INSIDE

Betting data from the FIFA Club World Cup How do US operators fare in the off-season? DFS in California – what’s the state of play?

INSIDE

Betting data from the FIFA Club World Cup How do US operators fare in the off-season? DFS in California – what’s the state of play?

Gambling Insider looks into the rise of influencers within US sports betting marketing, as well as their impact across Latin America

The way of the world is changing. More precisely, how media is being consumed has already undergone immense change.

Yes, television is still around (and so too print magazines like this one). But watching the latest Netflix or Peacock series is far more important today than catching the newest episode of a 40-year-old soap opera on national TV.

Social media – and in particular influencer marketing – has embodied this change. It is a far more personal – and perhaps lucrative – method of engaging the audience of today.

Of course, traditional methods are still paramount, no pun intended, with gambling operators funnelling huge investment into TV advertising, sports sponsorships and the like. But there is so much value to be found in Instagram, X/Twitter, YouTube and more.

On the US side, an influencer who works with PrizePicks takes part in our cover feature, exploring the exact appeal of this personalised marketing route. Rather than celebrities who flash across your screen with a thumbs up and a smile, influencer marketing can involve a brand ambassador actually using an operator’s site, placing their own wagers, then posting a video analysis explaining precisely why. Players can engage in discussion with that very ambassador, creating an almost-incomparable rise in engagement.

In Latin America, however, influencer marketing has taken a very different, darker turn already. Perhaps it is my naivety, but as Gambling Insider Editor I was yet to come across anything as brazen as the approach of so many LatAm operators and influencers. Despite a whole national enquiry into these dealings in Brazil, there is still no clear understanding or regulation of how influencers and operators should work together responsibly.

The whole influencer phenomenon is most apparent in countries like Brazil and Argentina, where the popularity of one individual – that a typical gambling CEO may never have heard of –will carry far more weight with millions of followers than a famous athlete or politician.

But the dangers of that very influence going unchecked are also most apparent in South America. Indeed, there are numerous arrest warrants still active, after masses of players were duped into thinking the Fortune Tiger (“Jogo do Tigrinho”) slot possessed a glitch that would guarantee bettors lavish millionaire lifestyles, involving fast cars and even faster winnings.

We zone in on both influencer marketing in Brazil and Argentina in our cover section as a result, discussing the subsequent regulatory dissonance and what can be done to combat this in future.

Elsewhere in this Sports Betting Focus , we look at how US operators fare during the NFL off-season, as well as the undetermined status of daily fantasy sports’ legality in California. There is also a 20-year anniversary for DS Virtual Gaming – a landmark worth celebrating in today’s dynamic and rapidly changing industry.

COO, EDITOR IN CHIEF

Julian Perry

EDITOR

Tim Poole

Tim.Poole@gamblinginsider.com

SENIOR STAFF WRITER

Beth Turner

STAFF WRITERS

Will Underwood, Rory Calland

CONTENT WRITER

Megan Elswyth

LEAD DESIGNER

Claudia Astorino

DESIGNERS

Olesya Adamska, Callum Flett, Gabriela Baleva

JUNIOR DESIGNER

Medina Mammadkhanova, Monika Petrova

ASSISTANT DESIGNER Tanya Aleksova ILLUSTRATOR

PUBLISHING ASSISTANT

Ockenden

(0)

Juqula Michael.Juqula@gamblinginsider.com

Tel:

Tel: +44 (0) 203 787 4615 Irina Litvinova

Irina.Litvinova@gamblinginsider.com

Tel: +44 (0) 203 855 0662

BUSINESS DEVELOPMENT MANAGER - U.S.

Tel: +1 702 850 8503 AWARDS SPONSORSHIP MANAGER

Pugh

Michelle.Pugh@globalgamingawards.com

Tel: +44 (0) 207 360 7590

With panel reviews, interviews, features and company profiles completing the rest of this issue, I’ll give my final shoutout to our exclusive Betby data, assessing betting trends during this summer’s FIFA Club World Cup.

There may always be more pound-for-pound revenue in online casino than sports betting, but let’s not forget what unites the masses. I for one still live for sport as a spectator and, combined with the positive impact responsible gambling can have, sports and betting remain a powerful combination.

CREDIT MANAGER Rachel Voit

WITH THANKS TO:

Betby, DS Virtual Gaming, Marc Zwillinger, Araksi Sargsyan, Data.Bet, Bart Snoeks, SportGenerate, Tomás García Botta, Augustín Díaz Fúnes, Trent Attyah, Mike Quigley, Kevin Hennessy, Greg Karamitis & Les Ottolenghi.

06 THE TAX MAP

Gambling Insider looks into which states are raising sports betting tax rates in 2025

08 DATA: CLUB WORLD CUP

Data from Betby’s operator network highlights betting trends from the 2025 FIFA Club World Cup

16 IGB PANEL REVIEWS

We report from a sports betting-related talk from London

18 QUIET SEASON

Major US operators share how they retain positive activity in the NFL off-season

22 INFLUENCERS WINNING HEARTS & MINDS

Gambling Insider takes a deep dive into the emerging trend of influencer marketing – focusing first on the US

27 A MATTER OF INFLUENCE

Influencer marketing is shaping perceptions in Argentina, but not in a positive way...

31 ONCE UPON A TIGER

Influencers have been a huge topic of discussion in Brazil, even leading to a national inquiry...

38 TAKING THE REINS

VIP Play CEO Les Ottolenghi discusses his iGaming career and appointment to the top job

42 AMBITION & BELIEF

DS Virtual Gaming Chief Commercial Officer, Araksi Sargsyan, reflects on the company’s journey on its 20-year anniversary

44 TAXATION IN THE NATION

Gambling Insider explores the potential ramifications of rising tax rates in the US sports betting landscape

48 UN-SOLD GROUND

A DFS legal expert speaks with Gambling Insider about the legal contention in the state of California

Gambling Insider looks into which states are raising sports betting tax rates in 2025, as well as some of the early responses from sportsbooks

While the state will not be raising its sports betting tax rate in 2025, Colorado Governor Jared Polis chose to eliminate an operator’s ability to deduct a certain percentage of “free bets” from its taxable revenue each year. House Bill 1311 will gradually phase out the deduction until it is completely removed by 1 July 2026, and is expected to reduce the amount of promotions offered by sportsbooks throughout the state. The new law went into effect on 1 July, limiting free bet deductions to 2% per month before falling to 1% in January 2026.

Wyoming’s Select Committee on Capital Financing and Investments proposed legislation in June that would double the online sports betting tax rate in the state from 10% of operator revenue to 20%. The Committee believes an increase to the tax rate would align Wyoming with other states in which the offering is legal, as the average figure across the US is approximately 19%. The legislation has not been approved at the time of writing, but would also increase the tax rate on skill-based games in Wyoming from 20% to 25%, as well as the rate on horse wagering from 1.5% to 2.5%.

> 21.5%

Louisiana will also join other states around the US in increasing its tax rate on sports wagering activity, as Governor Jeff Landry signed House Bill 639 into law in June, raising the current tax rate of 15% to 21.5% beginning 1 August. In addition to increasing the state’s sports betting tax, the bill will create the Supporting Programs, Opportunities, Resources and Teams Fund, set to receive 25% of the revenue generated from sports wagering. The Fund can be used by athletic departments of NCAA division one programs for the benefit of student athletes, as the 21.5% tax aligns online sports betting with the tax rate enforced upon retail wagering activity in Louisiana.

In response to the decision by Illinois lawmakers, both FanDuel and DraftKings will be enforcing a $0.50 per wager transaction fee for all bets placed in Illinois, while Fanatics also announced a $0.25 per bet fee beginning in the fall. Flutter, the owner and operator of FanDuel, stated it would cease enforcing the fee should the Illinois Government choose to repeal the tax increase. Fanatics will most likely not be affected by the $0.25 to $0.50 increase following the first 20 million wagers, as only DraftKings and FanDuel are projected to witness this level of activity within the state. ESPN Bet and Circa Sports, by contrast, have introduced minimum wager requirements.

Senator John Keenan proposed the Bettor Health Act in early 2025, which looks to raise Massachusetts’ tax rate on online betting platforms from 20% to 51%, ban sports betting advertisements during game broadcasts and limit how much people can bet until an affordability check is conducted. Sports Betting Alliance, a trade association representing sportsbooks such as DraftKings, FanDuel and BetMGM, says the increase will push Massachusetts bettors toward unregulated offerings and still have a negative effect on the tax revenue generated by operators. A committee hearing on the Bettor Health Act is still expected to be held by state lawmakers at the time of writing.

13%

Governor Phil Murphy originally looked to increase the sports wagering tax rate in New Jersey from 13% to 25% as part of his fiscal year 2026 budget proposal, but watched on as fellow lawmakers agreed to a 19.75% tax on all operators beginning next year. The increase was projected to add $402.4m in tax payments to New Jersey, designed to help offset a reported $58.1bn of spending in 2026, according to the newly approved budget. The figure represents a record high for state legislators, who also increased the tax rate on iGaming from 15% to 19.75%. ILLINOIS

Despite the state already implementing an adjusted gross sports wagering receipts tier system for taxes paid by operators, lawmakers have chosen to enforce a $0.25 fee for the first 20 million wagers accepted by a sportsbook, increasing to $0.50 for any wagers taken thereafter. The tax levy was announced following the approval of a new budget by both chambers of Illinois’ state legislature. The state’s Gaming Board reported total sports wagering handle of approximately $445m for April 2025 between professional, college and motorsport events. Operators have responded by either passing on a transaction fee to customers or enforcing a minimum wager – making Illinois an unprecedented sports betting market in this regard, and a fascinating case study.

In May, Maryland Governor Wes Moore officially signed the Budget Reconciliation and Financing Act of 2025, increasing the sports betting tax rate from 15% to 20%. Moore proposed legislation earlier in the year that would have raised the tax rate to 30%, but the state’s House, Ways and Means Committee voted to drop the tax rate to 20% – aiming to help reduce a $2.7bn budget deficit. As part of the bill, 95% of sports betting tax goes toward Maryland’s public education fund, while the remaining 5% is shared with the state’s general fund.

Despite North Carolina witnessing one of the more successful rollouts of sports betting in the offering’s history following its legalisation in 2024, lawmakers are already attempting to increase the tax rate from 18% to 36%. The budget proposal has not been signed into law at the time of writing, but the state has already generated $94m in tax revenue from sports betting throughout fiscal year 2025 alone, exceeding projections from the North Carolina State Lottery Commission. If approved, the proposed tax rise would officially go into effect for operators on 1 October 2025.

Sports betting supplier Betby provides Gambling Insider with exclusive data from its operator network on the first FIFA Club World Cup since the tournament’s new format was announced

- According to data from Betby’s partner network, the trend of major tournaments seeing more prematch betting than in-play continued at the FIFA Club World Cup

- However, another trend consistent with other major tournaments persisted – in terms of turnover (total amount of money wagered), this was much more even. Indeed, live turnover represented 45.3%, with pre-match turnover amounting to 54.7%

- This suggests players betting live were betting more con dently and with greater sums

- Individually, only twp PSG players made the top 10 in terms of attracting bets across all player markets. By comparison, four Real Madrid players featured

- Only one player featured from champions Chelsea (Cole Palmer), while the eternal greatness of Lionel Messi attracted the highest turnover – despite his team exiting at the group stage, and despite him being 38 years of age...

- 20% of bets were placed on player shots on goal – the highest of any player market, demonstrating the growing popularity of player stats markets

- Turnover, though, was still highest for player goals – and rather high for VAR too

- Huge tournament favourite PSG was the most bet-on team, which suited operators right down to the ground after PSG lost to Chelsea in the nal

- While eventual champions Chelsea was the third-most bet-on team, Inter Milan actually saw the second-most turnover behind PSG. This perhaps suggests some emotional home betting from Italian fans, or credit given for Inter’s run to the Champions League final

- Real Madrid was the most popular team to bet on in the last four, with both PSG and Fluminense – interestingly – generating more wagers than eventual champion Chelsea

- Rather anomalously, though, PSG attracted almost half of all turnover in the semi- nals, far exceeding its three rivals. So whoever was backing PSG... was betting big

12.29% of betting on the FIFA Club World Cup semi-finals was placed via a bet builder

33.39% of all semi-final bets were placed on the 1x2 (result: win, loss or draw) market

- There were no surprises when PSG was made an odds-on favourite for the final, given its Champions League victory and its 4-0 semi-final win over Real Madrid

- Chelsea, though, ensured a superb day for operators, with its 3-0 victory meaning 77.9% of bets and 86.6% of turnover was placed on the eventual losing team (PSG)

- Ousmane Dembele and Desire Doue attracted the most bets out of anyone, when analysing player markets in the nal. In fact, four of the top ve players represented losing side PSG

- Achraf Hakimi’s high ranking represents how well he contributed as an attacking force, despite being a rightback by nature

- Enzo Fernandes, Moises Caicedo and Marc Cucurella –one can speculate – would have generated bets based on their tackling and foul contributions

- Just like in overall tournament betting, the nal saw a majority of bets placed on shots on goal

- The most turnover went on goals, however, while cards were also a signi cant area of interest (they usually are when Moises Caicedo and Enzo Fernandes are playing!)

For over 20 years, DS Virtual Gaming has rede ned the virtual gaming experience through innovation, precision and a deep commitment to regulated, responsible markets. As industry pioneers, we’ve consistently anticipated player needs and turned those insights into intelligent product design – delivering engaging content and seamless accessibility anytime, anywhere.

Our latest breakthrough is the launch of proprietary single-player terminals, a product that reflects our forward-thinking philosophy. Now rolling out across Europe, Africa and Latin America, these terminals mark a major step toward our mission: Giving players full autonomy and 24/7 access to the games they love.

At DS Virtual Gaming, we ask one vital question: How can we give players more control over their gaming experience? Years ago, we began answering that question with the launch of the Order Ticket Solution – a system that let players create their own bets and collect tickets after payment at a cashier. This self-service model gave players more freedom and

set the stage for more immersive, user-led gaming.

Our single-player terminals build on that legacy. These fully independent, all-in-one machines give players direct access to our entire game portfolio, day or night, without relying on staff or operating hours. Whether in betting shops, arcades or other entertainment venues, the experience is always just a touch away.

Crafted in collaboration with MIKKA GmbH, a global leader in hardware development, the terminal combines sleek design with smart engineering. Weighing 100 kilograms and echoing the elegance of a premium casino, it’s a showpiece that delivers both performance and presence.

But looks are only part of the story. These terminals are built for plug-andplay simplicity. Operators won’t face long waits for integrations, complex configurations or third-party delays. With DS Virtual Gaming, you get a turnkey solution backed by in-house support – everything you need to go live, fast.

We recognise that many operators already have infrastructure in place. That’s why we don’t ask partners to start from scratch. For those with existing terminals who want to expand their game o erings, we provide custom integration solutions. Even if your current hardware lacks a gaming platform, we can deploy our content in a way that ts your operational setup.

This level of adaptability is why DS Virtual Gaming continues to earn the trust of top operators globally. Our goal is to provide tools that are as flexible as they are advanced.

With our proprietary terminals now active and more innovations underway, we’re shaping the future of gaming environments. As the industry evolves, so does our commitment to delivering secure, scalable and player-centric solutions that meet the needs of modern gaming culture.

At DS Virtual Gaming, we’re not just creating products – we’re building systems that empower players, simplify operations and raise the standard for what virtual gaming can be.

In June 2025, DATA.BET strengthened its portfolio capabilities by adding sports betting and opened a new chapter in the company’s history. The sportsbook covers over 50,000 events per month, featuring over 63 pre-match and 38 live sports, along with 1,000+ available markets. This sports betting launch marks a strategic evolution of DATA.BET’s business model – applying proven technology to a new domain where automation, scalability and operational performance can make an immediate di erence.

DATA.BET’s upgraded solution delivers comprehensive sportsbook functionality through a single integration point. The o ering includes Odds Feed, Risk Management, interactive Widgets, Video Streaming and customisable tools like Bet Builder – all integrated into a single, cohesive system. With a 24/7 in-house trading team ensuring over 93% market uptime, dynamic odds adjustments and automated settlements, operators receive consistent performance across all content types.

providers can integrate using the Single Page Application (iFrame) solution – a process comparable to connecting a new game provider that can be completed within a few weeks. Apart from SPA, there is a possibility of integrating Odds Feed via API for more extensive coverage.

Once integrated, operators access a comprehensive feature set designed to maximise player engagement and betting volumes while delivering a broader, player-centric betting experience. Cashout allows players to settle their bets before the event concludes, both single and multiple bets, and Player Props allows for placing bets on specific actions. Video Streaming covers football, American football, tennis and basketball. These interactive Widgets help turn the operator’s project into a key information source, eliminating the need to seek information elsewhere.

custom engagement modules, this solution allows for faster rollout and better longterm maintainability across product lines.

DATA.BET’s expansion results from the company’s technical capacity are reaching a level where its core models, initially developed for esports, can be e ectively applied to a broader range of disciplines. These models are built to handle large volumes of data with speed, structure and classification accuracy, making them well-suited for the complexities of traditional sports where fast decisionmaking and dynamic market management are required.

The company’s portfolio now includes esports, sports and virtual sports, providing access to all betting verticals through one delivery point. This reduces the time and resources typically required for multi-provider integrations. Betting operators, casinos and platform

Many betting businesses may face signi cant entry barriers when adding a sportsbook vertical, including integration complexity and operational setup. DATA. BET’s offering addresses a clear gap for operators and platform providers who miss out on a sports opportunity.

The primary challenge in the market is that bookmakers must choose between signing up for a complete platform that includes everything from tech to payments or piecing together multiple data sources. DATA.BET identified this massive opportunity for a high-quality, plug-and-play solution that works seamlessly for any market. Clients from Canada, Brazil, Finland, Sweden, Poland, Ukraine and the Philippines have already experienced the benefits of this unified approach, reporting improved operational consistency and faster time to market compared to their previous multi-vendor setups.

A common challenge for operators expanding in the betting space is maintaining consistent product logic and user experience when switching verticals. By offering consolidated infrastructure complete with streaming, pricing tools and

The company maintains complete control through an integrated portfolio of services built and maintained internally. This ensures adaptability and compliance while relying on official data sources to ensure quality, precision and consistency at every stage of the process. The in-house data science team fully adapted its mathematical models, synchronising them with the tempo, segmentation and logic of traditional sports events, developing new classification protocols and pricing mechanics while preserving the speed and consistency of the existing system. From the beginning, the company has focused on building sustainable, long-term technical infrastructure using the synergy of AI automation and 24/7 trader supervision, ensuring stable performance and relying on data-driven systems that support different content types through a single, flexible infrastructure.

DATA.BET’s sports launch represents the next revolution in the company’s history. The initial rollout focuses on high-demand, globally recognised sports and leagues, including football, basketball, tennis and American football, with infrastructure designed to integrate new disciplines e ciently. This allows operators to meet specific audience preferences, offering a wide coverage of sports without compromising performance or quality.

Earlier this year, we reported on FanDuel’s partnership with Are You Watching This?! for real-time sports alerts. Now that little phrase tells you everything. These little parcels of information delivered at rapid speed epitomise how casual viewers and bettors engage with sporting events across the world nowadays. Gone are the times of only watching your local football team and no longer do we rely on the morning papers to nd out who won the European Cup the night before. Calls for an end to the 3pm blackout on Premier League games increase because punters struggle to contextualise the idea of not being able to watch the sport they want to watch, wherever they are.

People want to watch the Super Bowl, they want the Aussie Rules and see no reason why they shouldn’t be able to bet on horseracing in Mongolia just as easily as they can the FA Cup Final. Crucially, they want to know what’s going on in real time. Or as close as.

Speed for speed’s sake is not the sole focus of Bart Snoeks’ talk at the Pulse Theatre, but slicing an extra second off your latency is big business in the world of sports betting. So, providers have to hop to it. Snoeks is the Tech Sales Lead at Dolby OptiView, the tech giant’s live streaming solution. In horse and greyhound racing, as Snoeks explains, speed is still king. It’s very easy for a betting operator to quantify the losses that bad latency is costing it. They can see clearly see the well-meaning flutters coming in as players follow a stream

that’s 10 seconds out of sync. In reality, the race is run and those bets will now be rendered invalid. The operator can do nothing but watch those stakes flutter away.

One use case Snoeks cited involved an operator covering some horseracing thousands of miles away. It was working with a latency of 12 seconds until Dolby reduced that to one. Overnight, revenue rose over 20%, according to Snoeks, as those wagers previously lost in betting window purgatory became valid.

But even overlooking that immediate gratification (and why would you?), Snoeks is convinced the Dolby OptiView technology represents a worthwhile investment. To his point, the watch-time statistics he provides bear that out. The same company experienced a 29% increase on that metric after switching to Dolby, indicating that when players compare sites and see that one is further ahead than another, they’re likely going to stick around a bit longer than with a laggier platform.

That treasured low latency is a boon for security, too. With faster and better controlled streams, the betting window can be eased open at the same time the door is shut on bad actors.

“So DRM is encrypting your content, decrypting it on the player side, making sure that it doesn’t get stolen on the way. In the cloud, we are one of the only solutions out there that can do this at low latency, and make sure your content is encrypted and decrypted without being stolen in the middle.”

Dolby is a storied innovator in sound and vision, but in sports betting, data is just as vital a component. In the battle for eyes and bets, especially on sports like football, data prevails. It sounds off-trend, but does that mean pure latency speed capabilities take a back seat?

“When we talk about latency for sports betting, most of our competitors say: ‘As fast as possible, that’s what’s needed.’ We do not agree with that.”

‘No secondary streams’ is a drum Snoeks beats repeatedly and, in practice, that can mean slowing the visual stream slightly to synchronise it with the data. Because: “What sense does it make if a viewer is watching data streams on a secondary device, because it’s faster than a video stream?”

In-play betting can’t be ignored as an opportunity for operators. Syncing data in an assured, intuitive way that gives the player the most encouragement and licence to make informed in-play bets is only going to boost revenue.

But data goes both ways, and as well as keeping track of the score, Dolby wants to know what and when people are watching. Where are they when they bet, and on what device? The more user data Dolby can process and roll out to clients, the more those operators are going to be able to refine their offering.

Achieving the level of consistency and technical smoothness that Dolby needs for all this is not without its challenges. For the protocols to scale out, it has to be able to

optimise under sub-optimal technical conditions. Look at Brazil, perhaps the most talked-about emerging market of the moment, Dolby has no choice but to be light on its feet as the streaming traffic intensifies.

“To cope with that, you can’t come up with a tier-three or tier-two solution. You need to have a steady cloud solution, tier one, and also with decent ISP connectivity, because in the end, your data centre can be great, but your traffic to the end user using the local ISP connectivity needs to be assured as well.”

Showing adaptability and an ability to localise the approach to building up your tech infrastructure in every region gives Dolby the tools to flatten out itso ffering; ensuring that both users and operators are getting a fair crack of the whip, wherever they are. “We should have one experience. For me that’s not only in sports betting, but also in regular streaming.”

Gathering around the screen at the local bookies may be a more obsolete way to bet on sports than it used to be, but innovating landbased channels is still on the agenda for Dolby. “We have a technology whereby we can stream multiple games and see them simultaneously. That could be one game with multiple camera angles, but for betting use cases, that could also be a multi-game live stream.”

The traditional betting shop can be hamstrung by a limited number of screens, which often may be insufficient to show all the streams the shop has the rights to. With Dolby OptiView, Snoeks proudly tells us how a player

can select exactly which stream they want to watch and bet on from an interactive preview display.

One concern might be the quality of these streams, not in terms of speed, but resolution. Broadcast rights often have stipulations on what kind of bit-rate the stream can be run at. Dolby certainly wouldn’t want a grainy stream tarring its reputation and has instead found a

solution using AI to improve the quality of the stream while keeping the resolution itself the same. A neat workaround that doesn’t jeopardise the broadcast agreement.

Sports betting is a huge market and one sport is not like the other, but Snoeks’ exposition of Dolby OptiView’s capabilities might be a vision of the future, arriving in real-time.

As the NFL prepares to kick off on 4 September, operators such as DraftKings, PrizePicks and Fanatics share how each continues to witness positive activity in the league’s off-season period.

No matter who one asks in the sports betting industry, operators and suppliers alike would confirm the number one producer of handle and revenue is the National Football League (NFL) – and the activity it drives between September and the Super Bowl every February. Through weekly lines, betting props and futures offerings, sportsbooks find little issue in navigating the fall and winter months while the NFL dominates television and streaming viewership.

Prior to the 2024-2025 season, the American Gaming Association (AGA) projected US bettors would wager $35bn on NFL contests and confirmed a handle of $26.7bn for the 2023-2024 season through analysis conducted once play had concluded. For Super Bowl 59 in February, the AGA predicted a total wager amount of $1.39bn in the matchup between the Kansas City

Chiefs and Philadelphia Eagles, a new record generated for the event. The league also bears witness to a significant

portion of the highest individual wagers placed each year in the US, as sportsbooks take bets of six-to-seven figures and possibly extending further for the big game.

“No single event unites sports fans like the Super Bowl, and that excitement extends to sports betting, with this year’s record legal handle reflecting its widespread appeal,” AGA President and CEO Bill Miller said at the time of announcement. “This figure underscores the positive impact of the legal market – from protecting consumers to generating tax revenue that benefits communities across the country – while enhancing the game experience for all.”

While the NFL undergoes its annual o -season period – covering the majority

of February through the end of August –operators must identify ways of maintaining similar levels of activity while utilising fellow US sporting leagues such as Major League Baseball (MLB), the National Basketball Association (NBA) and National Hockey League (NHL). The NBA and NHL typically complete its final matchups by the end of June each year, leaving baseball as the final major US sport in competition for July and August.

Circa Resort & Casino VP of Operations

Mike Palm spoke with Gaming America as part of an exclusive interview to cover the type of activity seen throughout the NBA

and NHL Finals events in June, having said, “The NBA is one of those leagues that’s heavily driven by player props. Betting over/ under points, assists, rebounds, sometimes depending on the player over/under steals. So no matter the teams that are playing, people will still get involved in wagering on individual players, and that’s what the NBA has become more and more about. Wagering on player stats more than actually placing money on either side.”

Sportsbooks received a level of good fortune to begin the summer when the NHL and NBA Finals matchups reached six and seven games, respectively, despite many around basketball believing the Oklahoma City Thunder would defeat the Indiana Pacers in five games or less. The Edmonton Oilers and Florida Panthers series was certainly a noteworthy result in addition to the thrilling basketball event, but failed to reach similar heights to the franchises’ first Stanley Cup Finals battle in June 2024, when Edmonton nearly claimed victory after going down 3-0 in a best-of-seven contest.

“At DraftKings, we operate at the speed of sports – and that means sports never pause. While the NFL is a cornerstone of the American sports calendar, our platform thrives year-round by tapping into the continuous rhythm of sports. Whether a thrilling tournament like March Madness,

or the drama of the NBA and NHL Playoffs or the daily cadence of MLB action, we offer fans an immersive, narrative-first betting experience that evolves in real-time with the sports world,” DraftKings CRO Greg Karamitis told Gambling Insider.

“Our customers don’t just watch it all ‒ they engage with it all and we’ve built our product to surface storylines across all sports – curating rich real-time live content and social features that let fans share their voice. For our customers, it’s not just about placing bets, it’s about being part of the moment and, for us, it’s about creating a platform that moves with the rhythm of

Palm, VP of Operations, Circa

sports and keeps the energy high, every single day of the year.”

The NHL struggles to witness the same levels of betting activity as compared to an NFL or NBA year-over-year, but the introduction of player props or offerings such as “first goal scorer” has certainly played a crucial role in helping operators maintain interest in the sport. While the offering by no means pales in comparison to its football or basketball counterparts, ice hockey is held back by typically receiving the lowest viewership counts among the four major US sports. Operators such as BetMGM and Caesars have made attempts to forge new connections with the league, however, as NHL star Connor McDavid appeared in a responsible gambling campaign with BetMGM in 2024 while Caesars Digital began the integration of league branding across its online casino platforms.

PrizePicks has looked to make similar progress with the MLB, establishing new partnerships with franchises such as the Los Angeles Dodgers, San Diego Padres and San Francisco Giants in California alone. Baseball’s pace of play creates a relatively unmatched opportunity for sportsbooks compared with other sporting events, as fans or bettors could realistically place a live bet in between pitches, at bats or innings and earn payouts in real-time. Whether it be the result of a certain at-bat or even the speed of a pitch about to be thrown, it’s di cult to nd any sport that o ers similar timeframes to baseball for placing live bets.

“We’ve also recently expanded our relationships with several Major League Baseball organizations. PrizePicks is now the official daily fantasy sports partner for

five MLB franchises: the Atlanta Braves, Los Angeles Dodgers, San Francisco Giants, San Diego Padres and Houston Astros,” PrizePicks CMO Mike Quigley told Gambling Insider. “Driving further awareness in key markets directly to sports fans in these endemic environments is enabling us to expand the successful communities we’ve created to date, and reach even broader and more engaged target audiences.”

In 2023, the MLB named FanDuel as its third official sports betting partner, joining BetMGM and DraftKings while having worked with the league since 2019 as Authorized Gaming Operator according to the release. “The baseball fan is one of the most engaged in all of sports, which is why we’re delighted to be the new sports betting partner of Major League Baseball. Our team is eager to showcase FanDuel in nationally broadcast MLB games and help enhance game narratives and bring America’s Pastime directly into our mobile app and OTT platform for fans to watch and wager,” FanDuel Group President Christian Genetski said at the time of announcement. “We’re also very excited about the opportunity to work together with MLB on new betting product innovations that will give customers the opportunity to enhance their experience on every pitch from March until October.”

While the comments from Genetski appear standard, citing the specific timeframe in which the MLB carries its season through – and coincidentally the vast majority of NFL’s off-season – can help showcase the level of focus operators place on this potential activity standstill. Fanatics Betting and Gaming VP of Communications Kevin Hennessy spoke on the major sporting events outside of the MLB which helped to

retain betting interest from consumers, telling Gambling Insider: “The summer will see other sports taking center stage for customers at Fanatics Sportsbook. We will see an uptick in betting on baseball, soccer and tennis – due to major events like Wimbledon and US Open, and women’s sports like the WNBA and NWSL will get their moment to shine.”

Hennessy went on to predict Indiana Fever star Caitlin Clark would be one of the most bet-on athletes across all of July, only for the women’s basketball sensation to battle through injuries for a large portion of the month. It is not yet known what type of impact Clark being unavailable had for sportsbooks and the level of activity seen for the WNBA, but results from her final March Madness tournament in 2024 help indicate the type of potential she holds for women’s sports betting.

DraftKings reportedly witnessed 3.5x more bets on the 2024 Women’s March Madness tournament compared to the prior year period, and nearly four times as much total money was wagered on the individual matchups. BetMGM’s WNBA betting activity was up 175% through Clark’s rookie year in 2024, while Hennessy confirmed the Fever’s over/under win total for the same season was the bet future of any WNBA offering from Fanatics sportsbook.

Fanatics also manages to utilize its branding outside of sports betting to generate consumer interest in the operator throughout the summer, most notably its Fanatics Fest event which ran from June 20 ‒22 this year. “Fanatics has a larger footprint in the world of sports and entertainment, so the summer is great for our customers

with unique access to events like MLB All-Star Weekend, WWE SummerSlam and more,” Hennessy said.

The overall rise in popularity around sports betting has also helped to lessen the impact of when the NFL is not active, as the AGA reported on July 23 gross gaming revenue (GGR) for the offering increased 24.3% year-over-year to US$1.37bn for May 2025. Over the course of January through May 2025, sports betting GGR showcased growth of 13.1% from the prior year period for a total revenue of $6.5bn in the ve-month stretch.

Not only that, the AGA stated US residents wagered approximately $12.1bn throughout May 2025 alone, an increase of 15.5% year-over-year while the national hold rate for operators equated to 11.3%, the highest recorded since September 2024 by the Association. Even without the NFL, various sporting leagues continue to inflate the appeal of offerings for consumers throughout the summer seasons, greatly showcased by the financial success garnered by operators in recent months.

“Key summer events like major golf tournaments, blockbuster UFC cards and global soccer matches offer incredible moments of engagement opportunities. By delivering immersive product experiences –like enhanced live betting, custom markets and curated content around these marquee moments – we’re not just reacting to fan interest, we’re amplifying it,” Karamitis said. “That momentum carries forward, keeping customers active and engaged as the sports calendar transitions back to NFL, NBA, NHL and more.”

From the March Madness college

“Fans are watching together, debating narratives and sharing opinions with their community. That’s a big part of what makes sports special”

basketball tournament – both men and women’s – to the NBA/NHL Finals and finally the MLB season, new promotions and innovation can be introduced while thoughts of NFL activity are put on the backburner.

Operators such as FanDuel continue to make use of its long-term collaborations with the MLB, offering promotions such as $150 in bonus bets for any $5 wager placed on a baseball game or receiving one month of the league’s streaming service for no cost. DraftKings is offering users parlay boosts for both the MLB and WNBA, while also creating a “no sweat” token for home run wagers placed every Friday throughout the baseball season.

“The NBA, NHL and MLB each attract different audiences and regional fanbases, creating entry points for expanding our reach. Beyond just extending reach, these leagues are a gateway into the broader culture of sports fandom. Sports don’t happen in a vacuum – they’re inherently social,” Karamitis said.

“Fans are watching together, debating narratives and sharing opinions with their community. That’s a big part of what makes sports special, and it’s a dynamic we aim to capture in our sportsbook. Whether it’s sharing picks, seeing what others are betting or experiencing the live sweat together, we bring betting into the social arena. It’s about

more than just the bet – it’s about being part of the moment.”

With the NFL season just days away, however, the time for new activations and promotions is nearing for operators, including improved touchdown betting offerings from DraftKings or Circa Sports’ Survivor and Million VII contests, featuring its highest payout to date of $21m, as well as the introduction of Circa Grandissimo. The anticipation of football kicked o into high gear on July 31, especially, when the rst preseason action of the year was played between the Los Angeles Chargers and Detroit Lions, albeit resulting in a lopsided a air. Still, the NFL off-season is as much about opportunity as it is finding ways to keep bettors entertained when live football cannot be found, displayed by the growing momentum for additional verticals from consumers. As week one is set to kick off on September 4, any fear of having to punt on the spring and summer months has long been tossed to the wayside by operators. Despite the NFL remaining sports betting’s king, leagues such as the NBA, NHL, MLB and WNBA have exemplified time-andtime again how noise can be generated even when one would assume the industry is at its quietest.

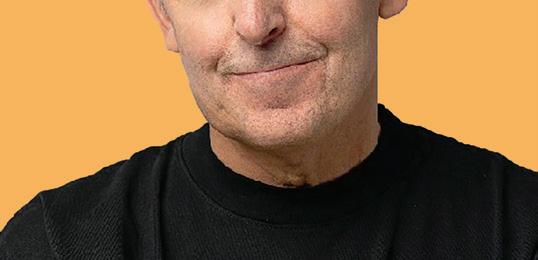

As sportsbooks continue to partner with influencers, former athletes and celebrities, Gambling Insider speaks with multiple operators on how these collaborations help increase exposure in the US

Since the Professional and Amateur Sports Protection Act (PASPA) was overturned in May 2018, US sports betting’s rise through verticals such as online wagering, daily fantasy sports (DFS) and even events contracts has been undeniable throughout the six-year period. The growth of sports wagering extends further than the di ering betting types provided by operators, however, as the utilisation of social media, television and advertisements have helped propel consumer bases to new heights. As social media becomes an apparent necessity for people of all ages across the US, opportunities to create betting accounts in which followers can track daily picks, parlays and even live wagers have begun to integrate itself with the marketability of operators.

Having founded the BookIt Sports brand in 2019, Trent Attyah became one of the first recognisable figures on social media platforms such as X (formerly known as Twitter), TikTok and Instagram for the bets he would place on any given day. As many entertainment viewers may have discovered in watching Attyah lose a particular wager, his personality resonated with fellow bettors given the frustration or elation he was experiencing in real time. While BookIt Sports does not offer sports betting to its consumers, Attyah harnessed the attention he had garnered through social media and used it to form a new collaboration with PrizePicks just four years after the operator had originally debuted in the space.

“I had this idea for a mobile app that was essentially an Instagram for sports bets. It was a social media platform and, long story short, we ended up pivoting from the social platform to creating a content brand but just for sports betters. I was on TikTok, which is where I really started, and was just making relatable content about betting even though at the time I was not affiliated with PrizePicks in any way and wasn’t even really a fan of player projections,” Attyah told Gambling Insider.

“I was only betting on teams, overs/ unders and stuff like that. But I was making videos that my audience, the average sports bettor in the space, could really resonate with and ended up going viral overnight. It was crazy and I was just posting videos, getting millions and millions of views, which then led to getting some inquiries about partnerships.”

Attyah “obviously” began his

search for a potential collaboration by focusing on one of the “Goliaths” in DraftKings and FanDuel. But he was also being constantly reminded of a certain DFS operator that had plenty of ideas as to how both parties could expand their respective business ventures. “There was one partner that would always, so persistently, want to hit my inbox and sell me on their product. And that was PrizePicks.”

“At the time, I’d never heard of PrizePicks or had any idea what they were. But they were so persistent; they would not give up. And I kept shutting it down because I didn’t like choosing players or daily fantasy, that wasn’t my thing. I loved traditional sportsbooks, but it got to a point where I said ‘okay, let’s just give them the time of day, hear them out and see what’s up,’” Attyah explained.

“I think they had maybe five employees, which is crazy considering where they are now; but we took the phone call and they were just so sold on me. At the time they had no partnerships with influencers, so I think they just did the best they could to sell me on this product, what it does, where they’re going, what the future looks like and so I took a chance.”

That “chance” was in the form of a one-month contract between Attyah and PrizePicks, having now grown into a six-year partnership that has helped the operator expand its business to 45 states within the US along with Washington DC. Attyah, meanwhile, has now surpassed 375,000 followers on X and currently maintains more than 486,000 followers through TikTok where he originated.

PrizePicks CMO Mike Quigley also spoke on the different methods with which the operator has applied its collaboration with Attyah and fellow in uencers such as Drew “Druski” Desbordes and Joe Budden. He told Gambling Insider: “Partnerships and collaborations with notable creators have been a signi cant driver of PrizePicks’ brand awareness, interest and engagement for years. We have had the good fortune to work with many talented in uencers and personalities early in their careers, watching them ascend while promoting our brand and growing into some of the top creators in all of sports and entertainment.”

Quigley continued: “Not only do we utilise brand partners for social media campaigns, we tap them for national advertising spots that drive mass market awareness for sports fans across the country. These ambassadors speak to our audience on both a mass and micro scale through diverse mediums, allowing us to attract new players across a variety of demographics.”

Touching on how PrizePicks goes about seeking potential deals with various influencers, Quigley stated the operator constantly spreads awareness of the brand through “smart and efficient” partnerships as opposed to finding the “biggest names possible” which may command “large spends” and show little ROI.

“Partners like Druski and Trent Attyah are two prime examples. Our member base is very social media-driven and our goal is to meet them where they are, something that Druski and Trent have perfected. They have cracked the code to becoming engaging social personas and are able to disseminate our brand messages in creative ways that our members grasp,” Quigley said.

Attyah found little issue in describing why fellow operators may struggle to generate

similar levels of growth as PrizePicks. “The way they’ve been able to establish this brand, this culture and this community is light years ahead of anybody or any of the other goliaths in the space. Look at all these other little guys that are under the big three, the reason they’re failing is because of their lack of community, their lack of culture and the lack of just understanding what the user wants.”

A comparable partnership is perhaps that of DraftKings with NBA superstar LeBron James, as well as with celebrity comedian Kevin Hart. Or perhaps not so comparable... Attyah certainly had choice words for how he believes collaborations with influencers can provide higher levels of consumer interest for sportsbook operators.

“LeBron’s not playing DraftKings, he never will. He doesn’t give a s**t and same with Kevin Hart. Druski and I are obsessed with PrizePicks. We’ll play it every single day. We’re posting content about it, asking for plays, we just genuinely use the product. I guarantee you LeBron’s never used DraftKings and more than likely Kevin Hart doesn’t use DraftKings either,” Attyah said.

Despite the stance Attyah takes on celebrities and former athletes becoming partners with sportsbooks, it has not stopped brands such as BetMGM from forging its own collaborations, having done so with former New York Yankees shortstop Derek Jeter in July 2025. BetMGM Director of Brand AJ Mazza told Gambling Insider : “Derek Jeter and really all of our

athlete ambassadors, we do deals with them to include obviously their name, image and likeness in our advertising, but also in all of our communications, quite frankly. With athletes particularly like Derek Jeter, Wayne Gretzky, Barry Sanders, we built into all of those contracts the ability for us to host VIP events and visiting people from a hospitality perspective.

“When we look at a Lions game, for example, and we want to take some of our players to a VIP suite, we can have a meet and greet with Barry Sanders there. It’s really important for our contract that we build in the ability to leverage them both in advertising and in some of those more intimate opportunities we want to give our players as well as on the iCasino or iGaming side.”

In 2020, the operator partnered with

a Gretzky Light the Lamp slot game exclusively in New Jersey and Michigan in February 2025.

The NHL Hall-of-Famer starred in the operator’s advertising campaign, Vegas Magic, which highlighted how live dealer games from BetMGM Casino let players “feel the magic of Vegas” in their own homes, ending with Gretzky at the blackjack table making a reference to his famous jersey number 99. “The ability to bring ‘Vegas Magic’ to its players is one of the biggest reasons BetMGM is so unique. Gretzky Light the Lamp is a great combined example of my role as a BetMGM ambassador and the company’s constant innovation,” Gretzky said at the time of launch.

celebrity actor Jamie Foxx for a new advertising campaign, The King of Sportsbooks, as part of a relationship that has now extended over five years. As recently as the 2024-2025 NFL season, Foxx was starring in digital campaigns to help promote numerous BetMGM offerings for its consumer base. Even walking around the Las Vegas Strip, it is near impossible to not come across an advertisement board with Foxx and the BetMGM logo displayed. Location, as Mazza explained with Sanders and the Detroit Lions, is key for these partnerships to find success within the market BetMGM is looking to expand its presence.

“If you go into MGM Grand Detroit, we will be featuring Barry Sanders more prominently than if you were at MGM Springfield where you’ll see Kevin Garnett on the wall, as we do try to leverage all of our brand ambassadors if we have one in a key market,” Mazza said.

“Oftentimes you would see Jamie Foxx in Las Vegas if we didn’t have a perfect fit from an athlete perspective. It’s focused mostly on the celebrity and athlete ambassador themself, but certainly it’s a big piece of the puzzle when it comes to our team and league partners especially. In the land-based casinos or in the sports books we will leverage those markets as well, whether it be the Lions in Detroit or the Raiders in Vegas, so we use both the athletes and league IP. But again, it’s about extending the brand and creating a continuity between the digital and physical experience that we feel are the only brand that can offer.”

Mazza also spoke on how BetMGM prefers to nd ambassadors who are a greater t to promote the respective sport its hoping to draw increased activity. These include Jeter for baseball, Sanders for football and Gretzky for hockey, having even released

Not shying away from how social media can be applied to generate traction on the operator’s sports betting and iCasino offerings, Mazza commented: “Obviously, being able to harness their reach is great for us. We work into all of our deals, the social media posts, posting on our behalf, their ads and their paid content. Jamie Foxx has 17 million followers on Instagram, Kevin Garnett has over a million, Jeter just shy of a million, and so it’s important for us to use that as a handle or a mouthpiece for the brand. A lot of people trust spokespeople, whether those are now influencers or celebrities. If they’re advocating for something, some people make decisions based on that. We are able to leverage their personal handles, but then also use them in our own sort of paid advertising on social media as well.”

or create memorable and

rest of the category.

Mazza continued: “We believe these legendary athletes help convey or create memorable and legendary experiences on and offline, unlike the rest of the category. It’s really going to be about the campaign, the launches and we’re really excited to bring it to market.”

excited to bring it to market.”

operator’s newly introduced

will hope to be featured “for a long time,” but “certainly”

the MGM brand in general can the industry’s history, Mazza

Mazza went on to preview the operator’s newly introduced “Legendary” brand which will hope to be featured “for a long time,” but “certainly” into the 2025-2026 NFL season kicking off in September. Highlighting how the MGM brand in general can be traced back throughout the industry’s history, Mazza explained the operator’s sense of “credibility” in the sports betting landscape even while still expanding its presence in the market.

“I think when we look at our place in sort of the landscape of sportsbook operators and iGaming, we are certainly the entertainment brand having been born out of Las Vegas and

with MGM as our parent company. We feel like it gives us the liberty to have credibility and to lean into athletes, celebrities and the more entertaining spectrum,” Mazza said.

“It’s part of our brand DNA to utilise them because we believe celebrities and athletes can help breakthrough to people who are fans of them. They obviously accrue their own personal following, and when used properly, the goal is to hopefully resonate with the respective player’s fanbase.”

Fanatics Betting and Gaming VP of Communications Kevin Hennessy additionally explained how the sportsbook integrates its ambassadors with the sport in which they have the most experience, having said, “The best example that I can give in our short

history is when Jalen Rose headlined our college basketball campaign.

“We were looking for someone that had real credibility in the college basketball space and there aren’t too many people that can say they revolutionized the college game like Jalen - as a member of the Michigan Fab 5. He headlined our ad campaign and one customer received tickets to San Antonio to the game and met with Jalen. It was an experience that Fanatics and only Fanatics could offer. For Fanatics Sportsbook and Casino it will always be about authenticity. If we are working with a wellknown figure we will have an authentic reason for bringing that person on board.”

A relatively unconsidered part of forming these collaborations with in uencers, athletes and celebrities is the possibility of a negative response from the public if a bet, parlay or future were to be unsuccessfully promoted by each respective gure. Take a FanDuel or DraftKings, which routinely partner with various sports networks and leagues to showcase its odds during a live broadcast, or even have part of the broadcasting team make wagers on air. If one were to see Charles Barkley recommend taking the over on points at halftime, what’s stopping a near automatic reaction of ooding the NBA Hall-of-Famer with hate messages if the bet were to be deemed unsuccessful?

This is not to say a Charles Barkley, Wayne Gretzky or Trent Attyah would care for the negative responses each could be exposed to given either their dissociation with social

media, or in Attyah’s case, the knowledge that some online voices are much quieter inperson than through a cellphone or laptop.

“99% of the time what people are saying in my DMs would never be said in person. I’ve had thousands of run-ins with people in public, and I’ve never once had somebody say anything negative to me. I know these people are mad at the moment, and they want to express their anger and put it on somebody else, which is me typically,” Attyah said.

“But I know for a fact if I met them in person, they wouldn’t say that. In fact, some dude the other day ran into me at the Rangers game and was begging me to follow him on Twitter. He loves me, he’s a huge fan, so I say ‘fine, I’ll follow him.’ I clicked his profile, check his DMs and there’s 17 straight messages of him saying, f**k you, you’re a piece of s**t, go to hell, and this is literally a prime example of what I’m talking about. He was so nice, happy to see me, asking for a picture. There’s two sides to it every time, but I never let it get to me and I just keep pushing through.”

Ultimately, the cover of a hidden pro le picture or typing from behind a mobile device is enough to drive any user towards sending hateful messages towards ambassadors of a respective operator, and even current athletes face the same issue in their day-to-day lives. Universities around the US have had to relay messages about the dangers of sending hate to an 18-, 19- or 20-year-old student just attempting to help their team win in whatever way possible.

In July 2025, during the MLB’s All-Star Break, starting pitcher Lucas Giolito had to confront Commissioner Rob Manfred about the negativity his own family has seen from sports bettors and the difficulties explaining to his young daughter why people online would want to endanger their livelihood. It’s one of the many reasons, as Mazza would go on to point out, why the popularity of partnering with athletes who are still competing in their respective sport has not grown among sportsbooks.

That, along with the fact leagues prohibit its athletes from, at the very least, wagering on the sports itself, is why operators such as DraftKings who do find themselves collaborating with athletes like James, will typically refrain from having the star speak on basketball wagers, or showcase any type of bet within the advertisement as well. Mazza also explained how having a Gretzky or Jeter discuss wagering on a sport they weren’t involved in can feel inauthentic for viewers, providing insight as to how the operator features its most prominent ambassadors.

As the popularity around social media and sports betting continues to rise, the presence of ambassadors, influencers and celebrity partners will grow along with it, highlighted by a clear goal from operators of finding well-known voices to command attention towards its product. Influence is certainly a powerful trait to carry, and for those who can discover the right people to harness it with, the sports betting community has no limits as to what type of results can be discovered.

With expert analysis from lawyers in both the crypto and gambling spaces, Gambling Insider assesses the state of influencer marketing in Argentina. Indeed, it is shaping perceptions of the market, but not necessarily for the better...

In 2024 and so far in 2025, online gambling and casino advertising have dominated headlines across Latin America, particularly in Argentina. But not for the reasons the industry might have hoped. What emerged was a troubling lack of awareness around existing regulations, as in uencers, content creators and celebrities began promoting online casinos on social media without considering crucial factors: whether the platforms were legally authorised,

properly regulated or whether their promotional content encouraged responsible gambling practices.

The regulatory framework in Argentina

is straightforward for those who take the time to understand it. As lawyer Tomás García Botta, Partner at MF Estudio –Abogados, tells Gambling Insider: “Today in Argentina, you can’t really talk about a grey market, a white market, or a black market. Gambling is either authorised or prohibited. And this is very clear.”

The distinction is even simpler than many realise: legal gambling sites in Argentina must have domains ending in .bet.ar, while anything else operates illegally. Yet, despite this clarity, a significant disconnect persists between regulatory reality and public understanding. So what went wrong, and why has this become such a contentious issue?

The complexity begins with Argentina’s federal structure. Unlike countries with centralised gambling regulation, Argentina distributes authority across provinces, each with its own licensing requirements and advertising rules – not unlike the US’ state-by-state regulatory system for different forms of gambling. This creates a fragmented landscape where a platform legal in Buenos Aires City cannot operate in Buenos Aires Province, and vice versa.

García Botta states: “You can’t talk about advertising regulation at a national level. Regulatory competence in gambling matters belongs to the provinces. It’s what we call ‘non-delegated’ competence.” This patchwork system has practical consequences that highlight the confusion. He adds: “Watch any major football match, and you’ll see betting company advertisements displaying

multiple provincial logos, sometimes three or four different regulators on a single ad. Even more telling, these ads often feature multiple responsible gambling messages, each tailored to different provincial requirements.”

While regulatory attention traditionally focused on traditional advertising channels, research by the ALEA (Argentina’s State Lottery Association) revealed where the real problem allegedly lies. Its study on how minors access gambling found that the majority were reaching these platforms through influencer promotion instead of football sponsorships or TV ads. García Botta says: “According to the ALEA, when it comes to gambling exposure, minors aren’t influenced by traditional football advertising or what logos appear on team jerseys; they’re influenced by what influencers and streamers do on social media platforms. That’s what the younger public consumes and pays attention to most.”

This concept is particularly concerning because minors can only access illegal gambling sites, since legal platforms have mandatory age verification systems. The influencers driving this traffic were, knowingly or unknowingly, promoting unregulated platforms that represent over 90% of Argentina’s gambling market.

The influencer problem, like ogres and onions, reveals multiple layers of accountability. Legal gambling companies now conduct background checks on influencers, with some refusing to work with creators who have previously promoted illegal sites. But the responsibility extends beyond corporate due diligence.

Tomás García Botta, Partner, MF Estudio –Abogados

García Botta argues: “There’s a responsibility for in uencers themselves regarding the content they promote and the impact that promoting illegal activity can have on the rest of the activities they promote. There are no influencers who only advertise gambling: they advertise a variety of brands, products, or services and, ultimately, those other clients they have can be a ected if they’re advertising something illegal.”

This creates a domino effect for content creators. An influencer’s decision to promote illegal gambling platforms doesn’t just risk legal consequences; it can damage

relationships with legitimate brands who may reconsider partnerships with creators associated with illegal activities. The lawyer points to a broader issue affecting the influencer space: many content creators operate from what they perceive as a moral high ground, declaring they don’t accept gambling money. But this blanket rejection often originates from a fundamental misunderstanding.

“You see many digital media outlets that raise a flag saying ‘I don’t receive money from gambling’ as if it were a moral standard,” García Botta observes. However, failing to distinguish between legal and illegal operations opens a different discussion about business sustainability. Rejecting all gambling partnerships might seem ethical, but it puts legitimate, regulated companies in the same category as illegal operations.

But proper gambling promotion could be achievable if influencers followed what regulations actually demand. Many influencers seem unaware of these comprehensive requirements, but Law 6330 in Buenos Aires City establishes specific guidelines for gambling advertising, including requirements for interactive advertising featuring public personalities. García Botta breaks down what proper gambling promotion should include: “When you promote a gambling product, you have to emphasise that it is an entertainment offer, that you have to participate in that entertainment offer responsibly, and that if that entertainment offer somehow affects your mental health, your relationships with others, or your personal finances, you need to seek help. The provider needs to offer channels for assistance, for example, the responsible gambling programs that different provinces have, and tools to limit your consumption and participation in games.”

The requirements also include clear prohibitions: “You cannot diminish or undervalue the importance of work concerning gambling. You cannot say that you’re going to become a millionaire through gambling, or that you should

gamble to pay off debt.” Real examples of problematic content have emerged in the Argentinian market. García Botta recalls seeing influencers advertising that they were paying for dates based on blackjack results, or worse, promoting gambling as debt solutions. “We saw examples of some more well-known influencers who advertised gambling by talking about playing to pay debt, playing as a way to have an additional source of income,” he says. “The reaction from society was very strong in that regard – and that message was corrected quickly.”

The issue moved beyond social media criticism when authorities began taking action. Several high-pro le cases have emerged of Argentinian influencers facing legal scrutiny for promoting illegal betting sites, highlighting the gap between the perceived normalcy of gambling partnerships and their actual legal status. These cases underscore a critical point: many content creators allegedly entered gambling partnerships without understanding the legal landscape they were navigating. The investigations revealed that in uencers were often promoting platforms that not only lacked proper licensing but also targeted jurisdictions where they had no authorisation to operate.

The most significant legal action came from Buenos Aires City, which launched a major criminal case against influencers promoting illegal gambling sites. García Botta notes that this prosecution had immediate industry effects. Agustín Díaz Fúnes, Chief Compliance Officer at Guavapay and a lawyer specialising in crypto and gambling, spoke to Gambling Insider and emphasised the broader significance of this enforcement action: “Today the tools are already there; the legislation is already in place in each of the jurisdictions. Perhaps it was a bit confusing – at the end of 2024, there was a bill that was being discussed and, listening to the speeches in Congress, it seemed like there was no regulation at all. But the reality is that today there are many tools; there has been a lot of work by regulators on this issue.”

The case substantially reduced illegal gambling advertising on social media and forced a public conversation about the distinction between legal and illegal operations. However, when sanctions were eventually imposed on the influencers involved, the Argentinian public was unhappy, to say the least. Indeed, the

or advertising media, here in Argentina, there’s a regulatory restriction regarding the tools you have to advance against or apply sanctions to influencers. There are some contravention codes like Buenos Aires City’s that criminalise advertising, but the penalty is a fine, so ultimately the deterrent element of the sanction has limited value.”

Agustín Díaz Fúnes, Chief Compliance Officer, Guavapay

Buenos Aires City case involved several prominent Argentinian influencers who had been promoting illegal betting platforms to their substantial social media followings. The investigation revealed these content creators had been directing their audiences to unregulated sites that lacked proper licensing, age verification systems and consumer protections.

The legal action sent a clear message about enforcement and the resulting penalties, which involved posting a video on the influencers’ social media platforms speaking about the risks of gambling and taking a gambling course. But they were viewed by many observers as disproportionately light compared to the income these influencers had generated from their gambling partnerships, and the potential societal impact of their promotions.

García Botta acknowledges this enforcement gap: “In terms of influencers

The economic calculation is straightforward for content creators: if the fine for promoting illegal gambling is less than the income generated from these partnerships, it becomes a business expense rather than a deterrent. “The person who’s going to engage in borderline activity thinks about how much it costs versus what profit they have, and they keep doing it,” García Botta explains.

As enforcement actions against in uencers multiply and public debate intensi es, a fundamental question emerges: is additional regulation the solution to the in uencer gambling advertising problem? Díaz Fúnes suggests the issue may be more complex than simply adding new rules targeting content creators. “Maybe it’s not about more regulation, but better regulation. The reality is that the norms exist: each province has quite robust frameworks. It’s not that there’s nothing there,” he explains.

Instead, he points to the need for deeper understanding of how influencers and their audiences interact with digital platforms: “Maybe we should review how people interact with this

technology, do more refined work to understand why these situations occur. Maybe we should think about how people relate to technology: this idea of opening an app to consume content and spending 12 hours looking at your phone.

audiences; especially younger followers who trust their recommendations across all categories.

As Argentina’s provinces continue developing their approach to digital gambling, the influencer advertising challenge highlights the need for regulatory frameworks that acknowledge the unique relationship between content creators and of broader digital consumption patterns. Young audiences don’t just trust influencers with gambling recommendations. They follow their lifestyle advice, product suggestions and entertainment choices across all categories.”

The Argentinian experience suggests that effective solutions require coordination that includes influencers as stakeholders rather than just targets of enforcement. Instead of simply restricting gambling advertising further, the focus may need to shift toward educating content creators about legal distinctions, creating clearer guidelines for responsible promotion

and helping influencers understand their role in consumer protection.

The question isn’t whether to regulate influencer gambling advertising more strictly, but how to create a framework that gives content creators clear, enforceable guidelines while protecting their their audiences in the digital age.

“The evolution of technology that’s been happening in recent times is enormous,” Díaz Fúnes notes. “By creation moves faster than regulatory

“This perspective reframes the influencer gambling issue as part its very nature, regulation always comes after people’s actions.” This creates a particular challenge for influencer oversight, where content creation moves faster than regulatory frameworks can adapt.

The solution likely lies not in restricting influencers, but in empowering them with the knowledge and tools to promote responsibly. García Botta is unequivocal in his conclusion: “Society benefits when you have a regulated entertainment offer, and prohibiting an activity that has always existed is favouring the illegal offer.”

Gambling Insider reports from Brazil on the country’s state of influencer marketing, best summed up by the recent, high-profile rise and fall of the CPI das Bets

A sunkissed country developed its market without realising the king was already in checkmate. Welcome to Brazil! We’ve got samba, caipirinha and… suspiciously enthusiastic in uencer partnerships with illegal betting operators.

Before the Government could even finish deciding how to regulate the national betting sector, a digital tsunami of affiliate links, promises of easy cash and a fortuitous, or perhaps not so much, tiger washed up on the gambling shores.

And like any great saga, it didn’t take long before the smiling faces on screen were replaced by subpoenas, deleted posts and bizarre Senate hearings. Amid the copious amount of influencers and operators growing in Brazil’s sector, the Senate decided to investigate the phenomenon further – before it was too late, and to hard to keep up with it all.

Ultimately, however, what we saw was the rise and fall of Brazil’s ill-fated Parliamentary Commission of Inquiry into

online betting and influencer marketing (CPI das Bets).

THE EYE OF THE TIGER AND THE INFLUENCERS WHO RODE IT

It all started with a Tiger – more precisely, the notorious Jogo do Tigrinho, the local nickname for Fortune Tiger. Aggressively marketed to young, working-class audiences by Brazilian in uencers, the game promised instant wins and withdrawals with just a tap and a dream. In a country where 15% of the population placed at least one bet in a year and many rely completely on government assistance, the question wasn’t just how it became so popular but why nobody thought about regulating it sooner.

Now, gambling is the same in principle worldwide. No one at Gambling Insider will chastise a good game for being made or marketed appropriately – quite the opposite. But Brazil saw a different phenomenon. Illegal operators were teaming up with influencers who

essentially misled – to put it moderately –their followers by pretending there were glitches in the game that guaranteed wins. Videos were posted of a rags-to-riches story where influencers were now spending their days in Ferraris all because of Fortune Tiger. Any legitimate marketing team in today’s gambling society will know that is outright deception.

The ads were flashy, upbeat and relentless. The platforms didn’t just promise fun, they promised income. For influencers, it was a perfect match. Betting links paid more than beauty deals ever could and still do. Some creators stopped pushing skincare routines altogether and turned their content into 24/7 gambling infomercials.

And no, we’re not talking only about nano or micro influencers, who could actually use the fact that they only have the internet as a source of income, but also the mega-influencers, with millions of followers, millions in the bank and a much wider community.

For example, it came to light that one big influencer wasn’t just promoting a betting platform, she owned it. This wasn’t a bad brand deal gone rogue, it was full-on entrepreneurial integration, with the swipe-up link leading straight to her bottom line.

Known for flashy content and an aggressive promo style, when legal operations knew what she was up to, she vanished. For two months, she was officially on the run, dodging authorities while her name made national headlines. She was eventually arrested in Cuiabá and what had started as an ad campaign turned into a legal thriller, complete with affiliate links and a getaway car. Her case was handled by police and prosecutors through the regular courts but it was one of the many that raised questions on how much influencers should be held accountable for these types of actions. The lines between influencer and operator were now so blurred, the CPI had to expand its scope again.

At the centre of the storm was Senator Soraya Thronicke. Lawyer by training, politician by blood and the one who decided enough was enough to start