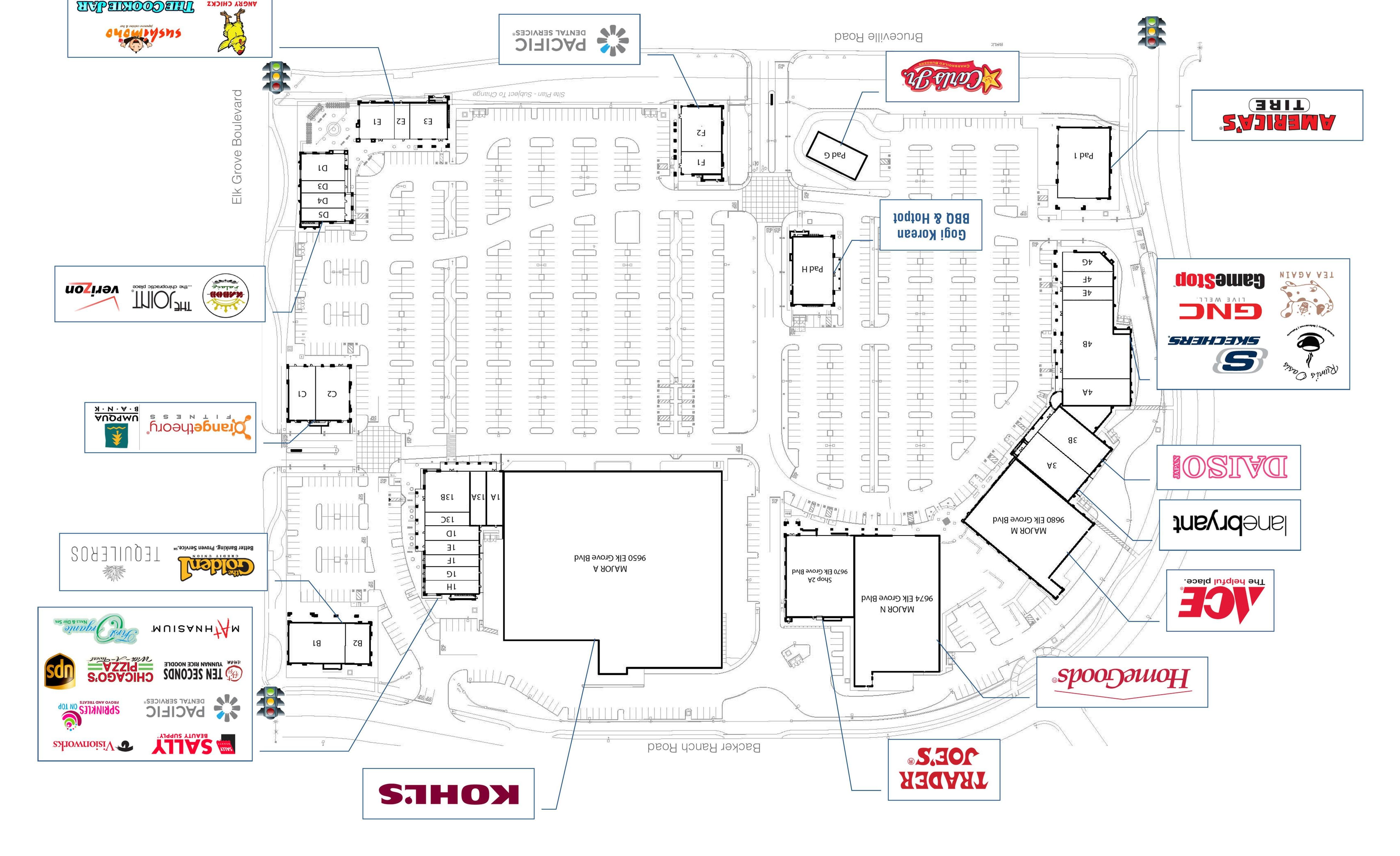

382,000 SF Costco-anchored power center + MANY MORE TO BE ANNOUNCED SOON!

• Affluent demographic with a strong daytime and evening population

• The shopping center features an excellent tenant mix with a newly opened Costco

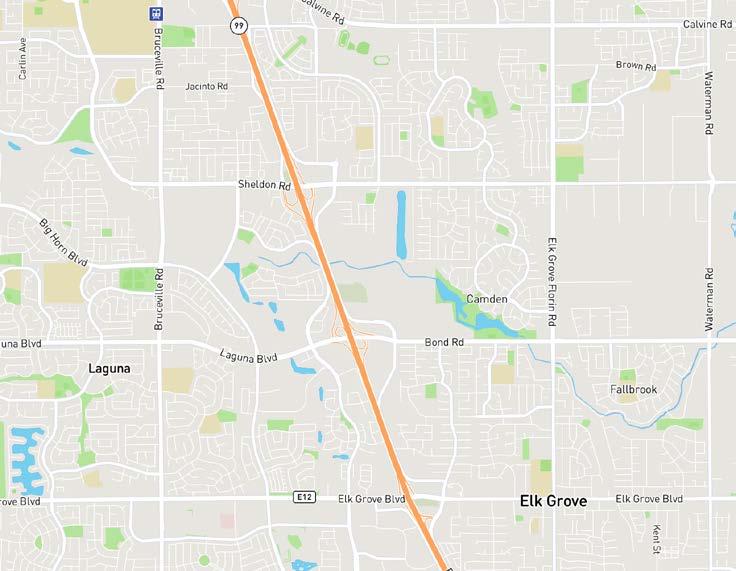

• The Ridge has high visibility with strong traffic counts at the busy intersection of Elk Grove Blvd and Bruceville Rd with over 70,000 CPD

• Easy ingress/egress with convenient access to both Interstate 5 and Highway 99

• Signalized hard corner of Bruceville Road & Elk Grove Boulevard

• High population density with large residential growth immediately to the south of The Ridge

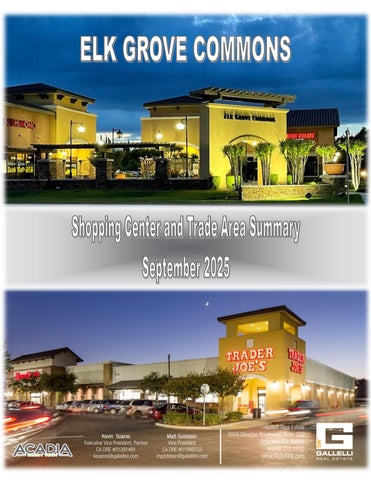

• Shared intersection with Trader Joe’s, Kohl’s, Nugget Market, and many more

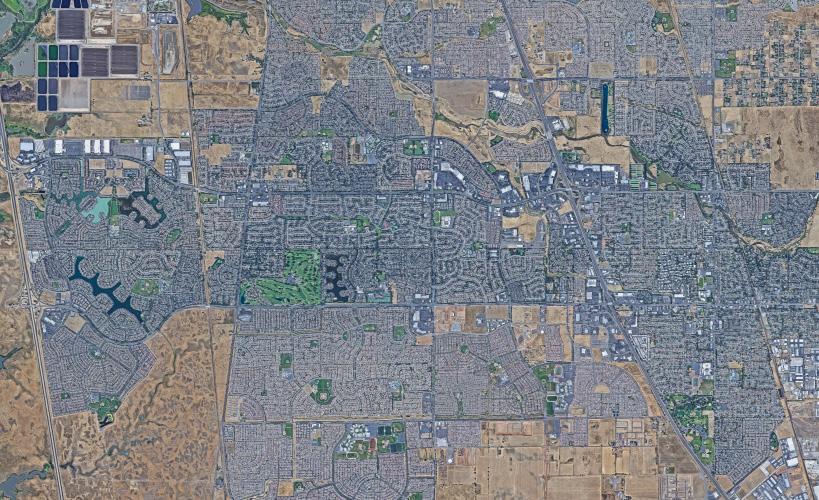

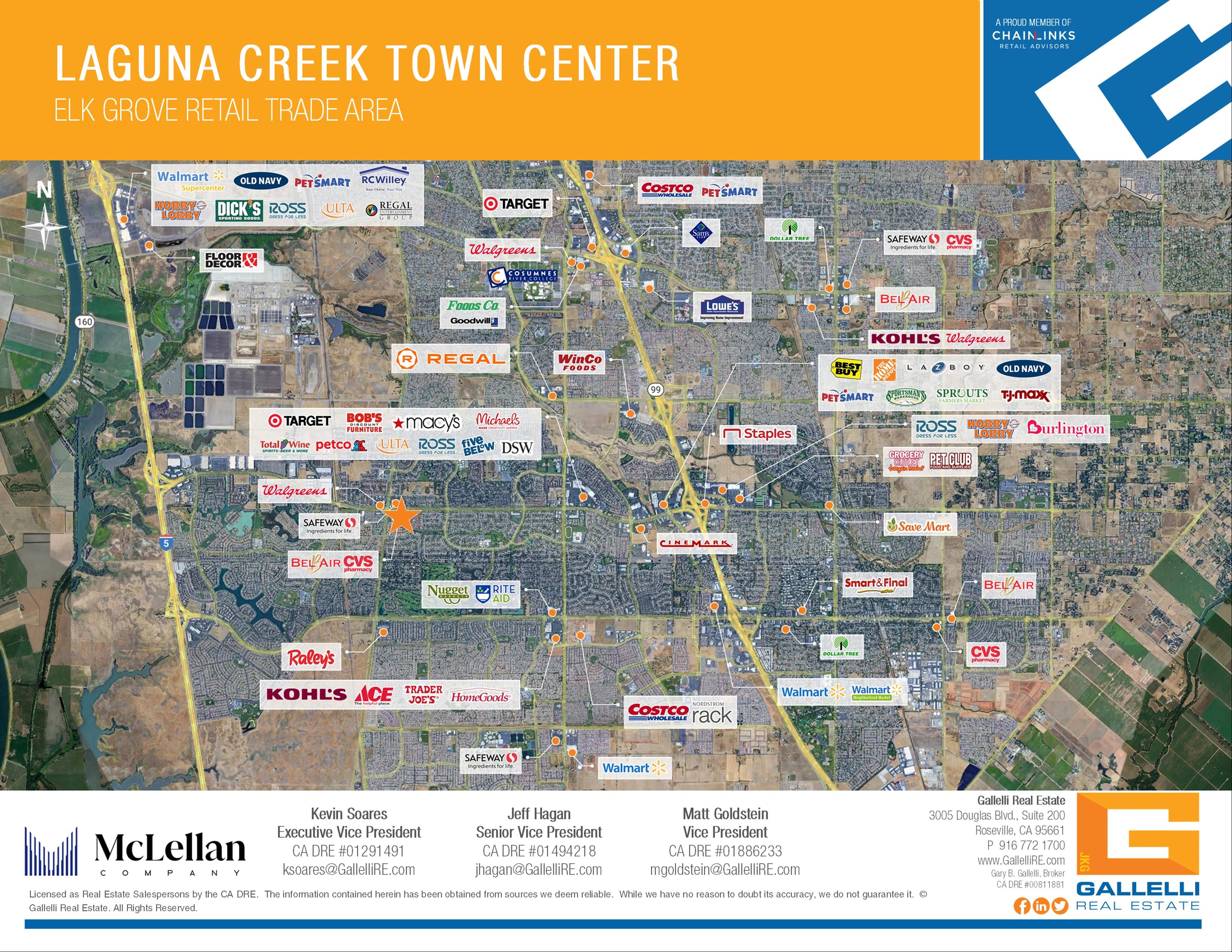

Elk Grove is located just south of the state capital of Sacramento, and approximately halfway between San Francisco and Lake Tahoe.

Elk Grove’s location provides easy access to two major freeways, the Sacramento International Airport, rail lines and two ports. The City of Elk Grove is known for an award winning school district, a variety of outstanding restaurants, a historical district, first-rate parks, and much more. Elk Grove has a prosperous business community that boasts a diversity of shops, services and promising careers.

Elk Grove is a family-oriented, diverse community with a population over 181,000—with one of the largest growth markets in the country due to its affordable housing and strong employment base.

There is a large amount of residential growth planned to the immediate south of Elk Grove Boulevard.

KELLY RULE | BRE# 01173419

m 314-954-7735 | d 916-465-8843

e krule@pappasinvestments.com

@pappasinvestments

www.pappasinvestments.com

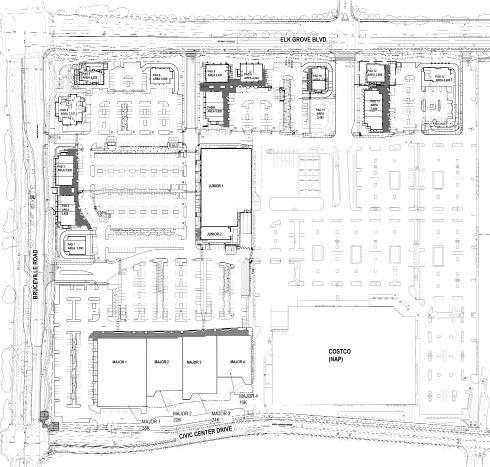

• Exciting planned Lifestyle Center adjacent to the city’s proposed Civic Center and proposed Mercy Hospital (approx. 350 beds & 4,000 employees)

• High visibility, easy ingress/egress, and convenient access to both Interstate 5 and Highway 99

• Affluent demographic with a strong daytime and evening population

• High population density with large residential growth immediately to the south of The Village

• Elk Grove Blvd is the major thoroughfare linking highway 99 and Interstate 5

• One block west is the 400,000 SF Ridge Shopping Center anchored by Costco with significant residential projects south of Elk Grove Blvd

Elk Grove is located just south of the state capital of Sacramento, and approximately halfway between San Francisco and Lake Tahoe.

Elk Grove’s location provides easy access to two major freeways, the Sacramento International Airport, rail lines and two ports. The City of Elk Grove is known for an award winning school district, a variety of outstanding restaurants, a historical district, first-rate parks, and much more. Elk Grove has a prosperous business community that boasts a diversity of shops, services and promising careers.

Elk Grove is a family-oriented, diverse community with a population over 181,000—and one of the largest growth markets in the country due to its affordable housing and strong employment base.

There is a large amount of residential growth planned to the immediate south of Elk Grove Boulevard.

SWC ELK GROVE BLVD & BIG HORN BLVD / ELK GROVE, CA

KELLY RULE | BRE# 01173419

m 314-954-7735 | d 916-465-8843

e krule@pappasinvestments.com

@pappasinvestments

www.pappasinvestments.com

chris.campbell@cbre.com Lic. 01204114

Marketplace 99

9134 E. Stockton Blvd. | Elk Grove, CA 95624

• Marketplace 99 includes many strong national tenants as well as smaller regional tenants

• Notable companies surrounding the project include Sutter Health and Kaiser Permanente

• 5.4 Million visits to center in 2023

• Dense residential population surrounding the center

• California Family Fitness is located to the right of the Shopping Center seeing hundreds of Elk Grove residents per day and bringing families to the project

• Cosumnes Oaks High School and Elk Grove High School are both within two miles of the Shopping Center with a combined student population of approximately 12,516 students

2024 Estimated Demographics* - 3 Miles

136,443 Daytime Population

*Source: FastReport

3,781 Businesses

160,928 Population

129,936 Highway 99 ADT

49,391 Households

$130,159 Avg. HH Income

Not to scale. All dimensions are approximate.

Laguna Gateway l is located adjacent to the 99 freeway and is located at the prominent intersection of Laguna Blvd and Stockton Blvd.

The center is anchored by Home Depot, Best Buy, TJ Maxx, Bed Bath & Beyond, Old Navy, and features tenants such as Jamba, Coldstone Creamery, Sleep Number, Holiday Inn, Wells Fargo, and many more.

Elk Grove is located just south of the state capital of Sacramento, and approximately halfway between San Francisco and Lake Tahoe.

Elk Grove’s location provides easy access to two major freeways, the Sacramento International Airport, rail lines and two ports. The City of Elk Grove is known for an award winning school district, a variety of outstanding restaurants, a historical district, first-rate parks, and much more. Elk Grove has a prosperous business community that boasts a diversity of shops, services and promising careers.

Elk Grove is a family-oriented, diverse community with a population over 170,000—with one of the largest growth markets in the country due to its affordable housing and strong employment base.

There is a large amount of residential growth planned to the immediate south of Elk Grove Boulevard.

NEC LAGUNA BLVD & BIG HORN BLVD, ELK GROVE, CA

KELLY RULE | BRE# 01173419

m 314-954-7735 | d 916-465-8843

e krule@pappasinvestments.com

@pappasinvestments

www.pappasinvestments.com

Shadow-anchored by Walmart center next door, this gated community with retail component is located on desired Elk Grove Boulevard in the heart of Elk Grove near Hwy 99. New pads planned for delivery in October of 2020.

The former site of Nursery of the Capital, this unique infill site offers commercial uses such as a bank, day care or a coffee shop. The remaining property is exclusive gated residential community built by Woodside Homes. Many of the majestic Oaks dotting the property are being preserved.

Laguna Blvd & Big Horn Blvd just one block from the 99 freeway.

• Laguna Gateway ll is located one block from the 99 freeway and is located at the prominent intersection of Laguna Blvd and Big Horn Blvd.

• The center is anchored by Sprouts Grocery and features tenants such as Sportsman’s Warehouse, PetSmart, Citibank, Red Robin, Club Pilates, Citibank, Sport Clips, and many more.

SPACE HIGHLIGHTS

• Second Generation restaurant

• FF&E remains

• 3,500 SF End Cap

NEC LAGUNA BLVD & BIG HORN BLVD, ELK GROVE, CA

40,116 SF anchor opportunity available at the prominent corner of Laguna Blvd & Big Horn Blvd just one block from the 99 freeway.

KELLY RULE | BRE# 01173419

m 314-954-7735 | d 916-465-8843

e krule@pappasinvestments.com

@pappasinvestments

www.pappasinvestments.com

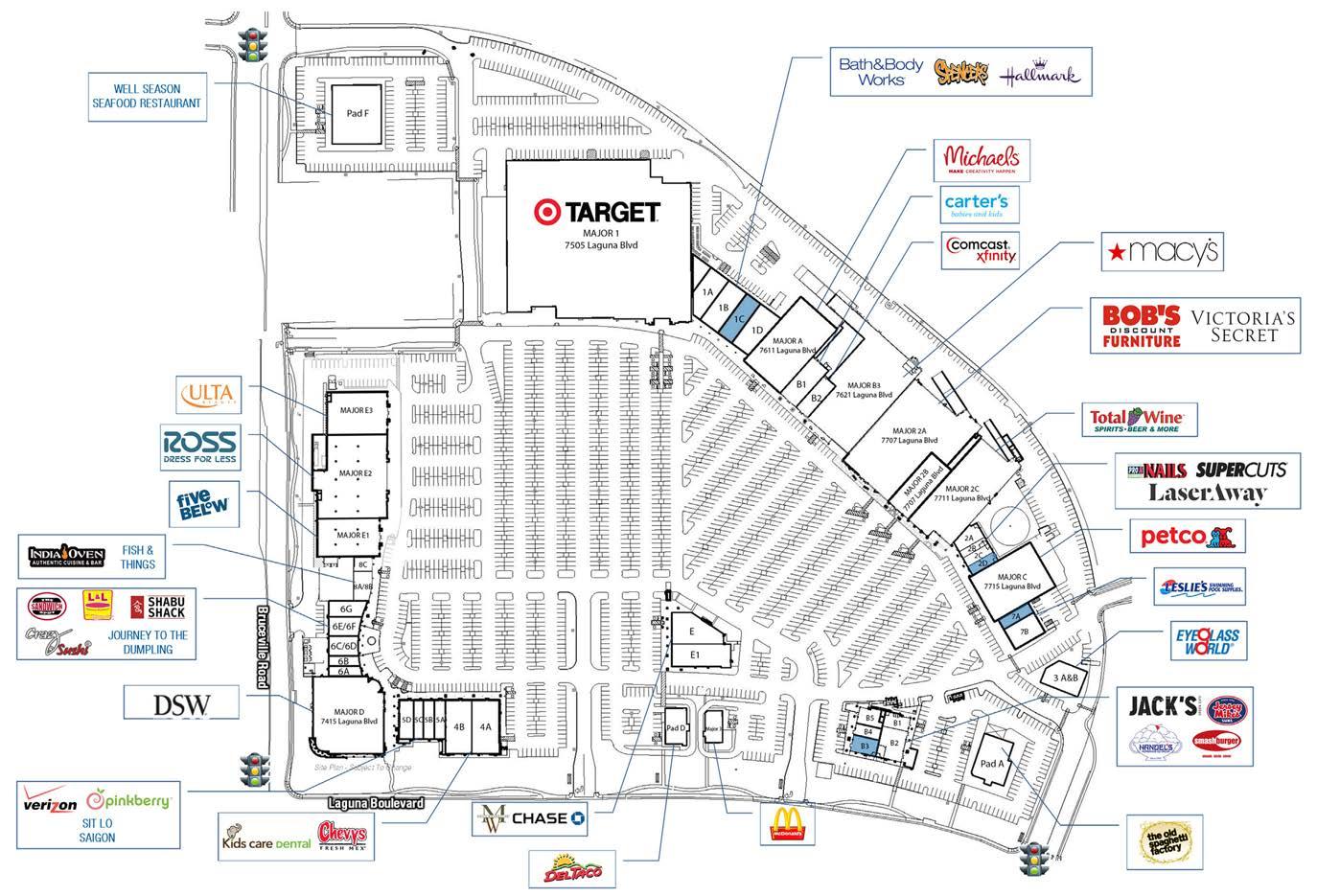

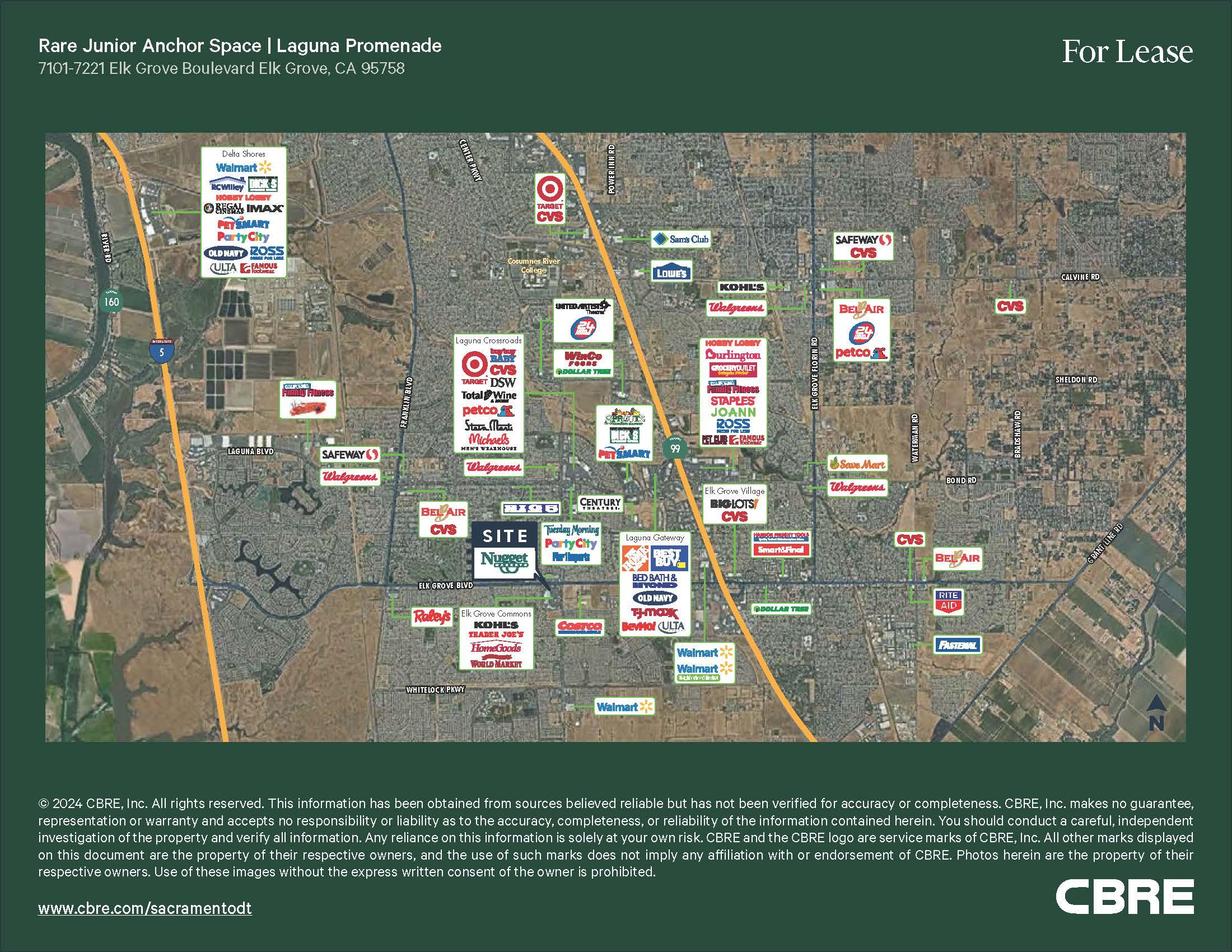

Laguna Crossroads is a ±439,820 square foot community center located at the northeast corner of Laguna Boulevard and Bruceville Road in the heart of the Elk Grove/Laguna trade area.

The center is centrally located and positioned to draw from all points in the Elk Grove trade area.

Laguna Crossroads is anchored by Target, Michaels, Petco, Total Wine & More and DSW Shoes and is part of more than ±1,000,000 square feet of retail along the Laguna Boulevard corridor. Most recent additions to the center are Macy’s, Ross, Bob’s Discount Furniture, Five Below, Ulta, and Bath & Body Works.

With a city population of approximately 176,584, the City of Elk Grove continues to be one of the strongest retail sub-markets in the Greater Sacramento Region.

Major employers that are located in Elk Grove include Sutter Health, Kaiser Permanente, Apple and the Elk Grove Unified School District.

±439,820 SQUARE FEET

ANCHOR TENANTS

TARGET, MACY’S, TOTAL WINE, DSW SHOES, MICHAELS, ROSS, ULTA, VICTORIA’S SECRET, BOB’S DISCOUNT FURNITURE

±23,172ADT

±39,491ADT

±31,497ADT

±27,939ADT

LAGUNA CROSSROADS HAS ±6.2 MILLION VISITS PER YEAR. (PLACER AI)

KEVIN SOARES

Executive Vice President CA DRE #01291491 ksoares@gallellire.com

JEFF HAGAN

Senior Vice President CA DRE #01494218 jhagan@gallellire.com MATT GOLDSTEIN

Vice President CA DRE #01886233 mgoldstein@gallellire.com

GALLELLI REAL ESTATE

3005 Douglas Boulevard, Suite 200 Roseville, CA 95661 (916) 772-1700 gallellire.com

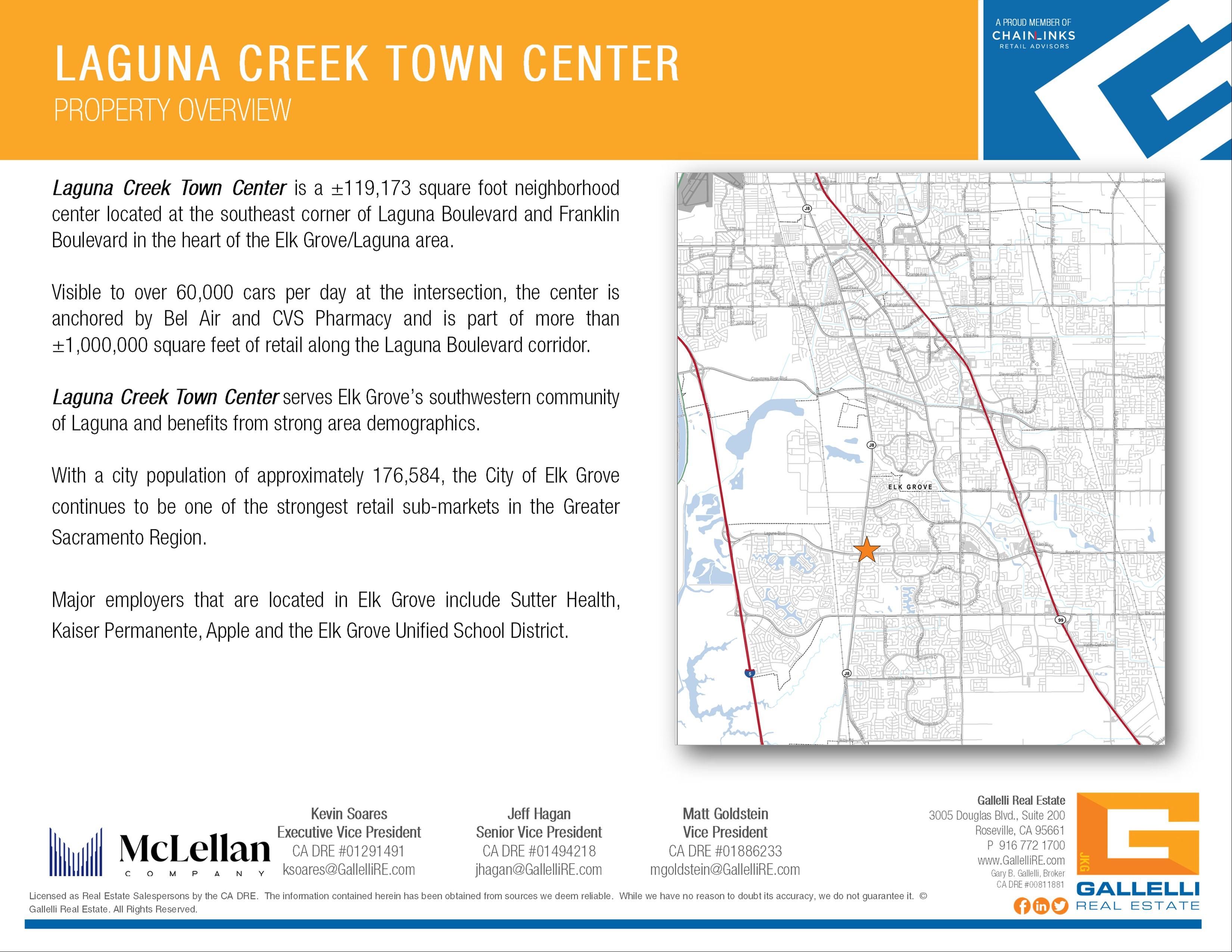

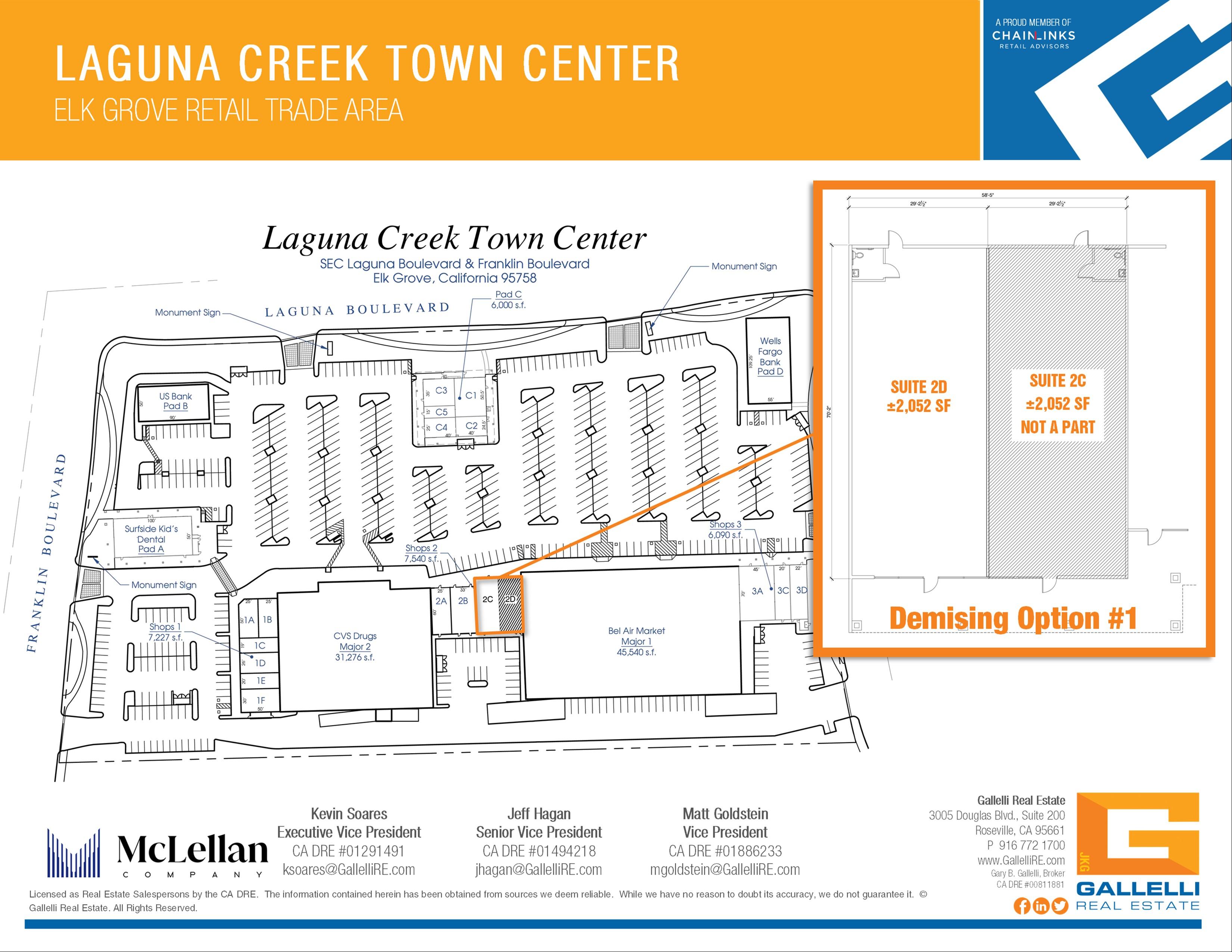

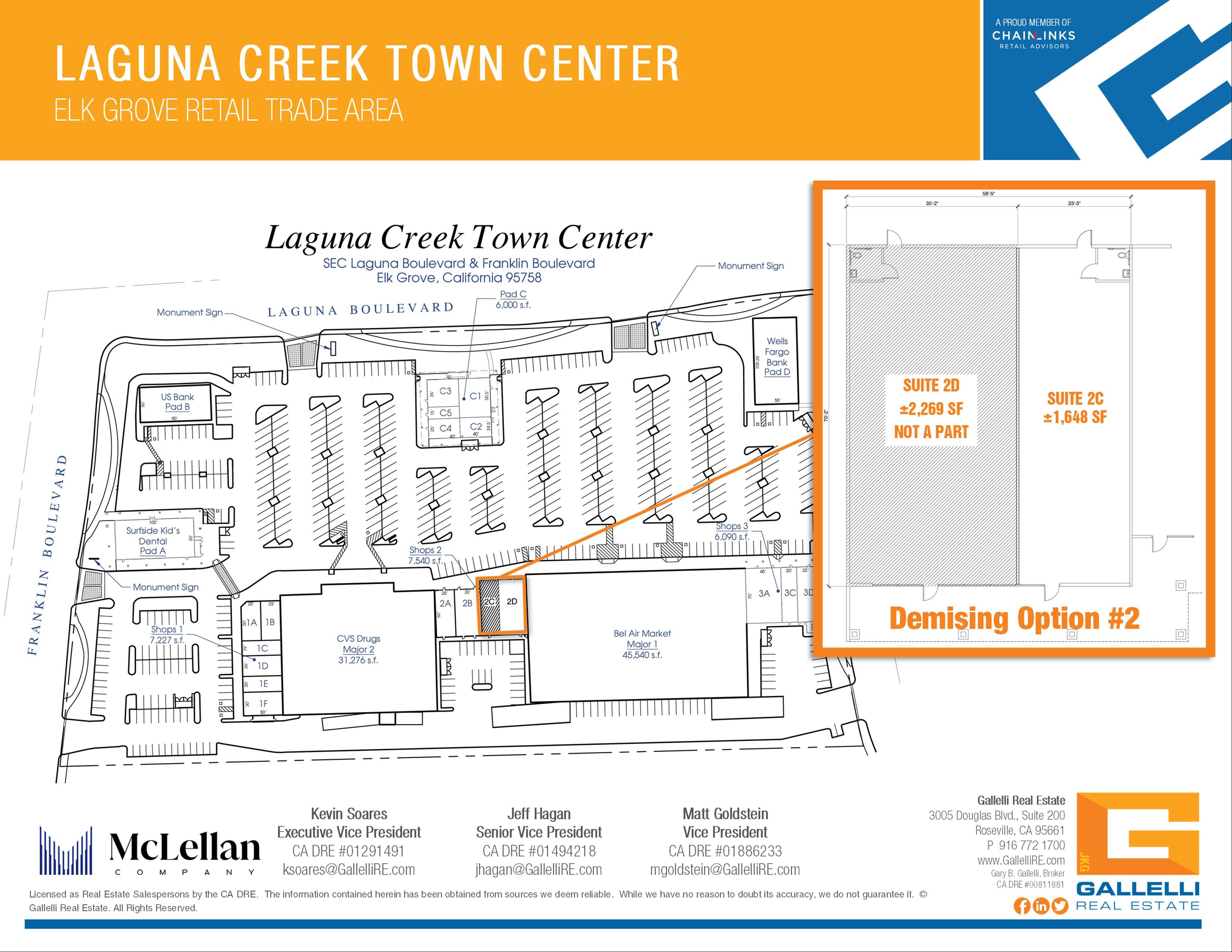

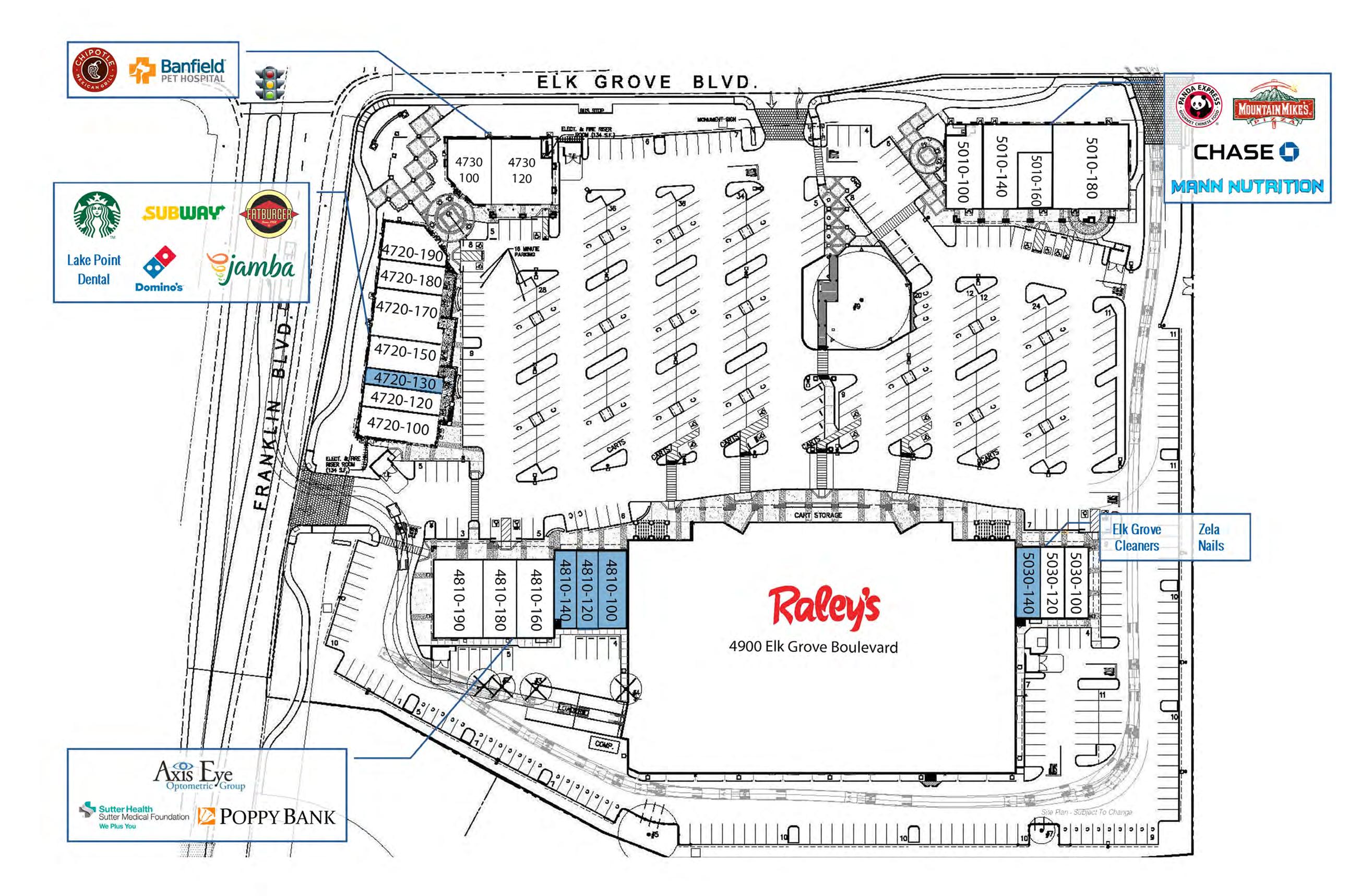

Raley’s Center of Elk Grove is located at the southeast corner of Elk Grove and Franklin Boulevards in Elk Grove, California, which is Sacramento County’s second largest city with an estimated population of ±176,210 people.

Ideally situated in the northwest portion of the East Franklin Specific Plan, the center draws from both western Elk Grove and the Laguna sub-trade areas. The center serves an excellent demographic profile that boasts an average household income of $171,577 in a 1-mile radius.

Raley’s Center of Elk Grove is a ±103,760 square foot neighborhood shopping center that is anchored by Sacramento’s premier grocer Raley’s and offers a broad range of services with its tenant mix.

Notable tenants include Starbucks, Chipotle, Jamba Juice, Chase Bank, Panda Express and Banfield Pet Hospital.

Additional services include medical services, dentistry, dry cleaning, and a nail salon.

SUPERMARKETS

#5 Raley’s - Emerald Bay

South Lake Tahoe,

1.0 M Visits* * Annual 2023 Report - Placer.ai

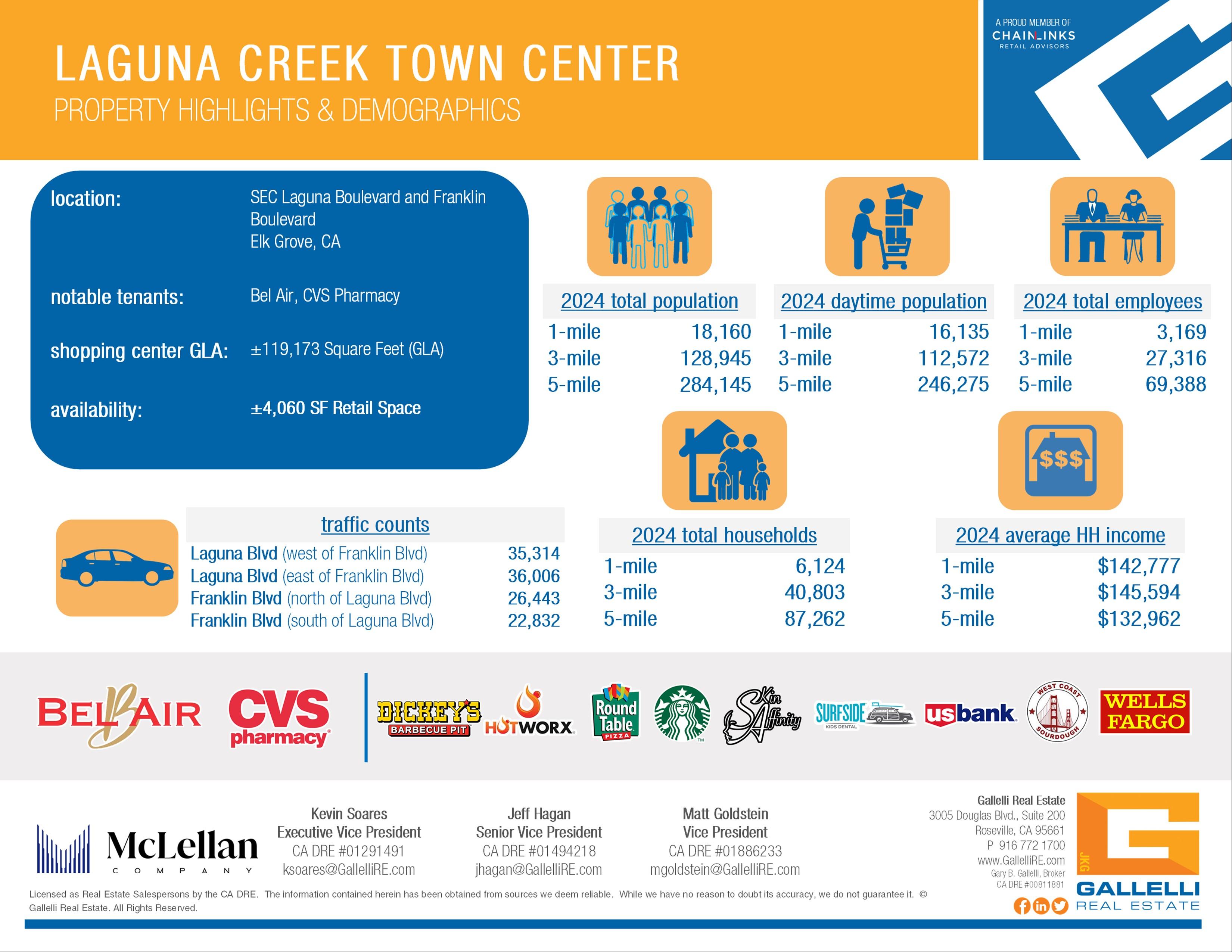

location: SWC Whitelock Parkway and Bruceville Road Elk Grove, CA

notable tenants: Safeway, Bank of America, Starbucks, Pacific Dental, Round Table Pizza

shopping center GLA: ±92,296 Square Feet (GLA)

availability: ±1,198 SF & ±1,210 SF End Cap Space

±2,000 SF Future Pad

Kevin Soares

Executive Vice President CA DRE #01291491 ksoares@GallelliRE.com

Matt Goldstein

Vice President CA DRE #01886233 mgoldstein@GallelliRE.com

Laguna Reserve Marketplace is a Safeway anchored center which is located at the southwest corner of Whitelock Parkway and Bruceville Road in Elk Grove, California.

Ideally situated in the northeast area of the East Franklin Specific Plan, the center draws from both western Elk Grove and the Laguna sub-trade areas.

Notable tenants within close proximity include Walmart, Nugget Market, Kohl’s, Trader Joe’s and HomeGoods.

Other traffic generators in close proximity include Del Webb’s Glenbrooke Senior Community and Franklin High School.

With a city population of approximately 176,584, the City of Elk Grove continues to be one of the strongest retail sub-markets in the Greater Sacramento Region.

Major employers that are located in Elk Grove include Sutter Health, Kaiser Permanente, Apple and the Elk Grove Unified School District.

Kevin Soares

Executive

Vice President

CA DRE #01291491

ksoares@GallelliRE.com

Matt Goldstein Vice President

CA DRE #01886233

mgoldstein@GallelliRE.com

SWC Bruceville Road & Whitelock Parkway - Elk Grove, CA

1. Leased Retail Space (Internal ID: SA-123180 System ID: 11730) Renaissance Creek

Center Type:

8670 Sierra Collage Blvd Roseville CA 95661

Total Building SF: 10,585 SF

Comp SF: 20,000 SF

Asking Rate/Type:

Actual/Starting Rate: $21.00 NET

Commencement: 1/1/2026

Lease Type: New Tenancy Type: Direct Term: 120 months

TI Allowance: TI Allowance/SF: $118.00 Free Rent:

Escalation:

Parking Spaces: Traffic Count:

Construction: Ceiling Height:

Seller/Landlord CPF Renaissance Creek, LLC

Buyer/Tenant Sierra Trading Post, Inc. Listing

jhagan@gallellire.com kconley@gallellire.com gary@gallellire.com

2. Leased Retail Space (Internal ID: SA-123543 System ID: 12108)

Center Type:

NEC Laguna Boulevard & Bruceville Road, Ste Major B3 Elk Grove, CA Market: Sacramento / Sub-Market: Elk Grove

Total Building SF: 439,820 SF

Comp SF: 27,000 SF

Asking Rate/Type:

Actual/Starting Rate: $24.00 NET

Listing

Commencement: 9/1/2024

Lease

3. Leased Retail Space (Internal ID: SA-123535 System ID: 7088) Laguna Reserve Marketplace Center Type:

SWC Whitelock Parkway & Bruceville Road, Ste Major A Elk Grove, CA 95758 Market: Sacramento / Sub-Market: Elk Grove Ret

Total Building SF: 95,109 SF

Comp SF: 55,000 SF

Asking Rate/Type: Negotiable

Actual/Starting Rate: $21.00 NET

Commencement: 1/1/2025

Seller/Landlord Elk Grove Commercial Property Investors, LLC

Buyer/Tenant Safeway Inc

Listing

Procuring Broker CBRE

Prepared By:

4. Leased Retail Space (Internal ID: SA-123049 System ID: 11544) Chico

Center Type:

/SEC East 20th St & Dr Martin Luther King Pkwy at Hwy 99, Ste 16 Chico, CA 95928

Total Building SF: 264,335 SF

Comp SF: 25,002 SF

Asking Rate/Type:

Actual/Starting Rate: $16 00 NET NER: NNN Rate: CAM: Cap Rate(%): Year Built: Off-Market: 07/31/2024 Months on Market:

Seller/Landlord Chico Crossroads, LP

Buyer/Tenant REI, Inc.

Listing Broker

Listing Broker

Commencement: 3/1/2025

Lease Type: New Tenancy Type: Direct Term: 120 months TI Allowance: TI Allowance/SF: $40.00 Free Rent:

Escalation:

Parking Spaces: Traffic Count:

5. Leased Retail Space (Internal ID: SA-123542 System ID: 12293) Marketplace at Birdcage Center Type:

5975 Birdcage Centre Lane Citrus Heights, CA 95610

Total Building SF: 338,783 SF

Comp SF: 25,040 SF

Asking Rate/Type:

Actual/Starting Rate: $14.50 NET

Seller/Landlord MP Birdcage Marketplace, LLC

Buyer/Tenant HomeGoods, Inc. Procuring

Market: Northeast / Sub-Market: Citrus Heights/Orangevale

6. Leased Retail Space (Internal ID: SA-123180 System ID: 11730)

Center Type:

SEC East 20th St & Dr. Martin Luther King Pkwy at Hwy 99, Ste #18 Chico, CA 95928

Total Building SF: 264,335 SF

Comp SF: 8,598 SF

Asking Rate/Type:

Actual/Starting Rate: $18 00 NET NER: NNN

Seller/Landlord Chico Crossroads, L.P.

Buyer/Tenant Skechers

Procuring Broker Cushman & Wakefield

1. Leased Retail Space (Internal ID: SA-123565 System ID: 12313) Laguna Reserve Marketplace Center Type:

SWC Whitelock Parkway & Bruceville Road Elk Grove, CA Market: Sacramento / Sub-Market: Elk Grove

Total Building SF: 92,296 SF

Comp SF: 5,200 SF

Asking Rate/Type:

Actual/Starting Rate: $39.00 NET NER: NNN Rate: CAM: Cap

Commencement: 11/1/2025

Lease Type: New Tenancy Type: Direct Term: 120 months TI Allowance: TI Allowance/SF: $25.00 Free Rent: Escalation: Parking Spaces: Traffic Count: Construction: Ceiling Height:

Seller/Landlord Elk Grove Commercial Property., LLC

Buyer/Tenant Pacific Dental Services, LLC

Listing

Listing

Procuring Broker Gallelli Real Estate

2. Leased Retail Space (Internal ID: SA-123529 System ID: 12038) Raley's Center of Elk Grove Center Type:

SEC Elk Grove Boulevard & Franklin Boulevard, Ste 150 Elk Grove, CA 95758 Market: Sacramento / Sub-Market: Elk Grove Ret

Total Building SF: 103,760 SF

Comp SF: 1,484 SF

Asking Rate/Type:

Actual/Starting Rate: $40.80 NET

Seller/Landlord

Buyer/Tenant Fat Burger Listing

3. Leased Retail Space (Internal ID: SA-123422 System ID: 12129)

Center Type:

7119 Elk Grove Blvd. Elk Grove, CA 95758

Total Building SF: 96,749 SF

Comp SF: 1,125 SF

Asking Rate/Type:

Actual/Starting Rate: $33.50 NET

Prepared By: Prepared For: Kevin

Soares

Brenda Pierce

Commencement: 12/1/2023

Lease

Construction: Ceiling Height:

Seller/Landlord Laguna Promenade

Buyer/Tenant Postal Annex Listing Broker

4. Leased Retail Space (Internal ID: SA-123329 System ID: 11948)

Prepared For: Kevin Soares

Prepared By: Brenda Pierce

The Ridge Shopping Center Center Type:

7450 Elk GRove Blvd. Elk Grove, CA 95757

Total Building SF: 356,341 SF

Comp SF: 2,400 SF

Asking Rate/Type:

Actual/Starting Rate: $48.00 NET NER: NNN Rate:

Commencement: 3/1/2023

Lease Type: New Tenancy Type: Direct Term: 120 months TI Allowance:

Parking Spaces: Traffic Count:

Construction: Ceiling Height:

Seller/Landlord The Ridge EG West, LP

Buyer/Tenant Chipolte Mexican Grill, Inc.

Procuring Broker

Procuring

Procuring

5 Leased Retail Space (Internal ID: SA-123565 System ID: 12313)

Prepared By: Prepared For: Kevin Soares

Brenda Pierce

Raley's Center of Elk Grove Center Type:

SEC Elk Grove Boulevard & Franklin Boulevard Elk Grove, CA Market: Sacramento / Sub-Market: Elk Grove

Total Building SF: 103,760 SF

Comp SF: 2,000 SF

Asking Rate/Type:

Actual/Starting Rate: $36.00 NET NER: NNN Rate: CAM: Cap Rate(%): Year Built: Off-Market: 02/08/2024 Months on Market:

Seller/Landlord 4720 Elk Grove Blvd., LP

Buyer/Tenant Axis Eye Optometric Group

Listing Broker

Listing

Procuring Broker CBRE

Commencement: 2/1/2024

Lease Type: New Tenancy Type: Direct Term: 60 months TI Allowance: TI Allowance/SF: Free Rent:

Parking Spaces: Traffic Count:

Construction: Ceiling Height:

6. Leased Retail Space (Internal ID: SA-123521 System ID: 12261) Raley's Center of Elk Grove Center Type:

4720 Elk Grove Blvd. Elk Grove, CA 95758 Market: Sacramento / Sub-Market: Elk Grove

Total Building SF: 10,238 SF Comp SF: 2,384 SF

Asking Rate/Type:

Actual/Starting Rate: $37.68 NET NER: NNN

Seller/Landlord 4720 Elk Grove Blvd., LP

Buyer/Tenant Lake Point Dental

7. Leased Retail Space (Internal ID: SA-123452 System ID: 12172) Laguna

Center Type:

SWC Whitelock Parkway & Bruceville Road Elk Grove, CA 95757

Total Building SF: 92,296 SF

Comp SF: 4,000 SF

Asking Rate/Type:

Actual/Starting Rate: $39.00 NET

Commencement: 10/1/2024

Lease Type:Renewal

Tenancy

Seller/Landlord Elk Grove Commercial Property Investors, LLC

Buyer/Tenant Round Table Pizza Listing Broker

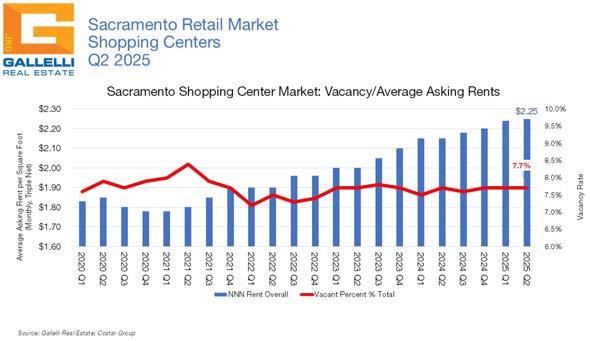

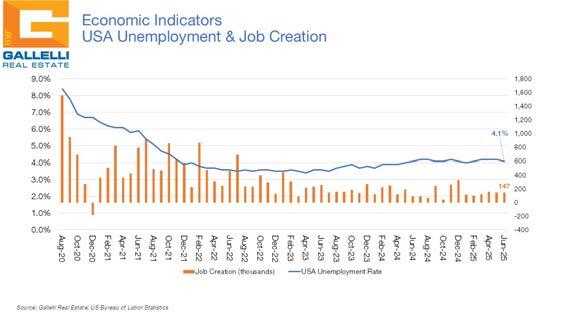

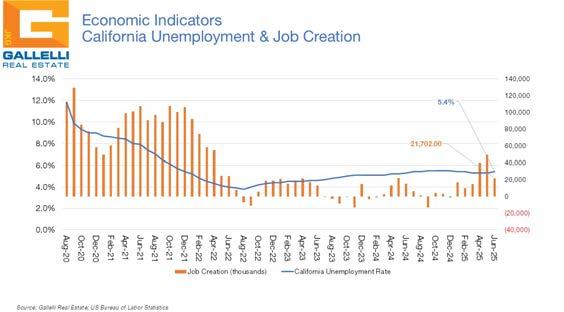

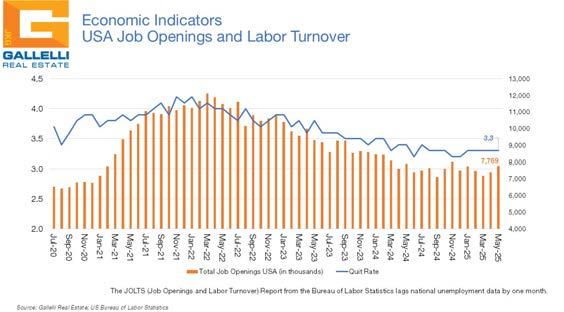

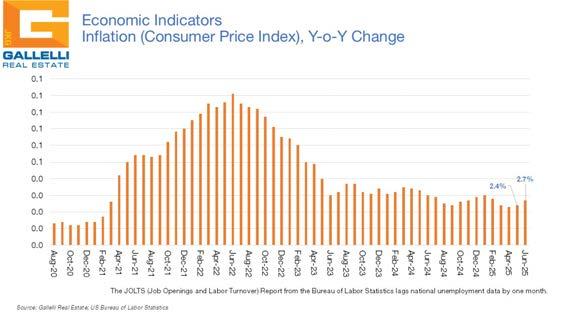

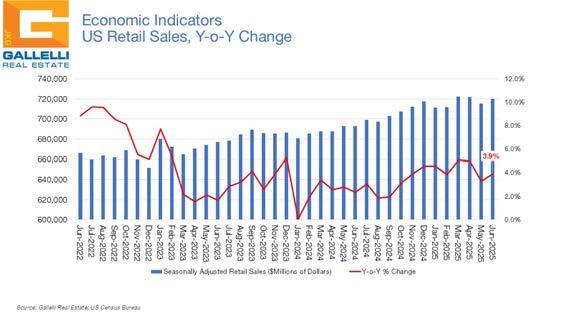

Vacancy for shopping center space in the Sacramento region stood at 7.7% as of the end of Q2 2025. It has held at this rate for three consecutive quarters now and has moved no more than two basis points in either direction from this mark since 2022. This is not to say that activity has been flat or stagnant.

The challenges of the pandemic sent vacancy to a peak of 8.4% by Q2 2021, but retail demand rebounded hard over the next 18 months. By Q3 2022, the market had absorbed nearly one million square feet (MSF) of formerly vacant space as local vacancy fell to 7.3%--its lowest reading since early 2008. But since that time, national chain bankruptcies and closures have picked up substantially. According to PNC Real Estate Market Analytics, which tracks merchant bankruptcies, the US market set a record with 78 retail chains filing bankruptcy in 2020 (their data only includes retailers and not restaurant, fitness chains or other nontraditional users of shop space). Last year 43 chains filed bankruptcy, the second largest total they have tracked in the 20 years they have been tracking the marketplace. Through the halfway mark of 2025, they have tracked 22 major chain bankruptcies, meaning that the market is currently on pace to surpass last year’s total count.

The latest casualty is the furniture and furnishings chain At Home, which will be closing at least 32 stores nationally as part of its bankruptcy (this number could go up), including their local store at the Delta Shores shopping center in Sacramento. Meanwhile, ‘tween retailer Claire’s was reportedly also planning on filing Chapter 11 as this report went to press. The chain

operates eight stores in the region, primarily at mall, lifestyle, and outlet center locations.

Yet, despite these challenges, vacancy has held steady so far. The market recorded 31,000 square feet (SF) of positive net absorption in Q2 2025. Though a negligible figure given the market’s overall size of 66.1 MSF (30,000 SF is roughly the size of an average T.J. Maxx store), the Sacramento market has managed to eke out positive occupancy gains in five of the last six quarters amidst the national trend of increased closures.

This is partially due to continued expansion from grocery store chains, discounters, and off-price apparel concepts. But it is also due to continued robust growth from QSR/fast casual chains, gyms/fitness concepts, beauty (from aesthetics/MediSpas to retailers and salons), and a mix of other non-traditional space users (car washes, urgent care, veterinary hospitals among just a few).

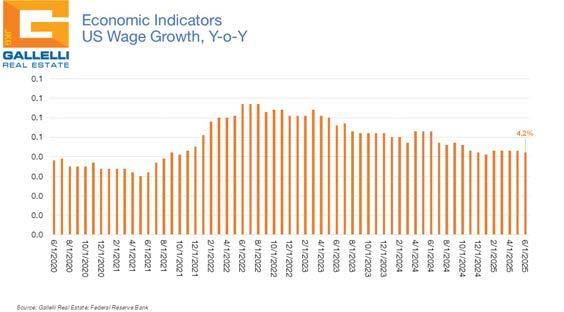

Meanwhile, none of the recent headwinds impacting the market have slowed rental rate growth. The current average asking rent we are tracking is $2.25 per square foot (PSF) on a monthly triple net basis. We should note that this figure is useful as a benchmark only; lease rates for retail space are heavily discounted depending upon the size

of the space (the larger the box, the cheaper the rate) and can vary significantly based on the location, class and co-tenants of a center—all of which are critical factors in driving varying sales outcomes. This number is up 4.7% from where it stood a year ago, making retail the commercial real estate product type currently driving the strongest gains locally.

Our brokers still report a shortage of available Class A space, particularly for smaller shop spaces. This is driving particularly sharp rent increases on renewals for some tenants. Anecdotally we know of multiple instances where smaller space tenants have renewed existing Class A spaces at rates of 20% or more than their previous rents. With little new development in the pipeline (and most new construction heavily pre-leased prior to delivery), the balance of power in negotiations locally still favors landlords.

Additionally, there is another factor that is starting to play out for some longer-term big box tenants upon renewal. Box tenants tend to lock in lower rates at longer terms. The early 2000s were boom times for local retail demand (as well as development). One common lease structure that we saw 20 years ago was the 10-year term with the right of two 5-year renewal options. We are starting to see an increasing number of tenants having already exercised both of their renewal options facing major rent increases—with rates sometimes as much as doubling at today’s market rate.

Another challenge facing many tenants is the fact that most retail (and industrial) deals are transacted regionally on a triple net basis, meaning that in addition to rent tenants are responsible for the cost of property taxes, insurance, common area maintenance (CAM), and utilities. Net expenses have effectively doubled over the past five years. Anecdotally, we are seeing instances where the $0.40 PSF nets of a few years ago are suddenly $0.80 PSF nets, or $0.50 PSF nets are now moving in on $0.95 PSF. While the cost of insurance, CAM and utilities have skyrocketed in recent years, increased property taxes have been a major driver of this trend. This is particularly the case for properties that have recently sold, triggering the reassessment process and giving some pricing advantages to long-term landlords. Ultimately this trend challenges the ability of landlords to command rental rate growth. In Sacramento’s industrial market it is already a factor (among many) for that product type posting modestly negative

growth this quarter. A lack of new product has largely insulated local retail landlords from this trend, though a sharp decline in demand could potentially change this.

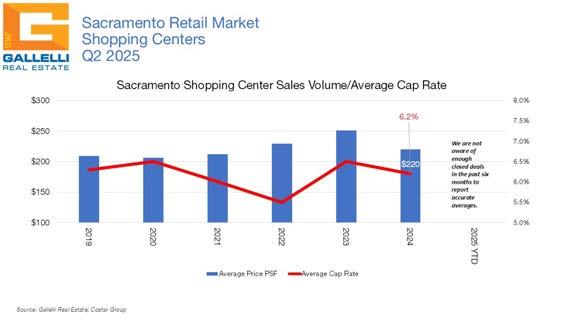

A lack of major new construction is one of the major factors that has enabled Sacramento’s shopping center to maintain market equilibrium despite the recent spate of closures. Since 2009, the region has added only 20 new shopping centers accounting for just over 2.3 MSF of product. In other words, the market’s inventory has increased by just 3.4% in 16 years. In the eight years prior to that, the market had an average of 3.5% growth annually in each year (2000 to 2008). The arrival of the Great Financial Crisis (GFC) in 2008 was just the beginning of more than a decade of challenges that would play out for retail real estate. By the late 2010s, the accelerated rise of eCommerce led to a major uptick in retailer bankruptcies and strategic closures. That trend was not yet over when the pandemic hit. Yet construction did not bounce back in the wake of the post-pandemic retail boom because the culprit as of late has been construction costs (which are still averaging roughly 40% above where they stood as recently as early 2022).

We are currently tracking 309,000 SF of new product in the development pipeline with delivery dates scheduled through 2026. But most of this space is already accounted for. We don’t know of any major projects that have moved forward with construction since 2008 that did not at least have a committed anchor tenant. Speculative development has largely been limited to inline shop space. For example, one of the larger projects currently in the pipeline is a 66,000 SF building for Whole Foods that is scheduled for delivery in Q4 2025.. Likewise, a 43,000 SF Nugget grocery store will be coming online in October 2025 at Whitney Ranch in the Roseville/Rocklin market and development has begun on a new 161,000 SF Costco that Gallelli Real Estate brokered in the planned Baseline Marketplace project in West Roseville.

But while most of the new product in the pipeline is already accounted for, questions remain as to how long local vacancy levels can hold. Much of this will be determined by how the big picture economy impacts consumer spending and retail demand in the months ahead.

Through the first half of 2025, uncertainty surrounding the effects of tariffs initially left many industry leaders cautious. Economists and pundits issued dire warnings, and the stock market fell sharply following the tariff announcement. However, as of this report, the three major indices—the Dow, Nasdaq, and S&P—are all trading well above their pre-announcement level.

Despite early concerns, little increase in the cost of goods has been observed since tariffs were imposed so far. Meanwhile, though recent data from outplacement firm Challenger, Grey & Christmas showed U.S. employers announced 744,000 layoffs through the first half of 2025. Notably, nearly 287,000 of those were attributed to cuts by the Department of Governmental Efficiency (DOGE), skewing the headline number.

While the short-term impact of tariffs remains in flux, some longer-term benefits are beginning to take shape. Tariffs have boosted tax revenues on foreign products, and, more importantly, they are encouraging reinvestment in domestic operations that should ultimately result in the creation of solid, middle-class jobs. Numerous corporations have committed to expanding U.S. facilities and manufacturing capacity. For instance, Apple has pledged more than $600 billion towards building U.S. based facilities, while TSMC has committed $100 billion to semiconductor manufacturing on American soil. Many other companies have made similar commitments or are actively evaluating new investments.

Ultimately, the level of headwinds the tariff policy creates for the greater economy remains in flux. Looking to the final half of the year, barring any unforeseen “black swan” events, the state of the overall economy will depend overwhelmingly on the kind of trade deals the administration is able to cut in the months ahead.

Gallelli Real Estate is a private firm that specializes in commercial real estate services and property management. We believe that as a boutique firm whose understanding of the business runs as deep as our core values, our advantage is large. We take pride in our unique approach to offer more individual solutions that address the ever changing needs of our clients and the industry. After all, our success is measured by the success of our clients and the strength and longevity of our relationships.

rosborne@gallellire.com

Land/Investments ebenoit@gallellire.com