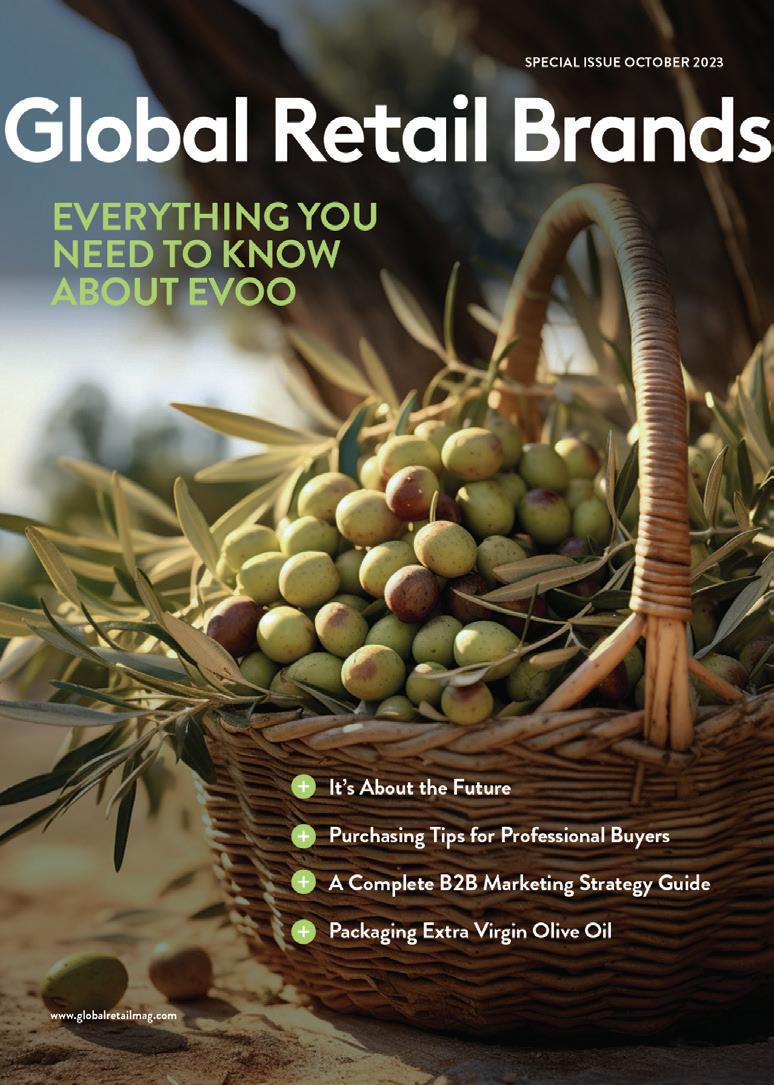

Your Worry-Free Source for Extra Virgin Olive Oil

We partner with trusted cooperatives across the Mediterranean to deliver high-quality extra virgin olive oil, thoughtfully tailored to your store's brand. With certified

STRATEGY

The Great Retail Game Rebalance

Private Brands on the Rise

The Global Perspective

Making Meaning in a Crowded Aisle

Think Like a Buyer, Act as a Developer

BRANDING

The Label Story Branding Authenticity

Beyond Private Label

Fair Trade, Smart Play

From Budget Buys to Brand Promises

TACTICS

Elements of a Winning Costco Pallet Display

The Value of Trusted Sourcing

Ecodesign as a Game Changer for Private Label and Branded Products

The Third Path

Balancing Heritage and Retail Demand CATEGORIES

The Tomato Supply Chain

No/Low-Alcohol Beverages Are The Modern World’s Newest Elixir

Best Practices, Trends, and Threats in Extra Virgin Olive Oil

How Branded Coffee Wins in a Private Label World

How Olive Oil Awards Strengthen Brand Positioning

Meet the Authors

Giovanni Quaratesi

HEAD OF CORPORATE

GLOBAL AFFAIRS, CERTIFIED ORIGINS GROUP

Jim Wisner PRESIDENT, WISNER MARKETING LLC

Maria Dubuc PRESIDENT, MBD

Marie Jallot Colombel

PASTRY COOK AND BAKER

Norma Brito

GENERAL MANAGER, CERTIFIED ORIGINS MEXICO

Silvia D’Alesio

RESEARCH FELLOW, POLITECNICO DI MILANO

Silvia Garcia Gonzalez

BUSINESS DEVELOPMENT

B2B FOOD, BEVERAGES AND FLAVORS

Christian Sbardella MARKETING AND COMMUNICATIONS DIRECTOR, TOSCANO PGI EVOO CONSORTIUM

Winette Winston

CEO, ORIGIN BRANDS AND CATALAN GOURMET

Fair Trade FAIR TRADE USA™

Alessio Costa CRISIS, REPUTATION MANAGEMENT, CORPORATE COMMUNICATIONS, SEC NEWGATE ITALIA

Michael Carrier

TECHNICAL SALES DIRECTOR, BERKLEY

Jakob Rackl

RESEARCH ASSOCIATE, TECHNICAL UNIVERSITY OF MUNICH

Prof. Luisa Menapace PhD

PROFESSOR, TECHNICAL UNIVERSITY OF MUNICH

Jordi Oliver-Solà

CO-FOUNDER AND CEO, INÈDIT

Adriana Sanz Mirabal

SENIOR PROJECT MANAGER, INÈDIT

Sofía Garín Martínez

SENIOR PROJECT MANAGER, INÈDIT

Michael Ray Robinov

CO-FOUNDER & CEO, FARM TO PEOPLE

Matteo Bolla

ITALIAN SALES MANAGER, VALDO

Christian Stivaletti CEO, LASELVA

Riccardo Astolfi

FOOD & BEV INNOVATOR

Morgan Drummond

SENIOR DIRECTOR OF PRIVATE LABEL, MISFITS MARKET

Daniele Foti

MARKETING VP NORTH AMERICA, LAVAZZA

Alfonso Serrano

COMMERCIAL DIRECTOR, ALMAZARAS DE LA SUBBÉTICA

Lely Moreno

MANAGING DIRECTOR, CERTIFIED ORIGINS IBERICA

Introduction

In today’s rapidly evolving retail landscape, businesses face a complex web of challenges, from balancing private labels and national brands to navigating supply chain disruptions, tariffs, and global trade uncertainties. These issues are reshaping how retailers play the game

That’s why we partnered with Certified Origins and a select group of industry innovators to explore how retailers can strike the right balance for success.

One of the most persistent tensions is between private label products and national brands. Private labels offer retailers higher margins and greater control over pricing and inventory. However, national brands often bring customer loyalty and brand recognition that private labels can’t easily match. This creates a strategic dilemma: push private labels for profitability, or maintain strong relationships with national brands to attract and retain customers?

At the same time, supply chain challenges remain a significant pain point. Global disruptions caused by the COVID-19 pandemic, geopolitical tensions, and climate-related events have led to inventory shortages, increased lead times, and higher transportation costs. Even as supply chains stabilize in some sectors, lingering fragility and unpredictability make it difficult for retailers to plan effectively.

Tariffs and global trade dynamics add another layer of complexity. Ongoing trade disputes, particularly between major economies like the U.S. and China, have led to fluctuating tariffs that impact sourcing decisions and cost structures. For example, electronics, apparel, and home goods (categories commonly reliant on overseas manufacturing) are particularly vulnerable to tariff shifts. Retailers must constantly reassess their supplier networks to mitigate risks and manage cost volatility.

Moreover, ethical sourcing and sustainability are becoming critical considerations in global trade. Consumers are increasingly demanding transparency in how products are made and where they come from. Retailers, therefore, are under pressure to ensure that their global supply chains are not only efficient but also responsible, a challenge that often requires significant investment and oversight.

To adapt, many retailers are diversifying their supply bases, investing in technology to improve supply chain visibility, and exploring nearshoring options to reduce dependence on distant markets. Additionally, some are renegotiating contracts with national brands or developing premium private label lines to compete more directly on quality and branding.

In this climate of uncertainty and change, agility is key. Retailers that can nimbly adjust their product mix, sourcing strategies, and brand relationships will be better positioned to weather disruptions and meet evolving consumer expectations. The stakes are high, but so are the opportunities for those who can innovate and adapt.

Many thanks to Giovanni Quaratesi and his colleagues at Certified Origins and the team at The Armin Bar. Their devotion to providing inspiring content and compelling graphics makes this endeavor enjoyable, rewarding and fun.

Phillip Russo Founder / Editor phillip@globalretailmag.com

@philliprussopov

The Great Retail Game Rebalance

THE NEXT CHAPTER OF FOOD RETAIL CEN TERS ON PRECI SION, SHARED VALUES, AND MEANINGFUL CONNECTIONS

BY GIOVANNI QUARATESI, HEAD OF CORPORATE GLOBAL AFFAIRS CERTIFIED ORIGINS GROUP

There was a time when the rules of retail were straightforward. Store shelves were battlegrounds where competition played out clearly: brands offered loyalty, private labels provided savings, and retailers chose their alliances. In 2025, the rules have evolved, and so has the game.

Private labels have transformed from basic value-tier products into serious competitors with distinct identities, narratives, and in some cases, cult-like followings. Branded products, once dominant by default, have had to refine their purpose, rethink their messaging, and rebuild emotional and ethical connections with customers.

This is not necessarily a binary conflict, it’s a dynamic redistribution of value.

Today’s retail landscape is a lot like Monopoly. Owning the most expensive properties doesn’t guarantee success. Strategy, adaptability, and balance are what matter. The same principle can be applied to food retail.

Private Labels Go Premium

In the United States, private label products now hold a 20.7% market share, with total sales exceeding $270 billion. In Europe, the trend is even more pronounced: private labels make up nearly 40% of grocery sales, rising above 50% in countries like Switzerland and Spain.

A recent report from Nielsen IQ indicates that 50% of global consumers are purchasing more private label products than ever. In markets like Germany (61%), Spain (58%), Italy (53%), France (54%), and India (56%), private label penetration is well above average, and even in the U.S. and Canada, around 48% of consumers are now increasing their private label purchases (46% in the UK).

What was once a cost-saving option has become a core retail standard. Brands like Costco’s Kirkland Signature now generate over $60 billion in annual revenue across food, apparel, and household goods, outpacing even global giants like Nike. Kirkland’s rise illustrates just how far private labels have moved beyond their generic origins.

Retail Reinvented

At the same time, the retail landscape is undergoing significant changes. Store closures surged in 2024, with over 7,100 shuttered in the U.S. and nearly 13,000 chain outlets closing in the UK alone. Yet almost 5,800 new stores opened in the U.S., and around 9,000 in Britain, mostly concentrated in discount, club, and value-oriented formats.

Some retailers are falling behind, as happens in any business sector, while others are evolving. Modern, flexible approaches are increasingly replacing traditional retail models.

Stores are becoming more curated, mission -driven, and digitally connected. Whole Foods, for example, has launched its “Daily Shop” concept in New York: smaller-format stores tailored to urban convenience and online integration.

This shift positions private labels not as margin tools, but as strategic assets. Retailers now oversee the entire lifecycle, from product conception to shelf execution, allowing faster innovation, deeper alignment with consumer data, and greater control over sourcing and pricing.

Branded products aren’t yielding ground. Instead, they’re responding with focused storytelling, social media influence, and agile marketing. Today’s most successful brands don’t just compete on quality, they thrive on coherence, cultural relevance, and consistency.

Where Online Meets In-Store

Retail spaces are evolving into curated experiences. In the U.S., grocers like Sprouts are treating their stores and shelves as narrative platforms, not just product displays. In Europe, Carrefour and Albert Heijn have reimagined stores to emphasize freshness, digital integration, and specialty foods.

In China, Alibaba’s Hema stores blend physical shopping with digital services, live cooking, and app-based checkout. In Canada, Loblaws is investing in urban flagship stores, while in Mexico, La Comer is developing gourmet markets that blend food halls with retail.

At the same time, direct-to-consumer (DTC) food brands are rewriting the playbook.

“The goal isn’t to win the shelf anymore, it’s to design smarter, include more, and keep everyone in the game.”

Many leading U.S. food startups - Blue Apron ($420M in annual revenue), HelloFresh (founded in Germany in 2011, $8.1B global revenue), and ButcherBox - started online as direct-to-consumer brands; Blue Apron and HelloFresh later entered select U.S. retail, while ButcherBox remains exclusively online. In Italy, Cortilia connects hundreds of producers with consumers through a digital-first platform that prioritizes freshness and convenience.

The DTC food market, valued at $50.7 billion in 2023, is projected to reach $195.4 billion by 2031. That explosive growth is driven by consumers who want personalization, traceability, and direct relationships with the brands they trust.

Yet the most transformative development is the rise of omnichannel food retail. Leading global players are investing heavily in formats that blend the digital and physical. Walmart now commands over one-third of U.S. online grocery sales, turning stores into logistics hubs. Amazon is fusing its grocery banners into a unified ecosystem. Carrefour is streamlining quick delivery with driveup options. Aeon is rolling out automated fulfillment centers. Alibaba’s Freshippo offers real-time delivery, app-based shopping, and interactive in-store experiences.

These players aren’t choosing between online and offline, they’re integrating both. The result is a seamless, always-on shopping journey where the consumer decides the channel and the retailer delivers the outcome.

Consumer behavior has shifted toward online grocery shopping in recent years. In China, approximately 13% of grocery sales now occur online, while in South Korea the figure is around 12%. The United States also reports that about 12% of grocery sales take place online. In Europe, the United Kingdom leads with roughly 10% of grocery sales online, followed by France at 8%. Italy and Germany are rapidly catching up, with each reporting nearly 6% of grocery sales made online.

Across all regions, the trend is the same: grocery shopping is increasingly hybrid, personalized, and tech-enabled.

Global online grocery sales are projected to surpass $1 trillion by 2027 and could reach or exceed $2 trillion by 2030. Physical grocery stores won’t vanish, but they are being reimagined as spaces for inspiration, sampling, and fulfillment.

Winning Today’s Game

The game has changed.

In Monopoly, victory doesn’t go to the player with the most expensive hotels, but to the one with the smartest spread, steady traffic, and a strategy that keeps the game moving. The same holds in food retail. Success isn’t always about owning the most expensive real estate on the board. It’s about building places, online and offline, that people return to with trust, curiosity, and a sense of belonging.

The most valuable products today aren’t always the most expensive. They’re the ones that deliver meaning, value, and cultural relevance. Retailers and brands that recognize this aren’t chasing dominance by scale, they’re building ecosystems with clarity and purpose.

In this new era, the goal isn’t to win the shelf, it’s to play well. To design smarter. To include more. And to keep everyone in the game.

is Head of Corporate Global Affairs at Certified Origins, where he leads global communication strategies, stakeholder relations, and public outreach. With a deep commitment to food culture, innovation, and sustainability, he is a vocal ambassador for transparency and authenticity in the global food system. Whether representing Certified Origins at international forums or collaborating with public and private sectors, Giovanni champions initiatives that connect people to real food and support healthier choices.

Sources:

PLMA & Circana, Private Label 2024 Market Share Reports

· McKinsey, European Retail Reconfiguration, 2024

· eMarketer, U.S. Retail Closures & Openings Data, 2024

· Statista, Global Direct-to-Consumer Food Market Forecast (2021–2031)

· ButcherBox Company Reports, 2024

· Cortilia Annual Performance Review, 2024

· Netcomm, Italy e-Grocery Data, 2024

· Walmart Q2 2024 Earnings Call, Online Grocery Sales

· Amazon Grocery Strategy, 2023–2024 Updates

· NielsenIQ “2025 Global Outlook on Private Label & Branded Products”, 2025

· Carrefour Digital Roadmap, 2024

· Aeon x Ocado Partnership Updates, Japan Retail News, 2023–2024

· Alibaba Group (Freshippo/Hema) Annual Results, 2024

· Bain, Global Online Grocery Forecast to 2030

· McKinsey, Future of Online Food Retail in Europe, 2024

· Euromonitor, Online Grocery Trends Asia Pacific, 2023–2025

· Mercatus, U.S. Online Grocery Benchmark Reports

Giovanni Quaratesi

wolterke - stock.adobe.com

Private Brands on the Rise

THE DYNAMICS OF CHANGE

BY JIM WISNER, PRESIDENT WISNER MARKETING LLC

For several years now, the media has been filled with stories, many with clever titles like “Brands on the Run,” “End of the Big Brand Era,” and others, describing how large-scale Consumer Packaged Goods (CPGs) manufacturers are struggling and private brands* are becoming increasingly important to shoppers. Often, these stories imply that when the economy returns to “normal” (whatever that means), shoppers will return to their favorite brands of years gone by. No one should expect this to happen. Private brands have evolved to the point where the notion of a “golden age” is no longer adequate to describe what is taking place.

*also referred to as private label, store brands, retailer-owned brands, “generics”, and many other terms. FMI – the Food Industry Association – has adopted private brand as the preferred term for retailer-owned brands, better reflecting their destination status with today’s shoppers.

The State of the Game

Private brands are now growing at an accelerating rate and continuing to gain market share. In 2024, sales reached a record $270.6 billion and 20.7% market share. Growth was nearly four times the rate of national brands. In the first quarter of 2025, private brands grew at 5% versus only 0.8% for national brands, gaining market share at an even faster rate. This marked 30 straight months that private brands have outperformed national brands (PLMA/Circana). In the coming year, 48% of shoppers expect to make somewhat or much more private brand purchases than in the prior year, versus only 3% expecting to purchase less, continuing these growth trends into the future. By 2030, private brands are expected to reach over $400 billion in sales and a 24% share.¹

Why Have Private Brands Emerged?

Trial - Supply scarcity during the pandemic and rising prices during the recent inflationary period have led consumers to try many private brand items for the first time. The experience was a good one and has resulted in both repeat purchases and an increased willingness to explore additional items across many categories.

Quality - Not only has the quality of traditional national brand equivalent private brands continued to improve over the years, but the introduction of premium and better-for-you brands now offer shoppers a better-quality choice that is still typically offered at a savings from national brand counterparts. It is these brands that have become a gateway for shoppers trying private brands in a category for the first time.

Retailer Emphasis - Every major retailer has made growth of their own brand products a strategic priority for their company. Companies like Kroger are launching nearly a thousand new items each year. Most retailers have evolved from dedicating limited personnel for their private brand programs to hiring larger staffs with extensive branding and CPG experience. The reasons are clear. Private brand influence

on store selection and customer loyalty has grown dramatically. Today, 57% of shoppers say that their primary store’s private brands are a very or extremely important reason to shop there. Among younger shoppers the number is considerably higher.2

Innovation - During the pandemic, many manufacturers trimmed their product portfolios and deemphasized new product development. New items and new ideas are now disproportionately coming from retailers and private brand manufacturers. Nearly a third of all new products launched today are private brands, and only 26% of branded product introductions are new items rather than simple line extensions.³ Increasingly, what is new and interesting to the shopper is coming from the retailer’s private brand portfolio.

Premium and Better-for-You Products - While price and national brand equivalent items are still important, growth is being driven by products that do not fit the traditional private brand mold. Kroger’s clean label Simple Truth is now a $3 billion+ brand. New premium offerings, such as Frederik’s by Meijer offer shoppers a very elevated product experience that was previously only available in specialty and gourmet shops. Private brands are no longer just about price; they provide an everexpanding array of choices for the shopper.

Millennials and Gen Z - Younger generations, less influenced by the limited media that their parents grew up with, and with a much broader range of available items, can approach brand choices far more objectively.

Loyalties are now driven by performance (quality) and alignment with lifestyle values and dietary interests. Increasingly, private brands have taken the lead in addressing these consumer needs. Younger shoppers embrace private brands in far greater numbers than prior generations. Assumptions about quality no longer start with skeptical expectations but are formed by experience.

Private Brands Are Far More Profitable than Most Realize - It has long been understood that private brands typically bring higher gross margins and penny profit per unit than other brands on the shelf. But private brands also require a significantly lower relative inventory investment than their national brand counterparts. As a result, the return on invested capital is more than double for private brands (54.6%) than for mainstream national brands

(23.5%).⁴ Additionally, the notion of a residual effect suggests that shopper savings from private brands are available for the customer to spend on other items in the store, resulting in additional sales and gross margin for the retailer.

What to Expect Going Forward

For years, many national brand executives (and even some in the media) regarded private brands as one-dimensional, merely offering similar products at a lower price. They have now evolved from a price-driven alternative to a first choice for many consumers.

The emergence and accelerating growth of private brands is far more than a current trend and represents a fundamental shift in shopper and retailer dynamics. It is occurring across all consumer demographics and income segments.

This change is only in its early stages and will remain a key driver of retailer success in the future.

“The emergence and accelerating growth of private brands is far more than a current trend and represents a fundamental shift in shopper and retailer dynamics.”

1 NielsenIQ/AT Kearney. What’s Ahead for Shoppers and Private Brands. May 2024.

2 FMI. The Power of Private Brands 2025: Consumer Trends – From Stores to Homes.

3 Mintel. 2024 Global New Products Database.

4 FMI/Wisner Marketing. Private Brand management: A Shopper-centric Approach. 2020.

A Climate-Friendly EVOO Brand

Join us in our commitment to sustainability with ClimatePartner. Offset carbon emissions and reduce environmental impact without compromising on taste.

The Global Perspective

NAVIGATING GROWTH, REGULATION, AND REGIONALITY IN PRIVATE LABEL

BY MARIA DUBUC, PRESIDENT MBD

At MBD, we manage retailer and national brands locally and globally. This article examines the growth of private label in emerging markets, how regulations and labeling laws impact competition, as well as regional differences in the industry. We begin by highlighting two of our long-time client partners, PriceSmart and Smart & Final stores.

Growth in Emerging Markets

PriceSmart is a membership model, large format ‘club-style’ retailer largely in South and Central America. With warehouse club locations in emerging and developing markets that reach 12 countries and one U.S. territory, their private brand program is complex and unique.

The success is largely driven by great product selections, combined with strong brand equity and management across 13 countries.

While Member’s Selection brand has been in existence for quite some time, its recent growth in their emerging markets is impressive.

Consumers in all countries, and of all ages, are so interested in their brand, they are willing to join as members in order to gain access to their exclusive products. And when they do join, they keep coming back for more!

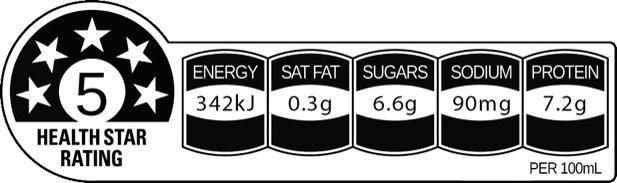

PriceSmart has always held a ‘one label fits all countries’ goal, labeling laws across countries recently came into play, creating regional differences which affect competition.

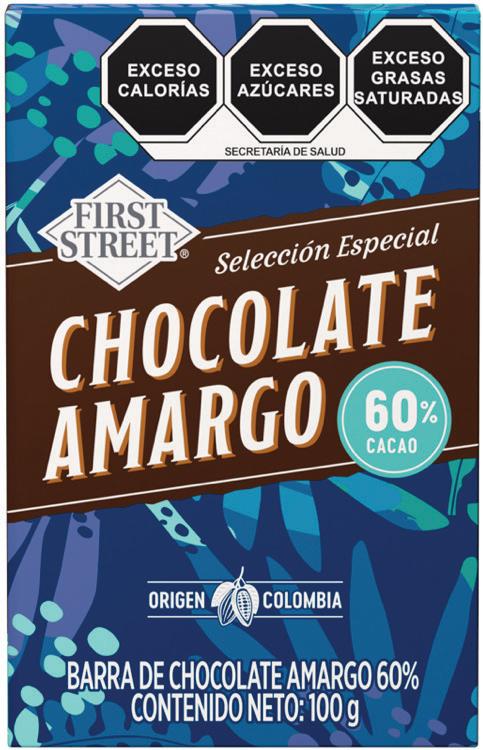

In 2023, Colombia mandated front-of-package nutrition labels on foods high in sodium, saturated fat, and added sugar. The law, known as Ley Comida Chatarra (Junk Food Law), was passed in July 2021, but the regulations and final label design were implemented in 2023. The implementation included an 18-month period for the industry to adjust.

As with other countries enforcing similar rules, they were hoping to expose these facts on the front of pack in an effort to reduce obesity and promote healthy eating.

In Colombia’s case, the graphic solution depicts quite large octagon shapes in the upper right area of the principal display panel of each package. With their ‘one label fits all’ policy, the only solution at this time is to add stickers to the package for Colombia.

For PriceSmart’s Member’s Selection brand, this has proven to be quite disruptive, diluting their

“Stickers often sit on top of the brand logo and cover up other important information on the front of pack.”

successful brand-forward approach. Stickers often sit on top of the brand logo and cover up other important information on the front of pack, in some cases the statement of identity. Furthermore, when it sits beside other brands on the shelf, it impedes the confidence of the shopper.

Since this is a fairly new mandate, and has only affected the Colombia market thus far, PriceSmart’s strategy is to continue with stickering before they adopt this new system across all countries. Should other countries follow suit, or the U.S. mandate their laws for front of pack labeling, a decision will have to be made as far as which country’s graphics will be used. And of course, if unique labels need to be created for each country, this will increase costs across the board.

Canada UK, Ecuador, South Korea, Peru

Spain, Belgium, Germany

Australia, New Zealand

Acquisitions and Regional Differences

Smart & Final stores were recently purchased by Chedraui Group Mexico, forming Chedraui USA. Chedraui USA also owns and operates El Super and Fiesta Mart banners in the U.S. Immediately upon acquisition, we began to consider strategy and opportunities for their brands across banners and locations. The centralizing of the brands made for better buying power, and leaned into the already built equity these brands carried in the southwest region of the country.

For example, El Super and Fiesta Mart began to leverage Smart & Final private brands, and vice versa. Design systems and color strategies were quickly developed. Decision trees were put into place to determine which brands’ look and feel will trump the other. Bilingual opportunities were put into play.

Soon after, Chedraui realized the benefit of a centralized agency model. MBD was able to help strategize and iterate quickly and efficiently to take advantage of the crosscountry and cross-banner opportunities. Smart & Final’s original foresight into a centralized program also contributed to the speed-to-market successes that followed. This led to the expansion of the MBD centralized model for Chedraui brands in Mexico. As a global agency, we were already familiar with the rules and regulations in Mexico, including NOM approvals.

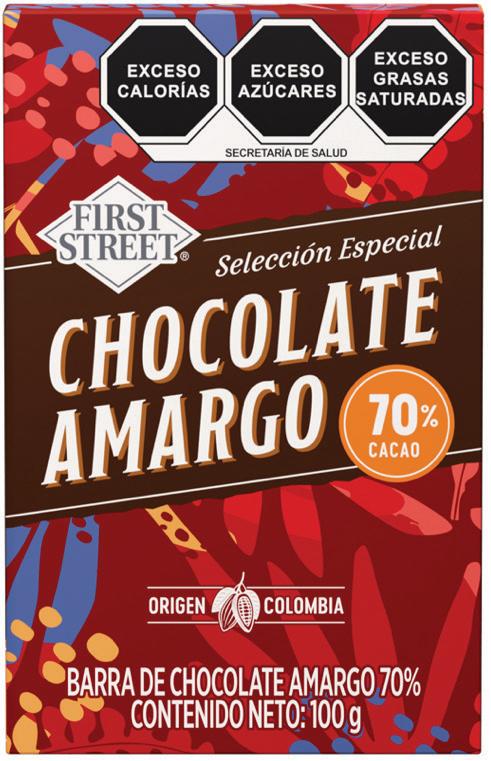

But here, once again, regulations came into play. Mexico also mandates a front-ofpackage warning label system with similar rules and graphic style to Colombia. Mexico officially began implementing this system in October 2020. The law was approved in October 2019 and amendments to the Official Mexican Standard (NOM-051) for pre-packaged food and drinks were approved in January 2020. The FOP system uses octagonal warning labels on products with high levels of sugar, saturated fats, trans fats, calories, and salt.

In this case, MBD was able to build the graphics into our design resulting in a much more pleasing package which invokes confidence from the consumer.

The brand mark was reduced in size, the logo and SOI dropped down on the package to allow space for the required size of the octagon, and a background pattern was used for interest and excitement.

Regionality Matters

Where countries like the UK, Australia and New Zealand have a similar model for their go-to market strategy for a given private brand program, in the U.S. we have regional differences that require retailers to take notice of the consumers in each region. This goes beyond state by state and often gets down to specific sections of a town or city based on the demographics in that area. Retailers who adapt and develop products and related packaging graphics for each region benefit from increased sales. Opportunities to communicate with consumers in their native language are important and meaningful. Customers respond with their purchasing dollars.

Furthermore, state by state regulations could really trip up those new to the industry and brand/package design. It is my recommendation to pay careful attention to where your product is sold and provide the shopper what they are looking for in that region, in that particular category, and in some cases right down to each product.

U.S. Regulatory Notables

As the co-chair on the FMI Private Brand Leadership Councils’ Technical Regulatory Packaging Compliance (TRPC) working group, my head is spinning with upcoming potential regulation changes. A few highlights are noted below.

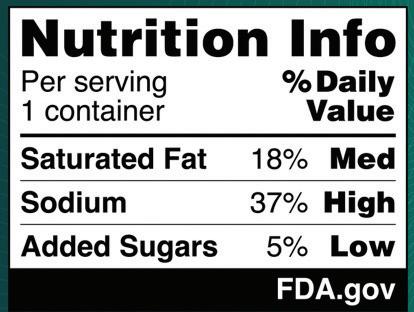

Front of pack nutritional requirements have been on the FDA’s radar for several years now and are up for consideration this year. If passed, the proposed graphic will be similar in size to the Nutrition Facts Panel and will sit in the top third of the front of the package of any products deemed high in saturated fat, sodium, and added sugar.

USA (proposed):

Top 3 Hot Topics Regarding Regulatory Initiatives:

FDA Front of Pack Nutrition Labeling | Awaiting Proposed Rule | Comments extended to 07/15/25 if finalized

FDA “Healthy” Claim | Federal Register 12/27/24 | Effective 04/28/25 | Compliance 02/25/28 | Final Rule

FDA Guidance for Industry: 1/6/25 Q&A Food Allergen Labeling (Edition 5)

In conclusion, regional differences and regulations have a major impact on competition across the globe. When embarking upon a new brand or product category, do your homework, know your consumer, understand the legalities across states. And with that you will be better suited to succeed in each market.

Maria Dubuc, president of MBD, is a creative and workflow expert in the retail landscape, Maria’s 30-year career translates branding experiences into eye-catching design that is unique and distinct for each client. She has created new private brands and redesigned / repositioned existing brands with leading retailers, while also implementing workflow management systems specifically tailored to the clients’ needs. Current clients include The Home Depot, Smart & Final, PetSmart, 7-Eleven, PriceSmart, BJ’s Wholesale Club, Sprouts Farmers Market, WinCo Foods, Natural Grocers and more.

Making Meaning in a Crowded Aisle

UNITED SODAS AND THE REAL WORK OF BUILDING A FOOD BRAND

BY MARIE JALLOT COLOMBEL, PASTRY COOK AND BAKER

It’s 2025. You are at the supermarket, looking to buy a simple pack of pasta for dinner. It should be an easy decision, however, you find yourself staring at dozens of options: different brands, shapes, promises, origin stories. Some claim to be a “family recipe,” while others highlight their protein content, or try to convince you that lentil pasta is just like regular pasta, but “better for you.” What should be a quick trip to the supermarket turns into a small yet impactful existential crisis.

This scenario plays out across nearly every aisle in the grocery store for every product.

The food and beverage segment is saturated with consumer-packaged goods (CPGs), each competing for shelf space and, more importantly, your attention. But what makes a brand stand out and ultimately succeed while many others fail?

An estimated 30,000 new CPGs (including both non-food and beverage items) launch in the U.S. each year. However, only around 15% make it to the two-year mark. In a landscape shaped by evolving food trends, shifting shopping habits, and relentless competition, how do new food and beverage start-ups stand out and carve their niche?

This article explores the journey of an emerging beverage brand, United Sodas, to understand what fuels their growth. The story offers insights into the strategies food entrepreneurs in New York City use to ensure they are among the few success stories.

United Sodas: How to Build a Beverage Company

United Sodas is a beverage company founded in Brooklyn, New York, and launched in May 2020 amid the pandemic as a direct-toconsumer brand. From the beginning, the brand had a clear goal: to redefine soda for the 21st century. During a discussion with Arielle Darr, head of B2B at the company, I got a glimpse into how they are developing a brand that is both culturally resonant and strategically disciplined.

United Sodas is a “better-for-you” soda company with 12 distinct flavors, from Pear Elderflower (my favorite) to Ginger Ale, all made with high-quality ingredients, no added chemicals or flavorings, and just 8 grams of organic cane sugar per can (compared to the 39 grams found in a traditional can of Coca-Cola).

“Building a brand is not just about having a great product and wishing for the best. It’s a marathon, not a sprint.”

The packaging aesthetic is just as fine-tuned as the formula: sleek, minimalist, matte cans in bold monochromatic colors that reflect the rainbow. The design, like the flavor profiles, speaks directly to the target consumers: affluent millennials willing to spend a few more dollars on a high-quality, premium beverage.

Talking with Darr, I got a sense that United Sodas is not pursuing fleeting wellness trends. They aim to withstand the test of time, just like Coca-Cola, but healthier and more flavorful.

Their growth playbook includes the following:

• A bold and flavorful product crafted for everyone, featuring high-quality ingredients.

• A minimal, yet eye-catching aesthetic that stops consumers in their tracks and stands out on crowded shelves.

• A digital-first launch that evolved into a thriving wholesale business with national reach across retail, food service, and independents.

• A thoughtful growth strategy rooted in testing, feedback, and close relationships with both retailers and consumers.

Finally, “Don’t chase hype,” Darr says. Building long-lasting value is key to growth. “Stay focused on what drives loyalty and cash flow, not just visibility,” she adds.

While the goal may seem deceptively simple, modernizing soda by building a healthier product for everyone, the effort put into creating a successful CPG brand has been strategic and exceptionally well done.

Since launching five years ago, United Sodas has continued to grow steadily. Their story illustrates that building a CPG brand requires not just time, energy and investment, but more importantly, intentionality, storytelling, and grit.

How to Stand Out and Stay In on the Shelf

Building a brand is not just about having a great product and wishing for the best. It’s a marathon, not a sprint.

Here are the pillars CPG food companies should focus on to stand the test of time:

1. Define core values and communicate them clearly.

What does your brand stand for? In a world of endless options, consumers aren’t just buying a product, they’re buying into a belief system. Whether it’s sustainability, cultural heritage,

or ingredient integrity, your values should guide everything from packaging to product development and social media.

2. Know your market.

Every entrepreneur should have a clearly defined target audience: individuals who embody the values of the product or service they offer.

Understanding this audience enables more direct, relevant and effective communication.

3. Differentiate or disappear.

In today’s crowded CPG landscape, every product must earn its shelf space. Whether through a distinctive ingredient blend, cultural relevance, or innovative packaging, the product’s value proposition must be immediately clear, and unforgettable.

4. Make storytelling strategic.

Great brands do not just sell products, they sell stories. From the founder’s background to the origin of ingredients, storytelling creates emotional bonds that drive purchasing decisions. Be consistent, intentional, and community-driven.

5. Fund growth wisely.

While most founders start by bootstrapping, scaling requires outside investment. Know when to raise money, how much to raise, and from whom.

Strategic capital can propel a brand from a farmer’s market booth to national retail shelves, as demonstrated by another beverage success story, Poppi.

Conclusions

Finally, as Darr says, “Scale intentionally. Focus on 1 or 2 regions and test the product. Refine your marketing and pricing. Once a strong presence is built in these regions, the company will be better positioned to expand nationally.”

Marie Jallot Colombel is a New York-based culinary creative. With a background in pastry, food studies, and food product development, she brings a multifaceted approach to storytelling that blends theoretical knowledge and hands-on experience. Marie is passionate about exploring the intersection of food, history, and and business.

Authentic Real Food for Spanish Food Lovers

From Extra Virgin Olive Oil to Almonds

Try the best flavors that Spain has to offer

“In

Mexico, private labels have moved far beyond their early image as lower-tier options. Today, they’re recognized for quality, reliability, and value.”

Think Like a Buyer, Act as a Developer

PRIVATE LABEL FOOD STRATEGIES THAT DELIVER RESULTS IN MEXICO

BY NORMA BRITO, GENERAL MANAGER CERTIFIED ORIGINS MEXICO

Private labels have evolved from being mere cost-effective alternatives to becoming strategic assets for retailers. In Mexico, this transformation is particularly significant, offering brands and manufacturers a unique opportunity to innovate and expand.

As someone who spent nearly two decades as a buyer, and now develops health-forward food products for private labels in Mexico and Asia, I’ve seen this transformation up close. This article draws on this dual perspective to offer a practical guide for manufacturers and retailers looking to thrive in Mexico’s evolving private label landscape.

The Mexican Food Retail Landscape: A Blend of Tradition and Modernity

Mexico’s food retail sector combines a unique blend of old and new. In 2023, total food retail sales reached $78.4 billion, with traditional markets accounting for 56.5% of the market share, catering primarily to lower and middleincome consumers. But modern retail formats (supermarkets, hypermarkets, and convenience chains) are expanding rapidly, fueled by urbanization and evolving consumer habits (USDA Foreign Agricultural Service).

Private Labels in Food: From Generic to Gourmet

In Mexico, private labels have moved far beyond their early image as lower-tier options. Today, they’re recognized for quality, reliability, and value, and in many cases, they’re outperforming national brands in growth. Retailers are expanding private label offerings beyond basic goods to include premium, organic, and health-forward products. In 2023,

private label products held approximately 28% of the market share in Mexico, making it one of the leading markets in Latin America. This growth is driven by consumers seeking costeffective options without compromising quality, especially amid economic uncertainties.

Key Players in the Mexican Food Retail Sector

Understanding the major retailers is crucial for private label success. Mexican consumers are increasingly open to private labels (PLs), particularly in food, household goods, and wellness categories.

Walmart:

Mexico’s market leader, Walmart blends smart product segmentation with supply chain strength. The company is also investing heavily in digital transformation and e-commerce innovation.

Costco:

A club-format retailer with few SKUs and deep supplier partnerships. Costco is trusted for its quality-value ratio and selective product curation.

Soriana/Chedraui:

These national chains are ramping up investment in store brands, often tying product development to regional preferences and consumer insights.

FEMSA Comercio (OXXO):

With over 20,000 convenience stores, OXXO has significantly contributed to private label growth across Latin America.

Think Like a Buyer: Insights for Food Manufacturers

From a buyer’s point of view, building successful food products for private labels means balancing performance, reliability, and consumer appeal.

Here are key elements to focus on:

Flavor First:

No matter how functional or innovative, a product that doesn’t taste good won’t last. In Mexico, taste is king, even in wellness categories.

Local Palate, Global Standards:

Combine authentic Mexican flavor profiles with high-quality ingredients and international certifications like USDA Organic, Non-GMO Project, or Halal.

Margin and Velocity:

Buyers look for products that offer strong margins and strong sales performance.

Differentiation:

Products that stand out for their health benefits, local sourcing, or innovation are far more likely to be picked up.

Consistency and Reliability:

A great product is only as good as its supply chain. Buyers value manufacturers who can deliver consistent quality and meet production timelines.

Strategic Partnerships:

Buyers seek long-term collaborations with manufacturers who can align with their brand vision and customer needs.

Act Like a Developer: Building a Successful Private Label Food Strategy

To develop effective private label food products that resonate, focus on:

• Consumer Insights: Base product decisions on real consumer data and emerging trends, not assumptions.

• Product Innovation: Create products that meet specific or growing consumer needs, such as health-conscious or environmentally friendly options.

• Packaging and Branding: Invest in appealing packaging that resonates with the target audience and communicates the product’s value.

• Regulatory Compliance: Ensure products meet all local regulations and standards, particularly in labeling and safety.

National vs. Imported Products: Navigating the Food Market

Understanding the dynamics between national and imported goods is crucial for sourcing and pricing strategies:

• Imports: In 2023, Mexico’s consumer goods imports were valued at approximately $158 billion, representing 26.13% of total imports (WITS).

• Trade Relations: Over 40% of Mexico’s total goods imports are from the United States, highlighting the importance of cross-border trade (United States Trade Representative).

• Tariffs and Regulations: Recent tariffs on low-cost imports from countries without free-trade agreements aim to protect local industries and may influence sourcing decisions.

From Transactional to Transformational Partnerships

Winning in Mexico’s private label food sector isn’t about shortterm wins, it’s about long-term collaboration. Success requires a dual mindset: think like a buyer to understand retail needs and act as a developer to create compelling products. By aligning with retailer strategies, prioritizing innovation, and staying attuned to market dynamics, companies can build private label offerings that truly connect with Mexican consumers.

Norma Brito leads Certified Origins’ team in Mexico and manages a key international account. With over 17 years of experience as a buyer across various categories, she now focuses on educating consumers about the health benefits of extra virgin olive oil and the Mediterranean diet. She actively promotes high-quality, healthy food products from the Mediterranean to global markets.

Photo by JCarlos VBrito - stock.adobe.co

The Label Story

INSIGHTS FROM MILAN AND CHICAGO’S SUPERMARKET SHELVES

BY SILVIA GARCIA GONZALEZ, BUSINESS DEVELOPMENT B2B FOOD, BEVERAGES AND FLAVORS AND SILVIA D’ALESIO, RESEARCH FELLOW, POLITECNICO DI MILANO

Two friends and food innovators - one in Chicago, the other in Milancome together on this page, literally and figuratively, to embark on a culinary adventure that starts with something as everyday as grocery shopping.

Our carts rarely carry an ordinary list, instead, they’re filled with foods for inspiration. This article explores labeling as a critical tool for both consumer information and product positioning. We examine innovative developments in label design, such as the use of icons and Nutri-Score, to analyze strategies adopted by private label and branded products, focusing on chocolate bars. Through a comparative lens between the EU and US food markets, we investigate how packaging informs consumers and helps position products, both on the shelf and in the mind.

Our research, centered on chocolate bars in Chicago and Milan, examines how private labels compete with brand loyalty in shaping purchasing decisions. We explore a range of attributes, including brand type, chocolate variety, health claims (like the nutrition traffic light system), and pricing.

Milan: Shopping Habits, and Empty Shelves

Our story begins with a seemingly ordinary Tuesday for Silvia D. as she navigates the vibrant aisles of a Milanese supermarket, a quick stop that unknowingly sets the stage for a transatlantic chocolate quest. Fast forward, and we find Silvia G. embarking on a similar expedition amidst the bustling shelves of a Chicago grocery store. Though separated by an ocean, both Silvias are on a parallel journey, a subtle hunt for that perfect chocolate bar, a quest not unlike Charlie Bucket’s pursuit of Willy Wonka’s golden ticket. And perhaps, just perhaps, the labels

they seek hold a little secret within their display - a playful nod to their shared moniker the Silvia’s Supermarket Scouters - a treasure waiting to be discovered, one delicious bite at a time. As Willy Wonka himself might say, “The suspense is terrible... I hope it will last!”

In Milan, preference for Italian manufacturer brands suggests that brand reputation and consumer quality perception play a crucial role in consumer decision-making for chocolate bars. Initial observations in major supermarkets in the city center (Carrefour and Esselunga) highlighted the intrinsic relationship between shelf placement and packaging labels.

Notably, the emptiest shelves often belong to branded chocolate bars, such as Perugina or Novi (see figure 1), indicating that brand image significantly influences purchasing behavior.

Figure 1. Spot the difference on the shelf: private label vs branded related to empty shelf (in green).

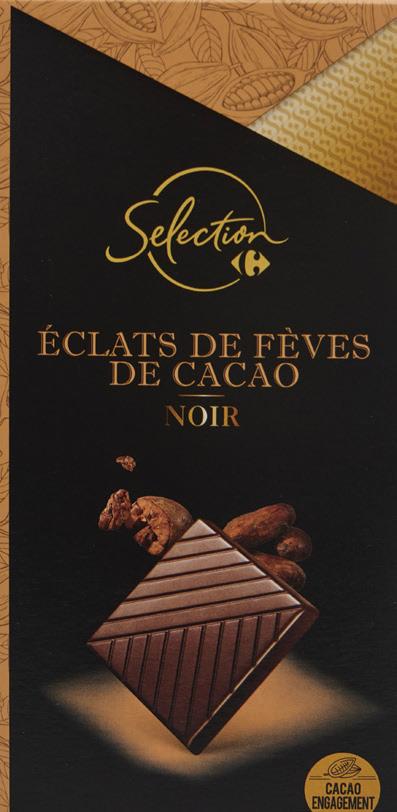

Another aspect we observed relates to chocolate type preferences. Milk chocolate received the most positive evaluation, followed by dark and then white chocolate, highlighting the importance of taste and familiarity in consumer choices. One noticeable detail is that color coding is consistent across both branded and private labels to indicate chocolate type: brown for dark chocolate, blue for milk chocolate, and white for white chocolate (see Figure 2-3).

Meanwhile, in the premium segment, dark chocolate bars are often distinguished by the percentage of cocoa displayed on the packaging. Here, both private label and branded products tend to use similar packaging formats, favoring a thin paper box over the traditional double foil that clings tightly to the bar (see Figure 4).

Packaging, Health Codes, Pricing and Perception Gaps

Attention to nutritional codes is more prominent in private labels, which tend to rely more heavily on the traffic light system. These products often feature simpler graphics, with fewer images and clearer lettering, in contrast to the more elaborate branded labels that emphasize visual richness through detailed imagery, fonts, and colors.

This may reveal a gap between health trends and consumer expectations for indulgent treats, indicating that while consumers may express interest in healthier options, taste ultimately remains paramount. This supports the common consumer intuition that “unhealthy = tasty” suggesting that indulgence is often prioritized over health claims and poor information labels.

Price sensitivity is another critical finding, especially in a market where chocolate is often perceived as an affordable luxury. The observed negative correlation between price and consumer utility underscores the need for manufacturers to strike a balance between quality and affordability in order to maintain customer interest Interestingly, higher prices do not necessarily lead to lower preferences, but lower prices do not have a positive impact on perceived utility either.

This suggests that in the Italian market, insights regarding brand loyalty and marketing strategies should be tailored to target consumers with higher expectations around chocolate quality, as they tend to exhibit stronger brand allegiance.

Figure 2 and 3. Color-coded chocolate labels Branded (Novi) vs private (Carrefour Classic).

Figure 4. A packaging paper box means something special or experience premium chocolate for both private and branded labels.

Shelf Strategy and the Branded Experience

To gain a deeper understanding of consumer behavior in the chocolate market, one area to explore is the dedicated monobrand shelf (such as that of Lindt), where the entire brand’s product portfolio is displayed (Figure 5). In this context, brand-specific attributes such as packaging can further enhance the appeal to consumers. Additionally, distribution channel strategies are crucial in increasing the visibility and desirability of branded labels in the chocolate market, especially when private labels are typically positioned adjacent to multiple competitors, diminishing their ability to stand out.

Regarding the perception of the Italian consumer, although the analysis remains based only on field observation data, it can be inferred that in Milan Supermarkets, the preference for manufacturer brands is driven by the perception of quality and reliability.

In addition, chocolate type (e.g., milk, dark, white) and taste play a key role in consumer choices. While private labels are gradually improving in terms of quality and price positioning, they still struggle to compete with established brands when it comes to loyalty and perceived quality.

In summary, private labels are gaining ground and offering a competitive alternative, but brands remain a crucial factor in consumers’ purchasing decisions, even in the chocolate category. Brand loyalty and quality perception continue to distinguish branded products from private labels, influencing consumers’ willingness to pay and shaping final purchase choices.

These results suggest that for Italian chocolate manufacturers and retailers, as well as for those in similar markets, prioritizing the sensory appeal of chocolate, particularly the taste associated with milk chocolate, may be more effective than emphasizing health-related claims such as sugar-free labels.

Additionally, since brand loyalty plays a significant role in purchase decisions, especially towards well-known manufacturer brands, investing in brand building and maintaining product quality consistent with consumer taste preferences will be crucial. Price sensitivity also remains important, indicating that competitive pricing strategies are key to retaining and attracting customers. Overall, a balanced approach, one that highlights taste, maintains brand strength, and considers price competitiveness, is likely to deliver the best results in terms of consumer acceptance and sales performance in the chocolate market.

Chicago: Vibrancy, Variety, and Visibility

On the other side of the ocean, in Chicago, Silvia G. found herself pondering the subtle nuances between her local grocery store (Whole Foods and Mariano’s in Downtown Chicago) and Silvia’s in Milan.

“It’s fascinating,” she mused, pausing by a towering display of shelves stacked with chocolate bars. Here, the sheer volume and bold, often vibrant colored packaging captures attention at first glance. Above all, it reveals a clear competition for brand awareness and consumer preference.

There is an emphasis on flavor, ingredient origins and sustainability across branded products. As Silvia G. stood before the seemingly endless rows of chocolate bars in the Chicago supermarket, she pulled out a small notebook and pen.

Figure 5. A world of chocolate, all in one place for a mono-brand shelf dedicated to showcasing the complete product portfolio.

With a thoughtful furrow in her brow, she began to jot down observations, her pen moving steadily as she mentally categorized and contrasted the various brands and displays. The composition of the shelves, the prominence of certain flavors, the packaging styles: each detail was meticulously recorded in her little black book, a personal inventory of the American chocolate landscape unfolding before her eyes.

When it comes to chocolate bars, most of the cocoa origins trace back to Europe (Belgium, Switzerland, Italy) although many are packed and distributed in the U.S., American and European brands lead. Shelf placement and product assortment vary between retailers, and this was no exception. There was a large variety of chocolate bar brands (15 at Whole Foods, 13 at Mariano’s), with Whole Foods opting for vertical placement (Figure 6), and Mariano’s (Figure 7) using a horizontal layout. This difference may influence the shopper’s experience and purchase behavior, particularly for first-time purchases.

Chocolate bars are a food category that uses packaging to communicate brand values and connect with shoppers and consumers. In terms of packaging design, there is a mix of plain and classic visuals versus disruptive packaging labeling with colors, designs, sealing formats, all of which help build brand identity and presence on the shelf (Figure 8). Recycle/sustainable packaging is also present, especially at Whole Foods.

Compared to the Milan market, color coded labeling to differentiate between dark and milk chocolate is less relevant. Instead, there is a greater emphasis on flavor variety, with some brands offering up to nine SKUs (Figure 9). Private labels are increasingly adopting this trend and becoming competitive in packaging, quality, and price versus branded chocolate bars. However, the offering is limited to basic flavors and cacao percentages only (Figure 10). More disruptive, small to medium sized local brands were found at Whole Foods, whereas Mariano’s carried more established international brands.

Figure 6. Vertical placement in Whole Foods.

Figure 7. Mariano’s Supermarket.

Figure 8. Creative packaging variety in chocolate bars.

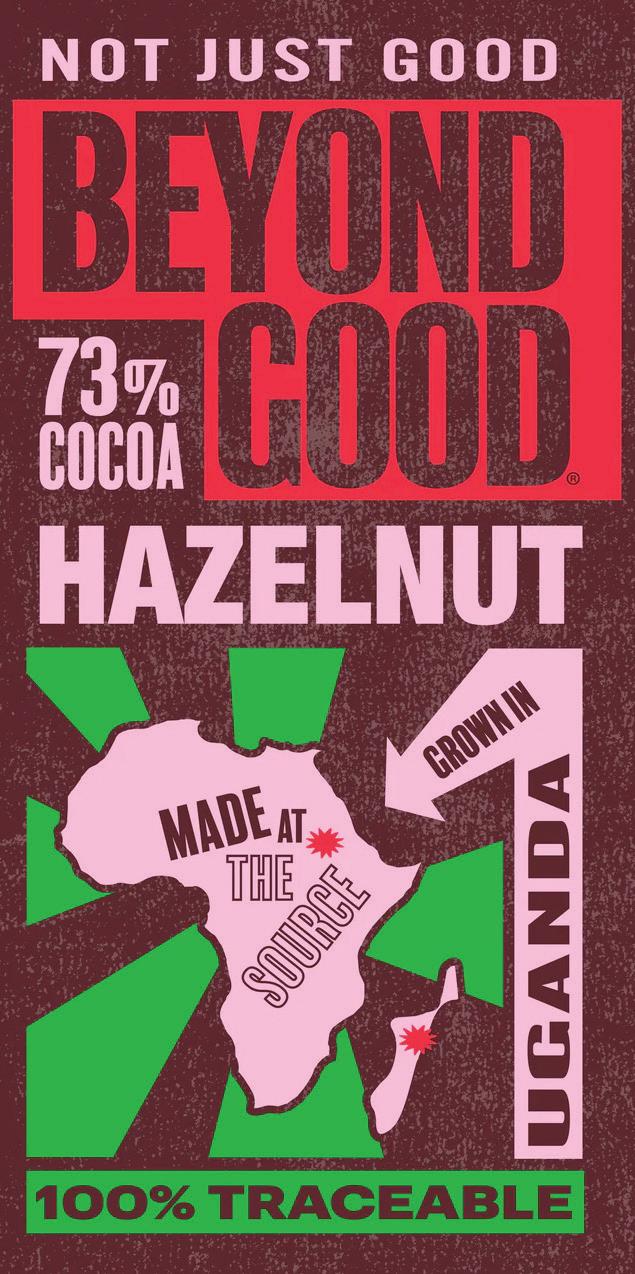

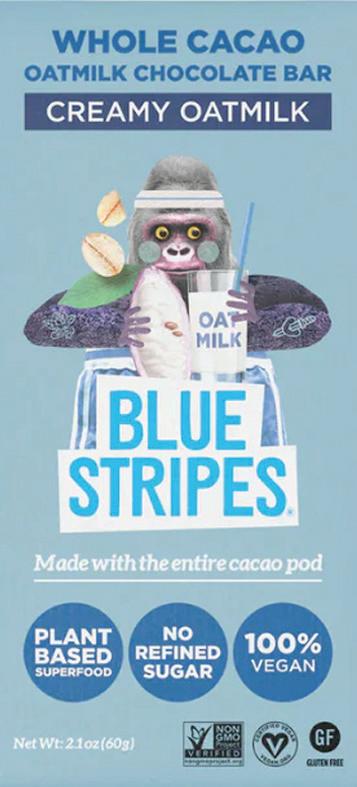

Claims are an essential part of brand identity and product positioning. For nutritional labeling, sugar content ranks first, followed by fat content. Some brands emphasize the type of sugar or sweetener used, as well as the type of oils. Overall, the most prominent claims beyond nutritional value relate to cocoa percentage, fair trade, and sustainability. Figures 8 and 11 show examples of brands using these claims as part of their identity.

While both supermarkets offered a diverse range of chocolate, the Chicago stores appeared to prioritize mass-market appeal and value, with a noticeable presence of familiar, widely advertised brands. In contrast, the Milanese supermarket seemed to offer a potentially more curated selection, possibly with a greater emphasis on artisanal or European brands, and a different approach to shelf organization and presentation. The initial observations suggest that cultural differences in consumption and retail strategies are subtly yet distinctly reflected in the chocolate aisles of these two supermarket chains across continents.

Findings: American vs European

In conclusion, both American and European brands dominate the shelves. Packaging typically uses traditional paper with visual branding, but there is no color labeling to distinguish between dark and milk chocolate. Whole Foods notably features more recyclable and sustainable packaging. The two supermarkets share many brands, but Whole Foods offers a greater variety of small and medium local brands, while Mariano’s focuses more on well-established international brands. Both supermarkets highlight claims like non-GMO, fair trade, gluten-free, and organic attributes.

Branded bars often include claims such as “100% vegan,” “no refined sugar,” “plant-based superfood,” “women owned,” and “carbon neutral.” Some brands emphasize cocoa origin as distinct from manufacturing location, reflecting a trend toward transparency and ethical sourcing.

Packaging plays a crucial role in brand identity and consumer connection. While traditional paper packaging with brand visuals is common, sustainable or recyclable packaging is more prominent at Whole Foods. There is a notable absence of color coding to differentiate dark and milk chocolate. Claims on packaging emphasize nutritional aspects such as sugar content, type of sweeteners, oils, percentage of cocoa, fair trade, and sustainability. Whole Foods tends to combine classic and disruptive packaging designs, enhancing shelf presence.

Figure 10. Private label 365 Whole Foods – Milk and dark chocolate.

Figure 9. Wide flavor options in chocolate bars.

“Packaging plays a crucial role in brand identity and consumer connection.”

Conclusions

Comparative analysis of branded and private label chocolate labels shows that consumers lean toward a preference for branded products over private label products. However, private labels are joining the race to become more competitive in packaging, quality and price compared to branded chocolate bars.

Based on the shelf displacement in both cities, Milan shows a strong connection to tradition and brand loyalty, more intensely toward manufacturers’ brands than private labels, unlike in Chicago. Perhaps this is because consumers tend to perceive branded products as being of higher quality and show a greater willingness to pay a higher price for these products than for private labels. Particularly in the case of chocolate, affective value and trust in the brand play an important role in purchasing choices.

In Chicago, small-medium and emerging brands are gaining shelf space, competing with large manufacturers and private labels, and giving options to the consumers to connect with the brand beyond flavor.

And so, much like Charlie Bucket’s wondrous exploration within the labyrinthine halls of Willy Wonka’s factory, Silvia G.’s and Silvia D.’s separate supermarket visits culminated in a fascinating discovery: not of a golden ticket, but of the diverse and telling labels adorning chocolate bars across continents. Their initial scouting expeditions have unearthed a wealth of insights, offering numerous avenues for reflection and potential evolution in the way chocolate bar shelves are conceived and presented within large-scale retail environments.

From packaging nuances to brand prominence and the overall shopping experience, the journey through these seemingly ordinary aisles has laid the groundwork for a deeper understanding of consumer behavior and the art of chocolate merchandising.

Silvia Garcia is an enthusiastic senior professional with 14 years of international experience in B2B commercial functions in F&B ingredients across USA, Canada, and Mexico. She has led more than 20 innovation projects and regional product launches, including marketing and business development strategies with successful sales. She holds a degree in Food Industry Engineering (ITESM Monterrey/Guelph University) and MSc in Food Innovation and Product Design (Erasmus Mundus).

Silvia D’Alesio is a specialist in bridging research, innovation, and technology transfer in Food Tech and Packaging Design, with nearly a decade of experience. She holds a degree in Food Science and Technology (UNINA, Federico II) and an International Master’s in Food Innovation and Product Design (FIPDes.eu). She teaches experimental design at UNIMI, lectures on Eco Design at NABA, and was recently a research fellow at POLIMI. Her work, including with the Digital Food Ecosystem, focuses on coordinating research and innovation projects across universities, companies, and startups.

Branding Authenticity

STRATEGIES FROM THE TOSCANO PGI EXTRA VIRGIN OLIVE OIL CONSORTIUM

BY CHRISTIAN SBARDELLA, MARKETING AND COMMUNICATIONS DIRECTOR, TOSCANO PGI EVOO CONSORTIUM

In an era when consumers increasingly want to know not just what they’re buying but where it comes from, Tuscany has emerged as a model for transforming agricultural heritage into market power. At the heart of this success is the Toscano PGI Extra Virgin Olive Oil Consortium, a regional organization with the mission to protect the authenticity of Tuscan olive oil while positioning it as a global symbol of quality, culture, and traceability.

Understanding Toscano PGI Extra Virgin Olive Oil

But what does PGI mean? PGI stands for Protected Geographical Indication, a European certification that ensures a product is closely tied to a specific geographic area and produced according to defined standards. For Toscano PGI Extra Virgin Olive Oil (EVOO), this means that every stage of production, from harvesting to pressing to bottling, must take place entirely within Tuscany. The result is an oil that is not only traceable and certified but also deeply connected to its place of origin.

Established in 1997, the Consortium plays a key role in Tuscany’s agricultural economy. The Toscano Protected Geographical Indication (PGI) was officially recognized in 1998, and today nearly 8,000 members across the entire region represent every part of the supply chain: producers, mills, and bottlers.

Tuscany, though small in size, is a major force in Italy’s olive oil sector.

The Consortium includes:

• Over 20% of Tuscany’s 36,000 olive oil producers.

• Around 60% of the region’s olive mills.

• 15-20% of Tuscany’s total olive oil production.

While annual production varies with harvest conditions, these figures have remained steady over time, reflecting the strength of the Consortium’s control system in making the certified portion a trusted reference point for quality, safety, and origin.

By comparison, California, the largest olive oil-producing state in the U.S., has around 40,000 acres of olive groves and 400 producers, much of which is concentrated in the Central Valley. Tuscany’s figures demonstrate how deeply olive oil production is embedded in its culture, economy, and regional identity, with thousands of small producers contributing to a certified, high-value product.

Oversight and Protection

The PGI certification lies at the heart of the Consortium’s activities. Operating under the supervision of Italy’s Ministry of Agriculture, Food Sovereignty and Forests, responsibilities include the protection, monitoring and promotion of the Toscano PGI EVOO designation.

This means monitoring and reporting any misuse of the “Tuscan” name: whether imitation, misrepresentation, or unauthorized use, particularly in markets outside the European Union, where PGI labels lack recognition and are less regulated.

These actions are fundamental in protecting producers, supporting the integrity of the product, and giving consumers confidence in what they are purchasing.

At the same time, the Consortium, working closely with its member network, helps protect and maintain the Tuscan landscape, an essential part of what makes this product distinctive.

Promotion: From Everyday Product to Specialty

Olive oil is often seen as a commodity, with many products competing on price. The Consortium’s strategy focuses on helping Toscano PGI EVOO stand out as a specialty product, known not only for its high quality, but also for its connection

to Tuscan culture, lifestyle, and wellbeing. Marketing activities focus largely on consumers, supported by selective trade initiatives. These include:

• Advertising campaigns across digital and print channels.

• Strategic placement in culinary, lifestyle and wellness outlets.

• Sporting event sponsorships to emphasize health benefits.

All these efforts aim to position Toscano PGI EVOO as a product with both tangible qualities, like traceability and certification, and intangible ones, such as cultural significance and connection to the Tuscan landscape and way of life.

Transparency and Trust

The Consortium ensures 100% Tuscan origin and full traceability throughout the supply chain.

Since 2003, in fact, the Consortium has offered a traceability tool on its website, www.olitoscanoigp.it, where consumers can enter a code from the bottle and learn about its full journey, from grower to bottler. This system helps consumers make informed choices and strengthens trust in the product.

The Tuscan Model:

• Clear, enforced standards for origin and quality.

• Strong institutional support for protecting the designation.

• Strategic communication and marketing focused on culture and lifestyle, not just product attributes.

• Investment in transparency to build long-term consumer trust.

International Reach

Toscano PGI EVOO is well-regarded in global markets, with especially strong demand in countries outside the European Union, including the United States and Canada, followed by markets in Germany and Northern Europe.

The product’s appeal is deeply connected to the strength of the “Tuscany” brand: a name that carries environmental beauty, history, culture, and craftsmanship. Each bottle of Toscano PGI EVOO represents this connection to place and heritage, offering something unique that can’t be replicated elsewhere.

“Tuscany’s figures demonstrate how deeply olive oil production is embedded in its culture, economy, and regional identity.”

Christian Sbardella is Marketing and Communications Director of the Toscano PGI Extra Virgin Olive Oil Consortium. He oversees all promotional activities and works with the Board of Directors to shape the Consortium’s brand strategy. Alongside his professional work, he teaches at university master’s programs and professional schools, sharing his knowledge and passion for olive oil. Since 2008, he has been a certified professional olive oil taster, registered in Italy’s national list recognized by the Ministry of Agriculture.

Beyond Private Labels

HOW AUTHENTIC BRANDS LIKE SEGGIANO

THRIVE IN A STORE-BRAND ERA

BY WINETTE WINSTON, CEO ORIGIN BRANDS AND CATALAN GOURMET

A Changing Retail Landscape

Private label products have experienced remarkable growth in recent years. In Europe, they now account for nearly 40% of grocery sales, and in some countries like Switzerland, exceed 50%. In North America, private label grocery sales saw nearly 4% yearover-year growth in 2024, outpacing many national brands. Retailers are investing more in their own brands, not just for margin advantages, but because consumers are becoming more confident in their quality.

This shift raises a critical question for premium food brands: when supermarkets devote more shelf space to their ownlabel organic pastas or extra virgin olive oils, how do independent brands continue to justify their place?

In my experience leading Seggiano, I believe the answer is simple: by staying radically committed to what makes us different.

“This approach isn’t about nostalgia, it reflects a rooted belief that customers still care about where their food comes from.”

Lessons from Tuscany: Why Place Still Matters

Seggiano was born in the heart of Tuscany. What began as a small-scale olive oil operation rooted in the traditions of a single region has grown into a full range of authentic Italian foods, now available in over 20 countries. Though our portfolio has expanded, our focus remains clear: collaborate only with specialists who value tradition, quality ingredients, and transparency.

This approach isn’t about nostalgia, it reflects a rooted belief that customers still care about where their food comes from. Many of our collaborators are multigenerational family businesses. They’re not chosen because they’re efficient, but because they’re experts.

The name Seggiano comes from the hilltop village near Monte Amiata that inspired our first product: a robust, single-origin extra virgin olive oil made from the Olivastra Seggianese olive, unique to that microregion. That origin story continues to define us. Over time, our range expanded to include artisan pasta, sauces, vinegars, antipasti, and vegan pestos, each chosen for its integrity, provenance, and taste.

What Sets a Brand Apart in a World of “Good Enough”?

Retailers have raised the bar on private labels, introducing sleek packaging, chef-style messaging, and regionally inspired stories that echo those of premium producers. So where does that leave independent brands like Seggiano, and what sets us apart?

1. Traceable origins you can trust.

Each product in our range is rooted in a specific place and made by someone we’ve worked with over time. Our Lunaio Extra Virgin Olive Oil, for example, comes from organic groves in Tuscany, pressed within hours of harvest. Our pastas are made with high-quality Italian durum wheat, bronze-die cut, and slow-dried for superior texture. These are details driven by producers, not just product development.

2. Products with soul, not spin.

Where private labels often aim to mimic, we aim to maintain. We don’t make “Italian-style” food, we source from Italians making food they themselves would proudly serve. That distinction is cultural, not cosmetic.

3. Relentless consistency.

Whether you’re buying our passata in London or Los Angeles, the product inside reflects the same uncompromising standards, season after season. That kind of consistency, across small-batch producers, doesn’t happen by accident. It takes deep relationships, ongoing collaboration, and a refusal to cut corners.

Choosing Channels With Intention

One of the most important decisions a premium brand can make is where to show up. For us, growth doesn’t mean being everywhere, whether that’s a fine foods shop in the UK, a gourmet grocer in the Netherlands, or Whole

Foods Market in the U.S. These stores aren’t just points of sale, they’re trusted curators. In these contexts, shoppers aren’t just looking for affordability, they’re seeking something with character and context. That’s where premium brands grounded in authenticity can thrive.

We’ve also learned to be cautious with promotions. While price competition is tempting, especially when private labels sit on the same shelf, we’ve found that discounting can dilute perception. Instead, our energy goes toward clear storytelling, educational materials, and packaging that invites curiosity rather than making claims.

Educate, Don’t Imitate

Perhaps the most valuable tool a brand has in today’s market is not just their product, it’s perspective.

Have a story? Tell it.

Whether through packaging, website, or in-store tastings, we’re constantly inviting customers behind the curtain. Want to know where your olive oil comes from? We’ll show you the grove. Curious why our pesto tastes fresher? It’s raw, never pasteurized.

Provenance and process are the new luxury. Today’s shopper wants to know more than just whether a product is organic. They want to know: Who made it? How? And why should I care?

They should not only understand what they’re buying, but why it matters.

When you meet that desire for knowledge with honesty, customers don’t just buy, they believe. That belief builds loyalty stronger than any points program or promotion ever could.

Looking Ahead:

Slower, Smarter, Stronger

Private label is not a temporary shift, it’s a structural change. But the same tools that have made it successful - efficiency, scale, smart positioningdon’t negate the relevance of independent brands.

At Seggiano, we’re not trying to outpace private labels. We’re trying to go deeper in the direction we’ve always followed. That means:

• Remaining faithful to producer relationships.

• Going slow when everyone else speeds up, prioritizing product integrity over speed to market.

• Pursuing innovation that enhances, rather than replaces, tradition.

• Focusing on flavor, transparency, and trust, not trends.

Premium brands can thrive in the future of food retail, but not by being louder or bigger. Only by being clearer, truer, and more deliberate. The shelves may be more crowded, but distinction still matters. Especially when it’s earned.

Winette Winston is CEO of Origin Brands, owner of Seggiano, Bellucci & Lunaio brands as well as Catalan Gourmet, a Spanish gourmet foods importer. She leads thoughtful M&A, team integration, and sustainable commercial growth across the UK, US, and EU. Since joining Seggiano USA in 2015, she has guided the consolidation of multiple artisan food businesses into a unified portfolio. With 20+ years in food and consumer goods, Winette is known for building high-performing teams, scaling mission-driven brands, and growing with integrity and purpose.

“Fair Trade USA understands that farmers, workers, and fishers know their communities best and possess unique knowedge on how to protect local ecosystems.”

Fair Trade, Smart Play

STRATEGIC RETAIL WINS IN A GLOBAL MARKET

BY FAIR TRADE USA™

Fair Trade USA is the leading third-party certifier of fair trade products in North America. Partners who bring Trade Certified™ products to market commit to meeting rigorous supply chain standards in ethics and sustainability. Standards at certified farms, factories, and fisheries include fair pay for all workers, safe working conditions, strong environmental safeguards, and distribution of Community Development Funds that support worker-led projects.

Founded in 1998 as a response to the struggles of coffee farmers in Nicaragua, the organization has since expanded standards to more than 30 product categories. Fair Trade Certified products span across diverse industries including produce, coffee, tea, packaged goods, seafood, personal care, clothing, and more. The impact of certification among farmers and workers is significant and often generational, with many using Community Development Funds to increase healthcare access, expand education, and create opportunities for economic growth. Empowerment is at the core of the mission. Fair Trade USA understands that farmers, workers, and fishers know their communities best and possess unique knowledge on how to protect local ecosystems.

Brands and retailers who source and offer Fair Trade Certified products are improving livelihoods and building sustainable supply chains while also appealing to increasing consumer demand for ethical and sustainable business practices. Both retailers and brand partners have seen increased sales, consumer loyalty, and brand awareness while doing better for planet and people.

Better Supply Chains Mean Better Business

Today more than ever, consumers are expecting brands and retailers to take accountability for their social and environmental impact. Consumers are also increasingly fluent in identifying values-aligned brands and telling the difference between real commitments and greenwashing. Fair Trade Certification is a trusted label that demonstrates a commitment to creating better livelihoods, protecting the environment, and an investment in a sustainable future. When retailers put Fair Trade Certified products on their shelves, more consumers are given the opportunity to support supply chains that prioritize workers, help eliminate child labor, and put capital back into the hands of producers.

Fair Trade Certified farms and factories come with incredible stories of impact from workers who are experts in their fields, and who have used Community Development Funds to improve the lives of their families and peers. When retailers and brand partners share these stories, consumers see the real people behind the product, building trust while showing how certification makes a difference.

NatureSweet, a produce brand available at retailers like Whole Foods, Kroger, and Walmart, features a QR code on its Fair Trade Certified tomatoes, allowing shoppers to scan and discover real stories from associates working in their greenhouses. Similarly, Barissimo, Aldi’s tea and coffee brand, highlights its commitment to Fair Trade by printing certification details and the values behind them directly on its packaging.

Retailers have also seen success when providing clear signage, grouping certified products, and preparing employees to be knowledgeable about Fair Trade Certified for questions from shoppers. Certification, especially when it is clearly displayed on packaging and marketing materials, opens lines of communication between brands, retailers, and consumers. It shares the values behind products and makes it easy to differentiate between items that are truly driving impact, and brands who may be greenwashing.

Consumers are Choosing Ethical, Sustainable Brands

A recent study by McKinsey revealed that 73% of Gen Z shoppers report that they choose to purchase from brands they consider ethical, while nine out of ten believe that companies have a responsibility to address environmental and social issues. A PwC study from 2024 also shares that not only are consumers prioritizing brands with strong values, but many say they are willing to spend 9.7% more, on average, for sustainably produced or sourced goods.

These numbers are telling, and speak to an increasing demand for more product options that prioritize the planet and people. As this demand grows, Fair Trade USA continues to stand out as one of the most recognized and trusted labels in the market. While Fair Trade has been a trusted presence in retail for decades, its visibility and consumer recognition has grown significantly in recent years. Due to long-held consumer trust, brands partnering with Fair Trade USA - and retailers who carry their products - are resonating across broad demographics and establishing loyal customers.

Retailers Doing It Right

A wide and diverse array of retailers carry Fair Trade Certified products, all with different consumer bases. Walmart, the largest retailer in the world, offers certified products under both private label and branded products. This shows a commitment to the Fair Trade mission and acknowledges the growing demand for more sustainable and ethical products on shelves.

Many e-commerce retailers choose to add social and environmental certifications to their product search filters, making it easy for shoppers to browse for the products that align with their values. Thrive Market includes a Fair Trade Certified section on their site, while Amazon highlights certified items through its ‘Climate Pledge Friendly’ program.