Vacancy for shopping center space in the Sacramento region stood at 7.7% as of the end of Q2 2025. It has held at this rate for three consecutive quarters now and has moved no more than two basis points in either direction from this mark since 2022. This is not to say that activity has been flat or stagnant.

The challenges of the pandemic sent vacancy to a peak of 8.4% by Q2 2021, but retail demand rebounded hard over the next 18 months. By Q3 2022, the market had absorbed nearly one million square feet (MSF) of formerly vacant space as local vacancy fell to 7.3%--its lowest reading since early 2008. But since that time, national chain bankruptcies and closures have picked up substantially. According to PNC Real Estate Market Analytics, which tracks merchant bankruptcies, the US market set a record with 78 retail chains filing bankruptcy in 2020 (their data only includes retailers and not restaurant, fitness chains or other nontraditional users of shop space). Last year 43 chains filed bankruptcy, the second largest total they have tracked in the 20 years they have been tracking the marketplace. Through the halfway mark of 2025, they have tracked 22 major chain bankruptcies, meaning that the market is currently on pace to surpass last year’s total count.

The latest casualty is the furniture and furnishings chain At Home, which will be closing at least 32 stores nationally as part of its bankruptcy (this number could go up), including their local store at the Delta Shores shopping center in Sacramento. Meanwhile, ‘tween retailer Claire’s was reportedly also planning on filing Chapter 11 as this report went to press. The chain

operates eight stores in the region, primarily at mall, lifestyle, and outlet center locations.

Yet, despite these challenges, vacancy has held steady so far. The market recorded 31,000 square feet (SF) of positive net absorption in Q2 2025. Though a negligible figure given the market’s overall size of 66.1 MSF (30,000 SF is roughly the size of an average T.J. Maxx store), the Sacramento market has managed to eke out positive occupancy gains in five of the last six quarters amidst the national trend of increased closures.

This is partially due to continued expansion from grocery store chains, discounters, and off-price apparel concepts. But it is also due to continued robust growth from QSR/fast casual chains, gyms/fitness concepts, beauty (from aesthetics/MediSpas to retailers and salons), and a mix of other non-traditional space users (car washes, urgent care, veterinary hospitals among just a few).

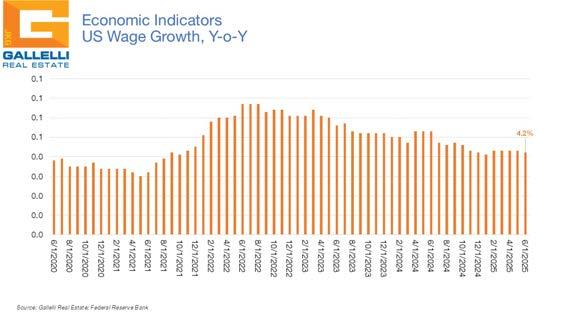

Meanwhile, none of the recent headwinds impacting the market have slowed rental rate growth. The current average asking rent we are tracking is $2.25 per square foot (PSF) on a monthly triple net basis. We should note that this figure is useful as a benchmark only; lease rates for retail space are heavily discounted depending upon the size

of the space (the larger the box, the cheaper the rate) and can vary significantly based on the location, class and co-tenants of a center—all of which are critical factors in driving varying sales outcomes. This number is up 4.7% from where it stood a year ago, making retail the commercial real estate product type currently driving the strongest gains locally.

Our brokers still report a shortage of available Class A space, particularly for smaller shop spaces. This is driving particularly sharp rent increases on renewals for some tenants. Anecdotally we know of multiple instances where smaller space tenants have renewed existing Class A spaces at rates of 20% or more than their previous rents. With little new development in the pipeline (and most new construction heavily pre-leased prior to delivery), the balance of power in negotiations locally still favors landlords.

Additionally, there is another factor that is starting to play out for some longer-term big box tenants upon renewal. Box tenants tend to lock in lower rates at longer terms. The early 2000s were boom times for local retail demand (as well as development). One common lease structure that we saw 20 years ago was the 10-year term with the right of two 5-year renewal options. We are starting to see an increasing number of tenants having already exercised both of their renewal options facing major rent increases—with rates sometimes as much as doubling at today’s market rate.

Another challenge facing many tenants is the fact that most retail (and industrial) deals are transacted regionally on a triple net basis, meaning that in addition to rent tenants are responsible for the cost of property taxes, insurance, common area maintenance (CAM), and utilities. Net expenses have effectively doubled over the past five years. Anecdotally, we are seeing instances where the $0.40 PSF nets of a few years ago are suddenly $0.80 PSF nets, or $0.50 PSF nets are now moving in on $0.95 PSF. While the cost of insurance, CAM and utilities have skyrocketed in recent years, increased property taxes have been a major driver of this trend. This is particularly the case for properties that have recently sold, triggering the reassessment process and giving some pricing advantages to long-term landlords. Ultimately this trend challenges the ability of landlords to command rental rate growth. In Sacramento’s industrial market it is already a factor (among many) for that product type posting modestly negative

growth this quarter. A lack of new product has largely insulated local retail landlords from this trend, though a sharp decline in demand could potentially change this.

A lack of major new construction is one of the major factors that has enabled Sacramento’s shopping center to maintain market equilibrium despite the recent spate of closures. Since 2009, the region has added only 20 new shopping centers accounting for just over 2.3 MSF of product. In other words, the market’s inventory has increased by just 3.4% in 16 years. In the eight years prior to that, the market had an average of 3.5% growth annually in each year (2000 to 2008). The arrival of the Great Financial Crisis (GFC) in 2008 was just the beginning of more than a decade of challenges that would play out for retail real estate. By the late 2010s, the accelerated rise of eCommerce led to a major uptick in retailer bankruptcies and strategic closures. That trend was not yet over when the pandemic hit. Yet construction did not bounce back in the wake of the post-pandemic retail boom because the culprit as of late has been construction costs (which are still averaging roughly 40% above where they stood as recently as early 2022).

We are currently tracking 309,000 SF of new product in the development pipeline with delivery dates scheduled through 2026. But most of this space is already accounted for. We don’t know of any major projects that have moved forward with construction since 2008 that did not at least have a committed anchor tenant. Speculative development has largely been limited to inline shop space. For example, one of the larger projects currently in the pipeline is a 66,000 SF building for Whole Foods that is scheduled for delivery in Q4 2025.. Likewise, a 43,000 SF Nugget grocery store will be coming online in October 2025 at Whitney Ranch in the Roseville/Rocklin market and development has begun on a new 161,000 SF Costco that Gallelli Real Estate brokered in the planned Baseline Marketplace project in West Roseville.

But while most of the new product in the pipeline is already accounted for, questions remain as to how long local vacancy levels can hold. Much of this will be determined by how the big picture economy impacts consumer spending and retail demand in the months ahead.

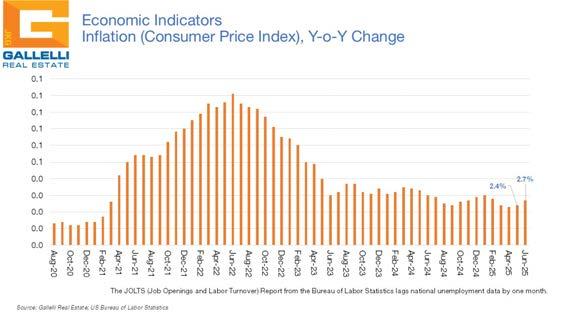

Through the first half of 2025, uncertainty surrounding the effects of tariffs initially left many industry leaders cautious. Economists and pundits issued dire warnings, and the stock market fell sharply following the tariff announcement. However, as of this report, the three major indices—the Dow, Nasdaq, and S&P—are all trading well above their pre-announcement level.

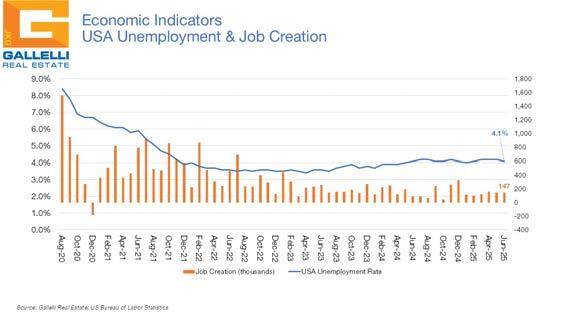

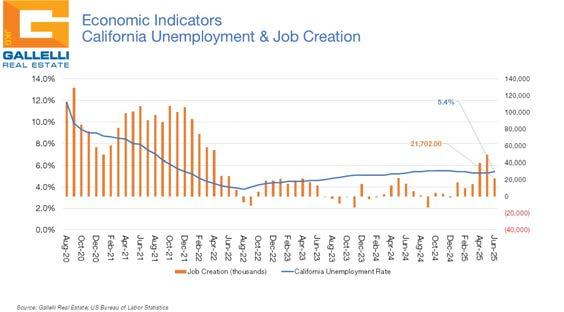

Despite early concerns, little increase in the cost of goods has been observed since tariffs were imposed so far. Meanwhile, though recent data from outplacement firm Challenger, Grey & Christmas showed U.S. employers announced 744,000 layoffs through the first half of 2025. Notably, nearly 287,000 of those were attributed to cuts by the Department of Governmental Efficiency (DOGE), skewing the headline number.

While the short-term impact of tariffs remains in flux, some longer-term benefits are beginning to take shape. Tariffs have boosted tax revenues on foreign products, and, more importantly, they are encouraging reinvestment in domestic operations that should ultimately result in the creation of solid, middle-class jobs. Numerous corporations have committed to expanding U.S. facilities and manufacturing capacity. For instance, Apple has pledged more than $600 billion towards building U.S. based facilities, while TSMC has committed $100 billion to semiconductor manufacturing on American soil. Many other companies have made similar commitments or are actively evaluating new investments.

Ultimately, the level of headwinds the tariff policy creates for the greater economy remains in flux. Looking to the final half of the year, barring any unforeseen “black swan” events, the state of the overall economy will depend overwhelmingly on the kind of trade deals the administration is able to cut in the months ahead.

Gallelli Real Estate is a private firm that specializes in commercial real estate services and property management. We believe that as a boutique firm whose understanding of the business runs as deep as our core values, our advantage is large. We take pride in our unique approach to offer more individual solutions that address the ever changing needs of our clients and the industry. After all, our success is measured by the success of our clients and the strength and longevity of our relationships.

rosborne@gallellire.com

Land/Investments ebenoit@gallellire.com