Stock smarter with America’s most trusted partner for premium household paper goods.

Managing supply chains in today’s unpredictable landscape isn’t easy— but with the right partner, it can be. Global Tissue Group has spent decades perfecting our processes, scaling our production, and delivering high-quality bath tissue, paper towels, facial tissue, and napkins that retailers trust.

Scan to see why top retailers trust GTG for household paper essentials:

Our commitment to reliability, flexibility, and seamless fulfillment means you can focus on growing your business while we ensure your shelves stay stocked with the premium products your customers expect.

This has been a very challenging issue to produce. In 2012, we envisioned this magazine as a source of global learning, inspiration and sharing. We still do. The beauty of this approach has had a benefit I never imagined and will always be grateful for. It’s the people I’ve met and how much I’ve learned from them not only from a business perspective, but from a personal one. Some of my best friends and many of my favorite people I’ve met have been through this magazine and the industry it serves.

So it literally pains me to see the amount of chaos in the world today. I end my day hoping it will cease and I wake up realizing it hasn’t. The world order I’ve known my entire life, the one my father and his 5 brothers fought for in WW2 is being upended by a world leader who is at best, myopic.

So let me emphatically say this. No one person represents the thoughts, hopes and dreams of the American people. Please believe me when I tell you there’s still a lot of good in the United States and a millions of really good people who just go about the business of caring for others (nurses, fire-fighters, teachers, etc.) and making the world a better place. When you think about the US, think of these people first…it will help us all get through the madness.

Speaking of the US, some recent news from PLMA is very encouraging:

“As

Over the first two months of 2025 store brands continued to dominate national brands by outperforming their counterparts in both dollar and unit sales across all U.S. outlets, per Circana Unify+.

Store brand dollar sales gained 5.6% and unit sales rose 1.7%, compared to national brands, which were up only 1% in dollars and down 0.8% in units, as of February 23, 2025, vs the same two-month period a year ago. For 2025, store brand market shares have moved up to 21.7% for dollars and to 23.9% for units, both all-time highs that reflect private label’s superior, multiyear performance vs brands at checkout.”

None of these results would be possible without the innovation, quality and service provided by the suppliers serving our industry, especially those whose capabilities are showcased in this Supplier Guide Issue. We thank them profusely.

Phillip Russo Founder / Editor phillip@globalretailmag.com

With their crispy crust, golden-yellow texture, and exceptional flavor, our breads will elevate your bakery’s performance to new heights. Bring the taste of Italy to your customers with our fine breads, made with durum wheat semolina, mother yeast, and natural fermentation.

Contact us today to learn more: gourmetbreads@oropan.it

2025 I VOLUME 13 I NUMBER 1 OF 4

Phillip Russo EDITOR / PUBLISHER phillip@globalretailmag.com

Jacco van Laar BRAND AMBASSADOR jacco@globalretailmag.com

Melissa Subatch CREATIVE DIRECTOR info@melissasubatchdesign.com

Andrew Quinn DIGITAL DIRECTOR andrew.quinniii@gmail.com

Luisa Colombo EUROPEAN DIRECTOR luisa@globalretailmag.com

Ana Maria Jimenez Aguilar BUSINESS DEVELOPMENT ana@globalretailmag.com

Sabine Geissler GREENTASTE.IT Italian Business Development s.geissler@greentaste.it

CONTRIBUTORS

Perry Seelert Emerge perry@emergefromthepack.com

Christopher Durham Velocity Institure cdurham@retailbrandsinstitute.org

Maria Dubuc

Marketing By Design mdubuc@mbdesign.com

Hans Kraak Kraak Media kraakmedia@gmail.com

Elena Sullivan sullivan.elena@gmail.com

Tom Prendergast PLMA tprendergast@plma.com

Koen A. M. De Jong IPLC kdejong@iplc-europe.com

Published, Trademarked and all rights reserved by: Kent Media

Phillip Russo, Principal 225 1st Ave N. / Unit 3501 St. Petersburg, FL 33701 Tel. +1 917 743 6711 All rights reserved under the Library of Congress. No part of this publication may be reproduced or transmitted in any form or by any means,

Global Retail Brands is published 4 times a year.

Editorial Submissions phillip@globalretailmag.com

Advertising Inquiries – EUROPE luisa@globalretailmag.com

Advertising Inquiries – AFRICA, AMERICAS, ASIA, AUSTRALIA, MIDDLE EAST phillip@globalretailmag.com • ana@globalretailmag.com

Subscription Information phillip@globalretailmag.com www.globalretailmag.com

LUISA COLOMBO

Luisa is an International Sales specialist with over 30 years of experience in the development organization and sales of products and services in an international environment. She has acquired extensive skills in promotion and advertising for the private label sector. Expert in the development of innovative sectors and products. For Global Retail Brands she shares the working group with Ms. Ana Maria Jimenez.

KOEN DE JONG

Koen has extensive management experience in the private label manufacturing industry in Germany, France, the United Kingdom and the Netherlands. He has been involved in numerous M&A transactions in the Benelux. His private label strategy and business planning involvement includes company analysis and benchmarking, board consulting and the participation in supervisory boards. He speaks fluent English, German, French and Dutch (mother tongue).

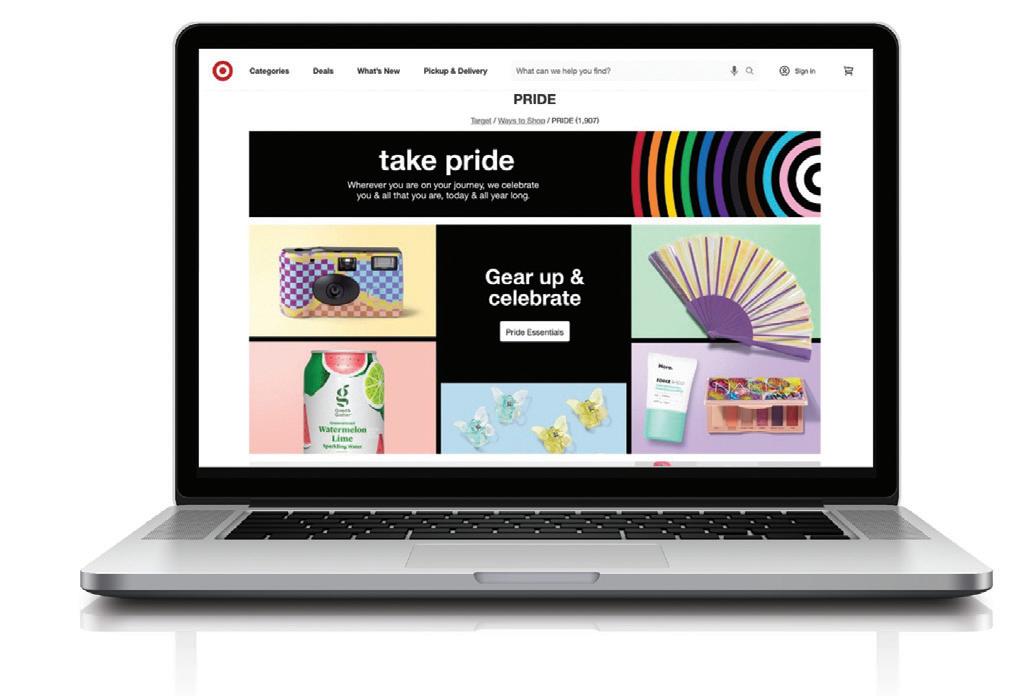

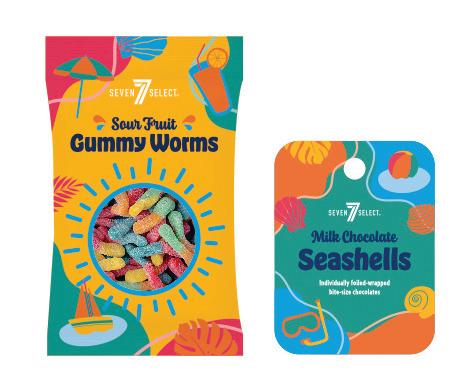

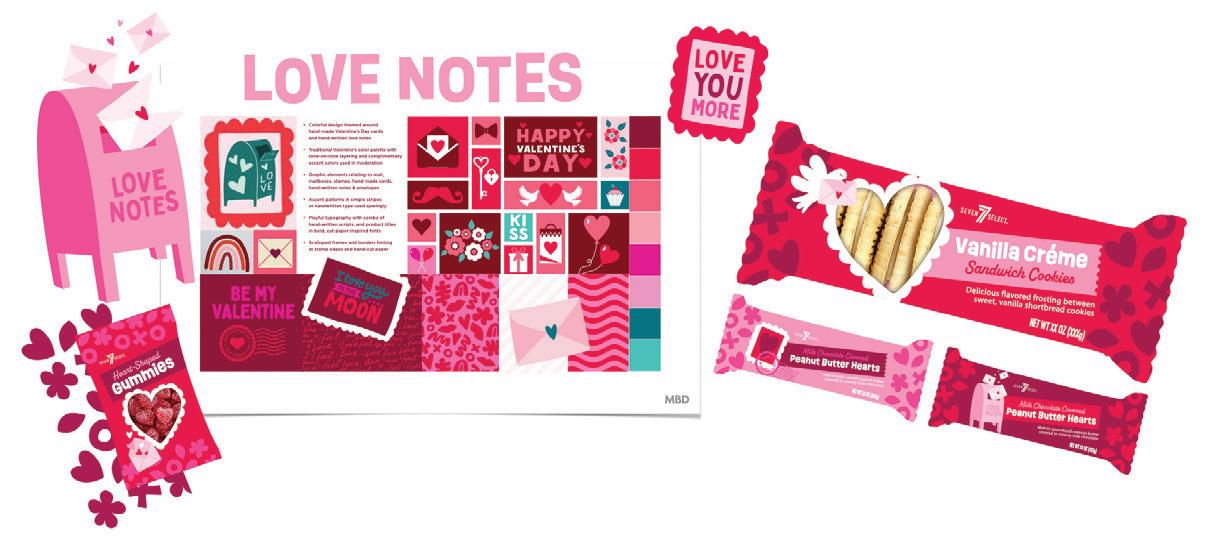

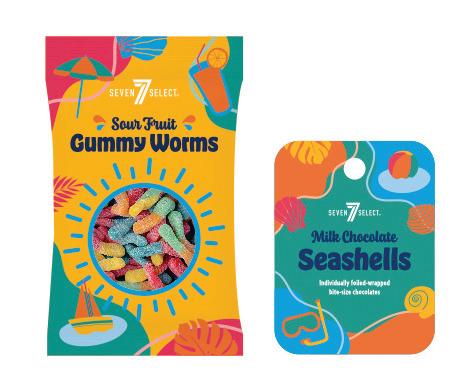

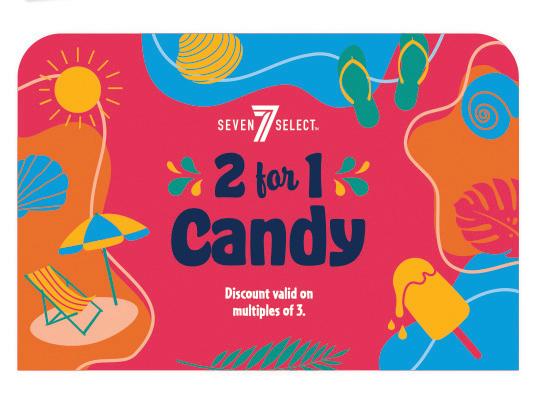

MARIA DUBUC

President of MBD, is a creative and workflow expert in the retail landscape, Maria’s 30-year career translates branding experiences into eye-catching design that is unique and distinct for each client. he has created new private brands and redesigned/repositioned existing brands with leading retailers, while also implementing workflow management systems specifically tailored to the clients’ needs. Current clients include The Home Depot, Smart & Final, PetSmart, 7-Eleven, PriceSmart, BJ’s Wholesale Club, Sprouts Farmers Market, WinCo Foods, Natural Grocers and more.

CHRISTOPHER DURHAM

President of the Velocity Institute. Prior to this he founded the groundbreaking site My Private Brand. He is the co-founder of The Vertex Awards. He began his retail career building brands at Food Lion and Lowe’s Home Improvement. Durham has worked with retailers around the world, including Albertsons, Family Dollar, Petco, Staples, Office Depot, Best Buy, Metro Canada. Durham has published seven definitive books on private brands, including Fifty2: The My Private Brand Project and Vanguard: Vintage Originals.

EUGENE GERDEN

is a freelance writer who writes on a wide range of international topics, from commerce to chemistry and from wine to aviation. He has contributed to many publications, including Decanter, International Aviation News, Chemistry World and The Journal of Commerce. For Decanter, he has covered several stories on wine markets and production in Russia, Georgia and Bulgaria. gerden.eug@gmail.com

HANS KRAAK

Hans Kraak is educated in biology and journalism and wrote three books about nutrition and health. He worked for the Dutch ministry of Agriculture, Nature and Food quality and the Netherlands Nutrition Centre. As editor in chief he publishes in the Dutch Magazine for Nutrition and Dietetics, as a food and wine writer he published in Meininger’s Wine Business International and reports for PLMA Live EU and PLMA USA.

KATE NICHTER

Kate has over 10 years of experience in the design industry, with the last 6 years focused on the CPG space as an Account Manager at MBD. Her expertise lies in fostering strong relationships with clients and retailers, ensuring their goals are not only met but exceeded. Passionate about design and product innovation, Kate is dedicated to delivering impactful packaging solutions that drive success and stand out in the marketplace.

PERRY SEELERT

A retail branding and marketing expert, with a passion for challenging conventional strategy and truths. Perry is the Strategic Partner and Co-founder of Emerge, a strategic marketing consultancy dedicated to helping Retailers, Manufacturers and Services grow exponentially and differentiate with purpose.

Head to Page 70 and 71 for MBD's Retailer Spotlight on 7-Eleven’s, 7-Select Seasonal Program

COSMOPROF / COSMOPACK

Bologna 20 - 23 MAY www.cosmoprof.com

PLMA LEADERSHIP CONFERENCE

Scottsdale, AZ, USA 2 – 4 APRIL www.plma.com

VELOCITY CONFERENCE + EXPO Charlotte, NC 13 - 15 MAY www.velocityinstitute.org

PLMA’S WORLD OF PRIVATE LABEL Amsterdam 20 - 21 MAY www.plmainternational.com

IDDBA

New Orleans, LA 1 - 3 JUNE www.iddba.org

FOOD TAIPEI

Taipei, Taiwan 26 - 29 JUNE foodtaipei.com.tw/en/index.html

SUMMER FANCY FOOD SHOW

New York, NY 29 JUNE - 1 JULY www.specialtyfood.com

JULY

COSMOPROF NORTH AMERICA

Las Vegas, NV 15 - 17 JULY www.cosmoprofnorthamerica.com

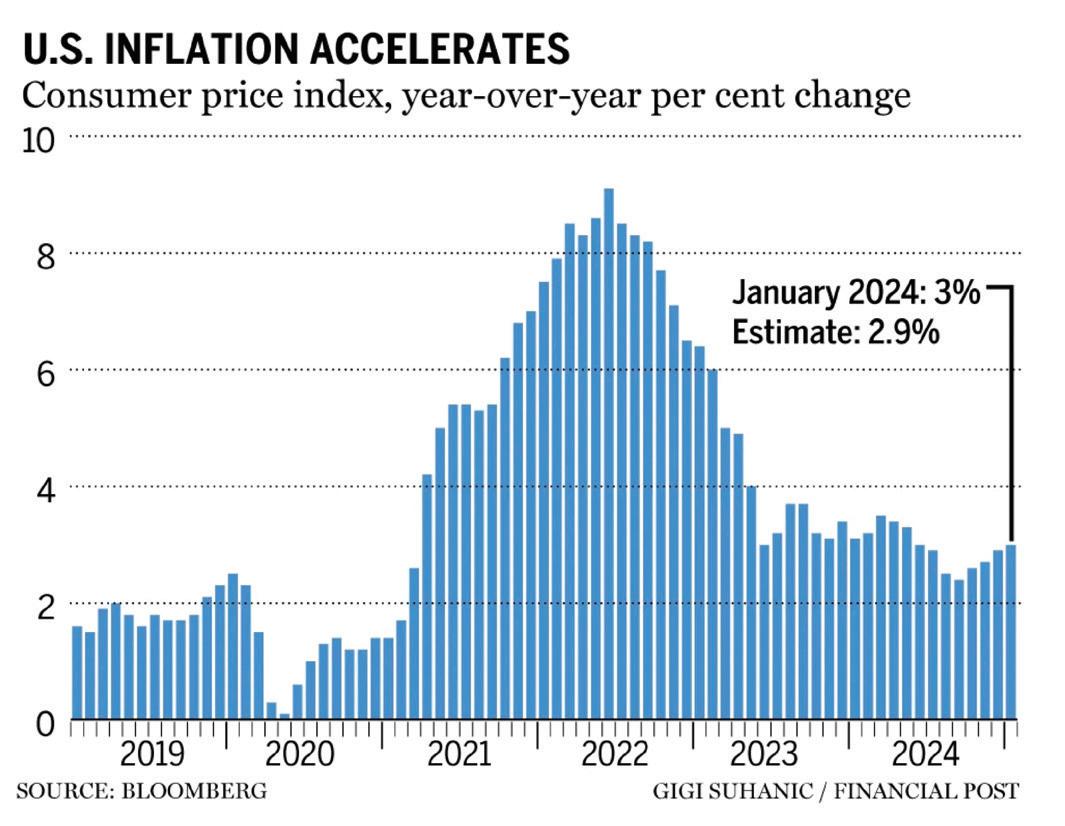

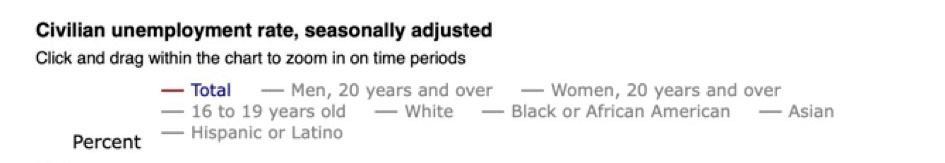

Store brands across the U.S. closed the books on 2024 with new records set in annual sales and dollar and unit market shares.

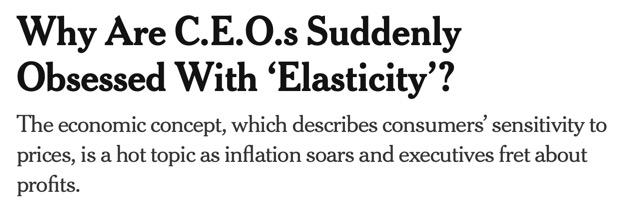

The topline numbers tell a compelling story. Store brand dollar sales in all outlets increased 4x that of national brands last year as the products surged ahead 3.9% compared to a gain of only 1% for their branded counterparts. Looking at unit sales, the head to head disparity was much the same. Store brands advanced 2.3% versus the figure for all of 2023 while national brands dropped -0.6%.

As a result of this enthusiastic response to the products by shoppers at the country’s checkouts, store brands (or private label, retailer brands, own brands) set all-time highs in both key market share metrics — moving up to 20.7% in dollar

share and to 23.1% in unit share, for the period from January 8 to December 29, 2024, reports PLMA, per data from Circana Unify+.

One of every four food and non-food grocery products purchased throughout the U.S. during the year carried the store’s name or one of its proprietary brands.

Total store brand sales volume for 2024 surpassed a quarter trillion dollars, coming in at $271 billion, an increase of $9 billion over the prior 52 weeks and establishing an all-time high in annual revenue. Sales of store brand units were up 1.5 billion to 67.4 billion, another record.

Taking a longer view, annual dollar sales of U.S. store brands increased

by $51.7 billion, or plus 23.6%, over the past four years -- from 2021 to 2024 -- while annual store brand unit sales moved ahead 2.1%, or up 1.4 billion. By comparison, over the same period national brands gained 11.5% in annual dollar sales but slumped -6.8%, or down 16.2 billion, in annual unit sales.

Increases in market shares signal store brands’ superior multi-year performance vs national brands. Store brand dollar share rose 1.6 points from 19.1% in 2021 to 20.7% in 2024 while unit share advanced 1.5 points from 21.6% to 23.1%.

Pulling more than their own weight, store brands accounted for nearly half, 47%, of all sales gains last year in U.S. retailing (or $9 billion of the industry’s $19 billion overall growth).

2024 Sales Dashboard

$218,872,974,826

$927,467,435,579

$247,314,095,849 $988,771,253,283

$261,587,403,216 $1,023,428,384,953

$1,033,780,881,098 2021 2022

$270,580,954,204

65,991,814,086 240,170,155,150

65,468,069,530 231,377,798,796

65,844,817,282 225,303,165,772

67,362,282,262 223,931,725,136

Store brand sales finished the year on the upswing, perhaps auguring a strong start to 2025. Over the second half, from July 14 through the balance of 2024, dollar volume gained 4.6%, vs plus 3.5% for the first six months.

“We are gratified that the new numbers represent an end of the sharp sales volatility of the last several years and a return to the steady state to which our industry is historically accustomed,” says Peggy Davies, PLMA President.

“Middle single digit increases year over year are a sweet spot where store brand sales have traditionally found themselves. Sales spikes -- up and down -- such as we experienced earlier this decade wreaked havoc on the supply chain, the sourcing of ingredients, meeting packaging needs, human resources, capital requirements, pricing, and corporate planning, among other operational issues.”

Departmental sales provide a comprehensive picture of the 2024 results. All ten food and non-food sections finished ahead of the prior year in store brand dollar sales with the two largest departments -- Refrigerated (+ 7.5%) and General Food (+4.3%) -- gaining the most. Beverages were up by 4%, followed by Beauty (+3.7%), Home Care (+3.4%) and Frozen (+3.3%).

Looking at total departmental store brand sales, Refrigerated was again the largest with $57.7 billion, followed by General Food ($51.7 billion), General Merchandise ($25.5 billion), Frozen ($21.6 billion), Home ($18.5 billion), Beverages ($14.4 billion), Pet Care $5.3 billion) and Beauty ($3.8 billion).

When it came to store brand unit sales, nine departments improved. Leading the way were Beverages and Pet Care, which both rose 3.5%, followed by Home Care (+3.3%), General Food (+2.8%), Refrigerated (+2.7%), Frozen (+2.1%), Beauty (+1.9%), and General Merchandise (+0.1%). Only Health declined at -0.4%.

The top departments for total store brand unit sales were General Food (18.8 billion), Refrigerated (14.9), General Merchandise and Beverages (both 4.9 billion), Frozen (4.6 billion), Health (2.4 billion), Beauty (974 million), Pet Care (931 million) and Home Care (736 million).

In market shares, store brands increased in food and non-food product departments across the board.

Store brand unit share rose in every department, with the best gains in General Food, +0.7%, followed by Beverages, General Merchandise and Home Care, all +0.5%. Share is highest in General Merchandise at 41.4%, next are Refrigerated (38.4%), Frozen (27.5%) and Health (25.5.%).

As for store brand dollar share, the largest gains were in Frozen (+0.6%), General Food (+0.5%) and General Merchandise (+0.4%). Top store brand dollar shares were in Refrigerated (36.4%), General Merchandise (33.4%) and Frozen (25.9%).

Drilling down further, store brand expansion occurred in a majority of categories. The products racked up dollar sales gains in 129 of the 167 edible categories (77% of them) in which they were sold and enjoyed unit sales improvement in 118 (71%). Among the 153 non-edible categories that offered store brands, dollar sales growth was recorded in 79 (52% of them) and there were unit sales increases in 85 (56%).

PLMA’s Davies pointed to a statement by former Kroger Kroger CEO Rodney McMullen as an excellent explanation of private label’s ascension and the strategic importanceof the products to retailers and consumers.

McMullen told investors, “The profitability of Our Brands is several hundred basis points higher than national brands. And if the CPGs are willing to continue to give up share to Our Brands we’re OK because we find once a customer tries Our Brands the repeat rate of their coming back is incredibly high because what they find is there’s no compromise on quality, and they have great value for the money.”

News from PLMA’s International Council reveal that Private Label brands continue to gain momentum across Europe, with total sales reaching €352 billion in 2024, according to data from NielsenIQ. This marks a 0.11 percentage point increase in market share from 2023, bringing private labels to 38.1% of the total grocery sector.

NielsenIQ’s survey, conducted across 17 European markets for PLMA’s 2025 International Private Label Yearbook, found that private label sales increased in nine out of the 17 countries. Europe remains a dominant global player in private label sales, with 10 countries exceeding a 30% market share of which five surpassing 40%. The region’s three largest grocery markets - Germany, the United Kingdom, and France - hold a collective private label share of 39.7%, reflecting a 0.1 percentage point increase from the previous year.

Among the highest-growing markets, Spain leads with a 1.2 percentage point increase in private label share, followed by the Czech Republic (+0.5 pp), Portugal (+0.4 pp), and France (+0.4 pp). Switzerland remains the strongest private label market, boasting a 52.0% share, making it the only country with a share above 50%.

After a decline in unit volumes in 2023, the grocery market is showing signs of recovery, with total unit sales increasing by 1.27% in 2024, adding 5.24 billion units. Private labels have been the primary driver of this growth, contributing over 75% of the total increase, while manufacturers’ brands accounted for the remaining 25%.

Consumer perception of private labels continues to evolve, reinforcing their value proposition. A YouGov study indicates that shoppers have rated the price-performance ratio of private label products higher than in previous years. As a result, retailers with strong private label portfolios are gaining favour among price-conscious consumers.

Consumer attitudes toward private labels are shifting, leading to their transformation from budget-friendly alternatives to competitive, high-quality product lines. According to NielsenIQ, 50% of global consumers report an increased willingness to purchase private label products, and 40% say they would pay higher prices for them if they perceive superior quality. This trend reflects a growing “branding effect” in private labels.

Across product categories, private label growth is particularly strong in Ambient Food, Confectionery & Snacks, and Perishable Food, which collectively account for an average of 46.8% private label value share, representing €221 billion across the 17 tracked European markets. The highest growth within large markets (Germany, United Kingdom and France) was observed in Ambient Food and Alcoholic Beverages.

Spain and Portugal saw private label share gains of +1.1 percentage points, with Frozen Food growing by +2.0 percentage points. In contrast, Healthcare

and Pet Food saw slight declines in these regions. Belgium and the Netherlands experienced a minor -0.3 percentage point decline overall, but still showed growth in Healthcare, Ambient Food, Confectionery & Snacks, and Alcoholic Beverages. In Eastern Europe, private label share grew by +0.3 percentage points, led by Home Care, Perishable Food, and Ambient Food.

Scandinavian markets saw a slight -0.04 percentage point decline in private label share, mainly in Paper Products (-1.3 pp), Alcoholic Beverages (-0.2 pp), Frozen Food (-0.2 pp), Non-Alcoholic Beverages (-0.1 pp), and Ambient Food (-0.03 pp). However, growth was still visible in Health Care (+1.4 pp) and Health & Beauty (+0.4 pp).

A recent PLMA industry survey among private label manufacturers and retailers found that nine out of 10 industry professionals expect private label sales to continue growing in the coming years. With evolving consumer preferences, strong price-performance value, and increasing premiumization, private labels are poised for continued expansion across European markets.

According to NielsenIQ, total private label sales across the 17 European countries grew by €9.5 billion, reinforcing the sector’s resilience and growth potential in a competitive retail landscape.

This is Tutto Pannocarta, the only one with a triple integrated function: cloth, sponge, paper. Each individual sheet can be washed, wrung out and reused numerous times. The secret of this product lies in Airlaid technology, which makes it possible to obtain a paper with a thick and consistent texture, very similar to fabric, but with the properties and versatility of paper. Tutto Pannocarta, the technological paper rolls.

Find out more on tuttoxtutto.it

The Private Label Manufacturers Association is preparing for its largest and most highly anticipated 2025 World of Private Label International Trade Show, May 20-21 at the RAI Amsterdam Convention Centre.

With a record-breaking number of exhibitors and high expectations from retailers and manufacturers globally PLMA’s World of Private Label International Trade Show reaffirms its position as the premier meeting place for the private label industry worldwide.

With over 3,100 exhibitors from 73 countries, including new pavilions from Canada, Scotland, Bulgaria, Morocco, and Ukraine, the trade show floor will showcase a diverse and innovative range of private label products across all FMCG categories. The show floor will be divided into Food and Non-Food halls, allowing attendees to efficiently explore emerging trends, innovations, and new product developments in a dynamic business environment.

“As private label continues to expand across all markets, companies are seeking innovative products, sustainable solutions, and dependable business partners,” said PLMA President Peggy Davies. “This year’s two-day event, featuring the largest concentration of private label professionals in the industry, will spotlight key trends such as sustainability, health-conscious products, and convenience, while offering exhibitors and buyers an ideal opportunity to connect and grow their businesses.”

PLMA’s annual trade show is the key industry event. With a strong demand for networking, insights, and collaboration, this year’s show is more important than ever.

The trade show has proved itself as the perfect formula for success, combining all the essential elements for growth:

As private label continues to expand across all markets, companies are seeking innovative products, sustainable solutions, and dependable business partners.

Peggy Davies, President, PLMA

• Innovation at PLMA’s Idea Supermarket®, showcasing the latest private label product trends and packaging solutions.

• Intelligence through expert seminars, including presentations, case studies, and workshops on important industry topics. Speakers include Jumbo Supermarkten in The Netherlands and NielsenIQ who will give an analysis on private label market shares in Europe.

• Business Opportunities on the Trade Show Floor, where exhibitors and buyers come together to create new partnerships and drive private label forward.

With a record number of participants drawing top-tier visitors, PLMA’s 2025 World of Private Label International Trade Show sets the stage for private label success.

We’re delighted that PLMA President, Peggy Davies, shared some thoughts on the world’s largest PLMA Event and the industry overall.

What makes PLMA’s World of Private Label unique this year?

We’re thrilled to welcome the largest number of exhibitors and buyers to date, creating an incredibly dynamic atmosphere filled with energy, our distinctive buzz, and insightful business conversations happening throughout the trade show floor. With a sharp focus on key private label emerging trends and innovative products, including sustainability, health, and convenience. PLMA is the ultimate platform to cultivate & build valuable business relationships.

What can we expect from this year’s trade show?

The trade show floor is divided into 9 Food and 5 Non-Food halls, with 3,100+ companies from over 70 countries showcasing their latest private label offerings, making it a truly global event. On Monday, May 19, the day before the trade show, we also offer a seminar program and workshops, with all registered visitors and exhibitor personal invited to attend.

Why should one come to Amsterdam and visit the trade show?

This is an easy one: without a doubt, this show is the place to be if you are involved in private label, whether in manufacturing, procurement or retail. It is where business develops, thrives & grows offering the perfect blend for success: strengthening relationships, exploring trends and innovation, and discovering new developments with like-minded professionals. Don’t just take my word for it—come see for yourself! I’m confident it will be an exceptional experience you won’t want to miss.

Over 3,100 exhibitors from 73 countries showcase their latest private label offerings

What are the biggest private label trends emerging from this year’s show?

Ongoing trends like vegan, plantbased, and organic products are widely represented at the trade show, with a growing offering of sustainable food and non-food products. These trends highlight opportunities for the industry to take the lead in creating a greener world.

How has retailer demand changed post-pandemic, and what are they looking for?

Post-pandemic, retailer demand in the FMCG industry has evolved significantly, with a heightened focus on flexibility, efficiency, and responsiveness. Retailers are increasingly seeking products that align with shifting consumer priorities, such as health, sustainability, and convenience. With the pandemic accelerating digital adoption, there’s a growing demand for innovative e-commerce solutions and improved supply chain transparency. Retailers are looking for partners who can quickly adapt to changing market conditions, offer more sustainable packaging options, and provide faster, more reliable delivery solutions.

How does the current private label market compare to last year?

According to data from NielsenIQ commissioned by PLMA, private label continues to gain momentum across Europe, with total sales reaching €352 billion in 2024, a 2.8% increase compared to the previous year. In all of the 17 countries private label Euro sales increased.

How does the European private label market compare to North America or Asia?

Europe remains a dominant global player in private label sales, with 10 countries exceeding a 30% market share, of which five surpass the 40% mark. The three European largest grocery markets; Germany, the United Kingdom, and France, hold a collective private label share of 39.7%, reflecting a 0.1 percentage point increase from the previous year.

Private label continues to gain momentum across Europe, with total sales reaching €352 billion

What networking opportunities does PLMA offer to help buyers connect with exhibitors?

PLMA offers retailers an online Matchmaking service to set up appointments with exhibitors in advance of the show. PLMA Matchmaker is part of PLMA’s online Show Navigator which is launched to all visitors and exhibitors mid-April.

What advice would you give to a first-time exhibitor at PLMA Amsterdam?

PLMA organises one of the most efficient trade shows in the world. To make the most of your experience, preparation is key. Registered visitors use PLMA's online Show Navigator to map out a successful strategy for their visit to the event. Show Navigator provides a dynamic show floor map and extensive search functionalities to locate exhibitors and products. Exhibitors have various options to upgrade their standard listings in Show Navigator to stand out from the competition, such as advertisements, logos, videos, press releases and detailed company profiles.

How does the event highlight sustainable and eco-friendly private label products?

In PLMA’s Idea Supermarket sustainability is a major focus. Many examples are on display, including sustainable packaging, eco-friendly growing methods, and responsible sourcing. All offering plenty of inspiration for those looking to explore and acquire knowledge about sustainable private label products.

What key industry challenges will the upcoming seminars and workshops address, and how will they help attendees navigate these issues?

The seminar programme on Monday 19 May will offer a behind-the-scenes look at Jumbo, the second-largest Dutch retailer. They will provide insights into their strategies and the challenges they face. Nielsen IQ will report on the private label market share in Europe and the implications, trends and forecasts in the different countries.

How do you see the future of private label evolving in the next 5 to 10 years, especially in light of shifting consumer behaviours and market trends?

Private label has always been closely aligned with evolving consumer behaviours, and this trend will only continue. As consumers increasingly prioritize healthy eating, convenient meal solutions, and sustainable products, private label brands are uniquely positioned to respond swiftly. Unlike established national brands, private labels are able to adapt to emerging trends, offering tailored solutions

that meet the immediate demands of consumers. Whether it’s developing healthier options, eco-friendly cleaning products, or time-saving food solutions, private label offers retailers the agility to stay ahead of the curve and keep pace with changing consumer preferences.

What role do you believe sustainability and innovation will play in the future growth of private label brands?

Sustainability has become a major factor over the past five years, evolving so fast that it is now essential in the development of all new private label products, whether in materials or sourcing. Market trends clearly show this shift. There is no turning back, sustainability is here to stay!

As competition between private label and national brands intensifies, what strategies will be crucial for private label brands to succeed in the future?

Private label has traditionally been seen as a more affordable alternative to national brands. However, while price is an advantage, quality remains the key factor for consumers. Price alone has never driven repeat purchases, if the quality doesn’t meet expectations, consumers are unlikely to buy again.

The first Private Label Packaging Conference, hosted by PLMA on 30 January in The Hague, brought together private label manufacturers, retailers, and industry leaders to discuss new packaging legislation. The event underscored the urgency for innovation in packaging, particularly in response to regulatory changes and the growing demand for sustainability.

Benjamin Punchard (above), Global Packaging Insights Director at Mintel, emphasized that the private label packaging sector is at a turning point, making innovation more necessary than ever. He pointed out that sustainability remains a key focus, advising the industry to embrace eco-friendly materials like paper as technological advancements improve its quality and barrier properties. While plastic continues to dominate, the shift toward responsible use is evident through material reduction, increased recyclability, and higher recycled plastic content.

Greet De Feyter, Head of Product Sustainability, and Ilka Lannau (above), Head of Division Private Label at Colruyt Group, shared insights into how their company encourages consumers to make sustainable choices. Colruyt introduced the Eco-Score label in 2021, classifying products from A (green, low environmental impact) to E (red, high environmental impact). The retailer has linked the score to its loyalty program, rewarding customers who purchase eco-score A or B products with points that can be exchanged for sustainability initiatives.

Kevin Loos, Retail & Channel Manager at Tetra Pak, highlighted the importance of collaboration and innovation in navigating big data, new regulations, and sustainability transformation. He outlined four key steps for bringing packaging innovations to market: co-creation with manufacturers and retailers, AI-driven design based on consumer behaviour analysis, strategic launch processes that include marketing and education, and emphasizing packaging benefits that enhance logistics and shelf space efficiency.

Karlijn van den Berg, E-Commerce Manager at Hema in the Netherlands, discussed the role of packaging in digital retail. She explained that packaging is not just important in physical stores but also in online marketplaces, where it can be brought to life through interactive elements, augmented reality, and dynamic product displays.

Leena Whittaker, Director of Competitiveness at EuroCommerce, provided an overview of the new EU Packaging and Packaging Waste Regulation (PPWR), which came into effect on February 11, 2025. The details of the regulations are even now in development. Whittaker urged manufacturers, packaging companies and retailers to inform them of problems that they run into when implementing the new regulations.

Regina Mestre, Analyst Food & Agribusiness Packaging at Rabobank, moderated a panel discussion on the PPWR, where experts from different parts of the value chain: PreZero, Mondi Group, and Swedish retailer Axfood explored cost control in sustainable packaging.

The

• Aims to prevent waste, boost high-quality recycling by requiring packaging to be fully recyclable by 2030 and to reduce the need for primary resources

• New sustainablility requirements for packaging

• Promote reusable and refillable packaging solutions for foood and non-food, including transport packaging and Deposit-Return Schemes

• Waste prevention via requirement to minimize packaging volume and weight and empty-space ration of max 40%.

APPLIES TO ALL :

• Packaging (B2C and B2B)

• Packaging materials

• Packaging Waste

Alexander Reitz from PreZero acknowledged that while costs may initially rise, the market will adapt and drive prices down over time. Nadja Dahlgren, Packaging Developer at the Swedish retailer Axfood/Dagab also pointed out that by designing packaging more efficiently and reducing excess air, companies can lower transport costs. Marco Macoratti, Head of Sustainable Packaging Solutions at Mondi Group, emphasized that collaboration across the value chain is essential for optimizing costs and ensuring effective sustainability measures.

Steen Tjarks, President of Tjarks & Tjarks Design Group, underscored the influence of design on consumer purchasing decisions. A study conducted by the company with over 15,500 participants across the US and Europe examined the key factors influencing consumers' "Willingness To Pay" (WTP). The findings revealed that design accounts for up to 27.6% of WTP variance for private labels, making it just as critical as price and quality combined. The life cycle for redesigning private label products has shortened significantly, driven by shifting consumer expectations.

Loe Limpens, founder of concept creation agency Wow or Never, observed that some companies still view packaging as a cost rather than an investment. He described packaging design as a strategic process that integrates various elements to introduce a product; a brand, a retailer and to tell their story. He strongly encouraged investing in the best design as it will pay off in the end.

The PLMA Packaging Conference made it clear that packaging is undergoing a major transformation, driven by regulatory changes, sustainability demands, and digital innovation. As the industry navigates this shift, collaboration, creativity, and a willingness to embrace change will determine which companies emerge as leaders in the evolving packaging landscape.

Conducted as part of PLMA’s prestigious Salute to Excellence Awards programme, nine awards were presented in five categories: Best Packaging Design, Best Sustainable Packaging, Best Convenience Packaging, Best Performance Excellence and Best Innovation in Packaging.

The winners were chosen from 200 entries, spanning from individual products to entire ranges. Entries were evaluated by a panel of experts in design, sales, marketing, and sustainability. Products were judged based on aesthetics, consumer engagement, clarity of message, boldness, innovation and brand identity.

Peggy Davies, president of PLMA, remarked: “The judging process was both dynamic and insightful, providing valuable perspectives on the evolving landscape of packaging.”

PACKAGING: PERFORMANCE

EXCELLENCE

Billa iki, REWE Group

PACKAGING DESIGN: NON-FOOD

HEMA PACKAGING DESIGN: FOOD

BILLA, REWE

PACKAGING DESIGN: FOOD rohlik group

CONVENIENCE PACKAGING: Gruppo VeGe

PACKAGING DESIGN: NON-FOOD

SUN, SELEX

SUSTAINABLE PACKAGING: NON-FOOD ROSSMAN

SUSTAINABLE PACKAGING: FOOD

Billa iki, REWE Group

PACKAGING INNOVATION: Auchan

Certified Origins was born in 2006 thanks to the union of two Tuscan cooperatives of farmers and an organization specializing in international sales and distribution to export and provide fresh and authentic Extra Virgin Olive Oil to families everywhere in the world.

Today, we remain cooperative-owned and continually expand our portfolio by directly sourcing from farmers and other cooperatives in the Mediterranean region. The confidence and trust built over decades in the industry allow us to guarantee the quality of our products and give us access to the scale necessary to work with retail organizations.

Our international presence, with multiple bottling plants between the USA and Europe, is supported by a flexible distribution and warehousing network, which enables us to deliver anywhere globally within 4-8 weeks and in as short as 2 days in the USA and Canada.

Since our foundation, we have continuously dedicated time and resources to obtaining all the most recognized certifications for quality, safety, and traceability available in the food industry worldwide. We have also worked closely with third-party control bodies to develop additional internal audits and a code of conduct to set our standards above the global benchmark.

Since 2019, we have constantly invested in Research & Development, particularly technology and tracking systems. Today, we can deploy the latest technologies and third-party certifications to reduce the risk of information manipulation and fraud at the source while monitoring our food supply chain’s quality and safety standards.

Thanks to our partnerships with the University of Salento and Eurofins, we have built one of the largest databases available to scientifically verify the authenticity and origin of our Extra Virgin Olive Oils by investing in nuclear magnetic resonance (NMR) and isotopic signatures technologies.

CARBON REDUCTION:

Certified Origins has introduced multiple carbon-reduction and compensation programs for Italian Extra Virgin Olive Oils lines under its flagship brand, Bellucci. Collaborating with agricultural associations, we have also developed broader strategic initiatives to promote resilience and minimize environmental impact throughout our supply chain.

RECYCLED PACKAGING:

We are committed to reducing our global environmental footprint by incorporating responsible sourcing practices in our product development. The PET and cardboard used in our packaging are from up to 50% recycled materials, and we are actively working to increase this percentage and extend these practices across our entire portfolio.

SUSTAINABILITY INTEGRATION :

Certified Origins integrates sustainability across all company areas by promoting transparency, targeted training, and clear communication. Through dedicated initiatives, we ensure that responsible practices are embraced fully and continuously improved across our operations.

GREEN ENERGY:

Our Italian headquarters and bottling facility implemented an energy efficiency plan prioritizing renewable energy sources and responsible resource management. This initiative includes:

• Utilizing photovoltaic panels for energy and olive pits as renewable fuel sources for heating.

• Installing a monitoring system to track energy consumption across facility operations.

• Ensuring that 100% of Italy’s external electricity supply will come from renewable sources.

On December 2nd, 2024 the pigmentbased dyeing process PIGMENTURA of CHT Germany GmbH was awarded with the German Ecodesign Award in the Product category.

Inspired by Inditex, the CHT Group developed PIGMENTURA by CHT, an innovative and sustainable dyeing process that reduces water consumption in the dyeing process by up to 96%.

The German Ecodesign Award honors designers, companies and students from Germany and Europe whose work make an important contribution to the sustainable transformation of the German economy and society. The award has been granted annually since 2012 by the German Ministry for the Environment and the German Environment Agency in cooperation with the International Design Center Berlin.

Dr. Annegret Vester, Chief Sustainability Officer at CHT, about PIGMENTURA:

“Developing chemical products and processes that make textile production more sustainable is of utmost importance to us. Our development departments have always worked together with our colleagues in application technology and our customers to make energy-intensive and water-intensive dyeing processes more sustainable.

PIGMENTURA is an example of how completely new processes can be developed when existing processes are being rethought: The starting point was traditional pigment dyeing where the pigments have to be “bound” to the textile using special components. PIGMENTURA follows the idea of adsorbing pigments on the surface and thus simplifying the process.

It was a highlight when it became clear what great savings potential can be achieved in the dyeing process with PIGMENTURA. The classic reactive dyeing of textiles is associated with very high energy and water consumption.

There were numerous obstacles to overcome during the development phase, as each individual process step had to be developed to process maturity. Added to this is the diversity of textiles, which leads to significant changes in dyeing behavior, which we have now been able to standardize with PIGMENTURA.

PIGMENTURA by CHT is already in use in the fashion industry worldwide. This makes rivers cleaner, as lower water consumption also results in less wastewater. We are on the way to active environmental protection in the global textile industry.”

Traditional dyeing processes consume significant amounts of water and energy –resources we can no longer take for granted. PIGMENTURA by CHT offers a modern pigment-based dyeing process designed to minimize environmental impact.

PIGMENTURA by CHT reduces resource consumption while delivering superior results:

No water required for soaping or rinsing

Outstanding color fastness for lasting quality

Soft, comfortable feel with every touch

Minimal machine soiling and low cleaning effort

Seamless integration into existing processes

Choose PIGMENTURA by CHT and make a difference – one fabric at a time.

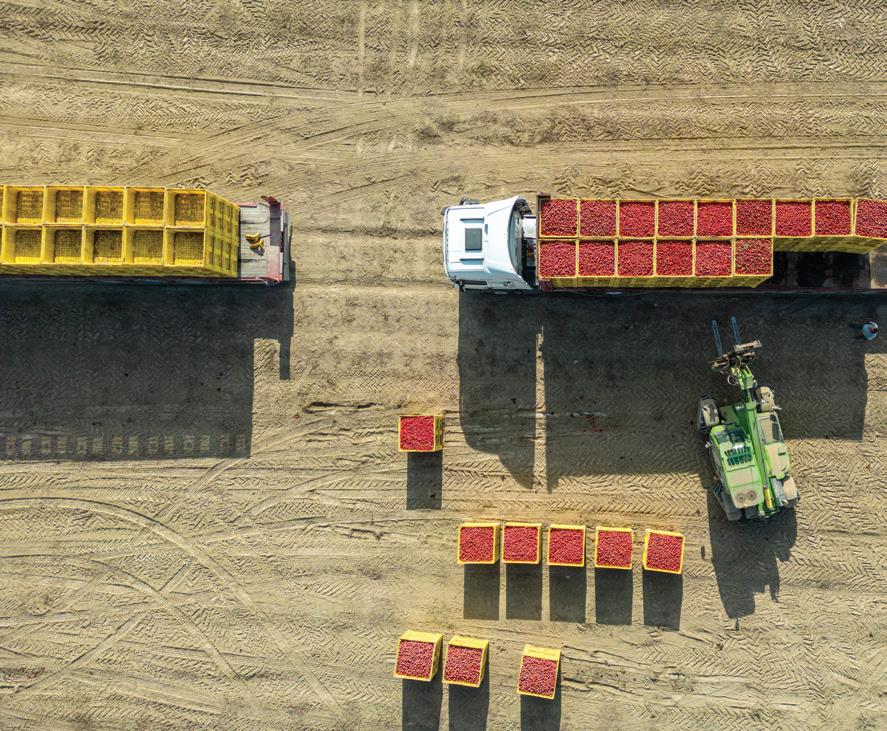

Headquartered in Angri, in the province of Salerno, Italy, La Doria exemplifies Italian excellence in the food canning sector. Specializing in the production of tomato derivatives, ready-made sauces, canned pulses, juices, and fruit-based beverages, the company stands out as Europe’s leading producer of canned pulses, peeled tomatoes, and tomato pulp for the retail sector. Furthermore, La Doria ranks among Italy’s top producers of fruit juices and is the leading European producer of private-label ready-made sauces. Recently, through a significant acquisition, the Group has expanded its portfolio to include pasta, offering an even broader range of products.

La Doria is a trusted supplier to major retail and discount chains worldwide. Its commitment to private label production is evident, with over 97% of the Group’s revenue derived from this segment. The company aims to offer

high-quality products at competitive prices, positioning itself as a strong alternative to commercial brands. With extensive expertise and a continuous focus on research and development, La Doria is synonymous with reliability and innovation in the food sector. With nine production plants located across Campania (Angri, Sarno, Fisciano, Salerno, and Pastorano), Emilia-Romagna (Parma and Faenza), Basilicata (Lavello) and Liguria (Chiusanico), La Doria has successfully combined Italian production tradition with a strong international presence. Exports account for over 80% of revenue, with a solid foothold in key markets such as the United Kingdom, Germany, the rest of Europe, Australia, and Japan. This global success is based on careful selection of raw materials and cutting-edge production processes that ensure high-quality standards.

La Doria is not only a successful company but also a responsible enterprise that operates according to well-defined ethical principles. Environmental sustainability, legality, transparency, and respect for human rights are fundamental values guiding every aspect of production and distribution. The Group is firmly committed to responsible energy resource management, waste recycling, and reducing the environmental impact of packaging. Moreover, La Doria promotes fair working conditions throughout the supply chain, collaborating closely with producers’ organizations to ensure respect for workers’ rights.

Since its founding, La Doria has maintained a strong connection with its local community by supporting educational initiatives for young people, urban regeneration projects, and social inclusion programs. The company contributes to the growth of the local economy by sourcing from a network of suppliers primarily located in Southern Italy, thereby further strengthening the national production fabric.

Thanks to its commitment to quality, sustainability, and innovation, La Doria remains a benchmark in the international food industry. With a continually evolving product range and a strategy focused on responsible growth, the Group establishes itself as an outstanding partner for large-scale distribution, bringing the best of Italian food tradition to millions of consumers worldwide.

commerciale.estero@gruppoladoria.it

Le Bontà continues to impress with groundbreaking innovations! Chiaverini Firenze is set to revolutionize its portfolio with an exciting new launch: jams in aluminum tubes. Just two years after the international debut of its iconic jam range, and after latest new Hazelnut Spread, the historic Florentine brand does not stop its innovation strategy.

Introducing a game-changing innovation: practical, sustainable, and innovative

The first jam in an aluminum tube! Unique in the market, this practical and easy-to-use format ensures maximum freshness and convenience. Sustainable and fully recyclable, it reflects our commitment to the environment. With this iconic new design, we’re redefining the way we enjoy jam, making it even more versatile and modern—perfect for every moment of the day!

Experience pure hazelnut bliss Chiaverini’s latest Hazelnut Cream is a true indulgence, crafted with 30% real hazelnuts and a time-honored recipe. Made with only the finest ingredients, it’s free from artificial flavors, colorings, preservatives, and palm oil. Its silky texture and rich, nutty flavor make it a must-have for any food lover’s pantry.

Chiaverini Jams have been defining Florentine culture since 1928. Originating from the passion of the Chiaverini Brothers, their commitment to quality echoes in every jar, making Chiaverini a staple in Florentine homes. The secret to Chiaverini’s success lies in simplicity: just fruit, sugar, and passion. Each jar is a testament to the art of slow cooking, melding flavors into perfection. Chiaverini's jams are history, Florence's essence in every jar. Each represents dedication, heritage, and resilience. Chiaverini isn't just a taste of Florence; it's a taste of history, a flavor transcending time.

The packaging of the Chiaverini “Pail” is not just a container; it represents an evolution from rustic wood to sleek aluminum. The new line, featuring distinct colors for each flavor, caters to collectors while upholding the brand’s essence and tradition.

Chiaverini Jams is part of LeBontà Group, a Tuscan based company that brings together high-quality brands with a strong connotation of genuine and natural products. www.chiaverinifirenze.it/en www.lebonta.it/en

Lucart, a major European manufacturer of thin MG paper for flexible packaging, is a key player in the consumer goods and away-from-home markets as a producer and transformer of tissue and airlaid paper. Its attention to people, sustainable processes, and approach to innovation means it offers cutting-edge products that meet market challenges and customers’ needs

Fiberpack® is their flagship project in this field. It combines advanced technology with environmentally friendly processes, demonstrating that circular economy principles are fully applicable to the tissue sector.

In 2010, Lucart created a project called “EcoNatural, “ based on the idea of utilizing all the elements of beverage cartons according to circular economy principles. This type of packaging is widely used in the food industry to protect and preserve food, and it has a high natural cellulose fiber content, making it more ecological compared to other packaging materials of fossil origin. Due to its mixed composition of cellulose fibers (74%), aluminum (4%), and polyethylene (22%), this material is often not recovered at the end of its life or is only partially recovered.

The production process relies on innovative technology that separates cellulose fibers found in beverage cartons from polyethylene and aluminum through physical-mechanical action. With this technology, harmful substances that may affect people or the environment are avoided. They produce tissue products using the fibers obtained through this process and recover aluminum and polyethylene, converting them into a homogeneous material called Al.Pe.®, which other industries use to create various items.

The tons of Fiberpack® paper produced by Lucart from 2013 to 2023 have contributed to the recovery of over 10.7 billion beverage cartons, saving more than 4.6 million trees and preventing over 281,300 tons of CO2e from being emitted into the atmosphere.

In the first stage of the project, Lucart achieved the goal of creating two new raw materials to enhance recovery processes by modifying and streamlining the traditional paper recycling process in the paper mill: Fiberpack® and Al.Pe.®.

The second phase of the EcoNatural Project involved combining the two new, previously obtained raw materials into a single product that provides value to our customers: Fiberpack® paper and Al. Pe dispenser.

The third stage involved establishing Newpal S.p.A., a joint venture with CPR System dedicated to molding high-quality recycled pallets. In the Borgo a Mozzano plant, a new facility has been installed that can produce plastic granules from the homogeneous material composed of polyethylene and aluminum obtained from the recycling process of beverage cartons. The granule, referred to as GranPlast, serves as the raw material for Newpal S.p.A., which molds recycled plastic pallets using a plant specially designed for non-virgin plastics. This project will close the recycling loop for Tetra Pak® beverage cartons, creating significant environmental benefits and new business opportunities. Pallets made by Newpal are utilized by CPR System, a leader in Italy in the production, handling, and recycling of collapsible plastic packaging and pallets. CPR System recovers and reuses pallets that, at the end of their life and after multiple uses, are not sent to landfills but are reintegrated into the industrial process. This collaboration between Lucart and CPR System generates new environmental benefits and business opportunities

• It makes full use of production waste and creates shared value.

• It produces a reusable product in the circuit managed by CPR System, which at the end of its life is actually recycled to made new pallets.

• It offers the market a quality recycled plastic pallet at a highly competitive price.

Another important piece of news concerns the new range of products called Infinity, which was launched in 2023.

Infinity is the plant pot line resulting from the collaboration between Lucart and Pasquini & Bini, with the contribution of the Department of Agricultural, Food and Agro-Environmental Sciences of the University of Pisa. The pots are made from GranPlast material, which is the polyethylene and aluminum separated during the beverage carton process at the Borgo a Mozzano plant. In addition to finding further applications in various fields, it has been discovered that the characteristics of the material support plant growth by regulating root temperature and promoting phytostimulation. The absence of carbon black simplifies disposal at the end of cultivation.

Lucart is also the only brand in its target market that offers Airlaid products with exceptional absorbency and strength. The Airlaid technology utilizes long, highly resistant cellulose fibers that never come into contact with water during the

production process (dry paper) to remain super absorbent. Fibers treated with this process naturally form a “dam” structure, yielding outstanding results: they can absorb up to seven times their weight and, thanks to their exceptional resistance, can be reused up to twenty times, compared to one or two for competitors products.

Lucart is a company composed of individuals who opt for innovative and sustainable processes in the development, transformation, and manufacturing of paper products, collaborating responsibly for the future of both their business and the planet.

Lucart has always been at the forefront of studying innovative packaging that reduces the environmental impact of its products. After launching the world’s first line of toilet paper with Mater-Bi corn starch packaging in 1997, the company developed a series of products with completely plastic-free packaging in 2019.

www.lucartgroup.com

When it comes to in-store bakeries in modern retail outlets, a lack of innovation often hinders category performance and overlooks consumer expectations.

Today, international supermarket chains have a new partner to enhance their in-store bakery business: OROPAN S.P.A. from Altamura, Italy.

Founded by Vito Forte, one of Altamura’s most renowned bakers since 1956, Oropan S.p.A. embodies the rich tradition of Italian bread-making. As a child, Vito Forte collected hand-kneaded dough from local housewives to take to the community oven for baking. This early experience laid the foundation for his mastery of traditional bread-making techniques, utilizing durum wheat semolina, mother yeast (lievito madre), and a slow natural raising process. The result is a unique range of breads and bakery products, characterized by their distinctive crispy crust and golden-yellow texture, naturally containing protein and antioxidants.

Today, Oropan S.p.A. stands as one of Italy's most respected bakery companies. The firm successfully merges traditional production methods with innovative technologies to create a diverse range of products, including bread, focaccia, friselle, and bread rolls. With significant production capabilities, Oropan S.p.A. is the ideal partner for both national and international retailers. Their products are distributed daily across 2,400 retail stores in Italy and in 25 international markets (both EU and non-EU). A hallmark of the company is its robust quality management system, certified by esteemed organizations such as BRCGS (AA+), IFS (Higher Level), and ISO 9001:2015.

OROPAN S.p.A. places sustainability at the core of its operations, fully embracing ESG principles to foster a better future for the environment, its employees, local communities, and future generations. The company’s steadfast commitment to social and environmental responsibility is evident in its numerous voluntary certifications, including ISO 14001:2015 (Environmental Management System), ISO 45001:2018 (Occupational Health and Safety Management Systems), ISO 14046:2014 (Water footprint), and ISO 14064-1:2019 (Carbon footprint). Additionally, Oropan S.p.A. has led innovation in the Italian market by introducing the first bread made from a sustainable and certified supply chain under ISCC Plus.

Looking ahead, OROPAN S.p.A. will showcase its offerings at PLMA in Amsterdam and ANUGA in Cologne in 2025.

gourmetbreads@oropan.it

• THE LEADING B2B BEAUTY EVENT IN THE AMERICAS, DEDICATED TO ALL SECTORS OF THE INDUSTRY

• LAS VEGAS MANDALAY BAY CONVENTION CENTER

• JULY 15 – 17, 2025

• COSMOPROFNORTHAMERICA.COM

• REGISTER NOW AND SAVE UP TO 30% WITH EARLY BIRD SAVINGS!

THE ONLY B2B BEAUTY EVENT FOR THE ENTIRE SUPPLY CHAIN IN THE AMERICAS: INGREDIENTS & RAW MATERIALS, PRIVATE LABEL & CONTRACT MANUFACTURING, MACHINERY, PACKAGING

Valsa Group, a leading manufacturer of frozen, chilled, and ambient pizza, pinsa, focaccia, and snacks, identifies its primary goal as promoting the true Italian food lifestyle across the globe. The headquarters is located in Valsamoggia, in the very heart of Italy. This is where the history of the Group began; nevertheless, our roots extend from North to South, through our 10 plants, following a purely Italian entrepreneurial path.

Our daily commitment can be summed up as follows: CULTURE. EXCELLENCE. INNOVATION.

Valsa Group launches a new range of deep-fried pizzas and snacks. Introducing the surprising Pan Frit, a soft and melty delight in every bite: the most delightful Italian fried dough. Light and fragrant, it offers a flavorful alternative to bread itself, making it the perfect match for both sweet and savory options. Stuff it, dip it, share it: Pan Frit is the irresistible treat you won’t want to give up.

The amazing mini panzerotti are delightful treats from the heart of Apulia, blending the authenticity of Mediterranean cuisine with modern convenience. A flavorful filling in numerous variations is wrapped in thin, golden dough, representing one of the most traditional Italian recipes.

And…what if pizza could be taken to the next level? Deep-fried pizza, a voyage through uncharted local Italian traditions: a mouthful of tasty, delicious nuances; it is the perfect product to be shared or enjoyed alone. The most flavorful dough you’ve ever tasted in a pizza.

A deep-fried (R)evolution, showcasing the exceptional quality found exclusively within Valsa Group.

The Group’s strategy strength is the combination of traditional manufacturing processes and a greater focus on consumer convenience while maintaining the highest quality standards. In the contemporary market, convenience supported by premium quality is essential to creating value in the supply chain.

Valsa Group is a reputable and recognized business partner in 50 countries worldwide. This success is due to its focus on sustainability, production capacity, organizational integration, and innovative convenience, alongside a strong commitment to transparency, waste reduction, and the use of green energy.

Through the brands Valpizza, La Pizza+1, Forno Ludovico, Megic Pizza, Ghiottelli, Il Borgo, and Tuscanya Bakery, Valsa Group is a unique, largescale, and highly qualified partner able to supply a wide range of items in each category, from frozen to deli.

info@valsagroup.it

TUTTOFOOD: Hall 5 Stand E05

Dozens of distribution chains and hundreds of private label product manufacturers in Europe and elsewhere have already chosen the V-Label brand to identify products suitable for vegetarians and vegans. The V-Label brand’s unique characteristics make it the perfect ally and partner for private label products, retailers and large-scale distributors.

First of all, the V-Label brand is registered in over 70 countries around the world and is distributed worldwide, allowing international distributors and producers to use a single, distinct vegetarian and vegan label independent of where their products are manufactured or distributed. Despite its widespread use, the V-Label brand continues to maintain the same criteria and testing methods for product designation, and the uniform nature of this process allows for it to be implemented throughout the world without any variation.

The V-Label brand guidelines were established by major European Vegetarian and Vegan Associations in order to provide assurance and guarantee safety for customers and consumers. Checks are performed with the utmost care to ensure quality and compliance with the standards of the V-Label brand, which is synonymous with reliability and safety for the end customer.

For this reason, self-declarations are not accepted: individual ingredients and manufacturing procedures are inspected in order to be able to stand behind the vegetarian or vegan designation appearing on the labels of the products bearing the brand.

And, while the inspections are indeed strict in order to ensure compliance with quality standards, our product assistance is tailored to the customer. We know how complex distribution can be and thus our goal is to provide the utmost flexibility to better assist manufacturers and distributors, starting from being on the ground locally to break down language barriers and issues arising from working across different time zones.

We always have expert personnel capable of handling all the technical aspects of product verification and facilitating the necessary procedures.

To make it easier for consumers purchasing the products, the V-Label brand comes in three different categories: vegetarian, vegan and raw vegan. This allows distributors and manufacturers to use the same brand to promote different qualities of the products being offered to the public.

What began back in the 1970s as an institutional symbol of the Italian Vegetarian Association has grown to become the most recognized vegetarian and vegan symbol in the world: the history of the brand is itself an assurance of excellence in the vegetarian and vegan industry.

Finding a sure way to showcase products and be selected by consumers is a must nowadays. What really makes the difference is what feature is chosen to promote: quality, sensitivity towards sustainability issues, safety, and transparency are among the most important.

That’s why today we are the first choice of thousands of customers: this is what the V-Label conveys every day.

www.vlabel.org

In 1948, in Yongtai Village, Shanghai county, China, an entrepreneur started a small, private, manufacturing company with a goal to provide laundry soap to local residents in postwar China. This was the start of what would be later known as “Shanghai Bái Māo” by locals, or Shanghai Whitecat, he embarked on a journey of necessity, groundbreaking innovation, and a steadfast commitment to safeguarding the healthy lives of families. Motivated by necessity after the end of World War II, Shanghai Whitecat worked diligently to provide much needed laundry cleaning products that surpassed traditional soap, made from soap bean and “Yizi” (made from pig pancreas and plant ash), for more effective cleanliness and well-being to local families.

In 1959, Shanghai Whitecat achieved its first of many mmilestones by introducing the first domestically produced package of synthetic laundry detergent powder “Gong nong” in mainland China. Since then, Whitecat has achieved many milestones.

• 1963: 1st autonomous washing powder paper bag packaging machine

• 1981: 1st domestically developed and produced pack of Super Concentrated Laundry Powder

• 1987: Whitecat brand and our Jaimei brand Laundry Powder awarded the “Shanghai Famous Brand” certificate

• 1995: Whitecat Laundry Powder was awarded the “Golden Bridge Award” for National Best selling Domestic Product for 4 consecutive years.

• 2004: Whitecat liquid detergent was chosen as “China Famous Brand”

• 2018: Whitecat Lemon Black Tea Dishwashing liquid won the “2017 China Biggest Award of Quality Consumer – Quality Gold Award”

• 2018: Shanghai Hutchison Whitecat Co., Ltd., was awarded “China’s Top 100 Daily Chemicals”

As Shanghai Whitecat celebrates its longevity, our narrative transcends labels and brands. It’s a story of enduring innovation, necessity, and lives touched. Whitecat is humbled by the trust of millions of families who rely on us daily to safeguard their healthy lives.

Trust built over many decades of hard-work and investment in research and development.

• More than 100 national patents

• Millions of dollars spent every year in R&D

• Over 50 research and development personnel (> 50% with Master’s or doctoral degrees)

Our technology center is the only national standard laboratory in the light chemicals industry.

Investments in latest scientific equipment such as gas chromatography/mass spectrometry

(GC/MS), Fourier infrared spectrometer and other advanced international standard analysis and testing instruments ensure we keep our commitment to delivering highquality, cost-effective Home Care and Personal Care products to safeguard the healthy lives of families into a better tomorrow.

Whitecat’s dynamic culture of innovation, born out of necessity in 1948, is now shifting to Sustainability, safeguarding healthy families better for all, including our planet.

We are very excited to launch our sustainable, nature inspired, line of products for our private label naturebased, sustainable Home Care and Personal Care products that your customers will simply Love!

• Concentrated cleaning pods/ sheets/tablets

• Lactic acid-based cleaning products

• Soda-based cleaning products And more innovative products to come.

Join us in this exhilarating journey towards a greener, more sustainable tomorrow with Whitecat!

www.whitecatusa.com

In the dynamic landscape of the food industry, Winland Foods has emerged as a beacon of quality, innovation, and sustainability. Founded by passionate food enthusiasts with extensive industry experience and backed by Investindustrial, Winland Foods is dedicated to redefining meal preparation for consumers worldwide.

Specializing in a wide array of products, Winland Foods offers pasta, sauces, syrups, dressings, jams, jellies, pie fillings, pita chips, dry dinners and baking ingredients. This extensive range caters to both beloved consumer brands and bespoke private label solutions, serving retail markets and foodservice channels alike.

At the heart of Winland Foods lies a steadfast commitment to excellence. Their mission is to win the minds of customers, the hearts of consumers, the respect of suppliers, and the

loyalty of employees. This mission is underpinned by core values of quality, integrity, respect, and collaboration, ensuring that every product meets and exceeds consumer expectations.

With facilities across the United States, Canada, and Italy, Winland Foods ensures efficient and sustainable manufacturing processes. Their modern facilities are equipped with energyefficient technologies designed to reduce energy consumption, conserve water, and minimize food waste. Such initiatives reflect their dedication to environmental stewardship and operational efficiency.

The Research, Development, and Implementation team at Winland Foods is pivotal in driving culinary innovation. From conceptualization to commercialization, the team employs a rigorous experimental design approach, ensuring that new products resonate with consumers while maintaining cost-effectiveness. Complementing this is a robust Quality Management System that oversees every facet of production, ensuring that products adhere to the highest safety and quality standards.

Winland Foods recognizes its role in fostering a sustainable future. Winland Foods is committed to responsible ingredient sourcing, waste reduction, and minimizing environmental impact.

Collaborations with suppliers and partners are integral to these efforts, ensuring that sustainability and social responsibility are woven into the fabric of their operations.

CEO Eric Beringause encapsulates the company's ethos: "We believe that everyone deserves access to delicious, high-quality, and nutritious food that doesn't break the bank." This sentiment reflects Winland Foods' dedication to delivering exceptional value while upholding principles of integrity, respect, and collaboration.

In essence, Winland Foods stands as a testament to what can be achieved when passion, expertise, and a commitment to excellence converge. As the company looks to the future, it remains poised to set new benchmarks in the food industry, ensuring that quality, innovation, and sustainability remain at the forefront of its mission.

Kevin Kollock Chief

Commercial Officer

Kevin.Kollock@winlandfoods.com

www.winlandfoods.com

Certified Origins was born in 2006 thanks to the union of two Tuscan cooperatives of farmers and an organization specializing in international sales and distribution to export and provide fresh and authentic Extra Virgin Olive Oil to families everywhere in the world.

Today, we remain cooperative-owned and continually expand our portfolio by directly sourcing from farmers and other cooperatives in the Mediterranean region. The confidence and trust built over decades in the industry allow us to guarantee the quality of our products and give us access to the scale necessary to work with retail organizations.

FOR MORE INFORMATION:

Giovanni Quaratesi, Head of Corporate Global Affairs giovanni@certifiedorigins.com

www.certifiedorigins.com

The CHT Group is a medium-sized global player for specialty chemicals and active worldwide in development, production and sales. CHT Germany GmbH in Tübingen is the headquarters of the group of companies which focuses on sustainable chemical products and process solutions. TEXTILE SOLUTIONS of CHT improve the quality, functionality as well as look and purity of textiles and optimize their manufacturing processes.

In the fields of silicones, building materials, paints, coatings, leather, release agents, paper, agrochemicals, mining as well as cleaning and care products innovative products and process solutions are provided by INDUSTRY SOLUTIONS.

By combining the strengths of the complete group further innovative products, applications or processes are continually developed and vast technical support is offered within the SCIENCE & SERVICE SOLUTIONS. Highly qualified specialists work in state-of-the art laboratories for development, analytics and application technique in order to work out ideas and solutions that meet the latest requirements.

The CHT Group with its own production and sales locations is represented by 27 companies worldwide. In the financial year 2024, the CHT Group generated a group turnover of 614 million Euro with approx. 2,500 employees.

Global Tissue Group offers a complete line of paper products for every customer need. A versatile selection of household paper products for every price point and use case, designed to meet the demands of all customers and market segments. From value-tier to ultra-premium, we provide quality, consistency and customization you can trust.

Comprehensive services to elevate your household paper programs. Global Tissue Group offers a range of services designed to meet the unique needs of retailers, wholesalers, and national brands. When you work with Global Tissue, you gain a trusted partner committed to delivering quality, exceptional service, and innovative products to support your growing household paper needs.

www.globaltissuegroup.com

Headquartered in Angri (Salerno, Italy), La Doria is a prominent Italian company in the vegetable canning industry, specializing in tomato derivatives, ready-made sauces, canned pulses, juices, and fruit-based beverages. Today, La Doria stands as Europe's leading producer of canned pulses, peeled tomatoes, and tomato pulp in the retail sector, as well as one of Italy's top producers of fruit juices and beverages. Additionally, it holds the position of Europe's leading private-label ready-made sauce producer.

Following a recent acquisition, La Doria has expanded its product portfolio to include pasta, further enhancing its comprehensive range of offerings. As a trusted supplier to major retail and discount chains worldwide, the company is primarily focused on private-label production, manufacturing products for leading retailers. Remarkably, over 97% of the Group’s revenue is derived from this segment. This strategic specialization reflects La Doria’s strong commitment to excelling in large-scale retail and organized distribution, delivering high-quality products at highly competitive prices as an alternative to the brand.

www.gruppoladoria.it/en

Le Bontà was founded in 1994 in Prato, in the Tuscan hinterland, with the aim of creating sauces, meat sauces and patès that express the best Tuscan gastronomic tradition.

In more than 20 years of activity, the Le Bontà trademark has created a production system able to respond to the needs of private labels, by offering recognized product quality, the reliability of careful and meticulous management, and flexibility that facilitates the purchasing brand.

The GDOs select numerous recipes each day to put on the tables of Italian and European consumers. And, each day, as a provider of private labels, we ensure high-level consulting with the aim of shelf success and success on the table.

Chiaverini Jams join the family of products from brands Nuova Terra: a broad selection of natural and organic cereals, seeds and soups; I Toscanacci: a line of high-quality sauces without preservatives; Bonvé: a line of vegan and organic sauces and Accademia Toscana: a range of sophisticated and very high-quality sauces for the Italian and foreign markets.

www.lebonta.it

www.chiaverinifirenze.it/en

Lucart, a major European manufacturer of thin MG paper for flexible packaging, is a key player in the consumer goods and away-from-home markets as a producer and transformer of tissue and airlaid paper. Its focus on people, sustainable processes, and innovation means it offers cutting-edge products that meet market challenges and customers’ needs.

Fiberpack® is their flagship project in this field, combining advanced technology with environmentally friendly processes. This demonstrates that circular economy principles are fully applicable to the tissue sector.

Lucart is also the only brand in its target market that offers Airlaid products with exceptional absorbency and strength performance. The Airlaid technology utilizes long, highly resistant cellulose fibers that never come in contact with water during the production process (dry paper), ensuring they remain super absorbent. Fibers treated with this process naturally form a “dam” structure, providing outstanding results: they can absorb up to 7 times their weight and, thanks to their exceptional resistance, can be reused up to 20 times, compared to 1 or 2 times for competitive products.

www.lucartgroup.com/en

A full-service strategy, creative and packaging artwork design agency built to meet the challenges and opportunities facing Private Label and National Brands today. Since 1990, MBD has been on a mission to produce stand out, award-winning packaging to our multichannel customers. We are a global agency that builds brand and differentiates our clients from the competition, which in return increases their ROI.

Our strategy begins by defining a clear brand voice with strong storytelling. What makes MBD different and unique is our tri-focus approach:

1. CREATE: Originality is the driving principle of our work. We bring brands to life through story-telling and visual flair. Creativity should be nurtured, encouraged to grow, and never compromised. From start-ups to international billion-dollar brands, our work helps to sell thousands of products and services globally.

2. MANAGE: Our detail driven design team take the voice and vision of the brand and adapt using our best-in-class approach to developing the packaging artwork. Unique and ownable graphics are key to portraying the quality across an entire range. While our workflow solutions tie it all together with centralization and automation.

3. ROLLOUT: MBD create more than 12,000 pieces of artwork every year with teams large enough to execute programs with thousands of SKUs, but nimble enough be brand guardians with a single voice.

We also pride ourselves with color managed artwork that is compliant and consistently on brand.

OROPAN S.p.A. is the category leader in producing durum wheat bread from Italy's Puglia region. Founded in 1956 by renowned baker Vito Forte, the company is the ideal partner for supermarket in-store bakeries, leveraging freshly baked products to enhance the customer experience.

Using traditional methods with durum wheat semolina, mother dough, and natural fermentation, OROPAN S.p.A. distributes its products daily to over 2,400 stores in Italy and 25 international markets. Certified with BRC (AA+), IFS (Higher), and ISO 9001 standards, the company also demonstrates a strong commitment to ESG sustainability initiatives, ensuring quality, tradition, and responsibility at every step (ISO 45001:2018 - Occupational Health and Safety Management Systems, ISO 14001:2015 Environmental Management System, and ISO 50001:2018Energy Management System)

Seneca Foods ensures US farm fresh goodness through our 26 facilities located in prime American growing regions. A leading global provider of packaged fruits and vegetables, Seneca’s flexible packaging solutions meet evolving consumer needs: from traditional cans and frozen foods, to convenient pouches and plastic cups. Organic options also available.

At Seneca, we believe that everyone deserves year-round access to great-tasting food that’s also great for you. That’s why we’re bringing families and organizations all over the world real food that’s nutritious, affordable, and delicious.

By remaining committed to those we serve, we’re going to continue growing as the leader in the fruit and vegetable industry. At Seneca, we’re still doing things the way we always have- the right way.

Think globally, grow locally. We’re proud to say, “We feed the world.”

Valsa Group as leading manufacturer of chilled, frozen and ambient pizzas, focaccias, pinsas and snacks, identifies its primary goal in promoting the true Italian food lifestyle all over the world. The headquarters is located in Valsamoggia, in the very heart of Italy. This is where the history of the Group began, nevertheless our roots go from North to South, through our 10 plants: in a purely Italian entrepreneurial path.