Your secret sauce for private brand success

Global Tissue Group’s commitment to keeping products in stock and on the shelf helps retailers turn everyday paper goods into trusted, high-performing brands.

With U.S. manufacturing and custom solutions, we keep your stores supplied— and your customers satisfied.

Let’s unlock your aisle’s potential.

And the Beat Goes On

In today’s unnervingly volatile global economy, the private-label sector is emerging as a beacon of resilience. As global supply chains buckle under the weight of escalating tariffs, political upheaval, and consumer anxiety, store brands are finding themselves, once again, in a sweet spot.

Tariff regimes imposed by the U.S. and reciprocated by trade partners are squeezing margin buffers across the fast-moving consumer goods (FMCG) landscape. Raw-material costs are rising, logistics are more fraught, and importers can no longer assume stable duty-free flows. The de minimis rule’s suspension for low-value parcels from China, for example, has disrupted ultra-fast fashion’s favored channel into the U.S.—a shockwave felt not only by platforms like Shein and Temu but by the entire apparel ecosystem. Meanwhile, retailers are seeing gross margins shrink by 1–5 percent and reporting sales decline globally.

Yet it is in this pressure cooker that private labels are finding an unexpected advantage. Inflationary pressures and tariff-driven cost shocks are forcing consumers to trade down—more of them are demanding value without compromising quality. Nearly half of U.S. shoppers now aim for private-label alternatives expressly to manage rising costs. Retailers are responding not with generic price cuts but with elevated private-label assortments—cleaner, better-designed, even premium-positioned. (As seen in the Vertex section of this issue)

Investment in private-label production also appears more robust than might be expected. The food and beverage segments, in particular, are viewed as stable bets by investors—even during volatility—thanks to steady consumer demand and relatively predictable input needs compared to more capital-intensive industries.

Political instability and macroeconomic turbulence add texture and risk. Retail giants like Primark warn that consumer sentiment is softening in Europe amid concerns around tax, jobs, and political volatility.

What’s clear is that the private-label industry is now navigating a complex trade-off: benefit from demand shifts and consumer willingness to embrace store brands, while managing input, logistics, and tariff risk. Success will depend on supply-chain agility: localized sourcing, tighter inventory control, flexible multisource networks, and transparency to consumers. For many retailers, private labels are not just a defensive play—but the blueprint for competitive advantage in a fragmented global market.

Phillip Russo Founder / Editor phillip@globalretailmag.com

www.linkedin.com/in/phillip-russo-b5a85a1

With their crispy crust, golden-yellow texture, and exceptional flavor, our breads will elevate your bakery’s performance to new heights. Bring the taste of Italy to your customers with our fine breads, made with durum wheat semolina, mother yeast, and natural fermentation.

Contact us today to learn more: gourmetbreads@oropan.it

PRIVATE LABEL TRADE SHOW

16-18, 2025 NOVEMBER I CHICAGO

Thousands of Great Store Brands Under One Roof

The strategic importance of store brands is widely recognized by the media, the financial community and, most importantly, by the C-suite of retailers across all formats.

PLMA’s “Store Brands Marketplace” will offer a world-class venue for commerce, concepts and connections. A million square feet of exhibit space devoted to over 35,000 food and nonfood products for every consumer life stage and lifestyle, 3,100 booths, and 2,000 experienced suppliers from 65 countries. Special sections for Wine & Spirits and Self Care & Wellness will also be featured.

Registration is now open for retailers and visitors.

For more information and to register for the Show, visit storebrandsmarketplace.com.

Where Retailers Suppliers Meet &

Phillip Russo EDITOR / PUBLISHER phillip@globalretailmag.com

Jacco van Laar BRAND AMBASSADOR jacco@globalretailmag.com

Melissa Subatch CREATIVE DIRECTOR info@melissasubatchdesign.com

Andrew Quinn DIGITAL DIRECTOR andrew.quinniii@gmail.com

Luisa Colombo EUROPEAN DIRECTOR luisa@globalretailmag.com

Ana Maria Jimenez Aguilar BUSINESS DEVELOPMENT ana@globalretailmag.com

Sabine Geissler GREENTASTE.IT Italian Business Development s.geissler@greentaste.it

CONTRIBUTORS

Perry Seelert Emerge perry@emergefromthepack.com

Christopher Durham Velocity Institure cdurham@retailbrandsinstitute.org

Maria Dubuc

Marketing By Design mdubuc@mbdesign.com

Hans Kraak Kraak Media kraakmedia@gmail.com

Elena Sullivan sullivan.elena@gmail.com

Tom Prendergast PLMA tprendergast@plma.com

Koen A. M. De Jong IPLC kdejong@iplc-europe.com

Published, Trademarked and all rights reserved by: Kent Media

Phillip Russo, Principal 225 1st Ave N. / Unit 3501 St. Petersburg, FL 33701 Tel. +1 917 743 6711

Global Retail Brands is published 4 times

Editorial

Advertising

The top of the range among kitchen rolls!

This is Tutto Pannocarta, the only one with a triple integrated function: cloth, sponge, paper. Each individual sheet can be washed, wrung out and reused numerous times. The secret of this product lies in Airlaid technology, which makes it possible to obtain a paper with a thick and consistent texture, very similar to fabric, but with the properties and versatility of paper. Tutto Pannocarta, the technological paper rolls.

Find out more on tuttoxtutto.it

Lucart S.p.A. Via Ciarpi, 77 - Porcari (LU) ITALIA

LUISA COLOMBO

Luisa is an International Sales specialist with over 30 years of experience in the development organization and sales of products and services in an international environment. She has acquired extensive skills in promotion and advertising for the private label sector. Expert in the development of innovative sectors and products. For Global Retail Brands she shares the working group with Ms. Ana Maria Jimenez.

JILL DEARING

Jill Dearing, founder & CEO of Dearing & Company, leverages her extensive experience in the grocery, food, and private brand industries to drive innovative solutions and strategic transformations. She can be reached via email at jdearing@dearingco.com or visit www.dearingco.com.

KOEN DE JONG

Koen has extensive management experience in the private label manufacturing industry in Germany, France, the United Kingdom and the Netherlands. He has been involved in numerous M&A transactions in the Benelux. His private label strategy and business planning involvement includes company analysis and benchmarking, board consulting and the participation in supervisory boards. He speaks fluent English, German, French and Dutch (mother tongue).

MARIA DUBUC

President of MBD, is a creative and workflow expert in the retail landscape, Maria’s 30-year career translates branding experiences into eye-catching design that is unique and distinct for each client. She has created new private brands and redesigned/repositioned existing brands with leading retailers, while also implementing workflow management systems specifically tailored to the clients’ needs. Current clients include The Home Depot, Smart & Final, PetSmart, 7-Eleven, PriceSmart, BJ’s Wholesale Club, Sprouts Farmers Market, WinCo Foods, Natural Grocers and more.

CHRISTOPHER DURHAM

President of the Velocity Institute.

Prior to this he founded the groundbreaking site My Private Brand. He is the co-founder of The Vertex Awards. He began his retail career building brands at Food Lion and Lowe’s Home Improvement. Durham has worked with retailers around the world, including Albertsons, Family Dollar, Petco, Staples, Office Depot, Best Buy, Metro Canada. Durham has published seven definitive books on private brands, including Fifty2: The My Private Brand Project and Vanguard: Vintage Originals.

EUGENE GERDEN

is a freelance writer who writes on a wide range of international topics, from commerce to chemistry and from wine to aviation. He has contributed to many publications, including Decanter, International Aviation News, Chemistry World and The Journal of Commerce. For Decanter, he has covered several stories on wine markets and production in Russia, Georgia and Bulgaria. gerden.eug@gmail.com

REBECCA HAMILTON

Rebecca is the CEO of award-winning Fish Agency and sister agency Whitespace Brands Inc. With over 30 years of experience, she has established herself as one of North America’s leaders in the fields of strategic branding, retail design, and communications for clients in the retail sector. Under Rebecca’s oversight, the Fish Agency brings brands to life at retail and has consistently delivered high ROI-generating retail experiences for its clients. She mentors and leads highly experienced and integrated teams that provide store design, package design for CPG and private brands, digital/social initiatives, “phygital” experiences, and advertising services.

HANS KRAAK

Hans Kraak is educated in biology and journalism and wrote three books about nutrition and health. He worked for the Dutch ministry of Agriculture, Nature and Food quality and the Netherlands Nutrition Centre. As editor in chief he publishes in the Dutch Magazine for Nutrition and Dietetics, as a food and wine writer he published in Meininger’s Wine Business International and reports for PLMA Live EU and PLMA USA.

PERRY SEELERT

A retail branding and marketing expert, with a passion for challenging conventional strategy and truths. Perry is the Strategic Partner and Co-founder of Emerge, a strategic marketing consultancy dedicated to helping Retailers, Manufacturers and Services grow exponentially and differentiate with purpose.

ANUGA

Cologne, Germany

4 – 8 OCTOBER

www.anuga.com

PLMA’S PRIVATE LABEL SUMMIT

Copenhagen, Denmark 28 – 29 OCTOBER www.plmainternational.com

DECEMBER

COSMOPROF INDIA

Mumbai, India

4 – 6 DECEMBER www.cosmoprofindia.com

JANUARY

MARCA BOLOGNA

Bologna, Italy

13 – 15 JANUARY www.marcabybolognafiere.com/en

NOVEMBER

COSMOPROF ASIA

Hong Kong

11 – 14 NOVEMBER www.cosmoprof-asia.com

PLMA’S US TRADE SHOW

Chicago, IL

16 – 18 NOVEMBER www.plma.com

FEBRUARY

ISM COLOGNE

Cologne, Germany

1 – 4 FEBRUARY www.ism-cologne.com

BIOFACH

Nuremberg, Germany

10 - 13 FEBRUARY www.biofach.de/en

NOTABLE

PLMA’s Summit in Copenhagen

What Today’s Consumers Expect and How Private Label Can Win

Today’s consumers are more informed, savvy, and demanding than ever, with easy access to information shaping their expectations. To stay competitive and one step ahead, a customercentric strategy is important. But how can we keep up with the constantly evolving behaviour of consumers, their rising expectations, and the need to deliver the customisation and personalisation they demand?

PLMA’s Private Label Summit in Copenhagen, 28-29 October 2025, will explore consumer mindsets and behaviours, uncovering emotional drivers and the strategic value of a consumer-first approach to building loyalty and driving private label growth.

“With stronger relationships, private labels shift from transactional to trusted brands,” said PLMA President Peggy Davies.

The Summit will turn insights into clear, practical tools that drive consumer engagement and strengthen meaningful connections.

Kantar will kick off the event with an analysis of how companies use data to understand, predict, and respond to customer behaviour; and how AI helps businesses stay ahead.

Institut for Kundetyper, a Danish company specializing in emotional customer segmentation, will explore the emotional reasons behind customer choices. Using academic methods with practical tools,

Kundetyper identifies different customer types and their unconscious purchasing habits and gives insights that help you make clear conscious, strategic choices to meet the customer latent wish.

Dunnhumby, a global customer data science company and known for its longstanding relationships with Tesco, will discuss how retailers use private brands to grow customer loyalty. This session explores the role of private brands in driving customer engagement, featuring real case studies and insights on gaining a competitive edge during economic challenges. Learn the strategies behind using private brands to build lasting customer relationships.

Simon-Kucher & Partners, a top consultant in marketing and pricing, will examine the shift from operational excellence (efficiency, cutting costs, optimizing processes), to commercial excellence (maximizing sales, pricing strategies, customer relationships) emphasizing the importance of a customer-centric approach, making decisions based on understanding customer needs. This session will examine the critical role of pricing, analysing different pricing scenarios and its effect on perceived value, service, and quality, and how these factors motivate consumers to choose private label products.

United Nordic, founded in 1964, is one of the world’s oldest and leading buying alliances, jointly owned by retailers Axfood (Sweden), NorgesGruppen (Norway), Dagrofa (Denmark), and wholesaler Martin & Servera (Sweden). United Nordic will demonstrate how a cross-border strategy can benefit retailers, suppliers and consumers, by improving efficiency, increasing purchase volumes, simplifying regulatory processes where possible and streamline sustainable agendas.

Agristo will share their success story as a 100% private label supplier. It will highlight how a companywide, consumer-centric approach, embraced across all departments and business units, is key to identify market opportunities, launch new products and support the sustainable innovation journey. By leveraging their industry expertise and actively collaborating with retailers, suppliers can turn transactional exchanges into valuable, lasting, and reliable partnerships.

The summit closes with a panel debate on the key recommendations shared, discussing whether they are realistic to implement.

Potential topics include: Personalization and targeted development: a winning strategy, or a costly illusion? How can we serve a fragmented market without losing focus? How can companies personalize products considering the diverse preferences within target groups? What is the potential of AI in analysing customer data and creating personalized offers?

On the first day of the summit, Euromonitor will set the tone by diving into the Scandinavian retail landscape and analysing clear trends in the region, followed by on-site visits to leading Danish supermarkets and discounters for a real-life experience and hands-on insights into private label.

PLMA’s Annual Private Label Summit is open to all PLMA members, retailers, manufacturers and trade press.

Through the First Half of 2025, U.S. Store Brands Far Outperformed National Brands on Sales Gains

MONTHLY DOLLAR SALES: SBS AND NBS

Leadership Conference in Bentonville on the horizon in April, the opportunities to connect, learn, and lead have never been more varied and plentiful.”

Store brand growth has been ubiquitous. Looking at departments, store brand dollar sales for the 52 weeks ending June 15 increased in seven of nine sections, led by Refrigerated, up 13%, followed by Beverages, (+4.8%), Frozen (+3.8%), General Food (+2.5%), Pet Care (+2%), Home Care (+1.4%), and Beauty (+1.1%). General Merchandise (-0.4%) and Health (-0.1%) were down.

Through the first six months of 2025 store brands in all U.S. retail outlets held a sizable lead over national brands when it came to the rate of dollar and unit sales gains.

Compared to the same period a year ago, store brand dollar sales were ahead 4.4% and unit sales were up 0.4%; by comparison, national brand dollar sales were plus 1.1% while unit sales fell 0.6%, per Circana’s data provided exclusively to PLMA.

Overall, store brand market shares for the first half of the year increased to 21.2% for dollars and 23.2% for units, both all-time highs.

PLMA projects total store brand sales for 2025 will approach $277 billion; in 2024, the figure was $271 billion, a record.

In unit sales, the top section was General Food at 20 billion, then Refrigerated (15 billion), General Merchandise and Frozen (both at 5 billion) and Health (2 billion).

"Our macro view for store brands remains optimistic," said Peggy Davies, PLMA President.

In unit sales, store brands were ahead in all but one department, with Beverages (+4.2%) showing the way, followed by Home Care (+3.4%), Pet Care (+3.3%), Frozen (+2.1%), Refrigerated (+1.3%), General Food (+1.2%), Beauty (+0.4%), and Health (+0.3%). Only General Merchandise (-2.5%) was off.

The leader in departmental dollar sales was Refrigerated, at $61 billion; next were General Food ($52 billion), General Merchandise ($26 billion), Frozen ($22 billion), Health ($18 billion), Beverages ($15 billion), Pet Care ($5 billion), and Beauty ($4 billion).

“Now's the time to lean in," she added. "PLMA strongly encourages participation in the 2025 Private Label Trade Show as well as our online and in-person offerings like PLMA Live! Presents Lunch and Learn, Meet the Retailers and Meet the Distributors, the Executive Education curriculum at the Show, and the unique Mastering Enterprise Sales Program. With Store Brands Month coming again next January 2026. Soucre: Cricana Unify+TM/PLMA

PLMA’s 2025 Private Label Trade Show:

2,000 Exhibitors from 65 Countries

PLMA’s 2025 “Private Label Trade Show - Nov. 16-18 at the Donald E. Stephens Convention Center in Chicago - is the ultimate “Store Brands Marketplace.” The Show is a one-ofa-kind hub of new products, ideas, innovation and connections.

The vibrant Show floor will feature 2,000 exhibitors from 65 countries and 35,000+ innovative store brand products and solutions –all under one roof.

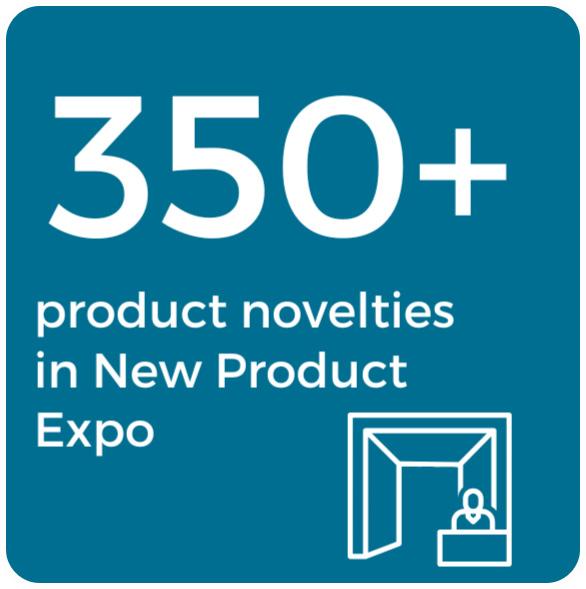

PLMA has significantly expanded its exhibit space to accommodate growing demand by adding more than 100 new exhibit booths to the Show floor this year.

Two special sections on the show floor this year are:

• Self-Care & Wellness in South Hall

• Wine & Spirits in North Hall

NOV

16-18, 2025

CHICAGO

From food and beverages to health, beauty, and household goods, the Show spans a wide range of categories - including wine & spirits, refrigerated and frozen foods, sustainable packaging, functional beverages, beauty, selfcare & wellness, unique snack items, confectionary, baby products, beauty products, pet care, kitchenware, flavors and ingredients from country of origin, convenience foods and foodservice and grab-and-go items, and much more.

The Show attracts a broad range of retail formats, including major supermarkets, supercenters, drug chains, wholesale clubs, dollar stores, specialty stores, mass merchandisers, online retailers, and convenience stores/travel stops.

Attendees can gain high-value insights on vital industry developments during Sunday’s opening seminars, Monday’s keynote breakfast featuring Joel Rampoldt, CEO of Lidl US and a retail trends breakfast that kicks off on the second day of the Show on Tuesday.

What’s more, attendees can experience product and packaging innovations first-hand by visiting the valuable onsite displays:

• PLMA’s Idea Supermarket®, featuring the latest product and packaging trends from around the globe.

• New Product Expo, a showcase of select product and packaging innovations from companies exhibiting at the show.

• PLMA's 2025 Salute to Excellence Award® Winners, an exhibit of retailer food and non-food product innovations chosen as best private label product in their categories by industry and consumer judges.

Attendees have access to the mobile-friendly Show Navigator - an essential tool offering an interactive map, a detailed exhibitor listing, information on PLMA’s New Product Expo, Idea Supermarket and much more.

storebrandsmarketplace.com

Lidl US CEO Joel Rampoldt to Keynote PLMA's 2025 Trade Show

Joel Rampoldt, CEO of Lidl US, will deliver the keynote address at PLMA's 2025 Private Label Trade Show, November 16-18 in Chicago.

A business leader with an exceptional track record in large-scale retail transformations, Rampoldt has widely recognized expertise in building teams and helping them tackle complex problems in customer offer, marketing, supply chain and financial management.

“I’m

honored to get the chance

to speak to our suppliers at this year’s PLMA Trade Show,”

said Rampoldt. “Here at Lidl US, we value our relationships with our suppliers tremendously and we’re excited to grow with our suppliers as we expand in the U.S.”

Rampoldt joined Lidl US as CEO in 2023. Prior to this, he was a Partner and Managing Director at AlixPartners, where he specialized in improving sales and profitability for retail clients through strategies focused on pricing, promotions, and operational efficiency.

"We are extremely pleased to welcome Joel as our keynote speaker. He is an accomplished and influential retail industry executive who leads a chain that is clearly a growing force in the U.S. market, much as it is in Europe," said PLMA President Peggy Davies.

Lidl, parent of Lidl US, operates more than 12,000 stores in 31 countries, employing more than 350,000 employees globally. It is part of the Schwarz Group, the world’s third-largest retailer.

The supermarket chain is well-known for its focus on private label, easy-to-shop layout and curated product selection that emphasizes essentials and popular items which contribute to budget-friendly, efficient shopping.

Lidl US, established in 2015, is headquartered in Arlington, VA., and operates 190+ stores on the East Coast.

Rampoldt will speak at the 8 a.m. keynote breakfast on Monday, November 17, at the Hyatt Regency O'Hare, which is adjacent to the Donald E. Stephens Convention Center, site of PLMA’s 2025 Private Label Trade Show.

Themed "Store Brands Marketplace," the Show will feature more than 35,000 food and nonfood products, 3,100 booths, and 2,000 exhibitors representing 65 countries. Registration is open.

PLMA’ s International Appeal: 50+ Country Pavilions

Nearly 900 international suppliers and 50+ country pavilions will be featured at PLMA’s 2025 “Store Brands Marketplace” Private Label Trade Show, Nov. 16-18 in Chicago.

In total, exhibitors will represent 63 countries in Europe, Latin America and Asia.

Country Pavilions for 2025 include: two Belgium Pavilions (Flanders and Wallonia), Italy, France, Spain, UK, three pavilions from Greece, Denmark, Poland, Georgia, Morocco, Turkey, Serbia, as well as a new pavilion from the Netherlands.

Mexico and Ecuador will be among other South American pavilions this year, including Brazil, Chile, Peru, Guatemala, Colombia and Costa Rica.

Canadian suppliers will be represented by three official pavilions.

Other pavilions include Australia and New Zealand, as well as several pavilions from China, South Korea, Thailand and Vietnam.

(Mexico, Ecuador, Netherlands, Flanders - Belgium are new for 2025)

These exhibitors will showcase a wide array of international products. Among them:

• Organic snacks for dogs and cats from Belgium;

• Organic and conventional baby food from Chile;

• Authentic fresh brioche and macarons from France;

• Yuca and cassava from Costa Rica

• Natural juices from Georgia;

• Medicinal herbs from Morocco

• Coconut drinks from Vietnam;

• Hearts of palm from Ecuador

• Authentic Neapolitan pizza and Italian gelato.

“This clearly reflects a demand for global flavors, which is growing at a rapid rate as today’s consumers are looking for more global and authentic food experiences,” said Enriketa Beluli, PLMA’s Manager of Global Pavilions. “Globally inspired foods, spurred by travel, Instagram or TikTok, and multiculturalism, are being enjoyed increasingly by consumers. Retailers and manufacturers are expanding their global lines, supported by a growing number of global suppliers and global availability of ingredients.”

The Self-Care & Wellness section will feature 50 manufacturers from different countries, including Colombia, Turkey, South Korea, and will feature skincare, beauty and wellness products.

After a record-breaking show last year, PLMA has added an additional 100 booths in the “World of Private Label” section, which has been expanded this year from the North Hall to an upgraded location in the Main Hall of the show floor.

In total, the Show will feature 3,100 booths and 2,000 exhibitors.

PLMA Offers International Exhibitors Insights into Winning Business in the U.S. Market

As an exclusive benefit to its international exhibitors at PLMA’s upcoming 2025 “Store Brands Marketplace”

Private Label Trade Show in Chicago, 16-18 November, PLMA once again held an online educational session focusing on understanding the U.S retail and private label market dynamics and best practices for success.

Topics included the economics of private label in the U.S., regulatory basics, tariffs, and finding the best path to market and action checklists and requirements.

“Navigating the U.S. Private Label Market,” presented by industry veteran Jim Wisner, President, Wisner Marketing Group, was a complimentary two-part online program held 30 September and 01 October as part of PLMA’s on-going efforts to provide its exhibitors with the tools needed to sharpen their approach on the Show floor in November.

Get Involved in Store Brands Month: January 2026

By every metric, from retailer and manufacturer involvement to trade press and social media coverage to shopper response, the inaugural Store Brands Month celebrated this past January across the U.S. was deemed a total success.

Conceived by PLMA as an annual event, the direct-to-consumer program is the result of a partnership among American retail chains, their suppliers and other industry players to promote the quality, performance, value and innovation of private label products to their customers.

The principal goal is to increase consumer trial of store brands in all food and nonfood categories. Trial is widely seen as a gateway to new, satisfied store brand customers, increased overall sales and added shopper loyalty. Surveys show that sampling is store brands’ best friend when it comes to convincing consumers to switch their allegiance from national brands to private label.

The result of a good experience with their new choice more often than not leads consumers to forsake their previously favored national brand and change their preference to the private label. Furthermore, a satisfactory experience with a store brand in one category often encourages trial of store brands in other parts of the store, what is known as the products’ “halo effect.”

The program provided insightful and immediate takeaways for suppliers on how to create their own roadmap to best leverage their unique products and identify current trends that will influence decision making and acceptance as they enter the U.S. market.

“With the ongoing growth each year and more interest from international suppliers, as well as recent global political and economic changes, we were happy to offer our exhibitors this exclusive benefit,” said PLMA’s Enriketa Beluli, Manager, Global Pavilions. “The tailored webinar was created to provide insights on how our Show can open up new opportunities in the U.S. market.”

www.plma.com

“In the midst of a multiyear runup in sales and shares in the U.S., the time was right to foster even greater visibility among consumers to our thriving industry,” explained Peggy Davies, PLMA President. “By joining forces with our partners, we seized the opportunity to expand the presence and strength of the largest CPG brand in the store: private brands.”

Aldi, Albertsons, Associated Wholesale Grocers, Dollar General, K-VA-T, Raley’s, SpartanNash, Topco and Wakefern were among operators that supported the campaign. There was also widespread representation by manufacturers, suppliers, and brokers, including Advantage Solutions, AmeriQual, Federated Group, Pacific Coast Producers, Red Gold, Subco Foods, and many others.

PLMA’s Davies added that after an “effective and rewarding debut of getting the word out, the association and its Store Brands Month partners are organizing to expand and enhance the celebration,” which will be reprised in January 2026.

www.plma.com

Q&A with PLMA President Peggy Davies

Q.

The private label landscape has changed significantly in recent years (inflation, geopolitical shifts, evolving consumer behaviors). Which current trends do you see as the most important for manufacturers and retailers?

A.

The private label sector has undergone a remarkable transformation, shaped by economic pressures, shifting global dynamics, and rapidly changing shopper expectations. One of the most important trends is the rising demand for high-quality products at competitive prices. Consumers are no longer willing to compromise—value now means exceptional quality and affordability, creating opportunities for manufacturers and retailers to innovate and differentiate.

Sustainability is another powerful driver. Shoppers are increasingly aware of environmental and social impacts, which is pushing private label brands toward responsible sourcing, sustainable packaging, and greater transparency.

Finally, digital acceleration is rewriting the rules of engagement. E-commerce, social commerce, and omnichannel retailing are now central to reaching today’s tech-savvy, value-driven consumer—particularly Gen Z—requiring brands to invest in strong digital strategies and seamless cross-channel experiences.

Q.

What excites you most about the private label industry at the moment?

A.

What excites me most about the private label industry right now is the unprecedented commitment from retailers and manufacturers to push boundaries—investing in innovation, design, and product quality at a level we’ve never seen before. There’s a clear mission to deliver products that don’t just match national brands, but often surpass them, while still offering price points that make them accessible to a wide range of shoppers.

What’s especially energizing is how quickly store brands are adapting to what today’s consumers care about most—sustainability, wellness, and convenience—while still delivering exceptional value. This agility has transformed private label into a brand. It’s inspiring to be part of an industry that’s reshaping the way people shop.

Consumers are no longer willing to compromise— value now means exceptional quality and affordability.”

Q.

What will success look like for you with regard to PLMA’s Store Brands Marketplace’ trade show, both in terms of the outcome for exhibitors and impact on the global industry?

A.

Success at PLMA’s “Store Brand Marketplace” private label trade show isn’t defined solely by the transactions or conversations that happen over two days—it’s about the lasting value the event delivers. For exhibitors, it’s walking away with new business opportunities, stronger relationships, and a renewed sense of direction. For attendees, it’s leaving inspired, better informed, and equipped with ideas they can implement immediately.

True success is when the event helps advance the global private label industry—sparking innovation, building partnerships, and reinforcing the role these brands play as a driver of growth worldwide. When the benefits extend far beyond the show floor, we know we’ve accomplished something meaningful.

Cheers to Excellence: Private Label Wines for Every Occasion

In recent years, supermarket own brand wines have quietly become serious contenders in the global wine market. Once dismissed as budget-friendly and uninspiring, these private label wines are now earning accolades, customer loyalty, and a growing share of the wine aisle. Their success reflects a broader shift in consumer expectations and buying behaviour — prioritizing quality, value, and transparency.

The shift is evident in the numbers. In the United States, private label wine sales is still in its early stages, in the 52-weeks to 13 July 2025 sales reached $44.9 million, up 16.9% in value and 13.2% in units from the previous year. In about half of US states supermarkets or drug stores are not allowed to sell wine.

Europe’s private label wine market is more mature, across the 17 countries tracked by NIQ, sales reached €32.63 billion in the year to 15 March 2025, representing 28% of the total wine market—up from 27.6% a year earlier and 27% two years ago. The steady climb confirms private label’s resilience in a region where brand competition is fierce and premiumisation trends are reshaping consumer expectations.

Part of this momentum comes from tapping into emerging consumer behaviours. The low and no-alcohol segment, once peripheral, is gaining traction within supermarket wine portfolios. Waitrose reports a 32% rise in low/no-alcohol sales, with Coop Denmark recording a 27% lift for alcohol-free wine. For retailers, private label branding enables them to introduce these innovations, marrying health-conscious lifestyles with familiar wine-drinking rituals.

Equally influential is the way social media trends are reshaping consumption. Platforms like TikTok have spawned unconventional pairings— such as wine with ice cream—that open the door for occasion-based merchandising and cross-category promotions. For supermarket buyers, this is a chance to make wine relevant to a younger, more experimental audience, often using private label as the accessible entry point.

In Germany, discount chain Norma has launched an organic Tempranillo (La Mancha D.O.) under its Bio Sonne line, delivering organic quality in a budget-friendly format. It’s examples like this that show how retailers are bringing both sustainable credentials and true value into their own wine offerings.

Retailers are also using private label wines to spark discovery through culinary storytelling. Coop Italia, for instance, showcases its Fior Fiore wine range via a “Food Village” tour— pairing its own brand wines with local gastronomic specialties and wine tastings across Italian towns. This kind of experiential marketing reinforces private label as a portal to both tradition and local pride.

Sustainability is another frontier where private label wine is leading

rather than following. Aldi’s decision to reduce glass bottle weights across 20 million units—cutting from 409g to 371g—demonstrates how own label can drive supply chain efficiencies with environmental benefits. The retailer’s aluminium wine bottles, 75% lighter than glass and fully recyclable, push the innovation envelope further. Even boxed wine, once seen purely as a value option, is being reframed as both premium and sustainable, as with Aldi’s Le Petit Poulet Rosé from Provence.

Quality remains the foundation of private label’s success. In the UK, Tesco’s “Finest” range has gained a reputation for dependable, interesting wines—featuring sought-after region’s wines like the brilliant La Chablisienne Finest Chablis Premier Cru. Booths has built such a strong reputation—and paired it with such savvy branding—that the E.H. Booth & Co. label now serves as a mark of style and distinction, including elegant New World Wines from New Zealand, South Africa and Argentina. These types of own brand lines prove that well-curated quality can rival national brands in both taste and appeal.

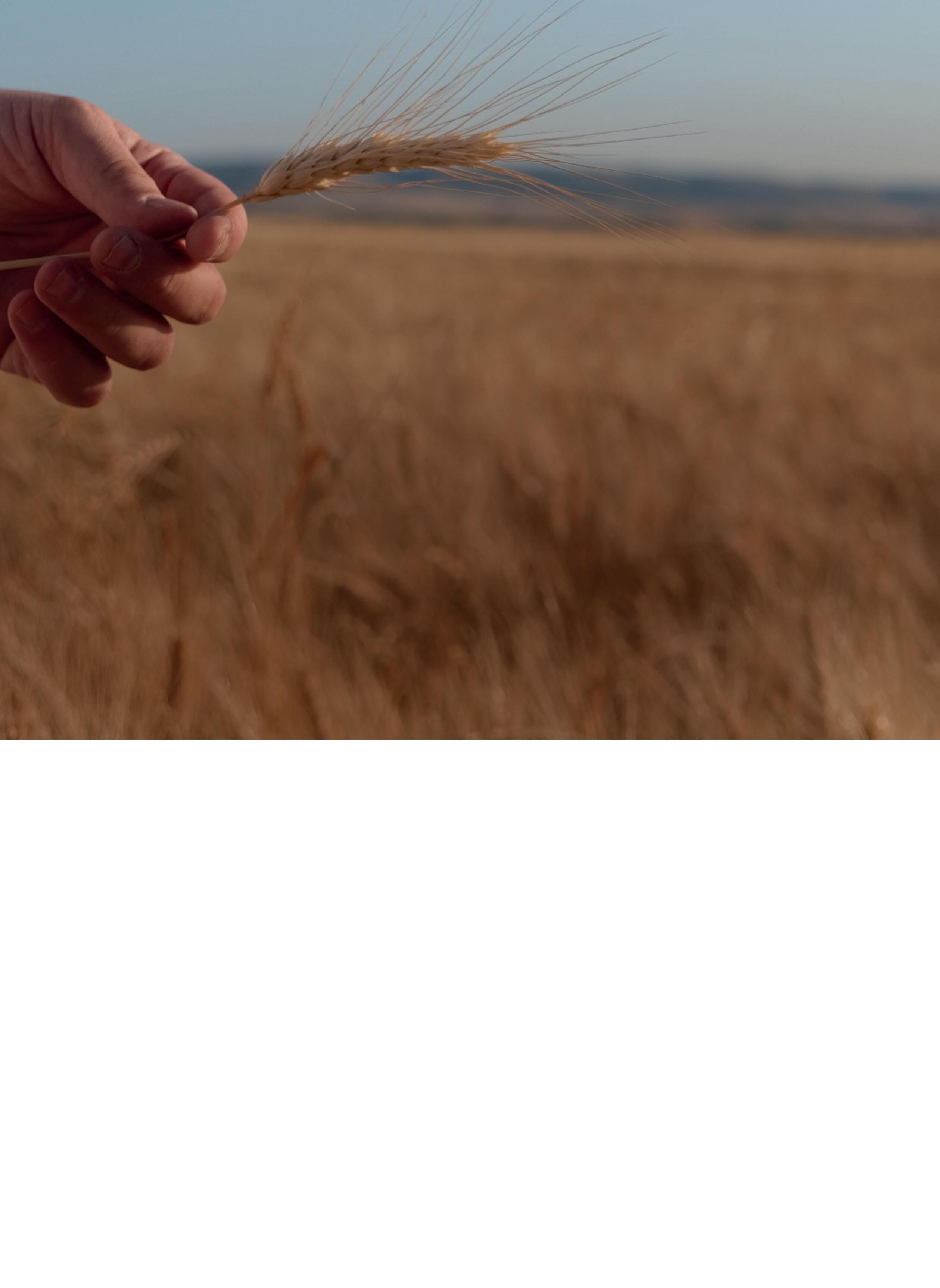

A Delicious New Addition to the Chiaverini Range

Le Bontà Keeps Impressing with Innovations!

Le Bontà continues to impress with groundbreaking innovations! Chiaverini Firenze is set to revolutionize its portfolio with an exciting new launch: jams in aluminum tubes. Just two years after the international debut of its iconic jam range, and after latest new Hazelnut Spread, the historic Florentine brand does not stop its innovation strategy.

Introducing a game-changing innovation: practical, sustainable, and innovative

The first jam in an aluminum tube! Unique in the market, this practical and easy-to-use format ensures maximum freshness and convenience. Sustainable and fully recyclable, it reflects our commitment to the environment. With this iconic new design, we’re redefining the way we enjoy jam, making it even more versatile and modern—perfect for every moment of the day!

Not Just A Breakfast Spread, A Gourmet Lover’s Indulgence

Experience pure hazelnut bliss Chiaverini’s latest Hazelnut Cream is a true indulgence, crafted with 30% real hazelnuts and a time-honored recipe. Made with only the finest ingredients, it’s free from artificial flavors, colorings, preservatives, and palm oil. Its silky texture and rich, nutty flavor make it a must-have for any food lover’s pantry.

A Legacy of Dedication

Chiaverini Jams have been defining Florentine culture since 1928. Originating from the passion of the Chiaverini Brothers, their commitment to quality echoes in every jar, making Chiaverini a staple in Florentine homes. The secret to Chiaverini’s success lies in simplicity: just fruit, sugar, and passion. Each jar is a testament to the art of slow cooking, melding flavors into perfection. Chiaverini's jams are history, Florence's essence in every jar. Each represents dedication, heritage, and resilience. Chiaverini isn't just a taste of Florence; it's a taste of history, a flavor transcending time.

An Unmistakable Symbol

The packaging of the Chiaverini “Pail” is not just a container; it represents an evolution from rustic wood to sleek aluminum. The new line, featuring distinct colors for each flavor, caters to collectors while upholding the brand’s essence and tradition.

Chiaverini Jams is part of LeBontà Group, a Tuscan based company that brings together high-quality brands with a strong connotation of genuine and natural products. www.chiaverinifirenze.it/en www.lebonta.it/en

NOTABLE

Where Premium Quality Meets Private Label

Certified Origins is a trusted partner for high-quality extra virgin olive oil (EVOO) and Mediterranean food products, offering customized private label programs for international retailers.

With decades of experience, we develop authentic, traceable food programs tailored to each retailer’s goals, sourcing directly from farms and cooperatives to ensure quality every step of the way.

Co-Creating Better Products

Private label is no longer just a cost-effective option; it’s an integral part of how people shop today. Across Europe and North America, store-brand offerings are driving loyalty, quality, and innovation. At Certified Origins, we see private label as a space where retailers can build identity and trust through purposeful development and tailored solutions. We collaborate closely with buyers to co-create product lines that reflect customer values, from responsible sourcing to health-forward choices.

A U.S.-European Model

Located in Newport News, Virginia, our bottling and logistics center embodies our integrated model: Mediterranean quality, know-how, and craftsmanship, delivered with North American speed and efficiency.

With teams in the U.S., Mexico, Italy, Spain, and China, we connect international supply with localized service, creating strategic opportunities for our partners across continents. Our adaptable network enables delivery within 4 to 8 weeks globally, or as fast as 2 days across key markets.

Certified Quality

From the very beginning, Certified Origins has always been dedicated to meeting and exceeding the highest global standards for food safety, quality, and transparency.

Through third-party certifications, advanced technology, and robust traceability systems, we constantly monitor our supply chain, share data with partners, and raise the bar in customer satisfaction. We are certified by IFS, BRC, and ISO 22005, and rely on advanced labs, blockchain, and external audits to ensure full compliance with international law and labeling requirements.

Industry Innovation

In partnership with the University of Salento, we’ve built a significant database based on Nuclear Magnetic Resonance (NMR) and isotopic signature to verify the authenticity and origin of our EVOOs. Using cutting-edge NMR analysis, we can trace each EVOO back to its verified source. Our database now includes over 1,000 unique olive oil profiles and continues to grow each year.

Responsible Sourcing

Certified Origins actively fosters collaboration across the supply chain to drive positive impact. We regularly distribute ESG supplier surveys to assess and align sustainability performance, partner on agricultural projects that promote climate resilience, and consistently explore better packaging alternatives.

We’ve implemented carbon compensation programs for some of our Italian EVOO lines and are working toward introducing reduction measures. Most of our olive oil packaging contains up to 50% recycled PET and cardboard, with ongoing efforts to increase these levels across our portfolio. In Italy, our bottling facility operates on renewable energy, including solar power and olive pits for heating, and is continuously monitored for energy efficiency.

Market Research

We believe it’s essential to share clear, timely insights in a market shaped by constant change. That’s why we publish monthly Olive Oil Market Reports and a quarterly bulletin, covering trends in production, pricing, logistics and more. We also contribute to editorial projects that highlight our team’s expertise and help advance conversations around building a more responsible food system.

Private Label Success Across Continents

WE SUPPORT LEADING RETAILERS WORLDWIDE.

We have a proven track record in delivering successful private label programs in extra virgin olive oil and specialty food categories.

With offices in the U.S., Mexico, Italy, Spain, and China, and bottling operations in both the U.S. and Italy, we provide global reach with localized execution. Our end-to-end model supports retail growth with sourcing, quality assurance, packaging, and logistics tailored to each market.

Leader in the Food Canning Sector Now Offers Pasta

Too!

Headquartered in Angri, in the province of Salerno, Italy, La Doria exemplifies Italian excellence in the food canning sector. Specializing in the production of tomato derivatives, ready-made sauces, canned pulses, juices, and fruit-based beverages, the company stands out as Europe’s leading producer of canned pulses, peeled tomatoes, and tomato pulp for the retail sector. Furthermore, La Doria ranks among Italy’s top producers of fruit juices and is the leading European producer of private-label ready-made sauces. Recently, through a significant acquisition, the Group has expanded its portfolio to include pasta, offering an even broader range of products.

La Doria is a trusted supplier to major retail and discount chains worldwide. Its commitment to private label production is evident, with over 97% of the Group’s revenue derived from this segment. The company aims to offer

high-quality products at competitive prices, positioning itself as a strong alternative to commercial brands. With extensive expertise and a continuous focus on research and development, La Doria is synonymous with reliability and innovation in the food sector. With 12 production plants located across Campania (Angri, Sarno, Fisciano, Salerno, and Pastorano), Emilia-Romagna (Parma and Faenza), Basilicata (Lavello) Liguria (Chiusanico) and Lombardia (Verolanuova e Fara Gera d’Adda). La Doria has successfully combined Italian production tradition with a strong international presence. Exports account for over 80% of revenue, with a solid foothold in key markets such as the United Kingdom, Germany, the rest of Europe, Australia, and Japan. This global success is based on careful selection of raw materials and cuttingedge production processes that ensure high-quality standards.

La Doria is not only a successful company but also a responsible enterprise that operates according to well-defined ethical principles. Environmental sustainability, legality, transparency, and respect for human rights are fundamental values guiding every aspect of production and distribution. The Group is firmly committed to responsible energy resource management, waste recycling, and reducing the environmental impact of packaging. Moreover, La Doria promotes fair working conditions throughout the supply chain, collaborating closely with producers’ organizations to ensure respect for workers’ rights.

Since its founding, La Doria has maintained a strong connection with its local community by supporting educational initiatives for young people, urban regeneration projects, and social inclusion programs. The company contributes to the growth of the local economy by sourcing from a network of suppliers primarily located in Southern Italy, thereby further strengthening the national production fabric.

Thanks to its commitment to quality, sustainability, and innovation, La Doria remains a benchmark in the international food industry. With a continually evolving product range and a strategy focused on responsible growth, the Group establishes itself as an outstanding partner for largescale distribution, bringing the best of Italian food tradition to millions of consumers worldwide.

commerciale.estero@gruppoladoria.it

A Key Player In The Consumer Goods And Away-From-Home Markets

Lucart, a major European manufacturer of thin MG paper for flexible packaging, is a key player in the consumer goods and away-from-home markets as a producer and transformer of tissue and airlaid paper. Its attention to people, sustainable processes, and approach to innovation means it offers cutting-edge products that meet market challenges and customers’ needs

Fiberpack® is their flagship project in this field. It combines advanced technology with environmentally friendly processes, demonstrating that circular economy principles are fully applicable to the tissue sector.

In 2010, Lucart created a project called “EcoNatural, “ based on the idea of utilizing all the elements of beverage cartons according to circular economy principles. This type of packaging is widely used in the food industry to protect and preserve food, and it has a high natural cellulose fiber content, making it more ecological compared to other packaging materials of fossil origin. Due to its mixed composition of cellulose fibers (74%), aluminum (4%), and polyethylene (22%), this material is often not recovered at the end of its life or is only partially recovered.

The production process relies on innovative technology that separates cellulose fibers found in beverage cartons from polyethylene and aluminum through physical-mechanical action. With this technology, harmful substances that may affect people or the environment are avoided. They produce tissue products using the fibers obtained through this process and recover aluminum and polyethylene, converting them into a homogeneous material called Al.Pe.®, which other industries use to create various items.

The tons of Fiberpack® paper produced by Lucart from 2013 to 2023 have contributed to the recovery of over 10.7 billion beverage cartons, saving more than 4.6 million trees and preventing over 281,300 tons of CO2e from being emitted into the atmosphere.

Another important piece of news concerns the new range of products called Infinity, which was launched in 2023.

Infinity is the plant pot line resulting from the collaboration between Lucart and Pasquini & Bini, with the contribution of the Department of Agricultural, Food and Agro-Environmental Sciences of the University of Pisa. The pots are made from GranPlast material, which is the polyethylene and aluminum separated during the beverage carton process at the Borgo a Mozzano plant.

Lucart is also the only brand in its target market that offers Airlaid products with exceptional absorbency and strength. The Airlaid technology utilizes long,

highly resistant cellulose fibers that never come into contact with water during the production process (dry paper) to remain super absorbent.

Fibers treated with this process naturally form a “dam” structure, yielding outstanding results: they can absorb up to seven times their weight and, thanks to their exceptional resistance, can be reused up to twenty times, compared to one or two for competitors products.

Lucart is a company composed of individuals who opt for innovative and sustainable processes in the development, transformation, and manufacturing of paper products, collaborating responsibly for the future of both their business and the planet.

Lucart has always been at the forefront of studying innovative packaging that reduces the environmental impact of its products. After launching the world’s first line of toilet paper with Mater-Bi corn starch packaging in 1997, the company developed a series of products with completely plasticfree packaging in 2019.

Colored by nature.

OROPAN S.p.A.: Your Sustainable Bakery Partner

OROPAN S.p.A., the leading Italian bakery company producing authentic durum wheat breads from the Apulia region in southern Italy, will exhibit at ANUGA in Cologne from October 4th to 8th at hall 3.2 booth B38.

“We warmly invite all our international customers and industry professionals to visit us during the show to discover our latest product offerings and experience the quality of our world-renowned breads, which we distribute across 25 markets”, said Francesco Forte, Commercial Director of OROPAN SpA.

Don’t miss the chance to explore Oropan’s innovative and sustainable bakery solutions, designed to drive success in both in-store retail and foodservice.

Company Uniqueness

Founded by Vito Forte, one of Altamura’s most renowned bakers since 1956, Oropan S.p.A. embodies the rich tradition of Italian bread-making. As a child, Vito Forte collected hand-kneaded dough from local housewives to take to the community oven for baking. This early experience laid the foundation for his mastery of traditional bread-making techniques, utilizing durum wheat semolina, mother yeast (lievito madre), and a slow natural raising process. The result is a unique range of breads and bakery products characterized by their distinctive crispy crust and golden-yellow texture, naturally containing protein and antioxidants.

Product Range and Quality Certifications

Today, Oropan S.p.A. stands as one of Italy’s most respected bakery companies. The firm successfully merges traditional production methods with innovative technologies to create a diverse range of products, including bread, focaccia, friselle, and bread rolls. With significant production capabilities, Oropan S.p.A. is the ideal partner

for both international retailers and foodservice distributors. Theirs products are distributed daily across +2,400 retail stores in Italy and in 25 international markets (both EU and non-EU). A hallmark of the company is its robust quality management system, certified by esteemed organizations such as BRCGS (AA+), IFS (Higher Level), ISO 9001:2015.

Your Sustainable Bread Partner

OROPAN S.p.A. places sustainability at the heart of its operations, fully embracing ESG principles to foster a better future for the environment, its employees, local communities, and future generations. The company’s steadfast commitment to social and environmental responsibility is reflected in its numerous voluntary certifications, including ECOVADIS bronze medal, ISO 14001:2015 (Environmental Management System) and ISO 45001:2018 (Occupational Health and Safety Management Systems). Additionally, Oropan S.p.A. has led innovation in the Italian market by introducing the first bread made from a sustainable and certified supply chain under ISCC Plus.

gourmetbreads@oropan.it

New, Ready-Topped Chilled Pinsa from Valsa Group

Valsa Group, as a leading manufacturer of frozen, chilled, and ambient pizza, pinsa, focaccia, and snacks, defines its main goal as promoting the authentic Italian food lifestyle worldwide. The headquarters is situated in Valsamoggia, in the very heart of Italy. This is where the company’s history began, yet our roots extend from North to South through our seven plants, embodying a truly Italian entrepreneurial journey. Our daily commitment can easily be summarized: CULTURE . EXCELLENCE . INNOVATION.

Always keeping consumers’ needs and emerging trends in mind, Valsa Group is introducing a ready-topped, chilled pinsa. This outstanding product is designed to maximize convenience for final consumers, with its many delicious toppings that can be baked in a few minutes straight from the fridge.

This new pinsa range aligns with our core quality standards: GMOfree, clean label without added preservatives, only 100% Italian tomatoes, and crafted to respect authentic Italian traditions through natural long leavening and hand stretching.

An exclusive mix of flours and high hydration make our pinsa the best way to experience the authentic taste and scents of Italy. Available in many flavors: Margherita, Diavola, Amatriciana, and many more. The perfect way to savor the best Italian bakery heritage: experience Italy in every single bite.

Chilled or chilled from frozen: an explosion of flavors with the high, outstanding quality you can find within Valsa Group only.

The Group’s strategic strength lies in combining traditional manufacturing processes with a greater focus on consumer convenience, while maintaining the highest quality standards. In the modern market, convenience supported by premium quality is essential to creating value in the supply chain.

Valsa Group is a reliable and wellknown business partner in 50 countries worldwide; this is a result of the choices and investments in sustainability, production capacity, organizational integration and convenience innovation, with a special commitment to process transparency, waste reduction and green energy use.

Through the brands Valpizza, La Pizza+1, Forno Ludovico, Megic Pizza, Ghiottelli, Il Borgo, Tuscanya Bakery and Yahm, Valsa Group is the unique large-scale and highly qualified partner able to supply a wide range of items in each category, from frozen to deli.

The V-Label: The International Vegetarian and Vegan Brand Par Excellence

The V-Label brand is an internationally recognized symbol that identifies vegetarian, vegan, and raw vegan products and services par excellence.

Created in 1976 as an institutional symbol of the Italian Vegetarian Association, it is now the most recognized synonym for vegetarian and vegan products among consumers worldwide. Its clear, unique image is intuitively linked to vegetarianism and veganism in every part of the globe, effectively transcending any language barriers.

Officially presented internationally at the first European Vegetarian Congress held in Italy in 1985, it quickly spread first to Europe, and shortly thereafter to the rest of the world.

The V-Label brand is now registered in over 70 countries worldwide and can be found globally: it clearly and safely identifies products and services of various types, from food to textiles and from footwear to cosmetics, as compatible with the vegetarian and vegan lifestyle.

But being international doesn’t just mean being widespread, it requires much more than this. It involves the ability to effectively transmit and receive often technical content without making mistakes. This is made possible by the close relationships we have cultivated with our customers. In most cases, the V-Label brand is distributed by local managers who, being

familiar with the local language and culture, can better convey information to producers and consumers. This local approach also enables us to handle technical material in documents without risking translation errors or misunderstandings.

Despite the widespread availability of the brand in extremely different areas, both in terms of culture and traditions, the V-Label brand has maintained the same verification criteria and standards in every place. This uniformity aims to offer seriousness and quality to consumers who rely on the V-Label brand when choosing which products to buy.

The balance between the local approach and adaptation and the standardization of criteria and processes so that they remain unchanged is what makes the V-Label brand truly international, even more than its widespread coverage.

Are you looking for expertise in vegetarian and vegan expert with world-class experience? Contact us by writing to: segreteria@vlabel.it

www.vlabel.org

Innovating Cleanliness: Whitecat’s 76-Year Journey Safeguarding Healthy Families

Chapter 1: A cat was born in 1948

In 1948, in Yongtai Village, Shanghai county, China, an entrepreneur started a small, private, manufacturing company with a goal to provide laundry soap to local residents in postwar China. This was the start of what would be later known as “Shanghai Bái Māo” by locals, or Shanghai Whitecat, he embarked on a journey of necessity, groundbreaking innovation, and a steadfast commitment to safeguarding the healthy lives of families. Motivated by necessity after the end of World War II, Shanghai Whitecat worked diligently to provide much needed laundry cleaning products that surpassed traditional soap, made from soap bean and “Yizi” (made from pig pancreas and plant ash), for more effective cleanliness and well-being to local families.

Chapter 2: Pioneering Innovation since 1959

In 1959, Shanghai Whitecat achieved its first of many mmilestones by introducing the first domestically produced package of synthetic laundry detergent powder “Gong nong” in mainland China. Since then, Whitecat has achieved many milestones.

• 1963: 1st autonomous washing powder paper bag packaging machine

• 1981: 1st domestically developed and produced pack of Super Concentrated Laundry Powder

• 1987: Whitecat brand and our Jaimei brand Laundry Powder awarded the “Shanghai Famous Brand” certificate

• 1995: Whitecat Laundry Powder was awarded the “Golden Bridge Award” for National Best selling Domestic Product for 4 consecutive years.

• 2004: Whitecat liquid detergent was chosen as “China Famous Brand”

• 2018: Whitecat Lemon Black Tea Dishwashing liquid won the “2017 China Biggest Award of Quality Consumer – Quality Gold Award”

• 2018: Shanghai Hutchison Whitecat Co., Ltd., was awarded “China’s Top 100 Daily Chemicals”

Chapter 3: Longevity Through Innovation

As Shanghai Whitecat celebrates its longevity, our narrative transcends labels and brands. It’s a story of enduring innovation, necessity, and lives touched. Whitecat is humbled by the trust of millions of families who rely on us daily to safeguard their healthy lives.

Trust built over many decades of hard-work and investment in research and development.

• More than 100 national patents

• Millions of dollars spent every year in R&D

• Over 50 research and development personnel (> 50% with Master’s or doctoral degrees)

Our technology center is the only national standard laboratory in the light chemicals industry.

(GC/MS), Fourier infrared spectrometer and other advanced international standard analysis and testing instruments ensure we keep our commitment to delivering highquality, cost-effective Home Care and Personal Care products to safeguard the healthy lives of families into a better tomorrow.

Chapter 4: Sustainability for a Better Tomorrow

Whitecat’s dynamic culture of innovation, born out of necessity in 1948, is now shifting to Sustainability, safeguarding healthy families better for all, including our planet.

We are very excited to launch our sustainable, nature inspired, line of products for our private label naturebased, sustainable Home Care and Personal Care products that your customers will simply Love!

• Concentrated cleaning pods/ sheets/tablets

• Lactic acid-based cleaning products

• Soda-based cleaning products And more innovative products to come.

Join us in this exhilarating journey towards a greener, more sustainable tomorrow with Whitecat!

Investments in latest scientific equipment such as gas chromatography/mass spectrometry www.whitecatusa.com

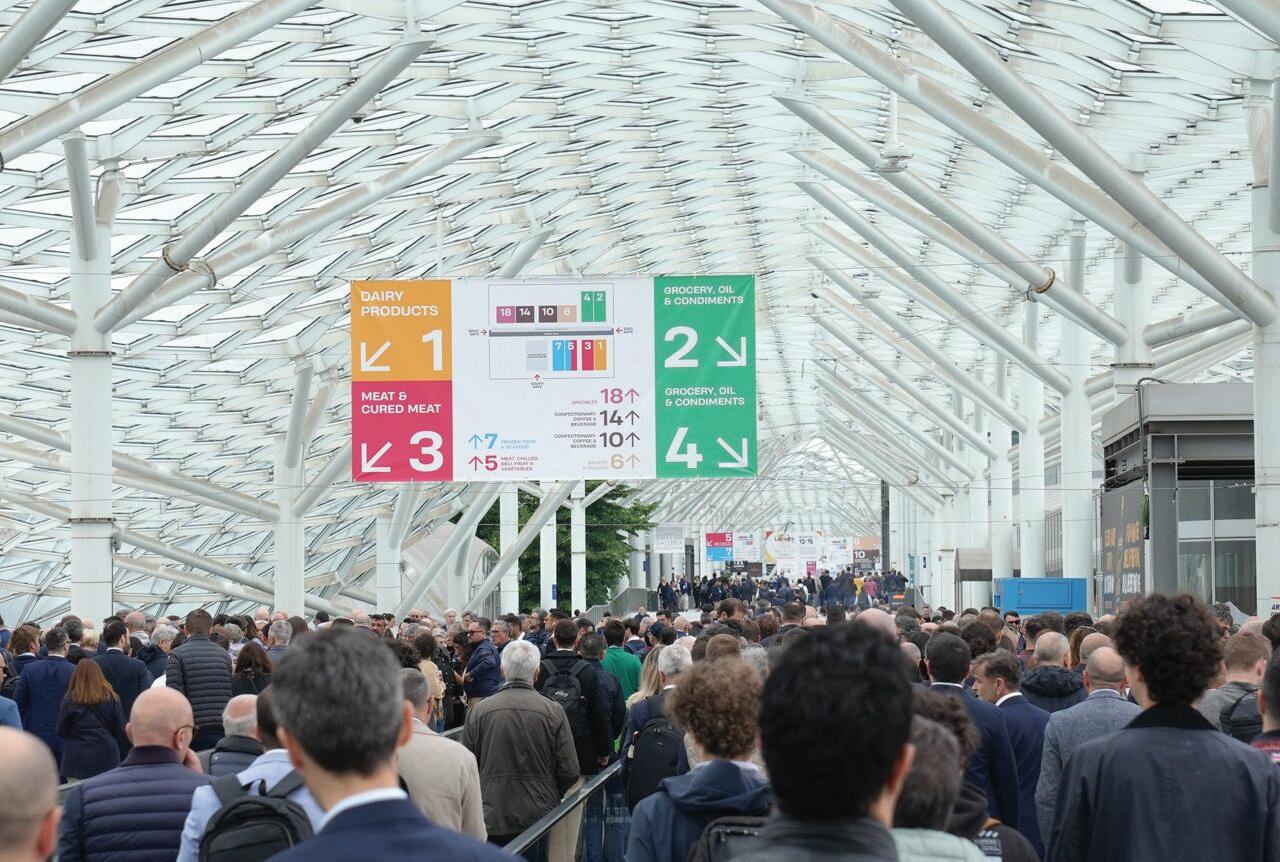

World’s Largest Food Trade Fair

4 – 8 October Cologne, Germany

Try out innovations and experience tastes, establish new contacts and intensify existing partnerships, profit from experts and understand trends: Anuga unites the world of food and beverages into a unique trade fair experience.

With 10 trade shows under one roof it brings supply and demand together in a targeted manner. Attractive events, special events and congresses ensure an inspiring transfer of knowledge. As a business, ordering and networking platform, Anuga creates the ideal basis for valuable business relations and sustainable growth.

Anuga not only provides a platform for networking but also offers profound insights into the pioneering developments of the industry. The congress and event program present a diverse range of conferences, workshops, experience areas, and speaker sessions. Key industry concerns are addressed, while innovations are showcased and discussed.

Strategic alliance reinforces Iberian food market: Koelnmesse and IFEMA launch Anuga Select Ibérica

Koelnmesse, organiser of the world's biggest trade fair for food and beverages, Anuga, and IFEMA MADRID, one of the biggest exhibition centres in Europe, have formed a strategic alliance to strengthen the Spanish and entire Iberian food market. The cooperation unites the strengths of both partners and leads to the premiere of a new trade fair format: Anuga Select Ibérica, which will celebrate its first edition in Madrid from 16 to 18 February 2027. The aim is to bring together local and international industry players, boost trade and further develop Spain as an important hub of the international food industry.

Anuga Select Ibérica is the result of the integration and further development of two established trade fair formats of IFEMA MADRID: Meat Attraction is an international trade fair that covers the entire value chain of the meat industry, focusing on production, export and technologies.

With its focus on Spain and Portugal as key growth drivers, Anuga Select Ibérica is sending a strong signal for the region. Thanks to its geographical location, the Iberian Peninsula plays a key role in the trade between Europe, Latin America and North Africa. Anuga Select Ibérica aims to optimally exploit the potential of the Iberian market while at the same time building bridges to the Latin American export markets.

Gerald Böse, President and Chief Executive Officer of Koelnmesse GmbH, and Daniel Martínez, Executive Vice President of IFEMA MADRID, signed the agreement for this strategic partnership in Madrid on 29 July 2025.

www.anuga-iberica.com

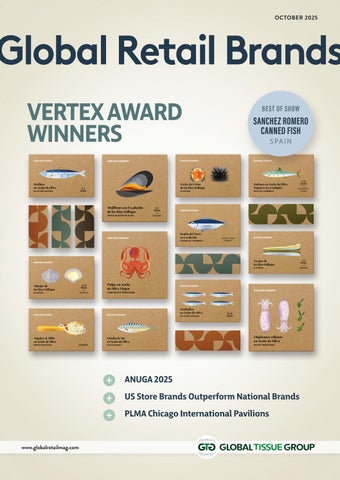

VERTEX AWARDS 2025

THE WINNERS ARE...

Welcome to the 12th Annual Vertex Award winner’s feature. This year’s competition included entries from 30 countries Each represents the absolute best in package design from around the globe regardless of who owns the brand. That’s right; these are the best package designs in the world – full stop.

CHRISTOPHER

DURHAM

President, The Velocity Institute

Co-founder, The Vertex Awards

Brought to you by

PHILLIP RUSSO

Publisher, Global Retail Brands

Co-founder, The Vertex Awards

BEST OF SHOW

SANCHEZ ROMERO CANNED FISH

SANCHEZ ROMERO

SANCHEZ ROMERO

SPAIN

SUPPERSTUDIO

PACKAGED GOODS

NORTH AMERICA & SOUTH AMERICA

GIANT X SEA ISLE SPIKE ICE TEA

THE GIANT CO.

UNITED STATES

AHOLD DELHAIZE USA

LICENSED OR CO-BRAND

EUROPE & AFRICA

KRUIDVAT

LIMITED EDITION

SNOWMAN

KRUIDVAT

KRUIDVAT

NETHERLANDS

GUTS&GLORIOUS.

HOLIDAY OR LIMITED-EDITION

CHOICE

ASIA, AUSTRALIA, NEW ZEALAND

WOOLWORTHS HEALTHY CRACKERS

WOOLWORTHS

WOOLWORTHS

AUSTRALIA

BOXER & CO.

ORGANIC AND NATURAL PACKAGED GOODS

NORTH AMERICA & SOUTH AMERICA EQUATOR

AGENCY OF THE YEAR

EUROPE & AFRICA

SUPPER STUDIO

BRONZE

SILVER

ASIA, AUSTRALIA, NEW ZEALAND

MOTOR BRAND DESIGN

SILVER

14 WINNERS • 5 COUNTRIES • 6 AGENCIES | GOLD: 7 SILVER: 5 • BRONZE: 2

YEAR

NORTH AMERICA & SOUTH AMERICA

THE FRESH MARKET

RETAILER OF THE YEAR

EUROPE & AFRICA

GOLD SANCHEZ ROMERO

RETAILER OF THE YEAR

ASIA, AUSTRALIA, NEW ZEALAND

ALDI AUSTRALIA

2025 VERTEX AWARDS

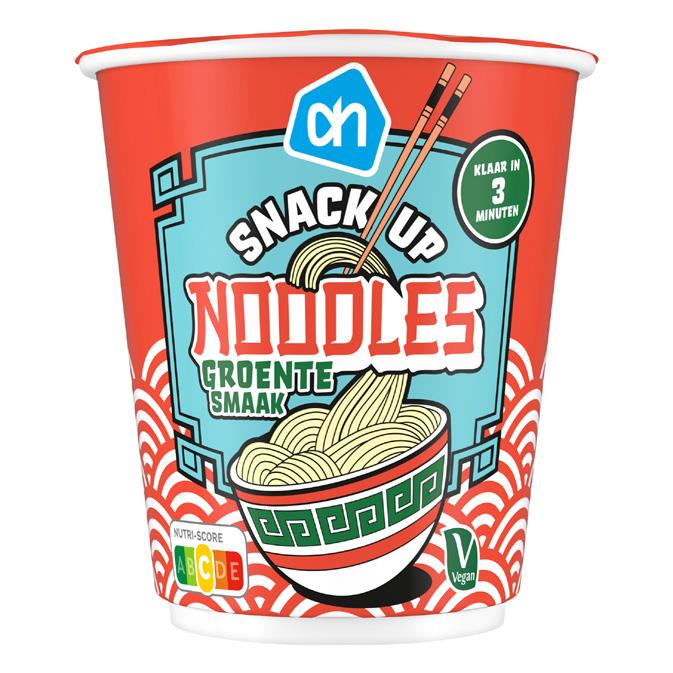

ALBERT HEIJN SNACKUP

ALBERT HEIJN

ALBERT HEIJN

NETHERLANDS

BRAND POTENTIAL PACKAGED GOODS

OVERJOYED HALLOWEEN

OVERJOYED HALLOWEEN ALBERTSONS

UNITED STATES

ALBERTSONS IN-HOUSE PACKAGED GOODS

OVERJOYED CONES AND CUPS

OVERJOYED CONES AND CUPS ALBERTSONS

UNITED STATES STERLING BRANDS FROZEN

SPECIALLY SELECTED FLAVOURED CHEDDARS

SPECIALLY SELECTED

ALDI INC.

UNITED STATES

MOTOR BRAND DESIGN

PACKAGED GOODS

FARMWOOD FAKEAWAY

FARMWOOD

ALDI AUSTRALIA

AUSTRALIA

MOTOR BRAND DESIGN

FROZEN

HILLCREST LOW SUGAR COCONUT BARS

HILLCREST

ALDI AUSTRALIA

AUSTRALIA

MOTOR BRAND DESIGN

PACKAGED GOODS

REGAL NO SUGAR

FLAVORED SOFT DRINKS

REGAL

ALDI AUSTRALIA

AUSTRALIA

MOTOR BRAND DESIGN

BEVERAGES: NON-ALCOHOLIC

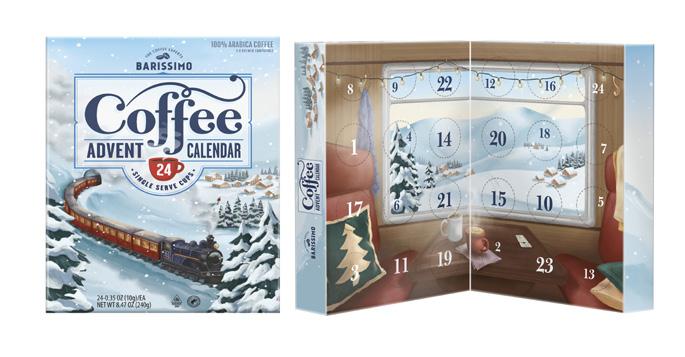

BARISSIMO

SWEET ITALY

FLAVORED GROUND COFFEE

BARISSIMO

ALDI US

UNITED STATES

EQUATOR DESIGN

PACKAGED GOODS

SWEET HAVEN FROZEN DESSERT

SWEET HAVEN

ALDI AUSTRALIA

AUSTRALIA

MOTOR BRAND DESIGN

FROZEN

CLANCY’S SWEET POTATO CHIPS

CLANCY’S

ALDI US

UNITED STATES

EQUATOR DESIGN

PACKAGED GOODS

TAKEAWAY READY MEALS

CO-OP

CO-OP

UNITED KINGDOM

EQUATOR DESIGN

INTERNATIONAL/SPECIALTY FOOD

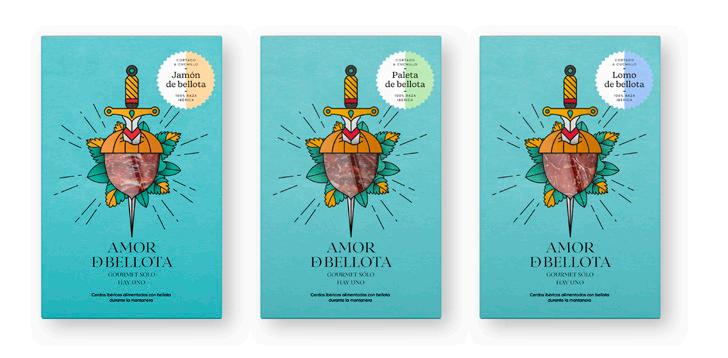

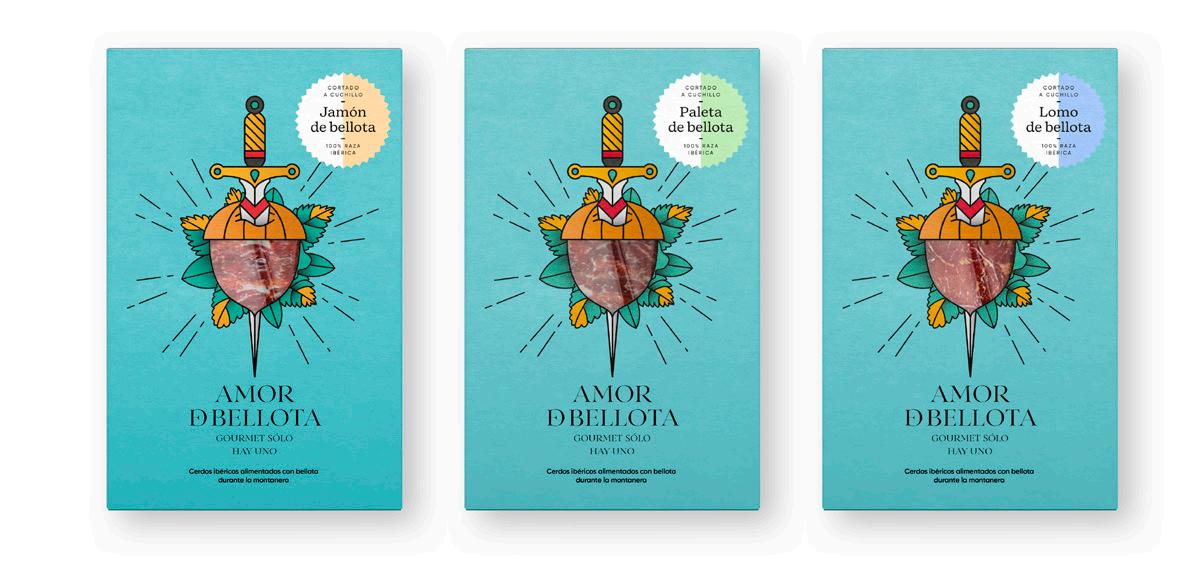

AMOR DE BELLOTA SLICED

AMOR DE BELLOTA

AMOR DE BELLOTA

SPAIN

SUPPERSTUDIO

PACKAGED GOODS

2025 VERTEX AWARDS

CO-OP BAKE AT HOME FROZEN PASTRIES

BAKE AT HOME

CO-OP

UNITED KINGDOM

EQUATOR DESIGN FROZEN

WELL MARKET

WELL MARKET CVS HEALTH

UNITED STATES MARKS, AN SGS CO. NEW BRAND

THE ICE CREAM BAR

DOSROMBOS

DOSROMBOS

SPAIN

SUPPERSTUDIO NEW BRAND

TEA AND INFUSIONS

EL CORTE INGLÉS

EL CORTE INGLÉS

SPAIN

SUPPERSTUDIO

PACKAGED GOODS

CONDOMS

ETOS

ETOS

NETHERLANDS

DESIGN BRIDGE AND PARTNERS

REDESIGNED BRAND

CONDOMS

ETOS

ETOS

NETHERLANDS

DESIGN BRIDGE AND PARTNERS

HEALTH CARE

2025 VERTEX AWARDS GOLD

CONFITURE

JUMBO’S CONFITURE

JUMBO SUPERMARKTEN B.V.

NETHERLANDS

OD DESIGNSTUDIO

PACKAGED GOODS

FRUIT SPREADS

JUMBO’S

JUMBO SUPERMARKTEN B.V.

NETHERLANDS

OD DESIGNSTUDIO

PACKAGED GOODS

MEXICAN FOOD

JUMBO’S

JUMBO SUPERMARKTEN B.V.

NETHERLANDS

OD DESIGNSTUDIO

INTERNATIONAL/SPECIALTY FOOD

PASTA SAUCES

JUMBO’S

JUMBO SUPERMARKTEN B.V.

NETHERLANDS

OD DESIGNSTUDIO

INTERNATIONAL/SPECIALTY FOOD

HOME AMBIANCE

REED DIFFUSERS

KRUIDVAT

KRUIDVAT

NETHERLANDS

GUTS&GLORIOUS

HOME CARE & CLEANING

ABOUND

ABOUND

KROGER

UNITED STATES

THINKHAUS IDEA FACTORY

REDESIGNED BRAND

SEXUAL WELLBEING, SEXTOYS

KRUIDVAT

KRUIDVAT

NETHERLANDS

BRANDNEW DESIGN AMSTERDAM

HEALTH CARE

NEDERLANDS

OPENLUCHTMUSEUM BEERS

NEDERLANDS OPENLUCHTMUSEUM

NEDERLANDS OPENLUCHTMUSEUM

NETHERLANDS

BRUM BRAND- AND PACKAGING DESIGNERS

BEVERAGES: ALCOHOLIC

BARE

BARE

LANDERS

PHILIPPINES

DAYMON DESIGN

ORGANIC AND NATURAL HBC & BABY

INTERNATIONAL RIOS

RIOS

PENNY INTERNATIONAL

CZECH REPUBLIC

ELFENBEIN STUDIOS GMBH & CO. KG

REDESIGNED BRAND

R ASIAN TASTE KIT

R REMA 1000 NORWAY EVERLAND

INTERNATIONAL/SPECIALTY FOOD

PREMIUM DESSERTS

R REMA 1000 NORWAY EVERLAND FROZEN

SANCHEZ

ROMERO

SANCHEZ ROMERO

SANCHEZ ROMERO

SPAIN

SUPPERSTUDIO

NEW BRAND

2025 VERTEX AWARDS

CANNED VEGETABLES

SANCHEZ ROMERO

SANCHEZ ROMERO

SPAIN

SUPPERSTUDIO

PACKAGED GOODS

CHRISTMAS SWEETS

SANCHEZ ROMERO

SANCHEZ ROMERO

SPAIN

SUPPERSTUDIO

HOLIDAY OR LIMITED-EDITION

2025 VERTEX AWARDS GOLD

PREMIUM QUALITY NUT MIXES

MINASAMANO OSUMITSUKI

SEIYU

JAPAN

MOMENTUM JAPAN

PACKAGED GOODS

PICK ME UP PROVISIONS

PICK ME UP PROVISIONS

STAPLES

UNITED STATES

MBD

NEW BRAND

PREMIUM GELATO

SPROUTS

SPROUTS FARMERS MARKET

UNITED STATES

MBD

FROZEN

2025 VERTEX AWARDS GOLD

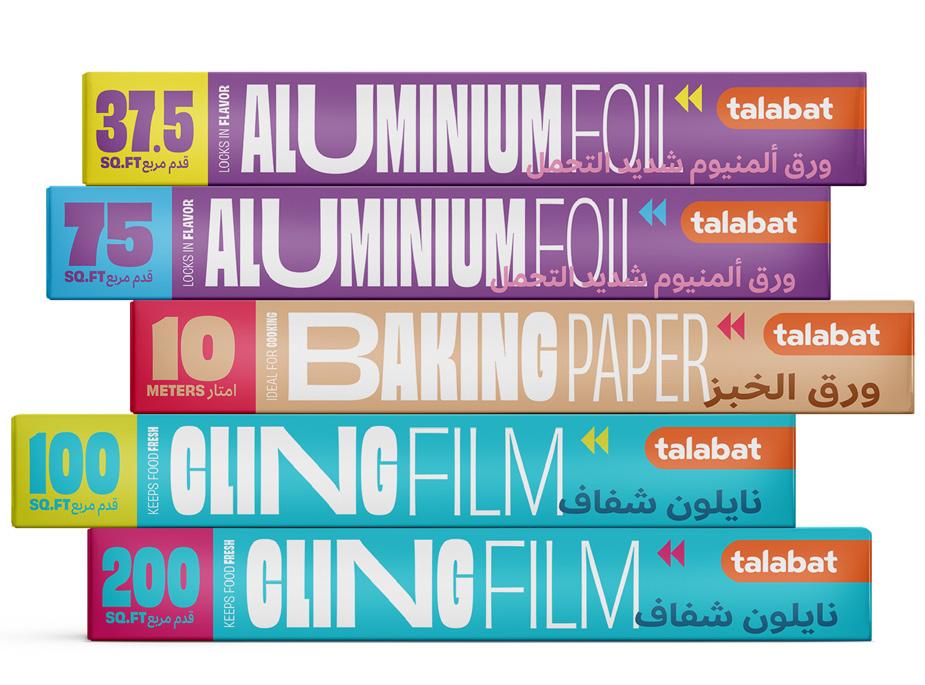

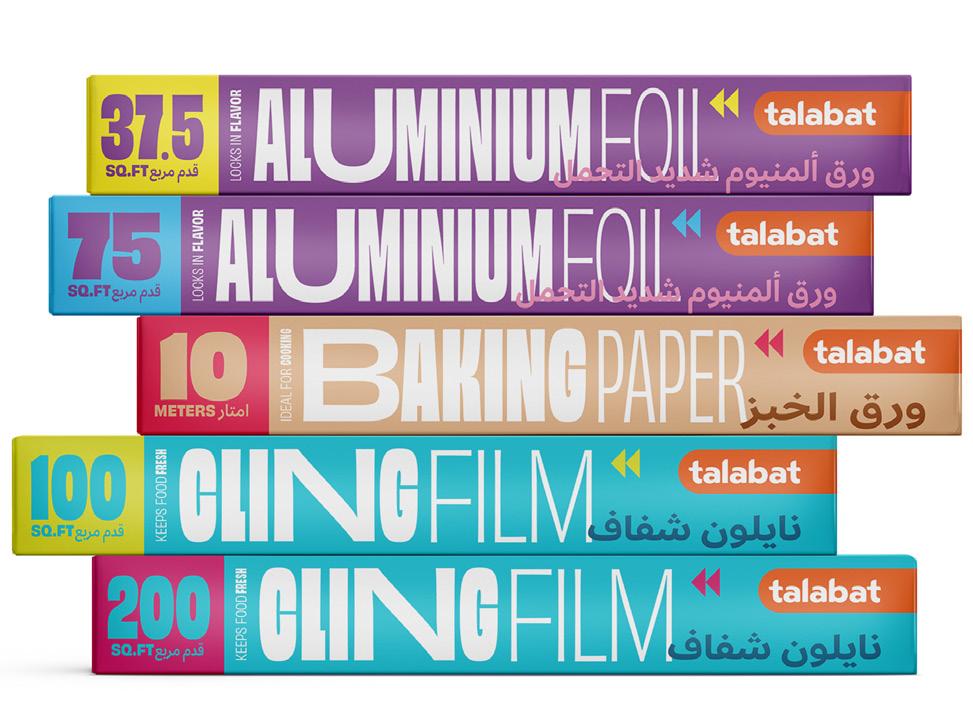

KITCHEN FOILS

TALABAT

TALABAT

UNITED ARAB EMIRATES

DAYMON DESIGN

COOKING & KITCHENWARE

THE GOOD WITCH CLEANING

THE GOOD WITCH

UDEA (EKOPLAZA)

NETHERLANDS

BRUM BRAND- AND PACKAGING DESIGNERS

HOME CARE & CLEANING

GOURMET POPCORN

THE FRESH MARKET

THE FRESH MARKET

UNITED STATES

EQUATOR DESIGN

PACKAGED GOODS

2025 VERTEX AWARDS GOLD

YARRAH

YARRAH ORGANIC PET FOOD

ZOOPLUS | FRESSNAPF | EKOPLAZA | BIOCOOP

NETHERLANDS

PEPPEL DESIGN

PET PRODUCTS

ALBERT HEIJN BIO SOEPEN

ALBERT HEIJN BIO

ALBERT HEIJN

NETHERLANDS

BRAND POTENTIAL

PACKAGED GOODS

VERTEX AWARDS 2026:

Call for Entries Opens November 14

The spotlight is once again on excellence in Retailer-owned Brand package design. The Vertex Awards, recognized globally as the premier competition for brand design, will officially open for entries on November 14, 2025. Designers, agencies, and retailers everywhere are invited to submit their best work and showcase the creativity shaping today’s retailerowned brand, private brand, and private label programs.

Since its founding in 2014, the Vertex Awards has grown into the largest competition of its kind. What started as an idea to give Retailer-owned Brands a stage of their own has become a truly global celebration of design. Over the years, winners have come from every corner of the world, from supermarket icons in Europe to emerging retailers in Asia to fresh, bold concepts in North America. Each year, the awards tell a story about where the industry is headed and how design continues to evolve to meet the needs of shoppers.

“Every year the Vertex Awards spotlight the very best thinking in brand, design, and execution for Retailer-owned Brands,” says Christopher Durham, Co-Founder of the Vertex Awards. “Great design changes how people shop. It builds trust, drives trial, and elevates entire categories. We cannot wait to see what this year’s creative community brings.”

His fellow Co-Founder, Phillip Russo, Publisher of Global Retail Brands magazine, adds: “From private label to private brand to Retailer-owned Brand, design has the power to connect with

CHRISTOPHER DURHAM PRESIDENT

VELOCITY

consumers in ways that shape loyalty and long-term growth. This competition continues to raise the bar globally, and we are proud to champion the creativity behind the brands people bring into their homes every day.”

A Global Benchmark for Design

Entries are welcome from retailers, design agencies, manufacturers, and in-house creative teams. Only Retailer-owned Brands, private brands, and private labels are eligible. National brands are not included.

The competition features more than a dozen categories, including food, beverage, household, health and beauty, baby, pet, seasonal, innovation, sustainable design, and limited edition. An international panel of judges will review every entry anonymously, scoring them on Creativity, Consumer Relevance, Executional Excellence, and Business Impact.

Winners will be honored with Gold, Silver, and Bronze awards, along with special recognitions such as Best of Show, Publisher’s Choice, Design Agency of the Year, and Retailer of the Year. With entries coming from dozens of countries, the Vertex Awards remain the standard for creativity and performance in Retailer-owned Brand, private brand, and private label design.

And this year, the celebration will be bigger than ever. Winners of the 2025 competition will be recognized at Vertex Awards Galas in New York and Amsterdam in May 2026. These gatherings bring together designers,

INSTITUTE

retailers, and thought leaders to honor the best work in the industry and to connect a global community passionate about Retailer-owned Brands.

Raising the Bar for Retailer-owned Brands

The Vertex Awards are more than a celebration of individual projects. They shine a light on the entire Retailer-owned Brand industry, while also recognizing the work being done in private brands and private labels. The awards help elevate design as a driver of business success and a powerful way to build consumer loyalty.

As Russo points out, the work recognized through the Vertex Awards often shapes the way millions of people experience products in their daily lives. It is a reminder that Retailer-owned Brand design is not an afterthought, but a force that reflects both creativity and innovation.

Entries Open 14 November www.vertexawards.org.

Christopher Durham President of the Velocity Institute. Prior to this he founded the groundbreaking site My Private Brand. He is the co-founder of The Vertex Awards. He began his retail career building brands at Food Lion and Lowe’s Home Improvement. Durham has worked with retailers around the world, including Albertsons, Family Dollar, Petco, Staples, Office Depot, Best Buy, Metro Canada. Durham has published seven definitive books on private brands, including Fifty2: The My Private Brand Project and Vanguard: Vintage Originals.

MBD WINS 1O VERTEX AWARDS AT THE 2025 VELOCITY CONFERENCE

In today’s competitive retail environment, packaging must do more than just catch the eye—it has to tell a story, deliver on brand promise, and forge an emotional connection in a matter of seconds.

This is the challenge we embrace every day at MBD. And this year, we’re proud to see that work recognized on a global stage.

At the 2025 Vertex Awards— announced during the Velocity Conference in Charlotte—MBD took home ten awards across six different retailers. The Vertex Awards celebrate the best in private brand package design from around the world, and each entry is judged on creativity, marketability, and innovation. We’re thrilled that our clients’ brands stood out in such a competitive field.

AWARD-WINNING DESIGNS:

Sprouts Organic Kombucha

CATEGORY:

Beverages – Non-Alcoholic (ready to drink)

To appeal to health-conscious shoppers, MBD designed a fruitforward mandala background and a tea bag–shaped placard that nods to the kombucha’s natural roots. Vibrant, earthy colors and fruity imagery enhance taste appeal, while the overall design reflects the organic simplicity and functional benefits that matter most to Sprouts’ core consumers.

Sprouts Premium Gelato

CATEGORY: Frozen

Inspired by small-batch, gourmet gelato brands, this design brings flavor to life with custom illustrations that hint at each indulgent variety. A bold yet elegant type system reinforces the premium nature of the product, while a playful, flavorforward color palette introduces an unexpected pop that reflects Sprouts’ unique and creative flavor combinations.

Sprouts Italian Soda

CATEGORY:

Beverages – Non-Alcoholic (ready to drink)

This vintage-style design gives a playful, farmers market spin to a classic Italian beverage. Retro fonts, nostalgic illustrations, and a “Product of Italy” stamp combine with Sprouts’ unique personality, creating a package that feels both timeless and delightfully unexpected on shelf.

BJ’s Diapers

CATEGORY:

Baby – Diapers, wipes, medicine, food

MBD developed a cheerful, modern look for BJ’s premium diaper line, using size-specific woodland animal illustrations to engage parents and support easy navigation. A vertical holding device simplifies shopability, while a soft tan background paired with bright, happy accents delivers a premium yet approachable tone for the caregiving set.

BJ’s Frozen Appetizers

CATEGORY: Frozen

This redesign establishes a cohesive visual system across both Everyday and Premium tiers, using rich topdown food photography and SKUspecific color blocking to support appetite appeal and variety. A dark blue marble background adds contrast and sophistication, giving this versatile product line a unified, high-quality feel.

PriceSmart Pasta

CATEGORY: International/Specialty Food

Balancing fun and authenticity, this design uses whimsical raw pasta patterns set against a rich blue background and paired with upscale type. A prominent “Italy bug” acts as a seal of quality and provenance, lending credibility to a beloved pantry staple while making it visually stand out.

Smart & Final Mexican Breads & Cookies

CATEGORY: Packaged Goods

MBD honored cultural heritage through a vibrant, papel picado–inspired design that celebrates traditional Mexican baking. Bold colors, simple typography, and color-coded panels create a festive yet practical packaging solution that makes navigation easy while adding excitement to shelf and pantry.

7-Eleven Sparkling Tea Beverages

CATEGORY: Beverages – Non-Alcoholic (ready to drink)