OFFICIAL TRADE JOURNAL OF THE MICHIGAN CANNABIS INDUSTRY ASSOCIATION

Highway Horticulture has a winning strategy driven by partnerships with other brands

SSG

Shout

We are fortunate to be partnering with SSG to help manage our

Greg and the entire SSG Team have been a tremendous help in the implementation and administration of our employee benefits program across our multiple locations. Their expertise and knowledge regarding coverage and cost, technology, and ACA compliance has provided exceptional value in helping us make informed decisions!

GREG SUDDERTH CEO & Lead Benefits Advisor

We focus on the kind of growth that doesn’t come from a seed.

Focused on your next move. Cannabis. It’s complicated. It’s capital intense. And it’s highly regulated. To focus on growing your company, you need a financial partner who understands state requirements, compliance issues and the unique landscape of the industry. As longtime members of the MiCIA, Maner Costerisan’s team of experts helps dispensaries, processors, secure transporters and cultivators across the state achieve their goals.

We assist cannabis companies managing the complexities of running multiple entities and provide CFO-level expertise to those looking to develop or execute buy-sell strategies. Our tech experts integrate cloud-based accounting financial software with your current systems –including seed-to-sale software — providing you with a new level of customized, real-time data, so you can make more informed business decisions. We know how to turn America’s new cash crop into a long-term plan.

Business leaders in the cannabis industry say they trust the attorneys of Plunkett Cooney to help them secure and renew licenses, anticipate legal pitfalls and win in court. Grow your cannabis business with confidence. Get the Plunkett Cooney perspective.

n Business Transactions & Planning n Cannabis Law n Commercial Litigation

n Employment Law n Environmental & Energy Law n Government Relations

n License Applications & Renewals n Mergers & Acquisitions n Real Estate Transactions

n Regulatory Compliance n Trust & Estate Planning n Tax Law

ATTORNEYS & COUNSELORS ORNEYS AT LAW

J Jeffreffrey M. Sc y Schroder

Direct: (248) 594-2796

jschroder@plunkettcooney.com

Wensdy Von Buskirk

Lauren Wethington

24

The

By Douglas E. Mains

The

By Kevin A. McKinney

Because Republicans won back the majority in the Michigan House of Representatives this past fall, the 103rd Legislature started off more slowly than recent past sessions. Newly elected House Speaker Matt Hall was very methodical in naming new committees, chairs, and committee members, who certainly will have different priorities than their predecessors. The speaker also announced his House Oversight Committee, which is tasked with reviewing aspects of the Whitmer administration and has the unprecedented authority to subpoena anyone to appear before the committee. No doubt, these investigations and hearings will spur public attention as they will focus on the auditor general’s reports.

The Senate was not up for reelection this past fall and only made minor changes in committee assignments because of the vacancy left by former Sen. Kristen McDonald Rivet, who resigned to represent the 8th Congressional District nationally. The governor has yet to announce a date for a special election to fill this Senate vacancy, thereby leaving Senate Democrats with a 19-18 functioning majority. This is the environment that has unfolded and continues the hyperpartisanship between the party caucuses, legislative chambers, and gubernatorial administration.

Even late in this first quarter, some committees are now just beginning to meet. The Legislature did, however, find a compromise to the highly controversial issue addressing the tip wage and the earned sick leave issue prior to the Michigan Supreme Court’s deadline of Feb. 21.

The governor has submitted her executive state budget recommendations for fiscal year 2025–2026 to the House and Senate appropriations committees, and the appropriations process has started. This year will be much more challenging given the divided Legislature, significantly fewer surplus funds to cushion spending priorities, and yet-to-be-

determined large reductions in federal dollars coming to the state. Additionally, the House Republicans’ top priority to deal with local road funding is based on finding significant general fund savings to fund the $3 billion needed annually to fix the roads without raising new taxes. The governor’s recent announcement of how to fund the roadwork is significantly different from the House and Senate Republicans’ plans, so the highly politized local road funding package will be entangled with the budget negotiations over the next several months.

Of great concern and surprise with the governor’s proposal was the inclusion of a suggested 32% wholesale tax on recreational cannabis. This proposed tax would be close to $500 million annually and is a significant component of her initial funding plan. The MiCIA has expressed strong opposition to the proposal and its very untimely impact on the cannabis industry. To date, there has been only a lukewarm reception from a few legislative offices that would consider this tax even with the realization that it would require a supermajority vote in both chambers to pass.

The MiCIA will continue to meet with legislative members as well as the Whitmer administration to strongly oppose this proposal. So far, House Republican leadership states the road funding proposal can be achieved through redirecting current general fund monies and has little interest in any new tax revenue at this stage of negotiations.

The MiCIA has also been in discussion with Sen. Jeremy Moss, D-Southfield, who chairs the Senate Regulatory Affairs Committee, about ongoing challenges for Michigan licensees and

possible legislative remedies needed in the cannabis industry. Moss has agreed to open this public discussion with a dedicated committee hearing on the “state of the industry.” This opportunity will allow major stakeholders like the MiCIA and the Cannabis Regulatory Agency to share with policymakers a more realistic analysis of the current cannabis market in Michigan. This should help prompt additional interest in tackling the MiCIA’s priority of stopping the flow of illicit products into Michigan’s regulated market in order to stabilize the legal industry.

Another key legislative initiative is dealing with the current unregulated and untested intoxicating hemp products that are getting into the hands of consumers, particularly our youth. A significant bipartisan, bicameral package is expected to be introduced in the coming weeks.

Other legislation that the MiCIA will be monitoring will be the merger bill between the Michigan Regulation and Taxation of Marihuana Act and the Medical Marihuana Facilities Licensing Act as well as the bill creating the authority for the state reference lab.

Finally, the MiCIA will continue to support efforts to secure funding in the state budget for the state’s social equity program.

With all that is ahead of us with the budget negotiations and policy that will create a better and more stable business environment, it is paramount that you continue to fully support the MiCIA and effectively engage in the political and legislative arena at the grassroots level. Not doing so is not a good option and, more importantly, not a good business decision.

Kevin A. McKinney

KevinA.McKinneyisthe leadlobbyistfortheMiCIA.

“What makes us unique is that while we work with these incredible national brands, we also remain committed to local legacy Michigan brands that have stayed true to their values in the cannabis space. It’s a really awesome dynamic.”

Highway Horticulture has a winning strategy driven by partnerships with other brands BY WENSDY VON

With a 28,000-square-foot processing facility in Marshall; a 20,000-square-foot grow in Cassopolis co-located with a retail store; and the house brand Inner Circle producing flower, pre-rolls, infused products, and concentrates, Highway Horticulture is a standout player in Michigan’s cannabis scene. Yet, the company doesn’t stop there.

ing their brand as it benefits everyone.”

One of Highway Horticulture’s most recognizable national brands is Belushi’s Farm, headed by actor and cannabis advocate Jim Belushi. He often heads to Michigan to help promote his Blues Brothers–branded products.

“He’ll come out to dispensaries and local events to engage with people and share his story about how he got into the industry,” says Kelsey Palmer, director of wholesale for Highway Horticulture.

Keef is another national name doing well for Highway Horticulture with its high-dose-cannabis-infused sodas.

Complementing these national names are legacy Michigan brands that date back to the caregiver days.

“We recognized that Michigan loves Michigan-made products and Michigan brands,” Sayers says.

Triple Phoenix, helmed by legacy operator Harry Barracuda, his daughter Rachel

Pell, and partner Daryl Mynes, produces its line of Mellow Bars and freeze-dried fruits in its own designated space within Highway Horticulture’s facility.

Partnering with Highway Horticulture “has been a great fit because their team shares our values,” Pell says. “It’s also helpful for sales to be part of a ‘house of brands.’ … It’s been great for us to be part of this ecosystem.”

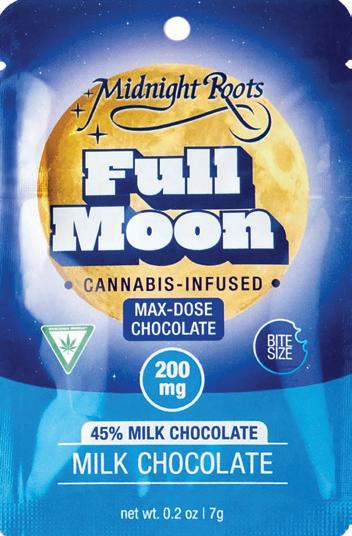

Another legacy brand, Midnight Roots, creates cannabis-infused chocolate bars and Full Moons — high-dose chocolate discs — in a variety of creative flavors.

Jake Greba, who co-owns Midnight Roots with Pat Anderson, has won 12 High Times Cannabis Cups for breeding and growing flower, but he decided to focus on chocolate as a competitive niche.

“We design, create, and make all our own chocolates,” Greba says. “Highway handles some of the final packaging and

logistics, and we share sales efforts.”

Being part of Highway Horticulture also opened the door for Midnight Roots to collaborate with Belushi’s Farm on The Blues Brothers Jivin’ Java milk chocolate bar dusted with a coffee-and-toffee crumble.

“It’s been our bestselling bar so far,” Greba says. The collab is an example of how brands find synergy within the Highway Horticulture ecosystem.

Likewise, having a carefully curated selection of brands helps Highway Horticul-

ture provide dispensaries with a thoughtful variety of products. “We’re a one-stop shop across the categories for retailers,” Sayers says.

Palmer notes another benefit of Highway Horticulture’s deliberate approach to brand partnerships: “Having two national brands that are big multistate operators helps us break through doors and knock down barriers.” At the same time, she adds, “what makes us unique is that while we work with these incredible national brands, we also remain committed to local legacy Michigan brands that have stayed true to their values in the cannabis space. It’s a really awesome dynamic.”

Recently, Highway Horticulture launched its new house brand Inner Circle, aiming for a more exclusive but accessible feel.

“We’re introducing new genetics to the market while staying familiar in key categories,” says Jonny Griffis, director of processing operations. “We’ll be releasing products like concentrates, BHO [butane hash oil], and solventless hash rosin, which we haven’t done in a while. It’s exciting to dive back into concentrates.”

Griffis came on board from True North Collective, where he was the company’s first employee.

“The potential to create my own products was a big selling point in transitioning here,” he says. “This opportunity allowed me to learn new things, leverage my industry experience, and make more unilateral decisions. It’s been great working with Nick and helping navigate the market, coming up with cool, competitive products that can gain market share.”

In late January, Highway Horticulture opened a dispensary in Kalamazoo through a joint venture with Bloom City Club, and at press time, the company was planning to add to its staff of around 60 employees.

Highway Horticulture’s partners also have some exciting things in the works. Pell is relaunching Detroit Oil vape carts this year, and Keef will introduce new flavors, including Mr. Puffer, a Dr. Pepper dupe, and High Octane, which is similar to Mountain Dew and contains 100 milligrams of caffeine.

With stiff competition in the Michigan

Top: Highway Horticulture’s brand partner Midnight Roots (co-owned by Jake Greba, inset left, and Pat Anderson, inset right) collaborated with Jim Belushi (inset center) on The Blues Brothers Jivin’ Java milk chocolate bar. Above: Highway Horticulture also partners with the Keef soda brand.

market, it’s been a bumpy road for cannabis companies, but Sayers says Highway Horticulture is charting a course to success.

“It just makes us work harder to find more savings and to find more efficiencies to counter the price compressions we’re seeing across the board,” Sayers says. “I’m hopeful that having strong business practices and good business leaders running our business units is going to help us get

through this as other players are kind of falling by the wayside.”

Sayers says he can afford to be choosy before bringing any new partners along for the ride.

“We’re open for business to take on more brands,” he says, “but we’ve gone through a little bit of a cycle of picking the winners, and that’s what we’re running with.”

Keep your workforce up to date with continuing education courses or degree programs. Become a partner to upskill your workforce, train new employees, request student interns, or fill open positions.

Programs include:

Cannabis

Human Resources

Business Accounting

Marketing

Information Technology and AI

Supply Chain Management

And more

To become a partner and search programs visit CE.baker.edu

Freshman state Reps. Ron Robinson and Steve Frisbie discuss the future of Michigan’s cannabis industry

BY LAUREN WETHINGTON

Elected in November 2024 to represent Michigan’s 58th District in the state’s House of Representatives, Ron Robinson is one of four new state House legislators who received an “A” grade on the MiCIA’s 2024 politician scorecard. (The other three are Steve Frisbie, R-Pennfield Township; Stephen Wooden, D-Grand Rapids; and Karl Bohnak, R-Deerton.)

The small-business owner and retired United States Marine Corps member now represents parts of Sterling Heights, Warren, and Shelby Charter Township, as well as his hometown of Utica. At the time of this writing, Utica was home to two cannabis retailers (Cloud Cannabis Co. and Puff Utica), which Robinson calls “great neighbors.” (The city approved two more retail licenses in 2024, and JARS Cannabis opened a store in Utica in early 2025.)

“They’ve been great stewards of the community,” Robinson says of Puff Utica. “They’re everything you could hope they would be as a local business. They’re good community patrons. They’ve donated things to the city that have enriched the community.”

Prior to the beginning of his term in Michigan’s House of Representatives, Robinson held a seat on Utica’s city council, which granted those two additional recreational cannabis licenses during his tenure. Robinson says one of his biggest concerns when

he was contemplating the new licenses was crime, but reviewing the statistics for the existing dispensaries in his city alleviated that concern.

“Besides some littering of some bags from the dispensaries, the crime — at least in Utica — wasn’t really an issue,” Robinson says. “[Police] were getting more calls from Home Depot and Best Buy than they were from the dispensaries.”

Robinson wanted to learn what his neighbors thought. During bike rides with his wife, he stopped and held informal interviews with about 100 other locals to get their takes on Utica’s budding cannabis scene.

“Almost 70% had no problem with two more cannabis stores; maybe 20% were against it, and then the rest just were indifferent,” Robinson says. “Even the Christian people, going to church every week, come out and ask me about [whether] there are going to be consumption shops. … People are starting to understand that it’s not going away, and, like I said before, they’re good businesspeople.”

Moving forward, Robinson wants to look into the question of oversaturation and license caps, citing Hazel Park as an example of a community with a particularly full cannabis scene.

“Business owners kind of want to see a cap on how many licenses you’ve given out. I don’t know how I feel about that, because I believe in the free market,” Robinson says, although he adds that he does think “four [dispensaries] is a good number for Utica.”

Robinson also has concerns about Section 280E of the federal Internal Revenue Code, which prohibits businesses that “illegally” traffic Schedule I or II substances from deducting business expenses — an option almost every other business owner has.

“That’s something that needs to be looked at, because it’s completely unfair,” Robinson says.

“Unfair” is also the word he uses to describe the stigma that still lingers around cannabis in some spaces. But he contends that progress is being made.

“I’m one of those people that if I don’t know something, I want to learn it,” Robinson says. “And the more I learn about [cannabis], it’s obviously helpful for a lot of people. … From what I’ve seen so far, I’m very happy with the cannabis stores in my neighborhood.”

Hailing from Pennfield Township, freshman state Rep. Steve Frisbie represents Michigan’s 44th District, which also encompasses Battle Creek, Springfield, Bedford Township, Convis Township, Lee Township, Clarence Township, Sheridan Township, and Albion. The gig is a change of pace for Frisbie, who previously served in emergency medical services for more than 40 years. He also shared his knowledge of the field as an adjunct professor at Kellogg Community College, where he taught for 23 years.

“After the 2022 election, what started happening in Lansing was not anything I much agreed with,” Frisbie says. “And I decided, after 41 years [in EMS], it was a good time for

me to look at running in the state House.”

Prior to his election, Frisbie served for 13 years as a commissioner in Calhoun County, including as the board of commissioners’ chair from 2019 to 2023. He says he saw a “proliferation” of cannabis operations in the county, prompting him to echo Robinson’s concerns about so many similar businesses all staying afloat.

“I’m just wondering — in the supply and demand kind of thing — how long all these

businesses are going to be able to survive,” he says, although he praises the entrepreneurial spirit. “Good for them — it’s a free market. They get to offer a product and promote good business.”

Frisbie says a big concern of his is the lack of testing methods that can accurately determine whether someone is under the influence of cannabis while driving or on the job, for example. Currently available tests only reveal whether THC is present in someone’s system, not whether the individual is actively impaired. Such tests can lock even occasional cannabis users out of certain careers.

“Coming from the EMS side of things, we couldn’t allow it because the federal rules say you can’t have it in your system,” Frisbie explains. “Of course, there are levels [of THC] that are affecting you, and there are probably levels that are not. Can we get that resolved somewhat quickly, just to determine, are you under the influence or not?”

Although he says he is not a user himself, Frisbie hopes Michigan’s cannabis businesses face fewer “stumbling blocks” in the future.

“How do we get rid of the conflicts that cause some big problems for cannabis operators, such as the banking, the federal laws?” Frisbie wonders, noting that “the citizens wanted to have it as an alternative to other things, like alcohol, and it’s legal, so we have to adopt it and adapt to it.”

—State Rep. Steve Frisbie

“The citizens wanted to have [cannabis] as an alternative to other things, like alcohol, and it’s legal, so we have to adopt it and adapt to it.”

By Adam Fromm

The United States Patent and Trademark Office issues registrations for trademarks used with cannabis industry goods and services, despite the federal illegality of psychoactive THC products. This is because there is no prohibition on the registration of trademarks with federally legal goods and services that are commonly sold by cannabis companies.

These federally legal goods and services include apparel, batteries, consulting services, grinders, software, grow systems, lighting, education services, packaging, pipes, stickers, backpacks, retail services, rolling papers, topical skin products, podcasts, vape pens, watering systems, and more.

Many states also grant registrations for marks used with psychoactive THC goods that are legal within that state.

Given the amount of time, money, and effort put into developing a company’s products and services, it is vital to register and protect the company’s trademarks and intellectual property, when possible, through a combination of federal and state protection. Notably, U.S. trademark rights are granted to the party that either first uses a trademark in commerce or first files an application for a

Given the amount of time, money, and effort put into developing a company’s products and services, it is vital to register and protect the company’s trademarks and intellectual property, when possible, through a combination of federal and state protection.

trademark that is ultimately registered.

Even so, registration of a cannabis trademark as a valuable business asset is just one side of the proverbial coin. The other side considers whether, notwithstanding a registration, the mark can be used in commerce without significant risk of competitor conflicts.

To assess this risk, cannabis companies should also conduct “clearance” searches using the USPTO trademark register and some internet searching for same or similar trademarks used by competitors to sell same or similar goods and services. Cannabusinesses should also search state trademark registers where they operate, because, as suggested above, competitors will often pursue state registrations of trademarks with psychoactive THC.

Bright-line issues are commonly easy to detect with limited searching when a desired trademark is already used in identical manner by another company. In other words, it is often easy to detect the use of identical trademarks with identical goods and services. However, businesses launching new brands must also consider similar (and not just identical) trademarks in prior use, including marks with similar spellings, sounds, meanings, additional words, or fewer words, that are used with same, similar, or related goods and services. For example, a CRAFTY mark used with vape pens will likely conflict with a CANNACRAFTY mark also used with vape pens.

and services that have no relationship to the cannabis industry. For example, a GOLDEN trademark used with cannabis goods and services is unlikely to conflict with a GOLDEN trademark used with carpeting.

Some cannabis companies have sought to leverage popular consumer brands from other industries, only to face cease and desist letters and possibly even lawsuits. Well-known examples include STARBUDS, ZKITTLEZ, and GORILLA GLUE. This highlights the importance of avoiding trademark infringement and ensuring originality in branding within the cannabis industry.

Registration of original cannabis trademarks is an important step that should be pursued by businesses as early as possible, at both the state and federal level. It is perhaps even more important to vet the trademarks against earlier use by competitors. That way, businesses can benefit from the power of cannabis trademarks that not only accrue equity as assets but are also free and clear from competitor conflicts.

Adam Fromm is a Chicago-based Cannamark intellectual property attorney at Clark Hill, PLC.

A similar mark uncovered by a cannabis company is less likely to be a risk to the business if the similar mark is used with goods

This column is intended for general informational purposes only and does not constitute legal advice or a solicitation to provide legal services. The information in this column is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. Readers should not act upon this information without seeking professional legal counsel. The views and opinions expressed herein represent those of the individual author only and are not necessarily the views of Clark Hill PLC.

BY DOUGLAS E. MAINS

After years of promising that a new rule set was coming, Michigan’s Cannabis Regulatory Agency finally released a draft late last year. Despite the length and complexity of the proposed rule set, most of the CRA’s current rules would remain in effect, albeit with many reworded and rearranged for better clarity. Two other goals of this rule set are clearly to (a) eliminate redundancies and (b) codify the CRA’s bulletins, FAQs, and other guidance. However, in addition to administrative, clerical, and formatting changes, the CRA has also proposed many substantive revisions, some of which would represent drastic changes. The most significant modifications are highlighted here, with a citation to the proposed rule for reference.

In a noteworthy change, the CRA is proposing to allow for the denial of applications if an applicant has had a civil judgment entered against it for failing to pay for cannabis-related “work, services, products, or equipment.” R 420.11(1) (i) and R 420.14(2)(a). The CRA could also reject applicants with a history of regulatory noncompliance or of distributing alcohol or tobacco to minors. R 420.11(1)(j), (k) and R 420.14(2)(a).

The CRA is proposing to extend the current review and approval requirements related to licensing and management agreements to manufacturing agreements as well. R 420.21(2), (3). All agreements that a licensee enters would also be required to contain certain terms, including terms related to cost and price calculation, regardless of whether the agreement would otherwise need to be disclosed to the CRA. R 420.21(4).

The rules include several provisions regarding intellectual property. Specifically, applicants would be required to disclose all “trademarks, service marks, or brands” they plan to use. R 420.6(1)(a)(vi). Subsequent changes to those marks or brands would require CRA preapproval. R 420.18(2)(e).

Additionally, licensees would be required to notify the CRA of any changes to their insurance policies or property documents, including changes regarding

the frequency or amount of any rental payments. R 420.15(8)(e)–(f). The rules also state that the closure of a license does not terminate the CRA’s authority to impose sanctions, which is currently only the case for Medical Marihuana Facilities Licensing Act licensees. R 420.806(4).

Another major, although not unexpected, change is that the rules would eliminate the prohibition on having an ownership interest in more than one microbusiness or five adultuse grower licenses. R 420.16. As a result, excess marihuana grower licenses would be phased out, with the CRA no longer granting those licenses but continuing to renew existing licenses while treating them as if they were Class C growers. R 420.103(1)–(3).

The CRA is also proposing changes to other special license types. Designated consumption establishment licenses would only be required when a business allows on-site cannabis consumption for more than seven consecutive days and charges an entry fee, requires a membership, or sells goods or services while individuals are consuming. R 420.102(1). Designated consumption establishments would also be allowed to co-locate with non-cannabis businesses so long as all relevant zoning and permitting requirements were met and no alcohol were available for sale, served, or consumed on-site. R 420.102(3)–(5).

A temporary marihuana event license would no longer be required for an event where marihuana is consumed but not sold. R 420.1(2)(aa). The Class A microbusiness license would also undergo changes, namely that an individual who holds an ownership interest or management position in such a business would be prohibited from being a supplemental applicant for another licensee. R 420.110(4). Additionally, Class A microbusinesses would be allowed to engage in processing and to sell flower to other businesses. R 420.110(1)(b), (e).

The CRA is proposing significant changes to business operations, including to surveillance requirements. The rules would require that all sampling be recorded, R 420.302(9), and,

controversially, that licensees maintain their surveillance system in a manner that allows the CRA to have real-time access to their cameras through a web-based portal. R 420.209(11)(a).

The CRA is also proposing changes to Metrc reporting. Specifically, growers and processors would be required to indicate the exact location at their facility where specific plants and products are located. R 420.201(2) (c) and R 420.201(4)(f). Processors would also be required to enter product expiration dates, as well as data related to the amount of marihuana used during processing. R 420.201(4) (b)–(e). Safety compliance facilities would be required to upload certificates of analysis for each sample. R 420.201b(2). All licensees would be required to notify the CRA of any incorrect information entered into Metrc, correct any error within seven days, and document the reason for the error. R 420.201(10).

In addition to new Metrc requirements, licensees would also have new operational directives, including a mandate that most licensees perform physical inventory audits at least twice annually, R 420.202(6), and that all licensees comply with their standard operating procedures. R 420.213(1). Licensees would also be required to weigh all flower within 48 hours of shipping to account for moisture loss, R 420.216(4)(b), and to verify the accuracy of any shipment within 72 hours of receipt. R 420.216(5)(b).

Changes would also be coming for individual license types. Growers would be required to associate each part of a harvested plant with the specific plant tag it came from. R 420.205a(3). Growers would also no longer be allowed to transfer untested marihuana for processing, as current R 420.303(6) is not included in the proposed rules. Processors would be required to maintain certificates of analysis for all non-cannabis ingredients used in making infused products and would be required to comply with records of formulation for infused products. R 420.208(5), (7). For retail businesses, no separate point-of-sale area would be required, R 420.501(b), and delivery

drivers would be allowed to work for multiple locations so long as all were under common ownership and the driver were only working for one location per trip. R 420.502(6).

The rules also include changes related to marketing, including requiring that brand advertisements comply with the same requirements as product advertisements, R 420.507, and allowing businesses to advertise that their cannabis has not been treated with radiation or other decontamination methods. R 420.508.

Accounting and recordkeeping requirements would also change for licensees, who would be required to use a double-entry bookkeeping system and general ledger software. R 420.22(2). All growers, processors, and retail businesses would also be required to perform monthly reconciliations of their Metrc revenue, their general ledger, and, if applicable, their point-of-sale revenue and to document any discrepancies. R 420.22(3), (6).

Notably, the rules would prohibit licensees from converting any cannabinoid into another using any type of chemical reaction other than, in certain circumstances, decarboxylation, R 420.218a(1), and would prohibit the sale of such converted cannabinoids. R 420.218a(2). Certain testing failures would also be prohibited from being remediated, including positive tests for vitamin E acetate or MCT oil. R 420.309(2). The rules would also permit the CRA to require a licensee to have any product in its inventory tested or retested at the licensee’s expense. R 420.802(1), (2).

The rules would allow growers, processors, and stores to create pre-rolls, but only a processor could create infused pre-rolls. R 420.401(1), (2). Additionally, pre-rolls from multiple harvest batches could be included in a single package. R 420.401(5).

For edibles, the rules include requirements related to serving sizes. For solid items with multiple servings, the rules would require the item to be scored in a way that allows a customer to break it easily into single portions. R 420.402a(3)(a). For packages containing multiple servings of a single product, the rules would require the product to be sold with a measuring device to allow a consumer to measure a single serving, unless a single

CPA Kareyna Miller from LEACIF weighs in on cannabis accounting

By Kathy Gibbons

“You have to know what your numbers are before you can move forward with other decisions.”

When Kareyna Miller founded LEACIF in 2014, cannabis wasn’t on her radar. She was focused on bookkeeping for small businesses, with the goal of using technology to offer primarily remote support.

In 2017, however, she saw the opportunity to launch a separate accounting firm that would specialize in cannabis. Her timing proved fortuitous given the legalization of adult-use cannabis in Michigan in 2018, and Miller spent about four years building the company and her client list of cannabis growers, processors, and retailers.

Eventually, Miller decided she wanted her long-term purpose to focus on cannabis, and she returned to LEACIF in 2021 and pivoted her business model. “Before, we were eager to work with anybody and everyone and were excited to grow and saw the opportunity,” she says. She has since scaled back to serve a more fine-tuned list of clients in the cannabis industry with whom she says she has a deeper, hands-on relationship.

Here, she talks about what she’s learned, how it’s going, and the financial landscape for cannabis operations.

This interview has been edited for length and clarity.

HOW HAS YOUR DIRECTION EVOLVED?

We went from working with hundreds of clients in the industry in the early days to now supporting many less but in a very detailed and hands-on manner. I had the opportunity to work with the Michigan Cannabis Regulatory Agency and was part of the first work group for designing the procedures for the initial AFS [annual financial statement] reports required of all Michigan cannabis

license holders. I am also a founding member of our cannabis resource group with the Michigan Association of CPAs.

Our business model and the initial vision for the firm was to combine technology with accounting and be able to offer remote accounting services. Being a new industry, cannabis was open to that business model versus more traditional industries. The openness to a more modernized process was attractive, and accounting service providers were very much needed to support the industry as it began to develop into a regulated structure.

HOW HAVE THINGS CHANGED ON THE ACCOUNTING FRONT FROM WHEN YOU STARTED TO NOW?

Before, it was a lot of chaos, for lack of better words. It’s very difficult to give high-level service, attention to detail, timely communication, and timely report deliveries when you’re managing so many different clients. That’s a good way to scale quickly, but it doesn’t in my opinion provide the right service for the clients for how they’re going to benefit. Now I spend considerable time with my clients talking through business management issues, pricing strategy issues, tax planning, looking at new markets, looking at how they can pivot their existing business model — things that really take time and attention to detail. I still do the accounting, I still oversee my clients’ books, do the tax preparation, all of the compliance aspects, but what’s different is I feel I’m part of my clients’ businesses now. I’m a member of their team in many respects, where before it was more of a transactional relationship. We got the work done but didn’t spend a lot of

time with the clients otherwise.

I’ve seen clients go through mergers, go through forming partnerships and manufacturing joint ventures with other operators. Some of the clients I work with have fairly significant issues they are dealing with: disputes with business partners, creative manufacturing agreements they’re trying to put together or work under. If somebody comes into the industry without that type of experience, I don’t think they’d be able to help advise at all on some of these issues. Businesses have to have somebody who understands what the requirements are. There’s a lot specific to cannabis that you’re not going to see in another industry.

IMPORTANT IS

Accounting drives a lot of other processes. Let’s say a retailer is not hitting the sales margins they want to. We see that first from the accounting side. The numbers don’t lie. That foundation, which is essentially fact based, can help drive what your sales decisions are or what your operational decisions are. If you’re having a conversation with your CPA about making sure your cost per pound is under a certain number, or margins are at a certain percentage on the retail side, if you’re not hitting those goals, the conversation turns to: How can you? That starts with the accounting. You have to know what your numbers are before you can move forward with other decisions.

Another measure I’ve been using lately is nondeductible expenses as a percentage of revenue. This helps businesses understand how well they are controlling costs that are not allowed to be deducted because of IRS Code Section 280E, which allows marijuana business owners to deduct the cost of goods sold but not ordinary expenses.

IN

One of the things that stands out is understanding the time it takes to be compliant and make sure each detail is correct. There’s a lot of underestimation of what is involved in having a fully complete accounting system and treating it as a strategic initiative for your business. That’s where your numbers are and your planning begins. If you’re not taking the time to make sure your performance reflects that, if you’re not studying your key indicators, using financial information to drive your business decisions — if you’re just looking at it as “I have to have these things in place so I don’t get a fine from the CRA” — that’s not enough.

Another thing is on the cost accounting side and making sure you’re in a good position with 280E. Something I wish licensees understood better is that you may have opportunities to be more strategic, but your day-to-day accounting has to reflect that. It’s not just adjustments that happen at year-end or quarter-end. If you want to take a strong inventory costing position within the regulations, that takes time to do, and you need to make sure your day-to-day accounting is set up to support that.

One thing I see is that licensees don’t understand the time and complexity with the AFS. Even if they’re working with a CPA who specializes in cannabis, there may still be holes. They need to provide their revenue reconciliation and make sure it agrees with Metrc, making sure reports they generate from their system have what the AFS needs to look at and pull samples from.

If you have an in-house accounting department or in-house accountant maintaining your QuickBooks and they don’t understand the tax implications — the planning around 280E — that’s not good enough. There’s a lot of that out there; licensees have to control their costs. A lot of times I see where they’re trying to cut costs in their accounting and have people come in who maybe aren’t as experienced — they know bookkeeping, but they don’t know cannabis bookkeeping — and it doesn’t help the licensees. The books may have every transaction captured, but there’s no planning.

The other is the 280E. I have had all of my clients ask me if 280E applies anymore because of media attention around proposals to decriminalize or reschedule cannabis nationally, but I have to explain that yes, it does apply. It creates a lot of illusion out there when there are companies taking the

position that it doesn’t apply to them. The IRS positions that have come out specifically say it does apply.

I see more consolidation happening in the next couple years. I also see more of the average-size growers moving into the retail sector. They’re not able to get their products

out how they want to from a wholesale perspective — they can’t find the right processor partners or right retail partners to sell to — so they’re looking at “Let’s just open our own store.”

I think you’ll see more manufacturing agreements that are kind of out-of-the-box.

As an example, we had a client who was really struggling a couple years ago and thought they would maybe have to close their doors. They decided to get into an entirely different revenue stream, and now they provide services to other growers and processors right along with selling their own products that they grow. We’ll see more of that.

And having a stronger focus on accounting is going to come into play as businesses mature. I think we’ll see an increase in operators realizing the benefit of having a stronger focus on accounting and financial planning.

What they are, why you need one, and how to apply

By Patrick Dunn

Astate wastewater permit is required for any cannabis growing or processing operation that discharges wastewater into Michigan’s waterways, as it is for any business that does so. We connected with Josef Greenberg, a public information officer at the Michigan Department of Environment, Great Lakes, and Energy, to learn more about wastewater permits. Here’s everything you need to know.

Greenberg notes that cannabis growing or processing facilities may discharge different kinds of wastewater, including irrigation runoff; processing wastewater from topicals, edibles, or concentrates; reverse osmosis backwash concentrate; dehumidification condensate; and water softener backwash.

“These types of wastewaters can contain concentrated amounts of pollutants, including, but not limited to, nitrates and phosphorus from fertilizers, or metals such as iron, aluminum, thallium, and vanadium,” Greenberg writes via email.

He adds that the permits are designed to ensure that wastewater is discharged in a way that is “non-injurious” to protected uses of state waters, such as using groundwater for drinking or protecting aquatic organisms.

A wastewater permit certifies that your business is treating and discharging wastewater in a way that isn’t harmful to state waters. Wastewater permits require businesses to check how much wastewater is released and note any pollutants in it by sampling the wastewater before it is discharged or monitoring the groundwater via groundwater wells.

EGLE’s Water Resources Division issues

wastewater permits. To obtain one, you can submit an application using EGLE’s MiEnviro Portal at mienviro.michigan.gov/ncore/ external/home.

“A wastewater sample must be included, and the proposed treatment must be designed to meet groundwater and/or surface water quality standards,” Greenberg says. “The wastewater discharge permit is needed before a discharge occurs.”

An annual permit fee, ranging from $240 to $7,500, is established when the permit is issued. The fee depends on the permit type and category. Wastewater permits are effective for a maximum of five years, and facilities must renew their permits before they expire.

Greenberg emphasizes that a permit is required for all businesses that discharge wastewater to state waters, regardless of the operation’s size.

“There are many ways to dispose of wastewater generated at a facility,” he says. “In most scenarios, a wastewater discharge permit would be required.”

Some limited options are available to circumvent discharging wastewater into state waters and therefore needing to obtain a wastewater permit. For instance, Greenberg notes, your local municipality’s wastewater treatment plant may be willing and able to accept your wastewater. You could also pump wastewater into an on-site tank serviced by a liquid industrial by-product transporter.

Some wastewater disposal methods have their own specific permitting considerations. For example, if your business discharges wastewater to a surface water body, you

must meet surface water quality standards prior to discharge and obtain a National Pollutant Discharge Elimination System permit from EGLE. To discharge wastewater to the ground or groundwaters, you must determine what groundwater quality standard is required for your planned method of disposal and obtain a groundwater discharge permit from EGLE. Discharging sanitary sewage to an on-site wastewater system may require a construction permit from your local health department.

Greenberg says this is one of the most common questions EGLE receives from cannabis facility operators. He says grows’ irrigation runoff may fit the definition of wastewater, which is “liquid waste generated by industrial, commercial, or municipal processes that is discharged (disposed of) directly or indirectly into the waters of the state, including groundwater.”

“EGLE has data showing that this runoff can include pollutants that are or may become injurious to the protected uses of the waters of the state,” he says. “For example, irrigation runoff water may contain elevated levels of nitrate. This is hazardous if it increases the concentration of nitrate in the groundwater, which may impact a nearby drinking water [source]. This can cause the source of drinking water to be harmful to human health.”

DOES MY CANNABIS OPERATION NEED OTHER ENVIRONMENTAL PERMITS?

Maybe. For example, Greenberg says that processors “should assess whether their air emissions need an air permit, determine if wetland permits are needed, and if facilities are required to properly dispose of waste.” More information is available at michigan. gov/eglecannabis

him have to contend with heavy advertising regulations. Social media, in particular, can feel like navigating a minefield. “We had our Facebook shut down,” Basore says. “Our Instagram has been fine, but we have to be really careful.” Meta, the parent company of Facebook and Instagram, disallows ads that “promote or offer the sale of” THC products, cannabis products with similar psychoactive components, or drug paraphernalia. That’s why cannabis-related social media accounts tend to shy away from pushing anything in particular and instead deal in general vibes and coded captions.

Beyond social media platforms, myriad rules govern how cannabis products can be marketed and sold in Michigan. Douglas E. Mains, a lawyer and partner at Honigman LLP in Lansing, who has been instrumental in drafting cannabis laws in the state, highlights a few: Sellers can’t target children with their advertisements, and they can’t advertise products to the public unless they can show that no more than 30% of that audience is underage (18 for medical, 21 for recreational). Product advertisements must feature certain health and safety warnings, too. Mains argues that cannabis brands and cannabis products are different things and therefore the product advertising rules shouldn’t apply to brands, which may be why so many highways are lined with billboards featuring a cannabis brand’s name splashed in wink-wink green and not much else.

That distinction might change, however, if the Michigan Cannabis Regulatory Agency’s proposed new rules go into effect. “In the new rules, what they’ve proposed is the advertising and marketing restrictions would apply to both a product and a brand,”

Mains explains. Such a change “raises some questions,” he adds: Would the name of a cannabis store be considered a “marijuana brand,” meaning billboards advertising a new store opening might need to include a health warning? Would every branded piece of merch have to come slapped with a warning label? He says that’s a topic the industry will want to keep an eye on over the coming months. “[I’m] hoping the CRA will look back at that rule and take a little more [of a] nuanced approach to it,” he says.

Given cannabis’s federal standing, television and radio ads aren’t even part of the conversation at this point. Will cannabis ads one day run back-to-back during the big game like celeb-endorsed liquor brands? Time will tell.

In the meantime, Basore and enthusiasts like him are making do and then some. Basore has always been a fan of what he calls “guerrilla marketing.” Think T-shirts for budtenders, who become walking

billboards, or “thank-you” swag that leads to word-of-mouth marketing. Over the years, the Redemption team has cultivated invaluable relationships with fellow industry folk and consumers. “But it’s also getting our story out there, what we do with our foundation, the money that we give back, the people that we’re helping,” Basore says. “It’s all authentic.”

Basore served four years in prison for felony charges related to the manufacture and distribution of cannabis. The dispensary he opened in 2010 was raided, though he believed it to be in full compliance with state laws. When he was released, Basore entered the advocacy space. Today, 10% of Redemption’s proceeds go to help individuals negatively affected by what he deems “the war on cannabis.” Basore has an actual relationship with cannabis and an understanding of the real-life consequences of its criminalization on users and the larger community. He implores up-and-coming brands to lean into their own real stories and let those inform the way they do business — and to embrace the grind. “There are no fluff jobs in cannabis in Michigan,” he says.

Mains wants to see more normalization of the cannabis industry and a thoughtful regulatory approach to marketing rules. “It’s not this nefarious criminal product that we’ve all been raised to think it is,” he says. Basore shares the lawyer’s sentiments, noting that he’s been “kicked out of 15 bank accounts since 2010.” And to the powers that be: “Just treat us like any other business. That’s all we ask for, a fair shot.”

“[Our marketing is] also getting our story out there, what we do with our foundation, the money that we give back, the people that we’re helping. It’s all authentic.”

—Ryan Basore, Redemption Cannabis

Lucid Green’s QR codes streamline the cannabis supply chain and product data

By Patrick Dunn

Lucid Green co-founder and CEO Larry Levy is on a mission to make shipping, stocking, and buying cannabis products easier — all with QR codes.

“Essentially, we’re all about driving efficiency throughout the entire supply chain,” Levy says.

New York City– and Los Angeles–based Lucid Green, founded in 2018, uses QR codes as the key to everything from product tracking to inventory management to customer relationship management. Nationally, 7 million product units a month carry Lucid Green’s QR codes; 1.5 million of those units are in Michigan, where the company counts five brands and more than 20 retail locations among its clients. Lucid Green is also planning for significant growth as it lobbies to make its technology an industry standard.

Here’s a look at how Lucid Green’s technology fits into each stage of the cannabis supply chain and how the company’s leaders are envisioning expansion in Michigan.

A cannabis product’s Lucid Green journey begins when that product is shipped from a supplier to a retailer. The supplier generates a unique Lucid Green QR code for every single product label, similar to “a serial number on a $1 bill,” Levy says.

The QR code affords suppliers an “unparalleled” level of insight into what happens to their products after they ship, Levy says. Lucid Green’s technology provides suppliers with reports on the age of their products, sales velocity, and when products are likely to go out of stock or be overstocked.

The QR code also contains information on the specific ingredients, and ingredient batches, used in each product unit. That comes in handy for identifying affected units if there’s a recall on an ingredient.

“When it comes to a recall, you know which batch it applies to, and you can see exactly where every single product is in the supply chain,” Levy says.

When a product shipment marked with Lucid Green QR codes arrives at a retail store, the retailer enjoys a simplified inventory management process. The retailer scans a case ID tag, which automatically uploads product information — including names, descriptions, certificates of analysis (or COAs), dosages, and effects — into the retailer’s point-of-sale system for every unit in the case.

“They can then crack open that box and put the product on the shelf, ready for sale,” Levy says. “The retailer has no stick-

“We’re all about driving efficiency throughout the entire supply chain.”

—Larry Levy, Lucid Green

ering that they have to do.”

Lucid Green QR codes also allow retailers to track their inventory easily. Since each unit has a unique QR code, units must be scanned individually when purchased, rather than a single item being scanned repeatedly, if a consumer buys multiple units of the same product. Retailers are ensured a product count that’s accurate down to the unit. This also allows retailers to profile customers based on their purchase history, right down to the chemical composition of their favorite products.

“We can really dial in what works for people,” Levy says.

Lucid Green QR codes also hold a wealth of beneficial information for the cannabis consumer. A consumer who scans a Lucid Green code can access the product’s COA and other product information via the LucidID app. If a product has been recalled, scanning its QR code will result in a warning message to return it to the retailer.

“[Consumers] get all the information about how to have a safe, consistent, and enjoyable experience,” Levy says.

The app also offers what Levy describes as a “digital canvas” that brands can use to communicate with customers. Brands may use that “canvas” to allow users to accumulate points they can redeem for products or swag.

Zak Mall is the director of sales and marketing at Blue Fox Brands (which has offices in Lansing as well as California, Colorado, and Massachusetts) and CaliBlaze, which is available in Michigan and Colorado. Cali-Blaze and Blue Fox Brands have been using Lucid Green QR codes for about six months. Mall says he particularly

“We’re not putting trash in our product. We want to show [consumers] what’s in it, give them the test results, let them see it, have transparency on everything, and make it easier for our retailers to carry us. And that’s what Lucid does.” —Zak Mall, Blue Fox Brands and Cali-Blaze

has appreciated Lucid Green’s consumer marketing capacity, which allows him to incentivize customers to buy more of his product and to return to his retail partners.

Between that function and Lucid Green’s consumer transparency benefits, Mall says Lucid Green helps his brands accomplish a goal of connecting better with customers.

“We have nothing to hide,” he says. “We’re not putting trash in our product. We want to show [consumers] what’s in it, give them the test results, let them see it, have transparency on everything, and make it easier for our retailers to carry us. And that’s what Lucid does.”

A QR FUTURE?

Levy says the hypothetical “nirvana” future

for Lucid Green is one in which cannabis brands can use just Lucid Green QR codes to track their products within Michigan’s statewide Metrc system. As of now, brands must generate and put a separate Metrc transfer/package ID on each case of product. Levy says Lucid Green is currently lobbying the state of Michigan to amend its rules so that Metrc tracking data can be either physically or digitally queried. That would mean multiple cases in a shipment could have a single Metrc tracking tag associated with them via QR code, rather than the shipper having to generate and buy a Metrc ID for every case.

Levy says this change would be a boon to most large cannabis brands, who he estimates would save $20,000 to $40,000

a year on Metrc transfer tags. He adds that Lucid Green stands ready for its QR codes to replace traditional physical label information fully.

“It can be done today,” Levy says.

Mall anticipates that Lucid Green will become an industry standard as brands, retailers, and consumers recognize its benefits.

“Once the retailers fully embrace and understand it, the need for product that has it will grow,” he says. “And once the manufacturers see how good it is, they’ll realize that it’s kind of one of those things that you don’t want to live without.”

A trusted advisor specializing in governmental accounting and cannabis, Michael Rolka provides annual financial statement preparation to ensure compliance with complex Cannabis Regulatory Agency reporting requirements.

1. HOW DO CANNABIS BUSINESSES DETERMINE IF THEY’RE REQUIRED TO SUBMIT AN ANNUAL FINANCIAL STATEMENT AFS REPORT?

Cannabis businesses can verify their next AFS due date through the Accela Citizens Access Portal. The CRA sends email reminders from CRA-AFS@michigan.gov six months before the report is due, specifying the due date, reporting period, and licenses to be included. Generally, medical marijuana and adult-use licensees must file a financial statement every three years, or a shorter time period as determined by the CRA.

2. WHAT ARE THE KEY REQUIREMENTS FOR PREPARING AN AFS REPORT, AND HOW CAN YEO & YEO HELP?

The AFS report must be conducted by an independent certified public accountant licensed in Michigan, performed according to attestation engagement standards, and submitted as an Excel document using the official CRA form. The CPA and CPA firm must be actively licensed and registered in Peer Review before completing the AFS report. Yeo & Yeo meets all CRA requirements for performing AFS reports, making them an ideal partner for navigating the complexities of AFS reporting and ensuring full compliance.

3. WHAT ARE THE PENALTIES FOR NONCOMPLIANCE WITH AFS REPORTING REQUIREMENTS?

The CRA disciplinary guidelines (updated Aug. 2, 2024) outline a $10,000 penalty for violations under rules 20 and 27701, which concern the failure to transmit financial statements to the agency. However, the guidelines emphasize that the CRA makes each determination on a case-bycase basis and that the final resolution “may deviate from that referenced in the guidelines,” potentially involving measures beyond fines such as “the suspension, revocation, restriction, or refusal to renew a license; and/or other terms to address the violation.”

4. HOW CAN A WELLPREPARED AFS REPORT BENEFIT MY BUSINESS BEYOND CRA COMPLIANCE?

A well-prepared AFS offers benefits beyond compliance. It may provide the company with confidence that its recordkeeping and policies are appropriate. This information serves as a foundation for strategic planning, allowing you to identify areas for cost reduction, revenue growth opportunities, and operational efficiencies. Alternatively, the process of preparing for an AFS can also uncover operational inefficiencies, leading to better overall business management. This can help reduce the risk of fraud and identify potential financial irregularities early on.

5. HOW CAN I GET ADDITIONAL VALUE FROM MY REQUIRED AFS REPORT BY LEVERAGING IT FOR INVESTOR AND LENDER RELATIONS?

A comprehensive AFS report, while required for compliance, can be a powerful tool for enhancing investor and lender relations. By sharing this detailed financial statement, you demonstrate transparency and professionalism, which are crucial when seeking investments or loans. The AFS provides potential investors or lenders with a clear, CRA-compliant picture of your business’s financial position, potentially improving your access to capital. You can use the AFS report to showcase your commitment to regulatory compliance and financial best practices, building trust with stakeholders. During negotiations with potential investors or lenders, you can reference specific data points from your AFS report to support your business case, growth projections, and financial stability. This can strengthen your position and potentially lead to more favorable terms or increased funding opportunities.

MICHAEL ROLKA, CPA, CGFM PRINCIPAL

YEO & YEO CPAS & ADVISORS

880 W. Long Lake Road, Suite 400 Troy, MI 48098

248-239-0900

yeoandyeo.com

michael.rolka@yeoandyeo.com

Thomas O’Sullivan, CPA, CFE

We remove obstacles so you can unleash potential.

Strict regulations. Tax implications. Security procedures. Surging competition. It all requires a trusted partner with wide capabilities and a personal, customized approach. Our Cannabis Services Group brings a wealth of experience in cannabis, agribusiness, manufacturing and retail, making us uniquely qualified to help you navigate the complexities. Let us help you thrive.

AUDIT

Since the early ’90s, Josh Del Rosso, aka Josh D, has been the keeper of the OG Kush legacy. Staying true to his love for the plant and protecting the most elite, hand-selected cuts of OG Kush, Josh D has weathered the storm of early cannabis regulation and has stayed true to his beliefs and values as a true legacy grower.

His passion for providing people with the best medicine continues to drive his brand today. After almost 30 years of cultivating one of the most sought-after cannabis strains, he is proud to announce his partnership with Pro Gro to bring iconic strains to Michigan.

JOSH D X PRO GRO: A NATURAL PARTNERSHIP

The relationship between Josh D and Pro Gro grew from a shared appreciation for quality. After they connected with each other, Josh D and Pro Gro’s founder recognized excellence in each other’s products and saw an opportunity to work together.

After two years of collaboration, Josh D products made their Michigan debut in late 2024 with these strains: OG Kush Story, Bobby Shaloha, Ojos Rojos, and Wild Lÿfe.

JOSH D’S EARLY DAYS IN CANNABIS

Josh D’s journey with cannabis began in his teenage years, when he was fueled by a deep passion for the plant. In 1991, he took his first steps into cultivation, dedicating himself to honing his craft. By 1996, he was growing OG Kush indoors, refining his techniques and focusing on quality.

As legalization efforts grew, Josh D launched his brand legally in Washington in 2014. Over the past decade, he has built strategic partnerships while keeping quality at the core.

“I’ve been a cannabis enthusiast since I was a young man, and I started growing when I was a teenager back in ’91,” he says. “I always dreamed of the day it was legalized so no one went to jail anymore over this incredibly beneficial plant.”

THE LEGACY OF OG KUSH

For Josh D, OG Kush Story has been more than just a strain — it has been the centerpiece of his career and a lifelong passion. Its impact extends far beyond personal significance, shaping the entire cannabis industry.

Emerging alongside advancements in indoor cultivation like hydroponics and lighting

technology, OG Kush revolutionized high-end cannabis production. Its genetics laid the foundation for many of today’s most popular strains, solidifying its place in cannabis history.

Pinpointing the exact number of OG Kush varieties is difficult, but Josh D estimates there are hundreds of OG Kush strains and thousands of new genetics stemming from its lineage.

As he states, “OG is king for a reason!”

At press time, Josh D’s brand was preparing to release new live-resin vapes and fresh batches of flower in early April. Josh D is excited to bring something unique and exciting — showcasing new terpene profiles and convenient formats — to the Michigan market.

Josh D’s advice to aspiring cannabis entrepreneurs is simple: “Fight for what you believe in and stay true to yourself and your

values. Respect the history of this amazing plant and the ones that fought for our freedom to grow and use it.”

Surrounding yourself with like-minded people and partnering with those who share your vision is key to success. Josh D’s partnership with Pro Gro, rooted in a shared commitment to quality and aligned values, stands as a testament to these principles. ■

Attendees brought the glam to the annual soiree in Detroit on Dec. 12