GENERAL SITUATION IN MEXICO

Weekly Review I August 28, 2024

Weekly Review I August 28, 2024

Canada will impose a 100% tax on electric and certain hybrid vehicles made in China starting October 1, 2024. Additionally, a 25% tax will be applied to steel and aluminum products imported from China starting October 15, 2024. These measures aim to protect Canada’s automotive industry and jobs in the steel and aluminum sectors. A public consultation will also be launched to explore additional taxes on other critical sectors.

SOURCE: MEXICO INDUSTRY

Stellantis has begun producing electric vehicles at its Toluca plant in the State of Mexico with a $1.6 billion investment. The plant, updated for the STLA Large platform, aims to enhance electromobility and solidify the state as a key automotive production hub. This initiative is expected to create thousands of jobs, boost the local economy, and strengthen Mexico’s position in the global automotive industry. The plant will serve both the North American and international markets.

SOURCE: MEXICO NOW

The Sonora Automotive Cluster was officially established at Ford’s Hermosillo plant with Juan Carlos Campoy Ramos as its president. The cluster aims to attract investment and benefits to the region, positioning Sonora as an attractive investment destination. Governor Alfonso Durazo Montaño emphasized that it will boost the local economy by creating quality jobs. The initiative, supported by USAID, seeks to enhance local supply chains, increase local sourcing, and promote nearshoring, while also focusing on improved regulations, infrastructure, and regional economic growth.

SOURCE: MEXICO INDUSTRY

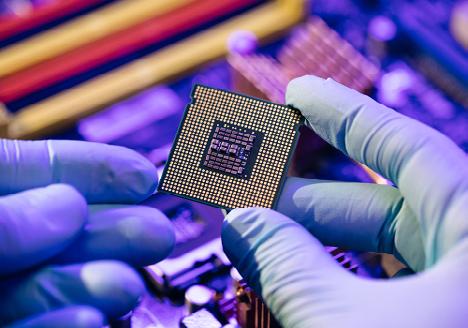

Tamaulipas has signed a collaboration agreement with CINVESTAV to boost training in the semiconductor industry. This partnership, endorsed by Governor Américo Villarreal Anaya, aims to develop new specialists through advanced education and training programs. The initiative will enhance the state’s ability to produce semiconductor professionals and leverage its strategic location near the U.S. border. The agreement will benefit educators and students at various institutions, providing them with updated technological and pedagogical tools to excel in semiconductor technologies.

SOURCE: MEXICO NOW

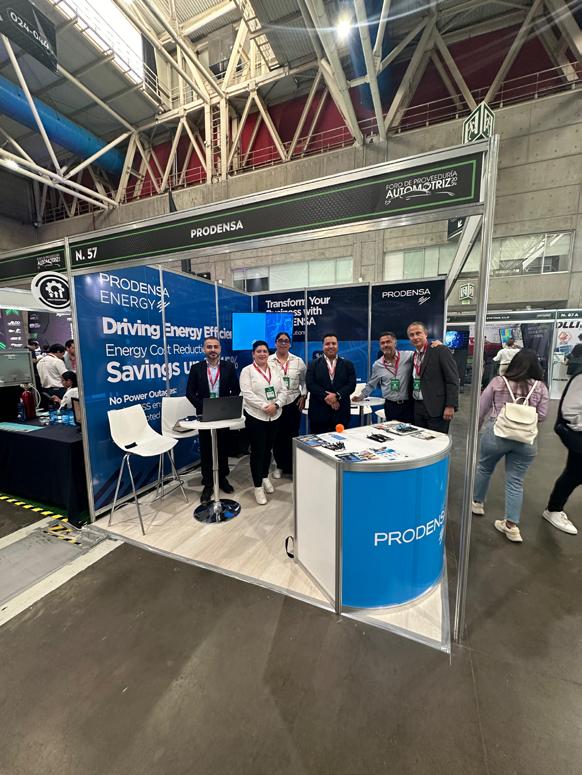

The Coahuila Automotive Industry Cluster organized the event “Automotive Industry Experts Conversations,” which brought together key representatives from automotive companies and consulting firms to discuss the transformation of the industry in Coahuila. Emilio Cadena, CEO of Prodensa, participated in the panel “Electrifying the Present and the Future: Redefining Automotive Processes and the Value Chain” alongside Alberto Piñones, VP of Operations at Lear; Ing. Erick Gonzalez, Global Director of Operational Excellence; and Ricardo Apaez from Driven.

SOURCE: PRODENSA

Cristina Hermosillo Ramos, president of Desarrollo Económico e Industrial de Tijuana (DEITAC), announced the organization’s upcoming 35th anniversary of fostering foreign investment in Tijuana. She noted the satisfaction of recent companies with the city’s skilled workforce and rapid team formation. Although Mexico graduates many engineers, more highly educated professionals are needed. David Moreno, DEITAC’s director, mentioned four FIDEM-funded projects impacting sectors like aerospace and biotechnology. DEITAC has managed over 300 investment projects, focusing on economic promotion and nearshoring. Hermosillo Ramos emphasized Tijuana’s continued strength in advanced manufacturing and its ongoing appeal for foreign investment.

SOURCE: INDUSTRIAL NEWS BC

The IMMEX Forum 2024, organized by Index Nuevo León, emerged as a key event for the maquiladora and manufacturing industries, focusing on crucial topics related to Mexico’s foreign trade. The forum featured discussions on modernizing the IMMEX and PROSEC programs, highlighting their importance for economic growth and international trade opportunities. Keynote speaker Javier Ortiz emphasized the need for program updates, while panels addressed customs and trade perspectives under the new government, the impact of T-MEC renegotiation, and customs digitalization. Additionally, Roberto Serralde’s conference on new manufacturing schemes explored fiscal and commercial implications, and Valeria Jiménez Medina provided insights on VAT and IEPS certification audits. The forum underscored the importance of modernization, digitalization, and regulatory compliance as essential for maintaining competitiveness and growth in Mexico’s manufacturing sector.

SOURCE: MEXICO INDUSTRY

Index Mexicali recently hosted a meeting for general managers, featuring Prodensa as keynote speakers. During the event, Marco Kuljacha, the President of Prodensa, provided an in-depth analysis of industry perspectives and trends anticipated for the conclusion of 2024. His presentation aimed to offer valuable insights into how the industry is expected to evolve and the factors influencing its future trajectory. Meanwhile, Álvaro García, VP of Human Resources at Prodensa, delivered a presentation focused on the labor environment in Mexico. He addressed various challenges and opportunities that businesses may encounter, providing a comprehensive overview of the current and future state of labor conditions in the country. This meeting served as a platform for sharing expert knowledge and fostering discussions on key issues impacting the industry and workforce.

SOURCE: PRODENSA/INDEX MEXICALI

The 2024 Automotive Supply Forum has begun at the Poliforum in León, Guanajuato, covering 13,500 square meters and featuring over 400 exhibitors. Organized by the Guanajuato Automotive Cluster (CLAUGTO), this event serves as a key networking and business platform for industry professionals, suppliers, and buyers. It is anticipated to attract more than 12,000 visitors, including over 800 buyers from OEMs, Tier 1, and Tier 2 automotive companies. At the inauguration, outgoing CLAUGTO president Rolando Alaniz emphasized the importance of talent development among the seven strategic lines pursued during his tenure. He also highlighted that Guanajuato is one of Mexico’s top four states contributing to the country’s trade balance through strategic supply chain strengthening, investment attraction, and local business opportunities.

SOURCE: MEXICO INDUSTRY

The State Energy Commission of Baja California has successfully concluded a tour in California, strengthening strategic partnerships with key energy sector players such as TESLA and the California Energy Commission. The visit focused on collaboration in areas like decarbonization and electric mobility, culminating in the signing of a Memorandum of Understanding (MoU) that paves the way for future joint projects. This collaboration aims to advance clean energy solutions and sustainability, marking a significant step in enhancing cross-border cooperation between Baja California and California.

SOURCE: INDUSTRIAL NEWS BC

The Sonora government plans to construct eight industrial parks by the end of this year and early 2025, aiming to attract national and international businesses and create new jobs. Margarita Vélez de la Rocha, Secretary of Economy for Sonora, detailed that these parks will be distributed across various cities: Hermosillo, Obregón, Navojoa, and San Luis Río Colorado. The projects are at different stages, with the first one, a South Korean industrial plant focused on electric vehicle harnesses, set to open in Cajeme on August 27 and another near Ciudad Obregón Airport in early November. The South Korean plant is expected to create 1,500 jobs initially and up to 4,000 in total, with a $40 million investment.

SOURCE: ENTORNO INFORMATIVO

NUEVO LEON

The Mexican Chamber of the Construction Industry (CMIC) in Nuevo León and Interpuerto Monterrey have signed a collaboration agreement to link CMIC-affiliated companies with those relocating to the Interpuerto Monterrey complex, including offering workforce training through CMIC’s institute. This partnership aims to ensure access to skilled labor for new businesses and support the growth of the industrial park. Additionally, CMIC Nuevo León and the Mexican Social Security Institute (IMSS) have strengthened their collaboration to improve affiliation processes and prevent misinformation, with a focus on transparency and direct communication between the organizations.

SOURCE: EL ECONOMISTA

CHIHUAHUA

In Chihuahua, the Enlace de Prácticas y Entrenamientos en el Extranjero (EPEX) project was presented to Taiwanese manufacturing companies in Ciudad Juárez to enhance collaboration among manufacturing firms, authorities, and the education sector. The project aims to develop a skilled workforce by providing students with global competencies and international work experience. This involves internships abroad in the manufacturing sector, with the goal of applying acquired knowledge upon returning to local industries. The presentation, conducted by the Government of Chihuahua’s Secretariat of Innovation and Economic Development (SIDE) along with the Innovation and Competitiveness Institute (i2C) and CENALTEC Juárez, included visits to Taiwanese companies like Winstron, Pegatron, Inventec, and Foxconn. With over 20 years of operation, EPEX has benefited more than 300 students and is expected to positively impact the region by preparing the workforce for specialized, high-value jobs and new investments.

SOURCE: MEXICO INDUSTRY

The groundbreaking ceremony for the VYNMSA Torreón Industrial Park marked a significant event for Torreón’s industry and economy. This major project, involving an investment of over 2 billion pesos, is set to create 7,000 direct and 23,000 indirect jobs, positioning the region as a key industrial hub. The event was attended by Coahuila Governor Manolo Jiménez, VYNMSA CEO Mario Chapa, INMEX Director General Manolo Martín, Torreón Mayor Román Alberto Cepeda, and VYNMSA executives. The park will feature speculative warehouses of Class “A” standards, available from early 2025, with sizes ranging from 5,663 to 11,142 m². This new development adds to VYNMSA’s portfolio of 26 industrial parks across various Mexican states, reflecting their 30 years of experience in industrial real estate and comprehensive services.

SOURCE: MEXICO INDUSTRY

Mexican company QSM Semiconductores will showcase its advancements in chip manufacturing at Expo Encuentro Industrial y Comercial Querétaro 2024. The firm aims to establish Mexico as a key player in semiconductor production, with plans to start its first chip manufacturing plant by 2025. QSM Semiconductores, which has a Center for Engineering and a Design Center, seeks to produce the first chips labeled “Made in Mexico,” leveraging local engineering talent and Mexican investors. At the expo, QSM will demonstrate the chip manufacturing process, including silicon wafers, integrated circuits, and photolithography masks, as well as their developments in semiconductor technology such as drones, robots, and various sensors. Alejandro Franco, the company’s founder and CEO, emphasized the importance of reducing technological dependency and positioning Mexico on the semiconductor map. The event is organized by the Querétaro State Sustainable Development Secretariat in collaboration with business associations and industry clusters.

SOURCE: MEXICO INDUSTRY

In 2024, Aguascalientes has attracted over $480 million in Chinese investments, primarily targeting the automotive and information technology sectors, with an expected creation of 6,900 jobs. Esaú Garza de Vega, head of the Aguascalientes Secretariat of Economic Development, Science, and Technology (SEDECyT), highlighted the state’s success in drawing foreign investment due to its advanced industrial infrastructure, skilled workforce, and favorable business environment. He emphasized that strategic collaboration with China could significantly boost Mexico’s economy and enhance its global industrial standing. Garza de Vega stressed the importance of a balanced approach that considers both immediate benefits and long-term economic and social impacts, advocating for sustainable and diversified investment strategies to ensure robust future growth.

SOURCE: MEXICO INDUSTRY

The return to school in Mexico City is expected to generate approximately MXN 5.196 billion, a 22.7% increase from 2023, according to the National Chamber of Commerce, Services, and Tourism of Mexico City (Canaco CdMx). This estimate is based on current economic indicators and the outlook for the 2024-2025 school year. Retail stores and supermarkets offering promotions and discounts on school supplies are also expected to benefit. Families are projected to spend between MXN 2,200 and MXN 3,700 per student. To help families save money while maintaining quality, the Federal Consumer Protection Agency (Profeco) has published a back-to-school guide with recommendations. According to data from the National Institute of Statistics and Geography (Inegi), around 1.029 million children and adolescents in Mexico City will return to in-person classes. However, approximately 9,878 children under the age of 15 may not attend due to economic difficulties.

SOURCE: MSN

The State of Mexico, led by Delfina Gómez, attracted USD 1.709 billion in Foreign Direct Investment (FDI) in the second quarter of this year, reflecting a 24.7% increase compared to the same period in 2023. This figure represents 88.5% of the total FDI collected last year. The Mexican Secretariat of Economy reported that national FDI reached a record high of MXN 31.096 billion in the second quarter, up 7% from the previous year. Laura González Hernández, the state’s Secretary of Economic Development, attributed this growth to the State Development Plan’s economic policies. The State of Mexico now ranks as the fourth-largest FDI recipient in the country, with significant contributions from the United States (47.5%), Germany (15.7%), and Belgium (5%). Key investment sectors include manufacturing (55.7%), transportation equipment manufacturing (21.7%), beverage industries (6.3%), and retail trade (25.2%). In the second quarter of 2024 alone, the state secured MXN 450 million in FDI, making it the third-largest recipient of FDI nationwide, a figure 5.7 times higher than the same period in 2023.

SOURCE: EL FINANCIERO

With an investment of 700 million dollars and the potential creation of 2,500 jobs, VOLVO announced the expansion of its operations in Mexico, it will be located in Cienega de Flores, Nuevo León.

EDGEWELL

The American personal care company will invest 110 million dollars to build a plant in the FINSA industrial park in Aguascalientes. Their arrival will bring the creation of 1,370 jobs.

The German company has started the construction of its new plant in Aguascalientes, where 90 million dollars will be invested. The project is expected to create 200 jobs in its first phase, with the potential to reach 500 jobs in its final phase.

SOURCES : MEXICO NOW, MEXICO INDUSTRY, CLUSTER INDUSTRIAL

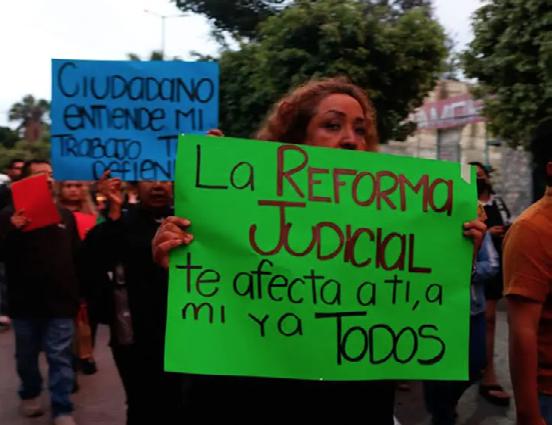

• Regarding judicial reform, he noted that while the rating agencies disapproved of it, they did not protest when tax breaks were given to big corporations. He asserted that Mexico’s economy is strong, with low foreign debt and record reserves in the Bank of Mexico. Any changes in the exchange rate are due to external factors, not judicial reforms. López Obrador announced that on September 1, he will present the final report of his six-year term, detailing the state of the economy and his administration’s achievements. He stressed the continuity of his policies with the upcoming president and highlighted Mexico’s attractiveness for foreign investment.

• López Obrador said the relationship with Ken Salazar is on hold due to Salazar’s stance on judicial reform, but the overall bilateral relationship between the governments remains intact. He emphasized the need to respect Mexico’s sovereignty and stated that no violations of the country’s sovereignty or Constitution will be tolerated. Communication with the U.S. embassy could resume with a letter showing respect for Mexico. Relations with the U.S. Department of State and President Biden remain positive.

• BAJA CALIFORNIA: INITIATIVE TO AMEND ARTICLES 153 AND 154 OF THE PUBLIC HEALTH LAW FOR THE STATE

Presented by: Local Deputy Araceli Geraldo Núñez (BC - MORENA)

Purpose: Establish that the establishments requiring a health license in accordance with the General Health Law will include:

Those involved in the processing of medications containing narcotics and psychotropics; vaccines; toxoids; animal-derived sera and antitoxins; and blood derivatives.

Those dedicated to the production, manufacturing, or preparation of medications, pesticides, plant nutrients, or toxic or hazardous substances.

Compounding centers for the preparation of nutritional and medicinal parenteral mixtures.

Those involved in the sale and supply of medications that can only be obtained with a prescription or special permit.

Repeal the health license requirement for establishments dedicated to the sale of food, alcoholic and non-alcoholic beverages, meeting and entertainment venues, lodging establishments, among others.

Status: 2024-08-22 - Initiative referred to the Committee for review.

• INITIATIVE WITH DRAFT DECREE TO AMEND THE GENERAL HEALTH LAW

Presented by: Deputy Éctor Jaime Ramírez Barba (Gto - PAN)

Purpose: The initiative seeks to establish the following objectives for the National Health System:

The initiative aims to enhance the protection and proper handling of sensitive personal data by both private entities and public institutions, in compliance with existing laws. It promotes the use of artificial intelligence (AI) to improve healthcare and research. Cofepris will be responsible for assessing risks associated with AI in healthcare, and developers of AI systems must ensure data protection and register their systems with federal health authorities.

The Ministry of Health will set regulations for the development, use, and supervision of AI in healthcare, requiring healthcare professionals to oversee its application. A new chapter in the General Health Law defines “Artificial Intelligence Applied to Health” and specifies that AI systems can only be used with patients’ informed consent.

In the transitional phase, the Ministry of Health must collaborate with INAI to promote awareness of data protection obligations and train those responsible for data handling, particularly concerning the risks posed by new technologies.

Status: 2024-08-21 - Published in the Parliamentary Gazette.

• Agreement Establishing the Structure and Organization of the Advisory Council of the National Employment Service of the Ministry of Labor and Social Welfare

Presented by: Ministry of Labor and Social Welfare

Purpose: To establish the structure and organization of the Advisory Council of the National Employment Service as a body providing opinions and advice to the Ministry of Labor and Social Welfare regarding policies, programs, and public actions implemented within the framework of labor intermediation conducted between the labor and productive sectors.

Status:2024-08-26 - Request for MIR removal or File.

• Agreement Establishing the Guidelines for Designating Representatives of National Worker and Employer Organizations to the Advisory Council of the National Employment Service

Presented by: Ministry of Labor and Social Welfare

Purpose: To establish the guidelines for appointing representatives of national worker and employer organizations to be part of the Advisory Council of the National Employment Service.

Status: 2024-08-26 - Request for MIR removal or File.

Mexico’s e-commerce landscape is booming, offering foreign retailers a vast and growing market. With a young, digitally savvy population and increasing disposable income, Mexico presents a prime opportunity for expansion.

Key Market Dynamics:

• Rapid Growth: Mexico’s e-commerce market is one of the fastest-growing globally, driven by the pandemic and increasing internet penetration.

• Young Population: A large portion of the population is under 35, fueling online shopping trends.

• Rising Disposable Income: The growing middle class has more spending power, driving e-commerce growth.

Opportunities for Foreign Retailers:

• Large Consumer Base: Mexico’s vast population offers a significant market for foreign products.

• Favorable Trade Agreements: USMCA provides preferential access to the North American market.

• Growing Digital Adoption: High internet penetration and smartphone usage facilitate online shopping.

Market Entry Strategies:

• Direct-to-Consumer (DTC): Establish a direct presence in Mexico through a subsidiary.

• Distributor Partnerships: Leverage local expertise to navigate the market.

• Cross-Border E-commerce: Sell directly to Mexican consumers from your home country.

Key Considerations:

• Logistics and Fulfillment: Efficient shipping, inventory management, and customer service are crucial.

• Legal and Regulatory Environment: Understand Mexican customs, tax implications, and consumer protection laws.

• Payments and Processors: Offer a variety of payment options to cater to different customer preferences.

• By understanding the market dynamics, navigating regulations, and building a strong online presence, foreign retailers can successfully capitalize on Mexico’s e-commerce boom.

Mexico’s appliance industry is thriving, driven by factors like favorable trade agreements, a skilled workforce, and proximity to major markets. Global giants and domestic manufacturers have established operations in Mexico, producing a wide range of appliances. The industry is a significant contributor to the country’s economy, with exports reaching $15 billion annually. Mexico’s appliance market is also growing domestically, fueled by urbanization and rising incomes. This thriving sector offers opportunities for foreign companies looking to invest and expand their operations in Mexico.

Mindfacturing® is a streamlined solution for companies looking to hire Mexican talent without setting up a local entity. Offered by PRODENSA, this binational employment solution is ideal for startups, small businesses, and companies in sectors like IT, accounting, R&D, consulting, and digital marketing.

As an Employer of Record (EOR), PRODENSA handles all HR and administrative functions, ensuring legal compliance and allowing companies to focus on their core operations. Mindfacturing® offers a cost-effective and scalable solution, providing quick access to Mexican talent.

While Mindfacturing® is beneficial for many, it may not be suitable for all business functions, especially those requiring on-site services or extensive local presence. For companies seeking a simplified and efficient way to hire in Mexico, Mindfacturing® presents a viable option.