ear readers,

Welcome back to another issue of HOPE-FULL! What a busy few months our final quarter of 2023/24 turned out to be.

In this edition, we round off what has been without a doubt our best year in business yet, thanks to our amazing team, brokers and stakeholders. Plus, we want to take this as an opportunity to thank everyone once again who sent our team gifts for Christmas. While Christmas feels like a long time ago, we really appreciate receiving so many nice gestures from our key partners, brokers and borrowers.

Finally, we’re delighted to announce that the brilliant team at MSB Solicitors have been confirmed as the official sponsor of HOPE-FULL. They have been a fantastic supporter of our team for a number of years now and have played a huge role in our success, which is why we’re delighted to have them feature in our quarterly updates.

So, without further ado, we hope you enjoy the final edition of HOPE-FULL in our 2023/24 financial year. Bring on the rest of 2024!

EMILY CROWE Senior Marketing & PR Executive

P4-P5 Ending the year on a high:

The numbers are in! Check out some of our latest company milestones for 2023/24

P6-P7 Residential enhancement: Forward-thinking approach to help our borrowers

P8 Signed, sealed, delivered:

Proudly supporting a repeat borrower with an exciting deal

P9 Got the need for speed?:

Let’s talk about our fast-track valuation methods

P10-P11 Out & about:

Find out what we’ve been up to

P12-P13 Proud sponsors:

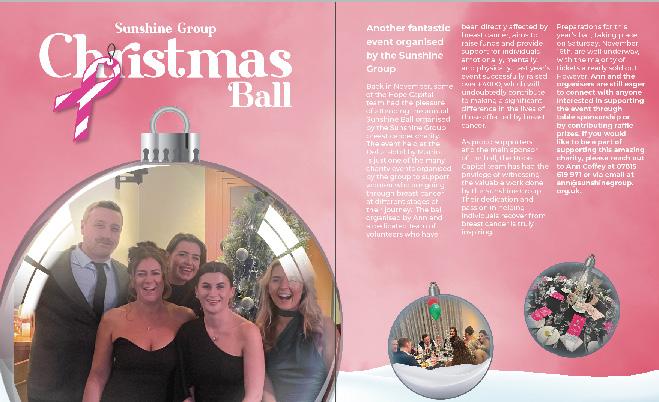

Another fantastic event organised by the Sunshine Group

P14-P15 Promotions:

Celebrating key promotions within the team

P16 Growing our team:

Meet our newest members of the Hope Capital team

P17 Our shining star: Hats off to our first-ever Star of Hope Manager’s Choice Award winner!

P18-P19 Annual employee survey:

Let’s hear what our team had to say about Hope Capital

P20-P21 myHOPE:

We’ve enhanced our employee benefit scheme

P22-P23 Special thanks to MSB:

Find out how this magazine is benefiting others

The numbers are in! Check out some of our latest company milestones for 2023/24

Take a look at some of our highlights from 2023 vs 2022:

+106%

Increase in completions

+86% Increase in enquiries

2023 was another success story for Hope Capital with impressive growth. In true #relationshipsbeyondlending spirit, we’re already continuing to hit new milestones in 2024 as well.

On top of these impressive were also delighted to unveil funding line with Shawbrook November, securing a £25m which will be key in supporting ambitions as we look to develop proposition and achieve further

Our CFO, Kate, had this to say about the exciting development:

We’re experiencing an extremely successful period, with significant growth in enquiries and completions. To have Shawbrook Bank join our funding panel will be instrumental and we’re very grateful to their team for this fantastic opportunity.

As we continue our mission to simplify all things bridging, we’d like to thank our brokers, investors and stakeholders who’ve come with us on this journey so far. We can’t wait to see what the future holds!

Kate Cowan Chief Financial Officer+86% Increase in loan book enquiries

+100%

stats, we unveil a new Shawbrook Bank in £25m facility supporting our develop our further growth.

e’re known industry-wide for our great rates and flexible approach. That’s why our latest enhancement welcomed the introduction of reduced residential rates, along with improved internal processes and efficiencies.

This combination not only ensures our trust within the marketplace but also enables borrowers to take advantage of our very competitive fixed rates. While the Bank of England may have decided to retain interest rates for the fourth consecutive time on the bounce, we’re delighted to be able to reduce our rates to support our brokers and borrowers with affordable options.

Proudly supporting a repeat borrower with an exciting deal

Another great deal in the bag! It’s been fantastic to support so many brokers and borrowers over the past few months with a diverse range of deals. One notable case we’re proud to have worked on was with a repeat borrower who was so impressed with the service and experience we provided for a previous deal that they decided to collaborate with us again.

What was the borrower looking for? In this case, they needed to secure a bridging loan to build a modern, state-of-theart residential property where an initial gross loan of £144,500 was required to commence the development and then a further refurbishment facility of £700,000 for the build. Originally the loan was agreed for an 18-month period, however, because of delays related to planning conditions, we showcased the flexibility

we’re renowned for by agreeing to offer a further 6 months to facilitate the marketing and sale. Working alongside Bespoke Property Finance Consultants Ltd, we pulled out all of the stops to deliver what was needed, resulting in a very happy borrower and broker alike. Here’s what the broker had to say:

Chris Johnson, Bespoke Property Finance Consultants Ltd, commented: “This was a great investment opportunity for the client, where speed, flexibility and transparency was key to get the deal across the line. The client was extremely impressed with how efficiently we could provide funding and it was fantastic to work with the Hope Capital team on another successful project.”

Let’s talk about our fast-track valuation methods

‘How quickly can you provide a bridging loan?’. Without a doubt the most common question we are asked. Speed is almost on every borrower’s cards when they are looking to use shortterm finance. However, we find there is still a big misunderstanding about how we can turn around a loan so quickly, often in just a number of days.

So, how do we achieve this? This is partly achieved through the valuations methods we offer, which is why in November, we launched an insightful and educational campaign

all about this area. Thanks to the continuing growth of technology and processes, there are now a range of valuation models available in the lending market to help borrowers move swiftly through the transaction process. Our campaign covered things like AVMs, also known as Automated Valuation Model, which are delivered instantly for free, as well as desktop valuations which are made available within 48 hours.

We see it as our responsibility to help raise the profile of the bridging market, which

is why we were thrilled the campaign was so well received and we’re looking forward to sharing updates about our latest campaigns in the next edition of HOPEFULL. Watch this space!

Find out what we’ve been up to:

22nd November

10th November

Finance Professional Show: exhibited at the busiest and most varied financial trade show in London

20th November

Q3 Update: hosted our quarterly team briefing

Q3 November

Women in Finance Awards : proud to have been shortlisted in the ‘Employer of the Year’ category, as well as our brilliant Chief Financial Officer, Kate, who was a finalist in the ‘CFO of the Year’ category

23rd November

Meet the Funder Event: participated in a fantastic event hosted by Synergy Commercial Finance

23rd November

Lord’s Taverners Liverpool Sporting Event: fundraising dinner hosted by Glaisyers ETL Global

23rd November

Mortgage Industry Marketing Awards: proud to have been shortlisted in the ‘Best Use of Social Media’ category

25th November

Sunshine Group Ball: honoured to have sponsored and attended the annual breast cancer charity ball

30th November

NACFB Commercial Lender Awards: thrilled to have been shortlisted in the ‘Service Excellence Award’ category

13th December

Christmas Lunch: organised by Fieldfisher

8th Decemeber

Christmas Catch Up: drinks hosted by MSB

15th December

A Hope Holiday Cheer! christmas celebration for the Hope Capital team

Back in November, some of the Hope Capital team had the pleasure of attending the annual Sunshine Ball organised by the Sunshine Group breast cancer charity. The event held at the Delta Hotel by Marriott is just one of the many charity events organised by the group to support women who are going through breast cancer at different stages of their journey. The ball, organised by Ann and a dedicated team of volunteers who have been directly affected by

breast cancer, aims to raise funds and provide support for individuals emotionally, mentally, and physically. Last year’s event successfully raised over £4000, which will undoubtedly contribute to making a significant difference in the lives of those affected by breast cancer.

As proud supporters and the main sponsor of the ball, the Hope Capital team has had the privilege of witnessing the valuable work done by the Sunshine Group. Their dedication and passion in helping

Preparations for this year’s ball, taking place on Saturday 16th November, are well underway, with the majority of tickets already sold out. However, Ann and the organisers are still eager to connect with anyone interested in supporting the event through table sponsorship or by contributing raffle prizes. If you would like to be a part of supporting this amazing charity, please reach out to Ann Coffey at 07815 619 971 or via email at ann@sunshinegroup. org.uk.

Climbing the ladder: introducing you to our new Head of Sales. Big news broke in February as we proudly announced our brand-new Head of Sales, Kim Parker. Kim joined our team in 2022 as an Internal BDE and hit the ground running straight away. From being promoted to Sales Team Manager in 2023, to now being appointed as Head of Sales, Kim is a true example of the internal progression opportunities available.

Kim has over 15 years’ experience under her belt, including roles as a Premier Relationship Manager at Barclays, resulting in having immense knowledge and understanding of how to support our brokers and borrowers.

We’re extremely proud of Kim, who thoroughly deserves this recognition owing to her hard work, leadership and the way she has transformed the sales team to ensure we are continuing to hit milestones on a regular basis. Well done Kim!

Kim Parker, Head of Sales at Hope Capital, commented: I’m absolutely delighted to have received this recognition. As we continue our track record of consistent growth, I’m looking forward to working with Jonathan, Kate and the senior management team to help implement a number of exciting changes we have in the pipeline, which will no doubt accelerate our expansion across the market.

The promotions didn’t stop there! Not only was Kim promoted to Head of Sales in the last quarter, but we also made a series of other key promotions within the team, as we continue to roll out plans to propel our growth strategy.

Charlie Gregory, who previously held the title of Business Development Manager has now been promoted to Senior Business Development Manager, where he will continue to support clients in London and the South, while having more involvement in the

strategic direction of the sales team and overall business.

Congratulations Charlie!

Our Underwriting department has also witnessed substantial growth with the announcement of two newly created Senior Underwriter roles, as well as a new Underwriter role.

Andy Bate who joined the lender in June 2021 and Ryan Peers who joined the business in April 2022, have both been promoted to Senior Underwriters following demonstrating exceptional performances in their roles. Well done both.

Hammad Abbasi has also progressed from Underwriting Coordinator to an Underwriter where he will play a crucial part in making decisions on applications and progressing deals through to completion and helping to further strengthen the business. Keep up the great work, Hammad!

Andy Bate Senior Underwriter

Ryan Peers Senior Underwriter

Hammad Abbasi Underwriter

Andy Bate Senior Underwriter

Ryan Peers Senior Underwriter

Hammad Abbasi Underwriter

e’re delighted to introduce two new talented members to our team. Michelle Powell has joined as our Business Administrator, bringing her expertise to streamline and enhance our administrative processes, contributing to the overall efficiency of our post completions operations.

We’re also excited to welcome Daisy Howard, who has joined us as a Graphic & Web Designer. With her creative skills and innovative approach, Daisy will play a crucial role in shaping our visual identity, ensuring our online presence is not only functional but visually engaging.

Both Michelle and Daisy bring unique perspectives and skills to the Hope Capital team, and we look forward to the positive impact they will undoubtedly have on our team and the services we provide to our brokers and borrowers.

Michelle Powell Business Adminstator

Michelle Powell Business Adminstator

Hats off to our first-ever Star of Hope Manager’s Choice Award winner!

There were many reasons to celebrate in the past quarter, particularly when we crowned Laurel as the winner of our brand-new award programme the Star of Hope Manager’s Choice Award. As you may have seen, every quarter our team nominate one person in the business who has gone above and beyond, naming them as our Star of Hope. The Star of Hope Manager’s Choice Award was created to achieve the same thing: recognise someone in the team who has displayed an

exceptional performance, however, in this case, the winner is selected by our Senior Management team.

We’re extremely lucky to boast an unbelievable team, who are all exceptionally hard working and talented in their fields. It therefore wasn’t an easy task for our Senior Management team to select the winner, however after much discussion it was clear our brilliant Senior Underwriting Coordinator, Laurel Livesey would be the rightful

champaion.

2024 has already proven to be a fantastic year for Laurel, with the announcement of becoming our Senior Underwriting Coordinator in February. Having a significant amount of experience in an underwriting role, we’re looking forward to the further improvements

Laurel is going to make to our services, resulting in quicker turnaround times for brokers and borrowers.

Congratulations Laurel, keep up the great work!

Let’s hear what our team had to say about Hope Capital

At Hope Capital, we prioritise a culture of openness and value the input of our team, encouraging year-round feedback through various mechanisms. Apart from traditional surveys, we engage in unique approaches such as our Beer or Brew drop-in sessions, encouraging an environment where team members feel comfortable sharing

their thoughts. Aligned with our commitment to continuous improvement, we uphold an open-door policy, ensuring that communication channels remain accessible for our employees.

Recently, we conducted our annual, anonymous employee survey, reaffirming our dedication to understanding and addressing the evolving

needs of our team members. The real power of our survey lies not just in collecting responses but in the proactive steps we take to implement changes and enhancements based on the feedback received, fostering a workplace that truly values its employees.

100% feel their manager understands and values their work

100% understand how they individually contribute towards the company success

100% would recommend us as an employer and are planning on staying

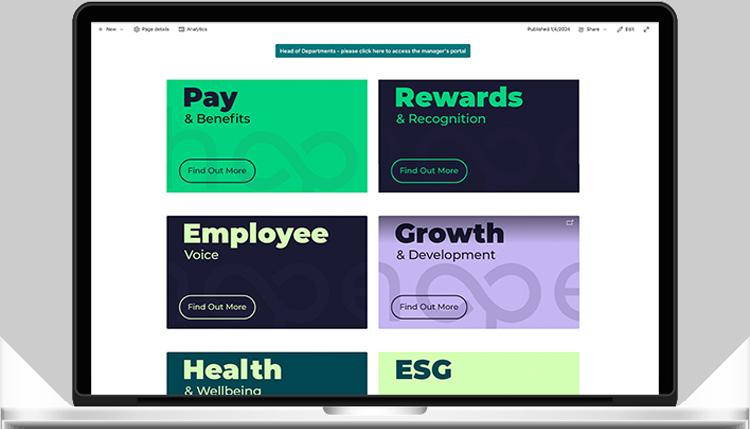

We’ve enhanced our employee benefit scheme

As we step into 2024, we’re proud to introduce our revitalised well-being and benefits scheme, myHOPE, designed to enhance the overall experience for our valued team members.

Among the highlights of myHOPE are significant improvements to our maternity and paternity policies, reflecting our commitment to supporting employees during pivotal life

moments.

We’re excited to unveil a range of new familyfriendly policies that recognise the diverse needs of our team members, promoting a healthy work-life balance.

Introducing a values and behavioural framework, we aim to foster a positive and inclusive workplace culture where everyone feels welcomed, treated fairly, and fully supported to unleash their potential.

As part of our continuous commitment, we’re proud to launch our first-ofits-kind mutual respect policy, reinforcing our dedication to creating an environment where mutual respect is paramount.

At Hope Capital, our journey into 2024 is marked by a steadfast commitment to the wellbeing, growth, and success of our incredible team.