JULY MARKET REPORT

Transaction volume is flat for July vs prior, and down 13.1% YTD. Meanwhile, July’s dollar volume is down 33.3% compared to prior, and YTD is 9.5%. July was lighter than last year; however, looking at YTD numbers provides a better indication of the market as a whole. We are slightly down on the year, $531.1M in total dollar volume vs $587.5M in 2023. That said, YTD home dollar volume still puts 2024 as the 4th largest year in Nantucket Real Estate history thus far.

While the Nantucket market remains active, we have begun to see some cracks in certain segments of our market and relative strength in others. This contrast is driving the downtick in dollar volume we have seen this year. YTD, we have seen ten transactions that closed for $8M+, which is flat compared to 2023. However, of those ten transactions, four have been $15M+, which ties 2022 for the most we have ever seen in this price range. On the other hand, sales under $3M continue to stagnate. Sustained interest rates of 6.5%+ have priced some of these buyers out due to the increased debt servicing cost. YTD, we have seen 55 transactions close for under $3M. This is down from 68 in 2023 and 99 in 2022. This segment of our market has seemingly transitioned to a buyer’s market. The average DOM for homes currently available up to $3M is 127, while our average DOM in 2023 at this price point was 100.

Another trend that stood out in July was price improvements. In July 2024, we saw 53 price improvements compared to 18 in July 2023. This is the highest amount of price adjustments that we have seen in a single month since September 2019. In addition, there have been 161 price improvements YTD, the most we have seen since 2019 before our market turned to the upside during the pandemic. Over the past few years, we have seen various instances of owners listing their properties for aspirational numbers to try and take advantage of the Nantucket market momentum. It would appear those days are ending and appropriate pricing is key to effectively market and sell listings.

*Market data and analysis provided by GPP agent Ethan Ulmer*

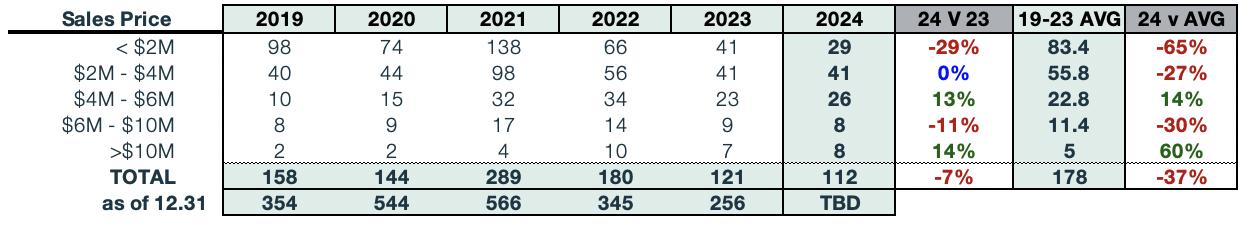

ALL SALES AS OF JULY 31

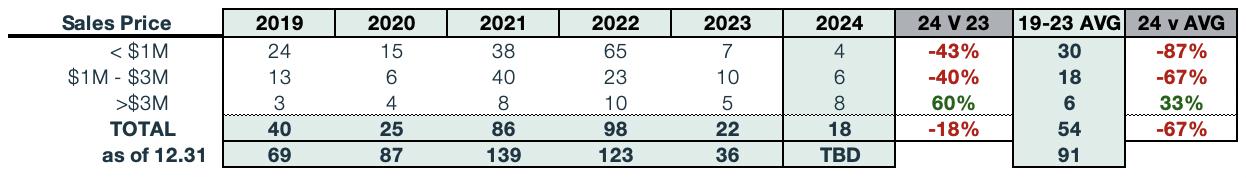

HOUSE SALES AS OF JULY 30

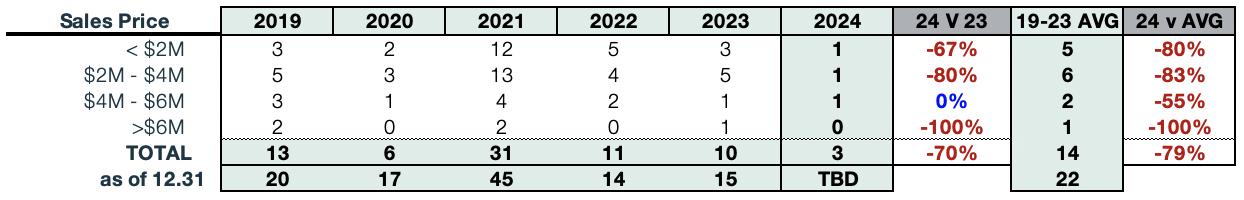

LAND SALES AS OF JULY 31

COMMERCIAL SALES AS OF JULY 31

THE CURRENT MARKET AT A GLANCE

$6.2M

AVERAGE ASKING PRICE OF AVAILABLE HOMES

138

AVERAGE DAYS ON MARKET OF AVAILABLE PROPERTIES

80

AVERAGE DAYS ON MARKET OF PENDING PROPERTIES

250 AVAILABLE PROPERTIES

56 NUMBER OF PENDING SALES

3 BEACON LANE | $21,950,000

To join our weekly newsletter, please scan the the flowcode!