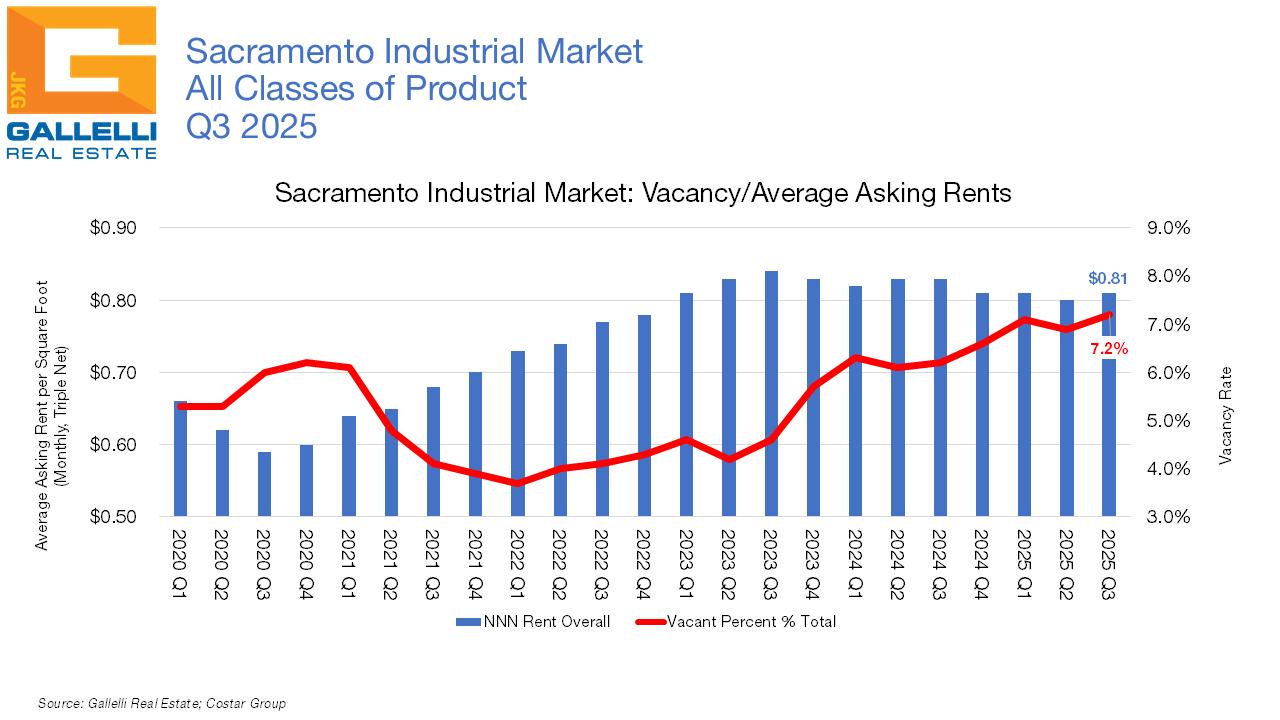

Average Asking Rate (NNN) $0.81 PSF

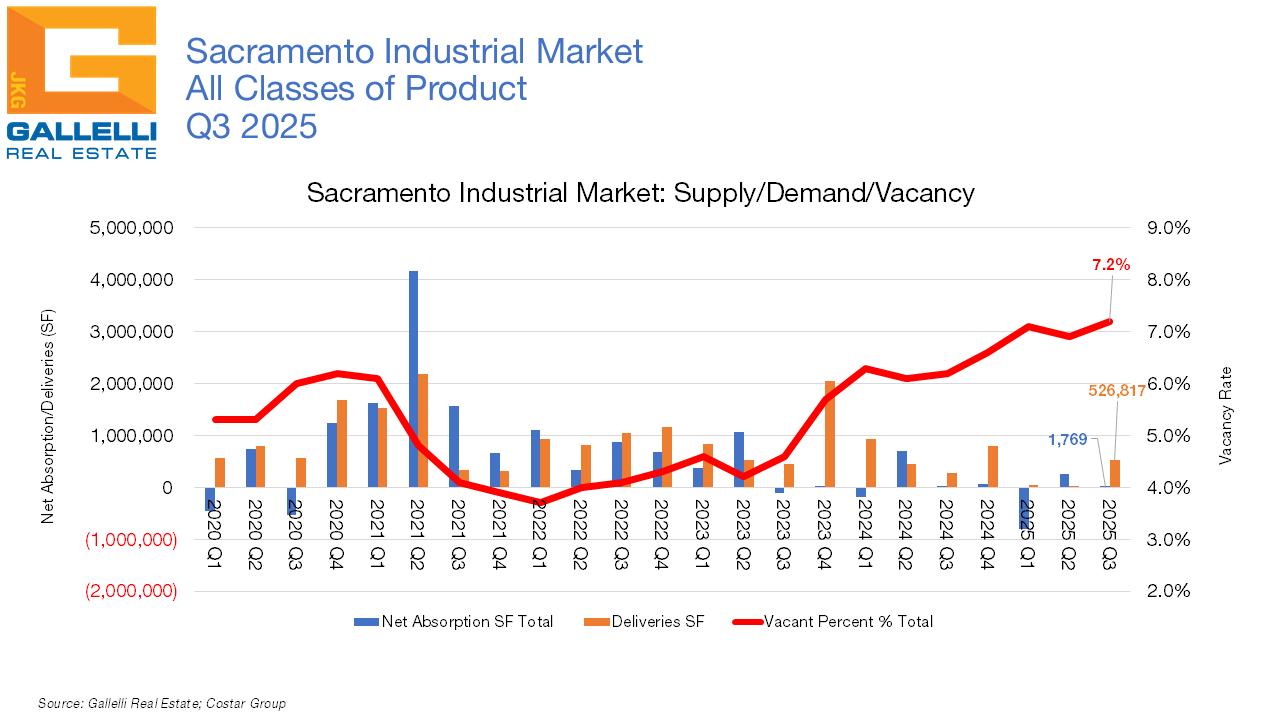

VACANCY CREEPS UP DESPITE DIMINISHING DEVELOPMENT PIPELINE

Industrial vacancy in the Sacramento region jumped in Q3 2025 from 6.9% to 7.2%. While the market recorded occupancy growth, the 2,000 square feet (SF) of positive net absorption posted this quarter was negligible. Meanwhile, developers added 527,000 SF of new speculative space, and that disparity between supply (new development) and demand (net absorption) translated into an uptick in vacancy.

Only five of the region’s 16 distinct submarkets recorded occupancy growth in Q3. The Davis/ Woodland trade area led the way with 782,000 SF of positive net absorption that significantly reduced vacancy from the 11.7% rate of three months ago to today’s 7.2% level. Not surprisingly, this is where the quarter’s largest deals transpired. Agricultural co-op Pacific Coast Producers leased 516,760 SF of space within the Woodland Distribution Center (1755 E. Beamer Street) for local canning operations (they specialize in tomatoes and locally grown fruits). The second largest deal was logistics firm iCargoEx’s renewal and expansion of 222,000 SF of space at 550. N. Pioneer Avenue in Woodland.

The McClellan submarket recorded 294,000 SF of positive net absorption in the last three months. Vacancy here now stands at 4.9%, down from 6.5%. While McClellan Park landed a few new

smaller tenants this quarter, the largest deal of Q3 was construction firm Southland Industries’ lease of 107,000 SF at 3021-3034 Peacekeeper Way.

West Sacramento was also in the black this quarter. The market posted 163,000 SF of positive net absorption, thanks in large part to the move-in of TWM (Tire & Wheel Master) Wholesale to 148,000 SF of space at 3095 Mary Place. Vacancy in West Sacramento now stands at 6.7%, down from the midyear reading of 7.4%. Both the Auburn/Newcastle (+82,172 SF) and Folsom/El Dorado (+2,834) submarkets recorded occupancy gains in Q3, but space givebacks across the market outpaced these.

The Power Inn submarket posted the greatest occupancy declines. Move-outs at Depot Park and Florin Depot Park helped to drive negative net absorption of -254,000 SF in Q3. Meanwhile, though this trade area did see one of the region’s larger deals of the quarter (Ferguson’s 109,000 SF lease at Depot Park), it was a renewal and did not net any growth. Though this was the fourth consecutive quarter of increased vacancy, that metric stood at just 3.3% a year ago and now is still at a healthy 5.6%.

The Roseville/Rocklin submarket recorded -192,000 SF of negative net absorption in Q3, thanks largely to move-outs at the Lincoln Air Center, the Cincinnati Industrial Center, and a few other projects. Like the Power Inn market, vacancy here has also been on an upward trajectory in recent quarters after reaching cyclical low points. A year ago, industrial vacancy in this trade area was only 1.4%, with few options for any local businesses to expand. Today it stands at a healthy 5.8%.

The Natomas/Northgate market posted occupancy declines of -190,000 SF in Q3, despite multiple new leases like the recent lease of 70,000 SF of cold storage space by food service management and packaged meal company Elior North America at 7070 Badiee Drive at Metro Air Park, though this has not translated into occupancy growth yet as Elior won’t be occupying until they consolidate from locations in West Sacramento and Tracy next year. The largest new deal of the quarter was Starbucks’ deal for 57,000 SF of distribution space at 4040 Vista Park Court in Natomas. But space givebacks included 3PL’s return of 145,000 SF of space at Metro Air Park as well as a mix of smaller users at Northgate Industrial Park and a few other projects. Vacancy in Natomas is now at 12.1%, up from the 10.0% reading of three months ago, though below the 12.4% rate of Q3 2024.

The Sunrise submarket saw its vacancy rate climb from 4.1% to 5.3% this quarter, recording negative net absorption of -158,000 SF. This metric was partially driven by Aura Hardwoods’ move-out out of 64,000 SF at 2477 Mercantile Drive as well as some smaller outbound moves from tenants at Gold River Industrial Center and the Sunrise Industrial Park.

RENTS HIT THE WALL

The current average asking rent for industrial space in the Sacramento region is $0.81 per square foot (PSF) on a monthly triple net basis. After years of outsized rent growth, this metric has hit a wall. The current asking rate is down -2.4% from where it stood one year ago. While sluggish demand certainly plays into this, there is another factor at play here. Most industrial (and retail) deals are transacted regionally on a triple net basis, meaning that in addition to rent

tenants are responsible for the cost of property taxes, insurance, and utilities. While the average asking rent for industrial space has doubled since 2015, net expenses have effectively done so over roughly the past five years. Ultimately, this puts a limit on how much rental rate growth a property can command. It remains to be seen whether the overall economy will cooperate heading into 2026, but an emptying development pipeline should bode well for maintaining market equilibrium heading into next year. In the meantime, we are hearing anecdotally of more concessions on longer term deals with free rent being the primary offering.

THE INCREDIBLE SHRINKING DEAL?

Despite recording negative net absorption this quarter, gross absorption (deal activity) was up in Q3. We tracked 2.7 million square feet (MSF) of leasing activity over the past three months, compared to 1.8 MSF in Q2 2025. The difference is that deals were dominated by renewals that did not translate into occupancy gains. Additionally, the trend of shrinking deal size continues, though that trend may be more a matter of perspective.

At the peak of the last leasing cycle in 2021, local vacancy fell to a record low of just 3.7% and the market recorded a whopping 8.0 MSF of occupancy growth. Not surprisingly, this spurred a wave of aggressive development as well as outsized rental rate growth. The average asking rent for industrial space was $0.60 per square foot (PSF) on a monthly triple net basis at the close of 2020. It jumped 14.2% over the next year, averaging $0.70 PSF by Q4 2021.

Demand at that time was spread across a wide variety of user types, from smaller local users to regional distribution and logistics players but from 2017 to 2022 the market was experiencing an eCommerce fulfillment explosion, led by Amazon as they sought to create same day delivery capabilities across the continental United States. Amazon would lease, purchase, or develop more than 150 MSF of space nationally during these years, with 1.0 MSF requirements becoming commonplace. Their competitors were also making moves—or, at least, trying to keep up. Sacramento was late to experience this growth wave, but it began to play out in 2020.

One comment we have heard from multiple players in the market lately is that deal sizes are getting smaller—and they are, if you compare them to 2020, 2021 or 2022 when the trend of active eCommerce requirements was playing out. We crunched the numbers and found that the average industrial deal size increased by roughly one third during those years compared to the years immediately prior and since. Deals in the region are getting smaller. But they are just reverting to the norm prior to the recent wave of eCommerce fulfillment demand.

DEVELOPERS TAKING A BREAK

Local developers have added roughly 15.3 MSF of industrial space to market over the past five years, or roughly 8.5% of the region’s entire inventory. They set records in the process (the 4.4 MSF of new space deliveries added in 2021 is the highest level of industrial development we have tracked since we started keeping data in 1999). As of Q3 2025, there was just 581,000 SF of new product under construction in the region, the lowest amount of product in the development pipeline since 2018, with nearly all of it in the form of build-tosuits. That number is about to climb; Costco is going to begin construction on a 949,000 SF distribution center in Q4. The projects in the pipeline will help to drive stronger occupancy growth totals heading into 2026 and won’t negatively impact vacancy. It remains to be seen if the greater economy will cooperate next year, though the pause in new construction will benefit landlords that have experienced the upward trajectory of vacancy in recent years as a flood of new product has come online.

LOOKING AHEAD

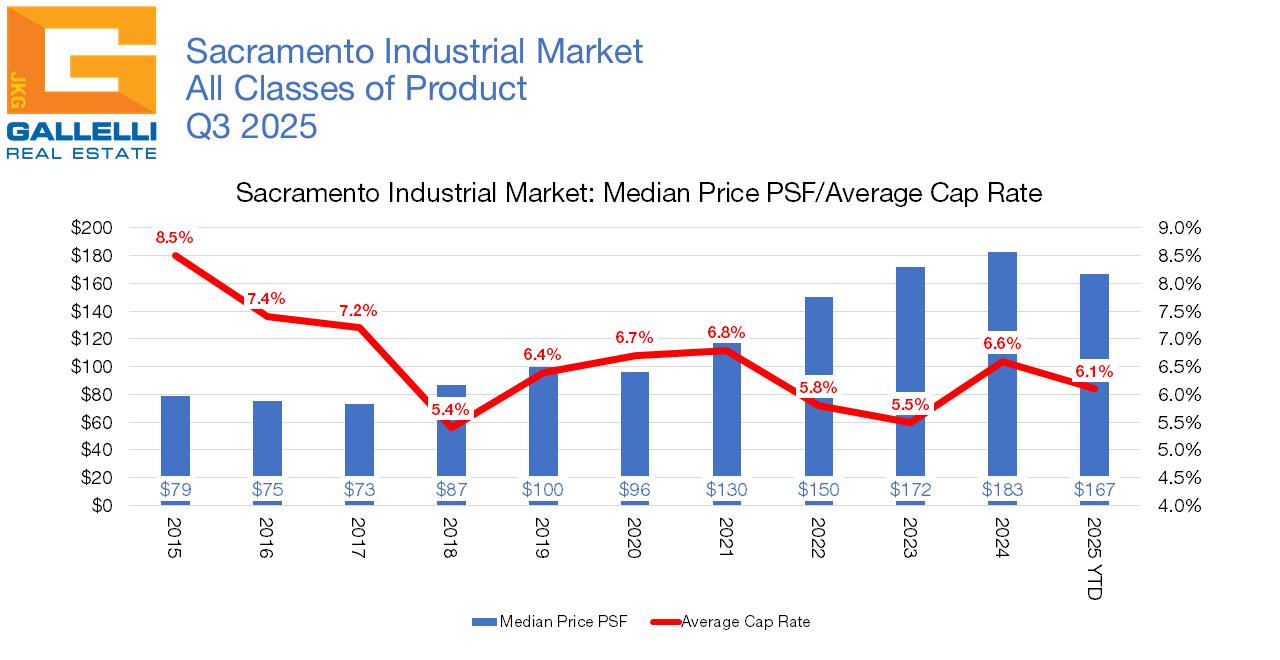

Initial economic uncertainty regarding tariff impacts appears to be fading, with many companies that had paused moves earlier in the year returning to dealmaking. Consumer spending has continued to hold up far better than most early economist predictions, though many warn that the full impact of many tariffs has yet to hit the market. Meanwhile, unemployment remains near 50-year lows, though employment growth has been slowing substantially in recent months. While US stock indices are all at or near historic highs, much of those gains in 2025 have been driven by companies at the forefront of artificial intelligence (AI) creation—with AI increasingly being cited as a driving force for layoffs and flattening employment growth. Risks remain but should a negative economic scenario play out in the coming year, but recent moves by the Federal Reserve should prove beneficial to the real estate industry.

The September interest rate cut by the Fed will be a boost in the arm for real estate and will almost certainly be the first of multiple reductions. That cut—a 25-basis point reduction—isn’t likely to set off a flood of investment activity overnight. But as this report went to press, Fed Chair Jerome Powell said that the Fed would likely cut its key interest rate at least two more times this year stating that “rising downside risks to employment have shifted our assessment of the balance of risks.” We think this is likely to spur increased activity heading into 2026 even if the economy faces some turbulence.

Industrial Leases