GREEN MOUNTAIN AGENT VERMONTINSURANCEAGENTSASSOCIATION|December2022

Insurance

is

trade

100 independent insurance agencies in

with more than 900 employees VIAA

independent insurance agents represent more than one insurance company, and as a result, can offer clients a wider choice of auto, home, business, life and employee benefits t IN THIS EDITION: 3 Ways Technology Can Help Independent Agencies Find and Keep Great Talent See Page 23

Vermont

Agents Association

a statewide

association representing nearly

Vermont,

member

600 Blair Park Road, Suite 100

Williston, VT 05495

Phone: 802-229-5884 Fax: 802-876-7912 www.viaa.org

VIAA Officers

President

Michael R. Barrett

Vice President

Jessica Fleury, ACSR

Secretary/Treasurer

Ian Sutherland, CIC, AAI-M

National Director Ronald Bixby

Directors

Daniel J. Rodliff, CIC, CPIA, LUTCF

Aislyn M. Allen, CISR

Laurie Audy

Executive Director

Mary M. Farley, MBA, AAIM

05

Letter from the President 06 Association News 12

On the Hill 18

Risk Management Introducing the Big “I” Guardian Risk Management Web Site 23

Agency Management 3 Ways Technology Can Help Independent Agencies Find and Keep Great Talent 31

E&O Corner What Inflation Means for Your Insurance & Business 37 Agency & Company News

CONTENT ________________ December 2022

Green Mountain Agent is a publication of

www.viaa.org 3

4 www.viaa.org

December 2022

“And now, the end is near, and so I face the final curtain”; yes, I’ve always wanted to quote “the Chairman of the Board/ Ol’ Blue Eyes” …That being said, it is astonishing how quickly the past year has gone. It has been my honor and privilege to serve as President of VIAA for 2022. Throughout my term, my focus remained the same, to empower you, are members with the incredible tools and knowledge base that comes with your VIAA membership.

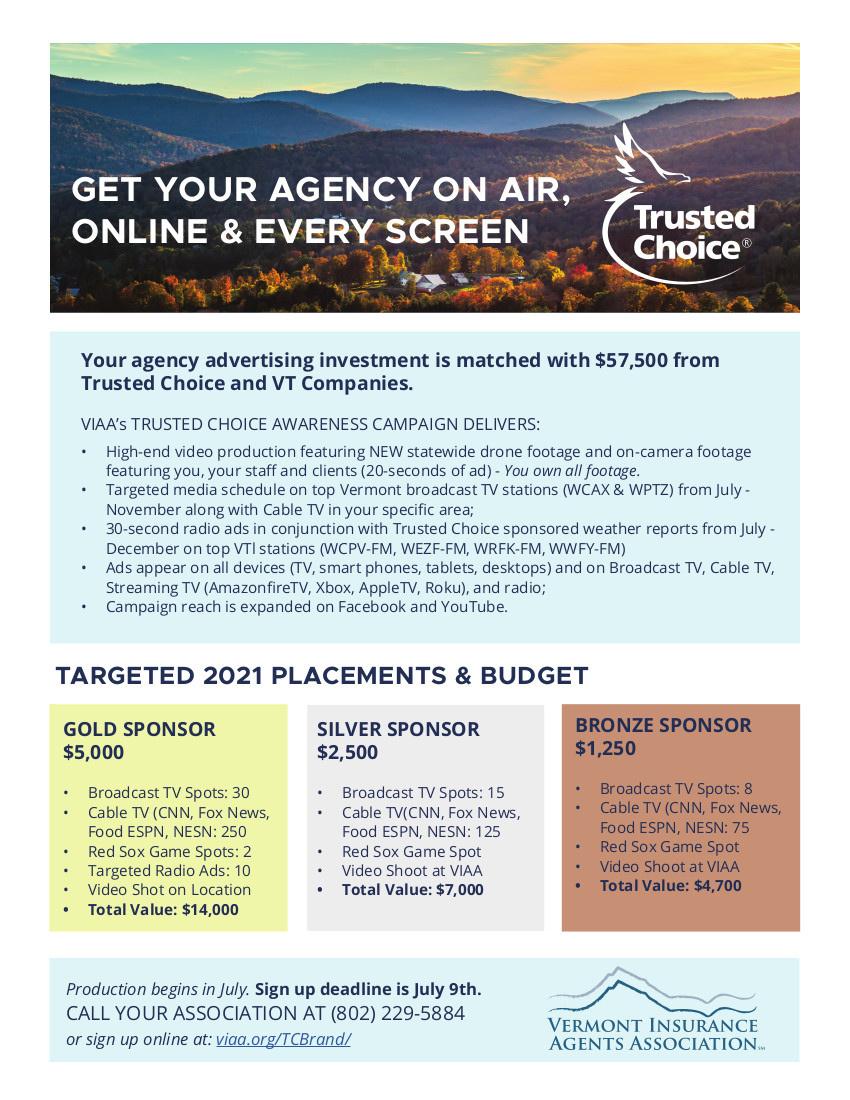

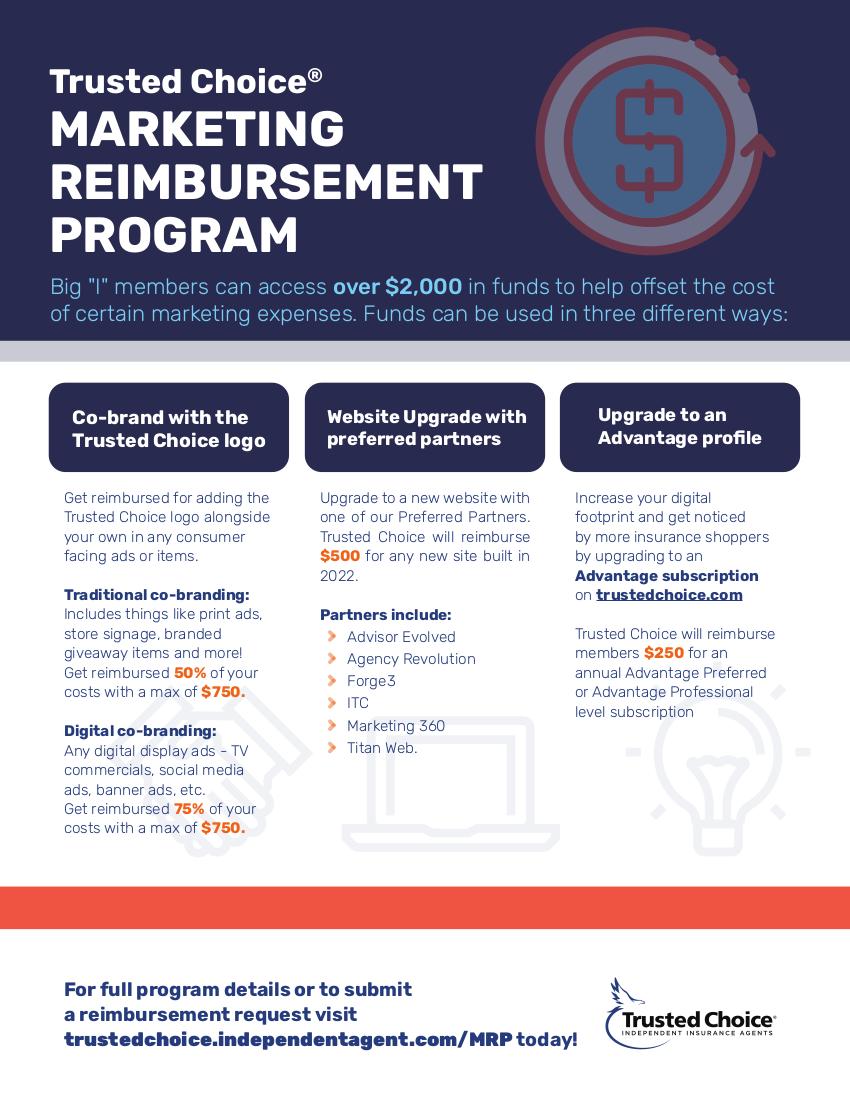

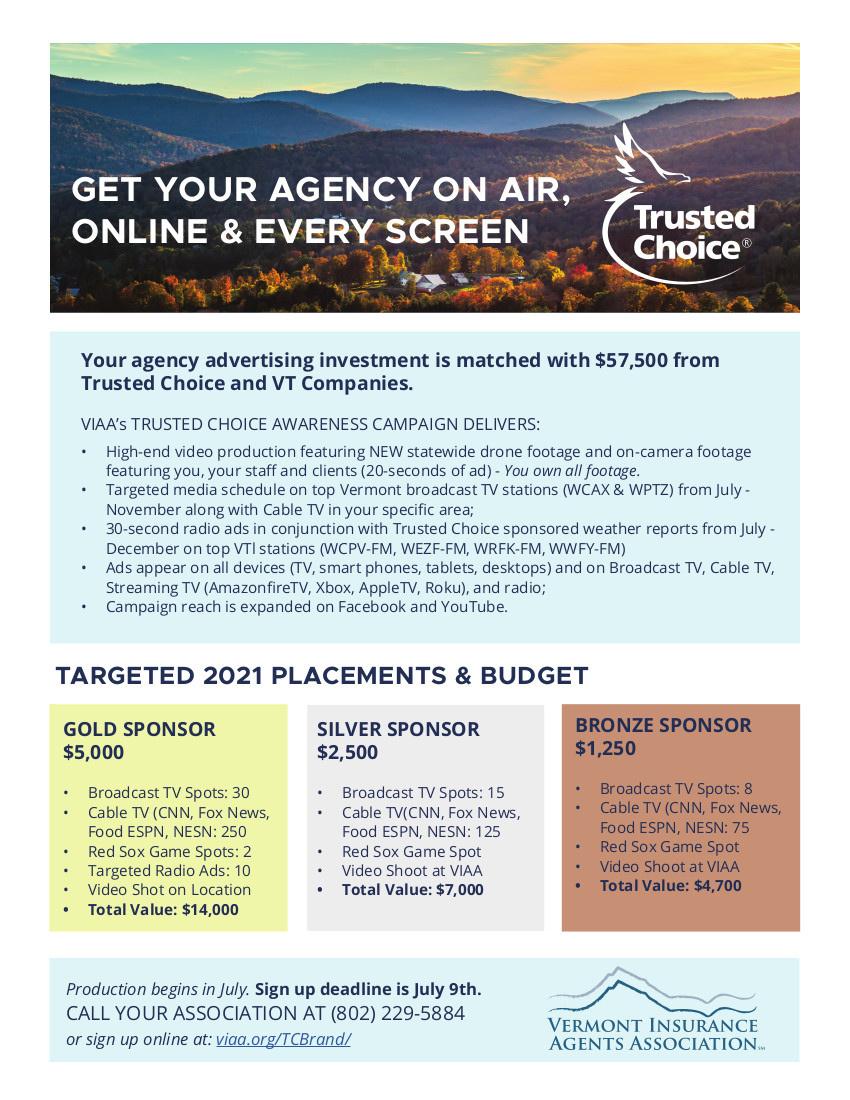

A highlight of my year was relaunching the co-branded VIAA/Trusted Choice TV commercials; first starting with a general ad in the spring, shifting to agency specific commercials over the past month or so. At the cost, it was and remains an incredible opportunity for agencies of all sizes within our membership footprint. The number of my clients that have mentioned seeing our agency ad has been overwhelming! If you did not join in this year, stay tuned as we do it all over again next year.

As the clock hits midnight at the end of this month, your new President will take the helm. I am so excited for Jessica Fleury to be your next President! You are in extremely capable hands under her leadership. As you may know, immediate past Presidents remain on the board, I look forward to continuing to work with Jess as she charges forward!

A huge thank you to our members for being a part of the Vermont Insurance Agents Association. Please never hesitate to reach out to any of the VIAA staff or directors, myself included, if you have any questions. There is much at your fingertips. Have a safe and happy holiday season, and a happy new year!

Michael Barrett President, VIAA

Michael Barrett President, VIAA

LETTER FROM THE PRESIDENT

www.viaa.org 5

Michael R. Barrett VIAA President

TRUSTED CHOICE® RELIEF FUND HELPS AGENTS IN 2022

WhetheritwaswildfiresinColorado,tornados andfloodinginKentuckyorHurricaneIanin Florida,theTrustedChoice®ReliefFundhas beenprovidingfinancialassistanceto insuranceindustrypersonnelimpactedby naturaldisastersthroughout2022.

Atthetimeofpublication,theReliefFundhas distributed$91,366through25grantsin2022. Thankstogeneroussupportfromindividual agents,agencies,37stateassociationsandBig “I"carrierpartners,therehavebeen approximately$175,000inpledgesof donationsthisyear.

VisittheTrustedChoiceReliefFundwebpage todonateortoapplyforagrant.

6 www.viaa.org

NEW SOCIAL MEDIA TRAINING NOW AVAILABLE

TrustedChoicehaslaunchedabrandnewsocial mediatrainingprogramthatprovidestipsfor choosingandoptimizingthebestsocialchannels foryouragency.

Whetheryouneedtostartfromscratchorare tryingtotakeyourstrategytogreaterheights,you canchoosewhichleveltogetstartedonbasedon theirexperience.

GetStartedNow

VIDEO MARKETING BEST PRACTICES

WEBINAR

Join Agency Revolution, a Trusted Choice® preferred partner, Dec. 7 at 2 p.m. ET, as it hosts the webinar, “Video Marketing Best Practices." Topics include finding the right tools and equipment to get started, how and where to share your videos for maximum impact, and more!

Register Here www.viaa.org 7

www.viaa.org 9

VIAA EDUCATION Any time. Any where. Get it done. viaa.org/Education 10 www.viaa.org

ON THE HILL Control of Congress Divided as Republicans Choose Leadership

On Wednesday night, eight days after the 2022 midterm elections, news outlets officially called control of the U.S. House of Representatives for the Republican Party. Despite falling short of expectations, Republicans wrestled control of the House away from the Democratic Party and, in doing so, will provide a significant check on the executive branch's legislative agenda.

However, the Republican House majority will be extremely narrow and navigating sucha small margin is likely to prove challenging for the incoming leadership.

As of press time, Republicans control 218 seats, Democrats control 210 seats and 7 seats have not been determined. Five of those seats are in California, which has upto 33 days following the election to count ballots before certifying a winner. One outstanding race is in Colorado and another is in Alaska, which will be decided Nov. 23 through ranked choice voting.

Accounting for these outstanding races, Republicansare expected to increasetheir majority by just a few seats.

On Tuesday,Republicans intheHouse held their leadership elections.Rep.Kevin McCarthy (R-California) secured hisparty's nomination for speakeroftheHouse andnow advancesto a fullvote in the House on Jan.3 where he will need to secure 218 votesto become the 55th person in U.S. history tohold the speaker's gavel.

The Republican Party'snew majority leader will be Rep.Steve Scalise(R-Louisiana), who ran unopposedin a sign of overwhelming support. Meanwhile, ina closeracefor majority whip,Rep. Tom Emmer (RMinnesota) emerged victorious.

Having served aschairoftheNational RepublicanCongressionalCommittee (NRCC) for the past two election cycles, Rep. Emmer was the chief architect behind flippingHouse

12 www.viaa.org

control and his conference rewarded him. Speculation suggests that Emmer will name Rep. Guy Reschenthaler (R-Pennsylvania) as his chief deputy whip, which is an especially important role in a closely divided Congress.

In the race for House GOP conference chair, Rep. Elise Stefanik (R-New York) won convincingly and retains a position that she held for much of the current Congress. Rounding out the leadership team is Rep. Richard Hudson (R-North Carolina), who will take the helm of the NRCC from Emmer.

On Thursday morning, Speaker of the House Nancy Pelosi (D-California) announced that she will not seek a leadership position in the next Congress but will continue to serve in the House. Rep. Pelosi was the first woman to serve as speaker and has served as the leader of the House Democrats for nearly 20 years. Additionally, House Majority Leader Rep. Steny Hoyer (D-Maryland) said he won't seek a leadership position but will remain in Congress. Other leadership changes are expected as well. Democrats in the House are scheduled to hold their leadership elections the week of Nov. 28.

The Democratic Party successfully defended all their vulnerable seats in the Senate and is guaranteed to retain control of the upper chamber with a minimum of 50 seats. The race in Georgia is headed to a Dec. 6 runoff to determine whether Democrats will control the upper chamber 51-49, or whether the current 50-50 split will give Vice President Kamala Harris the tiebreaking vote.

On Wednesday, Republicans in the Senate held their leadership elections. There were no changes at the top as Sen. Mitch McConnell (R-Kentucky) retained his position as the party's leader in the Senate. Sen. John

Thune (R-South Dakota)and Sen. John Barrasso (R-Wyoming) continue aswhipand conferencechair, respectively. ThenewPolicy Committee chair will be Sen. JoniErnst(RIowa) and the new vice chairoftheGOP Conferencewill be Sen. ShelleyMoore Capito (R-West Virginia). Taking over the reinsofthe National RepublicanSenatorial Committee will be Sen. Steve Daines (R-Montana).

Democrats in the Senate are scheduledto hold their leadership elections onDec. 8,two days after the Georgiarunoff.

Nathan Riedelis Big “I" vice presidentof political affairs. Reprinted, with permission, from IA magazine.

On the Hill continued

www.viaa.org 13

Risk Management

INTRODUCING THE BIG “I” GUARDIAN RISK MANAGEMENT WEB SITE

The Big “I” Professional Liability risk management web site formerly known as “E&O Happens” is now E&O Guardian. The web site provides a new look and feel for the agency risk management information library, and in addition to improved navigation and readability, contains a robust new collection of 20 minute “Lightning Learning” webinars on a variety of essential E&O topics that Big “I” members may access on demand.

As an insurance agent, you know that claims happen. But you also know that claims can sometimes be avoided, or with best risk management practices in place, well defended. When actively taking steps to safeguard your agency against E&O claims, you are wisely investing in measures that can prevent the loss of your time and agency resources.

Visitors to the new E&O Guardian site can tap into a variety of educational materials. Make time to explore the site and dive into specialty agency risk management articles on a wide variety of topics, recorded webinars, an archive of newsletters, and more.

There is also a set of practical tools available for your agency’s download and use, including sample checklists, procedures manuals, disclaimers, and customer letters.

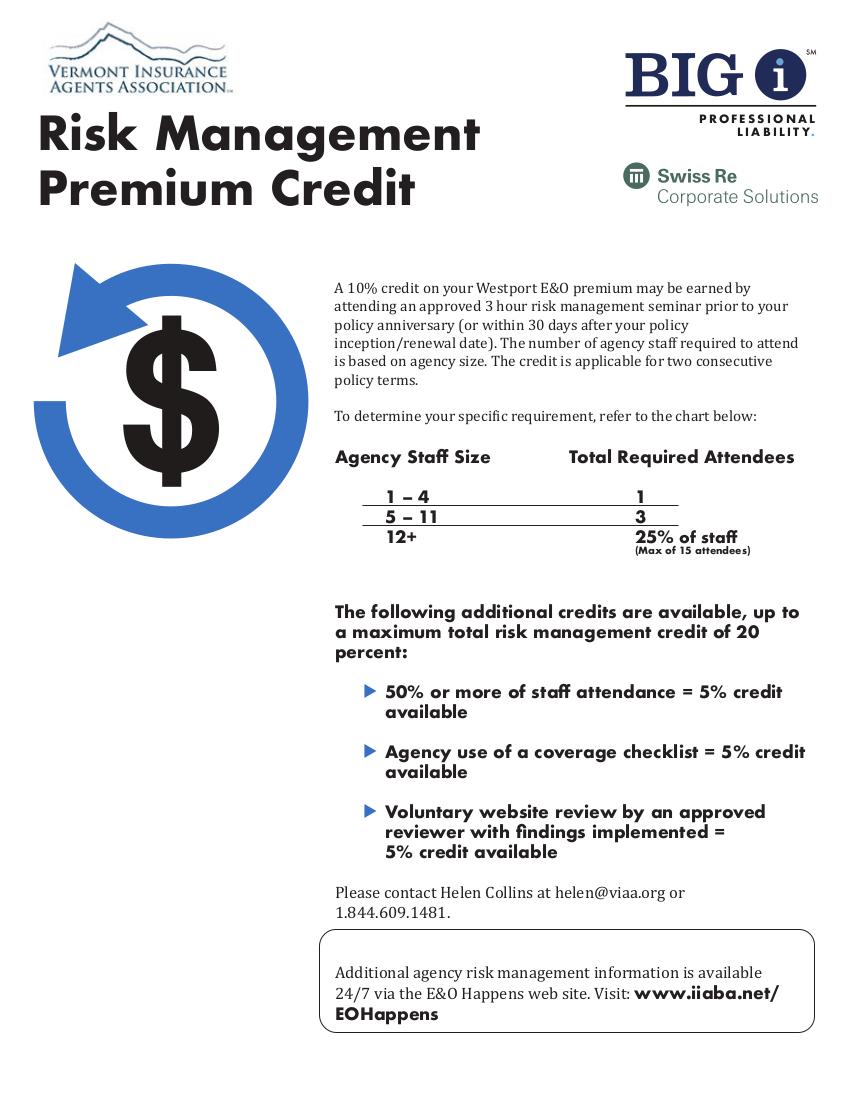

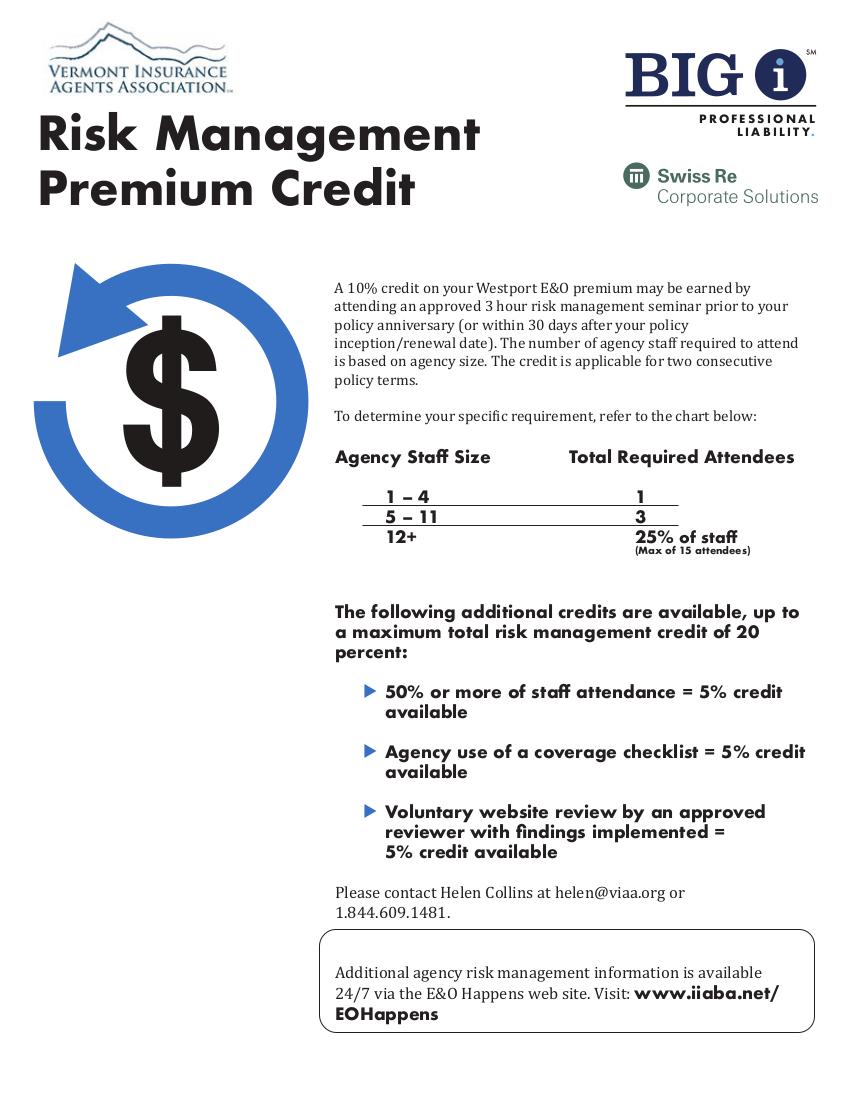

Swiss Re Corporate Solutions policyholders can find information about how to report a claim or learn how to earn discounts on their E&O premium via multiple credit opportunities.

Coming soon to site are special areas regarding Agency Standard of Care and exclusive claims data revealing the most common and costly types of claims.

There is no charge to access E&O Guardian; it is provided as a Swiss Re policyholder and Big “I” member benefit. Some content is available to all members, with certain exclusive resources locked down for Swiss Re policyholders. Simply log in with your Big “I” username and password.

Please visit E&O Guardian at www.independentagent.com/EOGuardian today to tap into key information and tools to mitigate agency errors and omissions.

18 www.viaa.org

22 www.viaa.org

Agency Management

3 WAYS TECHNOLOGY CAN HELP INDEPENDENT AGENCIES FIND AND KEEP GREAT TALENT

ByMikeErlandson

When the college class of 2021 grabbed their diplomas and embarked on their budding careers, they became the first generation of workers younger than tech giants Google and Amazon. That means we officially have a new workforce who have lived their entire lives in a tech-centric way.

Further, the COVID-19 pandemic accelerated the use of tech among all generations. Inoffice gatherings were replaced by virtual meetings while people of all technology competencies started using food delivery apps and even buying houses and cars online.

This surge of everyday tech use extends into the office and is only growing. For independent agencies to continue to grow

and attract top new talent—all under the spotlight of the Great Resignation where employees are demanding more from employers—they need to develop a genuine belief that the only way forward is techforward.

Here are three strategies for a tech-forward mindset that independent agents can use to find and keep talent:

1)Investinamodernemployee experience. When prospective employees walk into an independent agency office for an interview, does it feel like 2022? Or does it feel like 2002?

Employees of all ages want their work life to be easier and faster. In outdated conditions, it

www.viaa.org 23

won't take long for employees to get frustrated and turn their direction to another company that offers what they consider to be baseline modern technology.

Investing in cloud-based solutions that allow streamlined operations, mobile access and an open platform so that key tech can work together is one of the most important ways to create a modern experience at a workplace.

Here are a few examples of modernizing the workplace:

A self-service portal so employees and their clients can interact digitally.

Automated workflow processes to empower employees with their work. Data analytics tools to give agencies valuable insights into their business. Manager dashboards and data tools to give agencies valuable insights. Sales and marketing tools to manage and automate the entire sales process.

2)Usetechtofreeuptimesoemployees canspenditonwhatmatters.

Providing high-quality client service is at the heart of what an insurance agency does. By freeing up an employee's workday from routine tasks like filling out paperwork, working on non-licensed work or entering data manually, they have more time to spend it where they really want to—working with and for clients.

Too much time spent on paperwork is a relevant problem for agencies, according to Vertafore's 2022 insurance workforce whitepaper, which examined the current state of insurance professionals in the industry. When asked about the amount of time spent on tasks in a given week, the answer “creating proposals" garnered 26% of votes, not far behind “communicating with clients," which was 29%. Paperwork may not be how most agents want to spend their time, but it is claiming a significant portion of their week.

When employees have the right digital tools in place, they will be more efficient and have more time to act as trusted client advisors. And, in turn, those employees are more likely to stick around as valued members of the agency's staff.

3)Embracetechtorespondtowhat employeeswant.

For many, flexibility is no longer seen as a “nice to have" when choosing where to work, according to the whitepaper. When insurance company owners were asked what changes they made to retain employees in the past year, they ranked “adding remote work options" and “increased work flexibility" as second and third respectively, behind the leading item of “financial compensation," according to Vertafore's whitepaper.

To stand out in the pack of hiring companies, an agency needs to offer a flexible work environment that allows employees to work the way they want. If the agency doesn't offer it, that candidate will find a place that does.

A remote work environment also needs to operate well and help employees feel connected to each other. Cloud technology is a critical component in helping a company

3 Ways Technology Can Help Independent Agencies Find and Keep Great Talent Continued 24 www.viaa.org

respond to the shifting expectations of employees by creating a successful remote work environment that fosters connection, visibility and accountability among employees and managers.

Embracing this hybrid work model can also help agencies reach more talent in other markets. For example, an agency with remote opportunities can now hire talent in other states where it originally wasn't able to. Broadening an agency's potential talent pool like this is only possible with a flexible workspace powered by technology.

No matter where an agency is on the path to modernization, it's never too late to put a solid plan in place to meet employees and clients where they want to be met. Because the truth is that every graduating class from here on out will be entering the workforce with the belief that a tech-centric workplace is just the way it is.

Reprinted with permission from IA Magazine.

3 Ways Technology Can Help Independent Agencies Find and Keep Great Talent Continued www.viaa.org 25

26 www.viaa.org

www.viaa.org 27

WhatInflationMeansfor YourInsurance&Business

ByElizabethWhitney,J.D.

Swiss Re Corporate Solutions is closely monitoring two types of inflation that may be relevant to your business and E&O insurance: consumer price index inflation and social inflation. In these continually uncertain times, we hope this will help you understand what we are looking at and not only how it affects E&O insurance, but how it affects your clients.

Consumer Price Index (CPI) Inflation

This type of inflation is measured by the consumer price index, which is defined as the price change of a basket of goods or services typically purchased by specific groups. This inflation index rose 7.5% in 2021 and to an annualized rate of 8.3% for April 2022 — the highest level in 40 years.

Why does this matter to you? Because it drives up the overall cost of claims. Consumer price increases result in paying more on claims due to rising attorney fees for claims defense and higher actual claim values. For instance, due to inflation, the cost of rebuilding a home that burned down may be 20% more for materials and labor than it was 3 years ago.

Social Inflation

This type of inflation is related to strategies used by plaintiff attorneys to inflame juries and increase jury awards. Our defense counsel use strategies to combat these emotionally charged tactics, but it can be an uphill battle.

Inflation: Protect your clients, Protect yourself

Inflation can create exposure risks for insurance agency clients. Rising construction costs could mean that a building that was adequately insured a year ago may now be underinsured. Though agencies are not responsible for determining the appropriate limits, you should recommend that your customers reconsider the limits on their policies in light of inflation. Some carriers have sent out notices to policyholders similar to the following.

E&O CORNER

www.viaa.org 31

If your carriers are not sending a similar message, you may consider encouraging them to do so. You should communicate a similar message to your customers:

Policy limits that were adequate as recently as a year ago may now be inadequate due to steeply increased construction costs.

Even if a partial loss is within your current limit, a substantial coinsurance penalty may be assessed if the property is no longer ‘insured to full value’. Customers should use available resources to reassess the adequacy of their limits and, if needed, ask you to quote higher limits.

There is a “Sample letter for information regarding increased building costs” available on the E&O Guardian Website, which is the exclusive E&O risk management website for IIABA members who are also insured by companies within the Swiss Re Corporate Solutions group. This and other sample letters are there for you to adapt for your agency.

Unfortunately, if your client finds themselves underinsured, they may look to your agency to make them whole. To avoid or mitigate an E&O claim we recommend the following best practices.

Customer Communication Best Practices

Good: Have a conversation with your clients at renewal and explain that due to inflation they may be underinsured now when they were not in the past.

Better: After you have had this conversation, make a contemporaneous note in your Agency Management System documenting the conversation.

Best: After you have had this conversation, follow it up with a letter to your client documenting the conversation.

Finally, when you have offered them higher limits and if they reject them, make sure you have them sign that they are rejecting the higher limits. Otherwise, you may find yourself in a “he said, she said” situation.

Remember, if you are insured with Swiss Re Corporate Solutions, your deductible will be waived (up to $25,000) if there is a written, contemporaneous documentation of the refusal of any customer to accept any type of coverage or limit offered by you and a subsequent claim alleges the failure to secure that coverage or limit.

While it is impossible to know what the future holds, by looking to our history we can provide advice and tools that will help you better service your clients and hopefully, avoid or mitigate an E&O claim.

Insurance products underwritten by Westport Insurance Corporation and Swiss Re Corporate Solutions America Insurance Corporation, Kansas City, Missouri, members of Swiss Re Corporate Solutions.

This article is intended to be used for general informational purposes only and is not to be relied upon or used for any particular purpose. Swiss Re shall not be held responsible in any way for, and specifically disclaims any liability arising out of or in any way connected to, reliance on or use of any of the information contained or referenced in this article. The information contained or referenced in this article is not intended to constitute and should not be considered legal, accounting or professional advice, nor shall it serve as a substitute for the recipient obtaining such advice. The views expressed in this article do not necessarily represent the views of the Swiss Re Group (“Swiss Re”) and/or its subsidiaries and/or management and/or shareholders.

Elizabeth Whitney, J.D. is the Head of US Agents, Senior Vice President, Senior Vice President, Swiss Re Corporate Solutions. Elizabeth is a licensed attorney who has spent the last 24 years focused on various aspects of professional liability including claims, risk management and underwriting.

Inflation Means for Your Insurance & Business continued

What

32 www.viaa.org

www.viaa.org 35

36 www.viaa.org

COMPANY & AGENCY NEWS www.viaa.org 37

The Hanover Appoints Eric M. Schuler to Lead Management and Executive Liability Business

The Hanover Insurance Group, Inc. (NYSE: THG) today announced it has appointed Eric M. Schuler president of management and executive liability, effective immediately. In this role, Schuler will assume responsibility for the strategy and execution of The Hanover's management liability business, which offers highly specialized solutions for a broad range of private companies, nonprofit organizations and financial institutions.

With more than 23 years of experience in the management liability business, Schuler is a strong leader with deep industry knowledge, and has been instrumental in The Hanover's management liability expansion. He first joined The Hanover in 2010 as a liability underwriting director. Schuler also served as the director of management liability for the organization's Northeast region and later, assistant vice president, management liability. He most recently led the underwriting and field efforts for management liability lines as vice president of management and executive liability. Prior to joining The Hanover, Schuler held leadership roles at Zurich North America.

At the same time, Jon R. Martin will assume the role of vice president, management and executive liability for the company's field team, succeeding Schuler in the position. With a strong background in sales and underwriting management, Martin will continue the momentum Schuler has built for the team. Previously, Martin served as vice president, distribution management, professional lines at The Hanover, where he led new business initiatives across the company's management liability, professional liability, cyber and healthcare business. Prior to The Hanover, Martin served as vice president, sales and distribution at Berkley FinSecure, now Berkley Financial Specialists.

In addition, The Hanover announced it has appointed Greggory S. Ketay vice president, distribution management, where he will build on the strong foundation established by Martin, assuming leadership responsibilities for the company's regional distribution directors in the professional and executive lines space. Ketay brings nearly 35 years of specialty experience to the role and has been with The Hanover since 2017, first joining the organization as vice president, architects and engineers. Ketay quickly assumed responsibility for the company's lawyers professional liability business and most recently held the role of vice president, professional liability programs for The Hanover.

Xxxxx

38 www.viaa.org

Betsy Bishop Wins ATHENA Leadership Award

Union Mutual is pleased to announce Betsy Bishop, a member of the Company’s Board of Directors, was honored by the Central Vermont Chamber of Commerce with the ATHENA Leadership Award in recognition of her guidance, achievement, and community spirit.

The ATHENA Leadership Award, named for the Greek goddess known for her strength, wisdom, courage and enlightenment, honors those whose mentorship has inspired others – particularly women – to realize their full leadership potential.

Betsy Bishop, President of the Vermont Chamber of Commerce since 2009, has devoted her impressive career to fostering innovative ideas for businesses and employees statewide. She started the VT Chamber Foundation, and under her guidance and vision, The Vermont Futures Project was born, leveraging data to study and promote workforce development. She is on the Vermont Futures Project Board and advocates for a thriving economy by growing Vermont’s workforce, grand list, median income, housing, gross state product and small and medium sized businesses. She serves on a wide variety of state government committees and boards of directors.

www.viaa.org 39

Current Job Postings

Titus Insurance, located in beautiful Shelburne, VT ishiring! Are you an experienced insurance professional? If so, come joinour Personal Lines Team! We are seeking two, highly motivated individuals whoareoutgoing, confident and a team player.

The first Position will be instrumental in managinga book of business through expertisein retention, client servicing, technology marketing andsales support.

REQUIRED SKILLS & QUALIFICATIONS

Must have a Property & Casualty InsuranceProducer License Experience in working with variousinsurancecompanies andsystems Ability to perform in depth coverageanalysis and policy reviews Must have integrity, a positive attitude, be highly professional, reliable, focused andhave attention to detail

Our second position available is an Entry Level Personal Lines position withonthe job training. Insurance is a challengingfield that requires skills such as attention to detail,confidentiality,the ability to multitask and navigate numerous computerprograms. Understanding the coverages, insurance carriers and insured’s needskeeps insurancevery interesting. Learn skills onthe job to service client needs for Home, Auto, Farm and Business Insurance. Obtain your VTProducers

License and be on your way to a rewarding career intheinsurance industry!

Send your resume today to Annette Hannah atannette@titusinsurance.net

40 www.viaa.org

www.viaa.org 41

42 www.viaa.org

Michael Barrett President, VIAA

Michael Barrett President, VIAA