The Impact of Participation in Carbon Emission Trading on a Firm's Financial Performance and Innovation.

Dr. Ehsan Nikbakht, Zarb School of Business

Sambodhi Vasani, Finance & Economics ‘23

Giga Zukhubaia, Columbia University MSOR

Dr. Ehsan Nikbakht, Zarb School of Business

Sambodhi Vasani, Finance & Economics ‘23

Giga Zukhubaia, Columbia University MSOR

What is a Carbon Emission Trading (CET) Program?

• Programs designed to limit the amount of Greenhouse Gas (GHG) emitted into the environment by factories and corporations.

• The purpose is to make businesses responsible for environmental damage that is done and place a cost on putting out excess GHG.

• Placing a cost on polluting the climate should promote innovation of new efficient technology and increase companies’ use of environmentally friendly practices.

Types of Carbon Emission Programs

• There are two types of CET Programs:

• Compulsory Credit Markets such as in the EU, UK, China, and California

• Voluntary Credit Markets such as VERRA, Gold Standard, and Terra Pass

• The Compliance program works by allotting companies a set

amount of carbon credits.

• If companies exceed the carbon limit, they must buy carbon credits from the carbon credit market

• If companies emit less than the allotted amount, they can sell credits or use them to fund environmental projects

• Voluntary programs aim to offset GHG emissions by developing environmental projects and purchasing carbon credits.

Existing Research Continued

• A few studies on the EU ETS found that while there is a reduction in emissions, there is no significant effect on the financial performance of participating companies. While studies on China’s program seem to find that the impact is different depending on the industry.

• For instance, in a study by Yue-Jun Zhang and Jing-Yue Liu, it was concluded that the impact of CET is heterogeneous across industries.

• Nonferrous metal industries see a reduction in financial performance, while power industries see an improvement.

• A 2-4 lag on the impact of CET is observed, and the impact seems to change from negative to positive over time.

• The results of these research papers do not consolidate into one opinion; studies have varying outcomes.

• Studies do not consider whether a firm had to purchase additional credits or had excess credits; depending on performance in the CET program, the impact can vary.

Data

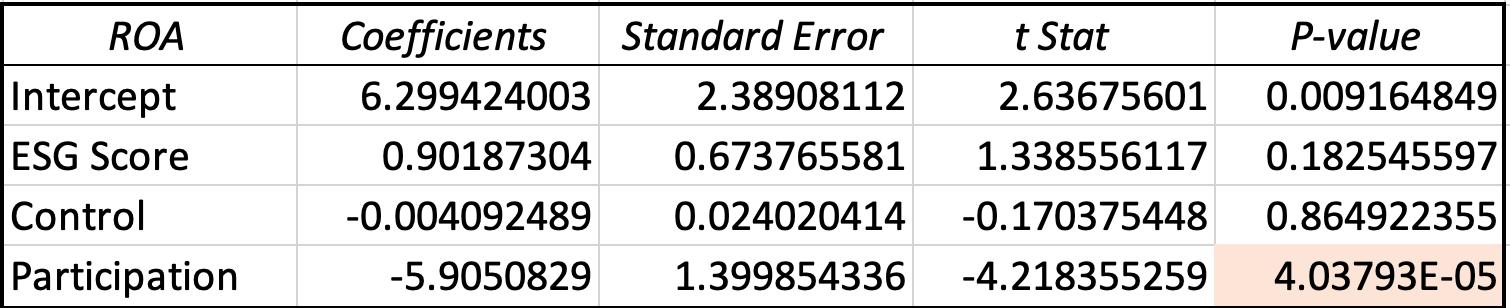

and Methods • Regression analysis for the impact of CET on financial ratios and spending • The following variables were included in the study: • Tobin’s Q (Explained) – to reflect the financial performance and comparative advantage of the firm in the market, also expected future growth • ROA (Explained) – reflects the profitability and performance of a firm • R&D Intensity (Explained) – to reflect any changes in investment made for Research and Development of new innovative technology • ESG Score (Explanatory) – As a proxy for performance in CET programs • Control – Outside factors that can affect performance • The following data for 170 public firms were collected from Bloomberg Terminal

Regression Equations

• To test the impact of CET on innovation activity in a firm, the following equation was tested: • � &� = � + �! ������������� + �" �������� + �# ������� + � • To test the impact of CET on a firm’s financial performance, the following equations were tested: • ���� � $ � � = � + �! ������������� + �" �������� + �# ������� + � • ��� = � + �! ������������� + �" �������� + �# ������� + �

Results

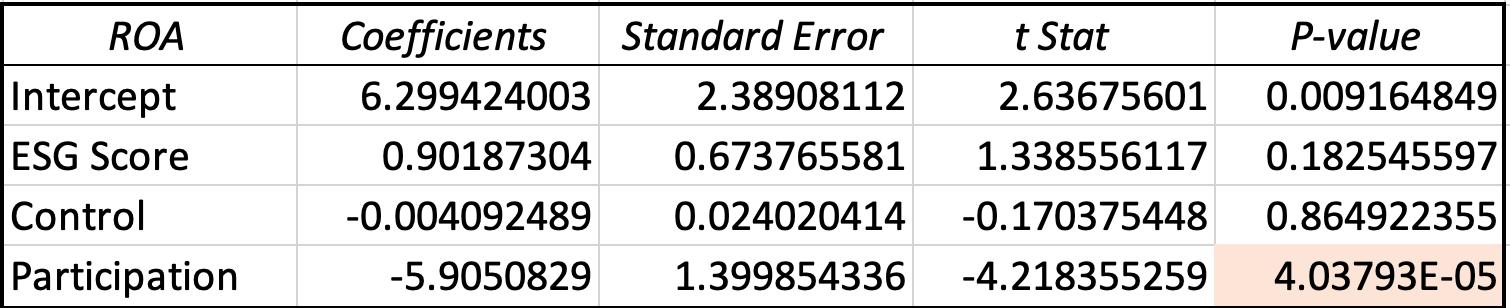

• The results of Tobin’s Q and ROA equations show that at any given reasonable significance level, the impact of participation is significant. While the impact of ESG scores is not statistically significant

• Given a lenient significance level of 10%, the coefficients for ESG score and Participation are statistically significant in the regression results for R&D Intensity.

Interpretation

• From the results of the regression analysis, it can be understood that participation in a Carbon Emission Program seems to negatively impact a company’s ROA, implying a reduction in a company’s asset efficiency.

• Furthermore, the negative relationship between Tobin’s Q and participation implies that a firm’s value in the market in comparison to book value has decreased.

• These effects can be a consequence of an increase in the cost of production and operation caused by the CET program.

• While the lack of statistical significance for ESG scores hints that actual performance and change in practices do not seem to have any effect on a company’s financial performance.

Limitations

• Because ESG scores include other factors alongside environmental practices, the interpretation of the ESG scores cannot be isolated to the environmental factors.

• Being part of the Carbon Emission program can have other effects on a company that could be related to financial performance. These factors need to be identified and included in the control to have accurate results.

• The impact of CET on financial performance may have a lag effect, and the impact could change with time.

Future Research:

• Need to find a better proxy for performance in the Carbon Emission Program

• I will be continuing this research project, with the hope that with more time, I will be able to find a more extensive and reliable data set

Thank you, President Poser and Hofstra Honors College, for the opportunity to do research and learn about something that interests me so much.

Thank You, Dr. Nikbakht, for your guidance and supporting my interests.

Works Cited

• ARB emissions trading program - California Air Resources Board . (n.d.). Retrieved December 4, 2022, from https://ww2.arb.ca.gov/sites/default/files/cap-andtrade/guidance/cap_trade_overview.pdf

• Bekhet, H. A., Alhyari, J. A., & Yusoff, N. Y. (2020). Highlighting determinants of financial performance of the Jordanian Financial Sector: Panel Data Approach. International Journal of Financial Research, 11(6), 237. https://doi.org /10.5430/ijfr.v11n6p237

• California Air Resources Board . (n.d.). Retrieved December 4, 2022, from https://ww2.arb.ca.gov/sites/default/files/2021-02/ct_reg_unofficial.pdf

• Chapter 1: How Does The Cap and Trade Program Work? (n.d.). Retrieved December 4, 2022, from https://ww2.arb.ca.gov/sites/default/files/cap-andtrade/guidance/chapter1.pdf

• Dechezleprêtre, A., Nachtigall, D., & Venmans, F. (2022). The joint impact of the European Union Emissions Trading System on carbon emissions and Economic Performance. Journal of Environmental Economics and Management, 102758. https://doi.org /10.1016/j.jeem.2022.102758

• Environmental Protection Agency. (n.d.). How Do Emissions Trading Programs Work? EPA. Retrieved December 4, 2022, from https://www.epa.gov/emissions-tradingresources/how-do-emissions-trading-programs-work

• Liu, M., Zhou, C., Lu, F., & Hu, X. (2021). Impact of the implementation of carbon emission trading on corporate financial performance: Evidence from listed companies in China. PLOS ONE, 16(7). https://doi.org /10.1371/journal.pone.0253460

• Zhang, Y.-J., & Liu, J.-Y. (2018). Does carbon emissions trading affect the financial performance of high energy-consuming firms in China? Natural Hazards, 95(1-2), 91–111. https://doi.org /10.1007/s11069-018-3434-5

Dr. Ehsan Nikbakht, Zarb School of Business

Sambodhi Vasani, Finance & Economics ‘23

Giga Zukhubaia, Columbia University MSOR

Dr. Ehsan Nikbakht, Zarb School of Business

Sambodhi Vasani, Finance & Economics ‘23

Giga Zukhubaia, Columbia University MSOR