Future Forces Impacting Private Label

ACTION - Small Prices and Big Smiles

Salute to Excellence Winners Revealed www.globalretailmag.com www.vertexawards.org

Future Forces Impacting Private Label

ACTION - Small Prices and Big Smiles

Salute to Excellence Winners Revealed www.globalretailmag.com www.vertexawards.org

I have been attending PLMA’s World of Private Label in Amsterdam for twenty years now. As I’ve visited the city multiple times, I’ve grown fond of it, and I cherish the memories of spending quality time with friends and business associates. To me, this fair offers much more than just a chance to trade. It allows me to interact with people, stay updated on the latest trends, brainstorm new ideas, and enjoy myself.

We are lucky as an industry that our hard work is paying off. Retail brands are thriving and surpassing national brands, and this is not just because consumers want to save money. In my two decades of experience, I have seen private label products transform from basic, budget-friendly options to high-quality choices that consumers genuinely enjoy.

Our industry is facing widespread challenges that impact society as a whole. It’s no longer feasible to consume the earth’s resources at the same rate as before. We must take responsibility for our actions not just for our own well-being, but for the benefit of future generations. Therefore, sustainability and plant-forward initiatives are essential measures, not just temporary trends.

In this issue, we take a closer look at the current state of the industry. Our featured topics include a retailer that prioritizes sustainability and affordability, a provider of eco-friendly plastic alternatives, a design competition aimed at propelling retail brands forward, and trade events focused on advancing these initiatives. Perry Seelert’s article poses the question, “Why can’t we...?” as a call to action for us to constantly strive for innovation and improvement instead of becoming complacent with our achievements.

Join us on Monday evening, May 22, at the Doubletree Amsterdam Centraal Station for the Vertex Awards Celebration. And of course, we would love to see you in person during PLMA at our stand in Hall 2, C.15.

We extend our gratitude to our contributors and clients who have made this magazine possible. We wish them all the best for an enjoyable and productive show, and continued success in their endeavors.

Kind regards,

Phillip Russo Founder / Editor phillip@globalretailmag.com

They have many names: Store brands, private label, retailer brands, own brands. Hailed as dynamic, innovative and pervasive, they’re a US$ 230 billion a year industry that presents boundless opportunities for international suppliers. Store brands in the United States are enjoying record sales and shares and expanding every day into new categories, chains, channels, platforms. By whatever name, one word describes them best: Phenomenon. To experience them at PLMA Chicago, email exhibit@plma.com or visit www.plma.com.

PLMA’s 2023 PRIVATE LABEL TRADE SHOW 12-14 NOVEMBER • CHICAGO

Phillip Russo EDITOR / PUBLISHER phillip@globalretailmag.com

Jacco van Laar BRAND AMBASSADOR jaccovanlaar@globalretailmag.com

Melissa Subatch

CREATIVE DIRECTOR info@melissasubatchdesign.com

Andrew Quinn DIGITAL DIRECTOR andrew.quinniii@gmail.com

Luisa Colombo Italian Business Development luisa@globalretailmag.com

Sabine Geissler GREENTASTE.IT Italian Business Development s.geissler@greentaste.it

CONTRIBUTORS

Perry Seelert Emerge perry@emergefromthepack.com

Christopher Durham Velocity Institure cdurham@retailbrandsinstitute.org

Maria Dubuc Marketing By Design mdubuc@mbdesign.com

Hans Kraak Kraak Media kraakmedia@gmail.com

Elena Sullivan sullivan.elena@gmail.com

Tom Prendergast PLMA tprendergast@plma.com

Rebecca Hamilton The Fish Agency Rebecca@therealfish.agency

Published, Trademarked and all rights reserved by: Kent Media Phillip Russo, Principal 45 Upper Kent Hollow Road Kent, CT 06757 Tel. +1 917 743 6711

All rights reserved under the Library of Congress. No part of this publication may be r eproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying and recording, or by any information storage or retrieval system, except as may be expressly permitted in writing by the copyright owner. Opinions expressed by contributors are theirs alone and do not necessarily reflect those of the publisher.

Global Retail Brands is published 4 times a year.

Editorial Submissions phillip@globalretailmag.com

Advertising Inquiries – EUROPE luisa@globalretailmag.com

Advertising Inquiries – AFRICA, AMERICAS, ASIA, AUSTRALIA, MIDDLE EAST phillip@globalretailmag.com

Subscription Information phillip@globalretailmag.com

MARIA DUBUC

A creative and workflow expert in the retail landscape, Maria’s 30-year career translates branding experiences into eye-catching design that is unique and distinct for each client. he has created new private brands and redesigned/repositioned existing brands with leading retailers, while also implementing workflow management systems specifically tailored to the clients’ needs. Current clients include The Home Depot, Smart & Final, PetSmart, 7-Eleven, PriceSmart, BJ’s Wholesale Club, Sprouts Farmers Market, WinCo Foods, Natural Grocers and more. With SKU counts from 1,000 to more than 10,000 annually.reinvention and innovative execution.

CHRISTOPHER DURHAM

President of the Velocity Institute

Prior to this he founded the groundbreaking site My Private Brand. He is the co-founder of The Vertex Awards. He began his retail career building brands at Food Lion and Lowe’s Home Improvement. Durham has worked with retailers around the world, including Albertsons, Family Dollar, Petco, Staples, Office Depot, Best Buy, Metro Canada. Durham has published seven definitive books on private brands, including Fifty2: The My Private Brand Project and Vanguard: Vintage Originals.

Chris is an industry leading influence in retail and brand design, with a career dedicated to delivering world class consumer experiences. Chris has led the creative in support of the largest and most influential brands in footwear, apparel, consumer electronics, and food & beverage. In 2020, Chris was named to Design: Retail’s 40 under 40, recognizing his achievements throughout his 20 years in the industry. Prior to joining SGK, Chris was a client partner in a Global Creative Director role at Under Armour. As VP, Creative & Design at SGK, Chris currently leads the creative teams for SGK Brand Experience.

MARK FIELD

Mark Field has extensive technical and commercial experience in the international food manufacturing and retail industries, having worked at a senior level across the European red meat and poultry industry for some of the world’s most reputable companies. Mark has formed strategic relationships with iconic brands McDonalds and KFC, and leading UK retailers including: Tesco, Marks & Spencer, Sainsbury’s and Walmart.

Mark moved to Melbourne, where he headed up Australia’s most significant food brand growing their worth to over $9billion while delivering around 1,200 new products each year. Mark is the approachable expert who heads up Prof. Mark’s passion for food and consumer-led innovation is evident. However, it is his proven track record for building strong teams, improving cultural change, and delivering world-class products that set Prof. apart.

Rebecca is the CEO of award-winning Fish Agency and sister agency Whitespace Brands Inc. With over 30 years of experience, she has established herself as one of North America’s leaders in the fields of strategic branding, retail design, and communications for clients in the retail sector. Under Rebecca’s oversight, the Fish Agency brings brands to life at retail and has consistently delivered high ROIgenerating retail experiences for its clients. She mentors and leads highly experienced and integrated teams that provide store design, package design for CPG and private brands, digital/social initiatives, “phygital” experiences, and advertising services.

HANS KRAAK

Hans Kraak is educated in biology and journalism and wrote three books about nutrition and health. He worked for the Dutch ministry of Agriculture, Nature and Food quality and the Netherlands Nutrition Centre. As editor in chief he publishes in the Dutch Magazine for Nutrition and Dietetics, as a food and wine writer he published in Meininger’s Wine Business International and reports for PLMA Live EU and PLMA USA.

Founder of Cibus Nexum and an agricultural engineer with 25 years of experience at FMCG companies and global outsourcing projects.

PERRY SEELERT

A retail branding and marketing expert, with a passion for challenging conventional strategy and truths. Perry is the Strategic Partner and Co-founder of Emerge, a strategic marketing consultancy dedicated to helping Retailers, Manufacturers and Services grow exponentially and differentiate with purpose.

SOPHIE VAN DE WATER

As an international food business student at Aeres College, Sophie studied in Canada at Dalhousie University and interned in Vancouver. She is currently working on her graduation internship at Cibus Nexum and writing her thesis on the protein shift within traditional dairy companies.

MONIQUE WALTON

Creative Strategy Manager, MBD

Monique brings over 20 years of marketing, design and creative strategyto MBD. With a focus in retail, Monique enjoys helping retailers navigate their needs into a smooth delivery with successful outcomes.

VELOCITY CONFERENCE + EXPO

Charlotte, NC

16-18 MAY

www.velocityinstitute.org

PLMA’S WORLD OF PRIVATE LABEL

Amsterdam

23 - 24 MAY

www.plmainternational.com

JUNE

IDDBA

Anaheim, CA

4-6 JUNE

www.iddba.org

SUMMER FANCY FOOD SHOW

New York, NY

25-27 JUNE

www.specialtyfood.com

JULY

COSMOPROF NORTH AMERICA

Las Vegas, NV

11-13 JULY

www.cosmoprofnorthamerica.com

VELOCITY SUSTAINABILITY CONFERENCE

Austin, TX

26 – 27 SEPTEMBER

www.velocityinstitute.org

TOY FAIR

New York, NY

30 SEPTEMBER – 3 OCTOBER

www.toyfairny.com

ANUGA

Cologne, Germany

7 – 11 OCTOBER

www.anuga.com

PLMA US TRADE SHOW

Chicago, IL

12 – 14 NOVEMBER

www.plma.com

COSMOPROF ASIA

Hong Kong, China

14 – 17 NOVEMBER

www.cosmoprof-asia.com

When it comes to store brand sales, last year’s record, double-digit gains are a tough act to follow. But the Q1 results are in, and they bring good news: The products are experiencing the same rate of growth.

“The Q1 results are particularly impressive since they are compared to 2022 sales figures, which were historically high for U.S. store brands,” said PLMA President Peggy Davies.

• Store brands continue to far outperform national brands in sales. Across all U.S. grocery channels, store brand dollar volume jumped 10.3%, nearly twice the gain of national brands (which grew 5.6%), compared to the same threemonth period a year ago.

• Store brand market shares jumped higher. Dollar share rose to 19.1% and unit share advanced to 20.8%, vs Q1 of last year when the numbers were 18.5% for dollars and 20.3% for units.

• Among the 17 food and non-food departments Circana tracks for PLMA, 15 saw increased store brand dollar sales during the first quarter. Double-digit gainers were Beverages (up 17.1%), Bakery (+16.8%), General Food (+16%), Refrigerated (+15.5%), Floral (+13.1%), Deli Prepared (+12.4%) and Health Care (+10%).

• Other departmental winners included Deli Cheese (up 9%), General Merchandise (+8.8%), Beauty (+7.4%), Frozen (+7.1%), Produce (+6.8%), Deli Meat and Liquor (both at +5.8%) and Health (+4.3%). Only Tobacco (off 11.8%) and Meat (down 1.6%) slipped.

• Looking at store brand unit sales, six departments improved, led by Floral (up 5%), Deli Prepared (+2.1%), Bakery (+1.8%), General Merchandise (+1.3%), Produce (+0.8%) and Liquor (+0.7%).

During the first three months of this year, store brands picked up right where they left off in 2022, with double-digit sales increases and greater market share in both dollars and units, according to nationwide data provided exclusively to PLMA by Circana (formerly IRI and NPD). The figures include 2023 food and nonfood sales in all outlets as of March 26.

• Store brands fared significantly better than national brands in unit sales, as well. As was the case last year, all brands shed units. But like in 2022, store brand units decreased far less than those of national brands. During Q1 of 2023, they were off 1% vs minus 3.9% for national brands, about one-fourth the decline.

• This disparity in unit sales can be attributed to consumers switching to store brands from national brands. It was even more pronounced in March, when store brands were down only 0.7% compared to national brands, which were off five times that figure at 3.5%.

To explain the new and enhanced visualization features of the association's unique data portal, PLMA will offer a special session of its popular online Lunch and Learn program on May 11 at 12:30 p.m. EST. Called "IRI to Circana: Relaunching the PLMA Member Insights Program," it will be a comprehensive, 45-minute tutorial conducted by Jim Carlson of Circana. For more information on the session, contact info@plma.com or visit "Conferences and Education" at www.plma.com to register.

ORGANISER: Private Label Manufacturers Association www.plmainternational.com

MEMBERS:

More than 4.000 manufacturers from over 70 countries

SHOW VENUE:

RAI Exhibition Centre Amsterdam, The Netherlands

SHOW DATES:

Tuesday 23 May 2023

Wednesday 24 May 2023

OPENING HOURS:

23 May: 09.00 – 18.30

24 May: 09.00 – 16.30

EXHIBITOR PROFILE:

Manufacturers of private label FMCG food and non-food from 70 countries.

PAVILIONS:

57 national and regional pavilion organisers from 37 countries

EXHIBITORS: 2.600+ companies

SURFACE: 40.000 net m2

VISITOR PROFILE: Trade professionals from 120 countries, including buyers from supermarkets, hypermarkets, discounters, drugstores, and department stores, as well as importers and exporters, manufacturers, consultants, sales agents, and packaging & design experts.

HALLS:

The show covers all three complexes and 12 halls of the RAI. Halls 1-8 Food Section (1900+ exhibitors), Halls 8-12 Non-Food Section (700+ exhibitors).

PLMA Idea Supermarket® -

Area of Innovation, NPD and Inspiration

PLMA Idea Supermarket® is the special area that displays private label ranges of 60+ retailers from Europe, United States, Latin America, Africa and Asia. The theme of Idea Supermarket is ‘Trends in Private Label’. The aisles of Idea Supermarket provide a world tour of new private label developments and introductions by retailers worldwide.

PLMA’s New Product Expo showcases the newest products by this year’s exhibitors. On display are more than 400 of the latest innovations in the private label industry, from product to marketing to packaging. All New Product Expo selections are displayed in the PLMA Idea Supermarket.

PLMA’s 2023 International Salute to Excellence Awards.

The Awards give recognition and honour retailers for innovation and quality in the creation of their private label programs. All award-winning products are displayed in the PLMA Idea Supermarket.

Pre-Show Seminars:

Monday 22 May from 14.00 to 16.00 hrs.

Venue: Forum Room, RAI Exhibition Centre

VIDEO: Announcing PLMA’s 2023 International Salute to Excellence Awards Honouring retailers for excellence in private label products and packaging

Current Outlook of European Private Label Trends

The latest update of the country-by-country market share data and trends

speaker :

Kayleigh Meister, Analytical Team Lead, NielsenIQ

Behavior Changes of FMCG Shoppers in Challenging Times

Insight in consumer attitudes and the implications for private label retailers and manufacturers

speaker :

Servé Muijres, Retail Consultant Shopper GFK Netherlands

Learn from The World’s Largest Retailer: Walmart Opportunities in global sourcing and international negotiations - Interactive with Q&A

speaker :

Arjan Both, Senior Vice President Food Sourcing, Walmart

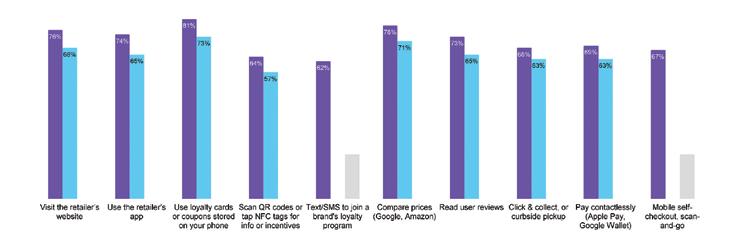

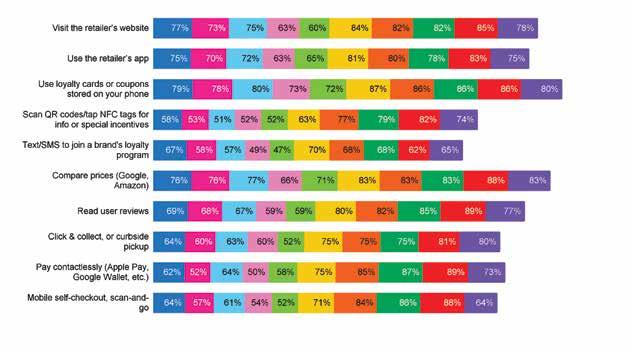

Mobile app experience company Airship released new global consumer research at Shoptalk to shed light on consumer behaviors and preferences for mobile apps from retailers.

Across 11,000 consumer respondents, 78% are using retailers’ mobile apps either more often or about the same as last year. This preference for retail apps extends across age groups and household income levels. Generationally, 81% of millennials and 79% of Gen X report using retail apps more or about the same as last year, followed by 72% of both Gen Z and boomers. High household incomes lead in regular use of retail apps at 82%, followed by 79% of medium and 75% of low income levels.

When asked about 10 different activities one might use their smartphone to accomplish while shopping in-store, using the retailer’s app grew the most year over year. Globally, 74% of respondents said they are likely to use the brand’s app when shopping at its physical storefronts.

Consumers Opt in to Brand Communications on Smartphones

For most countries and generations, the likelihood of using a retailer’s app while shopping in-store is only a few percentage points behind visiting the retailer’s website despite first having to download apps from the App Store or Google Play.

Mobile apps have an inherent advantage to reach people wherever they are at the exact moment it matters most, as notifications are served up on smartphone lock screens. When consumers were asked what motivates them to opt in to receive brand communications on their smartphone, discounts, loyalty rewards and offers personalized to browsing behaviors, past purchases and current location saw the biggest gains over the prior year. The data suggests that inflation and the current economy is driving more deal-motivated behaviors from consumers. It also demonstrates an opportunity for retailers to expand customer understanding as shoppers are more motivated to share personal information in exchange for valuable offers and convenient experiences that better meet their needs.

“Today’s consumers are increasingly turning to mobile apps from their favorite retailers to score deals, gain special access and improve their overall customer experience, particularly while shopping at brick-and-mortar stores,” said Thomas Butta, Chief Strategy and Marketing Officer, Airship. “As marketing budgets are pinched and consumers face economic pressures, retailers need greater agility to create and optimize valuable app experiences that grow customer understanding and reward them individually, making life easier and better for everyone involved.”

The survey was completed in partnership with Sapio Research in February 2023 among 11,000 consumers, age 18 and older in the U.S., Canada, U.K., France, Germany, South Africa, Singapore, Thailand, Indonesia and Brazil.

www.airship.com

TO DOWNLOAD THE FULL REPORT: https://www.airship.com/lp/enhancing-shopper-value-in-2023

Certified Origins sprouted from humble beginnings when a small collective of olive farmers in rural Tuscany, Italy, joined their passion for producing fresh, authentic extra virgin olive oil. We are still cooperative-owned to this day, and from extra virgin olive oil to tomato sauce, we are an industry leader in sustainable sourcing and authentic food programs. We select the best quality ingredients and develop custom recipes and packaging to meet your wholesale needs, all verified by our advanced traceability and production line technology.

This confidence and trust built over decades means we can guarantee the quality of our products, and gives us access to scale.

We have a state-of-the-art, 4.0 production lines for traceable extra virgin olive oil. Using innovative Internet of Things (IoT) technology framework, we have optimal production efficiency and continuous monitoring to ensure supply consistency with faster planning of production and related shipments.

Since 2019 we have invested over $1 Million in Research & Development in transparency & traceability.

We are certified as ISO 22005 to guarantee traceability and are the first olive oil company operating on Oracle blockchain technology to ensure transparency. Using this innovative Oracle blockchain and new 4.0 Production IoT technologies, we track each shipment to reduce the risk of information manipulation at the source, while ensuring food supply chain transparency.

● Carbon Neutrality: Certified Origins launched multiple lines of carbon-neutral Italian EVOOs under its flagship brand Bellucci.

● Loop: Certified Origins has signed a partnership with Loop to adhere to the global packaging reuse platform program launching the first refillable Italian Bellucci Extra Virgin Olive Oil.

Our international distribution and warehousing network and services mean we can deliver anywhere in the globe within 4-8 weeks, and in as short as 2 days in the USA and Canada.

At Certified Origins, we are also pioneering and investing in Nuclear Magnetic Resonance (NMR) technology to verify EVOO origin authenticity. This research is in partnership with the University of Salento and can verify the Extra Virgin Olive Oil origin authenticity. A large private database of unique «fingerprints» with +1k different origin olive oils is able to provide scientific support to EVOO authenticity, and each year our database increases by hundreds of samples to further improve the accuracy of the results.

● Pet 50% Recycled: Certified Origins converted PET used for packaging from virgin material to 50% recycled material

● Green Energy: Certified Origins uses energy supplied by photovoltaic panels and olive pits as a fuel source.

www.certifiedorigins.com

The Frostkrone Food Group will once again be showcasing cool new finger food ideas at this year's PLMA in Amsterdam when innovative enthusiasm meets well-founded snack expertise. The finger food and snack expert has three exciting food ranges to entice trade visitors at the largest Private Label Trade Fair, in keeping with this year's fair motto: Small Bites - Big Flavour.

The new Flavourites range marks Frostkrone’s successful move into the future of fingerfood development. The new and unique food range is crafted with a special technology that makes it possible to customise products flexibly in size and weight according to the customer’s wishes. Flexibility is also very high when it comes to the choice of ingredients.

Among the three variations that can be tested at the PLMA are the Flavourites Crispy Cream Cheese Jalapeños Pops: Their crunchy coating is immediately followed by the deliciously spicy flavour of the jalapeños, blended with the creamy, smooth flavour of cream cheese. Flavourites Crispy Paprinos Cream Cheese Pops are a sweet and tangy combination of red cherry peppers and creamy cream cheese. Also available are Flavourites Crispy Jalapeños Nacho Cheese Bites with the unique combination of spicy jalapeños and tangy nacho cheese.

These Frostkrone bestsellers are now also available as chilled convenience products for the refrigerated sector. Once again, the company group has broadened its portfolio of finger food and snacks: Visitors to the PLMA can sample Chilled Mozzarella Sticks with a melt-in-the-mouth core of pure tender mozzarella, as well as savoury Chilled Gouda Rings and spicy Chilled Chilli Cheese Nuggets.

Anybody into potatoes will love the Crispy Veggie Snack range. As small and fine as they are, coated in a crispy, golden-brown coating and filled with delicious mashed potato.

The ideal snack for watching series marathons, at game nights with friends or as food for nerves during gaming. Be sure to try them: Enjoy either pure and crispy as Crispy Potato Sticks or deliciously combined as Crispy Queso-Potato Balls with tasty spicy nacho cheese, Crispy Garlic Potato Balls with a core of mild cream cheese or Crispy Beetroot Bites with beetroot.

All finger food variations can be quickly prepared in the oven or deep fryer in just a few minutes until golden brown and then eaten straight away.

www.frostkrone-foodgroup.com

Le Bontà was founded in 1994 in Prato, in the Tuscan hinterland, to create sauces, meat sauces, and patès that express the best Tuscan gastronomic tradition.

Last October, Le Bontà Srl moved to a new 9,000 m2 plant in Campi Bisenzio (FI), bringing together two divisions (sauces and cereals) in a unique production center. The project was guided by a desire to embark on a sustainable path.

The lines of sauces have been renewed. The company has invested in new technologies and machinery that triple the production capacity and

allow us to replicate the authenticity of recipes with a perfect mix of tradition and innovation.

This year, Le Bontà Srl will launch a contemporary range that pays tribute to its origins: Chianina ragout, Porcini mushrooms and truffle sauce, Aglione sauce, cacio e pepe sauce, Norma sauce and Amatriciana sauce.

The Cacio e Pepe sauce embodies the whole soul of the people of the Lazio region and above all of the city of Rome, a city devoted to grandeur and majesty but which never forgets the simplicity of its origins.

Like Carbonara and Amatriciana, the Cacio e Pepe sauce is one of the Italian culinary tradition’s tastiest and most popular dishes. i Toscanacci have reinterpreted this historic recipe using the Tuscan DOP pecorino together with the Roman pecorino.

The new references arise from the great ability to evolve historical recipes in a new current and original key. The new products are suitable for all those who want to taste everyday typical Italian and quality flavors: they are ideal for everyone, young and older adults.

For more information: www.lebonta.it

La Doria S.p.A., headquartered in Angri (Salerno, Italy), is the leading European producer of canned legumes, peeled and pulped tomatoes in the retail segment and among the leading Italian producers of fruit juices and beverages. The Company is also Europe’s leading producer of private label pasta sauces. In 2022 they reported consolidated revenues of 1.018 billion euros with a workforce of 898 employees.

The Company can claim leadership positions in particularly competitive foreign markets such as the United Kingdom, Australia, and Japan. It ranks first in the UK market for the production of private label tomato derivatives and baked beans.

In addition to private labels, the Group also produces under the La Doria brand, which has been on the market for about 60 years, Vivi G / Vi G bio (for fruit juices), La Romanella (for the Discount channel), Althea, Bella Parma (for ready-made sauces) and other major Italian and international brands (co-packing).

High-quality products at competitive prices, high service level and volumes, breadth and depth of the product range as well as segmentation of the offer are all key factors on which La Doria leverages. Also increasingly important are credentials in terms of sustainability and in particular our pivot to the environment and responsible supply chain management.

The foreign market is the main channel for La Doria, from which more than 80 % of revenues are generated. The company operates with considerable shares in England, Germany, rest of Europe, Australia and Japan, and aims to strengthen its presence in high-potential markets such as the U.S., Asia and the Far East with specific products related to local taste and consumption habits. In the UK, La Doria, is the first company to export tomato derivatives and preserved legumes (baked beans) under private label, while in Australia and Japan it is the first company to export tomato derivatives. About 97 % of their sales are generated by private labels, industrial brands and co-packing account for 3% and have grown strongly in recent years.

commerciale.estero@gruppoladoria.it commerciale.italia@gruppoladoria.it

Lucart, a major European manufacturer of thin MG paper for flexible packaging, is a key player in the consumer goods and away-from-home markets as a producer and transformer of tissue and airlaid paper. Its attention to people, sustainable processes, and approach to innovation means they offer cutting-edge products that meet market challenges and customers’ needs.

Fiberpack® is their flagship project in this field: it combines advanced technology and environmentally friendly processes, demonstrating that circular economy principles are fully applicable to the tissue sector.

Lucart created this project starting from the idea of using all the elements of beverage cartons according to circular economy principles. The production process relies on an innovative technology that separates the cellulose fibers found in beverage cartons from polyethylene and aluminum by physical-mechanical action. With this technology, they avoid substances that may be harmful to people or the environment. They produce tissue products with the fibers obtained through this process and recover the aluminum and polyethylene, converting them into a homogeneous material called Al.Pe.®, which other industries use to produce various items.

The tons of Fiberpack® paper Lucart has produced from 2013 to 2021 have contributed to the recovery of more than 7.6 billion beverage cartons, saving more than 3.3 million trees and preventing more than 195,000 t of CO2e from being emitted into the atmosphere.

Lucart’s continuous research and development work has led to many projects aiming to improve the quality and performance of its products. One such project has led to the innovative QMilk® process, which makes it possible to extract and transform the basic proteins in milk into a soft and precious fiber without using chemical agents. The process pre¬serves the amino acids, and all the moisturizing and nourishing prop¬erties of milk in the resulting fiber. It guarantees a 100% natural formula that is dermatologically tested, ultrasoft, and highly resistant.

Lucart is also the only brand in its target market to offer Airlaid products with exceptional absorbency and strength performance. The Airlaid technology uses long, highly resistant cellulose fibers that never come into contact with water during the production process (dry paper) to remain super absorbent. Fibers treated with this process naturally form a “dam” structure, offering outstanding results: can absorb up to 7 times its weight and, thanks to its exceptional resistance, can be reused up to 20 times, compared to 1 or 2 for competitive products.

Lucart is a company made up of people who choose to use innovative and sustainable processes in development, transformation, and manufacturing of paper products, collaborating responsibly for the future of their business and the planet.

Lucart has always been at the forefront of the study of innovative packaging able to reduce the environmental impact of its products. After launching the world’s first line of toilet paper with materbi corn starch packaging in 1997, the company created a series of products with entirely plastic-free packaging in 2019.

The exclusive Airlaid Technology, which uses air instead of water to produce a special paper fabric of cellulose fibers, enhances the performance of Tutto the paper cloth, giving it high resistance, even when wet, and increased absorption power. Tutto the paper cloth is dermatologically tested and is suitable for contact with food.

For several years now, the number of critical consumers, meaning those who pay attention to the characteristics of the products they are purchasing, has been on the rise. There are an increasing number of people who are not taken in by a beautiful label, but rather prefer to read and understand its contents. These are consumers who independently choose what to purchase on ethical, environmental and health criteria rather than relying on the convenience and self-glorification of the producer.

Market trends indicate an ever-increasing demand for vegan products and we increasingly see products characterized as such on supermarket shelves. But are all the products that claim to be vegan really vegan?

While just a few years ago consumers found it difficult to find vegan or plantbased products, nowadays it can be difficult to navigate among the myriad of brands, symbols and slogans that ascribe this characteristic to products.

If consumers have the right to make conscious decisions about what they purchase, then it should be required that the information relating to the marketed product is reported properly. This is precisely what the V-Label brand sets out to do, by assisting manufacturers to properly report the vegan characteristic of their product and allowing consumers to make well-informed purchasing decisions.

The V-Label brand predates the vegan or plant-based trends currently dominating marketplaces: it was established in 1976, and has from that time always been a trusted guide for consumers.

Easy to recognize, it is currently the leading brand in the vegetarian, vegan and raw vegan product certification and identification industry.

International in scope, the brand is easily the most recognized by consumers around the world. Despite its extensive and widespread use, the brand has upheld the uniformity of contents and criteria for awarding the brand certification in order to ensure consumers and producers the same level of quality controls regardless of where individual items are produced or sold.

The V-Label brand has never permitted self-declaration as a method of verification: every ingredient, coadiuvants, and production method is verified by means of document checks and frequently inspection visits in order to safeguard consumers’ freedom of choice.

Clear and unambiguous, it is a valuable ally for companies wishing to enter the vegan and plant-based market with transparency. In fact, by emplying scrupulous controls, V-Label is able to declare products suitable on the basis of the criteria established by the major European Vegetarian and Vegan Associations.

Protecting consumers’ ability to make informed purchases and helping companies to properly address the ever-growing vegan demand is our duty, just as the freedom of choice of those purchasing and producing is a right that must be safeguarded.

www.vlabel.org segreteria@vlabel.it

Plastic is a versatile material that has revolutionized the world, from consumer goods to medical equipment. However, its non-biodegradable nature has led to vast amounts of plastic waste being dumped in landfills, waterways, and oceans, causing harm to wildlife and ecosystems. In recent years, there has been an increasing awareness of the need to reduce our reliance on plastic and find sustainable alternatives.

A study by Brandwatch analyzed more than 100 million social media posts about plastic pollution and found that 82% of consumers feel guilty about using plastic and 72% believe that companies should do more to reduce their plastic footprint. This growing concern about plastic pollution is driving a global movement to reduce its impact. The Ellen MacArthur Foundation launched the New Plastics Economy

Global Pledge in 2018, which commits companies to making all plastics reusable, recyclable, or com postable by 2025. As of 2023, over 1,000 companies have signed the pledge, including some of the largest companies in the world, such as Pepsi, Nestle, and Procter & Gamble.

Governments are also taking action to address the plastic problem. In the US, several states have banned single-use plastic bags, while countries such as Mexico, Belize, Costa Rica, Panama, Colombia, and Ecuador have passed strict laws banning some or all types of plastic. This trend is set to continue as the world recognizes the urgent need to address the growing problem of plastic waste.

Startups are emerging to tackle plastic pollution with innovative solutions. Biorgani, a Guatemalan-based company, produces a bioresin from corn starch that can be used in all existing plastic manufacturing machines. This bioresin is compostable, reducing carbon dioxide emissions and replacing fossil-based plastic. Biorgani’s innovative solution has attracted the attention of PriceSmart, one of the largest operators of membership warehouse clubs in Central America, the Caribbean, and South

America, which has invested $3.6 million in a plant that uses Biorgani’s corn starch technology to produce packaging for products.

Biorgani's success is a clear testament to the rising demand for sustainable alternatives to plastic. With increasing awareness among businesses and consumers regarding the detrimental effects of plastic pollution on the environment, the need for innovative solutions to this pressing problem has never been greater. Companies that can step up to this challenge and offer sustainable alternatives to plastic are likely to thrive in the future. As we collectively strive for a better tomorrow, let us keep in mind that every little effort can make a significant difference in reducing our dependence on plastic and safeguarding our planet for generations to come.

www.biorgani.tech

Since its founding in 1899, the family business, now run by the third and fourth generations, has continued to develop.

They constantly pursue their goal of

Valsa Group is a leading manufacturer of chilled, frozen and ambient pizzas, pinsas, and snacks. Their primary goal is to provide true, authentic Italian food lifestyle all over the globe. They are headquartered in Valsamoggia, the very heart of Italy, and this is where their story began and continues with 8 plants in a purely Italian entrepreneurial path.

Their daily commitment is to: CULTURE, EXCELLENCE, INNOVATION.

With an eye for consumers’ needs, as well as emerging trends, Valsa Group introduced a “pinsa solution” project in early 2023. It is founded on these four pillars:

Cover any range of temperature: from frozen, to chill, to ambient.

Satisfy every need of the final consumer, ranging from plain to ready-topped pinsa.

Never forget their core quality policies: GMO free, clean label without adding preservatives, only 100% Italian tomatoes, respecting the authentic Italian traditions in our production lines, guarantee natural leavening and hand stretching.

Always provide comprehensive service to partners, allowing them to ship not only the frozen line, but the whole range of products, thanks to the chilled and ambient from frozen technologies at their disposal to any destination.

An exclusive mix of flours and high hydration make their pinsa the best way to experience the authentic taste and scents of Italy. Each pinsa is individually hand-stretched like the real Italian tradition. They are available in a variety of flavors: from the plain base, then classic, multigrain, topped margherita, Diavola, Amatriciana, and many more. The perfect way to complete any retailers’ range with authentic, Italian products, bringing Italy to their customers within a single bite.

Valsa Group is a reliable and well-known business partner in fifty countries around the world. A result of the choices and investments made in production

capacity, organizational integration, convenience innovation, and sustainability, all while staying committed to process transparency, waste reduction and green energy use.

Through the brands Valpizza, La Pizza +1, Forno Ludovico, Megic Pizza, Ghiottelli, and Tuscanya Bakery, Valsa Group has established itself as a unique, large-scale, highly qualified, and reliable partner, able to supply a wide, diversified and always evolving range of products for each category, frozen to deli.

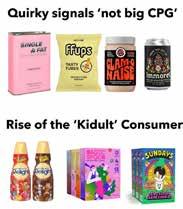

During the PLMA Leadership Conference in Orlando, Florida in March, several industry experts spoke about what it takes to win in the store brand industry. Kevin Ryan, CEO, Malachite Strategy and Research lead things off with his presentation, Beyond the Horizon: Future Forces Impacting Private Label. We wanted to share highlights of his presentation as we feel these insights will benefit both retailers and suppliers who are looking to prepare their businesses for what lies ahead for our industry.

There’s a link to this feature at the end of the article as well as details on how to reach Kevin directly.

FOODSERVICE/C-STORES

GROCERY RETAIL

CONSUMER CULTURE

KEVIN RYAN, CEO, MALACHITE STRATEGY & RESEARCHConsumers consistently want to ‘have their cake and eat it too,’ and new technologies are obliging. From sweet proteins to sugar that turns to fiber in the gut, taste and healthy can both be prioritized.

As concerns about supply chain stability and the effect of climate change on crops ripples through the industry, manufacturers and retailers invest upstream to ensure a healthy pipeline of raw ingredients.

C-stores: the new 3rd place.

As coffee shops turn to mobile-only pickup, c-stores have the potential to take their place. By becoming a restaurant, an EV charging hub, or a grocery store, c-stores just might be our new home-away-from-home.

Retailers need to rethink how they make money. With delivery and curbside pickup expanding, the standard model of grocery is eroding. Retailers will be experimenting with new ways to offer new services with higher margins.

Entertainment Goes Mainstream.

After a pandemic of isolation, people are anxious to get out and get together. However, with younger consumers increasingly saying no to alcohol, people are looking for alternatives to bars. Eatertainment facilities are making eating out more of an adult social event.

Restaurants are realizing that their brand can go further than their storefront. From high-end establishments to fast-food, restaurants are using their name and their creative forces to expand further into grocery.

The digital revolution is changing consumers’ perception of the grocery store. When people shop online or walk through the store with a phone, the aisles are reduced to a search bar. Categories are no longer held captive by aisles and brands have more latitude to stretch and grow.

As categories become more fluid, products that once were defined in one form are showing up in another. Now consumers are looking for new ways to experience the flavors they love in alternative textures and shapes.

As VC funding becomes more difficult to find, the era of DTC only brands becomes much more difficult. Instead, small brands are finding retail partnerships, combined with social media savvy, creates the correct mix for success.

Mass couponing all but disappeared during the pandemic and it may never return. Instead, retailers and manufacturers are seeing the power of using individual shopper data to target consumers with personalized deals.

As industrialized nations grow older, healthcare becomes top of mind. At the same time, consumer see food as a type of medicine, opening the door for retailers to bridge the gap between health and wellness.

Big brands seem so adult, always talking about health, nutrition and value. Sometimes consumers just want to have fun! Small brands have a different vibe, they are quirky, silly, and have a definite point of view compared to big brands.

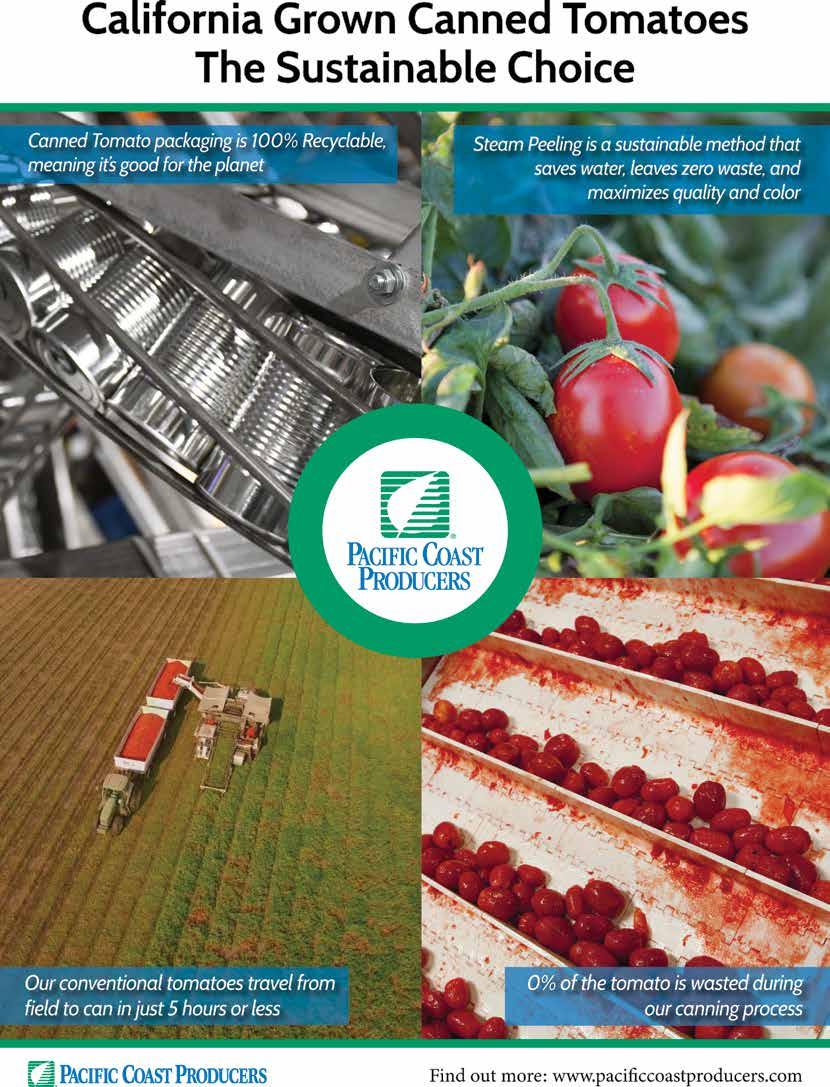

It’s the Oscar of Private Brand packaging design and it began with an unmet need a decade ago.

The Private Brands industry needed a platform for recognizing the acceleration of its stunning design, innovation, and excellence. Private Brands were evolving into true brands and their design advances needed to be showcased.

Enter the Vertex Awards, launched ten years ago to help define best-inclass design across retail sectors in the U.S. and globally.

“The awards have captured the amazing talent of designers and the strong commitments of their retail organizations,” said Christopher Durham, President of Velocity Institute, who co-founded the awards with Phillip Russo, Publisher, Global Retail Brands.

Over the last decade, the program has presented more than 1,000 trophies to over 125 retailers and 82 agencies from 63 countries worldwide. The momentum has continued even through a pandemic, a recession, and inflation and supply chain challenges.

“Private Brand packaging design is crucial for signaling quality and innovation to consumers,” said Russo. “The Vertex awards have underscored the highly creative ways retailers are approaching design.”

The tenth anniversary of the Vertex Awards is an opportunity to celebrate highlights from the past decade and ponder what’s ahead.

Private Brand packaging design is crucial for signaling quality and innovation to consumers, The Vertex awards have underscored the highly creative ways retailers are approaching design.

- Phillip Russo Founder Global Retail BrandsThe Vertex Awards is the only global competition devoted exclusively to the art of Private Brand package design.

Companies enter in a wide range of categories based on products or type of private brand (such as new brand, redesigned brand, etc.) Winners in each category are awarded a gold, silver, or bronze award, and the highest scoring entry in the entire competition receives a “Best of Show” award.

The Vertex Awards jury is composed of highly respected and experienced branding and package design professionals, handpicked from the retail, Private Brands and design industries around the world.

The Vertex Awards program has helped accelerate design by raising the profiles of efforts around the world, leading other retailers to raise their own games.

As an example, retailers in the U.S. had the opportunity to learn about award-winning efforts from counterparts in Europe, Australia, and other parts of the world.

There will be a lot to celebrate at this year’s Vertex Awards presentations in the U.S. and Europe. They will be accompanied by 10th anniversary celebrations. The celebrations will take place May 17 at the Velocity conference in Charlotte, N.C., and May 22 in Amsterdam, coinciding with PLMA’s annual “World of Private Label” International Trade Show in that city.

MAY 17, 2023

CHARLOTTE, NC

Celebrate the winners of the 10th Anniversary

The Vertex Awards helped to overcome long held assumptions about global Private Brand design, Durham asserted.

Most observers assume that England, Canada, and a select group of European countries were the undisputed leaders in private brands design.

However, Durham said, the awards showcased other countries that have been performing just as well or better. These include New Zealand and Spain, which weren’t necessarily top of mind before.

MAY 22, 2023

The Monday Night of PLMA Amsterdam, The Netherlands

U.S. retailers were stunned by the level of design they were seeing, They weren’t even familiar with many of the global winners.- Christopher Durham President Velocity Institute BY HANS KRAAK

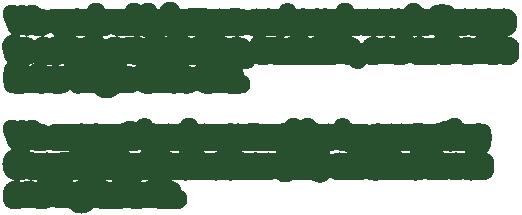

Conquers Europe; Affordable And Sustainable Can Co-Exist

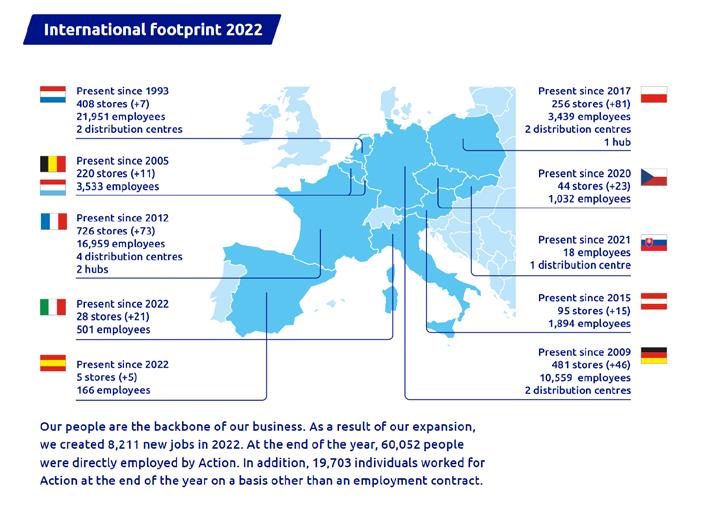

With the adage ‘Small prices and big smiles,’ Action is Europe's fastest-growing retail chain. It is currently mainly non-food in its assortment. The share in private label products is still relatively small, with 73 products in 2022, but poised for growth due to consumer demand.

Action started 30 years ago as a small store in the Netherlands. The company now operates 2,263 stores in the Netherlands, Belgium, France, Germany, Luxembourg, Austria, Poland, the Czech Republic, Italy, and Spain. Nearly 15 million customers are served weekly in stores and another 6.5 million online. And its network of stores and distribution centers, as well as the logistical infrastructure, is still expanding rapidly, with Portugal the next country in line.

Logistics and consistency seem to be Action’s driving force. You can visit a store in France, the Netherlands, Germany, or Spain in one week, buying the same products and getting the same promotions without noticing you are

in a different country. Approximately 95 percent of the assortment is the same all over Europe. According to Action CEO Hajir Hajji,

Wherever Action starts now, it seems to hit consumers from day one, which is reflected in the company’s value. In March 2022, the British investor 3iGroup, which has owned Action since 2011, noted a value of 4.5 billion; in 2022, this was 7 billion, and at the latest presentation of the annual figures, in March 2023, over 10 billion was realized. 3iGroup has invested in expansion, modernization of the brickand-mortar network and the staff.

Despite the growth of Action, the perception of many consumers – especially in the Netherlands – is of cheap throw-away items and an assortment mainly consisting of batch goods, only made in China. CEO Hajji is determined to change these perceptions. “It is impossible to serve millions of customers in 11 countries in almost 2500 stores with only batches of goods. In the beginning, the share of batches was bigger indeed, but since then, the company has also worked with vast suppliers and producers that grew along with them. As a result, at least 40 percent of our products we buy in Europe now, and this percentage still grows because we take sustainability seriously”, Hajji stated in the Dutch newspaper Telegraaf.

Next to enhancing the sustainability of stores and processes, the company strives to make the assortment more and more climate and environmentally friendly. Some private label products of Action have already received awards for this, including the bamboo underwear from the private label Ziki, a winner in the Salute to Excellence contest from PLMA, and the bed sheets from the label Hotel Royal.

According to Hajji, sustainability and affordability can go hand in hand. “Quality and sustainability are important to us, and still, we can serve our customers with affordable prices,” she states. Ninety percent of the cotton and ninety-two percent of the wooden products the company sells are certified sustainable. “Without scaling up our prices,” Hajji emphasizes. Action works with modest margins within the interest of the customers.” She asks herself why some companies in 2023 still ask such high prices.

It is impossible to serve millions of customers in 11 countries in almost 2500 stores with only batches of goods

Suppliers wanting to land on the Action shelves must pledge to work responsibly, ethically, and transparently. “Action not only strives to create a positive impact within our organization but also throughout our value chain. Together with our suppliers, NGOs, governments, international certification bodies, and standards, we work to strengthen the sustainability of our value chain”, the company states on its website.

To create positive social and environmental impact and identify supply chain risks, Action focuses

on transparency, working together with ImpactBuying. “We jointly aim to improve the circumstances of workers and their families and lower the environmental impact of the products,” says Laurien Dwars, Social Compliance Specialist at Action. With a rapidly changing assortment and many suppliers, having full transparency in the supply chain is a very challenging task, she admits. Action has already achieved 100% final product manufacturer transparency for all its private label products in 2022. For all its white label products (brands owned by Actions suppliers), Action aims to be fully transparent by 2025.

Hans Kraak

Hans Kraak is educated in biology and journalism and wrote three books about nutrition and health. He worked for the Dutch ministry of Agriculture, Nature and Food quality and the Netherlands Nutrition Centre. As editor in chief he publishes in the Dutch Magazine for Nutrition and Dietetics, as a food and wine writer he published in Meininger’s Wine Business International and reports for PLMA Live EU and PLMA USA.

started in the private brand industry in 1993 consulting retailers on how to strategically grow, market and nurture their programs into meaningful assets. Own brand programs and portfolios that consumers once interacted with begrudgingly 30 years ago are now brands they really care about. They mean something, and the emotional relationship with a retailer’s brand today is totally different.

Sterile, two-dimensional Begrudging embrace Follower

Story-less

Palpable personality

[Almost] lovingly embraced

Innovator

Investment in the story

The progress we are seeing in own brands is amazing across almost all retail channels, and the design, marketing and strategic acumen invested have been key reasons. But even with all the progress, there are still many, many areas which are crying for help.

The private brand industry cannot be satisfied with where it stands, and in a post-Covid world, CPG brands are hungry to promote, innovate and claw back share. We must seek out pockets where we can improve, and here are a few of these pockets that I see across the store. We can start by asking ourselves “Why Can’t We……” and fill in the blanks.

Even with the progress of private brands, there are still many opportunity areas and cages to be rattled

These two departments have multi-billion scope and some of the best CPGs in the business (P&G, Kimberly Clark, Colgate), but this should not deter private brands from winning, which we don’t. They have been historically devoid of own brand innovation and credibility, and it shows in the low penetration.

Target is one of the few to challenge this history in baby care, by exclusively marketing Millie Moon, positioned in the ultrapremium segment and launched in 2021.

Now one thing you must recognize is that even though this ultrapremium or “eco-chic” diaper segment is growing (hello bello, Rascal + Friends, The Honest Co, all good), it is still less than 4% of the U.S. market. It is niche. I also don’t like the word “luxury” as a prominent descriptor in Millie Moon, because it feels alienating in a category where the average consumer struggles and still spends $900 a year. Nevertheless, it is an attempt to go upmarket in own/exclusive brands where most retailers have not. Why can’t we…..develop a diaper that actually outperforms Pampers in dryness and absorbency, and market it heavily and consistently on the merits? Why can’t we (while we are at it), eliminate the brand Luvs from the assortment, which is designed to eat into private brand share?

Oral care has been another tough department for own brands, and there are retailers who have tried to penetrate it or even innovate within it. One of the biggest own brands in the world, Costco’s Kirkland Signature, tried to enter oral care with a toothpaste 5 years ago going right after Colgate and Crest. It didn’t last long…..you can see from the aftermarket Amazon reviews how consumers thought of it. The product functionally did not perform well.

CVS tried to pursue the category through innovation, launching a charcoal toothpaste through their Live Better brand, free of dyes/sulfates and “developed by dentists”. It is now relegated to aftermarket websites and has been discontinued.

With categories like Oral Care and Baby Care, there is an opportunity to develop products that are functionally superior, but for them to resonate, you cannot just put them on the shelf and expect them to automatically gain traction. The toothpaste section is renowned for its merchandising and sku density, where it is tough to even find the own brand selection. No, for any of these baby care and oral care offerings to really succeed, there needs to be a concerted marketing effort to explain the innovations and reasons-for-being. A great product alone will not sell just on the merits, especially going after CPG brands with long-standing equities.

be more resolute in eliminating duplication on the shelf and eliminating CPG brands with declining equity/share or little reason-for-being?

I thought COVID and some of the brand/sku simplicity that was necessitated (from a weary supply chain) during these 18 months was going to have a stickiness, but it seems like I was too optimistic. Many retailers have reverted to keeping too many duplicative skus, all with the same reasons for being.

I mean how many honey bears does a retailer really need?

Shoprite in the U.S., like many retailers, has multiple: Their own Shoprite Brand, Golden Blossom, Wholesome Pantry Organic (their own), Steve & Ed’s raw honey, Gunter’s clover and Glicks brand.

This is just one small example amidst a sea of clutter and duplication that exists in many, many retailers. All of this duplication has a negative effect on a retailer’s own brand and its potential share. Why can’t we just be more determined to eliminate unnecessary assortment the consumer doesn’t value?

There are also many CPG brands that negatively affect private brands and don’t deserve to be on the shelf through their own share numbers. In a multibillion-dollar sub-category like Paper Towels, Georgia Pacific’s Brawny has less than a 4.0 dollar share nationally.

It carves out a bare existence through a stream of BOGO’s, but basically the consumer has voted, with a declining brand share that has been proven out over the last five years. There is a similar story with Heinz mustard, a category where the Heinz brand name has little-to-no carryover and is anemic compared to French’s mustard and private brand. The only reason it remains on the shelf is that Kraft Heinz has literally poured a ton of money into the near half billion category

Private brands are already the #1 player in commodity categories like milk and eggs, but why can’t we make them even more differentiated when it comes to the stories we tell. The truth is we can, and if you can do it in big, everyday categories, it makes private brands even more credible and prominent in the consumers’ eyes.

WHY CAN’T WE... transform more commodities in the store with innovative points of difference and stories?

Dorothy Lane Market, one of the best independent grocers in the world out of Dayton, Ohio differentiates many commodities in their own brand portfolio, and eggs is one where they challenge the consumer to think about “what makes a good egg?”

They explain through their marketing what a cage free chicken is and the importance of non-GMO grains.

They also are cage-free chickens. This means that there are multiple openings on the barns that offer the chickens shelter and nesting areas. This not only supplies ventilation, but the chickens are free to roam green pasture as they wish.

Trader Joe’s is also storytelling around their pasture raised eggs.

The hens that produce Carol’s Eggs Pasture Raised Eggs are, in fact, raised on dedicated pastureland, where they’re allotted 108 square feet of space each—that’s plenty of room to roam and forage as they please. The pastureland is never treated with herbicides, and the hens are never given hormones or antibiotics. Transforming commodity categories and creating differentiation through your private brands is one of the most powerful tools you can develop as a retailer. It creates an everyday relationship with your brand that is meaningful.

In Psychology you learn about the primacy and recency effect and the power that it has over your memory and overall impression. Basically, it is a fancy way of saying that a consumer’s first touch and last touch are critical in their experiences with a brand, store, service or relationship.

I have always been a big believer that retailers’ private brands should be strong embracers of this primacy-recency psychology – private brands should be the first thing that a shopper interacts with entering, and the last thing when checking out.

At Stew Leonard’s markets, as a shopper, the first thing you see is their mission emblazoned on a stone, that the customer is always right. Thinking of this through private brands’ eyes, any retailer could tell you what their own brands’ mission is when you enter the store. This could be incredibly powerful.

When you check out, why can’t we make private brands the main thing you interact with, reinforcing a positive image and the “recency effect” in the consumer’s mind.

Trader Joe’s showcases own brands in the checkout line in many of their stores with unique chocolates, nutrition bars and other impulse products. They very much support the first, last (and even middle) touch philosophy bolstering their own brands.

Asking ourselves “why can’t we?” around private brands opens our minds to further possibilities, but it also has the effect of never being satisfied. Hopefully the ideas above are just the tip of the iceberg and can open up more dialogue about ideas where we can grow and push. I would be interested in a part 2 of this article and would welcome your “why can’t we” ideas, so please email me with additional thoughts.

Perry Seelert is retail branding and marketing expert, with a passion for challenging conventional strategy

and truths. He is the Strategic Partner and Co-founder of Emerge, a strategic marketing consultancy dedicated to helping Retailers, Manufacturers and Services grow exponentially and differentiate with purpose. Please contact Perry at perry@emergefromthepack.com

be the first and last touch for every consumer who shops in the store?

Oh, how I love this time of year! Not only am I inspired by New England springtime, I also draw so much inspiration from the Vertex Awards and Natural Products Expo West, where design trends emerge and come at us from all angles.

As a super fan of private brand design trends worldwide, I am so honored to be a judge of the Vertex Awards. It is exciting to learn the results and be able to share take-aways from these global entries. From punchy illustrated ingredients to ecstatic colors, this year saw an eclectic mixed bag of excitement, curiosity and innovation used to resonate with consumers.

While there were so many beautiful designs, here are a few of MBD’s favorite entries from the Vertex Awards this year:

Natural Products Expo West kick starts Q2 with passion and power! This year did not disappoint with over 85,000 people, 900 new booths, and a ton of inspiring design trends. Seen were bold fonts, wrap around patterns, pastels and newstalgia to name a few. My personal favorite you ask? Brand characters!

This year is even more exciting for MBD with the launch of the Sprouts Farmers Markets ‘better for you’ brand redesign. The redesign is largely driven by the talents of our creative team — No, I’m not biased, these designs are amazing and quirky, with a very specific, detail-driven strategy behind each product. They are disrupting categories and shelf sets with a plethora of fun!

Maria Dubuc, MBD - President

Maria Dubuc, MBD - President

Healthy ingredients, perception of product freshness and happy pets is increasingly relevant.

Get consumers’ attention with unconventional colors.

What advice can MBD provide to retailers who want to build brands where consumers take notice?

“Consumers want to be surprised and delighted with each and every SKU. Retailers need to take risks, break out of category norms and build brands that excite AND entice.”

Tracy LeMere, MBD - Creative Director

“Trending for the past 3-4 years, is that consumers want to have fun and enjoy their shopping experiences. So, to be able to craft a great atmosphere, retailers are allowing designers to take more creative liberties.”

Maria Dubuc, MBD - PresidentGiving a mascot something fun to do brings the package to life. It’s a playful touch that helps story-telling without sacrificing cohesion.

For good times and good vibes, give something classic a new twist.

“The choices made in how to best sell your brand is the experience for your consumer. When curiosity is piqued and trust is earned, the return on investment is greater. It’s an exciting time for own brands growth. For example, at the end of 2022, Sprouts announced their Q4 results and net sales rose 6% on a year-over-year basis.”

Devon See, MBD Sr. Account Manager

“From maximalism to surrealism. From illustration to photography. You need to be unique and ownable. Consumers are purchasing items that spark joy for them personally. You can’t skimp on imagery if you want to compete today, especially with so many products being offered.”

Monique Walton, MBDCreative Strategy Manager

“Laws, regulations and consumer preferences are always changing in the packaged goods. Changes that take specialists like MBD to get ahead of. MBD are watching the proposed changes closely and how they will impact our clients’ designs. Stay tuned for more to come on this subject in the near future.”

Sam Sniezek, MBD - QC

Maria Dubuc. President, MBD

Maria’s 30-year career in retail packaging translates into awardwinning solutions in the private label packaging sector. Producing SKU counts from 1,000 to more than 10,000 annually, Maria‘s expertise lies in scalable design excellence and innovative execution, while also implementing workflow management systems specifically tailored to the clients’ needs.

Monique Walton

Creative Strategy Manager, MBD Monique brings over 20 years of marketing, design and creative strategy to MBD. With a focus in retail, Monique enjoys helping retailers navigate their needs into a smooth delivery with successful outcomes.

Consumers are grappling with uncertainty as the cost-of-living increases at a startling rate and the impact of fragile ‘just in time’ supply chains impacting choice. However, there is a strong sense that the PL category might capture the favorable trade winds and rapidly accelerate its share of the grocery market.

Observers of the sector have witnessed the growth and private label penetration of well-recognized grocers: Canadian Loblaws, USA Trader Joes, UK Tesco or Sainsburys as examples, each with well-established PL alongside the increase in market share of the major discounters, Aldi, or Lidl.

Let’s recap why a strong PL strategy is important: Loblaws, Canada (one of the best food grocers) has led the charge with PL. In the early days of the journey, Dave Nichols (Head of PL) developed the Ultimate Chocolate Chip Cookie – a box of the best-tasting cookies that became a beacon for PL winning on value (quality x price). Delivering on two key objectives, firstly inspiring team members to become ambassadors for their company-owned PL products and – equally importantly – a great product only available within Loblaw’s stores, driving customer loyalty. Today many of the most successful grocers with strong PL have their own Ultimate Chocolate Chip Cookie replicating this strategy.

A successful PL strategy gives customers a reason to shop with a particular grocer, recognizing they can only buy these products within this chain, leading to what is commonly referred to as a ‘destination’ to shop. Attracting consumers to a

particular grocery chain based on the value or strength of the PL range means that while within the store, they shop the leading brands, the grocer wins a larger basket spend.

A plethora of factors are impacting consumer trends today; analysts are increasingly applying the term ‘consumer fatigue’ as the economic environment continues to impact spending habits. History shows that in times of hardship, consumers switch to frugality, which should be good for PL across multiple tiers.

• Increase strategic supplier relationships to maintain supply and encourage longer-term investment. Partnerships drive growth through collaboration.

• Incorporate the Environmental, Social, and Governance (ESG) agenda to the private label strategy, targeting reduction in food waste, sustainable packaging, and social compliance across complex supply chains.

• Understanding where consumers have sufficient trust to switch to a PL option is crucial for success. Growing penetration will depend on strong category strategies and recognizing where high brand loyalty will prevent consumers from

• Increased discount for loyalty program members, visual at the point of purchase, further highlighting saving opportunities.

Interesting Innovations driving consumer engagement. Additionally, as grocers look to improve engagement with consumers, we are seeing some interesting innovations that include:

• Digital solutions taking Key Value Items (KVI – the lines that retailers are regularly price compared on) and personalizing to consumers.

• Compare and save strategies at point of shelf on key lines highlighting the savings by switching from the leading brand to a PL offer.

• Shielding during promotional activity whereby the PL product remains the best value offer maintaining profit levels per product sold.

Continued on page 61 >

As consumers look for value and quality, and the opportunity it brings to build consumer loyality.

Private label products have become an increasingly popular choice for consumers seeking nutritious and affordable food options, particularly as the economy faces rising inflation. However, as the private label industry continues to grow and evolve, there is a debate over whether new terms, such as “Comanufacturing” or “3PIM” (3rd party innovation & manufacturing), are more suitable than the traditional term “private label.”

One potential advantage of the new terms is that they better reflect the collaborative and innovative nature of the private label industry. The term “Co-manufacturing” highlights the partnership between retailers and manufacturers, while “3PIM” emphasizes the role of innovation and manufacturing.

These new terms may be more inclusive and descriptive for industry professionals and could better capture the full scope of the industry.

Another potential advantage of using new terms is that they could potentially help to rebrand private label products and eliminate the negative connotations often associated with the term “private label.” By using a new term such as “Co-manufacturing” or “3PIM,” retailers may be able to create a more positive image for their store-brand products and elevate them to a level of respectability equal to that of national brands.

However, there are also potential drawbacks to using these new terms. Firstly, they may not be as widely recognized or understood as the term “private label,” which has been used

for decades and is well established in the industry. This could lead to confusion and require additional explanation for those not familiar with the new terminology.

Secondly, the new terms may not accurately reflect the full scope of the industry and the organizations that represent it. While "Comanufacturing" emphasizes the partnership between retailers and manufacturers, it does not fully capture the role of other players in the industry, such as brokers, agents, and consultants. Similarly, "3PIM" focuses on innovation and manufacturing, but does not account for other aspects of the private label industry, such as branding, marketing, and distribution.

In conclusion, the debate over the suitability of new terms for the private label industry is complex, and there are both advantages and disadvantages to consider. While new terms such as “Co-manufacturing” or “3PIM” may better reflect the collaborative and innovative nature of the industry, they may not be as widely recognized or inclusive as the traditional term “private label.”

Ultimately, the decision to adopt new terminology should be made with careful consideration of the impact on all stakeholders, including industry professionals, organizations, and consumers. Regardless of the terminology used to describe the industry, private label products will continue to play a vital role in meeting the needs of consumers seeking affordable nutrition. This for sure will be the number one topic number at the PLMA Amsterdam 2023.

Pascal Ruzius

Founder of Cibus Nexum and an agricultural engineer with 25 years of experience at FMCG companies and global outsourcing projects.

Sophie van de Water

As an international food business student at Aeres College, Sophie studied in Canada at Dalhousie University and interned in Vancouver. She is currently working on her graduation internship at Cibus Nexum and writing her thesis on the protein shift within traditional dairy companies.

Phygital marketing is defined as the joining of online and offline environments that combines the best parts of each to create a more satisfying customer experience. With the swipe of a mobile device, consumers can access marketing stories that are entertaining, educational, and connected to the brand.

Connected packaging embeds QR codes, barcodes or image recognition onto the physical package that drives to digital content. This type of packaging connects consumers to relevant content through a browserbased app accessed through a mobile device.

The Fish Agency helped Save On Foods launch their new lifestyle brand Only Goodness to become one of the first Private Brands in North America to incorporate QR codes into their product packaging. Only Goodness now sets itself apart by simplifying the journey to healthy living through its clear and straightforward messaging, innovative use of smart packaging (featuring QR code) and affordable pricing strategy.

The smart packaging helps consumers in their journey to healthy living by driving consumers to a list of each and every artificial ingredient that will never be found in Only Goodness products. In the months to come, consumers will be able to access nutritional content from registered dieticians and other healthy living advice.

If you’ve ever caught a Pokémon or used a filter to become a mouse during an online video call, then you’ve used augmented reality.

Examples of brands using augmented reality include:

• Ikea uses augmented reality technology to insert a 3D object into the mobile view of a user’s surroundings, which helps people see how furniture might look in their homes before they buy.

• Jack Daniels creates a fully immersive experience with a downloadable app that allows consumers to take a virtual tour of their Distillery.

• Corby Spirit and Wine Limited engaged with the Fish Agency to create an immersive AR experience that featured Brand Ambassadors walking through featured cocktails for their Wiser’s Whisky and Ungava Gin brands.

It’s not surprising that, according to Goldman Sachs, the global market for augmented reality in retail is expected to reach $1.6 billion by 2025.

How to incorporate phygital marketing into your brand design:

• Know your brand story and consider where it intersects with your customers’ lifestyles.

• Highlight those intersections in a phygital experience to help build loyalty and drive buying choices.

• Decide on the context—at home, in-store or on the go—wherever you believe your customer would find an augmented shopping experience most valuable.

• Clearly define what success looks like and ensure your experience allows you to collect the data you need to refine and scale phygital marketing across your organization.

Rebecca

HamiltonRebecca is the CEO of award-winning Fish Agency and sister agency Whitespace Brands Inc. With over 30 years of experience, she has established herself as one of North America’s leaders in the fields of strategic branding, retail design, and communications for clients in the retail sector.

Under Rebecca’s oversight, the Fish Agency brings brands to life at retail and has consistently delivered high ROI-generating retail experiences for its clients. She mentors and leads highly experienced and integrated teams that provide store design, package design for CPG and private brands, digital/social initiatives, “phygital” experiences, and advertising services.

Rebecca@therealfish.agency

The future of retail will be defined by a connected marketplace, where customers can seamlessly transition between physical and digital experiences.

Emerging technologies such as AR, VR, and AI will play a critical role in creating this connected experience by providing personalized and immersive shopping experiences that cater to the individual needs and preferences of each customer. These technologies can be used to create personalized and immersive experiences that engage customers and differentiate brands from competitors. The retail industry has undergone a rapid transformation over the past decade with the adoption of these new technologies. Retailers now have the potential to enhance the customer experience by providing personalized and immersive shopping journeys. This whitepaper aims to explore the role of AR, VR and AI in the future of retail and how they will shape the connected experience.

AR in Retail —

AR refers to the overlay of digital content onto the physical world, typically through the use of a smartphone or tablet. AR can be used in the retail industry to provide customers with an immersive and interactive shopping experience. Consumers can use AR to try on clothing virtually, visualize furniture in their home, or see how a shade of lipstick will look once applied. For example, IKEA’s Place app uses AR to allow customers to preview furniture

in their homes before making a purchase. This reduces the likelihood of returns and improves the overall shopping experience.

AR can also be used to enhance the in-store experience. Retailers can use AR to provide customers with information about products, such as ingredients or reviews, by scanning a product with their smartphone. AR can also be used to create interactive displays or games that engage customers and encourage them to spend more time in-store. This mobile-enhanced experience is quickly becoming an expectation for the digital-first consumer.

VR in Retail —

VR technology creates a fully immersive digital environment that simulates the physical world. In retail, VR can be used to create virtual stores that customers can explore and interact with. This allows customers to experience products in a more immersive and engaging way, which can lead to increased sales and customer loyalty.