The largest one day annual machinery sale in the South West is moving to a larger, more accessible site in 2026.

Each spring for 70 years, the sale has offered tractors, vehicles, farm machinery, livestock equipment and miscellaneous items for auction from vendors across Somerset and further afield, to what has become an international selection of buyers

One sale was missed during Covid 19 but, borne out of necessity, was the Marteye online bidding portal This offers buyers the chance to not only bid from home but also browse through all the items ahead of the sale day.

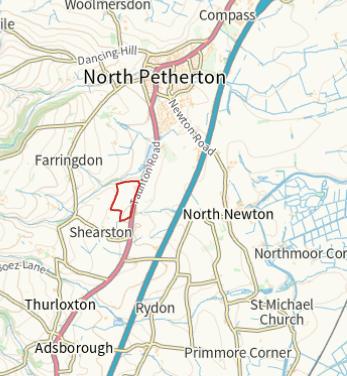

Now auctioneers Greenslade Taylor Hunt, who have been at the helm of the sale since its inception, are excited to announce the move to a new site off the A38 between Taunton and Bridgwater Its precise location can be found on page 3.

The site will enable the sale to grow and flourish, providing convenient access from this main arterial road and plenty of space for more and varied machinery items.

For more information or to book in your items, contact machinery@gth net or call 01278 410250

Spring is finally here and is traditionally seen as the prime time to put your farm or rural property onto the market. However, with the proposed changes to inheritance tax reliefs and recent suspension of the SFI schemes, the government does not currently seem to be providing much encouragement to the agricultural industry! What effect may this have on the likely supply and value of land and farms coming to the market? We have spoken with Greenslade Taylor Hunt’s head of Rural Agency, Richard Webber, to give us his thoughts

Despite the political changes we keep having to endure in the agricultural sector, most farmers are still keen to secure and grow their farms for future generations In the current climate, some of the older generation may decide it is time to ‘hang up their boots’, which may result in some potential sales, especially with the future tax reliefs being significantly reduced Capital grants and environmental schemes have been more important of late, but there is current uncertainty in some of those areas On a more positive note, agricultural commodity prices have generally remained buoyant, helping to reassure buyers Will all this result in more farms and land coming to the market?

Whilst it’s probably too early to predict, the majority of our current sales are being driven by the common themes of downsizing/ upsizing, retirement and probate, and there is certainly no sign of any panic as a result of the government changes Whether this is still to come

only time will tell Undoubtedly, some of the main factors that will be key in determining farm and land values over the next year or two will be level of supply and location/access, coupled with lender confidence As always, the key in any successful property sale is prudent pricing and quality presentation

If you were to departmentalise the potential buyers into active farmers, lifestyle buyers, investors and environmental organisations, we are still seeing interest from each category Active farmers are continuing to grow their businesses, whilst working with their accountants, solicitors, and ourselves as agents, to try and minimise the approaching inheritance tax burden The ever present demand for lifestyle farms and the desire to find space, privacy and solitude for the family’s personal health and well-being remains a principle aim of many purchasers relocating to the south west In living here, we can often

take for granted the fantastic countryside, our relatively safe surroundings and relaxed lifestyle. While investment in land and farms may slow, we are still experiencing demand from the environmental sector for tree planting, carbon offsetting, carbon sequestration and rewilding, and these are likely to have an increasing influence on land values in the years ahead Of course, smaller land parcels generally sell to non-farming buyers, with a whole raft of weird and wonderful potential end use ideas

First impressions count! Rural properties tend to look at their very best in the spring and summer months and in anticipation of this we are currently launching a number of new farms and smallholdings across the depth and breadth of Devon, Somerset and Dorset Thus far we have been very pleased with the response, with a strong level of enquiries from prospective purchasers seeking good quality large commercial farms, attractive

residential smallholdings and parcels of land If this interest continues it could bode well for those farmers and landowners who may ultimately decide to come to the market in 2025 Of course, the simple age-old adage of ‘they don’t make it any more ’ could also be one of the underlining themes as to why prices remain firm

If you are considering selling agricultural assets then please contact your GTH local specialist rural agent by going to our website, www gth net/contact You can also watch a video about our Farm Agency service by scanning the QR code below:

We reflect on an outstanding run of property auctions which saw a range of agricultural land, residential and commercial property go under the hammer

Property auctions provide sellers with certainty of a sale – once the gavel comes down, the sale is sealed The process also helps buyers with a clear timeframe for the whole process Our traditional in-house local property auctions are augmented by a livestream service enabling the widest possible audience for the property showcased

It is becoming an increasingly popular way of selling land and property as the procedure is relatively straightforward, with all the necessary legal and administrative matters in place prior to the start of the sale

Auctioneer, Valuer and Partner, Rob Baker explains the pros of selling at auction: “Although it’s usually considered to be reserved for fixeruppers and unwanted properties, this isn’t true at all Auctions provide a fast route to achieving a sale for those looking to sell quickly They have become a lot more accessible with live streaming and online options, meaning there are more buyers for each property

Auction remains a fantastic method of sale for many types of properties, including residential, agricultural and commercial Whilst not all properties would be suited to auction

it can be an excellent opportunity to realise and maximise the value of an asset that otherwise may well sit empty until any compromises can be surmounted ”

Prices of note achieved recently include £199,000 for a single parcel of 9 93 acres of land at Fiddington, near Bridgwater This was well in excess of the pre-sale guide and equated to £20,000 per acre

Meanwhile two acres of attractive amenity, pastureland at Croscombe, near Wells, sold for £66,000 –dwarfing its £25,000 guide price

A spacious three bedroom farmhouse in a stunning, peaceful location at Benville, near Corscombe, Dorset, with approximately 8 63 acres of permanent pasture land and lakes was another highlight It attracted a good deal of interest and sold for well in excess of its guide price The gavel falling at £559,000 The property was subject to an agricultural tie – meaning it must be occupied by people engaged in farming or a similar rural enterprise However, this restriction did not deter buyers and again shows the versatility of an auction sale for achieving competitive prices

Auctioneer, Valuer and Associate, Jamie Batt commented: We are very much underway with our auctions for 2025 with a packed schedule and an outstanding number of all types of property, be it agricultural, equestrian, commercial and residential coming forward We look forward to this being our most successful year yet and ultimately achieving the best result for our valued clients ”

Continued from front page

The site is just off the A38, slightly closer to North Petherton (and Sedgemoor) It is level, larger than the previous site and has better access Operators GTH are excited to secure a bright future for the sale, continuing the annual tradition for many years to come Its precise location can be found at: ///life bats annual (using the What3Words app)

We have all heard about the changes to IHT so we thought we would seek expert advice from Kate Bell, Partner at Albert Goodman, and asked her the pressing questions on the subject

1 The treasury predicted only 27% of farms would be affected by the changes to inheritance tax, what proportion of your clients do you think will actually be affected?

At least 95% - with the value of land, property, plant, machinery, and stock you soon reach £1M of assets (the new limit for APR and BPR per person) and given that this is currently non transferrable I think that most farmers and landowners will be impacted in one way or another

Food for thought: We shouldn’t limit our thoughts to those still with us – if a loved one passed away within the last two years then you are still within the window to vary the Will, you could consider revisiting this to potentially skip a generation albeit I appreciate this can be tough for everyone involved

2 APR has created most headlines but apart from this, what is the biggest threat to have come out of Labour’s recent budgets for your clients?

BPR – this is business property relief which was combined with APR in the £1M cap This impacts all business owners, not just farmers and with intensive farming not qualifying for APR this is also what some poultry and pig farmers are reliant upon as well BPR can cover 100% of the value of all business assets including any hope value on land/property and potentially rental properties together with any other assets within the business

3. Are you encouraging your clients to start their succession planning earlier? If so, what are your recommendations?

I think that succession planning could always come earlier Some may have taken succession planning advice in good time, but this advice may (in some cases) have been to hold onto everything until death The changes to the IHT rules mean that not only does a plan need to be formed, but this plan is now likely to include the gifting of assets at an earlier stage in life However, to ensure that these gifts are valid from an IHT perspective you cannot continue to receive any benefit from the assets gifted away and therefore gifts should be enabled through planning your income for retirement whether that be you continuing to hold income generating assets or you have a pension to turn to

4. Where your clients have concerns over passing land down to younger generations, particularly where their age and marital status is of concern, what would you advise them to do in this instance?

This is where we work with specialist solicitors Potentially a well-designed partnership agreement can be used to tie the assets to the partnership which may help a little Gifts into trusts can be made but these are also impacted by the £1M allowance which is split between trusts if multiple trusts are set up Prenuptial or postnuptial agreements can be considered - you can blame your professionals to take the sting out of the conversation a

little! Finally, a detailed letter of wishes to support the Will

Food for thought: The easiest method may be to trust the younger generations, not to try and control them from your grave and allow them to learn from their own mistakes (however much that may hurt)

5. If your clients were to start the succession process now, are there any assets which you think are more important to transfer now than others?

I will keep it simple – those that are likely to increase in value Gifting locks in the value at the date of the gift so even if you were not to survive the seven years or even until taper relief starts you will still have reduced the IHT burden.

“Consider the objectives and your long term goals”

6 Now that live and deadstock is being brought into the equation of valuations for APR purposes, is there anything our clients can do to lessen the impact?

Technically these have always been brought into the equation but as they received 100% BPR relief little emphasis was put on the valuation This is where we need the specialist valuers such as GTH to provide a relevant valuation – I am sure that soon we will have case law

surrounding relevant values when HMRC start challenging IHT values more

8. If you could describe what actions farmers should be taking in three steps, what would these be and why?

1 Assess the situation – this will include assessing the value of your assets (all your assets, which now includes pensions, which previously could have been outside of IHT), and your Wills and Partnership Agreements to understand your potential IHT liability

2 Consider the objectives and longterm goals – how much does everyone require to live and who do you want to end up with the assets in the long term? – to minimise the liabilities in the short term may create a bigger conflict (which always comes at a cost) in the longer term Also, food for thought: IHT at 20% and then no capital gains tax may still seem very attractive if assets are going to be sold in the future

3 Discuss possible options – discuss the options you have ahead and ensure you consult with all of your professional advisors (accountant, solicitor, land agent, financial adviser) and then consider acting. However, please note that the detailed legislation is still to be issued and so you may wish to wait until there is certainty over whether there will be any transitional rules albeit I think, at present, that looks hopeful

Alongside the considerable challenges of income and cashflow facing UK farming, the changes to Business Property Relief (BPR) and Agricultural Property Relief (APR) announced in last year ’ s autumn budget have caused widespread concern among those looking to the future The government has proposed that from 6th April 2026 the full 100% relief from Inheritance Tax will be restricted to the first £1 million of combined agricultural and business property. Thereafter, APR and BPR will apply at a rate of 50%

We have been informed by the government that the £1 million taxfree allowance will be on top of the existing spousal exemptions and nilrate bands. Therefore, depending on circumstances, farming businesses may be able to pass on up to £3 million before paying Inheritance Tax Nonetheless, the high value of agricultural land, farmhouses and other assets mean these changes are likely to affect many farming businesses and have underlined the importance of professional advice.

Since autumn of last year, Greenslade Taylor Hunt has seen an increase in clients requesting valuations of their farms and agricultural land across Devon, Somerset and Dorset to assist with the early stages of estate and tax planning. In these cases, we are able to provide our valuation expertise across the range of rural assets from our offices across the South West. Thereafter, these valuations can form the basis of more extensive discussions with a trusted accountant or solicitor

The recent grass auctions took place at Sedgemoor Auction Cen

Well, the old adage that ‘when cattle are dear, grass is cheap’ certainly did not hold true at Greenslade Taylor Hunt’s Annual Grass Auction at Sedgemoor Auction Centre on Tuesday 1st April - and the vendors who entered their grass into the sale certainly were no April Fools!

The 1400 acres forward at the sale sold to a full room, even with numerous bidders on the online Marteye system and competition for the grass in the region was fierce

The sale commenced with the Taunton and Bridgwater area sale which saw prices to £261/acre for grass at Blagdon Hill, £184/acre for grass at Creech St Michael and £177/ acre for grass at West Monkton

The Langport and Central Somerset area sale saw prices to £325/acre for grass at Othery and £291/acre for grass at Burrowbridge The Highbridge and North Somerset District sale saw prices to £213/acre at Tarnock, £191/acre at East Huntspill and £182/acre at Mark

The overall average per acre for the sale at £110/acre was slightly down on last year, but this was solely due to the quality of grass on offer, with the majority of lots sold at both this and last year ’ s sales commanding stronger prices this year

Contact the team about future crop sales on 01278 410250

One of the Government’s main priorities is to help grow the economy, and one of the mechanisms available to achieve this is to increase infrastructure spending This will more than likely lead to further compulsory purchase schemes, such as new roads, electricity lines, water pipes or railway connections which will affect private landowners and occupiers.

We have dealt with compulsory purchase schemes ranging from the new National Grid T pylon line, laying of underground water and gas pipes, the sale of land to utility companies, Environment Agency river and drainage works, through to telecom communication masts and new road schemes; the most recent of which being the widening of the A303 and the Banwell Bypass.

Compulsory purchase and the associated compensation are complicated subjects with numerous layers of legislation and case law dating back to the 1800s

If you are aware of one of these potential schemes affecting your land or property, it is advisable to make early engagement with the acquiring authority and do not ignore their communications Early engagement is recommended with an independent agent who can advise you of your rights

GTH can assist from the initial design stage while advising on your rights and the compulsory purchase process, as well as trying to mitigate the impact of the scheme on retained property, reducing the land take, and managing the compulsory purchase process, all the way through to agreeing the final compensation claim.

For bespoke advice for your individual situation, please contact your local GTH office via www gth net/branches

Strategic Land is a term used by the development sector for any land which has potential for conversion from agricultural use to development use This is land which is outside of the development boundary or builtup area of a settlement It offers a medium to long term opportunity to landowners in this type of location to derive a significant uplift in value

The aim is to promote the land through the local planning authority's Development Plan (Local Plan and Neighbourhood Plan) On allocation, a planning application can be prepared and submitted

Once permission is granted, the land can be marketed and disposed of to a buyer with the aim of maximising value and/or leaving a legacy

GTH works with colleagues across its network of offices and can advise clients from project inception through to completion of the sale of the land

Contact GTH’s Development Land & Planning team to discuss your options Their experts would be delighted to meet you for a noobligation conversation

Contact Development Land & Planning on 01823 334466 or landplanning taunton@gth net | landplanning exeter@gth net

Simon Havens, Chairman and head of Residential Sales at Greenslade Taylor Hunt, comments on the growing influence of artificial intelligence within the property industry

AI (Artificial Intelligence) is suddenly everywhere Academics, lawyers, writers, students, and all those who fact-check and refine their work online are turning to AI

It’s also increasingly used by estate agents But reliance on AI has its drawbacks in our business If you want to churn out the same thing as every other agent, that’s fine But when we market a property we want it to be uniquely special, to match that uniquely special buyer And just as no two properties or people are the same, no two estate agents are either

Any experienced estate agent will tell you that matching people with property shouldn’t be left to an algorithm How often has a buyer been to view a property which on paper ticks all the boxes, only to be disappointed when they actually see it? It may have sounded as if it had everything but they just didn't like it, or it didn't feel right

AI can’t anticipate taste, or the fact that when it comes to the crunch a buyer will trade certain requirements for something practically or emotionally better, such as a great view, access to schools and transport, or a large garden

The permutations of a house buyer’s desires and dreams are infinite and way, way beyond the capabilities of AI to predict

So if you want an agent who relies on experience and instinct, who listens to what buyers need and is invested at an emotional level, then choose an agent with property intelligence and not just artificial intelligence

If you’d like to start your own property journey and need some expert advice, find out more about selling your home with GTH or to book a valuation, head to gth net/sell/selling-your-home

As average stock prices sold through Sedgemoor increase by as much as 81% on the year, is there any sign if it slowing and what is around the corner? We speak to Store and Prime Cattle auctioneer and head of Sedgemoor Market, Robert Venner, and Dairy & Calf Auctioneer, Andrew Clements, for an insight into the current trade

It’s true Looking at average prices through Sedgemoor at the start of 2025 and at the same period in 2024, the calf price has risen by a whopping 81% From a nationwide lack of keen rearers to a packed ringside, the current record demand can mainly be put down to the rise in value of prime, barren and store cattle creating more confidence in the beef industry as a whole

Robert notes: “The finished price through Sedgemoor is up 44% on the year and the stores are up by 56%, which is huge This has created more fire for the younger stirks and the aforementioned calves.”

Andrew comments: “The dairy trade has also risen in part due to the continual rise of the barren cow market pushing up the residual values This has meant that over the past two years farmers have not been keeping so many problem cows and are therefore able to pay more for the replacement A large number of

flying herds have been unable to source heifers from abroad due to restrictions on imports due to Bluetongue, which has also bolstered the domestic market

We are now regularly seeing the best dairy cows break the £3,000 barrier, even commercially! Almost mirroring the beef trade, the stronger trade for the top-end cows has lifted the price of youngstock this spring ”

We have already had an unexpected change to the Bluetongue Restriction zone, which surprised the South West’s farmers. As we conclude the seasonal Low Vector Period, we are likely to see a change to movement rules again, and while lots of rumours circulate, we don’t expect to receive too much notice before they implement any changes So, always keep an eye on our socials and website and get in touch with our auctioneers for all the latest information

One morning in October 2024, Sunny, farm sales secretary at Sedgemoor Auction Centre, didn’t turn up for work as usual News came through that she had been involved in a serious road traffic accident on her way to the office

Fortunately, Dorset & Somerset Air Ambulance was scrambled and they flew her to hospital in Bristol Playing their part alongside the NHS ambulance service and NHS staff at the hospital, they helped to save her life

Sunny is recovering but the traumatic experience has galvanised the Sedgemoor team, who have vowed to do all they can to raise money for the vital work the air ambulance services undertake

So, on Friday 23rd May 2025 a team of GTH staff and auctioneers from Sedgemoor Market will ‘set off’ on two static bikes at Sedgemoor Auction Centre, and they won’t stop pedalling for a full 24 hours! They will start at 11am on the Friday and will conclude on Saturday 24th May

at 11am, when the market will be in full swing

Their aim is to raise in excess of £5,000 for this deserving charity Please donate to help them achieve their target – you never know if you or a loved one might one day be grateful for their vital service

Scan the QR code opposite to donate!