GREEN MOUNTAIN AGENT VERMONTINSURANCEAGENTSASSOCIATION|November2022 Vermont Insurance Agents Association is a statewide trade association representing nearly 100 independent insurance agencies in Vermont, with more than 900 employees VIAA member independent insurance agents represent more than one insurance company, and as a result, can offer clients a wider choice of auto, home, business, life and employee benefits t IN THIS EDITION: Best Practices Study Highlights See Page 25

Williston,

05495

802-229-5884

802-876-7912

President

Michael R. Barrett

Vice

Jessica Fleury,

CIC,

Daniel J. Rodliff, CIC, CPIA,

Aislyn M. Allen, CISR

M. Farley,

CONTENT ________________ November 2022

President

ACSR Secretary/Treasurer Ian Sutherland,

AAI-M National Director Ronald Bixby Green Mountain Agent is a publication of 600 Blair Park Road, Suite 100

VT

Phone:

Fax:

www.viaa.org 05 Letter from the President 06 Association News 13 On the Hill 18 Perpetuation "Doing Success Planning the Hard Way" 26 Best Practices "Big "i" and Reagan Consulting Release 2022 Best Practices Study Results" 32 E&O Corner "Planning" 38 Agency & Company News VIAA Officers Directors

LUTCF

Laurie Audy Executive Director Mary

MBA, AAIM www.viaa.org 3

4 www.viaa.org

Ok, who dressed as Flo for Halloween?!?!? I must know! While my term as President of VIAA is ending soon, I remain fully energized and hopeful to garner more interaction and enthusiasm in all that the Vermont Insurance Agents Association has to offer to our members.

My request to you is to acquaint, or even reacquaint yourself with www.viaa.org. Visit the site, login, review the drop-down tabs on the top right of the site. Click on all of them and browse, look under “Education,” catch-up on the “News,” stay connected with our “Events,” check out the “Evolving Leaders” information, plus my favorite, look in the “Insurance Resources” section. The number of resources at your fingertips is powerful and can help you tremendously as you chart your path forward in this crazy industry, we call insurance!

The focus of VIAA’s board is you! At all of our meetings, our focus is how to deliver the information and resources efficiently and effectively. Planning for VIAA’s 2023 Golf Outing and EVOLVE 2023 planning will be in full swing (pun intended), before we know it, so it is my hope you “hold the date” for these upcoming events in 2023!

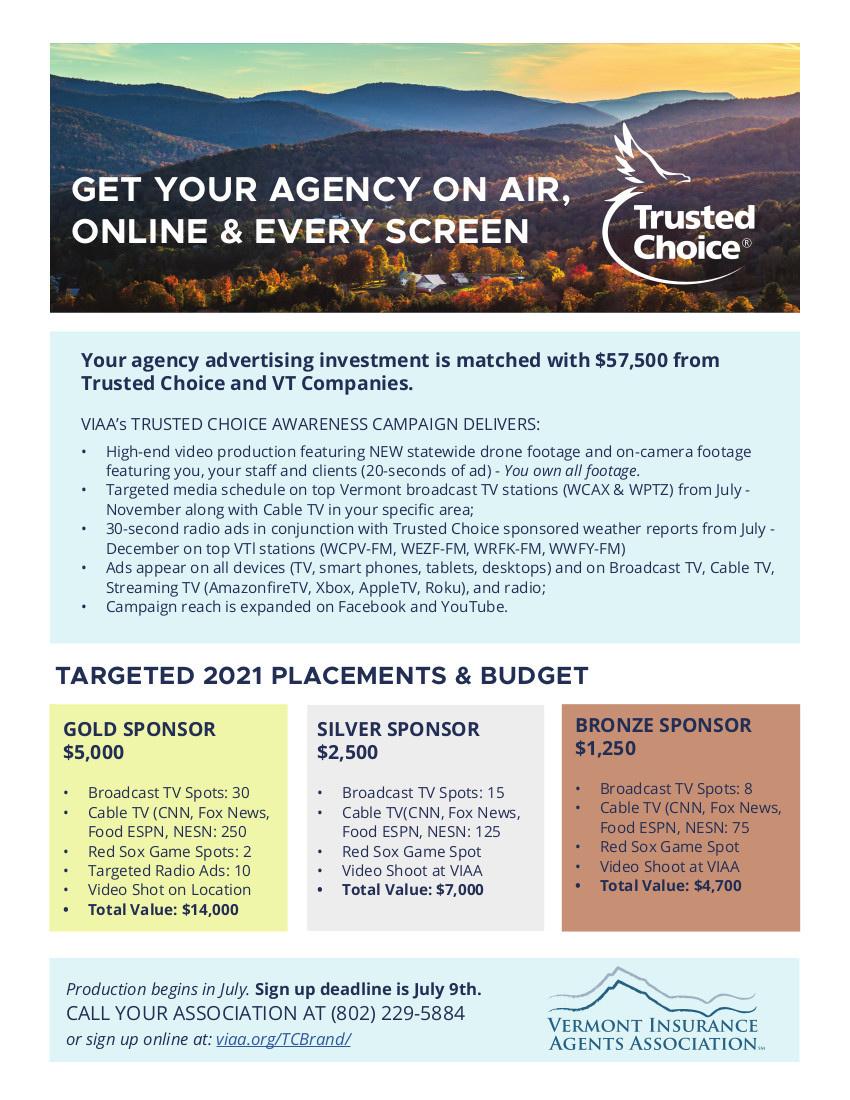

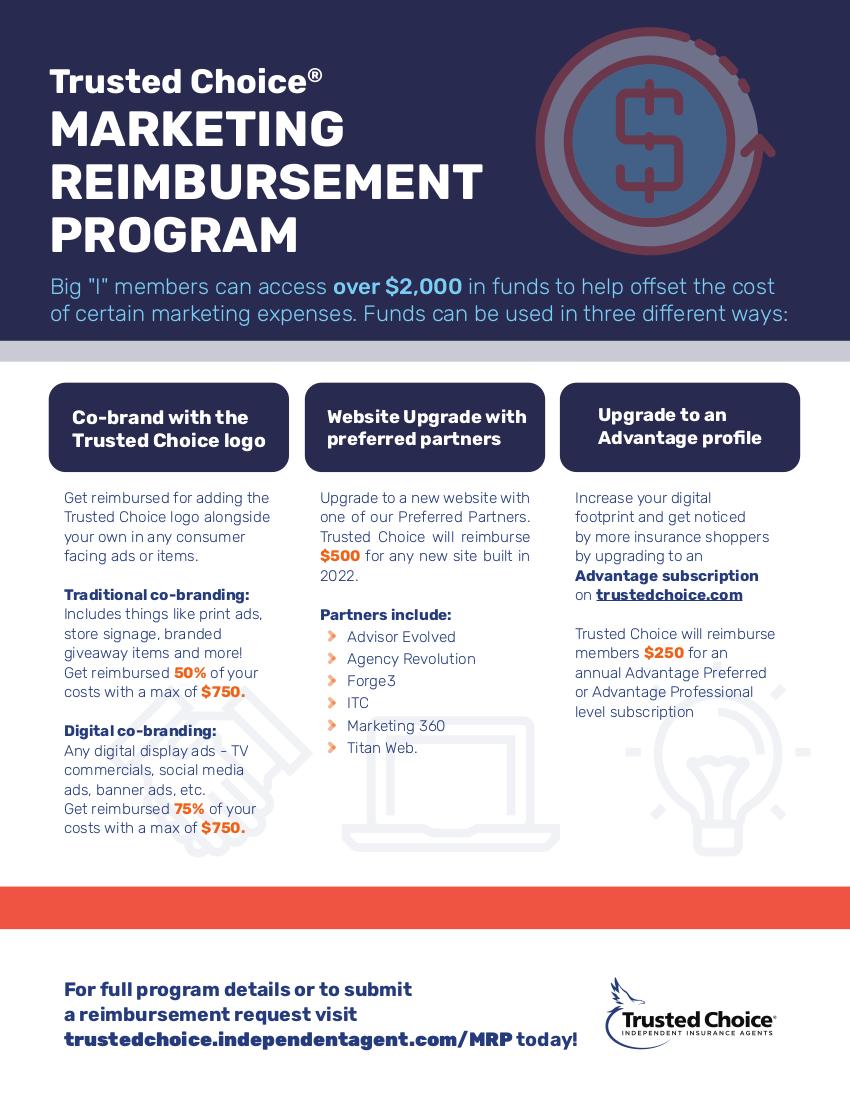

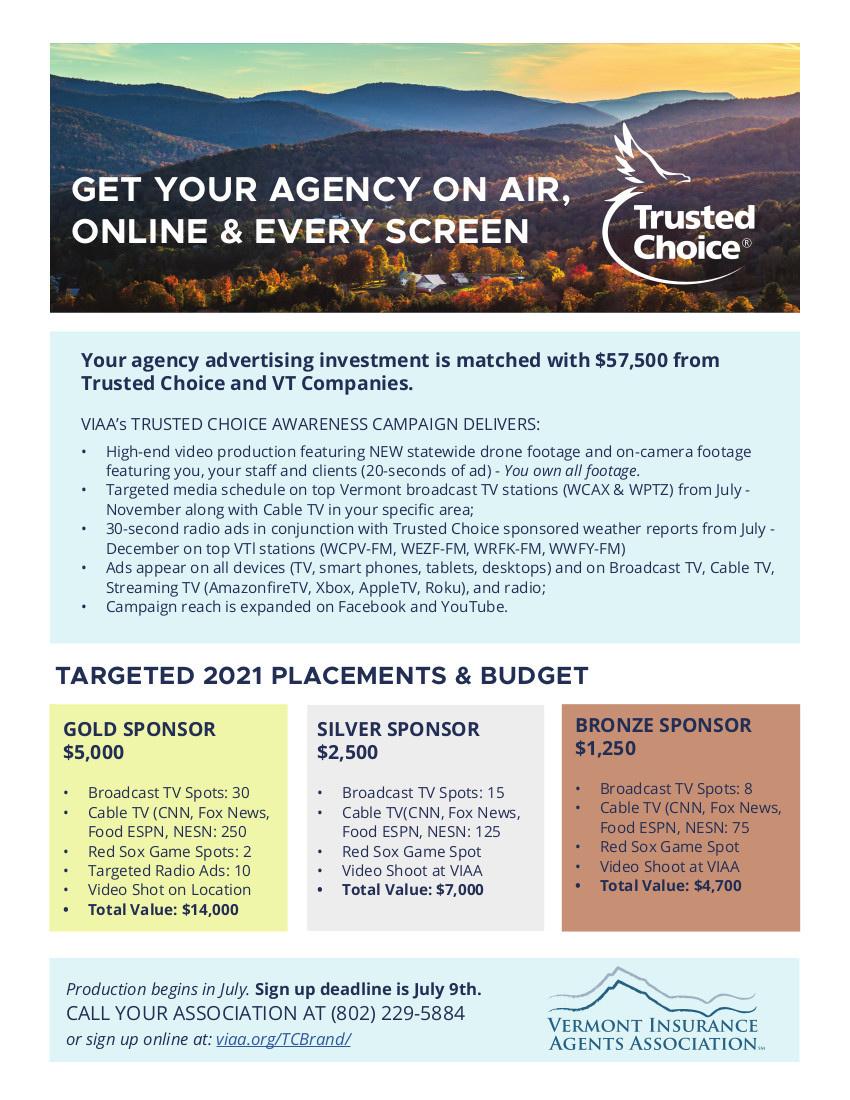

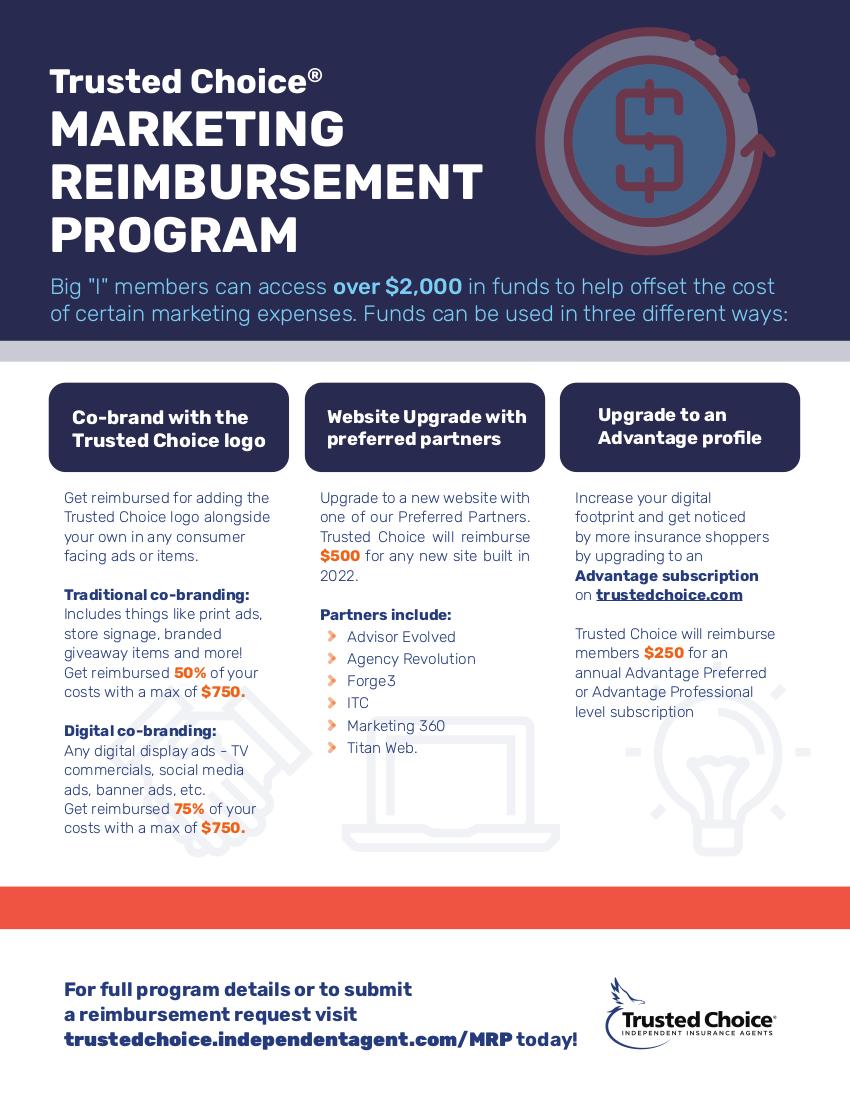

Finally, make sure to keep an eye out for the agency specific TV commercials as part of the co-branded campaign with VIAA and Trusted Choice. They continue to air, and to be honest are a nice change of pace from the current plethora of political commercials! If you like what you see, make sure to join us next year as we hope to do the campaign again.

Stay well!

Michael Barrett

President, VIAA

Michael R. Barrett VIAA President

LETTER FROM THE PRESIDENT November 2022

www.viaa.org 5

VT OUTSTANDING CSR FOR 2022

Eachyear,agroupofexceptionalinsurance professionalsareselectedtorepresenttheir statesandthencompetetobecomethe NationalOutstandingCSRoftheYear. AndrewSykpack,ofKinneyInsurance,wasthis year'swinnerforVermont.

Tobeeligibleforthetopstatehonor,the2022 candidatessubmittedanessayonthefollowing topic: “TransferableSkillsarelearnedfrom experiencewhichincludespriorcareers, education,volunteerwork,orpersonal encounters.Whatarethetopthreeskillsyou transferredfromoutsidetheinsuranceindustry toyourcurrentjobrole?Discusshowyou leverageyourskills,continuetodevelopand evolvethem,andhowyoutransferyour expertisetootherstoensureperpetually exceptionalcustomerservice.”

Additionally,entrantsmusthavedemonstrated commendableservicetotheiragencies,their industry,andtheircommunity. CongratulationsAndrew!

Andrew Skypack

Andrew Skypack

6 www.viaa.org

BIG 'I' RISK MANAGEMENT PUBLISHES

TWO NEW AGENCY RESOURCES

TheBig“I"hascreatedtwonewmaterialstoassist Big“I"memberagencies.

The“CommercialProducerOnboardingGuide,"a self-pacedlearningresource,providesanoverview andlearningpaththrough13coreprerecorded “LightningLearning"riskmanagementwebinars.

The“SampleAgencyProceduresManual"isa templatedesignedforbothpersonaland commerciallinesagencyworkflow.

Theseresourcesareaavailabletoyou,freeof

Download Here Download Here

charge. Pleasehaveyouruseridandpassword availabletoaccessthem. www.viaa.org 7

www.viaa.org 9

VIAA EDUCATION Any time. Any where. Get it done. viaa.org/Education

ON THE HILL CMS Releases FAQ on Medicare Regulations

Lastmonth,theCenters for Medicare & Medicaid Services (CMS) issued a final rule titled,“MedicareProgram: Contract Year 2023 Policy andTechnical Changes to the Medicare Advantageand Medicare PrescriptionDrug Benefit Programs."

Thefinal rule revised the Medicare Advantage(Part C) program and Medicare PrescriptionDrug Benefit (Part D) program regulations. Amongother things, the rule redefinedthird-party marketing organizations (TPMOs) to include individual agents and brokersandrequiresthem to record enrollment conversations and prominently displaya standard disclaimer. The rule took effecton Oct.1.

Lastweek,CMSissuedan FAQ foragents andbrokers abouttheimplementation of the Medicare marketingrecording requirements andtheTPMO disclaimer.

Prior totheserequirements going into effect, the Big “I" joined withother agent andbroker trade associations tosend alettertoCMS noting concernswith the rule and the lackof guidance surrounding it. That letter also requested adelay of 6-12 months. Unfortunately, CMS didnotrespond.

This week, Rep.Mariannette Miller-Meeks (RIowa) sent a letter to CMSoutliningher concerns, specifically with the recording requirements. She requested a one-year suspension of the rule so that “companiescan properly implement thissystem."

The Big “I" will continue to work with its congressionalallies to educate CMS about the valuable role that independent agentsand brokers playin this process and differentiate them from thebad actors that CMS shouldbe seeking to regulate.

Printed with permission from IA Magazine.

www.viaa.org 13

Perpetuation

DOING SUCCESSION PLANNING THE HARD WAY

ByPetervanAartrijk

ByPetervanAartrijk

As long as baby boomers have owned independent insurance agencies, they've heard a drumbeat on succession planning from merger & acquisition consultants, financial advisories and bankers: “Do not wait. Get an agency valuation. Create a written perpetuation strategy. Give yourself a five- to seven-year runway to stage an orderly exit. You'll thank us later."

Do principals listen? Some do. But most wait.

Waiting can bring uncertainty and chaos. And Exhibit A is Avery Moore, now president & CEO of ECI Insurance in Piedmont, Oklahoma. After an emotional ride, at age 32, Moore took ownership of the agency last year.

The agency is a family legacy for Moore. Her grandfather, Earnie Cornelius, returned from the Korean War and founded ECI in 1964. Back then, Piedmont was a town of 5,000.

He said he wanted to be a big fish in a small pond, Moore says. Today, it's a bedroom community for Oklahoma City and the county is growing fast.

Cornelius' son, Scott Cornelius, later took over the firm along with his sister Denise Johnson, Moore's mother. Decades later, there was the next generation to consider: Moore and her cousin were in line for ownership.

Moore was skeptical about insurance as a career at first but fell in love with it while working at another independent agency. In 2014, she bought her mom's book—Johnson is now CEO of Big I Oklahoma—and started producing.

“Being family owned has been an incredible source of pride for our family," Moore says. “It was always understood that I would take over the agency with my cousin. But there was nothing in writing. My uncle [Scott Cornelius]

18 www.viaa.org

said, 'Nothing is going to happen to me, and I'll retire when I'm 67—and you guys can take it over.'"

HardConversations

Moore joined a local women's executive group. When she presented what she thought were her major business issues, the group pushed back with a bigger problem. “They said, 'The problem you're presenting is not the problem. There is nothing actually tying you to the agency. There is no buy/sell agreement,'" Moore recounts.

The issue wasn't on Moore's radar. “It was the first time I heard the terms 'buy/sell' and 'first right of refusal,'" she says. “With our family, everything had just sort of worked out. Nothing bad had ever happened in the past. When I heard that from the group, I had to have a conversation with my uncle."

Moore asked her uncle for a written agreement, but he was reluctant. “He felt like I was trying to push him out—but I was trying to protect my work," she says.

The conversation continued for four years. They finally signed in May 2020. The plan called for Cornelius to retire at age 67. Moore and her cousin had first right of refusal on the agency's book. They would be 50-50 owners. The purchase price would be 1.5 times the commission value—perhaps half of what ECI Insurance might fetch in the open market. In addition, Cornelius would fund a 15-year note at a 4% interest rate.

Why an owner-financed loan? Cornelius was uninsurable, Moore explains. He had been treated for skin cancer in years past, so his retirement plan was the value in the agency's book.

In sum, Cornelius offered Moore the same deal his dad offered him. “He wanted to give us the same opportunity," Moore says. “He

was an incredibly generous person."

Indeed, such a low sale price and attractive financing terms are typical in family succession plans. Owners seek to continue the local brand, customer loyalty and family agency legacy, which in the case of ECI Insurance is a legacy spanning seven decades.

Tragedy Strikes

Moore's uncle's generous terms never came to pass. There would be no 15-year loan window. In early 2021, he suddenly passed away from cancer. The family was forced into finding another way to keep the agency in the family.

Two days after the funeral, Moore and her family sat down with lawyers. “It was the worst-case scenario," she relates. “My aunt was grieving the loss of the love of her life. Attentions on business got lost along the way. I was negotiating the best benefit for myself … but to do that in the middle of grief … I wouldn't want anyone to have to go through that."

Moore said the succession plan wasn't clear on a transition in the event of a sudden death

IDoing Succession Planning The Hard Way Continued www.viaa.org 19

—or how to treat contingency income, profit sharing or customer fees in agency revenue.

Meanwhile, the agency team needed attention. “It took five months of me trying to hold on to my employees," Moore says. “It felt like 'Top Gun'—trying to hold on and pull out of a nosedive just to keep the team and business going." Cornelius had hired two staffers a few weeks before he died.

FinancingTravails

In April 2021, Moore began to seek financing to buy out her cousin's first right of refusal and assume ownership of the entire firm. Her agency friends gave her names of bankers for loans. “Our financial health was incredibly good," she says. “I was so confident walking into that first bank."

For collateral, the banker asked about ECI's hard assets. He wasn't as interested in commission revenue or customer lists. After the fourth failed meeting, Moore sat on the curb outside the bank and cried.

“I said, 'I don't know how I'm going to do this,'" she says. “For a female entrepreneur like me, there was so much head trash going on at the beginning: Can I do this? Can I lead my team? Will they follow me? Can I make it successful? All the doubts were going on in my head that I can't do it. But I told myself I am taking this opportunity."

Moore approached a total of eight banks. It was a “no" from all. Finally, taking her mom's advice, Moore called InsurBanc.

Scott Freiday, division director at InsurBanc, told Moore he had helped other agencies transition through an unexpected death of a principal. And he thought he could help ECI Insurance.

In fact, Freiday relates, “All of the agency's credit metrics were solid. It was a thirdgeneration owner, a strong, well-established agency, a great market, and an excellent

book of business. We could do all the financing they were looking for, including buying out the cousin and establishing a line of credit."

“[Moore] was well experienced and clearly capable of running the agency," Freiday says. “Avery spent a significant amount of time working at the agency. It was clear she was the one to take over. She had the experience and the mentorship there."

The InsurBanc deal closed in 30 days, and the agency was now wholly owned by Moore. Looking back, she is still amazed. “I had just turned 32 and I'm borrowing millions of dollars," Moore says. “I don't know many 32-year-olds who can borrow millions of dollars."

“InsurBanc is like the Oprah Winfrey of lending —they've got lots of wisdom," she says. “They do all our banking. They're literally almost an extension of our agency because now we have a banking relationship. We didn't have that with our local bank."

A year after the sale, the firm is doing well, with 15 employees. Last year the firm grew commission revenue by 11.5% and year-todate gross revenue 2022 is up 18%. Moore says she's joining an agency cluster to generate more growth. The book is more diversified as well, including life and health products.

“I have an incredible team," Moore says. “We didn't lose a single employee during all of that. That was one of my biggest fears. Those are the people I show up for every day."

“I miss Scott every day," Moore continues. “We talk about him all the time. My uncle and I were incredibly close. He was my mentor. At least once a week I still try to text him."

“Sales is so easy compared with agency ownership and management," she adds.

Peter van Aartrijkis principal at insurance branding firm Aartrijk. Reprinted with permission from IA Magazine.

Inside-Outside Game: Is an Internal Offer Really Worth Less Than an External? Continued 20 www.viaa.org

BIG ‘I’ AND REAGAN CONSULTING RELEASE 2022 BEST PRACTICES STUDY RESULTS

ByAnneMarieMcPhersonSpears

As the independent agency channel moves past the coronavirus pandemic and into uncertain economic headwinds, Best Practices agencies achieved record highs in organic growth and profitability, according to the 2022 Best Practices Study by the Big “I" and Reagan Consulting.

The Best Practices update is the first one in its three-year cycle, examining the firms that newly qualified as a 2022 Best Practices Agency. The annual study, conducted jointly in a longstanding partnership between the Big “I" and Reagan Consulting for the past 29 years, provides critical performance benchmarks in six agency revenue categories ranging from under $1.25 million to over $25 million.

“The past few years have brought challenges for independent agencies and their clients, but top-performing agencies have demonstrated resiliency as they've weathered these obstacles to grow their businesses and even break study records in numerous categories," says Chris Boggs, Big “I" vice president of agent development, education and research. “These industry leaders are setting the bar and demonstrating the independent agency channel has never been healthier."

The Best Practices Study analyzes takeaways from nominated Best Practices firms throughout the nation that have been recognized for outstanding management and financial achievement in categories such as

Best Practices

www.viaa.org 25

income and expense distribution; revenue and profitability growth; sales and service staff compensation and productivity; technology expenses; and property-casualty and life-health carrier representation.

“Best Practices agencies are writing the playbook for success, and agencies can look to these strategies to guide them toward operational excellence as they seek to better serve their clients," says Tom Doran, a partner with Reagan Consulting. “As these industry leaders are setting the bar and demonstrating the independent agency channel has never been healthier, study results also indicate that an increased focus on producer recruitment and development is a must to maintain the industry's progress."

Key findings from the update include:

Organic growth breaks Best Practices Study record. At 9.2%, organic growth was up 2.5 times from last year's results of 3.7%. Organic growth increased in all six revenue groups in this year's study. Profitability remained at all-time highs. At 26.2%, Best Practices agency profitability went up slightly from last year's 25.9% result.

The Rule of 20 achieved a record high. The Rule of 20, calculated by adding 50% of profitability to organic growth, reached a record high in this year's study of 24 versus 18 in last year's study. The Rule of 20 is the best metric with which to gauge overall agency health. Sales velocity gained ground from last year. While a hard market continued to provide much of the organic growth lift, new business improved materially in this year's study. Sales velocity totaled 15.5% versus last year's 13.2%.

Mergers & acquisitions bolstered growth. In the 2022 study results, 22.3% of Best Practices agencies acquired business, up from 16.4% in last year's study.

Producer recruitment and development proves challenging. Net unvalidated producer payroll (NUPP), a measure of producer recruitment and development, remained at 1.1% of net revenues compared to 1.2% in last year's study. A healthy NUPP investment would be 1.5%-2.0%, an indication that agencies should consider redirecting a portion of today's record profits toward new producer investments.

Shareholder and producer ages hold steady. The weighted average shareholder age (WASA) was 53.2 years, and the weighted average producer age (WAPA) was 48.6. Agencies should manage these two metrics carefully as lower WASA and WAPA are critical to long-term agency perpetuation.

The annual Best Practices Study began in 1993 as a joint initiative between the Big “I" and Reagan Consulting and studies leading agencies and brokers in the country to help independent agents build the value of their agencies.

AnneMarieMcPhersonSpearsisIAnews editor.

Reprinted with permission from IA Magazine.

Big ‘I’ and Reagan Consulting Release 2022 Best Practices Study Results Continued 26 www.viaa.org

www.viaa.org 27

28 www.viaa.org

E&O CORNER Planning

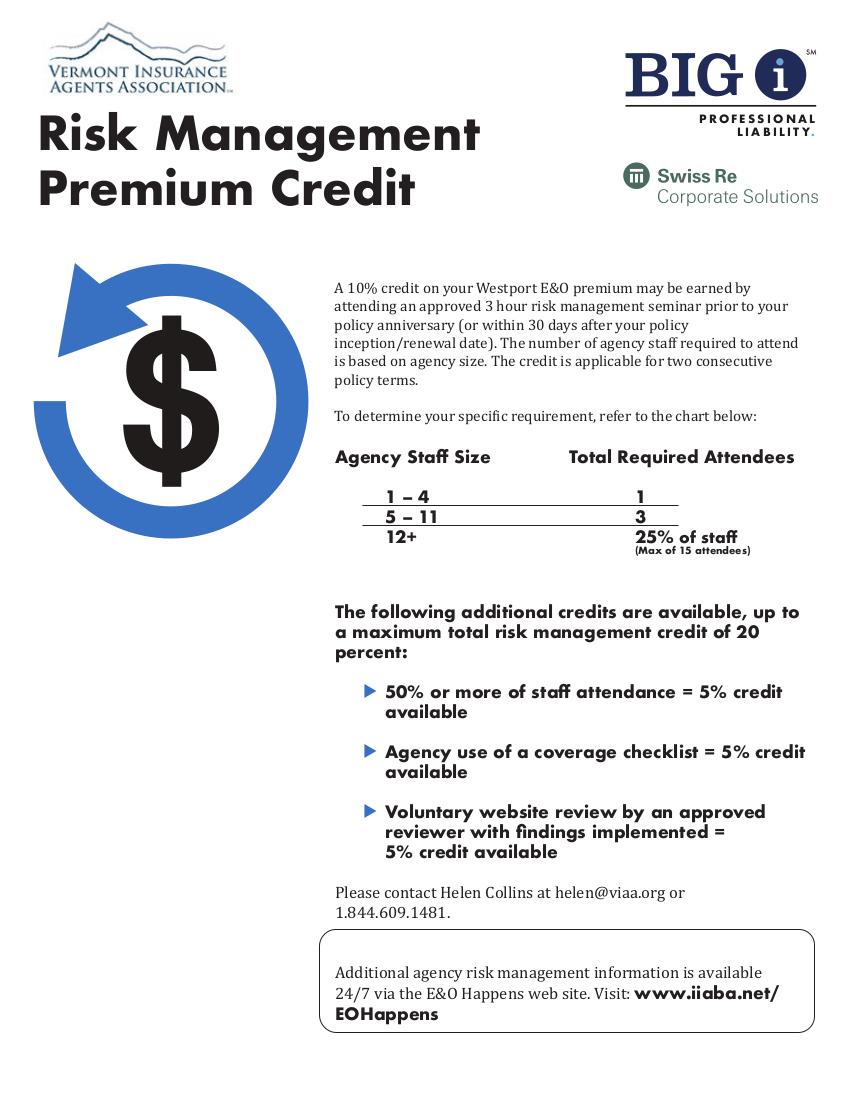

ByRichardF.Lund,J.D.,VicePresident,SeniorUnderwriter,SwissRe CorporateSolutions

ByRichardF.Lund,J.D.,VicePresident,SeniorUnderwriter,SwissRe CorporateSolutions

"Plans are nothing. Planning is everything."

Dwight Eisenhower; President, General of the Army

I recently attended my daughter's graduation from St. Louis University (Go Billikens!) and the commencement speaker was the United States Ambassador to Ireland, Kevin O'Malley. A double SLU graduate (Business, Law), he began his comments with a simple statement from former President Dwight D. Eisenhower: "Plans are nothing. Planning is everything." The President's statement referred to the United States' battle plans during World War II. They were continually being revised to address changing circumstances. The Ambassador's message to the graduates was while you may think you have a plan for your life, that plan will change as your circumstances change.

The same is true for you as an insurance professional. While you may have a business plan in place, change in circumstances may cause you to modify your plans. As you plan for your agency's future, your staff's future, your own future, circumstances, mostly in the form of market forces, cause you to change your business plan to adapt to those forces.

And the same is true about agency risk management. Over the last 25 years, think about some of the things that have changed the way you do business and helped you to change your risk management. One of the first was the change from agency billed policies to direct bill policies. Until the late 1980's to early 1990's, virtually all insurance agencies sold the carriers' policies and also collected the premiums. Then, carriers began the process of "direct bill", especially for renewals. From a risk management standpoint, this was one of the best improvements as it did two things: 1) took

the agencies out of the money handling business, which was a significant cause of E&O loss due to discrepancies regarding payment of premiums, and 2) it removed the agency from the process of notifying the customer when the premium was due and cancellation of the policy for failure to pay, one of the largest areas of E&O loss at the time.

Unfortunately, we still see some claims involving the notification of insureds when their premium is due, even though the agent has no such duty to do so, but they're due to the agencies not adapting to changes in the market which have removed them from this part of the transaction and continuing to insert themselves when they have no such duty. Numerous articles are available on the IIABA Virtual University and E&O Happens if you want more information about how to avoid this exposure.

Another significant area that has just recently been on the rise is that insurance carriers are no longer requiring agents to submit signed applications for insurance policies they write for their customers. In fact, many carriers' online systems may not even allow agents to submit

32 www.viaa.org

applications or the applications they submit do not match the criteria used to underwrite or price the risk. While the carriers may believe this streamlines the process, it eliminates the ability to defend an E&O claim when a dispute arises as to the risk that was being insured.

However, we have seen many agencies that have adapted and are planning their own internal systems to create appropriate documentation even when the carriers have not done so.

Yet another area that is causing E&O exposures is that of technology in general. Agency websites, Facebook, smart phones, tablets and many other forms of technology were unheard of as little as 15 years ago. Now, they are everywhere and makes planning for these technologies crucial to conducting business. You should especially take into account how your agency can protect its information and itself from E&O claims arising from new technology.

As General Eisenhower said, "Plans are nothing. Planning is everything." Protect your agency from potential E&O claims by planning continually to adapt as circumstances change in your business .

This article is intended to be used for general informational purposes only and is not to be relied upon or used for any particular purpose. Swiss Re shall not be held responsible in any way for, and specifically disclaims any liability arising out of or in any way connected to, reliance on or use of any of the information contained or referenced in this article. The information contained or referenced in this article is not intended to constitute and should not be considered legal, accounting or professional advice, nor shall it serve as a substitute for the recipient obtaining such advice. The views expressed in this article do not necessarily represent the views of the Swiss Re Group ("Swiss Re") and/or its subsidiaries and/or management and/or shareholders.

Copyright 2022 Swiss Re. All rights reserved. You may use this for private or internal purposes but note that any copyright or other proprietary notices must not be removed. You are not permitted to create any modifications or derivative works of this, or to use it for commercial or other public purposes, without the prior written permission of Swiss Re.

Planning continued

Richard F.Lund,JD,isaVicePresidentand Senior UnderwriterofSwissReCorporate Solutions,underwritinginsuranceagentserrors andomissionscoverage.Hehasalsobeenan insurance agentsE&Oclaimscounselandhas writtenandpresentednumerousE&Orisk management/losscontrolseminars,mocktrials andarticlesnationwidesince1992.

www.viaa.org 33

www.viaa.org 37

COMPANY & AGENCY NEWS 38 www.viaa.org

Three Decades of A.M. Best “A” Ratings for Ohio Mutual

Ohio Mutual Insurance Group achieved a milestone, marking 30 consecutive years of earning an “A” (Excellent) financial strength rating from insurance rating organization A.M. Best, which also reaffirmed its issuer credit rating of “a+” for the regional insurance carrier.

The ratings include the three companies that represent Ohio Mutual’s intercompany pool: Ohio-domiciled Ohio Mutual Insurance Company, its wholly owned subsidiary United Ohio Insurance Company, and Maine-domiciled Casco Indemnity Company – all entities of holding company Ohio Mutual Insurance Group, Inc.

In its rating rationale, A.M. Best offered positive analysis of Ohio Mutual’s strong balance sheet, favorable operating performance, long-lasting relationships, and stable outlook.

Founded in 1899, A.M. Best Company is the world’s oldest and most authoritative insurance rating and information source. More information is available at ambest.com.

Acuity Earns Industry Leadership Awards From ACORD

Xxxxx

Acuity earned industry leadership awards from ACORD, which were presented at ACORD Connect 2022. ACORD is a nonprofit organization recognized as the global standard-setting body for the insurance and related financial services industries.

Joan Ravanelli Miller, J.D., Ph.D., General Counsel and Vice President – Human Resources, was honored with the 2022 Women’s Insurance Advancement Award.

Acuity also received two ACORD Case Study Awards for:

Expanding digital distribution in small commercial. Using ACORD-based standards and services, Acuity created real-time integration with systems utilized by online digital agencies, including independent agencies that use digital platforms, to reduce the time and expense of entering data.

Enhancing independent agency workflow. AcuityutilizedACORDstandards to create integrations between Acuity’s systems and software solutions usedbyindependent agents to allow agentsto perform sales and servicing tasks in theirsystemsof choice,enabling agents to focus onproviding guidance and coverage customizationbased on theconsumer’s needs.

www.viaa.org 39

40 www.viaa.org

Andrew Skypack

Andrew Skypack

ByPetervanAartrijk

ByPetervanAartrijk

ByRichardF.Lund,J.D.,VicePresident,SeniorUnderwriter,SwissRe CorporateSolutions

ByRichardF.Lund,J.D.,VicePresident,SeniorUnderwriter,SwissRe CorporateSolutions