GREEN MOUNTAIN AGENT VERMONTINSURANCEAGENTSASSOCIATION|October2022 Vermont Insurance Agents Association is a statewide trade association representing nearly 100 independent insurance agencies in Vermont, with more than 900 employees VIAA member independent insurance agents represent more than one insurance company, and as a result, can offer clients a wider choice of auto, home, business, life and employee benefits t IN THIS EDITION: New Officers for VIAA Inducted See Page 8

Green Mountain Agent is a publication of

2022

Letter from the President

600 Blair Park Road, Suite 100

Williston, VT 05495

Phone: 802-229-5884

Fax: 802-876-7912 www.viaa.org

Evolve 2022 08 Association News

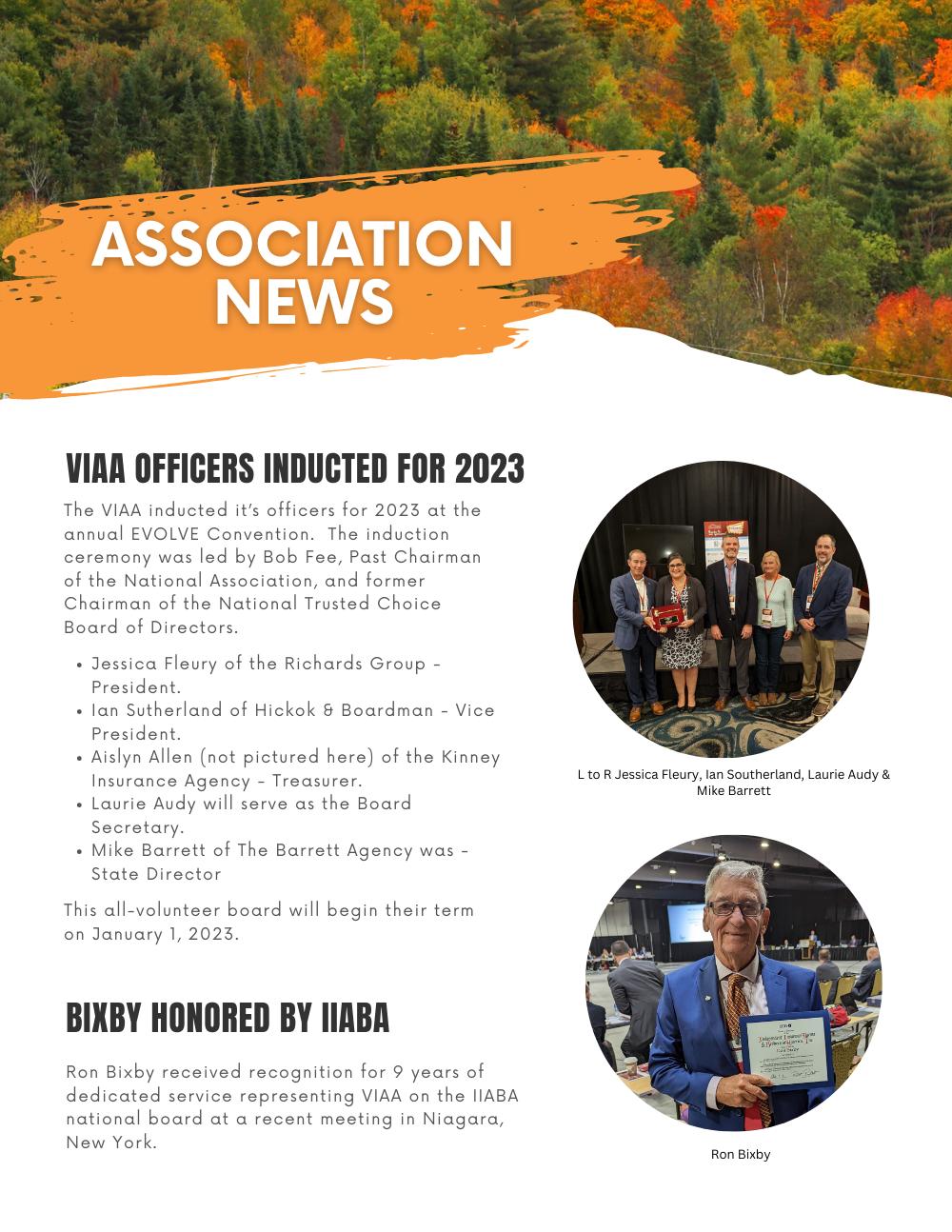

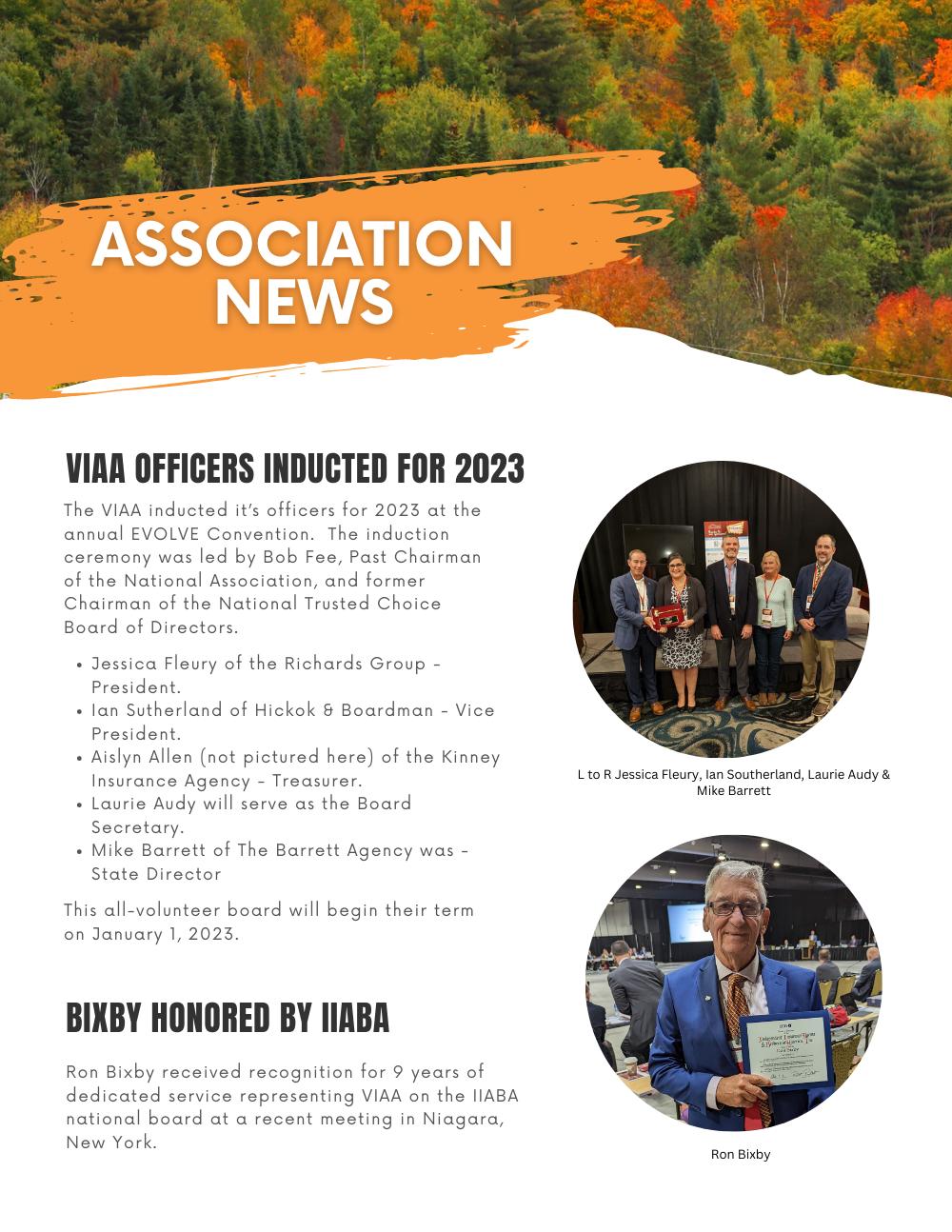

VIAA Officers Inducted for 2023

President

Michael R. Barrett

Vice President

Jessica Fleury, ACSR Secretary/Treasurer

Ian Sutherland, CIC, AAI-M

National Director

Ronald Bixby

VIAA Officers Directors

Daniel J. Rodliff, CIC, CPIA, LUTCF

Aislyn M. Allen, CISR

Laurie Audy

Executive Director

Mary M. Farley, MBA, AAIM

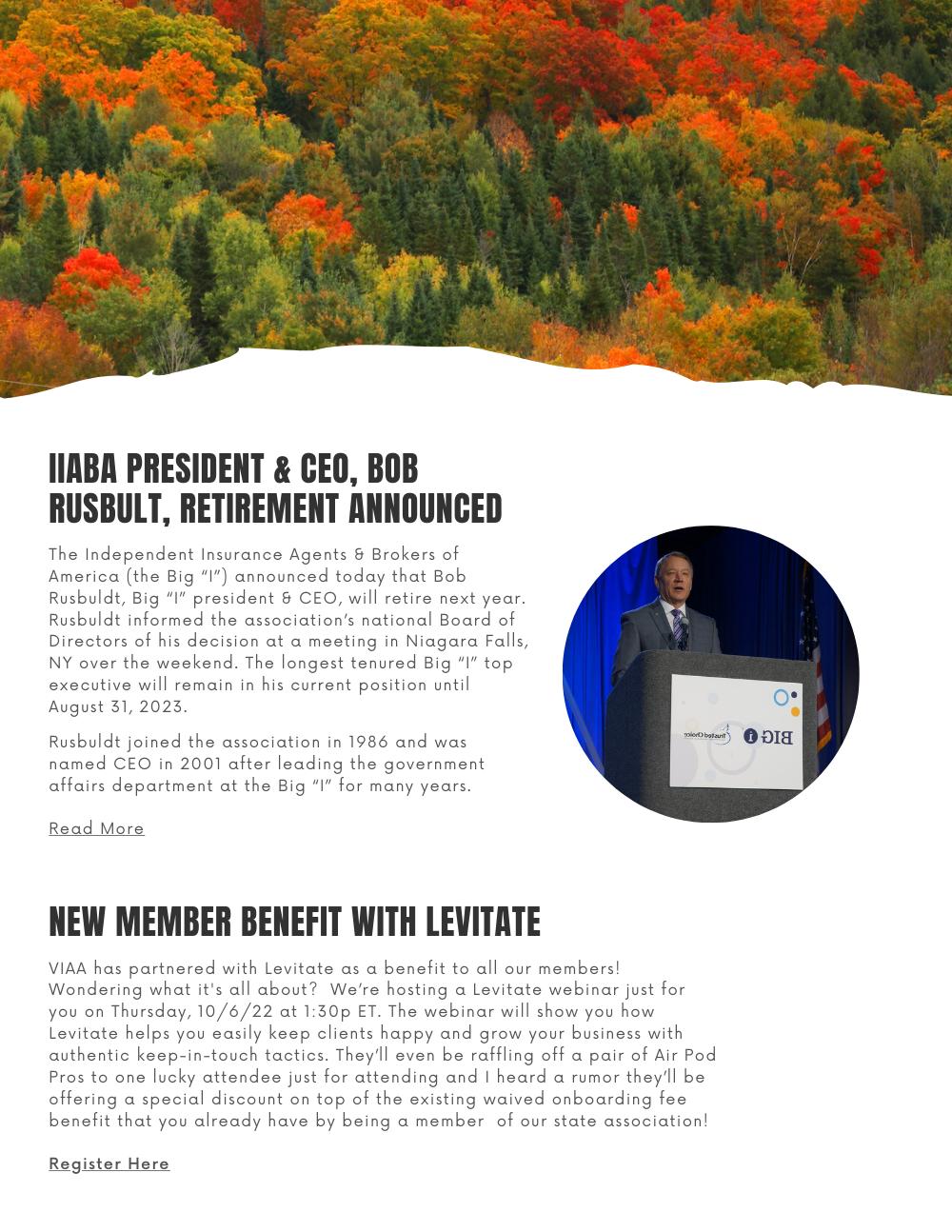

Bixby Honored by IIABA IIABA President & CEO Retirement New Member Benefit with Levitate

On the Hill 19 Perpetuation

"Inside-Outside Game: Is an Internal Offer Really Worth Less Than an External?"

Diversity

Stats About Women in Insurance That Every Agent Needs to Know"

E&O Corner "What Scares You?"

Agency & Company News

CONTENT ________________ October

05

06

14

26

"

33

39

www.viaa.org 3

4 www.viaa.org

Fallisintheair,theleavesareaboutatpeak,whichbegsthe question;haveyouturnedupyourthermostatyet?Itusedtobea battleinmyhouse,thoughasIgetolder,Ifinditlessofanissueto wait!

LetitbeknownthatEVOLVE22isinthebooks!Ahuge congratulationstoourVicePresident,JessicaFleury,whowiththe helpofaROCKSTARGROUPfromNEASandVIAA,pulledoffa fantasticeventattheDoubleTreeinBurlingtonlastweek.In additiontothosethatplannedthisincredibleevent,Iwishtothank themanycompanysponsorsandvendors,whomwithoutyour support,thiseventwouldnotbepossible.

Michael R. Barrett VIAA President

Thusfar,thefeedbackforEVOLVE22isglowing;peopleparticularlylikedtheCEORoundtable,hosted bytheBig“I”pastChairmanBobFee,withLeeDowgiewiczfromCo-operativeInsuranceCompanies, LisaKeysarfromUnionMutualandDanBridgefromVermontMutualInsurance.Itwasanhonoranda pleasuretohearfromtheseleadersinourindustry!

Ifyouhavenotmadeittoourannualconventions,pleasemakeitaprioritytodosonextyear.Itreally isanexcellentopportunitytonetworkwithcompanyrepresentatives,meetupwithyourpeers,learn, grabcovetedCEcredits,winaprize(ortwo),andjustgetoutoftheoffice.Ihonestlylookforwardto theseeventsandIthinkyoushouldtoo,asIreturntomyofficereinvigoratedforwhatwedodayinand dayoutinthiscrazyworldofinsurance.

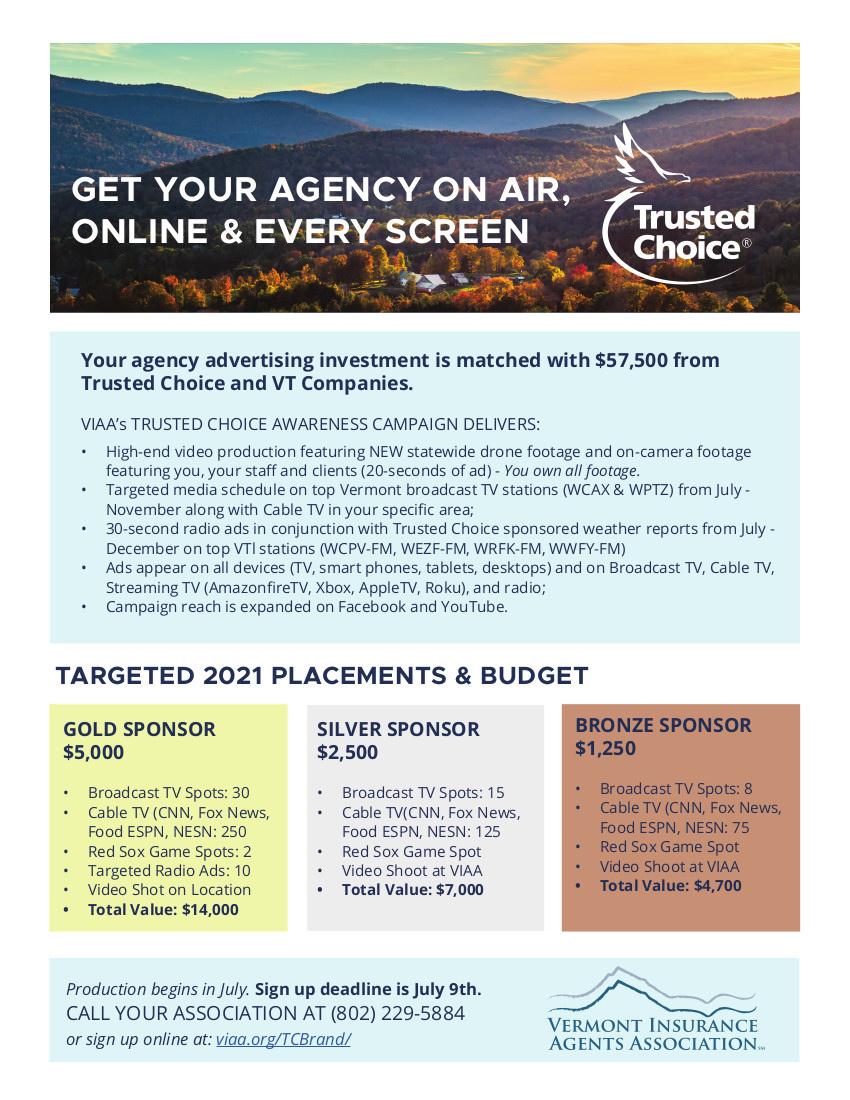

AsIbegintofinishoutmyyearasPresident,Iremainfocusedonhelpingyou,ourmembers,take advantageofthebenefitsofVIAA,whichbringsgreattoolsandopportunitywithBig“I”andTrusted Choice.Pleasekeepaneyeoutforphase2ofourTrustedChoicebrandingcampaignwithTVadson localTVstations(plusNESN),highlightingthefollowingagencyparticipants:Hickok&Boardman, KinneyInsurance,TheRichardsGroup,andBarrettInsuranceAgency.Itismyhopeyouwillseethese adsandtakeadvantageofnextyear’scampaign!

Remember,ifyoustillarelookingforCEcredits,gotoviaa.org,clickontheEducationtab,andfinda courseorcoursesthatworkforyouandyourschedule.

Staywell!

MichaelBarrett President,VIAA

LETTER FROM THE PRESIDENT October 2022

www.viaa.org 5

8 www.viaa.org

www.viaa.org 9

10 www.viaa.org

VIAA

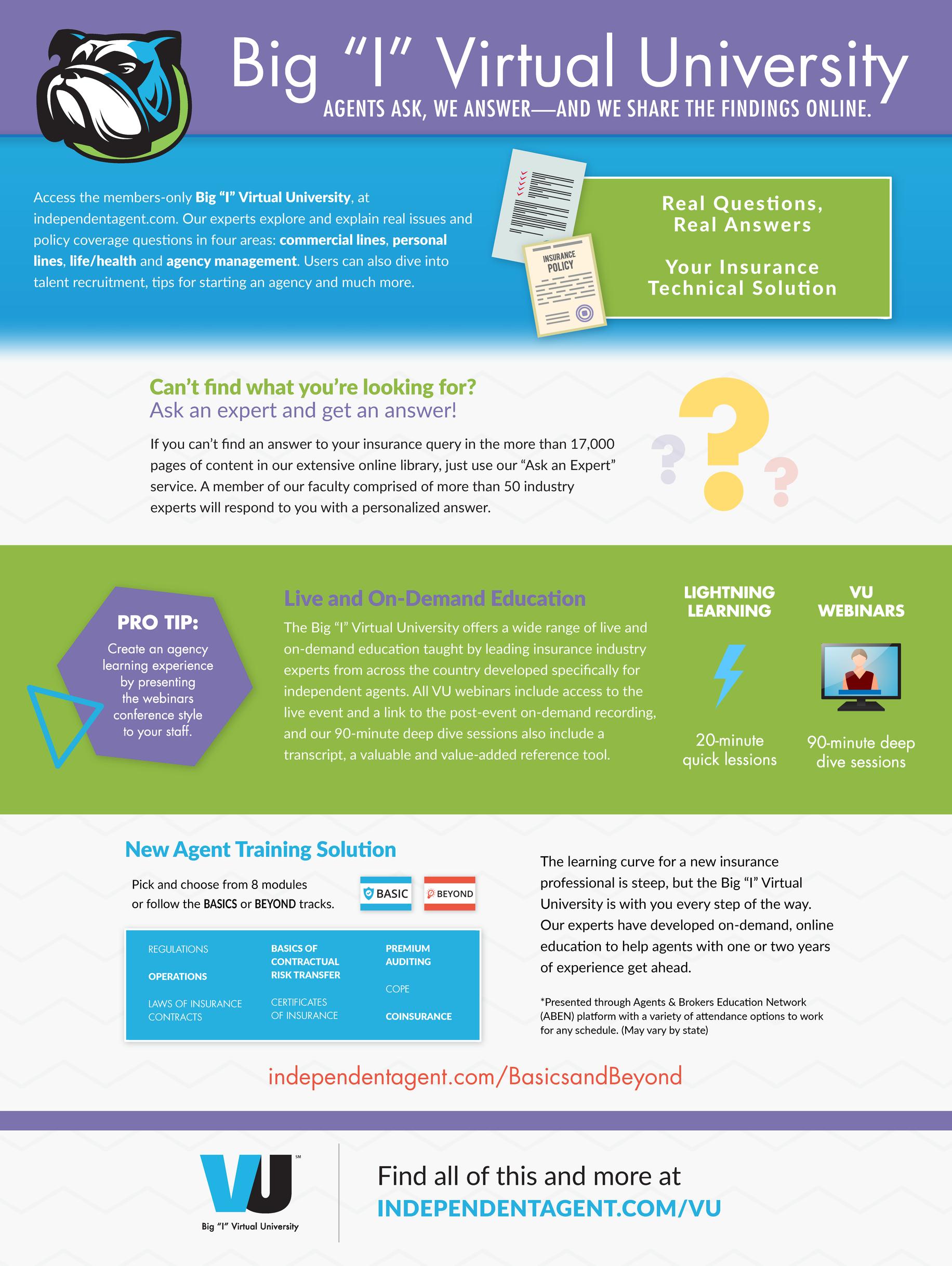

EDUCATION Any time. Any where. Get it done. viaa.org/Education

ON THE HILL

Congressional Reauthorization for the National Flood Insurance Program

Congress must periodically renew the NFIP’s statutory authority tooperate. On Sept. 30, 2022,the presidentsigned legislation passed byCongress thatextends the National Flood Insurance Program’s (NFIP’s) authorization toDec.16, 2022.

FEMA and Congress have never failed to honor the floodinsurance contracts in place withNFIPpolicyholders. Should the NFIP’s authorization lapse,FEMA would still have authority toensurethepayment of valid claimswith availablefunds. However, FEMA wouldstop selling andrenewing policies for millions of properties incommunities across thenation.Nationwide,the National Association of Realtorsestimate in 2017 that alapse mightimpact approximately 40,000 home saleclosingsper month.

NFIP reauthorizationis an opportunity for Congress totakeboldsteps to reduce the

complexity of theprogramand strengthenthe NFIP’s financial frameworkso thatthe program can continue helping individuals and communitiestake the criticalstepofsecuring flood insurance.

The level of damage from recentcatastrophic storms makes it clear that FEMA needs a holistic plan toreadythenationfor managing the cost of flooding under the NFIP.

Learn more

14 www.viaa.org

Perpetuation

INSIDE-OUTSIDE GAME: IS AN INTERNAL OFFER REALLY WORTH LESS THAN AN EXTERNAL?

ByScottFreiday

Independentagencysaletransactionsare continuingatastrongpacein2022.Organic growthratesandprofitabilityarebooming, accordingtoReaganConsulting.Those financialdriverscontinuetosteeragency merger-and-acquisitionpricesupward.

Inthisenvironment,someagencyprincipals arelookingforagameplantoselltheirfirm, whethertoanoutsidebuyer(suchasa strategicinvestororaprivate-equityinvestor) oraninsidebuyer(throughanagency perpetuation—continuingtheindependent agencyasitexistsbutwithnewleadership).

Agencyprincipalsmayperceiveanoutside saleasmorelucrativethanaperpetuation.

Butisaninternalofferreallyworthlessthan anexternal?Aninternaloffertoperpetuatean agencycanbeasappealingasanexternal saleorevenmoreso.Here’salookatwhy. Whilethefinancialtermsofthesaleare alwaysatopconsideration,thepricetagis onlyoneofthekeyconsiderationsforan agencyowner.Someoftheotherstypically are:

Thesellingowner’sroleintheagency afterthesale.

Thetimelineforthetransaction(especially forthesellingowner).

www.viaa.org 19

StartwithGoals

Agencyownerslookingtosellwholookatthe pricetagsofothermerger-and-acquisition transactionsinthemarketplacearein essencestartingatthefinishline.Insteadof doingthat,it’sproductivetostartbylooking atgoalsfor1)theownerand2)thefutureof theagency.

Thoseaspirationsprovideaguidinglight throughthesometimes-complicatedprocess ofdecidinguponanagencysaleor perpetuationtransaction.Questionstoask include:DoIwanttocontinueworkingor retireoutright?WhatresponsibilityifanydoI wanttotakeafterIselltoathirdpartyor perpetuatemyagencytoaninternalbuyer?

UnderstandHowInside&OutsideBuyers

Can Differ

Whileanypotentialbuyercovetsthepotential growthandprofitabilityofatargetagency,a handywaytocategorizeagencybuyersisto dividethemintoinsidebuyersandoutside buyers.

Internalbuyersarethosealreadyworking withinanagency,andusuallybecome ownersthroughtheprincipal’sdecisionto perpetuate.Commonly,insidebuyersare familymembersand/orproducersorother keyemployeesworkingattheagency.

Externalbuyerscomeinacouplevariations. Firstistheprivateequity(“PE”)buyer,whois notnecessarilyfamiliartoanagencyowner butisattractedbytheagency’sfinancial performance,growthprospects,and/or marketshare.SomePEbuyersacquirean agencytomergeitsoperationsintoanother. Infact,somesellersperceivethatPEbuyers aremaking“bookofbusinesspurchases.”It’s oftentrue,though,thatPEbuyerswantthe sellerinvolvedafterthesaletorunthatbook ofbusiness,continuetomanageresults,or takeonasalesrole.

Asecondtypeofoutsidebuyeristhe strategicbuyer.Possiblyalreadyknownto theowner,heorshemightbeapeerfroma nearbygeographicareaoreventhesame city.Likeaperpetuationbuyer,astrategic buyerislikelytocarryonanacquired agency’soperationsastheyare.However, it’salsopossiblethestrategicbuyermight wanttochangethenameoftheagency, consolidateoperations,ormakeother changes.Strategicbuyersmightbeless likelytowantasellingownertoremainon, sincethesebuyersareinvolvedinthe agencybusinessalreadyandmightnotneed thesupportthataperpetuationbuyermight want.

LookatNon-FinancialFactorsDriving Value

Asaletoathird-partybuyermayseemto havethehighestnumberatfirstlook.But therecouldbenon-financialfactorsatplay.A private-equitybuyer,forexample,mightfold theagencyintoanother.Thismaymeanthe agencylocationmayclose,employee arrangementsmaychange,agencybranding

Inside-OutsideGame:IsanInternalOfferReallyWorthLessThananExternal? Continued 20 www.viaa.org

Inside-OutsideGame:IsanInternalOfferReallyWorthLessThananExternal?

Continued

mayshift,andsoon.Anexternalbuyeralso mightfeellessobligedtocontinuethe agency’scommunityinvolvement.Aselling principalneedstoconsiderthosefactorsin lightofthegoalsheorshehasset.

ExaminetheEarnoutComponent

Anissuewithoutsidebuyers,oftenwithPE deals,isthe“earnoutcomponent”inthesale. Theseearnoutsarepaymentstriggeredifthe sellerhelpstheagencyhitfinancialtargets afterthesale.

Thosetargetscanbeambitioustohit.So whilePEdealsmightsoundinitiallylikebigdollartransactions,anoutsideobservermight notreallyknowhowthatearnoutaffectsthe pricethesellergets.(Keepinmindthatany agencymerger-and-acquisitioninformation availablethroughwordofmouthisusually incomplete.)

Recognize Post-SaleRoleinPerpetuation

Forownersthinkingaboutanagency perpetuation,it’svitaltodiscussthose ambitionswithpotentialbuyersasearlyas possible.Thiscanhelpuncoverhowmuch interesttheyhaveinbeingfutureagency owners.Havingthoseconversationscan clarifywhat’spossible.

Perpetuationdeals,aswithanytransaction, alsoinvolveatransitionforthesellingowner. Boththeseller’sroleandthetransaction timelineareimportanthere.Theselling ownermighttakearoleasamentor,produce business,workasaconsultant,and/ortake otherresponsibilitieswhilethenewowners workintototheirnewroles.Thattransition rolelikelywouldbespecifiedinthepurchase agreement.

Stagedperpetuations(thosethattakeplace overseveralyearsthroughtwoormore steps)canbeappealingtoownerswhowant togetoutoftheagencygradually.Theycan

resultinpricesequivalenttoorevenmore thananexternalsalebycashinginona portionofownershipnowandbuilding shareholdervalueastheagencygrows. Thosesharescouldbeworthmoredownthe roadandtheprincipalcontinuestobenefit fromtheagency’scashflowwhileremaining apartialowner.

Butownerswhowanttoexitthebusiness quicklymightbemoreamenabletosellingto athirdpartywithnoinvolvementafterthe sale.However,ownerswhomakeanoutside salewithoutsettingaplanfortheircareer aftersellingtheiragencysometimeswantto getbackintotheagencybusinessaftera coupleofyears—havingexperienced“seller’s remorse.”

Foranyagencysale,itcanhelptothinkof theowner’sroleintermsofhisorher “runway”:Theprincipalmaybetakingoffby sellingtheagency,butiftheyhaven’tdecided fullyonadestinationtheymightnotbe satisfiedwithwheretheyland.

ThinkAboutTaxTreatment

Oneotherconsiderationforanyagency owneristhetaxtreatmentofthesale.For instance,astagedperpetuationcanallowthe ownertoreceivesaleproceedsstaggered overaperiodofyears,whichcanbe attractivenotjustfortaxreasonsbutalso financialreasons.

Whateverthoughtsanagencyownerhas todayaboutafuturesaleorperpetuation,the strongestadviceIgivetoanyoneistotakea broadviewofthethreefactors:financial terms,thesellingowner’sroleafterthesale, andthetransactiontimeline.

ScottFreidayisseniorvicepresidentand division director of InsurBanc,adivisionof Connecticut CommunityBank,N.A.Anexperton agency mergersand acquisitions, agencyperpetuation and financing,hehas presentedat numerous venues nationwide.

www.viaa.org 21

Diversity

STATS ABOUT WOMEN IN INSURANCE THAT EVERY AGENT NEEDS TO KNOW

ByLibertyMutualandSafeco

ByLibertyMutualandSafeco

Empoweringwomeninagenciesiscrucialfor thefuturesuccessoftheindependentagent channel.Womennowoutnumbermeninthe insuranceindustry.Andstudieshaveshown thatcompanieswithmoregenderdiversityon theirexecutiveteamsaremoreprofitable thancompanieswithlessdiverseleadership.

LibertyMutualandSafecowantedtosee agenciesthrivefarintothefuture. Theirresearchteamrecentlysurveyedmore than350womeninindependentinsurance agenciestolearnabouttheirexperiences, challengesandneeds.ThenewAgentforthe Futurereport,“TheStateofWomenin IndependentInsuranceAgencies: Representation,Compensationand Recognition,"divesintowhatwelearnedand

providespracticaltakeawaysforwomento growtheirinsurancecareersandforleaders toempowerwomenininsuranceagencies.

Herearesomeofthemostsurprisingstats fromtheresearch:

1)Womenmakeup96%ofcustomerservice representatives(CSRs)and68%ofproducers butonly31%ofagencyprincipals.Women areoverrepresentedinentry-levelandservice positionsbutstillunderrepresentedin leadershippositions.Morethan1in3female agencyprincipalssaytheyareoftentheonly womanintheroom.

Therearetremendousopportunitiesfor agenciestotapintothepotentialoffemale employees,developtheirtalentsandconsider themforperpetuationplans.

26 www.viaa.org

2)Morethanhalf(52%)ofwomenyounger than50whoworkasfrontlinestaffare interestedinbecomingapartnerintheir agencies.Ourresearchfoundthatmany womenarereadyandeagertostepinto leadershiproles.Morethanhalfofwomen betweentheagesof23and49saidthey wereinterestedinbecomingapartner,and morethanoneinfourwantedtolearnabout stepstobuyorstartanagency.

Tohireandretaintalentedwomen,agencies needtoprovidecareerdevelopment opportunitiesandshowthattherearepaths forcareergrowth.Thismayincludeinvesting incontinuingtrainingandeducation, encouragingmentorshipandsponsorship andhavingongoingconversationsabout careergoals.

3)64%offemalefrontlinestafffeeltheyare paidlessthantheirmalepeers.Thegender wagegapspersistininsurance.Female insurancesalesagentsmake67.6%ofwhat menmakeinthesamerole,accordingtothe U.S.DepartmentofLabor.

Reasonsforthepaygaparecomplex,butit's importantforemployeestoknowtheyare beingcompensatedfairly.Whenwomen believetheyarebeingpaidlessthanmenfor thesamework,theyarelikelytoleave. Toensureequalpayforequalwork,agency leaderscanconductapayauditandmake suretheyaretransparentabouthow compensationworksintheagency.

4)Nearly90%offemaleownersand principalssaytheyreceivethecredibilityfrom peersandstaffthattheyfeeltheydeserve. Manyofthewomenwesurveyedfeltthey hadtoworkharderthantheirmalepeersto provethemselves.However,mostofthem felttheirhardworkpaidoff.Thosewhohad beenintheindustryforawhilesaidtheyhad seenthingsimproveforwomeninthe industryandrecommendedinsuranceasa greatcareerpath.

“This has been a wonderful career path for me as a woman, a mother and a business owner," said a previous agency owner, “I would recommend agency leadership to anyone of either gender for its flexibility and ability for advancement and recognition based on good sales and management styles."

Want to learn more about empowering women in insurance? Read the full report, “The State of Women in Independent Insurance Agencies."

Reprinted with permission from IA Magazine.

StatsAboutWomeninInsuranceThatEveryAgentNeedstoKnow Continued www.viaa.org 27

www.viaa.org 29

E&O CORNER

WhatScaresYou?

ByRichardF.Lund,J.D.,VicePresident,SeniorUnderwriter,SwissRe CorporateSolutions

Aroundmyfavoritetimeofyear,Halloween, therearealotoftelevisionshowsandinternet articlesaboutscarythings.Itmademethink thatasaninsuranceagenterrorsand omissionsaficionado,whatisitthatscaresme and,inturn,whatshouldscareYOU?

Virtuallyeveryclaimthatismadeagainst insuranceagentsultimatelycomesdowntoan unpaidunderlyingclaim.Whetherit'san automobileloss,apersonalinjuryloss,a commercialpropertyorliabilityloss,or whateverthesituationis,ultimatelyit'sthe failuretoproperlyplaceaninsurancecoverage thatresultsinfinancialdamagetoyour customer.Whiletherearemanynuancesand otherthingsthatcanleadtothisevent,the ultimateresultissomeonehasbeenfinancially disadvantaged.Andthenthescarypart happens:Theymakeanerrorsandomissions claim.

FromanE&Ostandpoint,asyougoaboutyour dailyroutine,bemindfulofwhatyouaredoing. Youprobablyhavealotofthoughtsaboutthe variouscustomersyouhaveandtheirneeds. Youmentallytrytoprioritizehowyouwill respondtothem.Witheverythingelsegoing on,youmayforgetexactlywhatitwasyou werethinkingaboutwhenyoufirstwere contactedbythecustomer,andwhatitisthat youwantedandneededtodoforthem.So howdoyouputyourmindateaseandknow thatyouaredoingtherightthingforthem?

Oneword:consistency.

Consistencystartsthedayyouragencyopens. Orthedayyoufirstgotoworkatanagency. Orwhenyoutakeoveranagencyfromanother agent.Ifyoustartfromdayonewithconsistent practices,thechancesofyoudoingthings

correctlyeverytimeincrease.Andtheoddsofyou doingsomethingwrongandcommittinganerroror omissionaregreatlyreduced.

Agenciesthatdevelopoperationalproceduresand requireallstafftoconsistentlyusethemwillbe lesslikelytohaveanE&Oclaim.Beingconsistent inyourhiringpracticesalsoapplies.Youknowthe typesofemployeesyouwant,somakeachecklist ofquestionsthatwillhelpyoulearnabouttheir insuranceexperience.Andthesameistruewith usingcoveragechecklists.Byconsistentlyusinga coveragechecklist,youeliminatethelikelihoodof forgettingtoofferacoverage,limitordeductible option.Consistentclaimsreportingproceduresis alsoveryimportant.Whetheryouareaonepersonoperation,ora10-,50-or200-person shop,havingconsistentoperationsforeveryone willlessentheriskofanE&Oclaim. Withoutconsistentoperationalprocedures, everyoneintheofficecouldbeoperatingontheir own,andwhenthat'sthecase,scarythings happen.Ifonepersondoesthingsoneway,and anotherdoesthemanotherway,andyetanother persondoesthemathirdway,thechancesforan

www.viaa.org 33

errorhavemultiplied.We'veallheardthephrase "therighthanddidn'tknowwhatthelefthandwas doing."That'swhathappenswhenconsistent practicesarenotfollowed. Thebestexamplesaredepositionquestionsthat arevirtuallyalwaysaskedofagentswhenlitigation ensuesafteranuncoveredclaim.Theplaintiff's attorneywillinvariablyask:"Didyou?"andthengo ontostatetheexactthingthattheyknowthe agentDIDN'Tdo.Butifthatagenthada consistentpracticeinplacebeforetheclaim happened,theagentwouldnothavetothink,"Did I?",butratherwouldbeabletosay,"IDID!!!"If youcananswerthatway,thenyoumaynoteven beinthesituationwhereyourdepositionmustbe taken,becausetherewon'tbeanyerrorinthefirst place.Andthenyouwon'thaveareasontobe scared.

RichardF.Lund,JD,isaVicePresidentand Senior UnderwriterofSwissReCorporate Solutions,underwritinginsuranceagentserrors andomissionscoverage.Hehasalsobeenan insurance agentsE&Oclaimscounselandhas writtenand presentednumerousE&Orisk management/losscontrolseminars,mocktrials andarticlesnationwidesince1992.

This articleis intended to be used for general informational purposes only andis not tobe relied upon or used for any particular purpose. Swiss Reshallnot be held responsible in any way for, and specifically disclaims any liability arising out of or in any way connectedto, reliance on or use of any of the information contained orreferenced in this article. The information contained or referenced inthis articleisnot intended to constitute and should not be consideredlegal,accounting or professional advice, nor shall it serve asasubstitutefor the recipient obtaining such advice. The views expressedinthis article do not necessarily represent the views of the Swiss ReGroup ("Swiss Re") and/or its subsidiaries and/or management and/or shareholders.

Copyright 2022 Swiss Re. All rights reserved. You mayuse this for private orinternalpurposes but note that any copyrightor other proprietary notices must not be removed. You are not permitted to create any modifications or derivative works of this, or to use it for commercial or other public purposes, without the prior written permission of Swiss Re.

WhatScaresYou? continued 34 www.viaa.org

&

COMPANY

AGENCY NEWS www.viaa.org 39

UnionMutualInsuranceCompanyrecentlyannounceditsparticipationinaninnovative,communityownedsolarprojectunderdevelopmentbytheAcornRenewableEnergyCo-opofMiddlebury,Vermont. TheCompany’sChiefFinancialOfficer,JenniferGalfetti,citedtheprojectaspartofUnionMutual’s ongoingeffortstobeagoodcorporatecitizenandenvironmentalsteward.

Theprojectinvolvesa150kWsolararrayonthecappedformermunicipallandfillonBeecherHillRoadin Hinesburg,Vermont,whichwillsoonoffersharestoVermontresidentswithanelectricmeterinthe VermontElectricCooperative(VEC)serviceterritory.Theseinvestorswillreceivetheproject’snet meteredcreditsontheirVECbills,andaftersixyears,areprojectedtotakefullownershipoftheproject whentheequitystructureisexpectedto“flip.”

AsthesoleSeriesAMemberinvestor,UnionMutualhasprovidedroughlyone-thirdofthecapitalto

Xxxxx

constructtheprojectandwillreceivefederaltaxcreditsinreturninadditiontokeepinginvestmentcosts downforSeriesBmemberinvestors. Union Mutual Invests in Community Solar Project Current Job Postings The Essex Agency is Hiring! The Essex Agency, located in Essex Junction, is seeking an experienced Personal Lines Customer Service Representative. AMS experience is preferred. Please forward your resume and references to John Handy at jhandy@essexagency.com 40 www.viaa.org

www.viaa.org 41

42 www.viaa.org

ByLibertyMutualandSafeco

ByLibertyMutualandSafeco