With growing chatter – no longer just among industry circles – that Las Vegas has lost its magic, how can the gambling powerhouse bounce back?

FACING FACTS: What does the data say about Las Vegas’ recent performance?

THE EXPLAINER:

What’s going on between Penn Entertainment and HG Vora?

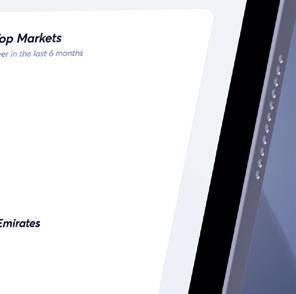

Our market focuses zone in on Ireland, India & Brazil

TJulian Perry, COO, Editor-in-Chief

COO, EDITOR IN CHIEF

Julian Perry

EDITOR

Tim Poole

Tim.Poole@gamblinginsider.com

SENIOR STAFF WRITER

Beth Turner

STAFF WRITERS

Will Underwood, Rory Calland, Kirk Geller

CONTENT WRITER

Megan Elswyth

LEAD DESIGNER

Claudia Astorino

DESIGNERS

Olesya Adamska, Callum Flett, Gabriela Baleva

Tim Poole, Editor

he legend of Las Vegas and the reality of the city are, at the moment, two very different things.

Around the world, when one thinks of gambling, Las Vegas is still top of mind. In movies, in shows, at the very G2E event this magazine is travelling to...

But, as we explore in this issue of Gambling Insider , Vegas' recent history has taken a contrasting path to its mythical reputation.

To be clear, Las Vegas is still the American home of gambling. Globally, the fact Macau has surpassed it for gambling revenue is simply the result of Vegas serving as its inspiration. Billions of dollars in revenue still find their way into the Nevada Gaming Control Board's monthly reports – putting it all rather into perspective.

There has, however, of late been vehement discussion of struggles in Las Vegas. Prices have been rising for some time and, now, revenue – and tourism numbers – are falling. Some local media outlets paint a very bleak picture, while other Vegas executives dismiss any worries out of hand. One thing is for sure: Las Vegas has always been able to reinvent itself whatever foe it has faced.

But where exactly does the truth lie? In this magazine, we analyse the data, while Las Vegas historian and expert Oliver Lovat provides his thesis in our cover feature. For years, he has written within the pages of both Gambling Insider and Gaming America, analysing Vegas' main trends and, occasionally, serving important warnings. There is no better authority on the subject.

He feels Las Vegas may have broken The Promise – an intangible contract with customers that provides them with the escapism they need to truly enjoy their stay. The question now: how does Las Vegas regain customer trust, and how important will this be in restoring former glories?

Elsewhere in this edition, lawyer Edward Carstairs writes for the first time in Gambling Insider, about the value of brand – and IP protection. Carstairs impressed me at iGB Live with his presentation on the topic, and we have reviews of several other panels at London's summer show.

We also have an interview with a casino manager in Ireland, a market full of recent regulatory change. Internationally, we look even further out – at India and Brazil, countries that – alongside the Philippines – are sending a message to the gambling industry.

Indeed, as nations stand up to illegal gambling forces, increasingly restrictive measures are having knock-on effects for regulated operators. But, in prioritising the battle against illegal gambling, legislators and regulators are not consulting the licensed market, whose complaints are falling on deaf ears. If the industry as a collective wants policymakers to look at it favourably, actions in the Philippines and some in Brazil have already done irreparable damage.

India's decision to ban all real-money gambling was sudden and left Flutter Entertainment CEO Peter Jackson "extremely disappointed." And yet this is the direction in which some major nations seem to be heading.

JUNIOR DESIGNERS

Medina Mammadkhanova, Monika Petrova

ASSISTANT DESIGNER

Tanya Aleksova

ILLUSTRATOR

Judith Chan

MARKETING & EVENTS MANAGER

Mariya Savova

FINANCE & ADMINISTRATION ASSISTANT

Dhruvika Patel

PUBLISHING ASSISTANT

Abi Ockenden

IT MANAGER

Tom Powling

COMMERCIAL DIRECTOR

Deepak Malkani

Deepak.Malkani@gamblinginsider.com

Tel: +44 (0) 204 591 3117

ACCOUNT DIRECTOR

Michael Juqula

Michael.Juqula@gamblinginsider.com

Tel: +44 (0) 207 039 9186

SENIOR ACCOUNT MANAGER

William Aderele

William.Aderele@gamblinginsider.com

Tel: +44 (0) 203 884 9277

ACCOUNT MANAGERS

Irina Litvinova

Irina.Litvinova@gamblinginsider.com

Tel: +44 (0) 203 855 0662

Serena Kwong

Serena.Kwong@gamblinginsider.com

Tel: +44 (0) 203 787 4615

BUSINESS DEVELOPMENT MANAGER - U.S. Miguel Malave

Miguel.Malave@playerspublishing.com

Tel: +1 702 850 8503

AWARDS SPONSORSHIP MANAGER

Michelle Pugh

Michelle.Pugh@globalgamingawards.com

Tel: +44 (0) 207 360 7590

Finally, I'd like to highlight our 'Explainer' feature, which on this occasion talks through the Penn Entertainment vs HG Vora saga (a tale we have nicknamed 'The Penndashians').

Vora saga (a tale we have nicknamed 'The Penndashians').

With all the genuinely entertaining stories gambling has to tell, I don't think it'll be our last such feature!

TP, Editor

CREDIT MANAGER

Rachel Voit

WITH THANKS TO:

Oliver Lovat, Alessandro Colnago, Edward Carstairs, Manav Bhargava, Steven Paton, Hayk Sargsyan, Pedro Romero, Neil Montgomery, Araksi Sargsyan, Mariia Shmelova, Markus Buechele, Volodymyr Saratovskyy, Steven Valentine, Anastasiia Shcherbyna and Z-Gaming Asia.

Gambling Insider magazine ISSN 2043-9466

Gambling Insider pulls back the curtain on one of the industry’s most important

50 Penn vs HG Vora

Gambling Insider untangles the web of legal back-and-forth between Penn Entertainment and HG Vora

54 Luck of the Irish

Carlton Entertainment Group

We look back and analyse some of the most thought-provoking panels from this year’s iGB

Manager Alessandro Colnago breaks down the changes in Ireland’s gaming market

58 Reputation matters

First-time contributor Edward Carstairs breaks down the importance of brand – and IP protection

We

Renowned Las Vegas expert Oliver Lovat analyses the current state of America's

Returning contributor Manav Bhargava discusses India's potential and how it is impacted by recent legislation

WiseGaming’s Steven Paton breaks down the company’s goals

Slotting in

Galaxsys CEO Hayk Sargsyan explains the company’s expansion into slots 70 Magic in the air

Can magic mushrooms treat problem gambling? BetBlocker's Pedro Romero argues they can

72 Brazil 101

Gambling Insider regular contributor Neil Montgomery gives us an overview of the latest updates to the Brazilian market

Roundtable

Industry experts weigh in on land-based innovation

84 Araksi Sargsyan Ds Virtual Gaming

85 Mariia Shmelova Aff.Tech

86 Markus Buechele Novomatic

88 Volodymyr Saratovskyy Champion

90 Steven Valentine Comtrade Gaming 91 Anastasiia Shcherbyna MelBet

92 What's new? Gambling Insider delves into the latest products on offer

98 Z-Gaming Asia

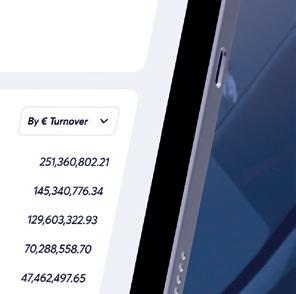

One current narrative paints Las Vegas as a picture of decline. Others, however, claim everything is as it always was in Las Vegas. Below, Gambling Insider explores the Nevada Gaming Revenue data... Nevada H1 growth

There is disquiet in Las Vegas. A sense of decay has started pervading discussions around the region as the revenue figures coming out of Nevada show tentative signs of stagnation and downturn. But while certain sectors have struggled, the Nevada eco-system is big enough to adapt, and it displays a natural resilience. In fact, steady statewide revenues are slightly disguising the more significant redistributions of weight going on below the surface. Over the past few months, Clark County has taken a string of disheartening blows, while the perhaps less glamourous, but better value for money areas a little out of town, like Boulder, have seemed to pick up the slack and mop up some of that lost custom.

The most notable signs of sector distress have come from the past six months' tourism figures. Yearon-year growth over that time seems the most obviously impactful of those stressors. A trade war with Canada has seen flight bookings from the country to Vegas plummet by 70%. But not only Canada – the costs associated with a flight to Vegas make it a luxury that for most people isn’t aligned with the pressures of inflation and cost of living. How much was The Strip relying on those international tourists? Are domestic visitors, for whom the sight of the Venetian is more commonplace, going elsewhere, prioritising value over grandeur? Macau, by comparison, has seen annual growth every month this yaer except for February.

Casinos on The Strip are manned in the main by MGM Resorts or Caesars. Both are giants but in the data, there are clear signs of, if not panic, then proactive cost-cutting. There is talk of casino floors getting quieter, with dealer lay-offs contributing on top of decreased footfall. MGM has cut concierge services at six of its hotels, and two of the most famous venues in the country, Flamingo and Caesars, have been quietly and slowly downsizing. Clearly, the situation is far from terminal and the changes are manageable for now, but they are subtle indicators of a prevailing headwind.

Las Vegas was built on escapism. The lights, the shows, the scale – all of it is designed to draw you in to the Vegas dreamworld. But it really made that stick when it combined those qualities with great value. An exclusive, premium feel, but with broad appeal. For the longest time, Vegas has been able to attract the average punter as well as the ‘wealthy whale,’ people happy to spend a few dollars, while lacking the finances or will to join the high-rollers. Arguably, with travel and accommodation seen as more of a luxury, it’s remote casinos that can trade on the value ticket. And even in Vegas, where blackjack is the most popular game, it’s sports betting that’s pointing in the right direction amid this state of uncertainty.

As the house scratches around for value on its end, inevitably, the product becomes gradually eroded. And people are noticing. Not only are there complaints around service and rising costs, but rising hold percentages in Vegas’ slots are souring players’ views of the gambling haven. Suddenly there are more lay-offs and prices get higher still –a vicious cycle is playing out and it’s a fiddly one to escape from.

Reports of the fall of Vegas may be a little exaggerated. The area has shown resilience in the past, bouncing back from the pandemic with aplomb. For all the warning signs, there are also hardy survivors shining through the data. Baccarat’s revenues seem to be able to survive almost anything. Perhaps standing firmest of all though is the multi-denomination slot machine, which has defied every trend and posted hale and hearty growth figures every month this year.

Gambling Insider tracks online casino operator and supplier prices. Stock prices are taken across a six-month period (March 2025 – August 2025) – and from the close of the first available date of the month

• Six-month high - March (16.15 EUR)

• Six-month low - June (12.60 EUR)

• Market capitalisation - US$2.94bn (as of 1 August 2025)

• Six-month high – August (29.57 USD)

• Six-month low – March (21.39 USD)

• Market capitalisation – US$9.21bn (as of 1 August 2025)

- August (858 SEK)

• Six-month high - July (36.89 USD)

• Six-month low - April (29.94 USD)

• Market capitalisation - US$9.589bn (as of 1 August 2025)

• Six-month high - March (35.04 EUR)

• Six-month low - April (27.28 EUR)

• Market capitalisation - US$6.37bn (as of 1 August 2025)

• Six-month high - August (271.20 USD)

• Six-month low - April (222.82 USD)

• Market capitalisation - US$52.587bn (as of 1 August 2025)

• Six-month high - August (1002.5 GBp)

• Six-month low - April (574 GBp)

• Market capitalisation - US$8.48bn (as of 1 August 2025)

The most prestigious Awards in gaming are returning to Barcelona during ICE week 2026

It’s impossible to take part in G2E and witness the entire gambling world descend on Las Vegas without being struck dumb by the sheer mass of talent within the industry. We can’t wait to share in that awe come October when the conference kicks off. But no great industry summit is complete without the addition of the most prestigious Awards in gaming. Yes, the nominees are in, let the hush fall over the room, because the Global Gaming Awards Americas are back.

Well, we can’t wait. But the the Awards train doesn’t stop rolling, either, so with the US event just around the corner, we’re taking a look a little further on down the track to January, when we’ll be heading over to ICE for round two in Barcelona and the ninth Global Gaming Awards for Europe, the Middle East and Africa. From Las Vegas to the cobbles of Las Ramblas.

The Global Gaming Awards calendar is jam-packed these days – just how we like it. It was only in June that we headed out to Manila to celebrate the champions of the Asia-Pacific region, but we’re not the kind to rest on our laurels.

It will be the second time that ICE and the Global Gaming Awards have taken place in Barcelona, and we’re not in the habit of complaining about hopping over to sunny Spain every now and again. Mariya Savova, Global Gaming Awards Event Manager: “Barcelona offers a unique blend of worldclass hospitality and vibrant energy, making it the perfect setting to celebrate excellence in the gaming industry and there’s no better time to do that than during the industry’s biggest trade show – ICE.”

The industry’s biggest show and the industry’s biggest Awards ceremony: a match made in Catalonia. While we grow and change, our commitment to integrity

stays resolute. And we know it takes more than just words to make that a reality, which is why we’ve been partnered with KPMG as our independent adjudicator since the first EMEA Awards in 2014.

We’ll be teamed up again this time, and our process remains as rigorous as it ever was. Micky Swindale, a Partner with the KPMG Global Gaming Team, is keen that “any company or individual who earns a place on the final Shortlist should feel a genuine sense of achievement.”

That’s why each company is only able to be nominated once per category, so if that company runs multiple brands, they won’t get two bites at the apple. And when it comes to selecting a winner, the responsibility is diffused between a panel of more than 50 of the most highly regarded executives in the business. Again, that process is systematically vetted with our strict one-executive-per-company rule. KPMG makes sure the voting process is operated and recorded in the most robustly honest and transparent way possible.

Rest assured, we know that, without trust, it can’t stand, and each time we put on an event, be that in Las Vegas, Barcelona, London or Manila, we aim to re-earn that trust.

, midd l

highlighted that €123.4bn ($143.8m)was raised in gross gaming revenue in 2024. That’s a solid 5% annual increase.

The Shortlisted nominees will be announced in our official Shortlist magazine. We won’t leave it up to your imagination either as to why either, we’ll tell you exactly what it was that’s impressed us so much about them over the past year.

And what a year it has been across Europe, The Middle East and Africa.

Over 70% of Africans now own a mobile phone, and with mobile money an established part of daily life, opportunities have been abound. InsaGames showed its businesscanny and innovative spark by launching its mobile-first iGaming platform, which crucially tends to the reality of some of these emerging regions. Where bandwidth is limited and internet connections volatile, there was a gap in the market for infrastructure-friendly, light-weight games.

In the Middle East, the United Arab Emirates is still readying itself to enter the regulated market. The land-based situation over there is ever-changing too, with that golden Wynn Resorts casino rising out of the shifting regulatory sands and scheduled to open in early 2027.

The old heads of gambling in Europe have been mixing it again, of course, showing the depth of the continent’s gambling roots and the span of its branches. A report by the European Betting and Gaming Association

But who’s been marching at the vanguard this time? There’ll be winners to look out for in new categories and old favourites. For the first time we’ll find out who’s definitively been leading the charge on Crash Games. Plus, we’ll see if anyone can take the Social Responsibility crown from Betsson.

With 15 categories, there is so much to play for. Soft2Bet was a very happy winnerslast year, taking home three prizes, including the Executive of the Year Award for Founder and CEO, Uri Poliavich. And after seven special years hosting the Awards at the Hippodrome in London, it had an added significance that The Hippodrome Casino took home the title of Casino of the Year.

Like any industry that innovates, certain classifications and categories become blurred or irrelevant over time. Our Awards must change with them, and there has been a slight reshuffle, as Savova explains: “We’re always evolving the Awards to reflect the industry in this particular moment in time. The addition of the Crash Game of the Year category recognises the rapid growth of this genre, which has become a major talking point in the industry. We figured that now is the right time to shine a spotlight on it by creating a separate category.

“As for merging the Retail and Online Sports Betting Operator categories, no one can deny that the future of the industry is omnichannel. We have heard top executives from the industry’s biggest companies say those exact words. If you look at Europe, most major brands operating high street betting shops now run thriving online platforms –and the retail and digital business arms increasingly support and strengthen each other. Recognising sports betting excellence as a whole simply felt like the most accurate reflection of today’s market.”

Last year was a massive year of change, then, for both the Awards and ICE itself, but the Gran Via at Fira de Barcelona is an incredibly modern and spacious venue, and it made the upheaval feel like the most natural of steps. We’re very glad to be heading back. Savova hailed it as a phenomenally smooth transition, and a great success, pointing out: “There were challenges, but it wasn’t anything we couldn’t cope with.”

It felt like an appropriate setting for the industry’s most prestigious of Awards and this year’s event will be even better as we settle back with some more familiarity into our new home. For those who attended last year, they may remember a certain piano bar going down particularly well. We can reveal that something special is being planned for 2026, though if you want to find out what it is you’ll have to come along and see for yourself. Make sure you’ve got your seat.

We look ahead to the vaunted Global Gaming Expo as it gears up for its 25th anniversary

It’s one milestone after another at the moment. Following on from our very own 15th birthday celebrations (see: the July/August issue of Gambling Insider magazine), attention is turning to G2E’s 25th anniversary – and everyone’s invited by the looks of things.

Yes, it’s that time of year again and the gambling world is preparing to put its best foot forward as it anticipates the Global Gaming Expo’s return to the expansive halls of the Venetian Sands Expo. There will be very little time to look back and admire conferences of the past with so much to play for at this year’s event. This Las Vegas staple is the event for product launches, after all, and anyone with serious ambitions of conquering the US in the next 12 months will be here polishing their newest wares and daring to catch the eye.

Since its inception, the industry expo has, in true Vegas style, adopted a ‘go big or go home’ ethos. Even at the inaugural edition in 2001, the LVCC welcomed 10,000 attendees through the doors. But this flagship gathering was always going to command bigger and bigger audiences, and this year will see more than 25,000 of the best and brightest arriving to put their cards on the table.

G2E is the place to get things done – a chance for you to press the flesh with representatives from the global gambling community. It’s also an opportunity to be a part of the wider conversation and fill your head with all the knotty discussions of the day. The Expo Hall will be opening its doors on 7 October, but the panels will be kicking

off the day before. So, if you want to hear expert opinions on hot topics like Brazil, fraud in iGaming, event contracts and sports integrity, you’ll want to be rolling in bright and early on Monday 6 October. In total, 330 speakers across more than 100 sessions make up the Education hemisphere of G2E –plenty to chew on there.

We expect you wouldn’t want to miss the Monday Keynote, either. As yet, the speaker is yet to be unveiled, but be aware, keynote speeches at G2E have a glitzy history with Whoopi Goldberg and Magic Johnson numbering among the stars who have taken on the mantle in the past, including of course industry CEOs like Jason Robins, Amy Howe, Bill Hornbuckle and more.

The extravagant stalls that get bigger and brighter every year can be as dazzling as a night out on The Strip, so you might want to plan ahead. Helpfully, if you’re in iGaming, there’s an entire zone dedicated to the sector. And if you’re interested in scouting out the newcomers, as with last year, first and second-time exhibitors will be gathered in their own specific zone. This year, the hosts are expecting nearly 400 exhibitors all told.

Brand new for this edition is the G2E Dealer Championship, a unique opportunity for the best of the very best US casino card dealers to separate themselves from the pack and claim the crown. Other innovations for 2025 include a designated Meeting Zone, offering a dedicated space for those important head-to-heads.

In Vegas news, it’s been quite a year for

anyone running a sportsbook in the area, especially for baseball and hockey. The figures for May make for pretty blissful reading if that’s your bag – according to the Nevada Gaming Control Board, sports betting on The Strip was up 31.6% year-over-year for the month.

Downtown Vegas has also been showing perky signs of growth of late – and there’ll be no shortage of discussion on these topics and much more once the festivities get going. There’s just no avoiding the growing significance of iGaming and sports betting in the US.

One other event showing no sign of slowing down is the Las Vegas Grand Prix; anyone thinking of sticking around for a round of baccarat will find the roads overrun with squealing F1 cars in November. The organisers of the event shared that the 2024 race generated $934m in revenue – no surprise, then, that the contest has just been renewed until 2027.

Global Gaming Expo organisers Reed Exhibitions and the American Gaming Association will be leaning into the future with some of the industry’s trademark resilience. The 2024 edition showed an increase in attendance year-over-year, with exhibitors hailing from 117 different countries, territories and regions. Notably, last year also welcomed a record 115 international exhibitors; if that trend continues, the opportunities for global partnerships and network building are going to be vast.

G.Games CCO Helen Walton spoke about an ever-discussed topic at an iGB Live panel in London. Below, we summarise her main messages

Whether you’re a big gaming fan or not, you’ll be aware that Super Mario 64 and Call of Duty Black Ops 6 are bridged by several generational leaps in innovation. Not only with the graphics evolving from 2D to 3D, but also the rich environments that support a variety of player actions. Some modern games on the market can react to sound or movement detected around the controller while it’s in the players’ hands; others ask the player to make decisions that guide them through deep, branching storylines. But what about games with a smaller gameplay loop? This restriction hasn’t stopped developers – instead, they’ve risen to the occasion. Minit, an indie game, puts a time limit of 60 seconds per run of the game. This creates a unique experience, where the player learns more about the story and the environment with each interaction. It’s a hook for casual, yet rewarding play.

As for slots… While Reel ‘Em In by WMS Industries was the first ever slot to include a second-screen video, it seems like the innovation stopped there. If you look

at pictures of the two, you’ll see some glaring similarities between the standard slot reel layout, the symbols, the act of pulling a lever or pressing a button... even the imagery of a man in a bucket hat catching a fish in the same. So why haven’t slot games changed over the decades? Well, there seems to be an opinion in the industry that if it isn’t broken, don’t fix it. After all, slots create eye-watering levels of revenue each year across the globe, so why meddle with something that is clearly working? Not all innovation is good either, especially when it’s change just for the sake of it – look at Coca-Cola’s $34m mistake when it tried to launch a New Coke product in 1985. Although the product saw initial success after market launch, many felt it was an “intrusion on tradition” and after months of widespread unrest, Coca-Cola finally reverted back to the same formula – thus, a cautionary tale about change was born.

Innovation is rarely a straight line, too, and it’s certainly easier said than done. Kodak was extremely successful and continued to innovate the camera, but when the phone market evolved to include cameras, it could no longer compete with the ease of having everything in one. No longer would you have to carry a phone, a camera and a pager whenever you went out! A similar thing happened with Blockbuster and Netflix. While the first was beloved and established, the latter offered an easier service. Neither Kodak nor Blockbuster offered bad products, and both companies had a loyal customer base – the market simply evolved beyond them. Technology and strategy are rarely the problem, it’s often the lack of speed and internal processes within companies that cause them to be left behind. As for railways, they were a great idea and everyone was pushing for them to be built, but they simply did not return financial success to investors. They were considered a societal success, but a financial disaster.

Innovation is often only great in hindsight. However, if you only focus on what’s popular in the market, this can create a funnel effect. Say you like Big Bass Bonanza –and it’s successful. You want to make a successful slot, so you inadvertently create a similar game. It performs well. You repeat the process over and over until the idea becomes so concentrated it no longer works. By this point, you haven’t created anything new; you’ve just followed a rabbithole of successful features that may not be relevant within a few months. This is not an innovative process; it is more like a spiral downwards as the market continues to cannibalise anything that becomes popular. By doing this, you also ignore those customers who do not like this slot and begin to isolate them from your products. While you’ve been chasing the number one slot, the rest of your customers have moved on.

Innovation often comes from desperation. But

the slot industry isn’t desperate – it’s performing better than ever. We do know there is a gap for disruptive innovation, though, just look at the adjacent entertainment markets. Sweepstakes are worth $6.2bn, while skin gambling is worth $50bn; not to mention Spribe and the spring of crash games. Even if slot providers don’t think they have to offer anything new to the audience, it’s clear slots are no longer the be-all and end-all of iGaming. Live show games have proved popular in recent years, with the

emergence of game show titles, virtuals and even marble racing made possible.

Walton finished up her panel with a poignant confession. She revealed to the audience that G.Games is spending £15m ($20.2m) trying to innovate the slot game genre. She didn’t go into detail about what to expect, but Walton did seem excited that the team were even trying. Will the final product fail to move the market, or could it become the next iGaming innovation?

Imagine you’re in charge of creating your company’s next slot game. Which aspects do you focus on?

At an iGB Live panel in July, speakers discussed charity donations within our sector, with the issue of greenwashing a consistent theme throughout

Linda Lindsay

CHIPS Co-Founder and Trustee: Raised £2m ($2.7m)+ and provided over 500 wheelchairs

David da Silva

SoGood Partners Co-Founder: Works with charities to improve collaboration and operations

Simon Pilkington

Best Betting Media Managing Director: Ran six ultramarathons in six days for charity

Fundraising for charity is nothing new for this or any industry, but have you ever noticed the kinds of charities the majority of gambling industry attention goes towards? These organisations often

support people suffering from gambling harm, which is understandable considering the ethical responsibility of operating within the gambling sphere, but this shouldn’t be where the support ends. There is so much good coming from the gambling industry, yet due to the unspoken bias towards gambling charities, it can be difficult for others to get the coverage they deserve.

Those were the conclusions of a panel at iGB Live at the Excel Centre in London in July. That aforementioned focus can also create problems of its own. If an industry only donates money towards charities that try to offset the harm caused by it, this can influence public perception. On one hand, you have Ben & Jerry’s associated with social justice causes, Tom’s Shoes known for giving free shoes to children in need, and Dave’s Killer Bread leaning into hiring people

with criminal backgrounds. On the other, while gambling companies predominantly give to gambling harm charities, this can inadvertently strengthen the association between the two.

What is being done at the moment?

As Co-Founder and Trustee of CHIPS, Lindsay has spent years hosting charity events to raise money for specialised wheelchairs catering to disabled children whose families cannot afford them, or cannot get the support through the NHS. These events are often attended by senior members of the gambling industry, including its annual Golf Tournament at the Woburn Club, but also include small-scale events hosted by individuals around the country. Since its inception, CHIPS has raised over £2m and provided over 500 wheelchairs for children in

need, but who reading has heard of the charity?

This is not a slight against the charity; instead, it raises an important point because it has operated in our space for many years, yet there is little coverage of it. “We can always find children who are in need, but we can’t always find the support of the industry to help them,” Lindsay told the panel. “As soon as you see the pictures of the children in the wheelchairs, their story and your help become tangible. But how do you maintain coverage past that?”

Despite not directly working for the charity sector himself, Simon Pilkington was still driven to call upon the iGaming sector to donate to a cause he felt passionate towards. After taking part in charity boxing matches in 2023 for Oliver’s Wish, Pilkington organised an event where he would run six ultramarathons back to back in six days – 183.5 miles or 295.3km. This raised £55,000+ for Oliver’s Wish, a charity focused on babies, children and young people organised posthumously on behalf of Oliver Dowling –“and for two fat men running down a path, that’s alright!” Pilkington explained on his GoFundMe page that “I’m excited and so determined to raise as much money as I can as part of Oliver’s Army, while hopefully bringing the iGaming community together in the process.”

Although he may not have spoken about his endeavours at the panel, it is worth mentioning David da Silva’s own efforts in the charity sector. As Moderator, he was busy asking Pilkington and Linday questions, but Da Silva is the Co-Founder of SoGood Partners. This organisation works with charities to improve visibility, collaboration, awareness and donation allocation using data tools and industry expertise. While it is important to donate to charity, Da Silva also recognises the importance of supporting charities with longterm growth and stability, rather than relying on one-time engagements.

Besides, just because somebody assumes a good act is being done only to cover up a bad one, that should not prevent the good act from being done in the first place. The panel at this event agreed that, while these accusations are inevitable, it’s important to push through them until they soften and subside over time. And as for any worries that Pilkington was charity washing? “F*** it,” he laughed. “We’re going to keep doing it because we believe in it.”

What can we do to help?

Of course, the topic of charity washing or greenwashing also came up in the panel. The gambling industry is a controversial one, so the more cynical among us may immediately disparage any acts of charity as simply trying to sweep any negative effects of operators under the rug. After all, who would feel comfortable criticising a big casino if the company donated millions to a cause close to their heart?

Well, it’s not always as complicated as that. Gambling operators are already donating large sums to good causes, yet it has done very little for their public image. It’s unlikely that supporting non-gambling charities would sway their image into something untouchable.

Many gambling verticals have already embraced charity work. Each year, Betting & Gaming Council members in the UK raise money to be split among various nominated charities, with the most recent Britannia Stakes race bringing in £450,000. Since 2019, they have raised over £6m for a range of health, sport and veteran charities such as Prostate Cancer UK, Sue Ryder, NHS Charities Together, the Royal Navy & Royal Marines Charity, ABF the Soldier’s Charity and the RAF Benevolent Fund. Racing With Pride, an LGBT+ charity, also partnered with the British European Breeders’ Fund and York Racecourse to deliver a Pridecentric raceday.

Outside of racing, there are countless charity lotteries and raffles, not to mention the National Lottery donation funds. Rank Group has also been partnered with Carers

Trust since 2014, holding regular fundraising events inside casinos to support unpaid carers. But is the gambling sector doing enough to support some of the little guys, too? It can be all too easy to donate to the major charities, but the panel urged people to speak up if they want companies and co-workers to support the niche ones too.

After asking the experts, Lindsay revealed that some of her most successful charity drives have come from intercompany donations, where one company wants to donate more than its competitor. This is a great strategy, especially with there being so many rivalries in this industry. Pilkington urged people to be vocal and not hesitate to ask people to support their charity work. It may sound silly, but even if it feels embarrassing to do, people don’t innately know if you’re supporting a charity event unless you tell them – and people will be more willing to help out than you may think!

With the rise of accessible online donation pages such as JustGiving and GoFundMe, it’s easier than ever to pitch in. Finally, Da Silva raised an interesting point: 8 million people volunteer monthly, which means most organisations will already have somebody involved with charity work. But are the people around them aware of this, and are they given the chance to help them out?

Food for thought.

At

a panel at iGB Live in London, key figures from three social enterprises combatting gambling harm discuss the Research, Education and Treatment levy

The new RET levy is gestating. The structure is in place, but industry, trade bodies and the potential recipients of the contributions are all waiting to assess its efficacy once the money starts being distributed.

“This is now public money.” says Rob Mabbett of Better Change. Accountability and transparency are non-negotiables for the speakers on this panel. There is a weariness in how they each reflect on the years of highly charged debate.

Wes Himes, Senior Advisor to the BGC and the Moderator of this panel, calls for a measured academic perspective that rises above heavily politicised and unconstructive argument. For Mabbett, this would mean no prioritising of one aspect of RET over another, no agendas, but a cohesive, collegiate approach. Treatment is as important as prevention, which is in turn as important as research.

Evaluating success in each of those areas will not be straightforward. Prevention was the letter retired and replaced when RPT became RET, but it is still very much at the forefront of the conversation. The problem is that measuring the success of prevention is finnicky. It’s an invisible metric and Clark Carlisle, Business Development Manager at

Gordon Moody asks the audience: how do we keep a record of cases that never happened because of improved education practices?

And what of that lost ‘E?’ Education. Is it really any easier to judge success here than with prevention? Well, the panellists agree that a calm and considered approach to doing so will be crucial. As Carlisle points out, if awareness and education campaigns do the job they’re supposed to, the numbers of people self-excluding or seeking treatment for gambling addiction will almost certainly rise. And though a necessary part of the long-term vision, this adds to the predicament facing Gordon Moody.

The residential treatment provider has consistently been 300% oversubscribed. Initially, success for them would mean being able to cater to the current need and meeting the bare minimum. Except, Carlisle reveals that residential treatment doesn’t fall under NICE (National Institute for Health Care Excellence) guidelines, meaning the charity is in danger of being excluded from the part of the funding due to go to the NHS. Those funds can be distributed to appropriate third-sector organisations but the team at Gordon Moody are none-the-wiser as to what criteria they need to fulfil to be in contention for that money.

So, the NHS accounts for 50% of the levy, and education for 30%, but research and innovation will be the home of the last 20%.

Victoria Corbishley takes on the question of who and what ought to lead this element of preventing gambling harm. For Corbishley, the voice of lived experience must be a significant part of the conversation.

Young people too are references as essential to the research process. To illustrate his point, Carlisle made a live case study of the audience by asking who had heard of Skibidi Toilet. There was no sea of hands and no shortage of raised eyebrows. But the people who created the aforementioned YouTube channel, which receives billions and billions of views and who-knows-howmuch in ad revenue, probably won’t be particularly bothered. Their demographic is decidedly Gen Alpha, and particularly vulnerable to the flimsy advertising guardrails in place across social media.

A common theme of panels at the Sustainable Gambling Zone is accessibility. Everyone has a casino in their pocket and most tech-savvy young people could feasibly be gambling illegally from lock screen in 30 seconds flat. For Corbishley’s ambitions of innovation to come true, working with people who have heard of Skibidi Toilet could be the keystone to success.

Looking forward to the next five years of the levy, Corbishley also has high hopes that the capacity for individualisation in the treatment piece will be expanded. The more choice and flexibility people have for their treatment, perhaps the more likely it is that they will actively seek it.

But if the education isn’t already in place, that treatment will still manage to be both oversubscribed and underutilised. Carlisle shared a damning advisory that if you asked most people who walk out of GA (Gamblers Anonymous) meetings whether they believe themselves to be gambling addicts, most will say no. It certainly seems there are a number of hurdles like this that will have to be leapt over simultaneously.

If people are going to seek treatment, no matter how flexible their options, they have to understand that they need it. Collaboration between gambling harm service providers and operators alike will surely prove pivotal in whether this levy helps the gambling industry clear those hurdles... at the first hurdle.

The black-market paradox cropped up a few times at iGB Live. On day one there was a whole panel dedicated to it. Here on day two, with tongues a little looser, it was explored somewhat more robustly.

Peter Rampertaap, Coordinator Operational Supervisor with the Netherlands Gambling Authority (Kansspelautoriteit/ KSA), disarmed the audience by rebuffing the idea that stringent safer gambling regulations had the unintended effect of driving people to unlicensed shores. Debuting some KSA statistics, he claimed that: “93% of players in the Netherlands are gambling in the legal market.” And that’s despite the nation being a notoriously tight regulatory environment to operate in.

The conversation buffered while everyone processed this. This was neither an ‘um’ nor an ‘ah,’ it was a decisive figure that seemed to point a clear way forward.

Maybe... maybe not. Sensing that it didn’t ring true in the room, Rampertaap caveated the claim by acknowledging that it doesn’t take into account GGR. The KSA report itself concedes that heavier players may have transferred to illegal operators, while search volume data even tentatively suggests that the black market could have grown.

So, back to square one? Not exactly. It’s important to distinguish between actual figures and hypothetical ones. The KSA doesn’t know the GGR of the black market because, as Mike de Graaff, Co-Founder of BetComply, points out: “It is a black hole of data.” Unlicensed gambling operators no more want to share their player statistics with the KSA than with their local chief inspector. That 93% is not speculation, and the Dutch Gaming Authority has just cause to be buoyed.

Continuing the positive spin is Marian Mihaila, Global Responsible Gaming Manager at Superbet Group. He is keen to press home how optimum safer gambling tools should be empowering the end users rather than frustrating and restricting them. Feeling safe and supported while gambling ought to be a comfort not an annoyance, and employing high-quality UX alongside engaging and innovative content is not on the list of things to curb for regulators.

THAT’S THE IDEA, ANYWAY.

De Graaff is clear that it is perhaps easier to say all of the above than it is to budget for it. While a card-carrying legitimate operator bears the financial burden of educating its customer base on player protection, a nefarious operation can

unload its entire marketing budget on aggressive advertising. There is nothing stopping that company making unfair claims to undercut its opponents – no rule it hasn’t already ignored anyway.

Now, no one feels sorry for the operator that isn’t allowed to promote with as much financial firepower as it would like. Boo-hoo indeed. But it matters when you’re pitting the legal market directly against the illegal one. The decline of one is fuel for the other.

De Graaff shares the shocking example of VBet, an Armenian operator whose Dutch site was wiped off the map by the Google algorithms and replaced by an unlicensed imitator. Despite putting in the hard yards acquiring the relevant licences and marketing itself legitimately, its rightful customers were being siphoned off to an illegal site. Where is the incentive now? The positive encouragement to comply?

Smarter compliance is the focus of this panel. And keen to leave the hand wringing to others, BetBlocker’s Pedro Romero encouraged the panel to proffer some solutions...

A clever example of operators showing canny –to give bandit gambling operators a taste of their own medicine – is Dutch companies

implementing SEO-engineering that ranks them highly on Google when players who have previously self-excluded, using CRUKS, search for non-CRUKS gambling sites.

And what of AI? Here there is more of a note of caution. “A weapon can be used to defend or attack,” says De Graaff. Accountability is so central to compliance and no one who’s sole objective is to build trust is going to do so right now by using AI. “AI-powered” is not yet a value proposition. Romero wonders whether the gambling industry is actually any good at learning from its mistakes? Is it Groundhog Day again? The note of caution turns to hopelessness.

Well, perhaps not. As a concluding note of optimism, De Graaff pointed out that New Zealand is a new market, and that’s no cut-and-paste job. Fifteen operators, a smaller more manageable pond, with some admittedly large fish. The hope is that they don’t destroy each other, that they learn from the past and that the market is controlled enough that each has space to operate. The hope is, of course, that they just might work together to establish a sustainably compliant model that future markets can follow.

Mike de Graaff - CCO and Co-Founder, BetComply, Marian Mihaila - Global Responsible Gaming Manager, Peter Rampertaap - COS, Netherlands Gambling Authority, Pedro Romero - SGC, Psychologist & Counsellor, BetBlocker

Richard Hayler, from the Independent Betting Adjudication Service (IBAS), explains the hold up to the promised Gambling Ombudsman

Alternative Dispute Resolution is a mechanism to run the rule on contractual contests between consumers and businesses. In the gambling sector, they can settle financial disputes with sanctions of up to £10,000 ($13,500) –a non-legally binding power that is. More on that later... Nonetheless, ADR providers like IBAS are going into battle wearing legislative handcuffs – they can’t resolve everything. Their narrow mandate means that, when a disgruntled gambler engages IBAS, a process of expectation management takes place in the form of a small quiz.

If someone has been rude to you, if you’ve been the victim of a crime or the game you played was broken, you’ll soon be told you’ve come to the wrong place. The only disputes over which IBAS can wave its sceptre are contractual discrepancies. A European Directive in 2013 laid the foundations for these dividing walls and we have built our labyrinth of gambling redress upon them. So, if your case is that an operator irresponsibly allowed you to gamble more than you could afford, you’re not alone. But in its current form, IBAS can’t help.

Richard Hayler, Managing Director of IBAS, has just got back from blowing out the candles on case 100,000. There are many more IBAS has had to offload, whether upstairs

to the Gambling Commission (GC) or just back the way they came. Because despite the expectation-managing questions, social responsibility complaints make up 13% of resolution requests. How many others must turn away at the door?

The Licence Conditions and Code of Practice are requirements for any GC licence holder and compliance with the ‘social responsibility code’ is a three-line whip. Don’t uphold those values and the Commission can review, suspend, fine and prosecute. Social responsibility is already enshrined in the UK’s most revered of licensing literature, then, but in terms of redress it means little to players. What grim dissatisfaction it must be for that disgruntled gambler, who has questioned an operator’s adherence to this code, been passed from IBAS to GC, and seen all of these reprisals carried out, without a single seized penny going back in their own pocket.

The disconnect between the LCCP and the redress mechanism is clear but attempts to introduce a mechanism have been heavylegged. The mythical Gambling Ombudsman was first sighted in the 2023 White Paper but has so far failed to emerge from those pages and take shape. IBAS is in favour of the Ombudsman, and of being the

Ombudsman, but Hayler is game enough though to talk through the reservations. In fact, he gives us a textbook IBAS expectation management clinic. “It’s not going to be perfect to begin with,” and there is a “lack of legal precedent” for another thing. Whoever took on the mediatory mantle would be establishing the precedent as they went along with no case law to moor themselves to.

Observing ombudsman in other industries doesn’t comprehensively stack up the pros column either, Hayler explains. What is, in an ideal world, a totally independent and empowered body, in practice becomes feeble and contingent, muscles wasted by poor economy and veins pumped full of clogging bureaucracy. IBAS proudly wears that independence. But an Ombudsman couldn’t operate in isolation and, while the Gambling Commission is funded by the taxpayer, an Ombudsman would have to be financially bootstrapped by industry. This is no different in shape to any ADR, which are funded by willing operators, but the scale of the running expenses would be a different level.

Hayler envisions a few forward-thinking operators, taking the bull by the horns, signing up and bringing their proprietary redress systems to the table. But without this kind of buy-in from industry, the mythic Ombudsman will continue to be a fantasy. The absence of independent scrutiny, Hayler points out, is bad for operators too. Without it, if someone says they were allowed to gamble an unaffordable sum, it reflects badly on the betting company whether the claim holds water or not.

How convincing that argument is to most operators remains to be seen, hence the need for the forward-thinking ones to take the lead and ignore the noise that seems to have jammed the gears of this process. There’s a simmering frustration in how Hayler holds commentators and politicians to account for that noise. “Until you build a framework and put together the teams you can’t get anywhere near the territory of speculating what it might do.”

Hayler leaves us with a less than promising report: seemingly, the GC is saying the only way it can see it happening is if the rules are established in law, something the Government has said it won’t do.

Now that’s what you could call... expectation management.

With growing chatter – no longer just among industry circles – that Las Vegas has lost its magic amid soaring prices and falling tourism, Oliver Lovat delivers a historical analysis of whether Vegas has broken The Promise. And where does it go from here?

With 2026 in sight, we look forward to two notable anniversaries of properties that made Las Vegas; 80 years of The Flamingo and Caesars Palace turns 60. One would expect that, as two of the oldest properties on The Strip, they are nearing the end of their runs; however, both are thriving at a time when many of their newer competitors are facing pressure, as Las Vegas faces broader scrutiny.

Upon closer inspection, the origins of these two properties provide us with insights to factors that made Las Vegas so special. Indeed, their ongoing prosperity and relevance offer lessons in sustainability and, more importantly, reminds us of “The Promise” that enabled Las Vegas’ evolution, growth and reinvention, which remain vital to drive future success.

SETTING THE STAGE

On Boxing Day, 1946, The Flamingo opened at the third resort on Route 91, today’s Strip. The resort’s opening was considered a disaster; it was overbudget, the hotel wasn’t ready and, within months, the developers Billy Wilkerson and Benjamin Siegal exited the project, the latter in a more terminal fashion, to be replaced by Gus Greenbaum, Moe Sedway and Dave Berman. They honed the message and set the template for casino operations for the first generation of

Las Vegas casino owners.

Other than providing mythology to the city’s origin story, the legacy of The Flamingo is two-fold. Firstly, and not apparent at the time, was the importance of location. Secondly, was strategy.

The Flamingo’s appeal was not to the “frontier gamblers” of the other properties, but attracted customers of Wilkerson’s other hotels, nightclubs and restaurants dotted across California’s major cities. These properties were frequented by the subjects of his Hollywood Reporter magazine and the pleasure-seeking nouveau-riche, such as Siegal, where they could mingle with likeminded people.

When hotel developers Jay Sarno and Stan Mallin conceived their Cabana Palace across from The Flamingo, Las Vegas was already established as America’s gambling capital. The renamed Caesars Palace finally opened on 5 August 1966. It was elegant and fun, with an escapist theme, far removed from the bleak headlines of the mid-1960s and the backdrop of the Nevadan desert.

People loved Caesars Palace in a way they loved few other hotels. Not only could you eat, drink, dance, see shows, gamble, sit by the pool and play dice or cards, all in the same place, but they loved how being there made

them feel; they loved the escape, the fantasy, the entertainment, the experience. Opening night was attended by some of the country’s most recognisable names and faces.

Improbably, but crucially to the future of Las Vegas, was perhaps the least known person at the party: 26-year-old Steve Wynn. Sarno’s unappreciated and intuitive genius set out the strategic foundations that would define the market. Established at The Flamingo, advanced at Caesars Palace and absorbed by a young Wynn, “The Las Vegas Promise” was set.

REVIVING “THE PROMISE”

Faced with competition from Atlantic City, by the early 1980s, Las Vegas was relegated to the second-largest gaming market in the USA. The Flamingo became part of Hilton’s portfolio, removing all elements of the historic build. Caesars Palace had also expanded, but the primary attention and resources of the corporate parent, Caesars World, were directed on the east coast and other ventures.

The tragic fire at the MGM Grand remained a symbol of Las Vegas’ decline, with no new major resorts opening in market. As several Las Vegas casinos fell into bankruptcy, the consensus belief of remaining casino

operators was that if they were to compete against the newer, better located resorts in Atlantic City, they needed to be cheaper, with more offers, comps and discounts to attract customers, firmly in the middle and mass market. Rather than being an exclusive retreat for gamblers, Las Vegas became more inclusive to those on all budgets.

Las Vegas as a “value destination” stopped the financial bleeding, but this transactional tone made the experience all about “the deal.” Moreover, this strategy did not deliver the elevated escapism promised by the formative icons.

The importance of Wynn’s Mirage, which opened in 1989, was not the frequently misunderstood claim that by building big, it was the catalyst for the renewal of modern Las Vegas. Rather, it marked the culmination of Steve Wynn’s own experiences and insights, pulling in various strands of strategic thinking, lifting heavily from Caesars Palace and The Flamingo, reimagined alongside his own experiences, all showcased in a single property. Throughout development, Wynn was unyielding in delivering and communicating what he called “Keeping The Promise” to his customers. This was no accident – and he delivered.

There has been an influx of smart people into the Las Vegas hospitality and casino industry over the past decades, many of them, like me, with advanced business and finance degrees, with experience in other commercial environments.

Where such conversations were once limited to conference gatherings, I see almost weekly dialogue and pronouncements about strategy, offering various hypothesis to drive business revenues and shift the customer demographic. Turning all aspects of the business into revenue centres, eliminating under-performing elements and services, and maximising efficiencies has had the effect of record operating margins, evolving revenue mixes and a new customer demographic coming to the market.

Oliver Lovat

In this sense, these changes have proved successful, at least financially. In some cases, however, recent moves have alienated some customers familiar with past experiences and expectations, with the dissatisfaction playing out in social media. Although visitation data, commercial results and social media headlines do not tell the full story, there remains a story to be told.

True, on a macro-level there has been a decline in annual visitation, particularly from international markets. But this is as likely to be due to exogenous factors, notably a public trade spat with Canada and Mexico, and ongoing military conflict in various

“ Fun, pleasure, excitement, thrill, escapism, aspiration are embedded in ‘The Promise.’ Stay in our resort and you will feel better about who you are ”

countries, rather than to Las Vegas operators’ decision-making alone. Also true is that Las Vegas is not the bargain destination of popular conception, a legacy of the 1980s sell. Gamblers no longer subsidise other business units, as operators seek to bring in “the right” customers, rather than seek occupancy as the key performance metric.

National (and indeed, international) inflationary pressures have led to increased costs of goods, the labour unions have negotiated an increase in salaries from resorts, and the advent of mega-attractions (such as The Sphere and Allegiant Stadium) have pulled customer time and spend away from smaller attractions and venues, sometimes challenging their viability.

However, despite these very understandable and rational explanations, it would be churlish to blindly disregard the visitor sentiment as mere bluster. Instead, it may be that what is being vocally conveyed is something broader found in the present Las Vegas experience. Notable irritations are inconsistent service standards and the addition of a variety of fees and charges – some seeming arbitrary and excessive – to inflate what looks like decent value. It must be noted that cheaper pricing alone is not a guarantee

of competitive advance, but it is the perception of price-gouging that should be a concern. Unchecked, this is an easy pathway to dissatisfaction and product alienation.

McGovern and Moon observed in 2007: “Any CEO focused on long-term sustainability would be wise to identify these strategies and begin dismantling them. Clearly such practices work in the short term as the profits of certain practitioners attest, but as competitors emerge to exploit customers’ pent-up hostility, companies that bullied their customers in the ways described here should expect a punishing response sooner or later.”

It has taken a moment, but from the perspective of customers, something has changed, with dissatisfaction a more pronounced attitude than ever before. In this industry specifically, this is particularly alarming.

“ At every turn... creating love and capturing loyalty must be our strategic goals. If we do that, customers will keep coming back ”

customer, you “get something” back. This has proved highly effective and, moreover, it is quantitative – and if you can measure it, you can manage it.

Although the proponents of Las Vegas talk about the experiences that Las Vegas offers, rightly justifying the diversity and quality of what is served, that is only one aspect of a deeper – and in some cases lesser understood – insight to the drivers of strategic competitive advantage. My previous columns have addressed this in detail, but to summarise, in this industry there are only two drivers of sustainable competitive advantage: location and customer loyalty.

strategic competitive advantage. My previous something either functional or transactional,

Increasingly, the focus on loyalty is as something either functional or transactional, using points, access and status to entice customers to their resorts. By being a good

“stuff” in meeting their customers’ functional needs, but certain resorts have managed to dive deep into psychology and focus on embracing the emotional needs of customers, some that even the customers themselves cannot cognitively identify.

This is done not just by the physical building and design elements (including meticulously calibrated environments subliminally engaging across the senses), but the human interactions, employee culture, personal engagement. When staying at our resort, how do you feel?

My own research from 2011 and 2021 shows that some properties are more successful in capturing customer loyalty that others. Over the 10-year time period, these notably include The Flamingo, Caesars Palace, The Mirage (prior to closing), Bellagio and Wynn. Of these properties, there is no surprise that The Flamingo and Caesars Palace feature, personifying the “Las Vegas Promise” in Americana, being located in the best positions at the heart of The Strip and more recently having benefitted from the loyalty strategies enacted by Harrah’s/Caesars. All the other resorts were developed by Steve Wynn and his team.

Wynn’s views, like Sarno before him, were shaped by a deep, intuitive understanding customer psychology and placemaking. Wynn recalled the experiences of his parents’ generation at G2E in 2014. Summarising, his message: “They never saw a good day in years. If they didn’t go to war and get killed, they came out to The Great Depression, then World War II. But by luck, they experienced the rapid growth of the post-war years, and all they wanted was a taste of “the good life” – something they had only heard about.”

Many early resorts (and an increasing number of those today) were developed, programmed and operated based on function, with great resources and amenities – which are presented to the customer as marketing elements, either as differentiators or providing a reason to visit.

This misses the point. Theodore Levitt famously observed about marketing, that people do not merely buy products; they buy solutions to meet their needs. It is this that sets The Flamingo apart from The El Rancho, Caesars Palace from The Dunes, The Mirage from The MGM Grand, Bellagio from Mandalay Bay, and Wynn from Aria. It is not that they offer better

Fun, pleasure, excitement, thrill, escapism, aspiration are embedded in “The Promise.” Stay in our resort and you will feel better about who you are. If you don’t “feel” loved, it becomes about a transaction, thus increasing scope for dissatisfaction. Get this right and customers will return, repeatedly. In too many Las Vegas experiences, it is not being delivered.

When developing and programming a casino resort, the first question to ask is, who is your customer?

The answer is not always binary, with many newer (and larger), Strip resorts having to cater to multiple customer segments with the final product having to balance the competing needs of convention customers, casino players and nightlife mavens. In some cases, where the properties are relatively smaller, such as in Downtown Las Vegas, or focused on a particular geographic sub-market, as found in Station or Boyd’s properties, or where there is a singular “top-down” visionary (Wynn, Adelson) the priority is often clearer.

In a more corporate, risk-averse age (where real estate and operations are separate) the programming has become more formulaic to meet functional needs, (bars, restaurants, facilities and amenities) supplemented by events and experiences, underwritten by transactional drivers, each with a dedicated ROI, where the outcome is driving and maximising revenue, rather than seeking an emotional response from customers. Has modern, large-scale, diversified, convention-friendly, operationally heavy

and (by necessity) transactional Las Vegas broken the historic promise to customers? For many, particularly certain gaming customers in some properties, The Promise remains strong, but it needs constant renewal, with the realisation that what is lost can be found.

As 2026 marks the important milestones in the history of Las Vegas’ casino history, I challenge today’s operators and developers to (metaphorically) travel back in time to the early days of Las Vegas, appreciate what made

this city so remarkable and understand not just what, but why and how.

Those present at the opening of The Flamingo, Caesars Palace, Mirage and Bellagio, knew they were witnessing something special. They fell in love with Las Vegas in a way that was not merely transactional; the memories they hold dear are responses to engagement with the elements intended to solicit an emotional response. Las Vegas was created to provoke the expressions, behaviours and feelings that other places could not.

These responses to place are not unique to past customer demographics. Aspiration and the pursuit of self-validation are universal,

plus the realisation of achievement, embracing of emotion and recognition of experience. This generation even has an app to immediately communicate these moments to others. And when they fail to have these moments, there is an app for that too!

At every turn, whether it be appropriate pricing strategies, programming, investing in new experiences and amenities, or ensuring our hospitality delivery is at the pinnacle of the industry, creating love and capturing loyalty must be our strategic goals. If we do that, customers will keep coming back.

If we keep “The Las Vegas Promise” to our customers, they will keep theirs to us.

Oliver Lovat leads the Denstone Group, which offers strategic consultancy on customer-facing, asset-backed investments, including casinos. He has been a regular Gambling Insider contributor for years, but is mostly found in our sister publication Gaming America.

Some sagas just don’t seem to stop in gambling (the takeover of PointsBet comes to mind). A huge example receiving plenty of coverage this year, however, is the ongoing dispute between Penn Entertainment and HG Vora (affectionately nicknamed ‘the Penndashians’ within the Gambling Insider office). What exactly is going on? Megan Elswyth takes a closer look, including a dive into a 116-page manifesto…

Whether it’s David Einhorn scrapping with Bruce Berkowitz over St. Joe, or Bill Ackman’s seven-year feud with Carl Icahn, there are always disagreements in business. They don’t get much more public than Elon Musk’s recent spat with US President Donald Trump...

Rarely do they escalate to this degree but, when they do, it’s sure to attract the attention of those across the industry. This is exactly what happened this year when Penn Entertainment fell out with long-term shareholder HG Vora, resulting in around 20 press releases (and counting), multiple presentations, a lawsuit and even the launch of a website. From the outside, it may have seemed like it was only about Penn reducing the number of open Board chairs from three to two, but it goes much deeper than that.

When Penn announced on 29 January 2025 that it had received the list of three candidates from HG Vora, it seemed like a fairly innocuous business update. These were Johnny Hartnett, Carlos Ruisanchez and William Clifford.

While Penn agreed with the first two, they refused to appoint Clifford as his skills and experience were “against the needs of the Board” and he “failed to demonstrate the base level of open-mindedness required of all directors in order to explore value-generating solutions.” For the next few months, the two companies published various releases snapping at one another. HG Vora was accusing Penn’s management of “value-destructive deal-making, reckless capital allocation and poor execution,” while Penn was trying to refute the claims.

If this were an isolated incident, it could

easily be attributed to somebody not getting their way, but this investment company was not the first to raise issues with Penn management. A year earlier, on 31 May 2024, Will Wyatt from Donerail Group penned a six-page open letter to David Handler and the Board of Directors at Penn Entertainment, raising countless issues with the company. These included voting patterns for Board members, falling stock prices, troubling financial transactions and the poor current market capitalisation.

Wyatt also didn’t hold back from making sensationalist claims either, asking “whether Penn’s directors are really just riverboat gamblers, content with doubling down after each loss.” However, it wasn’t until 21 May when HG Vora published its 116-page presentation that people first started to pay

attention to the claims in full and realised that it was never just about the chairs.

Penn invested $4bn+ of shareholder capital, nearly double its current market capitalisation, attempting to build an online sports betting business

Despite paying $1.5bn+ to launch ESPN Bet, it only held 2% of the market share

The Interactive segment generated $1bn+ in adjusted EBITDA losses and approximately $850m in write-downs

Penn is worse off than in 2019 by nearly every financial metric

More than $11bn of shareholder value has been destroyed since 2021

Penn paid $550m for Barstool Sports then sold it for $1 four years later

More than $4bn spent on acquisitions and investments related to online sports betting

The company’s stock price is negative yearto-date and over the last one, two, three and four-year periods; as well as during CEO Jay Snowden’s tenure

Snowden’s target compensation is higher than all but one of his peers, even though he is the second-worst performing among his peers, and Penn is the second-smallest company

Barstool Sports, a sports and pop culture blog, had previously been dismissed by several potential business partners, including FanDuel, DraftKings and PokerStars. It’s unknown whether this was due to the business or perhaps owner Dave Portnoy’s controversial personality. Yet, despite several warnings, Penn acquired 36% of the media company in 2020 for $163m.

According to media reports at the time, Penn executives wanted to use Portnoy’s notoriety to attract a new demographic of players. And what made him notorious? Well, he had previously filed for bankruptcy following gambling losses, with other alleged misdeeds including: using fake press passes to unlawfully gain entry to events, claiming that some women deserved to be assaulted and even being accused of engaging in violent acts against women while filming them without their consent.How did Penn react? Snowden held a video conference call the next day and defended Portnoy, saying that if Portnoy was sexist or racist, they would not have gone into business with him. Snowden was wearing a Barstool Sports shirt during the call.

Between 2021 and 2023, Barstool ran a “Can’t Lose Parlay” in which 90% users lost their bet on; it advertised on university campuses; it cost Penn licences; it combined alcohol with in-person sports betting promotions; and it only achieved a 1.7% market share. Considering the above, Penn

decided the best course of action was... to double down and purchase the rest of the sports media company for $388m in 2023.

During an interview in 2020, Portnoy said “Penn needed us… and we named our price. There was no negotiation.” Penn would later sell Barstool Sports back to Portnoy in 2023 for just $1. That is not a typo.

In Snowden’s defence, he did say Barstool was a learning experience. Not every business decision can be perfect and it can be easy to criticise as an onlooker, but it’s different when you’re the one having to call the shots.

Later in 2023, Penn agreed to a $1.5bn deal with Disney to license the ESPN brand for its new sports betting division, ESPN Bet. When asked about the deal, The Walt Disney Company CEO Bob Iger said, “Penn stepped up in a very aggressive way and made an offer to us that was better than any of the competitive offers by far.” It was also a strange time to close a deal of this nature, considering that Flutter’s Fox Bet announced only a month earlier it would be closing amid challenging conditions for media-affiliated sports betting brands. Shareholders were also concerned. When questioned about this by analysts and investors, Snowden would avoid giving clear answers: “We haven’t disclosed it and we’re not going to,” “I’d rather wait until our Investor Day more toward the end of the year” and “I don’t want to get into too much detail on 2024 yet.”

Sports betting had already been legalised for five years by this point, and many of the brands in the space, such as FanDuel and DraftKings, had already capitalised on the market. Penn wanted to snag a 20% market share, but since launching ESPN Bet, the brand has achieved around 2-5%, depending on the state. While average interactive monthly users jumped from 189,000 to 771,000 after the launch, this fell quarter-over-quarter to 429,000. Although there was a small recovery in the last few quarters, MAUs are still down 27% overall. While customer retention is one of the most challenging aspects for any business, shareholders were still unimpressed by these figures.

Penn was not going to let HG Vora focus on the negatives, though. In an open letter to shareholders, the operator also highlighted that ESPN Bet had around 2 million users and the interactive vertical generated $162m in adjusted revenue in Q1 2025, which was a 78% improvement year-over-year. It claimed results would have been better if not for customer-friendly betting conditions, with profitability expected by 2026.

Before launching into the full performance

JOHNNY HARTNETT

Previously worked for Paddy Power and Sportsbet. Former CEO at Superbet Decades of experience in online gaming.

CARLOS RUISANCHEZ

Previously worked for Pinnacle Entertainment and Founding Partner of Sorelle Capital. Expertise in real estate and hospitality sectors. Delivered a 5x return to shareholders while CFO at Pinnacle.

WILLIAM CLIFFORD

Previously worked for Nevada Gaming Control Board, Golden Nugget, MGM, Sun International and Gaming and Leisure Properties Former CFO for Penn and allegedly drove 20x return for shareholders. More than 30+ years in the industry.

metrics, it’s worth covering something a little more personal, or personnel, if you will. The majority of Penn’s leadership have experience in land-based operations or corporate development, which may explain why the company is so well-known for its retail casinos, but these aren’t at the centre of this controversy. HG Vora claimed Penn has spent $4bn+, almost double its current market capitalisation, on M&A to build a sports betting brand, despite not having enough executives or board members with solid expertise in this area. The team that previously led the interactive strategy segment, the Levy Family, all departed Penn in mid-2024 but were not replaced quickly. Additionally, according to HG Vora, since 2020, Penn executives have logged more than 1,100 flights and 1,400 hours of flight time. While some travel is to be expected to different Penn properties, HG Vora has concerns that not all the flights are necessary. The 760 flights to Penn headquarters certainly seem reasonable, but HG Vora has highlighted that 462 flights seem to be to Snowden’s residence, while 212 are to CFO Felicia Hendrix’s home. By comparison, only 58 have been to Las Vegas and 27 to Lake Charles, one of Penn’s casino locations. It’s worth noting that Penn refutes all of this. The company has recently hired Aaron LaBerge as CTO and Billy Turchin as CPO to help with digital products, and while they weren’t brought on immediately after the departure of the Levy family, good appointments can take time. Could Penn have found people with online sports betting experience before spending $1.5bn on ESPN Bet? Sure, but at least it is trying to make up

for that now. As for the jet use, Penn cites these claims as “simply not based on the facts readily available in our public disclosure.”

PENN’S POOR PERFORMANCE?

While it was amusing to watch HG Vora complain about there being one less votable seat on the board and tracking the number of flights Penn executives may or may not have been using to commute on, these might have been ignored if Penn’s financial figures were better than they currently stand. Since shares peaked in 2021 at $136.47, Penn has since declined by around 88% to $16.74, which HG Vora translates to around $19bn in lost market value. The investors also complain that the interactive segment generated $1bn+ in adjusted EBITDA losses and approximately $850m in write-downs, leaving Penn worse off by nearly every financial metric compared to 2019. Even in 2025, the interactive segment is still negative in terms of its adjusted EBITDA, with Q1 figures sitting at a $89m loss. While Penn did announce $111.5m net income in Q1 this year, there will still be a long way to go to offset the $804.7m combined annual net losses accrued between 2023 and 2024 – and for investors, it may be too little, too late.

HG Vora also complained that, despite these results, despite Penn being the secondsmallest company in its peer group and despite Snowden being the second-worst performing CEO among his peers, his target compensation is higher than all but one of his peers – beating DraftKings, Caesars and EA.

By mid-June, both Penn Entertainment and

HG Vora had dragged other companies into the fray, touting that third parties had publicly agreed with them in an effort to discredit the other side. When Penn appointed Hartnett and Ruisanchez during the Annual Meeting of Shareholders, there was a collective sigh of relief. Surely the drama was over and the press releases would stop…

Well, there was one final report from HG Vora. Throughout the year, the capital management company had urged shareholders to vote using HG Vora’s Gold proxy card to signal if they wanted change at Penn - with more than 55% of all votes cast being done this way. A further 60% of votes were against the company’s Say-On-Pay proposal, too.

So have we seen the end of this?