GENERAL SITUATION IN MEXICO

Weekly Review I April 2, 2025

Weekly Review I April 2, 2025

• President Donald Trump has announced a new wave of reciprocal tariffs to take effect on April 2, 2025.

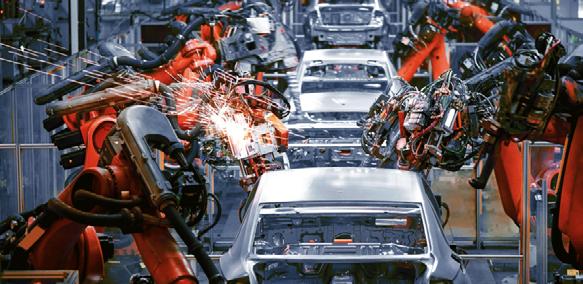

• The most significant measure includes a 25% tariff on all imported vehicles and auto parts.

• This action aims to reduce the U.S. global trade deficit (approximately $1.2 trillion), encourage domestic manufacturing, and apply commercial pressure on major trade partners such as Mexico, Germany, Japan, and South Korea.

• Simultaneously, the U.S. will impose a 25% tariff on countries that purchase oil or gas from Venezuela. This move primarily targets nations like China and India.

• The implementation of these tariffs will not be uniform; some countries may receive temporary exemptions based on decisions by the White House or the Secretary of State, Marco Rubio.

• The auto tariffs are forecasted to raise vehicle prices by $10,000 to $20,000 per unit, depending on the model and country of origin.

• According to industry sources such as Reuters and the Detroit Regional Chamber of Commerce, this impact may exceed the supply chain disruptions caused by the COVID-19 pandemic.

• Existing inflationary pressures will be aggravated:

• +20% increase in average car prices since 2019.

• +60% increase in auto insurance premiums.

• The American middle class, which constitutes the bulk of car buyers, will be particularly affected.

• Job losses are also expected in the auto sector, especially in Michigan, where one in five jobs is linked to the industry.

• These tariffs are expected to increase core PCE inflation by 0.3 percentage points, raising it to 3.1% — significantly above the Federal Reserve’s 2% target.

• JP Morgan projects a 0.2 percentage point reduction in U.S. GDP, bringing 2025 growth down to 1.3%.

• This inflationary trend may force the Federal Reserve to delay planned interest rate cuts or even consider additional hikes.

MEXICO:

• President Claudia Sheinbaum has adopted a diplomatic tone, pledging a formal response on April 3.

• The Bank of Mexico has preemptively lowered its interest rate to 9% to cushion economic shocks.

• The effectiveness of USMCA as a protective framework is being questioned by analysts and industry leaders

• The automotive industry in North America relies heavily on integrated supply chains facilitated by the USMCA.

• Vehicles manufactured in the U.S. often contain parts from Mexico, Canada, and Asia.

• Automakers from Japan, Germany, and Mexico may need to restructure operations or absorb substantial cost increases.

• Many companies are pausing hiring, investment, and expansion plans amid policy uncertainty.

• Mexican states such as Guanajuato, Aguascalientes, and Coahuila, home to major automotive clusters, are especially vulnerable.

International Reactions and Trade Tensions:

EUROPEAN UNION:

• Brussels is preparing retaliatory tariffs but has delayed implementation to pursue dialogue.

• EU leaders have criticized the tariffs as harmful to global trade and consumer welfare.

• Japan, South Korea, and Germany have issued formal complaints and are exploring legal recourse through the WTO.

MARKET RESPONSE AND ANALYST WARNINGS:

• Financial markets initially responded with cautious optimism due to potential flexibility in enforcement.

• The S&P 500 rose by 1.8% following the announcement.

• Despite that, sectors such as automotive, pharmaceuticals, and technology are experiencing heightened volatility.

• Historical data raises concerns: a previous round of tariffs under Trump’s first term yielded a net loss of 75,000 jobs in industries affected by rising input costs, despite minor gains in protected sectors like steel.

• Some view the move as a negotiation tactic likely to be moderated over time.

• Others warn of structural trade fragmentation, as firms consider relocating supply chains away from the U.S.

• The USMCA’s relevance as a shield against unilateral trade actions is under scrutiny.

• Upcoming policy decisions from the Federal Reserve, Mexico, and the EU will play a critical role in mitigating or exacerbating economic impacts.

SOURCE: REUTERS

President Claudia Sheinbaum announced that Mexico will formally respond to the new 25% US tariffs on automobiles after April 2, emphasizing ongoing negotiations with the US, particularly with Commerce Secretary Howard Lutnick. She stressed that tariffs on steel, aluminum, and automobiles should be addressed collectively rather than separately. While Trump’s tariffs, set to begin April 2, temporarily exempt some Mexican and Canadian auto parts, vehicles will still be taxed based on their non-US content. The US has granted a one-month exemption for certain automakers, but broader reciprocal tariffs remain imminent. Sheinbaum reaffirmed that under USMCA, tariffs should not apply, and Mexico is actively pursuing diplomatic solutions to mitigate economic repercussions. Meanwhile, global concerns grow over the tariffs’ impact, with China criticizing them and the US framing the move as part of its fentanyl crackdown rather than a trade dispute.

SOURCE: MEXICO BUSINESS NEWS

Starting in January 2026, Nissan Latin America will consolidate the production of its Nissan Frontier/Navara pickups at a single regional hub, the CIVAC plant in Morelos, Mexico, to enhance efficiency and sustainable growth. Currently, production is split between Mexico and Argentina, but the Morelos facility will handle all pickup manufacturing on its C2 Line, while the C1 Line will cease production in late 2025 after surpassing its initial targets. Rodrigo Centeno, President and CEO of Nissan Mexicana and Infiniti, highlighted this move as a testament to Mexico’s strong manufacturing tradition and Nissan’s commitment to delivering high-quality vehicles across Latin America. The shift aligns with Nissan’s global transformation strategy announced in 2025, aiming to improve competitiveness and operational agility. Meanwhile, Nissan Argentina will focus on strengthening commercial operations and customer experience. With this change, Nissan Latin America will consolidate manufacturing across its Aguascalientes (A1, A2, and Powertrain) and Morelos (CIVAC C2) plants in Mexico, alongside the Resende plant in Brazil, ensuring continued world-class production and exports to 70 markets.

SOURCE MEXICO NOW

• BILL TO AMEND ARTICLE 132 OF THE FEDERAL LABOR LAW

Presented by: Sen. María Del Rocío Corona Nakamura (Jal - PVEM)

Objective: Mandates employers to grant 20 working days of paid paternity leave for male workers upon childbirth or adoption.

Status: 2025-03-27 - Published in the Parliamentary Gazette

• BILL TO AMEND ARTICLE 123 OF THE CONSTITUTION

Presented by: Sen. Geovanna del Carmen Bañuelos De la Torre (LNal - MORENA)

Objective: Recognizes independent workers as individuals who engage in personal economic or professional activities without employer dependency.

Status: 2025-03-27 - Published in the Parliamentary Gazette

• BILL TO AMEND AND ADD TO ARTICLE 371 OF THE FEDERAL LABOR LAW

Presented by: Dip. Aciel Sibaja Mendoza (PlurMORENA)

Objective: Guarantees proportional gender representation in union leadership, ensuring full and equal participation of women. It mandates that executive positions and union structures at all levels be equitable, with gender alternation and equal conditions.

Status: 2025-03-25 - Published in the Parliamentary Gazette

• BILL TO AMEND ARTICLE 211 BIS 1 OF THE FEDERAL PENAL CODE

Presented by: Dip. Victor Manuel Pérez Díaz (Plur - PAN)

Objective: Establishes that unauthorized access to computer systems or protected data to steal, modify, destroy, copy, or alter information constitutes a crime. The penalty will be 3 to 10 years in prison and a fine of up to 1,000 Units of Measurement and Update. If the crime causes psychological or material harm to the victim, the penalty will be increased by one-third.

Status: 2025-03-26 - Published in the Parliamentary Gazette

• BILL TO AMEND THE FEDERAL PENAL CODE BY ADDING ARTICLE 252 BIS

Presented by: Sen. Rafael Alejandro Moreno Cárdenas (LNal - PRI)

Objective: Establishes that identity theft, including unauthorized use or appropriation of another’s identity to cause harm or gain undue profit, is a crime punishable by 2 to 5 years in prison and fines of 200 to 1,000 UMA, along with potential restitution. The same penalties apply to the use of AI software to create, distribute, or manipulate content with the intent to impersonate someone. AI is defined as systems capable of performing tasks traditionally requiring human intelligence, such as natural language processing and machine learning.

Status: 2025-03-25 - Published in the Parliamentary Gazette

• BILL TO ADD VARIOUS PROVISIONS TO THE INCOME TAX LAW

Presented by: Dip. Marcelo De Jesús Torres Cofiño (Plur - PAN)

Objective: Provides a tax incentive for income tax payers whose earnings come from exports affected by tariffs imposed by other countries. The incentive is a tax credit of 30% of the tariff costs, applied against income tax for the year the credit is determined. The credit can be carried forward for up to four years. An Interinstitutional Committee, with representatives from various government agencies, will oversee the implementation of this tax benefit and publish the relevant rules for its granting.

Status: 2025-03-26 - Published in the Parliamentary Gazette

The government of Baja California shut down four companies for fraudulently operating under the IMMEX program. This enforcement is part of “Operación Limpieza,” aimed at strengthening oversight of companies in foreign trade programs to ensure compliance with tax and customs laws. Additionally, the State Civil Protection Coordination conducted inspections, requiring businesses to maintain valid safety programs. One establishment was closed for failing to meet minimum safety standards.

SOURCE: AFN TIJUANA

The manufacturing sector in Sonora, a key player in selling local products internationally, ended March with widespread concerns about salaries and job preservation. This situation could either improve or worsen depending on the update to tariff policies between Mexico and the United States, scheduled for this Wednesday. Some sectors, like aerospace and medical, are seeing more activity, while others, such as automotive, electronics, and consumer goods, have slowed down. Jesús Gámez García, president of Index Sonora, emphasized that once the tariff policy situation is clarified after April 2, some halted investments will resume, and others will strengthen. According to a report from the National Institute of Statistics and Geography (Inegi), while business leaders remain optimistic about production, supplier relations, and inventory levels, there has been two months of pessimism regarding employment, coinciding with the early months of Donald Trump’s second term and his tariff policies affecting Mexico and other countries.

SOURCE: EXPRESO MEDIA

NUEVO LEON

Governor Samuel García Sepúlveda inaugurated Nuevo León’s stand at the Mexico Pavilion in Hannover Messe, the world’s leading industrial fair, highlighting the state’s advantages such as its new customs facility, infrastructure, and focus on innovation and electromobility. During his European trade tour, he met with Schneider Electric executives to discuss automation, energy efficiency, and AI-driven industrial solutions, reinforcing Nuevo León’s position as a key player in the USMCA trade zone. With Schneider Electric’s 25-year presence in the state, the discussions aimed to attract further investment and create job opportunities, strengthening the region’s role in advanced manufacturing and technology.

SOURCE: EL ECONOMISTA

DURANGO

As part of his international tour, Governor Esteban Villegas Villarreal inaugurated the Mexico Pavilion at Hannover Messe, the world’s leading industrial fair, where he promoted Durango as a prime destination for investment, innovation, and sustainable growth. With over 4,000 companies present, the event offers Durango a historic opportunity to attract global investors. Villegas highlighted the state’s $3.7 billion investment, hosting Latin America’s largest data center and expanding industries due to its resources, security, and talent. He emphasized Mexico’s strong global position and the importance of collaboration for further growth. Accompanied by key officials, the delegation aims to secure strategic alliances in energy, technology, and advanced manufacturing to drive industrial development and job creation in Durango.

SOURCE: SOL DE DURANGO

The Pocket Park León industrial park was inaugurated in the southern part of León, Guanajuato, within the Ciudad Industrial subdivision. Spanning 27 hectares, this compact industrial space will host both national and international companies and is expected to generate approximately 2,500 jobs. José Ma. Garza Treviño, president of Grupo GP Construcción y Desarrollos, highlighted that this is their first Pocket Park outside of Nuevo León, offering customized leasing and construction solutions. The park’s strategic location provides proximity to key transportation hubs, including León (5 km), Bajío Airport (25 km), and major trade routes. Governor Libia Dennise García Muñoz emphasized the project’s significance as a testament to investor confidence in Guanajuato’s industrial growth, noting that in the first six months of her administration, 12 investment projects worth over $2 billion have been secured, creating 4,343 jobs. The park’s advantages include accessibility to highways, availability of skilled labor, proximity to residential areas, enhanced security, and sustainable infrastructure.

SOURCE: MEXICO INDUSTRY

Governor Alejandro Armenta traveled to Mexico City to meet with officials from the Federal Secretariat of Infrastructure, Communications, and Transport (SICT) to secure funding for strategic infrastructure projects. José Luis García Parra, the chief of staff, emphasized the governor’s focus on projects with social impact. During the inauguration of Casa Carmen Serdán in Huejotzingo, García Parra highlighted Armenta’s efforts to obtain additional resources for state infrastructure. A few weeks prior, Armenta met with Jesús Antonio Esteva Medina, head of the SICT, to discuss the construction and modernization of the Intermixteca highway. These initiatives reflect the governor’s commitment to improving connectivity and regional development.

SOURCE: CONTRAPARTE

Illinois Governor JB Pritzker signed a trade agreement with the State of Mexico (Edomex) during a visit to Mexico, strengthening economic ties in manufacturing, agriculture, and finance. The agreement, an addendum to the Illinois-Mexico Sister-State Memorandum of Understanding (MOU), aims to enhance bilateral trade, supply chains, e-mobility investments, and sustainable water usage. Pritzker emphasized Illinois’ commitment to economic cooperation despite tensions in U.S.-Mexico trade under former President Trump’s tariff threats. Republican critics, including Illinois GOP Chair Kathy Salvi, denounced the trip as wasteful, arguing it burdens taxpayers while businesses struggle. The agreement also seeks to foster partnerships between government bodies, universities, and research institutions.

SOURCE: FOX BUSINESS

DHL has inaugurated a new distribution center in El Salto, Jalisco, with an investment of 9.3 million dollars. Strategically located in the Bajío region, the facility offers direct access to the Guadalajara International Airport and the Colima-Manzanillo corridor.

JUDD WIRE

The Japanese company Judd Wire announced a new investment of 31.9 million dollars to expand its electric cable production plant for the automotive industry in Aguascalientes. This investment will create 300 new jobs.

Steel manufacturer Tyasa plans to invest 450 million dollars between the end of 2023 and 2027. As part of this plan, a new special steel bar rolling mill—currently in the project phase—with a capacity of 350,000 tons will receive an investment of 250 million dollars. An additional 200 million dollars will be allocated to increase the production of finished goods, aiming to serve customers directly in central and southeastern Mexico.

SOURCES INVESTMENT NEWS, MEXICO INDUSTRY, CLUSTER INDUSTRIAL, EL ECONOMISTA

MEXICO’S HVAC MANUFACTURING INDUSTRY: POSITIONED FOR GLOBAL GROWTH

Mexico is heating up as a global hub for HVAC (Heating, Ventilation, and Air Conditioning) manufacturing, exporting $7.6 billion in 2024—primarily to the U.S. The country’s strategic location, skilled labor force, and favorable trade conditions under the USMCA are driving investment from global giants like Carrier, Trane, Daikin, and Lennox.

With demand rising for energy-efficient systems, smart HVAC technologies, and sustainable building practices, Mexico’s role in the North American HVAC market is set to grow. Key hubs like Monterrey, Querétaro, and Tijuana are thriving with industrial infrastructure and export-ready production.

But challenges remain—trade tensions, energy consumption, and evolving regulations demand smarter supply chains and greener solutions. Still, the outlook is strong: from residential growth to commercial demand in sectors like healthcare and data centers, Mexico is well-positioned to lead the future of HVAC.

Expanding operations into Mexico offers exciting opportunities—but success depends on smart planning and strategic execution. From turnkey solutions and soft-landing support to regulatory compliance and site selection, this guide breaks down the key steps to establish a competitive, cost-efficient manufacturing operation.

• Business Structures & Tax Strategy – Compare operational models to align with your long-term goals and maximize tax benefits.

• Cash Flow Modeling – Build financial projections that factor in labor costs, tariffs, and tax incentives.

• Site Selection – Analyze data-driven criteria like infrastructure, workforce availability, and logistics to find the right location.

• Regulatory Compliance – Stay ahead of environmental permitting, trade certifications, and customs procedures.

• Special Interest Due Diligence – Evaluate digital readiness, supply chain resilience, and sustainability performance.

Whether you’re a first-time investor or expanding operations, understanding Mexico’s regulatory landscape, cost structures, and strategic advantages is essential for long-term success.