊本県、大分県、宮崎県、鹿児島県、沖縄県を指す。

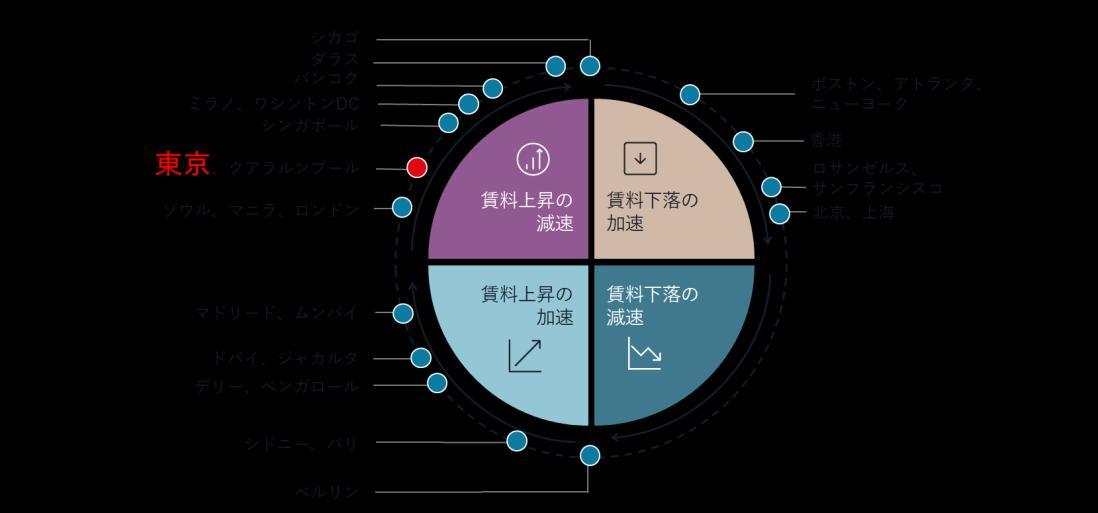

• 従業員数の増加と事業拡張によりテナントの動きが活発化し、大きな需要増加を記録

• 空室率が0.9%まで大幅に低下

• 賃料は2.4%上昇し月額坪あたり37,042円となり、7四半期連続の上昇を記録

9月の日銀短観によると、大企業製造業の業況判断DI(景況感 指数)は自動車部門の回復により1ポイント上昇して14となり、

2四半期連続の上昇となった。大企業非製造業の指数は34で変 わらずだった。従業員数の増加による移転需要や、良質物件へ の強い需要が見られている。2025年第3四半期の純需要は +205,000㎡であった。業種別では、情報サービス業、製造業、 医療業が牽引した。

第3四半期に新築のグレードAオフィスビル1棟が竣工した。今 期の東京グレードAオフィス市場の平均空室率は0.9%となり、 前期比1.6ポイント、前年同期比で2.3ポイント低下した。大手 町・丸の内サブマーケットではほぼ空室がなくなり、赤坂・六 本木サブマーケットでは1.4ポイントの低下となった。

賃料は第3四半期末時点で坪当たり月額平均37,042円となり、 前期比で2.4%上昇、前年同期比で7.5%上昇した。需給のひっ 迫により貸主有利な市場環境が継続しているため、赤坂・六本 木および大手町・丸の内のサブマーケットで賃料が上昇した。

2025年第3四半期の価格は、キャップレートが横ばいで推移す る中、賃料上昇を反映して四半期比で4.2%上昇、前年同期比 で12.9%上昇した。今四半期に発表された取引として、ゴール ドマンサックスのSPCによるグラントウキョウサウスタワー (区分所有)の一部持分売却があった。

見通し

2025年9月時点のオックスフォード・エコノミクスの予測によ ると、2025年末のGDP成長率は1.0%、消費者物価指数は3.2% となっている。リスクには関税の影響、サナエノミクスによる インフレ高進、海外経済の低迷などがある。新規供給がやや減 少するため来年のリーシング取引量は鈍化すると予想されるが、 オフィス需要は非常に堅調である。来年はさらなる賃料上昇を 受けて価格も上昇を続けると予測される。

注釈:需給と賃料は東京のAグレードオフィスを参照。需給は年初か ら当期の累計、面積は貸床面積を参照。

2020年 2021年 2022年 2023年 2024年 2025年 1,000㎡

純需要 新規供給 空室率

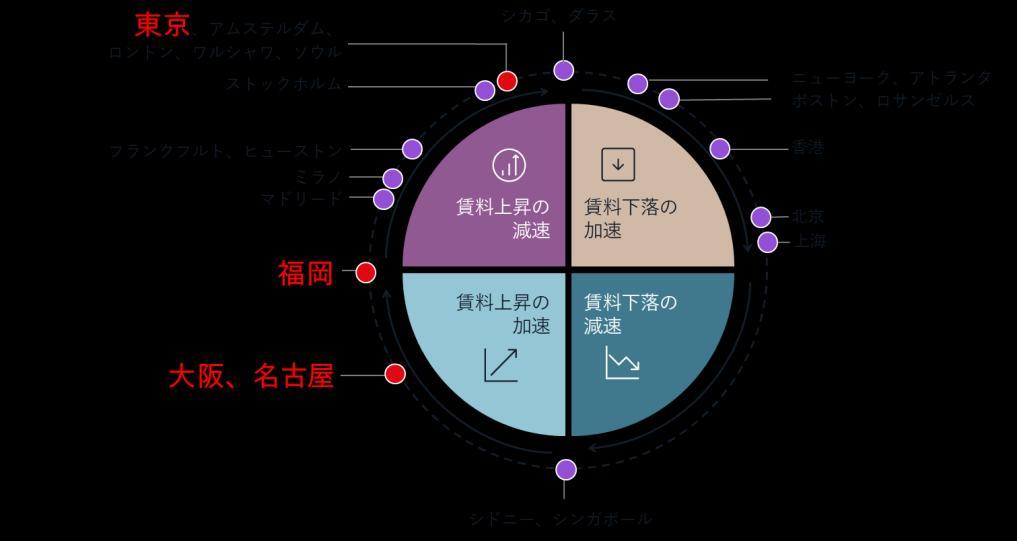

• 大阪Aグレードビルの賃料は月額坪あたり25,420円で2003年の観測以来最高を記録

• 人材を意識した移転需要が活発で梅田や御堂筋沿いのビルへの移転が目立つ

• 新築・既存ビルいずれも空室減少ペースが速く空室率は2.5%まで低下

9月の近畿短観によると、大企業製造業の業況判断は13ポイント(前 回14ポイント)、非製造業は30ポイント(前回33ポイント)となっ た。

第3四半期に新規供給はなかった。2025年以降に顕著となっている企 業の人材を意識した移転需要が活発で第3四半期の純需要は+22,000 ㎡となった。その結果、第3四半期末時点の空室率は、前期比0.8ポイ ント低下、前年同期比では1.3ポイント低下の2.5%となった。エリア やグレードを問わず大阪全体でテナントがまとまったオフィススペー スを確保することが困難になってきており、優良ビルで空室が発生し ても後継テナントが直ちに決定するケースが増えている。前期に竣工 した淀屋橋ステーションワンの空室消化も順調に進んだ。

第3四半期末時点での賃料は月額坪あたり25,420円となり、前期比 3.2%上昇、前年同期比10.8%の上昇となった。2003年の観測開始以 来のこれまでのピークであった2020年第2四半期の24,647円を超えた。 2022年からの大量供給期、とりわけ2024年に竣工した梅田エリアの 新築ビルの賃料が上昇をけん引し、既存ビルにも上昇が波及し、大阪 Aグレードビル全体の賃料が全面高の様相となっている。

見通し

Oxford Economicsの9月予測によると、大阪市の実質GDP成長率は

2025年+0.4%、2026年±0.0%と見込まれている。

賃貸市場では、2025年内の新規供給は残り1棟(淀屋橋ゲートタ ワー:中央区、延床面積13万㎡、12月竣工予定)である。足もとの

需要は堅調であるものの賃料の上昇スピードも速いために、新規供給 ビルは一定の空室を残して竣工する可能性が高いとみられる。従って、

2025年第4四半期末の空室率は今期の2.5%と同水準に留まると見込む。

2026年以降は需要の堅調さが維持され、新築ビルの空室消化が進展 し空室率の低下基調が継続するだろう。

賃料についても空室率の低下による需給のひっ迫を受けて上昇トレン ドが継続することが見込まれる。

投資市場では、好調な賃貸市場を受けて投資家の大阪での物件取得に 対する意欲が高い状況が続く。一方、売却案件が少ない状況の改善も 見込みにくいために、限られた投資機会を投資家間で取得競争を繰り 広げる状況も変わらない。

注釈:需給と賃料は大阪のAグレードオフィスを参照。需給は年初か ら当期の累計、面積は貸床面積を参照する。

需給の推移

2020年 2021年 2022年 2023年 2024年 2025年 (1,000㎡)

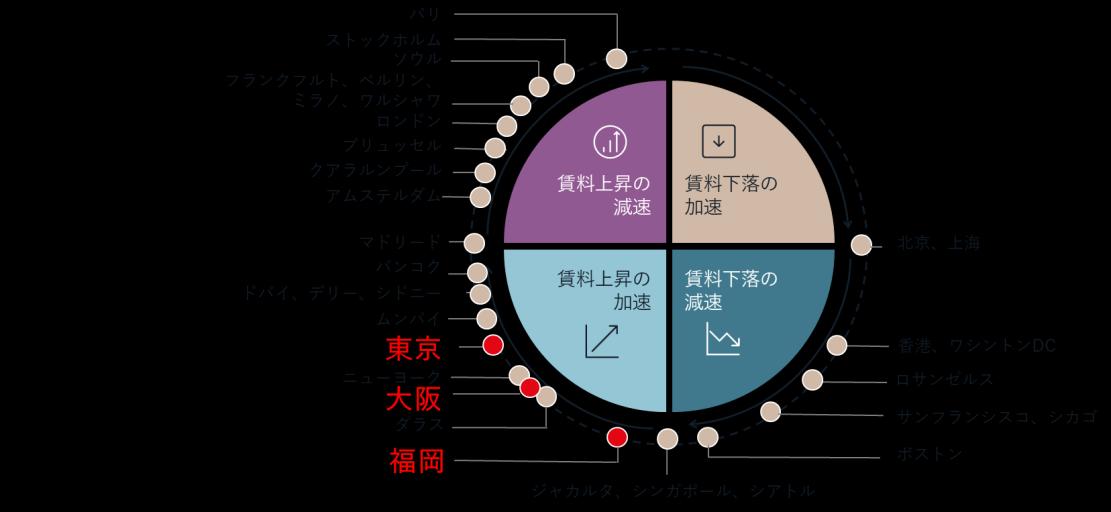

• 月額賃料は坪あたり21,835 円で前期比+1.2%も 、2025年以降上昇ペースが鈍化

• 業容拡大に伴う拡張移転が目立つ

• 空室率は新築ビルの空室消化が進展し、前期比-2.1ポイントの6.6%と大幅低下

9月の九州・沖縄短観によると、大企業製造業の業況判断は31ポイン ト(前回25ポイント)、非製造業は27ポイント(前回30ポイント) となった。

第3四半期に新規供給はなく、2次空室の発生も少ない中、業容拡大に 伴う拡張移転が目立ち、第3四半期の純需要は+11,000㎡となった。

第3四半期末時点の空室率は6.6%となり、前期比2.1ポイント低下、 前年同期比では1.4ポイント上昇した。2021年以降、天神ビッグバン による新規供給が断続的に続く中、前期竣工の天神住友生命FJビジネ スセンターでまとまった面積のテナント誘致が進展し、空室率低下に 大きく寄与した。足もとでは新規供給の影響を色濃く受ける天神エリ アでは300,000㎡以上の空室がある一方、博多駅エリアのは空室がほ とんどないという二極化が鮮明となっている。

第3四半期末時点での賃料は月額坪あたり21,835円となり、前期比 1.2%上昇、前年同期比8.0%上昇した。

新規供給ビルがけん引する賃料上昇の加速が一巡。2025年以降、上 昇ペースは明らかに鈍化している。

見通し

Oxford Economicsの10月予測によると、福岡市の実質経済成長率は 2025年に1.2%、2026年に0.5%と見込まれる。

賃貸市場では、2025年の新規供給は出尽くした。2次空室の発生も限 定的にとどまるとみられ2025年末(来期)の空室率は小幅に低下と なるだろう。賃料は近年の新規供給ビルが相場全体を押し上げる形で 上昇が続いてきた。しかし、2026年は3棟の新規供給(総貸床面積 75,000㎡)が予定されており再び空室率が上昇に転じることは避けら れない。こうした中、これまでのように新規供給ビルがけん引となっ て賃料が大幅上昇することは考えにくい。新築と既存ビル間で賃料の トレンドが変わってくる可能性が高い。投資市場では、投資家の投資 意欲の高い状況が継続していることから利回りは横ばいで推移するだ ろう。

注釈:需給と賃料は福岡のAグレードオフィスを参照。需給は年初か ら当期の累計、面積は貸床面積を参照する。

需給の推移

• プライムリテールエリアの路面店舗需要は引き続き堅調

• 銀座中央通り沿いにヒューリック銀座ビルと清和銀座ビルが竣工

• 賃料はふたたび上昇加速 路面賃料が上昇をけん引

主要指標

消費者マインドの下げ止まりと総雇用者所得の緩やかな持ち直 しに支えられ、2025年7月の家計消費は持ち直しの動きがみら れた。訪日外客数は引き続き過去最高記録を更新しており、イ ンバウンド消費も増加が続いた。こうした状況下、小売業販売 額は前年比増加が続いた。百貨店の美術・宝飾・貴金属の売上 高は、各ブランドの値上げに伴う駆け込み需要による前年の高 い水準との比較で前年比減少が続いた。第3四半期の新規開業 事例には、銀座中央通りに開業したティファニーとハリー・ ウィンストン、銀座晴海通りに開業したカルティエ、表参道沿 いに開業したハリー・ポッターショップが挙げられる。

第3四半期には「ヒューリック銀座ビル」が中央通り沿いに竣 工した(地上12階建て、延床面積13,000㎡)。路面テナントは ハリー・ウィンストン、ヴァンクリーフアンドアーペルとなっ ている。また、「清和銀座ビル」も同じく中央通り沿いに竣工 した(地上13階建て、延床面積5,000㎡)。路面テナントはロ エベ(2025年12月開業予定)となっている。原宿では「神宮前 3丁目PJ(仮称)」が着工した。地上5階建て、延床面積1,300 ㎡の規模で、原宿通り沿いに2026年に竣工予定である。

第3四半期の賃料は月額坪当たり102,164円となり、前四半期比 24%の上昇、前年同期比48%の上昇となった。需給のひっ迫を 背景に、路面・空中階ともに上昇し、14四半期連続の上昇と なった。価格は、賃料上昇を反映し、前四半期比1.1%の上昇、 前年同期比40%の上昇となった。当四半期の事例には、国内事 業会社による「JMFビル神宮前01」の取得が挙げられる。価格 は55億円、NOI利回りは2.4%であった。

見通し

オックスフォード・エコノミクスの10月時点の予測によれば、 2025年の個人消費は前回予測から上方修正され1.0%の増加、 2026年は据え置かれ0.7%の増加となっている。雇用・所得環 境の改善を背景に消費は持ち直すと予想される一方、リスク要 因には消費者心理の動向が挙げられる。

賃貸市場では、限定的な供給を背景に、路面店舗・空中階店舗 ともに賃料上昇が続き、平均賃料は上昇が続くと予測する。投 資市場においては、投資利回りは横ばい推移するとみられるた め、価格は賃料上昇に伴い、緩やかに上昇すると予想される。

注釈:賃料は東京のプライムリテールの1棟の平均を参照。面積は貸床面積を 参照する。小売業販売額は東京都既存店を参照する。

小売業販売額

前年比

• Eコマースの売上拡大を背景とした需要拡大は続く

• 空室率は9.1%と大幅に低下

• 濃淡は見られるものの全体的には賃料上昇続く

堅調な需要が続き2025年第3四半期の純需要は696,000㎡と なった。賃料を下げることで新たな需要が喚起され、新規供給 を上回る需要が生まれた。輸送費の上昇によって都心に近い立 地の物件は需要が強まる一方で、輸送距離が長くなる周辺部の 物件は需要が弱まり満床になるまでに2年近くかかるものも見 られる。

2025年第3四半期は4棟合計472,000㎡の新規供給があり、2棟 がベイエリア、残り2棟が内陸エリアで供給された。東京圏全 体の空室率は9.1%となり、前期比で116bps低下、前年同期比 79bps低下している。ベイエリアの空室率は16bps低下し8.3% となり、内陸エリアの空室率は155bps低下し9.4%である。

東京圏の月額坪当たり賃料は4,724円で前期比0.4%上昇、前年 同期比0.8%上昇となった。建築コストの上昇が新築物件の賃 料を上昇させ、その後周辺物件の賃料を押し上げる動きが続い ている。

東京圏の物流施設の価格(専有単価)は前期比0.5%上昇、前年同 期比0.6%上昇となった。賃料上昇を反映して価格も上昇して いる。今期の代表的な取引としては三井不動産の物流リートが ウォーバーグ・ピンカスに2物件売却した取引がある。

見通し

Eコマース等による堅調な需要拡大と建築コストの上昇が続き、 賃料上昇が続くと予想される。ただし好立地の物件は顕著に賃 料が上昇する一方で、空室率が高く輸送コストが増加している 周辺部の物件は賃料下落すると考えられる。

金利は今後さらに上昇すると考えられるが、既に多くの投資家 が金利上昇に備えていることや、保険会社に代表されるコア投 資家の堅調な投資需要が続くことから、利回りは横ばいで推移 すると予想される。結果として賃料成長が見られるエリア・物 件では不動産価格も上昇が続くと予想される。

需給の推移 注釈:東京圏に所在する賃貸の大型物流施設が対象。面積は貸床 面積を参照する。

単位:1,000㎡

JapanMarketDynamics -2025年第3四半期

• 新規物件の高稼働と既存物件の空室消化により空室率低下

• 新規物件がけん引する賃料上昇

• 国内投資家の堅調な投資需要

堅調な需要と大量の新規供給によって2025年第3四半期の純需 要は236,000㎡となった。Eコマース企業や3PL企業、小売業な ど様々な需要が見られる。

2025年第3四半期は3棟合計345,000㎡の新規供給があり、総ス

トック面積は 8,069,000㎡で前期比4.5%増加した。既存物件で空 室消化が進み、新規供給物件も概ね高稼働で竣工したため大阪 圏全体の空室率は前期比37bps低下し46%となった。前年同期 比では153bps上昇している。

大阪圏の月額坪当たり賃料は4,245円と、前期比0.9%上昇、前 年比2 4%の上昇となった。新規供給物件の高い賃料によって全 体平均が上昇している。

横ばいで推移する投資利回りと賃料上昇を反映し、大阪圏の物 流施設の価格(専有単価)は上昇傾向が続いている。代表的な取 引としてはESR尼崎DCの持分50%やESR藤井寺DCの取引が挙げ

られる。両物件とも国内投資家が出資しており、国内投資家の 物流施設に対する堅調な投資需要が見て取れる。

見通し

賃貸市場では2025年第4四半期以降にも複数の新規供給が予定 されているが、予約契約が多数締結されており高稼働で竣工す ると予想される。

25年年末にかけて空室率は低下し、2026年、 2027年と低い空室率が続くと見込まれる。

建築コストの高騰によって新築物件は賃料上昇が続いている。 既存物件も新築物件にけん引され賃料上昇が見込まれる。テナ ントの賃料負担力が懸念されるが、Eコマース関連の需要拡大 と既存物件に空室がほぼない状況から大阪圏全体の賃料上昇が 続くと予想される。

注釈:大阪圏に所在する賃貸の大型物流施設が対象。面積は貸床 面積を参照する。

需給の推移

:1,000㎡

• 新規供給物件の空室により空室率が上昇

• 一部物件の賃料見直しを受け、平均賃料は小幅に軟化

• 2026-2027年は新規供給増加により空室率上昇リスクが高まる

2025年第3四半期の福岡圏物流市場は、新規供給が純需要を上 回る展開となった。今期は約80,000㎡の新規供給に対し、純需 要は約4,000㎡にとどまった。

ロジステーション福岡小郡の供給により、総ストック面積は前 年同期比11.0%増の1,688,000㎡となった。これに伴い福岡圏

全体の空室率は 7.5% となり 、前期比440bps 、 前年同期比 200bps上昇した。ただし、この上昇は新規供給物件の影響が 大きく、既存物件の稼働は依然として堅調である。

福岡圏の月額坪当たり賃料は3,547円と、前期比0.1%低下、前 年比1.8%の上昇となった。一部物件で近隣相場との整合性を 図る賃料調整により小幅な下落がみられたものの、市場全体の 賃料水準は安定を維持している。また、新規供給があったエリ アでは賃料上昇も確認された。

投資利回りは引き続き横ばいで推移しており、一部で賃料調整 の動きがみられる中でも、物流施設の価格(専有単価)は高水準 を維持している。投資家の関心は依然として高いが、投資機会 は極めて限定的である。

見通し

リーシングの進展に伴い空室率が緩やかに改善する見通しであ

る。一部新築案件では竣工前から引き合いが複数みられるなど、

冷凍冷蔵機能やランプ付など高仕様物件への需要が市場を下支 えする見込み。

一方で、道路付けやアクセス条件に課題を抱える物件ではリー シングが停滞する可能性があり、賃料は立地・仕様による二極 化が進行する局面となる。

2026年から2027年にかけては、流通系・冷凍冷蔵対応施設を 中心とした選別的な需要拡大が続き、市場全体としては安定成 長期から再上昇への移行期を迎える見込みである。

物件価格も賃料上昇を反映して上昇が続くと予想される。

注釈:福岡圏に所在する賃貸の大型物流施設が対象。面積は貸床 面積を参照する。

需給の推移

単位:1,000㎡

• 堅調なインバウンド観光需要を後押しに成長は継続

• 2025年後半に、東京で複数のラグジュアリーホテルが開業

• 過去最高の運営パフォーマンスを継続

主要指標

客室増設数(前年同期比)

RevPAR成長(前年同期比) ↑

RevPAR サイクルステージ

注釈:東京のホテルとは、東京所在のラグジュアリー及びアッパーアップス ケールのホテルマーケットを意味する。

延べ宿泊者数は従業員数10名以上の施設を対象とした調査の結果を集計。

2025年第3四半期(1月~9月)の訪日外国人数は31,650,500人 となり、前年同期比17.7%増加した。7月に一部のアジア諸国 からの訪日外国人数が前年同月比で減少したものの、3,000万 人の大台突破は過去9か月で最も早いペースとなった。日本政 府観光局によると、2025年7月累計ベースでの東京における延

べ宿泊者数は前年同期比4.2%増加した。外国人宿泊者数は前 年同期比14.9%増加した一方で、日本人宿泊者数は前年同期比 7.2%減少した。

2025年第4四半期には、外資系ホテルとしては、JWマリオッ ト・ホテル東京が10月2日に、キャプション by Hyatt 兜町 東 京が10月7日に開業した。その他、大規模改修のために2024年 5月からクローズしていたパークハイアット東京が12月9日に リニューアルオープンする。

2025年第3四半期、東京のホテルマーケットは全てのセグメン トでパフォーマンスの成長を継続した。訪日外国人の継続的な 増加がADRの持続的な上昇を牽引し、稼働率も着実な回復を

示した。ラグジュアリー及びアッパーアップスケールセグメン トでは、前年同期比で引き続き大幅な改善が見られた。2025 年9月累計ベースでは、ADR・稼働率ともに前年同期比で大幅 に増加し、その結果、RevPARは前年を大きく上回る伸びを示 した。しかし、ADRの成長率は鈍化の兆しを見せている。

見通し

引続き地政学的リスクは依然として存在するものの、 2025年 第3四半期を経て不確実性は後退している。 2025年第4四半期 以降も、東京のホテルマーケットについては、堅調な業績動向 が継続する可能性が高い。ADRについては、2025年第4四半期 を経て、2025年通年で前年比で上昇することが想定されるが、 伸び率の鈍化傾向がより顕著になるか注視する必要がある。稼 働率についても、ADR同様、2025年通年で前年比で上昇する こと想定され、その要因の一つとして、中国の訪日人数の回復 があるが、来年以降、その特殊要因がなくなるため、ADRに 遅れて、鈍化していく可能性がある。

主要なホテル客室数 新規供給推移

JapanMarketDynamics -2025年第3四半期

不動産の環境認証取得動向

• 国内不動産のグリーンビルディング認証件数は増加、LEEDはデータセンター2件を含む19件

• 国内不動産のウェルネス認証件数は減少、WELLは14四半期ぶりに取得ゼロ

• サステナビリティマーケットダイナミクス日本語版は不動産のエネルギー性能に関する特別レポート付き

LEEDの第3四半期の認証取得件数は19件で、2009年からの 累計で352件(前期比+5.7%)となった。

CASBEE-建築の第3四半期の認証取得件数では23件で、当 期末時点で有効な認証を有する物件は 529 件 ( 前期比 +1.0%)となった。

CASBEE-不動産の第2四半期の認証取得件数は137件で、当 期末時点で有効な認証を有する物件は 2,699件(前期比 +5.1%)となった。

特別レポート 「不動産のエネルギー性能 理想と現実」

主要指標 グリーンビル認証(各認証の増加率の平均) 前期比 +3.9%

ウェルネス認証(各認証の増加率の平均)

-3.3%

注釈:LEED、WELL、Fitwelは全ランク、CASBEE-建築、CASBEE-不動産、 CASBEE-ウェルネスオフィスはB+以上を対象とする。

出所:USGBC, IBECs, IWBI, Fitwel

グリーンビル認証物件数の推移(認証取得年別)

WELLの第3四半期の認証取得件数は0件で、当期末時点で 有効な認証を有する物件は51件(前期比-15.0%)となった。

Fitwelの第3四半期の認証取得件数は0件で、当期末時点で 有効な認証を有する物件は5件(前期比±0.0%)にとどまっ た。

CASBEE-ウェルネスオフィスの第3四半期の認証取得件数は 9件で、当期末時点で有効な認証を有する物件は190件(前 期比+5.0%)となった。

サステナビリティ情報の開示義務化を前にグリーンビル ディング認証の取得が増えている。一方、海外投資家を中 心に不動産投資の判断に利用されるのは気候変動リスクを 評価するCRREM* Pathwayだ。第三者による確認を経て登 録された国内唯一の運用エネルギー消費量データベースと いえる DECC** データと CRREM Pathway を比較し 、 CASBEE-不動産認証のエネルギー評価レベルによる気候変 動リスクを調査した結果、2025年時点で多くの建物がすで に CRREM Pathway の逸脱年を迎えていることや 、 CASBEE-不動産認証で最高ランクを取得していても気候変 動リスクの高い物件があることが判明した。一刻も早いエ ネルギー性能向上に向けた建物運用の見直しや、空調/衛生 設備の燃料転換、電気設備の再生可能エネルギー導入が期 待される。

* CRREM: Carbon Risk Real Estate Monitor

** DECC: Data-base for Energy Consumption of Commercial Buildings

:

ジョーンズラングラサール株式会社

東京本社

〒102-0094

東京都千代田区紀尾井町1-3

東京ガーデンテラス紀尾井町

紀尾井タワー

03 4361 1800

福岡支社

〒810-0041

福岡県福岡市中央区

大名2-6-50

福岡大名ガーデンシティ

092 233 6801

お問合せ先

JLL リサーチ事業部

Tokyo.Research@jll.com

JapanResearchReports

関西支社

〒541-0041

大阪府大阪市中央区

北浜3-5-29

日本生命淀屋橋ビル

06 7662 8400

名古屋オフィス

〒450-6321

愛知県名古屋市中村区

名駅1-1-1

JPタワー名古屋21階

052 856 3357

JLLリサーチは、世界のあらゆる市場、あらゆるセクターにおける最新の不動産動向並びに将来予 測を提供します。全世界 550 名超のリサーチエキスパートが、60ヵ国を超える国々の経済及び不 動産のトレンドを日々調査・分析し、世界のリアルタイム情報と革新的考察を発信しています。グ ローバル、リージョン、そしてローカルの不動産市場におけるプロフェッショナルが集結する精鋭 リサーチチームは、今日の課題、さらに将来の好機をも特定し、不動産に関する最適な意思決定へ とお客様を導きます。

JLLリサーチは、適正な市場メカニズムが機能する公正・透明な不動産市場の形成に寄与すること を使命とし、より良い社会の実現に貢献していきます。

JLL(ニューヨーク証券取引所:JLL)は、不動産に関わるすべてのサービスをグローバルに提供す る総合不動産サービス会社です。オフィス、リテール、インダストリアル、ホテル、レジデンシャ ルなど様々な不動産の賃貸借、売買、投資、建設、管理などのサービスを提供しています。フォー チュン500®に選出されているJLLは、世界80ヵ国で展開、従業員約113,000名を擁し、2024年の売 上高は234億米ドルです。企業目標(Purpose)「Shape the future of real estate for a better world(不動産の未来を拓き、より良い世界へ)」のもと、お客様、従業員、地域社会、そして世界 を「明るい未来へ」導くことがJLLの使命です。JLLは、ジョーンズ ラング ラサール インコーポレ イテッドの企業呼称及び登録商標です。jll.com

OPYRIGHT©JONESLANGLASALLEIP,INC 2025

This reporthasbeenpreparedsolelyforinformationpurposesanddoesnotnecessarilypurporttobeacompleteanalysisof thetopicsdiscussed, whichareinherentlyunpredictable.Ithasbeenbasedonsourceswebelieve tobereliable,butwe havenotindependentlyverified thosesourcesandwedonotguaranteethattheinformationinthereportisaccurateor complete.Anyviewsexpressed inthereportreflectourjudgmentatthis dateandaresubject tochangewithoutnotice. Statementsthatareforward-lookinginvolveknownandunknownrisks anduncertaintiesthatmaycausefuturerealitiesto bemateriallydifferentfromthoseimpliedbysuchforward-lookingstatements.Advice wegivetoclientsinparticular situationsmaydifferfromtheviews expressedinthisreport.Noinvestmentorotherbusinessdecisionsshouldbemade basedsolelyontheviewsexpressedinthisreport.